by Adam Hartung | Jun 14, 2016 | Defend & Extend, Investing, Leadership, Web/Tech

Microsoft is buying Linked-In, and we should expect this to be a disaster.

It is clear why Linked-in agreed to be purchased. As revenues have grown, gross margins have dropped precipitously, and the company is losing money. And LInked-in still receives 2/3 of its revenue from recruiting ads (the balance is almost wholly subscription fees,) unable to find a wider advertiser base to support growth. Although membership is rising, monthly active users (MAUs, the most important gauge of social media growth) is only 9% – like Twitter, far below the 40% plus rate of Facebook and upcoming networks. With only 106M MAUs, Linked in is 1/3 the size of Twitter, and 1/15th the size of Facebook. And its $1.5B Lynda acquisition is far, far, far from recovering its investment – or even demonstrating viability as a business.

Even though the price is below the all-time highs for LNKD investors, Microsoft’s offer is far above recent trading prices and a big windfall for them.

But for Microsoft investors, this is a repeat of the pattern that continues to whittle away at their equity value.

Once upon a time, in a land far away, and barely remembered by young people, Microsoft OWNED the tech marketplace. Individuals and companies purchased PCs preloaded with Microsoft Windows 95, Microsoft Office, Microsoft Internet Explorer and a handful of other tools and trinkets. And as companies built networks they used PC servers loaded with Microsoft products. Computing was a Microsoft solution, beginning to end, for the vast majority of users.

Once upon a time, in a land far away, and barely remembered by young people, Microsoft OWNED the tech marketplace. Individuals and companies purchased PCs preloaded with Microsoft Windows 95, Microsoft Office, Microsoft Internet Explorer and a handful of other tools and trinkets. And as companies built networks they used PC servers loaded with Microsoft products. Computing was a Microsoft solution, beginning to end, for the vast majority of users.

But the world changed. Today PC sales continue their multi-year, accelerating decline, while some markets (such as education) are shifting to Chromebooks for low cost desktop/laptop computing, growing their sales and share. Meanwhile, mobile devices have been the growth market for years. Networks are largely public (rather than private) and storage is primarily in the cloud – and supplied by Amazon. Solutions are spread all around, from Google Drive to apps of every flavor and variety. People spend less computing cycles creating documents, spreadsheets and presentations, and a lot more cycles either searching the web or on Facebook, Instagram, WhatsApp, YouTube and Snapchat.

But Microsoft’s leadership still would like to capture that old world. They still hope to put the genie back in the bottle, and have everyone live and work entirely on Microsoft. And somehow they have deluded themselves into thinking that buying Linked-in will allow them to return to the “good old days.”

Microsoft has not done a good job of integrating its own solutions like Office 365, Skype, Sharepoint and Dynamics into a coherent, easy to use, and to some extent mobile, solution. Yet, somehow, investors are expected to believe that after buying Linked-in the two companies will integrate these solutions into the LInked-in social platform, enabling vastly greater adoption/use of Office 365 and Dynamics as they are tied to Linked-in Sales Navigator. Users will be thrilled to have their personal information analyzed by Microsoft big data tools, then sold to advertisers and recruiters. Meanwhile, corporations will come back to Microsoft in droves as they convert Linked-in into a comprehensive project management tool that uses Lynda to educate employees, and 365 to push materials to employees – and allow document collaboration – all across their mobile devices.

Do you really believe this? It might run on the Powerpoint operating system, but this vision will take an enormous amount of code integration. And with Linked-in operated as separate company within Microsoft, who is going to do this integration? This will involve a lot of technical capability, and based on previous performance it appears both companies lack the skills necessary to pull it off. How this mysterious, magical integration will happen is far, far from obvious, or explained in the announcement documents. Sounds a lot more like vaporware than a straightforward software project.

And who thinks that today’s users, from individuals to corporations, have a need for this vision? While it may sound good to Microsoft, have you heard Linked-in users saying they want to use 365 on Linked in? Or that they’ll continue to use Linked-in if forced to buy 365? Or that they want their personal information data mined for advertisers? Or that they desire integration with Dynamics to perform Linked-in based CRM? Or that they see a need for a social-network based project management tool that feeds up training documents or collaborative documents? Are people asking for an integrated, holistic solution from one vendor to replace their current mobile devices and mobile solutions that are upgraded by multiple vendors almost weekly?

