by Adam Hartung | Apr 30, 2014 | Current Affairs, Innovation, Leadership

Economic growth is a great thing. When the economy booms people make more, so they pay more income taxes. They spend more, which generates more sales tax. They upgrade homes and buy bigger homes, which have higher property taxes. But even though they pay more dollars in taxes, people are happy because they have more cash, and often the percent of their income spent overall on taxes is lower.

A virtuous circle where everyone benefits. Growth helps the citizens, and the community prospers.

For the industrial era, this virtuous circle was great for Illinois. Farmlands continued to prosper with bountiful crops, while new manufacturing jobs created higher incomes for those leaving the farms. The roadways and airports grew, while income taxes remained almost paltry by national standards. And Illinois could boast some of the country’s best public schools even while property taxes were below national averages. This growth environment kept locals in the state, and attracted people from the plains, other parts of the midwest, south and northeast as well as immigrants from foreign lands. Industrial growth propelled a great environment.

Last week many people were surprised by a recent Gallup survey showing that Illinois leads the USA in people wanting to leave their home state. A whopping 50% of the population would like to leave. And Illinois was 2nd from the top with percentage of people who have high intent to actually leave (at 19%.) So if those two groups overlap Illinois could lose 10% of its population in short order!

If ever there was one, this has to be a wake-up call!

The seeds of this problem were sown many years ago. When manufacturing started going offshore, Illinois was hard hit. A Center for Government Studies report shows that between 2000 and 2010 the number of people employed in Illinois actually declined by 115,000 (1.5%). Farming, wholesale and retail trade jobs fell by 135,000. But far worse was the decline in manufacturing jobs, which dropped by a whopping 311,000. Those were jobs which had been Illinois’ growth foundation for 60 years. And they were the employers who provided the network effect of business-to-business growth that kept the state’s virtuous circle spinning.

Despite the obviousness of this shift in employment – from manufacturing to services – the state reacted timidly to replace that employment base with another growth vehicle. In an era of growing financial services, Illinois failed to develop a strong banking sector, and in fact watched First Chicago/Bank One become JPMorganChase and leave – along with almost all its other large brethren. Despite leading engineering universities (University of Illinois Chicago, University of Illinois Urbana/Champaign, Northwestern, Illinois Institute of Technology, Northern Illinois, etc.) Illinois failed to develop a vibrant angel investing or venture capital community, and digital entrepreneurs were pushed toward the coasts for funding – and increasingly the talent followed them out of state.

It did not take long for the virtuous circle to become a stagnation spiral. As jobs left the state there was lower demand for housing, so people couldn’t sell their houses – especially after 2007. The housing bust that racked America hit the Chicago area, and all of Illinois, harder than many metros. And home prices have failed to recover at anything close to the national average. Chicago still leads major metro areas in percentage of homes with underwater mortgages. To maintain money for schools and roads communities were forced to raise property taxes. Today many people, especially in the 6 Chicago “collar counties,” pay property taxes that are higher than similar homes in Los Angeles and San Francisco! Property taxes that have become among the highest in the country.

With no growth in spending, communities raised sales taxes to generate more income. Today most Illinois citizens pay between 9-10% sales tax, again amongst the highest in the country. Which encourages even greater on-line shopping, and deterioration in the local retail trade.

Road maintenance, and general funding at the state level, pushed the state to raise highway tolls. What were $.25 toll machines on major arteries in the 1990s now cost $.75 (tripled) and the rate is double that ($1.50) if you don’t install an electronic toll device in your auto (sorry out-of-state drivers.)

Lacking growth, state income tax receipts could not keep up with state demands – especially for pensions that depended on both a vibrant stock market as well as higher state income. So Illinois doubled the income tax rate in an effort to fund pensions and avoid bankruptcy.

Yet, despite seeing taxes in all areas increase, residents are subject to declining services. Potholes remain an ever-present danger for drivers. Municipal traffic services (buses and rail cars) have increased prices by multiples, yet there are fewer routes and longer waits for customers.

Which leads to an even worse element of stagnation – aging population. As the jobs for people 16-44 declined, younger people left the state and that demographic actually declined by 3.2% between 2000 and 2010. Those who remained were older, so the Baby Boomers grew by 21%! However, this aged demographic is not in its prime “spending” years, and instead is much more likely to invest for retirement. Thus further dampening the local economy.

And, an aging population means that the number of children declined – dramatically. The “baby bust” resulted in a 6.2% decline in children under age 10 in Illinois last decade. Fewer children means less demand for school teachers, and all the things related to child rearing, further shrinking the economic growth prospects. While this is good news for property tax payers generally, it’s never a good sign to see closed schools simply because there’s no need for them.

Now the spiral becomes a self-fulfilling prophecy. Retiring boomers on a fixed income realize that they cannot afford to live in a state with such high, and rising, property taxes. Especially when other states have fixed taxes that are 1/4 to 1/3 what they pay in Illinois. These retirees (or soon to be retirees) discover lower property tax states often have sales taxes that are half what they pay in Illinois. The economics of staying become increasingly difficult to bear – while the benefits of leaving look ever more promising.

Entrepreneurs and business leaders see little reason to move more jobs into Illinois. When looking at facility locations they realize they can receive the same tax breaks almost anywhere, but employees would prefer the lower tax environment of other states – especially sun belt states like Texas which has no income tax. As Illinois offers tax breaks to dinosaurs like Sears, desperately trying to keep jobs despite failing corporate prospects, it becomes increasingly difficult to lure anyone other than small-employing headquarters locations into the state. And personal taxes keep going up to compensate for these ill-conceived legacy company support programs.

No wonder so many people think about leaving Illinois. And we haven’t even mentioned the weather (do you know how to spell P-O-L-A-R V-O-R-T-E-X?)

Growth is a wonderful thing. Everyone prospers when economic growth provides the virtual circle of more cash. But when the market turns toward the stagnation spiral – well it sucks for just about everyone.

Just ask the folks in Detroit – who are now auctioning off empty homes for $1,000 on the internet just to stop ongoing blight that is wrecking the city like an economic tsunami.

There is no simple answer for a declining economy like Illinois. But this was a situation that took over 2 decades to create. Failure to recognize the decline in manufacturing, and shift to digital economy jobs, left political and industry leaders arrogantly thinking everything would be fine. An inability to invest in creating a replacement powerhouse industry means the state has few resources to invest in anything at all now. Unable to leverage local university innovation with a comprehensive and effective program for funding projects has created a veritable slipper-slide from Illinois to California or New York for new graduates.

The answer will take a some time to develop, and implement. But one thing is clear, if Illinois’ leaders don’t come up with something soon there will be even fewer people around, and even greater problems developing. It would be easy to dismiss this Gallup poll, or let community pride keep one from taking its implications seriously. But that would be an even worse mistake. This is a serious wake-up call.

by Adam Hartung | Apr 8, 2014 | Current Affairs, Disruptions, In the Rapids, Innovation, Leadership

“Car dealers are idiots” said my friend as she sat down for a cocktail.

