by Adam Hartung | Jun 19, 2014 | Current Affairs, Disruptions, In the Swamp, Leadership, Web/Tech

Yesterday Amazon launched its new Kindle Fire smartphone.

“Ho-hum” you, and a lot of other people, said. “Why?” “What’s so great about this phone?”

The market is dominated by Apple and Samsung, to the point we no longer care about Blackberry – and have pretty much forgotten about all the money spent by Microsoft to buy Nokia and launch Windows 8. The world doesn’t much need a new smartphone maker – as we’ve seen with the lack of excitement around Google/Motorola’s product launches. And, despite some gee-whiz 3D camera and screen effects, nobody thinks Amazon has any breakthrough technology here.

But that would be completely missing the point. Amazon probably isn’t even thinking of competing heads-up with the 2 big guns in the smartphone market. Instead, Amazon’s target is everyone in retail. And they should be scared to death. As well as a lot of consumer products companies.

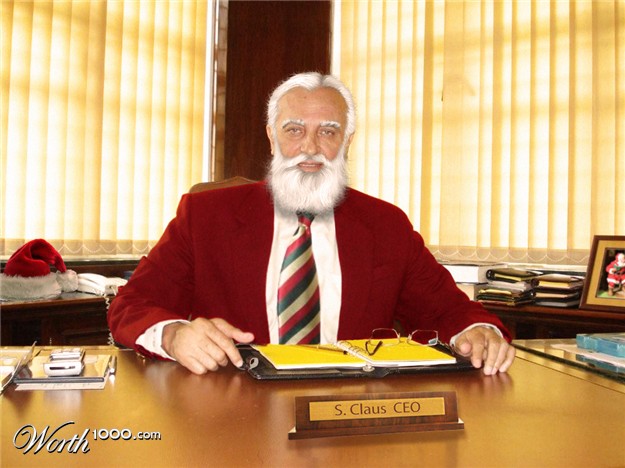

Amazon’s new Kindle Fire smartphone

Apple’s iPod and iPhones have some 400,000 apps. But most people don’t use over a dozen or so daily. Think about what you do on your phone:

- Talk, texting and email

- Check the weather, road conditions, traffic

- Listen to music, or watch videos

- Shopping (look for products, prices, locations, specs, availability, buy)

Now, you may do several other things. But (maybe not in priority,) these are probably the top 4 for 90% of people.

If you’re Amazon, you want people to have a great shopping experience. A GREAT experience. You’ve given folks terrific interfaces, across multiple platforms. But everything you do with an app on iPhones or Samsung phones involves negotiating with Apple or Google to be in their store – and giving them revenue. If you could bypass Apple and Google – a form of retail “middleman” in Amazon’s eyes – wouldn’t you?

Amazon has already changed retail markedly. Twenty years ago a retailer would say success relied on 2 things:

- Store location and layout. Be in the right place, and be easy to shop.

- Merchandise the goods well in the store, and have them available.

Amazon has killed both those tenets of retail. With Amazon there is no store – there is no location. There are no aisles to walk, and no shelves to stock. There is no merchandising of products on end caps, within aisles or by tagging the product for better eye appeal. And in 40%+ cases, Amazon doesn’t even stock the inventory. Availability is based upon a supplier for whom Amazon provides the storefront and interface to the customer, sending the order to the supplier for a percentage of the sale.

And, on top of this, the database at Amazon can make your life even easier, and less time consuming, than a traditional store. When you indicate you want item “A” Amazon is able to show you similar products, show you variations (such as color or size,) show you “what goes with” that product to make sure you buy everything you need, and give you different prices and delivery options.

Many retailers have spent considerably training employees to help customers in the store. But it is rare that any retail employee can offer you the insight, advice and detail of Amazon. For complex products, like electronics, Amazon can provide detail on all competitive products that no traditional store could support. For home fix-ups Amazon can provide detailed information on installation, and the suite of necessary ancillary products, that surpasses what a trained Home Depot employee often can do. And for simple products Amazon simply never runs out of stock – so no asking an aisle clerk “is there more in the back?”

And it is impossible for any brick-and-mortar retailer to match the cost structure of Amazon. No stores, no store employees, no cashiers, 50% of the inventory, 5-10x the turns, no “obsolete inventory,” no inventory loss – there is no way any retailer can match this low cost structure. Thus we see the imminent failure of Radio Shack and Sears, and the chronic decline in mall rents as stores go empty.

