by Adam Hartung | Apr 25, 2015 | Defend & Extend, Food and Drink, In the Rapids, In the Swamp, Innovation, Leadership, Transparency

If you don’t drink gin you may not know the brand Tanqueray, a product owned by Diageo. But Tanqueray has been around for almost 190 years, going back to the days when London Dry Gin was first created. Today Tanqueray is one of the most dominant gin brands in the world, and the leading brand in the USA.

But gin is not a growth category. And Tanqueray, despite its great product heritage and strong brand position, has almost no growth prospects.

But gin is not a growth category. And Tanqueray, despite its great product heritage and strong brand position, has almost no growth prospects.

Any product that doesn’t grow sales cannot generate profits to spend on brand maintenance. Firstly, if due to nothing more than inflation, costs always go up over time. It takes rising sales to offset higher costs. Additionally, small competitors can niche the market with new products, cutting into leader sales. And competitors will undercut the leader’s price to steal volume/share in a stagnant market, causing margin erosion.

Category growth stalls are usually linked to substitute products stealing share in a larger definition of the marketplace. For example sales of laptop/desktop PCs stalled because people are now substituting tablets and smartphones. The personal technology market is growing, but it is in the newer product category stealing sales from the older product category.

This is true for gin sales, because older drinkers – who dominate today’s gin market – are drinking less spirits, and literally dying from old age. In the overall spirits market, younger liquor drinkers have preferred vodkas and flavored vodkas which are “smoother,” sweeter, and perceived as “lighter.”

So, what is a brand manager to do? Simply let trends obsolete their product line? Milk their category and give up money for investing somewhere else?

That may sound fine at a corporate level, where category portfolios can be managed by corporate vice presidents. But if you’re a brand manager and you want to become a future V.P., managing declining product sales will not get you into that promotion. And defending market share with price cuts, rebates and deals will cut into margin, ruin the brand position and likely kill your marketing career.

Keith Scott is the Senior Brand Manager for Tanqueray, and his team has chosen to regain product growth by using sustaining innovations in a smart way to attract new customers into the gin category. They are looking beyond the currently dwindling historical customer base of London Dry Gin drinkers, and working to attract new customers which will generate category growth and incremental Tanqueray sales. He’s looking to build the brand, and the category, rather than get into a price war.

Building on demographic trends, Tanqueray’s brand management is targeting spirit drinkers from 28-38. Three new Tanqueray brand extensions are being positioned for greatest appeal to increasingly adult tastes, while offering sophistication and linkage to one of the longest and strongest spirits brands.

#1 – Tanqueray Rangpur is a highly citrus-flavored gin taking a direct assault on flavored vodkas. Although still very much a gin, with its specific herb-based taste, Rangpur adds a hefty, and uniquely flavored, dose of lime. This makes for a fast, easy to prepare gin and tonic or lime-based gimlet – 2 classic cocktails that have their roots in England but have been popular in the US since before prohibition. And, in defense of the brand, Rangpur is priced about 10-20% higher than London Dry.

#1 – Tanqueray Rangpur is a highly citrus-flavored gin taking a direct assault on flavored vodkas. Although still very much a gin, with its specific herb-based taste, Rangpur adds a hefty, and uniquely flavored, dose of lime. This makes for a fast, easy to prepare gin and tonic or lime-based gimlet – 2 classic cocktails that have their roots in England but have been popular in the US since before prohibition. And, in defense of the brand, Rangpur is priced about 10-20% higher than London Dry.

#2 – Tanqueray Old Tom and Tanqueray Milacca appeal to the demographic that loves specialty, crafted products. The “craft” product movement has grown dramatically, and nowhere more powerfully than amongst 28-42 year old beer drinkers. Old Tom and Milacca leverage this trend. Both are “retro” products, harkening to gins over 100 years ago. They are made in small batches and have limited availability. They are targeted at the consumer that wants something new, unique, unusual and yet tied to old world notions of hand-made production and high quality. These craft products are priced 25-35% higher than traditional London Dry.

#2 – Tanqueray Old Tom and Tanqueray Milacca appeal to the demographic that loves specialty, crafted products. The “craft” product movement has grown dramatically, and nowhere more powerfully than amongst 28-42 year old beer drinkers. Old Tom and Milacca leverage this trend. Both are “retro” products, harkening to gins over 100 years ago. They are made in small batches and have limited availability. They are targeted at the consumer that wants something new, unique, unusual and yet tied to old world notions of hand-made production and high quality. These craft products are priced 25-35% higher than traditional London Dry.

#3 – Tanqueray No. 10 is a “super-premium” product pointed at the customer who wants to project maximum sophistication and wealth. No 10 uses a special manufacturing process creating a uniquely smooth and slightly citrus flavor. But this process loses 40% of the product to “tailings” compared to the industry standard 10% loss. No. 10 is the high-end defense of the Tanqueray brand (a “top shelf” product as its known in the industry) priced 75-90% higher than London Dry.

No. 10 is being promoted with “invitation only” events being held in major U.S. cities such as New York, Chicago and Atlanta. No. 10 “trunk events” bring in some of the hottest, newest designers to showcase the latest in apparel trends, accompanied by hot, new musical talent. No. 10 is associated with the sophistication of super-premium brands – individualized and rare products – in a members-only environment. Targeted at the primary demographic of 28-38, No. 10 events are designed to lure these consumers to this product they otherwise might overlook .

Rather than addressing their gin category growth stall with price cuts and other sales incentives, which would lead to brand erosion, price erosion, and margin erosion, the Tanqueray brand team is leveraging trends to bring new consumers to their category and generate profitable growth. These innovative brand extensions actually build brand value while leveraging identifiable market trends. Notice that all these sustaining innovations are actually priced higher than the highest volume London Dry core product, thus augmenting price – and hopefully margin.

Too often leaders see their market stagnate and use that as an excuse lower expectations and accept sales decline. They don’t look beyond their core market for new customers and sources of growth. They react to competition with the blunt axe of pricing actions, seeking to maintain volume as margins erode and competition intensifies. This accelerates product genericization, and kills brand value.

The Tanqueray brand team demonstrates how critical sustaining innovation can be for maintaining growth at all levels of an organization. Even the level of a single product or brand. They are using sustaining innovations to lure in new customers and grow the brand umbrella, while growing the category and achieving desired price realization. This is a lesson many brands, and companies, should emulate.

by Adam Hartung | Apr 15, 2015 | Defend & Extend, In the Swamp, Leadership

The money is not going into developing any new markets or new products. It is not being used to finance growth of GE at all. Rather, Mr. Immelt will immediately begin a massive $50B stock buyback program in order to prop up the stock price for investors.

When Mr. Immelt took the job of CEO GE sold for about $40/share. Last week it was trading for about $25/share. A decline of 37.5%. During that same time period the Dow Jones Industrial Average, of which GE is the oldest component, rose from 9,600 to 17,900. An increase of 86.5%. This has been a very, very long period of quite unsatisfactory performance for Mr. Immelt.

