by Adam Hartung | May 30, 2014 | Current Affairs, In the Swamp, In the Whirlpool, Leadership, Sports, Web/Tech

Anyone who reads my column knows I’ve been no fan of Steve Ballmer as CEO of Microsoft. On multiple occasions I chastised him for bad decisions around investing corporate funds in products that are unlikely to succeed. I even called him the worst CEO in America. The Washington Post even had difficulty finding reputable folks to disagree with my argument.

Unfortunately, Microsoft suffered under Mr. Ballmer. And Windows 8, as well as the Surface tablet, have come nowhere close to what was expected for their sales – and their ability to keep Microsoft relevant in a fast changing personal technology marketplace. In almost all regards, Mr. Ballmer was simply a terrible leader, largely because he had no understanding of business/product lifecycles.

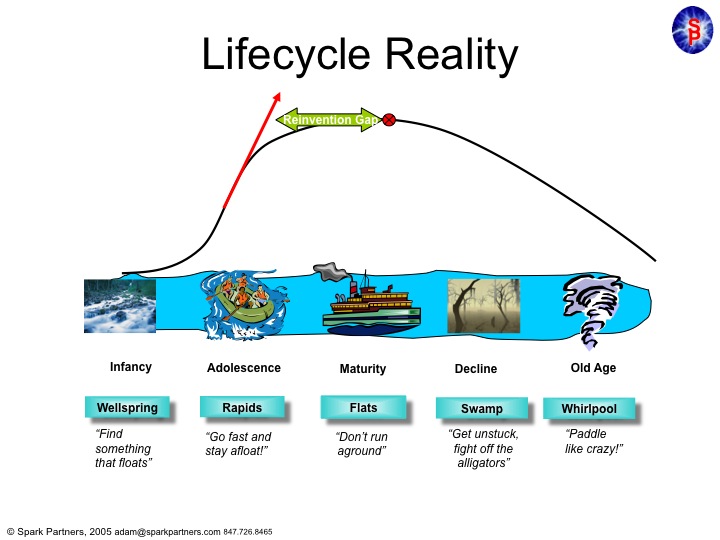

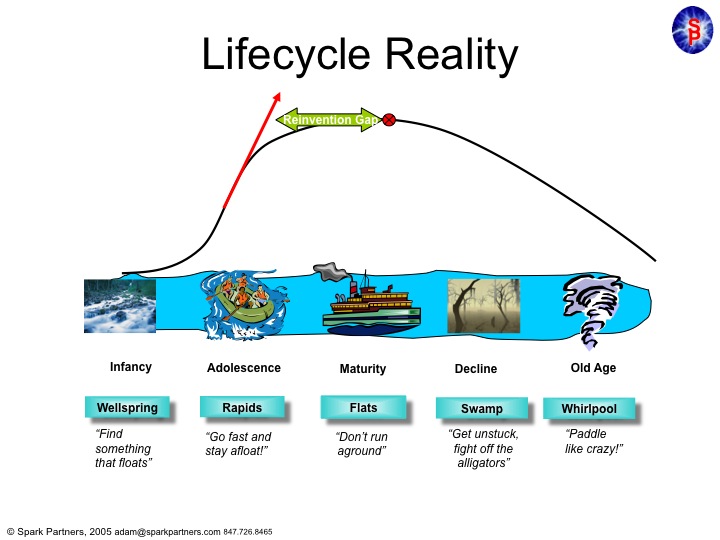

Microsoft was founded by Bill Gates, who did a remarkable job of taking a start-up company from the Wellspring of an idea into one of the fastest growing adolescents of any American company.

Microsoft was founded by Bill Gates, who did a remarkable job of taking a start-up company from the Wellspring of an idea into one of the fastest growing adolescents of any American company.

Under Mr. Gates leadership Microsoft single-handedly overtook the original PC innovator – Apple – and left it a niche company on the edge of bankruptcy in little over a decade.

Mr. Gates kept Microsoft’s growth constantly in the double digits by not only making superior operating system software, but by pushing the company into application software which dominated the desktop (MS Office.) And when the internet came along he had the vision to be out front with Internet Explorer which crushed early innovator, and market maker, Netscape.

But then Mr. Gates turned the company over to Mr. Ballmer. And Mr. Ballmer was a leader lacking vision, or innovation. Instead of pushing Microsoft into new markets, as had Mr. Gates, he allowed the company to fixate on constant upgrades to the products which made it dominant – Windows and Office. Instead of keeping Microsoft in the Rapids of growth, he offered up a leadership designed to simply keep the company from going backward. He felt that Microsoft was a company that was “mature” and thus in need of ongoing enhancement, but not much in the way of real innovation. He trusted the market to keep growing, indefinitely, if he merely kept improving the products handed him.

As a result Microsoft stagnated. A “Reinvention Gap” developed as Vista, Windows 7, then Windows 8 and one after another Office updates did nothing to develop new customers, or new markets. Microsoft was resting on its old laurels – monopolistic control over desktop/laptop markets – without doing anything to create new markets which would keep it on the old growth trajectory of the Gates era.

Things didn’t look too bad for several years because people kept buying traditional PCs. And Ballmer famously laughed at products like Linux or Unix – and then later at entertainment devices, smart phones and tablets – as Microsoft launched, but then abandoned products like Zune, Windows CE phones and its own tablet. Ballmer kept thinking that all the market wanted was a faster, cheaper PC. Not anything really new.

And he was dead wrong. The Reinvention Gap emerged to the public when Apple came along with the iPod, iTunes, iPhone and iPad. These changed the game on Microsoft, and no longer was it good enough to simply have a better edition of an outdated technology. As PC sales began declining it was clear that Ballmer’s leadership had left the company in the Swamp, fighting off alligators and swatting at mosquitos with no strategy for how it would regain relevance against all these new competitors.

So the Board pushed him out, and demoted Gates off the Chairman’s throne. A big move, but likely too late. Fewer than 7% of companies that wander into the Swamp avoid the Whirlpool of demise. Think Univac, Wang, Lanier, DEC, Cray, Sun Microsystems (or Circuit City, Montgomery Wards, Sears.) The new CEO, Satya Nadella, has a much, much more difficult job than almost anyone thinks. Changing the trajectory of Microsoft now, after more than a decade creating the Reinvention Gap, is a task rarely accomplished. So rare we make heros of leaders who do it (Steve Jobs, Lou Gerstner, Lee Iacocca.)

So what will happen at the Clippers?

Critically, owning an NBA team is nothing like competing in the real business world. It is a closed marketplace. New competitors are not allowed, unless the current owners decide to bring in a new team. Your revenues are not just dependent upon you, but are even shared amongst the other teams. In fact your revenues aren’t even that closely tied to winning and losing. Season tickets are bought in advance, and with so many games away from home a team can do quite poorly and still generate revenue – and profit – for the owner. And this season the Indiana Pacers demonstrated that even while losing, fans will come to games. And the Philadelphia 76ers drew crowds to see if they would set a new record for the most consecutive games lost.

In America the major sports only modestly overlap, so you have a clear season to appeal to fans. And even if you don’t make it into the playoffs, you still share in the profits from games played by other teams. As a business, a team doesn’t need to win a championship to generate revenue – or make a profit. In fact, the opposite can be true as Wayne Huizenga learned owning the Championship winning Florida Marlins baseball team. He payed so much for the top players that he lost money, and ended up busting up the team and selling the franchise!

