by Adam Hartung | Jul 28, 2014 | Current Affairs, Defend & Extend, In the Whirlpool, Web/Tech

Over the last couple of weeks big announcements from Apple, IBM and Microsoft have set the stage for what is likely to be Microsoft’s last stand to maintain any sense of personal technology leadership.

Custer Tries Holding Off An Unstoppable Native American Force

To many consumers the IBM and Apple partnership probably sounded semi-interesting. An app for airplane fuel management by commercial pilots is not something most people want. But what this announcement really amounted to was a full assault on regaining dominance in the channel of Value Added Resellers (VARs) and Value Added Dealers (VADs) that still sell computer “solutions” to thousands of businesses. Which is the last remaining historical Microsoft stronghold.

Think about all those businesses that use personal technology tools for things like retail point of purchase, inventory control, loan analysis in small banks, restaurant management, customer data collection, fluid control tracking, hotel check-in, truck routing and management, sales force management, production line control, project management — there is a never-ending list of business-to-business applications which drive the purchase of literally millions of devices and applications. Used by companies as small as a mom-and-pop store to as large as WalMart and JPMorganChase. And these solutions are bundled, sold, delivered and serviced by what is collectively called “the channel” for personal technology.

This “channel” emerged after Apple introduced the Apple II running VisiCalc, and businesses wanted hundreds of these machines. Later, bundling educational software with the Apple II created a near-monopoly for Apple channel partners who bundled solutions for school systems.

But, as the PC emerged this channel shifted. IBM pioneered the Microsoft-based PC, but IBM had long used a direct sales force. So its foray into personal computing did a very poor job of building a powerful sales channel. Even though the IBM PC was Time magazine’s “Man of the Year” in 1982, IBM lost its premier position largely because Microsoft took advantage of the channel opportunity to move well beyond IBM as a supplier.

Microsoft focused on building a very large network of developers creating an enormous variety of business-to-business applications on the Windows+Intel (Wintel) platform. Microsoft created training programs for developers to use its operating system and tools, while simultaneously cultivating manufacturers (such as Dell and Compaq) to build low cost machines to run the software. “Solution selling” was where VARs bundled what small businesses – and even many large businesses – needed by bringing together developer applications with manufacturer hardware.

It only took a few years for Microsoft to overtake Apple and IBM by dominating and growing the VAR channel. Apple did a poor job of creating a powerful developer network, preferring to develop everything users should want itself, so quickly it lacked a sufficient application base. IBM constantly tried to maintain its direct sales model (and upsell clients from PCs to more expensive hardware) rather than support the channel for developing applications or selling solutions based on PCs.

But, over the last several years Microsoft played “bet the company” on its launch of Windows 8. As mobile grew in hardware sales exponentially, and PC sales flattened (then declined,) Microsoft was tepid regarding any mobile offering. Under former CEO Steve Ballmer, Microsoft preferred creating an “all-in-one” solution via Win8 that it hoped would keep PC sales moving forward while slowly allowing its legions of Microsoft developers to build Win8 apps for mobile Surface devices — and what it further hoped would be other manufacturer’s tablets and phones running Win8.

This flopped. Horribly. Apple already had the “installed base” of users and mobile developers, working diligently to create new apps which could be released via its iTunes distribution platform. As a competitive offering, Google had several years previously launched the Android operating system, and companies such as HTC and Samsung had already begun building devices. Developers who wanted to move beyond Apple were already committed to Android. Microsoft was simply far too late to market with a Win8 product which gave developers and manufacturers little reason to invest.

Now Microsoft is in a very weak position. Despite much fanfare at launch, Microsoft was forced to take a nearly $1B write-off on its unsellable Surface devices. In an effort to gain a position in mobile, Microsoft previously bought phone maker Nokia, but it was simply far too late and without a good plan for how to change the Apple juggernaut.

Apple is now the dominant player in mobile, with the most users, developers and the most apps. Apple has upended the former Microsoft channel leadership position, as solution sellers are now offering Apple solutions to their mobile-hungry business customers. The merger with IBM brings even greater skill, and huge resources, to augmenting the base of business apps running on iOS and its devices (presently and in the future.) It provides encouragement to the VARs that a future stream of great products will be coming for them to sell to small, medium and even large businesses.

Caught in a situation of diminishing resources, after betting the company’s future on Windows 8 development and launch, and then seeing PC sales falter, Microsoft has now been forced to announce it is laying off 18,000 employees. Representing 14% of total staff, this is Microsoft’s largest reduction ever. Costs for the downsizing will be a massive loss of $1.1-$1.6B – just one year (almost to the day) after the huge Surface write-off.

Recognizing its extraordinarily weak market position, and that it’s acquisition of Nokia did little to build strength with developers while putting it at odds with manufacturers of other mobile devices, the company is taking some 12,000 jobs out of its Nokia division – ostensibly the acquisition made at a cost of $7.2B to blunt iPhone sales. Every other division is also suffering headcount reductions as Microsoft is forced to “circle the wagons” in an effort to find some way to “hold its ground” with historical business customers.

Today Apple is very strong in the developer community, already has a distribution capability with iTunes to which it is adding mobile payments, and is building a strong channel of VARs seeking mobile solutions. The IBM partnership strengthens this position, adds to Apple’s iOS developers, guarantees a string of new solutions for business customers and positions iOS as the platform of choice for VARs and VADs who will use iBeacon and other devices to help businesses become more capable by utilizing mobile/cloud technology.

Meanwhile, Microsoft is looking like the 7th Cavalry at the Little Bighorn. Microsoft is surrounded by competitors augmenting iOS and Android (and serious cloud service suppliers like Amazon,) resources are depleting as sales of “core” products stagnate and decline and write-offs mount, and watching as its “supply line” developer channel abandons Windows 8 for the competitive alternatives.

CEO Nadella keeps saying that that cloud solutions are Microsoft’s future, but how it will effectively compete at this late date is as unclear as the email announcement on layoffs Nokia’s head Stephen Elop sent to employees. Keeping its channel, long the source of market success for Microsoft, from leaving is Microsoft’s last stand. Unfortunately, Nadella’s challenge puts him in a position that looks a lot like General Custer.

by Adam Hartung | Jul 15, 2014 | Current Affairs, Defend & Extend, In the Swamp, Leadership

Famed actor and comedian Tracy Morgan has filed a lawsuit against Walmart. He was seriously injured, and his companion and fellow comedian James McNair was killed, when their chauffeured vehicle was struck by a WalMart truck going too fast under the control of an overly tired driver.

It would be easy to write this off as a one-time incident. As something that was the mistake of one employee, and not a concern for management. Walmart is huge, and anyone could easily say “mistakes will happen, so don’t worry.” And as the country’s largest company (by sales and employees) Walmart is an easy target for lawsuits.

