by Adam Hartung | Jan 27, 2011 | Current Affairs, Innovation, Leadership, Lock-in, Science, Web/Tech

Summary:

- The President has called for more innovation in America

- But American business management doesn’t know how to be innovative

- Business leaders focus on efficiency, not innovation

- America has no inherent advantage in innovation

- To increase innovation we need a change in incentives, to favor innovation over efficiency and traditional brick-and-mortar investments

- We need to highlight leaders that have demonstrated the ability to create jobs in the information economy, not the “old guard” just because they run big, but floundering, companies

It was good to hear the U.S. President call for more innovation in his State of the Union address this week. And it sounded like he wants most of that to come from business, rather than government. But I’m reminded the President is a lawyer and politician. As a businessman, well, let’s say he’s a bit naive. Most businesses don’t have a clue how to be innovative, as Forbes pointed out in November, 2009 in “Why the Pursuit of Innovation Usually Fails.”

Businesses by and large are not designed to be innovative. Modern management theory, going back to the days of Frederick Taylor, has been dominated by efficiency. For the last decade businesses have reacted to global competitive forces by seeking additional efficiency. Thus the offshoring movement for information technology and manufacturing eliminated millions of American jobs driving unemployment to double digits, and undermines new job creation keeping unemployment stubbornly high.

It is not surprising business leaders avoid innovation, when the august Wall Street Journal headlines on January 20 “In Race to Market, It Pays to Be Latecomer.” Citing a number of innovator failures, including automobiles, browsers and small computers, the journal concludes that it is smarter business to not innovate. Rather leaders should wait, let someone else innovate and then hope they can take the idea and make something of it down the road. Not a ringing pledge for how good management supports the innovation agenda!

The professors cited in the Journal article take a fairly common point of view. Because innovators fail, don’t be one. Lower your risk, come in later, hope you can catch the market at a future time. It’s easy to see in hindsight how innovators fail, so why take the risk? Keep your eyes on being efficient – and innovation is anything but efficient! Because most businesspeople don’t understand how to manage innovation, don’t try.

As discussed in my last blog, about Sara Lee, executives, managers and investors have come to believe that cost cutting, and striving for more efficiency, is the solution for most business problems. According to the Washington Post, “Immelt To Head New Advisory Board on Job Creation.” The President appointed the GE Chairman to this highly visible position, yet Mr. Immelt has spent most of the last decade shrinking GE, and pushing jobs offshore, rather than growing the company – especially domestically. Gone are several GE businesses created in the 1990s – including the recent spin out of NBC to Comcast. It’s ironic that the President would appoint someone who has overseen downsizings and offshoring to this position, instead of someone who has demonstrated the ability to create jobs over the last decade.

As one can easily imagine, efficiency is not the handmaiden of innovation. To the contrary, as we build organizations the desire for efficiency and “professional management” impedes innovation. According to Portfolio.com in “Can Google Be Entrepreneurial” even Google, a leading technology company with such exciting new products as Android and Chrome, has replaced its CEO Eric Schmidt with founder Larry Page in order to more effectively manage innovation. The contention is that the 55 year old professional manager Schmidt created innovation barriers. If a company as young and successful as Google struggles to innovate, one can only imagine the difficulties at traditional, aged American businesses!

While many will trumpet America’s leadership in all business categories, Forbes‘ Fred Allen is correct to challenge our thinking in “The Myth of American Superiority at Innovation.” For decades America’s “Myth of Efficiency” has pushed organizations to streamline, cutting anything that is not totally necessary to do what it historically did better, faster or cheaper. Innovation inside businesses was designed to improve existing processes, usually cutting cost and jobs, not create new markets with high growth that creates jobs and economic growth. Most executives would 10x rather see a plan to cut costs saving “hard dollars” in the supply chain, or sales and marketing, than something involving new product introduction into new markets where they have to deal with “unknowns.” Where our superiority in innovation originates, if at all, is unclear.

Lawyers are not historically known for their creativity. Hours spent studying precedent doesn’t often free the mind to “think outside the box.” Business folks have their own “precedent managers” – internal experts who set themselves up intentionally to block experimentation and innovation in the name of lowering risk, being conservative and carefully managing the core business. To innovate most organizations will be forced to “Fire the Status Quo Police” as I called for last September here in Forbes. But that isn’t easy.

