by Adam Hartung | Mar 2, 2011 | Books, Defend & Extend, eBooks, In the Rapids, In the Swamp, Innovation, Leadership, Lock-in

What separates business winners from the losers? A lot of pundits would say you need to be efficient, cost conscious and manage margins. Others would say you need to be really good (excellent) at something – much better than anyone else. Unfortunately, that sounds good but in our fast-paced, highly competitive world today those platitudes don’t really create winners. Success has much more to do with the ability to shift. And to create shifts.

Think about Amazon.com. This company was started as an on-line retail channel for books most stores would not stock on their shelves. But Amazon used the shift to internet acceptance as a way to grow into selling all books, and eventually came to dominate book sales. Not only have most of the small book stores disappeared, but huge chains like B. Dalton and more recently Borders, were driven to bankruptcy. Amazon then built on this shift to expand into selling lots more than books, becoming a force for selling all kinds of products. And even opening itself to become a portal for other on-line retalers by routing customers to their sites, and even taking orders for products shipped from other e-tailers.

More recently, Amazon has taken advantage of the shift to digitization by launching its Kindle e-reader. And by making thousands of books available for digital downloading. By acting upon market trends, Amazon has shifted quickly, and has caused shifts in the market where it participates. And this shifting has been worth a lot to Amazon. Over the last 5 years Amazon’s stock has risen from about $30/share to about $180/share – about a 45%/year compounded rate of return!

Chart source: Yahoo Finance

Chart source: Yahoo Finance

In the middle to late 1990s, as Amazon was just starting to appear on radar screens, it appeared like Sears would be the kind of company that could dominate the internet. After all Sears was huge! It was a Dow Jones Industrial Average (DJIA) member that had ample resources to invest in the emerging growth market. Sears had a history of pioneering markets. It had once dominated retail with its catalogs, then became a powerhouse in free standing retail stores, then led the movement to shopping malls as an anchor chain, and even used its history in lending to develop what became Discover card, and had once shown its ability to be a financial services company and even an insurer! Sears had shifted with historical trends, and surely the company would see that it could bring its resources to the shifting retail landscape in order to remain dominant.

Unfortunately, Sears went a different direction, prefering to focus on defending its current business model. As the chain struggled, it was dropped from the DJIA. Eventually a financier, Edward Lampert, used his takeover of bankrupt KMart (by buying up their bonds) to take over Sears! Under his leadership Sears focused hard on being efficient, controlling costs and managing margins. Extensive financial rigor was applied to Sears to improve the profitability of every line item, dropping poor performers and closing low margin stores. While this initially excited investors, Sears was unable to compete effectively against other retailers that were lower cost, or had better merchandise or service, and the value has declined from about $190/share to $80; a loss of about 60% (at its recent worst the stock fell to almost 30 – or a decline of 84% peak to trough!)

Chart Source: Yahoo Finance

Chart Source: Yahoo Finance

Meanwhile the world’s #1 retailer, Wal-Mart, has long excelled at being the very best at supply chain management, and low-price leadership in retailing. Wal-Mart has never varied from its original business model, and in the retail world it is undoubtedly the very best at doing what it does – buy cheap, sell cheap and run a very tight supply chain from purchase to sale. This excited some investors during the “Great Recession” as customers sought out low prices when fearing about their jobs and future.

But this strategy has not been able to produce much growth, as stores have begun saturating just about everywhere but the inner top 30 cities. And it has been completely unsuccessful outside the USA. As a result, despite its behemoth size, the value of Wal-Mart has really gone nowhere the last 5 years. While there has been price gyration (from $42 low to $62 high) for long-term investors the stock has really gone nowhere – mired mostly around $50. Chart Source: Yahoo Finance

Chart Source: Yahoo Finance

Investors in Amazon have clearly fared much better than Sears or Wal-Mart

Chart Source: Yahoo Finance

Chart Source: Yahoo Finance

Too often business leaders spend too much time thinking about what they do. They think about costs, margins, the “business model” and execution. But success really has less to do with those things than understanding trends, and capitlizing on those trends by shifting. You don’t have to be the lowest cost, or most efficient or even the most passionate. What works a lot better is to go where the trends are favorable, and give customers solutions that align with the trends. And if you do this early, before anyone else, you’ll have a lot of time to figure out how to make money before competitors try to cut your margins!

Recognize that most “execution” is about preserving what happened in the past. Trying to do things better, faster and cheaper. But in a rapidly changing world, new competitors change the basis of competition. Amazon isn’t a better classical bookseller, or retailer. It’s a company that leveraged trends – market shifts – to take advantage of new technologies and new ways of people shopping. First for books and then other things. Later it built on trends toward digitization by augmenting the production of electronic publications, which is destined to change the world of book publishing altogether – and even has impact on the publishing of everything from periodicals to manuals. Amazon is now creating market shifts, which is changing the fortunes of others.

For investors, employees and suppliers you are better off to be with the company that shifts. It has the ability to grow with the trends. And the faster you get out of those companies which are stuck, locked-in to their old business model and practices in an effort to defend historical behaviors, the better off you’ll be. Despite the P/E multiples, or other claims of “value investing,” to succeed you’re a lot better off with the company that’s finding and building on trends than the ones managing costs.

by Adam Hartung | Feb 18, 2011 | Current Affairs, In the Swamp, Innovation, Leadership, Lock-in, Openness, Television, Web/Tech

Business people keep piling onto the innovation and growth bandwagon. PWC just released the results of its 14th annual CEO survey entitled “Growth Reimagined.” Seems like most CEOs are as tired of cost cutting as everyone else, and would really like to start growing again. Therefore, they are looking for innovations to help them improve competitiveness and build new markets. Hooray!

But, haven’t we heard this before? Seems like the output of several such studies – from IBM, IDC and many others – have been saying that business leaders want more innovation and growth for the last several years! Hasn’t this been a consistent mantra all through the last decade? You could get the impression everyone is talking about innovation, and growth, but few seem to be doing much about it!

Rather than search out growth, most businesses are still trying to simply do what their business has done for decades – and marveling at the lack of improved results. David Brooks of the New York Times talks at length in his recent Op Ed piece on the Experience Economy about a controversial book from Tyler Cowen called “The Great Stagnation.” The argument goes that America was blessed with lots of fertile land and abundant water, giving the country a big advantage in the agrarian economy from the 1600s into the 1900s. During the Industrial economy of the 1900s America was again blessed with enormous natural resources (iron ore, minerals, gold, silver, oil, gas and water) as well as navigable rivers, the great lakes and natural low-cost transport routes. A rapidly growing and hard working set of laborers, aided by immigration, provided more fuel for America’s growth as an industrial powerhouse.

But now we’re in the information economy. Those natural resources aren’t the big advantage they once were. Foodstuffs require almost no people for production. And manufacturing is shifting to offshore locations where cheap labor and limited regulations allow for cheaper production. And it’s not clear America would benefit even if it tried maintaining these lower-skilled jobs. Today, value goes to those who know how to create, store, manipulate and use information. And success in this economy has a lot more to do with innovation, and the creation of entirely new products, industries and very different kinds of jobs.