It was evening, and this Vice President of a large health care equipment company was meeting me to brainstorm some business ideas. I asked her how her day went, when she gave the response above. She then proceeded to tell me she wanted to trade in her Lexus for a new, small SUV. She had gone to the BMW dealer, and after being studiously ignored for 30 minutes she asked “do the salespeople at this dealership talk to customers?” Whereupon the salespeople fell all over themselves making really stupid excuses like “we thought you were waiting for your husband,” and “we felt you would be more comfortable when your husband arrived.”

My friend is not married. And she certainly doesn’t need a man’s help to buy a car.

She spent the next hour using her iPhone to think up every imaginable bad thing she could say about this dealer over Twitter and Facebook using various interesting hashtags and @ references.

Truthfully, almost nobody likes going to an auto dealership. Everyone can share stories about how they were talked down to by a salesperson in the showroom, treated like they were ignorant, bullied by salespeople and a slow selling process, overcharged compared to competitors for service, forced into unwanted service purchases under threat of losing warranty coverage – and a slew of other objectionable interactions. Most Americans think the act of negotiating the purchase of a new car is loathsome – and far worse than the proverbial trip to a dentist. It’s no wonder auto salespeople regularly top the list of least trusted occupations!

When internet commerce emerged in the 1990s, buying an auto on-line was the #1 most desired retail transaction in emerging customer surveys. And today the vast majority of Americans, especially Millennials, use the web and social media to research their purchase before ever stepping foot in the dreaded dealership.

Tesla heard, and built on this trend. Rather than trying to find dealers for its cars, Tesla decided it would sell them directly from the manufacturer. Which created an uproar amongst dealers who have long had a cushy “almost no way to lose money” business, due to a raft of legal protections created to support them after the great DuPont-General Motors anti-trust case.

When New Jersey regulators decided in March they would ban Tesla’s factory-direct dealerships, the company’s CEO, Elon Musk, went after Governor Christie for supporting a system that favors the few (dealers) over the customer. He has threatened to use the federal courts to overturn the state laws in favor of consumer advocacy.

It would be easy to ignore Tesla’s position, except it is not alone in recognizing the trend. TrueCar is an on-line auto shopping website which received $30M from Microsoft co-founder Paul Allen’s venture fund. After many state legal challenges TrueCar now claims to have figured out how to let people buy on-line with dealer delivery, and last week filed papers to go public. While this doesn’t eliminate dealers, it does largely take them out of the car-buying equation. Call it a work-around for now that appeases customers and lawyers, even if it doesn’t actually meet consumer desires for a direct relationship with the manufacturer.

Apple’s direct-to-consumer retail stores were key to saving the company

Distribution is always a tricky question for any consumer good. Apple wanted to make sure its products were positioned correctly, and priced correctly. As Apple re-emerged from near bankruptcy with new music products in the early 2000’s Apple feared electronic retailers would discount the product, be unable to feature Apple’s advantages, and hurt the brand which was in the process of rebuilding. So it opened its own stores, staffed by “geniuses” to help customers understand the brand positioning and the products’ advantages. Those stores are largely considered to have been a turning point in helping consumers move from a world of Microsoft-based laptops, Sony music products and Blackberry mobile devices to new iDevices and resurging Macintosh popularity – and sales levels.

Attacking regulations sounds – and is – a daunting task. But, when regulations support a minority of people outside the public good there is reason to expect change. American’s wanted a more pristine society, so in 1920 the 18th Amendment was passed prohibiting alcohol. However, after a decade in which rampant crime developed to support illegal alcohol production Americans passed the 21st Amendment in 1933 to repeal prohibition. What seemed like a good idea at first turned out to have more negatives than positives.

Auto dealer regulations hurt competition, and consumers

Today Americans do not need a protected group of dealers to save them from big, bad auto companies. To the contrary, forced distribution via protected dealers inhibits competition because it keeps new competitors from entering the U.S. market. Small production manufacturers, and large ones in countries like India, are effectively blocked from reaching American customers because they lack a dealer base and existing dealers are uninterested in taking the risks inherent in taking these new products to market. Likewise, starting up an auto company is fraught with distribution risks in the USA, leaving Tesla the only company to achieve any success since the dealer protection laws were passed decades ago.

And that’s why Tesla has a very good chance of succeeding. The trends all support Americans wanting to buy directly from manufacturers. At the very least this would force dealers to justify their existence, and profits, if they want to stay in business. But, better yet, it would create greater competition – as happened in the case of Apple’s re-emergence and impact on personal technology for entertainment and productivity.

Litigating to fight a trend might work for a while. Usually those in such a position are large political contributors, and use both the political process as well as legal precedent to protect their unjustified profits. NADA (National Automobile Dealers Association) is a substantial organization with very large PAC money to use across Washington. The Association can coordinate election contributions at national and state levels, as well as funding for judge elections and contributions for legal defense.

But, trends inevitably win out. Today Millennials are true on-line shoppers. They have no patience for traditional auto dealer shenanigans. After watching their parents, and grandparents, struggle for fairness with dealers they are eager for a change. As are almost all the auto buyers out there. And they are supported by consumer advocates long used to edgy tactics of auto dealers well known for skirting ethics and morality when dealing with customers. Those seeking change just need someone positioned to lead the legal effort.

Tesla wins because it uses trends to be a game changer

Tesla has shown it is well attuned to trends and what customers want. When other auto companies eschewed Tesla’s first entry as a 2-passenger sports car using laptop batteries, Tesla proceeded to sell out the product at a price much higher competitive gas-powered cars. When other auto companies thought a $70,000 electric sedan would never appeal to American buyers, Tesla again showed it understood the market best and sold out production. When industry pundits, and traditional auto company execs, said it was impossible to build a charging grid to support users driving up the coast, or cross-country, Tesla built the grid and demonstrated its functionality.

Now Tesla is the right company, in the right place, to change not only the autos Americans drive, but how Americans buy them. It’s rarely smart to refuse a trend, and almost always smart to support it. Tesla looks to be positioning itself as much smarter than older, larger auto companies once again.

by Adam Hartung | Jan 8, 2014 | Current Affairs, In the Rapids, Innovation, Leadership, Web/Tech

Most investors really aren’t. They are traders. They sell too fast, and make too many transactions. That’s why most small “investors” don’t do as well as the market averages. In fact, most don’t even do as well as if they simply put money into certificates of deposit or treasury bills.

I subscribe to the idea you should be able to invest in a company, and then simply forget about it. Whether you invest $10 or $100,000, you should feel confident when you buy a stock that you won’t touch it for 3, 5 or even 10 years. Let the traders deal with volatility, just wait and let the company do its thing and go up in value. Then sometime down the road sell it for a multiple of what you paid.

