by Adam Hartung | Feb 28, 2017 | E-Commerce, Employment, real estate, Retail

(Photo: JOHN MACDOUGALL/AFP/Getty Images)

Amazon.com has become an important part of the American economy, and the lives of people globally. But, far too few people still understand the repercussions of Amazon’s success on retailers, consumer goods manufacturers, real estate – and ultimately everyone’s lives. The implications are enormous. Smart leaders, and investors, will plan for these implications and take advantage of the market shift.

Invest in ecommerce, divest traditional retailers.

The first implication is just thinking about investing in Amazon and/or its competitors in retail. In May, 2016 I compared the market value of Wal-Mart, the world’s largest retailer, with Amazon. At the time Wal-Mart was worth $216 billion, and Amazon was worth $332 billion. The difference could be explained by realizing that Wal-Mart was the leader at brick-and-mortar sales, which were shrinking, while Amazon was the leader in e-commerce, which is growing. Since then Wal-Mart’s value has increased to $222 billion – up $6 billion, 2.8%. Meanwhile Amazon’s value has increased to $403 billion- up $71 billion, 21.4%. Over three years (starting 3/3/14) Wal-Mart’s per share value has declined from $74 to $71 (down 4%,) while Amazon’s has risen from $370 to $845 (up 128%.)

To put it mildly, investing in Amazon, which is the leader in e-commerce, has created a great return. Contrastingly that value increase has been fueled by declines in traditional retailers. The Amazon Effect has caused shares in companies like Sears Holdings, JCPenney, Kohl’s, Macy’s and many other stalwarts of the bygone era to be crushed. Over the last year investors in XRT (the retail industry spider) have increased 1.6%, while the S&P 500 spider has jumped 22%. The number of retailers with debt rated at Moody’s most distressed level has tripled since 2009 – and Moody’s predicts this list will worsen over the next five years.

There is vastly too much retail space, and nobody knows what to do with it.

And this has an impact on real estate. As online sales come to over 11% of all holiday sales in 2016, and Amazon accounts for 40% of all those sales, it is clear people just don’t go to stores any more anywhere near the way they once did. Historically prime retail real estate was considered valuable – and in 2007 many people thought Sears real estate was worth more than Sears as a retailer. But no longer. According to Morningstar, Sears store closings alone could cause 200 malls to close.

It is apparent the Amazon Effect has left America with far more storefronts than needed. Stand-alone stores are being shuttered, with no alternative use for most buildings. Malls and shopping centers go begging as traffic drops, tenants leave, lease rates collapse and the facilities end up wholly or nearly empty. This means you don’t want to invest in retail real estate REITs. But it also means that neighborhoods, and sometimes entire towns, will be impacted as these empty buildings reduce interest in housing and push down residential prices.

Tax receipts will fall, and nobody knows how to replace them.

For a long time governments gave handouts to retailers in the form of tax breaks to build stores or locate their headquarters. But as stores close the property tax receipts decline, putting a greater burden on homeowners to pay for schools and infrastructure. Same with sales taxes which disappear from the local government coffers. And tax breaks once given to hold onto jobs – like the ones the village of Hoffman Estates and state of Illinois, gave Sears in 2011 to not move its headquarters, look far less justified. In short, the Amazon Effect has an enormous impact on the local tax base – and those missing dollars will inevitably have to come from residents – or a significant curtailing of services.

The impact on job eliminations will be staggering.

The Amazon Effect also has an impact on jobs. Amazon’s growth keeps escalating, from 19% in 2014 to 20% in 2015 to 28% in 2016, which takes the jobs away from traditional retailers. Macy’s plans to shed 10,000 workers as it shrinks and streamlines. JCPenney will eliminate 6,000 employees via early retirement completely separate from its store closings, and HHGregg is shedding 1,500 jobs as stores close. And thousands more are being lost across traditional retail in stores, supply chain positions and headquarters facilities.