Some retailers have tried to catch up with Amazon offering goods on-line. But the inventory is less, and delivery is still often problematic. Meanwhile, as they struggle to become more digital these retailers are competing on ground they know precious little about. It is becoming commonplace to read about hackers stealing customer data and wreaking havoc at Michaels Stores and Target. Thus on-line customers have far more faith in Amazon, which has 2 decades of offering secure transactions and even offers cloud services secure enough to support major corporations and parts of the U.S. government.

And Amazon, so far, hasn’t even had to make a profit. It’s lofty price/earnings multiple of 500 indicates just how little “e” there is in its p/e. Amazon keeps pouring money into new ways to succeed, rather than returning money to shareholders via stock buybacks or dividends. Or dumping it into chronic store remodels, or new store construction.

Today, you could shop at Amazon from your browser on any laptop, tablet or phone. Or, if you really enjoy shopping on-line you can now obtain a new tablet or phone from Amazon which makes your experience even better. You can simply take a picture of something you want, and your new Amazon smartphone will tell you how to buy it on-line, including price and delivery. No need to leave the house. Want to see the product in full 360 degrees? You have it on your 3D phone. And all your buying experience, customer reviews, and shopping information is right at your fingertips.

Amazon is THE game changer in retail. Kindle was a seminal product that has almost killed book publishers, who clung way too long to old print-based business models. Kindle Fire took direct aim at traditional retailers, from Macy’s to Wal-Mart, in an effort to push the envelope of on-line shopping. And now the Kindle Fire smartphone puts all that shopping power in your palm, convenient with your other most commonplace uses such as messaging, fact finding, listening or viewing.

This is not a game changing smartphone in comparison with iPhone 5 or Galaxy S 5. But, as another salvo in the ongoing war for controlling the retail marketplace this is another game changer. It continues to help everyone think about how they shop today, and in the future. For anyone in retail, this may well be seen as another important step toward changing the industry forever, and making “every day low prices” an obsolete (and irrelevant) retail phrase. And for consumer goods companies this means the need to distribute products on-line will forever change the way marketing and selling is done – including who makes how much profit.

by Adam Hartung | May 8, 2014 | Current Affairs, Leadership

Lots of press this week about Target’s CEO and Chairman, Gregg Steinhafel, apparently being forced out. Blame reached the top job after the successful cyber attack on the company last year. But investors, and customers, may regret this somewhat Board level over-reaction to a mounting global problem.

Richard Clark is probably America’s foremost authority on cyber attacks. He was on America’s National Security Council, and headed the counter-terrorism section. Since leaving government he has increasingly focused on cyber attacks, and advised corporations.

In early 2013 I met Mr. Clark after hearing him speak at a National Association of Corporate Directors meeting. He was surprisingly candid in his comments at the meeting, and after. He pointed out that EVERY company in America was being randomly targeted by cyber criminals, and that EVERY company would have an intrusion. He said it was impossible to do business without working on-line, and simultaneously it was impossible to think any company – of any size – could stop an attack from successfully getting into the company. The only questions one should focus on answering were “How fast can you discover the attack? How well can you contain it? What can you learn to at least stop that from happening again?”

So, while the Target attack was large, and not discovered as early as anyone would like, to think that Target is in some way wildly poor at security or protecting its customers is simply naive. Several other large retailers have also had attacks, include Nieman Marcus and Michael’s, and it was probably bad luck that Target was the first to have such a big problem happen, and at such a bad time, than anything particularly weak about Target.

We now know that all retailers are trying to learn from this, and every corporation is raising its awareness and actions to improve cyber security. But someone will be next. Target wasn’t the first, and won’t be the last. Companies everywhere, working with law enforcement, are all reacting to this new form of crime. So firing the CEO, 2 months after firing the CIO (Chief Information Officer), makes for good press, but it is more symbolic than meaningful. It won’t stop the hackers.

Where this decision does have great importance is to shareholders and customers. Target has been a decent company for its constituents under this CEO, and done far better than some of its competitors. The share price has doubled in the last 5 years, and Target has proven a capable competitor to Wal-Mart while other retailers have been going out of business (Filene’s Basement, Circuit City, Linens & Things, Dots, etc.) or losing all relevancy (like Abercrombie and Fitch and Best Buy.) And Target has been at least holding its own while some chains have been closing stores like crazy (Radio Shack 1,100 stores, Family Dollar 370 stores, Office Depot 400 stores, etc.)