But that would belie a much more concerning situation. One that should have investors plenty worried.

Walmart isn’t doing all that well. It is losing customers, even as the economy recovers. For a decade Walmart has struggled to grow revenues, and same store sales have declined – only to be propped up by store closings. Despite efforts to grow offshore, attempts at international expansion have largely been flops. Efforts to expand into smaller stores have had mixed success, and are marginal at generating new revenues in urban efforts. Meanwhile, Walmart still has no coherent strategy for on-line sales expansion.

Unfortunately the numbers don’t look so good for Walmart, a company that is absolutely run by numbers. Every single thing that can be tracked in Walmart is tracked, and managed – right down the temperature in every facility (store, distribution hub, office) 24x7x365. When the revenue, inventory turns, margin, distribution costs, etc. aren’t going in the right direction Walmart is a company where leadership applies the pressure to employees, right down the chain, to make things better.

Unfortunately, a study by Northwestern University Kellogg School of Management has shown that when a culture is numbers driven it often leads to selfish, and unethical, behavior. When people are focused onto the numbers, they tend to stretch the ethical (and possibly legal) boundaries to achieve those numerical goals. A great recent example was the U.S. Veterans Administration scandal where management migrated toward lying about performance in order to meet the numerical mandates set by Secretary Shinseki.

Back in November, 2012 I pointed out that the Walmart bribery scandal in Mexico was a warning sign of big problems at the mega-retailer. Pushed too hard to create success, Walmart leadership was at least skirting with the law if not outright violating it. I projected these problems would worsen, and sure enough by November the bribery probe was extended to Walmart’s operations in Brazil, China and India.

We know from the many employee actions happening at Walmart that in-store personnel are feeling pressure to do more with fewer hours. It does not take a great leap to consider it possible (likely?) that distribution personnel, right down to truck drivers are feeling pressured to work harder, get more done with less, and in some instances being forced to cut corners in order to improve Walmart’s numbers.

Exactly how much the highest levels of Walmart knows about any one incident is impossible to gauge at this time. However, what should concern investors is whether the long-term culture of Walmart – obsessed about costs and making the numbers – has created a situation where all through the ranks people are feeling the need to walk closer to ethical, and possibly legal, lines. While it may be that no manager told the driver to drive too fast or work too many hours, the driver might have felt the pressure from “higher up” to get his load to its destination at a certain time – or risk his job, or maybe his boss’s.

If this is a widespread cultural issue – look out! The legal implications could be catastrophic if customers, suppliers and communities discover widespread unethical behavior that went unchecked by top echelons. The C suite executives don’t have to condone such behavior to be held accountable – with costs that can be exorbitant. Just ask the leaders at JPMorganChase and Citibank who are paying out billions for past transgressions.

Worse, we cannot expect the marketplace pressures to ease up any time soon for Walmart. Competitors are struggling mightily. JCPenney cannot seem to find anyone to take the vacant CEO job as sales remain below levels of several years ago, and the chain is most likely going to have to close several dozen (or hundreds) of stores. Sears/KMart has so many closed and underperforming stores that practically every site is available for rent if anyone wants it. And in the segment which is even lower priced than Walmart, the “dollar stores,” direct competitor Family Dollar saw 3rd quarter profits fall another 33% as too many stores and too few customer wreak financial havoc and portend store closings.

So the market situation is not improving for Walmart. As competition has intensified, all signs point to a leadership which tried to do “more, better, faster, cheaper.” But there is no way to maintain the original Walmart strategy in the face of the on-line competitive onslaught which is changing the retail game. Walmart has continued to do “more of the same” trying to defend and extend its old success formula, when it was a disruptive innovator that stole its revenues and cut into profits. Now all signs point to a company which is in grave danger of over-extending its success formula to the point of unethical, and potentially illegal, behavior.

If that doesn’t scare the heck out of Walmart investors I can’t imagine what would.

by Adam Hartung | Jul 8, 2014 | Current Affairs, Food and Drink, In the Whirlpool, Leadership

Crumbs Bake Shop – a small chain of cupcake shops, almost totally unknown outside of New York City and Washington, DC – announced it was going out of business today. Normally, this would not be newsworthy. Even though NASDAQ traded, Crumbs small revenues, losses and rapidly shrinking equity made it economically meaningless. But, it is receiving a lot of attention because this minor event signals to many people the end of the “cupcake trend” which apparently was started by cable TV show “Sex and the City.”

However, there are actually 2 very important lessons all of us can learn from the rise, and fall, of Crumbs Bake Shop:

1 – Don’t believe in the myth of passion when it comes to business

Many management gurus, and entrepreneurs, will tell you to go into business following something about which you are passionate. The theory goes that if you have passion you will be very committed to success, and you will find your way to success with diligence, perseverance, hard work and insight driven by your passion. Passion will lead to excellence, which will lead to success.

And this is hogwash.

Customers don’t care about your passion. Customers care about their needs. Rather than being a benefit, passion is a negative because it will cause you to over-invest in your passion. You will “never say die” as you keep trying to make success out of an idea that has no chance. Rather than investing your resources into something that fulfills people’s needs, you are likely to invest in your passion until you burn through all your resources. Like Crumbs.

The founders of Crumbs had a passion for cupcakes. But, they had no way to control an onslaught of competitors who could make different variations of the product. All those competitors, whether isolated cupcake shops or cupcakes offered via kiosks or in other shops, meant Crumbs was in a very tough fight to maintain sales and make money. It’s not you (and your passion) that controls your business destiny. Nor is your customers. Rather, it is your competition.

When there are lots of competitors, all capable of matching your product, and of offering countless variations of your product, then it is unlikely you can sustain revenues – or profits. There are many industries where cutthroat competition means profits are fleeting, or downright elusive. Airlines come to mind. Magazines. And many retail segments. It doesn’t matter how much passion you have, when there are too many competitors it’s a lousy business.

2 – Trends really do matter

Cupcakes were a hot product for a while. And that’s great. But it wasn’t hard to imagine that the trend would shift, and cupcakes would be displaced by something else. Whatever profits you might have when you sit on a trend, those profits evaporate fast when the trend shifts and all competitors are fighting for sales in a declining market.

Remember Mrs. Field’s cookies? In the 1980s an attractive cook and her investment banker husband built a business on soft, chewy, warm cookies sold in malls and retail streets across America. It seemed nobody could get enough of those chocolate chip cookies.

But then, one day, we did. We’d collectively had enough cookies, and we simply quit buying them. Mrs. Fields (and other cookie brand) stores were rapidly replaced with pretzels and other foodstuffs.

Or look at Krispy Kreme donuts. In the 1990s people went crazy for them, often lining up at stores waiting for the neon sign to come on saying “hot donuts”. The company exploded into 400 stores as the stock flew like a kite. But then, in a very short time, people had enough donuts. There were a lot more donut shops than necessary, and Krispy Kreme went bankrupt.

