by Adam Hartung | Mar 22, 2011 | Current Affairs, Defend & Extend, In the Swamp, Leadership, Lock-in, Web/Tech

Summary:

- The Japanese nuclear crisis is the result of historical industry decisions to build very large facilities and transmit power to distant locations – a strategy at risk of “force majure” activities

- U.S. electric utilities are locked-in to identical approaches to generation and transmission, which puts them at equal risk AND limits their willingness to innovate or implement new solutions

- Historical industry approaches to planning are all based on extending the past, even though new technologies and approaches offer potentially better, and less risky, solutions. Utilities are merely one example

- Google is expert in a far better planning approach, using scenario planning for identifying and taking to market innovations and new solutions

- All companies, would benefit from planning like Google, rather than using traditional approaches – and several are bullet listed below

- The electric utility industry really needs to adopt a Google approach, or everyone remains at risk

Everybody is now aware of the great radiation risk Japan faces from its damaged nuclear reactor powered electricity generators. This has repercussions on U.S. electric utilities, as Americans have renewed concerns about the safety of similar General Electric supplied reactors.

For example, Crain’s Chicago Business reports “Exelon Faces Regulatory Fallout After Japanese Nuclear Disaster.” The country’s largest nuclear plant operator is facing stepped-up reviews, likely delays in expansion, and discussions about long-term viability of facilities that are 30 years into an anticipated 40 year life. All of this threatens the viability of meeting affordable electricity needs for millions of midwestern Americans in as little as 5 years. And it puts a lot of risk on the viability of Exelon as a going concern should the regulators require extensive re-investment to keep the plants open, or build replacements – most likely without a rate increase. All utilities dependent upon nuclear – and coal as well – for generation are now facing significant challenges.

This points out a horrible weakness in planning by most participants in America’s electric utility industry. Almost all planning boils down to “we need to increase capacity to meet needs. The cost of new plants, plant expansions and transmission lines from massive facilities to customers is $X, therefore, we need to lobby regulators, rate-setters and the populace to allow us a rate increase of $.xxx per kilowatt hour to cover the cost.” Planning entirely driven by the past. Projecting the future based upon historical demand, sources of generation, cost of fuel, etc. utilities mostly keep planning to do what they have always done, and asking regulators and customers to fund doing what they always did. If you want anything new (like a renewables effort) then the companies want the cost for that added on top of the “business as usual” price increase.

But customers are increasingly tired of hearing about rising rates, while they are constantly trying to conserve. The old “compact” in which the price regulators guaranteed utilities a rate of return is under considerable stress. Increasingly, people are asking why they need to pay more, why these plants are so expensive, why the industry keeps doubling down on old technologies and fuel sources. Customers, and regulators, are asking for innovation, but the industry offers almost nothing, because it’s planning is all about extending the past, and defending its historical approach and investments.

Today we know that the industry’s future will not be like the past. Increasingly customers (with government support in many cases) are demanding changes in the sourcing of electricity. Requesting decommissioning of polluting generators (coal in particular), shut-downs of perceived risky, and now aging, nuclear facilities, more supply from renewable, or sustainable, sources — and without higher prices.

There are a lot of new technologies available. And some customers recommend a dramatic change in approach, from huge, centralized generation facilities to many smaller, safer, renewable generation facilities that are decentralized and closer to end-users. But most industry veterans are unable to even consider these options, because they see no way to get to the future from today. They are locked-in to defending and extending what the industry has always done, even if it means extending known risks, environmental concerns and creating higher prices for fuel and maintenance.

And that’s where Larry Page and Google have a lot to offer the utility industry planners. Instead of planning from the past forward, Google plans from the future back to the present. By helping employees develop future scenarios the leaders at Google identify far better solutions than the linear, historical planning approaches. Once a better future is identified, then the organization is unleashed to create that future by planning backward from the scenario, figuring out how to implement it.

Wired magazine, in “Larry Page Wants to Return Google to its Start-up Roots” gives great insights to how Google has created a $30B business in a decade – using scenario planning at the heart of its approach to business.

- Don’t fear being audacious when setting goals. Even if you don’t reach the ultimate goal, your improvement could be game-changing for the industry and greatly benefit the early adopter

- Instead of saying trying to help somebody with an immediate question, ask what would have the maximum impact in 10 years. Don’t just accept more of the same, look for the best answer

- Leaders should not fear being viewed as having stepped into the future, and returned to tell everyone what they’ve seen

- Don’t assume that the way things are done is the best way. Instead, ask “why is it done like that? Is there possibly a better way?”

- Is the obstacle to future success something that is impossible – say because of the laws of physics – or is the obstacle a need for resources – in engineering, scale design or implementation? Don’t confuse things that can’t be done with things that simply lack resources (even if the initial resource demand seems very high)

- When someone pitches an idea, leader’s should avoid questioning the viability. Rather, they should offer a variation that is an order of magnitude more ambitious and ask why the latter cannot be accomplished.

- Ask regulators what they want, and try really hard to achieve that goal rather than arguing with them. Offer creative solutions that are non-traditional, but that just might achieve the goal. Change the conversation to achieving the goal, rather than extending the past.

- If an idea requires creative thinking, be excited about it. Don’t hesitate to represent unrealistic expectations.

- Speed is really, really important. If there is merit, rush it toward the future state as fast as possible. Let implementation and the marketplace determine what’s successful, rather than trying to guess.

- Do the numbers, but don’t expect those who disagree to believe your numbers. It’s easy for people to pooh-pooh projections. Don’t let disagreement over forecasts stop you from proceeding.

- Don’t let potential legal problems stop you. Take action, and deal with legal issues when, and if, they arise.

Planning for the future, and being ambitious about what that future entails, has created a slew of new products from Google that have benefited everyone around the world. Google’s use of scenario planning to drive development and investments is a business implementation of an historical echo – asking not what Google needs from historical customers to succeed, but rather what Google can do to create something future customers will value. Google uses planning to rush headlong into providing a growing and profitable future, rather than trying to optimize the historical solution.

Giant, centralized distribution facilities that use nuclear or fossil fuels, then sending electricity over massive distances losing upwards of 70-80% of the power in transmission, is the historical utility industry approach. For a very long time it worked pretty darn well. But the limitations of that approach are being seen, and felt, in many locations – causing blackouts in various regions, health risks in others, rising polution levels, rising demands for limited fuels, higher costs (especially for maintenance and upgrades) and potential deadly disasters from unexpected events of mother nature. Industry outsiders question whether America’s growth will be limited (due to supply or pricing issues) if this approach is not changed.

Lots of options exist for the electric utility industry to do things differently. But it will take a big change in how the industry leaders plan. Maybe they’ll ask the folks at Google for a few ideas on how to change their approach to planning. Can you imagine a future where Google managed the electric grid?

by Adam Hartung | Mar 9, 2011 | Current Affairs, Defend & Extend, eBooks, Food and Drink, In the Swamp, Innovation, Leadership, Lock-in, Openness

Summary:

- McDonald's relies on operational improvements to raise profits, these are short-lived and give no growth

- McDonald's growth cycles, and investors forget long-term it isn't growing much at all

- You can't depend on recurring recessions to make your business look good

- Apple has shown how to create long-term revenue growth, and greater investor wealth, by developing new markets and solutions

- Investors in McDonald's are likely to be less pleased than investors in Apple

Subway is now #1 in size, as "McDonald's Loses World's Biggest Title to Subway" according to Crain's Chicago Business. The transition wasn't hard to predict, since Subway has been much larger in the USA for several years. Now Subway has gained on McDonald's internationally. What's striking about this is that McDonald's could see it coming, and really did nothing about it. While Subway keeps focused on growth, McDonald's has focused on preserving its historical business. And that bodes poorly for long-term investor performance.