In short, owning a sports franchise doesn’t require the owner to understand lifecycles. You don’t have to understand much about business, or about business competition. You are protected from competitors, and as one of a select few in the club everyone actually works together – in a wholly uncompetitive way – to insure that everyone makes as much money as possible. You don’t even have to know anything about managing people, because you hire coaches to deal with players, and PR folks to deal with fans and media. And as said before whether or not you win games really doesn’t have much to do with how much money you make.

Most sports franchise owners are known more for their idiosyncrasies than their business acumen. They can be loud and obnoxious all they want (with very few limits.) And now that Mr. Ballmer has no investors to deal with – or for that matter vendors or cooperative parties in a complex ecosystem like personal technology – he doesn’t have to fret about understanding where markets are headed or how to compete in the future.

When it comes to acting like a person who knows little about business, but has a huge ego, fiery temper and loves to be obnoxious there is no better job than being a sports franchise owner. Mr. Ballmer should fit right in.

by Adam Hartung | May 22, 2014 | Current Affairs, Leadership

It is ironic that on this Memorial Day weekend (a remembrance of our fallen soldiers) America is learning that its military veterans have been ineffectively served by the Veterans Administration (VA) hospital system. Hundreds, if not thousands, have gone months without care – and some have even died while waiting.

No veteran should die while waiting for care. But we now know at least 40 have died. This is especially heinous because we now know those who provide care weren’t admitting to the fact that veterans were being denied care. And instead of tracking the waiting time these veterans underwent, the actual information was being tracked on hidden lists while factually inaccurate information was being disseminated.

At the top of all this is simply really bad leadership. That veterans were undergoing long waits is not a new story. In March, 2013 (14 months ago) Frontline ran a story that waits were inexcusably long (averaging 318 days,) and that the VA was doing little to solve the problem. Then, the day after Christmas, 2013, Military News ran a story quoting Secretary Shinseki providing several statistics indicating the backlog was down, wait times were down and this whole problem would disappear by 2015. Unfortunately, the American Legion – which has championed this issue – made it clear they thought the Secretary’s datapoints were inaccurate.

Now we are learning via CNN that the wait lists were being fudged in several hospitals, and that both hospital and VA leaders were well aware of this fudging. There were the reported facts, and then there were secret lists of people waiting for care.

How could this happen?

Chalk it up to lazy leadership, and an over-reliance on numbers and record-keeping. Instead of managing patients, Secretary Shinseki’s administration was managing numbers. And in this case, it caused people to die.

When long wait times were reported the President publicly admitted to being appalled, and he told Secretary Shinseki to do something. What the Secretary did was declare a standard of no more than 125 days from incident to care had to be met. And he told people to meet that goal, or they would risk losing their jobs.

As a leader, he didn’t offer a solution. He didn’t challenge his staff to find out the root cause of the problem and understand why these waits were so long. He didn’t hire outside consultants to evaluate the problem and propose solutions. He didn’t ask for “best practices” from industry. Instead, he pushed out a metric and a tracking system and threatened his team with pay cuts (or at least no bonuses,) demotions, career ending reviews and potentially termination. “Solve the problem, or else.” Then he was back to his office, and waiting for the “right” statistics to show up so he could say “all is well.”

This simply becomes a breeding ground for collusion, corruption and malfeasance as people try to save their income, careers and their jobs. If the order is to “make that number” then a way will be found to “make that number.” The command wasn’t to save lives, or improve care. The order was to reach a certain metric. So out comes all the creativity imaginable to give the boss what he wants. And in this case, it involved deception in record keeping, dual bookkeeping, hiding information, falsifying reports and even letting people die in order to give the Secretary the numbers he ordered them to report.

Meanwhile, the Secretary is so involved in managing his own career – and that of his boss – that he simply turned a blind eye to all other data. The American Legion was offering compelling statistics that things weren’t as the Secretary said. And there were multiple stories coming up in the press, and through the veteran networks, of patient experiences which did not match what the Secretary reported. But instead of listening to external information the Secretary ignored all of it and kept pushing his own organization to give him the numbers he wanted.

Leaders like to “manage by the numbers.” The study of business management was born around 1900 by Frederick Taylor and his theory of Scientific Management. Taylor believed all work could be broken down into inputs and outputs, everything could be measured, and if you set metrics for everyone then you could simply manage better. It was an engineering problem, and humans were just machines that needed to know the right metrics and produce to those metrics. Ah, the simplicity of Taylorism.

That management approach was greatly loved by business schools, and business leaders. Famously some Harvard Business School graduates and former Army officers (termed the “Whiz Kids”) in the 1940s went to a nearly failed Ford Motor company and turned it around. One of them, Robert McNamara, became the youngest President of Ford. They claimed their success was “statistical control.”

But McNamara left Ford to become Secretary of Defense for Lyndon Johnson and run the Vietnam War. He applied his same “statistical control” approach to the war that he used at Ford. Famous amongst these tracked, reported and closely watched statistics was the “body count.” Simply put, how many did you kill today? McNamara was sure if he could reach a “kill ratio” of 10 enemy dead to every 1 American dead the Vietnamese would give up.

How did that work out? Well, McNamara resigned in disgrace. Johnson was forced to step down after one term, realizing his failure in Vietnam made him unelectable. It turned out body counts included dogs, cats and cows as officers from Lieutenants to Generals were fudging the numbers. It encouraged burning down entire villages, and then simply deciding everyone – including Vietnamese civilians – would be included in the “body count.”

Needless to say, not America’s finest hour. And a mess that took another several years from which to extricate. There is a lot more to understanding international relations, and fighting a war, than simply tracking statistics. But unfortunately then Lieutenant Shinseki apparently learned the wrong message while he was in Vietnam. His penchant for using statistics to lead appears to have remained unwavered.

Unfortunately, far too many leaders like the lazy approach of using statistics. In the 1980s and 1990s a quality improvement program called Six Sigma caught on in America. But in many companies, Six Sigma became a management dogma rather than simply quality control. “You have to measure everything, or else it is simply not important” was a common part of Six Sigma. People suddenly had metrics given to them, even for jobs (like “Creative Director” or “Investor Relations”) where this made no sense. And they had charts on their doors tracking the data. If that chart didn’t point in an obviously northeasterly direction then it was clear the occupant was going to have pay, and longevity, problems.

Motorola was a leader in Six Sigma. The same Motorola that today is a shell of its former self. Although in the 1990s Motorola was heralded as a leader in modern management, today it has lost all relevance as its old businesses in radios and mobile phones have been made obsolete by new technologies, or taken over by companies like Google.

Far too often leaders think they can turn leadership into an engineering exercise. “Run business by the numbers” is a common refrain. Especially amongst leaders who come up via finance. “Everything can be turned into numbers, and spreadsheets, and if we manage the numbers the business will take care of itself.” We’ve all heard this.

But it simply isn’t true. We now know that even the famous Taylor falsified data in order to keep his guru status and promote Taylorism to client companies. Leadership involves going far, far beyond the numbers. It means understanding situations that defy simple measurement. It means knowing how to identify and solve problems – changing processes, procedures, directions, instructions, strategy and tactics. It means listening to external inputs to understand the greater marketplace, not just your own internal views. And it means understanding how to lead and manage people toward superior performance – not merely tracking performance statistics and slapping those who don’t return “the right numbers.”

Secretary Shinseki has a long and storied career. But as head of the VA, he truly blew it. And people died. This kind of lazy leadership cannot be tolerated in a field like health care, and hospital management.

