by Adam Hartung | May 20, 2021 | Computing, Innovation, Investing, Leadership, Software, Strategy, Trends

Stuck on the Core

This week, to almost no fanfare, a Microsoft Vice President issued a statement saying that Windows 10X (planned for 2019) would not ship in 2021. In fact, it would never ship. The technology enhancements would be integrated into existing Windows, and other products. While this gained little press, it is great news for customers and investors.

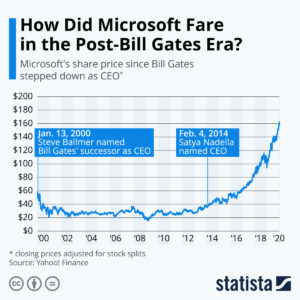

CEO Satya Nadella has officially changed the course of Microsoft. Under former CEO Ballmer the behemoth kept pouring money into Windows and Office. While the world was moving from PCs and PC servers to mobile devices and the cloud, Ballmer just kept pouring billions into old products. His slavish insistence on trying to defend & extend an old “core product line,” which every year was losing importance as PC sales slowed, was killing Microsoft — leading me to call Mr. Ballmer the worst CEO in America (my Forbes column that was by far the most read of any I ever penned.) After more than a decade as CEO, Ballmer had spent a lot of Microsoft money on new versions of its ancient product and bad acquisitions like Skype and Nokia, but he entirely missed the market shift in his customer base. In my blog post, “Microsoft, What Next?”, I described the challenges ahead to pull Microsoft out of the Growth Stall.

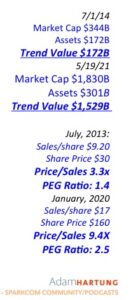

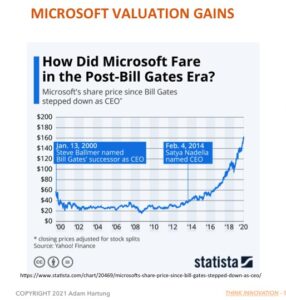

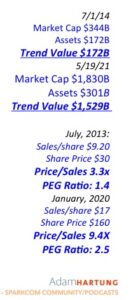

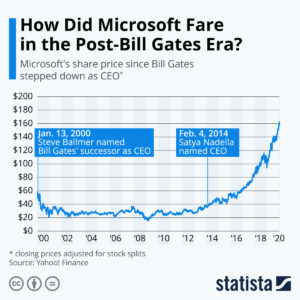

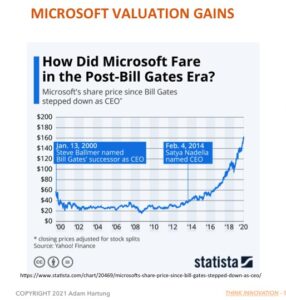

This chart shows just how much Microsoft has changed since Nadella took over. During Ballmer’s 13+ year leadership Microsoft’s valuation barely budged. (From left to small blue box.) But, Nadella rapidly shifted investments from Windows and Office to software as a service and cloud computing. (Graph rapidly increases.) That radical redirection enlivened both sales and earnings – and the company’s future growth prospects. In short, where the company had been locked-in to defending & extending its past, Nadella redirected the company onto trends. By doing so, he improved sales per/share 85%, the price/sales ratio from 3.3x to 9.4x, and the PEG ratio from 1.4 to 2.5. The company’s “trend value” (market cap increase over assets due to aligning with trends) since Nadella took charge has grown from $172 billion to a staggering $1.53 trillion!!! Now that is wealth creation!!!

This chart shows just how much Microsoft has changed since Nadella took over. During Ballmer’s 13+ year leadership Microsoft’s valuation barely budged. (From left to small blue box.) But, Nadella rapidly shifted investments from Windows and Office to software as a service and cloud computing. (Graph rapidly increases.) That radical redirection enlivened both sales and earnings – and the company’s future growth prospects. In short, where the company had been locked-in to defending & extending its past, Nadella redirected the company onto trends. By doing so, he improved sales per/share 85%, the price/sales ratio from 3.3x to 9.4x, and the PEG ratio from 1.4 to 2.5. The company’s “trend value” (market cap increase over assets due to aligning with trends) since Nadella took charge has grown from $172 billion to a staggering $1.53 trillion!!! Now that is wealth creation!!!

