by Adam Hartung | Oct 25, 2015 | Current Affairs, Defend & Extend, Food and Drink, In the Swamp, In the Whirlpool, Leadership, Web/Tech

This week McDonald’s and Microsoft both reported earnings that were higher than analysts expected. After these surprise announcements, the equities of both companies had big jumps. But, unfortunately, both companies are in a Growth Stall and unlikely to sustain higher valuations.

McDonald’s profits rose 23%. But revenues were down 5.3%. Leadership touted a higher same store sales number, but that is completely misleading.

McDonald’s leadership has undertaken a back to basics program. This has been used to eliminate menu items and close “underperforming stores.” With fewer stores, loyal customers were forced to eat in nearby stores – something not hard to do given the proliferation of McDonald’s sites. But some customers will go to competitors. By cutting stores and products from the menu McDonald’s may lower cost, but it also lowers the available revenue capacity. This means that stores open a year or longer could increase revenue, even though total revenues are going down.

Profits can go up for a raft of reasons having nothing to do with long-term growth and sustainability. Changing accounting for depreciation, inventory, real estate holdings, revenue recognition, new product launches, product cancellations, marketing investments — the list is endless. Further, charges in a previous quarter (or previous year) could have brought forward costs into an earlier report, making the comparative quarter look worse while making the current quarter look better.

Confusing? That’s why accounting changes are often called “financial machinations.” Lots of moving numbers around, but not necessarily indicating the direction of the business.

McDonald’s asked its “core” customers what they wanted, and based on their responses began offering all-day breakfast. Interpretation – because they can’t attract new customers, McDonald’s wants to obtain more revenue from existing customers by selling them more of an existing product; specifically breakfast items later in the day.

Sounds smart, but in reality McDonald’s is admitting it is not finding new ways to grow its customer base, or sales. The old products weren’t bringing in new customers, and new products weren’t either. As customer counts are declining, leadership is trying to pull more money out of its declining “core.” This can work short-term, but not long-term. Long-term growth requires expanding the sales base with new products and new customers.

Perhaps there is future value in spinning off McDonald’s real estate holdings in a REIT. At best this would be a one-time value improvement for investors, at the cost of another long-term revenue stream. (Sort of like Chicago selling all its future parking meter revenues for a one-time payment to bail out its bankrupt school system.) But if we look at the Sears Holdings REIT spin-off, which ostensibly was going to create enormous value for investors, we can see there were serious limits on the effectiveness of that tactic as well.

MIcrosoft also beat analysts quarterly earnings estimate. But it’s profits were up a mere 2%. And revenues declined 12% versus a year ago – proving its Growth Stall continues as well. Although leadership trumpeted an increase in cloud-based revenue, that was only an 8% improvement and obviously not enough to offset significant weakness in other markets:

It is a struggle to see the good news here. Office 365 revenues were up, but they are cannibalizing traditional Office revenues – and not fast enough to replace customers being lost to competitive products like Google OfficeSuite, etc.

Azure sales were up, but not fast enough to replace declining Windows sales. Further, Azure competes with Amazon AWS, which had remarkable results in the latest quarter. After adding 530 new features, AWS sales increased 15% vs. the previous quarter, and 78% versus the previous year. Margins also increased from 21.4% to 25% over the last year. Azure is in a growth market, but it faces very stiff competition from market leader Amazon.

We build our companies, jobs and lives around successful products and services. We want these providers to succeed because it makes our lives much easier. We don’t like to hear about large market leaders losing their strength, because it signals potentially difficult change. We want these companies to improve, and we will clutch at any sign of improvement.

As investors we behave similarly. We were told large companies have vast customer bases, strong asset bases, well known brands, high switching costs, deep pockets – all things Michael Porter told us in the 1980s created “moats” protecting the business, keeping it protected from market shifts that could hurt sales and profits. As investors we want to believe that even though the giant company may slip, it won’t fall. Time and size is on its side we choose to believe, so we should simply “hang on” and “ride it out.” In the future, the company will do better and value will rise.

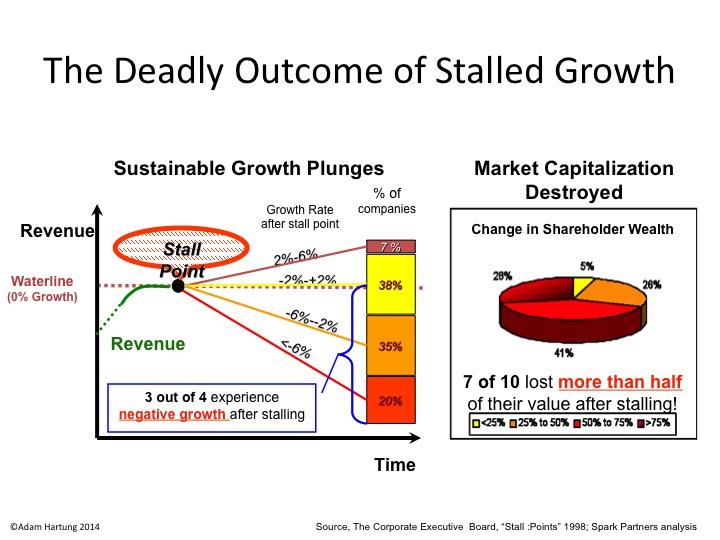

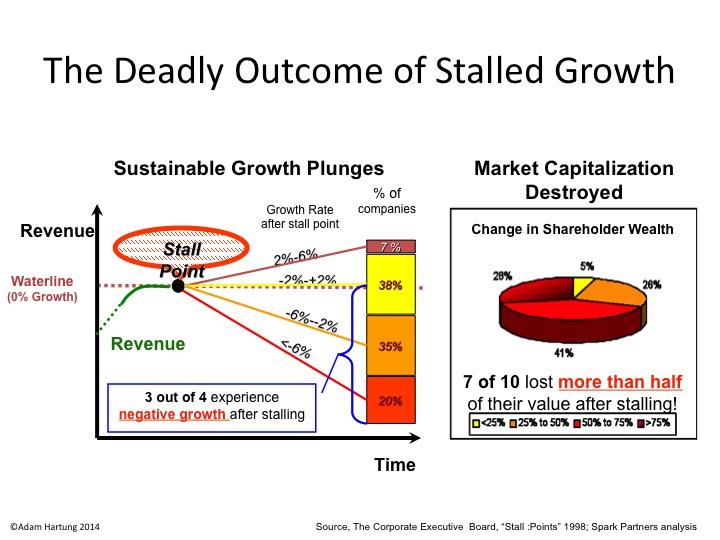

As a result we see that Growth Stall companies show a common valuation pattern. After achieving high valuation, their equity value stagnates. Then, hopes for a turn-around and recovery to new growth is stimulated by a few pieces of good news and the value jumps again. Only after a few years the short-term tactics are used up and the underlying business weakness is fully exposed. Then value crumbles, frequently faster than remaining investors anticipated.

McDonald’s valuation rose from $62/share in 2008 to reach record $100/share highs in 2011. But valuation then stagnated. It is only this last jump that has caused it to reach new highs. But realize, this is on a smaller number of stores, fewer products and declining revenues. These are not factors justifying sustainable value improvement.

Microsoft traded around $25/share from March, 2003 through November, 2011 – 8.5 years. When the CEO was changed value jumped to $48/share by October, 2014. After dipping, now, a year later Microsoft stock is again reaching that previous valuation ($50/share). Microsoft is now valued where it was in December, 2002 (which is half its all-time high.)

