by Adam Hartung | Jun 27, 2017 | Disruptions, Employment, Finance

Photo by Spencer Platt/Getty Images

I’m a believer in Disruptive Innovation. For almost 100 years economists have written about “Creative Destruction,” in which new technologies come along making old technologies — and the companies built on them — obsolete. In the last 20 years, largely thanks to the insights of faculty at the Harvard Business School, we’ve seen a dramatic increase in understanding how new companies use new technologies to disrupt markets and wipe out the profitability of companies that were once clearly successful. In a large way, we’ve come to accept that Disruptive Innovation is good, and the concomitant Creative Destruction of the old players leads to more rapid growth for the economy, increasing jobs and the wherewithal of everyone. Creative Destruction, in the pursuit of progress, is good because it helps economies to grow.

But, not really everyone benefits from Creative Destruction. The trickle down benefits to lots of people can be a long time coming. When market shifts happen, and people lose jobs to new competitors — domestic or offshore — they only know that their life, at least short term, is a lot worse. As they struggle to pay a mortgage, and find a new job, they often learn their skills are outdated. There are new jobs, but these folks are often not qualified. As they take lesser jobs, their incomes dwindle, and they may well lose their homes. And their healthcare.

Economists call this workplace transition “temporary economic dislocation.” Fancy term. They claim that eventually folks do enter the workplace who are properly trained, and those folks make more money than the workers associated with the previous, now inferior, technology. And, eventually, everyone finds new work – at something.

That’s great for economists. But terrible for the folks who lost their jobs. As someone once said “a recession is when your neighbor loses his job. A depression is when you lose your job.” And for a lot of people, the market shift from an industrial economy to an information economy has created severe economic depression in their lives.

A person learns to be a printer, or a printing plate maker, in the 1970s when they are 20-something. Good job, makes a great wage. Secure work, since printing demand just keeps rising. But then along comes the internet with PDF and JPEG documents that people read on a screen, and folks simply quit needing, or wanting, printed documents. In 2016, now age 50-something, this printer or plate-maker no longer has a job. Demand is down, and its really easy to send the printing to some offshore market like Thailand, Brazil or India where printing is cheaper.

What’s he or she to do now? Go back to school you may say. But to learn how to do what? Say it’s online (or digital) document production. OK, but since everyone in the 20s has been practicing this for over a decade it takes years to actually be skilled enough to be competitive. And then, what’s the pay for a starting digital graphic artist? A lot less than what they made as a printer. And who’s going to hire the 58-62 year old digital graphic artist, when there are millions of well trained 20-somethings who seem to be quicker, and more attuned to what the publishers want (especially when the boss ordering the work is 35-42, and really uncomfortable giving orders and feedback to someone her parents’ age.) Oh, and when you look around there are millions of immigrants who are able to do the work, and willing to do it for a whole lot less than anyone native born to your country.

In England last week these disaffected people made it a point to show their country’s leadership that their livelihoods were being “creatively destroyed.” How were they to keep up their standard of living with the flood of immigrants? And with the wealth of the country constantly shifting from the middle class to the wealthy business leaders and bankers? And with work going offshore to less developed countries? While folks who have done well the last 25 years voted overwhelmingly to remain in the EU (such as those who live in what’s called “The City”), those in the suburbs and outlying regions voted overwhelmingly to leave the EU. Sort of like their income gains, and jobs, left them.

A whole lot of anger. To paraphrase the famous line from the movie Network, they were mad as Hell and they weren’t going to take it any longer. Simply put, if they couldn’t participate in the wonderful economic growth of EU participation, they would take it away from those who did. The point wasn’t whether or not the currency might fall 10% or more, or whether stocks on the UK exchange would be routed. After all, these folks largely don’t go to Europe or America, so they don’t care that much what the Euro or dollar costs. And they don’t own stocks, because they aren’t rich enough to do so, so what does it hurt them if equities fall? If this all puts a lot of pain on the wealthy – well just maybe that is what they really wanted.

America is seeing this as well. It’s called the Donald Trump for president campaign. While unemployment is a remarkably low 5%, there are a lot of folks who are working for less money, or simply out of work entirely, because they don’t know how to get a job. They may laugh at Robert De Niro as a retired businessman now working for free in The Intern. But they really don’t think it’s funny. They can’t afford to work for free. They need more income to pay higher property taxes, sales taxes, health care and the costs of just about everything else. And mostly they know they are rapidly being priced out of their lifestyle, and their homes, and figuring they’ll be working well into their 70s just to keep from falling into poverty.

These people hate President Obama. They don’t care if the stock market has soared during his presidency – they don’t own stocks (and if they do in a 401K or similar program they don’t care because it does them no good today). They don’t care that he’s created more jobs than anyone since Reagan or Roosevelt, because they see their jobs gone, and they blame him if their recent college graduate doesn’t have a well-paying job. They don’t care if America is closing in on universal health care, because all they see is that health care is becoming ever more expensive – and often beyond their ability to pay. For them, their personal America is not as good as they expected it to be – and they are very, very angry. And the President is a very identifiable symbol they can blame.

