by Adam Hartung | Feb 3, 2016 | Current Affairs, Leadership, Lifecycle, Web/Tech

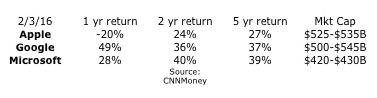

The three highest valued publicly traded companies today (2/3/16) are Google/Alphabet, Apple and Microsoft. All 3 are tech companies, and they compete – although with different business models – in multiple markets. However, investor views as to their futures are wildly different. And that has everything to do with how the leadership teams of these 3 companies have explained their recent results, and described their futures.

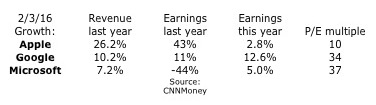

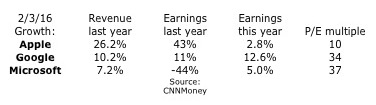

Looking at the financial performance of these companies, it is impossible to understand the price/earnings multiple assigned to each. Apple clearly had better revenue and earnings performance in all but the most recent year. Yet, both Alphabet and Microsoft have price to earnings (P/E) multiples that are 3-4 times that of Apple.

Much was made this week about Alphabet’s valuation exceeding that of Apple’s. But the really big story is the difference in multiples. If Apple had a multiple even half that of Alphabet or Microsoft it’s value would be much, much higher.

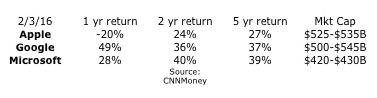

But, as we can see, investors did the best over both 2 years and 5 years by investing in Microsoft. And Apple investors have fared the poorest of all 3 companies regardless of time frame. Looking at investment performance, one would think that the revenue and earnings performance of these companies would be the reverse of what’s seen in the first chart.

The missing piece, of course, is future expectations. In this column a few days ago, I pointed out that Apple has done a terrible job explaining its future. In that column I pointed out how Facebook and Amazon both had stratospheric P/E multiples because they were able to keep investors focused on their future growth story, even more than their historical financial performance.

Alphabet stole the show, and at least briefly the #1 valuation spot, from Apple by convincing investors they will see significant, profitable growth. Starting even before earnings announcements the company was making sure investors knew that revenues and profits would be up. But even more they touted the notion that Alphabet has a lot of growth in non-monetized assets. For example, vastly greater ad sales should be expected from YouTube and Google Maps, as well as app sales for Android phones through Google Play. And someday on the short horizon profits will emerge from Fiber transmission revenues, smart home revenues via Nest, and even auto market sales now that the company has logged over 1million driverless miles.

This messaging clearly worked, as Alphabet’s value shot up. Even though 99% of the company’s growth was in “core” products that have been around for a decade! Yes, ad revenue was up 15%, but most of that was actually on the company’s own web sites. And most was driven by further price erosion. The number of paid clicks were up 30%, but price/click was actually down yet another 15% – a negative price trend that has been happening for years. Eventually prices will erode enough that volume will not make up the difference – and what will investors do then? Rely on the “moonshot” projects which still have almost no revenue, and no proven market performance!

But, the best performer has been Microsoft. Investors know that PC sales have been eroding for years, that PC sales will continue eroding as users go mobile, and that PC’s are the core of Microsoft’s revenue. Investors also knows that Microsoft missed the move to mobile, and has practically no market share in the war between Apple’s iOS and Google’s Android. Further, investors have known forever that gaming (xBox,) search and entertainment products have always been a money-loser for Microsoft. Yet, Microsoft investors have done far better than Apple investors, and long-term better than Google investors!

Microsoft has done an absolutely terrific job of constantly trumpeting itself as a company with a huge installed base of users that it can leverage into the future. Even when investors don’t know how that eroding base will be leveraged, Microsoft continually makes the case that the base is there, that Microsoft is the “enterprise” brand and that those users will stay loyal to Microsoft products.

Forget that Windows 8 was a failure, that despite the billions spent on development Win8 never reached even 10% of the installed base and the company is even dropping support for the product. Forget that Windows 10 is a free upgrade (meaning no revenue.) Just believe in that installed base.