And, who really thinks Microsoft is good at acquisition integration? Remember aQuantive? In 2007 Microsoft spent $6B (an 85% premium to market price) to purchase this digital ad agency in order to build its business in the fast growing digital ad space. Don’t feel bad if you don’t remember, because in 2012 Microsoft wrote it off. Of course, there was the buy-it-and-write-it-off pattern repeated with Nokia. Microsoft’s success at taking “bold moves” to expand beyond its core business has been nothing less than horrible. Even the $1.2B acquisition of Yammer in 2012 to make Sharepoint more collaborative and usable has been unsuccessful, even though rolled out for free to 365 users. Yammer is adding nothing to Microsoft’s sales or value as competitor Slack has reaped the growth in corporate messaging.

The only good news story about Microsoft acquisitions is that they missed spending $44B to buy Yahoo – which is now on the market for $5B. Whew, thank goodness that one got away!

Microsoft’s leadership primed the pump for this week’s announcement by having the Chairman talk about investing outside of the company’s core a couple of weeks ago. But the vast majority of analysts are now questioning this giant bet, at a price so high it will lower Microsoft’s earnings for 2 years. Analysts are projecting about a $2B revenue drop for $90B Microsoft next year, and this $26B acquisition will deliver only a $3B bump. Very, very expensive revenue replacement.

Despite all the lingo, Microsoft simply cannot seem to escape its past. Its acquisitions have all been designed to defend and extend its once great history – but now outdated. Customers don’t want the past, they are looking to the future. And no matter how hard they try, Microsoft’s leaders simply appear unable to define a future that is not tightly linked to the company’s past. So investors should expect Linked-In’s future to look a lot like aQuantive. Only this one is going to be the most painful yet in the long list of value transfer from Microsoft investors to the investors of acquired companies.

by Adam Hartung | Jun 9, 2016 | Innovation, Investing, Software, Teamwork

Last week Bloomberg broke a story about how Microsoft’s Chairman, John Thompson, was pushing company management for a faster transition to cloud products and services. He even recommended changes in spending might be in order.

Really? This is news?

Let’s see, how long has the move to mobile been around? It’s over a decade since Blackberry’s started the conversion to mobile. It was 10 years ago Amazon launched AWS. Heck, end of this month it will be 9 years since the iPhone was released – and CEO Steve Ballmer infamously laughed it would be a failure (due to lacking a keyboard.) It’s now been 2 years since Microsoft closed the Nokia acquisition, and just about a year since admitting failure on that one and writing off $7.5B And having failed to achieve even 3% market share with Windows phones, not a single analyst expects Microsoft to be a market player going forward.

So just now, after all this time, the Board is waking up to the need to change the resource allocation? That does seem a bit like looking into barn lock acquisition long after the horses are gone, doesn’t it?

The problem is that historically Boards receive almost all their information from management. Meetings are tightly scheduled affairs, and there isn’t a lot of time set aside for brainstorming new ideas. Or even for arguing with management assumptions. The work of governance has a lot of procedures related to compliance reporting, compensation, financial filings, senior executive hiring and firing – there’s a lot of rote stuff. And in many cases, surprisingly to many non-Directors, the company’s strategy may only be a topic once a year. And that is usually the result of a year long management controlled planning process, where results are reviewed and few challenges are expected. Board reviews of resource allocation are at the very, very tail end of management’s process, and commitments have often already been made – making it very, very hard for the Board to change anything.

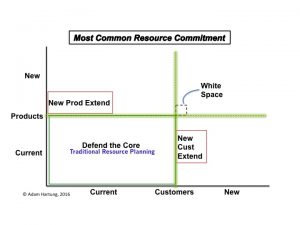

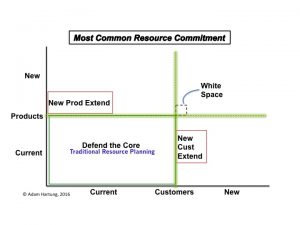

And these planning processes are backward-oriented tools, designed to defend and extend existing products and services, not predict changes in markets. These processes originated out of financial planning, which used almost exclusively historical accounting information. In later years these programs were expanded via ERP (Enterprise Resource Planning) systems (such as SAP and Oracle) to include other information from sales, logistics, manufacturing and procurement. But, again, these numbers are almost wholly historical data. Because all the data is historical, the process is fixated on projecting, and thus defending, the old core of historical products sold to historical customers.

