by Adam Hartung | May 15, 2016 | In the Swamp, Investing, real estate, Retail

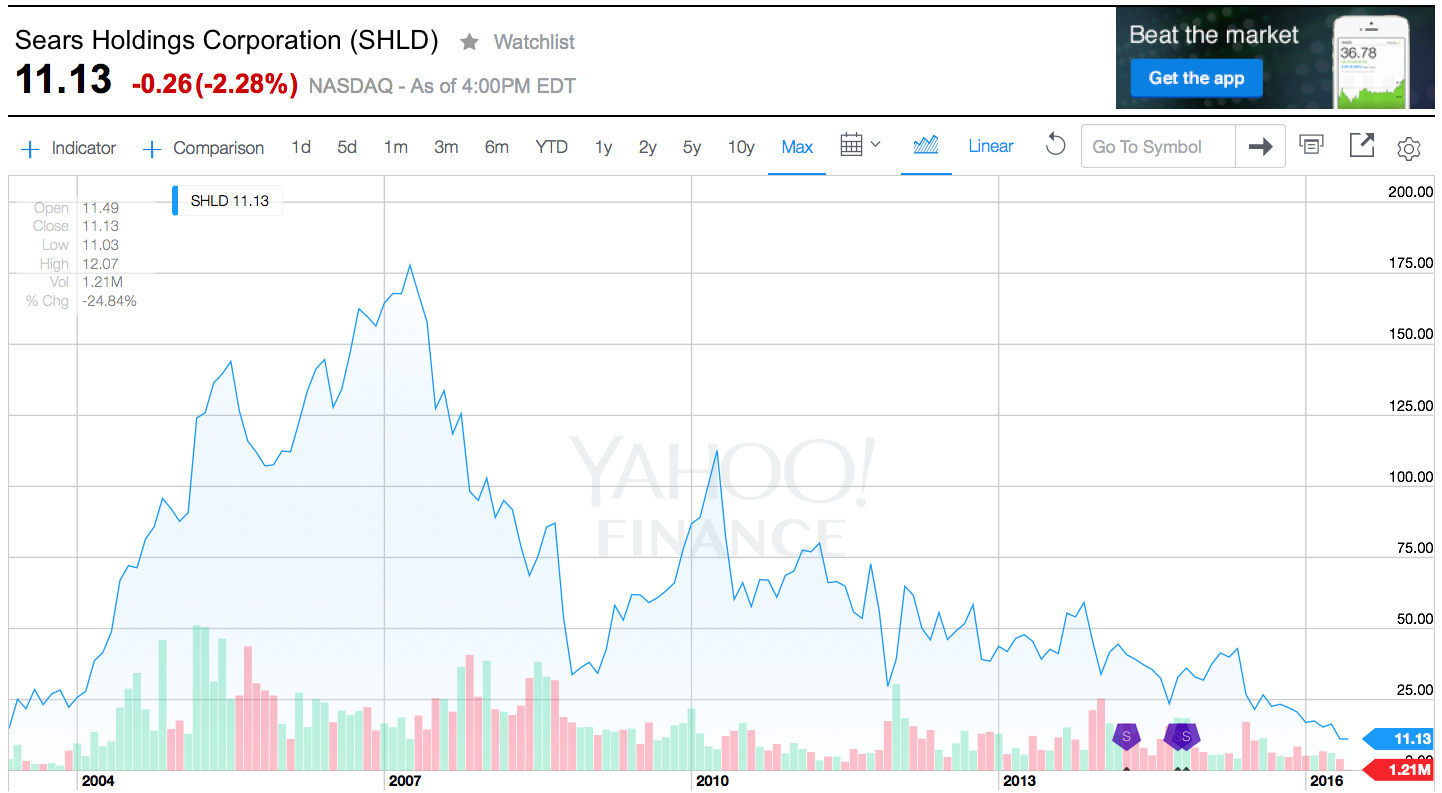

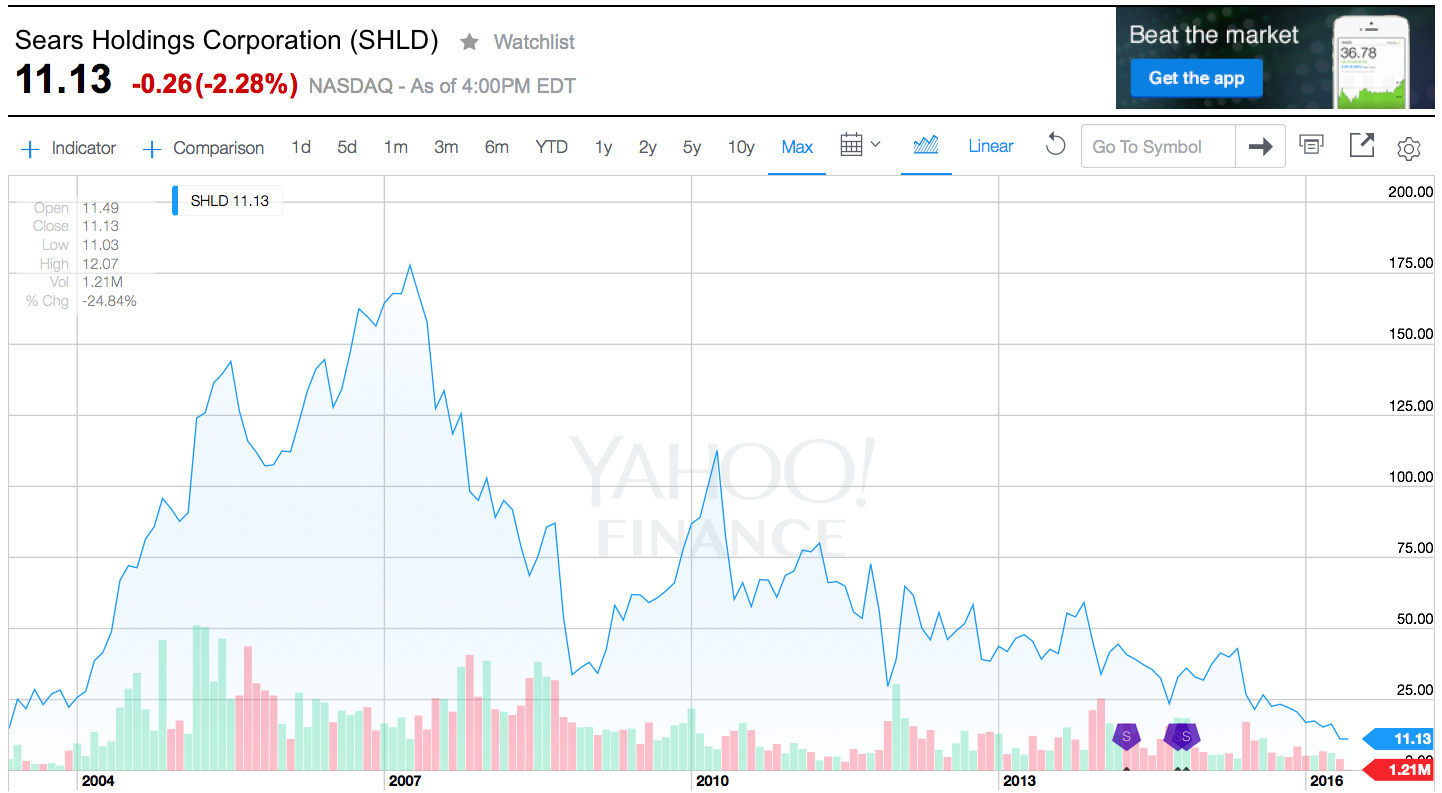

Last week Sears announced sales and earnings. And once again, the news was all bad. The stock closed at a record, all time low. One chart pretty much sums up the story, as investors are now realizing bankruptcy is the most likely outcome.

Chart Source: Yahoo Finance 5/13/16

Quick Rundown: In January, 2002 Kmart is headed for bankruptcy. Ed Lampert, CEO of hedge fund ESL, starts buying the bonds. He takes control of the company, makes himself Chairman, and rapidly moves through proceedings. On May 1, 2003, KMart begins trading again. The shares trade for just under $15 (for this column all prices are adjusted for any equity transactions, as reflected in the chart.)

Lampert quickly starts hacking away costs and closing stores. Revenues tumble, but so do costs, and earnings rise. By November, 2004 the stock has risen to $90. Lampert owns 53% of Kmart, and 15% of Sears. Lampert hires a new CEO for Kmart, and quickly announces his intention to buy all of slow growing, financially troubled Sears.

In March, 2005 Sears shareholders approve the deal. The stock trades for $126. Analysts praise the deal, saying Lampert has “the Midas touch” for cutting costs. Pumped by most analysts, and none moreso than Jim Cramer of “Mad Money” fame (Lampert’s former roommate,) in 2 years the stock soars to $178 by April, 2007. So far Lampert has done nothing to create value but relentlessly cut costs via massive layoffs, big inventory reductions, delayed payments to suppliers and store closures.

