by Adam Hartung | Jul 19, 2021 | Entertainment, Entrepreneurship, Innovation, Strategy, Trends

Netflix Redefines The Pivot

Last week Netflix announced it was going to enter gaming . Interestingly, the analyst reaction was, at best, mixed. Most didn’t think it was a great idea. My favorite is this quote in AdAge came from a pair of Bernstein analysts.

“Bernstein analysts Todd Juenger and Gini Zhang said in a note that they were “tepid” about Netflix getting into gaming, partly because it would mean a lesser focus on the core business. They worry about creating a distraction.”

These untalented analysts went on to say:

“It’s hard not to imagine that if Netflix were to launch its own video games, the majority of the company’s energy would be focused on the success of that new, different, exciting thing (even among employees who aren’t involved in it),” according to the note. It’s also unclear how the company can capitalize on the video-game content without raising prices—and potentially turning away some users unwilling to pay extra, they said.”

A History of Pivoting to Meet Customer Needs

Wow, I’ve heard that before. Remember how Netflix started? Back when we all went to Blockbuster or another video store to rent a tape or dvd overnight, Netflix offered to send them to our house. And let us keep them as long as we wanted. This convenience was so powerful Netflix drove Blockbuster, Family Video and all other traditional video rental stores bankrupt.

After this big win analysts thought that Netflix should take on Amazon in general merchandise e-commerce. After all, Netflix was the largest customer of UPS, USPS and Fedex at the time. Most analysts thought Netflix had the infrastructure to ship things, so they wanted to build on that infrastructure. But Netflix didn’t to that at all. Keeping its eyes on its Value Proposition of “Delivering Entertainment” Netflix instead went headlong into video streaming. And the stock tumbled dramatically as analysts said streaming wasn’t the “core” of Netflix. Netflix wasn’t a tech company, or a telecom or cable company and streaming would be a huge distraction for people lacking proper skills. Netflix’ Value Delivery System was dominated by logistics expertise, and the analysts were focused on milking more out of the Value Delivery System.

Of course Netflix knew its value was in keeping customers happy, not milking its invested assets. Netflix’ “core” was in knowing entertainment, so it had to develop the skills in streaming, or its customers would drift away. Further, Netflix knew it had nowhere near the savvy of Amazon for general merchandise marketing and sales. If it followed Amazon it would fritter away its Value Proposition, and probably never make any money chasing Amazon by trying to devote more energy to its logistics Value Delivery System.

Of course, Netflix was right. Leadership jettisoned the physical distribution Value Delivery System and built a new one around streaming technology. Just as the Bernstein analysts feared, Netflix had to raise prices. Which it did on physical distribution in order to raise the money to invest in streaming, which turned out to be the shot allowing Netflix to dominate globally, not just in the USA. It was enormous win for gaining customers, selling more stuff, and making more money.

About 5 years ago, Netflix realized it yet again had to change its Value Delivery System if it was to maintain its customer Value Proposition. So it scaled back investing in streaming, as that technology was becoming available to everyone. And it invested heavily in content production. Even though it had long distributed other people’s content, Netflix saw that to be a leader in “Delivering Entertainment” it had to create its own. So the money was shifted into making “House of Cards,” which was a huge hit, and “Orange is the New Black.” Now Netflix is the most prolific video content creator in North America. So much good content Netflix has jeopardized the future of TV networks, major movie studios and even entire theatre chains.

Where once the big employment center, and resource hog, in Netflix was logistics, Netflix leadership pivoted its Value Delivery System into streaming technology. Then it pivoted again into content creation. And now, as gaming has become “the next big thing” Netflix is once again pivoting its resources — into fast growing gaming.

Given this is the third pivot, and 4th Value Delivery System, in Netflix, would you bet against CEO Reed Hastings and his leadership team? The negative analysts are as dead wrong now as they were before. Netflix has demonstrated a keen understanding of their Value Proposition, and demonstrated the skill set to adapt their Value Delivery System to meeting emerging customer needs. I believe it is almost a certainty Netflix will find its way in on-line gaming as the trend keeps growing exponentially. And like all the other pivots, they’ll attract even more customers, and sell more product, and make more money.

Are you adaptable to new Value Delivery Systems as technology makes them available?

Do you clearly know your Value Proposition, and are you focused on it — or are you focused on running your Value Delivery System. Are you trying to maximize your old business, or are you seeing how emerging trends are creating new opportunities to grow by entering new businesses, with new Value Delivery Systems? Netflix has demonstrated how to grow very large, very fast. Are your eyes open to Trends and Market Shifts – and are you adaptable to take advantage of emerging market needs? Now is a good time to learn from Netflix.