Can your business tolerate it?

by Adam Hartung | May 16, 2014 | Current Affairs, Defend & Extend, In the Swamp, Leadership, Lifecycle, Web/Tech

IBM had a tough week this week. After announcing earnings on Wednesday IBM fell 2%, dragging the Dow down over 100 points. And as the Dow reversed course to end up 2% on the week, IBM continued to drag, ending down almost 3% for the week.

Of course, one bad week – even one bad earnings announcement – is no reason to dump a good company’s stock. The short term vicissitudes of short-term stock trading should not greatly influence long-term investors. But in IBM’s case, we now have 8 straight quarters of weaker revenues. And that HAS to be disconcerting. Managing earnings upward, such as the previous quarter, looks increasingly to be a short-term action, intended to overcome long-term revenues declines which portend much worse problems.

This revenue weakness roughly coincides with the tenure of CEO Virginia Rometty. And in interviews she increasingly is defending her leadership, and promising that a revenue turnaround will soon be happening. That it hasn’t, despite a raft of substantial acquisitions, indicates that the revenue growth problems are a lot deeper than she indicates.

CEO Rometty uses high-brow language to describe the growth problem, calling herself a company steward who is thinking long-term. But as the famous economist John Maynard Keynes pointed out in 1923, “in the long run we are all dead.” Today CEO Rometty takes great pride in the company’s legacy, pointing out that “Planes don’t fly, trains don’t run, banks don’t operate without much of what IBM does.”

But powerful as that legacy has been, in markets that move as fast as digital technology any company can be displaced very fast. Just ask the leadership at Sun Microsystems that once owned the telecom and enterprise markets for servers – before almost disappearing and being swallowed by Oracle in just 5 years (after losing $200B in market value.) Or ask former CEO Steve Ballmer at Microsoft, who’s delays at entering mobile have left the company struggling for relevancy as PC sales flounder and Windows 8 fails to recharge historical markets.

CEO Rometty may take pride in her earnings management. But we all know that came from large divestitures of the China business, and selling the PC and server business. As well as significant employee layoffs. All of which had short-term earnings benefits at the expense of long-term revenue growth. Literally $6B of revenues sold off just during her leadership.

Which in and of itself might be OK – if there was something to replace those lost sales. (Even if they didn’t have any profits – because at least we have faith in Amazon creating future profits as revenues zoom.)

What really worries me about IBM are two things that are public, but not discussed much behind the hoopla of earnings, acquisitions, divestitures and all the talk, talk, talk regarding a new future.

CNBC reported (again, this week,) that 121 companies in the S&P 500 (27.5%) cut R&D in the first quarter. And guess who was on the list? IBM, once an inveterate leader in R&D has been reducing R&D spending. The short-term impact? Better quarterly earnings. Long term impact????

The Washington Post reported this week about the huge sums of money pouring out of corporations into stock buybacks rather than investing in R&D, new products, new capacity, enhanced marketing, sales growth, etc. $500B in buybacks this year, 34% more than last year’s blistering buyback pace, flowed out of growth projects. To make matters worse, this isn’t just internal cash flow going for buybacks, but companies are actually borrowing money, increasing their debt levels, in order to buy their own stock!

And the Post labels as the “poster child” for this leveraged stock-propping behavior…. IBM. IBM

“in the first quarter bought back more than $8 billion of its own stock, almost all of it paid for by borrowing. By reducing the number of outstanding shares, IBM has been able to maintain its earnings per share and prop up its stock price even as sales and operating profits fall.

The result: What was once the bluest of blue-chip companies now has a debt-to-equity ratio that is the highest in its history. As Zero Hedge put it, IBM has embarked on a strategy to “postpone the day of income statement reckoning by unleashing record amounts of debt on what was once upon a time a pristine balance sheet.”

In the case of IBM, looking beyond the short-term trees at the long-term forest should give investors little faith in the CEO or the company’s future growth prospects. Much is being hidden in the morass of financial machinations surrounding acquisitions, divestitures, debt assumption and stock buybacks. Meanwhile, revenues are declining, and investments in R&D are falling. This cannot bode well for the company’s long-term investor prospects, regardless of the well scripted talking points offered last week.

by Adam Hartung | May 8, 2014 | Current Affairs, Leadership

Lots of press this week about Target’s CEO and Chairman, Gregg Steinhafel, apparently being forced out. Blame reached the top job after the successful cyber attack on the company last year. But investors, and customers, may regret this somewhat Board level over-reaction to a mounting global problem.

Richard Clark is probably America’s foremost authority on cyber attacks. He was on America’s National Security Council, and headed the counter-terrorism section. Since leaving government he has increasingly focused on cyber attacks, and advised corporations.

In early 2013 I met Mr. Clark after hearing him speak at a National Association of Corporate Directors meeting. He was surprisingly candid in his comments at the meeting, and after. He pointed out that EVERY company in America was being randomly targeted by cyber criminals, and that EVERY company would have an intrusion. He said it was impossible to do business without working on-line, and simultaneously it was impossible to think any company – of any size – could stop an attack from successfully getting into the company. The only questions one should focus on answering were “How fast can you discover the attack? How well can you contain it? What can you learn to at least stop that from happening again?”

So, while the Target attack was large, and not discovered as early as anyone would like, to think that Target is in some way wildly poor at security or protecting its customers is simply naive. Several other large retailers have also had attacks, include Nieman Marcus and Michael’s, and it was probably bad luck that Target was the first to have such a big problem happen, and at such a bad time, than anything particularly weak about Target.

We now know that all retailers are trying to learn from this, and every corporation is raising its awareness and actions to improve cyber security. But someone will be next. Target wasn’t the first, and won’t be the last. Companies everywhere, working with law enforcement, are all reacting to this new form of crime. So firing the CEO, 2 months after firing the CIO (Chief Information Officer), makes for good press, but it is more symbolic than meaningful. It won’t stop the hackers.

Where this decision does have great importance is to shareholders and customers. Target has been a decent company for its constituents under this CEO, and done far better than some of its competitors. The share price has doubled in the last 5 years, and Target has proven a capable competitor to Wal-Mart while other retailers have been going out of business (Filene’s Basement, Circuit City, Linens & Things, Dots, etc.) or losing all relevancy (like Abercrombie and Fitch and Best Buy.) And Target has been at least holding its own while some chains have been closing stores like crazy (Radio Shack 1,100 stores, Family Dollar 370 stores, Office Depot 400 stores, etc.)

Just compare Target’s performance to JCPenney, who’s CEO was fired after screwing up the business far worse than the cyber attack hurt Target. Or, look at Sears Holdings. CEO Ed Lampert was heralded as a hero 6 years ago, but since then the company he leads has had 28 straight quarters of declining sales, and closed 305 stores since 2010. Kmart has become a complete non-competitor in discounting, and Sears has lost all relevancy as a chain as it has been outflanked on all sides. CEO Lampert has constantly whittled away at the company’s value, and just this week told shareholders that they can simply plan on more store closings in the future.

And vaunted Wal-Mart is undergoing a federal investigation for bribing government officials in Mexico to prop up its business. Wal-Mart is constantly under attack by its employees for shady business practices, and even lost a National Labor Relations Board case regarding its hours and pay practices. And Wal-Mart remains a lightning rod for controversy as it fights with big cities like Chicago and Washington, DC about its ability to open stores, while Target has flourished in communities large and small with work practices considered acceptable. And Target has avoided these sort of internally generated management scandals.

CEOs, and Boards of Directors, across the nation have been seriously addressing cyber security for the last couple of years. Awareness, and protective measures, are up considerably. But there will be future attacks, and some will succeed. It is unclear blaming the CEO for these problems makes any sense – unless there is egregious incompetence.