Unfortunately, however, we keep hiring for the last economy. It starts with how Boards of Directors (and management teams) select – incorrectly, it appears – our business leaders. Still thinking like out-of-date industrialists, Scientific American offers us a podcast on how “Creativity Can Lesson a Leader’s Image.” Citing the same study, Knowledge @ Wharton offers us “A Bias Against ‘Quirky’ Why Creative People Can Lose Out on Creative Positions.” While 1,500 CEOs say that creativity is the single most important quality for success today – and studies bear out the greater success of creative, innovative leaders – the study found that when it came to hiring and promoting businesses consistently marked down the creative managers and bypassed them, selecting less creative types!

Our BIAS (Beliefs, Interpretations, Assumptions and Strategies) cause the selection process to pick someone who is seen as less creative. Consider these comments:

- “would you rather have a calm hand on the tiller, or someone who constantly steers the boat?”

- “do you want slow, steady conservatism in control – or irrational exuberance?”

- “do we want consistent execution or big ideas?”

These are all phrases I’ve heard (as you might have as well) for selecting a candidate with a mediocre track record, and very limited creativity, over a candidate with much better results and a flair for creativity to get things done regardless of what the market throws at her. All imply that what’s important to leadership is not making mistakes. Of you just don’t screw up the future will take care of itself. And that’s so industrial economy – so “don’t let the plant blow up.”

That approach simply doesn’t work any more. The Christian Science Monitor reported in “Obama’s Innovation Push: Has U.S. Really Fallen Off the Cutting Edge” that America is already in economic trouble due to our lock-in to out-of-date notions about what creates business success. In the last 2 years America has fallen from first to fourth in the World Economic Forum ranking of global competitivenes. And while America still accounts for 40% of global R&D spending, we rank remarkably low (on all studies below 10th place) on things like public education, math and science skills, national literacy and even internet access! While we’ve poured billions into saving banks, and rebuilding roads (ostensibly hiring asphalt layers) we still have no national internet system, nor a free backbone for access by all budding entrepreneurs!

Ask the question, “If Steve Jobs (or his clone) showed up at our company asking for a job – would we give him one?” Don’t forget, the Apple Board fired Steve Jobs some 20 years ago to give his role to a less creative, but more “professional,” John Scully. Mr. Scully was subsequently fired by the Board for creatively investing too heavily in the innovative Newton – the first PDA – to be replaced by a leadership team willing to jettison this new product market and refocus all attention on the Macintosh. Both CEO change decisions turned out to be horrible for Apple, and it was only after Mr. Jobs returned to the company after nearly 20 years in other businesses that its fortunes reblossomed when the company replaced outdated industrial management philosophies with innovation. But, oh-so-close the company came to complete failure before re-igniting the innovation jets.

Examples of outdated management, with horrific results, abound. Brenda Barnes destroyed shareholder value for 6 years at Sara Lee chasing a centrallized focus and cost reductions – leaving the company with no future other than break-up and acquisition. GE’s fortunes have dropped dramatically as Mr. Immelt turned away from the rabid efforts at innovation and growth under Welch and toward more cautious investments and reliance on a set of core markets – including financial services. After once dominating the mobile phone industry the best Motorola’s leadership has been able to do lately is split the company in two, hoping as a divided business leadership can do better than it did as a single entity. Even a big winner like Home Depot has struggled to innovate and grow as it remained dedicated to its traditional business. Once a darling of industry, the supply chain focused Dell has lost its growth and value as a raft of new MBA leaders – mostly recruited from consultancy Bain & Company – have kept applying traditional industrial management with its cost curves and economy-of-scale illogic to a market racked by the introduction of new products such as smartphones and tablets.

Meanwhile, leaders that foster and implement innovation have shown how to be successful this last decade. Jeff Bezos has transformed retailing and publishing simultaneously by introducing a raft of innovations, including the Kindle. Google’s value soared as its founders and new CEO redefined the way people obtain news – and the ads supporting what people read. The entire “social media” marketplace is now taking viewers, and ad dollars, from traditional media bringing the limelight to CEOs at Facebook, Twitter and Linked-in. While newspaper companies like Tribune Corp., NYT, Dow Jones and Washington Post have faltered, pop publisher Arianna Huffington created $315M of value by hiring a group of bloggers to populate the on-line news tabloid Huffington Post. And Apple is close to becoming the world’s most valuable publicly traded company on the backs of new product innovations.

But, asking again, would your company hire the leaders of these companies? Would it hire the Vice-President’s, Directors and Managers? Or would you consider them too avant-garde? Even President Obama washed out his commitment to jobs growth when he selected Mr. Immelt to head his committee – demonstrating a complete lack of understanding what it takes to grow – to innovate – in today’s intensely competitive information economy. Where he should have begged, on hands and knees, for Eric Schmidt of Google to show us the way to information nirvana he picked, well, an old-line industrialist.

Until we start promoting innovators we won’t have any innovation. We must understand that America’s successful history doesn’t guarantee it’s successful future. Competing on bits, rather than brawn or natural resources, requires creativity to recognize opportunities, develop them and implement new solutions rapidly. It requires adaptability to deal with new technologies, new business models and new competitors. It requires an understanding of innovation and how to learn while doing. Amerca has these leaders. We just need to give them the positions and chance to succeed!

by Adam Hartung | Feb 9, 2011 | Current Affairs, Defend & Extend, In the Swamp, In the Whirlpool, Leadership, Lock-in, Weblogs

Summary:

- Start-ups that flourish give themselves permission to do whatever is necessary to succeed

- Most acquisitions kill that kind of permssion, forcing the acquired company to adopt the acquirers legacy

- AOL’s legacy business has been dying for several years

- AOL’s history of acquisitions has been horrible, because it doesn’t learn from the acquisitions.

- AOL’s acquisition, and announced integration, of Huffington Post will likely do nothing to turn around AOL, and probably leave HuffPo about as well off as AOL’s acquisition of Bebo

After the Super Bowl Sunday Night AOL announced it’s acquisition of The Huffington Post for $350M. Given that you can’t give away a newspaper company these days, the acquisition shows there is still value in “news” if you understand the right way to deliver it. HuffPo’s team of bloggers has shown that it’s possible to build a profitable news organization today – if you do it right. Something the folks at Tribune Corporation still don’t understand.

BusinessInsider.com headlined “AOL’s Huffington Post Acquisition Makes Sense for Both Sides.” For Arianna Huffington and her investors the big cash payout shows a clear win. They are receiving a pretty penny for their start-up. Beyond them, it’s less clear. AOL’s been losing subscribers, and site vistors for years. They’ve made a number of acquisitions to spark up interest including blogs Engadget, Joystiq, ad network Tacoda and social networking site Bebo. None of those have flourished – in fact the opposite has happened. AOL investors lost almost all the $850M spent on Bebo as Facebook crushed it. So far, the AOL track record has been horrible!