In the years leading up to Ballmer’s firing I was a very loud critic of Microsoft. In multiple Forbes columns, (republished as blogs on my web site) I pushed for his ouster. But even more importantly I gave the company little hope of long term viability. By over-investing in outdated products it seemed most likely Microsoft would go the way of Hostess Baking, Sears, DEC and Sun Microsystems – irrelevant leading to failure. I rabidly recommended not owning Microsoft.

Microsoft Stock

2014-2021

The Impossible Just Takes a little Longer…

But Nadella achieved the improbable. Much like Jobs when he retook the reigns at Apple, Nadella quit looking (and investing) in the rear view mirror. Like Jobs, he dropped investing in PC’s. Instead he focused on the future, and where Jobs invested in mobility, Nadella has invested in the cloud. Very few companies make this kind of radical shift in resourcing projects, even when it is the obviously right thing to do. And Nadella deserves the credit for making this radical change in Microsoft, saving the company from near-oblivion while creating a very viable, valuable company in a short time. Where once I saw a company heading for infamy, now Microsoft shows all signs of leadership toward the next technology wave and longevity. Quietly saying the company has no plans for a new Windows version, which nobody cares about anyway, is a tremendous demonstration of looking forward rather than backward.

Jump the Re-Invention Gap

Do you have the insight to know when you’re company is over-investing in past solutions as markets shift? Are you like Ballmer, always making the next version of what once made you great, or are you like CEO Nadella – ready to unload your past focus in order to seek future growth? Are you letting market trends guide your investing and solution development, allowing you to de-invest in outdated technologies and products? Like Reed Hastings at Netflix, do you see the need to pivot? Netflix changed from an outdated business model (shipping DVDs and tapes) to a new model (streaming) in order to keep your company viable, and an industry leader. You must be if you want to thrive in the rapidly changing competitive marketplace of the 2020’s.

Do you have the insight to know when you’re company is over-investing in past solutions as markets shift? Are you like Ballmer, always making the next version of what once made you great, or are you like CEO Nadella – ready to unload your past focus in order to seek future growth? Are you letting market trends guide your investing and solution development, allowing you to de-invest in outdated technologies and products? Like Reed Hastings at Netflix, do you see the need to pivot? Netflix changed from an outdated business model (shipping DVDs and tapes) to a new model (streaming) in order to keep your company viable, and an industry leader. You must be if you want to thrive in the rapidly changing competitive marketplace of the 2020’s.

Did you see the trends, and were you expecting the changes that would happen to your demand? It IS possible to use trends to make good forecasts, and prepare for big market shifts. If you don’t have time to do it, perhaps you should contact us, Spark Partners. We track hundreds of trends, and are experts at developing scenarios applied to your business to help you make better decisions.

TRENDS MATTER. If you align with trends your business can do GREAT! Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business. Click for Assessment info. Or, to keep up on trends, subscribe to our weekly podcasts and posts on trends and how they will affect the world of business at www.SparkPartners.com

Give us a call or send an email. Adam@sparkpartners.com 847-726-8465.

by Adam Hartung | Dec 29, 2020 | eBooks, Innovation, Investing, Strategy, Trends

Thrive to the Future – 4 top trends for 2021 and beyond.