Creative Destruction, and disruptive innovations, are great for the winners. But they can be wildly painful to the losers. And when the disruptive innovations are as big, and frequent, as what’s happened the last 30 years – globalized economy, nationwide and international super banks, outsourcing, offshoring and the entirety of the Internet of Things – it has left a lot of people really concerned about their future. As they see the top 1% live opulent lifestyles, they struggle to keep a 12 year old car running and pay the higher license plate fees. They really don’t care if the economy is growing, or the dollar is strong, or if unemployment is at near-record lows. They feel they are on the losing end of the stick. For them, well, America really isn’t all that great anymore.

So, hungry for revenge, they are happy to kill the goose for dinner that laid the golden eggs. They will take what they can, right now, and they don’t care if the costs are astronomical. They will let tomorrow sort out itself, in a bit of hyper-ignorance to evaluate the likely outcome of their own actions.

Despite their hard times, does this not sound at the least petty, and short-sighted? Doesn’t it seem rather selfish to damn everyone just because your situation isn’t so good? Is it really in the interest of your fellow man to create bad outcomes just because you’ve not done well?

by Adam Hartung | Sep 16, 2016 | Leadership

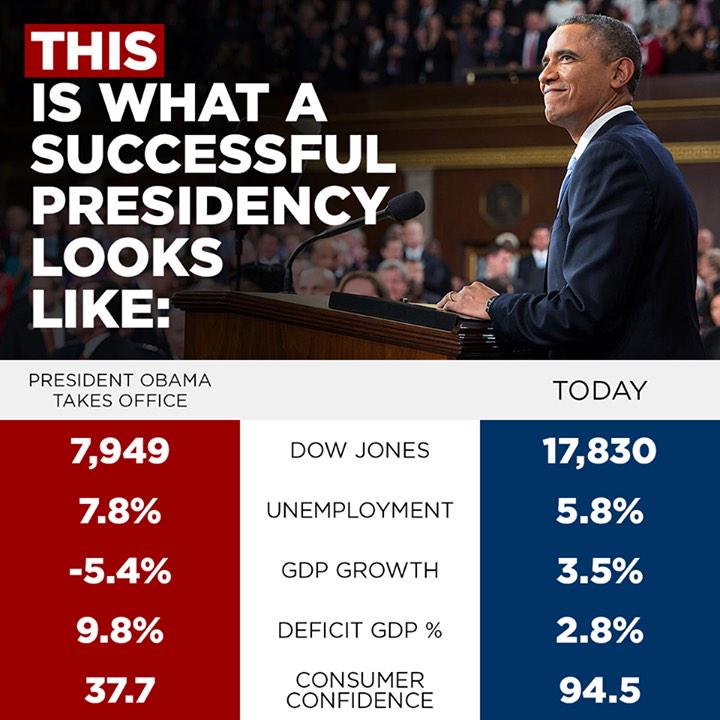

Donald Trump has been campaigning on how poorly America’s economy is doing. Yet, the headlines don’t seem to align with that position. Today we learned that U.S. household net worth climbed by over $1trillion in the second quarter. Rising stock values and rising real estate values made up most of the gain. And owners’ equity in their homes grew to 57.1%, highest in over a decade. Simultaneously this week we learned that middle-class earnings rose for the first time since the Great Recession, and the poverty rate fell by 1.2 percentage points.

Gallup reminded us this month that the percentage of Americans who perceive they are “thriving” has increased consistently the last 8 years, from 48.9% to 55.4%. And Pew informed us that across the globe, respect for Americans has risen the last 8 years, doubling in many countries such as Britain, Germany and France – and reaching as high as 84% favorability in Isreal.

Meanwhile Oxford Economics projected that a Republican/Trump Presidency would knock $1trillion out of America’s economy, and lower the GDP by 5%, mostly due to trade and tax policies. These would be far-reaching globally, likely not only creating a deep recession in America, but quite possibly the first global recession. But a Clinton Presidency should maintain a 1.5%-2.3% annual GDP growth rate.

Meanwhile Oxford Economics projected that a Republican/Trump Presidency would knock $1trillion out of America’s economy, and lower the GDP by 5%, mostly due to trade and tax policies. These would be far-reaching globally, likely not only creating a deep recession in America, but quite possibly the first global recession. But a Clinton Presidency should maintain a 1.5%-2.3% annual GDP growth rate.

I thought it would be a good idea to revisit the author of “Bulls, Bears and the Ballot Box,” Bob Deitrick. Bob contributed to my 2012 article on Democrats actually being better for the economy than Republicans, despite popular wisdom to the contrary.

