by Adam Hartung | Mar 13, 2014 | Food and Drink, Investing, Leadership, Lock-in, Trends

Understanding trends is the most important part of planning.

Yet, most business planning focuses on internal operations and how to improve them, usually neglecting trends and changes in the external environment that threaten not only sales and profits but the business’ very existence.

Take Sbarro’s recent bankruptcy. That was easy to predict, especially since it’s the second time down for the restaurant chain. You have to wonder why leadership didn’t do something different to avoid this fate.

Traditional retail has been in decline for a decade. As consumers buy more stuff on-line, from a rash of retailers old and new, there is simply less stuff being bought at stores. It’s an obvious trend which affects everyone. But we see business leaders surprised by the trend, reacting with store closings and cost reductions, and we are surprised by the headlines:

Thousands of retail stores will close in 2014. It should surprise no one that physical retail traffic has been in dramatic decline. Large malls are shutting down, and being destroyed, as the old “anchor tenants” like Sears and JC Penney flail. Over 200 large malls (over 250,000 square feet) have vacancy rates exceeding 35%. Retail rental prices keep declining as the overbuilt, or under-demolished, retail square footage supply exceeds demand.

Business planning is about defending and extending the past.

Given this publicly available information, you would think a company with most of its revenue tightly linked to traditional retail would —- well —- change. Yet, Sbarro stuck with its business of offering low cost food to mall shoppers. Its leaders continued focusing on defending & extending its old business, improving operations, while trends are clearly killing the business.

Almost all business planning efforts begin by looking at recent history. Planning processes starts with a host of assumptions about the business as it has been, and then try projecting those assumptions forward. Sbarro began when malls were growing, and its plans were built on the assumption that malls thrive. Now malls are dying, but that is not even part of planning for the future. Planning remains fixated on execution of a strategy that is no longer viable .

No one can “fix” Sbarro – they have to change it. Radically. And that means planning for a future which looks nothing like the past. Planning needs to start by looking at trends, and developing future scenarios about what customers need. Regardless of what the business did in the past.

Planning should be about understanding trends and developing future scenarios.

For all businesses the important planning information is not sales, sales per store, product line offerings, cost of goods sold, labor cost, gross margin, rents, cleanliness scores, safety record, location, etc., etc. The important information is in marketplace trends. For Sbarro, what will be dining trends in the future? What kind of restaurant experience do people want not only in 2014, but in 2020? Or should the company move toward delivery? At-home food preparation?

Success only happens when we understand trends and build our business to deliver what people want in the future. The world moves very fast these days. Technologies, styles, fashions, tastes, regulations, prices, capabilities and behaviors all change very quickly. Tomorrow is far less likely to look like today than to look, in important ways, remarkably different.

Plan for the future, not from the past.

To succeed in today’s fast changing environment requires we plan for the future, not from the past. We have to understand trends, and create keen vision about what customers will want in the future so we can steer our business in the right direction. Before we even discuss execution we have to make sure we are going to give customers what they want – which will be aligned with trends.

Otherwise, you can have the best run operation in the country and still end up like Sbarro.

Connect with me on LinkedIn, Facebook and Twitter.

Links:

Radio Shack is a leader… in irrelevancy… and why that’s important for you

Old assumptions, and the CEO’s bias, is killing Sears

Winners shift with trends, losers don’t – understanding Sears’ decline

The CEO problem and the failure of JCPenney

The RIGHT way to implement planning to thrive in changing markets

How to plan like Virgin, Apple and Google

by Adam Hartung | Mar 4, 2014 | Current Affairs, Disruptions, Leadership

Obamacare is the moniker for the Affordable Care Act. Unfortunately, a lot of people thought the last thing Obamacare would do was make health care more affordable. Yet, early signs are pointing in the direction of a long-term change in America’s cost of providing health services.

The November, 2013 White House report on “Trends in Health Care Cost Growth” provides a plethora of data supporting declining health care costs. Growth in health care cost per capita at 1% in 2011 was the lowest since record keeping began in the 1960s. Health care inflation now seems to be about the same as general inflation, after 5 decades of consistently outpacing other price increases. And Congressional Budget Office (CBO) projections of Medicare/Medicaid cost as a percent of Gross Domestic Product (GDP) have declined substantially since 2010.

Of course, one could easily accuse the White House of being self-serving with this report. But at a February National Association of Corporate Directors Chicago Conference on health care,

all agreed that, indeed, the world has changed as a result of Obamacare. And one short-term outcome is American health care trending toward greater affordability.

How Obamacare accomplished this, however, is not at all obvious.

Abdication: that is the word which best desribed patient health care choices for the last several decades. Patients simply did whatever they were told to do. If a test was administered, or a procedure recommended, or a referral to a specialist given, or a drug prescribed patients simply did what they were told – “as long as the insurance paid.”

The process of health care implementation, how patients were treated, was specified by medical professionals in conjunction with insurance companies and Medicare. Patients had little – or nothing – to do with the decision making process. The service was either offered, and largely free, or it wasn’t offered.

In effect, Americans abdicated health care decision-making to others. The decisions about what would be treated, when and how was almost wholly made without patient involvement. And what would be charged, as well as who would pay, was also made by someone other than the patient. The patient had no involvement in determining if there was any sort of cost/benefit analysis, or the comparing of different care options.

Insurance companies dickered with providers over pricing. Then employers dickered with insurance companies over what would be covered in a plan, what the price would be and what percentage was paid by the insurance company and what would be paid by patients. When a patient needed treatment either the employer’s insurance company paid, after a negotiation on price with the provider, or the insurance company did not. And patients largely consumed whatever care was offered under their plan.

Or, if it was Medicare the same process applied, just substitute for “employer” the words “a government agency.”

Americans had abdicated the decision-making process for health care to a cumbersome process that involved medical professionals, insurance companies and employers. While patients may have acted like health care was free, everyone knew it was not free. But the process of deciding what would be done, pricing and measuring benefits had been abdicated by patients to this process years ago.

Obamacare moves Americans from a world of abdication to a world of accountability. Everyone now has to be insured, so the decision about what coverage each person has, at what level and cost, is now in the hands of the patient. Rather than a single employer option, patients have a veritable smorgasboard of coverage options from which they can select. And this begins the process of making each person accountable for their health care cost.

When people receive treatment, by and large more is now being paid by the patient. And once people had to start paying, they had to be accountable for the cost (higher deductibles and co-pays had already started this process before Obamacare.) When people became accountable for the cost, a lot more questions started to be asked about the price and the benefit. Instead of consuming everything that was available, because there was no cost implication, patient accountability for some of the cost has now forced people to ask questions before committing to treatments.

Higher accountability now has consumers (patients) asking for more choices. And more choices pushes providers to realize that price and delivery make a difference to the patient – who is now a decision-making buyer.

In economic lingo, accountability is changing the health care demand and supply curves. Previously there was no elasticity of demand. Patients had no incentives to reduce demand, as health care was perceived as free. Providers had no incentive to alter supply, because the more they supplied the more they were paid. Both supply and demand went straight up, because there was no pricing element to stand in the way of both increasing geometrically.

But now patients are making decisions which alter demand. Increasingly they determine what procedures to have, based on price and expected outcomes. And supply is now altered based upon provider and price. Patients can shop amongst hospitals and outpatient facilities to determine the cost of minor surgery, for example, and decide which solution they prefer. More services, at different locations and different price points alter the supply curve, and make an impact on the demand curve. We now have elasticity in both demand and supply.