The jump in value of McDonald’s and Microsoft happened on short-term news regarding beating analysts earnings expectations for one quarter. The underlying businesses, however, are still suffering declining revenue. They remain in Growth Stalls, and the odds are overwhelming that their values will decline, rather than continue increasing.

by Adam Hartung | Oct 5, 2015 | Current Affairs, In the Rapids, Innovation, Leadership, Web/Tech

Twitter’s Board decided in July to oust the CEO, Dick Costolo, due to frustration over company profits. As I wrote at the time, Twitter had continued to add members, at a rate comparable to its social media competition. And it had grown revenues, while remaining the industry leader in revenue per active user.

But the concern was a lack of profits. Oh my, if rapid revenue growth but weak profits were a reason to fire a CEO, how does Jeff Bezos keep his job?

Anyway, Mr. Costolo was replaced by an original founder and former Twitter CEO Jack Dorsey on an interim basis. Four months later, after failing in its effort to find a suitable full-time CEO, the Board has made Mr. Dorsey the permanent CEO. While he simultaneously remains full time CEO of Square, a mobile payments processing company.

Anyway, Mr. Costolo was replaced by an original founder and former Twitter CEO Jack Dorsey on an interim basis. Four months later, after failing in its effort to find a suitable full-time CEO, the Board has made Mr. Dorsey the permanent CEO. While he simultaneously remains full time CEO of Square, a mobile payments processing company.

As I said in my last column on this subject, investors better beware.

Facebook is tearing up the social media market. It has grown to be not only #1 in active monthly users, but at 1.5B monthly active users (MSUs) the site has 5 times the number of users that Twitter has. By adding a slew of new features and functions Facebook has become more valuable to its users – and advertisers.

According to Statista, simultaneously Facebook has grown Facebook Messenger to 700M MSUs, acquired WhatsApp with 800M MSUs and Instagram with 400M MSUs. By constantly expanding the ecosphere Facebook now has 3.4B MSUs – over 10 times the number of Twitter. Facebook is so dominant that even muscular Google, with all its resources, abandoned its efforts to compete with the juggernaut by killing Google+ (which had 300M MSUs) earlier in 2015.

Twitter had great organic growth numbers, but unlike competitors it does not dominate any particular category of social media. Linked in, with only 100M MSUs dominates business networking, and bosts a user base that skews older and more professional. Pinterest and Instagram are battling it out for leadership in photo sharing. But it is unclear how one would describe a social growth category that Twitter dominates.

I actively use Twitter. But among my peers I am the exception. When I ask people over 40 if they use Twitter I regularly hear “I don’t get it. It all looks completely chaotic. Why would I want to follow people on Twitter, and why would I want to post.” This sounds a lot like what people said of Facebook and Linked in 5 years ago. But those companies found their connection with users and people now “get it.”

So the question is whether Mr. Dorsey will make Twitter into a site that is ubiquitous, at least for one category. Can he make the product so useful that users can’t live without it, and that continues drawing in massive new numbers of users?

Twitter has not changed much at all since it was founded. It still depends on users to sign on, start tweeting, and search out others a user wants to follow. And that means follow for some reason other than that person is a celebrity or politician that simply can’t stop spouting off. The Twitter user has to hunt for like minded individuals, find a way to connect with folks who are informative to their needs and then create a dialogue — and all with pretty much the same character limits and shrunken link technology available many years ago.

Apple floundered as a manufacturer of niche PCs. The returning CEO, Steve Jobs, resurrected the company by putting all his money on mobile. It wasn’t an improved Mac that turned around Apple, but rather the launch of the iPod and iTunes, followed by the iPhone and the iPad. The way Apple stole the thunder from previously dominant Microsoft was by creating new products built on the mobile trend that led to explosive growth.

Mr. Costolo left Twitter in far better shape than Apple was in when Mr. Jobs retook the reins. But will Mr. Dorsey be able to launch a series of new products that can create an Apple-like growth explosion?

Square, where Mr. Dorsey ostensibly spends half his time, is preparing to go public. But, even though it is currently considered by many the leader in its marketplace, Square is looking down the barrel of ApplePay – a technology on every iPhone that could make it obsolete. Then there’s also Google Wallet that is on all the other smartphones. Plus well funded outfits like PayPal and Mastercard. Square will need a very competent, capable and visionary CEO to guide its development competing with these – and other – well funded and powerful companies. Square will need to add features, functions and benefits if it is create long-term value.

A lot of new products are needed by two relatively small companies in short order if they are to survive. Success will not happen by cutting costs in either. It will require intensive product development with very rapid product cycles that bring in millions upon millions of new users.

Twitter was once a disruptive innovator. Now it is hard to recognize any innovation at Twitter. Does Mr. Dorsey get it? And if he does, can he do it? And do it twice, simultaneously?

by Adam Hartung | Aug 27, 2015 | In the Rapids, Innovation, Investing, Leadership, Web/Tech

As market volatility reached new highs this week, CNBC began talking about something called “FANG Investing.” Most commentators showed great displeasure in the fact that prior to the recent downturn high growth companies such as Facebook, Amazon, Netflix and Google (FANG) had performed much better than all the major market indices. And, in the short burst of recent recovery these companies again seemed to be doing much better.

Coined by “CNBC Mad Money” host Jim Cramer, he felt that FANG investing was bad for investors. He said he preferred seeing a much larger group of companies would go up in value, thus representing a much more stable marketplace.

Coined by “CNBC Mad Money” host Jim Cramer, he felt that FANG investing was bad for investors. He said he preferred seeing a much larger group of companies would go up in value, thus representing a much more stable marketplace.

Sound like Wall Street gobblygook? Good. Because as an individual investor why should you care about a stable market? What you should care about is your individual investments going up in value. And if yours go up and all others go down what difference does it make?

Most financial advisers today actually confuse investors much more than help them. And nowhere is this more true than when discussing risk. All financial advisers (brokers in the old days) ask how much risk you want as an investor. If you’re smart you say “none.” Why would you want any risk? You want to make money.

Only this is the wrong answer, because most investors don’t understand the question – because the financial adviser’s definition of risk is nothing like yours.

To a broker investment risk is this bizarre term called “beta,” created by economists. They defined risk as the degree to which a stock does not move with the market index. If the S&P down 5%, and the stock goes down 5%, then they see no difference between the stock and the “market” so they say it has no risk. If the S&P goes up 3% and the stock goes up 3%, again, no risk.

But if a stock trades based on its own investor expectation, and does not track the market index, then it is considered “high beta” and your broker will say it is “high risk.” So let’s look at Apple the last 5 years. If you had put all your money into Apple 5 years ago you would be up over 200% – over 4x. Had you bought the S&P 500 Index you would be up 80%. Clearly, investing in Apple would have been better. But your adviser would say that is “high risk.” Why? Because Apple did not move with the S&P. It did much better. It is therefore considered high beta, and high risk.

You buy that?

Thus, brokers keep advising investors buy funds of various kinds. Because the investors says she wants low risk, they try to make sure her returns mirror the indices. But it begs the question, why don’t you just buy an electronic traded fund (ETF) that mirrors the S&P or Dow, and quit paying those fund fees and broker fees? If their approach is designed to have you do no better than the average, why not stop the fees and invest in those things which will exactly give you the average?

Anyway, what individual investors want is high returns. And that has nothing to do with market indices or how a stock moves compares to an index. It has to do with growth.