When Mr. Immelt took the job of CEO GE sold for about $40/share. Last week it was trading for about $25/share. A decline of 37.5%. During that same time period the Dow Jones Industrial Average, of which GE is the oldest component, rose from 9,600 to 17,900. An increase of 86.5%. This has been a very, very long period of quite unsatisfactory performance for Mr. Immelt.

Prior to Mr. Immelt GE was headed by Jack Welch. During his tenure at the top of GE the company created more wealth for its investors than any company ever in the recorded history of U.S. publicly traded companies. GE’s value increased 40-fold (4000%) from 1981 to 2001. He expanded GE into new businesses, often far removed from its industrial manufacturing roots, as market shifts created new opportunities for growing revenues and profits. From what was mostly a diversified manufacturing company Mr. Welch lead GE into real estate as those assets increased in value, then media as advertising revenues skyrocketed and finally financial services as deregulation opened the market for the greatest returns in banking history.

Jack Welch was the Steve Jobs of his era. Because he had the foresight to push GE into new markets, create new products and grow the company. Growth that was so substantial it kept GE constantly in the news, and investors thrilled.

But Mr. Immelt – not so much. During his tenure GE has not developed any new markets. He has not led the company into any growth areas. As the world of portable technology has exploded, making a fortune for Apple and Google investors, GE missed the entire movement into the Internet of Things. Rather than develop new products building on new technologies in wifi, portability, mobility and social Mr. Immelt’s GE sold the appliance division to Electrolux and spent the $3.3B on stock buybacks.

Mr. Immelt’s tenure has been lacked by a complete lack of vision. Rather than looking ahead and preparing for market shifts, Immelt’s GE has reacted to market changes – usually for the poorer. Unprepared for things going off-kilter in financial services, the company was rocked by the financial meltdown and was only saved by an infusion from Berkshire Hathaway. Now it is exiting the business which generates nearly half its profits, claiming it doesn’t want to deal with regulations, rather than figuring out how to make it a more successful enterprise. After accumulating massive real estate holdings, instead of selling them at the peak in the mid-2000s it is now exiting as fast as possible in a recovering economy – to let the fund managers capture gains from improving real estate.

GE is now repatriating some $36B in foreign profits, on which it will pay $6B in taxes. Investors should realize this is happening at the strongest value of the dollar since Mr. Immelt took office. If GE needed these funds, which have been in offshore currencies such as the Euro, it could have repatriated them anytime in the last 3 years and those funds would have been $50B instead of $36B! To say the timing of this transaction could not have been poorer ….

The only thing into which Mr. Immelt has invested has been GE stock. And even that has been a lousy spend, as the price has gone down rather than up! Smart investors have realized that there is no growth in Immelt’s GE, and they have dumped the stock faster than he could buy it. Mr. Immelt’s Harvard MBA gave him insight to financial engineering, but unfortunately not how to lead and grow a major corporation. After 15 years Immelt will leave GE a much smaller, and as he said in the press release, “simpler” business. Apparently it was too big and complicated for him to run.

In the GE statement Mr. Immelt states “This is a major step in our strategy to focus GE around its competitive advantage.” Sorry Mr. Immelt, but that is not a strategy. Identifying growing markets and technologies to create strong, high profit positions with long-term returns is a strategy. Using vague MBA-esque language to hide what is an obvious effort at salvaging a collapsing stock price for another 2 years has nothing to do with strategy. It is a financial tactic.

The Immelt era is the story of a GE which has reacted to events, rather than lead them. Where Steve Jobs took a broken, floundering company and used vision to guide it to great wealth, and Jack Welch used vision to build one of the world’s most resilient and strong corporations, Jeffrey Immelt and his team were overtaken by events at almost every turn. CEO Immelt took what was perhaps the leading corporation of the last century and will leave it in dire shape, lacking a plan for re-establishing its once great heritage. It is a story of utterly failed leadership.

by Adam Hartung | Apr 2, 2015 | Current Affairs, Defend & Extend, In the Rapids, Innovation, Leadership, Web/Tech

Microsoft launched its new Surface 3 this week, and it has been gathering rave reviews. Many analysts think its combination of a full Windows OS (not the slimmed down RT version on previous Surface tablets,) thinness and ability to operate as both a tablet and a PC make it a great product for business. And at $499 it is cheaper than any tablet from market pioneer Apple.

Meanwhile Apple keeps promoting the new Apple Watch, which was debuted last month and is scheduled to release April 24. It is a new product in a market segment (wearables) which has had very little development, and very few competitive products. While there is a lot of hoopla, there are also a lot of skeptics who wonder why anyone would buy an Apple Watch. And these skeptics worry Apple’s Watch risks diverting the company’s focus away from profitable tablet sales as competitors hone their offerings.

Looking at these launches gives a lot of insight into how these two companies think, and the way they compete. One clearly lives in red oceans, the other focuses on blue oceans.

Blue Ocean Strategy (Chan Kim and Renee Mauborgne) was released in 2005 by Harvard Business School Press. It became a huge best-seller, and remains popular today. The thesis is that most companies focus on competing against rivals for share in existing markets. Competition intensifies, features blossom, prices decline and the marketplace loses margin as competitors rush to sell cheaper products in order to maintain share. In this competitively intense ocean segments are niched and products are commoditized turning the water red (either the red ink of losses, or the blood of flailing competitors, choose your preferred metaphor.)

On the other hand, companies can choose to avoid this margin-eroding competitive intensity by choosing to put less energy into red oceans, and instead pioneer blue oceans – markets largely untapped by competition. By focusing beyond existing market demands companies can identify unmet needs (needs beyond lower price or incremental product improvements) and then innovate new solutions which create far more profitable uncontested markets – blue oceans.

Obviously, the authors are not big fans of operational excellence and a focus on execution, but instead see more value for shareholders and employees from innovation and new market development.

If we look at the new Surface 3 we see what looks to be a very good product. Certainly a product which is competitive. The Surface 3 has great specifications, a lot of adaptability and meets many user needs – and it is available at what appears to be a favorable price when compared with iPads.

But …. it is being launched into a very, very red ocean.

The market for inexpensive personal computing devices is filled with a lot of products. Don’t forget that before we had tablets we had netbooks. Low cost, scaled back yet very useful Microsoft-based PCs which can be purchased at prices that are less than half the cost of a Surface 3. And although Surface 3 can be used as a tablet, the number of apps is a fraction of competitive iOS and Android products – and the developer community has not yet embraced creating new apps for Windows tablets. So Surface 3 is more than a netbook, but also a lot more expensive.

Additionally, the market has Chromebooks which are low-cost devices using Google Chrome which give most of the capability users need, plus extensive internet/cloud application access at prices less than a third that of Surface 3. In fact, amidst the Microsoft and Apple announcements Google announced it was releasing a new ChromeBit stick which could be plugged into any monitor, then work with any Bluetooth enabled keyboard and mouse, to turn your TV into a computer. And this is expected to sell for as little as $100 – or maybe less!

