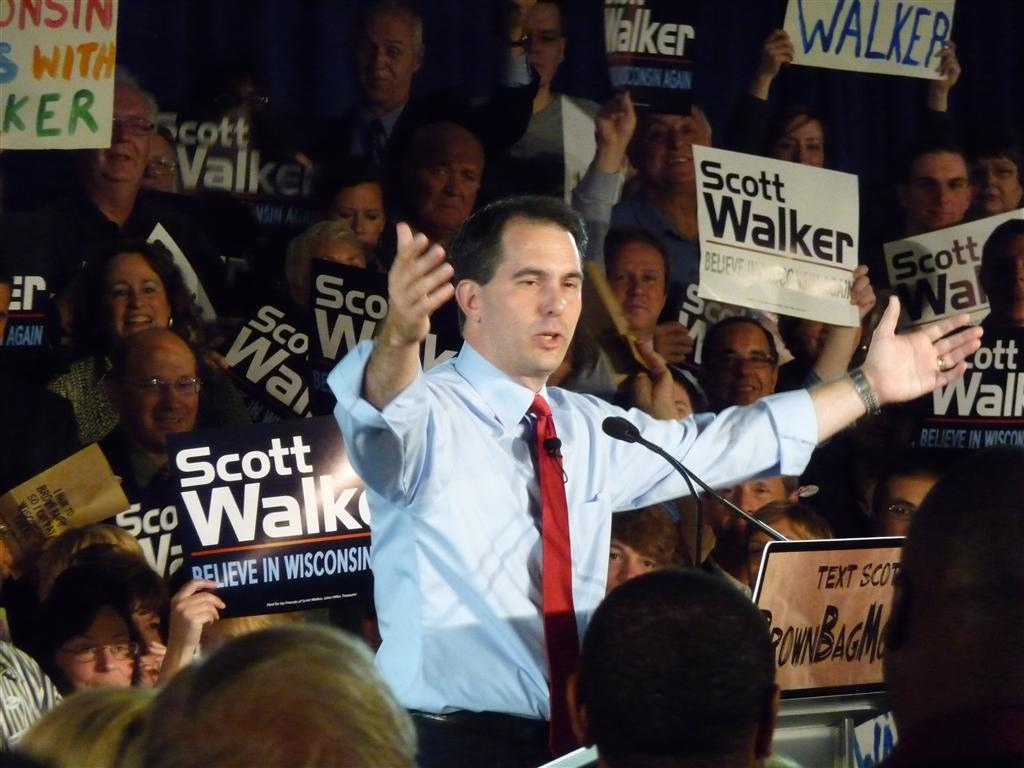

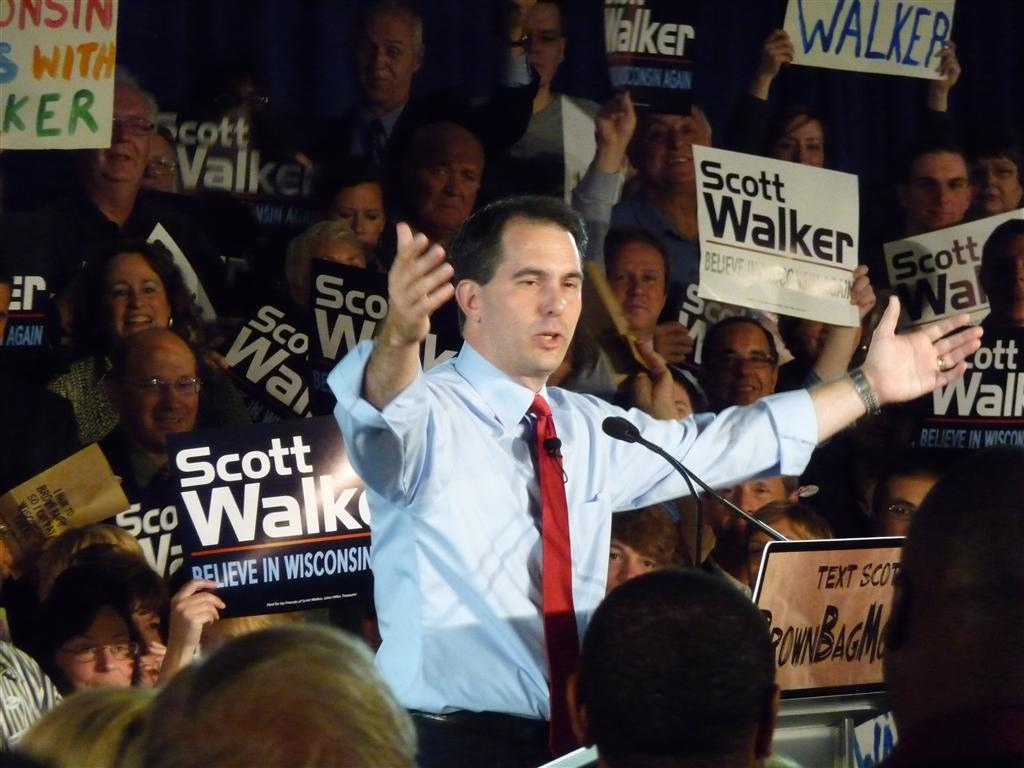

by Adam Hartung | Feb 18, 2015 | Current Affairs, Leadership

There has been a hullabaloo lately about Wisconsin Governor Walker’s lack of a degree. Some think this is a big deal, while others think almost nobody cares. In the end, we all should care about the formal education of any of our leaders. In government, business and elsewhere.

In Forbes magazine, 1998, famed management guru Peter Drucker wrote, “Get the assumptions wrong and everything that follows from them is wrong.” This is really important, because most leaders make most of their decisions based on assumptions. And many of those assumptions are based on how much, and how broad, that leader’s education.

We all make decisions on beliefs. It is easy to have incorrect beliefs. Early doctors believed that infections were due to bad blood, so they used bleeding as a cure-all for many wounds and illnesses. Untold millions of people died from this practice. A bad assumption, based on belief rather than formal study (in this case of the circulatory system) proved fatal.

In business, for thousands of years most sailors had no education about the curvature of the earth and its rotation the sun, thus they believed the world was flat and refused to sail further out to sea than the ability to keep their eyes on a shoreline. This limited trade, and delayed expansion into new markets.

Or, more recently, Steve Ballmer assumed that anyone using a smartphone would want a keyboard – because Blackberry dominated the market and had a keyboard. Thus he laughed at the iPhone launch. Oops. His assumption, and belief about the user experience, caused Microsoft to delay its entry into mobile markets and smartphones several years. Even though he had not studied smartphone user needs. Now Apple has half the smartphone market, while Blackberry and Microsoft each have less than 5%.