AOL clearly hopes HuffPo will bring it new visitors – but whether that works, and whether HuffPo continues growing, is now an open question. MediaPost.com reports “AOL Starts Mapping Plans for Huffington Post.” Unfortunately, it sounds much more as if AOL is trying to integrate HuffPo into its traditional organization – which will most likely do for HuffPo what integrating at News Corp did for MySpace – namely, layering it with “professional management,” additional systems, more overhead and rules for operating. Or, in other words, bury it in company legacy that strangles its abilitiy to innovate and shift with rapidly emerging market needs. The company that’s actually growing, winning in the marketplace, isn’t AOL. It’s HuffPo. If there’s any “integrating” needed it should be figuring out how to push AOL into HuffPo – not vice-versa.

As the New York Times headlined, this acquisition is “AOL’s Bet on Another Makeover.” And that’s what’s wrong. The acquisitions AOL made were pre-purchase successful because they were White Space endeavors that had close connection to the market. The founders gave their organization permission to do whatever it took to be successful, without artificial constraints based upon legacy. Their acquisitions have not used by AOL to create White Space with better market receptors – to teach AOL where growth lies. Rather, AOL has hoped they can use the acquisition to defend and extend their old success formula. AOL has hoped the acquisitions would allow them to slow the market shift, and preserve legacy operations.

As we’ve seen, that simply does not work. Markets shift for good reason, and the only way a business can thrive is to shift with them. At AOL the smart move would be to let Arianna run the show! A few months ago AOL purchased TechCrunch and ever since Michael Arrington, the founder, has been villifying AOL management for its bureaucracy and inability to adapt. What Mr. Armstrong, the relatively new CEO at AOL misses is that AOL’s business is dead. AOL needs to find an entirely new way of operating – and that’s what these acquisitions bring. AOL needs to get out of the way, let the acquisitions flourish, and learn something from them. AOL management needs to accept that the old AOL business model is rubbish, and what it must do is allow the acquisitions to operate in White Space, then learn from them! But that’s not been the history of AOL’s purchases, and doesn’t look like the case this time.

Mr. Armstrong could learn a lot from Sir Richard Branson. Virgin has made many acquisitions, and developed several new companies. He doesn’t try to integrate them, or drive them toward any particular business model From Virgin Airways to Virgin Money to Virgin Health Bank to Virgin Games (and all the other businesses) the requirement is that the business be tightly linked to market needs, operate in new ways and find out how to grow profitably. Virgin moves toward the new markets and businesses, it doesn’t expect the businesses to conform to the Virgin model.

I’d like to think AOL could learn from HuffPo and dramatically change. But from the announcements this week, it doesn’t look likely. AOL still looks like a management team desperately trying to save its old business, but without a clue how to do so. Too bad for AOL. Could be even worse for those who read HuffPo.

by Adam Hartung | Feb 3, 2011 | Defend & Extend, eBooks, In the Rapids, In the Swamp, Innovation, Leadership, Lock-in, Openness

Summary:

- Company size is irrelevant to job creation

- New jobs are created by starting new businesses that create new demand

- Most leaders behave defensively, trying to preserve the old business

- But success comes from acting like a start-up and creating new opportunities

- Companies need to do more future-based planning that can change the competitive landscape and generate more growth, jobs and higher rates of return

A trio of economists just published "Who Creates Jobs? Small vs. Large vs. Young" at the National Bureau of Economic Research. For years businesspeople have said that the majority of jobs were created by small companies, therefore we should provide loans and other incentives for small business. At the same time, we all know that large companies employee millions of people, and therefore they have received benefits to keep their companies going even in tough times – like the recent bailouts of GM and Chrysler. But what these researchers discovered was that size was immaterial to job creation – and this ages-old debate is really irrelevant!

Digging deeper into the data, they discovered as reported in the New York Times, "To Create Jobs, Nurture Start-Ups." Regardless of size, most businesses over time get stuck defending their original success formula. What helped them initially grow becomes locked-in by behavioral norms, structural decision-making processes and a business model cost structure that may be tweaked, but rarely changed. Best practices serve to focus management on defending that business, even as market shifts lower the industry growth rate and profits. It doesn't take long before defensive tactics dominate, and as the leaders attempt to preserve historical practices there are no new jobs created. Usually quite the opposite happens as cost cutting dominates, leading to outsourcing and lay-offs reducing the workforce.

Look no further than most members of the Dow Jones Industrial Average to witness the lack of jobs created by older companies desperately trying to defend their historical business model. But what we've failed to realize is how the same management practices dominate small business as well! Most plumbing suppliers, window installers, insurance agencies, restaurants, car dealers, nurseries, tool rental shops, hair cutters and pet sitters spend all their time just trying to keep the business going. They look no further than what they did yesterday when making business decisions. Few think about growth, preferring instead to just keep the business the same – maybe by the owner/operator's father 3 decades ago! They don't create any new jobs, and are probably struggling to maintain existing employment as computers and other business aids reduce the need for labor – while competition keeps whacking away at historical margins.

So if you want to create jobs, throwing incentives at General Electric, General Motors or General Dynamics is not likely to get you very far. And asking the leaders of those companies what it takes to get them to create jobs is a wasted conversation. They don't know, and haven't really thought about the question. Leaders of almost all big organizations are just trying to make next quarter's profit projection any way they can – and that doesn't involve new hiring. After a lifetime of cutting costs and preservation behavior, how is Jeffrey Immelt of GE supposed to know anything about creating new businesses which leads to job creation?

Nor is offering loans or grants to the millions of existing small businesses who are just trying to keep the joint running going to make any difference. Their psychology is not about offering new products or services, and banks sure don't want to take the risk of investing in new experimental behaviors. They have little, if any, interest in figuring out how to grow when most of their attention is trying to preserve the storefront in the face of new competitors on-line, or from India, China or Vietnam!

To create jobs you have to focus on growth – not defense. And that takes an entirely different way of thinking. Instead of thinking about the past you have to be obsessive about the future, and how you can do things differently! Most of the time, business leaders don't think this way until their backs are up against the wall, looking at potential failure! For example, how Mr. Gerstner turned around IBM when he moved the company away from mainframe obsession and pointed the company toward services. Or when Steve Jobs redirected Apple away from its Mac obsession and pushed the company into new markets for music/entertainment and smartphones. Unfortunately, these stories are so rare that we tend to use them for a decade (or even 2 decades)!

For years Cisco said it would obsolete its own products, and by implementing that direction Cisco has grown year after year in the tech world, where flame-outs abound (just look at what happened to Sun Microsystems, Silicon Graphics, AOL and rapidly Yahoo!) Look at how Netflix has pushed Blockbuster aside by expanding its business from snail-mail to downloads. Or how Amazon.com has found explosive growth by changing the way we read books, now selling more Kindle products than printed. Rather than thinking about how each could do more of what they always did, fearing cannibalization of the "core business," they are aiding destruction of their historical business by implementing the newest technology and solution before some start-up beats them to the punch!

As you enter 2011 and prepare for 2012, is your planning based upon doing more of what your business has always done? A start up has no last year, so its planning is based entirely on views of the future. Are you fixated on improving your operations? A start up has no operations, so it is fixated on competitors to figure out how it can meet market needs better, and use "fringe" solutions in new ways that competitors have not yet adopted. Are you hoping that market shifts slow, or stop, so revenue, market share and profit slides abate? A start up is looking for ways to disrupt the marketplace to it can grab high growth from existing solutions while generating new demand by meeting unmet needs. Are you trying to preserve resources in order to defend your business from competitors? A start up is looking for places to experiment with new solutions and figure out how to change the competitive landscape while growing revenues and profits.

