by Adam Hartung | Feb 29, 2012 | Current Affairs, Defend & Extend, In the Swamp, In the Whirlpool, Innovation, Leadership, Web/Tech

This week people are having their first look at Windows 8 via the Barcelona, Spain Mobile World Congress. This better be the most exciting Microsoft product since Windows was created, or Microsoft is going to fail.

Why? Because Microsoft made the fatal mistake of "focusing on its core" and "investing in what it knew" – time worn "best practices" that are proving disastrous!

Everyone knows that Microsoft has returned almost nothing to shareholders the last decade. Simultaneously, all the "partner" companies that were in the "PC" (the Windows + Intel, or Wintel, platform) "ecosystem" have done poorly. Look beyond Microsoft at returns to shareholders for Intel, Dell (which recently blew its earings) and Hewlett Packard (HP – which says it will need 5 years to turn around the company.) All have been forced to trim headcount and undertake deep cost cutting as revenues have stagnated since 2000, at times falling, and margins have been decimated.

This happened despite deep investments in their "core" PC business. In 2009 Microsoft spent almost $9B on PC R&D; over 14% of revenues. In the last few years Microsoft has launched Vista, Windows 7, Office 2009 and Office 2010 all in its effort to defend and extend PC sales. Likewise all the PC manufacturers have spent considerably on new, smaller, more powerful and even cheaper PC laptop and desktop models.

Unfortunately, these investments in their core expertise and markets have not excited users, nor created much growth.

On the other hand, Apple spent all of the last decade investing in what it didn't know much about in 2000. Rather than investing in its "core" Macintosh business, Apple invested in the trend toward mobility, being an early leader with 3 platforms – the iPod, iPhone and iPad. All product categories far removed from its "core" and what it new well. But, all targeted at the trend toward enhanced mobility.

Don't forget, Microsoft launched the Zune and the Windows CE phones in the last decade. But, because these were not "core" products in "core" markets Microsoft, and its partners, did not invest much in these markets. Microsoft even brought to market tablets, but leadership felt they were inferior to the PC, so investments were maintained in traditional PC products. The Zune, Windows phone and early Windows tablets all died because Microsoft and its partner companies stuck to investing their most important, and best known, PC business.

Where are we now? Sales of PC's are stagnating, and going to decline. While sales of mobile devices are skyrocketing.

Source: Business Insider 2/14/12

Today tablet sales are about 50% of the ~300M unit PC sales. But they are growing so fast they will catch up by 2014, and be larger by 2015. And, that depends on PC sales maintaining. Look around your next meeting, commuter flight or coffee shop experience and see how many tablets are being used compared to laptops. Think about that ratio a year ago, and then make your own assessment as to how many new PCs people will buy, versus tablets. Can you imagine the PC market actually shrinking? Like, say, the traditional cell phone business is doing?

By focusing on Windows, and specifically each generation leading to Windows 8, Microsoft took a crazy bet. It bet it could improve windows to keep the PC relevant, in the face of the evident trend toward mobility and ease of use. Instead of investing in new technologies, new products and new markets – things it didn't know much about – Microsoft chose to invest in what it new, and hoped it could control the trend.

People didn't want a PC to be mobile, they wanted mobility. Apple invested in the trend, making the MP3 player a winner with its iPod ease of use and iTunes market. Then it made smartphones, which were largely an email device, incredibly popular by innovating the app marketplace which gave people the mobility they really desired. Recognizing that people didn't really want a PC, they wanted mobility, Apple pioneered the tablet marketplace with its iPad and large app market. The result was an explosion in revenue by investing outside its core, in technologies and markets about which it initially knew nothing.

Apple would not have grown had it focused its investment on its "core" Mac business. In the last year alone Apple sold more iOS devices than it sold Macs in its entire 28 year history!