Just compare Target’s performance to JCPenney, who’s CEO was fired after screwing up the business far worse than the cyber attack hurt Target. Or, look at Sears Holdings. CEO Ed Lampert was heralded as a hero 6 years ago, but since then the company he leads has had 28 straight quarters of declining sales, and closed 305 stores since 2010. Kmart has become a complete non-competitor in discounting, and Sears has lost all relevancy as a chain as it has been outflanked on all sides. CEO Lampert has constantly whittled away at the company’s value, and just this week told shareholders that they can simply plan on more store closings in the future.

And vaunted Wal-Mart is undergoing a federal investigation for bribing government officials in Mexico to prop up its business. Wal-Mart is constantly under attack by its employees for shady business practices, and even lost a National Labor Relations Board case regarding its hours and pay practices. And Wal-Mart remains a lightning rod for controversy as it fights with big cities like Chicago and Washington, DC about its ability to open stores, while Target has flourished in communities large and small with work practices considered acceptable. And Target has avoided these sort of internally generated management scandals.

CEOs, and Boards of Directors, across the nation have been seriously addressing cyber security for the last couple of years. Awareness, and protective measures, are up considerably. But there will be future attacks, and some will succeed. It is unclear blaming the CEO for these problems makes any sense – unless there is egregious incompetence.

On the other hand, finding a CEO that can grow a business like Target, in a tough retail market, is not easy. Destroying KMart, while battling Wal-Mart, and still trying to figure out how to compete with Amazon.com is a remarkably difficult job. Perhaps the toughest CEO job in the country. Steinhafel had performed better than most. Investors, and customers, may soon regret that he’s not still leading Target.

by Adam Hartung | Feb 9, 2014 | Current Affairs, Defend & Extend, Food and Drink, In the Swamp, Leadership, Lifecycle, Lock-in

There is a definite trend to raising the minimum wage. Regardless your political beliefs, the pressure to increase the minimum wage keeps growing. The important question for business leaders is, “Are we prepared for a $12 or $15 minimum wage?”

President Obama began his push for raising the minimum wage above $10 a year ago in his 2013 State of the Union. Since then, several articles have been written on income inequality and raising the minimum wage. Although the case to raise it is not clear cut, there is no doubt it has increased the rhetoric against the top 1% of earners. And now the President is mandating an increase in the minimum wage for federal workers and contractors to $10.10/hour, despite lack of congressional support and flak from conservatives.

Whether the economic case is provable, it appears that public sentiment is greatly in favor of a much higher minimum wage. And it will not affect all companies the same. Those that depend upon low priced labor, such as retailers like Wal-Mart and fast food companies like McDonald’s have a much higher concern. As should their employees, suppliers and investors.

A recent Federal Reserve report took a specific look at what happens to fast food companies when the minimum wage goes up, such as happened in Illinois, California and New Jersey. And the results were interesting. Because they discovered that a higher minimum wage really did hurt McDonald’s, causing stores to close. But….. and this is a big but…. those closed stores were rapidly replaced by competitors that could pay the higher wages, leading to no loss of jobs (and an overall increase in pay for labor.)

The implications for businesses that use low-priced labor are clear. It is time to change the business model – to adapt for a different future. A higher minimum wage does not doom McDonald’s – but it will force the company to adapt. If McDonald’s (and Burger King, Wendy’s, Subway, Dominos, Pizza Hut, and others) doesn’t adapt the future will be very ugly for their customers and the company. But if these companies do adapt there is no reason the minimum wage will hurt them particularly hard.

The chains that replaced McDonald’s closed stores were Five Guys, Chick-fil-A and Chipotle. You might remember that in 1998 McDonald’s started investing in Chipotle, and by 2001 McDonald’s owned the chain. And Chipotle’s grew rapidly, from a handful of restaurants to over 500. But then in 2006 McDonald’s sold all its Chipotle stock as the company went IPO, and used the proceeds to invest in upgrading McDonald’s stores and streamlining the supply chain toward higher profits on the “core” business.