That means investing in big trends. Find a trend that is long-lasting, perhaps permanent, and invest in the leader. Then let the trend do all the work for you.

Imagine you bought AT&T in the 1950s as communication was about to proliferate and phones went into every business and home. Or IBM in the 1960s as computer technology overtook slide rules, manual databases and bookkeeping. Microsoft in the 1980s as personal computers became commonplace. Oracle in the 1990s as applications were built on relational databases. Google, Amazon and Apple in the last decade as people first moved to the internet in droves, and as mobile computing became the next “big thing.”

In each case investors put their money in a big trend, and invested in a leader far ahead of competitors with a strong management team and product pipeline. Then they could forget about it for a few years. All of these went up and down, but over time the vicissitudes were obliterated by long-term gains.

Today the biggest trend is social media. While many people still decry its use, there is no doubt that social media platforms are becoming commonplace in how we communicate, look for information, share information and get a lot of things done. People inherently like to be social; like to communicate. They trust referrals and comments from other people a lot more than they trust an ad – and often more than they trust conventional media. Social media is the proverbial fast flowing river, and getting in that boat is going to take you to a higher value destination.

And the big leader in this trend is Facebook. Although investors were plenty upset when Facebook tumbled after its IPO in 2012, if you had simply bought then, and kept buying a bit each quarter, you’d already be well up on your investment. Almost any purchase made in the first 12 months after the IPO would now have a value 2 to 3 times the acquisition price – so a 100% to 200% return.

But, things are just getting started for Facebook, and it would be wrong to think Facebook has peaked.

Few people realize that Facebook became a $5B revenue company in 2012 – growing revenue 20X in 4 years. And revenue has been growing at 150% per year since reaching $1B. That’s the benefit of being on the “big trend.” Revenues can grow really, really, really fast.

And the market growth is far from slowing. In 2013 the number of U.S. adults using Facebook grew to 71% from 67% in 2012. And that is 3.5 times as often as they used Linked-In or Twitter (22% and 18%.) And Facebook is not U.S. user dependent. Europe, Asia and Rest-of-World have even more users than the USA. ROW is 33% bigger than the USA, and Facebook is far from achieving saturation in these much higher population markets.

Advertisers desiring to influence these users increased their budgets 40% in 2013. And that is sure to grow as users and their interactions climb. According to Shareaholic, over 10% of all internet referrals come from Facebook, up from 7% share of market the previous year. This is 10 times the referral level of Twitter (1%) and 100 times the levels of Linked in and Google+ (less than .1% each.) Thus, if an advertiser wants to users to go to its products Facebook is clearly the place to be.

Facebook acquires more of these ad dollars than all of its competition combined (57% share of market,) and is 4 times bigger than competitors Twitter and YouTube (a Google business.) The list of Grade A advertisers is long, including companies such as Samsung ($100million,) Proctor & Gamble ($60million,) Microsoft ($35million,) Amazon, Nestle, Unilever, American Express, Visa, Mastercard and Coke – just to name a few.

And Facebook has a lot of room to grow the spending by these companies. Google, the internet’s largest ad revenue generator, achieves $80 of ad revenue per user. Facebook only brings in $13/user – less than Yahoo ($18/user.) So the opportunity for advertisers to reach users more often alone is a 6x revenue potential – even if the number of users wasn’t growing.

But on top of Facebook’s “core” growth there are new revenue sources. Since buying revenue-free Instagram, Facebook has turned it into what Evercore analysts estimate will be a $340M revenue in 2014. And as its user growth continues revenue is sure to be even larger in future years.

Even a larger opportunity for growth is the 2013 launched Facebook Ad Exchange (FBX) which is a powerful tool for remarketing unused digital ad space and targeting user behavior – even in mid-purchase. According to BusinessInsider.com FBX already sells to advertisers millions of ads every second – and delivers up billions of impressions daily. All of which is happening in real-time, allowing for exponential growth as Facebook and advertisers learn how to help people use social media to make better purchase decisions. FBX is currently only a small fraction of Facebook revenue.

Stock investing can seem like finding a needle in a haystack. Especially to small investors who have little time to do research. Instead of looking for needles, make investing easier. Eschew complicated mathematical approaches, deep portfolio theory and reams of analyst reports and spreadsheets. Invest in big trends that are growing, and the leaders building insurmountable market positions.

In 2014, that means buy Facebook. Then see where your returns are in 2017.

by Adam Hartung | Nov 6, 2013 | Defend & Extend, Innovation, Leadership, Web/Tech

Can you believe it has been only 12 years since Apple introduced the iPod? Since then Apple’s value has risen from about $11 (January, 2001) to over $500 (today) – an astounding 45X increase.

With all that success it is easy to forget that it was not a “gimme” that the iPod would succeed. At that time Sony dominated the personal music world with its Walkman hardware products and massive distribution through consumer electronics chains such as Best Buy, and broad-line retailers like Wal-Mart. Additionally, Sony had its own CD label, from its acquisition of Columbia Records (renamed CBS Records,) producing music. Sony’s leadership looked impenetrable.

But, despite all the data pointing to Sony’s inevitable long-term domination, Apple launched the iPod. Derided as lacking CD quality, due to MP3’s compression algorithms, industry leaders felt that nobody wanted MP3 products. Sony said it tried MP3, but customers didn’t want it.

All the iPod had going for it was a trend. Millions of people had downloaded MP3 songs from Napster. Napster was illegal, and users knew it. Some heavy users were even prosecuted. But, worse, the site was riddled with viruses creating havoc with all users as they downloaded hundreds of millions of songs.

Eventually Napster was closed by the government for widespread copyright infreingement. Sony, et.al., felt the threat of low-priced MP3 music was gone, as people would keep buying $20 CDs. But Apple’s new iPod provided mobility in a way that was previously unattainable. Combined with legal downloads, including the emerging Apple Store, meant people could buy music at lower prices, buy only what they wanted and literally listen to it anywhere, remarkably conveniently.

The forecasted “numbers” did not predict Apple’s iPod success. If anything, good analysis led experts to expect the iPod to be a limited success, or possibly failure. (Interestingly, all predictions by experts such as IDC and Gartner for iPhone and iPad sales dramatically underestimated their success, as well – more later.) It was leadership at Apple (led by the returned Steve Jobs) that recognized the trend toward mobility was more important than historical sales analysis, and the new product would not only sell well but change the game on historical leaders.

