by Adam Hartung | Jan 5, 2011 | Defend & Extend, In the Rapids, In the Swamp, Leadership, Lock-in, Openness

Summary:

- Business planning systems are designed to defend historical markets

- Rapidly shifting markets makes it impossible to grow by defense alone

- Growth requires understanding what customers want, and creating new solutions that most likely aren’t part of the current business

- You can’t grow if you don’t plan to grow, but to plan for growth you have to shift resources from traditional planning into scenario planning

- High growth companies like Virgin, Apple and Google plan to fulfill future needs, not defend & extend past practicess

Imagine you see a pile of hay. Above it is a sign flashing “find the needle.” That achievement would be hard. Change the sign to “find the hay” and suddenly achieving the goal becomes much easier. So, as the comedian Bill Engvall might ask, what’s your sign? Unfortunately, most businesses plan for 2011, and beyond, using the first sign. Very few do planning using the latter. Most businesses won’t grow, because they simply don’t know how to plan for growth!!

Most businesses start planning with “I’m in the horseshoe (for example) business. My market isn’t growing, and there is more capacity than demand. How can I grow?” For these people, their sign is “find the needle.”

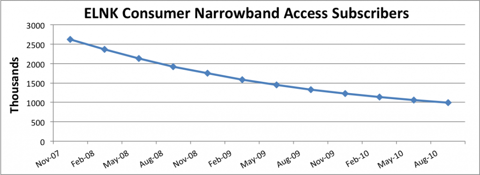

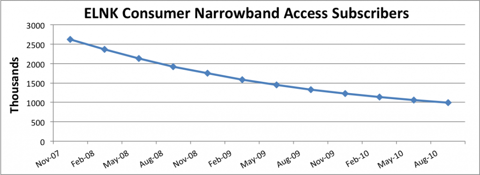

Take for example Earthlink. The company’s growth looked like a rocket ship in the early internet days as people by the millions signed up for dial-up service. But along came broadband, and the market for dial up died – never to return. Earthlink has no hope of growing as long as it thinks of itself as a dial-up company

Chart at SeekingAlpha.com author Ananthan Thangavel

Despite the absolute certainty that the market is shrinking, at this point almost all business planners will develop plans to defend this dying business as long as possible. Despite the impossibility of achieving good returns, there will be a plethora of actions to try and keep serving all the way to the very last customer. Just look at how AOL has invested millions trying to defend its dying internet access busiuness. Reality is, the company that walks away – gives up- is the smartest. There’s no way to make money as oversupply keeps too many companies spending too much to service too few customers.

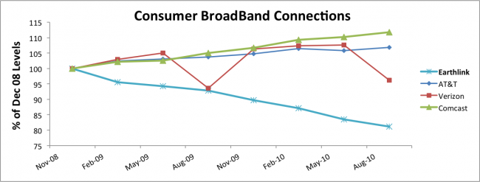

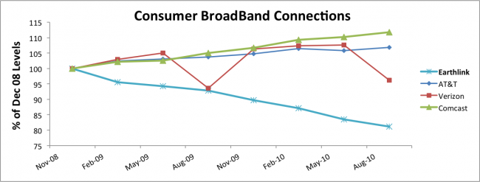

The next step for most planners is to attempt extending the business into something adjacent. For example, Earthlink would say “let’s invest in Broadband. We’ll hang onto customers as they want to switch, and maybe pick up a few customers.” But this completely ignores the fact that competitors already have a substantial lead. Competitors have learned the technology, and the marketplace. They are growing, and have no intention of giving up any room to a new competitor.

Chart at SeekingAlpha.com author Ananthan Thangavel

Planning systems are designed to keep the business doing more of what it always did, or possibly extending the business into adjacent markets after returns have faltered. Planning systems have no way of recognizing when a business, or market, has become obsolete. And practically never do they recognize the power of exsting competitors when looking at adjacent markets. As a result, the planning system produces no growth plans, leading 2011 to end with the self-fulfilling prophecy that the plan predicted – little or no growth.

The future for Earthlink is pretty grim. As it is for most companies that plan based upon history, trying to Defend & Extend their historical markets. In the highly dynamic, global marketplaces of 2011 trying to find growth by remaining focused on the past is like looking for the needle in a haystack. Maybe there’s something in there – but it’s not likely – and it’s even a lot less likely you’ll find it – and if you did, the cost of finding it will almost assuredly be greater than the value.

Alternatively, why not use planning resources to find, and develop, growth markets. Instead of looking at what you did (as in the past tense) try to figure out what you should do. Rather than studying past products, customers and markets, why not develop scenarios about the future that give you insight to what people will want to buy in 2011, 2012 and beyond? Rather than looking for needles, why not go explore the hay?

Newspapers kept focusing on declining subscriptions, when they should have been studying Craig’s List, eBay, Vehix.com and other on-line environments to learn the future of advertising. Had Tribune company poured its resources into its early internet investments, such as cars.com and careerbuilder.com, rather than trying to defend its traditional newspapers, it may well have avoided bankruptcy. But rather than looking to the future when doing its planning, and understanding that on-line news was going to explode, Tribune kept looking for the needle (cost cuts, layoffs, outsourcing, etc.) to save the old success formula.

Direct mail companies and Sunday insert printers have continued looking for ways to defend & extend their coupon printing business – despite the fact that nobody reads junk mail or uses printed coupons. Several have failed, and larger companies have merged trying to find “synergies” and more cost cuts. Simultaneously a 28 year old music major from Nothwestern university starts figuring out how to help companies acquire new customers by offering email coupons, and within 2 years his company, Groupon, is valued at around $6B. There’s nothing that stopped coupon powerhouse Advo from being Groupon, except that its planning system was devoted to finding the needle, while Groupon’s leaders decided to go play in the hay.

Hallmark and American Greetings want us to buy birthday and holiday cards for various occasions – in a world where almost nobody mails cards any longer. As they keep trying to defend their old business, and extend it into a few new opportunities for on-line cards, Twitter captures the wave of instant communications by offering everyone 140 character ways to communicate. Because Twitter is out where the growth is, the company raises $200M giving it a value of $3.7B.

Nothing stops any business from being anything it wants to be. But as most enter 2011 they will use their planning resources, including all those management meetings and hours of forms completion, to do nothing more than re-examine the historical business. Most will devolve into trying to figure out how to do more with less. As future forecasts look grim, or perhaps cautiously optimistic (based on a lot of things going right – like a mysterious pick-up in demand) there will be much nashing of teeth – and meetings looking for a needle that can be offered to employees and investors as a hope for rising future value.

Smart companies get out of that rut. They focus their planning on the future. What do customers want, and how can we give them what they want? How can we create whole new markets. Apple was a PC company, but by exploring mobility it became a provider of MP3 consumer electronics, downloadable music, a mobile device and app supplier and the early winner in cloud accessing tablets. Google has moved from a search engine to a powerhouse ad placement company and is pushing the edges of growth in mobile computing as well as several other markets. Virgin started as a distributor of long-playing vinyl record albums, but by exploring what customers really wanted it has become an international airline, cell phone company, international lender and space travel pioneer (to mention just a few of its businesses.)

You can grow in 2011, but to do so you need to shed the old planning system (and its resource wasting processes) and get serious about scenario planning. Focus on the future, not the past.

by Adam Hartung | Dec 23, 2010 | Defend & Extend, General, In the Rapids, Innovation, Leadership, Openness

“Goodbye 2010, the Year of Austerity” is the headline from Mediapost.com‘s Marketing Daily. And that could be the mantra for many, many companies. Nobody is winning today by trying to save their way to prosperity! As we move into this decade, it is important business leaders realize that the only way to create a strong bottom line (profit) is to develop a strong top line (revenue.) Recommendations:

- Never be desperate. Go to where the growth is, and where you can make money. Don’t chase any business, chase the business where you can profitably growth. Be somewhat selective.