This is classic red ocean behavior. The market is being fragmented into things that work as PCs, things that work as tablets (meaning run apps instead of applications,) things that deliver the functionality of one or the other but without traditional hardware, and things that are a hybrid of both. And prices are plummeting. Intense competition, multiple suppliers and eroding margins.

Ouch. The “winners” in this market will undoubtedly generate sales. But, will they make decent profits? At low initial prices, and software that is either deeply discounted or free (Google’s cloud-based MSOffice competitive products are free, and buyers of Surface 3 receive 1 year free of MS365 Office in the cloud, as well as free upgrade to Windows 10,) it is far from obvious how profitable these products will be.

Amidst this intense competition for sales of tablets and other low-end devices, Apple seems to be completely focused on selling a product that not many people seem to want. At least not yet. In one of the quirkier product launch messages that’s been used, Apple is saying it developed the Apple Watch because its other innovative product line – the iPhone – “is ruining your life.”

Apple is saying that its leaders have looked into the future, and they think today’s technology is going to move onto our bodies. Become far more personal. More interactive, more knowledgeable about its owner, and more capable of being helpful without being an interruption. They see a future where we don’t need a keyboard, mouse or other artificial interface to connect to technology that improves our productivity.

Right. That is easy to discount. Apple’s leaders are betting on a vision. Not a market. They could be right. Or they could be wrong. They want us to trust them. Meanwhile, if tablet sales falter….. if Surface 3 and ChromeBit do steal the “low end” – or some other segment – of the tablet market…..if smartphone sales slip….. if other “forward looking” products like ApplePay and iBeacon don’t catch on……

This week we see two companies fundamentally different methods of competing. Microsoft thinks in relation to its historical core markets, and engaging in bloody battles to win share. Microsoft looks at existing markets – in this case tablets – and thinks about what it has to do to win sales/share at all cost. Microsoft is a red ocean competitor.

Apple, on the other hand, pioneers new markets. Nobody needed an iPod… folks were happy enough with Sony Walkman and Discman. Everybody loved their Razr phones and Blackberries… until Apple gave them an iPhone and an armload of apps. Netbook sales were skyrocketing until iPads came along providing greater mobility and a different way of getting the job done.

Apple’s success has not been built upon defending historical markets. Rather, it has pioneered new markets that made existing markets obsolete. Its success has never looked obvious. Contrarily, many of its products looked quite underwhelming when launched. Questionable. And it has cannibalized its own products as it brought out new ones (remember when iPods were so new there was the iPod mini, iPod nano and iPod Touch? After 5 years of declining iPod sale Apple has stopped reporting them.) Apple avoids red oceans, and prefers to develop blue ones.

Which company will be more successful in 2020? Time will tell. But, since 2000 Apple has gone from nearly bankrupt to the most valuable publicly traded company in the USA. Since 1/1/2001 Microsoft has gone up 32% in value. Apple has risen 8,000%. While most of us prefer the competition in red oceans, so far Apple has demonstrated what Blue Ocean Strategy authors claimed, that it is more profitable to find blue oceans. And they’ve shown us they can do it.

by Adam Hartung | Mar 9, 2015 | Current Affairs, In the Rapids, Leadership, Television

The Netflix hit series “House of Cards” was released last night. Most media reviewers and analysts are expecting huge numbers of fans will watch the show, given its tremendous popularity the last 2 years. Simultaneously, there are already skeptics who think that releasing all episodes at once “is so last year” when it was a newsworthy event, and no longer will interest viewers, or generate subscribers, as it once did. Coupled with possible subscriber churn, some think that “House of Cards” may have played out its hand.

So, the success of this series may have a measurable impact on the valuation of Netflix. If the “House of Cards” download numbers, which are up to Netflix to report, aren’t what analysts forecast many may scream for the stock to tumble; especially since it is on the verge of reaching new all-time highs. The Netflix price to earnings (P/E) multiple is a lofty 107, and with a valuation of almost $29B it sells for just under 4x sales.

But investors should ignore any, and in fact all, hype about “House of Cards” and whatever analysts say about Netflix. So far, they’ve been wildly wrong when making forecasts about the company. Especially when projecting its demise.

But investors should ignore any, and in fact all, hype about “House of Cards” and whatever analysts say about Netflix. So far, they’ve been wildly wrong when making forecasts about the company. Especially when projecting its demise.

Since Netflix started trading in 2002, it has risen from (all numbers adjusted) $8.5 to $485. That is a whopping 57x increase. That is approximately a 40% compounded rate of return, year after year, for 13 years!

But it has not been a smooth ride. After starting (all numbers rounded for easier reading) at $8.50 in May, 2002 the stock dropped to $3.25 in October – a loss of over 60% in just 5 months. But then it rallied, growing to $38.75, a whopping 12x jump, in just 14 months (1/04!) Only to fall back to $9.80, a 75% loss, by October, 2004 – a mere 9 months later. From there Netflix grew in value by about 5.5x – to $55/share – over the next 5 years (1/10.) When it proceeded to explode in value again, jumping to $295, an almost 6-fold increase, within 18 months (7/11). Only to get creamed, losing almost 80% of its value, back down to $63.85, in the next 4 months (11/11.) The next year it regained some loss, improving in value by 50% to $91.35 (12/12,) only to again explode upward to $445 by February, 2014 a nearly 5-fold increase, in 14 months. Two months later, a drop of 25% to $322 (4/14). But then in 4 months back up to $440 (8/14), and back down 4 months later to $341 (12/14) only to approach new highs reaching $480 last week – just 2 months later.

That is the definition of volatility.

Netflix is a disruptive innovator. And, simply put, stock analysts don’t know how to value disruptive innovators. Because their focus is all on historical numbers, and then projecting those historicals forward. As a result, analysts are heavily biased toward expecting incumbents to do well, and simultaneously being highly skeptical of any disruptive company. Disruptors challenge the old order, and invalidate the giant excel models which analysts create. Thus analysts are very prone to saying that incumbents will remain in charge, and that incumbents will overwhelm any smaller company trying to change the industry model. It is their bias, and they use all kinds of historical numbers to explain why the bigger, older company will project forward well, while the smaller, newer company will stumble and be overwhelmed by the entrenched competitor.

And that leads to volatility. As each quarter and year comes along, analysts make radically different assumptions about the business model they don’t understand, which is the disruptor. Constantly changing their assumptions about the newer kid on the block, they make mistake after mistake with their projections and generally caution people not to buy the disruptor’s stock. And, should the disruptor at any time not meet the expectations that these analysts invented, then they scream for shareholders to dump their holdings.

Netflix first competed in distribution of VHS tapes and DVDs. Netflix sent them to people’s homes, with no time limit on how long folks could keep them. This model was radically different from market leader Blockbuster Video, so analysts said Blockbuster would crush Netflix, which would never grow. Wrong. Not only did Blockbuster grow, but it eventually drove Blockbuster into bankruptcy because it was attuned to trends for convenience and shopping from home.