Source: Business Insider 2/17/2012

Today, the iPhone business itself is bigger than all of Microsoft. The iPad business is bigger than the desktop PC business, and if included in the larger market for personal computing represents 17% of the PC market. And, of course, Apple is now worth almost twice the value of Microsoft.

We hear, all the time, to invest in what we know. But it turns out that is NOT the best strategy. Trends develop, and markets shift. By constantly investing in what we know we become farther and farther removed from trends. In the end, like Microsoft, we make massive investments trying to defend and extend our past products when we would be much, much smarter to invest in new technologies and markets that are on the trend, even if we don't know much, if anything, about them.

The odds are now stacked against Microsoft. Apple has a huge lead in product sales, market position and apps. It's closest challenger is Google's Android, which is attracting many of the former Microsoft partners (such as LG's recent defection) as they strive to catch up. Company's such as Nokia are struggling as the technology leadership, and market position, has shifted away from Microsoft as mobility changed the market.

Microsoft's technology sales used to be based upon convincing IT departments to use its platform. But today users largely buy mobile devices with their own money, and eschew the recommendations of the IT department. Just look at how users drove the demise of Research In Motion's Blackberry. IT needs to provide users with tools they like, and use platforms which are easy and low-cost to leverage with big app bases. That favors Apple and Android, not Microsoft with its far, far too late entry.

You can be smarter than Microsoft. Don't take the crazy bet of always doubling down on what you know. Put your focus on the marketplace, and identify shifts. It's cheaper, and smarter, to bet early on trends than constantly trying to fight the trend by investing – usually at an ever higher amount – in what you know.

by Adam Hartung | Aug 18, 2011 | Current Affairs, Defend & Extend, In the Swamp, Innovation, Leadership, Lifecycle, Web/Tech

The business world was surprised this week when Google announced it was acquiring Motorola Mobility for $12.5B – a 63% premium to its trading price (Crain’s Chicago Business). Surprised for 3 reasons:

- because few software companies move into hardware

- effectively Google will now compete with its customers like Samsung and HTC that offer Android-based phones and tablets, and

- because Motorola Mobility had pretty much been written off as a viable long-term competitor in the mobile marketplace. With less than 9% share, Motorola is the last place finisher – behind even crashing RIM.

Truth is, Google had a hard choice. Android doesn’t make much money. Android was launched, and priced for free, as a way for Google to try holding onto search revenues as people migrated from PCs to cloud devices. Android was envisioned as a way to defend the search business, rather than as a profitable growth opportunity. Unfortunately, Google didn’t really think through the ramifications of the product, or its business model, before taking it to market. Sort of like Sun Microsystems giving away Java as a way to defend its Unix server business. Oops.

In early August, Google was slammed when the German courts held that the Samsung Galaxy Tab 10.1 could not be sold – putting a stop to all sales in Europe (Phandroid.com “Samsung Galaxy Tab 10.1 Sales Now Blocked in Europe Thanks to Apple.”) Clearly, Android’s future in Europe was now in serious jeapardy – and the same could be true in the USA.

This wasn’t really a surprise. The legal battles had been on for some time, and Tab had already been blocked in Australia. Apple has a well established patent thicket, and after losing its initial Macintosh Graphical User Interface lead to Windows 25 years ago Apple plans on better defending its busiensses these days. It was also well known that Microsoft was on the prowl to buy a set of patents, or licenses, to protect its new Windows Phone O/S planned for launch soon.

Google had to either acquire some patents, or licenses, or serously consider dropping Android (as it did Wave, Google PowerMeter and a number of other products.) It was clear Google had severe intellectual property problems, and would incur big legal expenses trying to keep Android in the market. And it still might well fail if it did not come up with a patent portfolio – and before Microsoft!

So, Google leadership clearly decided “in for penny, in for a pound” and bought Motorola. The acquisition now gives Google some 16-17,000 patents. With that kind of I.P. war chest, it is able to defend Android in the internicine wars of intellectual property courts – where license trading dominates resolutions between behemoth competitors.