On the other hand, finding a CEO that can grow a business like Target, in a tough retail market, is not easy. Destroying KMart, while battling Wal-Mart, and still trying to figure out how to compete with Amazon.com is a remarkably difficult job. Perhaps the toughest CEO job in the country. Steinhafel had performed better than most. Investors, and customers, may soon regret that he’s not still leading Target.

by Adam Hartung | Apr 30, 2014 | Current Affairs, Innovation, Leadership

Economic growth is a great thing. When the economy booms people make more, so they pay more income taxes. They spend more, which generates more sales tax. They upgrade homes and buy bigger homes, which have higher property taxes. But even though they pay more dollars in taxes, people are happy because they have more cash, and often the percent of their income spent overall on taxes is lower.

A virtuous circle where everyone benefits. Growth helps the citizens, and the community prospers.

For the industrial era, this virtuous circle was great for Illinois. Farmlands continued to prosper with bountiful crops, while new manufacturing jobs created higher incomes for those leaving the farms. The roadways and airports grew, while income taxes remained almost paltry by national standards. And Illinois could boast some of the country’s best public schools even while property taxes were below national averages. This growth environment kept locals in the state, and attracted people from the plains, other parts of the midwest, south and northeast as well as immigrants from foreign lands. Industrial growth propelled a great environment.

Last week many people were surprised by a recent Gallup survey showing that Illinois leads the USA in people wanting to leave their home state. A whopping 50% of the population would like to leave. And Illinois was 2nd from the top with percentage of people who have high intent to actually leave (at 19%.) So if those two groups overlap Illinois could lose 10% of its population in short order!

If ever there was one, this has to be a wake-up call!

The seeds of this problem were sown many years ago. When manufacturing started going offshore, Illinois was hard hit. A Center for Government Studies report shows that between 2000 and 2010 the number of people employed in Illinois actually declined by 115,000 (1.5%). Farming, wholesale and retail trade jobs fell by 135,000. But far worse was the decline in manufacturing jobs, which dropped by a whopping 311,000. Those were jobs which had been Illinois’ growth foundation for 60 years. And they were the employers who provided the network effect of business-to-business growth that kept the state’s virtuous circle spinning.

Despite the obviousness of this shift in employment – from manufacturing to services – the state reacted timidly to replace that employment base with another growth vehicle. In an era of growing financial services, Illinois failed to develop a strong banking sector, and in fact watched First Chicago/Bank One become JPMorganChase and leave – along with almost all its other large brethren. Despite leading engineering universities (University of Illinois Chicago, University of Illinois Urbana/Champaign, Northwestern, Illinois Institute of Technology, Northern Illinois, etc.) Illinois failed to develop a vibrant angel investing or venture capital community, and digital entrepreneurs were pushed toward the coasts for funding – and increasingly the talent followed them out of state.

It did not take long for the virtuous circle to become a stagnation spiral. As jobs left the state there was lower demand for housing, so people couldn’t sell their houses – especially after 2007. The housing bust that racked America hit the Chicago area, and all of Illinois, harder than many metros. And home prices have failed to recover at anything close to the national average. Chicago still leads major metro areas in percentage of homes with underwater mortgages. To maintain money for schools and roads communities were forced to raise property taxes. Today many people, especially in the 6 Chicago “collar counties,” pay property taxes that are higher than similar homes in Los Angeles and San Francisco! Property taxes that have become among the highest in the country.

With no growth in spending, communities raised sales taxes to generate more income. Today most Illinois citizens pay between 9-10% sales tax, again amongst the highest in the country. Which encourages even greater on-line shopping, and deterioration in the local retail trade.

Road maintenance, and general funding at the state level, pushed the state to raise highway tolls. What were $.25 toll machines on major arteries in the 1990s now cost $.75 (tripled) and the rate is double that ($1.50) if you don’t install an electronic toll device in your auto (sorry out-of-state drivers.)

Lacking growth, state income tax receipts could not keep up with state demands – especially for pensions that depended on both a vibrant stock market as well as higher state income. So Illinois doubled the income tax rate in an effort to fund pensions and avoid bankruptcy.

Yet, despite seeing taxes in all areas increase, residents are subject to declining services. Potholes remain an ever-present danger for drivers. Municipal traffic services (buses and rail cars) have increased prices by multiples, yet there are fewer routes and longer waits for customers.

Which leads to an even worse element of stagnation – aging population. As the jobs for people 16-44 declined, younger people left the state and that demographic actually declined by 3.2% between 2000 and 2010. Those who remained were older, so the Baby Boomers grew by 21%! However, this aged demographic is not in its prime “spending” years, and instead is much more likely to invest for retirement. Thus further dampening the local economy.

And, an aging population means that the number of children declined – dramatically. The “baby bust” resulted in a 6.2% decline in children under age 10 in Illinois last decade. Fewer children means less demand for school teachers, and all the things related to child rearing, further shrinking the economic growth prospects. While this is good news for property tax payers generally, it’s never a good sign to see closed schools simply because there’s no need for them.

Now the spiral becomes a self-fulfilling prophecy. Retiring boomers on a fixed income realize that they cannot afford to live in a state with such high, and rising, property taxes. Especially when other states have fixed taxes that are 1/4 to 1/3 what they pay in Illinois. These retirees (or soon to be retirees) discover lower property tax states often have sales taxes that are half what they pay in Illinois. The economics of staying become increasingly difficult to bear – while the benefits of leaving look ever more promising.

Entrepreneurs and business leaders see little reason to move more jobs into Illinois. When looking at facility locations they realize they can receive the same tax breaks almost anywhere, but employees would prefer the lower tax environment of other states – especially sun belt states like Texas which has no income tax. As Illinois offers tax breaks to dinosaurs like Sears, desperately trying to keep jobs despite failing corporate prospects, it becomes increasingly difficult to lure anyone other than small-employing headquarters locations into the state. And personal taxes keep going up to compensate for these ill-conceived legacy company support programs.

No wonder so many people think about leaving Illinois. And we haven’t even mentioned the weather (do you know how to spell P-O-L-A-R V-O-R-T-E-X?)

Growth is a wonderful thing. Everyone prospers when economic growth provides the virtual circle of more cash. But when the market turns toward the stagnation spiral – well it sucks for just about everyone.

Just ask the folks in Detroit – who are now auctioning off empty homes for $1,000 on the internet just to stop ongoing blight that is wrecking the city like an economic tsunami.

There is no simple answer for a declining economy like Illinois. But this was a situation that took over 2 decades to create. Failure to recognize the decline in manufacturing, and shift to digital economy jobs, left political and industry leaders arrogantly thinking everything would be fine. An inability to invest in creating a replacement powerhouse industry means the state has few resources to invest in anything at all now. Unable to leverage local university innovation with a comprehensive and effective program for funding projects has created a veritable slipper-slide from Illinois to California or New York for new graduates.

The answer will take a some time to develop, and implement. But one thing is clear, if Illinois’ leaders don’t come up with something soon there will be even fewer people around, and even greater problems developing. It would be easy to dismiss this Gallup poll, or let community pride keep one from taking its implications seriously. But that would be an even worse mistake. This is a serious wake-up call.

by Adam Hartung | Apr 23, 2014 | Current Affairs, Leadership

Every quarter I have to be reminded that “earnings season” is again upon us. The ritual of public companies announcing their sales and profits from recent quarters that generates a lot of attention in the business press. And I always wonder why this is a big deal.