There are countless examples of bad decisions made when people use the wrong assumptions. At this time in Oklahoma, Texas and Colorado politicians are voting to refuse upgrading history education because the new curriculum is unacceptable to them. Their assumptions about America’s history are so strong that any factual evidence which might change those assumptions is so threatening that these politicians would prefer students be taught a fictitious history.

Our assumptions are built early in life. All through childhood our parents, aunts, uncles, religious leaders, mentors and teachers fill us with information. We process this information and build layers of assumptions. These assumptions help us to make decisions by allowing us to react based upon what we believe, rather than having to scurry around and do a research project every time a decision is required. Thus, the older we become the deeper these assumptions lie – and the more we rely on them as we undertake less and less education. As we age we decide based upon our beliefs, and less based upon any observable facts. Actually, we’ll often choose to ignore facts which indicate our assumptions and beliefs might be wrong (we call this a bias in others, and common sense when we do it ourselves.)

The more education you have, the more you can build assumptions that are likely to align with reality. It is no accident that the U.S. military uses education as a basis for promotions – rather than battlefield heroics. To move up requires officers go to war college and learn about history, politics, leadership and battles going back to long before the birth of Jesus. Good knowledge helps officers to be smarter about how to prepare for battle, organize for battle, conduct warfare, lead troops, treat a vanquished enemy and talk to the politicians for whom they work. Just look at the degrees amongst our military’s Colonels and General Officers and you find a plethora of masters and doctorate degrees. Education has long proven to be a superior warfare skill – especially when the enemy is operating on belief, guts and fight.