Traditional retail employs about 16.5 million Americans – nearly 10% of the entire workforce. 6.2 million are in the prime product lines targeted by e-commerce (GAFO – General, Apparel, Furniture and Other.) The Amazon Effect will continue to eliminate these positions. Over the next five years it is not unlikely that the decline of brick-and-mortar will cause 16% of GAFO jobs to disappear, which is almost 1 million jobs. Simultaneously this could easily cause 10% of the non-GAFO jobs (10.3 million) to disappear – which is another 1 million. This likely scenario would cause the loss of 2 million jobs in just five years, which is the entirety of all lost manufacturing jobs to China. The Trump administration has more employment concerns to face than just the return of manufacturing.

The Amazon Effect is changing grocery shopping, without even being a major competitor in that sector. Because Wal-Mart has lost so much general merchandise sales to e-commerce, the company has amped up grocery sales – which are now 56% of total revenue. To continue growing groceries Wal-Mart is undertaking a massive price war pitting itself against the long-running low cost grocer Aldi. This is creating even more intense profit pressure on Wal-Mart, which last year saw gross margins drop by eight points, as net income fell 18%. Such intense price competition is creating the need for even more cost cutting among all grocers – which means investors beware – and we can expect even more job cutting as the spiral downward continues.

Consumer Goods manufacturers, and their suppliers, will be stressed.

Of course this pushes the Amazon Effect onto consumer goods companies that supply grocery retailers. Wal-Mart has held meetings with P&G, Unilever, Conagra, Coca-Cola and other big name companies demanding across-the-board 15% price reductions at wholesale. And Wal-Mart expects these suppliers to help Wal-Mart beat its head-to-head competitors on price 8o% of the time. This will cause consumer goods manufacturers to cut their own costs, including jobs, as well as pressure their raw material suppliers to further reduce their costs – leading to an ongoing spiral of cost cutting, job eliminations and additional pressures for change.

The internet gave us e-commerce, and that birthed Amazon.com. Few predicted the enormous implications this would have on retail, and society. Every single American is affected by the Amazon Effect, which is now inescapable. The only remaining question is whether your business, your government leaders and you are planning for this and preparing for the inevitable changes which will continue coming?

by Adam Hartung | Jan 28, 2017 | Immigration, Leadership, Politics, Trends

(Photo: NICHOLAS KAMM/AFP/Getty Images)

“Get the assumptions wrong and nothing else matters” – Peter F. Drucker

President Donald Trump made it very clear last week that his administration intends to build a border wall between the U.S. and Mexico. And he intends to make Mexico pay for it. He is so adamant he is willing to risk U.S./Mexican relations, canceling a meeting with the Mexican president.

Unfortunately, this tempest is all because of a really bad idea. The wall is a bad idea because the assumptions behind this project are entirely false. Like far too many executives, President Trump is building a plan based on bad assumptions rather than obtaining the facts – even if they belie his assumptions – and developing a good solution. Making decisions, and investing, on bad assumptions is simply bad leadership.

The stated claim is Mexico is sending illegal immigrants across the border in droves. These illegal immigrants are Mexican ne’er do wells who are coming to America to live off government subsidies and/or commit criminal activity. The others are coming to steal higher paying jobs from American workers. America will create a h

Unfortunately, almost everything in that line of logic is untrue. And thus the purported conclusion will not happen.

1. Although it cannot be proven, analysts believe the majority (possibly vast majority) of illegal immigrants enter America by air. There are two kinds of illegal immigration. President Trump’s rhetoric focuses on “entries without inspection.” But most illegal immigrants actually arrive in America with a visa – and then simply don’t leave. These are called “overstays.” They come from Mexico, India, Canada, Europe, Asia, South America, Africa – all over the world. If you want to identify and reduce illegal immigration, you need to focus on identifying likely overstays and making sure they return. The wall does not address this.

3. More non-Mexicans than Mexicans were apprehended at the U.S. border – and the the number of Mexicans has been declining. From 1.6 million in 2000, by 2014 the number dwindled to 229,000 (a decline of 85%). If you want to stop illegal border immigrants into the U.S., the best (and least costly) policy would be to cooperate with Mexico to capture these immigrants as they flee Central America and find a solution for either housing them in Mexico or returning them to their country of origin. It is ridiculous to expect Mexico to pay for a wall when it is not Mexico’s citizens creating the purported illegal immigration problem on the border.