- Focus efforts on markets you know best. I add that it’s important you understand not to do just what you like, but learn to do what customers VALUE.

- Let go of crap, traditions and “playing it safe” actions. Growth is all about learning to do what the market wants, not trying to protect the past – whether processes, products or even customers.

- More lemonade making. You can’t grow unless you’re willing to learn from everything around you. We constantly find ourselves holding lemons, but those who prosper don’t give up – they look for how to turn those into desirable lemonade. What is your willingness to learn from the market?

- Austerity measures are counterproductive 99% of the time. Efficiency is the biggest obstacle to innovation. You don’t have to be a spendthrift to succeed, but you can’t be a miser investing in only the things you know, and have done before.

- Communicate, communicate, communicate. We don’t learn if we don’t share. Developing insight from the environment happens when all inputs are shared, and lots of people contribute to the process.

- Get off the downbeat buss. There’s more to success than the power of positive thinking, but it is very hard to gain insight and push innovation when you’re a pessimist. Growth is an opportunity to learn, and do exciting things. That should be a positive for everybody – except the status quo police.

Realizing that you can’t beat the cost-cutting horse forever (in fact, most are about ready for the proverbial glue factory), it’s time to realize that businesses have been under-investing in innovation for the last decade. While GM, Circuit City, Blockbuster, Silicon Graphics and Sun Microsystems have been failing, Apple, Google, Cisco, Netflix, Facebook and Twitter have maintained double-digit growth! Those who keep innovating realize that markets aren’t dead, they’re just shifting! Growth is there for businesses who are willing to innovate new solutions that attract customers and their dollars! For every dead DVD store there’s somebody making money streaming downloads. Businesses simply have to work harder at innovating.

Fast Company gives us “Five Innovative New Year’s Resolutions:”

- Associate. Work harder at trying to “connect the dots.” Pick up on weak signals, before others, and build scenarios to help understand the impact of these signals as they become stronger. For example, 24x7WallStreet.com clues us in that greater use of mobile devices will wipe out some businesses in “The Ten Businesses The Smartphone Has Destroyed.” But for each of these (and hundreds others over the next few years) there will be a large number of new business opportunities emerging. Just look at the efforts of Foursquare and Groupon and the direction those growth businesses are headed.

- Observe. Pay attention to what’s happening in the world, and think about what it means for your (and every other) business. $100/barrel oil has an impact; what opportunity does it create? Declining network TV watching has an impact – how will you leverage this shift? Don’t just wander through the market, and reacting. Figure out what’s happening and learn to recognize the signs of growth opportunities. Use market events to drive being proactive.

- Experiment. If you don’t have White Space teams trying figure out new business models, how will you be a future winner? Nobody “lucks” into a growth market. It takes lots of trial and learning – and that means the willingness to experiment. A lot. Plan on experimenting. Invest in it. And then plan on the positive results.

- Question. Keep asking “why” until the market participants are so tired they throw you out of the room. Then, invent scenarios and ask “why not” until they throw you out again. Markets won’t tell you what the next big thing is, but if you ask a lot of questions your scenarios about the future will be a whole lot better – and your experimentation will be significantly more productive.

- Network. You can’t cast your net too wide in the effort to obtain multiple points of view. Nothing is narrower than our own convictions. Only by actively soliciting input from wide-ranging sources can you develop alternative solutions that have higher value. We become so comfortable talking to the same people, inside our companies and outside, that we don’t realize how we start hearing only reinforcement for our biases. Develop, and expand, your network as fast as possible. Oil and water may be hard to mix, but it blending inputs creates a good salad dressing.

ChiefExecutive.net headlined “2010 CEO Wealth Creation Index Shows a Few Surprises.” Who creates wealth? Included in thte Top 10 list are the CEOs of Priceline.com, Apple, Amazon, Colgate-Palmolive and DeVry. These CEOs are driving industry innovation, and through that growth. This has produced above-average cash flow, and higher valuations for their shareholders. As well as more, and better quality jobs for employees. Meanwhile suppliers are in a position to offer their own insights for ways to grow, rather than constantly battling price discussions.

Who destroys wealth? In the Top 10 list are the CEOs of Dean Foods, Kraft, Computer Sciences (CSC) and Washington Post. These companies have long eschewed innovation. None have introduced any important innovations for over a decade. Their efforts to defend & extend old practices has hurt revenue growth, providing ample opportunity for competitors to enter their markets and drive down margins through price wars. Penny-pinching has not improved returns as revenues faltered, and investors have watched value languish. Employees are constantly in turmoil, wondering what future opportunities may ever exist. Suppliers never discuss anything but price. These are not fun companies to work in, or with, and have not produced jobs to grow our economy.

Any company can grow in 2011. Will you? If you choose to keep doing what you’ve always done – well you shouldn’t plan on improved performance. On the other hand, embracing market shifts and creating an adaptive organization that identifies and launches innovation could well make you into a big winner. Next holiday season when you look at performance results for 2011 they will have more to do with management’s decisions about how to manage than any other factor. Any company can grow, if it does the right things.

by Adam Hartung | Dec 17, 2010 | Current Affairs, Defend & Extend, In the Rapids, In the Swamp, Leadership, Web/Tech

Summary:

- Many people think it is OK for large companies to grow slowly

- Many people admire caretaker CEOs

- In dynamic markets, low-growth companies fail

- It is harder to generate $1B of new revenue, than grow a $100B company by $10B

- Large companies have vastly more resources, but they squander them badly

- We allow large company CEOs too much room for mediocrity and failure

- Good CEOs never lose a growth agenda, and everyone wins!

“I may just be your little rent collector Mr. Potter, but that George Bailey is making quite a bit happen in that new development of his. If he keeps going it may just be time for this smart young man to go asking George Bailey for a job.” From “It’s a Wonderful Life“ an employee of the biggest employer in mythical Beford Falls talks about the growth of a smaller competitor.

My last post gathered a lot of reads, and a lot of feedback. Most of it centered on how GE should not be compared to Facebook, largely because of size differences, and therefore how it was ridiculous to compare Jeff Immelt with Mark Zuckerberg. Many readers felt that I overstated the good qualities of Mr. Zuckerberg, while not giving Mr. Immelt enough credit for his skills managing “lower growth businesses” in a “tough economy.” Many viewed Mr. Immelt’s task as incomparably more difficult than that of managing a high growth, smaller tech company from nothing to several billion revenue in a few years. One frequent claim was that it is enough to maintain revenue in a giant company, growth was less important.

Why do so many people give the CEOs of big companies a break? Given that they make huge salaries and bonuses, have fantastic perquesites (private jets, etc.), phenominal benefits and pensions, and receive remarkable payouts whether they succeed or fail I would think we’d have very high standards for these leaders – and be incensed when their performance is sub-par.

Facebook started with almost no resources (as did Twitter and Groupon). Most leaders of start-ups fail. It is remarkably difficult to marshal resources – both enough of them and productively – to grow a company at double digit rates, produce higher revenue, generate cash flow (or loans) and keep employees happy. Growing to a billion dollars revenue from nothing is inexplicably harder than adding $10B to a $100B company. Compared to Facebook, GE has massive resources. Mr. Immelt entered the millenium with huge cash flow, huge revenues, and an army of very smart employees. Mr. Zuckerberg had to come out of the blocks from a standing start and create ALL his company’s momentum, while comparatively Mr. Immelt took on his job riding a bullet out of a gun! GE had huge momentum, a low cost of capital, and enough resources to do anything it wanted.

