by Adam Hartung | May 30, 2017 | Innovation, Lifecycle

Last week Microsoft announced its new Surface Pro 5 tablet would be available June 15. Did you miss it? Do you care?

Do you remember when it was a big deal that a major tech company released a new, or upgraded, device? Does it seem like increasingly nobody cares?

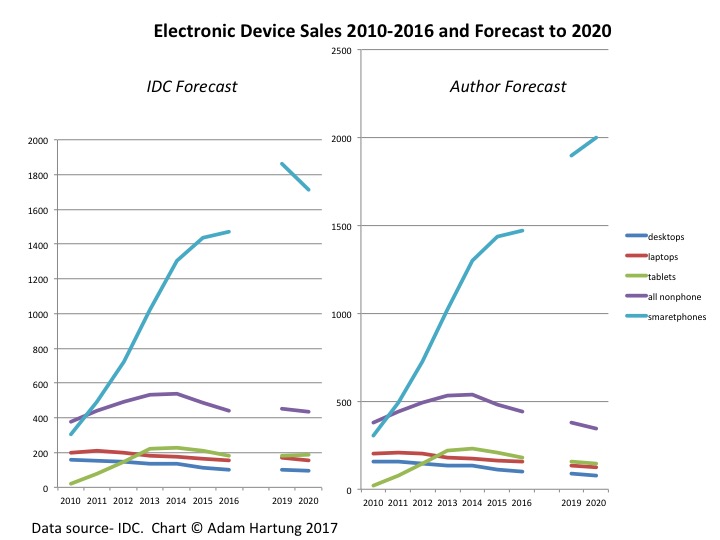

Non-phone device sales are declining, while smartphone sales accelerate

This chart compares IDC sales data, and forecasts, with adjustments to the forecast made by the author. The adjustments offer a fix to IDC’s historical underestimates of PC and tablet sales declines, while simultaneously underestimating sales growth in smartphones.

Since 2010 people are buying fewer desktops and laptops. And after tablet sales ramped up through 2013, tablet purchases have declined precipitously as well. Meanwhile, since 2014 sales of smartphones have doubled, or more, sales of all non-phone devices. And it’s also pretty clear that these trends show no signs of changing.

Why such a stark market shift? After all desktop and laptop sales grew consistently for some 3 decades. Why are they in such decline? And why did the tablet market make such a rapid up, then down movement? It seems pretty clear that people have determined they no longer need large internal hard drives to work locally, nor big keyboards and big screens of non-phone devices. Instead, they can do so much with a phone that this device is becoming the only one they need.

Today a new desktop starts at $350-$400. Laptops start as low as $180, and pretty powerful ones can be had for $500-$700. Tablets also start at about$180, and the newest Microsoft Surface 5 costs $800. Smartphones too start at about $150, and top of the line are $600-$800. So the purchase decision today is not based on price. All devices are more-or-less affordable, and with a range of capabilities that makes price not the determining factor.

Smartphones let most people do most of what they need to do

Every month the Internet-of-Things (IoT) is putting more data in the cloud. And developers are figuring out how to access that data from a smartphone. And smartphone apps are making it increasingly easy to find data, and interact with it, without doing a lot of typing. And without doing a lot of local processing like was commonplace on PCs. Instead, people access the data – whether it is financial information, customer sales and order data, inventory, delivery schedules, plant performance, equipment performance, maintenance specs, throughput, other operating data, web-based news, weather, etc. — via their phone. And they are able to analyze the data with apps they either buy, or that their companies have built or purchased, that don’t rely on an office suite.

Additionally, people are eschewing the old forms of connecting — like email, which benefits from a keyboard — for a combination of texting and social media sites. Why type a lot of words when a picture and a couple of emojis can do the trick?

And nobody listens to CD-based, or watches DVD-based, entertainment any longer. They either stream it live from an app like Pandora, Spotify, StreamUp, Ustream, GoGo or Facebook Live, or they download it from the cloud onto their phone.

To obtain additional insight into just how prevalent this shift to smartphones has become look beyond the USA. According to IDC there are about 1.8 billion smartphone users globally. China has nearly 600M users, and India has over 300 million users — so they account for at least half the market today. And those markets are growing by far the fastest, increasing purchases every quarter in the range of 15-25% more than previous years.