4. In 2015 over 43,000 Cubans illegally immigrated to the U.S. – about 20% as many as from Mexico. The cost of a wall is rather dramatically high given the weighted number of illegal immigrants from other countries.

5. The number of illegal immigrants living in the U.S. is actually declining. There are more Mexicans returning to live in Mexico than are illegally entering the U.S. Between 2009 and 2014 over 1 million illegal Mexican immigrants willingly returned to Mexico where working conditions had improved and they could be with family. In other words, there were more American jobs created by Mexicans returning to Mexico than “stolen” by new illegal immigrants entering the country. If the administration would like to stop illegal immigration the best way is to help Mexico create more high-paying jobs (say with a trade deal like NAFTA) so they don’t come to America, and those in America simply choose to go to Mexico.

6. Illegal immigrants are not “stealing” more jobs every year. Since 2006, the number of illegal immigrants working in the U.S. has stabilized at about 8 million. All the new job growth over the last decade has gone to legitimate American workers or legal immigrants working with proper papers. Illegal immigration is not the reason some Americans do not have jobs, and blaming illegal immigrants is a ruse for people who simply don’t want to work – or refuse to upgrade their skills to make themselves employable.

7. Illegal immigrants in the U.S. is not a rising group – in fact most illegal immigrants have been in the U.S. for over 10 years. In 2014, over 66% of all illegal immigrants had been in the U.S. for 10 years or more. Only 14% have been in the U.S. for 5 years or less. We don’t have a problem needing to stop new illegal immigrants (the ostensible reason for a wall). Rather, we have a need to reform immigration so all these long-term immigrants already in the workforce can be normalized and make sure they pay the necessary taxes.

8. The states where illegal immigration is growing are not on the Mexican border. The states with rising illegal immigration are Washington, Pennsylvania, New Jersey, Virginia, Massachusetts and Louisiana. Texas, New Mexico and Arizona have seen no significant, measurable increase in illegal immigrants. And California, Nevada, Illinois, Alabama, Georgia and South Carolina have seen their illegal immigrant population decline. A border wall does not address the growth of illegal immigrants, as to the extent illegal immigrants are working in the U.S. they are clearly not in the border states.

Good leaders get all the facts. They sift through the facts to determine problems, and develop solutions which address the problem.

Bad leaders jump to conclusions. They base their actions on outdated assumptions. They invest in the wrong places because they think they know everything, rather than making sure they know the situation as it really exists.

America’s “flood of illegal immigrants” problem is wildly overblown. Most illegal immigrants are people from advanced countries, often with an education, who overstay their visa limits. But few Americans seem to think they are a problem.

Most border crossing illegal immigrants today are minors from Central America simply trying to stay alive. They aren’t Mexican criminals, stealing jobs, or creating a crime spree. They are mostly starving.

President Trump has “whipped up” a lot of popular anxiety with his claims about illegal Mexican immigrants and the need to build a border wall. Interestingly, the state with the longest Mexican border is Texas – and of its 38 congressional members (36 in Congress, 2 in the Senate and 25 Republican) not one (not one) supports building the wall. The district with the longest border (800 miles) is represented by Republican Will Hurd, who said “building a wall is the most expensive and least effective way to secure the border.”

Good leaders do not make decisions on bad assumptions. Good leaders don’t rely on “alternative facts.” Good leaders carefully study, dig deeply to find facts, analyze those facts to determine if there is a problem – and then understand that problem deeply. Only after all that do they invest resources on plans that address problems most effectively for the greatest return.

by Adam Hartung | Nov 9, 2016 | Election, Marketing

(AP Photo/Wilfredo Lee, File)

November 9, 2016 – Donald Trump is the president-elect of the United States. It is a stunning upset. What are the lessons for marketers?