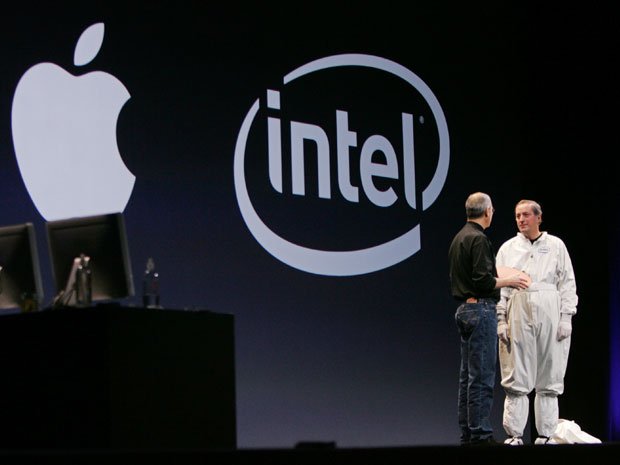

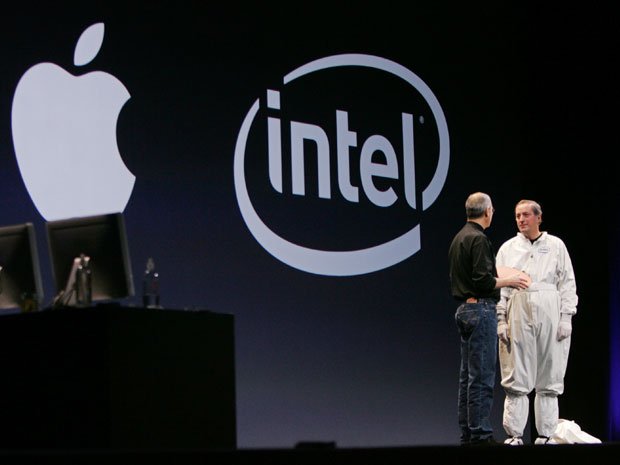

Which takes us to the mistake Intel made by focusing on “the numbers” when given the opportunity to build chips for the iPhone. Intel was a very successful company, making key components for all Microsoft PCs (the famous WinTel [for Windows+Intel] platform) as well as the Macintosh. So when Apple asked Intel to make new processors for its mobile iPhone, Intel’s leaders looked at the history of what it cost to make chips, and the most likely future volumes. When told Apple’s price target, Intel’s leaders decided they would pass. “The numbers” said it didn’t make sense.

Uh oh. The cost and volume estimates were wrong. Intel made its assessments expecting PCs to remain strong indefinitely, and its costs and prices to remain consistent based on historical trends. Intel used hard, engineering and MBA-style analysis to build forecasts based on models of the past. Intel’s leaders did not anticipate that the new mobile trend, which had decimated Sony’s profits in music as the iPod took off, would have the same impact on future sales of new phones (and eventually tablets) running very thin apps.

Harvard innovation guru Clayton Christensen tells audiences that we have complete knowledge about the past. And absolutely no knowledge about the future. Those who love numbers and analysis can wallow in reams and reams of historical information. Today we love the “Big Data” movement which uses the world’s most powerful computers to rip through unbelievable quantities of historical data to look for links in an effort to more accurately predict the future. We take comfort in thinking the future will look like the past, and if we just study the past hard enough we can have a very predictible future.

But that isn’t the way the business world works. Business markets are incredibly dynamic, subject to multiple variables all changing simultaneously. Chaos Theory lecturers love telling us how a butterfly flapping its wings in China can cause severe thunderstorms in America’s midwest. In business, small trends can suddenly blossom, becoming major trends; trends which are easily missed, or overlooked, possibly as “rounding errors” by planners fixated on past markets and historical trends.

Markets shift – and do so much, much faster than we anticipate. Old winners can drop remarkably fast, while new competitors that adopt the trends become “game changers” that capture the market growth.

In 2000 Apple was the “Mac” company. Pretty much a one-product company in a niche market. And Apple could easily have kept trying to defend & extend that niche, with ever more problems as Wintel products improved.

But by understanding the emerging mobility trend leadership changed Apple’s investment portfolio to capture the new trend. First was the iPod, a product wholly outside the “core strengths” of Apple and requiring new engineering, new distribution and new branding. And a product few people wanted, and industry leaders rejected.

Then Apple’s leaders showed this talent again, by launching the iPhone in a market where it had no history, and was dominated by Motorola and RIMM/BlackBerry. Where, again, analysts and industry leaders felt the product was unlikely to succeed because it lacked a keyboard interface, was priced too high and had no “enterprise” resources. The incumbents focused on their past success to predict the future, rather than understanding trends and how they can change a market.

Too bad for Intel. And Blackberry, which this week failed in its effort to sell itself, and once again changed CEOs as the stock hit new lows.

Then Apple did it again. Years after Microsoft attempted to launch a tablet, and gave up, Apple built on the mobility trend to launch the iPad. Analysts again said the product would have limited acceptance. Looking at history, market leaders claimed the iPad was a product lacking usability due to insufficient office productivity software and enterprise integration. The numbers just did not support the notion of investing in a tablet.

Anyone can analyze numbers. And today, we have more numbers than ever. But, numbers analysis without insight can be devastating. Understanding the past, in grave detail, and with insight as to what used to work, can lead to incredibly bad decisions. Because what really matters is vision. Vision to understand how trends – even small trends – can make an enormous difference leading to major market shifts — often before there is much, if any, data.

by Adam Hartung | Oct 9, 2013 | Current Affairs, In the Rapids, Innovation, Lifecycle

In 1985 there was universal agreement that investors should

be heavily in pharmaceuticals.

Companies like Merck, Eli Lilly, Pfizer, Sanofi, Roche, Glaxo and Abbott

were touted as the surest route to high portfolio returns.

Today, not so much.

Merck, once a leader in antibiotics, is laying off 20% of

its staff. Half in R&D; the

lifeblood of future products and profits.

Lilly is undertaking

another round of 2013 cost cuts. Over

the last year about 100,000 jobs have been eliminated in big pharma companies,

which have implemented spin-outs and split-ups as well as RIFs.

What happened? In the old days pharma companies had to demonstrate

their drug worked; called product efficacy. It did not have to be better than existing drugs. If the drug worked, without big safety

issues, the company could launch it.

Then the business folks took over with ads, distribution,

salespeople and convention booths, convincing doctors to prescribe and us to

buy.

Big pharma companies grew into large, masterful consumer

products companies. Leadership’s view of the market changed, as it was

perceived safer to invest in Pepsi vs. Coke marketing tactics and sales warfare

to dominate a blockbuster category than product development. Think of the marketing cost in the

Celebrex vs. Vioxx war. Or Viagra

vs. Cialis.

But the market shifted when the FDA decided new drugs had to

be not only efficacious, they had to enhance the standard of care. New drugs actually had to prove better in clinical trials than existing

drugs. And often safer, too.

Hurrumph. Big pharma’s enormous scale advantages in

marketing and communication weren’t enough to assure new product success. It actually took new products. But that meant bigger R&D investments,

perceived as more risky, than the new consumer-oriented pharma companies could

tolerate. Shortly pipelines

thinned, generics emerged and much lower margins ensued.