Chinese manufacturers are rapidly catching up to Apple and Samsung – there will be losers

Clayton Christensen often discusses how technology developers “overshoot” user needs. Early market leaders keep developing enhancements long after their products do all people want, producing upgrades that offer little user benefit. And that has happened with PCs and most tablets. They simply do more than people need today, due to the capabilities of the cloud, IoT and apps. Thus, in markets like China and India we see the rapid uptake of smartphones, while demand for PCs, laptops and tablets languish. People just don’t need those capabilities when the smartphone does what they want — and provides greater levels of portability and 24×7 access, which are benefits greatly treasured.

And that is why companies like Microsoft, Dell and HP really have to worry. Their “core” products such as Windows, Office, PCs, laptops and tablets are getting smaller. And these companies are barely marginal competitors in the high growth sales of smartphones and apps. As the market shifts, where will their revenues originate? Cloud services, versus Amazon AWS? Game consoles?

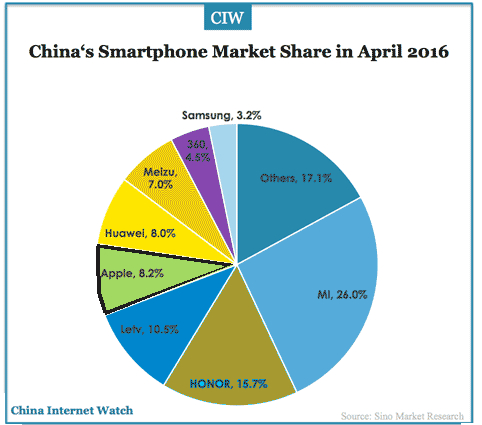

Even Apple and Samsung have reasons to worry. In China Apple has 8.4% market share, while Samsung has 6%. But the Chinese suppliers Oppo, Vivo, Huawei and Xiaomi have 58.4%. And as 2016 ended Chinese manufacturers, including Lenovo, OnePlus and Gionee, were grabbing over 50% of the Indian market, while Samsung has about 20% and Apple is yet to participate. How long will Apple and Samsung dominate the global market as these Chinese manufacturers grow, and increase product development?

When looking at trends it’s easy to lose track of the forest while focusing on individual trees. Don’t become mired in the differences, and specs, comparing laptops, hybrids, tablets and smartphones. Recognize the big shift is away from all devices other than smartphones, which are constantly increasing their capabilities as cloud services and IoT grows. So buy what suits your, and your company’s, needs — without “overbuying” because capabilities just keep improving. And keep your eyes on new, emerging competitors because they have Apple and Samsung in their sites.

by Adam Hartung | Feb 15, 2017 | Marketing, Mobile, Retail, Web/Tech

(Photo by Andrew Burton/Getty Images)

Apple’s stock is on a tear. After languishing for well over a year, it is back to record high levels. Once again Apple is the most valuable publicly traded company in America, with a market capitalization exceeding $700 billion. And pretty overwhelmingly, analysts are calling for Apple’s value to continue rising.

But today’s Apple, and the Apple emerging for the future, is absolutely not the Apple which brought investors to this dance. That Apple was all about innovation. That Apple identified big trends – specifically mobile – then created products that turned the trend into enormous markets. The old Apple knew that to create those new markets required an intense devotion to product development, bringing new capabilities to products that opened entirely new markets where needs were previously unmet, and making customers into devotees with really good quality and customer service.

That Apple was built by Steve Jobs. Today’s Apple has been remade by Tim Cook, and it is an entirely different company.

Today’s Apple – the one today’s analysts love – is all about making and selling more iPhones. And treating those iPhone users as a “loyal base” to which they can sell all kinds of apps/services. Today’s Apple is about using the company’s storied position, and brand leadership, to milk more money out of customers that own their devices, and expanding into adjacent markets where the installed base can continue growing.

UBS likes Apple because they think the services business is undervalued. After noting that it today would stand alone as a Fortune 100 company, they expect those services to double in four years. Bernstein notes services today represents 11% of revenue, and should grow at 22% per year. Meanwhile they expect the installed base of iPhones to expand by 27% – largely due to offshore sales – adding further to services growth.

