by Adam Hartung | May 30, 2014 | Current Affairs, In the Swamp, In the Whirlpool, Leadership, Sports, Web/Tech

Anyone who reads my column knows I’ve been no fan of Steve Ballmer as CEO of Microsoft. On multiple occasions I chastised him for bad decisions around investing corporate funds in products that are unlikely to succeed. I even called him the worst CEO in America. The Washington Post even had difficulty finding reputable folks to disagree with my argument.

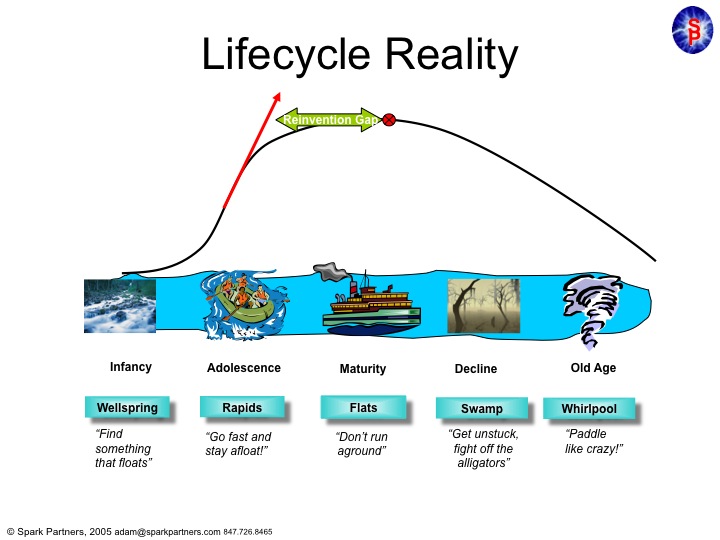

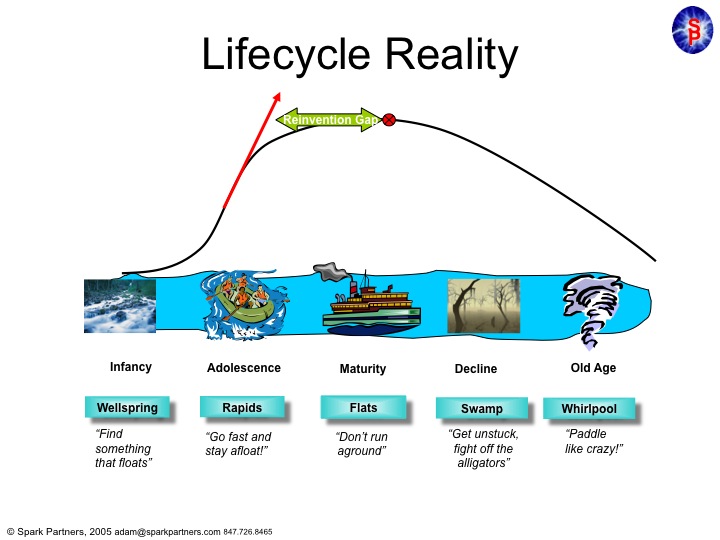

Unfortunately, Microsoft suffered under Mr. Ballmer. And Windows 8, as well as the Surface tablet, have come nowhere close to what was expected for their sales – and their ability to keep Microsoft relevant in a fast changing personal technology marketplace. In almost all regards, Mr. Ballmer was simply a terrible leader, largely because he had no understanding of business/product lifecycles.

Microsoft was founded by Bill Gates, who did a remarkable job of taking a start-up company from the Wellspring of an idea into one of the fastest growing adolescents of any American company.

Microsoft was founded by Bill Gates, who did a remarkable job of taking a start-up company from the Wellspring of an idea into one of the fastest growing adolescents of any American company.

Under Mr. Gates leadership Microsoft single-handedly overtook the original PC innovator – Apple – and left it a niche company on the edge of bankruptcy in little over a decade.

Mr. Gates kept Microsoft’s growth constantly in the double digits by not only making superior operating system software, but by pushing the company into application software which dominated the desktop (MS Office.) And when the internet came along he had the vision to be out front with Internet Explorer which crushed early innovator, and market maker, Netscape.