First, notice that candidate Hillary Clinton actually won the popular vote. With just under 120 million votes cast, Clinton gathered about 160,000 more votes than candidate Trump. A victory of just over .1%. So it is fair to say that on this metric, number of votes, there was a win for Clinton.

But, of course, the complexity of America’s electoral college means that Trump won more electoral votes, and thus the election. Non-Americans struggle to understand the electoral college – heck, a lot of American’s don’t understand it. Put simply, it was the founding father’s method of making sure different geographies achieved representation so that more dense population areas would not control an election.

Given that everyone knew that in the end it was these votes – electoral votes – that mattered, it is important to think through the marketing implications.

Monday, pre-election, I wrote that it appeared the marketing campaign of candidate Clinton was superior to that of candidate Trump. And, given that it achieved more popular votes, it may have been a superior campaign. But since it did not achieve the goal, its worth revisiting to see where that analysis erred, and what can be learned.

Product: Candidate Trump was very, very negative. He had nothing good to say about anything the incumbent president had done, nor anything good to say about candidate Clinton. He was the epitome of negative. Although the Clinton campaign claimed it would “go high” as the Trump campaign “went low” this really did not happen. Clinton’s campaign tried to duke it out toe-to-toe on who was worst.

In the end, this hurt both candidates. Neither had great appeal to voters, and both had extremely high negatives. But by succumbing to a bruising bad-on-bad punching match the Clinton campaign missed an opportunity to present the candidate as very favorable. The candidate that punched the hardest – and no doubt with his constant attacks, including threats to indict candidate Clinton this gave candidate Trump a bit of an edge – was going to win.

Lesson -Firstly, make your product favorable. Make it something people really want. Don’t say bad things about the competition until you’ve staked your favorable position. Clinton never really achieved a favorable position with enough voters.

Second, if you’re going to get into a dirty fight, don’t bring a knife – bring a gun. In a competition of negatives, you have to be every bit as negative as the competition. No holds barred. The meanest, ugliest, hardest hitting competitor will win.

Price: Candidate Clinton absolutely failed to make the case that the incumbent’s economic policies had favored most Americans. Despite tremendous job growth, declining unemployment, record low layoffs and record high equity values there persisted a notion that the American economy was in the tank. The campaign completely failed to make the case that the policies enacted previously, and anticipated to continue with Clinton, would be good for people’s pocketbooks.

Meanwhile, candidate Trump hammered away saying that the American economy was a wreck. His appeals to reducing international trade and limiting immigration in order to create more higher paying jobs in America convinced a large number of voters that these policies would be better for the economy and most workers.

Concerns about potential debt increases and an extension of income inequality were poorly made, and did not counter the overriding sense that more jobs would come from Trump’s policies. Thus, a lot of people were swayed to Trump’s xenophobic view of how to improve America’s economy. They remain convinced that Mexico will pay for an immigration limiting wall, and scaling back (or eliminating) trading pacts like NAFTA will somehow cause an inspired growth in American manufacturing jobs, and higher levels of good paying employment.

Lesson – you have to make the economic case for your product. You have to deliver a winning value proposition. Don’t expect customers to figure it out on their own, or assume they believe in your value proposition.

Place: This is where the breakdown was greatest for Clinton, and most beneficial for Trump. On Monday I noted several indicators that the Clinton campaign would do far better at getting out the vote than Trump. And, one could say they did given that Clinton won the popular vote.

But the Clinton error was relying too heavily on dense population states. New York, Illinois, California – states with very big cities that dramatically overwhelm the rural population produced landslide votes for Clinton. But in states with a more balanced population density, such as Ohio, Florida and Pennsylvania there was an insufficient effort at making sure non-city counties turned out for Clinton.

Contrarily, the Trump campaign won the battle for place by realizing they could win the rural states with limited effort. Large geographic swaths with low population density allowed Trump to pile up electoral votes (the ones that matter) almost unchallenged. Kansas, Oklahoma, Wyoming, Nebraska, South Dakota, North Dakota – all states benefiting precisely from the electoral system the founding fathers created – were key states that the Clinton campaign ignored in its distribution strategy.