America can be very innovative. Just look at the leadership America exerts in all things “social media” – from Facebook to Groupon! And look at how adroitly Apple has turned around by moving beyond its roots in personal computing to success in music (iPod and iTunes), mobile telephony and data (iPhone) and mobile computing (iPad). Netflix has used a couple of rounds of innovation to unseat old leader Blockbuster! But Apple and Netflix are still the rarities – innovators amongst the hoards of myopic organizations still focused on optimization. Look no further than the problems Microsoft – a tech company – has had balancing its desire to maintain PC domination while ineffectively attempting to market innovation.

What America needs is less bully pulpit, and more action if you really want innovation Mr. President:

- Increase tax credits for R&D

- Increase tax deductions and credits for new product launches by expanding the definition of what constitutes R&D in the tax code

- Implement penalties on offshore outsourcing to discourage the efficiency focus and the chronic push to low-cost global resources

- Lower capital gains taxes to encourage wealth creation through new business creation

- Manage the deficit by implementing VAT (value added taxes) which add cost to supply chain transactions, thus lowering the value of “efficiency” moves

- Make it much easier for foreign graduate students in America to receive their green cards so we can keep them here and quit exporting some of the brightest innovators we develop to foreign countries

- Create more tax incentives for investing in high tech – from nanotech to biotech to infotech – and quit wasting money trying to favor investments in manufacturing. Provide accelerated or double deductions for buying lab equipment, and stretch out deductions for brick-and-mortar spending. Better yet, quit spending so much on road construction and simply give credits to people who buy lab equipment and other innovation tools.

- Propose regulations on executive compensation so leaders aren’t encouraged to undertake short-term cost cutting measures merely to prop up short-term profits at the expense of long-term viability

- Quit putting “old guard” leaders who have seen their companies do poorly in highly placed positions. Reach out to those who really understand the information economy to fill such positions – like Eric Schmidt from Google, or John Chambers at Cisco Systems.

- Reform the FDA so new bio-engineered solutions do not follow regulations based on 50 year old pharma technology and instead streamline go-to-market processes for new innovations

- Quit spending so much money on border fences, DEA crack-downs on marijuana users and giant defense projects. Put the money into grants for universities and entrepreneurs to create and implement innovation.

Mr. President,, don’t expect traditional business to do what it has not done for over a decade. If you want innovation, take actions that will create innovation. American business can do it, but it will take more than asking for it. it will take a change in incentives and management.

by Adam Hartung | Jan 10, 2011 | Defend & Extend, Disruptions, Innovation, Leadership, Web/Tech

Summary:

- Communication is now global, instantaneous and free

- As a result people, and businesses, now adopt innovation more quickly than ever

- Competitors adapt much quicker, and react much stronger than ever in history

- Profits are squeezed by competitors rapidly adopting innovations

- But many business leaders avoid disruptions, leading to slower growth and declining returns

- To maintain, and grow, revenues and profits you must be willing to implement disruptions in order to stay ahead of fast moving competitors

- Amidst fast shifting markets, greatest value (P/E multiple and market cap) is given to those companies that create disruptions (like Facebook, Groupon, Twitter)

All business leaders know the pace of competitive change has increased.

It took decades for everyone to obtain an old-fashioned land line telephone. Decades for everyone to buy a TV. And likewise, decades for color TV adoption. Microwave ovens took more than a decade. Thirty years ago the words “long distance” implied a very big cost, even if it was a call from just a single interchange away (not even an area code away – just a different set of “prefix” numbers.) People actually wrote letters, and waited days for responses! Social change, and technology adoption, took a lot longer – and was considered expensive.

Now we assume communications at no cost with colleagues, peers, even competitors not only across town state, or nation, but across the globe! Communication – whether email, or texting, or old fashioned voice calls – has become free and immediate. (Consider Skype if you want free phone calls [including video no less] and use a PC at your local library or school building if you don’t own one.) Factoring inflation, it is possible to provide every member of a family of 5 with instant phone, email and text communication real-time, wirelessly, 24×7, globally for less than my parents paid for a single land-line, local-exchange only (no long distance) phone 50 years ago! And these mobile devices can send pictures!