Now, McDonald’s is shrinking while Chipotle is growing. Bloomberg/BusinessWeek headlined “Chipotle: The One That Got Away From McDonalds” (Oct. 3, 2013.) Investors were well served to trade in McDonald’s stock for Chipotle’s. And franchisees have suffered through sales problems as they raised prices off the old “dollar menu” while suffering higher food costs creating shrinking margins. Meanwhile Chipotle’s franchisees have been able to charge more, while keeping customers very happy, and maintain margins while paying higher wages. In a nutshell, Chipotle’s (and similar competitors) has captured the lost McDonald’s business as trends favor their business.

So McDonald’s obviously made a mistake. But that does not mean “game over.” All McDonald’s, Burger King and Wendy’s need to do is adapt. Fighting the higher minimum wage will lead to a lot of grief. There is no doubt wages will go up. So the smart thing to do is figure out what these stores will look like when minimum wages double. What changes must happen to the menu, to the store look, to the brand image in order for the company to continue attracting customers profitably.

This will undoubtedly include changes to the existing brands. But, these companies also will benefit from revisiting the kind of strategy McDonald’s used in the 1990s when buying Chipotle’s. Namely, buying chains with a different brand and value proposition which can flourish in a higher wage economy. These old-line restaurants don’t have to forever remain dominated by the old brands, but rather can transition along with trends into companies with new brands and new products that are more desirable, and profitable, as trends change the game. Like The Limited did when selling its stores and converting into L Brands to remain a viable company.

Now is the time to take action. Waiting until forced to take action will be too late. If McDonald’s and its brethren (and Wal-Mart and its minimum-wage-paying retail brethren) remain locked-in to the old way of doing business, and do everything possible to defend-and-extend the old success formula, they will follow Howard Johnson’s, Bennigan’s, Circuit City, Sears and a plethora of other companies into brand, and profitability, failure. Fighting trends is a route to disaster.

However, by embracing the trend and taking action to be successful in a future scenario of higher labor these companies can be very successful. There is nothing which dictates they have to follow the road to irrelevance while smarter brands take their place. Rather, they need to begin extensive scenario planning, understand how these competitors succeed and take action to disrupt their old approach in order to create a new, more profitable business that will succeed.

Disruptions happen all the time. In the 1970s and 1980s gasoline prices skyrocketed, allowing offshore competitors to upend the locked-in Detroit companies that refused to adapt. On-line services allowed Google Maps to wipe out Rand-McNally, Travelocity to kill OAG and Wikipedia to kill bury Encyclopedia Britannica. These outcomes were not dictated by events. Rather, they reflect an inability of an existing leader to adapt to market changes. An inability to embrace disruptions killed the old competitors, while opening doors for new competitors which embraced the trend.

Now is the time to embrace a higher minimum wage. Every business will be impacted. Those who wait to see the impact will struggle. But those who embrace the trend, develop future scenarios that incorporate the trend and design new business opportunities can turn this disruption into a big win.

by Adam Hartung | Dec 19, 2013 | Current Affairs, Leadership

Everyone has a stake in America’s big, public corporations. Either as an investor, employee, customer, supplier or community leader. So how these corporations perform is a big deal for all of us.

Unfortunately, we’ve had all too many corporations that have their problems. But, amazingly, we see little change in the CEO, or CEO compensation. When one of the USA‘s largest employers, McDonald’s, uses its hotline to tell low-paid employees they should avoid breaking open Christmas gift boxes, and instead return gifts for cash to buy gas and groceries, it’s not a bad idea to take a look at top executive pay. And with so many people still looking for work, and unemployment for people under 25 at something like 15%, there is an ongoing question as to whether CEOs are being held accountable or simply granted their jobs regardless of performance.

Given that Scrooge was a banker, why not start by looking at bank CEOs? And who better to glance at than the ultra-high profile Jamie Dimon, CEO and Chairman of JPMorganChase.

In 2012 Mr. Dimon told us there were really no problems in the JPMC derivatives business. We later learned that – oops – the unit did actually lose something like $6billion. Mr. Dimon was nice enough to admit this was more than a “templest in a teapot,” and eventually apoligized. He asked us to all realize that JPMC is really big, and mistakes will happen. Just forget about it and move on he recommended.

But in 2013 the regulators said “not so fast” and fined JPMC close to $1billion for failure to properly safeguard the public interest. The Board felt compelled to reflect on this misadventure and cut Mr. Dimon’s pay in half to a paltry $18.7million. That means in the year when things went $7billion wrong, he was paid nearly $37million – and the penalty was to subsequently receive only $19million. Thus his total compensation for 2 years, during which $7billion evaporated from the bank, was (roughly) $50M.