But then Mr. Gates turned the company over to Mr. Ballmer. And Mr. Ballmer was a leader lacking vision, or innovation. Instead of pushing Microsoft into new markets, as had Mr. Gates, he allowed the company to fixate on constant upgrades to the products which made it dominant – Windows and Office. Instead of keeping Microsoft in the Rapids of growth, he offered up a leadership designed to simply keep the company from going backward. He felt that Microsoft was a company that was “mature” and thus in need of ongoing enhancement, but not much in the way of real innovation. He trusted the market to keep growing, indefinitely, if he merely kept improving the products handed him.

As a result Microsoft stagnated. A “Reinvention Gap” developed as Vista, Windows 7, then Windows 8 and one after another Office updates did nothing to develop new customers, or new markets. Microsoft was resting on its old laurels – monopolistic control over desktop/laptop markets – without doing anything to create new markets which would keep it on the old growth trajectory of the Gates era.

Things didn’t look too bad for several years because people kept buying traditional PCs. And Ballmer famously laughed at products like Linux or Unix – and then later at entertainment devices, smart phones and tablets – as Microsoft launched, but then abandoned products like Zune, Windows CE phones and its own tablet. Ballmer kept thinking that all the market wanted was a faster, cheaper PC. Not anything really new.

And he was dead wrong. The Reinvention Gap emerged to the public when Apple came along with the iPod, iTunes, iPhone and iPad. These changed the game on Microsoft, and no longer was it good enough to simply have a better edition of an outdated technology. As PC sales began declining it was clear that Ballmer’s leadership had left the company in the Swamp, fighting off alligators and swatting at mosquitos with no strategy for how it would regain relevance against all these new competitors.

So the Board pushed him out, and demoted Gates off the Chairman’s throne. A big move, but likely too late. Fewer than 7% of companies that wander into the Swamp avoid the Whirlpool of demise. Think Univac, Wang, Lanier, DEC, Cray, Sun Microsystems (or Circuit City, Montgomery Wards, Sears.) The new CEO, Satya Nadella, has a much, much more difficult job than almost anyone thinks. Changing the trajectory of Microsoft now, after more than a decade creating the Reinvention Gap, is a task rarely accomplished. So rare we make heros of leaders who do it (Steve Jobs, Lou Gerstner, Lee Iacocca.)

So what will happen at the Clippers?

Critically, owning an NBA team is nothing like competing in the real business world. It is a closed marketplace. New competitors are not allowed, unless the current owners decide to bring in a new team. Your revenues are not just dependent upon you, but are even shared amongst the other teams. In fact your revenues aren’t even that closely tied to winning and losing. Season tickets are bought in advance, and with so many games away from home a team can do quite poorly and still generate revenue – and profit – for the owner. And this season the Indiana Pacers demonstrated that even while losing, fans will come to games. And the Philadelphia 76ers drew crowds to see if they would set a new record for the most consecutive games lost.

In America the major sports only modestly overlap, so you have a clear season to appeal to fans. And even if you don’t make it into the playoffs, you still share in the profits from games played by other teams. As a business, a team doesn’t need to win a championship to generate revenue – or make a profit. In fact, the opposite can be true as Wayne Huizenga learned owning the Championship winning Florida Marlins baseball team. He payed so much for the top players that he lost money, and ended up busting up the team and selling the franchise!

In short, owning a sports franchise doesn’t require the owner to understand lifecycles. You don’t have to understand much about business, or about business competition. You are protected from competitors, and as one of a select few in the club everyone actually works together – in a wholly uncompetitive way – to insure that everyone makes as much money as possible. You don’t even have to know anything about managing people, because you hire coaches to deal with players, and PR folks to deal with fans and media. And as said before whether or not you win games really doesn’t have much to do with how much money you make.

Most sports franchise owners are known more for their idiosyncrasies than their business acumen. They can be loud and obnoxious all they want (with very few limits.) And now that Mr. Ballmer has no investors to deal with – or for that matter vendors or cooperative parties in a complex ecosystem like personal technology – he doesn’t have to fret about understanding where markets are headed or how to compete in the future.