As a result, competitors know more about each other a whole lot faster, and take action much more quickly, than ever in history. Facebook, for example, is now connecting hundreds of millions of people with billions of communications every day. According to statistics published on Facebook.com, every 20 minutes the Facebook website produces:

- 1,000,000 shared links

- 1,323,000 tagged photos

- 1,484,000 event invitations

- 1,587,000 Wall posts

- 1,851,000 Status updates

- 1,972,000 Friend requests accepted

- 2,716,000 photos uploaded

- 4,632,000 messages

- 10,208,000 comments

Multiply those numbers by 3 to get hourly. By 72 to get daily. Big numbers! Alexander Graham Bell had to invent the hardware and string thousands of miles of cable to help people communicate with his disruption. His early “software” were thousands of “operators” connecting calls through central switchboards. Mark Zuckerberg and friends only had to create a web site using existing infrastructure and existing tools to create theirs. Rapidly adopting, and using, existing innovations allowed Facebook’s founders to create a disruptive innovation of their own! Disruption has allowed Facebook to thrive!

Facebook has disrupted the way we communicate, learn, buy and sell. “Word of mouth” referrals are now possible from friends – and total strangers. Product benefits and problems are known instantaneously. Networks of people arguably have more influence that TV networks! Many employees are likely to make more facebook communications in a day than have conversations with co-workers! Facebook (or twitter) is rapidly becoming the new “water cooler.” Only it is global and has inputs from anyone. Yet only a fraction of businesses have any plans for using Facebook – internally or to be more competitive!

Far too many business leaders are unwilling to accept, adopt, invest in or implement disruptions.

InnovateOnPurpose.com highlights why in “Why Innovation Makes Executives Uncomfortable:”

- Innovation is part art, and not all science. Many execs would like to think they can run a business like engineering a bridge. They ignore the fact that businesses implement in society, and innovation is where we use the social sciences to help us gain insight into the future. Success requires more than just extending the past – because market shifts happen. If you can’t move beyond engineering principles you can’t lead or manage effectively in a fast-changing world where the rules are not fixed.

- Innovation requires qualitative insights not just quantitative statistics. Somewhere in the last 50 years the finance pros, and a lot of expensive strategy consultants, led business leaders to believe that if they simply did enough number crunching they could eliminate all risk and plan a guaranteed great future. Despite hundreds of math PhDs, that approach did not work out so well for derivative investors – and killed Lehman Brothers (and would have killed AIG insurance had the government not bailed it out.) Math is a great science, and numbers are cool, but they are insufficient for success when the premises keep changing.

- Innovation requires hunches, not facts. Well, let’s say more than a hunch. Innovation requires we do more scenario planning about the future, rather than just pouring over historical numbers and expecting projections to come true. We don’t need crystal balls to recognize there will be change, and to develop scenario plans that help us prepare for change. Innovation helps us succeed in a dynamic world, and implementation requires a willingness to understand that change is inevitable, and opportunistic.

- Innovation requires risks, not certainties. Unfortunately, there are NO certainties in business. Even the status quo plan is filled with risk. It’s not that innovation is risky, but rather that planning systems (ERP systems, CRM systems, all systems) are heavily biased toward doing more of the same – not something new! Markets can shift incredibly fast, and make any success formula obsolete. But most executives would rather fail doing the same thing faster, working harder, doing what used to work, than implement changes targeted at future market needs. Leaders perceive following the old strategy is less risky, when in reality it’s loaded with risk too! Too many businesses have failed at the hands of low-risk, certainty seeking leadership unable to shift with changing markets (GM, Chrysler, Circuit City, Fannie Mae, Brach’s, Sun Microsystems, Quest, the old AT&T, Lucent, AOL, Silicon Graphics, Yahoo, to name a few.)

Markets are shifting all around us. Faster than imaginable just 2 decades ago. Leaders, strategists and planners that enter 2011 hoping they can win by doing more, better, faster, cheaper will have a very tough time. That is the world of execution, and modern communication makes execution incredibly easy to copy, incredibly fast. Even Wal-Mart, ostensibly one of the best execution-oriented companies of all time, has struggled to grow revenue and profit for a decade. Today, companies that thrive embrace disruption. They are willing to disrupt within their organizations to create new ideas, and they are willing to take disruptive opportunities to market. Compare Apple to Dell, or Netflix to Blockbuster.