If you want to thrive you have to grow. To grow, you have to think young! Be willing to plan for the future, like Apple did when it moved into new markets for music downloads. Be willing to find competitive holes and fill them with new technology, like Netflix. Don't fear market changes – create them like Cisco does with new solutions that obsolete previous generations. And keep testing new ways to expand the market, even as you see intense competition in historical markets being attacked by new competitors. That is the only way to create value, and generate new jobs!

by Adam Hartung | Jan 27, 2011 | Current Affairs, Innovation, Leadership, Lock-in, Science, Web/Tech

Summary:

- The President has called for more innovation in America

- But American business management doesn’t know how to be innovative

- Business leaders focus on efficiency, not innovation

- America has no inherent advantage in innovation

- To increase innovation we need a change in incentives, to favor innovation over efficiency and traditional brick-and-mortar investments

- We need to highlight leaders that have demonstrated the ability to create jobs in the information economy, not the “old guard” just because they run big, but floundering, companies

It was good to hear the U.S. President call for more innovation in his State of the Union address this week. And it sounded like he wants most of that to come from business, rather than government. But I’m reminded the President is a lawyer and politician. As a businessman, well, let’s say he’s a bit naive. Most businesses don’t have a clue how to be innovative, as Forbes pointed out in November, 2009 in “Why the Pursuit of Innovation Usually Fails.”

Businesses by and large are not designed to be innovative. Modern management theory, going back to the days of Frederick Taylor, has been dominated by efficiency. For the last decade businesses have reacted to global competitive forces by seeking additional efficiency. Thus the offshoring movement for information technology and manufacturing eliminated millions of American jobs driving unemployment to double digits, and undermines new job creation keeping unemployment stubbornly high.

It is not surprising business leaders avoid innovation, when the august Wall Street Journal headlines on January 20 “In Race to Market, It Pays to Be Latecomer.” Citing a number of innovator failures, including automobiles, browsers and small computers, the journal concludes that it is smarter business to not innovate. Rather leaders should wait, let someone else innovate and then hope they can take the idea and make something of it down the road. Not a ringing pledge for how good management supports the innovation agenda!

The professors cited in the Journal article take a fairly common point of view. Because innovators fail, don’t be one. Lower your risk, come in later, hope you can catch the market at a future time. It’s easy to see in hindsight how innovators fail, so why take the risk? Keep your eyes on being efficient – and innovation is anything but efficient! Because most businesspeople don’t understand how to manage innovation, don’t try.

As discussed in my last blog, about Sara Lee, executives, managers and investors have come to believe that cost cutting, and striving for more efficiency, is the solution for most business problems. According to the Washington Post, “Immelt To Head New Advisory Board on Job Creation.” The President appointed the GE Chairman to this highly visible position, yet Mr. Immelt has spent most of the last decade shrinking GE, and pushing jobs offshore, rather than growing the company – especially domestically. Gone are several GE businesses created in the 1990s – including the recent spin out of NBC to Comcast. It’s ironic that the President would appoint someone who has overseen downsizings and offshoring to this position, instead of someone who has demonstrated the ability to create jobs over the last decade.

As one can easily imagine, efficiency is not the handmaiden of innovation. To the contrary, as we build organizations the desire for efficiency and “professional management” impedes innovation. According to Portfolio.com in “Can Google Be Entrepreneurial” even Google, a leading technology company with such exciting new products as Android and Chrome, has replaced its CEO Eric Schmidt with founder Larry Page in order to more effectively manage innovation. The contention is that the 55 year old professional manager Schmidt created innovation barriers. If a company as young and successful as Google struggles to innovate, one can only imagine the difficulties at traditional, aged American businesses!

While many will trumpet America’s leadership in all business categories, Forbes‘ Fred Allen is correct to challenge our thinking in “The Myth of American Superiority at Innovation.” For decades America’s “Myth of Efficiency” has pushed organizations to streamline, cutting anything that is not totally necessary to do what it historically did better, faster or cheaper. Innovation inside businesses was designed to improve existing processes, usually cutting cost and jobs, not create new markets with high growth that creates jobs and economic growth. Most executives would 10x rather see a plan to cut costs saving “hard dollars” in the supply chain, or sales and marketing, than something involving new product introduction into new markets where they have to deal with “unknowns.” Where our superiority in innovation originates, if at all, is unclear.

Lawyers are not historically known for their creativity. Hours spent studying precedent doesn’t often free the mind to “think outside the box.” Business folks have their own “precedent managers” – internal experts who set themselves up intentionally to block experimentation and innovation in the name of lowering risk, being conservative and carefully managing the core business. To innovate most organizations will be forced to “Fire the Status Quo Police” as I called for last September here in Forbes. But that isn’t easy.

America can be very innovative. Just look at the leadership America exerts in all things “social media” – from Facebook to Groupon! And look at how adroitly Apple has turned around by moving beyond its roots in personal computing to success in music (iPod and iTunes), mobile telephony and data (iPhone) and mobile computing (iPad). Netflix has used a couple of rounds of innovation to unseat old leader Blockbuster! But Apple and Netflix are still the rarities – innovators amongst the hoards of myopic organizations still focused on optimization. Look no further than the problems Microsoft – a tech company – has had balancing its desire to maintain PC domination while ineffectively attempting to market innovation.

What America needs is less bully pulpit, and more action if you really want innovation Mr. President:

- Increase tax credits for R&D

- Increase tax deductions and credits for new product launches by expanding the definition of what constitutes R&D in the tax code

- Implement penalties on offshore outsourcing to discourage the efficiency focus and the chronic push to low-cost global resources

- Lower capital gains taxes to encourage wealth creation through new business creation

- Manage the deficit by implementing VAT (value added taxes) which add cost to supply chain transactions, thus lowering the value of “efficiency” moves

- Make it much easier for foreign graduate students in America to receive their green cards so we can keep them here and quit exporting some of the brightest innovators we develop to foreign countries

- Create more tax incentives for investing in high tech – from nanotech to biotech to infotech – and quit wasting money trying to favor investments in manufacturing. Provide accelerated or double deductions for buying lab equipment, and stretch out deductions for brick-and-mortar spending. Better yet, quit spending so much on road construction and simply give credits to people who buy lab equipment and other innovation tools.

- Propose regulations on executive compensation so leaders aren’t encouraged to undertake short-term cost cutting measures merely to prop up short-term profits at the expense of long-term viability

- Quit putting “old guard” leaders who have seen their companies do poorly in highly placed positions. Reach out to those who really understand the information economy to fill such positions – like Eric Schmidt from Google, or John Chambers at Cisco Systems.

- Reform the FDA so new bio-engineered solutions do not follow regulations based on 50 year old pharma technology and instead streamline go-to-market processes for new innovations

- Quit spending so much money on border fences, DEA crack-downs on marijuana users and giant defense projects. Put the money into grants for universities and entrepreneurs to create and implement innovation.