For more than a decade McDonald's size has swung back and forth as it opened stores, then closed hundreds in an "operational improvement program," before opening another round of stores – to then repeat the cycle. McDonald's has not shown any US store growth for a long time, and has relied on expanding its traditional business offshore.

Even the menu remains almost unchanged, dominated by burgers, fries and soft drinks. "New" product rollouts have largely been repeats of decades old products, like McRib, which cycle on and off the menu. And the most "strategic" decision we hear about was executives spending countless hours, along with thousands of franchisees, trying to figure out whether or not to reduce the amount of cheese on a cheeseburger (which they did, saving billions of dollars.) Even though it spent almost a decade figuring out how to launch McCafe, the whole idea gets little atttention or promotion. There just isn't much energy put into innovation, or growth at McDonald's. Or even trying to be a leader in new marketing tools like social media, where chains like Papa John's have done much better.

Most people have forgotten that McDonald's acquired and funded the growth of Chipotle's, one of the fastest growing quick food chains. But in 2006 McDonald's leadership sold Chipotle's to raise cash to fund another one of those operational improvement rounds. The business that showed the most promise, that has much more growth opportunity than the tiring McDonald's brand, was sold off in order to Defend and Extend the known, but not so great, McDonald's.

Sort of like selling your patents in order to pay for maintenance and upgrades on the worn out plant tooling.

Soon after Chipotle's sale the "Great Recession" started. And people quit dining out – or went downmarket. Thousands of restaurants closed, and chains like Bennigan's declared bankruptcy. As people started eating a bit more frequently in McDonald's investors cheered. But, this was really more akin to the old phrase "even a stopped clock is right twice a day." McDonald's was the benefactor of an unanticipated economic event. And as the economy has improved McDonald's has cheered its improved oprations and higher profits. But, where is future growth? What will create long-term growth into 2015 and 2020? (To be honest, I'm not sure where this will be for Subway, either.)

This cycle of bust and repair – which will lead to another bust when a competitor or other external event challenges McDonald's unaltered success formula – is very different from what's happened at Apple. Rather than raising money to defend its historical business (the Macintosh business) Apple actually cut back its Mac products to fund development of new businesses – the big winner being iPod and iTunes. Then Apple focused on additional new markets, transforming smart phone growth with the iPhone and altering the direction of computing with the iPad. Rather than trying to Defend its past and Extend into new markets (like McDonald's international efforts) Apple has created, and led, new markets.

Performance at Apple has been much better than McDonald's. As we can see, only during the clock-stopped period at the height of the recession did investors lose faith in Apple's growth, while defaulting to defensiveness at McDonald's.

Chart source: Yahoo Finance

Steve Toback at bNet.com gives us insight into how Apple has driven its growth in "10 Ways to Think Different – Inside Apple's Cult-like Culture." These 10 points look nothing like the McDonald culture – or hardly any company that has growth problems. A quick scan gives insight to how any company can identify, develop and grow with new solutions in new markets:

- Empower employees to make a difference.

- Value what's important, not minutiae

- Love and cherish the innovators

- Do everything important internally

- Get marketing

- Control the message

- Little things make a big difference

- Don't make people do things, make them better at doing things

- When you find something that works, keep doing it

- Think different

What's most worrisome is that the protectionist culture we see at McDonald's, and frankly most U.S. companies, is the kind that led General Motors to years of faultering results and eventual bankruptcy. Recall that GM once bought Hughes Aircraft and EDS as growth devices (around 1980,) and opened the greenfield Saturn division to learn how to compete with offshore auto makers head-on. But the first two were sold, just like McDonald's sold Chipotle, to raise funds for propping up the poorly performing auto business. Saturn was gutted of its uniqueness in cost-saving programs to "align" it with the other auto divisions, and closed in the recent bankruptcy. (Read more detail on The Fall of GM in this short eBook.)

While McDonald's isn't at risk of immediate bankruptcy, investors need to understand that it's value is unlikely to rise much. Operational improvements are not the source of growth. They are short-term tactics to support historical behaviors which trade off short-term profit improvement for long-term new market development. In McDonald's case, this latest round of performance focus matched up with an economic downturn, unexpectedly benefitting McDonald's very quickly. But long-term value comes from creating new business opportunities that meet changing needs. And for that you need to not sell your innovations — instead, invest in them to drive growth.

by Adam Hartung | Mar 2, 2011 | Books, Defend & Extend, eBooks, In the Rapids, In the Swamp, Innovation, Leadership, Lock-in

What separates business winners from the losers? A lot of pundits would say you need to be efficient, cost conscious and manage margins. Others would say you need to be really good (excellent) at something – much better than anyone else. Unfortunately, that sounds good but in our fast-paced, highly competitive world today those platitudes don’t really create winners. Success has much more to do with the ability to shift. And to create shifts.

Think about Amazon.com. This company was started as an on-line retail channel for books most stores would not stock on their shelves. But Amazon used the shift to internet acceptance as a way to grow into selling all books, and eventually came to dominate book sales. Not only have most of the small book stores disappeared, but huge chains like B. Dalton and more recently Borders, were driven to bankruptcy. Amazon then built on this shift to expand into selling lots more than books, becoming a force for selling all kinds of products. And even opening itself to become a portal for other on-line retalers by routing customers to their sites, and even taking orders for products shipped from other e-tailers.

More recently, Amazon has taken advantage of the shift to digitization by launching its Kindle e-reader. And by making thousands of books available for digital downloading. By acting upon market trends, Amazon has shifted quickly, and has caused shifts in the market where it participates. And this shifting has been worth a lot to Amazon. Over the last 5 years Amazon’s stock has risen from about $30/share to about $180/share – about a 45%/year compounded rate of return!

Chart source: Yahoo Finance

Chart source: Yahoo Finance

In the middle to late 1990s, as Amazon was just starting to appear on radar screens, it appeared like Sears would be the kind of company that could dominate the internet. After all Sears was huge! It was a Dow Jones Industrial Average (DJIA) member that had ample resources to invest in the emerging growth market. Sears had a history of pioneering markets. It had once dominated retail with its catalogs, then became a powerhouse in free standing retail stores, then led the movement to shopping malls as an anchor chain, and even used its history in lending to develop what became Discover card, and had once shown its ability to be a financial services company and even an insurer! Sears had shifted with historical trends, and surely the company would see that it could bring its resources to the shifting retail landscape in order to remain dominant.

Unfortunately, Sears went a different direction, prefering to focus on defending its current business model. As the chain struggled, it was dropped from the DJIA. Eventually a financier, Edward Lampert, used his takeover of bankrupt KMart (by buying up their bonds) to take over Sears! Under his leadership Sears focused hard on being efficient, controlling costs and managing margins. Extensive financial rigor was applied to Sears to improve the profitability of every line item, dropping poor performers and closing low margin stores. While this initially excited investors, Sears was unable to compete effectively against other retailers that were lower cost, or had better merchandise or service, and the value has declined from about $190/share to $80; a loss of about 60% (at its recent worst the stock fell to almost 30 – or a decline of 84% peak to trough!)

Chart Source: Yahoo Finance

Chart Source: Yahoo Finance

Meanwhile the world’s #1 retailer, Wal-Mart, has long excelled at being the very best at supply chain management, and low-price leadership in retailing. Wal-Mart has never varied from its original business model, and in the retail world it is undoubtedly the very best at doing what it does – buy cheap, sell cheap and run a very tight supply chain from purchase to sale. This excited some investors during the “Great Recession” as customers sought out low prices when fearing about their jobs and future.