Analysts further like Apple’s likely expansion into India – a previously almost untapped market. CEO Cook has led negotiations to have Foxxcon and Wistron, the current Chinese-based manufacturers, open plants in India for domestic production of iPhones. This expansion into a new geographic market is anticipated to produce tremendous iPhone sales growth. Do you remember when, just before filing for bankruptcy, Krispy Kreme was going to keep up its valuation by expanding into China?

Of course, with so many millions of devices, it is expected that the apps and services to be deployed on those devices will continue growing. Likely exponentially. The iOS developer community has long been one of Apple’s great strengths. Developers like how quickly they can deploy new apps and services to the market via Apple’s sales infrastructure. And with companies the size of IBM dedicated to building enterprise apps for iOS the story heard over and again is about expanding the installed base, then selling the add-ons.

Gee, sounds a lot like the old “razors lead to razor blade sales” strategy – business innovation circa 1966.

Overall, doesn’t this sound a lot like Microsoft? Bill Gates founded a company that revolutionized computing with low-cost software on low-cast hardware that did just about anything you would want. Windows made life easy. Microsoft gave users office automation, databases and all the basic work tools. And when the internet came along Microsoft connected everyone with Internet Explorer – for free! Microsoft created a platform with Windows upon which hordes of developers could build special applications for dedicated markets.

Once this market was created, and pretty much monopolized by Microsoft CEO Gates turned the reigns over to CEO Steve Ballmer. And Mr. Ballmer maximized these advantages. He invested constantly in developing updates to Windows and Office which would continue to insure Microsoft’s market share against emerging competitors like Unix and Linux. The money was so good that over a decade money was poured into gaming, even though that business lost more money than it made in revenue – but who cared? There were occasional investments in products like tablets, hand-helds and phones, but these were merely attractions around the main show. These products came and went and, again, nobody really cared.

Ballmer optimized the gains from Microsoft’s installed base. And a lot – a lot – of money was made doing this. nvestors appreciated the years of ongoing profits, dividends – and even occasional special dividends – as the money poured in. Microsoft was unstoppable in personal computing. The only thing that slowed Microsoft down was the market shift to mobile, which caused the PC market to collapse as unit sales have declined for six straight years (PC sales in 2016 barely managed levels of 2006). But, for a goodly while, it was a great ride!

Today all one hears about at Apple is growing the installed base. Maximizing sales of iPhones. And then selling everyone services. Oh yeah, the Apple Watch came out. Sort of flopped. Nobody really seemed to care much. Not nearly as much as they cared about 2 quarters of sales declines in iPhones. And whatever happened to AppleTV? ApplePay? iBeacons? Beats? Weren’t those supposed to be breakthrough innovations to create new markets? Oh well, nobody seems to much care about those things any longer. Attractions around the main event – iPhones!

So now analysts today aren’t put in the mode of evaluating breakthrough innovations and trying to guess the size of brand new, never before measured markets. That was hard. Now they can be far more predictable forecasting smartphone sales and services revenue, with simulations up and down. And that means they can focus on cash flow. After all, Apple makes more cash than it makes profit! Apple has a $246 billion cash hoard. Most people think Berkshire Hathaway, led by famed investor Warren Buffett, spent $6.6 billion on Apple stock in 2016 because Berkshire sees Apple as a cash generation machine – sort of like a railroad! And if those meetings between CEO Cook and President Trump can yield a tax change allowing repatriation at a low rate then all that cash could lead to a big one time dividend!

And, most likely, the stock will go up. Most likely, a lot. Because for at least a while Apple’s iPhone business is going to be pretty good. And the services business is going to grow. It will be a lot like Microsoft – at least until mobile changed the business. Or, maybe like Xerox giving away copiers to obtain toner sales – until desktop publishing and email cratered the need for copiers and large printers. Or, going all the way back into the 1950s and 60s, when Multigraphics and AB Dick practically gave away small printers to get the ink and plate sales – until xerography crushed that business. Of course you couldn’t go wrong investing in Sears for years, because they had the store locations, they had the brands (Kenmore, Craftsman, et.al.,) they had the credit card services – until Wal-Mart and Amazon changed that game.

You see, that’s the problem with all of these sort of “milk the base” businesses. As the focus shifts to grow the base and add-on sales the company loses sight of customer needs. Innovation declines, then evaporates as everything is poured into maximizing returns from the “core” business. Optimization leads to a focus on costs, and price reductions. Arrogance, based on market leadership, emerges and customer service starts to wane. Quality falters, but is not considered as important because sales are so large.

