by Adam Hartung | Feb 18, 2015 | Current Affairs, Leadership

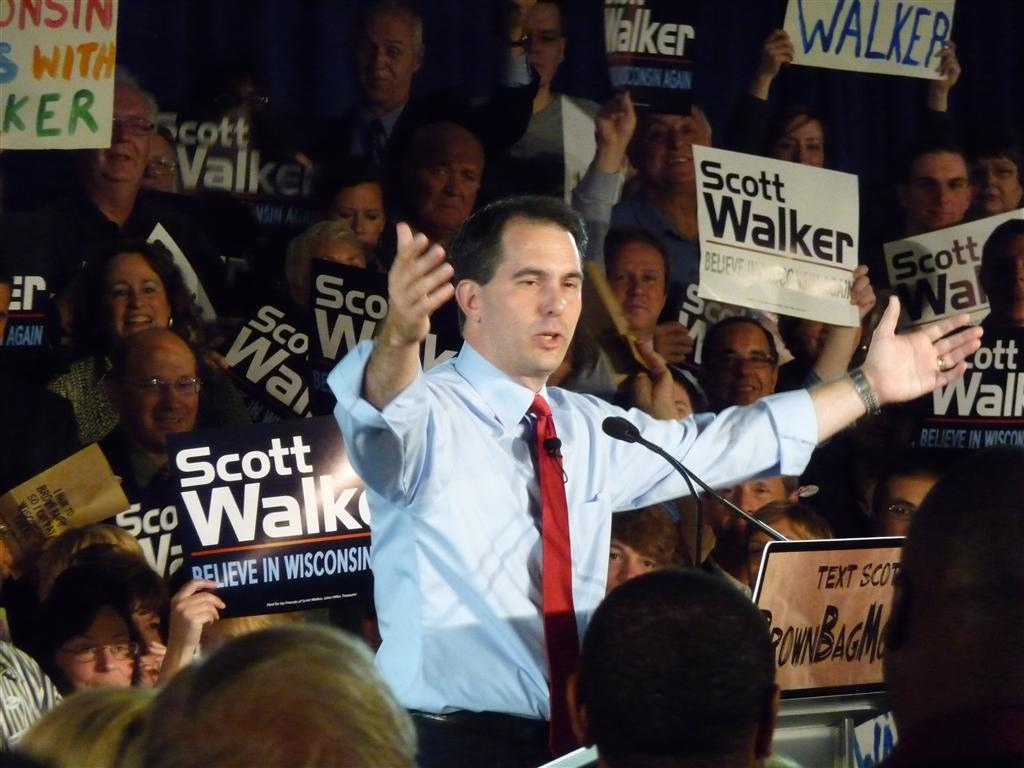

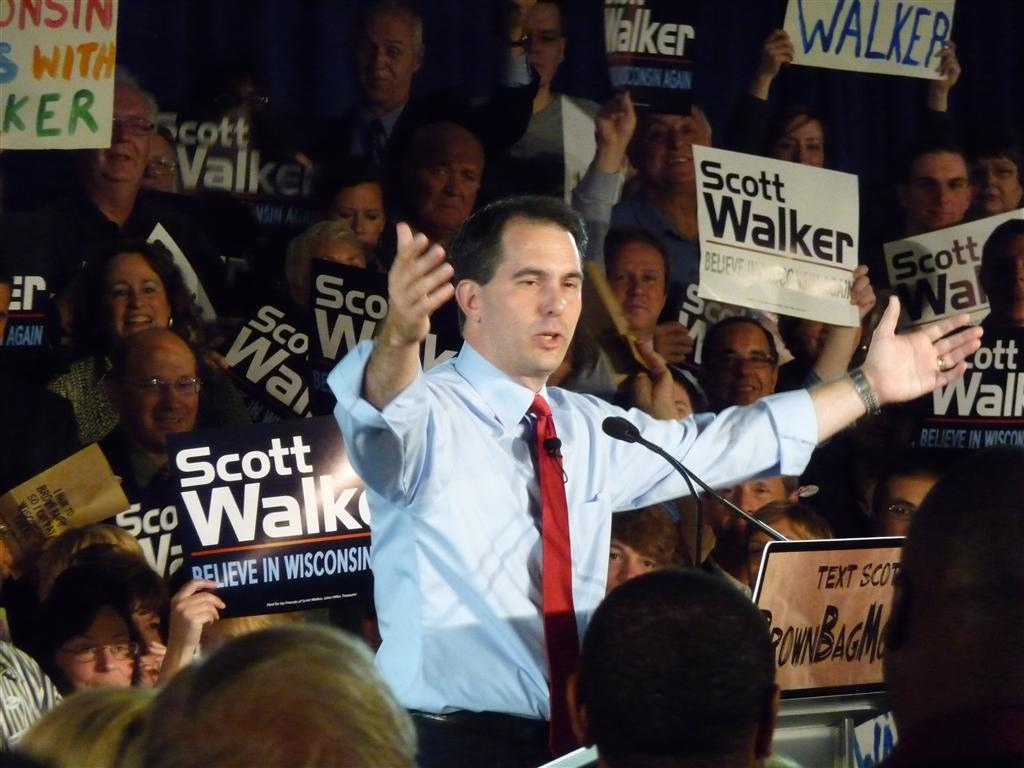

There has been a hullabaloo lately about Wisconsin Governor Walker’s lack of a degree. Some think this is a big deal, while others think almost nobody cares. In the end, we all should care about the formal education of any of our leaders. In government, business and elsewhere.

In Forbes magazine, 1998, famed management guru Peter Drucker wrote, “Get the assumptions wrong and everything that follows from them is wrong.” This is really important, because most leaders make most of their decisions based on assumptions. And many of those assumptions are based on how much, and how broad, that leader’s education.

We all make decisions on beliefs. It is easy to have incorrect beliefs. Early doctors believed that infections were due to bad blood, so they used bleeding as a cure-all for many wounds and illnesses. Untold millions of people died from this practice. A bad assumption, based on belief rather than formal study (in this case of the circulatory system) proved fatal.

In business, for thousands of years most sailors had no education about the curvature of the earth and its rotation the sun, thus they believed the world was flat and refused to sail further out to sea than the ability to keep their eyes on a shoreline. This limited trade, and delayed expansion into new markets.

Or, more recently, Steve Ballmer assumed that anyone using a smartphone would want a keyboard – because Blackberry dominated the market and had a keyboard. Thus he laughed at the iPhone launch. Oops. His assumption, and belief about the user experience, caused Microsoft to delay its entry into mobile markets and smartphones several years. Even though he had not studied smartphone user needs. Now Apple has half the smartphone market, while Blackberry and Microsoft each have less than 5%.

There are countless examples of bad decisions made when people use the wrong assumptions. At this time in Oklahoma, Texas and Colorado politicians are voting to refuse upgrading history education because the new curriculum is unacceptable to them. Their assumptions about America’s history are so strong that any factual evidence which might change those assumptions is so threatening that these politicians would prefer students be taught a fictitious history.

