by Adam Hartung | May 12, 2015 | Current Affairs, Leadership

NFL Commissioner Roger Goodall slammed Tom Brady and the New England Patriots today for what seemed, to many, like a pretty minor thing. Under-inflating balls to give the quarterback and receivers a small advantage would seem a far cry from the kind of offense causing you to suspend an MVP player for 4 games, fine the team owner $1M, and take away the coach’s #1 draft pick for 2016 and #4 draft pick for 2017.

But, largely, the Commissioner had little choice. And yes, he is making an example out of this situation.

In America the NFL is the sport. Where baseball was once “America’s game” that is no longer true. Today the NFL generates almost as much revenue as major league baseball (MLB) and the NBA combined. Players make more money than S&P 500 CEOs – and they are about the only people who do!

But the NFL has a raft of culture issues. First of all, it is really violent. The litany of players with lifetime injuries from football is remarkable. It seems like few who play in the NFL are able to go on to “regular lives” due to the remarkable stress the game puts on huge bodies colliding at remarkable speeds. There is no doubt that the game has led to many debilitating concussions, and players have been committing suicide at a surprising rate.

Remember “Bountygate?” From 2009 to 2011 the New Orleans Saints ownership and coaches paid players bonuses – “bounties” – if they injured an opposing player bad enough to have him removed from the game. This kind of thing was found to be endemic, and that some coaches had long promoted paying for injuring opposing players.

That is the kind of testosterone driven behavior that the NFL’s leadership realized was going to seriously damage the game, if not push it into legal regulation. While some fans (and in football, fan is truly short for fanatic) may have thought the practice a terrific reincarnation of Roman gladiator games, culturally this kind of behavior made the game less “family friendly” and likely to end up with ever more legal problems. The coaches were suspended, and the team lost draft picks.

Unfortunately, the NFL – despite its high pay – is nothing like baseball when it was the glory sport of America. In those days players had strict behavioral rules, and they could lose money – even their jobs – for simply getting drunk in public, or caught fornicating with someone other than their wife. Arguing with umpires caused multi-game suspensions, and fans sought out players with the quiet demeanor of Joe Dimaggio.

The NFL is rife with players struggling with criminal prosecution. Between January and July of 2013, 27 players were arrested. Between 2000 and 2013 two teams had 40 players arrested, and one had 35. The three least criminalistic teams in the league had 9 to 11 players put in handcuffs. It is a far too common sight on the news – NFL players handcuffed, or explaining to cameras why they were arrested. This is a big problem for a league that would like its players to be role models, and encourage mothers to allow their children to play the game – or go to games.

The Patriots have had their own problems. In 2007 coach Patriots’ Belichick was caught stealing signals from the New York Jets coaches. “Spygate” caused Commissioner Goodall to fine the coach $500,000 – the largest fine in history to that date. Additionally the team was stripped of its 2008 first round draft and fined $250,000. It was another example, like Bountygate, of a culture accepting of the notion that owners, coaches and players should “do whatever it takes to win,” and rules (or etiquette) be darned.

Then in 2013 Patriots’ player Aaron Hernandez was arrested for murder. Eventually he was arrested on two additional murder counts, and in just the last few months he was convicted on murder charges. As the news rolled out, we learned Mr. Hernandez had a long criminal record, including bar fights and shootings, going back to 2007. It appears as if the Patriots and the NFL turned a blind eye toward a very dangerous person – in order for the team to win more games. The “win at all costs” again appeared to be culturally dominant.

Now we have “deflategate.” Coach Belichick again in the spotlight, apparently for trying more tricks to gain an advantage – even if unfair. As the investigation continued the question became “even if Tom Brady didn’t know why the balls were deflated, as someone who touched the ball on every play why didn’t he report the issue to his coaches? Why didn’t he take personal responsibility for what could well be a rule violation, and seek to find the true answer? Why didn’t he try to play by the rules, and take care of this issue?” Instead, it appeared he was more than happy to take advantage of the situation, even if it was against the rules. Again, win at all costs – including breaking the rules.

Unfortunately this is now moving into the stadium. In recent TV interviews several people have pooh-poohed the whole issue. “What’s the big deal? Really? All this fuss over something so small?” And the comment heard over and over in “man-on-the-street” interviews “if you get caught, you get penalized.” Really – not that Mr. Brady should have reported this situation and fixed it – but rather that he got caught is all that mattered. It’s OK to cheat, just don’t get caught.

The NFL has a culture issue. In some stadiums the language is so course, and the fans so rough, that minors should never attend. And, as we said in an earlier time, “unfit company for a lady.” Tied, unfortunately, to players and coaches who implement a culture of violence, cheating and doing whatever one must to win – rather than simply playing a game.

And that is where Commissioner Goodall has to take action. He leads the league. He is the “man at the top.” It is his job, as leader, to set the tone on culture. If the NFL is to be “America’s sport” it’s his job to set the cultural tone for the sport, and demonstrate good leadership for his business, the owners, the coaches and the players. If we want fans to be sportsmanlike, it has to start with the players and those who are part of the NFL.

So there is no choice but to make an example of Mr. Brady. He sensed there was a problem. But he would rather win, and be MVP, than be honest. Wow, what a role model. And Mr. Belichick, now in in controversy #2, leads us to question if anything matters to him other than winning a superbowl ring – even if it means hiring a gun-toting shooter who can’t stay out of bar fights. And the Commissioner, like many of us, has to wonder, what is going on in that Patriots’ organization that Mr. Robert Kraft owns? What cultural tone is he setting, as the man atop the team? Is his view “win at all costs” and the rules be darned?

The NFL has a culture problem. Commissioner Goodall has his hands full. He has to deal with individualistic owners, who are rich and very powerful in their local communities. He has fans that are often far more caring of their team winning than playing by the rules. And he has players that, too often, or a very short step from prison – or committing horrendous acts of violence on the field that can maim or kill another player. He has to take stiff action, when he can, if he is to make any difference at all in trying to keep this culture from going completely off the rails.

Learn more about my public speaking, Board involvement and growth consulting at www.AdamHartung.com, or connect with me on LinkedIn, Facebook and Twitter.

by Adam Hartung | May 8, 2015 | Current Affairs, Defend & Extend, Food and Drink, In the Swamp, In the Whirlpool, Leadership

McDonald’s just had another lousy quarter. All segments saw declining traffic, revenues fell 11%. Profits were off 33%. Pretty well expected, given its established growth stall.

A new CEO is in place, and he announced is turnaround plan to fix what ails the burger giant. Unfortunately, his plan has been panned by just about everyone. Unfortunately, its a “me too” plan that we’ve seen far too often – and know doesn’t work:

- Reorganize to cut costs. By reshuffling the line-up, and throwing out a bunch of bodies management formerly said were essential, but now don’t care about, they hope to save $300M/year (out of a $4.5B annual budget.)

- Sell off 3,500 stores McDonald’s owns and operate (about 10% of the total.) This will further help cut costs as the operating budgets shift to franchisees, and McDonald’s book unit sales creating short-term, one-time revenues into 2018.

- Keep mucking around with the menu. Cut some items, add some items, try a bunch of different stuff. Hope they find something that sells better.

- Try some service ideas in which nobody really shows any faith, like adding delivery and/or 24 hour breakfast in some markets and some stores.

Needless to say, none of this sounds like it will do much to address quarter after quarter of sales (and profit) declines in an enormously large company. We know people are still eating in restaurants, because competitors like 5 Guys, Meatheads, Burger King and Shake Shack are doing really, really well. But they are winning primarily because McDonald’s is losing. Even though CEO Easterbrook said “our business model is enduring,” there is ample reason to think McDonald’s slide will continue.

Needless to say, none of this sounds like it will do much to address quarter after quarter of sales (and profit) declines in an enormously large company. We know people are still eating in restaurants, because competitors like 5 Guys, Meatheads, Burger King and Shake Shack are doing really, really well. But they are winning primarily because McDonald’s is losing. Even though CEO Easterbrook said “our business model is enduring,” there is ample reason to think McDonald’s slide will continue.

Possibly a slide into oblivion. Think it can’t happen? Then what happened to Howard Johnson’s? Bob’s Big Boy? Woolworth’s? Montgomery Wards? Size, and history, are absolutely no guarantee of a company remaining viable.

In fact, the odds are wildly against McDonald’s this time. Because this isn’t their first growth stall. And the way they saved the company last time was a “fire sale” of very valuable growth assets to raise cash that was all spent to spiffy up the company for one last hurrah – which is now over. And there isn’t really anything left for McDonald’s to build upon.

Go back to 2000 and McDonald’s had a lot of options. They bought Chipotle’s Mexican Grill in 1998, Donato’s Pizza in 1999 and Boston Market in 2000. These were all growing franchises. Growing a LOT faster, and more profitably, than McDonald’s stores. They were on modern trends for what people wanted to eat, and how they wanted to be served. These new concepts offered McDonald’s fantastic growth vehicles for all that cash the burger chain was throwing off, even as its outdated yellow stores full of playgrounds with seats bolted to the floors and products for 99cents were becoming increasingly not only outdated but irrelevant.

But in a change of leadership McDonald’s decided to sell off all these concepts. Donato’s in 2003, Chipotle went public in 2006 and Boston Market was sold to a private equity firm in 2007. All of that money was used to fund investments in McDonald’s store upgrades, additional supply chain restructuring and advertising. The “strategy” at that time was to return to “strategic focus.” Something that lots of analysts, investors and old-line franchisees love.

But look what McDonald’s leaders gave up via this decision to re-focus. McDonald’s received $1.5B for Chipotle. Today Chipotle is worth $20B and is one of the most exciting fast food chains in the marketplace (based on store growth, revenue growth and profitability – as well as customer satisfaction scores.) The value of all of the growth gains that occurred in these 3 chains has gone to other people. Not the investors, employees, suppliers or franchisees of McDonald’s.

