by Adam Hartung | Nov 18, 2015 | Current Affairs, Defend & Extend, In the Swamp, In the Whirlpool, Leadership, Web/Tech

Microsoft recently announced it was offering Windows 10 on xBox, thus unifying all its hardware products on a single operating system – PCs, mobile devices, gaming devices and 3D devices. This means that application developers can create solutions that can run on all devices, with extensions that can take advantage of inherent special capabilities of each device. Given the enormous base of PCs and xBox machines, plus sales of mobile devices, this is a great move that expands the Windows 10 platform.

Only it is probably too late to make much difference. PC sales continue falling – quickly. Q3 PC sales were down over 10% versus a year ago. Q2 saw an 11% decline vs year ago. The PC market has been steadily shrinking since 2012. In Q2 there were 68M PCs sold, and 66M iPhones. Hope springs eternal for a PC turnaround – but that would seem increasingly unrealistic.

The big market shift to mobile devices started back in 2007 when the iPhone began challenging Blackberry. By 2010 when the iPad launched, the shift was in full swing. And that’s when Microsoft’s current problems really began. Previous CEO Steve Ballmer went “all-in” on trying to defend and extend the PC platform with Windows 8 which began development in 2010. But by October, 2012 it was clear the design had so many trade-offs that it was destined to be an Edsel-like flop – a compromised product unable to please anyone.

The big market shift to mobile devices started back in 2007 when the iPhone began challenging Blackberry. By 2010 when the iPad launched, the shift was in full swing. And that’s when Microsoft’s current problems really began. Previous CEO Steve Ballmer went “all-in” on trying to defend and extend the PC platform with Windows 8 which began development in 2010. But by October, 2012 it was clear the design had so many trade-offs that it was destined to be an Edsel-like flop – a compromised product unable to please anyone.

By January, 2013 sales results were showing the abysmal failure of Windows 8 to slow the wholesale shift into mobile devices. Ballmer had played “bet the company” on Windows 8 and the returns were not good. It was the failure of Windows 8, and the ill-fated Surface tablet which became a notorious billion dollar write-off, that set the stage for the rapid demise of PCs.

And that demise is clear in the ecosystem. Microsoft has long depended on OEM manufacturers selling PCs as the driver of most sales. But now Lenovo, formerly the #1 PC manufacturer, is losing money – lots of money – putting its future in jeopardy. And Dell, one of the other top 3 manufacturers, recently pivoted from being a PC manufacturer into becoming a supplier of cloud storage by spending $67B to buy EMC. The other big PC manufacturer, HP, spun off its PC business so it could focus on non-PC growth markets.

And, worse, the entire OEM market is collapsing. For the largest 4 PC manufacturers sales last quarter were down 4.5%, while sales for the remaining smaller manufacturers dropped over 20%! With fewer and fewer sales, consolidation is wiping out many companies, and leaving those remaining in margin killing to-the-death competition.

And, worse, the entire OEM market is collapsing. For the largest 4 PC manufacturers sales last quarter were down 4.5%, while sales for the remaining smaller manufacturers dropped over 20%! With fewer and fewer sales, consolidation is wiping out many companies, and leaving those remaining in margin killing to-the-death competition.

Which means for Microsoft to grow it desperately needs Windows 10 to succeed on devices other than PCs. But here Microsoft struggles, because it long eschewed its “channel suppliers,” who create vertical market applications, as it relied on OEM box sales for revenue growth. Microsoft did little to spur app development, and rather wanted its developers to focus on installing standard PC units with minor tweaks to fit vertical needs.

Today Apple and Google have both built very large, profitable developer networks. Thus iOS offers 1.5M apps, and Google offers 1.6M. But Microsoft only has 500K apps largely because it entered the world of mobile too late, and without a commitment to success as it tried to defend and extend the PC. Worse, Microsoft has quietly delayed Project Astoria which was to offer tools for easily porting Android apps into the Windows 10 market.

Microsoft realized it needed more developers all the way back in 2013 when it began offering bonuses of $100,000 and more to developers who would write for Windows. But that had little success as developers were more keen to achieve long-term sales by building apps for all those iOS and Android devices now outselling PCs. Today the situation is only exacerbated.