Our assumptions are built early in life. All through childhood our parents, aunts, uncles, religious leaders, mentors and teachers fill us with information. We process this information and build layers of assumptions. These assumptions help us to make decisions by allowing us to react based upon what we believe, rather than having to scurry around and do a research project every time a decision is required. Thus, the older we become the deeper these assumptions lie – and the more we rely on them as we undertake less and less education. As we age we decide based upon our beliefs, and less based upon any observable facts. Actually, we’ll often choose to ignore facts which indicate our assumptions and beliefs might be wrong (we call this a bias in others, and common sense when we do it ourselves.)

The more education you have, the more you can build assumptions that are likely to align with reality. It is no accident that the U.S. military uses education as a basis for promotions – rather than battlefield heroics. To move up requires officers go to war college and learn about history, politics, leadership and battles going back to long before the birth of Jesus. Good knowledge helps officers to be smarter about how to prepare for battle, organize for battle, conduct warfare, lead troops, treat a vanquished enemy and talk to the politicians for whom they work. Just look at the degrees amongst our military’s Colonels and General Officers and you find a plethora of masters and doctorate degrees. Education has long proven to be a superior warfare skill – especially when the enemy is operating on belief, guts and fight.

There are many accomplished people lacking degrees. But we should note they were successful very narrowly, and frequently in business. Steve Jobs, Bill Gates and Mark Zuckerberg are clearly high IQ people. But their success was based on founding a business at a time of technological revolution, and then building that business with zealousness. And the luck of being in the right place at the right time with a new piece of technology. They were/are not asked to be widely acclaimed in a broad spectrum of capabilities such as diplomacy, historical accuracy, legal limitations, cultural differences, the arts, scientific advances in multiple fields, warfare tactics, etc. They were not asked to develop a turnaround plan for a bankrupt auto manufacturer at the height of the Great Recession. For all their great wealth creation, they would not be what were once called “Renaissance men.”

When Governor Walker attacks the educated, and labels them as “elites,” it should be noted that their backgrounds often mean they have more points of view to evaluate, and are more considered about the various risks which are being created by taking any specific action. Many Harvard or Columbia MBAs could never be entrepreneurs because they see the many reasons a business would likely fail, and thus they are reticent to commit. Yet, that same wider knowledge allows them to be more thoughtful when evaluating the options and making decisions regarding opening new plants, negotiating with unions, expanding distribution and financing options.