We have to recognize that in the mid-2000s McDonald’s had the option of doing 180degrees opposite what it did. It could have put its resources into the newer, more exciting concepts and continued to fidget with McDonald’s to defend and extend its life even as trends went the other direction. This would have allowed investors to reap the gains of new store growth, and McDonald’s franchisees would have had the option to slowly convert McDonald’s stores into Donato’s, Chipotle’s or Boston Market. Employees would have been able to work on growing the new brands, creating more revenue, more jobs, more promotions and higher pay. And suppliers would have been able to continue growing their McDonald’s corporate business via new chains. Customers would have the benefit of both McDonald’s and a well run transition to new concepts in their markets. This would have been a win/win/win/win/win solution for everyone.

But it was the lure of “focus” and “core” markets that led McDonald’s leadership to make what will likely be seen historically as the decision which sent it on the track of self-destruction. When leaders focus on their core markets, and pull out all the stops to try defending and extending a business in a growth stall, they take their eyes off market trends. Rather than accepting what people want, and changing in all ways to meet customer needs, leaders keep fiddling with this and that, and hoping that cost cutting and a raft of operational activities will save the business as they keep focusing ever more intently on that old core business. But, problems keep mounting because customers, quite simply, are going elsewhere. To competitors who are implementing on trends.

The current CEO likes to describe himself as an “internal activist” who will challenge the status quo. But he then proves this is untrue when he describes the future of McDonald’s as a “modern, progressive burger company.” Sorry dude, that ship sailed years ago when competitors built the market for higher-end burgers, served fast in trendier locations. Just like McDonald’s 5-years too late effort to catch Starbucks with McCafe which was too little and poorly done – you can’t catch those better quality burger guys now. They are well on their way, and you’re still in port asking for directions.

McDonald’s is big, but when a big ship starts taking on water it’s no less likely to sink than a small ship (i.e. Titanic.) And when a big ship is badly steered by its captain it flounders, and sinks (i.e. Costa Concordia.) Those who would like to think that McDonald’s size is a benefit should recognize that it is this very size which now keeps McDonald’s from doing anything effective to really change the company. Its efforts (detailed above) are hemmed in by all those stores, franchisees, commitment to old processes, ingrained products hard to change due to installed equipment base, and billions spent on brand advertising that has remained a constant even as McDonald’s lost relevancy. It is now sooooooooo hard to make even small changes that the idea of doing more radical things that analysts are requesting simply becomes impossible for existing management.

And these leaders, frankly, aren’t even going to try. They are deeply wedded, committed, to trying to succeed by making McDonald’s more McDonald’s. They are of the company and its history. Not the CEO, or anyone on his team, reached their position by introducing a revolutionary new product, much less a new concept – or for that matter anything new. They are people who “execute” and work to slowly improve what already exists. That’s why they are giving even more decision-making control to franchisees via selling company stores in order to raise cash and cut costs – rather than using those stores to introduce radical change.

These are not “outside thinkers” that will consider the kinds of radical changes Louis V. Gerstner, a total outsider, implemented at IBM – changing the company from a failing mainframe supplier into an IT services and software company. Yet that is the only thing that will turn around McDonald’s. The Board blew it once before when it sold Chipotle, et.al. and put in place a core-focused CEO. Now McDonald’s has fewer resources, a lot fewer options, and the gap between what it offers and what the marketplace wants is a lot larger.

by Adam Hartung | Apr 30, 2015 | Current Affairs, Defend & Extend, In the Rapids, Innovation, Leadership, Web/Tech

Last week saw another slew of quarterly earnings releases. For long term investors, who hold stocks for years rather than months, these provide the opportunity to look at trends, then compare and contrast companies to determine what should be in their portfolio. It is worthwhile to compare the trends supporting the valuations of market leaders Google and Facebook.

Google once again reported higher sales and profits. And that is a good thing. But, once again, the price of Google’s primary product declined. Revenues increased because volume gains exceeded the price decline, which indicates that the market for internet ads keeps growing. But this makes 15 straight quarters of price declines for Google. Due to this long series of small declines, the average price of Google’s ads (cost per click) has declined 70%* since Q3 2011!

Google once again reported higher sales and profits. And that is a good thing. But, once again, the price of Google’s primary product declined. Revenues increased because volume gains exceeded the price decline, which indicates that the market for internet ads keeps growing. But this makes 15 straight quarters of price declines for Google. Due to this long series of small declines, the average price of Google’s ads (cost per click) has declined 70%* since Q3 2011!

While this is a miraculous example of what economists call demand elasticity, one has to wonder how long growth will continue to outpace price degradation. At some point the marginal growth in demand may not equal the marginal decline in pricing. Should that happen, revenues will start going down rather than up.

Part of what drives this price/growth effect has been the creation of programmatic ad buying, which allows Google to place more ads in more specific locations for advertisers via such automated products as AdMob, AdExchange and DoubleClick Bid Manager. But such computerized ad buying relies on ever more content going onto the web, as well as ever more consumption by internet users.

Further, Google’s revenues are almost entirely search-based advertising, and Google dominates this category. But this is largely a PC-related sale. Today 67.5% of Google ad revenue is from PC searches, while only 32.5% is from mobile searches. Due to this revenue skew, and the fact that people do more mobile interaction via apps, messaging apps and social media than browser, search ad growth has fallen considerably. What was a 24% year over year growth rate in Q1 2012 has dropped to more like 15% for the last 8 quarters.

So while the market today is growing, and Google is making more money, it is possible to see that the growth is slowing. And Google’s efforts to create mobile ad sales outside of search has largely failed, as witnessed by the recent death of Google+ as competition for Twitter or Facebook. It is the market shift, to mobile, which creates the greatest threat to Google’s ability to grow; certainly at historical rates.

Simultaneously, Facebook’s announcements showed just how strongly it is continuing to dominate both social media and mobile, and thus generate higher revenues and profits with outstanding growth. The #1 site for social media and messenger apps is Facebook, by quite a large margin. But, Facebook’s 2014 acquisition of What’sApp is now #2. WhatsApp has doubled its monthly active users (MAUs) just since the acquisition, and now reaches 800million. Growth is clearly accelerating, as this is from a standing start in 2011.

Facebook Messenger at #3, just behind WhatsApp. And #5 is Instagram, another Facebook acquisition. Altogether 4 of the top 5 sites, and the ones with greatest growth on mobile, are Facebook. And they total over 3billion MAUs, growing at over 300million new MAUs/month. Thus Facebook has already emerged as the dominant force, with the most users, in the fast-growing, accelerating, mobile and app sectors. (Just as Google did in internet search a decade ago, beating out companies like Yahoo, Ask Jeeves, etc.)

Google is moving rapidly to monetize this user base. From nothing in early 2012, Facebook’s mobile revenue is now $2.5B/quarter and represents 67% of global revenue (the inverse of Google’s revenues.) Further, Facebook is now taking its own programmatic ad buying tool, Atlas, to advertisers in direct competition with Google. Only Atlas places ads on both social media and internet browser pages – a one-two marketing punch Google has not yet cracked.

Google’s $17.3B Q1 2015 revenue is 30 times the revenue of Facebook. There is no doubt Google is growing, and generating enormous profits. But, for long-term investors, growth is slowing and there is reason to be concerned about the long term growth prospects of Google as the market shifts toward more social and more mobile. Google has failed to build any substantial revenues outside of search, and has had some notable failures recently outside its core markets (Google + and Google Glass.) Just how long Google will continue growing, and just how fast the market will shift is unclear. Technology markets have shown the ability to shift a lot faster than many people expected, leaving some painful losers in their wake (Dell, HP, Sun Microsystems, Yahoo, etc.)

Meanwhile, Facebook is squarely positioned as the leader, without much competition, in the next wave of market growth. Facebook is monetizing all things social and mobile at a rapid clip, and wisely using acquisitions to increase its strength. As these markets continue on their well established trends it is hard to be anything other than significantly optimistic for Facebook long-term.

* 1x .93 x .88 x .84 x .85 x .94 x .96 x .94 x .93 x .89 x .91 x .94 x .98 x .97 x .95 x .93 = .295

by Adam Hartung | Apr 25, 2015 | Defend & Extend, Food and Drink, In the Rapids, In the Swamp, Innovation, Leadership, Transparency

If you don’t drink gin you may not know the brand Tanqueray, a product owned by Diageo. But Tanqueray has been around for almost 190 years, going back to the days when London Dry Gin was first created. Today Tanqueray is one of the most dominant gin brands in the world, and the leading brand in the USA.

But gin is not a growth category. And Tanqueray, despite its great product heritage and strong brand position, has almost no growth prospects.

But gin is not a growth category. And Tanqueray, despite its great product heritage and strong brand position, has almost no growth prospects.

Any product that doesn’t grow sales cannot generate profits to spend on brand maintenance. Firstly, if due to nothing more than inflation, costs always go up over time. It takes rising sales to offset higher costs. Additionally, small competitors can niche the market with new products, cutting into leader sales. And competitors will undercut the leader’s price to steal volume/share in a stagnant market, causing margin erosion.

Category growth stalls are usually linked to substitute products stealing share in a larger definition of the marketplace. For example sales of laptop/desktop PCs stalled because people are now substituting tablets and smartphones. The personal technology market is growing, but it is in the newer product category stealing sales from the older product category.

This is true for gin sales, because older drinkers – who dominate today’s gin market – are drinking less spirits, and literally dying from old age. In the overall spirits market, younger liquor drinkers have preferred vodkas and flavored vodkas which are “smoother,” sweeter, and perceived as “lighter.”

So, what is a brand manager to do? Simply let trends obsolete their product line? Milk their category and give up money for investing somewhere else?

That may sound fine at a corporate level, where category portfolios can be managed by corporate vice presidents. But if you’re a brand manager and you want to become a future V.P., managing declining product sales will not get you into that promotion. And defending market share with price cuts, rebates and deals will cut into margin, ruin the brand position and likely kill your marketing career.