Copyright Adam Hartung

Efforts to enhance the process by including extensions to new products or new customers are very, very difficult to implement. The “owners” of the planning processes are inherent skeptics, inclined to base all forecasts on past performance. They have little interest in unproven ideas. Trying to plan for products not yet sold, or for sales to customers not yet in the fold, is considered far dicier – and therefore not worthy of planning. Those extensions are considered speculation – unable to be forecasted with any precision – and therefore completely ignored or deeply discounted.

And the more they are discounted, the less likely they receive any resource funding. If you can’t plan on it, you can’t forecast it, and therefore, you can’t really fund it. And heaven help some employee has a really novel idea for a new product sold to entirely new customers. This is so “white space” oriented that it is completely outside the system, and impossible to build into any future model for revenue, cost or – therefore – investing.

Take for example Microsoft’s recent deal to sell a bunch of patent rights to Xiaomi in order to have Xiaomi load Office and Skype on all their phones. It is a classic example of taking known products, and extending them to very nearby customers. Basically, a deal to sell current software to customers in new markets via a 3rd party. Rather than develop these markets on their own, Microsoft is retrenching out of phones and limiting its investments in China in order to have Xiaomi build the markets – and keeping Microsoft in its safe zone of existing products to known customers.

The result is companies consistently over-investment in their “core” business of current products to current customers. There is a wealth of information on those two groups, and the historical info is unassailable. So it is considered good practice, and prudent business, to invest in defending that core. A few small bets on extensions might be OK – but not many. And as a result the company investment portfolio becomes entirely skewed toward defending the old business rather than reaching out for future growth opportunities.

This can be disastrous if the market shifts, collapsing the old core business as customers move to different solutions. Such as, say, customers buying fewer PCs as they shift to mobile devices, and fewer servers as they shift to cloud services. These planning systems have no way to integrate trend analysis, and therefore no way to forecast major market changes – especially negative ones. And they lack any mechanism for planning on big changes to the product or customer portfolio. All future scenarios are based on business as it has been – a continuation of the status quo primarily – rather than honest scenarios based on trends.

How can you avoid falling into this dilemma, and avoiding the Microsoft trap? To break this cycle, reverse the inputs. Rather than basing resource allocation on financial planning and historical performance, resource allocation should be based on trend analysis, scenario planning and forecasts built from the future backward. If more time were spent on these plans, and engaging external experts like Board Directors in discussions about the future, then companies would be less likely to become so overly-invested in outdated products and tired customers. Less likely to “stay at the party too long” before finding another market to develop.

If your planning is future-oriented, rather than historically driven, you are far more likely to identify risks to your base business, and reduce investments earlier. Simultaneously you will identify new opportunities worthy of more resources, thus dramatically improving the balance in your investment portfolio. And you will be far less likely to end up like the Chairman of a huge, formerly market leading company who sounds like he slept through the last decade before recognizing that his company’s resource allocation just might need some change.

by Adam Hartung | Oct 25, 2015 | Current Affairs, Defend & Extend, Food and Drink, In the Swamp, In the Whirlpool, Leadership, Web/Tech

This week McDonald’s and Microsoft both reported earnings that were higher than analysts expected. After these surprise announcements, the equities of both companies had big jumps. But, unfortunately, both companies are in a Growth Stall and unlikely to sustain higher valuations.

McDonald’s profits rose 23%. But revenues were down 5.3%. Leadership touted a higher same store sales number, but that is completely misleading.

McDonald’s leadership has undertaken a back to basics program. This has been used to eliminate menu items and close “underperforming stores.” With fewer stores, loyal customers were forced to eat in nearby stores – something not hard to do given the proliferation of McDonald’s sites. But some customers will go to competitors. By cutting stores and products from the menu McDonald’s may lower cost, but it also lowers the available revenue capacity. This means that stores open a year or longer could increase revenue, even though total revenues are going down.