A patient with a mild heart arythmia can decide if they really need an in-house EKG with a cardiologist review, or substitute an EKG detected from a smartphone diagnosed by an EKG tech remotely. With both services offered at very different price points (and a host of options in the middle,) it is possible for the patient to change their demand for something like an EKG – and on to total cost of cardiac care. They may buy more of some care, such as services they find less costly, or providers that are less pricey, and less of another service which is more costly due to the service, the provider or a combination of the two.

And thus accountability starts us down the road to greater affordability.

In distribution terms, the old system was a “wholesale system” which had very expensive suppliers with pricing which was opaque – and often very bizarre. Pricing was impossible to understand. Middlemen in insurance companies hired by employers tried to determine what services should be given to patients, and at what prices for the employers (not the patient) to pay. This wholesale distribution method of health care drove prices up. Neither those creating demand (patients) or those offering the supply (medical providers) had any incentive to use less health care or lower the price. And often it left both the patient and the supplier extremely unhappy with how they were treated by arbitrary middle men more interested in groups than individuals.

But the new system is a retail system. Because the patient no longer abdicates decision making to middle-men, and instead is accountable for the health care they receive and the price they pay. It is creating a far more rational pricing system, and generating new curves that are starting to balance both supply and demand; while simultaneously encouraging the implementation of new options that provide the ability to enhance the service and/or outcome at lower price points.

Obamacare is just beginning its implementation. “The devil is in the details,” and as we saw with the government web site for exchanges there have been many, many glitches. As with anything so encompassing and complex, there are lots of SNAFUs. The market is still far from transparent, and patients are far from educated, much less fully informed, decision makers. There is a lot of confusion amongst providers, suppliers and patients. Regulations are unclear, and not always handled consistently or judiciously.

But, America has made one heck of a start toward containing something which has overhung economic growth since the 1970s. The health care cost trend is toward greater price visibility, smarter consumers, more options and lower health care costs both short- and long-term.

In the 1960s Congress, and the nation, was deeply divided over passing the Civil Rights Act. Its impact would be significant on both the way of life for many people, and the economy. How it would shape America was unclear, and many opposed its passage. Called for by President Kennedy, President Johnson worked hard – and with lots of strong-arming – to obtain its passage after Kennedy’s death.

After a lot of haggling, some Congressional trickery, filibustering and a lot of legal challenges, the Civil Rights Act was passed in 1964 and it ushered in a new wave of economic growth as it freed resources to add to the American economy instead of being held back. It was a game changer for the nation, and 40 years later, it’s hard to imagine an America without the gains made by the Civil Rights Act.

Looking 40 years forward, Obamacare – the ACA – may well be legislation that is seen as an economic game changer. Although its passage was bruising to many in the nation, it changed health care from a system of patient abdication to one of patient accountability, and thereby directed health care toward greater affordability for the country and its citizens.

by Adam Hartung | Feb 24, 2014 | Current Affairs, Defend & Extend, In the Rapids, Leadership, Transparency, Web/Tech

Facebook is acquiring WhatsApp, a company with at most $300M revenues, and 55 employees, for $19billion. That’s billion – with a “b.” An astonishing figure that is second only to HP’s acquisition of market leader Compaq, which had substantial revenues and profits, as tech acquisitions. $19B is 13 times Facebook’s (not WhatsApp’s) entire 2013 net income – and almost 2.5 times Facebook’s (again, not WhatsApp’s) 2013 gross revenues!

On the mere face of it this valuation should make the most dispassionate analyst swoon. In today’s world very established, successful companies sell for far, far lower valuations. Apple is valued at about 13 times earnings. Microsoft about 14 times earnings. Google 33 times. These are small fractions of the nearly infinite P/E placed on WhatsApp.

But there is a leadership lesson offered here by CEO Zuckerberg’s team that is well worth learning.

Irrelevancy can happen remarkably quickly. True in any industry, but especially in digital technology. Examples: Research-in-Motion/Blackberry. Motorola. Dell. HP all lost relevancy in months and are struggling. (For those who want non-tech examples think of Circuit City, Best Buy, Sears, JCPenney, Abercrombie and Fitch.) Each of these companies was an industry leader that lust its luster, most of its customers, a big chunk of its employees and much of its market valuation in months when the company missed a market shift.

Although leadership knew what it had historically done to sell products profitably, in a very short time market trends reduced the value of the company’s historical success formula leaving investors, as well as management, wondering how it was going to compete.

Facebook is not immune to changing market trends. Although it has been the benchmark for social media, it only achieved that goal after annihilating early leader MySpace. And although Facebook was built by youthful folks, trends away from using laptops and toward mobile devices have challenged the Facebook platform. Simultaneously, changing communication requirements have altered the use, and impact, of things like images, photos, charts and text. All of these have the potential impact of slowly (or not so slowly) eroding the value (which is noticably lofty) of Facebook.

Most leaders address these kinds of challenges by launching new products to leverage the trend. And Facebook did just that. Facebook not only worked on making the platform more mobile friendly, but developed its own platform apps for photos and texting and all kinds of new features.

But, and this is critical, external companies did a better job. Two years ago Instagram emerged as a leader in image sharing. And WhatsApp has developed a superior answer for messaging.

Historically leadership usually said “we need to find a way to beat these new guys.” They would make it hard to integrate new solutions with their dominant platform in an effort to block growth. They would spend huge amounts on marketing and branding to try overcoming the emerging leader. Often they filed intellectual property litigation in an effort to cause short-term business interuption and threaten viability. They might even try hiring the emerging company’s tech leader away to stop development.

All of these actions were efforts to defend & extend the early leader’s market position. Even though the market is shifting, and trends are developing externally from the company, leadership will tend to look inside for an answer. It will often ignore the trend, disparage the competition, keep promising improvements to its historical products and services and blanket the media with PR as to its stated superiority.

But, as that list (above) of companies that lost relevancy demonstrates, this rarely works. In a highly interconnected, fast-paced, globally competitive marketplace customers go where they want. Quickly. Often leaving the early leader with a management team (and Board of Directors) scratching its head and wondering how it lost so much market position, and value, so quickly.

Hand it to Mr. Zuckerberg’s team. Instead of ignoring trends in its effort to defend & extend its early lead, they reached out and brought the leader to them. $1B for Instagram was a big investment, especially so close to launching an IPO. But, it kept Facebook relevant in mobile platforms and imaging.

And making a nosebleed-creating $19B deal for WhatsApp focuses on maintaining relevancy as well. WhatsApp already processes almost as many messages as the entire telecom industry. It has 450million users with 70% active daily, which is already 60% the size of Facebook’s daily user community (550million.) By bringing these people into the Facebook corporate family it assures the company of continued relevancy as the market shifts. It doesn’t matter if these are the same people, or different people. The issue is that it keeps Facebook relevant, rather than losing relevance to a competitor.

How will this all be monetized into $19B? The second brilliant leadership call by Facebook is to not answer that question.

Facebook didn’t know how to monetize its early leadership in users, but management knew it had to find a way. Now the company has grown from almost no revenues in 2008 to almost $8B in just 5 years. (Does your company have a plan to add $8B/year of organic revenue growth by 2019?)

So just as Facebook had to find its revenue model (which it is still exploring,) Zuckerberg’s team allows the leadership of Instagram and WhatsApp to remain independent, operating in their own White Space, to grow their user base and learn how to monetize what is an extraordinarily large group of happy folks. When looking to grow in new markets, and you find a team with the skills to understand the trends, it is independence rather than integration that makes the most sense organizationally.