Keith Scott is the Senior Brand Manager for Tanqueray, and his team has chosen to regain product growth by using sustaining innovations in a smart way to attract new customers into the gin category. They are looking beyond the currently dwindling historical customer base of London Dry Gin drinkers, and working to attract new customers which will generate category growth and incremental Tanqueray sales. He’s looking to build the brand, and the category, rather than get into a price war.

Building on demographic trends, Tanqueray’s brand management is targeting spirit drinkers from 28-38. Three new Tanqueray brand extensions are being positioned for greatest appeal to increasingly adult tastes, while offering sophistication and linkage to one of the longest and strongest spirits brands.

#1 – Tanqueray Rangpur is a highly citrus-flavored gin taking a direct assault on flavored vodkas. Although still very much a gin, with its specific herb-based taste, Rangpur adds a hefty, and uniquely flavored, dose of lime. This makes for a fast, easy to prepare gin and tonic or lime-based gimlet – 2 classic cocktails that have their roots in England but have been popular in the US since before prohibition. And, in defense of the brand, Rangpur is priced about 10-20% higher than London Dry.

#1 – Tanqueray Rangpur is a highly citrus-flavored gin taking a direct assault on flavored vodkas. Although still very much a gin, with its specific herb-based taste, Rangpur adds a hefty, and uniquely flavored, dose of lime. This makes for a fast, easy to prepare gin and tonic or lime-based gimlet – 2 classic cocktails that have their roots in England but have been popular in the US since before prohibition. And, in defense of the brand, Rangpur is priced about 10-20% higher than London Dry.

#2 – Tanqueray Old Tom and Tanqueray Milacca appeal to the demographic that loves specialty, crafted products. The “craft” product movement has grown dramatically, and nowhere more powerfully than amongst 28-42 year old beer drinkers. Old Tom and Milacca leverage this trend. Both are “retro” products, harkening to gins over 100 years ago. They are made in small batches and have limited availability. They are targeted at the consumer that wants something new, unique, unusual and yet tied to old world notions of hand-made production and high quality. These craft products are priced 25-35% higher than traditional London Dry.

#2 – Tanqueray Old Tom and Tanqueray Milacca appeal to the demographic that loves specialty, crafted products. The “craft” product movement has grown dramatically, and nowhere more powerfully than amongst 28-42 year old beer drinkers. Old Tom and Milacca leverage this trend. Both are “retro” products, harkening to gins over 100 years ago. They are made in small batches and have limited availability. They are targeted at the consumer that wants something new, unique, unusual and yet tied to old world notions of hand-made production and high quality. These craft products are priced 25-35% higher than traditional London Dry.

#3 – Tanqueray No. 10 is a “super-premium” product pointed at the customer who wants to project maximum sophistication and wealth. No 10 uses a special manufacturing process creating a uniquely smooth and slightly citrus flavor. But this process loses 40% of the product to “tailings” compared to the industry standard 10% loss. No. 10 is the high-end defense of the Tanqueray brand (a “top shelf” product as its known in the industry) priced 75-90% higher than London Dry.

No. 10 is being promoted with “invitation only” events being held in major U.S. cities such as New York, Chicago and Atlanta. No. 10 “trunk events” bring in some of the hottest, newest designers to showcase the latest in apparel trends, accompanied by hot, new musical talent. No. 10 is associated with the sophistication of super-premium brands – individualized and rare products – in a members-only environment. Targeted at the primary demographic of 28-38, No. 10 events are designed to lure these consumers to this product they otherwise might overlook .

Rather than addressing their gin category growth stall with price cuts and other sales incentives, which would lead to brand erosion, price erosion, and margin erosion, the Tanqueray brand team is leveraging trends to bring new consumers to their category and generate profitable growth. These innovative brand extensions actually build brand value while leveraging identifiable market trends. Notice that all these sustaining innovations are actually priced higher than the highest volume London Dry core product, thus augmenting price – and hopefully margin.

Too often leaders see their market stagnate and use that as an excuse lower expectations and accept sales decline. They don’t look beyond their core market for new customers and sources of growth. They react to competition with the blunt axe of pricing actions, seeking to maintain volume as margins erode and competition intensifies. This accelerates product genericization, and kills brand value.

The Tanqueray brand team demonstrates how critical sustaining innovation can be for maintaining growth at all levels of an organization. Even the level of a single product or brand. They are using sustaining innovations to lure in new customers and grow the brand umbrella, while growing the category and achieving desired price realization. This is a lesson many brands, and companies, should emulate.

by Adam Hartung | Apr 15, 2015 | Defend & Extend, In the Swamp, Leadership

The money is not going into developing any new markets or new products. It is not being used to finance growth of GE at all. Rather, Mr. Immelt will immediately begin a massive $50B stock buyback program in order to prop up the stock price for investors.