So it wasn’t hard to predict that shifting food tastes would eventually put an end to cupcake sales growth. Yet, Crumbs really didn’t prepare for trends to change. Despite revenue and profit problems, the leadership did not admit that cupcake sales had peaked, the market was going to decline, competition would become even more intense and Crumbs would need to find another business if it was to survive.

Few trends move as fast as tastes in sweets. But, trends do affect all businesses. Once we bought cameras (and film,) but now we use phones – too bad for Kodak. Once we used copiers, now we use email – too bad for Xerox. Once we watched TV, now we download from Netflix or Amazon – too bad for NBC, ABC, CBS and Comcast. Once we went to stores, now we order on-line – too bad for Sears. Once we used PCs, now we use mobile devices – too bad for Microsoft. These trends did not affect these companies as fast as shifting tastes affected Crumbs, but the importance of understanding trends and preparing for change is a constant part of leadership.

So Crumbs Bake Shop failure was one which could have been avoided. Leadership needed to overcome its passion for cupcakes and taken a much larger look at customer needs to find alternative products. It wasn’t hard to identify that some diversification was going to be necessary. And that would have been much easier if they had put in place a system to track trends, observing (and admitting) that their “core” market was stalled and they needed to move into a new trend category.

by Adam Hartung | Jul 1, 2014 | Current Affairs, Defend & Extend, Leadership, Religion

Yesterday the U.S. Supreme Court ruled in favor of Hobby Lobby and against the U.S. government in a case revolving around health care for employees. I’m a business person, not a lawyer, so to me it was key to understand from a business viewpoint exactly what Hobby Lobby “won.”

It appears Hobby Lobby’s leaders “won” the right to refuse to provide certain kinds of health care to their employees as had been mandated by the Affordable Care Act. The justification primarily being that such health care (all associated with female birth control) violated religious beliefs of the company owners.

As a business person I wondered what the outcome would be if the next case is brought to the court by a business owner who happens to be a Christian Scientist. Would this next company be allowed to eliminate offering vaccines – or maybe health care altogether – because the owners don’t believe in modern medical treatments?

This may sound extreme, and missing the point revolving around the controversy over birth control. But not really. Because the point of business is to legally create solutions for customer needs at a profit. Doing this requires doing a lot of things right in order to attract and retain the right employees, the right suppliers and customers by making all of them extremely happy. I don’t recall Adam Smith, Milton Friedman, Peter Drucker, Edward Demming, John Galbraith or any other historically noted business writer saying the point of business to set the moral compass of its customers, suppliers or employees.

I’m not sure where enforcing the historical religious beliefs of founders or owners plays a role in business. At all. Even if they have the legal right to do so, is it smart business leadership?

Hobby Lobby Store

Hobby Lobby competes in the extraordinarily tough retail market. The ground is littered with failures, and formerly great companies which are struggling such as Sears, KMart, JCPenney, Best Buy, etc. And recently the industry has been rocked with security breaches, reducing customer faith in stalwarts like Target. And profits are being challenged across all brick-and-mortar traditional retailers by on-line companies led by Amazon, who have much lower cost structures.

All the trends in retail bode poorly for Hobby Lobby. Hobby Lobby does almost no business on-line, and even closes its stores on Sunday. Given consumer desires to have what they want, when they want it, unfettered by time or location, a traditional retailer like Hobby Lobby already has its hands full just figuring out how to keep competitors at bay. Customers don’t need much encouragement to skip any particular store in search of easily available products and instant price information across retailers.

Social trends are also very clear in the USA. The great majority of Americans support health care for everyone. Including offering birth control, and all other forms of women’s health needs. This has nothing to do with the Affordable Care Act. Health care, and women’s rights to manage their individual reproductiveness, is something that is clearly a majority viewpoint – and most people think it should be covered by health insurance.

So, given the customer options available, is it smart for any retailer to brag that they are unwilling to offer employees health care? Although not tied to any specific social issues, Wal-Mart has long dealt with customer and employee defections due to policies which reduce employee benefits, such as health care. Is this an issue which is likely to help Hobby Lobby grow?

Is it smart, as Hobby Lobby competes for merchandise from suppliers, negotiates on leases with landlords, seeks new store permits from local governments, recruits employees as buyers, merchandisers, store managers and clerks, and seeks customers who can shop on-line or at competitors to brandish the sword of intolerance on a specific issue which upsets the company owner? And one where this owner is on the opposite side of public opinion?

Long ago a group of retired U.S. military Generals told me that in Vietnam America won every battle, but lost the war. Through overwhelming firepower and manpower, there was no way we would not win any combat mission. But that missed the point. As a result of focusing on the combat, America’s leaders missed the opportunity win “the hearts and minds” of most Vietnamese. In the end America left Vietnam in a rushed abandonment of Saigon, and the North Vietnamese took over all of South Vietnam. Although we did what leaders believed was “right,” and fought each battle to a win, in the end America lost the objective of maintaining a free, independent and democratic Vietnam.

The leaders of Hobby Lobby won this battle. But is this good for the customers, suppliers, communities where stores are located, and employees of Hobby Lobby? Will these constituents continue to support Hobby Lobby, or will they possibly choose alternatives? If in its actions, including legal arguing at the Supreme Court, Hobby Lobby may have preserved what its leaders think is an important legal precedent. But, have their strengthened their business competitiveness so they will be a long-term success?

Perhaps Hobby Lobby might want to listen to the CEO of Chick-fil-A, which suffered a serious media firestorm when it became public their owners donated money to anti-gay organizations. CEO Cathy decided it was best to “just shut up and go sell chicken.” Business is tough enough, loaded with plenty of battles, without looking for fights that are against trends.

by Adam Hartung | Jun 19, 2014 | Current Affairs, Disruptions, In the Swamp, Leadership, Web/Tech

Yesterday Amazon launched its new Kindle Fire smartphone.

“Ho-hum” you, and a lot of other people, said. “Why?” “What’s so great about this phone?”

The market is dominated by Apple and Samsung, to the point we no longer care about Blackberry – and have pretty much forgotten about all the money spent by Microsoft to buy Nokia and launch Windows 8. The world doesn’t much need a new smartphone maker – as we’ve seen with the lack of excitement around Google/Motorola’s product launches. And, despite some gee-whiz 3D camera and screen effects, nobody thinks Amazon has any breakthrough technology here.

But that would be completely missing the point. Amazon probably isn’t even thinking of competing heads-up with the 2 big guns in the smartphone market. Instead, Amazon’s target is everyone in retail. And they should be scared to death. As well as a lot of consumer products companies.