Microsoft trumpeted that its Surface tablet sales rose 22% in the last quarter! Yay! Of course there was no mention that in just the last 6 weeks of the quarter Apple’s newly released iPad Pro actually sold more units than all Surface tablets did for the entire quarter! Or that Microsoft’s tablet market share is barely registerable, not even close to a top 5 player, while Apple still maintains 25% share. And investors are so used to the Microsoft failure in mobile phones that the 49% further decline in sales was considered acceptable.

Instead Microsoft kept investors focused on improvements to Windows 10 (that’s the one you can upgrade to for free.) And they made sure investors knew that Office 365 revenue was up 70%, as 20million consumers now use the product. Of course, that is a cumulative 20million – compared to the 75million iPhones Apple sold in just one quarter. And Azure revenue was up 140% – to something that is almost a drop in the bucket that is AWS which is over 10 times the size of all its competitors combined.

To many, this author included, the “growth story” at Microsoft is more than a little implausible. Sales of its core products are declining, and the company has missed the wave to mobile. Developers are writing for iOS first and foremost, because it has the really important installed base for today and tomorrow. And they are working secondarily on Android, because it is in some flavor the rest of the market. Windows 10 is a very, very distant third and largely overlooked. xBox still loses money, and the new businesses are all relatively quite small. Yet, investors in Microsoft have been richly rewarded the last 5 years.

Meanwhile, investors remain fearful of Apple. Too many recall the 1980s when Apple Macs were in a share war with Wintel (Microsoft Windows on Intel processors) PCs. Apple lost that war as business customers traded off the Macs ease of use for the lower purchase cost of Windows-based machines. Will Apple make the same mistake? Will iPad sales keep declining, as they have for 2 years now? Will the market shift to mobile favor lower-priced Android-based products? Will app purchases swing from iTunes to Google Play as people buy lower cost Android-based tablets? Have iPhone sales really peaked, and are they preparing to fall? What’s going to happen with Apple now? Will the huge Apple mobile share be eroded to nothing, causing Apple’s revenues, profits and share price to collapse?

This would be an interesting academic discussion were the stakes not so incredibly high. As I said in the opening paragraph, these are the 3 highest valued public companies in America. Small share price changes have huge impacts on the wealth of individual and institutional investors. It is rather quite important that companies tell their stories as good as possible (which Apple clearly has not, and Microsoft has done extremely well.) And likewise it is crucial that investors do their homework, to understand not only what companies say, but what they don’t say.