What really matters to investors, employees, customers and vendors is “what will your business be like next quarter, and year?” We really don’t much care about the past. What we really want to know is “what should we expect in the future?”

For example, two companies announce quarterly results. One has a Price/Earnings (P/E) multiple of 12.8 and a dividend yield of 2.05%. The other has a multiple of 13.0, and a yield of 3.05%. For both companies net earnings overall were pretty much flat, but Earnings Per Share (EPS) improved due to an aggressive stock repurchase program. Both companies say they have new products in the pipeline, but they conservatively estimate full year results for 2014 to be flat or maybe even declining.

Do you know enough to make a decision on whether to buy either stock? Both?

Truthfully, the two companies are Xerox and Apple. Now does it matter?

While both companies have similar results and forward looking statements, how you view that information is affected by your expectations for each company’s future. So, in other words, the actual results are pretty meaningless. They are interpreted through the lens of expectations, which controls your decision.

You can say Xerox has been irrelevant for years, and its products increasingly look unlikely to change its future course, so you are disheartened by results you see as unspectacular and likewise see no reason to own the stock. For Apple you could say the same thing, and bring up the growing competitor sales of Android-based products. Or, you might say that Apple is undervalued because you have great faith in the growth of mobile products sales and you believe new devices will spur Apple to even better results. Whatever your conclusion about the announced earnings, those conclusions are driven by your view of the future – not the actual results.

Another example. Two companies have billions in sales, and devote their discussion of company value to technology and the use of new technology to pioneer new markets. Both companies report they continue a string of losses, and have no projection for when losses will become profits. There are no dividends. There is no P/E multiple, because there is no E. There is no EPS, again because there is no E. One company is losing $12.86/share, the other is losing $.61/share. Again, do these results tell you whether to buy either, one or both?

What if the first one (with the larger losses) is Sears Holdings, and the latter is Tesla? Now, suddenly your view on the data changes – based upon your view of the future. Either Sears is on the precipice of a turnaround to becoming a major on-line retailer that will sell some real estate and leverage the balance of its stores to grow, so you buy it, or you think Sears has lost all relevancy and you don’t buy it. Either you think Tesla is an industry game changer, so you buy it, or you think it is an over-rated fad that will never become big enough to matter and the giant global auto companies will destroy it, so you don’t buy it. It’s your future view that guides your conclusions about past results.

The critical factor when reviewing earnings is actually not the reported results. The critical factor is what you think the future is for these 4 companies. No matter how good or bad the historical results, your decision about whether to own the stock, buy the company products, work for the company or join its vendor program all hinges on your view about the company’s future.

Which makes not only the “earnings season” hoopla foolish, but puts a pronounced question mark on how executives – especially CEOs – in public companies spend their time as it relates to reporting results.

Enormous energy is spent by most CEOs and their staff on managing earnings. From the beginning to the end of every quarter the CFO and his/her staff pour over weekly outcomes in divisions and functions to understand revenues and costs in order to gain advance knowledge on likely results. Then, for the next several days/weeks the CFO’s staff, with the CEO and the leadership team, will pour over those results to make a myriad number of adjustments – from depreciation and amortization to deferring revenue changing tax structures or time-matching various costs – in order to further refine the reported results. Literally thousands of person-hours will be devoted to managing the reported results in order to provide the number they think is most appropriate. And this cycle is repeated every quarter.

But how many hours will be spent by that same CEO and the leadership team managing expectations about the company’s next year? How much time do these leaders spend developing scenarios, and communications, that will describe their vision, in order to manage investor expectations?

While every company has a CFO leading a large organization dedicated to reporting historical results, how many companies have a like-powered C level exec managing the expectations, and leading a large staff to create and deliver communications about the future?

It seems pretty clear that most management teams should consider reallocating their precious resources. Instead of spending so much time managing earnings, they should spend more time managing expectations. If we think about the difference between Xerox and Apple, one is quickly aware of the difference the CEOs made in setting expectations. People still wax eloquently about the future vision for Apple created by CEO Steve Jobs, who’s been dead 2.5 years, while almost no one can tell you the name of Xerox’ CEO. If you think about the difference between Sears and Tesla one only needs to think briefly about the difference between the numbers driven hedge fund manager and cost-cutting CEO Ed Lampert compared with the “visionary” communications of Elon Musk.

Investors should all think long term. Investors should care completely about what the next 3 to 5 years will mean for companies in which they place their money. What sales and earnings are reported from months ago is pretty meaningless. What really matters is what is yet to happen.

What we don’t need is a lot of time spent talking about old earnings. What we need is a lot more time spent talking about the future, and what we should expect from our investments.

by Adam Hartung | Apr 15, 2014 | Current Affairs, In the Rapids, Leadership, Transparency

Zebra Technologies is a company most people don’t recognize. Yet, I bet every product you buy has the product on which they specialize.

Since 1982 Zebra has been the leader in bar code printers and readers. Zebra was a pioneer in the application of bar codes for tracking pallets through warehouses, items used in a manufacturing line, shipment tracking and other uses for manufacturing and supply chain management. As the market leader Zebra Technologies developed its own software (ZPL) for printing barcodes, and made robust printing and reading machines that were the benchmark for rugged, heavy duty applications at companies from Caterpillar, to UPS and FedEx, to WalMart.

Although the company dabbled in RFID technology for product tracking, and is considered a leader in that market, the new technology really never “took off” due to higher costs compared with the boring, but effective and remarkably cheap, bar code. So Zebra plodded away making ever better, smaller, cheaper, faster bar code printers. It may not have been exciting, like the nondescript headquarters in far-suburban Chicago, but it met the market needs. Zebra was an excellent operational company that was delivering on its focus.

Even if it was, well …… boring.

But, like all markets, the bar code market began shifting. Generic software companies, like Microsoft, produced drivers that would work from a cheap PC to allow

cheap generic printers, like those from HP, to print bar codes. These were cheap enough to be considered disposable. Not a good thing for the better, but more expensive, market leader. Competitive, non-proprietary software and hardware leads to lower prices and margin compression. It’s a differentiation stealer.

Worse, lots of customers stopped caring much about bar codes altogether. Zebra’s customers realized bar codes were everywhere. Nothing new was really happening. When it came to delivering on the promise of really efficient, accurate and low cost supply chain management the bar code had a place. But no longer an exciting one. When your product is boring discussions with customers easily slip toward price rather than new products. And when you’re talking about price, and how to keep existing business, relevancy is at risk. You become a target for a new competitor to come along and steal your thunder (and profits) by relegating your product to generic-doom while taking the high rode of delivering more value by changing the game.

So hand it to Zebra’s leadership team that they observed the risk of staying focused on their status quo, and took action to change the game themselves. Today Zebra announced it is buying the enterprise device business of Motorola. And this is a big bet. At a price of $3.5B, Zebra is spending an amount nearly equal to its existing net worth. And it is borrowing $3.25B – almost the whole cost – greatly increasing the company’s debt ratios. That is a gutsy move.

Yet, in this one move Zebra will nearly triple its revenues.

This decision is not without risk. The acquired Motorola business has seen declining revenues – like a $500M decline in the last year (roughly 25%.) With many products built on Microsoft software, customers have been shifting to other solutions. Exactly how the old technologies will integrate with new ones in the Motorola lines is not clear. And even less clear is how a combined company will bring together old-line printer/scanners using proprietary software with the diverse, and honestly pricey, products that Motorola enterprise has been selling, to offer more competitive solutions.