Yet somehow we should think that we don’t have as high expectations from Mr. Immelt as we do Mr. Zuckerberg? That would seem, at the least, distorted.

In business school I read the story of how American steel manufacturers were eclipsed by the Japanese. Ending WWII America had almost all the steel capacity. Manufacturers raked in the profits. Japanese and German companies that were destroyed had to rebuild, which they progressively did with more efficient assets. By the 1960s American companies were no longer competitive. Were we to believe that having their industrial capacity destroyed somehow was a good thing for the foreign competitors? That if you want to improve your competitiveness (say in autos) you should drop a nuclear bomb on the facilities (some may like that idea – but not many who live in Detroit I dare say.) In reality the American leaders simply refused to invest in new technologies and growth markets, allowing competitors to end-run them. The American leaders were busy acting as caretakers, and bragging about their success, instead of paying attention to market shifts and keeping their companies successful!

Big companies, like GE, are highly advantaged. They not only have brand, and market position, but cash, assets, employees and vendors in position to help them be even more successful! A smart CEO uses those resources to take the company into growth markets where it can grow revenues, and profits, faster than the marketplace. For example Steve Jobs at Apple, and Eric Schmidt at Google have found new markets, revenues and cash flow beyond their original “core” markets. That’s what Mr. Welch did as predecessor to Mr. Immelt. He didn’t so much take advantage of a growth economy as help create it! Unfortunately, far too many large company CEOs squander their resources on low rate of return projects, trying to defend their existing business rather than push forward.

Most big companies over-invest in known markets, or technologies, that have low growth rates, rather than invest in growth markets, or technologies they don’t know as well. Think about how Motorola invented the smart phone technology, but kept investing in traditional cellular phones. Or Sears, the inventor of “at home shopping” with catalogues closed that division to chase real-estate based retail, allowing Amazon to take industry leadership and market growth. Circuit City ended up investing in its approach to retail until it went bankrupt in 2010 – even though it was a darling of “Good to Great.” Or Microsoft, which launched a tablet and a smart phone, under leader Ballmer re-focused on its “core” operating system and office automation markets letting Apple grab the growth markets with R&D investments 1/8th of Microsoft’s. These management decisions are not something we should accept as “natural.” Leaders of big companies have the ability to maintain, even accelerate, growth. Or not.

Why give leaders in big companies a break just because their historical markets have slower growth? Singer’s leadership realized women weren’t going to sew at home much longer, and converted the company into a defense contractor to maintain growth. Netflix converted from a physical product company (DVDs) into a streaming download company in order to remain vital and grow while Blockbuster filed bankruptcy. Apple transformed from a PC company into a multi-media company to create explosive growth generating enough cash to buy Dell outright – although who wants a distributor of yesterday’s technology (remember Circuit City.) Any company can move forward to be anything it wants to be. Excusing low growth due to industry, or economic, weakness merely gives the incumbent a pass. Good CEOs don’t sit in a foxhole waiting to see if they survive, blaming a tough battleground, they develop strategies to change the battle and win, taking on new ground while the competition is making excuses.

GM was the world’s largest auto company when it went broke. So how did size benefit GM? In the 1980s Roger Smith moved GM into aerospace by acquiring Hughes electronics, and IT services by purchasing EDS – two remarkable growth businesses. He “greenfielded” a new approach to auto manufucturing by opening the wildly successful Saturn division. For his foresight, he was widely chastised. But “caretaker” leadership sold off Hughes and EDS, then forced Saturn to “conform” to GM practices gutting the upstart division of its value. Where one leader recognized the need to advance the company, followers drove GM to bankruptcy by selling out of growth businesses to re-invest in “core” but highly unprofitable traditional auto manufacturing and sales. Meanwhile, as the giant failed, much smaller Kia, Tesla and Tata are reshaping the auto industry in ways most likely to make sure GM’s comeback is short-lived.

CEOs of big companies are paid a lot of money. A LOT of money. Much more than Mr. Zuckerberg at Facebook, or the leaders of Groupon and Netflix (for example). So shouldn’t we expect more from them? (Marketwatch.com “Top CEO Bonuses of 2010“) They control vast piles of cash and other resources, shouldn’t we expect them to be aggressively investing those resources in order to keep their companies growing, rather than blaming tax strategies for their unwillingness to invest? (Wall Street Journal “Obama Pushes CEOs on Job Creation“) It’s precisely because they are so large that we should have high expectations of big companies investing in growth – because they can afford to, and need to!

At the end of the day, everyone wins when CEOs push for growth. Investors obtain higher valuation (Apple is worth more than Microsoft, and almost more than 10x larger Exxon!,) employees receive more pay (see Google’s recent 10% across the board pay raise,) employees have more advancement opportunities as well as personal growth, suppliers have the opportunity to earn profits and bring forward new innovation – creating more jobs and their own growth – rather than constantly cutting price. Answering the Economist in “Why Do Firms Exist?” it is to deliver to people what they want. When companies do that, they grow. When they start looking inward, and try being caretakers of historical assets, products and markets then their value declines.

Can Mr. Zuckerberg run GE? Probably. I’d sure rather have him at the helm of GM, Chrysler, Kraft, Sara Lee, Motorola, AT&T or any of a host of other large companies that are going nowhere the caretaker CEOs currently making excuses for their lousy performance. Think what the world would be like if the aggressive leaders in those smaller companies were in such positions? Why, it might just be like having all of American business run the way Steve Jobs, Jeff Bezos and John Chambers have led their big companies. I struggle to see how that would be a bad thing.

by Adam Hartung | Dec 7, 2010 | Defend & Extend, In the Swamp, Leadership, Web/Tech

Today’s guest blog is provided by Mike Meikle, hope you enjoy:

Summary

- Oracle is at the top of the heap in the Traditional Software market.

- Traditional Software market is deflating with $7 billion less profit than 2009

- Software as a Service, a component of Cloud Computing, has a forecasted 26% annual growth rate over the next five years.

- Oracle Cloud Computing strategy is muddled with bi-polar corporate marketing and platform dependency.

- Customers feel trapped with Oracle and are looking for alternatives.

- Oracle is trapped in a classic Defend and Extend situation.

- Oracle seems to be following Microsoft in using 1990’s corporate strategy in 2011.

Throughout the 1990’s Microsoft held the dominant position in software. Firmly ensconced in Corporate and Consumer arenas, Microsoft generated enormous profits. With an overflowing war chest, MSFT aggressively quashed or bought out the competition – which eventually attracted the attention of the United States Justice Department.

After a little less than 10 years, Microsoft now fights to stay relevant as multiple challengers have exposed gaping holes in its armor. The tech giant’s senior leadership appears rudderless as product lines fail to get off the mark (Windows Phone 7) or flounder (Vista).

With this in mind let us turn toward Oracle. Long viewed as the top Database Management System (DBMS) for the corporate world, its database software underpins much of the global information economy. It has a large war chest stuffed with the profits created by costly traditional software licensing deals with locked-in customers. It has used that cash to acquire new lines of business (PeopleSoft, Sun) and competitors (ATG, MySQL).