But this strategy has not been able to produce much growth, as stores have begun saturating just about everywhere but the inner top 30 cities. And it has been completely unsuccessful outside the USA. As a result, despite its behemoth size, the value of Wal-Mart has really gone nowhere the last 5 years. While there has been price gyration (from $42 low to $62 high) for long-term investors the stock has really gone nowhere – mired mostly around $50. Chart Source: Yahoo Finance

Chart Source: Yahoo Finance

Investors in Amazon have clearly fared much better than Sears or Wal-Mart

Chart Source: Yahoo Finance

Chart Source: Yahoo Finance

Too often business leaders spend too much time thinking about what they do. They think about costs, margins, the “business model” and execution. But success really has less to do with those things than understanding trends, and capitlizing on those trends by shifting. You don’t have to be the lowest cost, or most efficient or even the most passionate. What works a lot better is to go where the trends are favorable, and give customers solutions that align with the trends. And if you do this early, before anyone else, you’ll have a lot of time to figure out how to make money before competitors try to cut your margins!

Recognize that most “execution” is about preserving what happened in the past. Trying to do things better, faster and cheaper. But in a rapidly changing world, new competitors change the basis of competition. Amazon isn’t a better classical bookseller, or retailer. It’s a company that leveraged trends – market shifts – to take advantage of new technologies and new ways of people shopping. First for books and then other things. Later it built on trends toward digitization by augmenting the production of electronic publications, which is destined to change the world of book publishing altogether – and even has impact on the publishing of everything from periodicals to manuals. Amazon is now creating market shifts, which is changing the fortunes of others.

For investors, employees and suppliers you are better off to be with the company that shifts. It has the ability to grow with the trends. And the faster you get out of those companies which are stuck, locked-in to their old business model and practices in an effort to defend historical behaviors, the better off you’ll be. Despite the P/E multiples, or other claims of “value investing,” to succeed you’re a lot better off with the company that’s finding and building on trends than the ones managing costs.

by Adam Hartung | Feb 18, 2011 | Current Affairs, In the Swamp, Innovation, Leadership, Lock-in, Openness, Television, Web/Tech

Business people keep piling onto the innovation and growth bandwagon. PWC just released the results of its 14th annual CEO survey entitled “Growth Reimagined.” Seems like most CEOs are as tired of cost cutting as everyone else, and would really like to start growing again. Therefore, they are looking for innovations to help them improve competitiveness and build new markets. Hooray!

But, haven’t we heard this before? Seems like the output of several such studies – from IBM, IDC and many others – have been saying that business leaders want more innovation and growth for the last several years! Hasn’t this been a consistent mantra all through the last decade? You could get the impression everyone is talking about innovation, and growth, but few seem to be doing much about it!

Rather than search out growth, most businesses are still trying to simply do what their business has done for decades – and marveling at the lack of improved results. David Brooks of the New York Times talks at length in his recent Op Ed piece on the Experience Economy about a controversial book from Tyler Cowen called “The Great Stagnation.” The argument goes that America was blessed with lots of fertile land and abundant water, giving the country a big advantage in the agrarian economy from the 1600s into the 1900s. During the Industrial economy of the 1900s America was again blessed with enormous natural resources (iron ore, minerals, gold, silver, oil, gas and water) as well as navigable rivers, the great lakes and natural low-cost transport routes. A rapidly growing and hard working set of laborers, aided by immigration, provided more fuel for America’s growth as an industrial powerhouse.

But now we’re in the information economy. Those natural resources aren’t the big advantage they once were. Foodstuffs require almost no people for production. And manufacturing is shifting to offshore locations where cheap labor and limited regulations allow for cheaper production. And it’s not clear America would benefit even if it tried maintaining these lower-skilled jobs. Today, value goes to those who know how to create, store, manipulate and use information. And success in this economy has a lot more to do with innovation, and the creation of entirely new products, industries and very different kinds of jobs.

Unfortunately, however, we keep hiring for the last economy. It starts with how Boards of Directors (and management teams) select – incorrectly, it appears – our business leaders. Still thinking like out-of-date industrialists, Scientific American offers us a podcast on how “Creativity Can Lesson a Leader’s Image.” Citing the same study, Knowledge @ Wharton offers us “A Bias Against ‘Quirky’ Why Creative People Can Lose Out on Creative Positions.” While 1,500 CEOs say that creativity is the single most important quality for success today – and studies bear out the greater success of creative, innovative leaders – the study found that when it came to hiring and promoting businesses consistently marked down the creative managers and bypassed them, selecting less creative types!

Our BIAS (Beliefs, Interpretations, Assumptions and Strategies) cause the selection process to pick someone who is seen as less creative. Consider these comments:

- “would you rather have a calm hand on the tiller, or someone who constantly steers the boat?”

- “do you want slow, steady conservatism in control – or irrational exuberance?”

- “do we want consistent execution or big ideas?”

These are all phrases I’ve heard (as you might have as well) for selecting a candidate with a mediocre track record, and very limited creativity, over a candidate with much better results and a flair for creativity to get things done regardless of what the market throws at her. All imply that what’s important to leadership is not making mistakes. Of you just don’t screw up the future will take care of itself. And that’s so industrial economy – so “don’t let the plant blow up.”

That approach simply doesn’t work any more. The Christian Science Monitor reported in “Obama’s Innovation Push: Has U.S. Really Fallen Off the Cutting Edge” that America is already in economic trouble due to our lock-in to out-of-date notions about what creates business success. In the last 2 years America has fallen from first to fourth in the World Economic Forum ranking of global competitivenes. And while America still accounts for 40% of global R&D spending, we rank remarkably low (on all studies below 10th place) on things like public education, math and science skills, national literacy and even internet access! While we’ve poured billions into saving banks, and rebuilding roads (ostensibly hiring asphalt layers) we still have no national internet system, nor a free backbone for access by all budding entrepreneurs!

Ask the question, “If Steve Jobs (or his clone) showed up at our company asking for a job – would we give him one?” Don’t forget, the Apple Board fired Steve Jobs some 20 years ago to give his role to a less creative, but more “professional,” John Scully. Mr. Scully was subsequently fired by the Board for creatively investing too heavily in the innovative Newton – the first PDA – to be replaced by a leadership team willing to jettison this new product market and refocus all attention on the Macintosh. Both CEO change decisions turned out to be horrible for Apple, and it was only after Mr. Jobs returned to the company after nearly 20 years in other businesses that its fortunes reblossomed when the company replaced outdated industrial management philosophies with innovation. But, oh-so-close the company came to complete failure before re-igniting the innovation jets.

Examples of outdated management, with horrific results, abound. Brenda Barnes destroyed shareholder value for 6 years at Sara Lee chasing a centrallized focus and cost reductions – leaving the company with no future other than break-up and acquisition. GE’s fortunes have dropped dramatically as Mr. Immelt turned away from the rabid efforts at innovation and growth under Welch and toward more cautious investments and reliance on a set of core markets – including financial services. After once dominating the mobile phone industry the best Motorola’s leadership has been able to do lately is split the company in two, hoping as a divided business leadership can do better than it did as a single entity. Even a big winner like Home Depot has struggled to innovate and grow as it remained dedicated to its traditional business. Once a darling of industry, the supply chain focused Dell has lost its growth and value as a raft of new MBA leaders – mostly recruited from consultancy Bain & Company – have kept applying traditional industrial management with its cost curves and economy-of-scale illogic to a market racked by the introduction of new products such as smartphones and tablets.