Yet, investors should be encouraged. Doing nothing would spell disaster for Zebra. It is a company that needs to re-invent itself for today’s pressing business needs — which have little in common with the top needs 30 years ago (or even 10 years ago.) In October, Zebra launched Zatar, a Web-based software that allows companies to deploy and manage devices and sensors connected to the Internet. In December Zebra purchased a company (Hart) for its cloud-based software to manage inventory. Now Zebra is looking to use these integration tools to bring together all kinds of devices the new company will manufacture to help companies achieve an entirely new level of efficiency and capability in today’s real-time manufacturing and logistics world.

We should admire CEO Anders Gustaffson’s leadership team for recommending such bold action. And the company’s Chairman and Board for approving it. Of course “there’s many a slip twixt the cup and the lip,” but at least Zebra’s investors, employees, suppliers and customers can now see that Zebra is really holding a viable cup, and that it is putting together a serious effort to provide better delivery to buyers lips.

This is a play to grow the company by following the trend to “the internet of things” with new solutions that are potential game changers. And there’s no way you can win unless you’re in the game. With these acquisitions, there is no doubt that what was mostly a manufacturing company – Zebra – is now “in the game” for doing new things with new technologies.

This is a play to grow the company by following the trend to “the internet of things” with new solutions that are potential game changers. And there’s no way you can win unless you’re in the game. With these acquisitions, there is no doubt that what was mostly a manufacturing company – Zebra – is now “in the game” for doing new things with new technologies.

This does beg some questions: What is your company doing to be a game changer? Are you resting on the laurels of strong historical sales – and maybe a strong historical market position? Do you recognize that your market is shifting, and it is undercutting historical strengths? Are you relying on operational excellence, while new technologies are threatening your obsolescence?

Or — are you thinking like the leaders at Zebra Technologies and taking bold action to be the industry game-changing leader, even if it means stretching your financials, your management team and the technology?

Most of us would rather be in the former, than the latter, I think.

by Adam Hartung | Apr 8, 2014 | Current Affairs, Disruptions, In the Rapids, Innovation, Leadership

“Car dealers are idiots” said my friend as she sat down for a cocktail.

It was evening, and this Vice President of a large health care equipment company was meeting me to brainstorm some business ideas. I asked her how her day went, when she gave the response above. She then proceeded to tell me she wanted to trade in her Lexus for a new, small SUV. She had gone to the BMW dealer, and after being studiously ignored for 30 minutes she asked “do the salespeople at this dealership talk to customers?” Whereupon the salespeople fell all over themselves making really stupid excuses like “we thought you were waiting for your husband,” and “we felt you would be more comfortable when your husband arrived.”

My friend is not married. And she certainly doesn’t need a man’s help to buy a car.

She spent the next hour using her iPhone to think up every imaginable bad thing she could say about this dealer over Twitter and Facebook using various interesting hashtags and @ references.

Truthfully, almost nobody likes going to an auto dealership. Everyone can share stories about how they were talked down to by a salesperson in the showroom, treated like they were ignorant, bullied by salespeople and a slow selling process, overcharged compared to competitors for service, forced into unwanted service purchases under threat of losing warranty coverage – and a slew of other objectionable interactions. Most Americans think the act of negotiating the purchase of a new car is loathsome – and far worse than the proverbial trip to a dentist. It’s no wonder auto salespeople regularly top the list of least trusted occupations!

When internet commerce emerged in the 1990s, buying an auto on-line was the #1 most desired retail transaction in emerging customer surveys. And today the vast majority of Americans, especially Millennials, use the web and social media to research their purchase before ever stepping foot in the dreaded dealership.

Tesla heard, and built on this trend. Rather than trying to find dealers for its cars, Tesla decided it would sell them directly from the manufacturer. Which created an uproar amongst dealers who have long had a cushy “almost no way to lose money” business, due to a raft of legal protections created to support them after the great DuPont-General Motors anti-trust case.

When New Jersey regulators decided in March they would ban Tesla’s factory-direct dealerships, the company’s CEO, Elon Musk, went after Governor Christie for supporting a system that favors the few (dealers) over the customer. He has threatened to use the federal courts to overturn the state laws in favor of consumer advocacy.

It would be easy to ignore Tesla’s position, except it is not alone in recognizing the trend. TrueCar is an on-line auto shopping website which received $30M from Microsoft co-founder Paul Allen’s venture fund. After many state legal challenges TrueCar now claims to have figured out how to let people buy on-line with dealer delivery, and last week filed papers to go public. While this doesn’t eliminate dealers, it does largely take them out of the car-buying equation. Call it a work-around for now that appeases customers and lawyers, even if it doesn’t actually meet consumer desires for a direct relationship with the manufacturer.

Apple’s direct-to-consumer retail stores were key to saving the company

Distribution is always a tricky question for any consumer good. Apple wanted to make sure its products were positioned correctly, and priced correctly. As Apple re-emerged from near bankruptcy with new music products in the early 2000’s Apple feared electronic retailers would discount the product, be unable to feature Apple’s advantages, and hurt the brand which was in the process of rebuilding. So it opened its own stores, staffed by “geniuses” to help customers understand the brand positioning and the products’ advantages. Those stores are largely considered to have been a turning point in helping consumers move from a world of Microsoft-based laptops, Sony music products and Blackberry mobile devices to new iDevices and resurging Macintosh popularity – and sales levels.

Attacking regulations sounds – and is – a daunting task. But, when regulations support a minority of people outside the public good there is reason to expect change. American’s wanted a more pristine society, so in 1920 the 18th Amendment was passed prohibiting alcohol. However, after a decade in which rampant crime developed to support illegal alcohol production Americans passed the 21st Amendment in 1933 to repeal prohibition. What seemed like a good idea at first turned out to have more negatives than positives.

Auto dealer regulations hurt competition, and consumers

Today Americans do not need a protected group of dealers to save them from big, bad auto companies. To the contrary, forced distribution via protected dealers inhibits competition because it keeps new competitors from entering the U.S. market. Small production manufacturers, and large ones in countries like India, are effectively blocked from reaching American customers because they lack a dealer base and existing dealers are uninterested in taking the risks inherent in taking these new products to market. Likewise, starting up an auto company is fraught with distribution risks in the USA, leaving Tesla the only company to achieve any success since the dealer protection laws were passed decades ago.

And that’s why Tesla has a very good chance of succeeding. The trends all support Americans wanting to buy directly from manufacturers. At the very least this would force dealers to justify their existence, and profits, if they want to stay in business. But, better yet, it would create greater competition – as happened in the case of Apple’s re-emergence and impact on personal technology for entertainment and productivity.

Litigating to fight a trend might work for a while. Usually those in such a position are large political contributors, and use both the political process as well as legal precedent to protect their unjustified profits. NADA (National Automobile Dealers Association) is a substantial organization with very large PAC money to use across Washington. The Association can coordinate election contributions at national and state levels, as well as funding for judge elections and contributions for legal defense.

But, trends inevitably win out. Today Millennials are true on-line shoppers. They have no patience for traditional auto dealer shenanigans. After watching their parents, and grandparents, struggle for fairness with dealers they are eager for a change. As are almost all the auto buyers out there. And they are supported by consumer advocates long used to edgy tactics of auto dealers well known for skirting ethics and morality when dealing with customers. Those seeking change just need someone positioned to lead the legal effort.