Further, while it is true that you can be smart and not have a degree, the number of those who have degrees yet lack intelligence is a much, much smaller number. If one is to err in picking those you want to have advise you, or represent you, the degree(s) is not a bad first step toward identifying who is likely to provide the best insight and offer the most help.

Further, there is nothing about a degree which limits one’s ability to fight. Look at Senator Cruz from Texas. Senator Cruz’s politics seem to be somewhat aligned with Governor Walker’s, and he is widely acknowledged as a serious fighter, yet he boasts an undergraduate degree from Princeton as well as graduating from Harvard Law School. An educational background anyone would label as “elitist” and remarkably similar to President Obama’s – whose background Governor Walker has thoroughly maligned.

We expect our leaders to be widely read, and keenly aware of the complexities of life. We want our attorney’s to have law degrees and pass the bar exam. We want our physicians to have medical degrees and pass the Boards. Increasingly we want our business leaders to have MBAs. We understand that education informs our minds, and helps us develop assumptions for making good decisions. We should not belittle this, nor be accepting of someone who implies that lacking a formal education is meaningless.

by Adam Hartung | Aug 29, 2014 | Current Affairs, In the Whirlpool, Leadership

It’s Labor Day, and a time when we naturally think about our jobs.

When it comes to jobs creation, no role is more critical than the CEO. No company will enter into a growth phase, selling more product and expanding employment, unless the CEO agrees. Likewise, no company will shrink, incurring job losses due to layoffs and mass firings, unless the CEO agrees. Both decisions lay at the foot of the CEO, and it is his/her skill that determines whether a company adds jobs, or deletes them.

Over 2 years ago (5 May, 2012) I published “The 5 CEOs Who Should Be Fired.” Not surprisingly, since then employment at all 5 of these companies has lagged economic growth, and in all but one case employment has shrunk. Yet, 3 of these CEOs remain in their jobs – despite lackluster (and in some cases dismal) performance. And all 5 companies are facing significant struggles, if not imminent failure.

#5 – John Chambers at Cisco

In 2012 it was clear that the market shift to public networks and cloud computing was forever changing the use of network equipment which had made Cisco a modern growth story under long-term CEO Chambers. Yet, since that time there has been no clear improvement in Cisco’s fortunes. Despite 2 controversial reorganizations, and 3 rounds of layoffs, Cisco is no better positioned today to grow than it was before.

Increasingly, CEO Chambers’ actions reorganizations and layoffs look like so many machinations to preserve the company’s legacy rather than a clear vision of where the company will grow next. Employee morale has declined, sales growth has lagged and although the stock has rebounded from 2012 lows, it is still at least 10% short of 2010 highs – even as the S&P hits record highs. While his tenure began with a tremendous growth story, today Cisco is at the doorstep of losing relevancy as excitement turns to cloud service providers like Amazon. And the decline in jobs at Cisco is just one sign of the need for new leadership.

#4 Jeff Immelt at General Electric

When CEO Immelt took over for Jack Welch he had some tough shoes to fill. Jack Welch’s tenure marked an explosion in value creation for the last remaining original Dow Jones Industrials component company. Revenues had grown every year, usually in double digits; profits soared, employment grew tremendously and both suppliers and investors gained as the company grew.

But that all stalled under Immelt. GE has failed to develop even one large new market, or position itself as the kind of leading company it was under Welch. Revenues exceeded $150B in 2009 and 2010, yet have declined since. In 2013 revenues dropped to $142B from $145B in 2012. To maintain revenues the company has been forced to continue selling businesses and downsizing employees every year. Total employment in 2014 is now less than in 2012.

Yet, Mr. Immelt continues to keep his job, even though the stock has been a laggard. From the near $60 it peaked at his arrival, the stock faltered. It regained to $40 in 2007, only to plunge to under $10 as the CEO’s over-reliance on financial services nearly bankrupted the once great manufacturing company in the banking crash of 2009. As the company ponders selling its long-standing trademark appliance business, the stock is still less than half its 2007 value, and under 1/3 its all time high. Where are the jobs? Not GE.

#3 Mike Duke at Wal-Mart

Mr. Duke has left Wal-Mart, but not in great shape. Since 2012 the company has been rocked by scandals, as it came to light the company was most likely bribing government officials in Mexico. Meanwhile, it has failed to defend its work practices at the National Labor Relations Board, and remains embattled regarding alleged discrimination of female employees. The company’s employment practices are regularly the target of unions and those supporting a higher minimum wage.

The company has had 6 consecutive quarters of declining traffic, as sales per store continue to lag – demonstrating leadership’s inability to excite people to shop in their stores as growth shifts to dollar stores. The stock was $70 in 2012, and is now only $75.60, even though the S&P 500 is up about 50%. So far smaller format city stores have not generated much attention, and the company remains far behind leader Amazon in on-line sales. WalMart increasingly looks like a giant trapped in its historical house, which is rapidly delapidating.