These changes take time, and the business looks really good as profits and cash flow continue, so it is easy to overlook these cultural and organizational changes, and their potential negative impact. Many applaud cost reductions – remember the glee with which analysts bragged about the cost savings when Dell moved its customer service to India some 20 years ago?

Today we’re hearing more stories about long-term Apple customers who aren’t as happy as they once were.

Genius bar experiences aren’t always great. In a telling AdAge column one long-time Apple user discusses how he had two iPhones fail, and Apple could not replace them leaving the customer with no phone for two weeks – demonstrating a lack of planning for product failures and a lack of concern for customer service. And the same issues were apparent when his corporate Macbook Pro failed. This same corporate customer bemoans design changes that have led to incompatible dongles and jacks, making interoperability problematic even within the Apple line.

Meanwhile, over the last four years Apple has spent lavishly on a new corporate headquarters befitting the country’s most valuable publicly traded company. And Apple leaders have been obsessive about making sure this building is built right! Which sounds well and good, except this was a company that once put customers – and unearthing their hidden needs, wants and wishes – first. Now, a lot of attention is looking inward. Looking at how they are spending all that money from milking the installed base. Putting some of the best managers on building the building – rather than creating new markets.

Who was that retailer that was so successful that it built what was, at the time, the world’s tallest building? Oh yeah, that was Sears.

Markets always shift. Change happens. Today it happens faster than ever in history. And nowhere does change happen faster than in technology and consumer electronics. CEO Cook is leading like CEO Ballmer. He is maximizing the value, and profitability, of the Apple’s core product – the iPhone. And analysts love it. It would be wise to disavow yourself of any thoughts that Apple will be the innovative market creating Jobs/Ives organization it once was.

How long will this be a winning strategy? Your answer to that should determine how long you would like to be an Apple investor. Because some day something new will come along.

by Adam Hartung | Sep 14, 2016 | Immigration, In the Rapids, Innovation, Telecom, Trends

I’m amazed about Americans’ debate regarding immigration. And all the rhetoric from candidate Trump about the need to close America’s borders.

I was raised in Oklahoma, which prior to statehood was called The Indian Territory. I was raised around the only real Native Americans. All the rest of us are immigrants. Some voluntarily, some as slaves. But the fact that people want to debate whether we allow people to become Americans seems to me somewhat ridiculous, since 98% of Americans are immigrants. The majority within two generations.

Throughout America’s history, being an immigrant has been tough. The first ones had to deal with bad weather, difficult farming techniques, hostile terrain, wild animals – it was very difficult. As time passed immigrants continued to face these issues, expanding westward. But they also faced horrible living conditions in major cities, poor food, bad pay, minimal medical care and often abuse by the people already that previously immigrated.

Throughout America’s history, being an immigrant has been tough. The first ones had to deal with bad weather, difficult farming techniques, hostile terrain, wild animals – it was very difficult. As time passed immigrants continued to face these issues, expanding westward. But they also faced horrible living conditions in major cities, poor food, bad pay, minimal medical care and often abuse by the people already that previously immigrated.

And almost since the beginning, immigrants have been not only abused but scammed. Those who have resources frequently took advantage of the newcomers that did not. And this persists. Immigrants that lack a social security card are unable to obtain a driver’s license, unable to open bank accounts, unable to apply for credit cards, unable to even sign up for phone service. Thus they remain at the will of others to help them, which creates the opportunity for scamming.

Take for example an immigrant trying to make a phone call to his relatives back home. For most immigrants this means using a calling card. Only these cards are often a maze of fees, charges and complex rules that result in much of the card’s value being lost. A 10-minute call to Ghana can range from $2.86 to $8.19 depending on which card you use. This problem is so bad that the FCC has fined six of the largest card companies for misleading consumers about calling cards. They continue to advise consumers about fraud. And even Congress has held hearings on the problem.

One outcome of immigrants’ difficulties has been the ingenuity and innovativeness of Americans. To this day around the world people marvel at how clever Americans are, and how often America leads the world in developing new things. As a young country, and due to the combination of resources and immigrants’ tough situation, America frequently is first at developing new solutions to solve problems – many of which are problems that clearly affect the immigrant population.