Thirdly, back to that valuation issue. $19B is a huge amount of money. Unless you don’t really spend $19B. Facebook has the blessed ability to print its own. Private money that it can use for such acquisitions. As long as Facebook has a very high market valuation it can make acquisitions with shares, rather than real money.

In the case of both Instagram and WhatsApp the acquisition is being made in a mix of cash, Facebook stock and restricted Facebook stock for employees. The latter two of these three items are not real money. They are simply pieces of paper giving claims to ownership of Facebook, which itself is valued at 22 times 2013 revenue and 116 times 2013 earnings. The price of those shares are all based on expectations; expectations which now require the performance of Instagram and WhatsApp to make happen.

By making acquisitions with Facebook shares the leadership team is able to link the newly acquired managers to the same overall goals as Facebook, while offering an extremely high price but without actually having to raise any money – or spend all that money.

All companies risk of becoming irrelevant. New technologies, customer behavior patterns, regulations, inventions and innovations constantly challenge old success formulas. Most leaders fall into a pattern of trying to defend & extend their old business in the face of market shifts, hastening the fall into irrelevancy. Or they try to acquire a new business, then integrate it into the old business which strips away the new business value and leads, inevitably, to irrelevancy.

The leaders of Facebook are giving us a lesson in an alternative approach. (1) Recognize the market shift. Accept it. If there is a better solution, rush toward it rather than ignoring it. (2) Bring it into the company, and leave it independent. Eschew integration and efforts to find “synergy.” (You never know, in 3 years the company may need to be renamed WhatsApp to reflect a new market paradigm.) (3) And as long as you can convince investors that you are maintaining your relevancy use your highly valued stock as currency to keep the company moving forward.

These are 3 great lessons for all leadership teams. And I continue to think Facebook is the one stock to own in 2014.

by Adam Hartung | Feb 18, 2014 | Current Affairs, Games, In the Swamp, Leadership

Microsoft has a new CEO. And a new Chairman. The new CEO says the company needs to focus on core markets. And analysts are making the same cry.

Amidst this organizational change, xBox continues its long history of losing money – as much as $2B/year. And early 2014 results show that xBox One is selling at only half the rate of Sony’s Playstation 4, with cumulative xBox One sales at under 70% of PS4, leading Motley Fool to call xBox One a “total failure.”

While calling xBox One a failure may be premature, Microsoft investors have plenty to worry about.

Firstly, the console game business has not been a profitable market for anyone for quite a while.

The old leader, Nintendo, watched sales crash in 2013, first quarter 2014 estimates reduced by 67% and the CEO now projecting the company will be unproftable for the year. Nintendo stock declined by 2/3 between 2010 and 2012, then after some recovery in 2013 lost 17% on the January day of its disappointing sales expectation. Not a great market indicator.

The new sales leader is Sony, but that should give no one reason to cheer. Sony lost money for 4 straight years (2008-2012), and was barely able to squeek out a 2013 profit only because it took a massive $4.6B 2012 loss which cleared the way to show something slightly better than break-even. Now S&P has downgraded Sony’s debt to near junk status. While PS4 sales are better than xBox One, in the fast shifting world of gaming this is no lock on future sales as game developers constantly jockey dollars between platforms.

Whether Sony will make money on PS4 in 2014 is far from proven. Especially since it sells for $100/unit (20%) less than xBox One – which compresses margins. What investors (and customers) can expect is an ongoing price war between Nintendo, Sony and Microsoft to attract sales. A competition which historically has left all competitors with losses – even when they win the market share war.

And on top of all of this is the threat that console market growth may stagnate as gamers migrate toward games on mobile devices. How this will affect sales is unknown. But given what happened to PC sales it’s not hard to imagine the market for consoles to become smaller each year, dominated by dedicated game players, while the majority of casual game players move to their convenient always-on device.

Due to its limited product range, Nintendo is in a “fight to the death” to win in gaming. Sony is now selling its PC business, and lacks strong offerings in most consumer products markets (like TVs) while facing extremely tough competition from Samsung and LG. Sony, likewise, cannot afford to abandon the Playstation business, and will be forced to engage in this profit killing battle to attract developers and end-use customers.

When businesses fall into profit-killing price wars the big winner is the one who figures out how to exit first. Back in the 1970s when IBM created domination in mainframes the CEO of GE realized it was a profit bloodbath to fight for sales against IBM, Sperry Rand and RCA. Thinking fast he made a deal to sell the GE mainframe business to RCA so the latter could strengthen its campaign as an IBM alternative, and in one step he stopped investing in a money-loser while strenghtening the balance sheet in alternative markets like locomotives and jet engines – which went on to high profits.

With calls to focus, Microsoft is now abandoning XP. It is working to force customers to upgrade to either Windows 7 or Windows 8. As PC sales continue declining, Microsoft faces an epic battle to shore up its position in cloud services and maintain its enterprise customers against competitors like Amazon.

After a decade in gaming, where it has never made money, now is the time for Microsoft to recognize it does not know how to profit from its technology – regardless how good. Microsoft could cleve off Kinect for use in its cloud services, and give its installed xBox base (and developer community) to Nintendo where the company could focus on lower cost machines and maintain its fight with Sony.

Analysts that love focus would cheer. They would cheer the benefit to Nintendo, and the additional “focus” to Microsoft. Microsoft would stop investing in the unprofitable game console market, and use resources in markets more likely to generate high returns. And, with some sharp investment bankers, Microsoft could also probably keep a piece of the business (in Nintendo stock) that it could sell at a future date if the “suicide” console business ever turns into something profitable.

Sometimes smart leadership is knowing when to “cut and run.”

Links:

2012 recognition that Sony was flailing without a profitable strategy

January, 2013 forecast that microsoft would abandon gaming

by Adam Hartung | Feb 9, 2014 | Current Affairs, Defend & Extend, Food and Drink, In the Swamp, Leadership, Lifecycle, Lock-in

There is a definite trend to raising the minimum wage. Regardless your political beliefs, the pressure to increase the minimum wage keeps growing. The important question for business leaders is, “Are we prepared for a $12 or $15 minimum wage?”

President Obama began his push for raising the minimum wage above $10 a year ago in his 2013 State of the Union. Since then, several articles have been written on income inequality and raising the minimum wage. Although the case to raise it is not clear cut, there is no doubt it has increased the rhetoric against the top 1% of earners. And now the President is mandating an increase in the minimum wage for federal workers and contractors to $10.10/hour, despite lack of congressional support and flak from conservatives.

Whether the economic case is provable, it appears that public sentiment is greatly in favor of a much higher minimum wage. And it will not affect all companies the same. Those that depend upon low priced labor, such as retailers like Wal-Mart and fast food companies like McDonald’s have a much higher concern. As should their employees, suppliers and investors.

A recent Federal Reserve report took a specific look at what happens to fast food companies when the minimum wage goes up, such as happened in Illinois, California and New Jersey. And the results were interesting. Because they discovered that a higher minimum wage really did hurt McDonald’s, causing stores to close. But….. and this is a big but…. those closed stores were rapidly replaced by competitors that could pay the higher wages, leading to no loss of jobs (and an overall increase in pay for labor.)

The implications for businesses that use low-priced labor are clear. It is time to change the business model – to adapt for a different future. A higher minimum wage does not doom McDonald’s – but it will force the company to adapt. If McDonald’s (and Burger King, Wendy’s, Subway, Dominos, Pizza Hut, and others) doesn’t adapt the future will be very ugly for their customers and the company. But if these companies do adapt there is no reason the minimum wage will hurt them particularly hard.