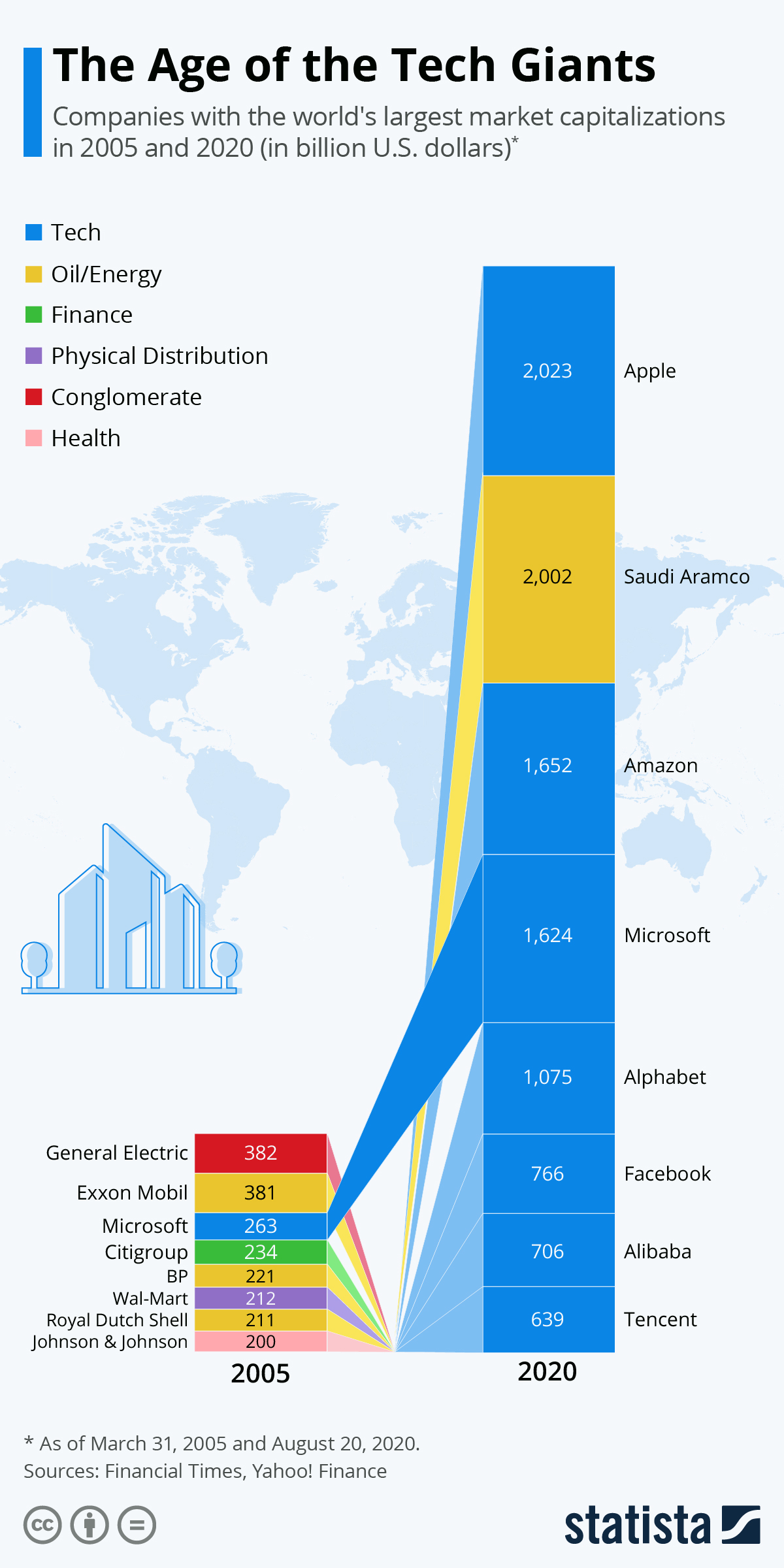

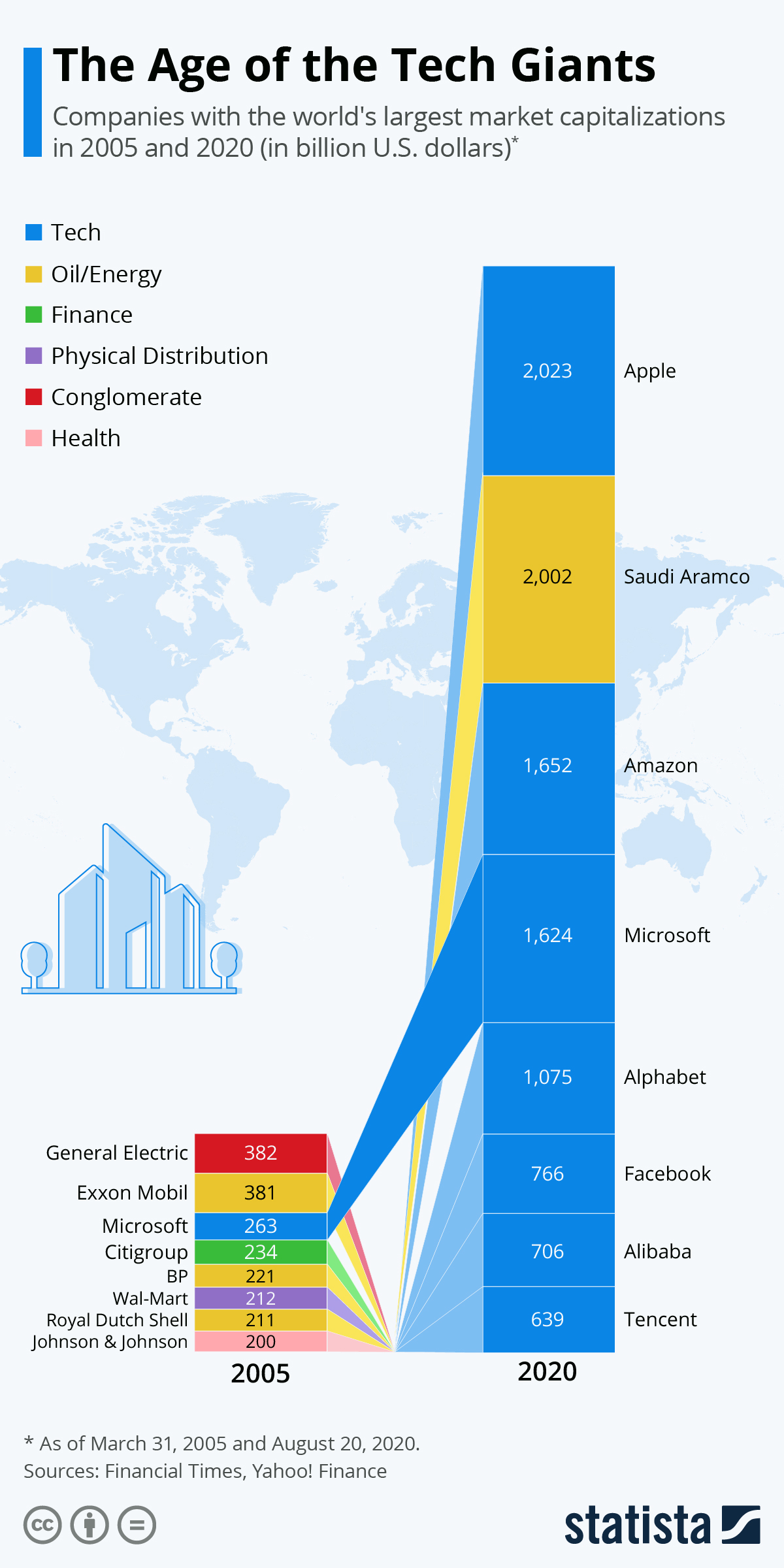

When looking at America’s 8 largest companies, a LOT has changed in 15 years. Back in 2005 the most valuable company was GE. The list was dominated by oil & gas companies; ExxonMobil, BP, Royal Dutch Shell. The biggest bank (Citi) and biggest retailer (Walmart) and 1 pharma company (J&J.) There was only 1 tech company on the list (Microsoft.)

But the world has changed, and that has impacted these companies dramatically. Most had GREAT pasts, but they did not adapt to a changing world. GE’s market cap has fallen 75% as it failed to keep up with trends. Oil companies failed to move into renewables and other industries (like electric car production) and they’ve lost over HALF their value. Walmart is most noted for missing the e-commerce trend, the big banks were clobbered by the Great Recession and “big pharma” hasn’t produced a blockbuster for many years. All down significantly.