My calls on Netflix have historically been quite good. Check out these links to previous articles:

How Netflix became the King of Strategic Pivots, 4/2018

Predicting Netflix Would Dominate Entertainment Content, 4/2016

Explaining Why and How Netflix content creation would be good for investors, 3/2015

Explaining why investors should buy Netflix stock when it crashed after announcing its move into streaming, 10/2011

Explaining why you should buy Netflix, predicting it would be the next Apple or Google, 11/2010

Netflix ended last week at $530/share. Had you bought it when I recommended in 11/2010 the stock was $25. You would have had a 25X gain. Had you added to your position in October, 2011 the stock was $16.75. You would have a gain of 31.6X. Had you added in 3/2015 when I recommended higher valuation for investors from content you would have bought at $62, for a gain of 8.5X in 6 years.

Did you see the trends, and were you expecting the changes that would happen to your demand? It IS possible to use trends to make good forecasts, and prepare for big market shifts. If you don’t have time to do it, perhaps you should contact us, Spark Partners. We track hundreds of trends, and are experts at developing scenarios applied to your business to help you make better decisions.

TRENDS MATTER. If you align with trends your business can do GREAT! Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business. Click for Assessment info. Or, to keep up on trends, subscribe to our weekly podcasts and posts on trends and how they will affect the world of business at www.SparkPartners.com

Give us a call or send an email. Adam@sparkpartners.com 847-726-8465.

by Adam Hartung | Dec 7, 2019 | Entertainment, Innovation, Marketing, Strategy, Television, Trends

Seven years ago (12 December, 2012) I said it was “The Day TV Died.” There were a LOT of skeptics. At the time, TV was by far still the dominant medium. But the trends were absolutely clear – ad revenues were quickly moving toward on-line opportunities. Print was already well into the grave, and radio was sputtering along with no growth at all. Eyeball momentum had shifted on-line, and thus ads moved on-line, and it was obvious that programming dollars would soon follow – meaning that TV programming was already in Stage 4 termination.

Trends and Tech drove Netflix growth

Meanwhile, Netflix and its brethren were poised to have a fabulous, furious growth. These same trends led me to a full-throated pitch to buy Netflix nine years ago (Nov. 2010.) After Netflix made the decision to raise prices for DVD distribution in order to push people toward streaming the stock crashed, but trends indicated that customer preferences would lead Netflix to be the content winner so despite widespread despair, I called for people to buy the stock in Oct. 2011. In Jan. 2012, I made Netflix one of my top 4 picks for the year. So by Jan. 2013, I was making it clear that TV was has-been, and Netflix was the company to own.