Profits can go up for a raft of reasons having nothing to do with long-term growth and sustainability. Changing accounting for depreciation, inventory, real estate holdings, revenue recognition, new product launches, product cancellations, marketing investments — the list is endless. Further, charges in a previous quarter (or previous year) could have brought forward costs into an earlier report, making the comparative quarter look worse while making the current quarter look better.

Confusing? That’s why accounting changes are often called “financial machinations.” Lots of moving numbers around, but not necessarily indicating the direction of the business.

McDonald’s asked its “core” customers what they wanted, and based on their responses began offering all-day breakfast. Interpretation – because they can’t attract new customers, McDonald’s wants to obtain more revenue from existing customers by selling them more of an existing product; specifically breakfast items later in the day.

Sounds smart, but in reality McDonald’s is admitting it is not finding new ways to grow its customer base, or sales. The old products weren’t bringing in new customers, and new products weren’t either. As customer counts are declining, leadership is trying to pull more money out of its declining “core.” This can work short-term, but not long-term. Long-term growth requires expanding the sales base with new products and new customers.

Perhaps there is future value in spinning off McDonald’s real estate holdings in a REIT. At best this would be a one-time value improvement for investors, at the cost of another long-term revenue stream. (Sort of like Chicago selling all its future parking meter revenues for a one-time payment to bail out its bankrupt school system.) But if we look at the Sears Holdings REIT spin-off, which ostensibly was going to create enormous value for investors, we can see there were serious limits on the effectiveness of that tactic as well.

MIcrosoft also beat analysts quarterly earnings estimate. But it’s profits were up a mere 2%. And revenues declined 12% versus a year ago – proving its Growth Stall continues as well. Although leadership trumpeted an increase in cloud-based revenue, that was only an 8% improvement and obviously not enough to offset significant weakness in other markets:

It is a struggle to see the good news here. Office 365 revenues were up, but they are cannibalizing traditional Office revenues – and not fast enough to replace customers being lost to competitive products like Google OfficeSuite, etc.

Azure sales were up, but not fast enough to replace declining Windows sales. Further, Azure competes with Amazon AWS, which had remarkable results in the latest quarter. After adding 530 new features, AWS sales increased 15% vs. the previous quarter, and 78% versus the previous year. Margins also increased from 21.4% to 25% over the last year. Azure is in a growth market, but it faces very stiff competition from market leader Amazon.

We build our companies, jobs and lives around successful products and services. We want these providers to succeed because it makes our lives much easier. We don’t like to hear about large market leaders losing their strength, because it signals potentially difficult change. We want these companies to improve, and we will clutch at any sign of improvement.

As investors we behave similarly. We were told large companies have vast customer bases, strong asset bases, well known brands, high switching costs, deep pockets – all things Michael Porter told us in the 1980s created “moats” protecting the business, keeping it protected from market shifts that could hurt sales and profits. As investors we want to believe that even though the giant company may slip, it won’t fall. Time and size is on its side we choose to believe, so we should simply “hang on” and “ride it out.” In the future, the company will do better and value will rise.

As a result we see that Growth Stall companies show a common valuation pattern. After achieving high valuation, their equity value stagnates. Then, hopes for a turn-around and recovery to new growth is stimulated by a few pieces of good news and the value jumps again. Only after a few years the short-term tactics are used up and the underlying business weakness is fully exposed. Then value crumbles, frequently faster than remaining investors anticipated.

McDonald’s valuation rose from $62/share in 2008 to reach record $100/share highs in 2011. But valuation then stagnated. It is only this last jump that has caused it to reach new highs. But realize, this is on a smaller number of stores, fewer products and declining revenues. These are not factors justifying sustainable value improvement.

Microsoft traded around $25/share from March, 2003 through November, 2011 – 8.5 years. When the CEO was changed value jumped to $48/share by October, 2014. After dipping, now, a year later Microsoft stock is again reaching that previous valuation ($50/share). Microsoft is now valued where it was in December, 2002 (which is half its all-time high.)