However there are some dark clouds on the horizon. The advent of Cloud Computing is a threat to its current licensing model. How will Oracle adapt to corporations implementing virtual servers and databases in the Cloud? Traditional software licensing is down $7 billion industry-wide from 2009. Meanwhile “software as a service” (SaaS) is seeing explosive growth, with a forecasted 26% annual growth rate over the next five years as a natural component of Cloud Computing.

Oracle has made some efforts to delve into the Cloud Computing fray with the Oracle Exalogic Elastic Cloud, or “Cloud-In-a-Box”, leveraging their SUN and ATG acquisitions. However this arrives several years behind the Amazon, Google, and Microsoft triumvirate of Cloud Computing products. Oracle’s Cloud offering will also have to overcome Oracle’s own negative statements about Cloud Computing. CEO Larry Ellison called Cloud Computing “complete gibberish” in late 2008.

Oracle also has problems with its customers. Chafing under the steep licensing costs and sub-standard support, nearly half are looking to shift to lower cost alternatives as they become available. Many have felt trapped by lack of suitable replacements. MySQL was one such competitor, but with Oracle purchasing SUN and getting MySQL in the bargain, that option disappeared. So customers have continued to (reluctantly) fork over licensing and maintenance fees to Oracle, creating the bulk of the organization’s profit stream.

Sound familiar?

Also, the champions of Oracle software offerings, developers, are dissatisfied with the company. The founders of MySQL and the creator of Java, now key software offerings of Oracle, have jumped ship as a result of disagreements with Oracle’s corporate direction.

Now Oracle finds itself in is a classic Defend & Extend situation. Nearly all their profits rely on historical licensing and maintenance for traditional software, a market that is rapidly shrinking. Current customers are unhappy with cost and service; hungry for alternatives and ready to embrace new solutions. But Oracle has arrived late and timidly to the Cloud Computing maketplace, attempting to leverage recently acquired assets where key personnel have left (and taking who knows how much vital market and product knowledge.) Not only will Oracle have to struggle to differentiate itself from other Cloud offerings going forward, it will have to incorporate their newly acquired assets (including technologies) into a cohesive offering while trying to ramp up top notch service.

Oracle will have to break out of the “consistency trap” if it is to drive profits toward new growth. New services that provide value to the customer will have to be developed and aggressively marketed. To grow future revenue and profits Oracle cannot rely on shoehorning customers into poorly fitting licensing and support models based on the fading market of yesteryear.

Or Oracle could choose to not change its old Success Formula. For advice on that approach Oracle’s Mr. Ellison talk to Microsoft’s Mr. Ballmer to see how well his 1990’s corporate strategy is working as Microsoft stumbles into 2011.

Thanks Mike! Mike Meikle shares his insights at “Musings of a Corporate Consigliere” (http://mikemeikle.wordpress.com/). I hope you read more of his thoughts on innovation and corporate change at his blog site. I thank Mike for contributing this blog for readers of The Phoenix Principle today, and hope you’ve enjoyed his contribution to the discussion about innovation, strategy and market shifts.

If you would like to contribute a guest blog please send me an email. I’d be pleased to pass along additional viewpoints on wide ranging topics.

by Adam Hartung | Dec 6, 2010 | Current Affairs, Defend & Extend, Disruptions, Food and Drink, Leadership, Lock-in

Summary:

- Business leaders like consistency

- Consistency leads to repetition, sameness, and lower rates of return

- Kraft's product lines are consistent, but without growth

- Kraft's value has been stagnant for 10 years

- Disruptive competitors make higher rates of return, and grow

- Disruptive competitors have higher valuations – just look at Groupon

"Needless consistency is the hobgoblin of small minds" – Ralph Waldo Emerson

That was my first thought when I read the MediaPost.com Marketing Daily article "Kraft Mac & Cheese Gets New, Unified Look." Whether this 80-something year old brand has a "unified" look is wholly uninteresting. I don't care if all varieties have the same picture – and if they do it doesn't make me want to eat more powdered cheese and curved noodles.

In fact, I'm not at all interested in anything about this product line. It is kind of amusing, in an historical way, to note that people (largely children) still eat the stuff which fueled my no-cash college years (much like ramen noodles does for today's college kids.) While there's nothing I particularly dislike about the product, as an investor or marketer there's nothing really to like about it either. Pasta products always do better in a recession, as people look for cheaper belly-fillers (especially for the kid,) so that more is being sold the last couple of years doesn't tell me anything I would not have guessed on my own. That the entire category has grown to only $800M revenue across this 8 decade period only shows that it's a relatively small business with no excitement! Once people feel their finances are on firm footing sales will soon taper off.

Kraft's Mac & Cheese is emblematic of management teams that lock-in on defending and extending old businesses – even though the lack of growth leaves them struggling to grow cash flow and create a decent valuation. Introducing multiple varieties of this product has not produced growth that even matched inflation across the years. Primarily, marketing programs have been designed to try keeping existing customers from buying something else. This most recent Kraft program is designed to encourage adults to try a product they gave up eating many years ago. This is, at best, "foxhole" marketing. Spending money largely just to keep the brand from going away, rather than really expecting any growth. Truly, does anyone think this kind of spending will generate a billion dollar product line in 2011 – or even 2012?

What's wrong with defensive marketing, creating consistency across the product line – across the brand – and across history? It doesn't produce high rates of return. There are lots of pasta products, even lots of brands of mac & cheese. While Kraft's product surely produces a positive margin, multiple competitors and lack of growth means increased spending over time merely leaves the brand producing a marginal rate of return. Incremental ad spending doesn't generate real growth, just a hope of not losing ground. We know people aren't flocking to the store to buy more of the product. New customers aren't being identified, and short-term growth in revenues does not yield the kinds of returns that would enhance valuation and make the world a better place for investors – or employees.

While Kraft is trying to create headlines with more spending in a very tired product, across town in Chicago Groupon has created a $500M revenue business in just 2 years! And new reports from the failed acquisition attempt by Google indicate revenues are likely to reach $2B in 2011 (CNNMoney.com, Fortune, "Google's Groupon Groping Reveals the Shifting Power of the Web World.") Where's Kraft in this kind of growth market? After all, coupons for Kraft products have been in mailers and Sunday inserts for 50 years. Why isn't Kraft putting money into a real growth business, which is producing enormous value while cash flow grows in multiples? While Groupon has created somewhere around $6B of value in 2 years, Kraft's value has only gone sideways for the last decade (chart at Marketwatch.com.)

Kraft has not introduced a new product since — well — DiGiorno. And that's been more than a decade. While the company has big revenues – so did General Motors. The longer a company plays defense, regardless of size, trying to extend its outdated products (and business model) the riskier that business becomes. While big revenues appear to offer some kind of security, we all know that's not true. Not only does competition drive down margins in these older businesses, but newer products make it harder and harder for the old products to compete at all. Eventually, the effort to maintain historical consistency simply allows competitors to completely steal the business away with new products, creating a big revenue drop, or producing such low returns that failure is inevitable.

Lots of business people like consistency. They like consistency in how the brand is executed, or how products are aligned. They like consistency in the technology base, or production capabilities. They like consistency in customers, and markets. They like being consistent with company history – doing what "made the company famous." They like the similarity of doing something again, and again, hoping that consistency will produce good returns.