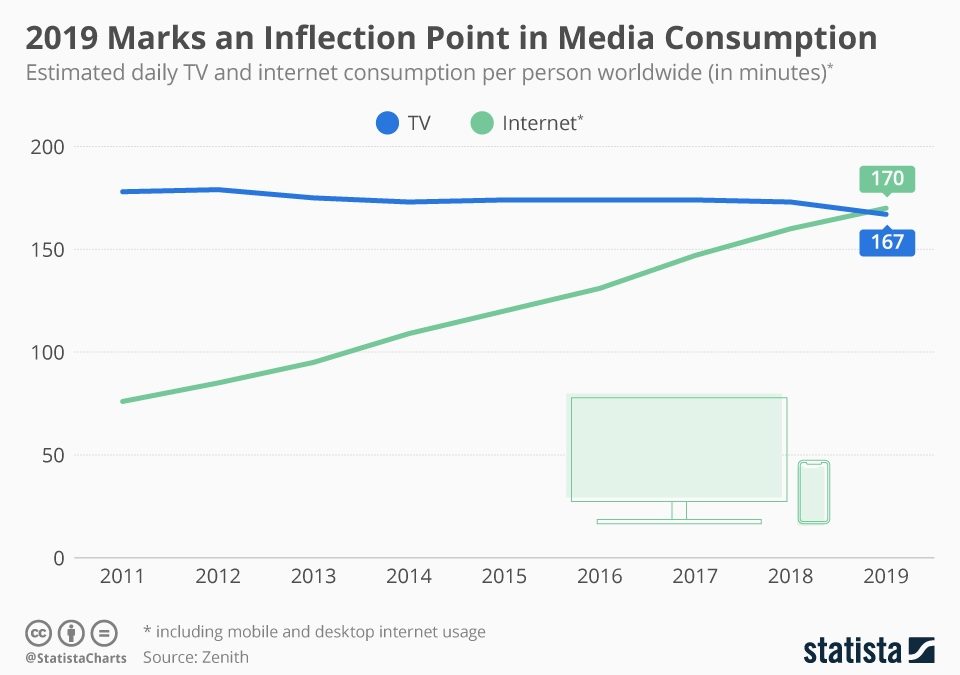

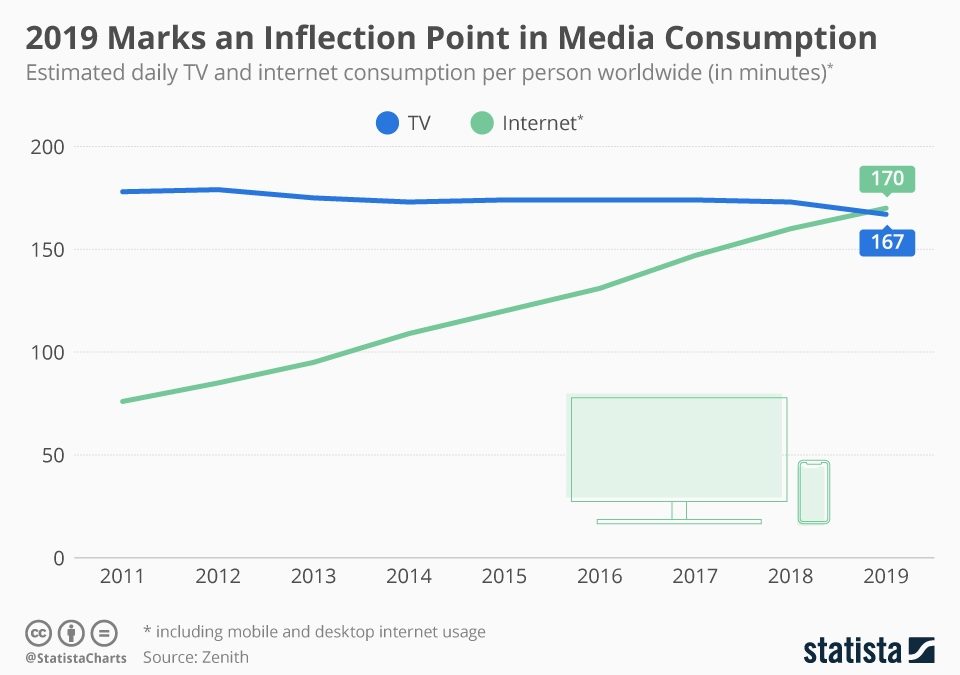

Now, Statista has produced the numbers showing that in 2019 internet media consumption exceeded TV consumption – for the first time ever. And this trend will not stop. It was wholly predictable years ago – and the trends all say this will only accelerate. Where once the competition for entertainment was Netflix, now there is Amazon Prime, Disney+, Comcast Peacock, AT&T HBO Max and Apple TV+. The traditional networks simply don’t have a chance.

Impact of Trends

These trends are having an enormous impact on how we behave, how advertisers behave, what technology we buy, what entertainment we watch, how we use other technology like social media, how we absorb news — and more. So the question is, did you see the trends 7,8,9 years ago? Have you adjusted your strategy? Are you sure where trends are headed, and are you prepared for the future? Will you be a winner as the world changes – in a pretty predictable way – or will you lose out and say “you know, way back when……”

by Adam Hartung | Apr 25, 2018 | Entertainment, Film, Innovation, Investing, Retail