One big question to ask is who wants to work for WalMart? In 2013 the company threatened to close all its D.C. stores if the city council put through a higher minimum wage. Yet, since then major cities (San Francisco, Chicago, Los Angeles, Seattle, etc.) have either passed, or in the process of passing, local legislation increasing the minimum wage to anywhere from $12.50-$15.00/hour. But there seems no response from WalMart on how it will create profits as its costs rise.

#2 Ed Lampert at Sears

Nine straight quarterly losses. That about says it all for struggling Sears. Since the 5/2012 column the CEO has shuttered several stores, and sales continue dropping at those that remain open. Industry pundits now call Sears irrelevant, and the question is looming whether it will follow Radio Shack into oblivion soon.

CEO Lampert has singlehandedly destroyed the Sears brand, as well as that of its namesake products such as Kenmore and Diehard. He has laid off thousands of employees as he consolidated stores, yet he has been unable to capture any value from the unused real estate. Meanwhile, the leadership team has been the quintessential example of “a revolving door at headquarters.” From about $50/share 5/2012 (well off the peak of $190 in 2007,) the stock has dropped to the mid-$30s which is about where it was in its first year of Lampert leadership (2004.)

Without a doubt, Mr. Lampert has overtaken the reigns as the worst CEO of a large, publicly traded corporation in America (now that Steve Ballmer has resigned – see next item.)

#1 Steve Ballmer at Microsoft

In 2013 Steve Ballmer resigned as CEO of Microsoft. After being replaced, within a year he resigned as a Board member. Both events triggered analyst enthusiasm, and the stock rose.

However, Mr. Ballmer left Microsoft in far worse condition after his decade of leadership. Microsoft missed the market shift to mobile, over-investing in Windows 8 to shore up PC sales and buying Nokia at a premium to try and catch the market. Unfortunately Windows 8 has not been a success, especially in mobile where it has less than 5% share. Surface tablets were written down, and now console sales are declining as gamers go mobile.

As a result the new CEO has been forced to make layoffs in all divisions – most substantially in the mobile handset (formerly Nokia) business – since I positioned Mr. Ballmer as America’s worst CEO in 2012. Job growth appears highly unlikely at Microsoft.

“CEOs – From Makers to Takers”

Forbes colleague Steve Denning has written an excellent column on the transformation of CEOs from those who make businesses, to those who take from businesses. Far too many CEOs focus on personal net worth building, making enormous compensation regardless of company performance. Money is spent on inflated pay, stock buybacks and managing short-term earnings to maximize bonuses. Too often immediate cost savings, such as from outsourcing, drive bad long-term decisions.

CEOs are the ones who determine how our collective national resources are invested. The private economy, which they control, is vastly larger than any spending by the government. Harvard professor William Lazonick details how between 2003 and 2012 CEOs gave back 54% of all earnings in share buybacks (to drive up stock prices short term) and handed out another 37% in dividends. Investors may have gained, but it’s hard to create jobs (and for a nation to prosper) when only 9% of all earnings for a decade go into building new businesses!

There are great CEOs out there. Steve Jobs and his replacement Tim Cook increased revenues and employment dramatically at Apple. Jeff Bezos made Amazon into an enviable growth machine, producing revenues and jobs. These leaders are focused on doing what it takes to grow their companies, and as a result the jobs in America.

It’s just too bad the 5 fellows profiled above have done more to destroy value than create it.

by Adam Hartung | May 30, 2014 | Current Affairs, In the Swamp, In the Whirlpool, Leadership, Sports, Web/Tech

Anyone who reads my column knows I’ve been no fan of Steve Ballmer as CEO of Microsoft. On multiple occasions I chastised him for bad decisions around investing corporate funds in products that are unlikely to succeed. I even called him the worst CEO in America. The Washington Post even had difficulty finding reputable folks to disagree with my argument.