When it comes to acting like a person who knows little about business, but has a huge ego, fiery temper and loves to be obnoxious there is no better job than being a sports franchise owner. Mr. Ballmer should fit right in.

by Adam Hartung | Apr 1, 2014 | Current Affairs, Defend & Extend, In the Swamp, Leadership, Web/Tech

“Hope springs eternal in the human breast” (Alexander Pope)

As it does for most investors. People do not like to accept the notion that a business will lose relevancy, and its value will fall. Especially really big companies that are household brand names. Investors, like customers, prefer to think large, established companies will continue to be around, and even do well. It makes everyone feel better to have a optimistic attitude about large, entrenched organizations.

And with such optimism investors have cheered Microsoft for the last 15 months. After a decade of trading up and down around $26/share, Microsoft stock has made a significant upward move to $41 – a new decade-long high. This price has people excited Microsoft will reach the dot.com/internet boom high of $60 in 2000.

After discovering that Windows 8, and the Surface tablet, were nowhere near reaching sales expectations after Christmas 2012 – and that PC sales were declining faster than expected – investors were cheered in 2013 to hear that CEO Steve Ballmer would resign. After much speculation, insider Satya Nadella was named CEO, and he quickly made it clear he was refocusing the company on mobile and cloud. This started the analysts, and investors, on their recent optimistic bent.

CEO Nadella has cut the price of Windows by 70% in order to keep hardware manufacturers on Windows for lower cost machines, and he announced the company’s #1 sales and profit product – Office – was being released on iOS for iPad users. Investors are happy to see this action, as they hope that it will keep PC sales humming. Or at least slow the decline in sales while keeping manufacturers (like HP) in the Microsoft Windows fold. And investors are likewise hopeful that the long awaited Office announcement will mean booming sales of Office 365 for all those Apple products in the installed base.

But, there’s a lot more needed for Microsoft to succeed than these announcements. While Microsoft is the world’s #1 software company, it is still under considerable threat and its long-term viability remains unsure.

Windows is in a tough spot. After this price decline, Microsoft will need to increase sales volume by 2.5X to recoup lost profits. Meanwhile, Chrome laptops are considerably cheaper for customers and more profitable for manufacturers. And whether this price cut will have any impact on the decline in PC sales is unclear, as users are switching to mobile products for ease-of-use reasons that go far beyond price. Microsoft has taken an action to defend and extend its installed base of manufacturers who have been threatening to move, but the impact on profits is still likely to be negative and PC sales are still going to decline.

Meanwhile, the move to offer Office on iOS is clearly another offer to defend the installed Office marketplace, and unlikely to create a lot of incremental revenue and profit growth. The PC market has long been much bigger than tablets, and almost every PC had Office installed. Shrinking at 12-14% means a lot less Windows Office is being sold. And, In tablets iOS is not 100% of the market, as Android has substantial share. Offering Office on iOS reaches a lot of potential machines, but certainly not 100% as has been the case with PCs.

Further, while there are folks who look forward to running Office on an iOS device, Office is not without competition. Both Apple and Google offer competitive products to Office, and the price is free. For price sensitive users, both individuals and corporations, after 4 years of using competitive products it is by no means a given they all are ready to pay $60-$100 per device per year. Yes, there will be Office sales Microsoft did not previously have, but whether it will be large enough to cover the declining sales of Office on the PC is far from clear. And whether current pricing is viable is far, far from certain.

While these Microsoft products are the easiest for consumers to understand, Nadella’s move to make Microsoft successful in the mobile/cloud world requires succeeding with cloud products sold to corporations and software-as-service providers. Here Microsoft is late, and facing substantial competition as well.

Just last week Google cut the price of its Compute Engine cloud infrastructure (IaaS) platform and App Engine cloud app platform (PaaS) products 30-32%. Google cut the price of its Cloud Storage and BigQuery (big data analytics) services by 68% and 85% as it competes headlong for customers with Amazon. Amazon, which has the first-mover position and large customers including the U.S. federal government, cut prices within 24 hours for its EC2 cloud computing service by 30%, and for its S3 storage service by over 50%. Amazon also reduced prices on its RDS database service approximately 28%, and its Elasticache caching service by over 33%.