By summer of 2014 it was clear that leadership in the developer world was clearly not Microsoft. Apple and IBM joined forces to build mobile enterprise apps on iOS, and eventually IBM shifted all its internal PCs from Windows to Macintosh. Lacking a strong installed base of Windows mobile devices, Microsoft was without the cavalry to mount a strong fight for building a developer community.

In January, 2015 Microsoft started its release of Windows 10 – the product to unify all devices in one O/S. But, largely, nobody cared. Windows 10 is lots better than Win8, it has a great virtual assistant called Cortana, and it now links all those Microsoft devices. But it is so incredibly late to market that there is little interest.

Although people keep talking about the huge installed base of PCs as some sort of valuable asset for Microsoft, it is clear that those are unlikely to be replaced by more PCs. And in other devices, Microsoft’s decisions made years ago to put all its investment into Windows 8 are now showing up in complete apathy for Windows 10 – and the new hybrid devices being launched.

AM Multigraphics and ABDick once had printing presses in every company in America, and much of the world. But when Xerox taught people how to “one click” print on a copier, the market for presses began to die. Many people thought the installed base would keep these press companies profitable forever. And it took 30 years for those machines to eventually disappear. But by 2000 both companies went bankrupt and the market disappeared.

Those who focus on Windows 10 and “universal windows apps” are correct in their assessment of product features, functions and benefits. But, it probably doesn’t matter. When Microsoft’s leadership missed the mobile market a decade ago it set the stage for a long-term demise. Now that Apple dominates the platform space with its phones and tablets, followed by a group of manufacturers selling Android devices, developers see that future sales rely on having apps for those products. And Windows 10 is not much more relevant than Blackberry.

by Adam Hartung | Sep 22, 2015 | Current Affairs, Disruptions, In the Rapids, Innovation

A recent analyst took a look at the impact of electric vehicles (EVs) on the demand for oil, and concluded that they did not matter. In a market of 95million barrels per day production, electric cars made a difference of 25,000 to 70,000 barrels of lost consumption; ~.05%.

You can’t argue with his arithmetic. So far, they haven’t made any difference.

But then he goes on to say they won’t matter for another decade. He forecasts electric vehicle sales grow 5-fold in one decade, which sounds enormous. That is almost 20% growth year over year for 10 consecutive years. Admittedly, that sounds really, really big. Yet, at 1.5million units/year this would still be only 5% of cars sold, and thus still not a material impact on the demand for gasoline.

But then he goes on to say they won’t matter for another decade. He forecasts electric vehicle sales grow 5-fold in one decade, which sounds enormous. That is almost 20% growth year over year for 10 consecutive years. Admittedly, that sounds really, really big. Yet, at 1.5million units/year this would still be only 5% of cars sold, and thus still not a material impact on the demand for gasoline.

This sounds so logical. And one can’t argue with his arithmetic.

But one can argue with the key assumption, and that is the growth rate.

Do you remember owning a Walkman? Listening to compact discs? That was the most common way to listen to music about a decade ago. Now you use your phone, and nobody has a walkman.

Remember watching movies on DVDs? Remember going to Blockbuster, et.al. to rent a DVD? That was common just a decade ago. Now you likely have shelved the DVD player, lost track of your DVD collection and stream all your entertainment. Bluckbuster, infamously, went bankrupt.

Do you remember when you never left home without your laptop? That was the primary tool for digital connectivity just 6 years ago. Now almost everyone in the developed world (and coming close in the developing) carries a smartphone and/or tablet and the laptop sits idle. Sales for laptops have declined for 5 years, and a lot faster than all the computer experts predicted.

Markets that did not exist for mobile products 10 years ago are now huge. Way beyond anyone’s expectations. Apple alone has sold over 48million mobile devices in just 3 months (Q3 2015.) And replacing CDs, Apple’s iTunes was downloading 21million songs per day in 2013 (surely more by now) reaching about 2billion per quarter. Netflix now has over 65million subscribers. On average they stream 1.5hours of content/day – so about 1 feature length movie. In other words, 5.85billion streamed movies per quarter.

What has happened to old leaders as this happened? Sony hasn’t made money in 6 years. Motorola has almost disappeared. CD and DVD departments have disappeared from stores, bankrupting Circuit City and Blockbuster, and putting a world of hurt on survivors like Best Buy.

The point? When markets shift, they often shift a lot faster than anyone predicts. 20%/year growth is nothing. Growth can be 100% per quarter. And the winners benefit unbelievably well, while losers fall farther and faster than we imagine.