Mr. President,, don’t expect traditional business to do what it has not done for over a decade. If you want innovation, take actions that will create innovation. American business can do it, but it will take more than asking for it. it will take a change in incentives and management.

by Adam Hartung | Jan 19, 2011 | Current Affairs, Disruptions, Games, In the Rapids, In the Swamp, Innovation, Leadership, Lock-in, Music, Openness, Web/Tech

The Wall Street Journal headlined Monday, “Apple Chief to Take Leave.” Forbes.com Leadership editor Fred Allen quickly asked what most folks were asking “Where does Steve Jobs Leave Apple Now?” as he led multiple bloggers covering the speculation about how long Mr. Jobs would be absent from Apple, or if he would ever return, in “What They Are Saying About Steve Jobs.” The stock took a dip as people all over raised the question covered by Steve Caulfield in Forbes’ “Timing of Steve Jobs Return Worries Investors, Fans.”

If you want to make money investing, this is what’s called a “buying opportunity.” As Forbes’ Eric Savitz reported “Apple is More Than Just Steve Jobs.” Just look at the most recent results, as reported in Ad Age “Apple Posts ‘Record Quarter’ on Strong iPhone, Mac, iPad Sales:”

- Quarterly revenue is up 70% vs. last year to $26.7B (Apple is a $100B company!)

- Quarterly earnings rose 77% vs last year to $6B

- 15 million iPads were sold in 2010, with 7.3 million sold in the last quarter

- Apple has $50B cash on hand to do new product development, acquisitions or pay dividends

ZDNet demonstrated Apple’s market resiliency headlining “Apple’s iPad Represents 90% of All Tablets Shipped.” While it is true that Droid tablets are now out, and we know some buyers will move to non-Apple tablets, ZDNet predicts the market will grow more than 250% in 2011 to over 44 million units, giving Apple a lot of room to grow even with competitors bringing out new products.

Apple is a tremendously successful company because it has a very strong sense of where technology is headed and how to apply it to meet user needs. Apple is creating market shifts, while many other companies are reacting. By deeply understanding its competitors, being willing to disrupt historical markets and using White Space to expand applications Apple will keep growing for quite a while. With, or without Steve Jobs.

On the other hand, there’s the stuck-in-the-past management team at Microsoft. Tied to all those aging, outdated products and distribution plans built on PC technology that is nearing end of life. But in the midst of the management malaise out of Seattle Kinect suddenly showed up as a bright spot! SFGate reported that “Microsoft’s Xbox Kinect beond hackers, hobbyists.” Seems engineers around the globe had started using Kinect in creative ways that were way beyond anything envisioned by Microsoft! Put into a White Space team, it was possible to start imagining Kinect could be powerful enough to resurrect innovation, and success, at the aging monopolist!

But, unfortunately, Microsoft seems far too stuck in its old ways to take advantage of this disruptive opportunity. Joel West at SeekingAlpha.com tells us “Microsoft vs. Open Kinect: How to Miss a Significant Opportunity.” Microsoft is dedicated to its plan for Kinect to help the company make money in games – and has no idea how to create a White Space team to exploit the opportunity as a platform for myriad uses (like Apple did with its app development approach for the iPhone.)

In the end, ZDNet joined my chorus looking to oust Ballmer (possibly a case study in how to be the most misguided CEO in corporate America) by asking “Ballmer’s 11th Year as Microsoft’s CEO – Is it Time for Him to Go?” Given Ballmer’s massive shareholding, and thus control of the Board, it’s doubtful he will go anywhere, or change his management approach, or understand how to leverage a breakthrough innovation. So as the Cloud keeps decreasing demand for traditional PCs and servers, Brett Owens at SeekingAlpha concludes in “A Look at Valuations of Google, Apple, Microsoft and Intel” that Microsoft has nowhere to go but down! Given the amazingly uninspiring ad program Microsoft is now launching (as described in MediaPost “Microsoft Intros New Corporate Tagline, Strategy“) we can see management has no idea how to find, or sell, innovation.

We often hear advice to buy shares of a company. Rarely recommendations to sell. But Apple is the best positioned company to maintain growth for several more years, while Microsoft has almost no hope of moving beyond its Lock-in to old products and markets which are declining. Simplest trade of 2011 is to sell Microsoft and buy Apple. Just read the headlines, and don’t get suckered into thinking Apple is nothing more than Steve Jobs. He’s great, but Apple can remain great in his absence.

by Adam Hartung | Jan 5, 2011 | Defend & Extend, In the Rapids, In the Swamp, Leadership, Lock-in, Openness

Summary:

- Business planning systems are designed to defend historical markets

- Rapidly shifting markets makes it impossible to grow by defense alone

- Growth requires understanding what customers want, and creating new solutions that most likely aren’t part of the current business

- You can’t grow if you don’t plan to grow, but to plan for growth you have to shift resources from traditional planning into scenario planning

- High growth companies like Virgin, Apple and Google plan to fulfill future needs, not defend & extend past practicess

Imagine you see a pile of hay. Above it is a sign flashing “find the needle.” That achievement would be hard. Change the sign to “find the hay” and suddenly achieving the goal becomes much easier. So, as the comedian Bill Engvall might ask, what’s your sign? Unfortunately, most businesses plan for 2011, and beyond, using the first sign. Very few do planning using the latter. Most businesses won’t grow, because they simply don’t know how to plan for growth!!

Most businesses start planning with “I’m in the horseshoe (for example) business. My market isn’t growing, and there is more capacity than demand. How can I grow?” For these people, their sign is “find the needle.”

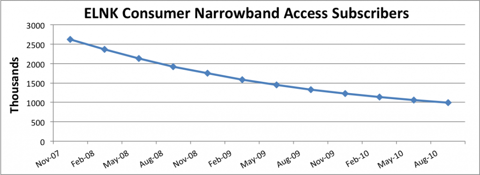

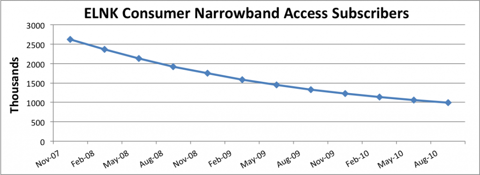

Take for example Earthlink. The company’s growth looked like a rocket ship in the early internet days as people by the millions signed up for dial-up service. But along came broadband, and the market for dial up died – never to return. Earthlink has no hope of growing as long as it thinks of itself as a dial-up company

Chart at SeekingAlpha.com author Ananthan Thangavel

Despite the absolute certainty that the market is shrinking, at this point almost all business planners will develop plans to defend this dying business as long as possible. Despite the impossibility of achieving good returns, there will be a plethora of actions to try and keep serving all the way to the very last customer. Just look at how AOL has invested millions trying to defend its dying internet access busiuness. Reality is, the company that walks away – gives up- is the smartest. There’s no way to make money as oversupply keeps too many companies spending too much to service too few customers.