What appeared to be a Clinton campaign advantage, largely strong support by the Democratic party, overly-relied on winning population dense counties. This was effectively countered by a very good job by the Trump campaign of acquiring votes in more rural, less dense, counties. This ground game, of making sure the votes were captured county-by-county, was decisive for Trump.

Lesson – distribution matters. It may seem boring. It’s a lot less sexy than writing ad copy or focusing on PR. But it really, really matters.

Promotion: It turns out money, and extreme messaging, still matters.

The Obama campaign was masterful at using modern marketing techniques, including internet marketing, mobile and social media, to obtain support. The Bernie Sanders primary campaign also proved adept at using these tools for gaining a good following. While the Clinton campaign lifted this part of the playbook, their implementation was not as integrated, nor effective, as either Obama or Sanders. The pieces were there, but the appeal was not as targeted to specific groups and therefore not nearly as effective. Clinton’s team used these tools, but they did not invest in them with the skills exhibited by Obama or Sanders, and they failed at bringing enough minorities, youth and women to the polls.

Meanwhile, Trump’s campaign once again made the case that money matters. Large advertising programs still make a difference. Marketing is changing, but in a winner-take-all, and you only get one chance, campaign classic advertising and PR used since the 1960s really matters. Things are changing, but they have not fully changed. If you are willing to spend enough money on traditional promotional tools, they still reach most of the people. It may not be efficient, but they are still effective.

Simultaneously, the old adage “any press is good press” proved valuable once again. Tapes of Trump saying outrageous things, and outrageous tweets, served to provide ample free promotion for the candidate. While many people complained about the message content, in the end simply being constantly in the news helped people get used to a very unusual campaign style. An unorthodox approach, letting outrageous behavior become so common that customers were able to look past the negatives, allowed the constant access to become an advantage.

There are great lessons here to be learned by marketers today.

- Distribution really matters. In the internet, Amazon.com age it is easy to think that if you build it they will come. But success still requires a lot of effort to make sure your product is in the right place when people are ready to buy. And that means on the web, on social media and eventually physical location.

- The trend is toward micro-marketing with targeted messages to targeted segments. But during the evolution old, brute force tools still make a difference. To make a trend work for you, you have to work hard at building on that trend. You cannot expect success merely by adopting the trend, you have to master highlighting the trend, and making it useful for your campaign to reach customers.

- Even messages built on myth cannot be ignored, and in fact must be fought extremely hard. Chipotle’s has struggled to convince customers its food won’t make them sick, because the message was not effectively countered. Similarly, despite ample evidence of a strong economy Clinton failed to convince customers that claims of a weak economy were unfounded. The message may be mythical, but it remains important if not addressed and countered.

- Make sure customers know how they benefit from your product. Don’t be “good enough” or “comparable.” Make sure the real benefits to customers of your product are front-and-center. As Clayton Christensen says, make sure you know what job the customer wants from your product and clearly fulfill that job better than alternatives. Don’t rely on the customer to figure out why your product is superior, make the case quite clearly for them.

- Don’t expect customers to understand your pricing. Make clear your value proposition. Regardless how you price, the value proposition must be immediately understood. Link how you will get the job done for the customer to the value you provide.

by Tim | Oct 16, 2016

AUDIO CLIPS FEATURING ADAM Audio clips of interviews, speeches, and talks with Adam “The Death of Sears” – Listen to the Wharton SiriusXM Radio Interview with Adam Hartung Host Dan Loney asks, “Is this the beginning of the end for Sears?” Adam Hartung and...

by Adam Hartung | Aug 31, 2016

Summer is a great time to plan White Space projects

August is beach season- you are probably on, near or thinking about relaxing on a beach! Well, to an innovation/disruption expert like me, beaches remind me of…white space! That’s the market which is beyond the “box” of the current success formula.

A colleague recently competed in the Chicago to Mackinac sailboat race. This year, after 12 hours of lightning, wind, rain and waves, the sun came out and they were greeted by the sight of the gleaming Sleeping Bear sand dunes on the Michigan shore. To the sailors, the dunes are a milestone of the race course. For innovators, they are a good analogy of the path to white space.