Only, what is Google going to do with Motorola (and Android) now? This acquisition doesn’t really fix the business model problem. Android still isn’t making any money for Google. And Motorola’s flat Android product sales don’t make any money either.

Source: Business Insider.com

In fact, the Android manufacturers as a group don’t make much money – especially compared to industry leader Apple:

Source: Business Insider.com

There was a lot of speculation that Google would sell the manufacturing business and keep the patents. Only – who would want it? Nobody needs to buy the industry laggard. Regardless of what the McKinsey-styled strategists might like to offer as options, Google really has no choice but to try running Motorola, and figuring out how to make both Android and Motorola profitable.

And that’s where the big problem happens for Google. Already locked into battles to maintain search revenue against Bing and others, Google recently launched Google+ in an all-out war to take on the market-leading Facebook. In cloud computing it has to support Chrome, where it is up against Microsoft, and again Apple. Oh my, but Google is now in some enormously large competitive situations, on multiple fronts, against very well-heeled competitors.

As mentioned before, what will Samsung and HTC do now that Google is making its own phones? Will this push them toward Microsoft’s Windows offering? That would dampen enthusiasm for Android, while breathing life into a currently non-competitor in Microsoft. Late to the game, Microsoft has ample resources to pour into the market, making competition very, very expensive for Google. It shows all the signs of two gladiators willing to fight to the loss-amassing death.

And Google will be going into this battle with less-than-stellar resources. Motorola is the market also ran. Its products are not as good as competitors, and its years of turmoil – and near failure – leading to the split-up of Motorola has left its talent ranks decimated – even though it still has 19,000 employees Google must figure out how to manage (“Motorola Bought a Dysfunctional Company and the Worst Android Handset Maker, says Insider“).

Acquisitions that “work” are ones where the acquirer buys a leader (technology, products, market) usually in a high growth area – then gives that acquisition the permission and resources to keep adapting and growing – what I call White Space. That’s what went right in Google’s acquisitions of YouTube and DoubleClick, for example. With Motorola, the business is so bad that simply giving it permssion and resources will lead to greater losses. It’s hard to disaagree with 24/7 Wall Street.com when divulging “S&P Gives Big Downgrade on Google-Moto Deal.”

Some would like to think of Google as creating some transformative future for mobility and copmuting. Sort of like Apple.

Yea, right.

Google is now stuck defending & extending its old businesses – search, Chrome O/S for laptops, Google+ for mail and social media, and Android for mobility products. And, as is true with all D&E management, its costs are escalating dramatically. In every market except search Google has entered into gladiator battles late against very well resourced competitors with products that are, at best, very similar – lacking game-changing characteristics. Despite Mr. Page’s potentially grand vision, he has mis-positioned Google in almost all markets, taken on market-leading and well funded competition, and set Google up for a diasaster as it burns through resources flailing in efforts to find success.

If you weren’t convinced of selling Google before, strongly consider it now. The upcoming battles will be very, very expensive. This acquisition is just so much chum in the water – confusing but not beneficial.

And if you still don’t own Apple – why not? Nothing in this move threatens the technology, product and market leader which continues bringing game-changers to market every few months.

by Adam Hartung | May 3, 2011 | Current Affairs, Defend & Extend, In the Swamp, Leadership, Lock-in, Web/Tech

For the first time in 20 years, Apple’s quarterly profit exceeded Microsoft’s (see BusinessWeek.com “Microsoft’s Net Falls Below Apple As iPad Eats Into Sales.) Thus, on the face of things, the companies should be roughly equally valued. But they aren’t. This week Microsoft’s market capitalization is about $215B, while Apple’s is about $365B – about 70% higher. The difference is, of course, growth – and how a lack of it changes management!