Amazon’s new Kindle Fire smartphone

Apple’s iPod and iPhones have some 400,000 apps. But most people don’t use over a dozen or so daily. Think about what you do on your phone:

- Talk, texting and email

- Check the weather, road conditions, traffic

- Listen to music, or watch videos

- Shopping (look for products, prices, locations, specs, availability, buy)

Now, you may do several other things. But (maybe not in priority,) these are probably the top 4 for 90% of people.

If you’re Amazon, you want people to have a great shopping experience. A GREAT experience. You’ve given folks terrific interfaces, across multiple platforms. But everything you do with an app on iPhones or Samsung phones involves negotiating with Apple or Google to be in their store – and giving them revenue. If you could bypass Apple and Google – a form of retail “middleman” in Amazon’s eyes – wouldn’t you?

Amazon has already changed retail markedly. Twenty years ago a retailer would say success relied on 2 things:

- Store location and layout. Be in the right place, and be easy to shop.

- Merchandise the goods well in the store, and have them available.

Amazon has killed both those tenets of retail. With Amazon there is no store – there is no location. There are no aisles to walk, and no shelves to stock. There is no merchandising of products on end caps, within aisles or by tagging the product for better eye appeal. And in 40%+ cases, Amazon doesn’t even stock the inventory. Availability is based upon a supplier for whom Amazon provides the storefront and interface to the customer, sending the order to the supplier for a percentage of the sale.

And, on top of this, the database at Amazon can make your life even easier, and less time consuming, than a traditional store. When you indicate you want item “A” Amazon is able to show you similar products, show you variations (such as color or size,) show you “what goes with” that product to make sure you buy everything you need, and give you different prices and delivery options.

Many retailers have spent considerably training employees to help customers in the store. But it is rare that any retail employee can offer you the insight, advice and detail of Amazon. For complex products, like electronics, Amazon can provide detail on all competitive products that no traditional store could support. For home fix-ups Amazon can provide detailed information on installation, and the suite of necessary ancillary products, that surpasses what a trained Home Depot employee often can do. And for simple products Amazon simply never runs out of stock – so no asking an aisle clerk “is there more in the back?”

And it is impossible for any brick-and-mortar retailer to match the cost structure of Amazon. No stores, no store employees, no cashiers, 50% of the inventory, 5-10x the turns, no “obsolete inventory,” no inventory loss – there is no way any retailer can match this low cost structure. Thus we see the imminent failure of Radio Shack and Sears, and the chronic decline in mall rents as stores go empty.

Some retailers have tried to catch up with Amazon offering goods on-line. But the inventory is less, and delivery is still often problematic. Meanwhile, as they struggle to become more digital these retailers are competing on ground they know precious little about. It is becoming commonplace to read about hackers stealing customer data and wreaking havoc at Michaels Stores and Target. Thus on-line customers have far more faith in Amazon, which has 2 decades of offering secure transactions and even offers cloud services secure enough to support major corporations and parts of the U.S. government.

And Amazon, so far, hasn’t even had to make a profit. It’s lofty price/earnings multiple of 500 indicates just how little “e” there is in its p/e. Amazon keeps pouring money into new ways to succeed, rather than returning money to shareholders via stock buybacks or dividends. Or dumping it into chronic store remodels, or new store construction.

Today, you could shop at Amazon from your browser on any laptop, tablet or phone. Or, if you really enjoy shopping on-line you can now obtain a new tablet or phone from Amazon which makes your experience even better. You can simply take a picture of something you want, and your new Amazon smartphone will tell you how to buy it on-line, including price and delivery. No need to leave the house. Want to see the product in full 360 degrees? You have it on your 3D phone. And all your buying experience, customer reviews, and shopping information is right at your fingertips.

Amazon is THE game changer in retail. Kindle was a seminal product that has almost killed book publishers, who clung way too long to old print-based business models. Kindle Fire took direct aim at traditional retailers, from Macy’s to Wal-Mart, in an effort to push the envelope of on-line shopping. And now the Kindle Fire smartphone puts all that shopping power in your palm, convenient with your other most commonplace uses such as messaging, fact finding, listening or viewing.

This is not a game changing smartphone in comparison with iPhone 5 or Galaxy S 5. But, as another salvo in the ongoing war for controlling the retail marketplace this is another game changer. It continues to help everyone think about how they shop today, and in the future. For anyone in retail, this may well be seen as another important step toward changing the industry forever, and making “every day low prices” an obsolete (and irrelevant) retail phrase. And for consumer goods companies this means the need to distribute products on-line will forever change the way marketing and selling is done – including who makes how much profit.

by Adam Hartung | Jun 5, 2014 | Current Affairs, Leadership

Charlie Sheen, Chandler Massey, Johnny Depp, Paula Abdul, Zac Efron, Rob Lowe, John Davidson, Dick van Patten… This is just a short, partial list of the people Jeff Ballard works with, and has worked with in some cases for nearly 30 years, as one of the top publicists in the entertainment industry.

Often CEOs will say that leading people is like herding cats. And too often, many leaders are unable to help some of their most talented managers reach full potential. Highly capable people can have insights that are hard to understand, and can be impatient to take action. In far too many cases organizations lose highly talented people because the leaders are unable to maintain long-term relationships and coach/assist those people productively. Or, even worse, the highly talented people are misunderstood and the organization pushes them out rather than figuring out how to get the most out of them.

Think of Steve Jobs. Fired by Apple, he later went on to great success at Pixar. And returned to save Apple from bankruptcy. Yet, few leaders – or organizations – would even have considered hiring him. Because they don’t know how to get the most of someone so highly talented.

As a publicist for some of the top actors in Los Angeles, Jeff Ballard has worked with, assisted the growth of, and become long-term friends with some very talented people. And layered on top of this is the impact of celebrity, and chronic media frenzies that can position and reposition these people in the public eye – as well as the eye of producers. What most CEOs would consider a once-in-a-decade set of issues for helping a developing high-performer move their career forward is literally daily activity for Jeff Ballard.

And through all of this he maintains some of the longest known relationships in what is widely considered one of the most fickle industries in America. In the fast changing entertainment industry people are often dropped like chattel as trends shift. Yet, Jeff Ballard’s clients stick with him for decades, and wax eloquently about how he has helped them to grow as people, and move their careers forward. While you’ve probably never heard of him (unless you are in the entertainment business,) Jeff Ballard has developed some of the sharpest leadership skills anywhere.

Charlie Sheen, Conner Greene, Jeff Ballard on set of “Anger Management”

How does he do it? How does he help highly talented people to achieve even greater results year after year?

1 – Be helpful. Seriously. Don’t just hang around. Don’t wait to be asked to do something. Be helpful. Every interaction is an opportunity to help someone. Think about how you are creating opportunities to help people. Think about their capabilities and their goals and always be helpful.

Too often leaders take their relationships for granted. Or worse, they see people in their network as a route for the leader to accomplish his goals. They see others as someone who can help them. One of Jeff’s great skills as a leader is seeing his role as helping others. The more he helps others, the better things work out.