As it entered streaming video, analysts did not understand the model and predicted Netflix would cannibalize its historical, core DVD business thus undermining its own economics. And, further, much larger Amazon would kill Netflix in streaming. Analysts screamed to dump the stock, and folks did. Wrong. Netflix discovered it was a good outlet for syndication, created a huge library of not only movies but television programs, and grew much faster and more profitably than Amazon in streaming.

Then Netflix turned to original programming. Again, analysts said this would be a huge investment that would kill the company’s financials. And besides that people already had original programming from historical market leaders HBO and Showtime. Wrong. By using analysis of what people liked from its archive, Netflix leadership hedged its bets and its original shows, especially “House of Cards” have been big hits that brought in more subscribers. HBO and Showtime, which have depended on cable companies to distribute their programming, are now increasingly becoming additional programming on the Netflix distribution channel.

Investors should own Netflix because the company’s leadership, including CEO Reed Hastings, are great at disruptive innovation. They identify unmet customer needs and then fulfill those needs. Netflix time and again has demonstrated it can figure out a better way to give certain user segments what they want, and then expand their offering to eat away at the traditional market. Once it was retail movie distribution, increasingly it is becoming cable distribution via companies like ComCast, AT&T and Time Warner.

And investors must be long-term. Netflix is an example of why trading is a bad idea – unless you do it for a living. Most of us who have full time day jobs cannot try timing the ups and downs of stock movements. For us, it is better to buy and hold. When you’re ready to buy, buy. Don’t wait, because in the short term there is no way to predict if a stock will go up or down. You have to buy because you are ready to invest, and you expect that over the next 3, 5, 7 years this company will continue to drive growth in revenues and profits, thus expanding its valuation.

Netflix, like Apple, is a company that has mastered the skills of disruptive innovation. While the competition is trying to figure out how to sustain its historical position by doing the same thing better, faster and cheaper Netflix is figuring out “the next big thing” and then delivering it. As the market shifts, Netflix is there delivering on trends with new products – and new business models – which push revenues and profits higher.

That’s why it would have been smart to buy Netflix any time the last 13 years and simply held it. And odds are it will continue to drive higher valuations for investors for many years to come. Not only are HBO, Showtime and Comcast in its sites, but the broadcast networks (ABC, CBS, NBC) are not far behind. It’s a very big media market, which is shifting dramatically, and Netflix is clearly the leader. Not unlike Apple has been in personal technology.

by Adam Hartung | Mar 9, 2015 | Current Affairs, Defend & Extend, In the Whirlpool, Leadership

Best Buy, the venerable electronics retailer, is hitting 52 week highs. Coming off a low of $24 in April, 2014 the current price of about $40 is a 67% increase in just 10 months. Analysts are now cheering investors to own the stock, with Marketwatch pronouncing that the last bearish analyst has thrown in the towel.

If you are a trader, perhaps you want to consider this stock. But if you aren’t an investment professional, and you buy and hold stocks for years, then Best Buy is not a stock you should own.

The bullish case for owning Best Buy is based on recovering sales per store, and recovering earnings, after a reduction in the number of stores, and employees, lowered costs. Further, with Radio Shack now in bankruptcy sales are showing an uptick as customers swing over. And that is expected to continue as Sears closes more stores on its marches toward bankruptcy. Additionally, it is hoped that lower gasoline prices will allow consumers to spend more on electronics and appliances at Best Buy.

But, this completely ignores the trend toward on-line retail sales, and the long-term deleterious impact this trend will have on Best Buy. According to the U.S. Census Bureau, on-line sales as a percent of all retail have grown from less than 2.4% in 2005 to over 7.6% by end of 2014 – more than tripling! But more critical to this discussion, all retail sales includes automobiles, lumber, groceries – lots of things where there is little or no online volume.

As most folks know, the number one category for online sales is computers and consumer electronics, which consistently accounts for about 20% of ALL online retail. In fact, about 25% of all consumer electronics are sold online. So the growth in online retail is disproportionately in the Best Buy wheelhouse. The segment where Best Buy competes against streamlined online retailers such as NewEgg.com, ThinkGeek.com and the ever-dominant Amazon.com.

So while in the short term some traditional retail customers will now shift demand to Best Buy, this is not unlike the revenue “bounce” Best Buy received when Circuit City failed. Short term up, but the long term trend continued hammering away at Best Buy’s core market.

This is a big deal because the marginal economic impact of this shift is horrific to Best Buy. In traditional retail most costs are “fixed,” meaning they can’t be changed much month to month. The cost of real estate, store maintenance, utilities and staff cannot be easily adjusted – unless there is a decision to close a gob of stores. Thus losing even a few sales, what economists call “marginal” sales, wreaks havoc on earnings.

Back in 2010 and 2011 Best Buy made a net income (’12 and ’13 were losses) of about 2.6% – or about $2.60 on every $100 revenue. Cost of Goods sold is about 75% of revenue. So on $100 of revenue, $25 is available to cover fixed costs. If revenue falls by just $10, Best Buy loses $2.50 of margin to cover fixed costs. Remember, however, that the net income is only $2.60. So losing 10% of revenue ($10 out of the $100) means Best Buy loses $2.50 of contribution to fixed costs, and that is deducted from net income of $2.60, leaving Best Buy with a meager 10cents of profitability. A 10% loss of revenue wipes out 96% of profits!

Now you know why retailers who lose even a small part of their sales are suddenly closing stores right and left.

Looking forward, online retail sales are forecast to grow by another 57%, reaching 11% of total retail by 2018. But, as we know, this is disproportionately going to be driven by consumer electronics. Which means that while sales for Best Buy stores are up short term, long term they will plummet. That means there will be more store closings, and layoffs as sales shrink. And, increasingly Best Buy will have to compete head-to-head online against entrenched, leading competitors who have been stealing market share for 10+ years.

If you want to trade on the short-term uptick in revenue, and return to slight profitability, then hold your breath and see if you can outsmart the market by picking the right time, and price, for buying and selling Best Buy. But, if you like to invest in strong companies you expect to grow for another 5 years without having to be a market timer, then avoid Best Buy.

Quite simply, it is never a good idea to bet against a long term trend. Short term aberrations will happen, and it may look like the trend has changed. But the trend to online commerce is picking up steam, not reducing. If you want to invest in retail, you want to invest in those companies that demonstrate they can capture the customer’s revenue in the growing, online marketplace.

by Adam Hartung | Feb 7, 2015 | In the Rapids, Innovation, Leadership, Transparency, Web/Tech

Apple was a high flyer. As the stock hit $700, analysts predicted it would reach $1,000. Then Steve Jobs died. He so personified the company that many felt his death left Apple leaderless. So the stock lost 42% of its value dropping to $400.