Tesla was barely an up-and-comer in 2012 when I said they would far outperform GM, Ford and Toyota. The famous Bob Lutz, a long-term widely heralded auto industry veteran chastised me in his own column “Tesla Beating Detroit – That’s Just Nonsense.”

Mr. Lutz said I was comparing a high-end restaurant to McDonald’s, Wendy’s and Pizza Hut, and I was foolish because the latter were much savvier and capable than the former. He should have used as his comparison Chipotle, which I predicted would be a huge winner in 2011. Those who followed my advice would have made more money owning Chipotle than any of the companies Mr. Lutz preferred.

The point? Market shifts are never predicted by incumbents, or those who watch history. The rate of change when it happens is so explosive it would appear impossible to achieve, and far more impossible to sustain. The trends shift, and one market is rapidly displaced by another.

While GM, Ford and Toyota struggle to maintain their mediocrity, Tesla is winning “best car” awards one after another – even “breaking” Consumer Reports review system by winning 103 points out of a maximum 100, the independent reviewer liked the car so much. Tesla keeps selling 100% of its production, even at its +$100K price point.

So could the market for EVs wildly grow? BMW has announced it will make all models available as electrics within 10 years, as it anticipates a wholesale market shift by consumers promoted by stricter environmental regulations. Petroleum powered car sales will take a nosedive.

The International Energy Agency (IEA) points out that EVs are just .08% of all cars today. And of the 665,000 on the road, almost 40% are in the USA, where they represent little more than a rounding error in market share. But there are smaller markets where EV sales have strong share, such as 12% in Norway and 5% in the Netherlands.

So what happens if Tesla’s new lower priced cars, and international expansion, creates a sea change like the iPod, iPhone and iPad? What happens if people can’t get enough of EVs? What happens if international markets take off, due to tougher regulations and higher petrol costs? What happens if people start thinking of electric cars as mainstream, and gasoline cars as old technology — like two-way radios, VCRs, DVD players, low-definition picture tube TVs, land line telephones, fax machines, etc?

What if demand for electric cars starts doubling each quarter, and grows to 35% or 50% of the market in 10 years? If so, what happens to Tesla? Apple was a nearly bankrupt, also ran, tiny market share company in 2000 before it made the world “i-crazy.” Now it is the most valuable publicly traded company in the world.

Already awash in the greatest oil inventory ever, crude prices are down about 60% in the last year. Oil companies have already laid-off 50,000 employees. More cuts are planned, and defaults expected to accelerate as oil companies declare bankruptcy.

It is not hard to imagine that if EVs really take off amidst a major market shift, oil companies will definitely see a precipitous decline in demand that happens much faster than anticipated.

To little Tesla, which sold only 1,500 cars in 2010 could very well be positioned to make an enormous difference in our lives, and dramatically change the fortunes of its shareholders — while throwing a world of hurt on a huge company like Exxon (which was the most valuable company in the world until Apple unseated it.)

[Note: I want to thank Andreas de Vries for inspiring this column and assisting its research. Andreas consults on Strategy Management in the Oil & Gas industry, and currently works for a major NOC in the Gulf.]

by Adam Hartung | Jul 8, 2015 | Current Affairs, Defend & Extend, In the Whirlpool, Leadership, Lock-in, Web/Tech

Microsoft announced today it was going to shut down the Nokia phone unit, take a $7.6B write-off (more than the $7.2B they paid for it,) and lay off another 7,800 employees. That makes the layoffs since CEO Nadella took the reigns almost 26,000. Finding any good news in this announcement is a very difficult task.

Unfortunately, since taking over as Microsoft’s #1 leader, Mr. Nadella has been remarkably predictable. Like his peer CEOs who take on the new role, he has slashed and burned employment, shut down at least one big business, taken massive write-offs, and undertaken at least one wildly overpriced acquisition (Minecraft) that is supposed to be a game changer for the company. He apparently picked up the “Turnaround CEO Playbook” after receiving the job and set out on the big tasks!

Unfortunately, since taking over as Microsoft’s #1 leader, Mr. Nadella has been remarkably predictable. Like his peer CEOs who take on the new role, he has slashed and burned employment, shut down at least one big business, taken massive write-offs, and undertaken at least one wildly overpriced acquisition (Minecraft) that is supposed to be a game changer for the company. He apparently picked up the “Turnaround CEO Playbook” after receiving the job and set out on the big tasks!