The chains that replaced McDonald’s closed stores were Five Guys, Chick-fil-A and Chipotle. You might remember that in 1998 McDonald’s started investing in Chipotle, and by 2001 McDonald’s owned the chain. And Chipotle’s grew rapidly, from a handful of restaurants to over 500. But then in 2006 McDonald’s sold all its Chipotle stock as the company went IPO, and used the proceeds to invest in upgrading McDonald’s stores and streamlining the supply chain toward higher profits on the “core” business.

Now, McDonald’s is shrinking while Chipotle is growing. Bloomberg/BusinessWeek headlined “Chipotle: The One That Got Away From McDonalds” (Oct. 3, 2013.) Investors were well served to trade in McDonald’s stock for Chipotle’s. And franchisees have suffered through sales problems as they raised prices off the old “dollar menu” while suffering higher food costs creating shrinking margins. Meanwhile Chipotle’s franchisees have been able to charge more, while keeping customers very happy, and maintain margins while paying higher wages. In a nutshell, Chipotle’s (and similar competitors) has captured the lost McDonald’s business as trends favor their business.

So McDonald’s obviously made a mistake. But that does not mean “game over.” All McDonald’s, Burger King and Wendy’s need to do is adapt. Fighting the higher minimum wage will lead to a lot of grief. There is no doubt wages will go up. So the smart thing to do is figure out what these stores will look like when minimum wages double. What changes must happen to the menu, to the store look, to the brand image in order for the company to continue attracting customers profitably.

This will undoubtedly include changes to the existing brands. But, these companies also will benefit from revisiting the kind of strategy McDonald’s used in the 1990s when buying Chipotle’s. Namely, buying chains with a different brand and value proposition which can flourish in a higher wage economy. These old-line restaurants don’t have to forever remain dominated by the old brands, but rather can transition along with trends into companies with new brands and new products that are more desirable, and profitable, as trends change the game. Like The Limited did when selling its stores and converting into L Brands to remain a viable company.

Now is the time to take action. Waiting until forced to take action will be too late. If McDonald’s and its brethren (and Wal-Mart and its minimum-wage-paying retail brethren) remain locked-in to the old way of doing business, and do everything possible to defend-and-extend the old success formula, they will follow Howard Johnson’s, Bennigan’s, Circuit City, Sears and a plethora of other companies into brand, and profitability, failure. Fighting trends is a route to disaster.

However, by embracing the trend and taking action to be successful in a future scenario of higher labor these companies can be very successful. There is nothing which dictates they have to follow the road to irrelevance while smarter brands take their place. Rather, they need to begin extensive scenario planning, understand how these competitors succeed and take action to disrupt their old approach in order to create a new, more profitable business that will succeed.

Disruptions happen all the time. In the 1970s and 1980s gasoline prices skyrocketed, allowing offshore competitors to upend the locked-in Detroit companies that refused to adapt. On-line services allowed Google Maps to wipe out Rand-McNally, Travelocity to kill OAG and Wikipedia to kill bury Encyclopedia Britannica. These outcomes were not dictated by events. Rather, they reflect an inability of an existing leader to adapt to market changes. An inability to embrace disruptions killed the old competitors, while opening doors for new competitors which embraced the trend.

Now is the time to embrace a higher minimum wage. Every business will be impacted. Those who wait to see the impact will struggle. But those who embrace the trend, develop future scenarios that incorporate the trend and design new business opportunities can turn this disruption into a big win.

by Adam Hartung | Jan 24, 2014 | Current Affairs, In the Swamp, Leadership

JPMorganChase Board of Directors this week voted to double CEO Jamie Dimon’s pay to something north of $20million. That he received such a big raise after the bank was forced to pay out more than $20B in fines for illegal activity has raised a number of eyebrows among analysts and shareholders. That he is receiving this raise after the bank laid off some 7,5000 employees in 2013, and recently announced it would not give employees raises due to the large fines, shows a distinct callousness toward employees, while raising questions about company leadership.

The Wall Street Journal reported that there was a lot of Board discourse about CEO Dimon’s pay package. But in the byzantine world of large company governance, apparently the Board felt compelled to pay Mr. Dimon tremendously well in order to send a message to Washington that the Board thought the regulators were wrong in pursuing malfeasance at JPMC. A show of support for the CEO who claimed this week he felt the bank had been treated unfairly.

Did that last paragraph leave you a bit confused? Because the logic, to be honest, is far from straightforward. The Board of a troubled bank with long-term leadership issues creating billions in trading losses and billions in fines for illegal behavior decided to withhold employee pay raises but double the CEO compensation in order to snub the nose of the regulators who have been pointing out years of unethical, if not illegal, behavior? The same regulators who might well see this very action as a good reason to heighten their investigations?

I’m not trying to oversimply the complexities of corporate governance, but this is some pretty tortured logic. When so many things have gone wrong, and it can be traced to leadership, rewarding that leader handsomely has the clear appearance of supporting his behavior, while punishing employees for the results of that leader’s actions.

Mr. Dimon is a media darling, and has been most of his career. He has also been outspoken on many issues during his career, drawing the attention of friends and foes. He is unabashed in his opinions, and even when he’s dead wrong – as when he referred to massive London trading losses as “a tempest in a teapot” he always speaks with total confidence. Mr. Dimon shows complete faith in his ability to be smarter than everyone else, and complete faith in his decisions, and he has no problem making sure everyone is fully aware of his absolute trust in himself.

But people are able to see trends. Although his defenders would like to say that the fines were related to issues which predated Mr. Dimon’s leadership, there are clear markers that differ. For example, it was the desperate search for higher profits under Mr. Dimon which led to the creation of the London trading desk, and giving it lattitude for big bets, that created some $7B in losses. Mr. Dimon’s final reaction was akin to “we make mistakes. Sorry. Time to move on.”

Oh yeah, and he fired the employees while claiming no personal responsibility.

And in January we learned that the bank was paying a $2.6B fine for aiding and abetting the ponzi scheme operated by Mr. Bernie Madoff. This behavior was something which had gone on for decades, without any oversight or reporting at the bank. This had continued while Mr. Dimon was CEO.

Why did these things happen? Because there was a huge desire to make more money.

Mr. Dimon is known for being as blunt with executives and employees as he is with the media. His “take no prisoners” style has been seen as crippling by many. Mr. Dimon focuses on results, and he is known for being brutal when he doesn’t receive the results he wants. For executives and employees that created a culture where delivering results to Mr. Dimon was paramount. And if that required taking big risks, or looking the other way about troubling behavior, well, people did what they had to do to make things happen at JPMC. If you had to bend the rules, or look the other way, to get results that was better than having to deal with the wrath of Mr. Dimon.

“The person at the top” sets the tone by which the organization behaves. And the more we learn about JPMC the more we see a company where the CEO loves to flash his POTUS cufflinks at the Congress and press, claim he’s taking the high road, and blame employees or predecessors when things go wrong. And that’s not a healthy environment.

Across the river from Wall Street Chris Christie, Governor of New Jersey, has become embroiled in controversy. His staff created an enormous traffic debacle in Fort Lee as retaliation against a mayor who did not support the Governor’s re-election bid. Mr. Christie fired the staffer, and claimed he knew nothing about it. But the majority of people in New Jersey aren’t buying the Governer’s ignorance.