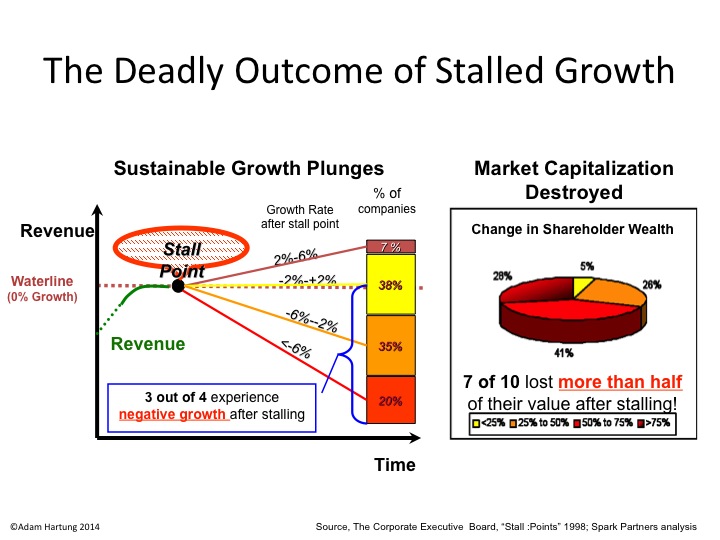

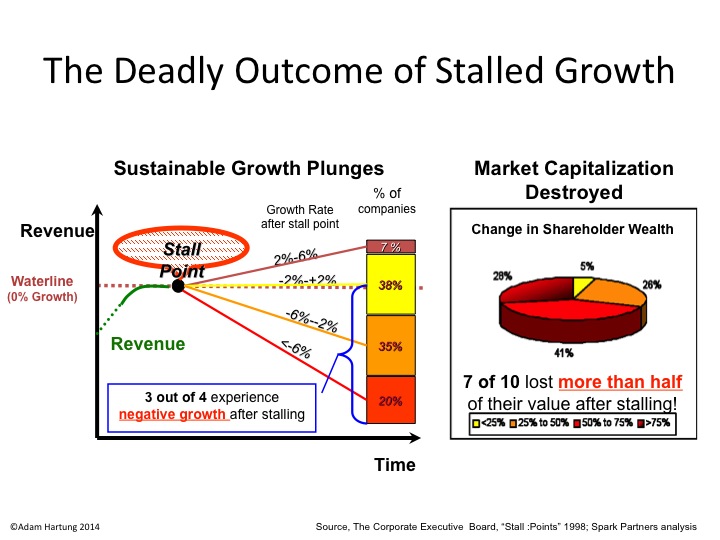

According to the Conference Board, growth stalls are deadly.

When companies hit a growth stall, 93% of the time they are unable to maintain even a 2% growth rate. 75% fall into a no growth, or declining revenue environment, and 70% of them will lose at least half their market capitalization. That’s because the market has shifted, and the business is no longer selling what customers really want.

At Microsoft, we see a company that has been completely unable to deal with the market shift toward smartphones and tablets:

- Consumer PC shipments dropped 8% last quarter

- Netbook sales plunged 40%

Quite simply, when revenues stall earnings become meaningless. Even though Microsoft earnings were up, it wasn’t because they are selling what customers really want to buy. In stalled companies, executives cut costs in sales, marketing, new product development and outsource like crazy in order to prop up earnings. They can outsource many functions. And they go to the reservoir of accounting rules to restate depreciation and expenses, delaying expenses while working to accelerate revenue recognition.

Stalled company management will tout earnings growth, even though revenues are flat or declining. But smart investors know this effort to “manufacture earnings” does not create long-term value. They want “real” earnings created by selling products customers desire; that create incremental, new demand. Success doesn’t come from wringing a few coins out of a declining market – but rather from being in markets where people prefer the new solutions.

Mobile phone sales increased 20% (according to IDC), and Apple achieved 14% market share – #3 – in USA (according to MediaPost.com) last quarter. And in this business, Apple is taking the lion’s share of the profits:

Image provided by BusinessInsider.com

When companies are growing, investors like that they pump earnings (and cash) back into growth opportunities. Investors benefit because their value compounds. In a stalled company investors would be better off if the company paid out all their earnings in dividends – so investors could invest in the growth markets.