Homebuilding falls off a cliff as real estate values tumble, and the Great Recession begins. Retailers are creamed by investors, and appliance sales dependent Sears crashes to $33.76 in 18 months. On hopes that a recovering economy will raise all boats, the stock recovers over the next 18 months to $113 by April, 2010. But sales per store keep declining, even as the number of stores shrinks. Revenues fall faster than costs, and the stock falls to $43.73 by January, 2013 when Lampert appoints himself CEO. In just under 2.5 years with Lampert as CEO and Chairman the company’s sales keep falling, more stores are closed or sold, and the stock finds an all-time low of $11.13 – 25% lower than when Lampert took KMart public almost exactly 13 years ago – and 94% off its highs.

What happened?

Sears became a retailing juggernaut via innovation. When general stores were small and often far between, and stocking inventory was precious, Sears invented mail order catalogues. Over time almost every home in America was receiving 1, or several, catalogues every year. They were a major source of purchases, especially by people living in non-urban communities. Then Sears realized it could open massive stores to sell all those things in its catalogue, and the company pioneered very large, well stocked stores where customers could buy everything from clothes to tools to appliances to guns. As malls came along, Sears was again a pioneer “anchoring” many malls and obtaining lower cost space due to the company’s ability to draw in customers for other retailers.

To help customers buy more Sears created customer installment loans. If a young couple couldn’t afford a stove for their new home they could buy it on terms, paying $10 or $15 a month, long before credit cards existed. The more people bought on their revolving credit line, and the more they paid Sears, the more Sears increased their credit limit. Sears was the “go to” place for cash strapped consumers. (Eventually, this became what we now call the Discover card.)

In 1930 Sears expanded the Allstate tire line to include selling auto insurance – and consumers could not only maintain their car at Sears they could insure it as well. As its customers grew older and more wealthy, many needed help with financia advice so in 1981 Sears bought Dean Witter and made it possible for customers to figure out a retirement plan while waiting for their tires to be replaced and their car insurance to update.

To put it mildly, Sears was the most innovative retailer of all time. Until the internet came along. Focused on its big stores, and its breadth of products and services, Sears kept trying to sell more stuff through those stores, and to those same customers. Internet retailing seemed insignificantly small, and unappealing. Heck, leadership had discontinued the famous catalogues in 1993 to stop store cannibalization and push people into locations where the company could promote more products and services. Focusing on its core customers shopping in its core retail locations, Sears leadership simply ignored upstarts like Amazon.com and figured its old success formula would last forever.

But they were wrong. The traditional Sears market was niched up across big box retailers like Best Buy, clothiers like Kohls, tool stores like Home Depot, parts retailers like AutoZone, and soft goods stores like Bed, Bath & Beyond. The original need for “one stop shopping” had been overtaken by specialty retailers with wider selection, and often better pricing. And customers now had credit cards that worked in all stores. Meanwhile, for those who wanted to shop for many things from home the internet had taken over where the catalogue once began. Leaving Sears’ market “hollowed out.” While KMart was simply overwhelmed by the vast expansion of WalMart.

What should Lampert have done?

There was no way a cost cutting strategy would save KMart or Sears. All the trends were going against the company. Sears was destined to keep losing customers, and sales, unless it moved onto trends. Lampert needed to innovate. He needed to rapidly adopt the trends. Instead, he kept cutting costs. But revenues fell even faster, and the result was huge paper losses and an outpouring of cash.

To gain more insight, take a look at Jeff Bezos. But rather than harp on Amazon.com’s growth, look instead at the leadership he has provided to The Washington Post since acquiring it just over 2 years ago. Mr. Bezos did not try to be a better newspaper operator. He didn’t involve himself in editorial decisions. Nor did he focus on how to drive more subscriptions, or sell more advertising to traditional customers. None of those initiatives had helped any newspaper the last decade, and they wouldn’t help The Washington Post to become a more relevant, viable and profitable company. Newspapers are a dying business, and Bezos could not change that fact.

Mr. Bezos focused on trends, and what was needed to make The Washington Post grow. Media is under change, and that change is being created by technology. Streaming content, live content, user generated content, 24×7 content posting (vs. deadlines,) user response tracking, readers interactivity, social media connectivity, mobile access and mobile content — these are the trends impacting media today. So that was where he had leadership focus. The Washington Post had to transition from a “newspaper” company to a “media and technology company.”

So Mr. Bezos pushed for hiring more engineers – a lot more engineers – to build apps and tools for readers to interact with the company. And the use of modern media tools like headline testing. As a result, in October, 2015 The Washington Post had more unique web visitors than the vaunted New York Times. And its lead is growing. And while other newspapers are cutting staff, or going out of business, the Post is adding writers, editors and engineers. In a declining newspaper market The Washington Post is growing because it is using trends to transform itself into a company readers (and advertisers) value.