Tesla wins because it uses trends to be a game changer

Tesla has shown it is well attuned to trends and what customers want. When other auto companies eschewed Tesla’s first entry as a 2-passenger sports car using laptop batteries, Tesla proceeded to sell out the product at a price much higher competitive gas-powered cars. When other auto companies thought a $70,000 electric sedan would never appeal to American buyers, Tesla again showed it understood the market best and sold out production. When industry pundits, and traditional auto company execs, said it was impossible to build a charging grid to support users driving up the coast, or cross-country, Tesla built the grid and demonstrated its functionality.

Now Tesla is the right company, in the right place, to change not only the autos Americans drive, but how Americans buy them. It’s rarely smart to refuse a trend, and almost always smart to support it. Tesla looks to be positioning itself as much smarter than older, larger auto companies once again.

by Adam Hartung | Apr 1, 2014 | Current Affairs, Defend & Extend, In the Swamp, Leadership, Web/Tech

“Hope springs eternal in the human breast” (Alexander Pope)

As it does for most investors. People do not like to accept the notion that a business will lose relevancy, and its value will fall. Especially really big companies that are household brand names. Investors, like customers, prefer to think large, established companies will continue to be around, and even do well. It makes everyone feel better to have a optimistic attitude about large, entrenched organizations.

And with such optimism investors have cheered Microsoft for the last 15 months. After a decade of trading up and down around $26/share, Microsoft stock has made a significant upward move to $41 – a new decade-long high. This price has people excited Microsoft will reach the dot.com/internet boom high of $60 in 2000.

After discovering that Windows 8, and the Surface tablet, were nowhere near reaching sales expectations after Christmas 2012 – and that PC sales were declining faster than expected – investors were cheered in 2013 to hear that CEO Steve Ballmer would resign. After much speculation, insider Satya Nadella was named CEO, and he quickly made it clear he was refocusing the company on mobile and cloud. This started the analysts, and investors, on their recent optimistic bent.

CEO Nadella has cut the price of Windows by 70% in order to keep hardware manufacturers on Windows for lower cost machines, and he announced the company’s #1 sales and profit product – Office – was being released on iOS for iPad users. Investors are happy to see this action, as they hope that it will keep PC sales humming. Or at least slow the decline in sales while keeping manufacturers (like HP) in the Microsoft Windows fold. And investors are likewise hopeful that the long awaited Office announcement will mean booming sales of Office 365 for all those Apple products in the installed base.

But, there’s a lot more needed for Microsoft to succeed than these announcements. While Microsoft is the world’s #1 software company, it is still under considerable threat and its long-term viability remains unsure.

Windows is in a tough spot. After this price decline, Microsoft will need to increase sales volume by 2.5X to recoup lost profits. Meanwhile, Chrome laptops are considerably cheaper for customers and more profitable for manufacturers. And whether this price cut will have any impact on the decline in PC sales is unclear, as users are switching to mobile products for ease-of-use reasons that go far beyond price. Microsoft has taken an action to defend and extend its installed base of manufacturers who have been threatening to move, but the impact on profits is still likely to be negative and PC sales are still going to decline.

Meanwhile, the move to offer Office on iOS is clearly another offer to defend the installed Office marketplace, and unlikely to create a lot of incremental revenue and profit growth. The PC market has long been much bigger than tablets, and almost every PC had Office installed. Shrinking at 12-14% means a lot less Windows Office is being sold. And, In tablets iOS is not 100% of the market, as Android has substantial share. Offering Office on iOS reaches a lot of potential machines, but certainly not 100% as has been the case with PCs.

Further, while there are folks who look forward to running Office on an iOS device, Office is not without competition. Both Apple and Google offer competitive products to Office, and the price is free. For price sensitive users, both individuals and corporations, after 4 years of using competitive products it is by no means a given they all are ready to pay $60-$100 per device per year. Yes, there will be Office sales Microsoft did not previously have, but whether it will be large enough to cover the declining sales of Office on the PC is far from clear. And whether current pricing is viable is far, far from certain.

While these Microsoft products are the easiest for consumers to understand, Nadella’s move to make Microsoft successful in the mobile/cloud world requires succeeding with cloud products sold to corporations and software-as-service providers. Here Microsoft is late, and facing substantial competition as well.

Just last week Google cut the price of its Compute Engine cloud infrastructure (IaaS) platform and App Engine cloud app platform (PaaS) products 30-32%. Google cut the price of its Cloud Storage and BigQuery (big data analytics) services by 68% and 85% as it competes headlong for customers with Amazon. Amazon, which has the first-mover position and large customers including the U.S. federal government, cut prices within 24 hours for its EC2 cloud computing service by 30%, and for its S3 storage service by over 50%. Amazon also reduced prices on its RDS database service approximately 28%, and its Elasticache caching service by over 33%.

To remain competitive, Microsoft had to react this week by chopping prices on its Azure cloud computing products 27%-35%, reducing cloud storage pricing 44%-65%, and whacking prices on its Windows and Linux memory-intensive computing products 27%-35%. While these products have allowed the networking division formerly run by now CEO Nadella to be profitable, it will be increasingly difficult to maintain old profit levels on existing customers, and even a tougher problem to profitably steal share from the early cloud leaders – even as the market grows.

While optimism has grown for Microsoft fans, and the share price has moved distinctly higher, it is smart to look at other market leaders who obtained investor favorability, only to quickly lose it.

Blackberry was known as RIM (Research in Motion) in June, 2007 when the iPhone was launched. RIM was the market leader, a near monopoly in smart phones, and its stock was riding high at $70. In August, 2007, on the back of its dominant status, the stock split – and moved on to a split adjusted $140 by end of 2008. But by 2010, as competition with iOS and Android took its toll RIM was back to $80 (and below.) Today the rechristened company trades for $8.

Sears was once the country’s largest and most successful retailer. By 2004 much of the luster was coming off when KMart purchased the company and took its name, trading at only $20/share. Following great enthusiasm for a new CEO (Ed Lampert) investors flocked to the stock, sure it would take advantage of historical brands such as DieHard, Kenmore and Craftsman, plus leverage its substantial real estate asset base. By 2007 the stock had risen to $180 (a 9x gain.) But competition was taking its toll on Sears, despite its great legacy, and sales/store started to decline, total sales started declining and profits turned to losses which began to stretch into 20 straight quarters of negative numbers. Meanwhile, demand for retail space declined, and prices declined, cutting the value of those historical assets. By 2009 the stock had dropped back to $40, and still trades around that value today — as some wonder if Sears can avoid bankruptcy.

Best Buy was a tremendous success in its early years, grew quickly and built a loyal customer base as the #1 retail electronics purveyor. But streaming video and music decimated CD and DVD sales. On-line retailers took a huge bite out of consumer electronic sales. By January, 2013 the stock traded at $13. A change of CEO, and promises of new formats and store revitalization propped up optimism amongst investors and by November, 2014 the stock was at $44. However, market trends – which had been in place for several years – did not change and as store sales lagged the stock dropped, today trading at only $25.

Microsoft has a great legacy. It’s products were market leaders. But the market has shifted – substantially. So far new management has only shown incremental efforts to defend its historical business with product extensions – which are up against tremendous competition that in these new markets have a tremendous lead. Microsoft so far is still losing money in on-line and gaming (xBox) where it has lost almost all its top leadership since 2014 began and has been forced to re-organize. Nadella has yet to show any new products that will create new markets in order to “turn the tide” of sales and profits that are under threat of eventual extinction by ever-more-capable mobile products.