But, of course, stalled companies like Microsoft and Research in Motion, don’t do that. Because they spend their cash trying to defend the old business. Trying to fight off the market shift. At Microsoft, money is poured into trying to protect the PC business, even as the trend to new solutions is obvious. Microsoft spent 8 times as much on R&D in 2009 as Apple – and all investors received was updates to the old operating system and office automation products. That generated almost no incremental demand. While revenue is stalling, costs are rising.

At Gurufocus.com the argument is made “Microsoft Q3 2011: Priced for Failure“. Author Alex Morris contends that because Microsoft is unlikely to fail this year, it is underpriced. Actually, all we need to know is that Microsoft is unlikely to grow. Its cost to defend the old business is too high in the face of market shifts, and the money being spent to defend Microsoft will not go to investors – will not yield a positive rate of return – so investors are smart to get out now!

Additionally, Microsoft’s cost to extend its business into other markets where it enters far too late is wildly unprofitable. Take for example search and other on-line products:

Chart source BusinessInsider.com

While much has been made of the ballyhooed relationship between Nokia and Microsoft to help the latter enter the smartphone and tablet businesses, it is really far too late. Customer solutions are now in the market, and the early leaders – Apple and Google Android – are far, far in front. The costs to “catch up” – like in on-line – are impossibly huge. Especially since both Apple and Google are going to keep advancing their solutions and raising the competitive challenge. What we’ll see are more huge losses, bleeding out the remaining cash from Microsoft as its “core” PC business continues declining.

Many analysts will examine a company’s earnings and make the case for a “value play” after growth slows. Only, that’s a mythical bet. When a leader misses a market shift, by investing too long trying to defend its historical business, the late-stage earnings often contain a goodly measure of “adjustments” and other machinations. To the extent earnings do exist, they are wasted away in defensive efforts to pretend the market shift will not make the company obsolete. Late investments to catch the market shift cost far too much, and are impossibly late to catch the leading new market players. The company is well on its way to failure, even if on the surface it looks reasonably healthy. It’s a sucker’s bet to buy these stocks.

Rarely do we see such a stark example as the shift Apple has created, and the defend & extend management that has completely obsessed Microsoft. But it has happened several times. Small printing press manufacturers went bankrupt as customers shifted to xerography, and Xerox waned as customers shifted on to desktop publishing. Kodak declined as customers moved on to film-less digital photography. CALMA and DEC disappeared as CAD/CAM customers shifted to PC-based Autocad. Woolworths was crushed by discount retailers like KMart and WalMart. B.Dalton and other booksellers disappeared in the market shift to Amazon.com. And even mighty GM faltered and went bankrupt after decades of defend behavior, as customers shifted to different products from new competitors.

Not all earnings are equal. A dollar of earnings in a growth company is worth a multiple. Earnings in a declining company are, well, often worthless. Those who see this early get out while they can – before the company collapses.

Update 5/10/11 – Regarding announced Skype acquisition by Microsoft

That Microsoft has apparently agreed to buy Skype does not change the above article. It just proves Microsoft has a lot of cash, and can find places to spend it. It doesn’t mean Microsoft is changing its business approach.

Skype provides PC-to-PC video conferencing. In other words, a product that defends and extends the PC product. Exactly what I predicted Microsoft would do. Spend money on outdated products and efforts to (hopefully) keep people buying PCs.

But smartphones and tablets will soon support video chat from the device; built in. And these devices are already connected to networks – telecom and wifi – when sold. The future for Skype does not look rosy. To the contrary, we can expect Skype to become one of those features we recall, but don’t need, in about 24 to 36 months. Why boot up a PC to do a video chat you can do right from your hand-held, always-on, device?