CEO Lampert could have chosen to transform Sears Holdings. But he did not. He became a very, very active “hands on” manager. He micro-managed costs, with no sense of important trends in retail. He kept trying to take cash out, when he needed to invest in transformation. He should have sold the real estate very early, sensing that retail was moving on-line. He should have sold outdated brands under intense competitive pressure, such as Kenmore, to a segment supplier like Best Buy. He then should have invested that money in technology. Sears should have been a leader in shopping apps, supplier storefronts, and direct-to-customer distribution. Focused entirely on defending Sears’ core, Lampert missed the market shift and destroyed all the value which initially existed in the great retail merger he created.

Impact?

Every company must understand critical trends, and how they will apply to their business. Nobody can hope to succeed by just protecting the core business, as it can be made obsolete very, very quickly. And nobody can hope to change a trend. It is more important than ever that organizations spend far less time focused on what they did, and spend a lot more time thinking about what they need to do next. Planning needs to shift from deep numerical analysis of the past, and a lot more in-depth discussion about technology trends and how they will impact their business in the next 1, 3 and 5 years.

Sears Holdings was a 13 year ride. Investor hope that Lampert could cut costs enough to make Sears and KMart profitable again drove the stock very high. But the reality that this strategy was impossible finally drove the value lower than when the journey started. The debacle has ruined 2 companies, thousands of employees’ careers, many shopping mall operators, many suppliers, many communities, and since 2007 thousands of investor’s gains. Four years up, then 9 years down. It happened a lot faster than anyone would have imagined in 2003 or 2004. But it did.

And it could happen to you. Invert your strategic planning time. Spend 80% on trends and scenario planning, and 20% on historical analysis. It might save your business.

by Adam Hartung | Mar 9, 2015 | Current Affairs, Defend & Extend, In the Whirlpool, Leadership

Best Buy, the venerable electronics retailer, is hitting 52 week highs. Coming off a low of $24 in April, 2014 the current price of about $40 is a 67% increase in just 10 months. Analysts are now cheering investors to own the stock, with Marketwatch pronouncing that the last bearish analyst has thrown in the towel.

If you are a trader, perhaps you want to consider this stock. But if you aren’t an investment professional, and you buy and hold stocks for years, then Best Buy is not a stock you should own.

The bullish case for owning Best Buy is based on recovering sales per store, and recovering earnings, after a reduction in the number of stores, and employees, lowered costs. Further, with Radio Shack now in bankruptcy sales are showing an uptick as customers swing over. And that is expected to continue as Sears closes more stores on its marches toward bankruptcy. Additionally, it is hoped that lower gasoline prices will allow consumers to spend more on electronics and appliances at Best Buy.

But, this completely ignores the trend toward on-line retail sales, and the long-term deleterious impact this trend will have on Best Buy. According to the U.S. Census Bureau, on-line sales as a percent of all retail have grown from less than 2.4% in 2005 to over 7.6% by end of 2014 – more than tripling! But more critical to this discussion, all retail sales includes automobiles, lumber, groceries – lots of things where there is little or no online volume.

As most folks know, the number one category for online sales is computers and consumer electronics, which consistently accounts for about 20% of ALL online retail. In fact, about 25% of all consumer electronics are sold online. So the growth in online retail is disproportionately in the Best Buy wheelhouse. The segment where Best Buy competes against streamlined online retailers such as NewEgg.com, ThinkGeek.com and the ever-dominant Amazon.com.

So while in the short term some traditional retail customers will now shift demand to Best Buy, this is not unlike the revenue “bounce” Best Buy received when Circuit City failed. Short term up, but the long term trend continued hammering away at Best Buy’s core market.

This is a big deal because the marginal economic impact of this shift is horrific to Best Buy. In traditional retail most costs are “fixed,” meaning they can’t be changed much month to month. The cost of real estate, store maintenance, utilities and staff cannot be easily adjusted – unless there is a decision to close a gob of stores. Thus losing even a few sales, what economists call “marginal” sales, wreaks havoc on earnings.

Back in 2010 and 2011 Best Buy made a net income (’12 and ’13 were losses) of about 2.6% – or about $2.60 on every $100 revenue. Cost of Goods sold is about 75% of revenue. So on $100 of revenue, $25 is available to cover fixed costs. If revenue falls by just $10, Best Buy loses $2.50 of margin to cover fixed costs. Remember, however, that the net income is only $2.60. So losing 10% of revenue ($10 out of the $100) means Best Buy loses $2.50 of contribution to fixed costs, and that is deducted from net income of $2.60, leaving Best Buy with a meager 10cents of profitability. A 10% loss of revenue wipes out 96% of profits!

Now you know why retailers who lose even a small part of their sales are suddenly closing stores right and left.