Growth is a wonderful thing. When a company grows it can write off big mistakes and nobody cares. It can overpay employees, give them free massages and lunches, and nobody cares. It can trade some of its stock for a tiny company, implying that company is worth a vast amount, in order to obtain new products it can push to its customers, and nobody cares. Growth hides a multitude of sins, and provides investors with the opportunity for higher valuations.

On the other hand, nobody ever cost cut a company into prosperity. Layoffs, killing products, shutting down businesses and selling assets does not create revenue growth. It causes the company to shrink, and the valuation to decline.

That’s why it is lower risk to invest in FANG stocks than those so-called low-risk portfolios. Companies like Facebook, Amazon, Netflix, Google — and Apple, EMC, Ultimate Software, Tesla and Qualcomm just to name a few others — are growing. They are firmly tied to technologies and products that are meeting emerging needs, and they know their customers. They are doing things that increase long-term value.

McDonald’s was a big winner for investors in the 1960s and 1970s as fast food exploded with the baby boomer generation. But as the market shifted McDonald’s sold off its investments in trend-linked brands Boston Market and Chipotle. Now its revenue has stalled, and its value is in decline as it shuts stores and lays off employees.

Thirty years ago GE tied its plans to trends in medical technology, financial services and media, and it grew tremendously making fortunes for its investors. In the last decade it has made massive layoffs, shut down businesses and sold off its appliance, financial services and media businesses. It is now smaller, and its valuation is smaller.

Caterpillar tied itself to the massive infrastructure growth in Asia and India, and it grew. But as that growth slowed it did not move into new businesses, so its revenues stalled. Now its value is declining as it lays off employees and shuts down business units.

Risk is tied to the business and its future expectations. Not how a stock moves compared to an index. That’s why investing in high growth companies tied to trends is actually lower risk than buying a basket of stocks — even when that basket is an index like DIA or SPY. Why should you own the low-or no-growth dogs when you don’t have to? How is it lower risk to invest in a struggling McDonald’s, GE or Caterpillar or some basket that contains them than investing in companies demonstrating tremendous revenue growth?

Good fishermen go where the fish are. Literally. Anybody can cast out a line and hope. But good fisherman know where the fish are, and that’s where they invest their bait. As an investor, don’t try to fish the ocean (the index.) Be smart, and put your money where the fish are. Invest in companies that leverage trends, and you’ll lower your risk of investment failure while opening the door to superior returns.

by Adam Hartung | Aug 6, 2015 | In the Rapids, Innovation, Leadership, Web/Tech

Would you like to triple your revenue next year? And have plans to keep tripling it – or more – every year into the future?

Of course you would. But is your business positioned for such explosive growth? Are you in growth markets, creating new products with new technologies that meet unmet needs and have the potential to completely change your business? Or are you stuck doing the same thing you’ve always done, a litle better, faster and cheaper in hopes you can just maintain your position?

If you’re constantly looking at your “core” markets and solutions, and you know those aren’t going to grow fast, what keeps you from changing to make your company a high growth winner?

First, most people don’t try. Leaders say it all the time, “I’m so busy running a business I don’t have time to chase rainbows. Sure technology is changing, but I don’t understand it, nor know how to use it. I’m better off investing in what I know than trying to chase trends.” That’s often followed by dragging out the old saw, usually attributed to Warren Buffet, of “don’t invest in what you don’t know – and I don’t know anything about trends.” The comfort, and ease, of repeating what you’ve always done allows lethargy to set in – so you keep doing more and more of what you’ve always done, over and again, hoping for a different result. It’s been attributed to Albert Einstein that such behavior is the very definition of insanity.

Everyone is busy. We live in a “culture of busy.” Years of layoffs and cost reductions have left most leaders simply struggling to keep up with making and selling last year’s solution. Constant busy-ness becomes a convenient excuse to not take the time to look at trends, evaluate new opportunities or consider doing things entirely differently. Busy, busy, busy – until someone knocks your business off its blocks and then you have all kinds of time on your hands.

For those who overcome these 2 built-in biases, the opportunities today are extra-ordinary. It is possible to slingshot into leadership positions with new solutions, literally from out of nowhere. If you take the time and try. Listen, and just do it – to steal from a popular ad campaign.

ikeGPS was started in 2003 as a government/military funded products research company. Focusing on the technology of lasers and cameras, they won contracts to develop and prototype new solutions with technology mostly buried in universities and labs. It was a good business, made money for the founders, and was intellectually stimulating. If not growing very fast or showing much potential of growing.

Eventually ikeGPS started making products with lasers and cameras for finding physical assets. This turned out to be quite beneficial for electric utilities, which have to maintain some 200,000 power poles in the U.S alone. EPC (Engineering, Procurement and Construction) companies like Black & Veatch, Bechtel. Burns & McDonel , FMC and Foster Wheeler had a need to find big physical things, then measure their size and location between each other and major points. For utility company suppliers like GE laser cameras for asset location were a handy, if slow growing business. Good, solid, reliable revenues, but not something that was going to create a $100M company.

So the Managing Director, Glenn Milnes, and Chief Marketing Officer, Jeff Ross, set about to see what they could do to become a $100M business. Not because anything in their history said they could do so. Rather because they wanted to make their company a bigger, faster growing and lot more valuable entity.

The first thing they identified was the trend to mobile devices. They noticed darn near everyone has one, and they were using them for all kinds of interesting things. There were thousands and thousands of apps, but none that really took advantage of the cameras to do much measuring, or integrated lasers. While they didn’t know anything about mobile operating systems, or much about the kinds of cameras in mobile phones or the software used for popular mobile camera uses – they could see a trend.

What if they could take their knowledge about lasers and cameras and figure out how to make mobile phones a lot more powerful? Could they apply what they knew into markets where they had no experience, using technologies with which they had no experience? Would it work, or waste their time? If it worked, what would they make? If they made something, who would buy it?

Despite these great questions, they wanted ikeGPS to grow, and they decided to take the cash flow from their solid, but low growth historical business and plow it into development of a new product. So they took to internal company brainstorming to see what they might do. And they came up with the very clever idea of making an add-on device that construction workers, like concrete installers, pavers, carpenters, masons and such, could use with their mobile phones to replace tape measures. Something that would be simple, easy to use, work with the phones in their pockets and be a lot more accurate than decades-old technology.

So they went to the lab and built it. They started design in October, 2013, and a year later they had a product ready to launch. – Spike! They took it to social media, Google adwords, all the low-cost ad tools available to small business today. They also went to industry trade shows, bought some ads in industry trade magazines and ads on industry specific sites. Things were OK, but it was a slow slog.

So they went to the lab and built it. They started design in October, 2013, and a year later they had a product ready to launch. – Spike! They took it to social media, Google adwords, all the low-cost ad tools available to small business today. They also went to industry trade shows, bought some ads in industry trade magazines and ads on industry specific sites. Things were OK, but it was a slow slog.

As they were preparing to launch Spike they thought, “why don’t we reach for outsiders to gain some input on this product. Let’s hear what others might have to say.” So they launched a Kickstarter campaign, offering investors the product to try. Via this route they gained the eyes and ears of early adopters.

This was when the surprise happened. The earliest adopters, and biggest fans of laser measuring via mobile devices weren’t in the construction business. They were signage companies. ikeGPS listened to their feedback, and realized they could tweek Spike to be very relevant for folks in signage. The made themselves accessible to these early adopters, and turned a few into fanatical loyalists.

With this early success, they began to downplay construction and seek signage companies. Across 2 months they placed about $20k (not millions, thousands) in ads in the 4 largest publishers to the signage industry. This led to on-line product sales, and smashing reviews.