The Skype acquisition is a predictable Defend & Extend management move. It gives the illusion of excitement and growth, when it’s really “so much ado about nothing.” And now there are $8.5B fewer dollars to pay investors to invest in REAL growth opportunities in growth markets. The ongoing wasting of cash resources in an effort to defend & extend, when the market trends are in another direction.

by Adam Hartung | Feb 9, 2010 | Defend & Extend, In the Swamp, Innovation, Leadership, Lock-in, Web/Tech

Sustaining growth is really hard. Consulting firm Bain & Company just published the statistic that only 12% of companies were able to grow revenues and profits more than 5.5% from 1998 to 2008 (read more in the Harvard Business Review downloadable book excerpt Profit from the Core.) Given that all companies want to grow, it seems remarkable so many stall.

But while most managers blame lack of growth on the economy, truth is we can learn a lot from those who DID sustain growth. What doesn't work, and what does, can be found by starting with a great OpEd column about Microsoft published in The New York Times "Microsoft's Creative Destruction." Former Microsoft Vice President Dick Brass provides insight to why Microsoft has become a market laggard in new products – despite enormous revenues, profits and new product development spending. Calling Microsoft "a clumsy, uncompetitive innovator," he says products are "lampooned" and the company is "failing." Harsh words.

He points out that profits are almost entirely from legacy products Windows and Office. "Microsoft has lost share in Web browsers, high-end laptops and smartphones. Despite billions in investment, its Xbox line is still at best an equal contender in the game console business." He explains how internal managers set up false hurdles, often claiming quality was the primary issue, for ClearType and a tablet PC. He claims the internal executives "sabotaged" new projects and he blames inability to meet market needs on "internecine warfare."

But all of that could be said about Apple as well. It once was just like Microsoft. In the 1990s Apple stopped everything but new Macs from making it to market. Remember that the first PDA (personal digital assistant) was Apole's Newton? Killing that product became a priority for several Apple executives, and caused the ouster of then CEO John Scully

So the Microsoft described behaviors can happen anyplace. When organizations begin to focus on Defending & Extending their "core" business it leads to hurdles and growth stalls. "Operational improvements" leads to "focusing" on doing what the business always did, perhaps just a touch better (like a next generation operating system [Vista], or a new variation on Office [2007].) The culture, decision-making processes and operating cost model all are geared to doing more of the same. Without intending any downside, in fact in pursuit of improved competitiveness in the "core" products, the business begins erecting hurdles to doing anything new, or different.

This problem isn't limited to Microsoft Although we can clearly see the impact and feel pessimistic about Microsoft's future. It has afflicted many companies, and is why they cannot adjust to market shifts. Even if loaded with executives and enormous budgets for R&D, technology or marketing. Don't forget how Apple looked even worse than Microsoft in 2000.

And that's why so few companies maintain growth. The desire to do more, better, faster, cheaper of what we've always done is overwhelming. Defending & Extending the existing business always looks marginally better, and marginally less risky, than doing something new, or different. In trying to maintain growth by getting better at what you've always done – you kill it.

Why? Because Defend & Extend management does not take account of market shifts. New products, new competitors, new technologies, new business models, new customer approaches — the list is endless of variations which competitors bring to the marketplace. And these variations change the market. Trying to stay on the same course becomes suicide when customers begin moving on.

And that's where Apple has excelled. When Steve Jobs took over he quit trying to Defend & Extend the Mac platform. To the contrary, he reduced the number of Mac models. Instead of planning based on old market share and sales, he pushed a rigorous scenario planning exercise to create a robust view of future markets – and what needs customers would like solved. He then led Apple to study competitors, both in-kind and on the fringe, to identify new markets being developed and new solutions being tested. He then Disrupted Apple – by cutting the Mac platforms and investing heavily in other market opportunities like music (iPod and iTunes). And he encouraged product managers to rush new products to market in order to obtain market feedback, using White Space teams to rapidly learn what would sell. And he repeated this again and again, agreeing to a joint development project with Motorola before entering into mobile phone testing and launch (iPhone.)