Looking forward, online retail sales are forecast to grow by another 57%, reaching 11% of total retail by 2018. But, as we know, this is disproportionately going to be driven by consumer electronics. Which means that while sales for Best Buy stores are up short term, long term they will plummet. That means there will be more store closings, and layoffs as sales shrink. And, increasingly Best Buy will have to compete head-to-head online against entrenched, leading competitors who have been stealing market share for 10+ years.

If you want to trade on the short-term uptick in revenue, and return to slight profitability, then hold your breath and see if you can outsmart the market by picking the right time, and price, for buying and selling Best Buy. But, if you like to invest in strong companies you expect to grow for another 5 years without having to be a market timer, then avoid Best Buy.

Quite simply, it is never a good idea to bet against a long term trend. Short term aberrations will happen, and it may look like the trend has changed. But the trend to online commerce is picking up steam, not reducing. If you want to invest in retail, you want to invest in those companies that demonstrate they can capture the customer’s revenue in the growing, online marketplace.

by Adam Hartung | May 8, 2014 | Current Affairs, Leadership

Lots of press this week about Target’s CEO and Chairman, Gregg Steinhafel, apparently being forced out. Blame reached the top job after the successful cyber attack on the company last year. But investors, and customers, may regret this somewhat Board level over-reaction to a mounting global problem.

Richard Clark is probably America’s foremost authority on cyber attacks. He was on America’s National Security Council, and headed the counter-terrorism section. Since leaving government he has increasingly focused on cyber attacks, and advised corporations.

In early 2013 I met Mr. Clark after hearing him speak at a National Association of Corporate Directors meeting. He was surprisingly candid in his comments at the meeting, and after. He pointed out that EVERY company in America was being randomly targeted by cyber criminals, and that EVERY company would have an intrusion. He said it was impossible to do business without working on-line, and simultaneously it was impossible to think any company – of any size – could stop an attack from successfully getting into the company. The only questions one should focus on answering were “How fast can you discover the attack? How well can you contain it? What can you learn to at least stop that from happening again?”

So, while the Target attack was large, and not discovered as early as anyone would like, to think that Target is in some way wildly poor at security or protecting its customers is simply naive. Several other large retailers have also had attacks, include Nieman Marcus and Michael’s, and it was probably bad luck that Target was the first to have such a big problem happen, and at such a bad time, than anything particularly weak about Target.

We now know that all retailers are trying to learn from this, and every corporation is raising its awareness and actions to improve cyber security. But someone will be next. Target wasn’t the first, and won’t be the last. Companies everywhere, working with law enforcement, are all reacting to this new form of crime. So firing the CEO, 2 months after firing the CIO (Chief Information Officer), makes for good press, but it is more symbolic than meaningful. It won’t stop the hackers.

Where this decision does have great importance is to shareholders and customers. Target has been a decent company for its constituents under this CEO, and done far better than some of its competitors. The share price has doubled in the last 5 years, and Target has proven a capable competitor to Wal-Mart while other retailers have been going out of business (Filene’s Basement, Circuit City, Linens & Things, Dots, etc.) or losing all relevancy (like Abercrombie and Fitch and Best Buy.) And Target has been at least holding its own while some chains have been closing stores like crazy (Radio Shack 1,100 stores, Family Dollar 370 stores, Office Depot 400 stores, etc.)

Just compare Target’s performance to JCPenney, who’s CEO was fired after screwing up the business far worse than the cyber attack hurt Target. Or, look at Sears Holdings. CEO Ed Lampert was heralded as a hero 6 years ago, but since then the company he leads has had 28 straight quarters of declining sales, and closed 305 stores since 2010. Kmart has become a complete non-competitor in discounting, and Sears has lost all relevancy as a chain as it has been outflanked on all sides. CEO Lampert has constantly whittled away at the company’s value, and just this week told shareholders that they can simply plan on more store closings in the future.

And vaunted Wal-Mart is undergoing a federal investigation for bribing government officials in Mexico to prop up its business. Wal-Mart is constantly under attack by its employees for shady business practices, and even lost a National Labor Relations Board case regarding its hours and pay practices. And Wal-Mart remains a lightning rod for controversy as it fights with big cities like Chicago and Washington, DC about its ability to open stores, while Target has flourished in communities large and small with work practices considered acceptable. And Target has avoided these sort of internally generated management scandals.

CEOs, and Boards of Directors, across the nation have been seriously addressing cyber security for the last couple of years. Awareness, and protective measures, are up considerably. But there will be future attacks, and some will succeed. It is unclear blaming the CEO for these problems makes any sense – unless there is egregious incompetence.