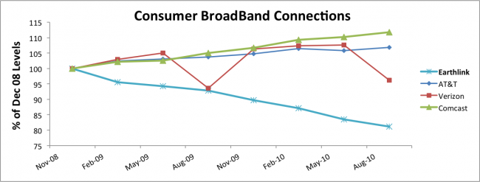

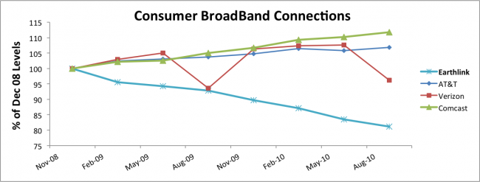

The next step for most planners is to attempt extending the business into something adjacent. For example, Earthlink would say “let’s invest in Broadband. We’ll hang onto customers as they want to switch, and maybe pick up a few customers.” But this completely ignores the fact that competitors already have a substantial lead. Competitors have learned the technology, and the marketplace. They are growing, and have no intention of giving up any room to a new competitor.

Chart at SeekingAlpha.com author Ananthan Thangavel

Planning systems are designed to keep the business doing more of what it always did, or possibly extending the business into adjacent markets after returns have faltered. Planning systems have no way of recognizing when a business, or market, has become obsolete. And practically never do they recognize the power of exsting competitors when looking at adjacent markets. As a result, the planning system produces no growth plans, leading 2011 to end with the self-fulfilling prophecy that the plan predicted – little or no growth.

The future for Earthlink is pretty grim. As it is for most companies that plan based upon history, trying to Defend & Extend their historical markets. In the highly dynamic, global marketplaces of 2011 trying to find growth by remaining focused on the past is like looking for the needle in a haystack. Maybe there’s something in there – but it’s not likely – and it’s even a lot less likely you’ll find it – and if you did, the cost of finding it will almost assuredly be greater than the value.

Alternatively, why not use planning resources to find, and develop, growth markets. Instead of looking at what you did (as in the past tense) try to figure out what you should do. Rather than studying past products, customers and markets, why not develop scenarios about the future that give you insight to what people will want to buy in 2011, 2012 and beyond? Rather than looking for needles, why not go explore the hay?

Newspapers kept focusing on declining subscriptions, when they should have been studying Craig’s List, eBay, Vehix.com and other on-line environments to learn the future of advertising. Had Tribune company poured its resources into its early internet investments, such as cars.com and careerbuilder.com, rather than trying to defend its traditional newspapers, it may well have avoided bankruptcy. But rather than looking to the future when doing its planning, and understanding that on-line news was going to explode, Tribune kept looking for the needle (cost cuts, layoffs, outsourcing, etc.) to save the old success formula.

Direct mail companies and Sunday insert printers have continued looking for ways to defend & extend their coupon printing business – despite the fact that nobody reads junk mail or uses printed coupons. Several have failed, and larger companies have merged trying to find “synergies” and more cost cuts. Simultaneously a 28 year old music major from Nothwestern university starts figuring out how to help companies acquire new customers by offering email coupons, and within 2 years his company, Groupon, is valued at around $6B. There’s nothing that stopped coupon powerhouse Advo from being Groupon, except that its planning system was devoted to finding the needle, while Groupon’s leaders decided to go play in the hay.

Hallmark and American Greetings want us to buy birthday and holiday cards for various occasions – in a world where almost nobody mails cards any longer. As they keep trying to defend their old business, and extend it into a few new opportunities for on-line cards, Twitter captures the wave of instant communications by offering everyone 140 character ways to communicate. Because Twitter is out where the growth is, the company raises $200M giving it a value of $3.7B.

Nothing stops any business from being anything it wants to be. But as most enter 2011 they will use their planning resources, including all those management meetings and hours of forms completion, to do nothing more than re-examine the historical business. Most will devolve into trying to figure out how to do more with less. As future forecasts look grim, or perhaps cautiously optimistic (based on a lot of things going right – like a mysterious pick-up in demand) there will be much nashing of teeth – and meetings looking for a needle that can be offered to employees and investors as a hope for rising future value.

Smart companies get out of that rut. They focus their planning on the future. What do customers want, and how can we give them what they want? How can we create whole new markets. Apple was a PC company, but by exploring mobility it became a provider of MP3 consumer electronics, downloadable music, a mobile device and app supplier and the early winner in cloud accessing tablets. Google has moved from a search engine to a powerhouse ad placement company and is pushing the edges of growth in mobile computing as well as several other markets. Virgin started as a distributor of long-playing vinyl record albums, but by exploring what customers really wanted it has become an international airline, cell phone company, international lender and space travel pioneer (to mention just a few of its businesses.)

You can grow in 2011, but to do so you need to shed the old planning system (and its resource wasting processes) and get serious about scenario planning. Focus on the future, not the past.

by Adam Hartung | Dec 6, 2010 | Current Affairs, Defend & Extend, Disruptions, Food and Drink, Leadership, Lock-in

Summary:

- Business leaders like consistency

- Consistency leads to repetition, sameness, and lower rates of return

- Kraft's product lines are consistent, but without growth

- Kraft's value has been stagnant for 10 years

- Disruptive competitors make higher rates of return, and grow

- Disruptive competitors have higher valuations – just look at Groupon

"Needless consistency is the hobgoblin of small minds" – Ralph Waldo Emerson

That was my first thought when I read the MediaPost.com Marketing Daily article "Kraft Mac & Cheese Gets New, Unified Look." Whether this 80-something year old brand has a "unified" look is wholly uninteresting. I don't care if all varieties have the same picture – and if they do it doesn't make me want to eat more powdered cheese and curved noodles.

In fact, I'm not at all interested in anything about this product line. It is kind of amusing, in an historical way, to note that people (largely children) still eat the stuff which fueled my no-cash college years (much like ramen noodles does for today's college kids.) While there's nothing I particularly dislike about the product, as an investor or marketer there's nothing really to like about it either. Pasta products always do better in a recession, as people look for cheaper belly-fillers (especially for the kid,) so that more is being sold the last couple of years doesn't tell me anything I would not have guessed on my own. That the entire category has grown to only $800M revenue across this 8 decade period only shows that it's a relatively small business with no excitement! Once people feel their finances are on firm footing sales will soon taper off.

Kraft's Mac & Cheese is emblematic of management teams that lock-in on defending and extending old businesses – even though the lack of growth leaves them struggling to grow cash flow and create a decent valuation. Introducing multiple varieties of this product has not produced growth that even matched inflation across the years. Primarily, marketing programs have been designed to try keeping existing customers from buying something else. This most recent Kraft program is designed to encourage adults to try a product they gave up eating many years ago. This is, at best, "foxhole" marketing. Spending money largely just to keep the brand from going away, rather than really expecting any growth. Truly, does anyone think this kind of spending will generate a billion dollar product line in 2011 – or even 2012?

What's wrong with defensive marketing, creating consistency across the product line – across the brand – and across history? It doesn't produce high rates of return. There are lots of pasta products, even lots of brands of mac & cheese. While Kraft's product surely produces a positive margin, multiple competitors and lack of growth means increased spending over time merely leaves the brand producing a marginal rate of return. Incremental ad spending doesn't generate real growth, just a hope of not losing ground. We know people aren't flocking to the store to buy more of the product. New customers aren't being identified, and short-term growth in revenues does not yield the kinds of returns that would enhance valuation and make the world a better place for investors – or employees.