The jump in value of McDonald’s and Microsoft happened on short-term news regarding beating analysts earnings expectations for one quarter. The underlying businesses, however, are still suffering declining revenue. They remain in Growth Stalls, and the odds are overwhelming that their values will decline, rather than continue increasing.

by Adam Hartung | Apr 2, 2015 | Current Affairs, Defend & Extend, In the Rapids, Innovation, Leadership, Web/Tech

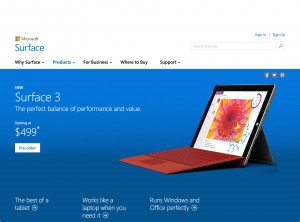

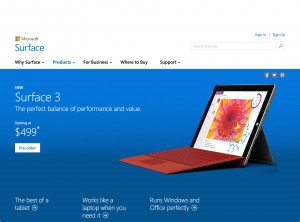

Microsoft launched its new Surface 3 this week, and it has been gathering rave reviews. Many analysts think its combination of a full Windows OS (not the slimmed down RT version on previous Surface tablets,) thinness and ability to operate as both a tablet and a PC make it a great product for business. And at $499 it is cheaper than any tablet from market pioneer Apple.

Meanwhile Apple keeps promoting the new Apple Watch, which was debuted last month and is scheduled to release April 24. It is a new product in a market segment (wearables) which has had very little development, and very few competitive products. While there is a lot of hoopla, there are also a lot of skeptics who wonder why anyone would buy an Apple Watch. And these skeptics worry Apple’s Watch risks diverting the company’s focus away from profitable tablet sales as competitors hone their offerings.

Looking at these launches gives a lot of insight into how these two companies think, and the way they compete. One clearly lives in red oceans, the other focuses on blue oceans.

Blue Ocean Strategy (Chan Kim and Renee Mauborgne) was released in 2005 by Harvard Business School Press. It became a huge best-seller, and remains popular today. The thesis is that most companies focus on competing against rivals for share in existing markets. Competition intensifies, features blossom, prices decline and the marketplace loses margin as competitors rush to sell cheaper products in order to maintain share. In this competitively intense ocean segments are niched and products are commoditized turning the water red (either the red ink of losses, or the blood of flailing competitors, choose your preferred metaphor.)

On the other hand, companies can choose to avoid this margin-eroding competitive intensity by choosing to put less energy into red oceans, and instead pioneer blue oceans – markets largely untapped by competition. By focusing beyond existing market demands companies can identify unmet needs (needs beyond lower price or incremental product improvements) and then innovate new solutions which create far more profitable uncontested markets – blue oceans.

Obviously, the authors are not big fans of operational excellence and a focus on execution, but instead see more value for shareholders and employees from innovation and new market development.

If we look at the new Surface 3 we see what looks to be a very good product. Certainly a product which is competitive. The Surface 3 has great specifications, a lot of adaptability and meets many user needs – and it is available at what appears to be a favorable price when compared with iPads.

But …. it is being launched into a very, very red ocean.

The market for inexpensive personal computing devices is filled with a lot of products. Don’t forget that before we had tablets we had netbooks. Low cost, scaled back yet very useful Microsoft-based PCs which can be purchased at prices that are less than half the cost of a Surface 3. And although Surface 3 can be used as a tablet, the number of apps is a fraction of competitive iOS and Android products – and the developer community has not yet embraced creating new apps for Windows tablets. So Surface 3 is more than a netbook, but also a lot more expensive.

Additionally, the market has Chromebooks which are low-cost devices using Google Chrome which give most of the capability users need, plus extensive internet/cloud application access at prices less than a third that of Surface 3. In fact, amidst the Microsoft and Apple announcements Google announced it was releasing a new ChromeBit stick which could be plugged into any monitor, then work with any Bluetooth enabled keyboard and mouse, to turn your TV into a computer. And this is expected to sell for as little as $100 – or maybe less!

This is classic red ocean behavior. The market is being fragmented into things that work as PCs, things that work as tablets (meaning run apps instead of applications,) things that deliver the functionality of one or the other but without traditional hardware, and things that are a hybrid of both. And prices are plummeting. Intense competition, multiple suppliers and eroding margins.

Ouch. The “winners” in this market will undoubtedly generate sales. But, will they make decent profits? At low initial prices, and software that is either deeply discounted or free (Google’s cloud-based MSOffice competitive products are free, and buyers of Surface 3 receive 1 year free of MS365 Office in the cloud, as well as free upgrade to Windows 10,) it is far from obvious how profitable these products will be.