In some disease areas, this evolution was disastrous for

patients. In antibiotics,

development of new drugs had halted.

Doctors repeatedly prescribed (some say overprescribed) the same antibiotics. As the bacteria evolved, infections

became more difficult to treat.

With no new antibiotics on the market the risk of death from

bacterial infections grew, leading to a national public health crisis. According to the Centers for Disease

Control (CDC) there are over 2 million cases of antibiotic resistant infections

annually. Today just one type of

resistant “staph infection,” known as MRSA, kills more people in the USA than

HIV/AIDs – killing more people every year than polio did at its peak. The most

difficult to treat pathogens (called ESKAPE) are the cause of 66% of hospital

infections.

And that led to an important market shift – via regulation

(Congress?!?!)

With help from the CDC and NIH, the Infectious Diseases

Society of America pushed through the GAIN (Generating Antibiotic Incentives

Now) Act (H.R. 2182.) This gave

creators of new antibiotics the opportunity for new, faster pathways through

clinical trials and review in order to expedite approvals and market launch.

Additionally new product market exclusivity was lengthened an additional 5

years (beyond the normal 5 years) to enhance investor returns.

Which allowed new game changers like Melinta Therapeutics

into the game.

Melinta (formerly Rib-X) was once considered a “biopharma science

company” with Nobel Prize-winning technology, but little hope of commercial

product launch. But now the large

unmet need is far clearer, the playing field has few to no large company

competitors, the commercialization process has been shortened and cheapened,

and the opportunity for extended returns is greater!

Venture firm Vatera Healthcare Partners, with a history of investing in game changers (especially transformational technology,) entered the picture as lead investor. Vatera's founder Michael Jaharis quickly hired Mary Szela, the former head of U.S.

Pharmaceuticals for Abbott (now Abbvie) as CEO. Her resume includes leading the growth of Humira, one of

the world’s largest pharma brands with multi-billion dollar annual sales.

Under her guidance Melinta has taken fast action to work

with the FDA on a much quicker clinical trials pathway of under 18 months for

commercializing delafloxacin. In layman’s

language, early trials of delafloxacin appeared to provide better performance

for a broad spectrum of resistant bacteria in skin infections. And as a one-dose oral (or IV)

application it could be a simpler, high quality solution for gonorrhea.

Melinta continues adding key management resources as it

seeks “breakthrough product” designation under GAIN from the FDA for its RX-04

product. RX-04 is an entirely

different scientific approach to infectious disease control, based on that previously

mentioned proprietary, Nobel-winning ribosome science. It’s a potential product category

game changer that could open the door for a pipeline of follow-on products.

Melinta is using GAIN to do something big pharma, with its

shrinking R&D and commercial staff, is unable to accomplish. Melinta is helping

redefine the rules for approving antibiotics, in order to push through new,

life-saving products.

The best news is that this game change is great for investors.

Those companies who understand the

trend (in this case, the urgent need for new antibiotics) and how the market

has shifted (GAIN,) are putting in place teams to leverage newly invented drugs

working with the FDA. Investment timelines and dollars are looking

far more manageable – and less risky.

Twenty-five years ago pharma looked like a big-company-only

market with little competition and huge returns for a handful of companies. But things changed. Now companies (like Melinta) with new

solutions have the opportunity to move much faster to prove efficacy and safety

– and save lives. They are the

game changers, and the ones more likely to provide not only solutions to the

market but high investor returns.

by Adam Hartung | Sep 19, 2013 | Current Affairs, In the Swamp, Innovation, Leadership, Television, Web/Tech

Apple announced the new iPhones recently. And mostly, nobody cared.

Remember when users waited anxiously for new products from Apple? Even the media became addicted to a new round of Apple products every few months. Apple announcements seemed a sure-fire way to excite folks with new possibilities for getting things done in a fast changing world.

But the new iPhones, and the underlying new iPhone software called iOS7, has almost nobody excited.

Instead of the product launches speaking for themselves, the CEO (Tim Cook) and his top product development lieutenants (Jony Ive and Craig Federighi) have been making the media rounds at BloombergBusinessWeek and USAToday telling us that Apple is still a really innovative place. Unfortunately, their words aren't that convincing. Not nearly as convincing as former product launches.

CEO Cook is trying to convince us that Apple's big loss of market share should not be troubling. iPhone owners still use their smartphones more than Android owners, and that's all we should care about. Unfortunately, Apple profits come from unit sales (and app sales) rather than minutes used. So the chronic share loss is quite concerning.

Especially since unit sales are now growing barely in single digits, and revenue growth quarter-over-quarter, which sailed through 2012 in the 50-75% range, have suddenly gone completely flat (less than 1% last quarter.) And margins have plunged from nearly 50% to about 35% – more like 2009 (and briefly in 2010) than what investors had grown accustomed to during Apple's great value rise. The numbers do not align with executive optimism.

For industry aficianados iOS7 is a big deal. Forbes Haydn Shaughnessy does a great job of laying out why Apple will benefit from giving its ecosystem of suppliers a new operating system on which to build enhanced features and functionality. Such product updates will keep many developers writing for the iOS devices, and keep the battle tight with Samsung and others using Google's Android OS while making it ever more difficult for Microsoft to gain Windows8 traction in mobile.

And that is good for Apple. It insures ongoing sales, and ongoing profits. In the slog-through-the-tech-trench-warfare Apple is continuing to bring new guns to the battle, making sure it doesn't get blown up.

But that isn't why Apple became the most valuable publicly traded company in America.

We became addicted to a company that brought us things which were great, even when we didn't know we wanted them – much less think we needed them. We were happy with CDs and Walkmen until we discovered much smaller, lighter iPods and 99cent iTunes. We were happy with our Blackberries until we learned the great benefits of apps, and all the things we could do with a simple smartphone. We were happy working on laptops until we discovered smaller, lighter tablets could accomplish almost everything we couldn't do on our iPhone, while keeping us 24×7 connected to the cloud (that we didn't even know or care about before,) allowing us to leave the laptop at the office.

Now we hear about upgrades. A better operating system (sort of sounds like Microsoft talking, to be honest.) Great for hard core techies, but what do users care? A better Siri; which we aren't yet sure we really like, or trust. A new fingerprint reader which may be better security, but leaves us wondering if it will have Siri-like problems actually working. New cheaper color cases – which don't matter at all unless you are trying to downgrade your product (sounds sort of like P&G trying to convince us that cheaper, less good "Basic" Bounty was an innovation.)

More (upgrades) Better (voice interface, camera capability, security) and Cheaper (plastic cases) is not innovation. It is defending and extending your past success. There's nothing wrong with that, but it doesn't excite us. And it doesn't make your brand something people can't live without. And, while it keeps the battle for sales going, it doesn't grow your margin, or dramatically grow your sales (it has declining marginal returns, in fact.)

And it won't get your stock price from $450-$475/share back to $700.