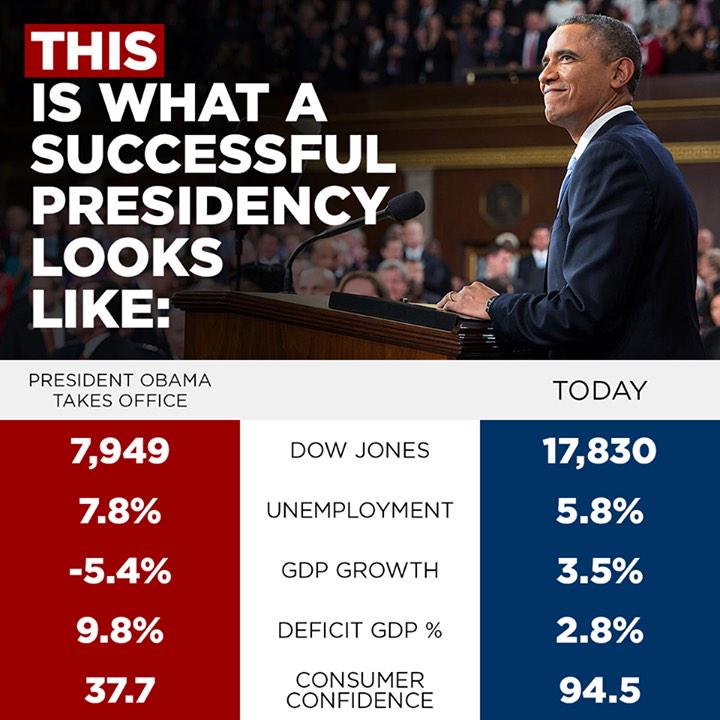

AH – Bob, there are a lot of people saying that the Obama Presidency was bad for the economy. Is that true?

Deitrick – To the contrary Adam, the Obama Presidency has economically been one of the best in modern history. Let’s start by comparing stock market performance, an indicator of investor sentiment about the economy using average annual compounded growth rates:

DJIA S&P 500 NASDAQ

Obama 11.1% 13.2% 17.7%

Bush -3.1% -5.6% -7.1%

Clinton 16.0% 15.1% 18.8%

Bush 4.8% 5.3% 7.5%

Reagan 11.0% 10.0% 8.8%

As you can see, Democrats have significantly outperformed Republicans. If you had $10,000 in an IRA, during the 16 years of Democratic administrations it would have grown to $72,539. During the 16 years of Republican administrations it would have grown to only $14,986. That is almost a 5x better performance by Democrats.

Obama’s administration has recovered all losses from the Bush crash, and gained more. Looking back further, we can see this is a common pattern. All 6 of the major market crashes happened under Republicans – Hoover (1), Nixon (2), Reagan (1) and Bush (2). The worst crash ever was the 58% decline which happened in 17 months of 2007-2009, during the Bush administration. But we’ve had one of the longest bull market runs in Presidential history under Obama. Consistency, stability and predictability have been recent Democratic administration hallmarks, keeping investors enthusiastic.

AH – But what about corporate profits?

Deitrick – During the 8 years of Reagan’s administration, the best for a Republican, corporate profits grew 26.82%. During the last 8 years corporate profits grew 55.79%. It’s hard to see how Mr. Trump identifies poor business conditions in America during Obama’s administration.

AH – What about jobs?

Deitrick – Since the recession ended in September, 2010 America has created 14,226,00 new jobs. All in, including the last 2 years of the Great Recession, Obama had a net increase in jobs of 10,545,000. Compare this to the 8 years of George W. Bush, who created 1,348,000 jobs and you can see which set of policies performed best.

AH – What about the wonkish stuff, like debt creation? Many people are very upset at the large amount of debt added the last 8 years.

Deitrick – All debt has to be compared to the size of the base. Take for example a mortgage. Is a $1million mortgage big? To many it seems huge. But if that mortgage is on a $5million house, it is only 20% of the asset, so not that large. Likewise, if the homeowner makes $500,000 a year it is far less of an issue (2x income) than if the homeowner made $50,000/year (20x income.)

The Reagan administration really started the big debt run-up. During his administration national debt tripled – increased 300%. This was an astounding increase in debt. And the economy was much smaller then than today, so the debt as a percent of GDP doubled – from 31.1% to 62.2%%. This was the greatest peacetime debt increase in American history.

During the Obama administration total debt outstanding increased by 63.5% – which is just 20% of the debt growth created during the Reagan administration. As a percent of GDP the debt has grown by 28% – just about a quarter of the 100% increase during Reagan’s era. Today we have an $18.5trillion economy, 4 to 6 times larger than the $3-$5trillion economy of the 1980s. Thus, the debt number may appear large, but it is nothing at all as important, or an economic drag, as the debt added by Republican Reagan.

Digging into the details of the Obama debt increase (for the wonks,) out of a total of $8.5trillion added 70% was created by 2 policies implemented by Republican Bush. Ongoing costs of the Afghanistan war has accumulated to $3.6trillion, and $2.9trillion came from the Bush tax cuts which continued into 2003. Had these 2 Republican originated policies not added drastically to the country’s operating costs, debt increases would have been paltry compared to the size of the GDP. So it hasn’t been Democratic policies, like ACA (Affordable Care Act), or even the American Reinvestment and Recovery Act which has led to home values returning to pre-crisis levels, that created recent debt, but leftover activities tied to Republican Bush’s foray into Afghanistan and Republican policies of cutting taxes (mostly for the wealthy.)