When Chandler Massey lost his phone, and he needed to do some interviews, Jeff ran to a store, bought a phone and a plan, and got the technology in Chandler’s hands in time for the interviews. This seemingly small thing was critical to the success of that event. But it demonstrated that by focusing on how to help, Jeff was willing to do what was necessary – whether big or small. And that builds long-lasting relationships. Chandler thanked Jeff by giving him his Emmy award.

Part and parcel with this, make sure you are only building relationships with clients, and your ecosystem, where you can add value. Too often leaders will take any business. Explore any relationship. But if you over-reach and take on a client, acquisition, merger, new product, new project, etc. where you are unable to really add value – unable to really help accomplish the goal – bad things will happen. So think ahead, and understand how you can be helpful.

2 – Add value fast. Every chance you can. Fix things – even things that may seem unimportant to you our outside your wheelhouse.

Dick van Patten once asked Jeff Ballard what to do about a broken sauna. Although far from his job, Jeff quickly took a look and then actually fixed the sauna. When producers are looking for actor A to be on a show, like Entertainment Tonight, for a variety of reasons this may not be a good fit. But rather than saying “no” – or worse, just letting requests go unanswered – Jeff will look quickly to understand the producer or media person’s needs and come up with a value added answer. Jeff constantly thinks about recommendations where all parts of his ecosystem could possibly help meet their needs.

When you constantly think about how to add value – and immediately – then people respect you. And they learn to trust you. When you are helping people reach their goals they listen to what you say. They are open to discuss alternative solutions. Far too often too many leaders think of themselves as “great deciders.” Or as the person responsible for making a “yes” or “no” answer and then moving on – leaving those around them to solve problems for themselves. But great leaders listen, and think about how to add value. Quickly.

3 – Separate talent from the person. Everyone is unique. Not everything a person does is on the direct path to greater success. But that doesn’t mean they aren’t talented – and able to continue to perform at superior levels despite something that didn’t go so well. Don’t be so foolish as to let the talent slip away because you are having issues with the person.

For actors, or sports celebrities, this can be easy to see. The media reports on something they say, or do, and it is easy to become negative about that individual. But, the next great performance (a movie, TV show, concert, CD, home run, winning goal, etc.) demonstrates that the person has talent. Leaders have the job of getting the most out of the talent – and not trying to manage the person – or worse, losing the talent because of “personal issues.”

Far too often organizations end up losing highly talented people because of the “black mark” syndrome. An up-and-comer does well for several years, but then something misses. For example, passionate effort to launch a new product or business creates conflict in the organization, and he shouts or otherwise acts out. HR is called in, and the manager is rebuked and forewarned — but worse he is now “marked” as problematic. All that talent is forgotten, undeveloped – or it simply goes to a competitor.

People are people. Some are easier to work with than others. But what’s important is whether they have talent, and whether as a leader you can bring out the most of that talent. Leaders don’t have the job of “changing people” (which far too often they really try to do,) but rather of helping people around them cultivate, develop and demonstrate their talents. If we focus on the talent we achieve far superior results while helping the person achieve their personal goals.

4 – Stay relevant, and keep those around you relevant. The world changes quickly. It is easy for leaders to expect those in their network – and especially their inner circle – to become complacent. To rest on their laurels of past success. Which all too quickly leads to problems. So it is critical that leaders constantly look around for what is emerging, and keep reminding their network of what is necessary to remain relevant. A pat on the back lasts one second, but helping someone stay relevant sustains their success far into the future.

Leaders can become so fixated on “performance” that they dehumanize those they coach. If, instead, they focus on providing guiding lights to people they can encourage them to adapt to change. They can help those they work with to stay current and growing. Too much time is spent reacting to what just happened, rather than figuring out how to achieve the long-term goal.

Jeff works constantly with his clients to understand what the market is seeking now, and will be seeking in the near future. Rather than reacting to events Jeff and his talented clients spends considerable time discussing what outcomes are desired, and whether or not a planned activity will lead to that outcome. By focusing on future relevancy Jeff leads clients to become proactive about achieving their goals. He helps them to make decisions today which are directed toward a future goal, rather than reacting to an historical event.

Over and again famous clients and top producers compliment Jeff Ballard for his honesty, integrity and loyalty. But these are not simply attributes. Many of us have these attributes. Rather, these are outcomes from Jeff Ballard’s long history of constantly helping people in his network, adding value quickly toward solving their problems, constantly focusing on bringing out the talent rather than chastising (or managing) the individual, and keeping everyone relevant and proactive rather than falling into patterns of reacting to something that already happened.

Jeff Ballard’s publicity firm is far from the largest in Los Angeles or New York. Yet, he helps clients who are famous, as well as new talent such as Conner Greene who you probably do not know. And no competitor can offer the long-term track record of performance Jeff has provided. Regularly clients who move to large publicity firms return to Jeff, seeking his counsel and advice in recognition of his leadership – generally absent from his competitors. Repeat business that all leaders seek, but don’t often achieve.

The next time you find yourself struggling to lead the people in your organization think of Jeff Ballard. His insights about leadership, rooted in the complex and difficult world of media publicity for celebrities, could help you be a far better leader in your organization.

by Adam Hartung | May 30, 2014 | Current Affairs, In the Swamp, In the Whirlpool, Leadership, Sports, Web/Tech

Anyone who reads my column knows I’ve been no fan of Steve Ballmer as CEO of Microsoft. On multiple occasions I chastised him for bad decisions around investing corporate funds in products that are unlikely to succeed. I even called him the worst CEO in America. The Washington Post even had difficulty finding reputable folks to disagree with my argument.

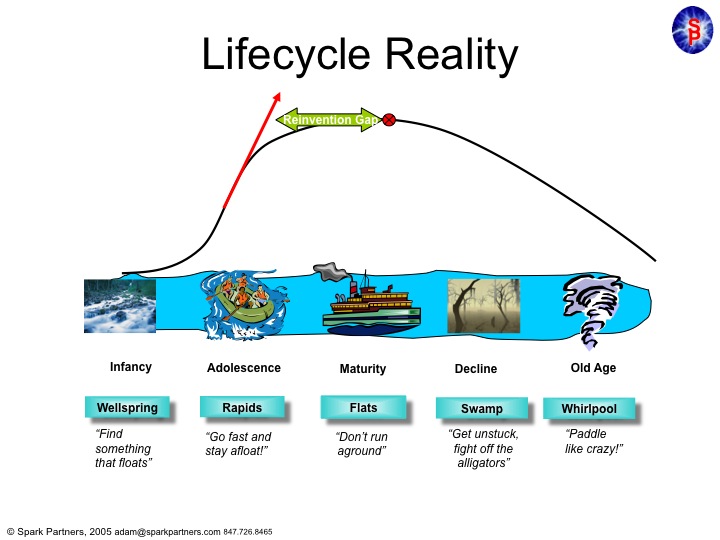

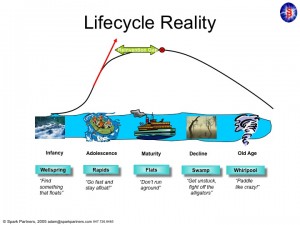

Unfortunately, Microsoft suffered under Mr. Ballmer. And Windows 8, as well as the Surface tablet, have come nowhere close to what was expected for their sales – and their ability to keep Microsoft relevant in a fast changing personal technology marketplace. In almost all regards, Mr. Ballmer was simply a terrible leader, largely because he had no understanding of business/product lifecycles.