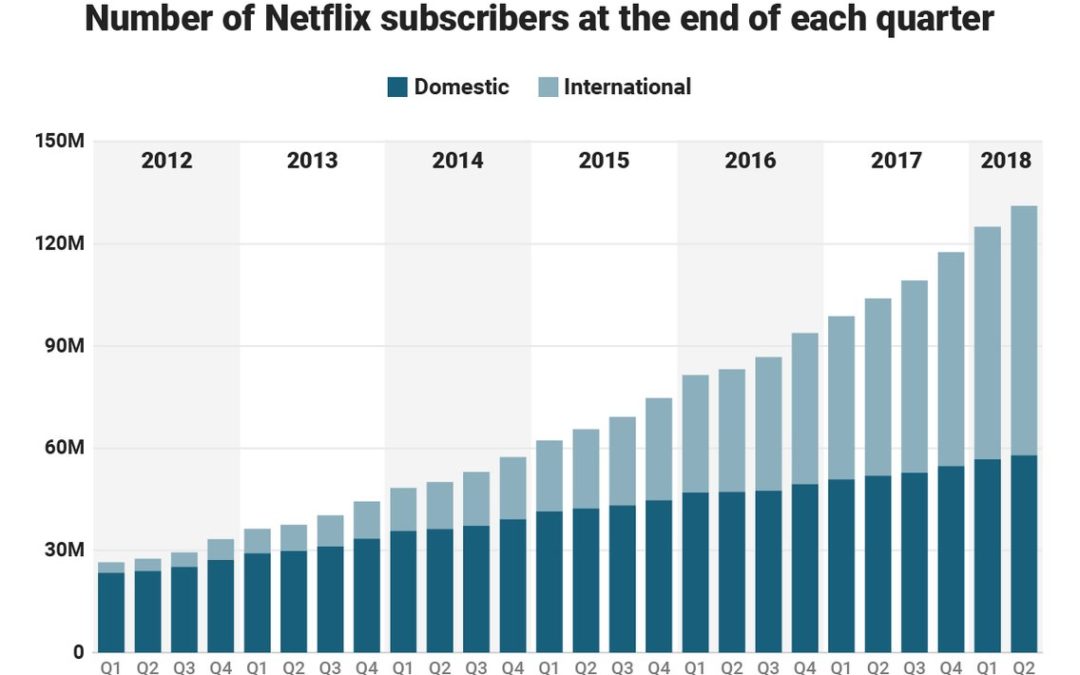

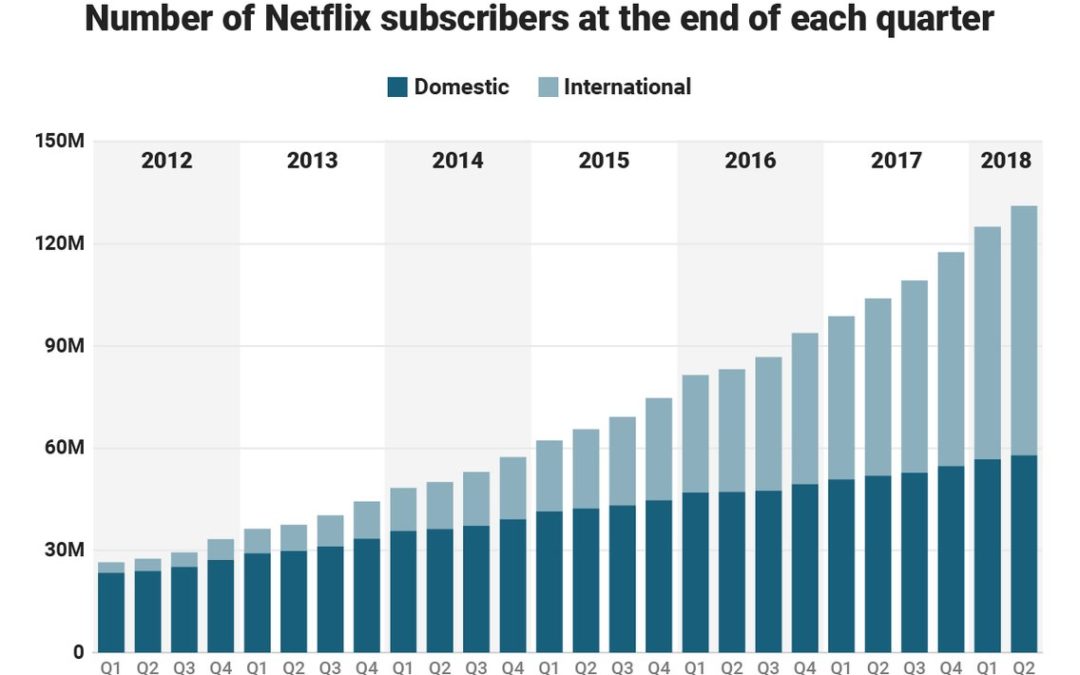

Netflix announced new subscriber numbers last week – and it exceeded expectations. Netflix now has over 130 million worldwide subscribers. This is up 480% in just the last 6 years – from under 30 million. Yes, the USA has grown substantially, more than doubling during this timeframe. But international growth has been spectacular, growing from almost nothing to 57% of total revenues. International growth the last year was 70%, and the contribution margin on international revenues has transitioned from negative in 2016 to over 15% – double the 4th quarter of 2017.

Accomplishing this is a remarkable story. Most companies grow by doing more of the same. Think of Walmart that kept adding stores. Then adding spin-off store brand Sam’s Club. Then adding groceries to the stores. Walmart never changed its strategy, leaders just did “more” with the old strategy. That’s how most people grow, by figuring out ways to make the Value Delivery System (in their case retail stores, warehouses and trucks) do more, better, faster, cheaper. Walmart never changed its strategy.

But Netflix is a very different story. The company started out distributing VHS tapes, and later DVDs, to homes via USPS, UPS and Fedex. It was competing with Blockbuster, Hollywood Video, Family Video and other traditional video stores. It won that battle, driving all of them to bankruptcy. But then to grow more Netflix invested far outside its “core” distribution skills and pioneered video streaming, competing with companies like DirecTV and Comcast. Eventually Netflix leaders raised prices on physical video distribution, cannibalizing that business, to raise money for investing in streaming technology. Streaming technology, however, was not enough to keep growing subscribers. Netflix leadership turned to creating its own content, competing with moviemakers, television and documentary producers, and broadcast television. The company now spends over $6B annually on content.

Think about those decisions. Netflix “pivoted” its strategy 3 times in one decade. Its “core” skill for growth changed from physical product distribution to network technology to content creation. From a “skills” perspective none of these have anything in common.

Could you do that? Would you do that?

How did Netflix do that? By focusing on its Value Proposition. By realizing that it’s Value Proposition was “delivering entertainment” Netflix realized it had to change its skill set 3 times to compete with market shifts. Had Netflix not done so, its physical distribution would have declined due to the emergence of Amazon.com, and eventually disappeared along with tapes and DVDs. Netflix would have followed Blockbuster into history. And as bandwidth expanded, and global networks grew, and dozens of providers emerged streaming purchased content profits would have become a bloodbath. Broadcasters who had vast libraries of content would sell to the cheapest streaming company, stripping Netflix of its growth. To continue growing, Netflix had to look at where markets were headed and redirect the company’s investments into its own content.