While Kraft is trying to create headlines with more spending in a very tired product, across town in Chicago Groupon has created a $500M revenue business in just 2 years! And new reports from the failed acquisition attempt by Google indicate revenues are likely to reach $2B in 2011 (CNNMoney.com, Fortune, "Google's Groupon Groping Reveals the Shifting Power of the Web World.") Where's Kraft in this kind of growth market? After all, coupons for Kraft products have been in mailers and Sunday inserts for 50 years. Why isn't Kraft putting money into a real growth business, which is producing enormous value while cash flow grows in multiples? While Groupon has created somewhere around $6B of value in 2 years, Kraft's value has only gone sideways for the last decade (chart at Marketwatch.com.)

Kraft has not introduced a new product since — well — DiGiorno. And that's been more than a decade. While the company has big revenues – so did General Motors. The longer a company plays defense, regardless of size, trying to extend its outdated products (and business model) the riskier that business becomes. While big revenues appear to offer some kind of security, we all know that's not true. Not only does competition drive down margins in these older businesses, but newer products make it harder and harder for the old products to compete at all. Eventually, the effort to maintain historical consistency simply allows competitors to completely steal the business away with new products, creating a big revenue drop, or producing such low returns that failure is inevitable.

Lots of business people like consistency. They like consistency in how the brand is executed, or how products are aligned. They like consistency in the technology base, or production capabilities. They like consistency in customers, and markets. They like being consistent with company history – doing what "made the company famous." They like the similarity of doing something again, and again, hoping that consistency will produce good returns.

But consistency is the hobgoblin of small minds. And those who are more clever find ways to change the game. Xerox figured out how to let everyone be a one-button printer, and killed the small printing press manufacturers. HP's desktop printers knocked the growth out of Xerox. Google figured out a better way to find information, and place ads, just about killing newspapers (and magazines.) Apple found a better way to use mobile minutes, taking a big bite out of cell phone manufacturers. Amazon found a better way to sell things, killing off bookstores and putting a world of hurt on many retailers. Netflix found a better way of distributing DVDs and digital movies, sending Blockbuster to bankruptcy. Infosys and Tata found a better way of doing IT services, wiping out PWC and nearly EDS. Hulu (and soon Netflix, Google and Apple) has found a better way of delivering television programming, killing the growth in cable TV. Groupon is finding a better way of delivering coupons, creating huge concerns for direct mail companies. Now tablet makers (like Apple) are demonstrating a better way of working remotely, sending shivers of worry down the valuation of Microsoft. These companies, failed or in jeapardy, were very consistent.

Those who create disruptions show again and again that they can generate growth and above average returns, even in a recession. While those who keep trying to defend and extend their old business are letting consistency drive their behavior – leading to intense competition, genericization, and lower rates of return. Maybe Kraft should spend more money looking for the next food we would all like, rather than consistently trying to convince us we want more Mac & Cheese (or Velveeta).

by Adam Hartung | Nov 23, 2010 | Current Affairs, Defend & Extend, In the Swamp, Innovation, Leadership, Lock-in, Web/Tech

Summary:

- Most planning systems rely on extending past performance to predict the future

- But markets are shifting too fast, making such forecasts wildly unreliable

- To compete effectively, companies must anticipate future market shifts

- Planning needs to incorporate a lot more scenario development, and competitor information in order to overcome biases to existing customers and historical products

- Apple and Google have taken over the mobile phone business, while the original leaders have fallen far behind

- Historical mobile phone leaders Nokia, Samsung, Motorola, RIM and Microsoft had the technologies and products to remain leaders, but they lacked scenarios of the future enticing them to develop new markets. Thus they allowed new competitors to overtake them

- Lacking scenarios and deep competitor understanding, companies react to market events – which is slow, costly and ineffective.

“Apple, Android Help Smartphone Sales Double Over Last Year” is the Los Angeles Times headline. Google-supplied Android phones jumped from 3% of the market to 26% versus the same quarter last year. iPhones remained at 17% of the market. Blackberry is now just under 15%, compared to about 21% last year. What’s clear is people are no longer buying traditional mobile phones, as #1 Nokia share fell from 38% to 27%. Like many market changes, the shift has come fast – in only a matter of a few months. And it has been dramatic, as companies not even in the market 5 years ago are now the leaders. Former leaders are struggling to stay in the game as the market shifts.

The lesson Google and Apple are teaching us is that companies must have a good idea of the future, and then send their product development and marketing in that direction. Although traditional cell phone manufacturers, such as Motorola and Samsung, had smartphone technology many years prior to Apple, they were so focused on their traditional markets they failed to look into the future. Busy selling to existing customers an existing technology, they didn’t develop scenarios about 2010 and beyond that would describe how the market could expand – far beyond where traditional phone sales would take it. Both famously said “so what” to the new technology, and used existing customer focus groups of people who had no idea the potential benefit of a smart phone to justify their willingness to remain fixated on the existing business. Lacking a forward planning process based on scenario development, and lacking a good market sensing system that would pick up on the early market shift as novice competitor Apple started to really change the market, these companies are now falling rapidly to the wayside.

Even smartphone pioneer Research in Motion (RIM) was so focused on meeting the needs of its existing “enterprise” customers that it failed to develop scenarios about how to expand the smartphone business into the hands of everyone. RIM missed the value of mobile apps, and the opportunity to build an enormous app database. Now RIM has been surpassed, and is showing no signs of providing effective competition for the market leaders. While the Apple and Android app base continues to explode, based upon 3rd and 4th generation product inducing more developers to sign up, and more customers to buy in, RIM has not effectively built a developer base or app set – causing it to fall further behind quarter by quarter.

Even software giant Microsoft missed the market. Fixated upon putting out an updated operating system for personal computers (Vista then later Windows 7) it let its 45% market share in smart phones circa 2007 disappear. Now approaching 2011 Microsoft has largely missed the market. Again, focused clearly upon its primary goal of defending its existing business in O/S and office automation software, Microsoft did not have a forward focused planning group that was able to warn the company that its new products might well arrive in a market that was stagnating, and on the precipice of a likely decline, because of new technology which could make the PC platform obsolete (a combination of smart mobile devices and cloud computing architecture.) Microsoft’s product development was being driven by its historical products, and market position, rather than an understanding of future markets and how it should develop for them.

We can see this lack of future scenario development and close competitor tracking has confused Microsoft. Desperately trying to recover from a market stall in 2009 when revenues and profits fell, Microsoft has no idea what to do in the rapidly expanding smartphone market today. Its first product, Kin, was dropped only two months after launch, which industry analysts saw as necessary given the product’s lack of advantages. But now Mediapost.com informs us in “Return of the Kin?” Microsoft is considering a re-launch in order to clear out old inventory.