Microsoft's proclivity toward D&E management is putting its future at grave risk. All signs are it will become another fateful, negative statistic. But it doesn't have to be that way. Microsoft can learn a lesson from its resurrected competitor and follow The Phoenix Principle. It can escape from xBox, and other new product, second-tier status if it will get a lot more robust about scenario planning, quit acting like the only game in town and start obsessing about competition. Disrupt its culture and decision making, and start using White Space to rapidly get new products in the market and learn how to match them with market needs to succeed!

by Adam Hartung | Jul 26, 2009 | Uncategorized

"Is the Party Over for Microsoft?" is the headline at Marketwatch.com. In case you missed it, last week Microsoft reported sales and earnings, and "Microsoft declines on disappointing results" was the most appropriate headline. Sales dropped 17%. Let's see, the last time we heard about a mega-corporation with double-digit revenue declines that would have been – oh yes – GM – and Chrysler.

This blog has been brutally negative on Microsoft for over 3 years. A quick look at the long-term chart and you'll note that the stock has not come near its 2000 high this decade. It's been mired in a go-nowhere range, and has recently broken down to prices last seen in the late 1990s. For investors, Microsoft has been only a disappointment.

But that's because the company has been equally disappointing for customers. Microsoft has been very consistent about trying to "milk" it's near-monopoly in desktop operating systems and office software. Even though the market has moved, Microsoft has done little to move with it. It's applications are "more of the same." It's operating systems have become bloated, and new versions have offered practically no advantages to switch. Meanwhile, customers are learning to enjoy Linux – and Macs again – as well as Unix for servers. There's literally been nothing for customers, investors — or suppliers to get excited about. Ask Dell, itself stuck in the doldrums as a Microsoft devotee.

It's not due to a lack of opportunities in the dynamic IT world. Since 2000 we've seen the emergence of Google, which simply cleaned Microsoft's clock in search and ad placement. The world of digital music became dominant, but that was claimed by Apple. Hot websites for information became valuable – but Marketwatch and HuffingtonPost (examples) are laying claim to attracting lots of readers. Microsoft simply missed these markets. Always late, and never really in step with shifting market requirements. The company tried, failed, and just kept "clipping coupons" from its near- monopoly.

It hasn't been hard to see the market shifting. Customers were put off by Microsoft's disregard for their needs in the 1990s. They searched for better solutions, and found them. Microsoft kept being Microsoft, but the world moved. Now, Microsoft is stuck. And what are they going to do to get out of their rut?

When a company is large, has a lot of cash, and has strong market share analysts are reluctant to predict it will do poorly. But Microsoft has been so Locked-in, for so long, it has been quietly letting all new markets go to new competitors. There have been NO Disruptions to the Success Formula. Windows and Office have dominated the investments. "Taking care of the franchise" has been the mantra. That meant doing more of the same. Which got us Vista – an operating system that was over a year late to market, and very easy to ignore. There hasn't been any White Space to develop new solutions. And as a result whenever Microsoft has tried to do anything new it has been late, with inferior product, a significant lack of knowledge about what the market really wanted, and out of step with new requirements for performance and price.

Microsoft won't declare bankruptcy in 2009 – or 2010. But it's acting just like GM. It's spending all its time trying to Defend & Extend its past. But in fast changing markets, that's not enough to remain viable. In markets moving as fast as IT, it's deadly. Remember DEC? Wang? Lanier? Burroughs? Univac? IBM mainframes? Cray supercomputers? Microsoft is more like GM than it's like Google. Thus, it's future isn't hard to predict. If you're an employee, time to brush up the resume. If you're an investor, time to look for the exit.

Do'nt miss the new ebook "The Fall of GM: What Went Wrong and How To Avoid It's Mistakes"