So then they made overtures to the large franchisors of signage related shops – with retail names like Fast Sign, Sign-o-Rama, Alphagraphics, Speedy Sign, Sign World, etc — in companies like Franchise Services and Alliance Franchise. Within 6 months of launch they had stopped chasing construction customers and were full-tilt developing signage companies, to great success. Even sign supply companies llke Reece Sign saw the benefit of promoting (and even reselling) these new laser camera add-ons for mobile devices to stimulate sales and move sign design and creation into the 21st century.

After making this switch, they initial launch sold 1,200 units at $500/unit retail . But better yet, contracts for promotion and reselling has the company convinced they will blow far beyond their projection of 4,000 units in the first year.But they did not simply forget about construction. The idea was still sound, but clearly the market had not developed. So they asked themselves, “if we listened to sign guys and they told us what to do, could we listen to construction guys for advice?”

They pursued finding out more about construction, and learned the market was dominated by brand names. Few products were bought without a strong brand name – and most products are purchased through the very large home improvement chains such as Home Depot, Lowe’s, Menard’s and others. But that would be a nearly impossible task, at extremely high cost, for little ikeGPS. So they pursued finding a partner which knew the industry.

In early 2015 ideGPS announced that Stanley Black&Decker would brand and sell Spike via traditional retail. The product should be on shelves before the end of year, and substantial additional sales volumes are expected.

In 2013 100% of ikeGPS revenues were in their traditional government/military and utility markets with their bespoke device. In just one year they developed a mobile device, and launched it. In 2015 1/3 or more of their $10.5 estimated revenue will be from Spike, and they expect to at a minimum triple revenues in 2016. And they think that rate of growth is sustainable into future years.

ikeGPS shows that it IS possible to move beyond historical markets and create new products for break-out growth. You aren’t stuck in old businesses with no hope of growth. if you want to grow, and reap the rewards of growth, you can. You have to

- Want to do it

- Take time to do it

- Pay attention to trends, and support obvious trend growth

- Learn about new technologies and how you can apply them. Start with the trend technologies first, then see how to apply something new. Don’t start by trying to push what you know onto another platform. Be ethnocentric in product development, not egocentric.

- Brainstorm how to meet unmet needs

- Listen to early sales results, and go where the need is highest/selling is easiest

- Don’t forget to learn from what did not work, and see if you can overcome early weaknesses.

by Adam Hartung | Aug 2, 2015 | Current Affairs, In the Rapids, In the Swamp, Leadership, Web/Tech

eBay was once a game changer. When the internet was very young, and few businesses provided ecommerce, eBay was a pioneer. From humble beginnings selling Pez dispensers, eBay grew into a powerhouse. Things we used to sell via garage sale we could now list on eBay. Small businesses could create stores on eBay to sell goods to customers they otherwise would never reach. And collectors as well as designers suddenly discovered all kinds of products they formerly could not find. eBay sales exploded, as traditional retail started it slide downward.

To augment growth eBay realized those selling needed a simple way to collect money from people who lacked a credit card. Many customers simply had no card, or didn’t trust giving out the information across the web. So eBay bought fledgling PayPal for $1.5B in 2002, in order to grease the wheels for faster ecommerce growth. And it worked marvelously.

But times have surely changed. Now eBay and Paypal have roughly the same revenue. About $8B/year each. eBay has run into stiff competition, as CraigsList has grown to take over the “garage sale” and small local business ecommerce. Simultaneously, powerhouse Amazon has developed its storefront business to a level of sophistication, and ease of use, that makes it viable for businesses from smallest to largest to sell products on-line. And far more companies have learned they can go it alone with internet sales, using search engine optimization (SEO) techniques as well as social media to drive traffic directly to their stores, bypassing storefronts entirely.

eBay was a game changer, but now is stuck in practices that have become far less relevant. The result has been 2 consecutive quarters of declining revenue. By definition that puts eBay in a growth stall, and fewer than 7% of companies ever recover from a growth stall to consistently increase revenue by a mere 2%/year. Why not? Because once in a growth stall the company has already missed the market shift, and competition is taking customers quickly in new directions. The old leader, like eBay, keeps setting aggressive targets for its business, and tells everyone it will find new customers in remote geographies or vertical markets. But it almost never happens – because the market shift is making their offering obsolete.

eBay was a game changer, but now is stuck in practices that have become far less relevant. The result has been 2 consecutive quarters of declining revenue. By definition that puts eBay in a growth stall, and fewer than 7% of companies ever recover from a growth stall to consistently increase revenue by a mere 2%/year. Why not? Because once in a growth stall the company has already missed the market shift, and competition is taking customers quickly in new directions. The old leader, like eBay, keeps setting aggressive targets for its business, and tells everyone it will find new customers in remote geographies or vertical markets. But it almost never happens – because the market shift is making their offering obsolete.

On the other hand, Paypal has blossomed into a game changer in its own right. Not only does it support cash and credit card transactions for the growing legions of on-line shoppers, but it is providing full payment systems for providers like Uber and AirBnB. It’s tools support enterprise transactions in all currencies, including emerging bitcoin, and even provides international financial transactions as well as working capital for businesses.

Paypal is increasingly becoming a threat to traditional banks. Today most folks use a bank for depositing a pay check, and making payments. There are loans, but frequently that is shopped around irrespective of where you bank. Much like your credit cards, which most people acquire for their benefits rather than a relationship with the issuing bank. If customers increasingly make payments via Paypal, and borrow money via operations like Quicken Loans (a division of Intuit,) why do you need a bank? Discover Services, which now does offer cash deposits and loans on top of credit card services, has found that it can grow substantially by displacing traditional banks.

Paypal is today at the forefront of digital payments processing. It is a fast growing market, which will displace many traditional banks. And emerging competitors like Apple Pay and Google Wallet will surely change the market further – while aiding its growth. How it will shake out is unclear. But it is clear that Paypal is growing its revenue at 60% or greater since 2012, and at over 100%/quarter the last 2 quarters.

Paypal is now valued at about $47B. That is roughly the same as the #5 bank in America (according to assets) Bank of New York Mellon, and number 8 massive credit card issuer Capital One, as well as #9 PNC Bank – and over 50% higher valuation than #10 State Street. It is also about 50% higher than Intuit and Discover. Based on its current market leadership and position as likely game changer for the banking sector, Paypall is selling for about 8 times revenue. If its revenue continues to grow at 100%/quarter, however, revenues will reach over $38B in a year making the Price/Revenue multiple of today only 1.25.

Meanwhile, eBay is valued at about $34B. Given that all which is left in eBay is an outdated on-line ecommerce conglomerator, stuck in a growth stall, that valuation is far harder to justify. It is selling at about 4.25x revenue. But if revenues continue declining, as they have for 2 consecutive quarters, this multiple will expand. And values will be harder and harder to justify as investors rely on hope of a turnaround.

eBay was a game changer. But leadership became complacent, and now it is very likely overvalued. Just as Yahoo became when its value relied on its holdings of Alibaba rather as its organic business shrank. Meanwhile Paypal is the leader in a rapidly growing market that is likely to change the face of not just how we pay, but how we do personal and business finance. There is no doubt which is more valuable today, and likely to be in the future.

by Adam Hartung | Jul 8, 2015 | Current Affairs, Defend & Extend, In the Whirlpool, Leadership, Lock-in, Web/Tech

Microsoft announced today it was going to shut down the Nokia phone unit, take a $7.6B write-off (more than the $7.2B they paid for it,) and lay off another 7,800 employees. That makes the layoffs since CEO Nadella took the reigns almost 26,000. Finding any good news in this announcement is a very difficult task.