This is not how most companies do strategy. Most try to figure out one thing they are good at, then optimize it. They examine their Value Delivery System, focus all their attention on it, and entirely lose track of their Value Proposition. They keep optimizing the old Value Delivery System long after the market has shifted. For example, Walmart was the “low cost retailer.” But e-commerce allows competitors like Amazon.com to compete without stores, without advertising and frequently without inventory (using digital storefronts to other people’s inventory.) Walmart leaders were so focused on optimizing the Value Delivery System, and denying the potential impact of e-commerce, that they did not see how a different Value Delivery System could better fulfill the initial Walmart Value Proposition of “low cost.” The Walmart strategy never took a pivot – and now they are far, far behind the leader, and rapidly becoming obsolete.

Do you know your Value Proposition? Is it clear – written on the wall somewhere? Or long ago did you stop thinking about your Value Proposition in order to focus your intention on optimizing your Value Delivery System?

That fundamental strategy flaw is killing companies right and left – Radio Shack, Toys-R-Us and dozens of other retailers. Who needs maps when you have smartphone navigation? Smartphones put an end to Rand McNally. Who needs an expensive watch when your phone has time and so much more? Apple Watch sales in 2017 exceeded the entire Swiss watch industry. Who needs CDs when you can stream music? Sony sales and profits were gutted when iPods and iPhones changed the personal entertainment industry. (Anyone remember “boom boxes” and “Walkman”?)

I’ve been a huge fan of Netflix. In 2010, I predicted it was the next Apple or Google. When the company shifted strategy from delivering physical entertainment to streaming in 2011, and the stock tanked, I made the case for buying the stock. In 2015 when the company let investors know it was dumping billions into programming I again said it was strategically right, and recommended Netflix as a good investment. And I redoubled my praise for leadership when the “double pivot” to programming was picking up steam in 2016. You don’t have to be mystical to recognize a winner like Netflix, you just have to realize the company is using its strategy to deliver on its Value Proposition, and is willing to change its Value Delivery System because “core strength” isn’t important when its time to change in order to meet new market needs.

by Adam Hartung | Feb 13, 2018 | Entertainment, Innovation, Investing, Television, Web/Tech

On January 23 Netflix’ value rose to $100B. The stock is now trading north of $250/share. A year ago it was $139/share. An 80% increase in just 12 months. And long-term investors have done very well. Five years ago (January, 2013) the stock was trading at $24/share – so the valuation has increased 10-fold in 5 years! A decade ago it was trading for $3/share – so if you got in early (NFLX went public in June, 2002) you are up 83X your initial investment (meaning $1,000 would be worth $83,000.)

Back in 2004 I wrote that Blockbuster was dead meat – because by going after streaming Netflix would make Blockbuster obsolete. Netflix was using external data to project its future, and thus its strategy was not to defend & extend its DVD rental business but to spend strongly to grow the replacement. In 2010 I wrote that Netflix had projected the complete demise of DVDs by 2013, and was thus investing all its resources into streaming in order to be the market leader. At the time NFLX was $15.68. Over the next year it took off, tripling in value to $42.16. By cannibalizing DVDs it’s strategy was to leave its competition in a dying marketplace.

But, investors weren’t as sure of the Netflix strategy as I was. They feared cannibalizing DVDs would cut out the “core” of Netflix and kill the company. By October, 2011 the stock had tumbled to $12 (a drop of over 70%.) But, with the stock at new lows after a year of declines I optimistically wrote “The Case for Buying Netflix. Really.” I told readers the stock analysts were wrong, and the Netflix strategy was spot-on.

Netflix went nowhere for the next year, trading between $9 and $12. But then in December, 2012 investors started seeing the results of Netflix strategy, with fast growing streaming subscriber rates. By January, 2014 the stock was trading north of $52, so those who bought when my article published made a 400% return in just over 2 years! By March, 2015 NFLX was up another 23%, to $62 when I told readers “Netflix Valuation Was Not a House of Cards.” The Netflix strategy to dominate streaming by offering its own content may have shocked a lot of people, due to the investment size, but it was the strategy that would allow Netflix to grow subscribers globally. That has driven the last jump, to $250 in just under 3 years – another 400%+ return!

Strategy matters- to company performance, and thus long-term investor returns. Netflix has been a volatile stock, and it has had plenty of naysayers. These were people looking only short-term, and fearful of strategic pivots that have proven highly valuable. If you want your company, and your investment portfolio, to succeed it is imperative you understand external trends and use them to develop the right strategy. And heed my forecasts.

by Adam Hartung | Sep 29, 2017 | Entertainment, Politics, Sports, Trends

LANDOVER, MD – SEPTEMBER 24: Washington Redskins players link arms during the national anthem before their game against the Oakland Raiders at FedExField on September 24, 2017 in Landover, Maryland. (Photo by Patrick Smith/Getty Images)

A recent top news story has been NFL players kneeling during the national anthem. The controversy was amplified when President Trump weighed in with objections to this behavior, and his recommendation that the NFL pass a rule disallowing it. This kind of controversy doesn’t make life easier for NFL leaders, but it really isn’t their biggest problem. Ratings didn’t start dropping recently, viewership has been declining since 2015.