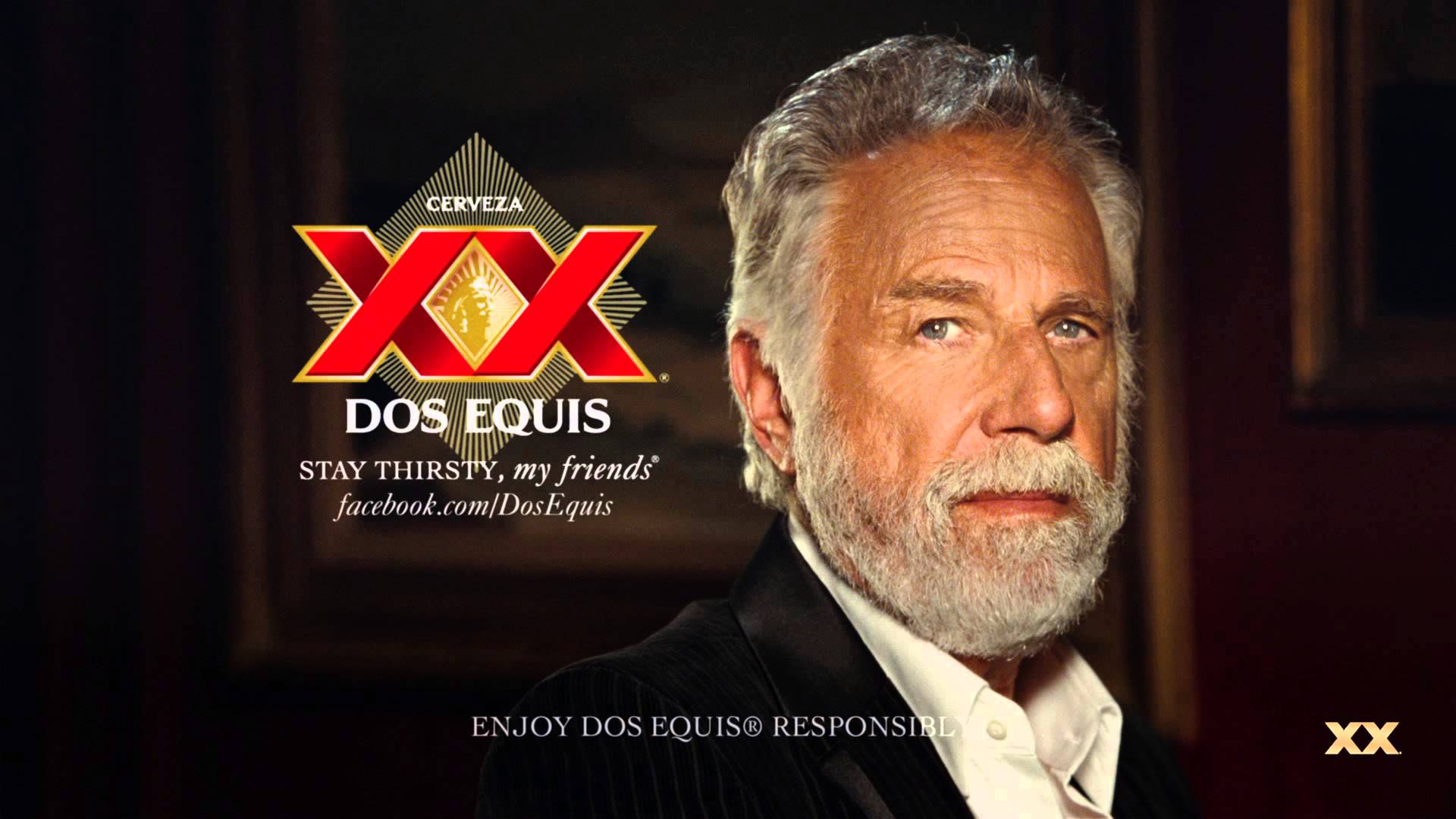

by Adam Hartung | Dec 18, 2014 | Current Affairs, Defend & Extend, Food and Drink, Leadership, Lifecycle

It is that time of year when many of us celebrate with an alcoholic beverage. But increasingly in America, that beverage is not beer. Since 2008, American beer sales have fallen about 4%.

But that decline has not been equally applied to all brands. The biggest, old line brands have suffered terribly. Nearly gone are old brands like Milwaukee’s Best, which were best known for being low priced – and certainly not focused on taste. But the most hurt, based on volume declines, have been what were once the largest brands; Budweiser, Miller Lite and Miller High Life. These have lost more than a quarter of their volume, losing a whopping 13million barrels/year of demand. These 3 brand declines account for 6% reduction in the entire beer market.

The popular myth is that this has been due to the rise of craft beers. And there is no doubt, craft beer sales have done well. Sales are up 80%. Many articles (including the WSJ)tout the growth of craft beers, which are ostensibly more tasty and appealing, as being the reason old-line brands have declined. It is an easy explanation to accept, and has largely gone unchallenged. Even the brewer of Budweiser, Annheuser-Busch InBev, has reacted to this argument by taking the incredible action of dropping clydesdale horses from their ads after 81 years – in an effort to woo craft beer drinkers, which are thought to be younger and less sentimental about large horses.

This all makes sense. Too bad it’s the wrong conclusion – and the wrong actions being taken.

Realize that craft beer sales are up from a small base, and today ALL craft beer sales still account for only 7.6% of the market. In fact, ALL craft beers combined sell only the same volume as the now smaller Budweiser. The problem with Budweiser sales – and sales of other big name brand beers – is a change in demographics.

Drinkers of Budweiser and Lite are simply older. These brands rose to tremendous dominance in the 1970s. Many of those who loved this brand are simply older – or dead. Where a hard working fellow in his 30s or 40s might enjoy a six pack after work, today that Boomer (if still alive) is somewhere between late 50s and 70s. Now, a single beer, or maybe two, will suffice thank you very much. And, equally challenging for sales, today’s Boomer is more often drinking a hard liquor cocktail, and a glass of wine with dinner. Beer drinking has its place, but less often and in lower quantities.

Meanwhile, Hispanics are a growing demographic. Hispanics are the largest non-white population in America, at 54million, and represent over 17% of all Americans. With a growth rate of 2.1%, Hispanics are also one of the fastest growing demographic segments – and increasingly important given their already large size. Hispanics are truly becoming a powerful buying group in American economics.