To remain competitive, Microsoft had to react this week by chopping prices on its Azure cloud computing products 27%-35%, reducing cloud storage pricing 44%-65%, and whacking prices on its Windows and Linux memory-intensive computing products 27%-35%. While these products have allowed the networking division formerly run by now CEO Nadella to be profitable, it will be increasingly difficult to maintain old profit levels on existing customers, and even a tougher problem to profitably steal share from the early cloud leaders – even as the market grows.

While optimism has grown for Microsoft fans, and the share price has moved distinctly higher, it is smart to look at other market leaders who obtained investor favorability, only to quickly lose it.

Blackberry was known as RIM (Research in Motion) in June, 2007 when the iPhone was launched. RIM was the market leader, a near monopoly in smart phones, and its stock was riding high at $70. In August, 2007, on the back of its dominant status, the stock split – and moved on to a split adjusted $140 by end of 2008. But by 2010, as competition with iOS and Android took its toll RIM was back to $80 (and below.) Today the rechristened company trades for $8.

Sears was once the country’s largest and most successful retailer. By 2004 much of the luster was coming off when KMart purchased the company and took its name, trading at only $20/share. Following great enthusiasm for a new CEO (Ed Lampert) investors flocked to the stock, sure it would take advantage of historical brands such as DieHard, Kenmore and Craftsman, plus leverage its substantial real estate asset base. By 2007 the stock had risen to $180 (a 9x gain.) But competition was taking its toll on Sears, despite its great legacy, and sales/store started to decline, total sales started declining and profits turned to losses which began to stretch into 20 straight quarters of negative numbers. Meanwhile, demand for retail space declined, and prices declined, cutting the value of those historical assets. By 2009 the stock had dropped back to $40, and still trades around that value today — as some wonder if Sears can avoid bankruptcy.

Best Buy was a tremendous success in its early years, grew quickly and built a loyal customer base as the #1 retail electronics purveyor. But streaming video and music decimated CD and DVD sales. On-line retailers took a huge bite out of consumer electronic sales. By January, 2013 the stock traded at $13. A change of CEO, and promises of new formats and store revitalization propped up optimism amongst investors and by November, 2014 the stock was at $44. However, market trends – which had been in place for several years – did not change and as store sales lagged the stock dropped, today trading at only $25.

Microsoft has a great legacy. It’s products were market leaders. But the market has shifted – substantially. So far new management has only shown incremental efforts to defend its historical business with product extensions – which are up against tremendous competition that in these new markets have a tremendous lead. Microsoft so far is still losing money in on-line and gaming (xBox) where it has lost almost all its top leadership since 2014 began and has been forced to re-organize. Nadella has yet to show any new products that will create new markets in order to “turn the tide” of sales and profits that are under threat of eventual extinction by ever-more-capable mobile products.

While optimism springs eternal long-term investors would be smart to be skeptical about this recent improvement in the stock price. Things could easily go from mediocre to worse in these extremely competitive global tech markets, leaving Microsoft optimists with broken dreams, broken hearts and broken portfolios.

Update: On April 2 Microsoft announced it is providing Windows for free to all manufacturers with a 9″ or smaller display. This is an action to help keep Microsoft competitive in the mobile marketplace – but it does little for Microsoft profitability. Android from Google may be free, but Google’s business is built on ad sales – not software sales – and that’s dramatically different from Microsoft that relies almost entirely on Windows and Office for its profitability

Update: April 3 CRN (Computer Reseller News) reviewed Office products for iOS – “We predict that once the novelty of “Office for iPad” wears off, companies will go back to relying on the humble, hard-working third parties building apps that are as stable, as handsome and far more capable than those of Redmond. It’s not that hard to do.”

by Adam Hartung | Sep 4, 2013 | Current Affairs, Defend & Extend, In the Whirlpool, Leadership, Lock-in, Web/Tech

Just over a week after Microsoft announces plans to replace CEO Steve Ballmer the company announced it will spend $7.2B to buy the Nokia phone/tablet business. For those looking forward to big changes at Microsoft this was like sticking a pin in the big party balloon!