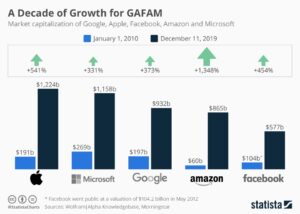

But, the value of the top 8 companies is MUCH higher than 15 years ago – 5X more. These losers were replaced by some very serious winners. From $2.1T in combined value, the top 8 are now worth $10.5T. But notably, only 1 company is still on that list – Microsoft – which is up 620%!

The list is now dominated by 7 technology companies.

And for good reason – they all followed trends. Apple, Amazon, Microsoft, Alphabet (Google,) Facebook, Alibaba and Tencent all built their strategies around developing solutions for people to follow the major trends of being mobile, operating asynchronously, supporting gig work and adding artificial intelligence (AI) to their customers. By refusing to rest on past laurels they have become the mega-giants of today. (Hartung, “Thrive to the Future – The 4 Top Trends for 2021 and Beyond)

That these companies would overtake old leaders was not a foregone conclusion – nor an obvious one to most people. Not only were the previous giants big, they had incredible reputations and extremely strong management teams. And these tech companies were not without problems.

That these companies would overtake old leaders was not a foregone conclusion – nor an obvious one to most people. Not only were the previous giants big, they had incredible reputations and extremely strong management teams. And these tech companies were not without problems.

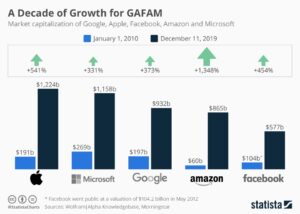

- Apple almost went bankrupt just a few years prior to 2005, trying to be the “Mac” company. But Apple built one innovation after another helping people meet the emerging big trends – until it became the most valuable company on the planet (10 yr value increase 540%)

- Microsoft was locked in to its Windows/Office domination and seemed unable (or unwilling) to acknowledge the big trends and its value languished under a terribly myopic CEO (Ballmer.) Yet, new leadership was able to see the trends and moved radically to build out cloud services and support for alternative customer solutions that changed the company and its fortunes (10 year value increase 330%)

- Amazon was a former book seller turned general merchandiser. But Amazon started applying technology to understand its customers and help them be better shoppers, using AI to make them the leader in all things e-commerce. Simultaneously Amazon built the worlds largest and most secure cloud services business (AWS) helping support all major trends (10 year value increase 1,350%)

- Google was a search engine, with an unclear business model. But Google went to unexpected lengths to make ALL forms of information digital, and accessible, and searchable. And it monetized that digitization in ways far beyond anyone expected leading to the end of newspapers and many other publishers (10 year value increase 370%)

- Facebook was considered a fad for young people. Most business leaders thought Facebook’s users would disappear, and its young leaders would learn there was no revenue in attracting eyeballs (just as News Corps learned and shut down MySpace.) But Facebook built out the trend for social contact in a mobile, asynchronous smart way creating an entirely new business market called “social media.” Facebook looked at trends in how people connected, making brilliant acquisitions early of Instagram and WhatsApp that allowed Facebook family of products to become the #1 use of the internet (10 year value increase 450%)

Key lessons?

First, the world is growing and leading businesses will grow. If you’re not growing, you’re dying. Just like GE and Exxon. Second, never plan from past success, but instead plan for the future. You don’t grow value by being operationally excellent, because the world is forever changing and it will make your past business less valuable even if you do run it well. Third, make sure your plans are all built on trends. Let trends be the wind in your sales, or the current under your boat, or whatever analogy you like – just be sure you’re using TRENDS to drive you business planning, product development and solutions generation. Customers buy trends and help for them to achieve the future.

Do you know your Value Proposition? Can you clearly state that Value Proposition without any linkage to your Value Delivery System? If not, you better get on that pretty fast. Otherwise, you’re very likely to end up like encyclopedias and newspaper companies. Or you’ll develop a neat technology that’s the next Segway. It’s always know your customer and their needs first, then create the solution. Don’t be a solution looking for an application. Hopefully Uber and Aurora will both now start heading in the right directions.