Unfortunately, since taking over as Microsoft’s #1 leader, Mr. Nadella has been remarkably predictable. Like his peer CEOs who take on the new role, he has slashed and burned employment, shut down at least one big business, taken massive write-offs, and undertaken at least one wildly overpriced acquisition (Minecraft) that is supposed to be a game changer for the company. He apparently picked up the “Turnaround CEO Playbook” after receiving the job and set out on the big tasks!

Unfortunately, since taking over as Microsoft’s #1 leader, Mr. Nadella has been remarkably predictable. Like his peer CEOs who take on the new role, he has slashed and burned employment, shut down at least one big business, taken massive write-offs, and undertaken at least one wildly overpriced acquisition (Minecraft) that is supposed to be a game changer for the company. He apparently picked up the “Turnaround CEO Playbook” after receiving the job and set out on the big tasks!

Yet he still has not put forward a strategy that should encourage investors, employees, customers or suppliers that the company will remain relevant long-term. Amidst all these big tactical actions, it is completely unclear what the strategy is to remain a viable company as customers move, quickly and in droves, to mobile devices using competitive products.

I predicted here in this blog the week Steve Ballmer announced the acquisition of Nokia in September, 2013 that it was “a $7.2B mistake.” I was off, because in addition to all the losses and restructuring costs Microsoft endured the last 7 quarters, the write off is $7.6B. Oops.

Why was I so sure it would be a mistake? Because between 2011 and 2013 Nokia had already lost half its market share. CEO Elop, who was previously a Microsoft senior executive, had committed Nokia completely to Windows phones, and the results were already catastrophic. Changing ownership was not going to change the trajectory of Nokia sales.

Microsoft had failed to build any sort of developer community for Windows 8 mobile. Developers need people holding devices to buy their software. Nokia had less than 5% share. Why would any developer build an app for a Windows phone, when almost the entire market was iOS or Android? In fact, it was clear that developing rev 2, 3, and 4 of an app for the major platforms was far more valuable than even bothering to port an app into Windows 8.

Nokia and Windows 8 had the worst kind of tortuous whirlpool – no users, so no developers, and without new (and actually unique) software there was nothing to attract new users. Microsoft mobile simply wasn’t even in the game – and had no hope of winning. It was already clear in June, 2012 that the new Windows tablet – Surface – was being launched with a distinct lack of apps to challenge incumbents Apple and Samsung.

By January, 2013 it was also clear that Microsoft was in a huge amount of trouble. Where just a few years before there were 50 Microsoft-based machines sold for every competitive machine, by 2013 that had shifted to 2 for 1. People were not buying new PCs, but they were buying mobile devices by the shipload – literally. And there was no doubt that Windows 8 had missed the mobile market. Trying too hard to be the old Windows while trying to be something new made the product something few wanted – and certainly not a game changer.

A year ago I wrote that Microsoft has to win the war for developers, or nothing else matters. When everyone used a PC it seemed that all developers were writing applications for PCs. But the world shifted. PC developers still existed, but they were not able to grow sales. The developers making all the money were the ones writing for iOS and Android. The growth was all in mobile, and Microsoft had nothing in the game. Meanwhile, Apple and IBM were joining forces to further displace laptops with iPads in commercial/enterprise uses.

Then we heard Windows 10 would change all of that. And flocks of people wrote me that a hybrid machine, both PC and tablet, was the tool everyone wanted. Only we continue to see that the market is wildly indifferent to Windows 10 and hybrids.

Imagine you write with a fountain pen – as most people did 70 years ago. Then one day you are given a ball point pen. This is far easier to use, and accomplishes most of what you want. No, it won’t make the florid lines and majestic sweeps of a fountain pen, but wow it is a whole lot easier and a darn site cheaper. So you keep the fountain pen for some uses, but mostly start using the ball point pen.

Then the fountain pen manufacturer says “hey, I have a contraption that is a ball point pen, sort of, and a fountain pen, sort of, combined. It’s the best of all worlds.” You would likely look at it, but say “why would I want that. I have a fountain pen for when I need it. And for 90% of the stuff I write the ball point pen is great.”

That’s the problem with hybrids of anything – and the hybrid tablet is no different. The entrenched sellers of old technology always think a hybrid is a good idea. But once customers try the new thing, all they want are advancements to the new thing. (Just look at the interest in Tesla cars compared to the stagnant sales of hybrid autos.)

And we’re up to Surface 3 now. When I pointed out in January, 2013 that the markets were rapidly moving away from Microsoft I predicted Surface and Surface Pro would never be important products. Reader outcry at that time from Microsoft devotees was so great that Forbes editors called me on the carpet and told me I lacked the data to make such a bold prediction. But I stuck by my guns, we changed some language so it was less blunt, and the article ran.

Two and a half years later and we’re up to rev number Surface 3. And still, almost nobody is using the product. Less than 5% market share. Right again. It wasn’t a technology prediction, it was a market prediction. Lacking app developers, and a unique use, the competition was, and remains, simply too far out front.

Windows 10 is, unfortunately, a very expensive launch. And to get people to use it Microsoft is giving it away for free. The hope is then users will hook onto the cloud-based Office 365 and Microsoft’s Azure cloud services. But this is still trying to milk the same old cow. This approach relies on people being completely unwilling to give up using Windows and/or Office. And we see every day that millions of people are finding alternatives they like just fine, thank you very much.

Gamers hated me when I recommended Microsoft should give (for free) xBox to Nintendo. Unfortunately, I learned few gamers know much about P&Ls. They all assumed Microsoft made a fortune in gaming. But anyone who’s ever looked at Microsoft’s financial filings knows that the Entertainment Division, including xBox, has been a giant money-sucking hole. If they gave it away it would save money, and possibly help leadership figure out a strategy for profitable growth.

Unfortunately, Microsoft bought Minecraft, in effect “doubling down” on the bet. But regardless of how well anyone likes the products, Microsoft is not making money. Gaming is a bloody war where Sony and Microsoft keep battling, and keep losing billions of dollars. The odds of ever earning back the $2.5B spent on Minecraft is remote.

The greater likelihood is that as write offs continue to eat away at profits, and as markets continue evolving toward mobile products offered by competitors hurting “core” Microsoft sales, CEO Nadella will eventually have to give up on gaming and undertake another Nokia-like event.

All investors risk looking at current events to drive decision-making. When Ballmer was sacked and Nadella given the CEO job the stock jumped on euphoria. But the last 18 months have shown just how bad things are for Microsoft. It is a near monopolist in a market that is shrinking. And so far Mr. Nadella has failed to define a strategy that will make Microsoft into a company that does more than try to milk its heritage.

I said the giant retailer Sears Holdings would be a big loser the day Ed Lampert took control of the company. But hope sprung eternal, and investors jumped on the Sears bandwagon, believing a new CEO would magically improve a worn out, locked-in company. The stock went up for over 2 years. But, eventually, it became clear that Sears is irrelevant and the share price increase was unjustified. And the stock tanked.

Microsoft looks much the same. The actions we see are attempts to defend & extend a gloried history. But they don’t add up to a strategy to compete for the future. HoloLens will not be a product capable of replacing Windows plus Office revenues. If developers are attracted to it enough to start writing apps. Cortana is cool, but it is not first. And competitive products have so much greater usage that developer learning curve gains are wildly faster. These products are not game changers. They don’t solve large, unmet needs.