But consistency is the hobgoblin of small minds. And those who are more clever find ways to change the game. Xerox figured out how to let everyone be a one-button printer, and killed the small printing press manufacturers. HP's desktop printers knocked the growth out of Xerox. Google figured out a better way to find information, and place ads, just about killing newspapers (and magazines.) Apple found a better way to use mobile minutes, taking a big bite out of cell phone manufacturers. Amazon found a better way to sell things, killing off bookstores and putting a world of hurt on many retailers. Netflix found a better way of distributing DVDs and digital movies, sending Blockbuster to bankruptcy. Infosys and Tata found a better way of doing IT services, wiping out PWC and nearly EDS. Hulu (and soon Netflix, Google and Apple) has found a better way of delivering television programming, killing the growth in cable TV. Groupon is finding a better way of delivering coupons, creating huge concerns for direct mail companies. Now tablet makers (like Apple) are demonstrating a better way of working remotely, sending shivers of worry down the valuation of Microsoft. These companies, failed or in jeapardy, were very consistent.

Those who create disruptions show again and again that they can generate growth and above average returns, even in a recession. While those who keep trying to defend and extend their old business are letting consistency drive their behavior – leading to intense competition, genericization, and lower rates of return. Maybe Kraft should spend more money looking for the next food we would all like, rather than consistently trying to convince us we want more Mac & Cheese (or Velveeta).

by Adam Hartung | Nov 29, 2010 | Current Affairs, Disruptions, In the Rapids, Innovation, Leadership, Lifecycle, Openness, Television, Web/Tech

Summary:

- Most leaders optimize their core business

- This does not prepare the business for market shifts

- Motorola was a leader with Razr, but was killed when competitors matched their features and the market shifted to smart phones

- Netflix's leader is moving Netflix to capture the next big market (video downloads)

- Reed Hastings is doing a great job, and should be emulated

- Netflix is a great growth story, and a stock worth adding to your portfolio

"Reed Hastings: Leader of the Pack" is how Fortune magazine headlined its article making the Netflix CEO its BusinessPerson of the Year for 2010. At least part of Fortune's exuberance is tied to Netflix's dramatic valuation increase, up 200% in just the last year. Not bad for a stock called a "worthless piece of crap" in 2005 by a Wedbush Securities stock analyst. At the time, popular wisdom was that Blockbuster, WalMart and Amazon would drive Netflix into obscurity. One of these is now gone (Blockbuster) the other stalled (WalMart revenues unmoved in 2010) and the other well into digital delivery of books for its proprietary Kindle eReader.

But is this an honor, or a curse? It was 2004 when Ed Zander was given the same notice as the head of Motorola. After launching the Razr he was lauded as Motorola's stock jumped in price. But it didn't take long for the bloom to fall off that rose. Razr profits went negative as prices were cut to drive share increases, and a lack of new products drove Motorola into competitive obscurity. A joint venture with Apple to create Rokr gave Motorola no new sales, but opened Apple's eyes to the future of smartphone technology and paved the way for iPhone. Mr. Zander soon ran out of Chicago and back to Silicon Valley, unemployed, with his tale between his legs.

Netflix is a far different story from Motorola, and although its valuation is high looks like a company you should have in your portfolio.

Ed Zander simply took Motorola further out the cell phone curve that Motorola had once pioneered. He brought out the next version of something that had long been "core" to Motorola. It was easy for competitors to match the "features and functions" of Razr, and led to a price war. Mr. Zander failed because he did not recognize that launching smartphones would change the game, and while it would cannibalize existing cell phone sales it would pave the way for a much more profitable, and longer term greater growth, marketplace.

Looking at classic "S Curve" theory, Mr. Zander and Motorola kept pushing the wave of cell phones, but growth was plateauing as the technology was doing less to bring in new users (in the developed world):

Meanwhile, Research in Motion (RIM) was pioneering a new market for smartphones, which was growing at a faster clip. Apple, and later Google (with Android) added fuel to that market, causing it to explode. The "old" market for cell phones fell into a price war as the growth, and profits, moved to the newer technology and product sets:

The Motorola story is remarkably common. Companies develop leaders who understand one market, and have the skills to continue optimizing and exploiting that market. But these leaders rarely understand, prepare for and implement change created by a market shift. Inability to see these changes brought down Silicon Graphics and Sun Microsystems in 2010, and are pressuring Microsoft today as users are rapidly moving from laptops to mobile devices and cloud computing. It explains how Sony lost the top spot in music, which it dominated as a CD recording company and consumer electronics giant with Walkman, to Apple when the market moved people from physical CDs to MP3 files and Apple's iPod.

Which brings us back to what makes Netflix a great company, and Mr. Hastings a remarkable leader. Netflix pioneered the "ship to your home" DVD rental business. This helped eliminate the need for brick-and-mortar stores (along with other market trends such as the very inexpensive "Red Box" video kiosk and low-cost purchase options from the web.) Market shifts doomed Blockbuster, which remained locked-in to its traditional retail model, made obsolete by competitors that were cheaper and easier with which to do business.

But Netflix did not remain fixated on competing for DVD rentals and sales – on "protecting its core" business. Looking into the future, the organization could see that digital movie rentals are destined to be dramatically greater than physical DVDs. Although Hulu was a small competitor, and YouTube could be scoffed at as a Gen Y plaything, Netflix studied these "fringe" competitors and developed a superb solution that was the best of all worlds. Without abandoning its traditional business, Netflix calmly moved forward with its digital download business — which is cheaper than the traditional business and will not only cannibalize historical sales but make the traditional business completely obsolete!

Although text books talk about "jumping the curve" from one product line to another, it rarely happens. Devotion to the core business, and managing the processes which once led to success, keeps few companies from making the move. When it happens, like when IBM moved from mainframes to services, or Apple's more recent shift from Mac-centric to iPod/iPhone/iPad, we are fascinated. Or Google's move from search/ad placement company to software supplier. While any company can do it, few do. So it's no wonder that MediaPost.com headlines the Netflix transition story "Netflix Streams Its Way to Success."

Is Netflix worth its premium? Was Apple worth its premium earlier this decade? Was Google worth its premium during the first 3 years after its Initial Public Offering? Most investors fear the high valuations, and shy away. Reality is that when a company pioneers a growth business, the value is far higher than analysts estimate. Today, many traditionalists would say to stay with Comcast and set-top TV box makers like TiVo. But Comcast is trying to buy NBC in order to move beyond its shrinking subscriber base, and "TiVo Widens Loss, Misses Street" is the Reuters' headline. Both are clearly fighting the problems of "technology A" (above.)

What we've long accepted as the traditional modes of delivering entertainment are well into the plateau, while Netflix is taking the lead with "technology B." Buying into the traditionalists story is, well, like buying General Motors. Hard to see any growth there, only an ongoing, slow demise.

On the other hand, we know that increasingly young people are abandoning traditional programing for 100% entertainment selection by download. Modern televisions are computer monitors, capable of immediately viewing downloaded movies from a tablet or USB drive – and soon a built-in wifi connection. The growth of movie (and other video) watching is going to keep exploding – just as the volume of videos on YouTube has exploded. But it will be via new distribution. And nobody today appears close to having the future scenarios, delivery capability and solutions of Netflix. 24×7 Wall Street says Netflix will be one of "The Next 7 American Monopolies." The last time somebody used that kind of language was talking about Microsoft in the 1980s! So, what do you think that makes Netflix worth in 2012, or 2015?