There are many accomplished people lacking degrees. But we should note they were successful very narrowly, and frequently in business. Steve Jobs, Bill Gates and Mark Zuckerberg are clearly high IQ people. But their success was based on founding a business at a time of technological revolution, and then building that business with zealousness. And the luck of being in the right place at the right time with a new piece of technology. They were/are not asked to be widely acclaimed in a broad spectrum of capabilities such as diplomacy, historical accuracy, legal limitations, cultural differences, the arts, scientific advances in multiple fields, warfare tactics, etc. They were not asked to develop a turnaround plan for a bankrupt auto manufacturer at the height of the Great Recession. For all their great wealth creation, they would not be what were once called “Renaissance men.”

When Governor Walker attacks the educated, and labels them as “elites,” it should be noted that their backgrounds often mean they have more points of view to evaluate, and are more considered about the various risks which are being created by taking any specific action. Many Harvard or Columbia MBAs could never be entrepreneurs because they see the many reasons a business would likely fail, and thus they are reticent to commit. Yet, that same wider knowledge allows them to be more thoughtful when evaluating the options and making decisions regarding opening new plants, negotiating with unions, expanding distribution and financing options.

Further, while it is true that you can be smart and not have a degree, the number of those who have degrees yet lack intelligence is a much, much smaller number. If one is to err in picking those you want to have advise you, or represent you, the degree(s) is not a bad first step toward identifying who is likely to provide the best insight and offer the most help.

Further, there is nothing about a degree which limits one’s ability to fight. Look at Senator Cruz from Texas. Senator Cruz’s politics seem to be somewhat aligned with Governor Walker’s, and he is widely acknowledged as a serious fighter, yet he boasts an undergraduate degree from Princeton as well as graduating from Harvard Law School. An educational background anyone would label as “elitist” and remarkably similar to President Obama’s – whose background Governor Walker has thoroughly maligned.

We expect our leaders to be widely read, and keenly aware of the complexities of life. We want our attorney’s to have law degrees and pass the bar exam. We want our physicians to have medical degrees and pass the Boards. Increasingly we want our business leaders to have MBAs. We understand that education informs our minds, and helps us develop assumptions for making good decisions. We should not belittle this, nor be accepting of someone who implies that lacking a formal education is meaningless.

by Adam Hartung | Nov 3, 2014 | Current Affairs, In the Rapids, Leadership, Web/Tech

On April 15 Zebra Technologies announced its planned acquisition of Motorola’s Enterprise Device Business. This was remarkable because it represented a major strategic shift for Zebra, and one that would take a massive investment in products and technologies which were wholly new to the company. A gutsy play to make Zebra more relevant in its B-2-B business as interest in its “core” bar code business was declining due to generic competition.

Last week the acquisition was completed. In an example of Jonah swallowing the whale, Zebra added $2.5B to annual revenues on its old base of $1B (2.5x incremental revenue,) an additional 4,500 employees joined its staff of 2,500 and 69 new facilities were added. Gulp.

As CEO Anders Gustafsson told me, “after the deal was agreed to I felt like the dog that caught the car. ”

Fortunately Zebra has a plan, and it is all around growth. Acquisitions led by private equity firms, hedge funds or leveraged buyout partners are usually quick to describe the “synergies” planned for after the acquisition. Synergy is a code word for massive cost cutting (usually meaning large layoffs,) selling off assets (from buildings to product lines and intellectual property rights) and shutting down what the buyers call “marginal” businesses. This always makes the company smaller, weaker and less likely to survive as the new investors focus on pulling out cash and selling the remnants to some large corporation.

There is no growth plan.

But Zebra has publicly announced that after this $3.25B investment they plan only $150M of savings over 2 years. Which means Zebra’s management team intends to grow what they bought, not decimate it. What a novel, or perhaps throwback, idea.

Minimal cost cutting reflects a deal, as CEO Gustafsson told me, “envisioned by management, not by bankers.”

Zebra’s management knew the company was frequently pitching for new work in partnership with Motorola. The two weren’t competitors, but rather two companies working to move their clients forward. But in a disorganized, unplanned way because they were two totally different companies. Zebra’s team recognized that if this became one unit, better planning for clients, the products could work better together, the solutions more directly target customer needs and it would be possible to slingshot forward ahead of competitors to grow revenues.

As CEO since 2007, Anders Gustafsson had pushed a strategy which could grow Zebra, and move the company outside its historical core business of bar code printers and readers. The leadership considered buying Symbol Technology, but wasn’t ready and watched it go to Motorola.