Instead most Americans see a negative pattern in the governor’s behavior. His “take no prisoners” attitude has created accomplishments, but simultaneously he’s shown he thinks its OK to take off the gloves and fight bare knuckle – and not stop before taking some pretty sketchy shots at people in his quest to come out on top. Now regulators are digging even deeper to see if his bullying behavior set the stage for problems, even if he didn’t do the dastardly deed himself. And, as for governance, it will be up to voters to decide if Mr. Christie’s leadership is what they want, or not.

But at JPMC the governance is up to the Board. And this Board is, unfortunately, controlled by Mr. Dimon. He is not just CEO, but also Chairman of the Board. He holds the “bully gavel” when it comes to Board matters. He is able to set the agenda, and control the data the Board receives. He is able to call the Board members, and strong arm them to see things his way. Although it is clear the bank would benefit from a seperation of the roles of CEO and Chairman, Mr. Dimon has stopped this from happening. And the big winner has been – Mr. Dimon.

The signal this sends for JPMC employees, customers and investors is not good. While the stock is up some 22% the last year, governance and the CEO should have a long-term vision and not be influenced by short-term price changes. In the case of JPMC the culture appears to be one where seeking results is primary. Even if it leads to taking inordinate risks (which can create huge losses,) or taking and supporting questionable clients (Bernie Madoff,) or operating on the edge of financial industry legality. And if things go wrong – look for a scapegoat. Primarily someone below you who you can blame, while you claim you either didn’t know about it or didn’t support their behavior.

At JPMC the important question now is less about CEO pay and more about governance. The Board clearly has lost its ability to control a CEO + Chairman able to push his will, even when the logic of some actions appears hard to follow. The Board should be addressing who should be the Chairman, what should be the strategy, is the bank doing the right things, are the right compliance tools in place, and then – after all of that – is compensation being set correctly. That Mr. Dimon received such an undeserved raise simply points to much bigger problems in governance – and raises questions about the future of JPMC.

by Adam Hartung | Jan 15, 2014 | Current Affairs, Leadership

The S&P 500 had a great 2013. Up 29.7% – its best performance since 1997. The Dow Jones Industrial Average (DJIA) ended the year up 26.5% – its best performance since 1995. And this happened as economic growth lowered the unemployment rate to 6.7% in December – the lowest rate in 5 years. And overall real estate had double-digit price gains, lowering significantly the number of underwater mortgages.

But if we go back to the beginning of 2013, most Wall Street forecasters were predicting a very different outcome. Long suffering bear Harry Dent predicted a stock crash in 2013 that would last through 2014, and ongoing cratering in real estate values. And bear Gina Martin Adams of Wells Fargo Securities predicted a market decline in 2013, a forecast she clung to and fully supported, despite a rising market, when predicting an imminent crash in September. Morgan Stanley’s Adam Parker also predicted a flat market, as did UBS analyst Jonathan Golub.

How could professionals who are paid so much money, have so many resources and the backing of such outstanding large and qualified institutions be so wrong?

An over-reliance on quantitative analysis, combined with using the wrong assumptions.

The conventional approach to Wall Street forecasting is to use computers to amass enormously complex spreadsheets combining reams of numbers. Computer models are built with thousands of inputs, and tens of millions of data points. Eventually the analysts start to believe that the sheer size of the models gives them validity. In the analytical equivalent of “mine is bigger than yours” the forecasters rely on their model’s complexity and sheer size to self-validate their output and forecasts.

In the end these analysts come up with specific forecast numbers for interest rates, earnings, momentum indicators and multiples (price/earnings being key.) Their faith that the economy and market can be reduced to numbers on spreadsheets leads them to similar faith in their forecasts.

But, numbers are often the route to failure. In the late 1990s a team of Wall Street traders and Nobel economists became convinced their ability to model the economy and markets gave them a distinct investing advantage. They raised $1billion and formed Long Term Capital (LTC) to invest using their complex models. Things worked well for 3 years, and faith in their models grew as they kept investing greater amounts.

But then in 1998 downdrafts in Asian and Russian markets led to a domino impact which cost Long Term Capital $4.6B in losses in just 4 months. LTC lost every dime it ever raised, or made. But worse, the losses were so staggering that LTC’s failure threatened the viability of America’s financial system. The banks, and economy, were saved only after the Federal Reserve led a bailout financed by 14 of the leading financial institutions of the time.

Incorrect assumptions played a major part in how Wall Street missed the market prediction for 2013. All models are based on assumptions. And, as Peter Drucker famously said, “if you get the assumptions wrong everything you do thereafter will be wrong as well” — regardless how complex and vast the models.

Conventional wisdom held that conservative economic policies underpin market growth, and the more liberal Democratic fiscal policies combined with a liberal federal reserve monetary program would bode poorly for investors and the economy in 2013. These deeply held assumptions were, of course, reinforced by a slew of conservative commentators that supported the notion that America was on the brink of runaway inflation and economic collapse. The BIAS (Beliefs, Interpretations, Assumptions and Strategies) of the forecasters found reinforcement almost daily from the rhetoric on CNBC, Bloomberg, Fox News and other programs widely watched by business people from Wall Street to Main Street.

Interestingly, when Obama was re-elected in 2012 a not-so-well-known investment firm in Columbus, OH – far from Wall Street – took an alternative look at the data when forecasting 2013. Polaris Financial Partners took a deep dive into the history of how markets perform when led by traditional conservative vs. liberal policies and reached the startling conclusion that Obama’s programs, including the Affordable Care Act, would actually spur investment, market growth, jobs and real estate! They had forecast a double digit increase in all major averages for 2012 and extended that same double digit forecast into 2013 – far more optimistic than anyone on Wall Street.

CEO Bob Deitrick and partner Steven Morgan concluded that the millenium’s first decade had been lost. Despite Republican leadership, the eqity markets were, at best, sideways. There were fewer people actually working in 2008 than in 2000; a net decrease in jobs. After a near-collapse in the banking system, due to deregulated computer-model based trading in complex derivatives, real estate and equity prices had collapsed.

“Fourteen years of stock market gains were wiped out in 17 months from October, 2007 to March, 2009” lamented Deitrick.

Polaris Partners concluded the situation was eerily similar to the 1920s at the end of Hoover’s administration. A situation which was eventually resolved via Keynesian policies of increased fiscal spending while interest rates were low, and federal reserve intervention to both expand the money supply and increase the velocity of money under Republican Fed chief Marriner Eccles and Democratic President Franklin Roosevelt.

While most people conventionally think that tax cuts led to economic growth during the Reagan administration, Polaris Financial turned that assumption upside down and put the biggest positive economic impact on the roll-back of tax cuts a year after being pushed by Reagan and passing Congress. Their analysis of the 1980 recovery focused on higher defense and infrastructure spending (fiscal policy,) a massive increase in debt (the largest peacetime debt increase ever) coupled with a more balanced tax code post-TEFRA.

Thus, eschewing complex econometric models, elaborately detailed spreadsheets of earnings and rolling momentum indicators, Polaris Financial focused instead on identifying the assumptions they believeed would most likely drive the economy and markets in 2013. They focused on the continuation of Chairman Bernanke’s easy monetary policy, and long-term fiscal policies designed to funnel money into investments which would incent job creation and GDP growth leading to an improvement in house values, and consumer spending, while keeping interest rates at historically low levels. All of which would bode extremely well for thriving equity markets.

