The End of Trumpism

Click for ebook

Businesses need to plan for the future. And part of planning are the assumptions you make. As Biden takes office, there is a lot of talk about whether the “movement” that Trump led is at its end, or just beginning. The good news is we have the tools to be predictive when answering that question, and those tools tell us that for the most part Trumpism is over.

As I wrote in August when California put to vote its “Gig Economy Law,” not even a state legislature can stop a trend. The Gig Economy is one of the biggest mega-trends out there, so trying to legislate away the trend and return to old methods of employment was simply not going to work. California needed to make changes that aligned with needs of gig workers, not try to outlaw the practice. And the measure failed.

It’s this same logic that makes me confident the policies that applied the last 4 years will go away, and any “movement” to try and return to that course will not succeed. Like California’s effort, the policies of Trumpism were anti-trend. While these policies could be enforced for a short time, they simply could not withstand the power of the long-term trends, and thus were doomed from the outset. Let’s take a look at some of those policies and trends, and review why they were (at best) short-term actions. {Note, this is not predicting an end to the Republican Party, nor Conservative politics. This discussion is focused on the American policies of the last 4 years during the Trump administration.}

-

- Anti-globalization is doomed to fail. We have the internet now. Everybody can see what’s happening in the world, and everybody can talk to everybody else. Borders have meaning, but trade across borders cannot be stopped. We all buy and sell products internationally daily. Even the Trump website sold apparel made in China. To try and stop trade is impossible, and tools like tariffs are simply woefully out of date. Those who try to interfere with globalization will have economic suffering, while allowing stronger international traders to grow. { Side note read column on why Brexit is Economic Destruction vs. Creative Destruction }

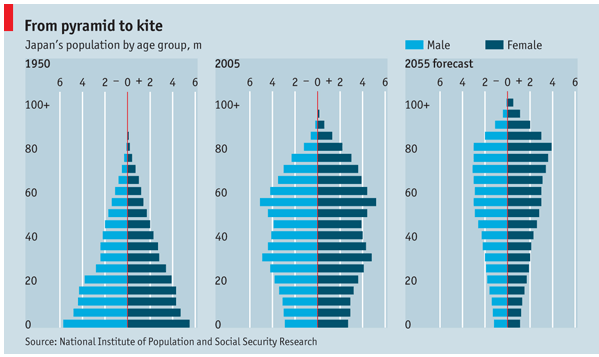

- Anti-immigration is doomed to fail. America, like almost all mature economies, is an aging demography. If you don’t add new people economic activity will suffocate under the weight of caring for the aged. You need demographic growth, and it needs to be younger people who are working. Simultaneously, companies that need skills need access to international markets to recruit people to work under visas. Immigration is good for economic growth, and an inherent part of globalization. Simply put, America needs immigration to keep growing. { Side note read column on why Japan’s aging demographics is an economic “time bomb”. }

- Chronic tax cuts without equal (or greater) investment is doomed to fail. The argument for low taxes is to provide more money for investing in business to grow – thus creating jobs that see higher pay due to increased demand for workers. However, recent tax cuts did not have associated policies for re-investment, and thus much of the money was used to repurchase shares of stock, make acquisitions of existing businesses and simply build a cash hoard. Simultaneously, tax cuts led to a reduction in government spending on infrastructure and other jobs creating projects, which further worsened the economic growth opportunity. This led to enormous income inequality – which has quite literally led to people “taking to the streets.” At some point policies have to shift toward investment to generate economic growth. { Side note read column on why share buybacks are not good for the economy nor good for shareholders. }

- Isolating China only makes them stronger. We have a balance of trade deficit with China, but tariffs and attempts to stop trade only made the balance of trade WORSE. The net is we want Chinese labor, and products, a lot more than they need American products. Retaliation is very real, and the USA is woefully unprepared for economic retaliation. The biggest market hurt by Chinese retaliation is agriculture, as witnessed by the incredible number of farm failures last 4 years. Them not buying from us doesn’t affect them nearly as much as it affects us. Meanwhile, China keep investing in global projects, their economy keeps growing, and now China’s economy is larger than the USA’s. We desperately need to focus on how to compete with China in global markets, not blindly think we can simply walk away. { Side note column on changing economic positions and how China’s growth is impacting global positions including currency valuations. }

- Sanctions and other policies to try controlling middle-east behavior are doomed. US policy was historically built on petroleum demand. But now these countries must move beyond oil sales to grow, and they desperately know this. The only successful long-term policy is to help these nations grow diversified economies so they can create jobs and keep their citizens happy. {Side note column on how falling petroleum demand is affecting global markets and changing the winners. }

- These are just some of the long-term trends that Trumpism ignored. Short-term shear force of will, lying about the data and ignoring the obvious could allow naysayers to hope they would change the trajectory of history. But long-term, trends always win. Evolution always moves forward, never backward. While Trumpism was a very interesting effort to fight trends, it was doomed to fail. And now that we can see the almost wholly negative economic implications of these policies it is extremely unlikely any such “movement” can re-establish itself. People do not act against their own self interest very long.

-

Winners don’t fear trends and the change they create. Rather they accept the trends on build on them to grow. Looking forward business should not plan for Trumpism to return in any meaningful way. As a set of policies they are as likely to succeed as storming the capital was likely to change the course of an election. Short term a lot of noise, long-term meaningless. So we can move forward building our plans based on trends, and a shift to economic policies much more aligned with long-term trends.

Key lessons?

First, the world is growing and leading businesses will grow. If you’re not growing, you’re dying. Second, never plan from past success, but instead plan for the future. You don’t grow value by being operationally excellent, because the world is forever changing and it will make your past business less valuable even if you do run it well. Third, make sure your plans are all built on trends. Let trends be the wind in your sales, or the current under your boat, or whatever analogy you like – just be sure you’re using TRENDS to drive you business planning, product development and solutions generation. Customers buy trends and help for them to achieve the future.

- Here at Spark Partners, we are experts at trend analysis, trend planning and effective resource allocation. Don’t let a comfort level on doing more of the same get in the way of your future growth. Embrace trends in the market and let us help you identify critical trends and invest smarter to build on trends and grow.

Don’t Miss Adam’s Recent Podcasts!

Did you see the trends, and were you expecting the changes that would happen to your demand? It IS possible to use trends to make good forecasts, and prepare for big market shifts. If you don’t have time to do it, perhaps you should contact us, Spark Partners. We track hundreds of trends, and are experts at developing scenarios applied to your business to help you make better decisions.TRENDS MATTER. If you align with trends your business can do GREAT! Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business. Click for Assessment info. Or, to keep up on trends, subscribe to our weekly podcasts and posts on trends and how they will affect the world of business at www.SparkPartners.com

Give us a call or send an email. Adam@sparkpartners.com 847-726-8465.