Did you see the trends, and were you expecting the changes that would happen to your demand? It IS possible to use trends to make good forecasts, and prepare for big market shifts. If you don’t have time to do it, perhaps you should contact us, Spark Partners. We track hundreds of trends, and are experts at developing scenarios applied to your business to help you make better decisions.

TRENDS MATTER. If you align with trends your business can do GREAT! Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business. Click for Assessment info. Or, to keep up on trends, subscribe to our weekly podcasts and posts on trends and how they will affect the world of business at www.SparkPartners.com

Give us a call or send an email. Adam@sparkpartners.com 847-331-6384

by Adam Hartung | Jan 16, 2020 | Boards of Directors, Defend & Extend, Leadership, Software, Web/Tech

People who follow my speaking and writing – including my over 400 Forbes columns – know that I preach the importance of growth. Successful organizations are agile – and agility is the sum of learning + adaptability. Smart organizations are constantly looking externally, gathering data, learning about markets and shifts – then structured to adopt those learnings into their business model and adapt the organization to new market needs.

Steve Ballmer was the antithesis of agility. For his entire career he knew only that  Windows and Office made all the money at Microsoft. So he kept investing in Windows and Office. He failed at everything else. False starts in phones, tablets, gaming – products came and went like ice cream cones on a hot August day. Ballmer laughed at the very notion of the iPhone ever being successful – while simultaneously throwing away $7.2B buying Nokia. Then there was $8.5B buying Skype. $400M buying the Borders Nook. Those were ridiculous acquisitions that just wasted shareholder money. To Ballmer, Microsoft’s future relied on maintaining Windows and Office.

Windows and Office made all the money at Microsoft. So he kept investing in Windows and Office. He failed at everything else. False starts in phones, tablets, gaming – products came and went like ice cream cones on a hot August day. Ballmer laughed at the very notion of the iPhone ever being successful – while simultaneously throwing away $7.2B buying Nokia. Then there was $8.5B buying Skype. $400M buying the Borders Nook. Those were ridiculous acquisitions that just wasted shareholder money. To Ballmer, Microsoft’s future relied on maintaining Windows and Office.

So as the market went mobile, Ballmer kept over-investing. He spent billions launching Windows 8, which I predicted was obviously going to fail at growing the Windows market as early as 2012. And it was easy to predict that Win8 tablets were going to be a bust when launched in 2012 as well. But Ballmer was “all-in” on Windows and Office. He was completely locked-in, and unwilling to even consider any data indicating that the PC market was dying – effectively driving Microsoft over a cliff.

It was not hard to identify Steve Ballmer as the worst CEO in America in 2012. When Ballmer took over Microsoft it was worth $60/share. He drove that value down to $20. And the company valuation was almost unchanged his entire 14 years as CEO. He remained locked-in to trying to Defend & Extend PC sales, and it did Microsoft no good. But when the Board replaced Ballmer with Nadella the company moved quickly into growth in gaming, and especially cloud services. In just 6 years Nadella has improved the company’s value by 400%!!!

Success is NOT about defending the past. Success IS about growth. Don’t be locked in to what worked before. Focus on what markets want and need – learn how to understand these needs – and then adapt to giving customers new solutions. Don’t make the mistakes of Ballmer – be a Nadella to lead your organization into growth opportunities!

by Adam Hartung | Jun 21, 2019 | Newsletter Post

The newsletters of Adam Hartung.

Keynote Speaker, Managing Partner, Author on Trends

Responding to Market Disruptions? Get Ahead of the Next One!

Market Threat Assessments

Recent studies of senior managers have shown that being blindsided by a disruption is the largest unresolved concern in strategy development today. That fear is too often real because disruption typically begins where it is least visible to management- on the fringes of the existing target markets. And, once the disruption “pirate ship” is sighted on the horizon, not only is it probably too late, but companies react poorly.