Then Zebra’s team knuckled down on their strategy work. CEO Gustafsson spelled out for me the 3 trends which were identified to build upon:

- Mobility would continue to be a secular growth trend. And business customers needed products with capabilities beyond the generic smart phone. For example, the kind of integrated data entry and printing device used at a remote rental car return. These devices drive business productivity, and customers hunger for such solutions.

- From the days of RFID, where Zebra was an early player, had emerged automatic data capture – which became what now is commonly called “The Internet of Things” – and this trend too had far to extend. By connecting the physical and digital worlds, in markets like retail inventory management, big productivity boosts were possible in formerly moribund work that added cost but little value.

- Cloud-based (SaaS and growth of lightweight apps) ecosystems were going to provide fast growth environments. Client need for capability at the employee’s (or their customer’s) fingertips would grow, and those people (think distributors, value added resellers [VARs]) who build solutions will create apps, accessible via the cloud, to rapidly drive customer productivity.

With this groundwork, the management team developed future scenarios in which it became increasingly clear the value in merging together with Motorola devices to accelerate growth. According to CEO Gustafsson, “it would bring more digital voice to the Zebra physical voice. It would allow for more complete product offerings which would fulfill critical, macro customer trends.”

But, to pull this off required selling the Board of Directors. They are ultimately responsible for company investments, and this was – as described above – a “whopper.”

The CEO’s team spent a lot of time refining the message, to be clear about the benefits of this transaction. Rather than pitching the idea to the Board, they offered it as an opportunity to accelerate strategy implementation. Expecting a wide range of reactions, they were not surprised when some Directors thought this was “phenomenal” while others thought it was “fraught with risk.”

So management agreed to work with the Board to undertake a thorough due diligence process, over many weeks (or months it turned out) to ask all the questions. A key executive, who was a bit skeptical in her own right, took on the role of the “black hat” leader. Her job was to challenge the many ideas offered, and to be a chronic skeptic; to not let the team become enraptured with the idea and thereby sell themselves on success too early, and/or not consider risks thoroughly enough. By persistently undertaking analysis, education led the Board to agree that management’s strategy had merit, and this deal would be a breakout for Zebra.

Next came completing financing. This was a big deal. And the only way to make it happen was for Zebra to take on far more debt than ever in the company’s history. But, the good news was that interest rates are at record low levels, so the cost was manageable.

Zebra’s leadership patiently met with bankers and investors to overview the market strategy, the future scenarios and their plans for the new company. They over and again demonstrated the soundness of their strategy, and the cash flow ability to service the debt. Zebra had been a smaller, stable company. The debt added more dynamism, as did the much greater revenues. The requirement was to decide if the strategy was soundly based on trends, and had a high likelihood of success. Quickly enough, the large shareholders agreed with the path forward, and the financing was fully committed.

Now that the acquisition is complete we will all watch carefully to see if the growth machine this leadership team created brings to market the solutions customers want, so Zebra can generate the revenue and profits investors want. If it does, it will be a big win for not only investors but Zebra’s employees, suppliers and the communities in which Zebra operates.

The obvious question has to be, why didn’t Motorola do this deal? After all, they were the whale. It would have been much easier for people to understand Motorola buying Zebra than the gutsy deal which ultimately happened.

Answering this question requires a lot more thought about history. In 2006 Motorola had launched the Razr phone and was an industry darling. Newly minted CEO Ed Zander started partnering with Google and Apple rather than developing proprietary solutions like Razr. Carl Icahn soon showed up as an activist investor intent on restructuring the company and pulling out more cash. Quickly then-CEO Ed Zander was pushed out the door. New leadership came in, and Motorola’s new product introductions disappeared.

Under pressure from Mr. Icahn, Motorola started shrinking under direction of the new CEO. R&D and product development went through many cuts. New product launches simply were delayed, and died. The cellular phone business began losing money as RIM brought to market Blackberry and stole the enterprise show. Year after year the focus was on how to raise cash at Motorola, not how to grow.

After 4 years, Mr. Icahn was losing money on his position in Motorola. A year later Motorola spun out the phone business, and a year after that leadership paid Mr. Icahn $1.2B in a stock repurchase that saved him from losses. The CEO called this buyout of Icahn the “end of a journey” as Mr. Icahn took the money and ran. How this benefited Motorola is – let’s say unclear.