While optimism springs eternal long-term investors would be smart to be skeptical about this recent improvement in the stock price. Things could easily go from mediocre to worse in these extremely competitive global tech markets, leaving Microsoft optimists with broken dreams, broken hearts and broken portfolios.

Update: On April 2 Microsoft announced it is providing Windows for free to all manufacturers with a 9″ or smaller display. This is an action to help keep Microsoft competitive in the mobile marketplace – but it does little for Microsoft profitability. Android from Google may be free, but Google’s business is built on ad sales – not software sales – and that’s dramatically different from Microsoft that relies almost entirely on Windows and Office for its profitability

Update: April 3 CRN (Computer Reseller News) reviewed Office products for iOS – “We predict that once the novelty of “Office for iPad” wears off, companies will go back to relying on the humble, hard-working third parties building apps that are as stable, as handsome and far more capable than those of Redmond. It’s not that hard to do.”

by Adam Hartung | Mar 25, 2014 | Current Affairs, Ethics, Leadership, Web/Tech

5:00pm, September 20, 2009 was when I got the call.

Someone’s telling me to call the Wisconsin Highway Patrol, my oldest son was in a terrible accident. Then I call the police, who tell me my son has been airlifted to a hospital. I’m in the car, madly driving 500 miles toward the hospital, talking to the doctor – hearing my son is in bad shape. It looks terminal. Continuing the drive, deep into the blackest night, in the pouring rain.

Then the call from the hospital. My son was dead.

I kept up the drive, made it to the hospital at daybreak. Yes, that is my son. Yes, he is dead.

I guess I had to see it to believe it.

Suddenly a new realization hit me. My son has two brothers. Both in college. Both 500 miles away. They had no idea what my last 14 hours were like. They knew nothing about their brother. How would they learn about this horrific news?

This accident was not a secret. It was newsworthy, even if far from a major city. My dead son had dozens of friends. And they all use Facebook. While as young men my sons don’t pay much attention to news radio or TV, they do pay attention to Facebook. And texting. How long would it take before someone went on-line and started telling the world that their brother was dead?

Do you call your sons on the phone and tell them their brother died?

Not wasting any time, I jumped in the car and started straight for my middle son’s college. He was the closest with his brother. They exchanged texts every day. He would be checking his phone and his Facebook account. I made the decision that this – this one thing – this had to be done in person. I would not call, I would not text, I was going to tell him in person.

But could I beat Facebook and texting?

I loaded up with coffee and went back onto the highway. And started another 10 hour drive. I just kept wondering “how long do I have? How long before these boys find the out – the hard way?”

I called my neighbor and told her the news. I gave her my Facebook access and told her to monitor my account, and to pay attention to any traffic from people in my son’s network. Look for anything that even hinted of bad news. I had to focus on driving and couldn’t distract myself with mobile.

Eight hours later I drove into Chicago. I was between 30 and 90 minutes to my son. Depending on Chicago traffic! But things seemed light; lighter than normal. Maybe, just maybe, I had time.

As I pulled across town I knew I was only 20 minutes from my middle son. Then my phone rang. It was my neighbor. “It’s there Adam. It’s there on Facebook. Somebody found out, and the kids are starting to spread the news. You better hurry.”

As safely, yet quickly, as possible I navigated in front of his 3 flat apartment on the south side. Luckily, a parking spot on the street. I pulled in, jumped out of the car and saw a window open in his apartment. I started calling up “hey, you up there? I need you to come unlock the door. Hey, come to the door.”

Laconically my son came to the door. I could tell by his eyes he didn’t know anything, and was curious why I was there. I went inside, put my arms around him, and told him his brother was dead.

He accused me of a bad joke. I quickly told him an accident happened, where, and that his brother didn’t make it.

Of course, he did not believe me. So he picked up his phone. He started looking for texts. He saw there were none from his brother. Then he jumped to his PC. He pulled up Facebook. He looked for his brother’s page – and then he started seeing the messages. Messages of disbelief, grief, anger and fear as expressed by so many people who are 21 or 22 and suddenly come face to face with mortality.

My son was in shock, as could be expected. But he was with me. Then it hit him “have you told my little brother?” I told him no. “We have to go tell him. Now. Before he finds out some other way.”

We then jumped back in the car and beat it to his younger brother’s college. My youngest son was far less of a social media fan. Also, college soccer kept him very busy. We knew he had been in class and soccer practice most of the day and evening, and he would not check anything until late at night. We had a very good chance that he had not heard anything.

Luckily, when we arrived at his college and found him, he confirmed he had not seen his phone or PC for several hours while at class, practice, eating and finishing homework. We told him the very, very bad news.

I’m glad my sons did not hear of their brother’s death via a text. Or via Facebook. It was a very, very, very difficult day for us. And the next several. Every minute etched forever in our memories.

As the next few days passed we all gained huge comfort from those who reached out to us via text, Facebook and Tweets. Hundreds of messages and postings came in. Social media was a tremendous way for all of us to connect and share stories about my now lost son. Young people told me things I would never have known had they been limited to telling me face-to-face, but which they were willing to share via Facebook. It was incredibly helpful.

We live in a very, very connected world.

Information, even things which may seem obscure in this large global environment, find their way to light quickly. We all want information now – not later. We want to know what, where and when – and we want to know it now. We sign up for email newsletters, Facebook pages, linked-in networks and listen to our colleagues on Twitter so we know things as soon as possible.

This is tough for those who have to communicate bad news. What’s the trade-off? Do you wait and do it personally? Or do you opt for moving quickly? Is it better someone know the information now – even if it is painful – or do you seek to inform them in a personal way to address their needs, emotions and questions? Do you broadcast the news, or keep it small? Do you send it impersonally, or personally? What is important?

Every organization is, to some extent, in the trust business

When you have to deliver bad news, how will you do it? Whether you have to announce a layoff, plant closing, industrial accident, data breach, product recall, product failure, program failure – or even a fatality – you are communicating information that is personal, and emotional. It is information that requires a sense of the person, not just the news. How will the information be received – and what does that mean for how it should be communicated?

It takes continuous effort to build trust, but it can be lost in a single, poorly constructed communication.

Malaysia Airlines had years to plan its communications for a downed plane. How would it tell the world such news? What tools would it use? A preparedness plan should contain not only the action plan, but the communications plan as well. And not only the message, but how it will be delivered. And how all touch points between the organization and the audience will be addressed.

Once flight 370 went missing Malaysia Airlines had days to plan its communications with families. There were several possible scenarios, yet all had a common theme of communicating passenger status. Passengers that are family members. The airline had significant time to plan what it would say, and how. To settle on texting families that their loved ones were forever gone was either incredibly bad planning, or indicates a significant lack of planning communications altogether.

When it was time for my sons to learn their brother was dead someone needed to be there to support them. Someone who cared. It was not news to be internalized without more discussion about what, how and why. All bad news shares this requirement, to address the human need to ask questions. Relying on email, texting, social media, newsletters or broadcast to share bad news ignores the very personal impact bad news has on the recipients.

Nobody wants to deliver bad news, but sometimes it is unavoidable. Being prepared is incredibly important if you want to maintain trust. Otherwise you can look as heartless, and untrustworthy, as Malaysia Airlines.

Connect with me on LinkedIn, Facebook and Twitter.

Microsoft was founded by Bill Gates, who did a remarkable job of taking a start-up company from the Wellspring of an idea into one of the fastest growing adolescents of any American company.

Microsoft was founded by Bill Gates, who did a remarkable job of taking a start-up company from the Wellspring of an idea into one of the fastest growing adolescents of any American company.