Yet he still has not put forward a strategy that should encourage investors, employees, customers or suppliers that the company will remain relevant long-term. Amidst all these big tactical actions, it is completely unclear what the strategy is to remain a viable company as customers move, quickly and in droves, to mobile devices using competitive products.

I predicted here in this blog the week Steve Ballmer announced the acquisition of Nokia in September, 2013 that it was “a $7.2B mistake.” I was off, because in addition to all the losses and restructuring costs Microsoft endured the last 7 quarters, the write off is $7.6B. Oops.

Why was I so sure it would be a mistake? Because between 2011 and 2013 Nokia had already lost half its market share. CEO Elop, who was previously a Microsoft senior executive, had committed Nokia completely to Windows phones, and the results were already catastrophic. Changing ownership was not going to change the trajectory of Nokia sales.

Microsoft had failed to build any sort of developer community for Windows 8 mobile. Developers need people holding devices to buy their software. Nokia had less than 5% share. Why would any developer build an app for a Windows phone, when almost the entire market was iOS or Android? In fact, it was clear that developing rev 2, 3, and 4 of an app for the major platforms was far more valuable than even bothering to port an app into Windows 8.

Nokia and Windows 8 had the worst kind of tortuous whirlpool – no users, so no developers, and without new (and actually unique) software there was nothing to attract new users. Microsoft mobile simply wasn’t even in the game – and had no hope of winning. It was already clear in June, 2012 that the new Windows tablet – Surface – was being launched with a distinct lack of apps to challenge incumbents Apple and Samsung.

By January, 2013 it was also clear that Microsoft was in a huge amount of trouble. Where just a few years before there were 50 Microsoft-based machines sold for every competitive machine, by 2013 that had shifted to 2 for 1. People were not buying new PCs, but they were buying mobile devices by the shipload – literally. And there was no doubt that Windows 8 had missed the mobile market. Trying too hard to be the old Windows while trying to be something new made the product something few wanted – and certainly not a game changer.

A year ago I wrote that Microsoft has to win the war for developers, or nothing else matters. When everyone used a PC it seemed that all developers were writing applications for PCs. But the world shifted. PC developers still existed, but they were not able to grow sales. The developers making all the money were the ones writing for iOS and Android. The growth was all in mobile, and Microsoft had nothing in the game. Meanwhile, Apple and IBM were joining forces to further displace laptops with iPads in commercial/enterprise uses.

Then we heard Windows 10 would change all of that. And flocks of people wrote me that a hybrid machine, both PC and tablet, was the tool everyone wanted. Only we continue to see that the market is wildly indifferent to Windows 10 and hybrids.

Imagine you write with a fountain pen – as most people did 70 years ago. Then one day you are given a ball point pen. This is far easier to use, and accomplishes most of what you want. No, it won’t make the florid lines and majestic sweeps of a fountain pen, but wow it is a whole lot easier and a darn site cheaper. So you keep the fountain pen for some uses, but mostly start using the ball point pen.

Then the fountain pen manufacturer says “hey, I have a contraption that is a ball point pen, sort of, and a fountain pen, sort of, combined. It’s the best of all worlds.” You would likely look at it, but say “why would I want that. I have a fountain pen for when I need it. And for 90% of the stuff I write the ball point pen is great.”

That’s the problem with hybrids of anything – and the hybrid tablet is no different. The entrenched sellers of old technology always think a hybrid is a good idea. But once customers try the new thing, all they want are advancements to the new thing. (Just look at the interest in Tesla cars compared to the stagnant sales of hybrid autos.)

And we’re up to Surface 3 now. When I pointed out in January, 2013 that the markets were rapidly moving away from Microsoft I predicted Surface and Surface Pro would never be important products. Reader outcry at that time from Microsoft devotees was so great that Forbes editors called me on the carpet and told me I lacked the data to make such a bold prediction. But I stuck by my guns, we changed some language so it was less blunt, and the article ran.

Two and a half years later and we’re up to rev number Surface 3. And still, almost nobody is using the product. Less than 5% market share. Right again. It wasn’t a technology prediction, it was a market prediction. Lacking app developers, and a unique use, the competition was, and remains, simply too far out front.