Recent investments have valued Facebook at $50B, Groupon at $6B and Twitter at almost $4B. Apple is now the second most valuable company (measured by market capitalization). Why? Because they are disrupting the way we do things. To thrive (perhaps survive by 2015) requires moving beyond the status quo, overcoming the perceived risk of innovation (and change) and taking the actions necessary to provide customers what they want in the future! Any company can thrive if it embraces the disruptions around it, and uses them to create a few disruptions of its own.

by Adam Hartung | Jan 5, 2011 | Defend & Extend, In the Rapids, In the Swamp, Leadership, Lock-in, Openness

Summary:

- Business planning systems are designed to defend historical markets

- Rapidly shifting markets makes it impossible to grow by defense alone

- Growth requires understanding what customers want, and creating new solutions that most likely aren’t part of the current business

- You can’t grow if you don’t plan to grow, but to plan for growth you have to shift resources from traditional planning into scenario planning

- High growth companies like Virgin, Apple and Google plan to fulfill future needs, not defend & extend past practicess

Imagine you see a pile of hay. Above it is a sign flashing “find the needle.” That achievement would be hard. Change the sign to “find the hay” and suddenly achieving the goal becomes much easier. So, as the comedian Bill Engvall might ask, what’s your sign? Unfortunately, most businesses plan for 2011, and beyond, using the first sign. Very few do planning using the latter. Most businesses won’t grow, because they simply don’t know how to plan for growth!!

Most businesses start planning with “I’m in the horseshoe (for example) business. My market isn’t growing, and there is more capacity than demand. How can I grow?” For these people, their sign is “find the needle.”

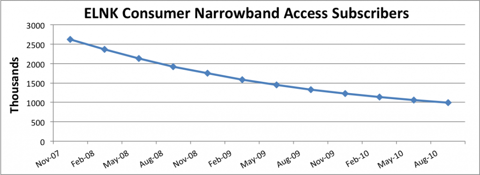

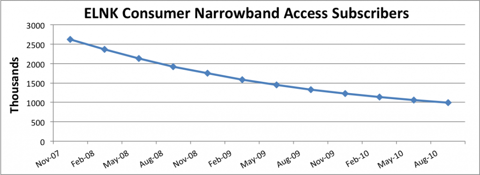

Take for example Earthlink. The company’s growth looked like a rocket ship in the early internet days as people by the millions signed up for dial-up service. But along came broadband, and the market for dial up died – never to return. Earthlink has no hope of growing as long as it thinks of itself as a dial-up company

Chart at SeekingAlpha.com author Ananthan Thangavel

Despite the absolute certainty that the market is shrinking, at this point almost all business planners will develop plans to defend this dying business as long as possible. Despite the impossibility of achieving good returns, there will be a plethora of actions to try and keep serving all the way to the very last customer. Just look at how AOL has invested millions trying to defend its dying internet access busiuness. Reality is, the company that walks away – gives up- is the smartest. There’s no way to make money as oversupply keeps too many companies spending too much to service too few customers.

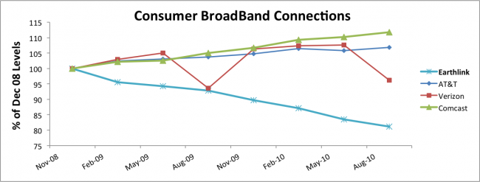

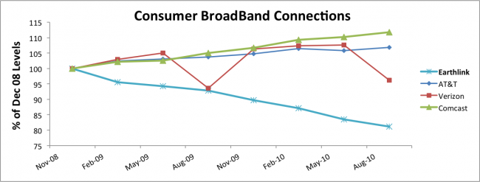

The next step for most planners is to attempt extending the business into something adjacent. For example, Earthlink would say “let’s invest in Broadband. We’ll hang onto customers as they want to switch, and maybe pick up a few customers.” But this completely ignores the fact that competitors already have a substantial lead. Competitors have learned the technology, and the marketplace. They are growing, and have no intention of giving up any room to a new competitor.

Chart at SeekingAlpha.com author Ananthan Thangavel

Planning systems are designed to keep the business doing more of what it always did, or possibly extending the business into adjacent markets after returns have faltered. Planning systems have no way of recognizing when a business, or market, has become obsolete. And practically never do they recognize the power of exsting competitors when looking at adjacent markets. As a result, the planning system produces no growth plans, leading 2011 to end with the self-fulfilling prophecy that the plan predicted – little or no growth.