But left in Icahn’s wake was a culture of cut and shred, rather than invest. After 90 years of invention, from Army 2-way radios to police radios, from AM car radios to home televisions, the inventor analog and digital cell towers and phones, there was no more innovation at Motorola. Motorola had become a company where the leaders, and Board, only thought about how to raise cash – not deploy it effectively within the corporation. There was very little talk about how to create new markets, but plenty about how to retrench to ever smaller “core” markets with no sales growth and declining margins. In September of this year long-term CEO Greg Brown showed no insight for what the company can become, but offered plenty of thoughts on defending tax inversions and took the mantle as apologist for CEOs who use financial machinations to confuse investors.

Investors today should cheer the leadership, in management and on the Board, at Zebra. Rather than thinking small, they thought big. Rather than bragging about their past, they figured out what future they could create. Rather than looking at their limits, they looked at the possibilities. Rather than giving up in the face of objections, they studied the challenges until they had answers. Rather than remaining stuck in their old status quo, they found the courage to become something new.

Bravo.

by Adam Hartung | Sep 25, 2014 | Current Affairs, In the Swamp, In the Whirlpool, Innovation, Sports, Web/Tech

Few businesses fail in a fiery, quick downfall. Most linger along for years, not really mattering to anyone – including customers, suppliers or even investors. They exist, but they aren’t relevant.

When a company is relevant customers are eager for new product releases, and excited to talk to salespeople. Media want to report on the company, its products and its leaders. Investors want to hear about what the company will do next to drive revenues and increase profits.

But when a company loses relevancy, that all disappears. Customers quit paying attention to new products, and salespeople are not given the time of day. The company begs for coverage of its press releases, but few media outlets pay attention because writing about that company produces few readers, or advertisers. Investors lose hope for big gains, and start looking for ways to sell the stock or debt without taking too big a loss, or further depressing valuations.

In short, when a company loses relevancy it is on the downward slope to failure. It may take a long time, but lacking market relevancy the company has practically no hope of increasing revenues or profits, or of creating many new and exciting jobs, or of being a great customer for suppliers. Losing relevancy means the company is headed out of business, it’s just a matter of time. Think Howard Johnson’s, ToysRUs, Sears, Radio Shack, Palm, Hostess, Samsonite, Pierre Cardin, Woolworth’s, International Harvester, Zenith, Sony, Rand McNally, Encyclopedia Britannica, DEC — you get the point.

Many people may not be aware that Microsoft made an exclusive deal with the NFL to provide Surface tablets for coaches and players to use during games, replacing photographs, paper and clipboards for reviewing on-field activities and developing plays. The goal was to up the prestige of Surface, improve its “cool” factor, while showing capabilities that might encourage more developers to write apps for the product and more businesses to buy it.

But things could not have gone worse during the NFL’s launch. Because over and again, announcers kept calling the Surface tablets iPads. Announcers saw the tablet format and simply assumed these were iPads. Or, worse, they did not realize there was any tablet other than the iPad. As more and more announcers made this blunder it became increasingly clear that Apple not only invented the modern tablet marketplace, but that it’s brand completely dominates the mindset of users and potential buyers. iPad has become synonymous with tablet for most people.

In a powerful way, this demonstrates the lack of relevancy Microsoft now has in the personal technology marketplace. Fewer and fewer people are buying PCs as they rely increasingly on mobile devices. Practically nobody cares any more about new releases of Windows or Office. In fact, the American Customer Satisfaction Index reported people think Apple is now considered the best PC maker (the Macintosh.) HP was near the bottom of the list, with Dell, Acer and Toshiba not faring much better.

And in mobile devices, Apple is clearly the king. In its first weekend of sales the new iPhone 6 and 6Plus sold 10million units, blasting past any previous iPhone model launch – and that was without any sales in China and several other markets. The iPhone 4 was considered a smashing success, but iPhone 4 sales of 1.7million units was only 17% of the newest iPhone – and the 9million iPhone 5 sales included China and the lower-priced 5C. In fact, more units could have been sold but Apple ran out of supply, forcing customers to wait. People clearly still want Apple mobile devices, as sales of each successive version brings in more customers and higher sales.

There are many people who cannot imagine a world without Microsoft. And the vast majority of people would think that predicting Microsoft’s demise is considerably premature given its size and cash hoard. But, that looks backward at what Microsoft was, and the assets it previously created, rather than looking forward.