And employees see this. As I wrote in my last column, it is valuable to listen to employees. As the bloom fell off the rose, and Nadella started laying people off while freezing pay, employee support of him declined dramatically. And employee faith in leadership is far lower than at competitors Apple and Google.

As long as Microsoft keeps playing catch up, we should expect more layoffs, cost cutting and asset sales. And attempts at more “hail Mary” acquisitions intended to change the company. All of which will do nothing to grow customers, provide better jobs for employees, create value for investors or greater revenue opportunities for suppliers.

by Adam Hartung | Jun 14, 2015 | Current Affairs, In the Rapids, Leadership, Web/Tech

Dick Costolo was let go from his role as CEO of Twitter, to be replaced by a former CEO that was also fired. Unfortunately, it looks very strongly as if the Board made this decision for the wrong reasons.

Even though investors have been unhappy with Twitter’s share price, as CEO Mr. Costolo was doing a decent job of growing the company and improving profits. And even though analysts keep offering reasons why he was fired, it looks mostly as if this was a political decision in a company with a “soap opera” executive culture. Investors should be worried.

Let’s compare Mr. Costolo to CEO Zuckerberg’s performance at Facebook, and Mr. Bezos’ performance at Amazon. The latter two have been widely heralded for their leadership, so it sets a pretty good bar.

None of these three companies have enough earnings to matter. If you aren’t a growth investor, and you always value a company on earnings, then none of these are your cup of tea. All are evaluated on revenue and user metrics.

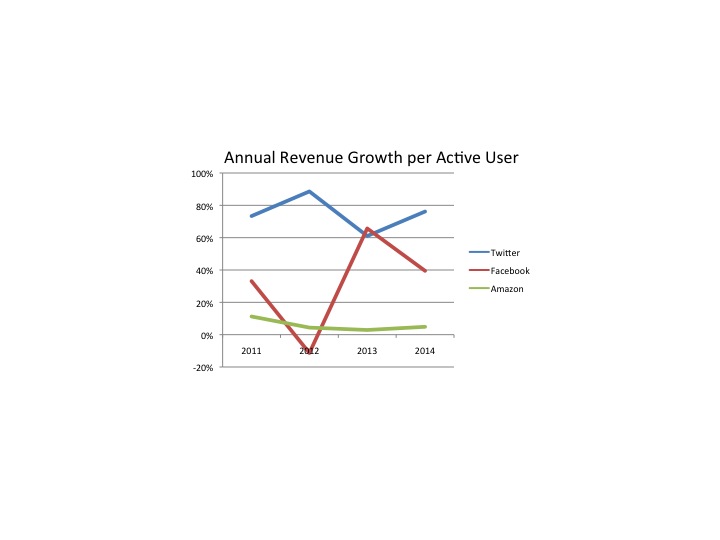

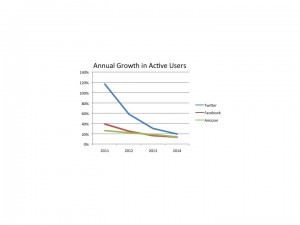

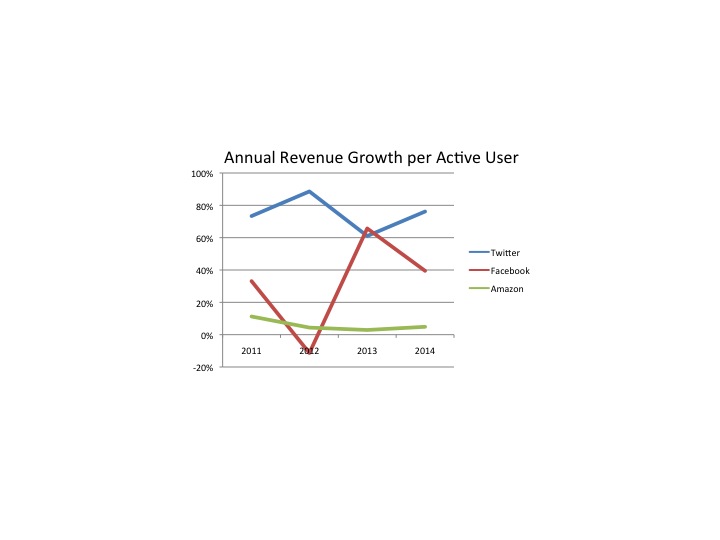

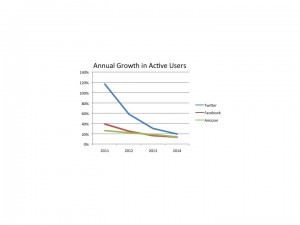

As you can see, Twitter’s revenue growth exceeds its comparators. Yes, its decline has been more dramatic, but we are comparing Twitter to companies that are much older and bigger. The net is to understand that revenues are growing, and at a better clip than Facebook and Amazon.

As you can see, Twitter’s revenue growth exceeds its comparators. Yes, its decline has been more dramatic, but we are comparing Twitter to companies that are much older and bigger. The net is to understand that revenues are growing, and at a better clip than Facebook and Amazon.

Next we should look at active monthly users. Again, these numbers are growing at all 3. And some analysts have said it is the deceleration in the rate of new user growth that doomed Mr. Costolo. But this defies logic given that during his tenure Twitter has dramatically outperformed its competition.

Next we should look at active monthly users. Again, these numbers are growing at all 3. And some analysts have said it is the deceleration in the rate of new user growth that doomed Mr. Costolo. But this defies logic given that during his tenure Twitter has dramatically outperformed its competition.

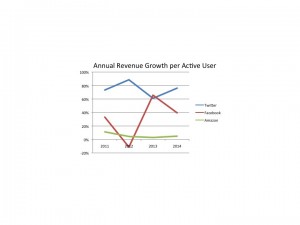

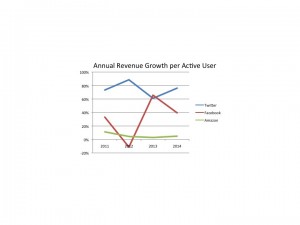

Lastly, let’s look at the “quality” of users. We can measure this by calculating the revenue per user. If this goes up, then the company is growing it top line by gaining more revenue per user – it is not “discounting” its way to higher volume. Instead,we can expect profits to improve based upon growth in this metric.

And here we can see that Twitter has wildly outperformed Facebook and Amazon. Twitter has grown its revenue per user by over 9-fold in the last 4 years, an excellent 75% per year compounded. Facebook, by comparison, roughly tripled its revenue/user (still very good) creating a 25%/year growth (certainly not to be sneezed at.) Amazon’s growth per user across the full 4 years was 25% – or about 4%/year.

And here we can see that Twitter has wildly outperformed Facebook and Amazon. Twitter has grown its revenue per user by over 9-fold in the last 4 years, an excellent 75% per year compounded. Facebook, by comparison, roughly tripled its revenue/user (still very good) creating a 25%/year growth (certainly not to be sneezed at.) Amazon’s growth per user across the full 4 years was 25% – or about 4%/year.

It isn’t hard to see that Mr. Costolo has been doing a pretty good job leading Twitter.

But Twitter has had a very checkered past when it comes to leaders. Several articles have been written about the revolving door on the CEO office, with founders back-stabbing each other as money is raised and efforts are made to improve company performance technologically and financially.

The Board has shown a proclivity to spend too much time listening to rumors, and previous CEOs. Rather than focusing on exactly how many users are coming aboard, and how much revenue is generated on those users.