Windows 10 is, unfortunately, a very expensive launch. And to get people to use it Microsoft is giving it away for free. The hope is then users will hook onto the cloud-based Office 365 and Microsoft’s Azure cloud services. But this is still trying to milk the same old cow. This approach relies on people being completely unwilling to give up using Windows and/or Office. And we see every day that millions of people are finding alternatives they like just fine, thank you very much.

Gamers hated me when I recommended Microsoft should give (for free) xBox to Nintendo. Unfortunately, I learned few gamers know much about P&Ls. They all assumed Microsoft made a fortune in gaming. But anyone who’s ever looked at Microsoft’s financial filings knows that the Entertainment Division, including xBox, has been a giant money-sucking hole. If they gave it away it would save money, and possibly help leadership figure out a strategy for profitable growth.

Unfortunately, Microsoft bought Minecraft, in effect “doubling down” on the bet. But regardless of how well anyone likes the products, Microsoft is not making money. Gaming is a bloody war where Sony and Microsoft keep battling, and keep losing billions of dollars. The odds of ever earning back the $2.5B spent on Minecraft is remote.

The greater likelihood is that as write offs continue to eat away at profits, and as markets continue evolving toward mobile products offered by competitors hurting “core” Microsoft sales, CEO Nadella will eventually have to give up on gaming and undertake another Nokia-like event.

All investors risk looking at current events to drive decision-making. When Ballmer was sacked and Nadella given the CEO job the stock jumped on euphoria. But the last 18 months have shown just how bad things are for Microsoft. It is a near monopolist in a market that is shrinking. And so far Mr. Nadella has failed to define a strategy that will make Microsoft into a company that does more than try to milk its heritage.

I said the giant retailer Sears Holdings would be a big loser the day Ed Lampert took control of the company. But hope sprung eternal, and investors jumped on the Sears bandwagon, believing a new CEO would magically improve a worn out, locked-in company. The stock went up for over 2 years. But, eventually, it became clear that Sears is irrelevant and the share price increase was unjustified. And the stock tanked.

Microsoft looks much the same. The actions we see are attempts to defend & extend a gloried history. But they don’t add up to a strategy to compete for the future. HoloLens will not be a product capable of replacing Windows plus Office revenues. If developers are attracted to it enough to start writing apps. Cortana is cool, but it is not first. And competitive products have so much greater usage that developer learning curve gains are wildly faster. These products are not game changers. They don’t solve large, unmet needs.

And employees see this. As I wrote in my last column, it is valuable to listen to employees. As the bloom fell off the rose, and Nadella started laying people off while freezing pay, employee support of him declined dramatically. And employee faith in leadership is far lower than at competitors Apple and Google.

As long as Microsoft keeps playing catch up, we should expect more layoffs, cost cutting and asset sales. And attempts at more “hail Mary” acquisitions intended to change the company. All of which will do nothing to grow customers, provide better jobs for employees, create value for investors or greater revenue opportunities for suppliers.

by Adam Hartung | Jun 7, 2015 | Defend & Extend, In the Swamp, Innovation, Leadership, Transparency

Did you ever notice that Human Resource (HR) practices are designed to lock-in the past rather than grow? A quick tour of what HR does and you quickly see they like to lock-in processes and procedures, insuring consistency but offering no hope of doing something new. And when it comes to hiring, HR is all about finding people that are like existing employees – same school, same degrees, same industry, same background. And HR tries its very hardest to insure conformity amongst employees to historical standard – especially regarding culture.

Several years ago I was leading an innovation workshop for leaders in a company that made nail guns, screw guns, nails and screws. Once a market leader, sales were struggling and profits were nearly nonexistent due to the emergence of competitors from Asia. Some of their biggest distributors were threatening to drop this company’s line altogether unless there were more concessions – which would insure losses.

They liked to call themselves a “fastener company,” which has long been the trend with companies that like to make it sound as if they do more than they actually do.

I asked the simple question “where is the growth in fasteners?” The leaders jumped right in with sales numbers on all their major lines. They were sure that growth was in auto-loading screwguns, and they were hard at work extending this product line. To a person, these folks were sure they new where growth existed.

But I had prepared prior to the meeting. There actually was much higher growth in adhesives. Chemical attachment was more than twice the growth rate of anything in the old nail and screw business. Even loop-and-hook fasteners [popularly referred to by the tradename Velcro(c)] was seeing much greater growth than the old-line mechanical products.

They looked at me blank-faced. “What does that have to do with us?” the head of sales finally asked. The CEO and everyone else nodded in agreement.