Since Reagan left office the U.S. economy has grown by $13.5trillion. 2/3 of that (67%) happened during Clinton and Obama (Democrats) with only 1/3 happening during Bush and Bush (Republicans.)

AH – What about public sentiment? Listening to candidate Trump one would think Americans are extremely unhappy with President Obama.

Deitrick – The U.S. Conference Board’s Consumer Confidence Index was at a record high 118.9 when Democrat Clinton left office. Eight years later, ending Republican Bush’s administration, that index was at a record low 26.8. Today that index is at 101.1. Perhaps candidate Trump should be reminded of Senator Daniel Patrick Moynihan’s famous quote “everyone is entitled to his own opinion, but not to his own facts.”

Candidate Trump’s rhetoric makes it sound like Americans live in a crime-filled world – all due to Democrats. But FBI data shows that violent crime has decreased steadily since 1990 – from 750 incidents per 100,000 people to about 390 today. Despite the rhetoric, Americans are much safer today than in the past. Interestingly, however, violent crime declined 10.2% in the second Bush’s 8 year term. But during the Clinton years violent crime dropped 34%, and during the Obama administration violent crime has dropped 17.8%. Democratic policies of adding federal money to states and local communities has definitely made a difference in crime.

Despite the blistering negativity toward ACA, 20million Americans are insured today that weren’t insured previously. That’s almost 6.25% of the population now with health care coverage – a cost that was previously born by taxpayers at hospital emergency rooms.

AH – Final thoughts?

Deitrick – We predicted that the Obama administration would be a great boon for Americans, and it has. Unfortunately there are a lot of people who obtain media coverage due to antics, loud voices, and access obtained via wealth that have spewed false information. When one looks at the facts, and not just opinions, it is clear that like all administrations the last 90 years Democrats have continued to be far better economic stewards than Republicans.

It is important people know the facts. For example, it would have kept an investor in this great bull market – rather than selling early on misplaced fear. It would have helped people to understand that real estate would regain its lost value. And understand that the added debt is not a great economic burden, especially at the lowest interest rates in American history.

[Author’s note: Bob Deitrick is CEO of Polaris Financial Partners, a private investment firm in suburban Columbus, Ohio. His firm uses economic and political tracking as part of its analysis to determine the best investments for his customers – and is proud to say they have remained long in the stock market throughout the Obama administration gains. For more on their analysis and forecasts contact PolarsFinancial.net]

by Adam Hartung | Nov 6, 2015 | Current Affairs, General, Lifecycle, Web/Tech

“As goes GM, so goes the Nation” is attributed to Charles Wilson, CEO of GM, in Congressional hearings 1953. His viewpoint was that GM was so big, and so important, that the country’s economic fortunes were inherently dependent on a robust General Motors.

And this was not so far fetched in the Industrial era. 1940s-1960s America was a manufacturing king. Following WWII industrial products dominated the economy, and post-war U.S. manufacturers made products sold around the world as other economies rebuilt and recovered, or just started emerging. With manufacturing the jobs and economic value creator, and GM the largest manufacturer and non-government employer of its time, what was good for GM was generally good for America.

But that tie has clearly broken. GM filed bankruptcy in the summer of 2009. From 2007 to 2009 American employment fell from 121.5M to just over 110M. Last month jobs rose by 271,000, pushing employment to a fully recovered 122M jobs. However, GM and its manufacturing partners have struggled to recover, as this economic expansion has largely left them behind.

We’ve seen a wild shift in the country’s economic base. In 1900 America was an agrarian economy. Over half the population lived on farms. Fully 9 out of 10 working people had a job related to agriculture and food production. But automation changed this dramatically. By 2010, fewer than 1 in 100 people worked in farming or agriculture. Farm incomes are at a 9 year low, and the future direction is downward. Rural towns have disappeared as people moved to cities, concentrating over half the nation’s wealth in just its 20 largest cities.

WWII marked the shift from an agrarian to an industrial economy for America. It was the industrial economy that pulled America out of the1930s Great Depression. The industrial revolution ushered in all kinds of mechanical automation, and it was applied to doing everything as labor shortages forced innovation to meet rising defense challenges. And it was the industrial economy that pushed America to the top. It was the industrial economy which trained most of today’s business leaders.

But we’re no longer an industrial economy. Just as the agrarian economy vanished, so too is the manufacturing economy. Manufacturing jobs have been declining since 1970, and by 2010 they represent only 13% of workers and 15% of the country’s GDP (Gross Domestic Product).

But we’re no longer an industrial economy. Just as the agrarian economy vanished, so too is the manufacturing economy. Manufacturing jobs have been declining since 1970, and by 2010 they represent only 13% of workers and 15% of the country’s GDP (Gross Domestic Product).

By 2000 we had started the shift from an industrial to an information economy. Digital bits replaced machines as the source of wealth creation. By 2010 it was services, and the huge growth in digital services, that caused the jobs recovery. Services now represent 84% of all jobs, and 82% of the economy. (Economic statistics from FTPress division of Pearson Publishing.)