The vitriol has been high amongst those who support, and those who oppose, the economic policies of Obama’s administration since 2008. But vitriol does not support, nor replace, good forecasting. Too often forecasters predict what they want to happen, what they hope will happen, based upon their view of history, their traing and background, and their embedded assumptions. They believe in the certainty of long-held assumptions, and forecast from that base.

But as Polaris Financial pointed out, in beating every major Wall Street firm over the last 2 years, good forecasting relies on looking carefully at historical outcomes, and understanding the context in which those results happened. Rather than relying on an interpretation of the outcome,they looked instead at the facts and the situation; the actions and the outcomes in its context. In an economy, everything is relative to the context. There are no absolute programs that are universally the right thing to do. Every policy action, and every monetary action, is dependent upon initial conditions as well as the action itself.

Too few forecasters take into account both the context as well as the action. And far too few do enough analysis of assumptions, preferring instead to rely on reams of numerical analysis which may, or may not, relate to the current situation. And are often linked to assumptions underlying the model’s construction – assumptions which could be out of date or simply wrong.

The folks at Polaris Financial Partners remain optimistic about the economy and markets for the next two years. They point out that unemployment has dropped faster under Obama, and from a much higher level, than during the Reagan administration. They see the Affordable Care Act opening more flexibility for health care, creating a rise in entrepreneurship and innovation (especially biotechnology) that will spur economic growth. Deitrick and Morgan see tax programs, and rising minimum wage trends, working toward better income balancing, and greater monetary velocity aiding GDP growth. Their projection is for improving real estate values, jobs growth, and minimal inflation leading to higher indexes – such as 20,000 on the DJIA and 2150 on the S&P.

Bob Deitrick co-authored, with Lew Goldfarb, “Bulls, Bears and the Ballot Box” in 2012 analyzing Presidential economic policies, Federal Reserve policies and stock market performance.

by Adam Hartung | Jan 8, 2014 | Current Affairs, In the Rapids, Innovation, Leadership, Web/Tech

Most investors really aren’t. They are traders. They sell too fast, and make too many transactions. That’s why most small “investors” don’t do as well as the market averages. In fact, most don’t even do as well as if they simply put money into certificates of deposit or treasury bills.

I subscribe to the idea you should be able to invest in a company, and then simply forget about it. Whether you invest $10 or $100,000, you should feel confident when you buy a stock that you won’t touch it for 3, 5 or even 10 years. Let the traders deal with volatility, just wait and let the company do its thing and go up in value. Then sometime down the road sell it for a multiple of what you paid.

That means investing in big trends. Find a trend that is long-lasting, perhaps permanent, and invest in the leader. Then let the trend do all the work for you.

Imagine you bought AT&T in the 1950s as communication was about to proliferate and phones went into every business and home. Or IBM in the 1960s as computer technology overtook slide rules, manual databases and bookkeeping. Microsoft in the 1980s as personal computers became commonplace. Oracle in the 1990s as applications were built on relational databases. Google, Amazon and Apple in the last decade as people first moved to the internet in droves, and as mobile computing became the next “big thing.”

In each case investors put their money in a big trend, and invested in a leader far ahead of competitors with a strong management team and product pipeline. Then they could forget about it for a few years. All of these went up and down, but over time the vicissitudes were obliterated by long-term gains.

Today the biggest trend is social media. While many people still decry its use, there is no doubt that social media platforms are becoming commonplace in how we communicate, look for information, share information and get a lot of things done. People inherently like to be social; like to communicate. They trust referrals and comments from other people a lot more than they trust an ad – and often more than they trust conventional media. Social media is the proverbial fast flowing river, and getting in that boat is going to take you to a higher value destination.

And the big leader in this trend is Facebook. Although investors were plenty upset when Facebook tumbled after its IPO in 2012, if you had simply bought then, and kept buying a bit each quarter, you’d already be well up on your investment. Almost any purchase made in the first 12 months after the IPO would now have a value 2 to 3 times the acquisition price – so a 100% to 200% return.

But, things are just getting started for Facebook, and it would be wrong to think Facebook has peaked.

Few people realize that Facebook became a $5B revenue company in 2012 – growing revenue 20X in 4 years. And revenue has been growing at 150% per year since reaching $1B. That’s the benefit of being on the “big trend.” Revenues can grow really, really, really fast.

And the market growth is far from slowing. In 2013 the number of U.S. adults using Facebook grew to 71% from 67% in 2012. And that is 3.5 times as often as they used Linked-In or Twitter (22% and 18%.) And Facebook is not U.S. user dependent. Europe, Asia and Rest-of-World have even more users than the USA. ROW is 33% bigger than the USA, and Facebook is far from achieving saturation in these much higher population markets.

Advertisers desiring to influence these users increased their budgets 40% in 2013. And that is sure to grow as users and their interactions climb. According to Shareaholic, over 10% of all internet referrals come from Facebook, up from 7% share of market the previous year. This is 10 times the referral level of Twitter (1%) and 100 times the levels of Linked in and Google+ (less than .1% each.) Thus, if an advertiser wants to users to go to its products Facebook is clearly the place to be.

Facebook acquires more of these ad dollars than all of its competition combined (57% share of market,) and is 4 times bigger than competitors Twitter and YouTube (a Google business.) The list of Grade A advertisers is long, including companies such as Samsung ($100million,) Proctor & Gamble ($60million,) Microsoft ($35million,) Amazon, Nestle, Unilever, American Express, Visa, Mastercard and Coke – just to name a few.

And Facebook has a lot of room to grow the spending by these companies. Google, the internet’s largest ad revenue generator, achieves $80 of ad revenue per user. Facebook only brings in $13/user – less than Yahoo ($18/user.) So the opportunity for advertisers to reach users more often alone is a 6x revenue potential – even if the number of users wasn’t growing.

But on top of Facebook’s “core” growth there are new revenue sources. Since buying revenue-free Instagram, Facebook has turned it into what Evercore analysts estimate will be a $340M revenue in 2014. And as its user growth continues revenue is sure to be even larger in future years.

Even a larger opportunity for growth is the 2013 launched Facebook Ad Exchange (FBX) which is a powerful tool for remarketing unused digital ad space and targeting user behavior – even in mid-purchase. According to BusinessInsider.com FBX already sells to advertisers millions of ads every second – and delivers up billions of impressions daily. All of which is happening in real-time, allowing for exponential growth as Facebook and advertisers learn how to help people use social media to make better purchase decisions. FBX is currently only a small fraction of Facebook revenue.

Stock investing can seem like finding a needle in a haystack. Especially to small investors who have little time to do research. Instead of looking for needles, make investing easier. Eschew complicated mathematical approaches, deep portfolio theory and reams of analyst reports and spreadsheets. Invest in big trends that are growing, and the leaders building insurmountable market positions.

In 2014, that means buy Facebook. Then see where your returns are in 2017.

by Adam Hartung | Dec 19, 2013 | Current Affairs, Leadership

Everyone has a stake in America’s big, public corporations. Either as an investor, employee, customer, supplier or community leader. So how these corporations perform is a big deal for all of us.

Unfortunately, we’ve had all too many corporations that have their problems. But, amazingly, we see little change in the CEO, or CEO compensation. When one of the USA‘s largest employers, McDonald’s, uses its hotline to tell low-paid employees they should avoid breaking open Christmas gift boxes, and instead return gifts for cash to buy gas and groceries, it’s not a bad idea to take a look at top executive pay. And with so many people still looking for work, and unemployment for people under 25 at something like 15%, there is an ongoing question as to whether CEOs are being held accountable or simply granted their jobs regardless of performance.