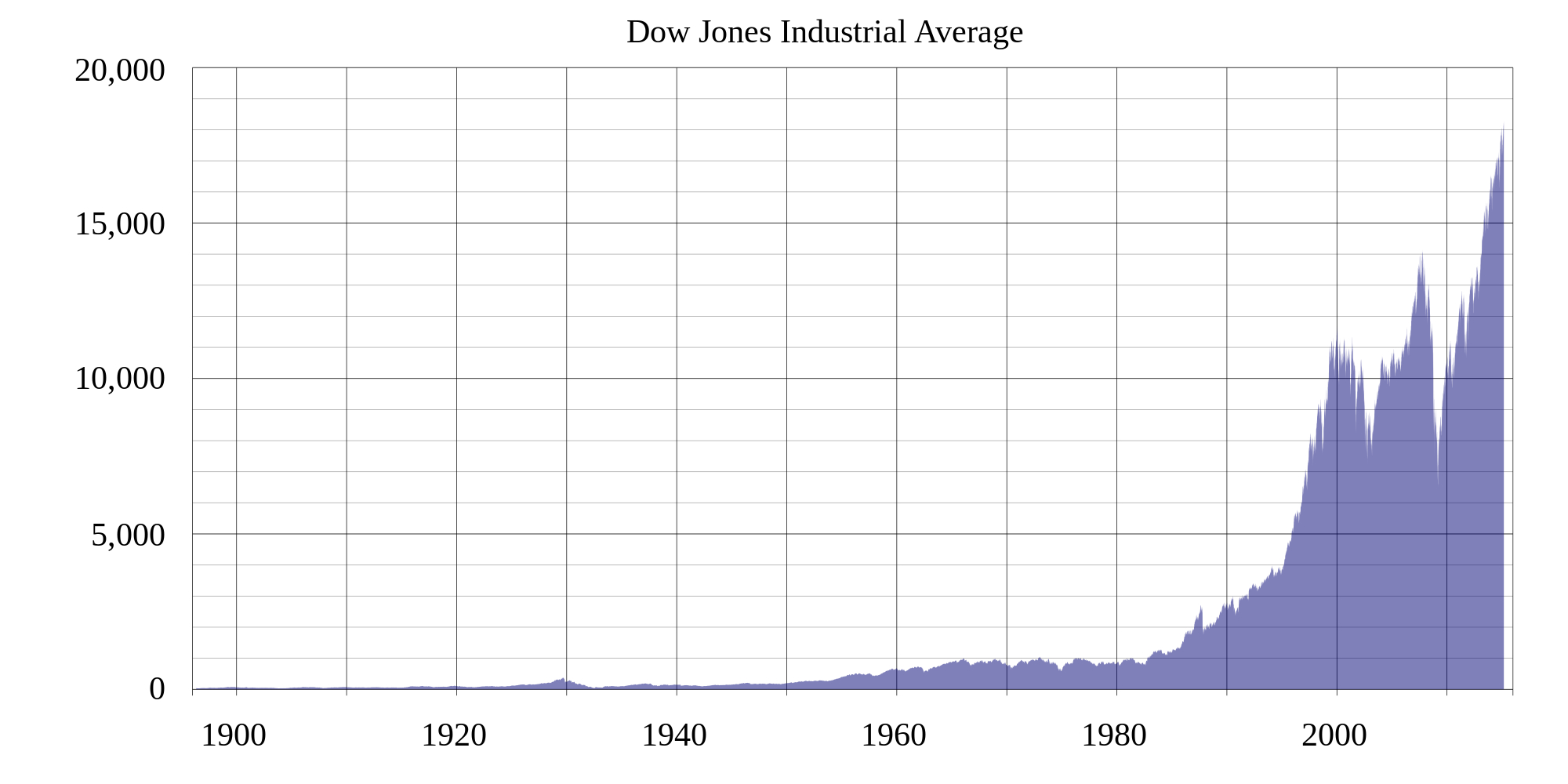

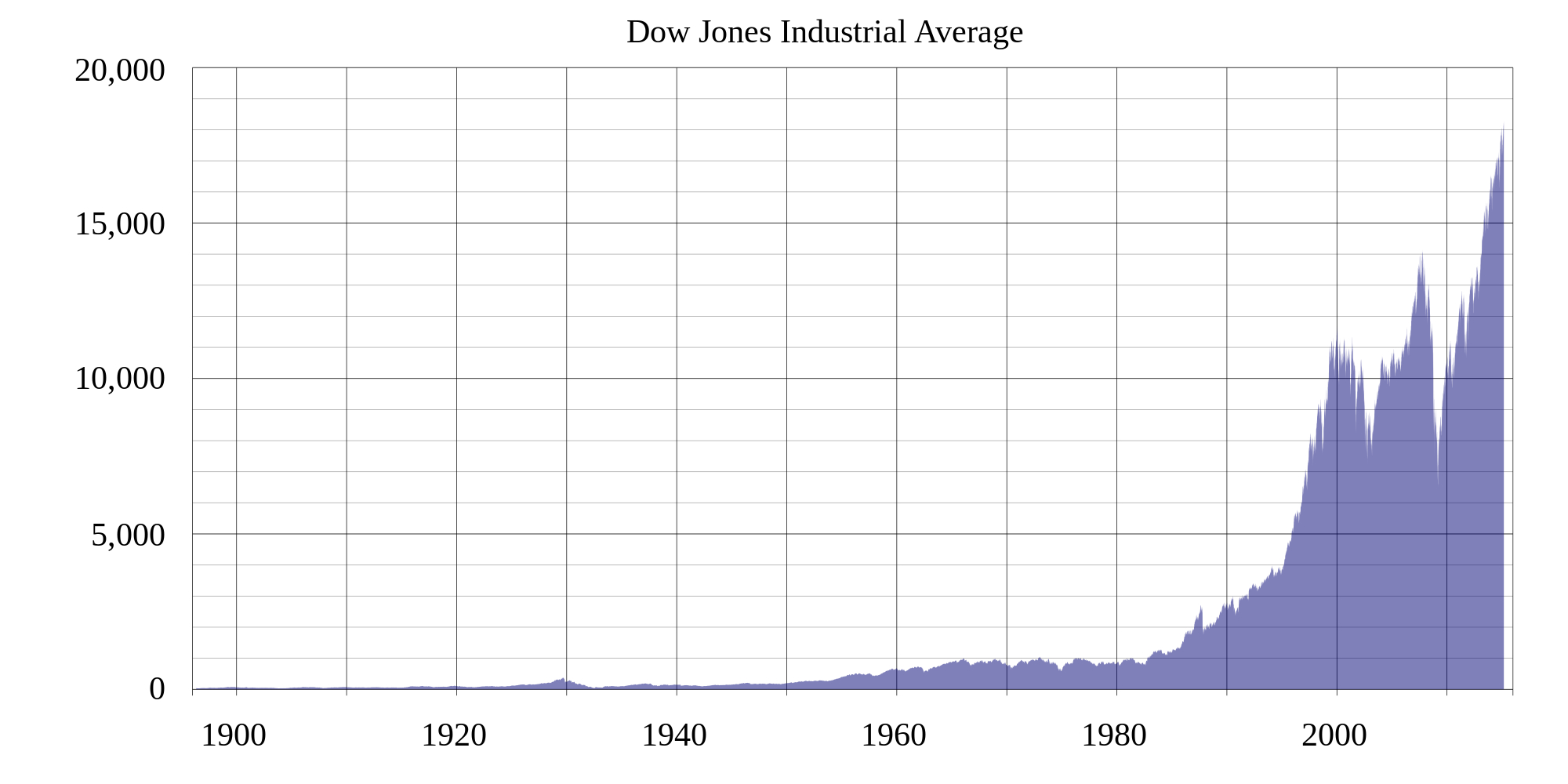

When Mr. Immelt took the job of CEO GE sold for about $40/share. Last week it was trading for about $25/share. A decline of 37.5%. During that same time period the Dow Jones Industrial Average, of which GE is the oldest component, rose from 9,600 to 17,900. An increase of 86.5%. This has been a very, very long period of quite unsatisfactory performance for Mr. Immelt.

When Mr. Immelt took the job of CEO GE sold for about $40/share. Last week it was trading for about $25/share. A decline of 37.5%. During that same time period the Dow Jones Industrial Average, of which GE is the oldest component, rose from 9,600 to 17,900. An increase of 86.5%. This has been a very, very long period of quite unsatisfactory performance for Mr. Immelt.

Prior to Mr. Immelt GE was headed by Jack Welch. During his tenure at the top of GE the company created more wealth for its investors than any company ever in the recorded history of U.S. publicly traded companies. GE’s value increased 40-fold (4000%) from 1981 to 2001. He expanded GE into new businesses, often far removed from its industrial manufacturing roots, as market shifts created new opportunities for growing revenues and profits. From what was mostly a diversified manufacturing company Mr. Welch lead GE into real estate as those assets increased in value, then media as advertising revenues skyrocketed and finally financial services as deregulation opened the market for the greatest returns in banking history.

Jack Welch was the Steve Jobs of his era. Because he had the foresight to push GE into new markets, create new products and grow the company. Growth that was so substantial it kept GE constantly in the news, and investors thrilled.

But Mr. Immelt – not so much. During his tenure GE has not developed any new markets. He has not led the company into any growth areas. As the world of portable technology has exploded, making a fortune for Apple and Google investors, GE missed the entire movement into the Internet of Things. Rather than develop new products building on new technologies in wifi, portability, mobility and social Mr. Immelt’s GE sold the appliance division to Electrolux and spent the $3.3B on stock buybacks.

Mr. Immelt’s tenure has been lacked by a complete lack of vision. Rather than looking ahead and preparing for market shifts, Immelt’s GE has reacted to market changes – usually for the poorer. Unprepared for things going off-kilter in financial services, the company was rocked by the financial meltdown and was only saved by an infusion from Berkshire Hathaway. Now it is exiting the business which generates nearly half its profits, claiming it doesn’t want to deal with regulations, rather than figuring out how to make it a more successful enterprise. After accumulating massive real estate holdings, instead of selling them at the peak in the mid-2000s it is now exiting as fast as possible in a recovering economy – to let the fund managers capture gains from improving real estate.

GE is now repatriating some $36B in foreign profits, on which it will pay $6B in taxes. Investors should realize this is happening at the strongest value of the dollar since Mr. Immelt took office. If GE needed these funds, which have been in offshore currencies such as the Euro, it could have repatriated them anytime in the last 3 years and those funds would have been $50B instead of $36B! To say the timing of this transaction could not have been poorer ….

The only thing into which Mr. Immelt has invested has been GE stock. And even that has been a lousy spend, as the price has gone down rather than up! Smart investors have realized that there is no growth in Immelt’s GE, and they have dumped the stock faster than he could buy it. Mr. Immelt’s Harvard MBA gave him insight to financial engineering, but unfortunately not how to lead and grow a major corporation. After 15 years Immelt will leave GE a much smaller, and as he said in the press release, “simpler” business. Apparently it was too big and complicated for him to run.

In the GE statement Mr. Immelt states “This is a major step in our strategy to focus GE around its competitive advantage.” Sorry Mr. Immelt, but that is not a strategy. Identifying growing markets and technologies to create strong, high profit positions with long-term returns is a strategy. Using vague MBA-esque language to hide what is an obvious effort at salvaging a collapsing stock price for another 2 years has nothing to do with strategy. It is a financial tactic.

The Immelt era is the story of a GE which has reacted to events, rather than lead them. Where Steve Jobs took a broken, floundering company and used vision to guide it to great wealth, and Jack Welch used vision to build one of the world’s most resilient and strong corporations, Jeffrey Immelt and his team were overtaken by events at almost every turn. CEO Immelt took what was perhaps the leading corporation of the last century and will leave it in dire shape, lacking a plan for re-establishing its once great heritage. It is a story of utterly failed leadership.

by Adam Hartung | Apr 9, 2015 | Current Affairs, Defend & Extend, Innovation, Leadership

This week a self-driving car built by Delphi of England completed a 9 day trip from San Francisco to New York City. The car traveled 3,400 miles, and was fully automated for 99% of the trip.

Attention has again focused on self-driving cars. There are a handful of players entering the market today, including Apple. But the most famous company by far is Google, which has put over 700,000 autonomous miles on its vehicles since pioneering the concept after winning a DARPA challenge to build a functioning prototype in 2005. In fact, we’re so used to hearing about the Google self-driving car that many of have stopped asking “Why Google? They aren’t in the auto business.”

Of course the idea of a self-driving auto is as old as the Jetson’s (and if you don’t know who the Jetson’s are you are, that was a long time ago.) And nobody should be surprised to hear that prototypes have been on the drawing board for 5 decades. But I bet you didn’t know that DuPont was once seriously engaged in such development.

In 1986 DuPont was America’s largest and most noteworthy chemical company. The company was a pioneer in petrochemicals, and was considered the company that brought the world plastic – at a time when plastic was considered a great, new invention. A leader in films of all sorts, DuPont leadership saw the opportunity for electronics to replace film in applications such as printing (where films were used in high volume for platemaking and proofing) and healthcare (where xRays and MRIs were a large film users.) They conceived of a future time when computers and monitors – digitial products – could replace analog film, and they chose to create a new business unit called Electronic Imaging to pioneer developing these applications.

As the team started they expanded the definition of Electronic Imaging to include all sorts of applications for digital imaging – and using all kinds of technologies. The breadth of analysis, and product development, included non-destructive parts testing, infrared uses such as heads-up displays and inventory identification, and radar applications. Which led the team to using a radar for automating an automobile.

In 1987 DuPont invested in a small company out of San Diego that accomplished something never done before. Using a phased-array radar hooked up to the brakes of a van, they were able to have the car recognize objects in front of the van, calculate in real time the distance between the van and these forward objects, calculate the relative speed of both objects (whether one or both were stationary or moving) and then apply braking in order to maintain a safe distance. If the forward object stopped, then the van would come to a complete stop.

This was all done with discreet componentry, and the team realized future success required developing more specific electronics, including specialized integrated chips that could operate faster and be more error-free. So they drove the prototype from San Diego to Wilmington, DE with a person behind the wheel, but relying as much as possible on the automated system to do all braking. The team collected data on location, speed, weather, traffic conditions, and many other items during the journey and prepared to take the project forward, planning to eventually build a module which could be installed in vehicles as small as cars or as large as 18-wheelers, with enough intelligence to adjust for different vehicle designs and applications (in order to calibrate for different braking distances.)

Net/net they had a working prototype. The product was expected to reduce the number of accidents by assisting drivers with braking. Multi-car pile-ups would become a thing of the past. And this device could potentially allow for better traffic flow because automated braking would reduce – maybe eliminate! – rear-end collisions. This wasn’t a self-driving car, but it was self-braking car, which would be a first step toward the sort of Jetson’s-esque vision the young team imagined.

What happened?

It didn’t take long for the older, “wiser” leadership to shut down the project. Even though several executives participated in a controlled demonstration of the prototype in an enclosed DuPont parking lot, the conclusion was that this project demonstrated just how off-track the new Electronic Imaging Department had become, and that it was clear folks needed to be reigned in and budgets cut:

- This clearly had nothing to do with film or replacing film. DuPont was a chemical company, and to the extent it had any interest in electronics it was where they were applied to potentially cannibalize film sales. Products which were not closely aligned with historical products were simply not to be pursued.