We all know what we want from Apple. We long for the days when the old CEO would have said "You like Google Glass? Look at this……. This will change the way you work forever!!"

We've been waiting for an Apple TV that let's us bypass clunky remote controls, rapidly find favorite shows and helps us avoid unwanted ads and clutter. But we've been getting a tease of Dick Tracy-esque smart watches.

From the world's #1 tech brand (in market cap – and probably user opinion) we want something disruptive! Something that changes the game on old companies we less than love like Comcast and DirecTV. Something that helps us get rid of annoying problems like expensive and bad electric service, or routers in our basements and bedrooms, or navigation devices in our cars, or thumb drives hooked up to our flat screen TVs —- or doctor visits. We want something Game Changing!

Apple's new CEO seems to be great at the Sustaining Innovation game. And that pretty much assures Apple of at least a few more years of nicely profitable sales. But it won't keep Apple on top of the tech, or market cap, heap. For that Apple needs to bring the market something big. We've waited 2 years, which is an eternity in tech and financial markets. If something doesn't happen soon, Apple investors deserve to be worried, and wary.

by Adam Hartung | Aug 6, 2013 | Current Affairs, Defend & Extend, In the Swamp, Innovation, Leadership

Jeff Bezos, founder of Amazon worth $25.2B just paid $250 million to become sole owner of The Washington Post.

Some think the recent rash of of billionaires buying newspapers is simply rich folks buying themselves trophies. Probably true in some instances – and that benefits no one. Just look at how Sam Zell ruined The Chicago Tribune and Los Angeles Times. Or Rupert Murdoch's less than stellar performance owning The Wall Street Journal. It's hard to be excited about a financially astute commodities manager, like John Henry, buying The Boston Globe – as it has all the earmarks of someone simply jumping in where angels fear to tread.

These companies lost their way long ago. For decades they defined themselves as newspaper companies. They linked everything about what they did to printing a daily paper. The service they provided, which was a mix of hard news and entertainment reporting, was lost in the productization of that service into a print deliverable.

So when people started to look for news and entertainment on-line, these companies chose to ignore the trend. They continued to believe that readers would always want the product – the paper – rather than the service. And they allowed themselves to remain fixated on old processes and outdated business models long after the market shifted.

The leaders ignored the fact that advertisers could obtain much more directed placement at targets, at far lower cost, on-line than through the broad-based, general ads placed in newspapers. And that consumers could get a much faster, and cheaper, sale via eBay, CraigsList or Vehix.com than via overpriced classified ads.

Newspaper leadership kept trying to defend their "core" business of collecting news for daily publication in a paper format. They kept trying to defend their local advertising base. Even though every month more people abandoned them for an on-line format. Not one major newspaper headmast made a strong commitment to go on-line. None tried to be #1 in news dissemination via the web, or take a leadership role in associating ad placement with news and entertainment.

They could have addressed the market shift, and changed their approach and delivery. But they did not.

Money manager Mr. Henry has done a good job of turning the Boston Red Sox into a profitable institution. But there is nothing in common between the Red Sox, for which you can grow the fan base, bring people to the ballpark and sell viewing rights, and The Boston Globe. The former is unique. The latter is obsolete. Yes, the New York Times company paid $1.1B for the Globe in 1993, but that doesn't mean it's worth $70M today. Given its revenue and cost structure, as a newspaper it is probably worth nothing.

But, we all still want news. Nobody wants the information infrastructure collecting what we need to know to crumble. Nobody wants journalism to die. But it is unreasonable to expect business people to keep investing in newspapers just to fulfill a public good. Even Mr. Zell abandoned that idea.

Thus, we need the news, as a service, to be transformed into a new, profitable enterprise. Somehow these organizations have to abandon the old ways of doing things, including print and paper distribution, and transform to meet modern needs. The 6 year revenue slide at Washington Post has to stop, and instead of thinking about survival company leadership needs to focus on how to thrive with a new, profitable business model.

And that's why we all should be glad Jeff Bezos bought The Washington Post. As head of Amazon.com The Harvard Business Review ranked him the second best performing CEO of the last decade. CNNMoney.com named him Business Person of the Year 2012, and called him "the ultimate disruptor."

By not doing what everyone else did, breaking all the rules of traditional retail, Mr. Bezos built Amazon.com into a $61B general merchandise retailer in 20 years. When publishers refused to create electronic books he led Amazon into competing with its suppliers by becoming a publisher. When Microsoft wouldn't produce an e-reader, retailer and publisher Amazon.com jumped into the intensely competitive world of personal electroncs creating and launching Kindle. And then upped the stakes against competitors by enhancing that into Kindle Fire. And when traditional IT suppliers like HP and Dell were slow to help small (or any) business move toward cloud computing Amazon launched its own network services to help the market shift.

Mr. Bezos' language regarding his intentions post acquisition are quite telling, "change… is essential… with or without new ownership….need to invent…need to experiment."

And that is exactly what the news industry needs today. Today's leaders are HuffingtonPost.com, Marketwatch.com and other web sites with wildly different business models than traditional paper media. WaPo success will require transforming a dying company, tied to an old success formula, into a trend-aligned organization that give people what they want, when they want it, at a profit.

And it's hard to think of someone better experienced, or skilled, than Jeff Bezos to provide that kind of leadership. With just a little imagination we can imagine some rapid moves:

- distribution of all content via Kindle style eReaders, rather than print. Along with dramatically increasing the cost of paper subscriptions and daily paper delivery

- Instead of a "one size fits all" general purpose daily paper, packaging news into more fitting targeted products. Sports stories on sports sites. Business stories on business sites. Deeper, longer stories into ebooks available for $.99 purchase. And repackaging of stories that cover longer time spans into electronic short-books for purchase.

- Packaging content into Facebook locations for targeted readers. Tying ads into these social media sites, and promoting ad sales for small, local businesses to the Facebook sites.

- Or creating an ala carte approach to buying various news and entertainment in an iTunes or Netflix style environment (or on those sites)

- Robustly attracting readers via connecting content with social media, including Twitter, to meet modern needs for immediacy, headline knowledge and links to deeper stories — with sales of ads onto social media

- Tying electronic coupons, and buy-it-now capabilities to ads linked to appropriate content

- Retargeting advertising sales from general purpose to targeted delivery at specific readers, with robust packages of on-line coupons, links to specials and fast, impulse purchase capability

- Increased use of bloggers and ad hoc writers to supplement staff in order to offer opinions and insights quickly, but at lower cost.

- Changes in compensation linked to page views and readership, just as revenue is linked to same.

We've watched a raft of newspapers and magazines disappear. This has not been a failure of journalism, but rather a failure of business leaders to address shifting markets and transform old organizations to meet modern needs. It's not a quality problem, but rather a failure of strategy to adapt to shifting markets. And that's a lesson every business leaders needs to note, because today, as I wrote in April, 2012, every company has to behave like a tech company!