The future for Earthlink is pretty grim. As it is for most companies that plan based upon history, trying to Defend & Extend their historical markets. In the highly dynamic, global marketplaces of 2011 trying to find growth by remaining focused on the past is like looking for the needle in a haystack. Maybe there’s something in there – but it’s not likely – and it’s even a lot less likely you’ll find it – and if you did, the cost of finding it will almost assuredly be greater than the value.

Alternatively, why not use planning resources to find, and develop, growth markets. Instead of looking at what you did (as in the past tense) try to figure out what you should do. Rather than studying past products, customers and markets, why not develop scenarios about the future that give you insight to what people will want to buy in 2011, 2012 and beyond? Rather than looking for needles, why not go explore the hay?

Newspapers kept focusing on declining subscriptions, when they should have been studying Craig’s List, eBay, Vehix.com and other on-line environments to learn the future of advertising. Had Tribune company poured its resources into its early internet investments, such as cars.com and careerbuilder.com, rather than trying to defend its traditional newspapers, it may well have avoided bankruptcy. But rather than looking to the future when doing its planning, and understanding that on-line news was going to explode, Tribune kept looking for the needle (cost cuts, layoffs, outsourcing, etc.) to save the old success formula.

Direct mail companies and Sunday insert printers have continued looking for ways to defend & extend their coupon printing business – despite the fact that nobody reads junk mail or uses printed coupons. Several have failed, and larger companies have merged trying to find “synergies” and more cost cuts. Simultaneously a 28 year old music major from Nothwestern university starts figuring out how to help companies acquire new customers by offering email coupons, and within 2 years his company, Groupon, is valued at around $6B. There’s nothing that stopped coupon powerhouse Advo from being Groupon, except that its planning system was devoted to finding the needle, while Groupon’s leaders decided to go play in the hay.

Hallmark and American Greetings want us to buy birthday and holiday cards for various occasions – in a world where almost nobody mails cards any longer. As they keep trying to defend their old business, and extend it into a few new opportunities for on-line cards, Twitter captures the wave of instant communications by offering everyone 140 character ways to communicate. Because Twitter is out where the growth is, the company raises $200M giving it a value of $3.7B.

Nothing stops any business from being anything it wants to be. But as most enter 2011 they will use their planning resources, including all those management meetings and hours of forms completion, to do nothing more than re-examine the historical business. Most will devolve into trying to figure out how to do more with less. As future forecasts look grim, or perhaps cautiously optimistic (based on a lot of things going right – like a mysterious pick-up in demand) there will be much nashing of teeth – and meetings looking for a needle that can be offered to employees and investors as a hope for rising future value.

Smart companies get out of that rut. They focus their planning on the future. What do customers want, and how can we give them what they want? How can we create whole new markets. Apple was a PC company, but by exploring mobility it became a provider of MP3 consumer electronics, downloadable music, a mobile device and app supplier and the early winner in cloud accessing tablets. Google has moved from a search engine to a powerhouse ad placement company and is pushing the edges of growth in mobile computing as well as several other markets. Virgin started as a distributor of long-playing vinyl record albums, but by exploring what customers really wanted it has become an international airline, cell phone company, international lender and space travel pioneer (to mention just a few of its businesses.)

You can grow in 2011, but to do so you need to shed the old planning system (and its resource wasting processes) and get serious about scenario planning. Focus on the future, not the past.

by Adam Hartung | Dec 17, 2010 | Current Affairs, Defend & Extend, In the Rapids, In the Swamp, Leadership, Web/Tech

Summary:

- Many people think it is OK for large companies to grow slowly

- Many people admire caretaker CEOs

- In dynamic markets, low-growth companies fail

- It is harder to generate $1B of new revenue, than grow a $100B company by $10B

- Large companies have vastly more resources, but they squander them badly

- We allow large company CEOs too much room for mediocrity and failure

- Good CEOs never lose a growth agenda, and everyone wins!

“I may just be your little rent collector Mr. Potter, but that George Bailey is making quite a bit happen in that new development of his. If he keeps going it may just be time for this smart young man to go asking George Bailey for a job.” From “It’s a Wonderful Life“ an employee of the biggest employer in mythical Beford Falls talks about the growth of a smaller competitor.