Everyone knows that Microsoft's future is at risk now that PC sales are declining globally at nearly 10% – with developing markets shifting even faster to mobile devices than the USA. And Microsoft has been the perpetual loser in mobile devices; late to market and with a product that is not a game changer and has only 3% share in the USA.

But, despite this grim reality, Microsoft has doubled-down (that's doubled its bet for non-gamblers) on its Windows 8 OS strategy, and continues to play "bet the company". Nokia's global market share has shriveled to 15% (from 40%) since former Microsoft exec-turned-Nokia-CEO Stephen Elop committed the company to Windows 8. Because other Microsoft ecosystem companies like HP, Acer and HP have been slow to bring out Win 8 devices, Nokia has 90% of the miniscule market that is Win 8 phones. So this acquisition brings in-house a much deeper commitment to spending on an effort to defend & extend Microsoft's declining O/S products.

As I predicted in January, the #1 action we could expect from a Ballmer-led Microsoft is pouring more resources into fighting market leaders iOS and Android – an unwinnable war. Previously there was the $8.5B Skype and the $400M Nook, and now a $7.2B Nokia. And as 32,000 Nokia employees join Microsoft losses will surely continue to rise. While Microsoft has a lot of cash – spending it at this rate, it won't last long!

Some folks think this acquisition will make Microsoft more like Apple, because it now will have both hardware and software which in some ways is like Apple's iPhone. The hope is for Apple-like sales and margins soon. But, unfortunately, Google bought Motorola months ago and we've seen that such revenue and profit growth are much harder to achieve than simply making an acquisition. And Android products are much more popular than Win8. Simply combining Microsoft and Nokia does not change the fact that Win8 products are very late to market, and not very desirable.

Some have postulated that buying Nokia was a way to solve the Microsoft CEO succession question, positioning Mr. Elop for Mr. Ballmer's job. While that outcome does seem likely, it would be one of the most expensive recruiting efforts of all time. The only reason for Mr. Elop to be made Microsoft CEO is his historical company relationship, not performance. And that makes Mr. Elop is exactly the wrong person for the Microsoft CEO job!

In October, 2010 when Mr. Elop took over Nokia I pointed out that he was the wrong person for that job – and he would destroy Nokia by making it a "Microsoft shop" with a Microsoft strategy. Since then sales are down, profits have evaporated, shareholders are in revolt and the only good news has been selling the dying company to Microsoft! That's not exactly the best CEO legacy.

Mr. Elop's job today is to sell more Win8 mobile devices. Were he to be made Microsoft CEO it is likely he would continue to think that is his primary job – just as Mr. Ballmer has believed. Neither CEO has shown any ability to realize that the market has already shifted, that there are two leaders far, far in front with brand image, products, apps, developers, partners, distribution, market share, sales and profits. And it is impossible for Microsoft to now catch up.

It is for good reason that short-term traders pushed down Microsoft's share value after the acquisition was announced. It is clear that current CEO Ballmer and Microsoft's Board are still stuck fighting the last war. Still trying to resurrect the Windows and Office businesses to previous glory. Many market anallysts see this as the last great effort to make Ballmer's bet-the-company on Windows 8 pay off. But that's a bet which every month is showing longer and longer odds.

Microsoft is not dead. And Microsoft is not without the ability to turn around. But it won't happen unless the Board recognizes it needs to steer Microsoft in a vastly different direction, reduce (rather than increase) investments in Win8 (and its devices,) and create a vision for 2020 where Microsoft is highly relevant to customers. So far, we're seeing all the wrong moves.

by Adam Hartung | Aug 23, 2013 | In the Swamp, Leadership, Software, Web/Tech

Steve Ballmer announced he would be retiring as CEO of Microsoft within the next 12 months. This extended timing, rather than immediately, shows clear the Board is ready for him to go but there is nobody ready to replace him.

The big question is, who would want Ballmer's job? It will be very tough to make Microsoft an industry leader again. What would his replacement propose to do? The fuse for a turnaround is short, and the options faint.