Doing more of the same, cutting costs and rich egos won't fix a newspaper. Only the willingness to experiment and find new solutions which transform these organizations into something very different, well beyond print, will work. Let's hope Mr. Bezos brings the same zest for addressing these challenges and aligning with market needs he brought to Amazon. To a large extent, the future of news and "freedom of the press" may well depend upon it.

by Adam Hartung | Jun 28, 2013 | Current Affairs, Defend & Extend, In the Rapids, In the Whirlpool, Innovation, Leadership, Web/Tech

The last 12 months Tesla Motors stock has been on a tear. From $25 it has more than quadrupled to over $100. And most analysts still recommend owning the stock, even though the company has never made a net profit.

There is no doubt that each of the major car companies has more money, engineers, other resources and industry experience than Tesla. Yet, Tesla has been able to capture the attention of more buyers. Through May of 2013 the Tesla Model S has outsold every other electric car – even though at $70,000 it is over twice the price of competitors!

During the Bush administration the Department of Energy awarded loans via the Advanced Technology Vehicle Manufacturing Program to Ford ($5.9B), Nissan ($1.4B), Fiskar ($529M) and Tesla ($465M.) And even though the most recent Republican Presidential candidate, Mitt Romney, called Tesla a "loser," it is the only auto company to have repaid its loan. And did so some 9 years early! Even paying a $26M early payment penalty!

How could a start-up company do so well competing against companies with much greater resources?

Firstly, never underestimate the ability of a large, entrenched competitor to ignore a profitable new opportunity. Especially when that opportunity is outside its "core."

A year ago when auto companies were giving huge discounts to sell cars in a weak market I pointed out that Tesla had a significant backlog and was changing the industry. Long-time, outspoken industry executive Bob Lutz – who personally shepharded the Chevy Volt electric into the market – was so incensed that he wrote his own blog saying that it was nonsense to consider Tesla an industry changer. He predicted Tesla would make little difference, and eventually fail.

For the big car companies electric cars, at 32,700 units January thru May, represent less than 2% of the market. To them these cars are simply not seen as important. So what if the Tesla Model S (8.8k units) outsold the Nissan Leaf (7.6k units) and Chevy Volt (7.1k units)? These bigger companies are focusing on their core petroleum powered car business. Electric cars are an unimportant "niche" that doesn't even make any money for the leading company with cars that are very expensive!

This is the kind of thinking that drove Kodak. Early digital cameras had lots of limitations. They were expensive. They didn't have the resolution of film. Very few people wanted them. And the early manufacturers didn't make any money. For Kodak it was obvious that the company needed to remain focused on its core film and camera business, as digital cameras just weren't important.

Of course we know how that story ended. With Kodak filing bankruptcy in 2012. Because what initially looked like a limited market, with problematic products, eventually shifted. The products became better, and other technologies came along making digital cameras a better fit for user needs.

Tesla, smartly, has not tried to make a gasoline car into an electric car – like, say, the Ford Focus Electric. Instead Tesla set out to make the best car possible. And the company used electricity as the power source. By starting early, and putting its resources into the best possible solution, in 2013 Consumer Reports gave the Model S 99 out of 100 points. That made it not just the highest rated electric car, but the highest rated car EVER REVIEWED!

As the big car companies point out limits to electric vehicles, Tesla keeps making them better and addresses market limitations. Worries about how far an owner can drive on a charge creates "range anxiety." To cope with this Tesla not only works on battery technology, but has launched a program to build charging stations across the USA and Canada. Initially focused on the Los-Angeles to San Franciso and Boston to Washington corridors, Tesla is opening supercharger stations so owners are never less than 200 miles from a 30 minute fast charge. And for those who can't wait Tesla is creating a 90 second battery swap program to put drivers back on the road quickly.

This is how the classic "Innovator's Dilemma" develops. The existing competitors focus on their core business, even though big sales produce ever declining profits. An upstart takes on a small segment, which the big companies don't care about. The big companies say the upstart products are pretty much irrelevant, and the sales are immaterial. The big companies choose to keep focusing on defending and extending their "core" even as competition drives down results and customer satisfaction wanes.

Meanwhile, the upstart keeps plugging away at solving problems. Each month, quarter and year the new entrant learns how to make its products better. It learns from the initial customers – who were easy for big companies to deride as oddballs – and identifies early limits to market growth. It then invests in product improvements, and market enhancements, which enlarge the market.

Eventually these improvements lead to a market shift. Customers move from one solution to the other. Not gradually, but instead quite quickly. In what's called a "punctuated equilibrium" demand for one solution tapers off quickly, killing many competitors, while the new market suppliers flourish. The "old guard" companies are simply too late, lack product knowledge and market savvy, and cannot catch up.

- The integrated steel companies were killed by upstart mini-mill manufacturers like Nucor Steel.

- Healthier snacks and baked goods killed the market for Hostess Twinkies and Wonder Bread.

- Minolta and Canon digital cameras destroyed sales of Kodak film – even though Kodak created the technology and licensed it to them.

- Cell phones are destroying demand for land line phones.

- Digital movie downloads from Netflix killed the DVD business and Blockbuster Video.

- CraigsList plus Google stole the ad revenue from newspapers and magazines.

- Amazon killed bookstore profits, and Borders, and now has its sites set on WalMart.

- IBM mainframes and DEC mini-computers were made obsolete by PCs from companies like Dell.

- And now Android and iOS mobile devices are killing the market for PCs.

There is no doubt that GM, Ford, Nissan, et. al., with their vast resources and well educated leadership, could do what Tesla is doing. Probably better. All they need is to set up white space companies (like GM did once with Saturn to compete with small Japanese cars) that have resources and free reign to be disruptive and aggressively grow the emerging new marketplace. But they won't, because they are busy focusing on their core business, trying to defend & extend it as long as possible. Even though returns are highly problematic.

Tesla is a very, very good car. That's why it has a long backlog. And it is innovating the market for charging stations. Tesla leadership, with Elon Musk thought to be the next Steve Jobs by some, is demonstrating it can listen to customers and create solutions that meet their needs, wants and wishes. By focusing on developing the new marketplace Tesla has taken the lead in the new marketplace. And smart investors can see that long-term the odds are better to buy into the lead horse before the market shifts, rather than ride the old horse until it drops.

by Adam Hartung | Jun 17, 2013 | Current Affairs, Games, Innovation

If you're not a golfer, you may not understand the title. But it is important.

Sunday was the final, of four days, of the U.S. Open. Golf is clearly not as fan-favorited as soccer, football, basketball or hockey. But many people are aware of the "major" golf tournaments – just as non-horseracers know about the Kentucky Derby or Preakness. So there was more awareness than average about the sport on Sunday, and a tremendously greater amount of media coverage.

Interestingly, the big winner on the day was Octopus Pants. If you're confused – read on!