So, back to that phone call. Some immigrants can use Microsoft Skype to talk with their relatives, using the Internet rather than a phone. But this requires the people back home have a PC and an internet connection. Both of which could be dicey. Another option would be to use something like Facebook’s WhatsApp, but this requires the person back home have either a PC or mobile device, and either a wireless connection or mobile coverage. And, again, this is problematic.

But once again, ingenuity prevails. A Romanian immigrant named Daniel Popa saw this problem, and set out to make communications better for immigrants and their families back home. In 2014 he founded QuickCall.com to allow users to make a call over wireless technology, but which can then interface with the old-fashioned wired (or wireless) telecom systems around the world. No easy task, since telephone systems are a complex environment of different international, national and state players that use a raft of different technologies and have an even greater set of complicated charging systems.

But this new virtual phone network, which links the internet to the traditional telecom system, is a blessing for any immigrant who needs to contact someone in a rural, or poor, location that still depends on phone service. If the person on the other end can access a WiFi system, then the calls are free. If the connection is to a phone system then the WiFi interface on the American end makes the call much cheaper – and performs far, far better than any other technology. QuickCall has built the carrier relationships around the world to make the connections far more seamless, and the quality far higher.

But like all disruptive innovations, the initial market (immigrants) is just the early adopter with a huge need. Being able to lace together an internet call to a phone system is pretty powerful for a lot of other users. Travelers heading to a remote location, like Micronesia, Africa or much of South America — and even Eastern Europe – can lower the cost of planning their trip and connect with locals by using QuickCall.com. And for most Americans traveling in non-European locations their cell phone service from Sprint, Verizon, AT&T or another carrier simply does not work well (if at all) and is very expensive when they arrive. QuickCall.com solves that problem for these travelers.

Small businesspeople who have suppliers, or customers, in these locations can use QuickCall.com to connect with their business partners at far lower cost. Businesses can even have their local partners obtain a local phone number via QuickCall.com and they can drive the cost down further (potentially to zero). This makes it affordable to expand the offshore business, possibly even establishing small scale customer support centers at the local supplier, or distributor, location.

In The Innovator’s Dilemma Clayton Christensen makes the case that disruptive innovations develop by targeting a customer with an unmet need. Usually the innovation isn’t as good as the current “standard,” and is also more costly. Today, making an international call through the phone system is the standard, and it is fairly cheap. But this solution is often unavailable to immigrants, and thus QuickCall.com fills their unmet need, and at a cost substantially lower than the infamous calling cards, and with higher quality than a pure WiFi option.

But now that it is established, and expanding to more countries – including developed markets like the U.K. – the technology behind QuickCall.com is becoming more mainstream. And its uses are expanding. And it is reducing the need for people to have international calling service on their wired or wireless phone because the available market is expanding, the quality is going up, and the cost is going down. Exactly the way all disruptive innovations grow, and thus threaten the entrenched competition.

The end-game may be some form of Facebook in-app solution. But that depends on Facebook or one of its competitors seizing this opportunity quickly, and learning all QuickCall.com already knows about the technology and customers, and building out that network of carrier relationships. Notice that Skype was founded in 2003, and acquired by Microsoft in 2011, and it still doesn’t have a major presence as a telecom replacement. Will a social media company choose to make the investment and undertake developing this new solution?

As small as QuickCall.com is – and even though you may have never heard of it – it is an example of a disruptive innovation that has been successfully launched, and is successfully expanding. It may seem like an impossibility that this company, founded by an immigrant to solve an unmet need of immigrants, could actually change the way everyone makes international calls. But, then again, few of us thought the iPhone and its apps would cause us to give up Blackberries and quit carrying our PCs around.

America is known for its ingenuity and innovations. We can thank our heritage as immigrants for this, as well as the immigrant marketplace that spurs new innovation. America’s immigrants have the need to succeed, and the unmet needs that create new markets for launching new solutions. For all those conservatives who fear “European socialism,” they would be wise to realize the tremendous benefits we receive from our immigrant population. Perhaps these naysayers should use QuickCall.com to connect with a few more immigrants and understand the benefits they bring to America.

by Adam Hartung | Jul 15, 2016 | Defend & Extend, Entertainment, Games, Innovation, Lock-in, Mobile, Trends

Poke’Mon Go is a new sensation. Just launched on July 6, the app is already the #1 app in the world – and it isn’t even available in most countries. In less than 2 weeks, from a standing start, Nintendo’s new app is more popular than both Facebook and Snapchat. Based on this success, Nintendo’s equity valuation has jumped 90% in this same short time period.