Meanwhile, leaders that foster and implement innovation have shown how to be successful this last decade. Jeff Bezos has transformed retailing and publishing simultaneously by introducing a raft of innovations, including the Kindle. Google’s value soared as its founders and new CEO redefined the way people obtain news – and the ads supporting what people read. The entire “social media” marketplace is now taking viewers, and ad dollars, from traditional media bringing the limelight to CEOs at Facebook, Twitter and Linked-in. While newspaper companies like Tribune Corp., NYT, Dow Jones and Washington Post have faltered, pop publisher Arianna Huffington created $315M of value by hiring a group of bloggers to populate the on-line news tabloid Huffington Post. And Apple is close to becoming the world’s most valuable publicly traded company on the backs of new product innovations.

But, asking again, would your company hire the leaders of these companies? Would it hire the Vice-President’s, Directors and Managers? Or would you consider them too avant-garde? Even President Obama washed out his commitment to jobs growth when he selected Mr. Immelt to head his committee – demonstrating a complete lack of understanding what it takes to grow – to innovate – in today’s intensely competitive information economy. Where he should have begged, on hands and knees, for Eric Schmidt of Google to show us the way to information nirvana he picked, well, an old-line industrialist.

Until we start promoting innovators we won’t have any innovation. We must understand that America’s successful history doesn’t guarantee it’s successful future. Competing on bits, rather than brawn or natural resources, requires creativity to recognize opportunities, develop them and implement new solutions rapidly. It requires adaptability to deal with new technologies, new business models and new competitors. It requires an understanding of innovation and how to learn while doing. Amerca has these leaders. We just need to give them the positions and chance to succeed!

by Adam Hartung | Feb 15, 2011 | Current Affairs, Defend & Extend, In the Swamp, Leadership, Web/Tech

Summary:

- Nokia agreed to develop smartphones with Microsoft software

- But Microsoft’s product is without users, developers or apps

- Apple and Google Android dominate developers, app base and users

- Apple and Google Android have extensive distribution, and customer acceptance

- Microsoft brings Nokia very little

- Nokia hopes it can succeed simply by ramming Microsoft product through distribution. This will be no more successful than its efforts with Symbian

- Apple is the winner, because Nokia didn’t select Google Android

“For First Time Ever, Smartphones Outsell PCs in Q4 of 2010” headlined BGR.com. This is a big deal, as it creates something of an inflection point – possibly what some would call a “tipping point” – in the digital technology market. For over 2 years some of us, using IDC data such as reported in ReadWriteWeb, have been predicting that PCs are on the way to extinction – much like mainframes and mini-computers went. Smartphone sales last quarter jumped 87.2% year-over-year to about 101M units. Meanwhile PC sales, a market manufacturers hoped would recover as “enterprises” resumed buying post-recession, grew only 5.5% in the like period, to 92.1M units. No doubt the installed base of the latter product is multiples of the former, but we can see that increasingly people are ready to use the newer, alternative technology.

This week Mediapost.com reported “Tablet Sales to Hit 242M by 2015.” Both NPD Group and iSuppli are projecting a 10-fold increase wtihin 5 years in the volume of these new devices, which is sure to devastate PC sales. Between smartphones and tablets, as well as the rapid development of cloud-based apps and data storage solutions, it’s becoming quite clear that the life-span of PC technology has its limits. Soon we’ll be able to do more, cheaper, better and faster with these new products than we ever could on a PC.

This is really bad news for Microsoft. Apple and Google dominate both these mobile markets. As Microsoft has fought to defend its PC business by re-investing in Vista, then Windows 7 and Office 2010, the market has been shifting away from the PC platform entirely. It’s common now to hear about corporations considering iPads and other tablets for field workers. And it’s impossible to walk through an airport, or sit in a meeting these days without seeing people use their smartphones and tablets, purchased individually at retail, while leaving their PCs at the office. Most corporate Blackberry users now have either an Apple or Android smartphone or tablet as they eschew their RIM product for anything other than required corporate uses.

Nokia has largely missed the smartphone market, choosing, like Microsoft, to continue investing in defending its traditional business. Long the largest cell phone supplier, Nokia did not develop the application base or developer network for Symbian (it’s proprietary smartphone technology) as it kept pumping out older devices. Nokia is reminiscent of the Ed Zander led Motorola disaster, where the company kept pumping out Razr phones until demand collapsed, nearly killing the company.

So the Board replaced the Nokia CEO. As discussed in Forbes on 5 October, 2010 in “HP and Nokia’s Bad CEO Selections” Nokia put in place a Microsoft executive. Given that Microsoft had missed the smartphone market entirely, as well as the tablet market, moving the Microsoft Defend & Extend way of thinking into Nokia didn’t look like it would bring much help for the equally locked-in Nokia. Exchanging one defensive management approach for another doesn’t create an offense – or new products.

It wasn’t much of a surprise last week when the 5-month tenured CEO, Stephen Elop, announced he thought Nokia’s business was in horrible shape via an internal email as reported in the Wall Street Journal, “Nokia, Microsoft Talk Cellphones.” Rather quickly, a deal was struck in which Nokia would not only pick up the Microsoft mobile operating system, but would use their products to promote other extremely poorly performing Microsoft products. “Nokia to Adopt Microsoft Bing, Adcenter” was another headline at MediaPost.com. Bing and adCenter were very late to market, and even with adoption by early market leader Yahoo! have been unable to make much inroad into the search and on-line ad placement markets dominated by Google.

Mr Elop went with what he knew, selecting Microsoft. I guess he’s the new “chief decider” at Nokia. His decision caused a break out of optimism amongst long-suffering Microsoft investors and customers who’ve gotten very little from the giant PC near-monopolist the last decade. Mediapost told us “Study: Surge of Support for Windows Phone 7” as developers who long ignored the product entirely were starting to consider writing apps for the device. After all this time, new hope beats within the breast of those still stuck on Microsoft.

But if ever there was a case of too little, and way, way too late, this has to be it. Two companies long known for weak product innovation, and success driven by market domination and distribution control strategies, are partnering to take on the two most innovative companies in digital technology as they create entirely new markets with new technologies.

RIM, the smartphone market originator, has seen its fortunes disintegrate as Blackberry sales fell below iPhones – even with over 10,000 apps. Today Microsoft has virtually NO apps, and NO developer base as it just now enters this market, “Google Searches for Mobile App Experts” (Wall Street Journal) as its effort continues to expand its 100,000+ apps base as it chases the 350,000+ apps already existing for the iPhone. Where Microsoft and Nokia hope to build an app base, and a user base, Apple and Google already have both, which theyt are aggressively growing.

Exactly what going to happen to slow Apple and Google’s growth in order to allow Microsoft + Nokia to catch up? In what fairy tale will the early hare take a nap so the awakened tortoise will be allowed to somehow, miraculously get back into the race?

Being late to market is never good. Look at how Sony, and everyone else, were late to digitally downloaded music. iPad and iTunes not only took off but continue to hold well over 50% of the market almost a decade later. Over the same decade Apple has held onto 2/3 of the download video market, while Microsoft’s Zune has struggled to capture less than 1/4 of Apple’s share (about 18% according to WinRumors.com).

Apple (and Google) aren’t going to slow down the pace of innovation to give Microsoft and Nokia a chance to catch up. Today (15 Feb., 2010) ITProPortal.com breaks news “Apple iPhone 5 to have 4 Inch Screen,” an upgrade designed to bring yet more users to its mobile device platform – away from PCs and competitive smarphones. The same article discusses how Google Android manufacturers are bringing out 4.3 inch screens in their effort to keep growing.