Given that Scrooge was a banker, why not start by looking at bank CEOs? And who better to glance at than the ultra-high profile Jamie Dimon, CEO and Chairman of JPMorganChase.

In 2012 Mr. Dimon told us there were really no problems in the JPMC derivatives business. We later learned that – oops – the unit did actually lose something like $6billion. Mr. Dimon was nice enough to admit this was more than a “templest in a teapot,” and eventually apoligized. He asked us to all realize that JPMC is really big, and mistakes will happen. Just forget about it and move on he recommended.

But in 2013 the regulators said “not so fast” and fined JPMC close to $1billion for failure to properly safeguard the public interest. The Board felt compelled to reflect on this misadventure and cut Mr. Dimon’s pay in half to a paltry $18.7million. That means in the year when things went $7billion wrong, he was paid nearly $37million – and the penalty was to subsequently receive only $19million. Thus his total compensation for 2 years, during which $7billion evaporated from the bank, was (roughly) $50M.

It appears unlikely anyone will be returning gifts to buy ham and beans in the Dimon household this year.

Mr. Dimon was spanked by the Board, and he is no longer the most highly paid CEO in the banking industry. That 2013 title goes to Wells Fargo CEO John Stumpf, who received about $23M. Wells Fargo is still sorting out the mess from all those bad mortgages which have left millions of Americans with foreclosures, bankruptcies, costly short-sales and mortgages greater than the home value. But, hotlines are now in place and things are getting better!

CEO compensation is interesting because it is all relative. Pay is minimally salary – never more than $1M (although that alone is a really big number to most people.) Bonuses make up most of the compensation,based on relative metrics tied to comparisons with industry peers. So, if an industry does badly and every company does poorly the CEOs still get paid their bonuses. You don’t have to be a Steve Jobs or Jeff Bezos with new insights, lots of growth, great products and margins to be paid a lot. Just don’t do a whole lot worse than some peer group you are compared against.

Which then brings us to the whole idea of why CEOs that make big mistakes – like the whopper at JPMC – so easily keep their jobs. Would a McDonald’s cashier that missed handing out change by $7 (1 one-billionth the JPMC mistake) likely be paid well – or fired? What about a JPMC bank teller? Yet, even when things go terribly wrong we rarely see a CEO lose their job.

During this shopping season, just look at Sears. Ed Lampert cut his pay to $1 in 2013. Hooray! But this did not help the company.

Sears and Kmart business is so bad CEO Lampert changed strategy in 2013 to selling profitable stores rather than more lawn mowers and hand tools in order to keep the company alive. Yet, as more employees leave, suppliers risk being repaid, communities lose their stores and retail jobs and tax base, Mr. Lampert remains Sears Holdings CEO. We accept that because he owns so much stock he has the “right” to remain CEO.

Perhaps Mr. Lampert deserves a visit from his own personal Jacob Marley, who might make him realize that there is more to life (and business) than counting cash flow and seeking lower cost financing options. Mr. Lampert can arise each morning before dawn to browbeat employees via conference webinars, and micromanage a losing business. But it leaves him sounding a lot like Scrooge. Meanwhile those behaviors have not stopped Sears and KMart from losing all market relevancy, and spiraling toward failure.

CEO pay-to-worker ratios have increased 1,000% since 1950. (How’s that for a “relative” metric?) Today the average CEO makes 200 times the company’s workforce (the top 100 make 300 times as much – and the CEO of Wal-Mart has a pension 6,182 times that of the average employee.) Is it any wonder so many investors, employees, customers, suppliers and community leaders are paying so much attention to CEO performance – and pay?

We are all thankful for the good CEO that develops long-range plans, spends time investing in growth projects, developing employees, increasing revenue and margins while expanding the communities in which the company lives and works. It just doesn’t happen often enough.

This Christmas, as many before, as we look at our portfolios, paychecks, pensions, product quality, service quality and communities too many of us wish far too often for better CEOs, and compensation really aligned with long-term performance for all constituencies.

by Adam Hartung | Dec 3, 2013 | Current Affairs, Leadership, Web/Tech

“A horse, a horse, my Kingdom for a Horse” King Richard cried out just before he was murdered (Richard III by Billy Shakespeare ~ 1592.)

King Richard of England was really, really unpopular. He was accused of ascending to the throne via various Michiavellian behaviors. Eventually he was trapped on the battlefield by his enemies, his horse was slain, and he uttered the above line – metaphorically begging for a way out of the trapped world that was his kingdom. He didn’t get the horse – and he died.

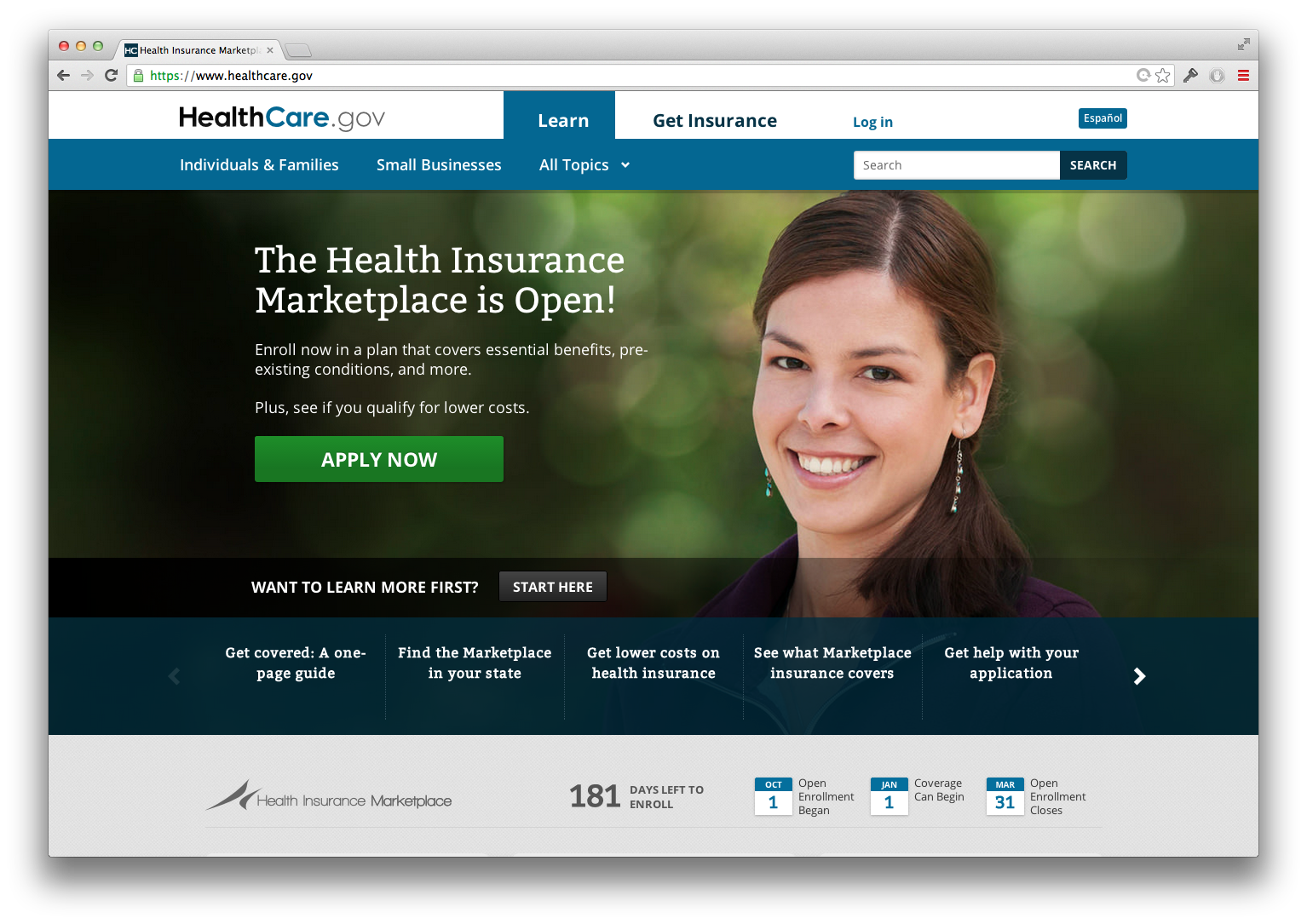

After over 20 years of fighting about health care the U.S. Congress passed the Affordable Care Act and the President signed it into law in 2010. About the only agreement in the country was that the ACA appealed to almost no one due to the compromises required to get it passed. It was fought by wide ranging constituencies, until in 2012 the Supreme Court upheld the law.