Today the 3 most valuable companies in America are Apple, Google and Microsoft. Number 6 is Facebook. Their value (and in the case of Apple, Google and Facebook rather rapid value explosion) has been due to understanding how to maximize the value of information. They don’t so much “make things” as they make life better through products which are purely ethereal – rather than something tangible.

Today the 3 most valuable companies in America are Apple, Google and Microsoft. Number 6 is Facebook. Their value (and in the case of Apple, Google and Facebook rather rapid value explosion) has been due to understanding how to maximize the value of information. They don’t so much “make things” as they make life better through products which are purely ethereal – rather than something tangible.

Today’s #1 valued retailer is Amazon, now worth more than Wal-mart. Amazon is largely a technology company, building its revenues by knowing more about the customer and what she wants, then matching that with the right products. All in a virtual shopping arena. No stores, salespeople and often no inventory needed. Its technology skills became so good the company has become the #1 provider of cloud services.

Tesla has done something everyone thought impossible. It has created a new auto company where many others failed (recall the DeLorean used in “Back to the Future”? Or the Bricklin?) But Tesla did this by building an entirely different car, one that is based on all new electric technology, that has far fewer moving parts, needs far less service, has better operating performance and actually bears little resemblance to the autos – or auto companies – of the past. Tesla is far more a technology company, designed for the information era, than what we would think of as a “car company.”

The ramifications of this are dramatic. Working class middle age white people are dying faster than any other demographic in America. Their death rates are up 22%, and continuing to increase precipitously. Cause: suicide, drugs and alcohol. This is the group that once found good paying jobs working machines in manufacturing. Now, untrained for the information era, they are unable to find work – even though demand for trained labor is outstripping supply.

Today’s growth companies, those powering the American economic engine, are filled with intellectual assets rather than physical assets. Apple, Google and Facebook (et.al.) are creating intellectual capital, and they need employees able to add to that capital base. it is not enough for job candidates to have a college degree any longer. Today’s job hunter has to be information savvy, digital savvy, tech savvy.

In the 1960s the gap widened dramatically between those in manufacturing and those in farming. By the 1970s farms were closing by the hundreds as value shifted out of agrarian production to industrial production. It was devastating to farm communities and farm families.

Today the gap is widening between those skilled in manufacturing or general knowledge and those with information-based skills. The former are seeing their dreams slip away, while the latter are making incomes at a young age that are hard to fathom. Cities like Detroit are crumbling, while San Francisco cannot supply enough housing for its workers. The shift to an information economy is fully in force, and change is accelerating. For those who make the shift much is to be gained, for those who do not there is much to lose.

by Adam Hartung | Sep 5, 2014 | Employment, Investing, Politics

The Bureau of Labor Statistics (BLS) just issued America’s latest jobs report covering August. And it’s a disappointment. The economy created an additional 142,000 jobs last month. After 6 consecutive months over 200,000, most pundits expected the string to continue, including ADP which just yesterday said 204,000 jobs were created in August. So, despite the lower than expected August jobs number, America will create about 2.5 million new jobs in 2014.

One month variation does not change a trend

Even thought the plus-200k monthly string was broken (unless revised upward at a future date,) unemployment did continue to decline and is now reported at only 6.1%. Jobless claims were just over 300k; lowest since 2007. And that is great news.

Back in May, 2013 (15 months ago) the Dow was out of its recession doldrums and hitting new highs. I asked readers if Obama could, economically, be the best modern President? Through discussion of that question, the #1 issue raised by readers was whether the stock market was a good economic barometer for judging “best.” Many complained that the measure they were watching was jobs – and that too many people were still looking for work.

To put this week’s jobs report in economic perspective I reached out to Bob Deitrick, CEO of Polaris Financial Partners and author of “Bulls, Bears and the Ballot Box” (which I profiled in October, 2012 just before the election) for some explanation. Since then Polaris’ investor newsletters have consistently been the best predictor of economic performance. Better than all the major investment houses.