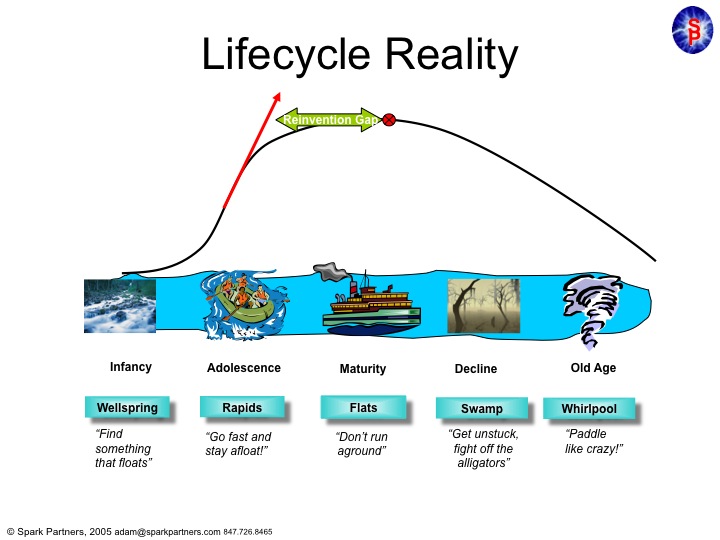

Unfortunately, Microsoft suffered under Mr. Ballmer. And Windows 8, as well as the Surface tablet, have come nowhere close to what was expected for their sales – and their ability to keep Microsoft relevant in a fast changing personal technology marketplace. In almost all regards, Mr. Ballmer was simply a terrible leader, largely because he had no understanding of business/product lifecycles.

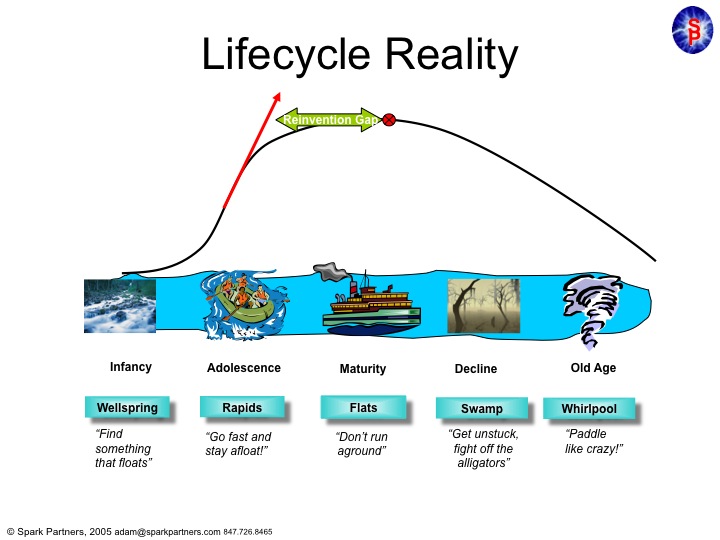

Microsoft was founded by Bill Gates, who did a remarkable job of taking a start-up company from the Wellspring of an idea into one of the fastest growing adolescents of any American company.

Microsoft was founded by Bill Gates, who did a remarkable job of taking a start-up company from the Wellspring of an idea into one of the fastest growing adolescents of any American company.

Under Mr. Gates leadership Microsoft single-handedly overtook the original PC innovator – Apple – and left it a niche company on the edge of bankruptcy in little over a decade.

Mr. Gates kept Microsoft’s growth constantly in the double digits by not only making superior operating system software, but by pushing the company into application software which dominated the desktop (MS Office.) And when the internet came along he had the vision to be out front with Internet Explorer which crushed early innovator, and market maker, Netscape.

But then Mr. Gates turned the company over to Mr. Ballmer. And Mr. Ballmer was a leader lacking vision, or innovation. Instead of pushing Microsoft into new markets, as had Mr. Gates, he allowed the company to fixate on constant upgrades to the products which made it dominant – Windows and Office. Instead of keeping Microsoft in the Rapids of growth, he offered up a leadership designed to simply keep the company from going backward. He felt that Microsoft was a company that was “mature” and thus in need of ongoing enhancement, but not much in the way of real innovation. He trusted the market to keep growing, indefinitely, if he merely kept improving the products handed him.

As a result Microsoft stagnated. A “Reinvention Gap” developed as Vista, Windows 7, then Windows 8 and one after another Office updates did nothing to develop new customers, or new markets. Microsoft was resting on its old laurels – monopolistic control over desktop/laptop markets – without doing anything to create new markets which would keep it on the old growth trajectory of the Gates era.

Things didn’t look too bad for several years because people kept buying traditional PCs. And Ballmer famously laughed at products like Linux or Unix – and then later at entertainment devices, smart phones and tablets – as Microsoft launched, but then abandoned products like Zune, Windows CE phones and its own tablet. Ballmer kept thinking that all the market wanted was a faster, cheaper PC. Not anything really new.

And he was dead wrong. The Reinvention Gap emerged to the public when Apple came along with the iPod, iTunes, iPhone and iPad. These changed the game on Microsoft, and no longer was it good enough to simply have a better edition of an outdated technology. As PC sales began declining it was clear that Ballmer’s leadership had left the company in the Swamp, fighting off alligators and swatting at mosquitos with no strategy for how it would regain relevance against all these new competitors.