This amidst a launch of the Windows Phone 7 that has gone nowhere. Firstly, there was insufficient advertising to gain any public awareness of the product launch earlier in November (Mediapost “Where’s the Windows Phone 7 Ad Barrage?“) Initial sales have gone nowhere “Windows Phone 7 Lands Without a Sound” [Mediapost], with many stores lacking inventory, very few promoting the product and Microsoft keeping surprisingly mum about initial sales. This has raised the question “Is Windows Phone 7 Dead On Arrival?” [Mediapost] as sales barely achieving 40,000 initial unit sales at launch, compared to daily sales of 200,000 Android phones and 270,000 iphones!

Companies, like Apple and Google, that have clear views of the future, based upon careful analysis of what can be done and tracking market trends, create scenarios that allow them to break out of the pack. Scenario development helps them to understand what the future can be like, and drive their product development toward creating new markets with more customers, more unit sales, higher revenues and improved cash flow. By studying early competitors, especially fringe ones, they create new products which are more highly desired, breaking them out of price competition (remember the Motorola Razr fiasco that nearly bankrupted the company?) and into higher price points and better earnings. Creating and updating future scenarios becomes central to planning – using scenarios to guide investments rather than merely projections based upon past performance.

Companies that base future planning on historical trends find themselves rapidly in trouble. Market shifts leave them struggling to compete, as customers quickly move to new solutions (old fashioned notions of “exit costs” are now dead). Instead of heading for the money, they are confused – lost in a sea of options but with no clear direction. Nokia, Samsung, RIM and Microsoft all have lots of resources, and great historical experience in the market. But lacking good scenario planning they are lost. Unable to chart a course forward, reacting to market leaders, and hoping customers will seek them out because they were once great.

Far too many companies do their planning off of past projections. One could say “planning by looking in the rear view mirror.” In a dynamic, global world this is not sufficient. When monster companies like these can be upset so fast, by someone they didn’t even think of as a traditional competitor (someone likely not even on the radar screen recently) how vulnerable is your company? Do you plan on 2015 looking like 2005? If not, how can future projections based on past actuals be valuable? it’s time more companies change their approach to planning to put an emphasis on scenario development with more competitive (rather than existing customer) input. That’s the only way to get rich, instead of getting lost.

by Adam Hartung | Nov 11, 2010 | Current Affairs, In the Whirlpool, Lock-in, Web/Tech

Summary:

- Business value requires meeting future needs

- Businesses have to transition to remain valuable

- U.S. News is smart to drop its print edition and go all digital

- Print newspapers and magazines are obsolete

- Old brands have no value

- Businesses have to develop and fulfull future scenarios, and forget about what made them successful in the past. Value comes from delivering in the future, not the past

Do you know any antique collectors? They scour for old things, considered rare because they are the remaining few out of a bygone era. For some people, these old things represent something treasured about the past – perhaps a turn in technology or some aspect of society. But there is no useful purpose to an antique. You can’t use the chair as a chair, for fear you’ll break it. Mostly, old things are just that – old things. Once useful, but no longer. They are remembrances. For most of us, seeing them in a museum once in a while is plenty often enough. We don’t need a houseful of them – and would happily trade the old Schwynn bicycle from high-school days for an iPad.

So what’s the value of the Chicago Tribune, or the Los Angeles Times? With the internet, tablets and other ereaders, mobile smartphones and laptops – why would anyone expect these newspapers to ever grow in value? Yes, they were once valuable – when readers could be “current” with daily news, largely from a single source. But now these newsapapers are practically obsolete. Expensive to create, expensive to print, expensive to distribute. And largely outdated by faster news outlets providing real time updates via the web, or television for those still not on-line. They are as valuable as a stack of 45 or 33 RPM records, or 8-track tapes (and if you don’t know what those are, ask your parents.)

As much as some of us, especially over 40, like the idea of newspapers and magazines – they really are obsolete. When automobiles were first created many people who grew up riding horses said the auto would never be able to displace the horse. Autos required petrol, where horses could feed anywhere. Autos required roads, where horses could walk (or tow a cart) practically anywhere. Mechanical autos broke down, where horses were reliable day after day. And autos were expensive to purchase and use. To those raised with horses, the auto seemed interesting but unnecessary – and with drawbacks. Yet, auto technology was clearly superior – offering better speed and longer distances, and the infrastructure was rapidly coming into place. The horse was obsolete. And this change made livery stables, saddle makers and blacksmiths obsolete as well. It took only a few years.

Today, printed documents like newspapers and magazines are obsolete. They have a purpose for travelers and commuters – but not for long. Tablets are making even the travelers use of paper unnecessary. With each of the 12million iPads sold (and who knows how many Kindles and other readers) another newspaper was unnecessary on the hotel room door. So I was extremely heartened to read that “U.S. News [and World Report] is ending its print edition” on MediaLifeMagazine.com.

Some might nostalgically say this decision is the end of something grand. Contrarily, this is the smart move by leadership to help the employees, customers and suppliers all continue pushing forward. As a print product U.S. News reached its end of life. As a digital product, U.S. News has a chance of becoming an important part of future journalism. While some are concerned the future digital product is not about the same old news it used to report, the facts are that we don’t need another magazine just for news. But the rankings and industry reports U.S. News has long created have the most value to readers (and therefore advertisers) and so the editors will be focusing on those areas. Smart move. Instead of doing what they always did, the editors are going to produce what the market wants. U.S. News has a fighting chance of survival, and thriving, if it focuses on the marketplace and meeting needs. It can expand with new products as it continues to learn what digital readers want, and advertisers will support. As an obsolete weekly magazine it didn’t have any value, but as a digital product it has a chance of being worth something.

I was shocked to read in Advertising Age “Meister Brau, Braniff and 148 other Trademarks to be Sold at Auction.” Who would want to buy a trademark of an old brand? It no longer has any value. Brands and trademarks have value when they help you aspire toward something in the future. A dead brand would have the cost not only of developing value — like Google in search or Android in phones has done; or the entire “i” line from Apple, or even Whole Foods or Prada. But to resurrect Meister Brau, Lucky Whip or Handi-Wrap would mean first overcoming the old (worn out and failed) position, and then trying to put something new on top. It’s even more expensive than starting from scratch with a brand that has no meaning – because you have to overcome the old meaning that clearly did not succeed.

Value is in the future. Yes, rare artifacts are sometimes cherished, and their tangible ownership (think of historical pottery, or rare furniture) can cannote something of a bygone era that provides an emotional trigger. These occasionally (like real items from the Titanic) can be collected and valuable. But a brand? Do you want a plastic Lucky Whip tub to help you recall bad 1960s deserts? Or a cardboard Handi-Wrap box to remind you of grandma’s leftovers? In business value is not about the past, it’s entirely about the future.

For businesses to create value they have to generate and fulfull scenarios about the future. Nobody cares if you were good last year (and certainly not if you were good last decade – anybody want an Oldsmobile?) They care about what you’re going to give them in the future. And all business planning needs to be looking forward, not backward. And that’s why it’s a good thing that U.S. News is going all digital. Maybe if the turnaround pros at Tribune Corporation understood this they could figure out how to grow revenues at Tribune or the Times again, and maybe get the company out of bankruptcy. Because trying to save any business by looking at what it used to do is never going to work.

Chart Source: Yahoo Finance