- DuPont had no history in radar, analogue electronics or development of integrated circuits. Yes, DuPont had an Electronics Department, but they sold film for solder masking and other applications of semiconductor and electronics manufacturing. DuPont was a chemical company, not a computer company or electronics company and this division was not going to change this situation.

- This product was seen as carrying too much liability risk. What if it failed? What if the car ran over a child? The auto industry was seen as litigious, and DuPont had no interest in a product that could have the kind of liability this one would generate. Yes, there was an Auto Department, but it sold films for safety glass, plastic sheets used for molding inside panels, and surface coatings which could be painted on the inside and/or outside of the vehicle. But those did not have the kind of failure possibility of this active radar device. [“By the way” the vice-Chairman asked “could that radar fry someone’s innards at a crosswalk?”]

- The market is too limited. Who would really want an automatic braking system? Given what it might cost, only the most expensive cars could install it, and only the wealthiest customers could afford it. This product was destined for niche use, at best, and would never have widespread installation.

Poof, away went the automatic automobile braking project. Once this dagger had been thrown, within just a few months everything that wasn’t printing or medical – in fact anything that wasn’t tied to printing films, xRays and MRI – was gone. Within 2 years leadership decided that for some variant of the 4 issues above the entire Electronic Imaging division was a bad idea. DuPont would be better served if it stuck to its core business, and if it spent money defending and extending film sales rather than trying to cannibalize them.

DuPont liked competing in the oceans where it had long competed. Venturing beyond those oceans was simply too risky. Today, 25 years later, DuPont is about 1/3 the size it was when its leaders launched the ill-fated Electronic Imaging division.

Google obviously has a different way of looking at the opportunity for automating automobile operation. Since winning the DARPA competition Google has spent a goodly sum building and testing ways to automate driving. And it has even gone so far as lobbying to make self-driving cars legal, which they now are in 4 states. Pessimists remain, but every quarter more people are thinking that self-driving cars will be here sooner than we might have imagined. This week’s cross-country achievement fuels speculation that the reality could be just around the corner.

Google seems happy to compete in new oceans. It dominates search, where its share is attacked every day by the likes of Yahoo and Microsoft. But simultaneously Google has invested far outside its core market, including software for PCs (Chrome) and mobile devices (Android), hardware (Nexus phones), media (Blogger, YouTube), payments (Wallet) and even self-driving cars. To what extent these, and dozens of other non-core products/services, will pay off for investors is yet to be determined. But at least Google’s leadership is able to overcome the desire to restrict the company’s options and look for future markets.

Which kind of organization is yours? Do you find reasons to kill new projects, or are you willing to experiment at creating new markets which might create dramatic growth?

by Adam Hartung | Apr 2, 2015 | Current Affairs, Defend & Extend, In the Rapids, Innovation, Leadership, Web/Tech

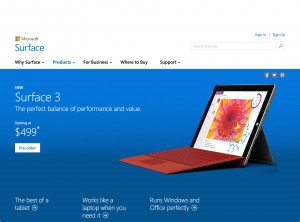

Microsoft launched its new Surface 3 this week, and it has been gathering rave reviews. Many analysts think its combination of a full Windows OS (not the slimmed down RT version on previous Surface tablets,) thinness and ability to operate as both a tablet and a PC make it a great product for business. And at $499 it is cheaper than any tablet from market pioneer Apple.

Meanwhile Apple keeps promoting the new Apple Watch, which was debuted last month and is scheduled to release April 24. It is a new product in a market segment (wearables) which has had very little development, and very few competitive products. While there is a lot of hoopla, there are also a lot of skeptics who wonder why anyone would buy an Apple Watch. And these skeptics worry Apple’s Watch risks diverting the company’s focus away from profitable tablet sales as competitors hone their offerings.

Looking at these launches gives a lot of insight into how these two companies think, and the way they compete. One clearly lives in red oceans, the other focuses on blue oceans.

Blue Ocean Strategy (Chan Kim and Renee Mauborgne) was released in 2005 by Harvard Business School Press. It became a huge best-seller, and remains popular today. The thesis is that most companies focus on competing against rivals for share in existing markets. Competition intensifies, features blossom, prices decline and the marketplace loses margin as competitors rush to sell cheaper products in order to maintain share. In this competitively intense ocean segments are niched and products are commoditized turning the water red (either the red ink of losses, or the blood of flailing competitors, choose your preferred metaphor.)

On the other hand, companies can choose to avoid this margin-eroding competitive intensity by choosing to put less energy into red oceans, and instead pioneer blue oceans – markets largely untapped by competition. By focusing beyond existing market demands companies can identify unmet needs (needs beyond lower price or incremental product improvements) and then innovate new solutions which create far more profitable uncontested markets – blue oceans.

Obviously, the authors are not big fans of operational excellence and a focus on execution, but instead see more value for shareholders and employees from innovation and new market development.

If we look at the new Surface 3 we see what looks to be a very good product. Certainly a product which is competitive. The Surface 3 has great specifications, a lot of adaptability and meets many user needs – and it is available at what appears to be a favorable price when compared with iPads.

But …. it is being launched into a very, very red ocean.

The market for inexpensive personal computing devices is filled with a lot of products. Don’t forget that before we had tablets we had netbooks. Low cost, scaled back yet very useful Microsoft-based PCs which can be purchased at prices that are less than half the cost of a Surface 3. And although Surface 3 can be used as a tablet, the number of apps is a fraction of competitive iOS and Android products – and the developer community has not yet embraced creating new apps for Windows tablets. So Surface 3 is more than a netbook, but also a lot more expensive.

Additionally, the market has Chromebooks which are low-cost devices using Google Chrome which give most of the capability users need, plus extensive internet/cloud application access at prices less than a third that of Surface 3. In fact, amidst the Microsoft and Apple announcements Google announced it was releasing a new ChromeBit stick which could be plugged into any monitor, then work with any Bluetooth enabled keyboard and mouse, to turn your TV into a computer. And this is expected to sell for as little as $100 – or maybe less!

This is classic red ocean behavior. The market is being fragmented into things that work as PCs, things that work as tablets (meaning run apps instead of applications,) things that deliver the functionality of one or the other but without traditional hardware, and things that are a hybrid of both. And prices are plummeting. Intense competition, multiple suppliers and eroding margins.

Ouch. The “winners” in this market will undoubtedly generate sales. But, will they make decent profits? At low initial prices, and software that is either deeply discounted or free (Google’s cloud-based MSOffice competitive products are free, and buyers of Surface 3 receive 1 year free of MS365 Office in the cloud, as well as free upgrade to Windows 10,) it is far from obvious how profitable these products will be.

Amidst this intense competition for sales of tablets and other low-end devices, Apple seems to be completely focused on selling a product that not many people seem to want. At least not yet. In one of the quirkier product launch messages that’s been used, Apple is saying it developed the Apple Watch because its other innovative product line – the iPhone – “is ruining your life.”

Apple is saying that its leaders have looked into the future, and they think today’s technology is going to move onto our bodies. Become far more personal. More interactive, more knowledgeable about its owner, and more capable of being helpful without being an interruption. They see a future where we don’t need a keyboard, mouse or other artificial interface to connect to technology that improves our productivity.

Right. That is easy to discount. Apple’s leaders are betting on a vision. Not a market. They could be right. Or they could be wrong. They want us to trust them. Meanwhile, if tablet sales falter….. if Surface 3 and ChromeBit do steal the “low end” – or some other segment – of the tablet market…..if smartphone sales slip….. if other “forward looking” products like ApplePay and iBeacon don’t catch on……

This week we see two companies fundamentally different methods of competing. Microsoft thinks in relation to its historical core markets, and engaging in bloody battles to win share. Microsoft looks at existing markets – in this case tablets – and thinks about what it has to do to win sales/share at all cost. Microsoft is a red ocean competitor.

Apple, on the other hand, pioneers new markets. Nobody needed an iPod… folks were happy enough with Sony Walkman and Discman. Everybody loved their Razr phones and Blackberries… until Apple gave them an iPhone and an armload of apps. Netbook sales were skyrocketing until iPads came along providing greater mobility and a different way of getting the job done.

Apple’s success has not been built upon defending historical markets. Rather, it has pioneered new markets that made existing markets obsolete. Its success has never looked obvious. Contrarily, many of its products looked quite underwhelming when launched. Questionable. And it has cannibalized its own products as it brought out new ones (remember when iPods were so new there was the iPod mini, iPod nano and iPod Touch? After 5 years of declining iPod sale Apple has stopped reporting them.) Apple avoids red oceans, and prefers to develop blue ones.