Microsoft has been on a downhill trajectory for at least 4 years. Although the company has introduced innovations in gaming (xBox and Kinect) as well as on-line (games and Bing), those divisions perpetually lose money. Stiff competitors Sony, Nintendo and Google have made these forays intellectually interesting, but of no value for investors or customers. The end-game for Microsoft has remained Windows – and as PC sales decline that's very bad news.

Microsoft viability has been firmly tied to Windows and Office sales. Historically these have been unassailable products, creating over 100% of the profits at Microsoft (covering losses in other divisions.) But, these products have lost growth, and relevancy. Windows 8 and Office 365 are product nobody really cares about, while they keep looking for updates from Apple, Google, Amazon and Samsung.

The market started going mobile 10 years ago. As Apple and Google promoted increased mobility, Microsoft tried to defend & extend its PC stronghold. It was a classic business inflection point in the making. Everyone knew at some point mobile devices would be more important than PCs. But most industry insiders (including Microsoft) kept thinking it would be later rather than sooner.

They were wrong. The shift came a lot faster than expected. Like in sailboat racing, suddenly the wind was taken out of Microsoft's sails as competitors shot to the lead in customer interest. While people were excited for new smartphones and tablets, Microsoft tried to re-engineer its historical product as an extension into the new market.

Windows 8 tablets and Surface tablets were ill-fated from the beginning. They did not appeal to the huge installed base of Windows customers, because changes like touch screens and tiles simply were too expensive and too behaviorally different. And they offered no advantage for people to switch that had already started buying iOS and Android products. Not to mention an app availability about 10% of the market leaders. Simply put, investing in Windows 8 and its own tablet was like adding bricks to a downhill runaway truck (end-of-life for PCs) – it sped up the time to an inevitable crash.

And spending money on poorly thought out investments like the Barnes & Noble Nook merely demonstrated Microsoft had money to burn, rather than a strategy for competing. Skype cost some $8B, but how has that helped Microsoft become more competive? It's not just an overspending on internal projects that failed to achieve any market success, but a series of wasted investments in bad acquisitions that showed Microsoft had no idea how it was going to regain industry leadership in a changing marketplace going more mobile and into the cloud every month.

Now the situation is pretty dire, and now is the time for Microsoft to give up on its defend and extend strategy for Windows/Office. Customers are openly uninterested in new laptops running Windows 8. And Win 8.1 will not change this lackadaisical attitude. Nobody is interested in Windows 8 phones, or tablets. This has left companies in the Microsoft ecosystem like HP, Dell and Nokia gasping for air as sales tumble, profits evaporate and customers flock to new solutions from Apple and Samsung. Instead of seeking out an update to Office for a new PC, people are using much lighter (and cheaper) cloud services from Amazon and office solutions like Google docs. And most of those old add-on product sales, like printers and servers, are disappearing into the cloud and mobile displays.

So now, after being forced to write off Surface and report a horrible quarter, the Board has pushed Ballmer out the door. Pretty remarkable. But, incredibly late. Just like the leaders at RIM stayed too long, leaving the company with no future options as Blackberry sales plummeted, Ballmer is taking leave as sales, profits and cash flow are taking a turn for the worst. And only months after a reorganization that simply made the whole situation a lot more confusing for not only investors, but internal managers and employees.

Microsoft has a big cash hoard, but how long will that last? As its distribution system falters, and sales drop, the costs will rapidly catch up with cash flow. Big layoffs are a certainty; think half the workforce in 2 years. Equally certain are sales of divisions (who can buy xBox market share and turn it competitively profitable?) or shut-downs (how long will Bing stay alive when it is utterly unnecessary and expensive to maintain?)

But, there is a better option. Without the cash from

Windows/Office, you can't keep much of the rest of Microsoft walking. So

now is the time to cut investments in Windows/Office and put money into the

best things Microsoft has going – primarily Kinect and cloud services. A radical restructuring of its spending and investments.

Kinect is an incredible product. It has found multiple applications Microsoft fails to capitalize upon. Kinect has the possibility of becoming the centerpiece for managing how we connect to data, how we store data, how we find data. It can bring together our smartphone, tablet and historical laptop worlds – and possibly even connect this to traditional TV and radio. It can be the centerpiece for two-way communications (think telephone or skype via all your devices.) Coupled with the right hardware, it can leapfrog iTV (which we still are waiting to see) and Cisco simultaneously.