Apple has now recaptured that lost value, and trades a bit above its former historic high. Apple is the most valuable publicly traded company in America, worth about $700B. For some perspective on just how large this valuation is, it roughly equals the combined values of Dow Jones Industrial Average stalwart, industry leading mega-companies Walmart ($281B #1 retailer,) GE ($242B #1 conglomerate,) McDonalds ($91B #1 restaurant,) and Dupont ($70B #1 chemical.)

Since Apple was on the edge of bankruptcy just 15 years ago, and its value has risen so far, so fast, many people question if it can go much higher. Yes, it’s had a great recent quarter. But can anyone expect this company to continue growing at this pace? Won’t smartphones be commoditized causing Apple to lose share, sales and profits to alternatives? And aren’t its new products like the iWatch sort of “faddish?”

Apple is actually leading another new marketplace development that may well be bigger than any previous market development (digital music, smartphones, tablets) which could well send its value much, much higher. This new market success revolves around developers, beacons, consumers, retailers and payments. Just like we didn’t know we wanted an iPod until we saw one, or an iPhone, new products that exploit the Internet of Things (IoT) is where Apple is again leading the creation of new products and markets.

Start with Apple’s developer ecosystem. No device has any value unless it has applications. Apple created the first smartphone developer network around iOS. Because Android implementations vary based on device manufacturer, Apple’s iOS remains by far the largest installed common device base in the USA, and globally. Thus, developers are attracted in the largest numbers to develop applications for iPhones and iPads running iOS before any other device. To have a sense of the size of this developer base, and the speed with which they develop for Apple products, when Apple launched its own software language for developers called Swift it was downloaded over 11million times in the first month. These developer companies, in total, captured over $25B in revenue just in the 4th quarter from AppStore sales.

Understandably, these developers are constantly creating new products which leverage the installed Apple mobile base. A base which continues to double every few months as globally people buy more iPhones (75million iPhone 6 and 6+ devices sold in the 4th quarter.) And a base growing internationally, as Apple just beat out Louis Vuitton and Hermes to become the #1 luxury brand in China. It is now a virtuous circle, where the more apps developers create the more people want iPhones, and the more iPhones people buy the more developers want to create new apps.

And this is not just consumer apps. Increasingly business systems are being built to use Apple products. Many of these are small to medium size developers and resellers. Additionally, in 2014 Apple and IBM joined forces to create IBM MobileFirst which is building enterprise applications for multiple industries which will allow people to do all their work on iPhones and iPads sold by IBM. Even though IBM has struggled of late, its enterprise application skills have long been a corporate strength, and the first wave of products rolled out in December.

Now focus on iBeacon. Beacons are small electronic devices which transmit a signal that can talk to a smartphone. These can cost anywhere from a few dollars to a nickel, depending upon what they do and signal range. Years ago Apple started developing beacons, and then optimized iOS 8 to selectively and efficiently pick up beacon signals and establish 2-way communications without dissipating the battery. Without a lot of fanfare to the general public, they began rolling out iBeacons several months ago.

Today there are millions of beacons in place. Miami airport uses them to help travelers find gates, food, etc. The New York Metropolitan Museum of Art and Guggenheim Museum use them for wayfinding, virtual guided tours and buying products. The Los Angeles Union Station and zoo, as well as the Orlando Seaworld, uses beacons to aid the customer experience, as this technology has become ready for prime time. Starbucks uses them to help loyal customers place orders. Retail applications are many, including finding products, couponing, product information, pricing and even purchase. Chain Store Age says that 2% of retailers had beacons installed in 2014, but that number will grow to 24% by end of 2015. A 12-fold increase in the installed base, at least.

Additionally, Facebook is now integrating beacons into the Facebook mobile app. This means iPhone users won’t need to download a museum or store app to communicate with beacons for their personal needs. Instead they can communicate via Facebook to find items, know what their friends think of the item, compare prices, etc. When the world’s largest social media platform incorporates beacons Mobile Marketer says this bridges digital and physical marketing, increases personalization in use of beacons, and beacons now accelerate the move to seamless mobile marketing and sales.

So, beacons and your idevice (including your iWatch or other wearable,) with the help of all those developers who are writing apps to bring you information, now make it possible for you to find your way around and learn more about things. And with ApplePay you can actually achieve the “last mile” of concluding the relationship between the business and consumer.

While mobile payment systems have been slow to get started, ApplePay has a lot more going for it. Firstly, it has the support of about all the major bank and card-issuing institutions because they see ApplePay as possibly lowering costs and increasing their revenue. Second, 78% of retailers think mobile pay is better and faster than their current point of sale systems. As a result, 43% of retailers plan to implement ApplePay by the end of 2015.

So, during 2015 we will be able to use beacons to find our way around, use beacons to identify services and products we want, and use beacons to tell us about the services and products either with apps from the location and retailer, or via Facebook mobile. Then we can buy those products immediately with ApplePay.

Even though Apple is a very highly valued company, it is again doing what made it such a big winner. Pioneering entirely new ways for consumers and businesses to get things done. New solutions are happening in all kinds of industries, pioneered by developers big and small. And when it comes to IoT, Apple products are at the center of the next big wave. Ancillary products, like watches and headphones, further support the use of Apple mobile products and the trend to IoT. Apple’s had a great run, but there is ample reason to believe that run has not stopped. There looks to be an entirely new wave of growth as Apple creates new products and solutions we didn’t even know we needed until they were in our hands.

by Adam Hartung | Jan 29, 2015 | Current Affairs, In the Whirlpool, Leadership, Web/Tech

This week Yahoo announced it is spinning off the last of its Alibaba holdings. This is a big deal, because it might well signal the end of Yahoo.

Yahoo created internet advertising. Yahoo was once the #1 home page for browsers across America. But the company has floundered for years, riddled with CEO problems, a contentious Board of Directors and no strategy for dealing with Google which overtook it in all markets.

To much fanfare the Board hired Marissa Mayer, a Google wunderkind we were told, in July, 2012 to mount a serious turnaround. And during her leadership the company’s stock value has tripled – from about $14.50/share to about $43.50. You would think investors would be thrilled and the company would be on the right track.

Only almost all that value creation was due to a stock investment made in 2005 – when Jerry Yang invested $1B to buy 40% of Alibaba. And Alibaba in 2014 became the most valuable IPO in history.

Yahoo today is valued at about $46B. The Alibaba shares being spun out are valued at between $40B and $44B. Which means that after adjusting for the ownership in Yahoo Japan (valued at $2.3B) the core Yahoo ad and portal business is worth between $2B and $4.7B. With just over $1B shares outstanding, that puts a value on Yahoo’s core business of between $2.00-$4.70/share – or about 1/6 to 1/3 the value when Ms. Mayer became CEO.

A highest value of $4.7B for the operating business of Yahoo puts it on par with Groupon. And worth far less than competitors Google ($347B) and Facebook ($212B). Even upstart, and often maligned, social media companies Twitter ($24B) and LinkedIn ($27B) have valuations 5 times Yahoo.