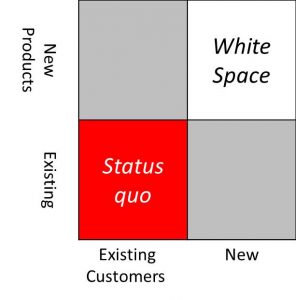

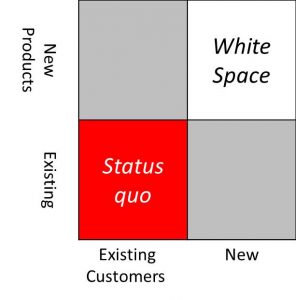

Innovation is often represented by a 2 x 2 matrix of new and existing products and customers. But this model does not capture a key obstacle to innovation adoption- behavior.

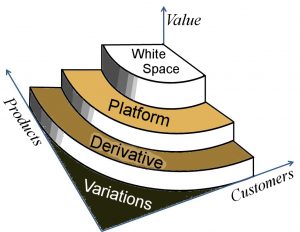

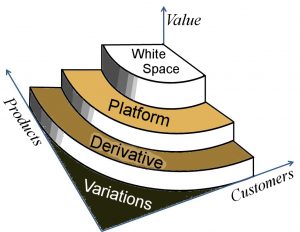

Another way to view innovations is to consider the four ways that innovation changes behaviors of the supplier and customer as innovative thinking moves upslope to white space.

Another way to view innovations is to consider the four ways that innovation changes behaviors of the supplier and customer as innovative thinking moves upslope to white space.

- Variations are products and services created within the existing Success Formula and do not change behaviors at all.

- Derivative innovations are typically expansions to the product itself. They extend the Success formula and require some changes in behavior.

- Platform innovations require changes in the Success formula for both supplier and customer.

- Finally, Fundamental innovations (White Space) create entirely new formula for success and behaviors for suppliers and customers.

Most companies devote the largest share of investment to Variations, at the bottom of the sand dune where the risk is minimal and the sand is flat. Then, they typically fund a few projects in Derivative and Platform innovations which are higher up the slope, but not far from the success formula on the beach. Very little investment is allocated to Fundamental projects because climbing that sand dune is difficult and risky.

The height of the sand dune can represent long term value to the company. After the tough climb through the sand, you are rewarded with breathtaking views and cool breezes. There usually are no “competitors” at the top- you have the market and profits to yourself to create a new success formula. The payoff goes up as you climb, with the highest rewards at the top.

To complete the analogy, the sands are like trends- soft, sliding, uncertain. Once you master the trends, the path to the top and white space is clear.

The Sleeping Bear Dunes in Michigan were named “The most beautiful place in America” by the Good Morning America show. Think about climbing to the top of your local beach to reach the whitespace at the top- you’ll enjoy the view.

Have a great end of your summer!

Let us help you use trends to drive your innovation, positioning, organizational design, staffing, and culture to gain more revenues, higher profits and increased valuation. By adding our trend expertise to your organizational knowledge, you can build a company that is future focused for greater success.

“One sits down on a desert sand dune, sees nothing, hears nothing.

Yet through the silence something…gleams.”

Antoine de Saint-Exupéry

Don’t let the rest of summer slip by. Start your 2017 new product planning by having us help you identify key trends and how they can impact your growth. Call us in August, mention this newsletter and receive a 15% discount on all services. Our summer guarantee – We’ll give you the key trends and impacts – or there is no charge!!

Send an email now, or pick up the phone and call us at 847-331-6384 or 847-331-6446.

For more on how to include trends in your planning, I’ve created a “how-to” that you can adapt for your team. See my Status Quo Risk Management Playbook.

Upcoming Conference Workshops on Status Quo Risk Management

Recent Forbes Columns:

Another way to view innovations is to consider the four ways that innovation changes behaviors of the supplier and customer as innovative thinking moves upslope to white space.

Another way to view innovations is to consider the four ways that innovation changes behaviors of the supplier and customer as innovative thinking moves upslope to white space.