It appears unlikely anyone will be returning gifts to buy ham and beans in the Dimon household this year.

Mr. Dimon was spanked by the Board, and he is no longer the most highly paid CEO in the banking industry. That 2013 title goes to Wells Fargo CEO John Stumpf, who received about $23M. Wells Fargo is still sorting out the mess from all those bad mortgages which have left millions of Americans with foreclosures, bankruptcies, costly short-sales and mortgages greater than the home value. But, hotlines are now in place and things are getting better!

CEO compensation is interesting because it is all relative. Pay is minimally salary – never more than $1M (although that alone is a really big number to most people.) Bonuses make up most of the compensation,based on relative metrics tied to comparisons with industry peers. So, if an industry does badly and every company does poorly the CEOs still get paid their bonuses. You don’t have to be a Steve Jobs or Jeff Bezos with new insights, lots of growth, great products and margins to be paid a lot. Just don’t do a whole lot worse than some peer group you are compared against.

Which then brings us to the whole idea of why CEOs that make big mistakes – like the whopper at JPMC – so easily keep their jobs. Would a McDonald’s cashier that missed handing out change by $7 (1 one-billionth the JPMC mistake) likely be paid well – or fired? What about a JPMC bank teller? Yet, even when things go terribly wrong we rarely see a CEO lose their job.

During this shopping season, just look at Sears. Ed Lampert cut his pay to $1 in 2013. Hooray! But this did not help the company.

Sears and Kmart business is so bad CEO Lampert changed strategy in 2013 to selling profitable stores rather than more lawn mowers and hand tools in order to keep the company alive. Yet, as more employees leave, suppliers risk being repaid, communities lose their stores and retail jobs and tax base, Mr. Lampert remains Sears Holdings CEO. We accept that because he owns so much stock he has the “right” to remain CEO.

Perhaps Mr. Lampert deserves a visit from his own personal Jacob Marley, who might make him realize that there is more to life (and business) than counting cash flow and seeking lower cost financing options. Mr. Lampert can arise each morning before dawn to browbeat employees via conference webinars, and micromanage a losing business. But it leaves him sounding a lot like Scrooge. Meanwhile those behaviors have not stopped Sears and KMart from losing all market relevancy, and spiraling toward failure.

CEO pay-to-worker ratios have increased 1,000% since 1950. (How’s that for a “relative” metric?) Today the average CEO makes 200 times the company’s workforce (the top 100 make 300 times as much – and the CEO of Wal-Mart has a pension 6,182 times that of the average employee.) Is it any wonder so many investors, employees, customers, suppliers and community leaders are paying so much attention to CEO performance – and pay?

We are all thankful for the good CEO that develops long-range plans, spends time investing in growth projects, developing employees, increasing revenue and margins while expanding the communities in which the company lives and works. It just doesn’t happen often enough.

This Christmas, as many before, as we look at our portfolios, paychecks, pensions, product quality, service quality and communities too many of us wish far too often for better CEOs, and compensation really aligned with long-term performance for all constituencies.

by Adam Hartung | Aug 1, 2013 | Defend & Extend, Food and Drink, In the Swamp, Leadership

Alex Robles protests in front of a McDonald’s in 2013, in Phoenix. (AP Photo/Ross D. Franklin)

Horatio Alger wrote books in the 1800s about young poor boys who became wealthy via clean living and hard work. Americans loved the idea that anyone can become rich, and loved those stories. We love them as much today as then, clinging to the non-rich roots of successes like Steve Jobs.

Unfortunately, such possibilities have been growing tougher in America. Today U.S. income inequality is among the highest in the world, while income mobility is among the lowest. You are more likely to go from rags to riches in France or Germany than the USA. Net/net – in current circumstances your most important decision is who will be your parents, because if you are born rich you will likely live a rich life, while if you are born poor you’ll probably die poor.

Organizations like Occupy Wall Street have tried to bring the problem of inequality and jobs to the face of America – with mixed results. But the truth is that 80% of Americans will face poverty and unemployment in their lifetimes. And the biggest growth in poverty, declining marriage rates and single mother households all belong to white Americans today. These poverty related issues are no longer tied to skin color or immigration they way they once were.

It’s safe to say that a lot of Americans are sounding like the famous Howard Beale phrase from the 1976 movie “Network” and starting to say “I’m mad as hell, and I’m not going to take this any more!”