Some think this is just a fad, after all it is just 2 weeks old. Candy Crush came along and it seemed really popular. But after initial growth its user base stalled and the valuation fell by about 50% as growth in users, time on app and income all fell short of expectations. And, isn’t the world of gaming dominated by the likes of Sony and Microsoft?

Some think this is just a fad, after all it is just 2 weeks old. Candy Crush came along and it seemed really popular. But after initial growth its user base stalled and the valuation fell by about 50% as growth in users, time on app and income all fell short of expectations. And, isn’t the world of gaming dominated by the likes of Sony and Microsoft?

A bit of history

Nintendo launched the Wii in 2006 and it was a sensation. Gamers could do things not previously possible. Unit sales exceeded 20m units/year for 2006 through 2009. But Sony (PS4) and Microsoft (Xbox) both powered up their game consoles and started taking share from Nintendo. By 2011 Nintendo sale were down to 11.6m units, and in 2012 sales were off another 50%. The Wii console was losing relevance as competitors thrived.

Sony and Microsoft both invested heavily in their competition. Even though both were unprofitable at the business, neither was ready to concede the market. In fall, 2014 Microsoft raised the competitive ante, spending $2.5B to buy the maker of popular game Minecraft. Nintendo was becoming a market afterthought.

Meanwhile, back in 2009 Nintendo had 70% of the handheld gaming market with its 3DS product. But people started carrying the more versatile smartphones that could talk, text, email, execute endless apps and even had a lot of games – like Tetrus. The market for handheld games pretty much disappeared, dealing Nintendo another blow.

Competitor strategic errors

Fortunately, the bitter “fight to the death” war between Sony and Microsoft kept both focused on their historical game console business. Both kept investing in making the consoles more powerful, with more features, supporting more intense, lifelike games. Microsoft went so far as to implement in Windows 10 the capability for games to be played on Xbox and PCs, even though the PC gaming market had not grown in years. These massive investments were intended to defend their installed base of users, and extend the platform to attract new growth to the traditional, nearly 4 decade old market of game consoles that extends all the way back to Atari.

Both companies did little to address the growing market for mobile gaming. The limited power of mobile devices, and the small screens and poor sound systems made mobile seem like a poor platform for “serious gaming.” While game apps did come out, these were seen as extremely limited and poor quality, not at all competitive to the Sony or Microsoft products. Yes, theoretically Windows 10 would make gaming possible on a Microsoft phone. But the company was not putting investment there. Mobile gaming was simply not serious, and not of interest to the two Goliaths slugging it out for market share.

Building on trends makes all the difference

Back in 2014 I recognized that the console gladiator war was not good for either big company, and recommended Microsoft exit the market. Possibly seeing if Nintendo would take the business in order to remove the cash drain and distraction from Microsoft. Fortunately for Nintendo, that did not happen.

Nintendo observed the ongoing growth in mobile gaming. While Candy Crush may have been a game ignored by serious gamers, it nonetheless developed a big market of users who loved the product. Clearly this demonstrated there was an under-served market for mobile gaming. The mobile trend was real, and it’s gaming needs were unmet.

Simultaneously Nintendo recognized the trend to social. People wanted to play games with other people. And, if possible, the game could bring people together. Even people who don’t know each other. Rather than playing with unseen people located anywhere on the globe, in a pre-organized competition, as console games provided, why not combine the social media elements of connecting with those around you to play a game? Make it both mobile, and social. And the basics of Poke’Mon Go were born.

Then, build out the financial model. Don’t charge to play the game. But once people are in the game charge for in-game elements to help them be more successful. Just as Facebook did in its wildly successful social media game Farmville. The more people enjoyed meeting other people through the game, and the more they played, the more they would buy in-app, or in-game, elements. The social media aspect would keep them wanting to stay connected, and the game is the tool for remaining connected. So you use mobile to connect with vastly more people and draw them together, then social to keep them playing – and spending money.