Which company will be more successful in 2020? Time will tell. But, since 2000 Apple has gone from nearly bankrupt to the most valuable publicly traded company in the USA. Since 1/1/2001 Microsoft has gone up 32% in value. Apple has risen 8,000%. While most of us prefer the competition in red oceans, so far Apple has demonstrated what Blue Ocean Strategy authors claimed, that it is more profitable to find blue oceans. And they’ve shown us they can do it.

by Adam Hartung | Mar 27, 2015 | Investing, Mobile, Software, Trends, Web/Tech

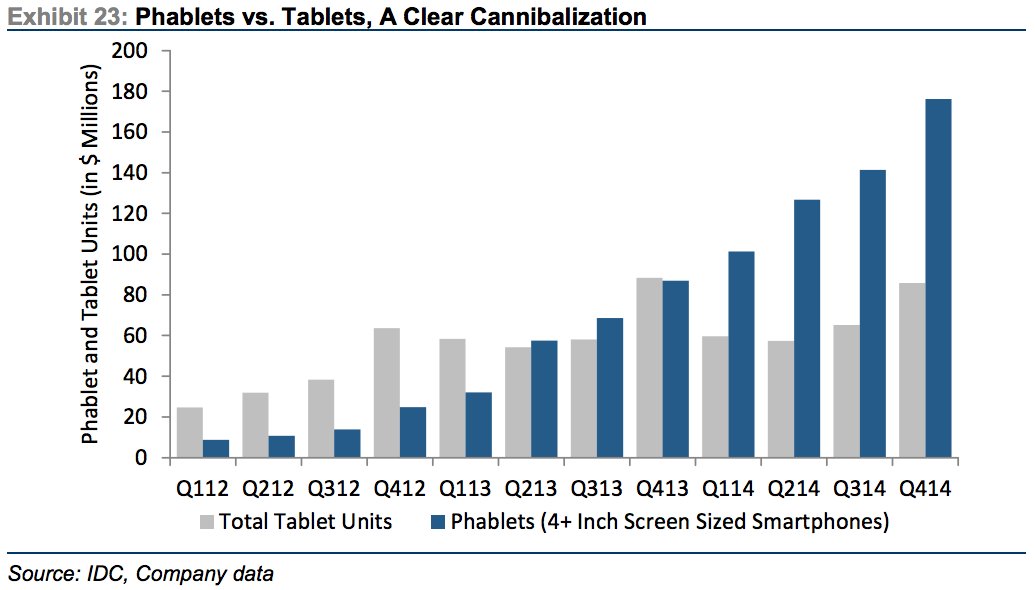

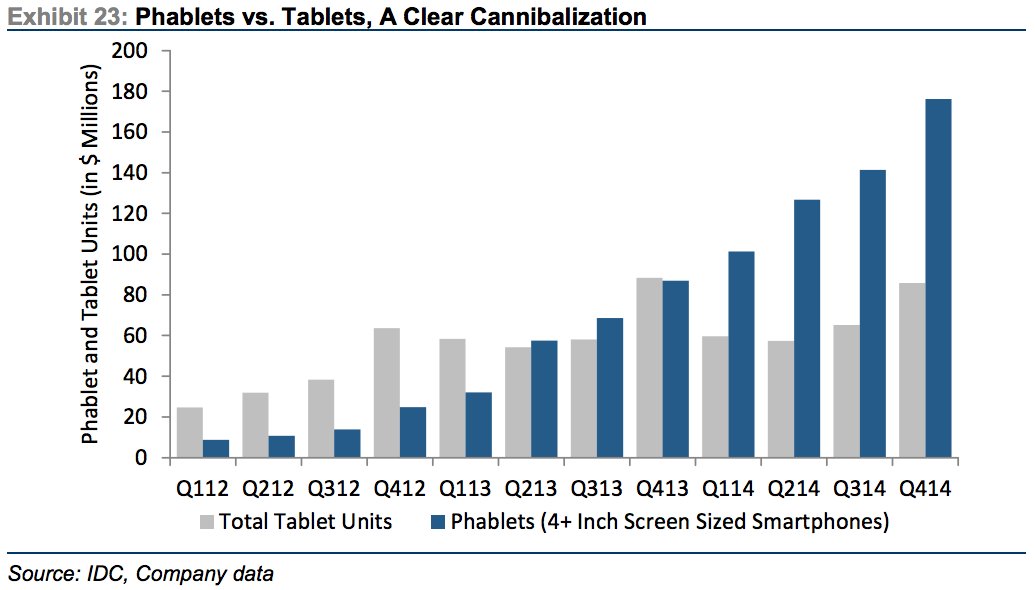

Phablets are a very hot, growing market. Phablets are those huge phones (greater than 4″ screen size) that some people carry around. From almost nothing in 2012, over the last 3 years the market has exploded:

Source: Jay Yarrow, Business Insider http://www.businessinsider.com/in-one-chart-heres-why-the-ipad-business-is-cratering-2015-3?utm_content=&utm_medium=email&utm_source=alerts&nr_email_referer=1

The original creator of this market data, Kulbinder Garcha of Credit Suisse, thinks this demonstrates cannibalization of tablet sales by phablets. And this is supposedly a bad thing for Apple.

But there is another way to look at this. By introducing and promoting a phablet (iPhone 6+ and Galaxy S6,) Apple and Samsung are growing users of mobile media and mobile apps. As the chart shows, growth in tablet sales was nothing compared to what happened when phablets came along. So people who didn’t buy a tablet, and maybe (likely?) wouldn’t, are buying phablets. The market is growing faster with phablets than had they not been introduced, and even if tablet sales shrink Apple and Samsung see revenues continue growing.

Who wins as phablet sales grow? Those who have phablet products in the market, and newer versions in the works.

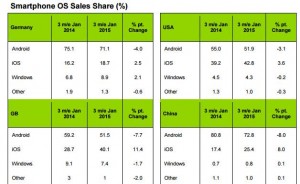

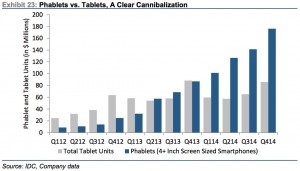

Source: Kantar WorldPanel and Seeking Alpha http://seekingalpha.com/article/3032926-microsoft-the-china-mobile-backed-lenovo-windows-10-smartphone-could-be-a-future-tailwind?ifp=0

As this chart shows, the companies who dominate smartphone sales are those who make Android-based products (#1 is Samsung) and Apple. Microsoft missed the mobile/smartphone trend, and even though it purchased Nokia it has never obtained anything close to double digit share in any market.

Unfortunately for Microsoft enthusiasts, and investors, Microsoft’s Windows10 product is focused first on laptop (PC) users, second on hybrid (products used as both a laptop and tablet), third tablets (primarily the slow-selling Microsoft Surface) and in a far, far trailing position smartphones.

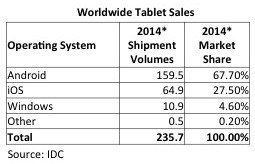

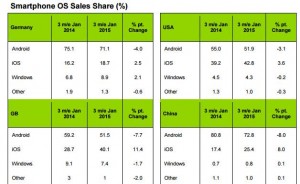

Source: IDC

As data from IDC shows, Surface sales are inconsequential. So the big loser from phablet cannibalization of tablets will be Microsoft. Given its very small user base, and the heavy losses Microsoft has taken on Surface, there is little revenue or cash flow to support an intense competitive effort in a shrinking market. Apple and Samsung will market hard to grow as many sales as possible, and likely will make the tablet products more affordable. Thus one should anticipate Microsoft’s very small tablet share would decline as tablet sales shrink.

This is the problem created when any business misses a major trend.

Microsoft missed the trend to mobile. They didn’t prepare for it in any of their major products, and they let new products, like music player Zune and Lumia phones, languish – and mostly die. By the time Microsoft reacted Apple and Samsung had enormous leads. Microsoft is still trying to play catch-up with its “core” Windows product.

But worse, because it is so far behind, Microsoft’s leaders are unable to forecast where the market will be in 3 years. Consequently they develop products for today’s market, like tablets (and their hybrid products,) which we now see will be obsolete as the market shifts to new products (like phablets.) Because Apple and Samsung already have the new products (phablets) they are prepared to cannibalize the old product sales (tablets) in order to overall grow the marketplace. But Microsoft has no phablet product, really no smartphone product, and will find itself most likely writing off more future Surface products as its tiny market share erodes to nothing.

So this trend to phablets continues to make a Microsoft comeback as a major personal technology competitor problematic. Windows 10 may be coming, but its relevance looks increasingly like that of new Blackberry models. There is little reason to care, because the products are years late and poorly positioned for leading edge customers. Further, developers will already be onto new competitive platforms long before the outdated Microsoft products make it to market. Without share you don’t capture developers, without developers you don’t have a robust app market, without apps you don’t capture customers, without customers you can’t build share — and that’s a terrible whirlpool Microsoft is captured within.

Be sure your business keeps its eyes on trends, and does not wait to react. Waiting can turn out to be deadly.

by Adam Hartung | Mar 23, 2015 | Current Affairs

The Dow Jones Industrial Average has been around for about 100 years. It is 30 of the largest market capitalization companies in the USA.

Lots of people think “the Dow,” as it is often called, is the value of the market. This is pretty far from correct, as there are literally thousands of stocks traded on the NYSE and NASDAQ. Better gauges of the overall market would be the NYSE Composite, or the NASDAQ composite. Or even the Wilshire 5000. These much larger data sets are better reflections of the overall stock market.

Some investors, especially small investors or those with little financial training, confuse “the Dow” with the S&P 500. The latter is simply the 500 largest public companies reviewed and evaluated for credit worthiness by Standard & Poors. Obviously, with 500 stocks it is 14 times broader than “the Dow.” So many would say it is a better market indicator than the DJIA.

Yet, lots of people refer to the DJIA, with little understanding of how it is created – and what it really means.

Simply put, the founder of Dow Jones and Company wrote a series of articles form about 1880 to 1900 on investing and stocks. After his death, editors at Dow Jones thought it would be good to consolidate his thoughts into an investing theory, which they called the Dow Theory.

Simply put, they developed three indices based upon a subset of stocks. One was an index of industrial companies, which were largely in commodities like coal, cotton, sugar and tobacco. The second was an index of transportation companies (called the Dow Transports) which was initially loaded with railroads and ocean shippers. The third were the emerging utility companies (Dow Utilities) which were gas distributors and electricity generation/distribution companies.

The Dow Theory was to watch these 3 indices. If two started to move in tandem, up or down, then this was considered an indicator of where the overall market would move in short order. If all 3 move together then it was considered a very strong bullish, or bearish, sign. Dow Theory was the first effort at predicting future stock movements.

After 100 years of academic research, not a lot of people use Dow Theory any longer. It has been replaced with 1,001 different approaches to predicting stock movement. And as other approaches have been created, the Dow Transports and the Dow Utilities are largely forgotten.

But the DJIA still carries a lot of attention. It has changed dramatically over time. The editors at Dow Jones (publisher of the Wall Street Journal and other business publications) review the list and update it. After WWII they determined that Industrials were better represented by steel companies, auto companies and other large manufacturers. Thus they dropped older commodity companies, just as their shares declined, and added companies like GM.