The returning CEO was himself previously replaced. And during his tenure there were many technical problems. Why he would be inserted, and the best performing CEO in company history shunted aside is completely unclear. But for investors, employees, users (of which I am one) and customers this change in leadership looks to be poorly conceived, and quite concerning. Mr. Costolo was doing a pretty good job.

Data on revenues came from Marketwatch for Twitter, Facebook and Amazon. Data on users (in Amazon’s case customers) came from Statista.com for Twitter, Facebook and Amazon. Charts were created by Adam Hartung (C).

by Adam Hartung | May 31, 2015 | Current Affairs, Defend & Extend, In the Whirlpool, Leadership, Web/Tech

Information technology (IT) services company Computer Sciences Corporation (CSC) recently announced it is splitting into two separate companies. One will “focus” on commercial markets, the other will “focus” on government contracts. Ostensibly, as we’ve heard before, leadership would like investors, employees and customers to believe this is the answer for a company that has incurred a number of high profile failed contracts, a turnover in leadership, vast losses and declining revenue.

Oh boy.

After years of poor performance, and an investigation by the UK parliament into a failed contract for the National Health Services, in 2012 CSC brought in a new CEO. Like most new CEOs, his first action was to announce a massive cost-cutting program. That primarily meant vast layoffs. So out the door went thousands of people in order to hopefully improve the P&L.

Only a services company doesn’t have any hard assets. The CSC business requires convincing companies, or government agencies, to let them take over their data centers, or PC deployment, or help desk, or IT development, or application implementation – in other words to outsource some part (or all) of the IT work that could be done internally. Winning this work has been an effort to demonstrate you can hire better people, that are more productive, at lower cost than the potential client.

So when CSC undertook a massive layoff, service levels declined. It was unavoidable. Where before CSC had 10 people doing something (or 1,000) now they have 7 (or 700). It’s not hard to imagine what happens next. Morale declines as layoffs ensue, and the overworked remaining employees feel (and perhaps really are) overworked. People leave for better jobs with higher pay and less stress. Yet, the contract requirements remain, so clients often start complaining about performance, leading to more pressure on the remaining employees. A vicious whirlpool of destruction starts, as things just keep getting worse.

Immediately after taking the CEO job in 2012 Mike Lawrie declared a massive $4.3B loss. This allowed him to “bring forward” anticipated costs of the anticipated layoffs, cancelled contracts, etc. Most importantly, it allowed him to “cost shift” future costs into his first year in the job – the year in which he would not be fired, regardless how much he wrote off. This is a classic financial machination applied by “turnaround CEOs” in order to blame the last guy for not being truthful about how badly things were, while guaranteeing the end of the new guy’s first year would show a profit due to the huge cost shift.

True to expectations, after one year with Lawrie as CEO, CSC declared a $1B profit for fyscal 2013 (about 20% of the previous write-off.) But then fyscal 2014 returned to the previous norm, as profits shrunk to just $674M on about $12B revenues (~5% net margin.) For 4th quarter of fyscal 2015 revenues dropped another 12.6% – not hard to imagine given the layoffs and ensuing customer dissatisfaction. Most troubling, the commercial part of CSC, which represents 75% of revenue, saw all parts of the business decline between 15-20%, while the federal contracting (much harder to cancel) remained flat. This is not the trajectory of a turnaround.

CEO Lawrie blames the deteriorating performance on execution missteps. And he has promised to keep his eyes carefully on the numbers. Although he has admitted that he doesn’t really know when, or if, CSC will return to any sort of growth.

No wonder that for more than a year prior to this split CSC was unable to sell itself. Despite a lot of hard effort, no banker was able to put together a deal for CSC to be purchased by a competitor or a private banking (hedge fund) operation.

If none of the professionals in making splits and turnarounds were willing to take on this deal, why should individual investors? In this case, watching people walk away should be a clear indicator of how bad things are, and how clueless leadership is regarding a fix for the problems.

The real problem at CSC isn’t “execution.” The real problem is that the market has shifted substantially. For decades CSC’s outsourcing business was the norm. But today companies don’t need a lot of what CSC outsources. They are closing down those costly operations and replacing them with cloud services, cloud application development and implementation, mobile deployments and significant big data analytics. Or looking for new services to solve problems like cybersecurity threats. CSC quite simply hasn’t done anything in those markets, and it is far, far behind. It is a big dinosaur rapidly being overtaken by competitors moving more quickly to new solutions.

One of CSC’s biggest competitors is IBM, which itself has had a series of woes. However, IBM has very publicly set up a partnership with Apple and is moving rapidly to develop industry-specific software as a service (SaaS) offerings that are mobile and operate in the cloud. These targeted enterprise solutions in health care, finance and other industries are designed to make the services offered by CSC obsolete.

Although it may have had a huge client base of 1,000 customers. And CSC brags that 175 of the Fortune 500 buy some services from it, exactly what does CSC bring to the table to keep these customers? Years of cost cutting means the company has not invested in the kinds of solutions being offered by IBM and competitors such as Accenture, HP and Dell domestically – and WiPro, TCS (Tata Consulting Services,) Infosys and Cognizant offshore. Not to mention dozens of up-and-coming small competiters who are right on the market for targeted solutions with the latest technology such as 6D Gobal Technologies. CSC is still stuck in its 1980s consulting model, and skill set, in a world that is vastly different today.

CSC has no idea how to “focus” on clients. That would mean investing in modern solutions to rapidly changing client needs. CSC failed to do that 15 years ago when most outsourcing involved heavy use of offshore resources. And CSC has never caught up. Leadership overly relied on selling old services, and discounting. It’s model caused it to underbid projects, until the UK government almost shut the company down for its inability to deliver, and constantly hiding actual results.

CSC has no idea how to “focus” on clients. That would mean investing in modern solutions to rapidly changing client needs. CSC failed to do that 15 years ago when most outsourcing involved heavy use of offshore resources. And CSC has never caught up. Leadership overly relied on selling old services, and discounting. It’s model caused it to underbid projects, until the UK government almost shut the company down for its inability to deliver, and constantly hiding actual results.

Now CSC lacks any of the capabilities, people or skills to offer clients what they want. Its diffuse customer base is more a liability than a benefit, because these customers are “end of life” for the services CSC offers. Years of declining revenues demonstrate that as value declines, contracts are either allowed to go to very cheap offshore providers, lapse completely or cancelled early in order to shift client resources to more important projects where CSC cannot compete.

This split is just an admission that leadership has no idea what to do next. Customers are leaving, and revenues are declining. Margins, at 5%, are terrible and there is no money to invest in anything new. Some of the world’s best investors have looked at CSC deeply and chosen to walk away. For employees and individual investors it is time to admit that CSC has a limited future, and it is time to find far greener pastures.

by Adam Hartung | May 22, 2015 | In the Whirlpool, Leadership, Lock-in, Web/Tech

Hewlett Packard yesterday announced second quarter results. And they were undoubtedly terrible. Revenue compared to a year ago is down 7%, net income is down 21% as the growth stall at HP continues.

Yet, CEO Meg Whitman remains upbeat. She is pleased with “the continued success of our turnaround.” Which is good, because nobody else is. Rather than making new products and offering new solutions, HP has become a company that does little more than constantly restructure!

This latest effort, led by CEO Whitman, has been a split of the company into two corporations. For “strategic” (red flag) reasons, HP is dividing into a software company and a hardware company so that each can “focus” (second red flag) on its “core market” (third red flag.) But there seems to be absolutely no benefit to this other than creating confusion.

This latest restructuring is incredibly expensive. $1.8billion in restructuring charges, $1billion in incremental taxes, $400million annually in duplicated overhead services, then another $3billion in separation charges across the two new companies. That’s over $5B – which is more than HP’s net income in 2014 and 2013. There is no way this is a win for investors.