So, amidst the “big announcement” of Microsoft and Nokia agreeing to work together on a new platform, where’s the product announcement? Where’s the app base? And exactly what is the strategy to be competitive in 2012 and 2015? Does anyone really think throwing money at this will create the products (hardware and software) fast enough to let either catch up with existing leaders? Does anyone think Microsoft products dependent upon Nokia’s distribution can save either’s mobile business – while Apple has just expanded to Verizon for distribution? And Google is already on almost all networks? And where is Microsoft or Nokia in the tablet business, which is closely associated with smartphone market for obvious issues of mobility and use of cloud-based computing architectures?

The good news here is for Apple fans. Nokia clearly should have chosen Android. This would give the laggard a chance of leveraging the base of technology at Google – including advances being made to the Chrome operating system and its advantages for the cloud. No matter what the price, it’s the only chance Nokia has. With this decision the most likely outcome is big investments by both Microsoft and Nokia to play catch-up, but limited success. Results will not likely cover investment rates, leading Nokia to a Motorola-like outcome. And Microsoft will remain a bit player in the fastest growing digital markets. Both have billions of dollars to throw away in this desperate effort. But the outcome is almost certain. It’s doubtful between the two of them they can buy enough developers, network agreements and users to succeed against the 2 growth leaders and the desperately defensive RIM.

Like I said last month in this blog “Buy Apple, Sell Microsoft.” It’s still the easiest money-making trade of 2011. Now thankfully reinforced by the former Microsoft exec running Nokia.

by Adam Hartung | Feb 9, 2011 | Current Affairs, Defend & Extend, In the Swamp, In the Whirlpool, Leadership, Lock-in, Weblogs

Summary:

- Start-ups that flourish give themselves permission to do whatever is necessary to succeed

- Most acquisitions kill that kind of permssion, forcing the acquired company to adopt the acquirers legacy

- AOL’s legacy business has been dying for several years

- AOL’s history of acquisitions has been horrible, because it doesn’t learn from the acquisitions.

- AOL’s acquisition, and announced integration, of Huffington Post will likely do nothing to turn around AOL, and probably leave HuffPo about as well off as AOL’s acquisition of Bebo

After the Super Bowl Sunday Night AOL announced it’s acquisition of The Huffington Post for $350M. Given that you can’t give away a newspaper company these days, the acquisition shows there is still value in “news” if you understand the right way to deliver it. HuffPo’s team of bloggers has shown that it’s possible to build a profitable news organization today – if you do it right. Something the folks at Tribune Corporation still don’t understand.

BusinessInsider.com headlined “AOL’s Huffington Post Acquisition Makes Sense for Both Sides.” For Arianna Huffington and her investors the big cash payout shows a clear win. They are receiving a pretty penny for their start-up. Beyond them, it’s less clear. AOL’s been losing subscribers, and site vistors for years. They’ve made a number of acquisitions to spark up interest including blogs Engadget, Joystiq, ad network Tacoda and social networking site Bebo. None of those have flourished – in fact the opposite has happened. AOL investors lost almost all the $850M spent on Bebo as Facebook crushed it. So far, the AOL track record has been horrible!

AOL clearly hopes HuffPo will bring it new visitors – but whether that works, and whether HuffPo continues growing, is now an open question. MediaPost.com reports “AOL Starts Mapping Plans for Huffington Post.” Unfortunately, it sounds much more as if AOL is trying to integrate HuffPo into its traditional organization – which will most likely do for HuffPo what integrating at News Corp did for MySpace – namely, layering it with “professional management,” additional systems, more overhead and rules for operating. Or, in other words, bury it in company legacy that strangles its abilitiy to innovate and shift with rapidly emerging market needs. The company that’s actually growing, winning in the marketplace, isn’t AOL. It’s HuffPo. If there’s any “integrating” needed it should be figuring out how to push AOL into HuffPo – not vice-versa.

As the New York Times headlined, this acquisition is “AOL’s Bet on Another Makeover.” And that’s what’s wrong. The acquisitions AOL made were pre-purchase successful because they were White Space endeavors that had close connection to the market. The founders gave their organization permission to do whatever it took to be successful, without artificial constraints based upon legacy. Their acquisitions have not used by AOL to create White Space with better market receptors – to teach AOL where growth lies. Rather, AOL has hoped they can use the acquisition to defend and extend their old success formula. AOL has hoped the acquisitions would allow them to slow the market shift, and preserve legacy operations.

As we’ve seen, that simply does not work. Markets shift for good reason, and the only way a business can thrive is to shift with them. At AOL the smart move would be to let Arianna run the show! A few months ago AOL purchased TechCrunch and ever since Michael Arrington, the founder, has been villifying AOL management for its bureaucracy and inability to adapt. What Mr. Armstrong, the relatively new CEO at AOL misses is that AOL’s business is dead. AOL needs to find an entirely new way of operating – and that’s what these acquisitions bring. AOL needs to get out of the way, let the acquisitions flourish, and learn something from them. AOL management needs to accept that the old AOL business model is rubbish, and what it must do is allow the acquisitions to operate in White Space, then learn from them! But that’s not been the history of AOL’s purchases, and doesn’t look like the case this time.

Mr. Armstrong could learn a lot from Sir Richard Branson. Virgin has made many acquisitions, and developed several new companies. He doesn’t try to integrate them, or drive them toward any particular business model From Virgin Airways to Virgin Money to Virgin Health Bank to Virgin Games (and all the other businesses) the requirement is that the business be tightly linked to market needs, operate in new ways and find out how to grow profitably. Virgin moves toward the new markets and businesses, it doesn’t expect the businesses to conform to the Virgin model.

I’d like to think AOL could learn from HuffPo and dramatically change. But from the announcements this week, it doesn’t look likely. AOL still looks like a management team desperately trying to save its old business, but without a clue how to do so. Too bad for AOL. Could be even worse for those who read HuffPo.

by Adam Hartung | Feb 3, 2011 | Defend & Extend, eBooks, In the Rapids, In the Swamp, Innovation, Leadership, Lock-in, Openness

Summary:

- Company size is irrelevant to job creation

- New jobs are created by starting new businesses that create new demand

- Most leaders behave defensively, trying to preserve the old business

- But success comes from acting like a start-up and creating new opportunities

- Companies need to do more future-based planning that can change the competitive landscape and generate more growth, jobs and higher rates of return

A trio of economists just published "Who Creates Jobs? Small vs. Large vs. Young" at the National Bureau of Economic Research. For years businesspeople have said that the majority of jobs were created by small companies, therefore we should provide loans and other incentives for small business. At the same time, we all know that large companies employee millions of people, and therefore they have received benefits to keep their companies going even in tough times – like the recent bailouts of GM and Chrysler. But what these researchers discovered was that size was immaterial to job creation – and this ages-old debate is really irrelevant!

Digging deeper into the data, they discovered as reported in the New York Times, "To Create Jobs, Nurture Start-Ups." Regardless of size, most businesses over time get stuck defending their original success formula. What helped them initially grow becomes locked-in by behavioral norms, structural decision-making processes and a business model cost structure that may be tweaked, but rarely changed. Best practices serve to focus management on defending that business, even as market shifts lower the industry growth rate and profits. It doesn't take long before defensive tactics dominate, and as the leaders attempt to preserve historical practices there are no new jobs created. Usually quite the opposite happens as cost cutting dominates, leading to outsourcing and lay-offs reducing the workforce.