So, just as decline in Boomer population and consumption has hurt the once great beer brands, we can look at the growth in Hispanic demographics and see a link to sales of growing brands. Two significant (non-craft volume) beer brands that more than doubled sales since 2008 are Modelo Especial and Dos Equis. In fact, these were the 2 fastest growing brands in America, even though the first does no English language advertising at all, and the latter only lightly funds advertising with an iconic multi-year campaign. Together their sales total almost 5.4M barrels – which makes these 2 brands equal to 1/3 the ENTIRE craft beer marketplace. And growing 33% faster!

Chasing the myth of craft sales is doing nothing for InBev and MillerCoors as they try to defend and extend outdated brands. On the other hand, Heineken controls Dos Equis, and Constellation Brands controls Modello Especial. These two companies are squarely aligned with demographic trends, and well positioned for growth.

So, be careful the next time you hear some simple explanation for why a product or service is declining. The answer might sound appealing, but have little economic basis. Instead, it is much smarter to look at big trends and you’ll likely see why in the same market one product is growing, while another is declining. Trends – such as demographics – often explain a lot about what is happening, and lead you to invest much smarter.

by Adam Hartung | Jan 22, 2012 | Defend & Extend, In the Rapids, Innovation, Leadership, Lock-in, Transparency, Web/Tech

Turning over a new year inevitably leads to selections for "CEO of the Year." Investor Business Daily selected Larry Page of Google 3 weeks ago, and last week Marketwatch.com selected Jeff Bezos of Amazon. Comparing the two is worthwhile, because there is almost nothing similar about what the two have done – and one is almost sure to dramatically outperform the other.

Focusing on the Future

What both share is a willingness to focus their companies on the future. Both have introduced major new products, targeted at developing new markets and entirely new revenue streams for their companies. Both have significantly sacrificed short-term profits seeking long-term strategic positioning for sustainable, higher future returns. Both have, and continue to, spend vast sums of money in search of competitive advantage for their organizations.

And both have seen their stock value clobbered. In 2011 Amazon rose from $150/share low to almost $250 before collapsing at year's end to about $175 – actually lower than it started the calendar year. Google's stock dropped from $625/share to below $475 before recovering all the way to $670 – only to crater all the way to $585 last week. Clearly the analysts awarding these CEOs were looking way beyond short-term investor returns when making their selections. So it is more important than ever we understand what both have done, and are planning to do in the future, if we are to support either, or both, as award winners. Or buy their stock.

Google participates in great growth markets

The good news for Google is its participation in high growth markets. Search ads continue growing, supplying the bulk of revenues and profits for the company. Its Android product gives Google great position in mobile devices, and supporting Chrome applications help clients move from traditional architectures and applications to cloud-based solutions at lower cost and frequently higher user satisfaction. Additionally, Google is growing internet display ad sales, a fast growing market, by increasing participation in social networks.

Because Google is in high growth markets, its revenues keep growing healthily. But CEO Page's "focus" leadership has led to the killing of several products, retrenching from several markets, and remarkably huge bets in 2 markets where Google's revenues and profits lag dramatically – mobile devices and search.

Because Android produces no revenue Google bought near-bankrupt Motorola to enter the hardware and applications business becoming similar to Apple – a big bet using some old technology against what is the #1 technology company on the planet. Whether this will be a market share winner for Google, and whether it will make or lose money, is far from certain.

Simultaneously, the Google+ launch is an attempt to take on the King Kong of social – Facebook – which has 800million users and remarkable success. The Google+ effort has been (and will continue to be) very expensive and far from convincing. Its product efforts have even angered some people as Google tried steering social networkers rather heavy-handidly toward Google products – as it did with "Search plus Your World" recently.

Mr. Page has positioned Google as a gladiator in some serious "battles to the death" that are investment intensive. Google must keep fighting the wounded, hurting and desperate Microsoft in search against Bing+Yahoo. While Google is the clear winner, desperate but well funded competitors are known to behave suicidally, and Google will find the competition intensive. Meanwhile, its offerings in mobile and social are not unique. Google is going toe-to-toe with Apple and Facebook with products which show no great superiority. And the market leaders are wildly profitable while continuously introducing new innovations. It will be tough fighting in these markets, consuming lots of resources.