But not even that was the end of the fight, because in October, 2013 Congress shut down the government as groups fought about whether the act would receive any funding to implement its own provisions. Eventually an agreement was reached, the government re-opened, and it looked like the ACA was going into practice.

Oh, but wait…

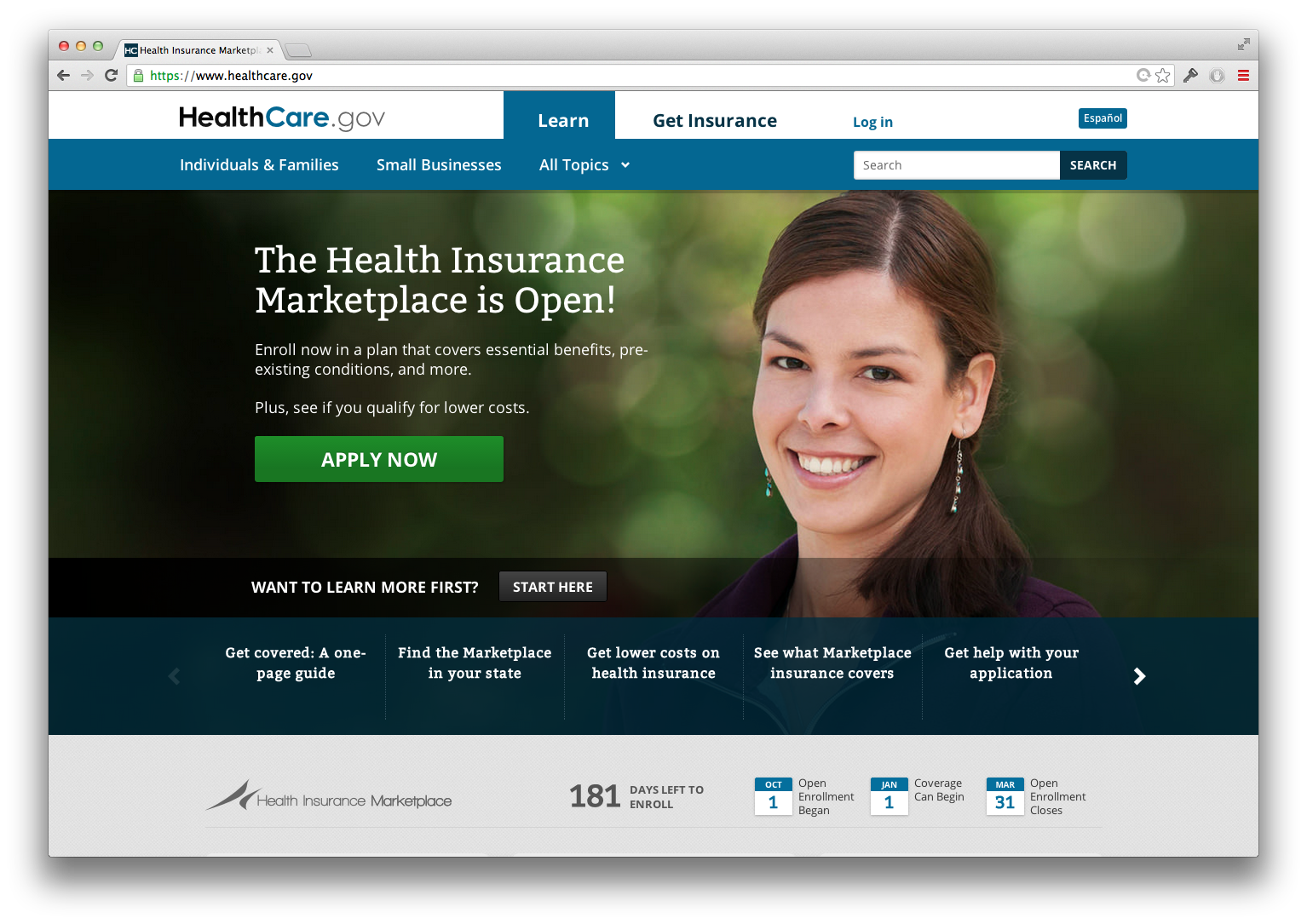

In today’s world everyone uses the internet. Face-to-face meetings are largely gone, and forests by the score are being saved as we refuse to use paper when a digital screen will accomplish our tasks. So it only made sense that when the U.S. population was to sign up for the benefits of this new law they would do so on the World Wide Web.

Folks would buy health insurance just like they buy books and clothes, and download movies, from a web site. Billions of transactions have happened over the web the last decade. Why, Google alone does over 5 billion searches each and every day. So it seemed easily practical, and doable, for implementation to be as easy as opening a new web site. We all expected that come November we’d simply hit the search button, go to the web site, price out the options and make our health insurance decisions.

Of course we all know how that worked out. Or didn’t. The site didn’t work for spit. Apple may be able to track about a million apps on its site, and it seems able to deliver about 4 million per day at an average price of about a buck. But the U.S. government web site – after spending over $400million (maybe even $1B) – couldn’t seem to process but a few thousand applications a day. So Congressional hearings started – cries for firing Secretary Sebelius rang out – and President Obama’s favorability plummeted faster than the failed effort messages came up in browsers at Healthcare.gov.

You could almost hear the President on the steps of the White House “A web site, a working web site, my Presidency for a working web site.”

There was a Chicago mayor who lost an election because he couldn’t clear the streets of snow. Something as simple as removing snow in a 1979 blizzard overtook everything Mayor Bilandic’s administration did, and wanted to do, for his great city. When Chicagoans couldn’t access their streets for 3 days they “threw the bastard out” by electing a new candidate (Jane Byrne) in the next primary – and she went on to be the next mayor.

And the only thing anyone remembers about Mayor Bilandic was he didn’t get the snow off the streets.

This lesson is not lost on any local mayor. You can have grand plans, and vision, but if you can’t keep the streets clean you get thrown out.

We’ve entered a new era of political expectations. Citizens now expect their politicians to build and operate functional web sites. They expect their government to do as least as good a job as private industry at everything digital. And if politicians, or administrators, flub a web implementation it can have signficant, damaging implications.

Failure to build a functional web site, meeting the average person’s expectations, is a terrible, terrible falure these days. Perhaps enough to lose the voters’ trust. Perhaps enough to breath new life into those who want to overturn your “landmark legislation.” And perhaps enough to kill your place in history.