Just how fast can lost relevancy impact a company? Look no further than Blackberry (formerly Research in Motion.) Blackberry was once totally dominant in smartphones. But in the second quarter of last year Apple sold 32.5million units, while Blackberry sold only 1.5million (which was still more than Microsoft sold.)

The complete lack of relevancy was exposed last week when Blackberry launched its new Passport phone alongside Apple’s iPhone 6 actions. While the press was full of articles about the new iPhone, were you even aware of Blackberry’s most recent effort? Did you recall seeing press coverage? Did you read any product reviews? And while Apple was selling record numbers, Blackberry analysts were wondering if the Passport could find a niche with “nostalgic customers” that would sell enough units to keep the company’s hardware unit alive. Reviewers now compare Passport to the market standard, which is the iPhone – and still complain that its use of apps is “confusing.” In a world where most people use their own smartphone, the only reason most people could think of to use a Passport was if their employer told them they were forced to.

Like with Radio Shack, most people have to be reminded that Blackberry still exists. In just a few years Blackberry’s loss of relevancy has made the company and its products a backwater. Now it is quite clear that Microsoft is entering a similar situation. Windows 8 was a weak launch and did nothing to slow the shift to mobile. Microsoft missed the mobile market, and its mobile products are achieving no traction. Even where it has an exclusive use, such as this NFL application, people don’t recognize its products and assume they are the products of the market leader. Microsoft really has become irrelevant in its historical “core” personal technology market – and that should scare its employees and investors a lot.

by Adam Hartung | Aug 6, 2014 | Defend & Extend, In the Whirlpool, Innovation, Lifecycle, Web/Tech

Remember the RAZR phone? Whatever happened to that company?

Motorola has a great tradition. Motorola pioneered the development of wireless communications, and was once a leader in all things radio – as well as made TVs. In an earlier era Motorola was the company that provided 2-way radios (and walkie-talkies for those old enough to remember them) not only for the military, police and fire departments, but connected taxies to dispatchers, and businesses from electricians to plumbers to their “home office.”

Motorola was the company that developed not only the thing in a customer’s hand, but the base stations in offices and even the towers (and equipment on those towers) to allow for wireless communication to work. Motorola even invented mobile telephony, developing the cellular infrastructure as well as the mobile devices. And, for many years, Motorola was the market share leader in cellular phones, first with analog phones and later with digital phones like the RAZR.

But that was the former Motorola, not the renamed Motorola Solutions of today. The last few years most news about Motorola has been about layoffs, downsizings, cost reductions, real estate sales, seeking tenants for underused buildings and now looking for a real estate partner to help the company find a use for its dramatically under-utilized corporate headquarters campus in suburban Chicago.

How did Motorola Solutions become a mere shell of its former self?

Unfortunately, several years ago Motorola was a victim of disruptive innovation, and leadership reacted by deciding to “focus” on its “core” markets. Focus and core are two words often used by leadership when they don’t know what to do next. Too often investment analysts like the sound of these two words, and trumpet management’s decision – knowing that the code implies cost reductions to prop up profits.

But smart investors know that the real implication of “focusing on our core” is the company will soon lose relevancy as markets advance. This will lead to significant sales declines, margin compression, draconian actions to create short-term P&L benefits and eventually the company will disappear.

Motorola’s market decline started when Blackberry used its server software to help corporations more securely use mobile devices for instant communications. The mobile phone transitioned from a consumer device to a business device, and Blackberry quickly grabbed market share as Motorola focused on trying to defend RAZR sales with price reductions while extending the RAZR platform with new gimmicks like additional colors for cases, and adding an MP3 player (called the ROKR.) The Blackberry was a game changer for mobile phones, and Motorola missed this disruptive innovation as it focused on trying to make sustaining improvements in its historical products.

Of course, it did not take long before Apple brought out the iPhone and with all those thousands of apps changed the game on Blackberry. This left Motorola completely out of the market, and the company abandoned its old platform hoping it could use Google’s Android to get back in the game. But, unfortunately, Motorola brought nothing really new to users and its market share dropped to nearly nothing.

The mobile phone business quickly overtook much of the old Motorola 2-way radio business. No electrician or plumber, or any other business person, needed the old-fashioned radios upon which Motorola built its original business. Even police officers used mobile phones for much of their communication, making the demand for those old-style devices rarer with each passing quarter.