In cloud services it will take a lot to compete with leaders Amazon, IBM, Apple and Google. They have made big investments, and are far in front. But, this is the bread-and-butter market for Microsoft. Millions of small businesses that want easy to use BYOD (bring your own device) environment, and easy access to data, documents and functionality for IT, like guaranteed data back-up and uptime, and user functionality like all those apps. These customers have relied on Microsoft for these kind of services for years, and would enjoy a services provider with an off-the-shelf product they can implement easily and cheaply that supports all their needs. Expensive to develop, but a growing market where Microsoft has a chance to leapfrog competitors.

As for Bing, give it to Yahoo – if Marissa Mayer will take it. Stop the bloodletting and get out of a market where Microsoft has never succeeded. Bing is core to Yahoo's business. If you can trade for some Yahoo stock, go for it. Let Yahoo figure out how to sell content and ads, while Microsoft refocuses on the new platform for 2017; from the user to the infrastructure services.

Strong leaders have their benefits. But, when they don't understand market shifts, and spend far too long trying to defend & extend past markets, they can put their organizations in terrible jeopardy of total failure. Ballmer leaves no with clear replacement, nor with any vision in place for leapfrogging competitors and revitalizing Microsoft.

So it is imperative the new leader provide this kind of new thinking. There are trends developing that create future scenarios where Microsoft can once again be a market leader. And it will be the role of the new CEO to identify that vision and point Microsoft's investments in the right direction to regain viability by changing the game on the current winners.

by Adam Hartung | Jun 5, 2013 | Current Affairs, Defend & Extend, In the Whirlpool, Leadership, Web/Tech

Microsoft CEO Steve Ballmer appears to be planning a major reorganization. The apparent objective is to help the company move toward becoming a "devices and services company" as presented in the company's annual shareholder letter last October.

But, the question for investors is whether this is a crafty move that will help Microsoft launch renewed profitable growth, or is it leadership further confusing customers and analysts while leaving Microsoft languishing in stalled markets? After all, the shares are up some 31% the last 6 months and it is a good time to decide if an investor should buy, hold or sell.

There are a lot of things not going well for Microsoft right now.

Everyone knows PC sales have started dropping. IDC recently lowered its forecast for 2013 from a decline of 1.3% to negative 7.8%. The mobile market is already larger than PC sales, and IDC now expects tablet sales (excluding smartphones) will surpass PCs in 2015. Because the PC is Microsoft's "core" market – producing almost all the company's profitability – declining sales are not a good thing.

Microsoft hoped Windows 8 would reverse the trend. That has not happened. Unfortunately, ever since being launched Windows 8 has underperformed the horrific sales of Vista. Eight months into the new product it is selling at about half the rate Vista did back in 2007 – which was the worst launch in company history. Win8 still has fewer users than Vista, and at 4% share 1/10th the share of market leaders Windows 7 and XP.

Microsoft is launching an update to Windows 8, called Windows 8.1 or "blue." But rather than offering a slew of new features to please an admiring audience the release looks more like an early "fix" of things users simply don't like, such as bringing back the old "start" button. Reviewers aren't talking about how exciting the update is, but rather wondering if these admissions of poor initial design will slow conversion to tablets.

And tablets are still the market where Microsoft isn't – even if it did pioneer the product years before the iPad. Bloomberg reported that Microsoft has been forced to cut the price of RT. So far historical partners such as HP and HTC have shunned Windows tablets, leaving Acer the lone company putting out Windows a mini-tab, and Dell (itself struggling with its efforts to go private) the only company declaring a commitment to future products.

And whether it's too late for mobile Windows is very much a real question. At the last shareholder meeting Nokia's investors cried loud and hard for management to abandon its commitment to Microsoft in favor of returning to old operating systems or moving forward with Android. This many years into the game, and with the Google and Apple ecosystems so far in the lead, Microsoft needed a game changer if it was to grab substantial share. But Win 8 has not proven to be a game changer.