Monday morning if you opened a Yahoo! browser window and looked the top "trending now" box there, plain as day, was "Octopus pants." US Open was not there. Nor was the name of the winner – Justin Rose (who came from behind to win.) Nor the name of the leader for almost the entire tournament, and a huge crowd favorite in the sport, Phil Mickelson.

But, back in the pack, was a very good golfer named Billy Horschel. Although he's a great golfer, and a previous PGA tournament winner, was almost impossible to think he would win the U.S. Open on the final day, even though he shot a great second round (it takes 4 rounds to complete the tournament.) Barring a near-miracle, the focus would be on the leaders Sunday so there was a chance the relative newcomer would not receive much attention. [He did end up 6th – which is far better than the famous Tiger Woods, who came in 36th.]

In golf this is important because not only did it mean he would take home a smaller purse, but it also meant his value as an endorser for sponsors is lower. As a fairly new golfer to the Professional Golf Association (PGA) tournaments Mr. Horschel is known in golf circles because he plays Ping brand clubs. But few people know that for apparel Mr Horschel is sponsored by Ralph Lauren.

So, on Sunday he showed up wearing a pair of pants covered with images of Octopus. Pants that are part of the Ralph Lauren RXL line. Mr. Horschel (and the Lauren team) was smart enough to use social media (Twitter, etc.) to heighten interest in his appearance. This bit of assault on the sensibilities of golf, combined with fashion, sent interest in Mr. Horschel's apparel – if not his golf – viral. Not only were golfers looking for glimpses of Mr. Horschel's run for the leader board, but people not usually interested int the game were tuning in and keeping tabs via their mobile devices on his performance — and his pants!

Now, a combination of thinking ahead as to what he might wear, combined with some help from a smart sponsor like Lauren, and really smart use of social media marketing has helped Mr. Horschel, Lauren and Octopus Pants to become a global sensation. More interesting to more people than the tournament winner, the tournament leader and even the biggest names (including Rory McElroy, Graham McDowell, Ian Poulter, Luke Donald) in the sport — and their sponsors.

Winning often means thinking, and doing things, outside the box. Preparing to do something unconventional is important. While I'm sure there was a plan for Mr. Horschel to be much more typically attired had he been the tournament leader, Lauren's team did a great job of figuring out multiple outcomes and how to be a winner under multiple scenarios. Planning for how to win under multiple contingencies is critical in business. And having outside-the-box solutions thought through and ready to implement is the sign of a winning strategy – from different product to using unconventional marketing techniques.

While we all should congratulate Justin Rose on a big win the U.S. Open, the big winner here was Ralph Lauren – and Octopus pants!

by Adam Hartung | Apr 4, 2013 | Disruptions, In the Rapids, Innovation, Leadership, Web/Tech

The iPad is now 3 years old. Hard to believe we've only had tablets such a short time, given how common they have become. It's easy to forget that when launched almost all analysts thought the iPad was a toy that would be lucky to sell a few million units. Apple blew away that prediction in just a few months, as people demonstrated their lust for mobility. To date the iPad has sold 121million units – with an ongoing sales rate of nearly 20million per quarter.

Following very successful launches of the iPod (which transformed music from CDs to MP3) and iPhone (which turned everyone into smartphone users,) the iPad's transformation of personal technology made Apple look like an impenetrable juggernaut – practically untouchable by any competitor! The stock soared from $200/share to over $700/share, and Apple became the most valuable publicly traded company on any American exchange!

But things look very different now. Despite huge ongoing sales (iPad sales exceed Windows sales,) and a phenomenal $30B cash hoard ($100B if you include receivables) Apple's value has declined by 40%!

In the tech world, people tend to think competition is all about the product. Feature and functionality comparisons abound. And by that metric, no one has impacted Apple. After 3 years in development, Microsoft's much anticipated Surface has been a bust – selling only about 1.5million units in the first 6 months. Nobody has created a product capable of outright dethroning the i product series. Quite simply, there have been no "game changer" products that dramatically outperform Apple's.

But, any professor of introductory marketing will tell you that there are 4 P's in marketing: Product, Price, Place and Promotion. And understanding that simple lesson was the basis for the successful onslaught Samsung has waged upon Apple in 2012 and 2013.

Samsung did not change the game with technology or product. It has used the same Android starting point as most competitors for phones and tablets. It's products are comparable to Apple's – but not dramatically superior. And while they are cheaper, in most instances that has not been the reason people switched. Instead, Samsung changed the game by focusing on distribution and advertising!

Chart courtesy Jay Yarrow, Business Insider 4/2/13 and Horace Dediu, Asymco

The remarkable insight from this chart is that Samsung is spending almost 4.5 times Apple – and $1B more than perennial consumer goods brand leader Coca-Cola on advertising! Simultaneously, Samsung has set up kiosks and stores in malls and retail locations all over America.

Can you imagine having the following conversation in your company in 2010?:

"As Vice President of Marketing I propose we take on the market leader not by having a superior product. We will change the game from features and function comparisons to availability and awareness. I intend to spend more than anyone in our industry on advertising – even more than Coke. And I will open so many information and sales locations that our products will be as available as Coke. We'll be everywhere. Our products may not be better, but they will be everywhere and everyone will know about them."

Samsung found Apple's Achilles heel. As Apple's revenues rose it did not keep its marketing growing. SG&A (Selling, General and Administrative) expense declined from 14% of revenues in 2006 to 5% in 2012; of course aiding its skyrocketing profits. And Apple continued to sell through its fairly limited distribution of Apple stores and network providers. Apple started to "milk" its hard won brand position, rather than intensify it.

Samsung took advantage of Apple's oversight. Samsung maintained its SG&A budget at 15% of revenues – even growing it to 24% for a brief time in 2009, before returning to 15%. As its revenues grew, advertising and distribution grew. Instead of looking back at its old ad budget in dollars, and maintaining that budget, Samsung allowed the budget to grow (to a huge number!) along with revenues.

And that's how Samsung changed the game on Apple. Once America's untouchable brand, the Apple brand has faltered. People now question Apple's sustainability. Some now recognize Apple is vulnerable, and think its best times are behind it. And it's all because Samsung ignored the industry lock-in to constantly focusing on product, and instead changed the game on Apple.

Something Microsoft should have thought about – but didn't.

Of course, Apple's profits are far, far higher than Samsung's. And Apple is still a great company, and a well regarded brand, with tremendous sales. There are ongoing rumors of a new iOS 7 operating system, an updated format for iPads, potentially a dramatically new iPhone and even an iTV. And Apple is not without great engineers, and a HUGE war chest which it could use on advertising and distribution to go heads up with Samsung.

But, at least for now, Samsung has demonstrated how a competitor can change the game on a market leader. Even a leader as successful and powerful as Apple. And Samsung's leaders deserve a lot of credit for seeing the opportunity – and seizing it!