NFL ratings stalled in 2015

NFL viewership had a pretty steady climb through 2014. But in 2015 ratings leveled. Then in 2016 viewership fell a whopping 9%. During the first 6 weeks of the 2016 regular season (into early October)viewership was down 11%. Through the first 9 weeks of 2016 ratings were down 14% before things finally leveled off. Although nobody had a clear explanation why viewership declined so markedly, there was widespread agreement that 2016 was a ratings crash for the league. Fox had its worst NFL viewership since 2008, and ESPN had its worst since 2005.

Interestingly, later analysis showed that overall people were watching 5% more games. But they were watching less of each game. In other words, fans had become more casual about their viewership. People were watching less TV, watching less cable, and that included live sports. And those who stream games almost never streamed the entire game.

And this behavior change wasn’t limited to the NFL. As reported at Politifact.com, Paulsen, editor in chief of Sports Media Watch said, “it’s really important to note the NFL is not declining while other leagues are increasing. NASCAR ratings are in the cellar right now. The NBA had some of its lowest rated games ever on network television last year… It’s an industry-wide phenomenon and the NFL isn’t immune to it anymore.” So the declining viewership problem is widespread, and much older than the recent national anthem controversy.

Live sports is not attracting new, younger viewers

Magna Global recently released its 2017 U.S. Sports Report. According to Radio + Television Business Report (RBR.com) the age of live sports viewers is scewing older. Much older. Today the average NFL viewer is at least 50. Similar to tennis, and college basketball and football. That’s second only to baseball at 57 – which was 50 as recently as 2000. But no sport is immune. NHL viewers are now typically 49. They were 33 in 2000. As simple arithmetic shows, the same folks are watching hockey but few new viewers are being attracted. Based on recent trends, Magna projects viewership for the Sochi Olympics and 2018 World Cup will both decline.

I’ve written before about the importance of studying demographic trends when planning. These trends are highly reliable, even if boring. And they provide a lot of insight. In the case of live sports watching, younger people simply don’t sit down and watch a complete game. Younger people have different behaviors. They watch an entire season of shows in one day. They multi-task, doing many things at once. And they prefer information in short bursts – like weekly blogs rather than a book. And they are more interested in outcomes, the final result, than watching how it happened. Where older people watch a game play-by-play, younger people simply want to know the major events and the final score.

To understand what’s happening with NFL ratings we really don’t have to look much further than simple demographics — the aging of the U.S. population — and the change in viewing behavior from older groups to younger groups.

Unfortunately, according to a recent CNN poll, while 56% of people under age 45 think the recent demonstrations are the right thing to do, 59% of those over 45 say the demonstrations are wrong. In its “core” NFL viewership folks don’t like the kneeling, so it would appear the NFL should heed the President’s advice. But, looking down the road, the NFL won’t succeed unless it finds a way to attract a younger audience. With younger people approving the demonstrations NFL leadership risks throwing the baby out with the bathwater if they knee-jerk control player behavior.

Understanding customer demographic trends, and adapting, is crucial to success

The demonstrations are interesting as an expression of American ideals. And they are gathering a lot of discussion. But they are not what’s plaguing NFL viewership. Today the NFL has a much bigger task of making changes to attract young people as viewers. Should leaders shorten the game’s length? Should they change rules to increase scoring and create more excitement during the game? Should they invest in more apps to engage viewers in play-by-play activity? Should they seek out ways to allow more gambling during the game? Whatever leadership does, the traditions of the NFL need to be tested and altered in order to attract new people to watching the game if they want to preserve the advertising dollars that make it a success.

When your business falters, do you look at long-term trends, or react to a short-term event? It’s easy for politicians and newscasters to focus on the short-term, creating headlines and controversy. But business leaders have an obligation to look much deeper, and longer term. It is critical we move beyond “that’s the way the game is played” to looking at how the game may need to change in order to remain relevant and engage new customers.

Note how boxing recently brought in a mixed martial arts fighter to take on the world champion. The outcome was nearly a foregone conclusion, but nobody cared because it brought in people to a boxing match that otherwise would not have been there. If you don’t recognize demographic shifts, and take actions to meet emerging trends you risk becoming as left behind as cricket, badminton, horseshoes, bocce ball and darts.

by Adam Hartung | Sep 28, 2017 | Entertainment, Leadership, Politics, Trends

Photo: NEW YORK, NY – FEBRUARY 19: Writers and crew of ‘The Late Show with Stephen Colbert’ attend 69th Writers Guild Awards New York Ceremony at Edison Ballroom on February 19, 2017 in New York City. (Photo by Nicholas Hunt/Getty Images)

The Late Show hosted by Stephen Colbert is now the #1 program in late night television. This come-from-far-behind change in market leadership, overtaking The Tonight Show hosted by Jimmy Fallon, is not about politics. It is about understanding trends and using them to create value.