In an effort to develop its own e-reader market Microsoft dumped some $300million into Barnes & Noble's Nook last year. But the e-reader market is fast disappearing as it is overtaken by more general-purpose tablets such as the Kindle Fire. Yet, Microsoft appears to be pushing good money after bad by upping its investment by another $1B to buy the rest of Nook, apparently hoping to obtain enough content to keep the market alive when Barnes & Noble goes the way of Borders. But chasing content this late, behind Amazon, Apple and Google, is going to be much more costly than $1B – and an even lower probability than winning in hardware or software.

Then there's the new Microsoft Office. In late May Microsoft leadership hoped investors would be charmed to hear that 1M $99 subscriptions had been sold in 3.5 months. However, that was to an installed base of hundreds of millions of PCs – a less than thrilling adoption rate for such a widely used product. Companies that reached 1M subscribers from a standing (no installed base) start include Instagram in 2.5 months, Spotify in 5 months, Dropbox in 7 months and Facebook (which pioneered an entire new marketplace in Social) in only 10 months. One could have easily expected a much better launch for a product already so widely used, and offered at about a third the price of previous licenses.

A new xBox was launched on May 21st. Unfortunately, like all digital markets gaming is moving increasingly mobile, and consoles show all the signs of going the way of desktop computers. Microsoft hopes xBox can become the hub of the family room, but we're now in a market where a quarter of homes lead by people under 50 don't really use "the family room" any longer.

xBox might have had a future as an enterprise networking hub, but so far Kinnect has not even been marketed as a tool for business, and it has not yet incorporated the full network functionality (such as Skype) necessary to succeed at creating this new market against competitors like Cisco.

Thankfully, after more than a decade losing money, xBox reached break-even recently. However, margins are only 15%, compared to historical Microsoft margins of 60% in "core" products. It would take a major growth in gaming, plus a big market share gain, for Microsoft to hope to replace lost PC profits with xBox sales. Microsoft has alluded to xBox being the next iTunes, but lacking mobility, or any other game changer, it is very hard to see how that claim holds water.

The Microsoft re-org has highlighted 3 new divisions focused on servers and tools, Skype/Lync and xBox. What is to happen with the business which has driven three decades of Microsoft growth – operating systems and office software – is, well, unclear. How upping the focus on these three businesses, so late in the market cycle, and with such low profitability will re-invigorate Microsoft's value is, well, unclear.

In fact, given how Microsoft has historically made money it is wholly unclear what being a "devices and services" company means. And this re-organization does nothing to make it clear.

My past columns on Microsoft have led some commenters to call me a "Microsoft hater." That is not true. More apt would be to say I am a Microsoft bear. Its historical core market is shrinking, and Microsoft's leadership invested far too much developing new products for that market in hopes the decline would be delayed – which did not work. By trying to defend and extend the PC world Microsoft's leaders chose to ignore the growing mobile market (smartphones and tablets) until far too late – and with products which were not game changers.

Although Microsoft's leaders invested heavily in acquisitions and other markets (Skype, Nook, xBox recently) those very large investments came far too late, and did little to change markets in Microsoft's favor. None of these have created much excitement, and recently Rick Sherland at Nomura securities came out with a prediction that Microsoft might well sell the xBox division (a call I made in this column back in January.)

As consumers, suppliers and investors we like the idea of a near-monopoly. It gives us comfort to believe we can trust in a market leader to bring out new products upon which we can rely – and which will continue to make long-term profits. But, good as this feels, it has rarely been successful. Markets shift, and historical leaders fall as new competitors emerge; largely because the old leadership continues investing in what they know rather than shifting investments early into new markets.

This Microsoft reorganization appears to be rearranging the chairs on the Titanic. The mobile iceberg has slashed a huge gash in Microsoft's PC hull. Leadership keeps playing familiar songs, but the boat cannot float without those historical PC profits. Investors would be smart to flee in the lifeboat of recent share price gains.

Microsoft was founded by Bill Gates, who did a remarkable job of taking a start-up company from the Wellspring of an idea into one of the fastest growing adolescents of any American company.

Microsoft was founded by Bill Gates, who did a remarkable job of taking a start-up company from the Wellspring of an idea into one of the fastest growing adolescents of any American company.