Unfortunately, this latest leader and her team haven’t been any more effective at improving the company’s business than previous regimes. Under CEO Mayer Yahoo used gains from Alibaba’s valuation to invest about $2.1B in 49 outside companies – with $2B of that being acquisitions of technology companies Flurry ($200M), BrightRoll ($640M) and Tumblr ($1.1). Under the most optimistic view of Yahoo, leadership spent 40% of the company’s value in acquisitions that have made no difference to ad revenues or profits.

In fact, Yahoo’s business revenues, and profits, have declined for 6 consecutive quarters. Despite the CEO’s mandate that employees could no longer work from home. A kerfuffle that proved yet another management distraction, and apparently an effort to cut staff without it looking like a layoff.

Meanwhile there have been big efforts to boost people going to the Yahoo portal. Such as hiring broadcaster Katie Couric to beef up the news section, and former New York Times tech columnist David Pogue to deepen tech coverage and New York Times Magazine political writer Matt Bai to draw in more readers. But these have done nothing to move the needle.

Consistently declining display advertising has left search ads a bigger, and more profitable, business. And while Yahoo’s CEO has been teasing ad agencies that she might begin another big brand campaign, including TV, to bring Yahoo more attention – and hopefully more advertisers – there is no evidence anyone cares as more and more dollars flow to “programmatic” ad buying where Google is king. In the digital ad marketplace Google has 31% share, Facebook 7.75% share and Yahoo a meager 2.36% share.

Soon there will be little left of the once mighty Yahoo. It has pretty much lost relevancy. Large investors are crying for a merger with AOL, whose inability to grow its portal, ad and media businesses has left its market cap at a mere $3.7B. But combining two companies that are market irrelevant, and declining, will probably have the same outcome as happened when merging KMart and Sears. The Yahoo growth stall remains intact, and revenues will decline along with profits as the market continues shifting to powerful and growing competitors Google, Facebook and other social media companies. Only now Yahoo’s leaders won’t have the Alibaba value mountain to hide behind

by Adam Hartung | Jan 22, 2015 | Current Affairs, Defend & Extend, Games, In the Swamp, Innovation, Leadership, Software, Web/Tech

Yesterday Microsoft conducted a pre-launch of Windows 10, demonstrating its features in an effort to excite developers and create some buzz before consumer launch later in 2015.

By and large, nobody cared. Were you aware of the event? Did you try to watch the live stream, offered via the Microsoft web site? Were you eager to read what people thought of the product? Did you look for reviews in the Wall Street Journal, USA Today and other general news outlets?

Microsoft really blew it with Windows 8 – which is the second most maligned Windows product ever, exceeded only by

Vista. But that wasn’t hard to predict, in June, 2012. Even then it was clear that Windows 8, and Surface tablets, were designed to defend and extend the installed Windows base, and as such the design precluded the opportunity to change the market and pull mobile users to Microsoft.

And, unfortunately, that is how Windows 10 has been developed. At the event’s start Microsoft played a tape driving home how it interviewed dozens and dozens of loyal Windows customers, asking them what they didn’t like about 8, and what they wanted in a Windows upgrade. That set the tone for the new product.

Microsoft didn’t seek out what would convert all those mobile users already on iOS or Android to throw away their devices and buy a Microsoft product. Microsoft didn’t ask its defected customers what it would take to bring them back, nor did it ask the over 50% of the market using Windows 7 or older products what it would take to get them to go to Windows mobile rather than an iPad or Galaxy tablet. Nope. Microsoft went to its installed base and asked them what they would like.

Imagine it’s 1975 and for two decades you have successfully made and sold small offset printing presses. Every single company of any size has one in their basement. But customers have started buying really simple, easy to use Xerox machines. Fewer admins are sending even fewer jobs to the print shop in the basement, as they choose to simply run off a bunch of copies on the Xerox machine. Of course these copies are more expensive than the print shop, and the quality isn’t as good, but the users find the new Xerox machines good enough, and they are simple and convenient.

What are you to do if you make printing presses? You probably need to find out how you can get into a new product that actually appeals to the users who no longer use the print shop. But, instead, those companies went to the print shop operators and asked them what they wanted in a new, small print machine. And then the companies upgraded their presses and other traditional printing products based upon what that installed base recommended. And it wasn’t long before their share of printing eroded to a niche of high-volume, and often color, jobs. And the commercial print market went to Xerox.

That’s what Microsoft did with Windows 10. It asked its installed base what it wanted in an operating system. When the problem isn’t the installed base, its the substitute product that is killing the company. Microsoft didn’t need input from its installed base of loyal users, it needed input from people who have quit using HP laptops in favor of iPads.

There are a lot of great new features in Windows 10. But it really doesn’t matter.

The well spoken presenters from Microsoft laid out how Windows 10 would be great for anyone who wants to go to an entirely committed Windows environment. To achieve Microsoft’s vision of the future every one of us will throw away our iOS and Android products and go to Windows on every single device. Really. There wasn’t one demonstration of how Windows would integrate with anything other than Windows. And there appeared on intention of making the future an interoperable environment. Microsoft’s view was we would use Windows on EVERYTHING.

Microsoft’s insular view is that all of us have been craving a way to put Windows on all our devices. We’ve been sitting around using our laptops (or desktops) and saying “I can’t wait for Microsoft to come out with a solution so I can throw away my iPhone and iPad. I can’t wait to tell everyone in my organization that now, finally, we have an operating system that IT likes so much that we want everyone in the company to get rid of all other technologies and use Windows on their tablets and phones – because then they can integrate with the laptops (that most of us don’t use hardly at all any longer.)”

Microsoft even went out of its way to demonstrate how well Win10 works on 2-in-1 devices, which are supposed to be both a tablet and a laptop. But, these “hybrid” devices really don’t make any sense. Why would you want something that is both a laptop and a tablet? Who wants a hybrid car when you can have a Tesla? Who wants a vehicle that is both a pick-up and a car (once called the El Camino?) Microsoft thinks these are good devices, because Microsoft can’t accept that most of us already quit using our laptop and are happy enough with a tablet (or smartphone) alone!

Microsoft presenters repeatedly reminded us that Windows is evolving. Which completely ignores the fact that the market has been disrupted. It has moved from laptops to mobile devices. Yes, Windows has a huge installed base on machines that we use less and less. But Windows 10 pretends that there does not exist today an equally huge, and far more relevant, installed base of mobile devices that already has millions of apps people use every single day over and over. Microsoft pretended as if there is no world other than Windows, and that a more robuts Windows is something people can’t wait to use! We all can’t wait to go back to a exclusive Microsoft world, using Windows, Office, the new Spartan browser – and creating documents, spreadsheets and even presentations using Office, with those hundreds of complex features (anyone know how to make a pivot table?) on our phones!

Just like those printing press manufacturers were sure people really wanted documents printed on presses, and couldn’t wait to unplug those Xerox machines and return to the old way of doing things. They just needed presses to have more features, more capabilities, more speed!