So the Board pushed him out, and demoted Gates off the Chairman’s throne. A big move, but likely too late. Fewer than 7% of companies that wander into the Swamp avoid the Whirlpool of demise. Think Univac, Wang, Lanier, DEC, Cray, Sun Microsystems (or Circuit City, Montgomery Wards, Sears.) The new CEO, Satya Nadella, has a much, much more difficult job than almost anyone thinks. Changing the trajectory of Microsoft now, after more than a decade creating the Reinvention Gap, is a task rarely accomplished. So rare we make heros of leaders who do it (Steve Jobs, Lou Gerstner, Lee Iacocca.)

So what will happen at the Clippers?

Critically, owning an NBA team is nothing like competing in the real business world. It is a closed marketplace. New competitors are not allowed, unless the current owners decide to bring in a new team. Your revenues are not just dependent upon you, but are even shared amongst the other teams. In fact your revenues aren’t even that closely tied to winning and losing. Season tickets are bought in advance, and with so many games away from home a team can do quite poorly and still generate revenue – and profit – for the owner. And this season the Indiana Pacers demonstrated that even while losing, fans will come to games. And the Philadelphia 76ers drew crowds to see if they would set a new record for the most consecutive games lost.

In America the major sports only modestly overlap, so you have a clear season to appeal to fans. And even if you don’t make it into the playoffs, you still share in the profits from games played by other teams. As a business, a team doesn’t need to win a championship to generate revenue – or make a profit. In fact, the opposite can be true as Wayne Huizenga learned owning the Championship winning Florida Marlins baseball team. He payed so much for the top players that he lost money, and ended up busting up the team and selling the franchise!

In short, owning a sports franchise doesn’t require the owner to understand lifecycles. You don’t have to understand much about business, or about business competition. You are protected from competitors, and as one of a select few in the club everyone actually works together – in a wholly uncompetitive way – to insure that everyone makes as much money as possible. You don’t even have to know anything about managing people, because you hire coaches to deal with players, and PR folks to deal with fans and media. And as said before whether or not you win games really doesn’t have much to do with how much money you make.

Most sports franchise owners are known more for their idiosyncrasies than their business acumen. They can be loud and obnoxious all they want (with very few limits.) And now that Mr. Ballmer has no investors to deal with – or for that matter vendors or cooperative parties in a complex ecosystem like personal technology – he doesn’t have to fret about understanding where markets are headed or how to compete in the future.

When it comes to acting like a person who knows little about business, but has a huge ego, fiery temper and loves to be obnoxious there is no better job than being a sports franchise owner. Mr. Ballmer should fit right in.

by Adam Hartung | May 16, 2014 | Current Affairs, Defend & Extend, In the Swamp, Leadership, Lifecycle, Web/Tech

IBM had a tough week this week. After announcing earnings on Wednesday IBM fell 2%, dragging the Dow down over 100 points. And as the Dow reversed course to end up 2% on the week, IBM continued to drag, ending down almost 3% for the week.

Of course, one bad week – even one bad earnings announcement – is no reason to dump a good company’s stock. The short term vicissitudes of short-term stock trading should not greatly influence long-term investors. But in IBM’s case, we now have 8 straight quarters of weaker revenues. And that HAS to be disconcerting. Managing earnings upward, such as the previous quarter, looks increasingly to be a short-term action, intended to overcome long-term revenues declines which portend much worse problems.

This revenue weakness roughly coincides with the tenure of CEO Virginia Rometty. And in interviews she increasingly is defending her leadership, and promising that a revenue turnaround will soon be happening. That it hasn’t, despite a raft of substantial acquisitions, indicates that the revenue growth problems are a lot deeper than she indicates.

CEO Rometty uses high-brow language to describe the growth problem, calling herself a company steward who is thinking long-term. But as the famous economist John Maynard Keynes pointed out in 1923, “in the long run we are all dead.” Today CEO Rometty takes great pride in the company’s legacy, pointing out that “Planes don’t fly, trains don’t run, banks don’t operate without much of what IBM does.”

But powerful as that legacy has been, in markets that move as fast as digital technology any company can be displaced very fast. Just ask the leadership at Sun Microsystems that once owned the telecom and enterprise markets for servers – before almost disappearing and being swallowed by Oracle in just 5 years (after losing $200B in market value.) Or ask former CEO Steve Ballmer at Microsoft, who’s delays at entering mobile have left the company struggling for relevancy as PC sales flounder and Windows 8 fails to recharge historical markets.

CEO Rometty may take pride in her earnings management. But we all know that came from large divestitures of the China business, and selling the PC and server business. As well as significant employee layoffs. All of which had short-term earnings benefits at the expense of long-term revenue growth. Literally $6B of revenues sold off just during her leadership.