The underserved market is vastly larger than the over-served market

Nintendo recognized that the under-served mobile gaming market is vastly larger than the overserved console market. Those console gamers have ever more powerful machines, but they are in some ways over-served by all that power. Games do so much that many people simply don’t want to take the time to learn the games, or invest in playing them sitting in a home or office. For many people who never became serious gaming hobbyists, the learning and intensity of serious gaming simply left them with little interest.

But almost everyone has a mobile phone. And almost everyone does some form of social media. And almost everyone enjoys a good game. Give them the right game, built on trends, to catch their attention and the number of potential customers is – literally – in the billions. And all they have to do is download the app. No expensive up-front cost, not much learning, and lots of fun. And thus in two weeks you have millions of new users. Some are traditional gamers. But many are people who would never be a serious gamer – they don’t want a new console or new complicated game. People of all ages and backgrounds could become immediate customers.

David can beat Goliath if you use trends

In the Biblical story, smallish David beat the giant Goliath by using a sling. His new technology allowed him to compete from far enough away that Goliath couldn’t reach David. And David’s tool allowed for delivering a fatal blow without ever touching the giant. The trend toward using tools for hunting and fighting allowed the younger, smaller competitor to beat the incumbent giant.

In business trends are just as important. Any competitor can study trends, see what people want, and then expand their thinking to discover a new way to compete. Nintendo lost the console war, and there was little value in spending vast sums to compete with Sony and Microsoft toe-to-toe. Nintendo saw the mobile game market disintegrate as smartphones emerged. It could have become a footnote in history.

But, instead Nintendo’s leaders built on trends to deliver a product that filled an unmet need – a game that was mobile and social. By meeting that need Nintendo has avoided direct competition, and found a way to dramatically grow its revenues. This is a story about how any competitor can succeed, if they learn how to leverage trends to bring out new products for under-served customers, and avoid costly gladiator competition trying to defend and extend past products.

by Adam Hartung | Jul 7, 2016 | Books, Entrepreneurship, Leadership, Marketing

Summer is here, and everyone needs a business book or two to read. I’m recommending The Founder’s Mentality – How To Overcome the Predictable Crises of Growth by two very senior partners and strategy practice heads at Bain & Company — Chris Zook and James Allen. Bain is one of the top three management consulting firms in the world, with 8,000 consultants in 55 offices, and has been ranked as one of the best places to work in America by Glass Ceiling.

Since both authors are still part of Bain, the book is somewhat bridled by their positions. No partner can bad mouth current or former clients, as it obviously could reveal confidential information — and it certainly isn’t good for finding new clients who would never want to risk being bad-mouthed by their consultant. So don’t expect a lambasting of poorly performing companies in this review of global cases. But after reviewing the work at their clients for over 20 years, and many other cases available via research, these fellows concluded that most companies lose the original founder’s mentality, get bound up in organizational complexity, and simply lose competitiveness due to the wrong internal focus. And they offer insights for how underperformers can regain a growth agenda.

Photo courtesy of Chris Zook

Moving From Mediocre To Good

I interviewed Chris Zook, and found him rather candid in his observations. When I asked why people should read The Founder’s Mentality I really liked his response, “Many people have read Good to Great. But, honestly, for many organizations the challenge today is simply to move from mediocre to good. They are struggling, and they need some straightforward advice on how to make progress toward growth when the situation likely appears almost impossible.”

You should read the book to understand the common root cause of corporate growth problems, and how a company can address those issues. This column offers some interesting thoughts from Chris about how to apply The Founder’s Mentality to eliminate unnecessary complexity and make your organization more successful.

Adam Hartung: What is the most critical step toward undoing needless, costly, time consuming complexity?

Chris Zook: The biggest problem is blockages built between the front line and the top staff. Honestly, the people at the top lose any sense of what is actually happening in the marketplace — what is happening with customers. 80% of the time successfully addressing this requires eliminating 30-40% of the staff. You need non-incremental change. Leaders have to get rid of managers wedded to past decisions, and intent on defending those decisions. Leaders have to get rid of those who focus on managing what exists, and find competent replacements who can manage a transition.

Hartung: Market shifts make companies non-competitive, why do you focus so much on internal organizational health?