My last post gathered a lot of reads, and a lot of feedback. Most of it centered on how GE should not be compared to Facebook, largely because of size differences, and therefore how it was ridiculous to compare Jeff Immelt with Mark Zuckerberg. Many readers felt that I overstated the good qualities of Mr. Zuckerberg, while not giving Mr. Immelt enough credit for his skills managing “lower growth businesses” in a “tough economy.” Many viewed Mr. Immelt’s task as incomparably more difficult than that of managing a high growth, smaller tech company from nothing to several billion revenue in a few years. One frequent claim was that it is enough to maintain revenue in a giant company, growth was less important.

Why do so many people give the CEOs of big companies a break? Given that they make huge salaries and bonuses, have fantastic perquesites (private jets, etc.), phenominal benefits and pensions, and receive remarkable payouts whether they succeed or fail I would think we’d have very high standards for these leaders – and be incensed when their performance is sub-par.

Facebook started with almost no resources (as did Twitter and Groupon). Most leaders of start-ups fail. It is remarkably difficult to marshal resources – both enough of them and productively – to grow a company at double digit rates, produce higher revenue, generate cash flow (or loans) and keep employees happy. Growing to a billion dollars revenue from nothing is inexplicably harder than adding $10B to a $100B company. Compared to Facebook, GE has massive resources. Mr. Immelt entered the millenium with huge cash flow, huge revenues, and an army of very smart employees. Mr. Zuckerberg had to come out of the blocks from a standing start and create ALL his company’s momentum, while comparatively Mr. Immelt took on his job riding a bullet out of a gun! GE had huge momentum, a low cost of capital, and enough resources to do anything it wanted.

Yet somehow we should think that we don’t have as high expectations from Mr. Immelt as we do Mr. Zuckerberg? That would seem, at the least, distorted.

In business school I read the story of how American steel manufacturers were eclipsed by the Japanese. Ending WWII America had almost all the steel capacity. Manufacturers raked in the profits. Japanese and German companies that were destroyed had to rebuild, which they progressively did with more efficient assets. By the 1960s American companies were no longer competitive. Were we to believe that having their industrial capacity destroyed somehow was a good thing for the foreign competitors? That if you want to improve your competitiveness (say in autos) you should drop a nuclear bomb on the facilities (some may like that idea – but not many who live in Detroit I dare say.) In reality the American leaders simply refused to invest in new technologies and growth markets, allowing competitors to end-run them. The American leaders were busy acting as caretakers, and bragging about their success, instead of paying attention to market shifts and keeping their companies successful!

Big companies, like GE, are highly advantaged. They not only have brand, and market position, but cash, assets, employees and vendors in position to help them be even more successful! A smart CEO uses those resources to take the company into growth markets where it can grow revenues, and profits, faster than the marketplace. For example Steve Jobs at Apple, and Eric Schmidt at Google have found new markets, revenues and cash flow beyond their original “core” markets. That’s what Mr. Welch did as predecessor to Mr. Immelt. He didn’t so much take advantage of a growth economy as help create it! Unfortunately, far too many large company CEOs squander their resources on low rate of return projects, trying to defend their existing business rather than push forward.

Most big companies over-invest in known markets, or technologies, that have low growth rates, rather than invest in growth markets, or technologies they don’t know as well. Think about how Motorola invented the smart phone technology, but kept investing in traditional cellular phones. Or Sears, the inventor of “at home shopping” with catalogues closed that division to chase real-estate based retail, allowing Amazon to take industry leadership and market growth. Circuit City ended up investing in its approach to retail until it went bankrupt in 2010 – even though it was a darling of “Good to Great.” Or Microsoft, which launched a tablet and a smart phone, under leader Ballmer re-focused on its “core” operating system and office automation markets letting Apple grab the growth markets with R&D investments 1/8th of Microsoft’s. These management decisions are not something we should accept as “natural.” Leaders of big companies have the ability to maintain, even accelerate, growth. Or not.