But rather than develop a new game changer that would make it once again competitive, Motorola decided to split the company into 2 parts. One would be the very old, and diminishing, radio business still sold to government agencies and niche business applications. This business was profitable, if shrinking. The reason was so that leadership could “focus” on this historical “core” market. Even if it was rapidly becoming obsolete.

The mobile phone business was put out on its own, and lacking anything more than an historical patent portfolio, with no relevant market position, it racked up quarter after quarter of losses. Lacking any innovation to change the market, and desperate to get rid of the losses, in 2011 Motorola sold the mobile phone business – formerly the industry creator and dominant supplier – to Google. Again, the claim was this would allow leadership to even better “focus” on its historical “core” markets.

But the money from the Google sale was invested in trying to defend that old market, which is clearly headed for obsolescence. Profit pressures intensify every quarter as sales are harder to find when people have alternative solutions available from ever improving mobile technology.

As the historical market continued to weaken, and leadership learned it had under-invested in innovation while overspending to try to defend aging solutions, Motorola again cut the business substantially by selling a chunk of its assets – called its “enterprise business” – to a much smaller Zebra Technologies. The ostensible benefit was it would now allow Motorola leadership to even further “focus” on its ever smaller “core” business in government and niche market sales of aging radio technology.

But, of course, this ongoing “focus” on its “core” has failed to produce any revenue growth. So the company has been forced to undertake wave after wave of layoffs. As buildings empty they go for lease, or sale. And nobody cares, any longer, about Motorola. There are no news articles about new products, or new innovations, or new markets. Motorola has lost all market relevancy as its leaders used “focus” on its “core” business to decimate the company’s R&D, product development, sales and employment.

Retrenchment to focus on a core market is not a strategy which can benefit shareholders, customers, employees or the community in which a business operates. It is an admission that the leaders missed a major market shift, and have no idea how to respond. It is the language adopted by leaders that lack any vision of how to grow, lack any innovation, and are quickly going to reduce the company to insignificance. It is the first step on the road to irrelevancy.

Straight from Dr. Christensen’s “Innovator’s Dilemma” we now have another brand name to add to the list of those which were once great and meaningful, but now are relegated to Wikipedia historical memorabilia – victims of their inability to react to disruptive innovations while trying to sustain aging market positions – Motorola, Sears, Montgomery Wards, Circuit City, Sony, Compaq, DEC, American Motors, Coleman, Piper, Sara Lee………..

by Adam Hartung | Apr 8, 2014 | Current Affairs, Disruptions, In the Rapids, Innovation, Leadership

“Car dealers are idiots” said my friend as she sat down for a cocktail.

It was evening, and this Vice President of a large health care equipment company was meeting me to brainstorm some business ideas. I asked her how her day went, when she gave the response above. She then proceeded to tell me she wanted to trade in her Lexus for a new, small SUV. She had gone to the BMW dealer, and after being studiously ignored for 30 minutes she asked “do the salespeople at this dealership talk to customers?” Whereupon the salespeople fell all over themselves making really stupid excuses like “we thought you were waiting for your husband,” and “we felt you would be more comfortable when your husband arrived.”

My friend is not married. And she certainly doesn’t need a man’s help to buy a car.

She spent the next hour using her iPhone to think up every imaginable bad thing she could say about this dealer over Twitter and Facebook using various interesting hashtags and @ references.

Truthfully, almost nobody likes going to an auto dealership. Everyone can share stories about how they were talked down to by a salesperson in the showroom, treated like they were ignorant, bullied by salespeople and a slow selling process, overcharged compared to competitors for service, forced into unwanted service purchases under threat of losing warranty coverage – and a slew of other objectionable interactions. Most Americans think the act of negotiating the purchase of a new car is loathsome – and far worse than the proverbial trip to a dentist. It’s no wonder auto salespeople regularly top the list of least trusted occupations!

When internet commerce emerged in the 1990s, buying an auto on-line was the #1 most desired retail transaction in emerging customer surveys. And today the vast majority of Americans, especially Millennials, use the web and social media to research their purchase before ever stepping foot in the dreaded dealership.

Tesla heard, and built on this trend. Rather than trying to find dealers for its cars, Tesla decided it would sell them directly from the manufacturer. Which created an uproar amongst dealers who have long had a cushy “almost no way to lose money” business, due to a raft of legal protections created to support them after the great DuPont-General Motors anti-trust case.