Microsoft was founded by Bill Gates, who did a remarkable job of taking a start-up company from the Wellspring of an idea into one of the fastest growing adolescents of any American company.

Microsoft was founded by Bill Gates, who did a remarkable job of taking a start-up company from the Wellspring of an idea into one of the fastest growing adolescents of any American company.

Under Mr. Gates leadership Microsoft single-handedly overtook the original PC innovator – Apple – and left it a niche company on the edge of bankruptcy in little over a decade.

Mr. Gates kept Microsoft’s growth constantly in the double digits by not only making superior operating system software, but by pushing the company into application software which dominated the desktop (MS Office.) And when the internet came along he had the vision to be out front with Internet Explorer which crushed early innovator, and market maker, Netscape.

But then Mr. Gates turned the company over to Mr. Ballmer. And Mr. Ballmer was a leader lacking vision, or innovation. Instead of pushing Microsoft into new markets, as had Mr. Gates, he allowed the company to fixate on constant upgrades to the products which made it dominant – Windows and Office. Instead of keeping Microsoft in the Rapids of growth, he offered up a leadership designed to simply keep the company from going backward. He felt that Microsoft was a company that was “mature” and thus in need of ongoing enhancement, but not much in the way of real innovation. He trusted the market to keep growing, indefinitely, if he merely kept improving the products handed him.

As a result Microsoft stagnated. A “Reinvention Gap” developed as Vista, Windows 7, then Windows 8 and one after another Office updates did nothing to develop new customers, or new markets. Microsoft was resting on its old laurels – monopolistic control over desktop/laptop markets – without doing anything to create new markets which would keep it on the old growth trajectory of the Gates era.

Things didn’t look too bad for several years because people kept buying traditional PCs. And Ballmer famously laughed at products like Linux or Unix – and then later at entertainment devices, smart phones and tablets – as Microsoft launched, but then abandoned products like Zune, Windows CE phones and its own tablet. Ballmer kept thinking that all the market wanted was a faster, cheaper PC. Not anything really new.

And he was dead wrong. The Reinvention Gap emerged to the public when Apple came along with the iPod, iTunes, iPhone and iPad. These changed the game on Microsoft, and no longer was it good enough to simply have a better edition of an outdated technology. As PC sales began declining it was clear that Ballmer’s leadership had left the company in the Swamp, fighting off alligators and swatting at mosquitos with no strategy for how it would regain relevance against all these new competitors.

So the Board pushed him out, and demoted Gates off the Chairman’s throne. A big move, but likely too late. Fewer than 7% of companies that wander into the Swamp avoid the Whirlpool of demise. Think Univac, Wang, Lanier, DEC, Cray, Sun Microsystems (or Circuit City, Montgomery Wards, Sears.) The new CEO, Satya Nadella, has a much, much more difficult job than almost anyone thinks. Changing the trajectory of Microsoft now, after more than a decade creating the Reinvention Gap, is a task rarely accomplished. So rare we make heros of leaders who do it (Steve Jobs, Lou Gerstner, Lee Iacocca.)

So what will happen at the Clippers?

Critically, owning an NBA team is nothing like competing in the real business world. It is a closed marketplace. New competitors are not allowed, unless the current owners decide to bring in a new team. Your revenues are not just dependent upon you, but are even shared amongst the other teams. In fact your revenues aren’t even that closely tied to winning and losing. Season tickets are bought in advance, and with so many games away from home a team can do quite poorly and still generate revenue – and profit – for the owner. And this season the Indiana Pacers demonstrated that even while losing, fans will come to games. And the Philadelphia 76ers drew crowds to see if they would set a new record for the most consecutive games lost.

In America the major sports only modestly overlap, so you have a clear season to appeal to fans. And even if you don’t make it into the playoffs, you still share in the profits from games played by other teams. As a business, a team doesn’t need to win a championship to generate revenue – or make a profit. In fact, the opposite can be true as Wayne Huizenga learned owning the Championship winning Florida Marlins baseball team. He payed so much for the top players that he lost money, and ended up busting up the team and selling the franchise!

In short, owning a sports franchise doesn’t require the owner to understand lifecycles. You don’t have to understand much about business, or about business competition. You are protected from competitors, and as one of a select few in the club everyone actually works together – in a wholly uncompetitive way – to insure that everyone makes as much money as possible. You don’t even have to know anything about managing people, because you hire coaches to deal with players, and PR folks to deal with fans and media. And as said before whether or not you win games really doesn’t have much to do with how much money you make.

Most sports franchise owners are known more for their idiosyncrasies than their business acumen. They can be loud and obnoxious all they want (with very few limits.) And now that Mr. Ballmer has no investors to deal with – or for that matter vendors or cooperative parties in a complex ecosystem like personal technology – he doesn’t have to fret about understanding where markets are headed or how to compete in the future.

When it comes to acting like a person who knows little about business, but has a huge ego, fiery temper and loves to be obnoxious there is no better job than being a sports franchise owner. Mr. Ballmer should fit right in.

by Adam Hartung | May 22, 2014 | Current Affairs, Leadership

It is ironic that on this Memorial Day weekend (a remembrance of our fallen soldiers) America is learning that its military veterans have been ineffectively served by the Veterans Administration (VA) hospital system. Hundreds, if not thousands, have gone months without care – and some have even died while waiting.

No veteran should die while waiting for care. But we now know at least 40 have died. This is especially heinous because we now know those who provide care weren’t admitting to the fact that veterans were being denied care. And instead of tracking the waiting time these veterans underwent, the actual information was being tracked on hidden lists while factually inaccurate information was being disseminated.

At the top of all this is simply really bad leadership. That veterans were undergoing long waits is not a new story. In March, 2013 (14 months ago) Frontline ran a story that waits were inexcusably long (averaging 318 days,) and that the VA was doing little to solve the problem. Then, the day after Christmas, 2013, Military News ran a story quoting Secretary Shinseki providing several statistics indicating the backlog was down, wait times were down and this whole problem would disappear by 2015. Unfortunately, the American Legion – which has championed this issue – made it clear they thought the Secretary’s datapoints were inaccurate.