This is the best private sector jobs creation performance in American history

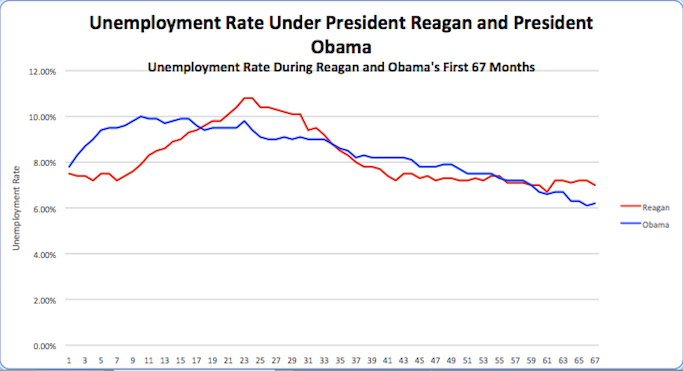

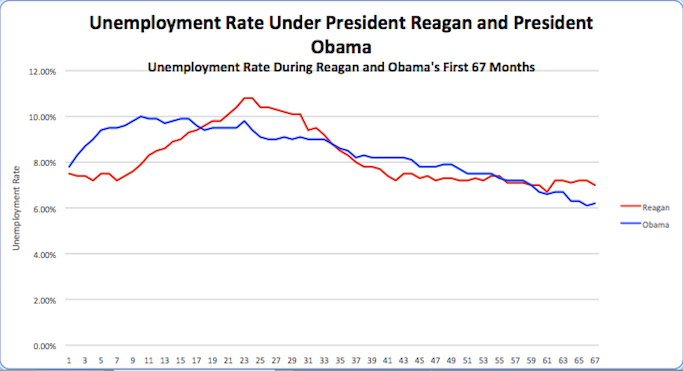

Bob Deitrick – “President Reagan has long been considered the best modern economic President. So we compared his performance dealing with the oil-induced recession of the 1980s with that of President Obama and his performance during this ‘Great Recession.’

Bob Deitrick – “President Reagan has long been considered the best modern economic President. So we compared his performance dealing with the oil-induced recession of the 1980s with that of President Obama and his performance during this ‘Great Recession.’

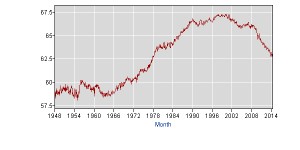

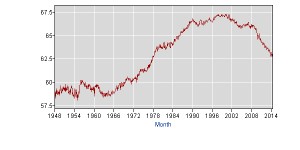

As this unemployment chart shows, President Obama’s job creation kept unemployment from peaking at as high a level as President Reagan, and promoted people into the workforce faster than President Reagan.

President Obama has achieved a 6.1% unemployment rate in his 6th year, fully one year faster than President Reagan did. At this point in his presidency, President Reagan was still struggling with 7.1% unemployment, and he did not reach into the mid-low 6% range for another full year. So, despite today’s number, the Obama administration has still done considerably better at job creating and reducing unemployment than did the Reagan administration.

We forecast unemployment will fall to around 5.4% by summer, 2015. A rate President Reagan was unable to achieve during his two terms.”

What about the Labor Participation Rate?

Much has been made about the poor results of the labor participation rate, which has shown more stubborn recalcitrance as this rate remains higher even as jobs have grown.

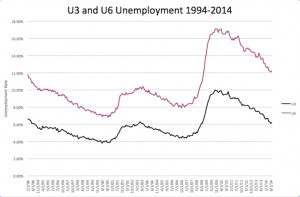

Source: Polaris Financial Partners Using BLS Data

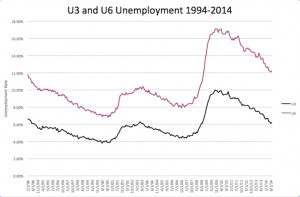

Bob Deitrick: “The labor participation rate adds in jobless part time workers and those in marginal work situations with those seeking full time work. This is not a “hidden” unemployment. It is a measure tracked since 1900 and called ‘U6.’ today by the BLS.

As this chart shows, the difference between reported unemployment and all unemployment – including those on the fringe of the workforce – has remained pretty constant since 1994.

Source: BLS Databases, Tables and Calculators by Subject – Labor Participation

Labor participation is affected much less by short-term job creation, and much more by long-term demographic trends. As this chart from the BLS shows, as the Baby Boomers entered the workforce and societal acceptance of women working changed labor participation grew.

Now that ‘Boomers’ are retiring we are seeing the percentage of those seeking employment decline. This has nothing to do with job availability, and everything to do with a highly predictable aging demographic.

What’s now clear is that the Obama administration policies have outperformed the Reagan administration policies for job creation and unemployment reduction. Even though Reagan had the benefit of a growing Boomer class to ignite economic growth, while Obama has been forced to deal with a retiring workforce developing special needs. During the 8 years preceding Obama there was a net reduction in jobs in America. We now are rapidly moving toward higher, sustainable jobs growth.”

Economic growth, including manufacturing, is driving jobs

When President Obama took office America was gripped in an offshoring boom, started years earlier, pushing jobs to the developed world. Manufacturing was declining, and plants were closing across the nation.

This week the Institute for Supply Management (ISM) released its manufacturing report, and it surprised nearly everyone. The latest Purchasing Managers Index (PMI) scored 59, 2 points higher than July and about that much higher than prognosticators expected. This represents 63 straight months of economic expansion, and 25 consecutive months of manufacturing expansion.

New orders were up 3.3 points to 66.7, with 15 consecutive months of improvement and reaching the highest level since April, 2004 – 5 years prior to Obama becoming President. Not surprisingly, this economic growth provided for 14 consecutive months of improvement in the employment index. Meaning that the “grass roots” economy made its turn for the better just as the DJIA was reaching those highs back in 2013 – demonstrating that index is still the leading indicator for jobs that it has famously always been.