Netflix is a great story. And likely a great investment as it takes on the market leadership for entertainment distribution. But the bigger story is how this could be applied to your company. Don't fear revenue cannibalization, or market shift. Instead, learn from, and behave like, Mr. Hastings. Develop scenarios of the future to which you can lead your company. Study fringe competitors for ways to offer new solutions. Be proactive about delivering what the market wants, and as the shift leader you can be remarkably well positioned to capture extremely high value.

by Adam Hartung | Nov 23, 2010 | Current Affairs, Defend & Extend, In the Swamp, Innovation, Leadership, Lock-in, Web/Tech

Summary:

- Most planning systems rely on extending past performance to predict the future

- But markets are shifting too fast, making such forecasts wildly unreliable

- To compete effectively, companies must anticipate future market shifts

- Planning needs to incorporate a lot more scenario development, and competitor information in order to overcome biases to existing customers and historical products

- Apple and Google have taken over the mobile phone business, while the original leaders have fallen far behind

- Historical mobile phone leaders Nokia, Samsung, Motorola, RIM and Microsoft had the technologies and products to remain leaders, but they lacked scenarios of the future enticing them to develop new markets. Thus they allowed new competitors to overtake them

- Lacking scenarios and deep competitor understanding, companies react to market events – which is slow, costly and ineffective.

“Apple, Android Help Smartphone Sales Double Over Last Year” is the Los Angeles Times headline. Google-supplied Android phones jumped from 3% of the market to 26% versus the same quarter last year. iPhones remained at 17% of the market. Blackberry is now just under 15%, compared to about 21% last year. What’s clear is people are no longer buying traditional mobile phones, as #1 Nokia share fell from 38% to 27%. Like many market changes, the shift has come fast – in only a matter of a few months. And it has been dramatic, as companies not even in the market 5 years ago are now the leaders. Former leaders are struggling to stay in the game as the market shifts.

The lesson Google and Apple are teaching us is that companies must have a good idea of the future, and then send their product development and marketing in that direction. Although traditional cell phone manufacturers, such as Motorola and Samsung, had smartphone technology many years prior to Apple, they were so focused on their traditional markets they failed to look into the future. Busy selling to existing customers an existing technology, they didn’t develop scenarios about 2010 and beyond that would describe how the market could expand – far beyond where traditional phone sales would take it. Both famously said “so what” to the new technology, and used existing customer focus groups of people who had no idea the potential benefit of a smart phone to justify their willingness to remain fixated on the existing business. Lacking a forward planning process based on scenario development, and lacking a good market sensing system that would pick up on the early market shift as novice competitor Apple started to really change the market, these companies are now falling rapidly to the wayside.

Even smartphone pioneer Research in Motion (RIM) was so focused on meeting the needs of its existing “enterprise” customers that it failed to develop scenarios about how to expand the smartphone business into the hands of everyone. RIM missed the value of mobile apps, and the opportunity to build an enormous app database. Now RIM has been surpassed, and is showing no signs of providing effective competition for the market leaders. While the Apple and Android app base continues to explode, based upon 3rd and 4th generation product inducing more developers to sign up, and more customers to buy in, RIM has not effectively built a developer base or app set – causing it to fall further behind quarter by quarter.

Even software giant Microsoft missed the market. Fixated upon putting out an updated operating system for personal computers (Vista then later Windows 7) it let its 45% market share in smart phones circa 2007 disappear. Now approaching 2011 Microsoft has largely missed the market. Again, focused clearly upon its primary goal of defending its existing business in O/S and office automation software, Microsoft did not have a forward focused planning group that was able to warn the company that its new products might well arrive in a market that was stagnating, and on the precipice of a likely decline, because of new technology which could make the PC platform obsolete (a combination of smart mobile devices and cloud computing architecture.) Microsoft’s product development was being driven by its historical products, and market position, rather than an understanding of future markets and how it should develop for them.

We can see this lack of future scenario development and close competitor tracking has confused Microsoft. Desperately trying to recover from a market stall in 2009 when revenues and profits fell, Microsoft has no idea what to do in the rapidly expanding smartphone market today. Its first product, Kin, was dropped only two months after launch, which industry analysts saw as necessary given the product’s lack of advantages. But now Mediapost.com informs us in “Return of the Kin?” Microsoft is considering a re-launch in order to clear out old inventory.

This amidst a launch of the Windows Phone 7 that has gone nowhere. Firstly, there was insufficient advertising to gain any public awareness of the product launch earlier in November (Mediapost “Where’s the Windows Phone 7 Ad Barrage?“) Initial sales have gone nowhere “Windows Phone 7 Lands Without a Sound” [Mediapost], with many stores lacking inventory, very few promoting the product and Microsoft keeping surprisingly mum about initial sales. This has raised the question “Is Windows Phone 7 Dead On Arrival?” [Mediapost] as sales barely achieving 40,000 initial unit sales at launch, compared to daily sales of 200,000 Android phones and 270,000 iphones!

Companies, like Apple and Google, that have clear views of the future, based upon careful analysis of what can be done and tracking market trends, create scenarios that allow them to break out of the pack. Scenario development helps them to understand what the future can be like, and drive their product development toward creating new markets with more customers, more unit sales, higher revenues and improved cash flow. By studying early competitors, especially fringe ones, they create new products which are more highly desired, breaking them out of price competition (remember the Motorola Razr fiasco that nearly bankrupted the company?) and into higher price points and better earnings. Creating and updating future scenarios becomes central to planning – using scenarios to guide investments rather than merely projections based upon past performance.

Companies that base future planning on historical trends find themselves rapidly in trouble. Market shifts leave them struggling to compete, as customers quickly move to new solutions (old fashioned notions of “exit costs” are now dead). Instead of heading for the money, they are confused – lost in a sea of options but with no clear direction. Nokia, Samsung, RIM and Microsoft all have lots of resources, and great historical experience in the market. But lacking good scenario planning they are lost. Unable to chart a course forward, reacting to market leaders, and hoping customers will seek them out because they were once great.

Far too many companies do their planning off of past projections. One could say “planning by looking in the rear view mirror.” In a dynamic, global world this is not sufficient. When monster companies like these can be upset so fast, by someone they didn’t even think of as a traditional competitor (someone likely not even on the radar screen recently) how vulnerable is your company? Do you plan on 2015 looking like 2005? If not, how can future projections based on past actuals be valuable? it’s time more companies change their approach to planning to put an emphasis on scenario development with more competitive (rather than existing customer) input. That’s the only way to get rich, instead of getting lost.

by Adam Hartung | Nov 16, 2010 | Defend & Extend, General, Innovation, Leadership, Web/Tech

Summary:

- Many companies block employee access to Facebook and other social network applications

- But these environments actually improve performance

- Social networks like Facebook allow people to be more productive, and are very inexpensive

- Facebook’s new email client is an example of how these environments can provide companies better services at lower cost – supplanting existing email, for example

- Those who embrace advances early gain an information advantage, as well as a cost advantage

- The new Facebook email client is a big deal for business, and should be explored by everyone

A year ago I was on a panel at the Indian Institute of Technology global conference. My fellow panelists were mostly IT heads from major corporations. When it came to Twitter, Linked-in, MySpace and Facebook – the world of social networking – universally they all blocked access. The reasons given were primarily data confidentiality (fear company information would escape) and productivity (fear employees would unproductively apply their time to personal efforts.) They saw no advantages to social network applications, only risk. Most of those companies – from pharmaceuticals to airlines – still deny access.

This follows a long list of things denied employees by large employers on the grounds of confidentiality and productivity

- employees don’t need a phone at their desk, who could they need to talk to and what do they need to say at work? They can write letters or memos.

- employees don’t need a personal computer. All data should be kept on secured tapes and accessed by productive data center professionals when it makes sense.

- employees don’t need a hard disk in their personal computer. We must keep all data away from employees and keep them focused on using applications tied to central data repositories for productivity

- employees don’t need laptops. Who knows where they will go, and what employees will do with them. They could let data escape, or spend time on personal letters and spreadsheets.