Look no further than most members of the Dow Jones Industrial Average to witness the lack of jobs created by older companies desperately trying to defend their historical business model. But what we've failed to realize is how the same management practices dominate small business as well! Most plumbing suppliers, window installers, insurance agencies, restaurants, car dealers, nurseries, tool rental shops, hair cutters and pet sitters spend all their time just trying to keep the business going. They look no further than what they did yesterday when making business decisions. Few think about growth, preferring instead to just keep the business the same – maybe by the owner/operator's father 3 decades ago! They don't create any new jobs, and are probably struggling to maintain existing employment as computers and other business aids reduce the need for labor – while competition keeps whacking away at historical margins.

So if you want to create jobs, throwing incentives at General Electric, General Motors or General Dynamics is not likely to get you very far. And asking the leaders of those companies what it takes to get them to create jobs is a wasted conversation. They don't know, and haven't really thought about the question. Leaders of almost all big organizations are just trying to make next quarter's profit projection any way they can – and that doesn't involve new hiring. After a lifetime of cutting costs and preservation behavior, how is Jeffrey Immelt of GE supposed to know anything about creating new businesses which leads to job creation?

Nor is offering loans or grants to the millions of existing small businesses who are just trying to keep the joint running going to make any difference. Their psychology is not about offering new products or services, and banks sure don't want to take the risk of investing in new experimental behaviors. They have little, if any, interest in figuring out how to grow when most of their attention is trying to preserve the storefront in the face of new competitors on-line, or from India, China or Vietnam!

To create jobs you have to focus on growth – not defense. And that takes an entirely different way of thinking. Instead of thinking about the past you have to be obsessive about the future, and how you can do things differently! Most of the time, business leaders don't think this way until their backs are up against the wall, looking at potential failure! For example, how Mr. Gerstner turned around IBM when he moved the company away from mainframe obsession and pointed the company toward services. Or when Steve Jobs redirected Apple away from its Mac obsession and pushed the company into new markets for music/entertainment and smartphones. Unfortunately, these stories are so rare that we tend to use them for a decade (or even 2 decades)!

For years Cisco said it would obsolete its own products, and by implementing that direction Cisco has grown year after year in the tech world, where flame-outs abound (just look at what happened to Sun Microsystems, Silicon Graphics, AOL and rapidly Yahoo!) Look at how Netflix has pushed Blockbuster aside by expanding its business from snail-mail to downloads. Or how Amazon.com has found explosive growth by changing the way we read books, now selling more Kindle products than printed. Rather than thinking about how each could do more of what they always did, fearing cannibalization of the "core business," they are aiding destruction of their historical business by implementing the newest technology and solution before some start-up beats them to the punch!

As you enter 2011 and prepare for 2012, is your planning based upon doing more of what your business has always done? A start up has no last year, so its planning is based entirely on views of the future. Are you fixated on improving your operations? A start up has no operations, so it is fixated on competitors to figure out how it can meet market needs better, and use "fringe" solutions in new ways that competitors have not yet adopted. Are you hoping that market shifts slow, or stop, so revenue, market share and profit slides abate? A start up is looking for ways to disrupt the marketplace to it can grab high growth from existing solutions while generating new demand by meeting unmet needs. Are you trying to preserve resources in order to defend your business from competitors? A start up is looking for places to experiment with new solutions and figure out how to change the competitive landscape while growing revenues and profits.

If you want to thrive you have to grow. To grow, you have to think young! Be willing to plan for the future, like Apple did when it moved into new markets for music downloads. Be willing to find competitive holes and fill them with new technology, like Netflix. Don't fear market changes – create them like Cisco does with new solutions that obsolete previous generations. And keep testing new ways to expand the market, even as you see intense competition in historical markets being attacked by new competitors. That is the only way to create value, and generate new jobs!

by Adam Hartung | Jan 19, 2011 | Current Affairs, Disruptions, Games, In the Rapids, In the Swamp, Innovation, Leadership, Lock-in, Music, Openness, Web/Tech

The Wall Street Journal headlined Monday, “Apple Chief to Take Leave.” Forbes.com Leadership editor Fred Allen quickly asked what most folks were asking “Where does Steve Jobs Leave Apple Now?” as he led multiple bloggers covering the speculation about how long Mr. Jobs would be absent from Apple, or if he would ever return, in “What They Are Saying About Steve Jobs.” The stock took a dip as people all over raised the question covered by Steve Caulfield in Forbes’ “Timing of Steve Jobs Return Worries Investors, Fans.”

If you want to make money investing, this is what’s called a “buying opportunity.” As Forbes’ Eric Savitz reported “Apple is More Than Just Steve Jobs.” Just look at the most recent results, as reported in Ad Age “Apple Posts ‘Record Quarter’ on Strong iPhone, Mac, iPad Sales:”

- Quarterly revenue is up 70% vs. last year to $26.7B (Apple is a $100B company!)

- Quarterly earnings rose 77% vs last year to $6B

- 15 million iPads were sold in 2010, with 7.3 million sold in the last quarter

- Apple has $50B cash on hand to do new product development, acquisitions or pay dividends

ZDNet demonstrated Apple’s market resiliency headlining “Apple’s iPad Represents 90% of All Tablets Shipped.” While it is true that Droid tablets are now out, and we know some buyers will move to non-Apple tablets, ZDNet predicts the market will grow more than 250% in 2011 to over 44 million units, giving Apple a lot of room to grow even with competitors bringing out new products.

Apple is a tremendously successful company because it has a very strong sense of where technology is headed and how to apply it to meet user needs. Apple is creating market shifts, while many other companies are reacting. By deeply understanding its competitors, being willing to disrupt historical markets and using White Space to expand applications Apple will keep growing for quite a while. With, or without Steve Jobs.

On the other hand, there’s the stuck-in-the-past management team at Microsoft. Tied to all those aging, outdated products and distribution plans built on PC technology that is nearing end of life. But in the midst of the management malaise out of Seattle Kinect suddenly showed up as a bright spot! SFGate reported that “Microsoft’s Xbox Kinect beond hackers, hobbyists.” Seems engineers around the globe had started using Kinect in creative ways that were way beyond anything envisioned by Microsoft! Put into a White Space team, it was possible to start imagining Kinect could be powerful enough to resurrect innovation, and success, at the aging monopolist!

But, unfortunately, Microsoft seems far too stuck in its old ways to take advantage of this disruptive opportunity. Joel West at SeekingAlpha.com tells us “Microsoft vs. Open Kinect: How to Miss a Significant Opportunity.” Microsoft is dedicated to its plan for Kinect to help the company make money in games – and has no idea how to create a White Space team to exploit the opportunity as a platform for myriad uses (like Apple did with its app development approach for the iPhone.)

In the end, ZDNet joined my chorus looking to oust Ballmer (possibly a case study in how to be the most misguided CEO in corporate America) by asking “Ballmer’s 11th Year as Microsoft’s CEO – Is it Time for Him to Go?” Given Ballmer’s massive shareholding, and thus control of the Board, it’s doubtful he will go anywhere, or change his management approach, or understand how to leverage a breakthrough innovation. So as the Cloud keeps decreasing demand for traditional PCs and servers, Brett Owens at SeekingAlpha concludes in “A Look at Valuations of Google, Apple, Microsoft and Intel” that Microsoft has nowhere to go but down! Given the amazingly uninspiring ad program Microsoft is now launching (as described in MediaPost “Microsoft Intros New Corporate Tagline, Strategy“) we can see management has no idea how to find, or sell, innovation.