As the economy changed over time, many changes were made to the DJIA. As financial services grew, big banks were added. As retail grew, huge retailers and consumer goods companies were added. As pharmaceuticals grew, they were added. As computer tech grew, large tech companies were added. Each time someone was added, someone was dropped. The only company from the original list is GE.

“The Dow” was continuously “rebalanced.” Thus, even though many companies that were once on the Dow are now completely gone, and many others are in bad shape. Former DJIA companies include: Kodak, Sears, Woolworths, International Harvester, General Motors, Chrysler, Johns-Manville, General Foods, National Steel, Loew’s Theatres.

Thus, the DJIA has had a great upward run for over 100 years. Because it isn’t “the market.” Rather, it is a handful of stocks selected by some of the very top leaders in business. These leaders constantly look to keep the index in growth sectors, while eliminating declining sectors. And removing companies that do really badly – like GM, which filed bankruptcy. In other words, this is an index of the very largest – and some would say safest – companies in America that have a growth capability.

Which is why it is so hard for individual investors – and even pros – to outperform the DJIA. While they tinker around with investments in individual “hot” stocks, and shorting “losers,” overall they rarely can do as well as the DJIA. For all their rebalancing and predicting, only 1 in 4 (or 1 in 5) beat the DJIA in the short term. Long term, only 2 out 2,862 funds have consistently beat the DJIA.

So, by adding Apple the editors are again setting up the DJIA for future growth. AT&T was removed, for the second time. In 2004 it was taken out as AT&T faced bankruptcy. Southwestern Bell bought the AT&T name, and it was added back again. Now it is gone – probably for good – because telecom simply doesn’t have the growth of other sectors like mobile devices.

This is one of the few investment opportunities where “the little guy” gets a tremendous break. Anyone can buy the DJIA. By purchasing Diamonds (Symbol DIA) anyone can buy the DJIA index. You don’t have to do any individual stock buys, nor track changes and do rebalancing. You don’t even have to deal with stock dividends, splits, etc. because the pros will do all of that for you. And, you can buy Diamonds via a low cost on-line broker like e-Trade or ScotTrade and your transaction costs are minimal – less than what you’d pay a mutual fund manager (who is unlikely to do as well as your Diamonds.)

I think most investors are fools to try timing the market. Most people have jobs far removed from financial services and analyzing companies. Even more people have little academic training in how to analyze financial statements, company reports, projections and market opportunities. Heck, if the pros who do this full time can’t beat the DJIA, do most of us have any chance at all?

The DJIA has had a great run the last several years. Investing in the DJIA has outperformed about all other investments, with the best growth rate compared to highly cyclical commodities like gold, or real estate and certainly bonds. And because it isn’t “the market,” but rather a carefully selected basket of large cap stocks, it offers investors the greatest probability of long-term gains with least risk and volatility.

Adding Apple to the DJIA shows that the folks at Dow Jones are keeping their eyes on the proverbial ball. It should encourage investors. And, if you want to share in the growth of equities without having to spend all your free time doing research – or paying high fees – simply buying DIA is a great option.

by Adam Hartung | Mar 10, 2015 | Current Affairs, Defend & Extend, Leadership, Lock-in

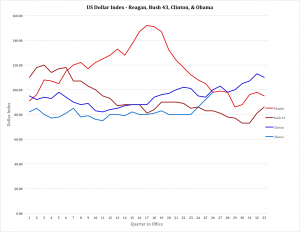

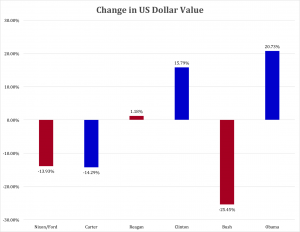

This week marks the 6th anniversary of the stock market’s bull run, with the S&P up 206%. Only 3 other times since WWII have equities had such a prolonged, sustained growth series. Simultaneously, last week saw yet another month with over 200,000 non-farm jobs created, making the current rate of jobs growth the best in 15 years. And, in a move that has taken some by surprise, the U.S. dollar is hitting highs against foreign currencies that have not been seen in over 12 years.

It is a rare economic trifecta, and demonstrates America is doing better than all other developed countries.

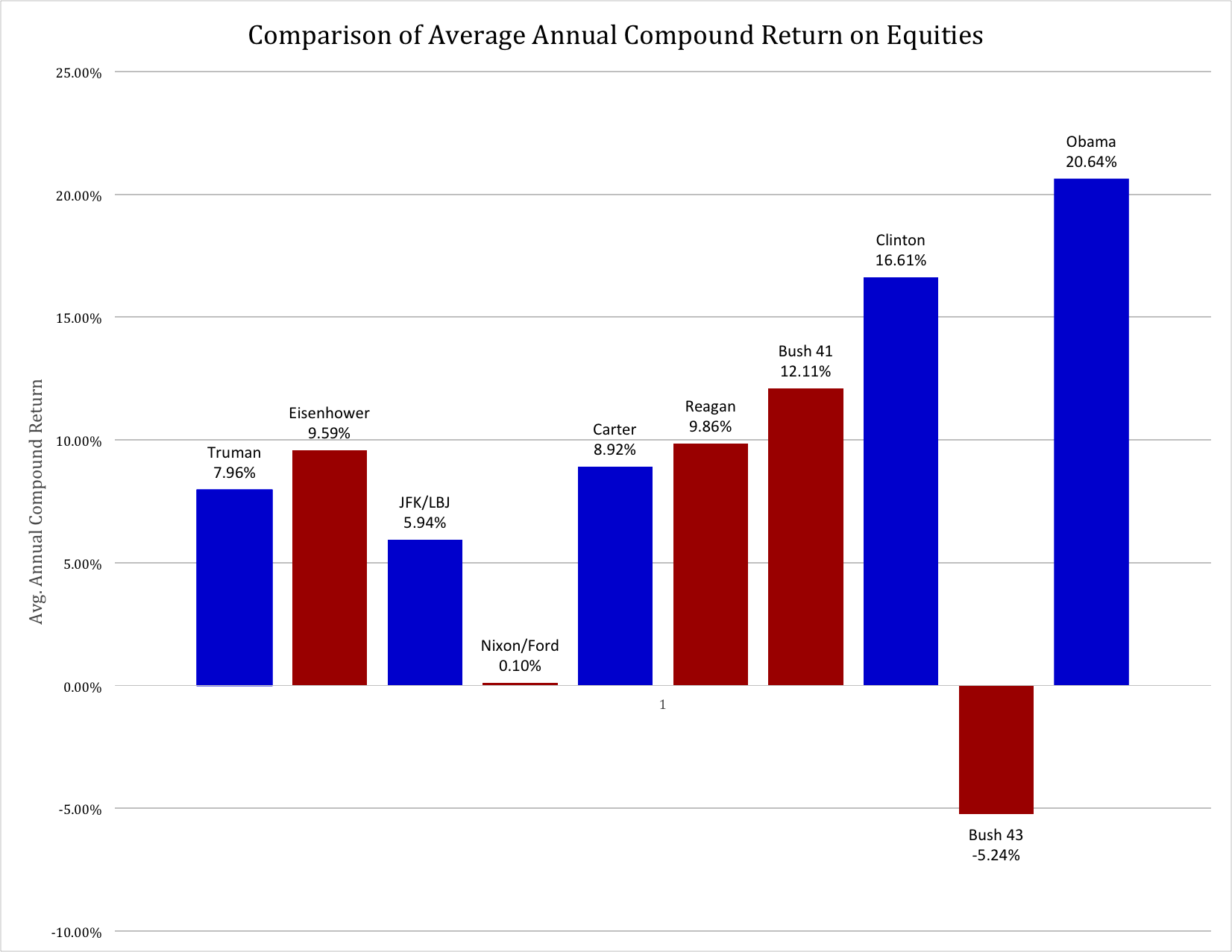

It seemed an appropriate time to re-interview Bob Deitrick, Managing Director of Polaris Financial Partners, and author of “Bulls, Bears and the Ballot Box” to obtain his take on the economy. Mr. Deitrick’s book reviewed America’s economic performance under each President since the creation of the Federal Reserve, and in direct opposition to conventional wisdom concluded presidents from the Democratic party were better economic stewards than Republican presidents. When published in 2012 Mr. Deitrick predicted that the economy would continue to do well under President Obama, and so far he’s been proven correct.

AH: Since we discussed “Obama’s Miracle Market” in January, 2014 stocks have continued to rise. Has this bull run surprised you, and do you think it will continue?