The best thing in Windows 10 is Cortana, which is a really cool, intelligent digital assistant. But, rather than making Cortana a tool developers can buy to integrate into their iOS or Android app the only way a developer can use Cortana is if they go into this exclusive Windows-only world. That’s a significant request.

Microsoft made this mistake before. Kinect was a great tool. But the only way to use it, initially, was on an xBox – and still is limited to Windows. Despite its many superb features, Kinect didn’t develop anywhere near its potential. Cortana now suffers from the same problem. Rather than offering the tool so it can find its best use and markets, Microsoft requires developers and consumers buy into the Windows-exclusive world if you want to use Cortana.

Microsoft hasn’t yet figured out that it lost relevance years ago when it missed the move to mobile, and then launched Windows 8 and Surface to markets that didn’t really want those products. Now the market has gone mobile, and the leader isn’t Microsoft. Microsoft has to find a way to be relevant to the millions of people using alternative products, and the Windows 10 vision, which excludes all those competing devices, simply isn’t it.

There was lots of neat geeky stuff shown. Surface tablets using Windows 10 with an xBox app can now do real gaming, which looks pretty cool and helps move Microsoft forward in mobile gaming. That may be a product that sets Sony’s Playstation and Nintendo’s Wii on their heels. But that’s gaming, and historically not where Microsoft makes any money (nor for that matter does Sony or Nintendo.)

There is a new interactive whiteboard that integrates Skype and Windows tablets for digital enhancement of brainstorming meetings. But it is unclear how a company uses it when most employees already have iPhones or Samsung S5s or Notes. And for the totally geeky there was a demo of a holographic headset. But when it comes to disruptive products like this success requires finding really interesting applications that otherwise cannot be completed, and then the initial customers who have a really desperate need for that application who will become devoted users.

Launching such disruptive products has long been the bane of Microsoft’s existence. Microsoft thinks in mass market terms, and selling to its base. Not developing breakthrough applications and finding niche markets to launch new uses. Nor has Microsoft created a developer community aligned with that kind of work. They have long been taught to simply continue to do things that defend and extend the traditional base of product uses and customers.

The really big miss for this meeting was understanding developer needs. Today developers have an enormous base of iOS and Android users to whom they can sell their products. Windows has less than 3% share in mobile devices. What developer would commit their resources to developing products for Windows 10, which has an installed base only in laptops and desktops? In other words, yesterday’s technology base? Especially when to obtain the biggest benefits of Windows 10 that developer has to find end use customers (companies or consumers) willing to commit 100% to Windows everywhere – even including their televisions, thermostats and other devices in our ever smarter buildings?

Windows 10 has a lot of cool features. But Microsoft made a big miss by listening to the wrong people. By assuming its installed base couldn’t wait for a Microsoft-exclusive solution, and by behaving as if the installed base of mobile devices either didn’t exist or didn’t matter, the company showed its hubris (once again.) If all it took to succeed were great products, the market would never have shifted from Macintosh computers to Windows machines in the 1990s. Microsoft simply doesn’t realize that it lacks the relevance to pull of its grand vision, and as such Windows 10 has almost no chance of stopping the Apple/Google/Samsung juggernaut.

by Adam Hartung | Jan 6, 2015 | Current Affairs, In the Rapids, Innovation, Leadership

Crude oil has dropped 50% in just 6 months. At under $50/barrel, gasoline is now selling for under $2/gallon in many places. This is a price rollback to 2008 prices – something almost no one expected in early 2014.

It is easy to jump to conclusions about what this will mean for sales of some products. And many analysts have been saying this is a terrible scenario for Tesla, which sells all electric cars. The theory is pretty simple, and goes something like this: People buy electric cars to save on petrol costs, so when petrol prices fall their interest in electric cars decline. With gasoline cheap again, nobody will want an electric car, so Tesla will do poorly.

But this is just an example of where common wisdom is completely wrong. And now that Tesla has lost about 1/3 of its value, due to this popular belief, it is offering investors a tremendous buying opportunity.

There are three big reasons we can expect Tesla to continue to do well, even if gasoline prices are low in the USA.

First, Teslas are great cars. Not simply great electric cars. So quickly we forget that Consumer Reports gave the Model S 99 out of a possible 100 points – the highest rating for an automobile ever. In 2013 Motor Trend had its first ever unanimous selection of the Best Car of the Year when all the judges selected the Model S. The Model S, and the Roadster before it, have won over customers not just because they use less petroleum – but rather because the speed, handling, acceleration, fit and detail, design and ride are considered extremely good – even when comparing with the likes of Mercedes and BMW – and when you don’t even consider it is an electric car.

It is a gross mis-assumption to say people buy Teslas because they are electric powered. People are buying Teslas because they are great cars which are fun to drive, perform well, look stylish, have low maintenance costs and very low operating costs. And they are more ecological in a world where people increasingly care about “going green.” In 2015 consumers will be able to choose not only the Roadster, and the fairly pricey Model S, but soon enough the smaller, and less expensive, Model 3 which is targeted squarely at BMW Series 3 customers. Teslas are designed to compete with all cars for consumer dollars, not just electric cars and not just on the basis of using less fuel.

Second, the market for autos is global and gasoline isn’t cheap everywhere. Take for example Hong Kong, where gasoline still retails for $8.50/gallon (as of 31Dec. 2014.) Or in Paris or Munich where gasoline costs $5/gallon – even though the Euro’s value has shrunk to only $1.20. Outside the USA most developed countries have a lot more demand for oil than they have production (if they have any at all.)

Almost all of these countries offer incentives for buying electric cars. For example, in Hong Kong and Singapore the import tax on an auto can be 100-200% of the car’s price (literally double or triple the price due to import taxes.) But in these same countries the tax is greatly reduced, or eliminated entirely, for buying an electric car for policy reasons to promote lower oil consumption and cleaner city air. So a $100,000 Mercedes E class in Hong Kong will cost $200,000+, while a $100,000 Model S costs $100,000.

Further, outside the USA most countries heavily tax gasoline and diesel in order to discourage consumption and yield infrastructure funds. So even as oil prices go down, gasoline prices do not decline in lock-step with oil price declines. Consumers in these countries have a much greater demand than U.S. consumers for high mileage (and electric) cars almost regardless of crude oil prices. So thinking that low USA gasoline prices reduces demand for electric cars is actually quite myopic.

Third, do you really think oil prices will stay low forever? Oil is a commodity with incredible political impact. Pricing is based on much more than “supply and demand.” At any given time Aramco, or its lead partners such as Saudi Arabia and the UAE, can decide to simply pump more, or less fuel. Today they are happy to pump a lot of oil because it hurts countries with which they have a bone to pick – such as Russia (now almost out of bank reserves due to low oil prices) and Iran. And it helps USA consumers, reducing domestic interest in things like the Keystone Pipeline which could lessen long-term reliance on Aramco oil. And investing in risky development projects like the arctic ocean. Tomorrow these countries could decide to pump less, as they did in the mid-1970s, driving up prices and almost killing the U.S. economy.