I pointed out to them they said they were in the fastener business. Not the nail and screw business. The nail and screw business had become a bloody fight, and it was not going to get any better. Why not move into faster growing, less competitive products?

Competitors were making lots of battery powered and air powered tools beyond nail guns and screw guns, and their much deeper product lines gave them much higher favorability with retail merchandisers and professional tool distributors. Plus, competitor R&D into batteries was already showing they could produce more powerful and longer-lasting tools than my client. In a few major retailers competitors already had earned the position of “category leader” recommending the shelf space and layout for ALL competitors, giving them a distinct advantage.

This company had become myopic, and did not even realize it. The people were so much alike that they could finish each others sentences. They liked working together, and had built a tightly knit culture. The HR head was very proud of his ability to keep the company so harmonious.

Only, it was about to go bankrupt. Lacking diversity in background, they were unable to see beyond their locked-in business model. And there sure wasn’t anyone who would “rock the boat” by admitting competitors were outflanking them, or bringing up “wild ideas” for new markets or products.

According to the New York Times 80% of hiring is done based on “cultural fit.” Which means we hire people we want to hang out with. Which almost always means people that are a lot like ourselves. Regardless of what we really need in our company. Thus companies end up looking, thinking and acting very homogenously.

It is common amongst management authors and keynote speakers to talk about creating “high-performance teams.” The vaunted Jim Collins in “Good to Great” uses the metaphor of a company as a bus. Every company should have a “core” and every employee should be single-mindedly driving that “core.” He says that it is the role of good leaders to get everyone on the bus to “core.” Anyone who isn’t 100% aligned – well, throw them off the bus (literally, fire them.)

We see this phenomenon in nepotism. Where a founder, CEO or Chairperson who succeeds uses their leadership position to promote relatives into high positions.

Wal-Mart’s Board of Directors, for example, recently elected the former Chairman’s son-in-law to the position of Chairman. He appears accomplished, but today Wal-Mart’s problem is Amazon and other on-line retail. Wal-Mart desperately needs outside thinking so it can move beyond its traditional brick-and-mortar business model, not someone who’s indoctrinated in the past.

The Reputation Institute just completed its survey of the most reputable retailers in the USA. Top of the list was Amazon, for the third straight year. Wal-Mart wasn’t even in the top 10, despite being the largest U.S. retailer by a considerable margin. Wal-Mart needs someone at the top much more like Jeff Bezos than someone who comes from the family.

Despite what HR often says, it is incredibly important to have high levels of diversity. It’s the only way to avoid becoming myopic, and finding yourself with “best practices” that don’t matter as competitors overwhelm your market.

Despite what HR often says, it is incredibly important to have high levels of diversity. It’s the only way to avoid becoming myopic, and finding yourself with “best practices” that don’t matter as competitors overwhelm your market.

Ever wonder why so many CEOs turn to layoffs when competitors cause sales and/or profits to stall? They are trying to preserve the business model, and everyone reporting to them is doing the same thing. Instead of looking for creative ways to grow the business – often requiring a very different business model – everyone is stuck in roles, processes and culture tied to the old model. As everyone talks to each other there is no “outsider” able to point out obvious problems and the need for change.

In 2011, while he was still CEO, I wrote a column titled “Why Steve Jobs Couldn’t Find a Job Today.” The premise was pretty simple. Steve Jobs was not obsessed with “cultural fit,” nor was he a person who shied away from conflict. He obsessed about results. But no HR person would consider a young Steve Jobs as a manager in their company. He would be considered too much trouble.

Yet, Steve Jobs was able to take a nearly dead Macintosh company and turn it into a leader in mobile products. Clearly, a person very talented in market sensing and identifying new solutions that fit trends. And a person willing to move toward the trend, rather than obsess about defending and extending the past.

Does your organization’s HR insure you would seek out, recruit and hire Steve Jobs, or Jeff Bezos? Or are you looking for good “cultural fit” and someone who knows “how to operate within that role.” Do you look for those who spot and respond to trends, or those with a history related to how your industry or business has always operated? Do you seek people who ask uncomfortable questions, and propose uncomfortable solutions – or seek people who won’t make waves?