Why give leaders in big companies a break just because their historical markets have slower growth? Singer’s leadership realized women weren’t going to sew at home much longer, and converted the company into a defense contractor to maintain growth. Netflix converted from a physical product company (DVDs) into a streaming download company in order to remain vital and grow while Blockbuster filed bankruptcy. Apple transformed from a PC company into a multi-media company to create explosive growth generating enough cash to buy Dell outright – although who wants a distributor of yesterday’s technology (remember Circuit City.) Any company can move forward to be anything it wants to be. Excusing low growth due to industry, or economic, weakness merely gives the incumbent a pass. Good CEOs don’t sit in a foxhole waiting to see if they survive, blaming a tough battleground, they develop strategies to change the battle and win, taking on new ground while the competition is making excuses.

GM was the world’s largest auto company when it went broke. So how did size benefit GM? In the 1980s Roger Smith moved GM into aerospace by acquiring Hughes electronics, and IT services by purchasing EDS – two remarkable growth businesses. He “greenfielded” a new approach to auto manufucturing by opening the wildly successful Saturn division. For his foresight, he was widely chastised. But “caretaker” leadership sold off Hughes and EDS, then forced Saturn to “conform” to GM practices gutting the upstart division of its value. Where one leader recognized the need to advance the company, followers drove GM to bankruptcy by selling out of growth businesses to re-invest in “core” but highly unprofitable traditional auto manufacturing and sales. Meanwhile, as the giant failed, much smaller Kia, Tesla and Tata are reshaping the auto industry in ways most likely to make sure GM’s comeback is short-lived.

CEOs of big companies are paid a lot of money. A LOT of money. Much more than Mr. Zuckerberg at Facebook, or the leaders of Groupon and Netflix (for example). So shouldn’t we expect more from them? (Marketwatch.com “Top CEO Bonuses of 2010“) They control vast piles of cash and other resources, shouldn’t we expect them to be aggressively investing those resources in order to keep their companies growing, rather than blaming tax strategies for their unwillingness to invest? (Wall Street Journal “Obama Pushes CEOs on Job Creation“) It’s precisely because they are so large that we should have high expectations of big companies investing in growth – because they can afford to, and need to!

At the end of the day, everyone wins when CEOs push for growth. Investors obtain higher valuation (Apple is worth more than Microsoft, and almost more than 10x larger Exxon!,) employees receive more pay (see Google’s recent 10% across the board pay raise,) employees have more advancement opportunities as well as personal growth, suppliers have the opportunity to earn profits and bring forward new innovation – creating more jobs and their own growth – rather than constantly cutting price. Answering the Economist in “Why Do Firms Exist?” it is to deliver to people what they want. When companies do that, they grow. When they start looking inward, and try being caretakers of historical assets, products and markets then their value declines.

Can Mr. Zuckerberg run GE? Probably. I’d sure rather have him at the helm of GM, Chrysler, Kraft, Sara Lee, Motorola, AT&T or any of a host of other large companies that are going nowhere the caretaker CEOs currently making excuses for their lousy performance. Think what the world would be like if the aggressive leaders in those smaller companies were in such positions? Why, it might just be like having all of American business run the way Steve Jobs, Jeff Bezos and John Chambers have led their big companies. I struggle to see how that would be a bad thing.

by Adam Hartung | Dec 6, 2010 | Current Affairs, Defend & Extend, Disruptions, Food and Drink, Leadership, Lock-in

Summary:

- Business leaders like consistency

- Consistency leads to repetition, sameness, and lower rates of return

- Kraft's product lines are consistent, but without growth

- Kraft's value has been stagnant for 10 years

- Disruptive competitors make higher rates of return, and grow

- Disruptive competitors have higher valuations – just look at Groupon

"Needless consistency is the hobgoblin of small minds" – Ralph Waldo Emerson

That was my first thought when I read the MediaPost.com Marketing Daily article "Kraft Mac & Cheese Gets New, Unified Look." Whether this 80-something year old brand has a "unified" look is wholly uninteresting. I don't care if all varieties have the same picture – and if they do it doesn't make me want to eat more powdered cheese and curved noodles.

In fact, I'm not at all interested in anything about this product line. It is kind of amusing, in an historical way, to note that people (largely children) still eat the stuff which fueled my no-cash college years (much like ramen noodles does for today's college kids.) While there's nothing I particularly dislike about the product, as an investor or marketer there's nothing really to like about it either. Pasta products always do better in a recession, as people look for cheaper belly-fillers (especially for the kid,) so that more is being sold the last couple of years doesn't tell me anything I would not have guessed on my own. That the entire category has grown to only $800M revenue across this 8 decade period only shows that it's a relatively small business with no excitement! Once people feel their finances are on firm footing sales will soon taper off.