On the other hand, finding a CEO that can grow a business like Target, in a tough retail market, is not easy. Destroying KMart, while battling Wal-Mart, and still trying to figure out how to compete with Amazon.com is a remarkably difficult job. Perhaps the toughest CEO job in the country. Steinhafel had performed better than most. Investors, and customers, may soon regret that he’s not still leading Target.

by Adam Hartung | Apr 8, 2014 | Current Affairs, Disruptions, In the Rapids, Innovation, Leadership

“Car dealers are idiots” said my friend as she sat down for a cocktail.

It was evening, and this Vice President of a large health care equipment company was meeting me to brainstorm some business ideas. I asked her how her day went, when she gave the response above. She then proceeded to tell me she wanted to trade in her Lexus for a new, small SUV. She had gone to the BMW dealer, and after being studiously ignored for 30 minutes she asked “do the salespeople at this dealership talk to customers?” Whereupon the salespeople fell all over themselves making really stupid excuses like “we thought you were waiting for your husband,” and “we felt you would be more comfortable when your husband arrived.”

My friend is not married. And she certainly doesn’t need a man’s help to buy a car.

She spent the next hour using her iPhone to think up every imaginable bad thing she could say about this dealer over Twitter and Facebook using various interesting hashtags and @ references.

Truthfully, almost nobody likes going to an auto dealership. Everyone can share stories about how they were talked down to by a salesperson in the showroom, treated like they were ignorant, bullied by salespeople and a slow selling process, overcharged compared to competitors for service, forced into unwanted service purchases under threat of losing warranty coverage – and a slew of other objectionable interactions. Most Americans think the act of negotiating the purchase of a new car is loathsome – and far worse than the proverbial trip to a dentist. It’s no wonder auto salespeople regularly top the list of least trusted occupations!

When internet commerce emerged in the 1990s, buying an auto on-line was the #1 most desired retail transaction in emerging customer surveys. And today the vast majority of Americans, especially Millennials, use the web and social media to research their purchase before ever stepping foot in the dreaded dealership.

Tesla heard, and built on this trend. Rather than trying to find dealers for its cars, Tesla decided it would sell them directly from the manufacturer. Which created an uproar amongst dealers who have long had a cushy “almost no way to lose money” business, due to a raft of legal protections created to support them after the great DuPont-General Motors anti-trust case.

When New Jersey regulators decided in March they would ban Tesla’s factory-direct dealerships, the company’s CEO, Elon Musk, went after Governor Christie for supporting a system that favors the few (dealers) over the customer. He has threatened to use the federal courts to overturn the state laws in favor of consumer advocacy.

It would be easy to ignore Tesla’s position, except it is not alone in recognizing the trend. TrueCar is an on-line auto shopping website which received $30M from Microsoft co-founder Paul Allen’s venture fund. After many state legal challenges TrueCar now claims to have figured out how to let people buy on-line with dealer delivery, and last week filed papers to go public. While this doesn’t eliminate dealers, it does largely take them out of the car-buying equation. Call it a work-around for now that appeases customers and lawyers, even if it doesn’t actually meet consumer desires for a direct relationship with the manufacturer.

Apple’s direct-to-consumer retail stores were key to saving the company

Distribution is always a tricky question for any consumer good. Apple wanted to make sure its products were positioned correctly, and priced correctly. As Apple re-emerged from near bankruptcy with new music products in the early 2000’s Apple feared electronic retailers would discount the product, be unable to feature Apple’s advantages, and hurt the brand which was in the process of rebuilding. So it opened its own stores, staffed by “geniuses” to help customers understand the brand positioning and the products’ advantages. Those stores are largely considered to have been a turning point in helping consumers move from a world of Microsoft-based laptops, Sony music products and Blackberry mobile devices to new iDevices and resurging Macintosh popularity – and sales levels.

Attacking regulations sounds – and is – a daunting task. But, when regulations support a minority of people outside the public good there is reason to expect change. American’s wanted a more pristine society, so in 1920 the 18th Amendment was passed prohibiting alcohol. However, after a decade in which rampant crime developed to support illegal alcohol production Americans passed the 21st Amendment in 1933 to repeal prohibition. What seemed like a good idea at first turned out to have more negatives than positives.

Auto dealer regulations hurt competition, and consumers

Today Americans do not need a protected group of dealers to save them from big, bad auto companies. To the contrary, forced distribution via protected dealers inhibits competition because it keeps new competitors from entering the U.S. market. Small production manufacturers, and large ones in countries like India, are effectively blocked from reaching American customers because they lack a dealer base and existing dealers are uninterested in taking the risks inherent in taking these new products to market. Likewise, starting up an auto company is fraught with distribution risks in the USA, leaving Tesla the only company to achieve any success since the dealer protection laws were passed decades ago.