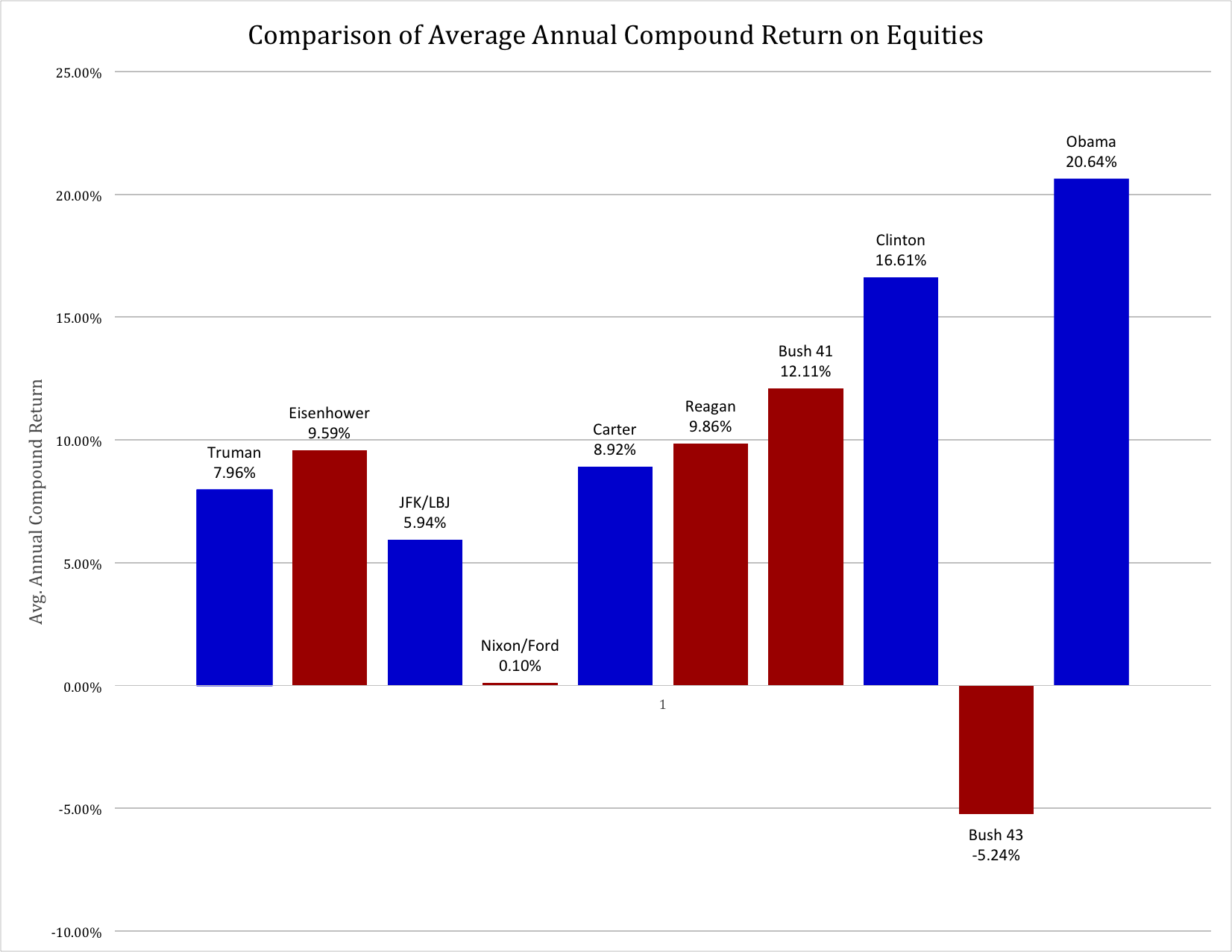

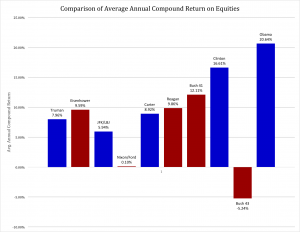

Bob Deitrick: No it has not surprised us. Looking across history since Hoover, Democrats in the White House have generally presided over good stock market gains. Since Clinton was elected, Democratic administrations have done remarkably well, with both Clinton and Obama outperforming the best Republican presidents which were Eisenhower and Reagan.

Looking at the S&P 500, Clinton and Obama have performed about the same with about a 17% annual rate of return through the first 62 months of office. Which is 70% better than the approximate 10% return of Republicans.

It is worth noting that when we take a broader gauge of equities (which we used in the book,) including the more volatile NASDAQ index and the highly selective Dow Jones Industrial Average, then the market’s performance during the Obama administration is unchallenged. The last 6 years generated compound annual returns of 22.5% (including dividend reinvestment) which is the best improvement in equities of all time.

It is also worth noting that the collapse of equities has happened 3 times since 1900, and all under Republican administrations – Hoover, Nixon/Ford, Bush 43. Even Carter had a rising equities market, and the Clinton + Obama years were unparalleled.

We agree with many other analysts that this bull market is not complete. We think the stock markets are only at the half way point in a secular bull cycle which will last, in total, 8 to 12 years.

AH: It was 6 months ago when you pointed out that President Obama outperformed President Reagan on jobs growth. At that time there were many, many naysayers. Yet, August’s numbers were later revised upward to over 200,000 and every month since has continued with strong jobs growth – some nearly 300,000. Are you surprised by the strength in jobs creation, and do you think it will stall?

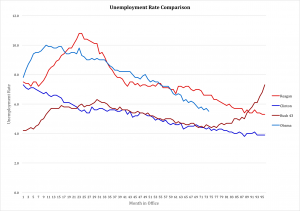

Bob Deitrick: Both Reagan and Obama inherited a bad jobs marketplace. Both of them saw unemployment spike into double digits early in their presidencies. And both created jobs programs that brought down the percentage of people unemployed. Obama had a lesser spike than Reagan, and during the last 5 years unemployment rate fell faster than it did under Reagan.

Both Democrats, Obama and Clinton, had big decreases in unemployment due to their policies. From peak to trough in this current administration unemployment has fallen by 5.5 percentage points, a decline of 81%. Clinton oversaw unemployment decline of 3.1 percentage points, or 73%. Both Democrats followed Bush Republican presidencies which had seen unemployment increase! During Bush 41 unemployment rose by 2 percentage points (5.4% to 7.3%,) and during Bush 43 unemployment nearly doubled from 4.2% to 8.3%. Not even the Carter presidency had unemployment increases anywhere close to the 12 years of Bush presidency.

Both Democrats, Obama and Clinton, had big decreases in unemployment due to their policies. From peak to trough in this current administration unemployment has fallen by 5.5 percentage points, a decline of 81%. Clinton oversaw unemployment decline of 3.1 percentage points, or 73%. Both Democrats followed Bush Republican presidencies which had seen unemployment increase! During Bush 41 unemployment rose by 2 percentage points (5.4% to 7.3%,) and during Bush 43 unemployment nearly doubled from 4.2% to 8.3%. Not even the Carter presidency had unemployment increases anywhere close to the 12 years of Bush presidency.

It is also worth noting that when comparing Obama and Reagan, Reagan undertook the largest increase in non-wartime deficit spending ever. He essentially used a form of “New Deal” debt spending on infrastructure and defense to stimulate jobs production. President Obama has been able to reduce the size of the annual deficit every year since taking office, in reality shrinking the amount of money spent by the government while simultaneously creating these new jobs. The only other president to accomplish this feat was Clinton, who actually balanced the budget during his presidency.

We believe the economy is very strong, and along with other analysts think the jobs recovery will remain intact. With less war spending, lower oil prices, more people covered by insurance, and higher minimum wages consumers will continue to spend and the economy will grow. New technology products will bring more people into the workforce, and manufacturing will continue its renaissance. We expect that unemployment will continue falling toward 4.4% by summer of 2016, returning the economy to non-wartime full employment.

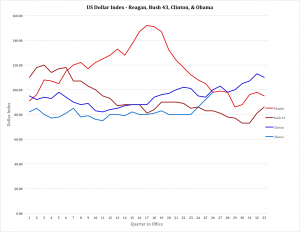

AH: For years many talk show hosts and guests have been declaring that the Fed was flooding the markets with cash and setting the stage for rampant inflation which would ruin the dollar and the U.S. economy. But in the last few months the dollar has rallied to rates we haven’t seen since the 1990s. Did this surprise you, and do you think the dollar will remain strong?

Bob Deitrick: We were not surprised. Ben Bernanke ranks right up there with the first ever Federal Reserve Chairman Marriner Eccles at knowing what to do to keep the American economy from collapsing in the wake of the country’s second depression. Only by re-inflating the economy with more cash, and keeping interest rates low, did America avoid a horrible repeat of the 1930s.

As a result of Democratic policies America re-invested in growth, which allowed companies to invest in plant and equipment and create new jobs, while lowering the deficit. This happened simultaneously with opposite policies being implemented in Europe and Japan (so called “austerity”) which has caused their economies to weaken. And slowed demand from Europe has reduced growth rates in China and India, all leading global investors to return to the U.S. dollar as a safe haven. It is because of our economic strength that the dollar is returning to rates we have not seen since the Clinton presidency.

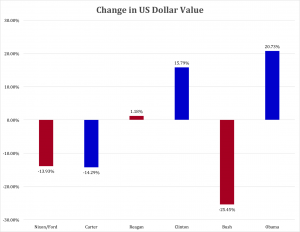

Many people recall the huge increase in the dollar’s value toward the middle of the Reagan presidency. However, as the U.S. deficits, and total debt, skyrocketed the dollar plummeted. By the time Reagan left office the dollar was worth almost the same as when he entered office.

And the combination of lower taxes plus costs for waging war in the middle east sent the U.S. debt exploding again under Bush 43. What had been a balanced budget under Clinton, which had pushed the dollar almost back to post-war highs, was destroyed causing the dollar to plummet 25%.

The dollar is now up 21% against a basket of world currencies. Given ongoing European weakness and the never-ending fight over austerity we see no reason to think the Euro will make a comeback any time soon. Rather, we predict the strong U.S. economy, especially with oil prices likely to remain low (and priced in dollars,) the U.S. dollar will continue to rally. It could well go back to Clinton-era highs and possibly approach the values during Reagan’s presidency. Should this happen it would be a record improvement in the dollar by any modern administration.

AH: Any concluding comments?

Bob Deitrick: I have voted for both Republicans and Democrats, and think of myself as a centrist. Most people, by definition, are centrists. I long believed that the GOP was the party which was best for the economy. But I could tell something wasn’t adding up during the Bush 43 presidency, so I chose to research the performance of both parties.

The GOP has created an illusion that it is a better economic steward by promoting itself as the party with the better business acumen, frequently touting elected officials from business schools and with MBAs rather than law degrees. The GOP, and the media leaders who identify with the GOP, tell Americans every chance they can that Republicans are the party of financial acuity and have the policies to create economic prowess. Yet we found through our research that these claims were little more than myth. In the modern era, post Great Depression and with a strong Federal Reserve in place, Democratic administrations have been far better stewards of the economy and caretakers of the government’s wallet.

We have coached investors to be in this equity market, and remain long, since early in the Obama administration. We have continued to remain long, and coach investors that in our opinion this remains the best course. We see the economy growing due to a balanced approach to jobs creation, spending and taxation. Were there less partisanship, such as occurred during the Reagan era when the Democrat party controlled the Congress while Republicans controlled the administration, it might be possible for the economy to grow even more quickly.