As the last 15 months have proven, jobs and economy are improving, and investors are benefiting

The stock market has converted the long-term growth in jobs and GDP into additional gains for investors. Recently the S&P has crested 2,000 – reaching new all time highs. Gains made by investors earlier in the Obama administration have further grown, helping businesses raise capital and improving the nest eggs of almost all Americans. And laying the foundation for recent, and prolonged job growth.

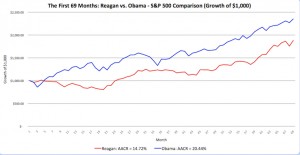

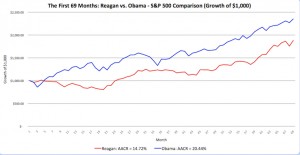

Source: Polaris Financial Partners

Bob Deitrick: While most Americans think they are not involved with the stock market, truthfully they are. Via their 401K, pension plan and employer savings accounts 2/3 of Americans have a clear vested interest in stock performance.

As this chart shows, over the first 67 months of their presidencies there is a clear “winner” from an investor’s viewpoint. A dollar invested when Reagan assumed the presidency would have yielded a staggering 190% return. Such returns were unheard of prior to his leadership.

However, it is undeniable that President Obama has surpassed the previous president. Investors have gained a remarkable 220% gain over the last 5.5 years! This level of investor growth is unprecedented by any administration, and has proven quite beneficial for everyone.

In 2009, with pension funds underfunded and most private retirement accounts savaged by the financial meltdown and Wall Street losses, Boomers and Seniors were resigned to never retiring. The nest egg appeared gone, leaving the ‘chickens’ to keep working. But now that the coffers have been reloaded increasingly people age 55 – 70 are happily discovering they can quit their old jobs and spend time with family, relax, enjoy hobbies or start new at-home businesses from their laptops or tablets. It is due to a skyrocketing stock market that people can now pursue these dreams and reduce the labor participation rates for ‘better pastures.”

Where myth meets reality

There is another election in just 8 weeks. Statistics will be bandied about. Monthly data points will be hotly contested. There will be a lot of rhetoric by candidates on all sides. But, understanding the prevailing trends is critical. Recognizing that first the economy, then the stock market and now jobs are all trending upward is important – even as all 3 measures will have short-term disappointments.

Although economic performance has long been a trademark issue for Republican candidates, there was once a Democratic candidate that won the presidency by focusing on the economy and jobs (Clinton,) and his popularity has never been higher! President Obama’s popularity is not high, and seems to fall daily. This seems incongruous with his incredible performance on the economy and jobs, which has outperformed his party predecessor – and every other modern President.

There are a lot of reasons voters elect a candidate. Jobs and the economy are just one category of factors. But, for those who place a high priority on jobs, economic performance and the markets the data clearly demonstrates which presidential administration has performed best. And shows a very clear trend one can expect to continue into 2015.

Economically, President Obama’s administration has outperformed President Reagan’s in all commonly watched categories. Simultaneously the current administration has reduced the debt, which skyrocketed under Reagan. Additionally, Obama has reduced federal employment, which grew under Reagan (especially when including military personnel,) and truly delivered a “smaller government.” Additionally, the current administration has kept inflation low, even during extreme international upheaval, failure of foreign economies (Greece) and a dramatic slowdown in the European economy.

by Adam Hartung | May 16, 2013 | Current Affairs, General, Leadership

With the stock market hitting new highs, some people have

already forgotten about the Great Recession. If you recall 2009, things looked pretty bleak

economically. But the outlook has changed dramatically in just 4 years. And it has been a boon for investors, as even the safest indices have yielded a 250% return (>25% annualized compound return:)

Source: Bulls, Bears and the Ballot Box at Facebook.com

Source: Bulls, Bears and the Ballot Box at Facebook.com

Meanwhile, trends have reversed direction with unemployment falling, and consumer confidence rising:

Source: Bulls, Bears and the Ballot Box at Facebook.com

Since this coincides with President Obama’s first term, I asked the authors of “Bulls, Bears and the Ballot Box,” (available on Amazon.com) which I reviewed in my October 11, 2012 column, to capture their opinions on how much Americans should attribute the equity

upturn, and improved economic prospects, to the President as we enter his second term.

Interview with Bob

Deitrick, co-Author "Bulls, Bears and the Ballot Box" (BBBB):

Q– Bob, how much credit should Americans give President

Obama for today’s improved equity values?

BBBB – Our research reviewed American economic performance

since President Roosevelt installed the first Federal Reserve Board

Chairman – Republican Marriner Eccles. We observed that even

though there are multiple impacts on the economy, it was clear that policy

decisions within each administration, from FDR forward, made a clear difference on performance. And

relatively quickly.

Presidents universally take credit when the economy does

well (such as Reagan,) and choose to blame other factors when the economy does

poorly (such as Carter.) But there

was a clear pattern, and link, between policy and financial market performance.

Although we hear almost no one in the Obama administration

taking credit for record index highs, they should. Because the President deserves

significant credit for how well this economy has done during his leadership.

The auto rescue plan has worked. American car manufacturers are still dominant and employing millions directly and in supplier companies. Wall Street reform

has been painful but it has re-instated faith amongst investors.