And that’s why Tesla has a very good chance of succeeding. The trends all support Americans wanting to buy directly from manufacturers. At the very least this would force dealers to justify their existence, and profits, if they want to stay in business. But, better yet, it would create greater competition – as happened in the case of Apple’s re-emergence and impact on personal technology for entertainment and productivity.

Litigating to fight a trend might work for a while. Usually those in such a position are large political contributors, and use both the political process as well as legal precedent to protect their unjustified profits. NADA (National Automobile Dealers Association) is a substantial organization with very large PAC money to use across Washington. The Association can coordinate election contributions at national and state levels, as well as funding for judge elections and contributions for legal defense.

But, trends inevitably win out. Today Millennials are true on-line shoppers. They have no patience for traditional auto dealer shenanigans. After watching their parents, and grandparents, struggle for fairness with dealers they are eager for a change. As are almost all the auto buyers out there. And they are supported by consumer advocates long used to edgy tactics of auto dealers well known for skirting ethics and morality when dealing with customers. Those seeking change just need someone positioned to lead the legal effort.

Tesla wins because it uses trends to be a game changer

Tesla has shown it is well attuned to trends and what customers want. When other auto companies eschewed Tesla’s first entry as a 2-passenger sports car using laptop batteries, Tesla proceeded to sell out the product at a price much higher competitive gas-powered cars. When other auto companies thought a $70,000 electric sedan would never appeal to American buyers, Tesla again showed it understood the market best and sold out production. When industry pundits, and traditional auto company execs, said it was impossible to build a charging grid to support users driving up the coast, or cross-country, Tesla built the grid and demonstrated its functionality.

Now Tesla is the right company, in the right place, to change not only the autos Americans drive, but how Americans buy them. It’s rarely smart to refuse a trend, and almost always smart to support it. Tesla looks to be positioning itself as much smarter than older, larger auto companies once again.

by Adam Hartung | Apr 1, 2014 | Current Affairs, Defend & Extend, In the Swamp, Leadership, Web/Tech

“Hope springs eternal in the human breast” (Alexander Pope)

As it does for most investors. People do not like to accept the notion that a business will lose relevancy, and its value will fall. Especially really big companies that are household brand names. Investors, like customers, prefer to think large, established companies will continue to be around, and even do well. It makes everyone feel better to have a optimistic attitude about large, entrenched organizations.

And with such optimism investors have cheered Microsoft for the last 15 months. After a decade of trading up and down around $26/share, Microsoft stock has made a significant upward move to $41 – a new decade-long high. This price has people excited Microsoft will reach the dot.com/internet boom high of $60 in 2000.

After discovering that Windows 8, and the Surface tablet, were nowhere near reaching sales expectations after Christmas 2012 – and that PC sales were declining faster than expected – investors were cheered in 2013 to hear that CEO Steve Ballmer would resign. After much speculation, insider Satya Nadella was named CEO, and he quickly made it clear he was refocusing the company on mobile and cloud. This started the analysts, and investors, on their recent optimistic bent.

CEO Nadella has cut the price of Windows by 70% in order to keep hardware manufacturers on Windows for lower cost machines, and he announced the company’s #1 sales and profit product – Office – was being released on iOS for iPad users. Investors are happy to see this action, as they hope that it will keep PC sales humming. Or at least slow the decline in sales while keeping manufacturers (like HP) in the Microsoft Windows fold. And investors are likewise hopeful that the long awaited Office announcement will mean booming sales of Office 365 for all those Apple products in the installed base.

But, there’s a lot more needed for Microsoft to succeed than these announcements. While Microsoft is the world’s #1 software company, it is still under considerable threat and its long-term viability remains unsure.

Windows is in a tough spot. After this price decline, Microsoft will need to increase sales volume by 2.5X to recoup lost profits. Meanwhile, Chrome laptops are considerably cheaper for customers and more profitable for manufacturers. And whether this price cut will have any impact on the decline in PC sales is unclear, as users are switching to mobile products for ease-of-use reasons that go far beyond price. Microsoft has taken an action to defend and extend its installed base of manufacturers who have been threatening to move, but the impact on profits is still likely to be negative and PC sales are still going to decline.

Meanwhile, the move to offer Office on iOS is clearly another offer to defend the installed Office marketplace, and unlikely to create a lot of incremental revenue and profit growth. The PC market has long been much bigger than tablets, and almost every PC had Office installed. Shrinking at 12-14% means a lot less Windows Office is being sold. And, In tablets iOS is not 100% of the market, as Android has substantial share. Offering Office on iOS reaches a lot of potential machines, but certainly not 100% as has been the case with PCs.

Further, while there are folks who look forward to running Office on an iOS device, Office is not without competition. Both Apple and Google offer competitive products to Office, and the price is free. For price sensitive users, both individuals and corporations, after 4 years of using competitive products it is by no means a given they all are ready to pay $60-$100 per device per year. Yes, there will be Office sales Microsoft did not previously have, but whether it will be large enough to cover the declining sales of Office on the PC is far from clear. And whether current pricing is viable is far, far from certain.