Research of corporate responses to disruption has shown that most companies ignore the threat, fortify existing positions or attempt to buy innovation. The first choice is not an option for an ongoing business. Fortification through distribution changes, product model proliferation and discounting only buys some additional time while wasting resources. Once a disruption enters the market, there’s little time for organic innovation efforts or “random acts of innovation” (Forbes) so companies often make acquisitions attempting to buy innovation.

Sadly, given the risk profile and limited experience in innovation, these are often sustaining innovations which are swept aside by the wave of disruption.

A very large example is when Microsoft fell behind in the  mobile market in 2014 and purchased Nokia, a weak player in mobile phones to get access to this market. The joint project, the Lumia phone, failed to catch on and Microsoft’s share fell by 50%- fail. Cisco tried to catch up with the photography trend by acquiring Pure Digital, the maker of low cost Flip cameras. Unfortunately, shortly after the acquisition, the high-resolution sensors included in smartphones took photography to a new level. Bye, Flip! Trend monitoring would have predicted this natural evolution as a high risk threat.

mobile market in 2014 and purchased Nokia, a weak player in mobile phones to get access to this market. The joint project, the Lumia phone, failed to catch on and Microsoft’s share fell by 50%- fail. Cisco tried to catch up with the photography trend by acquiring Pure Digital, the maker of low cost Flip cameras. Unfortunately, shortly after the acquisition, the high-resolution sensors included in smartphones took photography to a new level. Bye, Flip! Trend monitoring would have predicted this natural evolution as a high risk threat.

Even in successful acquisitions, founders often leave the firm, losing the source of innovative ideas long term. (Time, Inc.)

To anticipate external changes, marketing departments have embraced big data as a powerful tool to help companies identify new markets and consumer preferences. These tools use the past to predict the short-term future which is reasonable in a steady market. The problem is that big data cannot accurately anticipate dynamic disruptions.

But, you and your staff can.

Uncovering market opportunities that can deliver improved returns at a manageable risk for the firm is the goal. New products will also generate an increasing percentage of revenue leading to continued growth. Companies that master this process have a long range radar to identify potential opportunities in a process called, “continuous innovation”.

What’s on your company’s radar today?

Spark Partners is here to help as your coach on trends and innovation. We bring years of experience studying trends, organizations, and how to implement. We bring nimbleness to your strategy, and help you maximize your ability to execute.

Let us do an opportunity assessment for your organization. For less than your annual gym cost, or auto insurance premium, we could likely identify some good opportunities your blinders are hiding. Read my Assessment Page to learn more.

“Don’t plan for what you know. Plan for what you don’t know.”

Adam Hartung, Create Marketplace Disruption

For more on how to include trends in your planning, I’ve created a “how-to” that you can adapt for your team. See my

Status Quo Risk Management Playbook.

Give us a

call today, or send an email, so we can talk about how you can be a leader, rather than follower. Or check out the rest of the

website to read up on what we do so we can create the right level of engagement for you.

Hartung Recent Blog Posts on Leadership, Investing, Trends

Adam's book reveals the truth about how to use strategy to outpace the competition.

Follow Adam's coverage in the press and in other media.

Follow Adam's column in Forbes.

by Adam Hartung | May 9, 2019 | Innovation, Marketing, Strategy, Trends

Market Threat Assessment

Recent studies of senior managers have shown that being blindsided by a disruption is the largest unresolved concern in strategy development today.

That fear is too often real because disruption typically begins where it is least visible to management- on the fringes of the existing target markets. And, once the disruption “pirate ship” is sighted on the horizon, not only is it probably too late, but companies react poorly.

Some research of corporate responses to disruption has shown that most companies ignore the threat, fortify existing positions or attempt to buy innovation. The first choice is not an option for an ongoing business. Fortification through distribution changes, product model proliferation and discounting only buys some additional time while wasting resources. Once a disruption enters the market, there’s little time for organic innovation efforts so companies often make acquisitions attempting to buy innovation. Sadly, given the risk profile and limited experience in innovation, these are often sustaining innovations which are swept aside by the wave of disruption.