Which in and of itself might be OK – if there was something to replace those lost sales. (Even if they didn’t have any profits – because at least we have faith in Amazon creating future profits as revenues zoom.)

What really worries me about IBM are two things that are public, but not discussed much behind the hoopla of earnings, acquisitions, divestitures and all the talk, talk, talk regarding a new future.

CNBC reported (again, this week,) that 121 companies in the S&P 500 (27.5%) cut R&D in the first quarter. And guess who was on the list? IBM, once an inveterate leader in R&D has been reducing R&D spending. The short-term impact? Better quarterly earnings. Long term impact????

The Washington Post reported this week about the huge sums of money pouring out of corporations into stock buybacks rather than investing in R&D, new products, new capacity, enhanced marketing, sales growth, etc. $500B in buybacks this year, 34% more than last year’s blistering buyback pace, flowed out of growth projects. To make matters worse, this isn’t just internal cash flow going for buybacks, but companies are actually borrowing money, increasing their debt levels, in order to buy their own stock!

And the Post labels as the “poster child” for this leveraged stock-propping behavior…. IBM. IBM

“in the first quarter bought back more than $8 billion of its own stock, almost all of it paid for by borrowing. By reducing the number of outstanding shares, IBM has been able to maintain its earnings per share and prop up its stock price even as sales and operating profits fall.

The result: What was once the bluest of blue-chip companies now has a debt-to-equity ratio that is the highest in its history. As Zero Hedge put it, IBM has embarked on a strategy to “postpone the day of income statement reckoning by unleashing record amounts of debt on what was once upon a time a pristine balance sheet.”

In the case of IBM, looking beyond the short-term trees at the long-term forest should give investors little faith in the CEO or the company’s future growth prospects. Much is being hidden in the morass of financial machinations surrounding acquisitions, divestitures, debt assumption and stock buybacks. Meanwhile, revenues are declining, and investments in R&D are falling. This cannot bode well for the company’s long-term investor prospects, regardless of the well scripted talking points offered last week.

by Adam Hartung | Nov 6, 2013 | Defend & Extend, Innovation, Leadership, Web/Tech

Can you believe it has been only 12 years since Apple introduced the iPod? Since then Apple’s value has risen from about $11 (January, 2001) to over $500 (today) – an astounding 45X increase.

With all that success it is easy to forget that it was not a “gimme” that the iPod would succeed. At that time Sony dominated the personal music world with its Walkman hardware products and massive distribution through consumer electronics chains such as Best Buy, and broad-line retailers like Wal-Mart. Additionally, Sony had its own CD label, from its acquisition of Columbia Records (renamed CBS Records,) producing music. Sony’s leadership looked impenetrable.

But, despite all the data pointing to Sony’s inevitable long-term domination, Apple launched the iPod. Derided as lacking CD quality, due to MP3’s compression algorithms, industry leaders felt that nobody wanted MP3 products. Sony said it tried MP3, but customers didn’t want it.

All the iPod had going for it was a trend. Millions of people had downloaded MP3 songs from Napster. Napster was illegal, and users knew it. Some heavy users were even prosecuted. But, worse, the site was riddled with viruses creating havoc with all users as they downloaded hundreds of millions of songs.

Eventually Napster was closed by the government for widespread copyright infreingement. Sony, et.al., felt the threat of low-priced MP3 music was gone, as people would keep buying $20 CDs. But Apple’s new iPod provided mobility in a way that was previously unattainable. Combined with legal downloads, including the emerging Apple Store, meant people could buy music at lower prices, buy only what they wanted and literally listen to it anywhere, remarkably conveniently.

The forecasted “numbers” did not predict Apple’s iPod success. If anything, good analysis led experts to expect the iPod to be a limited success, or possibly failure. (Interestingly, all predictions by experts such as IDC and Gartner for iPhone and iPad sales dramatically underestimated their success, as well – more later.) It was leadership at Apple (led by the returned Steve Jobs) that recognized the trend toward mobility was more important than historical sales analysis, and the new product would not only sell well but change the game on historical leaders.