Additionally, HP has eliminated 48,000 jobs this this latest restructuring began in 2012. And the total will reach 55,000. So this is clearly not a win for employees.

The old HP will now be a hardware company, focused on PCs and printers. Both of which are declining markets as the world goes mobile. This is like the newspaper part of a media company during a split. An old business in serious decline with no clear path to sustainable sales and profits – much less growth. And in HP’s case it will be in a dog-eat-dog competitive battle to try and keep customers against Dell, Acer and Lenovo. Prices will keep dropping, and profits eroding as the world goes mobile. But despite spending $1.2billion to buy Palm (written off,) without any R&D, hard to see how this company returns profits to shareholders, generates new jobs, or launches new products for distributors and customers.

The new HP will be a software company. But it comes to market with almost no share against monster market leader Amazon, and competitors Microsoft and Cisco who are fighting to remain relevant. Even though HP spent $10B to buy ERP company Autonomy (written off) everyone has newer products, more innovation, more customers and more resources than HP.

Together there was faint hope for HP. The company could offer complete solutions. It could work with its distributors and value added resellers to develop unique vertical market solutions. By tweaking the various parts, hardware and software, HP had the possibility of building solutions that could justify premium prices and possibly create growth. But separated, these are now 2 “focused” companies that lack any new innovations, sell commodity products and lack enough share to matter in markets where share leads to winning developers and enterprise customers.

This may be the last stop for investors, and employees, to escape HP before things get a lot worse.

This may be the last stop for investors, and employees, to escape HP before things get a lot worse.

HP was the company that founded silicon valley. It was the tech place to work in the 1960s, 1970s and early 1980s. It was the Google, Facebook or Apple of that earlier time. When Carly Fiorina took over the dynamic and highly new product driven company in July, 1999 it was worth $45/share. She bought Compaq and flung HP into the commodity PC business, cutting new products and R&D. By the time the Board threw her out in 2005 the company was worth $35/share.

Mark Hurd took the CEO job, and he slashed and burned everything in sight. R&D was almost eliminated, as was new product development. If it could be outsourced, it was. And he whacked thousands of jobs. By killing any hope of growing the company, he improved the bottom line and got the stock back to $45.

Which is where it was 5 years ago today. But now HP is worth $35/share, once again. For investors, it’s been 25 years of up, down and sideways. The last 5 years the DJIA went up 80%; HP down 24%.

Companies cannot add value unless they develop new products, new solutions, new markets and grow. Restructuring after restructuring adds no value – as HP has demonstrated. For long-term investors, this is a painful lesson to learn. Let’s hope folks are getting the message loud and clear now.

by Adam Hartung | Apr 30, 2015 | Current Affairs, Defend & Extend, In the Rapids, Innovation, Leadership, Web/Tech

Last week saw another slew of quarterly earnings releases. For long term investors, who hold stocks for years rather than months, these provide the opportunity to look at trends, then compare and contrast companies to determine what should be in their portfolio. It is worthwhile to compare the trends supporting the valuations of market leaders Google and Facebook.

Google once again reported higher sales and profits. And that is a good thing. But, once again, the price of Google’s primary product declined. Revenues increased because volume gains exceeded the price decline, which indicates that the market for internet ads keeps growing. But this makes 15 straight quarters of price declines for Google. Due to this long series of small declines, the average price of Google’s ads (cost per click) has declined 70%* since Q3 2011!

Google once again reported higher sales and profits. And that is a good thing. But, once again, the price of Google’s primary product declined. Revenues increased because volume gains exceeded the price decline, which indicates that the market for internet ads keeps growing. But this makes 15 straight quarters of price declines for Google. Due to this long series of small declines, the average price of Google’s ads (cost per click) has declined 70%* since Q3 2011!

While this is a miraculous example of what economists call demand elasticity, one has to wonder how long growth will continue to outpace price degradation. At some point the marginal growth in demand may not equal the marginal decline in pricing. Should that happen, revenues will start going down rather than up.

Part of what drives this price/growth effect has been the creation of programmatic ad buying, which allows Google to place more ads in more specific locations for advertisers via such automated products as AdMob, AdExchange and DoubleClick Bid Manager. But such computerized ad buying relies on ever more content going onto the web, as well as ever more consumption by internet users.

Further, Google’s revenues are almost entirely search-based advertising, and Google dominates this category. But this is largely a PC-related sale. Today 67.5% of Google ad revenue is from PC searches, while only 32.5% is from mobile searches. Due to this revenue skew, and the fact that people do more mobile interaction via apps, messaging apps and social media than browser, search ad growth has fallen considerably. What was a 24% year over year growth rate in Q1 2012 has dropped to more like 15% for the last 8 quarters.

So while the market today is growing, and Google is making more money, it is possible to see that the growth is slowing. And Google’s efforts to create mobile ad sales outside of search has largely failed, as witnessed by the recent death of Google+ as competition for Twitter or Facebook. It is the market shift, to mobile, which creates the greatest threat to Google’s ability to grow; certainly at historical rates.

Simultaneously, Facebook’s announcements showed just how strongly it is continuing to dominate both social media and mobile, and thus generate higher revenues and profits with outstanding growth. The #1 site for social media and messenger apps is Facebook, by quite a large margin. But, Facebook’s 2014 acquisition of What’sApp is now #2. WhatsApp has doubled its monthly active users (MAUs) just since the acquisition, and now reaches 800million. Growth is clearly accelerating, as this is from a standing start in 2011.

Facebook Messenger at #3, just behind WhatsApp. And #5 is Instagram, another Facebook acquisition. Altogether 4 of the top 5 sites, and the ones with greatest growth on mobile, are Facebook. And they total over 3billion MAUs, growing at over 300million new MAUs/month. Thus Facebook has already emerged as the dominant force, with the most users, in the fast-growing, accelerating, mobile and app sectors. (Just as Google did in internet search a decade ago, beating out companies like Yahoo, Ask Jeeves, etc.)

Google is moving rapidly to monetize this user base. From nothing in early 2012, Facebook’s mobile revenue is now $2.5B/quarter and represents 67% of global revenue (the inverse of Google’s revenues.) Further, Facebook is now taking its own programmatic ad buying tool, Atlas, to advertisers in direct competition with Google. Only Atlas places ads on both social media and internet browser pages – a one-two marketing punch Google has not yet cracked.

Google’s $17.3B Q1 2015 revenue is 30 times the revenue of Facebook. There is no doubt Google is growing, and generating enormous profits. But, for long-term investors, growth is slowing and there is reason to be concerned about the long term growth prospects of Google as the market shifts toward more social and more mobile. Google has failed to build any substantial revenues outside of search, and has had some notable failures recently outside its core markets (Google + and Google Glass.) Just how long Google will continue growing, and just how fast the market will shift is unclear. Technology markets have shown the ability to shift a lot faster than many people expected, leaving some painful losers in their wake (Dell, HP, Sun Microsystems, Yahoo, etc.)

Meanwhile, Facebook is squarely positioned as the leader, without much competition, in the next wave of market growth. Facebook is monetizing all things social and mobile at a rapid clip, and wisely using acquisitions to increase its strength. As these markets continue on their well established trends it is hard to be anything other than significantly optimistic for Facebook long-term.

* 1x .93 x .88 x .84 x .85 x .94 x .96 x .94 x .93 x .89 x .91 x .94 x .98 x .97 x .95 x .93 = .295