A very large example is when Microsoft fell behind in the mobile market in 2014 and purchased Nokia, a weak player in mobile phones to get access to this market. The joint project, the Lumina phone, failed to catch on and Microsoft’s share fell by 50%- fail. Cisco tried to catch up with the photography trend by acquiring Pure Digital, the maker of low cost Flip cameras. Unfortunately, shortly after the acquisition, the high-resolution sensors included in smartphones took photography to a new level. Bye, Flip! Trend monitoring would have predicted this natural evolution as a high risk threat.

To anticipate external changes, marketing departments have embraced big data as a powerful tool to help companies identify new markets and consumer preferences. These tools use the past to predict the short-term future which is reasonable in a steady market. The problem is that big data cannot anticipate dynamic disruption.

But, you and your staff can.

As a key input to your next strategy workshop, use trends! As a start, gather info from the people closest to your market and further using Porter’s five force model. See my articles on Scenarios to expand these trends to actionable goals.

What’s on your company’s radar today?

We are here to help as your coach on trends and innovation. We bring years of experience studying trends, organizations, and how to implement. We bring nimbleness to your strategy, and help you maximize your ability to execute.

Go the www.adamhartung.com and view the Assessment Page. Send me a reply to this email, or call me today, and let’s start talking about what trends will impact your organization and what you’ll need to do to pivot toward greater success.

This chart shows just how much Microsoft has changed since Nadella took over. During Ballmer’s 13+ year leadership Microsoft’s valuation barely budged. (From left to small blue box.) But, Nadella rapidly shifted investments from Windows and Office to software as a service and cloud computing. (Graph rapidly increases.) That radical redirection enlivened both sales and earnings – and the company’s future growth prospects. In short, where the company had been locked-in to defending & extending its past, Nadella redirected the company onto trends. By doing so, he improved sales per/share 85%, the price/sales ratio from 3.3x to 9.4x, and the PEG ratio from 1.4 to 2.5. The company’s “trend value” (market cap increase over assets due to aligning with trends) since Nadella took charge has grown from $172 billion to a staggering $1.53 trillion!!! Now that is wealth creation!!!

This chart shows just how much Microsoft has changed since Nadella took over. During Ballmer’s 13+ year leadership Microsoft’s valuation barely budged. (From left to small blue box.) But, Nadella rapidly shifted investments from Windows and Office to software as a service and cloud computing. (Graph rapidly increases.) That radical redirection enlivened both sales and earnings – and the company’s future growth prospects. In short, where the company had been locked-in to defending & extending its past, Nadella redirected the company onto trends. By doing so, he improved sales per/share 85%, the price/sales ratio from 3.3x to 9.4x, and the PEG ratio from 1.4 to 2.5. The company’s “trend value” (market cap increase over assets due to aligning with trends) since Nadella took charge has grown from $172 billion to a staggering $1.53 trillion!!! Now that is wealth creation!!! Do you have the insight to know when you’re company is over-investing in past solutions as markets shift? Are you like Ballmer, always making the next version of what once made you great, or are you like CEO Nadella – ready to unload your past focus in order to seek future growth? Are you letting market trends guide your investing and solution development, allowing you to de-invest in outdated technologies and products? Like Reed Hastings at Netflix, do you see the need to pivot? Netflix changed from an outdated business model (shipping DVDs and tapes) to a new model (streaming) in order to keep your company viable, and an industry leader. You must be if you want to thrive in the rapidly changing competitive marketplace of the 2020’s.

Do you have the insight to know when you’re company is over-investing in past solutions as markets shift? Are you like Ballmer, always making the next version of what once made you great, or are you like CEO Nadella – ready to unload your past focus in order to seek future growth? Are you letting market trends guide your investing and solution development, allowing you to de-invest in outdated technologies and products? Like Reed Hastings at Netflix, do you see the need to pivot? Netflix changed from an outdated business model (shipping DVDs and tapes) to a new model (streaming) in order to keep your company viable, and an industry leader. You must be if you want to thrive in the rapidly changing competitive marketplace of the 2020’s.