The markets are far more predictable than they were four years ago, as VIX numbers demonstrate greater faith and less risk.

Even for small investors, such as thoughs limited to their 401(k) or IRA investments, the average annual compound

return on stocks under President Obama has been more than

24% since the lows of March, 2009.

This is a better result than either Clinton, Reagan or FDR who were the

prior winners in our book.

Q– Bob, what policies do you think were most important

toward achieving today’s new highs?

BBBB – Firstly, let’s review just how bad things were in

2009. In 2000 America was completing the longest

bull market in history. But by

the end of President Bush's tenure the country had witnessed 2 stock market crashes, and the DJIA had fallen 58%. This was the second worst market decline in history (exceeded

only by the Great Depression,) and hence the term “Great Recession” was born.

In 2000, at the end of Clinton’s administration, the

Consumer Confidence Index was at a record high 140.

By January, 2009 this index had fallen to an historic low of 25.3. Comparatively, when Reagan took office

at the end of the economically weak Carter years the Confidence Index

was still at 74.4! Today this

measure of how people feel about the country is still nowhere near 2000 levels,

but it is almost 3 times better than 4 years ago.

Significantly, in 2000 America had a budget surplus. By 2009 surpluses were long gone and the

country was racking up historic deficits as taxes were cut while simultaneously

outlays for defense skyrocketed to cover costs of wars in Iraq and

Afghanistan. Additionally, banks

were on the edge of failing due to unregulated real estate speculation and massive derivative losses.

Today the Congressional Budget Office is reporting a $200B decrease in the deficit almost entirely due to increased revenue from a growing economy and higher taxes on the wealthiest Americans. The deficit is now only 4% of the GDP, down from over 10% at the end of Bush's administration – and projections are for it to be only 2% by 2015 (before Obama leaves office.) America's "debt problem" seems largely solved, and almost all due to growth rather than austerity.

We can largely thank a fairer tax code, improved regulation and consistent SEC enforcement. Also, major strides in health care reform – something no other President has accomplished – has given American's more faith in their future, and an increased willingness to invest.

Q– To which President would you compare Obama’s economic

performance?

BBBB– By all measures, President Obama has outperformed

every modern President.

The easiest comparison would be to President Reagan, who’s

economic performance was superb. Even though Obama's performance is better.

Reagan had the enormous benefit of two major factors:

- a significantly better economy than Obama inherited, even if afflicted by inflation

- and his two terms coincided with the highest performing

demographic years of the Baby Boomer generation.

Today's demographics have shifted dramatically. The country is much older, with fewer

young people supporting a much larger near-retirement age group. This inherent demographic fact makes

creating economic growth monumentally harder than it was 30 years ago.

Few people think of Reagan as a stimulus addict. Yet, his administration’s military

build-up added $1trillion of stimulus to the national debt ($2.3trillion adjusted for

inflation) – the opposite of what is happening during the Obama years. Many like to think

that it was tax cutting which grew the economy, but undoubtedly we now know

that this dramatic defense and infrastructure (highways, etc.) stimulus had more to do with igniting economic growth. Reagan's spending looked far more like FDR than Herbert Hoover!

Ronald Reagan tripled the national debt during his tenure, creating what today's Congressional austerity advocates might have called "a legacy of unpayable debt for our grandchildren.” But, as we saw, later growth (during Clinton) resolved that debt and created a budget surplus by 2000.

Q– Bob, President’s Obama detractors liken the Affordable

Care Act (i.e. Obamacare) to an Armageddon on business, sure to kill economic

growth and plunge the country back into recession. Do you agree?

BBBB– To the contrary, ACA levels the playing field and will

be good for economic growth. Where

previously only large corporations could afford employee health care plans, in

the future far more employees will have far more equitable coverage. Further, today employees frequently are unable to leave a

company to start a new business because they would lose health care, which in

the future will not be true.

One leading indicator of the benefits of ACA might be the performance of healthcare and biotech stocks, which are up 20-30% and leaders in the current market rally.

Q– What policies would you recommend the Obama

administration follow in order to promote economic growth, more jobs and

greater returns for investors during the second term?

BBBB- Obama needs to make the cornerstone of his second term creating new job growth. That was the primary platform of his candidacy, and it is a platform long successful for the Democratic party. If President Obama can do this and govern effectively, this could be his real legacy.

Meanwhile Oxford Economics projected that a Republican/Trump Presidency would knock $1trillion out of America’s economy, and lower the GDP by 5%, mostly due to trade and tax policies. These would be far-reaching globally, likely not only creating a deep recession in America, but quite possibly the first global recession. But a Clinton Presidency should maintain a 1.5%-2.3% annual GDP growth rate.

Meanwhile Oxford Economics projected that a Republican/Trump Presidency would knock $1trillion out of America’s economy, and lower the GDP by 5%, mostly due to trade and tax policies. These would be far-reaching globally, likely not only creating a deep recession in America, but quite possibly the first global recession. But a Clinton Presidency should maintain a 1.5%-2.3% annual GDP growth rate.