Amidst this intense competition for sales of tablets and other low-end devices, Apple seems to be completely focused on selling a product that not many people seem to want. At least not yet. In one of the quirkier product launch messages that’s been used, Apple is saying it developed the Apple Watch because its other innovative product line – the iPhone – “is ruining your life.”

Apple is saying that its leaders have looked into the future, and they think today’s technology is going to move onto our bodies. Become far more personal. More interactive, more knowledgeable about its owner, and more capable of being helpful without being an interruption. They see a future where we don’t need a keyboard, mouse or other artificial interface to connect to technology that improves our productivity.

Right. That is easy to discount. Apple’s leaders are betting on a vision. Not a market. They could be right. Or they could be wrong. They want us to trust them. Meanwhile, if tablet sales falter….. if Surface 3 and ChromeBit do steal the “low end” – or some other segment – of the tablet market…..if smartphone sales slip….. if other “forward looking” products like ApplePay and iBeacon don’t catch on……

This week we see two companies fundamentally different methods of competing. Microsoft thinks in relation to its historical core markets, and engaging in bloody battles to win share. Microsoft looks at existing markets – in this case tablets – and thinks about what it has to do to win sales/share at all cost. Microsoft is a red ocean competitor.

Apple, on the other hand, pioneers new markets. Nobody needed an iPod… folks were happy enough with Sony Walkman and Discman. Everybody loved their Razr phones and Blackberries… until Apple gave them an iPhone and an armload of apps. Netbook sales were skyrocketing until iPads came along providing greater mobility and a different way of getting the job done.

Apple’s success has not been built upon defending historical markets. Rather, it has pioneered new markets that made existing markets obsolete. Its success has never looked obvious. Contrarily, many of its products looked quite underwhelming when launched. Questionable. And it has cannibalized its own products as it brought out new ones (remember when iPods were so new there was the iPod mini, iPod nano and iPod Touch? After 5 years of declining iPod sale Apple has stopped reporting them.) Apple avoids red oceans, and prefers to develop blue ones.

Which company will be more successful in 2020? Time will tell. But, since 2000 Apple has gone from nearly bankrupt to the most valuable publicly traded company in the USA. Since 1/1/2001 Microsoft has gone up 32% in value. Apple has risen 8,000%. While most of us prefer the competition in red oceans, so far Apple has demonstrated what Blue Ocean Strategy authors claimed, that it is more profitable to find blue oceans. And they’ve shown us they can do it.

by Adam Hartung | Nov 28, 2014 | Current Affairs, Innovation, Leadership, Web/Tech

Last week I gave 1,000 VHS video tapes to Goodwill Industries. These had been accumulated through 30 years of home movie watching, including tapes purchased for entertaining my 3 children.

It was startling to realize how many of these I had bought, and also surprising to learn they were basically valueless. Not because the content was outdated, because many are still popular titles. But rather because today the content someone wants can be obtained from a streaming download off Amazon or Netflix more conveniently than dealing with these tapes and a mechanical media player.

It isn’t just a shift in technology that made those tapes obsolete. Rather, a major trend has shifted. We don’t really seek to “own” things any more. We’ve become a world of “renters.”

The choice between owning and renting has long been an option. We could rent video tapes, and DVDs. But even though we often did this, most Boomers also ended up buying lots of them. Boomers wanted to own things. Owning was almost always considered better than renting.

Boomers wanted to own their cars, and often more than one. Auto renting was only for business trips. Boomers wanted to own their houses, and often more than one. Why rent a summer home, when, if you could afford it, you could own one. Rent a boat? Wouldn’t it be better to own your own boat (even if you only use it 10 times/year?)

Now we think very, very differently. I haven’t watched a movie on any hard media in several years. When I find time for video entertainment, I simply download what I want, enjoy it and never think about it again. A movie library seems – well – unnecessary.

As a Boomer, there’s all those CDs, cassette tapes (yes, I have them) and even hundreds of vinyl records I own. Yet, I haven’t listened to any of them in years. It’s far easier to simply turn on Pandora or Spotify – or listen to a channel I’ve constructed on YouTube. I really don’t know why I continue to own those old media players, or the media.