Kraft's Mac & Cheese is emblematic of management teams that lock-in on defending and extending old businesses – even though the lack of growth leaves them struggling to grow cash flow and create a decent valuation. Introducing multiple varieties of this product has not produced growth that even matched inflation across the years. Primarily, marketing programs have been designed to try keeping existing customers from buying something else. This most recent Kraft program is designed to encourage adults to try a product they gave up eating many years ago. This is, at best, "foxhole" marketing. Spending money largely just to keep the brand from going away, rather than really expecting any growth. Truly, does anyone think this kind of spending will generate a billion dollar product line in 2011 – or even 2012?

What's wrong with defensive marketing, creating consistency across the product line – across the brand – and across history? It doesn't produce high rates of return. There are lots of pasta products, even lots of brands of mac & cheese. While Kraft's product surely produces a positive margin, multiple competitors and lack of growth means increased spending over time merely leaves the brand producing a marginal rate of return. Incremental ad spending doesn't generate real growth, just a hope of not losing ground. We know people aren't flocking to the store to buy more of the product. New customers aren't being identified, and short-term growth in revenues does not yield the kinds of returns that would enhance valuation and make the world a better place for investors – or employees.

While Kraft is trying to create headlines with more spending in a very tired product, across town in Chicago Groupon has created a $500M revenue business in just 2 years! And new reports from the failed acquisition attempt by Google indicate revenues are likely to reach $2B in 2011 (CNNMoney.com, Fortune, "Google's Groupon Groping Reveals the Shifting Power of the Web World.") Where's Kraft in this kind of growth market? After all, coupons for Kraft products have been in mailers and Sunday inserts for 50 years. Why isn't Kraft putting money into a real growth business, which is producing enormous value while cash flow grows in multiples? While Groupon has created somewhere around $6B of value in 2 years, Kraft's value has only gone sideways for the last decade (chart at Marketwatch.com.)

Kraft has not introduced a new product since — well — DiGiorno. And that's been more than a decade. While the company has big revenues – so did General Motors. The longer a company plays defense, regardless of size, trying to extend its outdated products (and business model) the riskier that business becomes. While big revenues appear to offer some kind of security, we all know that's not true. Not only does competition drive down margins in these older businesses, but newer products make it harder and harder for the old products to compete at all. Eventually, the effort to maintain historical consistency simply allows competitors to completely steal the business away with new products, creating a big revenue drop, or producing such low returns that failure is inevitable.

Lots of business people like consistency. They like consistency in how the brand is executed, or how products are aligned. They like consistency in the technology base, or production capabilities. They like consistency in customers, and markets. They like being consistent with company history – doing what "made the company famous." They like the similarity of doing something again, and again, hoping that consistency will produce good returns.

But consistency is the hobgoblin of small minds. And those who are more clever find ways to change the game. Xerox figured out how to let everyone be a one-button printer, and killed the small printing press manufacturers. HP's desktop printers knocked the growth out of Xerox. Google figured out a better way to find information, and place ads, just about killing newspapers (and magazines.) Apple found a better way to use mobile minutes, taking a big bite out of cell phone manufacturers. Amazon found a better way to sell things, killing off bookstores and putting a world of hurt on many retailers. Netflix found a better way of distributing DVDs and digital movies, sending Blockbuster to bankruptcy. Infosys and Tata found a better way of doing IT services, wiping out PWC and nearly EDS. Hulu (and soon Netflix, Google and Apple) has found a better way of delivering television programming, killing the growth in cable TV. Groupon is finding a better way of delivering coupons, creating huge concerns for direct mail companies. Now tablet makers (like Apple) are demonstrating a better way of working remotely, sending shivers of worry down the valuation of Microsoft. These companies, failed or in jeapardy, were very consistent.

Those who create disruptions show again and again that they can generate growth and above average returns, even in a recession. While those who keep trying to defend and extend their old business are letting consistency drive their behavior – leading to intense competition, genericization, and lower rates of return. Maybe Kraft should spend more money looking for the next food we would all like, rather than consistently trying to convince us we want more Mac & Cheese (or Velveeta).