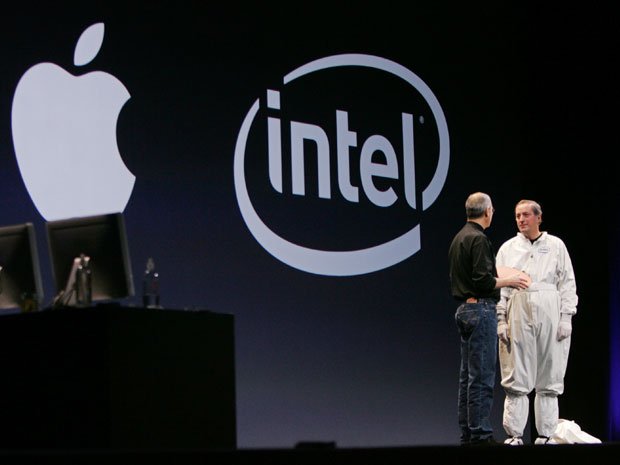

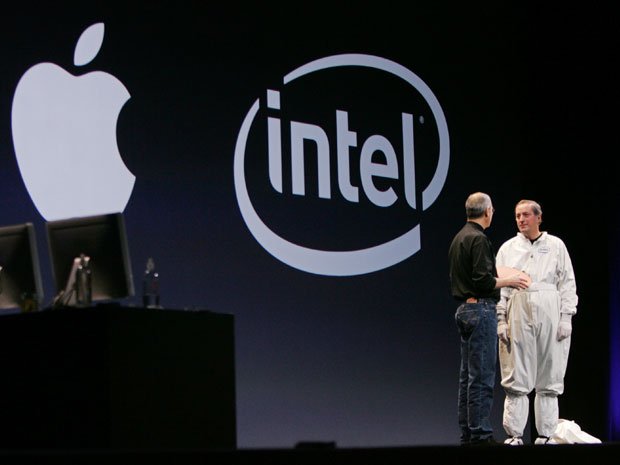

Which takes us to the mistake Intel made by focusing on “the numbers” when given the opportunity to build chips for the iPhone. Intel was a very successful company, making key components for all Microsoft PCs (the famous WinTel [for Windows+Intel] platform) as well as the Macintosh. So when Apple asked Intel to make new processors for its mobile iPhone, Intel’s leaders looked at the history of what it cost to make chips, and the most likely future volumes. When told Apple’s price target, Intel’s leaders decided they would pass. “The numbers” said it didn’t make sense.

Uh oh. The cost and volume estimates were wrong. Intel made its assessments expecting PCs to remain strong indefinitely, and its costs and prices to remain consistent based on historical trends. Intel used hard, engineering and MBA-style analysis to build forecasts based on models of the past. Intel’s leaders did not anticipate that the new mobile trend, which had decimated Sony’s profits in music as the iPod took off, would have the same impact on future sales of new phones (and eventually tablets) running very thin apps.

Harvard innovation guru Clayton Christensen tells audiences that we have complete knowledge about the past. And absolutely no knowledge about the future. Those who love numbers and analysis can wallow in reams and reams of historical information. Today we love the “Big Data” movement which uses the world’s most powerful computers to rip through unbelievable quantities of historical data to look for links in an effort to more accurately predict the future. We take comfort in thinking the future will look like the past, and if we just study the past hard enough we can have a very predictible future.

But that isn’t the way the business world works. Business markets are incredibly dynamic, subject to multiple variables all changing simultaneously. Chaos Theory lecturers love telling us how a butterfly flapping its wings in China can cause severe thunderstorms in America’s midwest. In business, small trends can suddenly blossom, becoming major trends; trends which are easily missed, or overlooked, possibly as “rounding errors” by planners fixated on past markets and historical trends.

Markets shift – and do so much, much faster than we anticipate. Old winners can drop remarkably fast, while new competitors that adopt the trends become “game changers” that capture the market growth.

In 2000 Apple was the “Mac” company. Pretty much a one-product company in a niche market. And Apple could easily have kept trying to defend & extend that niche, with ever more problems as Wintel products improved.

But by understanding the emerging mobility trend leadership changed Apple’s investment portfolio to capture the new trend. First was the iPod, a product wholly outside the “core strengths” of Apple and requiring new engineering, new distribution and new branding. And a product few people wanted, and industry leaders rejected.

Then Apple’s leaders showed this talent again, by launching the iPhone in a market where it had no history, and was dominated by Motorola and RIMM/BlackBerry. Where, again, analysts and industry leaders felt the product was unlikely to succeed because it lacked a keyboard interface, was priced too high and had no “enterprise” resources. The incumbents focused on their past success to predict the future, rather than understanding trends and how they can change a market.

Too bad for Intel. And Blackberry, which this week failed in its effort to sell itself, and once again changed CEOs as the stock hit new lows.

Then Apple did it again. Years after Microsoft attempted to launch a tablet, and gave up, Apple built on the mobility trend to launch the iPad. Analysts again said the product would have limited acceptance. Looking at history, market leaders claimed the iPad was a product lacking usability due to insufficient office productivity software and enterprise integration. The numbers just did not support the notion of investing in a tablet.

Anyone can analyze numbers. And today, we have more numbers than ever. But, numbers analysis without insight can be devastating. Understanding the past, in grave detail, and with insight as to what used to work, can lead to incredibly bad decisions. Because what really matters is vision. Vision to understand how trends – even small trends – can make an enormous difference leading to major market shifts — often before there is much, if any, data.