When New Jersey regulators decided in March they would ban Tesla’s factory-direct dealerships, the company’s CEO, Elon Musk, went after Governor Christie for supporting a system that favors the few (dealers) over the customer. He has threatened to use the federal courts to overturn the state laws in favor of consumer advocacy.

It would be easy to ignore Tesla’s position, except it is not alone in recognizing the trend. TrueCar is an on-line auto shopping website which received $30M from Microsoft co-founder Paul Allen’s venture fund. After many state legal challenges TrueCar now claims to have figured out how to let people buy on-line with dealer delivery, and last week filed papers to go public. While this doesn’t eliminate dealers, it does largely take them out of the car-buying equation. Call it a work-around for now that appeases customers and lawyers, even if it doesn’t actually meet consumer desires for a direct relationship with the manufacturer.

Apple’s direct-to-consumer retail stores were key to saving the company

Distribution is always a tricky question for any consumer good. Apple wanted to make sure its products were positioned correctly, and priced correctly. As Apple re-emerged from near bankruptcy with new music products in the early 2000’s Apple feared electronic retailers would discount the product, be unable to feature Apple’s advantages, and hurt the brand which was in the process of rebuilding. So it opened its own stores, staffed by “geniuses” to help customers understand the brand positioning and the products’ advantages. Those stores are largely considered to have been a turning point in helping consumers move from a world of Microsoft-based laptops, Sony music products and Blackberry mobile devices to new iDevices and resurging Macintosh popularity – and sales levels.

Attacking regulations sounds – and is – a daunting task. But, when regulations support a minority of people outside the public good there is reason to expect change. American’s wanted a more pristine society, so in 1920 the 18th Amendment was passed prohibiting alcohol. However, after a decade in which rampant crime developed to support illegal alcohol production Americans passed the 21st Amendment in 1933 to repeal prohibition. What seemed like a good idea at first turned out to have more negatives than positives.

Auto dealer regulations hurt competition, and consumers

Today Americans do not need a protected group of dealers to save them from big, bad auto companies. To the contrary, forced distribution via protected dealers inhibits competition because it keeps new competitors from entering the U.S. market. Small production manufacturers, and large ones in countries like India, are effectively blocked from reaching American customers because they lack a dealer base and existing dealers are uninterested in taking the risks inherent in taking these new products to market. Likewise, starting up an auto company is fraught with distribution risks in the USA, leaving Tesla the only company to achieve any success since the dealer protection laws were passed decades ago.

And that’s why Tesla has a very good chance of succeeding. The trends all support Americans wanting to buy directly from manufacturers. At the very least this would force dealers to justify their existence, and profits, if they want to stay in business. But, better yet, it would create greater competition – as happened in the case of Apple’s re-emergence and impact on personal technology for entertainment and productivity.

Litigating to fight a trend might work for a while. Usually those in such a position are large political contributors, and use both the political process as well as legal precedent to protect their unjustified profits. NADA (National Automobile Dealers Association) is a substantial organization with very large PAC money to use across Washington. The Association can coordinate election contributions at national and state levels, as well as funding for judge elections and contributions for legal defense.

But, trends inevitably win out. Today Millennials are true on-line shoppers. They have no patience for traditional auto dealer shenanigans. After watching their parents, and grandparents, struggle for fairness with dealers they are eager for a change. As are almost all the auto buyers out there. And they are supported by consumer advocates long used to edgy tactics of auto dealers well known for skirting ethics and morality when dealing with customers. Those seeking change just need someone positioned to lead the legal effort.

Tesla wins because it uses trends to be a game changer

Tesla has shown it is well attuned to trends and what customers want. When other auto companies eschewed Tesla’s first entry as a 2-passenger sports car using laptop batteries, Tesla proceeded to sell out the product at a price much higher competitive gas-powered cars. When other auto companies thought a $70,000 electric sedan would never appeal to American buyers, Tesla again showed it understood the market best and sold out production. When industry pundits, and traditional auto company execs, said it was impossible to build a charging grid to support users driving up the coast, or cross-country, Tesla built the grid and demonstrated its functionality.

Now Tesla is the right company, in the right place, to change not only the autos Americans drive, but how Americans buy them. It’s rarely smart to refuse a trend, and almost always smart to support it. Tesla looks to be positioning itself as much smarter than older, larger auto companies once again.