Now we are learning via CNN that the wait lists were being fudged in several hospitals, and that both hospital and VA leaders were well aware of this fudging. There were the reported facts, and then there were secret lists of people waiting for care.

How could this happen?

Chalk it up to lazy leadership, and an over-reliance on numbers and record-keeping. Instead of managing patients, Secretary Shinseki’s administration was managing numbers. And in this case, it caused people to die.

When long wait times were reported the President publicly admitted to being appalled, and he told Secretary Shinseki to do something. What the Secretary did was declare a standard of no more than 125 days from incident to care had to be met. And he told people to meet that goal, or they would risk losing their jobs.

As a leader, he didn’t offer a solution. He didn’t challenge his staff to find out the root cause of the problem and understand why these waits were so long. He didn’t hire outside consultants to evaluate the problem and propose solutions. He didn’t ask for “best practices” from industry. Instead, he pushed out a metric and a tracking system and threatened his team with pay cuts (or at least no bonuses,) demotions, career ending reviews and potentially termination. “Solve the problem, or else.” Then he was back to his office, and waiting for the “right” statistics to show up so he could say “all is well.”

This simply becomes a breeding ground for collusion, corruption and malfeasance as people try to save their income, careers and their jobs. If the order is to “make that number” then a way will be found to “make that number.” The command wasn’t to save lives, or improve care. The order was to reach a certain metric. So out comes all the creativity imaginable to give the boss what he wants. And in this case, it involved deception in record keeping, dual bookkeeping, hiding information, falsifying reports and even letting people die in order to give the Secretary the numbers he ordered them to report.

Meanwhile, the Secretary is so involved in managing his own career – and that of his boss – that he simply turned a blind eye to all other data. The American Legion was offering compelling statistics that things weren’t as the Secretary said. And there were multiple stories coming up in the press, and through the veteran networks, of patient experiences which did not match what the Secretary reported. But instead of listening to external information the Secretary ignored all of it and kept pushing his own organization to give him the numbers he wanted.

Leaders like to “manage by the numbers.” The study of business management was born around 1900 by Frederick Taylor and his theory of Scientific Management. Taylor believed all work could be broken down into inputs and outputs, everything could be measured, and if you set metrics for everyone then you could simply manage better. It was an engineering problem, and humans were just machines that needed to know the right metrics and produce to those metrics. Ah, the simplicity of Taylorism.

That management approach was greatly loved by business schools, and business leaders. Famously some Harvard Business School graduates and former Army officers (termed the “Whiz Kids”) in the 1940s went to a nearly failed Ford Motor company and turned it around. One of them, Robert McNamara, became the youngest President of Ford. They claimed their success was “statistical control.”

But McNamara left Ford to become Secretary of Defense for Lyndon Johnson and run the Vietnam War. He applied his same “statistical control” approach to the war that he used at Ford. Famous amongst these tracked, reported and closely watched statistics was the “body count.” Simply put, how many did you kill today? McNamara was sure if he could reach a “kill ratio” of 10 enemy dead to every 1 American dead the Vietnamese would give up.

How did that work out? Well, McNamara resigned in disgrace. Johnson was forced to step down after one term, realizing his failure in Vietnam made him unelectable. It turned out body counts included dogs, cats and cows as officers from Lieutenants to Generals were fudging the numbers. It encouraged burning down entire villages, and then simply deciding everyone – including Vietnamese civilians – would be included in the “body count.”

Needless to say, not America’s finest hour. And a mess that took another several years from which to extricate. There is a lot more to understanding international relations, and fighting a war, than simply tracking statistics. But unfortunately then Lieutenant Shinseki apparently learned the wrong message while he was in Vietnam. His penchant for using statistics to lead appears to have remained unwavered.

Unfortunately, far too many leaders like the lazy approach of using statistics. In the 1980s and 1990s a quality improvement program called Six Sigma caught on in America. But in many companies, Six Sigma became a management dogma rather than simply quality control. “You have to measure everything, or else it is simply not important” was a common part of Six Sigma. People suddenly had metrics given to them, even for jobs (like “Creative Director” or “Investor Relations”) where this made no sense. And they had charts on their doors tracking the data. If that chart didn’t point in an obviously northeasterly direction then it was clear the occupant was going to have pay, and longevity, problems.

Motorola was a leader in Six Sigma. The same Motorola that today is a shell of its former self. Although in the 1990s Motorola was heralded as a leader in modern management, today it has lost all relevance as its old businesses in radios and mobile phones have been made obsolete by new technologies, or taken over by companies like Google.

Far too often leaders think they can turn leadership into an engineering exercise. “Run business by the numbers” is a common refrain. Especially amongst leaders who come up via finance. “Everything can be turned into numbers, and spreadsheets, and if we manage the numbers the business will take care of itself.” We’ve all heard this.

But it simply isn’t true. We now know that even the famous Taylor falsified data in order to keep his guru status and promote Taylorism to client companies. Leadership involves going far, far beyond the numbers. It means understanding situations that defy simple measurement. It means knowing how to identify and solve problems – changing processes, procedures, directions, instructions, strategy and tactics. It means listening to external inputs to understand the greater marketplace, not just your own internal views. And it means understanding how to lead and manage people toward superior performance – not merely tracking performance statistics and slapping those who don’t return “the right numbers.”

Secretary Shinseki has a long and storied career. But as head of the VA, he truly blew it. And people died. This kind of lazy leadership cannot be tolerated in a field like health care, and hospital management.

Can your business tolerate it?

by Adam Hartung | May 16, 2014 | Current Affairs, Defend & Extend, In the Swamp, Leadership, Lifecycle, Web/Tech

IBM had a tough week this week. After announcing earnings on Wednesday IBM fell 2%, dragging the Dow down over 100 points. And as the Dow reversed course to end up 2% on the week, IBM continued to drag, ending down almost 3% for the week.

Of course, one bad week – even one bad earnings announcement – is no reason to dump a good company’s stock. The short term vicissitudes of short-term stock trading should not greatly influence long-term investors. But in IBM’s case, we now have 8 straight quarters of weaker revenues. And that HAS to be disconcerting. Managing earnings upward, such as the previous quarter, looks increasingly to be a short-term action, intended to overcome long-term revenues declines which portend much worse problems.

This revenue weakness roughly coincides with the tenure of CEO Virginia Rometty. And in interviews she increasingly is defending her leadership, and promising that a revenue turnaround will soon be happening. That it hasn’t, despite a raft of substantial acquisitions, indicates that the revenue growth problems are a lot deeper than she indicates.

CEO Rometty uses high-brow language to describe the growth problem, calling herself a company steward who is thinking long-term. But as the famous economist John Maynard Keynes pointed out in 1923, “in the long run we are all dead.” Today CEO Rometty takes great pride in the company’s legacy, pointing out that “Planes don’t fly, trains don’t run, banks don’t operate without much of what IBM does.”