While these Microsoft products are the easiest for consumers to understand, Nadella’s move to make Microsoft successful in the mobile/cloud world requires succeeding with cloud products sold to corporations and software-as-service providers. Here Microsoft is late, and facing substantial competition as well.

Just last week Google cut the price of its Compute Engine cloud infrastructure (IaaS) platform and App Engine cloud app platform (PaaS) products 30-32%. Google cut the price of its Cloud Storage and BigQuery (big data analytics) services by 68% and 85% as it competes headlong for customers with Amazon. Amazon, which has the first-mover position and large customers including the U.S. federal government, cut prices within 24 hours for its EC2 cloud computing service by 30%, and for its S3 storage service by over 50%. Amazon also reduced prices on its RDS database service approximately 28%, and its Elasticache caching service by over 33%.

To remain competitive, Microsoft had to react this week by chopping prices on its Azure cloud computing products 27%-35%, reducing cloud storage pricing 44%-65%, and whacking prices on its Windows and Linux memory-intensive computing products 27%-35%. While these products have allowed the networking division formerly run by now CEO Nadella to be profitable, it will be increasingly difficult to maintain old profit levels on existing customers, and even a tougher problem to profitably steal share from the early cloud leaders – even as the market grows.

While optimism has grown for Microsoft fans, and the share price has moved distinctly higher, it is smart to look at other market leaders who obtained investor favorability, only to quickly lose it.

Blackberry was known as RIM (Research in Motion) in June, 2007 when the iPhone was launched. RIM was the market leader, a near monopoly in smart phones, and its stock was riding high at $70. In August, 2007, on the back of its dominant status, the stock split – and moved on to a split adjusted $140 by end of 2008. But by 2010, as competition with iOS and Android took its toll RIM was back to $80 (and below.) Today the rechristened company trades for $8.

Sears was once the country’s largest and most successful retailer. By 2004 much of the luster was coming off when KMart purchased the company and took its name, trading at only $20/share. Following great enthusiasm for a new CEO (Ed Lampert) investors flocked to the stock, sure it would take advantage of historical brands such as DieHard, Kenmore and Craftsman, plus leverage its substantial real estate asset base. By 2007 the stock had risen to $180 (a 9x gain.) But competition was taking its toll on Sears, despite its great legacy, and sales/store started to decline, total sales started declining and profits turned to losses which began to stretch into 20 straight quarters of negative numbers. Meanwhile, demand for retail space declined, and prices declined, cutting the value of those historical assets. By 2009 the stock had dropped back to $40, and still trades around that value today — as some wonder if Sears can avoid bankruptcy.

Best Buy was a tremendous success in its early years, grew quickly and built a loyal customer base as the #1 retail electronics purveyor. But streaming video and music decimated CD and DVD sales. On-line retailers took a huge bite out of consumer electronic sales. By January, 2013 the stock traded at $13. A change of CEO, and promises of new formats and store revitalization propped up optimism amongst investors and by November, 2014 the stock was at $44. However, market trends – which had been in place for several years – did not change and as store sales lagged the stock dropped, today trading at only $25.

Microsoft has a great legacy. It’s products were market leaders. But the market has shifted – substantially. So far new management has only shown incremental efforts to defend its historical business with product extensions – which are up against tremendous competition that in these new markets have a tremendous lead. Microsoft so far is still losing money in on-line and gaming (xBox) where it has lost almost all its top leadership since 2014 began and has been forced to re-organize. Nadella has yet to show any new products that will create new markets in order to “turn the tide” of sales and profits that are under threat of eventual extinction by ever-more-capable mobile products.

While optimism springs eternal long-term investors would be smart to be skeptical about this recent improvement in the stock price. Things could easily go from mediocre to worse in these extremely competitive global tech markets, leaving Microsoft optimists with broken dreams, broken hearts and broken portfolios.

Update: On April 2 Microsoft announced it is providing Windows for free to all manufacturers with a 9″ or smaller display. This is an action to help keep Microsoft competitive in the mobile marketplace – but it does little for Microsoft profitability. Android from Google may be free, but Google’s business is built on ad sales – not software sales – and that’s dramatically different from Microsoft that relies almost entirely on Windows and Office for its profitability

Update: April 3 CRN (Computer Reseller News) reviewed Office products for iOS – “We predict that once the novelty of “Office for iPad” wears off, companies will go back to relying on the humble, hard-working third parties building apps that are as stable, as handsome and far more capable than those of Redmond. It’s not that hard to do.”