- employees don’t need their own printers. Send all jobs to a central printer location so we can control what is printed for confidentiality and to make sure somebody isn’t printing more than is necessary

- employees don’t need their own cell phones. What in the world do they need to say that can’t wait until they are in the office? How will we keep them from wasting time on personal calls?

- employees don’t need internet access at work. There’s nothing on the web that is important for their work, and it opens a security hole in our operations. If we give them internet access they’ll waste hours and hours browsing instead of working.

This list could go on for a long time, as I’m sure you can now imagine. Confidentiality and productivity are merely excuses for those who fear new tools. Reality is that all these new products improved productivity dramatically, helping employees get more done faster – and making them smarter on the job as well. Organizations that rapidly adopted these (and other) technologies actually achieved superior performance, and rapidly saw their costs decline as these lower cost solutions gave more productivity at lower prices. In most cases, something formerly proprietary and costly became available from an outside source much, much cheaper that worked a whole lot better. Like how the Post Office displaced private messenger services – even though it did have security risks and made it possible for anyone to send a letter (see what I mean, you can go back in time forever with these examples.)

Today social media is the next “big thing” to improve productivity. Facebook, Twitter and its counterparts offer full multi-media, real time interaction with people you know, and don’t know that well, globally. You can find out about everything remarkably fast, and often quite accurately, at practically no cost. No server need be bought – and you don’t even need a PC. A cheap smartphone or tablet will give you all you want – soon to include conferencing and video chat. And you don’t have to buy any software. And you can connect to everyone – not just the people in your company, or on your server, or even on your network or your network service provider. According to Gartner, at MediaPost.com “Implications of a Facebook email Client” will be noticable by 2012, and universal by 2014!

And that’s why “Facebooks Not email Announcement” (as reported in LiveBlog Twitter style on ReadWriteWeb.com) is important for business. Facebook email is going to be better, faster and cheaper than existing email – especially if you’re still using 2 decades out-of-date products like Lotus Notes! Something Facebook doesn’t even want to call email because of its advancements.

An email client for Facebook goes far beyond the value of a Microsoft Live server (think Hotmail+ if you’re not IT oriented). Even GMail, for all its great features, doesn’t offer everything you get in Facebook, due to how Facebook provides integration into everything else that makes its network wildly productive for those of us who realize we live in networks. You even have an archive, searchability – and the capability of creating multiple virtual private networks for doing all kinds of business activities in different markets! And practically free! Using incredibly cheap devices, in multiple varieties and platforms, that employees might well purchase themselves!

For use by everyone from execs to salespeople, businesses will soon be able to stop buying and handing out laptops. Even PCWorld addressed the opportunity in “Social Networks to Supplant email in Business?” Businesses will soon quit operating server farms for most communications. Even quit supporting networks for things like printing sales documents, or creating document-loaded USB drives to hand out. With everyone on tablets and smartphones, and connected over social networks, in a couple of years “leave behinds” will be unnecessary. Those in sales and purchasing will be able to obtain competitive reviews, and prices, and configurations almost instantaneously by asking people on their network for input and feedback. Email will become slow, and a siloed application less useful than products that sit on the network.

With each advance, new opportunities emerge. Doctors have long been notoriously unwilling to carry laptops, or email patients. From the operating room to test results, finding out from an M.D. what’s going on has been problematic. Now MediaPost tells us in “Doctors Without Social Media Borders” how patient communication is rising dramatically from adoption of social media. It lets the physician, and others in medicine, communicate faster, more productively and cheaper than anything before. And this is just one example of how behavior changes when new capabilities arise. Formerly unmet needs are satisfied, and people shift to where they achieve greatest satisfaction.

Once email was considered the “killer app” that made everyone need a PC – and access to the web. Social media takes email into entirely new orbits. Getting more done, faster, with more people, using more current data, verified by more access points, across multiple media creates competitive advantage. Those who ignore this trend will fall behind. Those who adopt it have the opportunity to beat their competition. Everyone knows that those who know the most, first, and are able to apply it have a big first mover advantage. If you’re not promoting this in your company – if you are in fact blocking it – you’ll soon have no chance of remaining competitive. You’ll just start falling behind – and the gap will widen.

by Adam Hartung | Nov 11, 2010 | Current Affairs, In the Whirlpool, Lock-in, Web/Tech

Summary:

- Business value requires meeting future needs

- Businesses have to transition to remain valuable

- U.S. News is smart to drop its print edition and go all digital

- Print newspapers and magazines are obsolete

- Old brands have no value

- Businesses have to develop and fulfull future scenarios, and forget about what made them successful in the past. Value comes from delivering in the future, not the past

Do you know any antique collectors? They scour for old things, considered rare because they are the remaining few out of a bygone era. For some people, these old things represent something treasured about the past – perhaps a turn in technology or some aspect of society. But there is no useful purpose to an antique. You can’t use the chair as a chair, for fear you’ll break it. Mostly, old things are just that – old things. Once useful, but no longer. They are remembrances. For most of us, seeing them in a museum once in a while is plenty often enough. We don’t need a houseful of them – and would happily trade the old Schwynn bicycle from high-school days for an iPad.

So what’s the value of the Chicago Tribune, or the Los Angeles Times? With the internet, tablets and other ereaders, mobile smartphones and laptops – why would anyone expect these newspapers to ever grow in value? Yes, they were once valuable – when readers could be “current” with daily news, largely from a single source. But now these newsapapers are practically obsolete. Expensive to create, expensive to print, expensive to distribute. And largely outdated by faster news outlets providing real time updates via the web, or television for those still not on-line. They are as valuable as a stack of 45 or 33 RPM records, or 8-track tapes (and if you don’t know what those are, ask your parents.)

As much as some of us, especially over 40, like the idea of newspapers and magazines – they really are obsolete. When automobiles were first created many people who grew up riding horses said the auto would never be able to displace the horse. Autos required petrol, where horses could feed anywhere. Autos required roads, where horses could walk (or tow a cart) practically anywhere. Mechanical autos broke down, where horses were reliable day after day. And autos were expensive to purchase and use. To those raised with horses, the auto seemed interesting but unnecessary – and with drawbacks. Yet, auto technology was clearly superior – offering better speed and longer distances, and the infrastructure was rapidly coming into place. The horse was obsolete. And this change made livery stables, saddle makers and blacksmiths obsolete as well. It took only a few years.

Today, printed documents like newspapers and magazines are obsolete. They have a purpose for travelers and commuters – but not for long. Tablets are making even the travelers use of paper unnecessary. With each of the 12million iPads sold (and who knows how many Kindles and other readers) another newspaper was unnecessary on the hotel room door. So I was extremely heartened to read that “U.S. News [and World Report] is ending its print edition” on MediaLifeMagazine.com.

Some might nostalgically say this decision is the end of something grand. Contrarily, this is the smart move by leadership to help the employees, customers and suppliers all continue pushing forward. As a print product U.S. News reached its end of life. As a digital product, U.S. News has a chance of becoming an important part of future journalism. While some are concerned the future digital product is not about the same old news it used to report, the facts are that we don’t need another magazine just for news. But the rankings and industry reports U.S. News has long created have the most value to readers (and therefore advertisers) and so the editors will be focusing on those areas. Smart move. Instead of doing what they always did, the editors are going to produce what the market wants. U.S. News has a fighting chance of survival, and thriving, if it focuses on the marketplace and meeting needs. It can expand with new products as it continues to learn what digital readers want, and advertisers will support. As an obsolete weekly magazine it didn’t have any value, but as a digital product it has a chance of being worth something.