Does your organization’s HR insure you would seek out, recruit and hire Steve Jobs, or Jeff Bezos? Or are you looking for good “cultural fit” and someone who knows “how to operate within that role.” Do you look for those who spot and respond to trends, or those with a history related to how your industry or business has always operated? Do you seek people who ask uncomfortable questions, and propose uncomfortable solutions – or seek people who won’t make waves?

Too many organizations suffer failure simply because they lack diversity. They lack diversity in geographic sales, markets, products and services – and when competition shifts sales stall and they fall into a slow death spiral.

And this all starts with insufficient diversity amongst the people. Too much “cultural fit” and not enough focus on what’s really needed to keep the organization aligned with customers in a fast-changing world. If you don’t have the right people around you, in the discussion, then you’re highly unlikely to develop the right solution for any problem. In fact, you’re highly unlikely to even ask the right question.

by Adam Hartung | May 22, 2015 | In the Whirlpool, Leadership, Lock-in, Web/Tech

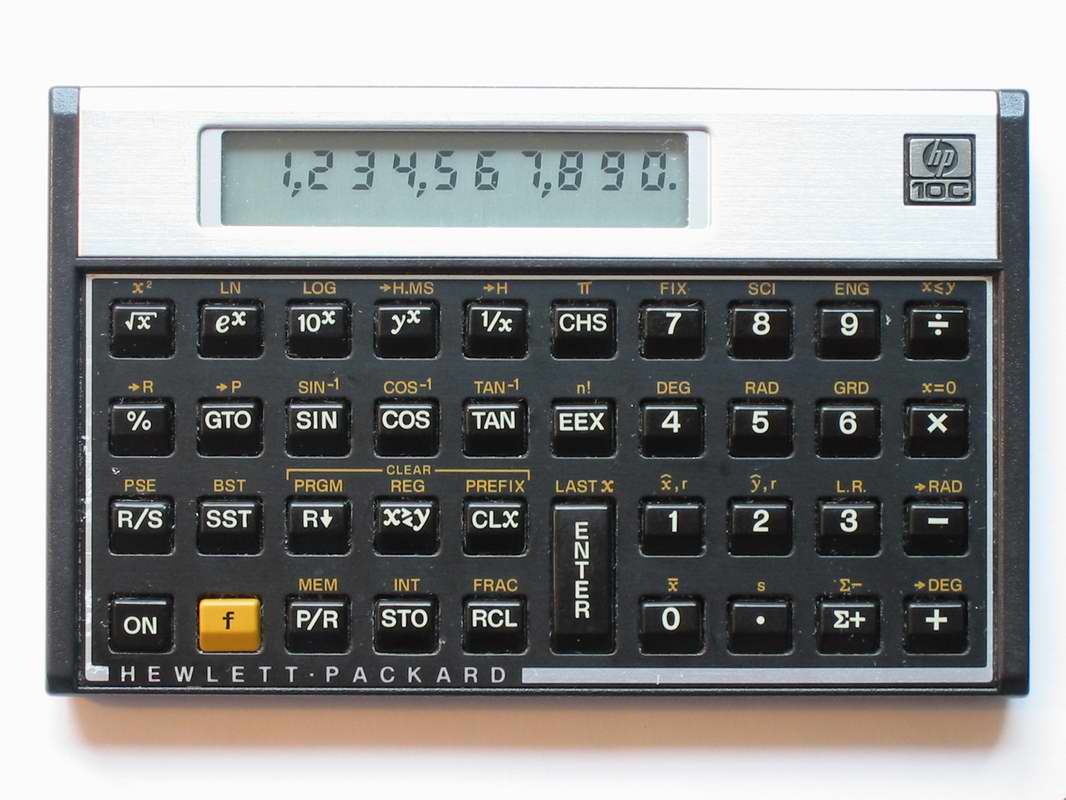

Hewlett Packard yesterday announced second quarter results. And they were undoubtedly terrible. Revenue compared to a year ago is down 7%, net income is down 21% as the growth stall at HP continues.

Yet, CEO Meg Whitman remains upbeat. She is pleased with “the continued success of our turnaround.” Which is good, because nobody else is. Rather than making new products and offering new solutions, HP has become a company that does little more than constantly restructure!

This latest effort, led by CEO Whitman, has been a split of the company into two corporations. For “strategic” (red flag) reasons, HP is dividing into a software company and a hardware company so that each can “focus” (second red flag) on its “core market” (third red flag.) But there seems to be absolutely no benefit to this other than creating confusion.