Since the big real estate meltdown many people are finding home ownership to be not as good as renting. Why take such a huge risk, paying that mortgage, if you don’t have to?

That this is a trend is even clearer generationally. Younger people really don’t see the benefit of home ownership, not when it means taking on so much additional debt. Home ownership costs are so high that it means giving up a lot of other things. And what’s the benefit? Just to say you own your home?

Where Boomers couldn’t wait to own a car, young people are far less likely. Especially in, or near, urban areas. The cost of auto ownership, including maintenance, insurance and parking, becomes really expensive. Compared with renting a ZipCar for a few hours when you really need a car, ownership seems not only expensive, but a downright hassle.

And technology has followed this trend. Once we wanted to own a PC, and on that PC we wanted to own lots of data – including movies, pictures, books – anything that could be digitized. And we wanted to own software applications to capture, view, alter and display that data. The PC was something that fit the Boomer mindset of owning your technology.

But that is rapidly becoming superfluous. With a mobile device you can keep all your data in a cloud. Data you want to access regularly, or data you want to rent. There’s no reason to keep the data on your own hard drive when you can access it 24×7 everywhere with a mobile device.

And the same is true for acting on the data. Software as a service (SaaS) apps allow you to obtain a user license for $10-$20/user, or $.99, or sometimes free. Why spend $200 (or a lot more) for an application when you can accomplish your task by simply downloading a mobile app?

So I no longer want to own a VCR player (or DVD player for that matter) to clutter up my family room. And I no longer want to fill a closet with tapes or cased DVDs. Likewise, I no longer want to carry around a PC with all my data and applications. Instead, a small, easy to use mobile device will allow me to do almost everything I want.

It is this mega trend away from owning, and toward a simpler lifestyle, that will end the once enormous PC industry. When I can do all I really want to do on my connected device – and in fact often do more things because of those hundreds of thousands of apps – why would I accept the size, weight, complexity, failure problems and costs of the PC?

And, why would I want to own something like Microsoft Office? It is a huge set of applications which contain dozens (hundreds?) of functions I never use. Wouldn’t life be much simpler, easier and cheaper if I acquire the rights to use the functionality I need, when I need it?

There was a time I couldn’t imagine living without my media players, and those DVDs, CDs, tapes and records. But today, I’m giving lots of them away – basically for recycling. While we still use PCs for many things today, it is now easy to visualize a future where I use a PC about as often as I now use my DVD player.

In that world, what happens to Microsoft? Dell? Lenovo?

The implications of this are far-reaching for not only our personal lives, and personal technology suppliers, but for corporate IT. Once IT managed mainframes. Then server farms, networks and thousands of PCs. What will a company need an IT department to do if employees use their own mobile devices, across common networks, using apps that cost a few bucks and store files on secure clouds?

If corporate technology is reduced to just operating some “core” large functions like accounting, how big – or strategic – is IT? The “T” (technology) becomes irrelevant as people focus on gathering and analyzing information. But that’s not been the historical training for IT employees.

Further, if Salesforce.com showed us that even big corporations can manage something as critical as their customer information in a SaaS environment on mobile devices, is it not possible to imagine accounting and supply chain being handled the same way? If so, what role will IT have at all?

The trend toward renting rather than owning is monumental. It affects every business. But in an ironic twist of fate, it may dramatically reduce the focus on IT that has been so critical for the Boomer generation.

Once upon a time, in a land far away, and barely remembered by young people, Microsoft OWNED the tech marketplace. Individuals and companies purchased PCs preloaded with Microsoft Windows 95, Microsoft Office, Microsoft Internet Explorer and a handful of other tools and trinkets. And as companies built networks they used PC servers loaded with Microsoft products. Computing was a Microsoft solution, beginning to end, for the vast majority of users.

Once upon a time, in a land far away, and barely remembered by young people, Microsoft OWNED the tech marketplace. Individuals and companies purchased PCs preloaded with Microsoft Windows 95, Microsoft Office, Microsoft Internet Explorer and a handful of other tools and trinkets. And as companies built networks they used PC servers loaded with Microsoft products. Computing was a Microsoft solution, beginning to end, for the vast majority of users.