Zook: You can’t respond to a market shift if the company is bound up in complex decision-making. Unless a leader attacks complexity, and greatly simplifies the decision-making process, a company will never do anything differently. Being aware of changes in the market is not enough. You have to internalize those changes and that requires reorganizing, and usually changing a lot of people. You won’t ever get the information from the front line to top management unless you change the internal company so that it is receptive to that information.

Hartung: You say simplification is critical to reversing a company’s stall-out. But isn’t focusing on the “core” missing market opportunities?

Zook: Analysts cheered Nardeli’s pro-growth actions at Home Depot. But the company stalled. The growth opportunities that external folks liked hearing about diverted attention from implementing what had made Home Depot great — the “orange army” of store employees that were so customer helpful. It is very, very hard to keep “growth projects” from diverting attention to good operations, and that’s why few founders are willing to chase those projects when someone brings them up for investment.

Hartung: You talk positively about Cisco and 3M, yet neither has done anything lately, in any market, to appear exemplary

Zook: It takes a long time to turn around a huge company. Cisco and 3M are still the largest in their defined markets, and profitable. Their long-term future is still to be determined, but so far they are making progress. Investors and market gurus look for turnarounds to happen fast, but that does not fit the reality of what it takes when these companies become very large.

Hartung: You talk about “Next Generation Leaders.” Isn’t that just more ageism? Aren’t you simply saying “out with the old leaders, you have to be young to “get it.”

Zook: Next Generation Leadership is not about age. It’s about mentality. It’s about being young, and flexible, in your thinking. What’s core to a company may well not be what a previous leader thinks, and a Next Gen Leader will dig out what’s core. For example, at Marvel the core was not comics. It was the raft of stories, all of which had the potential to be repurposed. Next Gen Leaders are using new eyes, dialed in with clarity to discover what is in the company that can be reused as the core for future growth. You don’t have to be young to do that, just mentally agile. Unfortunately, there aren’t nearly as many of these agile leaders as there are those stuck in the old ways of thinking.

Hartung: Give me your take on some big companies that aren’t in your book, but that are in the news today and on the minds of leaders and investors. Apply The Founder’s Mentality to these companies:

Microsoft

Zook: Did well due to its monopoly. Lost its Founder’s Mentality. Now suffering low growth rates relative to its industry, and in the danger zone of a growth stall-out. They have to refocus. Leadership needs to regain the position of attracting developers to their platform rather than being raided for developers by competitive platforms.

Apple

Zook: Jobs implemented The Founder’s Mentality brilliantly. Apple got close to its customers again with the retail stores, a great move to learn what customers really wanted, liked and would buy. But where will they turn next? Apple needs to make a big bet, and focus less on upgrades. They need to be thinking about a possible stall-out. But will Apple’s current leadership make that next big bet?

WalMart

Zook: One of the greatest founder-led companies of all time. Walton’s retail insurgency was unique, clear and powerful. Things appear to be a bit stale now, and the company would benefit from a refocusing on the insurgency mission, and taking it into renewal of the distribution system and all the stores.”

It’s been almost a decade since I wrote Create Marketplace Disruption – How To Stay Ahead of the Competition. In it I detailed how companies, in the pursuit of best practices build locked-in decision-making systems that perpetuate the past rather than prepare for the future. The Founder’s Mentality provides several case studies in how organizations, especially large ones, can attack that lock-in to rediscover what made them great and set a chart for a better future. Put it on your reading list for the next plane flight, or relaxation time on your holiday.

Throughout America’s history, being an immigrant has been tough. The first ones had to deal with bad weather, difficult farming techniques, hostile terrain, wild animals – it was very difficult. As time passed immigrants continued to face these issues, expanding westward. But they also faced horrible living conditions in major cities, poor food, bad pay, minimal medical care and often abuse by the people already that previously immigrated.

Throughout America’s history, being an immigrant has been tough. The first ones had to deal with bad weather, difficult farming techniques, hostile terrain, wild animals – it was very difficult. As time passed immigrants continued to face these issues, expanding westward. But they also faced horrible living conditions in major cities, poor food, bad pay, minimal medical care and often abuse by the people already that previously immigrated.

Some think this is just a fad, after all it is just 2 weeks old. Candy Crush came along and it seemed really popular. But after initial growth its

Some think this is just a fad, after all it is just 2 weeks old. Candy Crush came along and it seemed really popular. But after initial growth its