I was shocked to read in Advertising Age “Meister Brau, Braniff and 148 other Trademarks to be Sold at Auction.” Who would want to buy a trademark of an old brand? It no longer has any value. Brands and trademarks have value when they help you aspire toward something in the future. A dead brand would have the cost not only of developing value — like Google in search or Android in phones has done; or the entire “i” line from Apple, or even Whole Foods or Prada. But to resurrect Meister Brau, Lucky Whip or Handi-Wrap would mean first overcoming the old (worn out and failed) position, and then trying to put something new on top. It’s even more expensive than starting from scratch with a brand that has no meaning – because you have to overcome the old meaning that clearly did not succeed.

Value is in the future. Yes, rare artifacts are sometimes cherished, and their tangible ownership (think of historical pottery, or rare furniture) can cannote something of a bygone era that provides an emotional trigger. These occasionally (like real items from the Titanic) can be collected and valuable. But a brand? Do you want a plastic Lucky Whip tub to help you recall bad 1960s deserts? Or a cardboard Handi-Wrap box to remind you of grandma’s leftovers? In business value is not about the past, it’s entirely about the future.

For businesses to create value they have to generate and fulfull scenarios about the future. Nobody cares if you were good last year (and certainly not if you were good last decade – anybody want an Oldsmobile?) They care about what you’re going to give them in the future. And all business planning needs to be looking forward, not backward. And that’s why it’s a good thing that U.S. News is going all digital. Maybe if the turnaround pros at Tribune Corporation understood this they could figure out how to grow revenues at Tribune or the Times again, and maybe get the company out of bankruptcy. Because trying to save any business by looking at what it used to do is never going to work.

by Adam Hartung | Nov 1, 2010 | Defend & Extend, Leadership, Lock-in

Summary:

- When something works, we do more of it

- But markets shift, and what we did loses its ability to create growth

- Out of high growth comes Lock-in to old practices that blind us to potential market changes which could create price wars or obsolescence

- Lock-in gets in the way of seeing emerging market shifts

- Ikea is doing well now, but it is already seriously locked-in on an aging strategy

- Will Ikea continue succeeding as it runs into Wal-mart and other price-focused competitors?

- Will Ikea be able to adapt to changing markets as developed economies improve?

“If it works, do more of it” is a famous coaching recommendation. “Nothing succeeds like success” is another. Both are age old comments with simple meanings. Don’t overthink a situation. If something works, keep on doing it. And the more it works, the more you should “keep on keepin’ on” as once famous pop song lyrics recommended. One could ask, why should you try doing anything else, if what you’re doing is working? Many people would sagelyl recommend another common comment, “if it ain’t broke, don’t fix it!”

And this seems to be the philosophy of the new CEO at Ikea, Mikael Ohlsson as descibed in an Associated Press article on Chron.com, the web site for the Houston Chronicle, “New Ikea CEO Cuts Prices, Targets Frugal U.S. Families.”

A lifelong Ikea employee, Mr. Ohlsson joined Ikea right out of college in 1979 as a rug salesperson. He’s watched the company grow dramatically across his career. And he’s watched the company essentially grow by doing one thing – make home goods people need cheaply, figure out how to keep shipping and distribution costs to a minimum, and offer them directly to customers through your own stores. All designed to keep prices at a minimum. Most people would applaud him for focusing on doing more of the same.

And certainly today Ikea’s strategy is benefitting from the “Great Recession,” as we’ve come to call it. A flat economy, no job growth, little income growth, rampant unemployment, declining home values and limited credit access has helped Americans move along the road of penny-pinching.

Somewhat stylish, but primarily low-priced, furniture and other goods long appealed to college students. The fact that most of the furniture was designed for very economical shipping was a big plus with students that changed dorms and apartments frequently. Low price, in addition to the fact that most students are poor, was a benefit in case someone had to leave the stuff behind due to a longer move, downsizing, or simply lost their abode for a while. That the furniture and some of the other items didn’t hold up all that well wasn’t such a big deal, because nobody intended to keep it once school ended and they could afford something better.

But recent cheapness has caused a lot more people to start buying Ikea. That has contributed to a lot more growth than the company originally expected in developed countries like the USA. As sales grew, the company has been pushing year after year to keep lowering costs – and prices. The CEO proudly touted his ability to relocate manufacturing and distribution in order to drive down U.S. prices on several items. In language that sounds almost like Wal-Mart, he talks about constantly driving down cost, and price, in order to appeal to Americans – and even continental Europeans – in the throes of being cheap. Cost, cost, cost in order to sell cheap, cheap, cheap seems to have worked well for Ikea.

And that’s the worry foundation owners should have (Ikea is not publicly traded, it is owned by a foundation.) Ikea is rapidly catching the Wal-Mart Disease (see this blog 13 October). Focusing on execution, in order to lower cost, keep lowering price and expecting the market to expand. This will eventually lead to two very unpleasant side effects:

- Eventually Ikea will run headlong into Wal-Mart. And other price-focused competitors in the USA and other countries. In doing so, margins will be crimped, as will growth. When 2 (or more) companies compete on cost/price it creates a price war, and if it’s between Ikea and Wal-Mart expect the war to be incredibly bloody (this is also bad news for Microsoft shareholders, who are going to increasingly see Ikea join other competitors in pressuring Wal-Mart’s strategy.)

- What will happen to Ikea’s growth if the market shifts? What will happen if customers quit focusing on price, and start looking for better products (longer lasting, higher quality materials, increased sturdiness – for examples)? Or if they want different designs? Or they get tired of the long drives to those huge Ikea stores, and prefer shopping closer to home? Quite simply, what will happen to Ikea’s growth if something besides price retakes importance for customers in developed countries?

There is no doubt Ikea has had a great run. But in large part, fortuitous economic events played a big role. The rising percentage of youth going to colleges, as well as the large migration of developing country students to developed country universities, helped propel the need for affordable items appealing to students. Then the economic faltering post-2000, combined with the banking crisis, created a very slow economy in developed countries. Suburbanization gave Ikea the opportunity to build massive stores at affordable cost to which customers could flock. For 30 years these trends benefitted companies with a price focus – such as Ikea (and Wal-Mart). And all the company had to do was “more of the same.”

But will that remain the long-term trend? As households downsize, home prices stabilize then recover, developed economies improve, jobs grow again and incomes start rising is it possilble that customers will want something beyond low price?

And when that happens, will Ikea find itself so locked-in to its strategy that it cannot adjust to market shifts? What will it do with those manufacturing centers, distribution hubs and huge stores then? How will it be able to recognize the change in customer needs, and alter its merchandise – and stores – to meet changing needs? Or will Ikea rely far too long on improving execution of the strategy that got it where the company is today? Will its decision-making processes, designed to improve execution, keep Ikea making cheap furniture and other goods long after competing on price is sufficient?

Ikea is likely to do well for at least a couple more years. But one can already see how the company, and its CEO, have locked-in on what worked early in the company lifecycle. And now the focus is on executing the old strategy – reinforcing what the company locked-in upon. And there doesn’t seem to be a lot of concern about dealing with potential market shifts.

Most worrisome of all was the CEO’s comment, “I tend not to look so much at competition.” In a very real way, this shows a blindness towoard looking for price wars and market shifts. A blindness toward identifying emerging trends. A blindness toward identifying there may be groth opportunities in a year or two that are better than simply continuing to do what Ikea has always done. And even for a fast growing company, luckily positioned in the right place at the right time, this is something to be worried about.