Back in February, 2014 there was real concern about the future of late night television. Audiences had peaked decades before, when Nightline was huge and competed with The Tonight Show hosted by legend Johnny Carson. By 2014 many wondered if American programming after the late news was all shifting to cable TV as audiences continued shrinking. Producers replaced Jay Leno with Jimmy Fallon in order to revitalize viewers. Jimmy Kimmel was moved up in time as ABC killed Nightline, hoping he could carve out a growing niche. And David Letterman, late night’s senior statesman, was about to be replaced by cable satirist Stephen Colbert. But these changes gathered little industry interest, because the time slots simply were not doing well for broadcasters – or advertisers.

Fallon maintained a dominant lead in the time slot as Colbert’s first year was a yawner.

As

TheWrap.com reported in September, 2016, despite the fanfare of Colbert taking over hosting, he “posed no threat whatsoever to Jimmy Fallon.” Fallon’s show maintained a huge lead. With 3.65 million viewers it bested

The Late Show by over 800,000. Colbert, with 2.82 million viewers seemed mostly trying to keep a lead over Kimmel’s 2.3 million viewers.

ANDREW LIPOVSKY/NBC/NBCU PHOTO BANK VIA GETTY IMAGES

Meanwhile the producers at The Late Show kept their eyes on the mood of the electorate.

They had largely let Colbert promote Democrat Clinton, and even though she lost the election noted she had won the popular vote. As Colbert continued to criticize the President, his audience grew. Soon, Colbert was beating Fallon in total audience – something nobody predicted just a few months earlier. It was quite a surprise when the 2016-2017 September to May season drew to a close and it was discovered that Colbert actually won the time slot, producing a larger total audience than Fallon. It was only about 20,000 – but it was a win few saw coming.

The Late Show writers and producers noted the historic and growing unpopularity of President Trump, and the public interest in ongoing investigations, and built the headlines into the show. Variety headlined on 7/25/17 “Stephen Colbert’s Russia Week Lofts Late Show to Biggest Weekly Win Ever.” Using audience trends The Late Showdevoted a week to a comical look at Russia, which saw it generate a 2.87million total audience in comparison to The Tonight Show‘s 2.42million – a beat of a whopping 450,000 viewers.

All of this is very good news for CBS.

NBC (NBC/Universal is a division of Comcast) is not losing money on The Tonight Show. And in the desirable segment of those age 18-49 Fallon still has the largest audience. But, it is a good thing for CBS to have so many new viewers. It brings in more advertisers, and higher revenues for each ad. This leads to more profits.

One might say that this is all about the hosts, and their political leanings. Maybe the content is driven by host opinions. But CBS is winning viewers because it is following trends, and matching its programming to trends. This is growing its late night audience, while NBC’s is shrinking.

Steve Burke, chief executive of NBC Universal was quoted in the New York Times saying “I think the answer is for Jimmy to be Jimmy.” Sounds like what a father might say about his son when the boy finds himself in a rough patch. But I’m not so sure its the position a company CEO should take regarding a very expensive employee in the lead of a major project.

Maybe NBC’s producers should spend more time looking at trends, and figuring out how to program content that will improve The Tonight Show‘s competitiveness. The show was upended in just one year. What will total audience look like next May when the 2017-2018 season ends? Will revenues and profits be unaffected if NBC’s audience keeps falling while CBS’s keeps growing?

For the rest of us, the lesson should be clear. Nobody is relegated to always being #2. Regardless the leader’s size, if you study trends and figure out how to leverage them you can grow, and you can become #1.

Understanding trends and applying them to your business is the best way to invigorate growth and improve your competitiveness.

by Adam Hartung | Jul 15, 2016 | Defend & Extend, Entertainment, Games, Innovation, Lock-in, Mobile, Trends

Poke’Mon Go is a new sensation. Just launched on July 6, the app is already the #1 app in the world – and it isn’t even available in most countries. In less than 2 weeks, from a standing start, Nintendo’s new app is more popular than both Facebook and Snapchat. Based on this success, Nintendo’s equity valuation has jumped 90% in this same short time period.

Some think this is just a fad, after all it is just 2 weeks old. Candy Crush came along and it seemed really popular. But after initial growth its user base stalled and the valuation fell by about 50% as growth in users, time on app and income all fell short of expectations. And, isn’t the world of gaming dominated by the likes of Sony and Microsoft?

Some think this is just a fad, after all it is just 2 weeks old. Candy Crush came along and it seemed really popular. But after initial growth its user base stalled and the valuation fell by about 50% as growth in users, time on app and income all fell short of expectations. And, isn’t the world of gaming dominated by the likes of Sony and Microsoft?

A bit of history

Nintendo launched the Wii in 2006 and it was a sensation. Gamers could do things not previously possible. Unit sales exceeded 20m units/year for 2006 through 2009. But Sony (PS4) and Microsoft (Xbox) both powered up their game consoles and started taking share from Nintendo. By 2011 Nintendo sale were down to 11.6m units, and in 2012 sales were off another 50%. The Wii console was losing relevance as competitors thrived.