This latest restructuring is incredibly expensive. $1.8billion in restructuring charges, $1billion in incremental taxes, $400million annually in duplicated overhead services, then another $3billion in separation charges across the two new companies. That’s over $5B – which is more than HP’s net income in 2014 and 2013. There is no way this is a win for investors.

Additionally, HP has eliminated 48,000 jobs this this latest restructuring began in 2012. And the total will reach 55,000. So this is clearly not a win for employees.

The old HP will now be a hardware company, focused on PCs and printers. Both of which are declining markets as the world goes mobile. This is like the newspaper part of a media company during a split. An old business in serious decline with no clear path to sustainable sales and profits – much less growth. And in HP’s case it will be in a dog-eat-dog competitive battle to try and keep customers against Dell, Acer and Lenovo. Prices will keep dropping, and profits eroding as the world goes mobile. But despite spending $1.2billion to buy Palm (written off,) without any R&D, hard to see how this company returns profits to shareholders, generates new jobs, or launches new products for distributors and customers.

The new HP will be a software company. But it comes to market with almost no share against monster market leader Amazon, and competitors Microsoft and Cisco who are fighting to remain relevant. Even though HP spent $10B to buy ERP company Autonomy (written off) everyone has newer products, more innovation, more customers and more resources than HP.

Together there was faint hope for HP. The company could offer complete solutions. It could work with its distributors and value added resellers to develop unique vertical market solutions. By tweaking the various parts, hardware and software, HP had the possibility of building solutions that could justify premium prices and possibly create growth. But separated, these are now 2 “focused” companies that lack any new innovations, sell commodity products and lack enough share to matter in markets where share leads to winning developers and enterprise customers.

This may be the last stop for investors, and employees, to escape HP before things get a lot worse.

This may be the last stop for investors, and employees, to escape HP before things get a lot worse.

HP was the company that founded silicon valley. It was the tech place to work in the 1960s, 1970s and early 1980s. It was the Google, Facebook or Apple of that earlier time. When Carly Fiorina took over the dynamic and highly new product driven company in July, 1999 it was worth $45/share. She bought Compaq and flung HP into the commodity PC business, cutting new products and R&D. By the time the Board threw her out in 2005 the company was worth $35/share.

Mark Hurd took the CEO job, and he slashed and burned everything in sight. R&D was almost eliminated, as was new product development. If it could be outsourced, it was. And he whacked thousands of jobs. By killing any hope of growing the company, he improved the bottom line and got the stock back to $45.

Which is where it was 5 years ago today. But now HP is worth $35/share, once again. For investors, it’s been 25 years of up, down and sideways. The last 5 years the DJIA went up 80%; HP down 24%.

Companies cannot add value unless they develop new products, new solutions, new markets and grow. Restructuring after restructuring adds no value – as HP has demonstrated. For long-term investors, this is a painful lesson to learn. Let’s hope folks are getting the message loud and clear now.

The big market shift to mobile devices started back in 2007 when the iPhone began challenging Blackberry. By 2010 when the iPad launched, the shift was in full swing. And that’s when Microsoft’s current problems really began. Previous CEO Steve Ballmer went “all-in” on trying to defend and extend the PC platform with Windows 8 which began development in 2010. But by October, 2012 it was clear the design had so many trade-offs that it was destined to be an Edsel-like flop – a compromised product unable to please anyone.

The big market shift to mobile devices started back in 2007 when the iPhone began challenging Blackberry. By 2010 when the iPad launched, the shift was in full swing. And that’s when Microsoft’s current problems really began. Previous CEO Steve Ballmer went “all-in” on trying to defend and extend the PC platform with Windows 8 which began development in 2010. But by October, 2012 it was clear the design had so many trade-offs that it was destined to be an Edsel-like flop – a compromised product unable to please anyone. And, worse, the entire OEM market is collapsing. For the largest 4 PC manufacturers sales last quarter were down 4.5%, while sales for the remaining smaller manufacturers dropped over 20%! With fewer and fewer sales, consolidation is wiping out many companies, and leaving those remaining in margin killing to-the-death competition.

And, worse, the entire OEM market is collapsing. For the largest 4 PC manufacturers sales last quarter were down 4.5%, while sales for the remaining smaller manufacturers dropped over 20%! With fewer and fewer sales, consolidation is wiping out many companies, and leaving those remaining in margin killing to-the-death competition.