We often hear advice to buy shares of a company. Rarely recommendations to sell. But Apple is the best positioned company to maintain growth for several more years, while Microsoft has almost no hope of moving beyond its Lock-in to old products and markets which are declining. Simplest trade of 2011 is to sell Microsoft and buy Apple. Just read the headlines, and don’t get suckered into thinking Apple is nothing more than Steve Jobs. He’s great, but Apple can remain great in his absence.

by Adam Hartung | Jan 5, 2011 | Defend & Extend, In the Rapids, In the Swamp, Leadership, Lock-in, Openness

Summary:

- Business planning systems are designed to defend historical markets

- Rapidly shifting markets makes it impossible to grow by defense alone

- Growth requires understanding what customers want, and creating new solutions that most likely aren’t part of the current business

- You can’t grow if you don’t plan to grow, but to plan for growth you have to shift resources from traditional planning into scenario planning

- High growth companies like Virgin, Apple and Google plan to fulfill future needs, not defend & extend past practicess

Imagine you see a pile of hay. Above it is a sign flashing “find the needle.” That achievement would be hard. Change the sign to “find the hay” and suddenly achieving the goal becomes much easier. So, as the comedian Bill Engvall might ask, what’s your sign? Unfortunately, most businesses plan for 2011, and beyond, using the first sign. Very few do planning using the latter. Most businesses won’t grow, because they simply don’t know how to plan for growth!!

Most businesses start planning with “I’m in the horseshoe (for example) business. My market isn’t growing, and there is more capacity than demand. How can I grow?” For these people, their sign is “find the needle.”

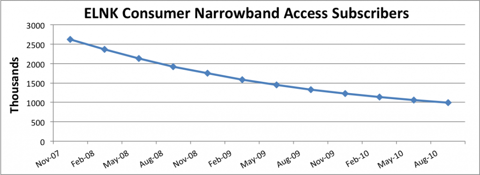

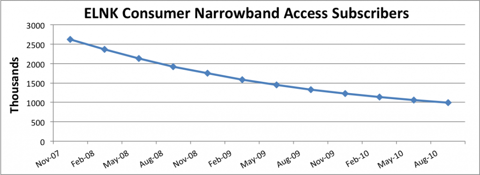

Take for example Earthlink. The company’s growth looked like a rocket ship in the early internet days as people by the millions signed up for dial-up service. But along came broadband, and the market for dial up died – never to return. Earthlink has no hope of growing as long as it thinks of itself as a dial-up company

Chart at SeekingAlpha.com author Ananthan Thangavel

Despite the absolute certainty that the market is shrinking, at this point almost all business planners will develop plans to defend this dying business as long as possible. Despite the impossibility of achieving good returns, there will be a plethora of actions to try and keep serving all the way to the very last customer. Just look at how AOL has invested millions trying to defend its dying internet access busiuness. Reality is, the company that walks away – gives up- is the smartest. There’s no way to make money as oversupply keeps too many companies spending too much to service too few customers.

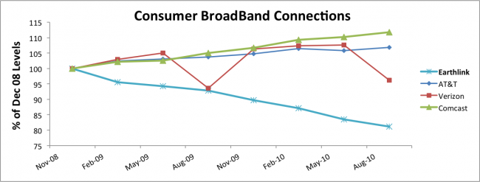

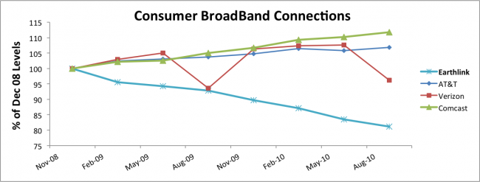

The next step for most planners is to attempt extending the business into something adjacent. For example, Earthlink would say “let’s invest in Broadband. We’ll hang onto customers as they want to switch, and maybe pick up a few customers.” But this completely ignores the fact that competitors already have a substantial lead. Competitors have learned the technology, and the marketplace. They are growing, and have no intention of giving up any room to a new competitor.

Chart at SeekingAlpha.com author Ananthan Thangavel

Planning systems are designed to keep the business doing more of what it always did, or possibly extending the business into adjacent markets after returns have faltered. Planning systems have no way of recognizing when a business, or market, has become obsolete. And practically never do they recognize the power of exsting competitors when looking at adjacent markets. As a result, the planning system produces no growth plans, leading 2011 to end with the self-fulfilling prophecy that the plan predicted – little or no growth.

The future for Earthlink is pretty grim. As it is for most companies that plan based upon history, trying to Defend & Extend their historical markets. In the highly dynamic, global marketplaces of 2011 trying to find growth by remaining focused on the past is like looking for the needle in a haystack. Maybe there’s something in there – but it’s not likely – and it’s even a lot less likely you’ll find it – and if you did, the cost of finding it will almost assuredly be greater than the value.

Alternatively, why not use planning resources to find, and develop, growth markets. Instead of looking at what you did (as in the past tense) try to figure out what you should do. Rather than studying past products, customers and markets, why not develop scenarios about the future that give you insight to what people will want to buy in 2011, 2012 and beyond? Rather than looking for needles, why not go explore the hay?

Newspapers kept focusing on declining subscriptions, when they should have been studying Craig’s List, eBay, Vehix.com and other on-line environments to learn the future of advertising. Had Tribune company poured its resources into its early internet investments, such as cars.com and careerbuilder.com, rather than trying to defend its traditional newspapers, it may well have avoided bankruptcy. But rather than looking to the future when doing its planning, and understanding that on-line news was going to explode, Tribune kept looking for the needle (cost cuts, layoffs, outsourcing, etc.) to save the old success formula.

Direct mail companies and Sunday insert printers have continued looking for ways to defend & extend their coupon printing business – despite the fact that nobody reads junk mail or uses printed coupons. Several have failed, and larger companies have merged trying to find “synergies” and more cost cuts. Simultaneously a 28 year old music major from Nothwestern university starts figuring out how to help companies acquire new customers by offering email coupons, and within 2 years his company, Groupon, is valued at around $6B. There’s nothing that stopped coupon powerhouse Advo from being Groupon, except that its planning system was devoted to finding the needle, while Groupon’s leaders decided to go play in the hay.

Hallmark and American Greetings want us to buy birthday and holiday cards for various occasions – in a world where almost nobody mails cards any longer. As they keep trying to defend their old business, and extend it into a few new opportunities for on-line cards, Twitter captures the wave of instant communications by offering everyone 140 character ways to communicate. Because Twitter is out where the growth is, the company raises $200M giving it a value of $3.7B.

Nothing stops any business from being anything it wants to be. But as most enter 2011 they will use their planning resources, including all those management meetings and hours of forms completion, to do nothing more than re-examine the historical business. Most will devolve into trying to figure out how to do more with less. As future forecasts look grim, or perhaps cautiously optimistic (based on a lot of things going right – like a mysterious pick-up in demand) there will be much nashing of teeth – and meetings looking for a needle that can be offered to employees and investors as a hope for rising future value.

Smart companies get out of that rut. They focus their planning on the future. What do customers want, and how can we give them what they want? How can we create whole new markets. Apple was a PC company, but by exploring mobility it became a provider of MP3 consumer electronics, downloadable music, a mobile device and app supplier and the early winner in cloud accessing tablets. Google has moved from a search engine to a powerhouse ad placement company and is pushing the edges of growth in mobile computing as well as several other markets. Virgin started as a distributor of long-playing vinyl record albums, but by exploring what customers really wanted it has become an international airline, cell phone company, international lender and space travel pioneer (to mention just a few of its businesses.)

You can grow in 2011, but to do so you need to shed the old planning system (and its resource wasting processes) and get serious about scenario planning. Focus on the future, not the past.

by Adam Hartung | Dec 17, 2010 | Current Affairs, Defend & Extend, In the Rapids, In the Swamp, Leadership, Web/Tech

Summary:

- Many people think it is OK for large companies to grow slowly

- Many people admire caretaker CEOs

- In dynamic markets, low-growth companies fail

- It is harder to generate $1B of new revenue, than grow a $100B company by $10B

- Large companies have vastly more resources, but they squander them badly

- We allow large company CEOs too much room for mediocrity and failure

- Good CEOs never lose a growth agenda, and everyone wins!