Oil prices have a long history of instability. Like most commodities. That’s why a state economy like Texas, where they produce a lot of oil, could boom the last 4 years, while manufacturing states (like Wisconsin and Illinois) suffered. With oil back under $50/barrel drilling rigs will go into mothballs, oil leases will go undeveloped, fracking projects will be stalled and the economy of oil producing states will suffer. Like happened in the mid-1980s when Saudi Arabia once again began flooding the market with oil and exploration and production companies across Texas went out of business.

Most people are smart enough to realize you look at all aspects of owning a new car. There are a lot of reasons to buy Tesla automobiles. Not only are they good cars, but they are changing the sales model by eliminating those undesirable auto dealers most consumers hate. And they are offering charging stations in many locations to make refills painless. And you don’t have to change the oil, or do quite a bit of other maintenance. And you do less damage to the environment. It’s not simply a matter of the price of fuel.

It is always risky to oversimplify consumer behavior. Decisions are rarely based entirely on price. And, as Apple has shown with sales if iOS devices and Macs, people often buy more expensive products when they offer a better experience and brand. Long term investors know that when a stock is beaten down by a short-term reaction to a short-term phenomenon (such as this fast decline in oil prices) it often creates an opportunity to buy into a company with a great future potential for growth.

by Adam Hartung | Dec 31, 2014 | General, In the Rapids, Transparency

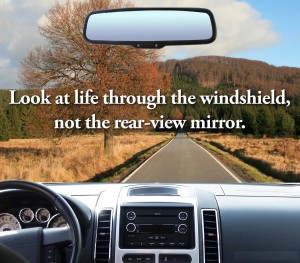

Results, results, results. We frequently hear that we should focus on results.

More often than not, focusing on results is a waste of time. Because it is looking in the rear view mirror, rather than the windshield.

Someone asked me today what I thought of Janet Yellen as head of the Federal Reserve. I found this hard to answer. Even though Chairperson Yellen has been in the job since February, her job as lead policy setter has almost no short term ramifications. It takes quarters – not months – to see the results of those policy decisions. Even after a year in office, it is very difficult to render an opinion on her performance as Fed leader. The fantastic 5% growth in the U.S. economy last quarter has much more to do with what happened before she took office – in fact years of policy setting before she took office – than what has happened since she became the top Fed governor.

We often forget what the word “results” means. It is the outcome of previous decisions. Results tell us something about decisions that happened in the past. Sometimes, far into the past. We all can remember companies where looking backward all looked well, right up until the company fell off a cliff. Circuit City. Brachs Candy. Sun Microsystems.

Further, “results” are impacted dramatically by things outside the control of management, such as:

- Changes in interest rates (or no changes when they remain low)

- Changes in oil prices (which have been dramatically lower the last 6 months)

- Changes in investor expectations and the overall stock market (which has been on a record-setting bull run)

- Inflation expectations (which remain at historical lows)

- Expectations about labor rates (which remain low, despite trends toward higher minimum wages)

- Technology advances (including rapid mobile growth in apps, beacons, payments, etc.)

We too often forget that last quarter’s (or even last year’s) results are due to decisions made months before. Gloating, or apologizing, about those results has little meaning. Results, no matter how recent, are meaningless when looking forward. Decisions made long ago caused those results. “Results” are actually unimportant when investing for the future.

What really matters are the decisions being made today which can cause future results to be wildly different – better or worse. What we need to focus upon are these current decisions and their ability to create future results:

- What are the goals being set for next year – or better yet for 2020?

- What are the trends upon which goals are being set? How are future goals aligned to major trends?

- What are the future expected scenarios, and how are goals being set to align with those scenarios?

- Who will be the likely future competitors, and how are goals being set make sure we the organization is prepared to compete with the right companies?

Far too often management will say “we just had great results. We plan to continue executing on our plans, and investors should expect similar future results.” But that makes no sense. The world is a fast changing place. Past results are absolutely not any indicator of future performance.

For 2015, and beyond, investors (and employees, suppliers and communities sponsoring companies) should resolve to hold management far more accountable for its future goals, and the process used to set those goals. Amazon.com maintains a valuation far higher than its historical indicates it should primarily because it is excellent at communicating key trends it watches, future scenarios it expects and how the company plans to compete as it creates those future scenarios.

In the 1981 Burt Reynolds’ movie “Cannonball Run” a character begins a trans-country auto race by ripping the rear view mirror from his car and throwing it out the window. “What’s behind me is not important” he proudly states. This should be the 2015 resolution of investors, and all leaders. Past results are not important. What matters are plans for the future, and future goals. Only by focusing on those can we succeed in creating growth and better results in the future.

But gin is not a growth category. And Tanqueray, despite its great product heritage and strong brand position, has almost no growth prospects.

But gin is not a growth category. And Tanqueray, despite its great product heritage and strong brand position, has almost no growth prospects. #1 – Tanqueray Rangpur is a highly citrus-flavored gin taking a direct assault on flavored vodkas. Although still very much a gin, with its specific herb-based taste, Rangpur adds a hefty, and uniquely flavored, dose of lime. This makes for a fast, easy to prepare gin and tonic or lime-based gimlet – 2 classic cocktails that have their roots in England but have been popular in the US since before prohibition. And, in defense of the brand, Rangpur is priced about 10-20% higher than London Dry.

#1 – Tanqueray Rangpur is a highly citrus-flavored gin taking a direct assault on flavored vodkas. Although still very much a gin, with its specific herb-based taste, Rangpur adds a hefty, and uniquely flavored, dose of lime. This makes for a fast, easy to prepare gin and tonic or lime-based gimlet – 2 classic cocktails that have their roots in England but have been popular in the US since before prohibition. And, in defense of the brand, Rangpur is priced about 10-20% higher than London Dry. #2 – Tanqueray Old Tom and Tanqueray Milacca appeal to the demographic that loves specialty, crafted products. The “craft” product movement has grown dramatically, and nowhere more powerfully than amongst 28-42 year old beer drinkers. Old Tom and Milacca leverage this trend. Both are “retro” products, harkening to gins over 100 years ago. They are made in small batches and have limited availability. They are targeted at the consumer that wants something new, unique, unusual and yet tied to old world notions of hand-made production and high quality. These craft products are priced 25-35% higher than traditional London Dry.

#2 – Tanqueray Old Tom and Tanqueray Milacca appeal to the demographic that loves specialty, crafted products. The “craft” product movement has grown dramatically, and nowhere more powerfully than amongst 28-42 year old beer drinkers. Old Tom and Milacca leverage this trend. Both are “retro” products, harkening to gins over 100 years ago. They are made in small batches and have limited availability. They are targeted at the consumer that wants something new, unique, unusual and yet tied to old world notions of hand-made production and high quality. These craft products are priced 25-35% higher than traditional London Dry.