This situation has given birth to a new trend – frequently referred to as the “living wage.” A living wage allows one parent to earn enough money from a single 40 hour per week job to feed, cloth, educate, transport and otherwise lead a decent life for a family of 4. Today in America this is in the range of $13.50-$15.00 per hour.

This, of course, should not be confused with the minimum wage which is a federally (or state) mandate to pay a specific minimum hourly wage. Because the minimum wage is lower than living wage, a movement has been started to match the two numbers – something which would roughly double today’s $7.25 federal minimum wage.

This concept would have been heresy just 40 years ago. America’s Chamber of Commerce and other pro-business groups have long attempted to abolish the minimum wage, and have fought hard against any and every increase.

As the income inequality gap has widened popularity has grown for this movement, however, and now 70% of Americans support higher minimum wages, almost 3 times those who don’t. Whether effective or not, this week fast food employees took to old fashioned strikes and picket lines in New York City, Chicago, St. Louis, Milwaukee and Detroit for higher wages.

Regardless of your opinion about the economics (or politics) of such a move, the trend is definitely building for taking action.

The biggest industries affected by such an increase would be fast food and retail. And if these companies don’t do something to adapt to this trend the results could be pretty severe.

McDonald’s is the largest fast food company. And it definitely does not pay a living wage. The company recently published for employees a budget for trying to live on a McDonald’s income, and it translated into requiring employees work 2 full-time jobs. Rancor about the posted budget was widespread, as even pro-business folks found it amazing a company could put out such a document while its CEO (and other execs) make many multiples of what most employees earn.

Estimates are that a wage increase to $15/hour for employees would cost McDonald’s $8B. McDonald’s showed $10B of Gross Income in 2012, and $8B of Pre-Tax Income. Obviously, should the living wage movement pass nationally McDonald’s investors would see a devastating impact. Simultaneously, prices would have to increase hurting customers and suppliers would likely be pinched to the point of losses.

Couple this with McDonald’s laissez-faire attitude about obesity trends, and you have two big trends that don’t bode well for rising returns for shareholders. Yet, other than opposing regulations and government action on these matters McDonald’s has shown no ability to adapt to these rather important, and impactful, trends. Hoping there will be no legislation is a bad strategy. Fighting against any change, given the public health and economic situation, is as silly as fighting against regulations on tobacco was in the 1960s. But so far there has been no proposed adaptation to McDonald’s 50 year old success formula offered to investors, employees, customers or legislators.

WalMart is America’s largest retailer. And the most vitriolic opposing higher wages. Even though a living wage increase would cost customers only $12/year. When Washington, DC passed a requirement retailers pay a living wage WalMart refused to build and open 4 proposed new stores. Even though the impact would be only $.46/customer visit (estimated at $12.50/customer/year.)

It would seem such harsh action, given the small impact, is a bit illogical. Given that WalMart is already out of step with the trend toward on-line shopping, why would the company want to take such an additional action fighting against a trend that affects not only its profits, but most of its customers — who would benefit from a rise in income and buying power?

In 1914 Henry Ford was suffering from high turnover and a generally unhappy workforce. He reacted by doubling pay – with his famous “$5 day”. Not only did he reduce turnover, he became the perferred employer in his industry – and rather quickly it became clear that employees who formerly could not afford an automobile were able to now become customers at the new, higher pay scale. Apparently nobody at WalMart is familiar with this story. Or they lack the will to apply it.

Fighting trends is expensive. Yet, most leadership teams become stuck defending & extending an old strategy – an old success formula – even after it is out of date. Most companies don’t fail because the leadership is incompetent, but rather because they fail to adapt to trends and changing circumstances. Long-lived companies are those which build for future scenarios, rather than trying to keep the world from changing by spending on lobbyists, advertising and other efforts to halt (or reverse) a trend.

McDonald’s and WalMart (and for that matter Yum Brands, Wendy’s, JCPenney, Sears, Best Buy and a whole host of other companies) are largely unwilling to admit that the future is likely to look different than the past. Will that kill them? It sure won’t help them. But investors could feel a lot more comfortable (as would employees, suppliers and customers) if they would develop and tell us about their strategies to adapt to changing circumstances.

Are you looking at trends, developing scenarios about the future and figuring out how to adapt in ways that will help you profitably grow? Or are you stuck defending and extending an old success formula even as markets shift and trends move customers in different directions?

Follow Adam's coverage in press and other media