“I may just be your little rent collector Mr. Potter, but that George Bailey is making quite a bit happen in that new development of his. If he keeps going it may just be time for this smart young man to go asking George Bailey for a job.” From “It’s a Wonderful Life“ an employee of the biggest employer in mythical Beford Falls talks about the growth of a smaller competitor.

My last post gathered a lot of reads, and a lot of feedback. Most of it centered on how GE should not be compared to Facebook, largely because of size differences, and therefore how it was ridiculous to compare Jeff Immelt with Mark Zuckerberg. Many readers felt that I overstated the good qualities of Mr. Zuckerberg, while not giving Mr. Immelt enough credit for his skills managing “lower growth businesses” in a “tough economy.” Many viewed Mr. Immelt’s task as incomparably more difficult than that of managing a high growth, smaller tech company from nothing to several billion revenue in a few years. One frequent claim was that it is enough to maintain revenue in a giant company, growth was less important.

Why do so many people give the CEOs of big companies a break? Given that they make huge salaries and bonuses, have fantastic perquesites (private jets, etc.), phenominal benefits and pensions, and receive remarkable payouts whether they succeed or fail I would think we’d have very high standards for these leaders – and be incensed when their performance is sub-par.

Facebook started with almost no resources (as did Twitter and Groupon). Most leaders of start-ups fail. It is remarkably difficult to marshal resources – both enough of them and productively – to grow a company at double digit rates, produce higher revenue, generate cash flow (or loans) and keep employees happy. Growing to a billion dollars revenue from nothing is inexplicably harder than adding $10B to a $100B company. Compared to Facebook, GE has massive resources. Mr. Immelt entered the millenium with huge cash flow, huge revenues, and an army of very smart employees. Mr. Zuckerberg had to come out of the blocks from a standing start and create ALL his company’s momentum, while comparatively Mr. Immelt took on his job riding a bullet out of a gun! GE had huge momentum, a low cost of capital, and enough resources to do anything it wanted.

Yet somehow we should think that we don’t have as high expectations from Mr. Immelt as we do Mr. Zuckerberg? That would seem, at the least, distorted.

In business school I read the story of how American steel manufacturers were eclipsed by the Japanese. Ending WWII America had almost all the steel capacity. Manufacturers raked in the profits. Japanese and German companies that were destroyed had to rebuild, which they progressively did with more efficient assets. By the 1960s American companies were no longer competitive. Were we to believe that having their industrial capacity destroyed somehow was a good thing for the foreign competitors? That if you want to improve your competitiveness (say in autos) you should drop a nuclear bomb on the facilities (some may like that idea – but not many who live in Detroit I dare say.) In reality the American leaders simply refused to invest in new technologies and growth markets, allowing competitors to end-run them. The American leaders were busy acting as caretakers, and bragging about their success, instead of paying attention to market shifts and keeping their companies successful!

Big companies, like GE, are highly advantaged. They not only have brand, and market position, but cash, assets, employees and vendors in position to help them be even more successful! A smart CEO uses those resources to take the company into growth markets where it can grow revenues, and profits, faster than the marketplace. For example Steve Jobs at Apple, and Eric Schmidt at Google have found new markets, revenues and cash flow beyond their original “core” markets. That’s what Mr. Welch did as predecessor to Mr. Immelt. He didn’t so much take advantage of a growth economy as help create it! Unfortunately, far too many large company CEOs squander their resources on low rate of return projects, trying to defend their existing business rather than push forward.

Most big companies over-invest in known markets, or technologies, that have low growth rates, rather than invest in growth markets, or technologies they don’t know as well. Think about how Motorola invented the smart phone technology, but kept investing in traditional cellular phones. Or Sears, the inventor of “at home shopping” with catalogues closed that division to chase real-estate based retail, allowing Amazon to take industry leadership and market growth. Circuit City ended up investing in its approach to retail until it went bankrupt in 2010 – even though it was a darling of “Good to Great.” Or Microsoft, which launched a tablet and a smart phone, under leader Ballmer re-focused on its “core” operating system and office automation markets letting Apple grab the growth markets with R&D investments 1/8th of Microsoft’s. These management decisions are not something we should accept as “natural.” Leaders of big companies have the ability to maintain, even accelerate, growth. Or not.

Why give leaders in big companies a break just because their historical markets have slower growth? Singer’s leadership realized women weren’t going to sew at home much longer, and converted the company into a defense contractor to maintain growth. Netflix converted from a physical product company (DVDs) into a streaming download company in order to remain vital and grow while Blockbuster filed bankruptcy. Apple transformed from a PC company into a multi-media company to create explosive growth generating enough cash to buy Dell outright – although who wants a distributor of yesterday’s technology (remember Circuit City.) Any company can move forward to be anything it wants to be. Excusing low growth due to industry, or economic, weakness merely gives the incumbent a pass. Good CEOs don’t sit in a foxhole waiting to see if they survive, blaming a tough battleground, they develop strategies to change the battle and win, taking on new ground while the competition is making excuses.

GM was the world’s largest auto company when it went broke. So how did size benefit GM? In the 1980s Roger Smith moved GM into aerospace by acquiring Hughes electronics, and IT services by purchasing EDS – two remarkable growth businesses. He “greenfielded” a new approach to auto manufucturing by opening the wildly successful Saturn division. For his foresight, he was widely chastised. But “caretaker” leadership sold off Hughes and EDS, then forced Saturn to “conform” to GM practices gutting the upstart division of its value. Where one leader recognized the need to advance the company, followers drove GM to bankruptcy by selling out of growth businesses to re-invest in “core” but highly unprofitable traditional auto manufacturing and sales. Meanwhile, as the giant failed, much smaller Kia, Tesla and Tata are reshaping the auto industry in ways most likely to make sure GM’s comeback is short-lived.

CEOs of big companies are paid a lot of money. A LOT of money. Much more than Mr. Zuckerberg at Facebook, or the leaders of Groupon and Netflix (for example). So shouldn’t we expect more from them? (Marketwatch.com “Top CEO Bonuses of 2010“) They control vast piles of cash and other resources, shouldn’t we expect them to be aggressively investing those resources in order to keep their companies growing, rather than blaming tax strategies for their unwillingness to invest? (Wall Street Journal “Obama Pushes CEOs on Job Creation“) It’s precisely because they are so large that we should have high expectations of big companies investing in growth – because they can afford to, and need to!

At the end of the day, everyone wins when CEOs push for growth. Investors obtain higher valuation (Apple is worth more than Microsoft, and almost more than 10x larger Exxon!,) employees receive more pay (see Google’s recent 10% across the board pay raise,) employees have more advancement opportunities as well as personal growth, suppliers have the opportunity to earn profits and bring forward new innovation – creating more jobs and their own growth – rather than constantly cutting price. Answering the Economist in “Why Do Firms Exist?” it is to deliver to people what they want. When companies do that, they grow. When they start looking inward, and try being caretakers of historical assets, products and markets then their value declines.

Can Mr. Zuckerberg run GE? Probably. I’d sure rather have him at the helm of GM, Chrysler, Kraft, Sara Lee, Motorola, AT&T or any of a host of other large companies that are going nowhere the caretaker CEOs currently making excuses for their lousy performance. Think what the world would be like if the aggressive leaders in those smaller companies were in such positions? Why, it might just be like having all of American business run the way Steve Jobs, Jeff Bezos and John Chambers have led their big companies. I struggle to see how that would be a bad thing.