Sony and Microsoft both invested heavily in their competition. Even though both were unprofitable at the business, neither was ready to concede the market. In fall, 2014 Microsoft raised the competitive ante, spending $2.5B to buy the maker of popular game Minecraft. Nintendo was becoming a market afterthought.

Meanwhile, back in 2009 Nintendo had 70% of the handheld gaming market with its 3DS product. But people started carrying the more versatile smartphones that could talk, text, email, execute endless apps and even had a lot of games – like Tetrus. The market for handheld games pretty much disappeared, dealing Nintendo another blow.

Competitor strategic errors

Fortunately, the bitter “fight to the death” war between Sony and Microsoft kept both focused on their historical game console business. Both kept investing in making the consoles more powerful, with more features, supporting more intense, lifelike games. Microsoft went so far as to implement in Windows 10 the capability for games to be played on Xbox and PCs, even though the PC gaming market had not grown in years. These massive investments were intended to defend their installed base of users, and extend the platform to attract new growth to the traditional, nearly 4 decade old market of game consoles that extends all the way back to Atari.

Both companies did little to address the growing market for mobile gaming. The limited power of mobile devices, and the small screens and poor sound systems made mobile seem like a poor platform for “serious gaming.” While game apps did come out, these were seen as extremely limited and poor quality, not at all competitive to the Sony or Microsoft products. Yes, theoretically Windows 10 would make gaming possible on a Microsoft phone. But the company was not putting investment there. Mobile gaming was simply not serious, and not of interest to the two Goliaths slugging it out for market share.

Building on trends makes all the difference

Back in 2014 I recognized that the console gladiator war was not good for either big company, and recommended Microsoft exit the market. Possibly seeing if Nintendo would take the business in order to remove the cash drain and distraction from Microsoft. Fortunately for Nintendo, that did not happen.

Nintendo observed the ongoing growth in mobile gaming. While Candy Crush may have been a game ignored by serious gamers, it nonetheless developed a big market of users who loved the product. Clearly this demonstrated there was an under-served market for mobile gaming. The mobile trend was real, and it’s gaming needs were unmet.

Simultaneously Nintendo recognized the trend to social. People wanted to play games with other people. And, if possible, the game could bring people together. Even people who don’t know each other. Rather than playing with unseen people located anywhere on the globe, in a pre-organized competition, as console games provided, why not combine the social media elements of connecting with those around you to play a game? Make it both mobile, and social. And the basics of Poke’Mon Go were born.

Then, build out the financial model. Don’t charge to play the game. But once people are in the game charge for in-game elements to help them be more successful. Just as Facebook did in its wildly successful social media game Farmville. The more people enjoyed meeting other people through the game, and the more they played, the more they would buy in-app, or in-game, elements. The social media aspect would keep them wanting to stay connected, and the game is the tool for remaining connected. So you use mobile to connect with vastly more people and draw them together, then social to keep them playing – and spending money.

The underserved market is vastly larger than the over-served market

Nintendo recognized that the under-served mobile gaming market is vastly larger than the overserved console market. Those console gamers have ever more powerful machines, but they are in some ways over-served by all that power. Games do so much that many people simply don’t want to take the time to learn the games, or invest in playing them sitting in a home or office. For many people who never became serious gaming hobbyists, the learning and intensity of serious gaming simply left them with little interest.

But almost everyone has a mobile phone. And almost everyone does some form of social media. And almost everyone enjoys a good game. Give them the right game, built on trends, to catch their attention and the number of potential customers is – literally – in the billions. And all they have to do is download the app. No expensive up-front cost, not much learning, and lots of fun. And thus in two weeks you have millions of new users. Some are traditional gamers. But many are people who would never be a serious gamer – they don’t want a new console or new complicated game. People of all ages and backgrounds could become immediate customers.

David can beat Goliath if you use trends

In the Biblical story, smallish David beat the giant Goliath by using a sling. His new technology allowed him to compete from far enough away that Goliath couldn’t reach David. And David’s tool allowed for delivering a fatal blow without ever touching the giant. The trend toward using tools for hunting and fighting allowed the younger, smaller competitor to beat the incumbent giant.

In business trends are just as important. Any competitor can study trends, see what people want, and then expand their thinking to discover a new way to compete. Nintendo lost the console war, and there was little value in spending vast sums to compete with Sony and Microsoft toe-to-toe. Nintendo saw the mobile game market disintegrate as smartphones emerged. It could have become a footnote in history.

But, instead Nintendo’s leaders built on trends to deliver a product that filled an unmet need – a game that was mobile and social. By meeting that need Nintendo has avoided direct competition, and found a way to dramatically grow its revenues. This is a story about how any competitor can succeed, if they learn how to leverage trends to bring out new products for under-served customers, and avoid costly gladiator competition trying to defend and extend past products.

Some think this is just a fad, after all it is just 2 weeks old. Candy Crush came along and it seemed really popular. But after initial growth its

Some think this is just a fad, after all it is just 2 weeks old. Candy Crush came along and it seemed really popular. But after initial growth its