But powerful as that legacy has been, in markets that move as fast as digital technology any company can be displaced very fast. Just ask the leadership at Sun Microsystems that once owned the telecom and enterprise markets for servers – before almost disappearing and being swallowed by Oracle in just 5 years (after losing $200B in market value.) Or ask former CEO Steve Ballmer at Microsoft, who’s delays at entering mobile have left the company struggling for relevancy as PC sales flounder and Windows 8 fails to recharge historical markets.

CEO Rometty may take pride in her earnings management. But we all know that came from large divestitures of the China business, and selling the PC and server business. As well as significant employee layoffs. All of which had short-term earnings benefits at the expense of long-term revenue growth. Literally $6B of revenues sold off just during her leadership.

Which in and of itself might be OK – if there was something to replace those lost sales. (Even if they didn’t have any profits – because at least we have faith in Amazon creating future profits as revenues zoom.)

What really worries me about IBM are two things that are public, but not discussed much behind the hoopla of earnings, acquisitions, divestitures and all the talk, talk, talk regarding a new future.

CNBC reported (again, this week,) that 121 companies in the S&P 500 (27.5%) cut R&D in the first quarter. And guess who was on the list? IBM, once an inveterate leader in R&D has been reducing R&D spending. The short-term impact? Better quarterly earnings. Long term impact????

The Washington Post reported this week about the huge sums of money pouring out of corporations into stock buybacks rather than investing in R&D, new products, new capacity, enhanced marketing, sales growth, etc. $500B in buybacks this year, 34% more than last year’s blistering buyback pace, flowed out of growth projects. To make matters worse, this isn’t just internal cash flow going for buybacks, but companies are actually borrowing money, increasing their debt levels, in order to buy their own stock!

And the Post labels as the “poster child” for this leveraged stock-propping behavior…. IBM. IBM

“in the first quarter bought back more than $8 billion of its own stock, almost all of it paid for by borrowing. By reducing the number of outstanding shares, IBM has been able to maintain its earnings per share and prop up its stock price even as sales and operating profits fall.

The result: What was once the bluest of blue-chip companies now has a debt-to-equity ratio that is the highest in its history. As Zero Hedge put it, IBM has embarked on a strategy to “postpone the day of income statement reckoning by unleashing record amounts of debt on what was once upon a time a pristine balance sheet.”

In the case of IBM, looking beyond the short-term trees at the long-term forest should give investors little faith in the CEO or the company’s future growth prospects. Much is being hidden in the morass of financial machinations surrounding acquisitions, divestitures, debt assumption and stock buybacks. Meanwhile, revenues are declining, and investments in R&D are falling. This cannot bode well for the company’s long-term investor prospects, regardless of the well scripted talking points offered last week.

by Adam Hartung | May 8, 2014 | Current Affairs, Leadership

Lots of press this week about Target’s CEO and Chairman, Gregg Steinhafel, apparently being forced out. Blame reached the top job after the successful cyber attack on the company last year. But investors, and customers, may regret this somewhat Board level over-reaction to a mounting global problem.

Richard Clark is probably America’s foremost authority on cyber attacks. He was on America’s National Security Council, and headed the counter-terrorism section. Since leaving government he has increasingly focused on cyber attacks, and advised corporations.

In early 2013 I met Mr. Clark after hearing him speak at a National Association of Corporate Directors meeting. He was surprisingly candid in his comments at the meeting, and after. He pointed out that EVERY company in America was being randomly targeted by cyber criminals, and that EVERY company would have an intrusion. He said it was impossible to do business without working on-line, and simultaneously it was impossible to think any company – of any size – could stop an attack from successfully getting into the company. The only questions one should focus on answering were “How fast can you discover the attack? How well can you contain it? What can you learn to at least stop that from happening again?”

So, while the Target attack was large, and not discovered as early as anyone would like, to think that Target is in some way wildly poor at security or protecting its customers is simply naive. Several other large retailers have also had attacks, include Nieman Marcus and Michael’s, and it was probably bad luck that Target was the first to have such a big problem happen, and at such a bad time, than anything particularly weak about Target.

We now know that all retailers are trying to learn from this, and every corporation is raising its awareness and actions to improve cyber security. But someone will be next. Target wasn’t the first, and won’t be the last. Companies everywhere, working with law enforcement, are all reacting to this new form of crime. So firing the CEO, 2 months after firing the CIO (Chief Information Officer), makes for good press, but it is more symbolic than meaningful. It won’t stop the hackers.

Where this decision does have great importance is to shareholders and customers. Target has been a decent company for its constituents under this CEO, and done far better than some of its competitors. The share price has doubled in the last 5 years, and Target has proven a capable competitor to Wal-Mart while other retailers have been going out of business (Filene’s Basement, Circuit City, Linens & Things, Dots, etc.) or losing all relevancy (like Abercrombie and Fitch and Best Buy.) And Target has been at least holding its own while some chains have been closing stores like crazy (Radio Shack 1,100 stores, Family Dollar 370 stores, Office Depot 400 stores, etc.)

Just compare Target’s performance to JCPenney, who’s CEO was fired after screwing up the business far worse than the cyber attack hurt Target. Or, look at Sears Holdings. CEO Ed Lampert was heralded as a hero 6 years ago, but since then the company he leads has had 28 straight quarters of declining sales, and closed 305 stores since 2010. Kmart has become a complete non-competitor in discounting, and Sears has lost all relevancy as a chain as it has been outflanked on all sides. CEO Lampert has constantly whittled away at the company’s value, and just this week told shareholders that they can simply plan on more store closings in the future.

And vaunted Wal-Mart is undergoing a federal investigation for bribing government officials in Mexico to prop up its business. Wal-Mart is constantly under attack by its employees for shady business practices, and even lost a National Labor Relations Board case regarding its hours and pay practices. And Wal-Mart remains a lightning rod for controversy as it fights with big cities like Chicago and Washington, DC about its ability to open stores, while Target has flourished in communities large and small with work practices considered acceptable. And Target has avoided these sort of internally generated management scandals.

CEOs, and Boards of Directors, across the nation have been seriously addressing cyber security for the last couple of years. Awareness, and protective measures, are up considerably. But there will be future attacks, and some will succeed. It is unclear blaming the CEO for these problems makes any sense – unless there is egregious incompetence.

On the other hand, finding a CEO that can grow a business like Target, in a tough retail market, is not easy. Destroying KMart, while battling Wal-Mart, and still trying to figure out how to compete with Amazon.com is a remarkably difficult job. Perhaps the toughest CEO job in the country. Steinhafel had performed better than most. Investors, and customers, may soon regret that he’s not still leading Target.