Entering 3 gladiator battles simultaneously is ambitious, to say the least. Whether Google can afford the cost, and can win, is debatable. As a result it only takes a small miss, comparing actual results to analyst expectations, for investors to run – as they did last week.

Amazon redefines competition in its markets

CEO Bezos' leadership at Amazon is very different. Rather than gladiator wars, Amazon brings out products that are very different and avoids head-to-head competition. Amazon expands new markets by meeting under- or unserved needs with products that change the way customers behave – and keeps competitors from attacking Amazon head-on:

- Amazon moved from simply selling books to selling a vast array of products on the web. It changed retail buying not by competing directly with traditional retailers, but by offering better (and different) on-line solutions which traditional retailers ignored or adopted far too slowly. Amazon was very early to offer web solutions for independent retailers to use the Amazon site, and was very early to offer a mobile interface making shopping from smartphones fast and easy. Because it wasn't trying to defend and extend a traditional brick-and-mortar retail model, like Wal-Mart, Amazon has redefined retail and dramatically expanded shopping on-line.

- Amazon changed the book market with Kindle. It utilized new technology to do what publishers, locked into traditional mindsets (and business models) would not do. As the print market struggled, Amazon moved fast to take the lead in digital publishing and media sales, something nobody else was doing, producing fast revenue growth with higher margins.

- When retailers were loath to adopt tablets as a primary interface for shoppers, Amazon brought out Kindle Fire. Cleverly the Kindle Fire is not directly positioned against the king of all tablets – iPad – but rather as a product that does less, but does things like published media and retail very well — and at a significantly lower price. It brings the new user on-line fast, if they've been an Amazon customer, and makes life simple and easy for them. Perhaps even easier than the famously easy Apple products.

In all markets Amazon moves early and deftly to fulfill unmet needs at a very good price. And then it captures more and more customers as the solution becomes more powerful. Amazon finds ways to compete with giants, but not head-on, and thus rapidly grow revenues and market position while positioning itself as the long term winner. Amazon has destroyed all the big booksellers – with the exception of Barnes & Noble which doesn't look too great – and one can only wonder what its impact in 5 years will be on traditional retailers like Kohl's, Penney's and even Wal-Mart. Amazon doesn't have to "win" a battle with Apple's iPad to have a wildly successful, and profitable, Kindle offering.

The successful CEO's role is different than many expect

A recent RHR International poll of 83 mid-tier company CEOs (reported at Business Insider) discovered that while most felt prepared for the job, most simultaneously discovered the requirements were not what they expected. In the past we used to think of a CEO as a steward, someone to be very careful with investor money. And someone expected to know the business' core strengths, then be very selective to constantly reinforce those strengths without venturing into unknown businesses.

But today markets shift quickly. Technology and global competition means all businesses are subject to market changes, with big moves in pricing, costs and customer expectations, very fast. Caretaker CEOs are being crushed – look at Kodak, Hostess and Sears. Successful CEOs have to guide their businesses away from investing in money-losing businesses, even if they are part of the company's history, and toward rapidly growing opportunities created by being part of the shift. Disruptors are now leading the success curve, while followers are often sucking up a lot of profit-killing dust.

Amazon bears similarities to the Apple of a decade ago. Introducing new products that are very different, and changing markets. It is competing against traditional giants, but with very untraditional solutions. It finds unmet needs, and fills them in unique ways to capture new customers – and creates market shifts.

Google, on the other hand, looks a lot like the lumbering Microsoft. It has a near monopoly in a growing market, but its investments in new markets come late, and don't offer a lot of innovation. Google's products end up competing directly, somewhat like xBox did with other game consoles, in very, very expensive – usually money-losing – competition that can go on for years. Google looks like a company trying to use money rather than innovation to topple an existing market leader, and killing a lot of good product ideas to keep pouring money into markets where it is late and not terribly creative.

Which CEO do you think will be the winner in 2015? Into which company are you prepared to invest? Both are in high growth markets, but they are being led very, very differently. And their strategies could not be more different. Which one you choose to own – as a product customer or investor – will have significant consequences for you (and them) in 3 years.

It's worth taking the time to decide which you think is the right leadership today. And be sure you know what leadership principles you are adopting, and following in your organization.