by Adam Hartung | Feb 11, 2016 | Current Affairs, In the Whirlpool, Leadership, Lock-in

USAToday alerted investors that when Sears Holdings reports results 2/25/16 they will be horrible. Revenues down another 8.7% vs. last year. Same store sales down 7.1%. To deal with ongoing losses the company plans to close another 50 stores, and sell another $300million of assets. For most investors, employees and suppliers this report could easily be confused with many others the last few years, as the story is always the same. Back in January, 2014 CNBC headlined “Tracking the Slow Death of an Icon” as it listed all the things that went wrong for Sears in 2013 – and they have not changed two years later. The brand is now so tarnished that Sears Holdings is writing down the value of the Sears name by another $200million – reducing intangible value from the $4B at origination in 2004 to under $2B.

This has been quite the fall for Sears. When Chairman Ed Lampert fashioned the deal that had formerly bankrupt Kmart buying Sears in November, 2004 the company was valued at $11billion and 3,500 stores. Today the company is valued at $1.6billion (a decline of over 85%) and according to Reuters has just under 1,700 stores (a decline of 51%.) According to Bloomberg almost no analysts cover SHLD these days, but one who does (Greg Melich at Evercore ISI) says the company is no longer a viable business, and expects bankruptcy. Long-term Sears investors have suffered a horrible loss.

When I started business school in 1980 finance Professor Bill Fruhan introduced me to a concept that had never before occurred to me. Value Destruction. Through case analysis the good professor taught us that leadership could make decisions that increased company valuation. Or, they could make decisions that destroyed shareholder value. As obvious as this seems, at the time I could not imagine CEOs and their teams destroying shareholder value. It seemed anathema to the entire concept of business education. Yet, he quickly made it clear how easily misguided leaders could create really bad outcomes that seriously damaged investors.

As a case study in bad leadership, Sears under Chairman Lampert offers great lessons in Value Destruction that would serve Professor Fruhan’s teachings well:

As a case study in bad leadership, Sears under Chairman Lampert offers great lessons in Value Destruction that would serve Professor Fruhan’s teachings well:

1 – Micro-management in lieu of strategy. Mr. Lampert has been merciless in his tenacity to manage every detail at Sears. Daily morning phone calls with staff, and ridiculously tight controls that eliminate decision making by anyone other than the top officers. Additionally, every decision by the officers was questioned again and again. Explanations took precedent over action as micro-management ate up management’s time, rather than trying to run a successful company. While store employees and low- to mid-level managers could see competition – both traditional and on-line – eating away at Sears customers and core sales, they were helpless to do anything about it. Instead they were forced to follow orders given by people completely out of touch with retail trends and customer needs. Whatever chance Sears and Kmart had to grow the chain against intense competition it was lost by the Chairman’s need to micro-manage.

2 – Manage-by-the-numbers rather than trends. Mr. Lampert was a finance expert and former analyst turned hedge fund manager and investor. He truly believed that if he had enough numbers, and he studied them long enough, company success would ensue. Unfortunately, trends often are not reflected in “the numbers” until it is far, far too late to react. The trend to stores that were cleaner, and more hip with classier goods goes back before Lampert’s era, but he completely missed the trend that drove up sales at Target, H&M and even Kohl’s because he could not see that trend reflected in category sales or cost ratios. Merchandising – from buying to store layout and shelf positioning – are skills that go beyond numerical analysis but are critical to retail success. Additionally, the trend to on-line shopping goes back 20 years, but the direct impact on store sales was not obvious until customers had long ago converted. By focusing on numbers, rather than trends, Sears was constantly reacting rather than being proactive, and thus constantly retreating, cutting stores and cutting product lines.

3 – Seeking confirmation rather than disagreement. Mr. Lampert had no time for staff who did not see things his way. Mr. Lampert wanted his management team to agree with him – to confirm his Beliefs, Interpretations, Assumptions and Strategies — to believe his BIAS. By seeking managers who would confirm his views, and execute, rather than disagree Mr. Lampert had no one offering alternative data, interpretations, strategies or tactics. And, as Mr. Lampert’s plans kept faltering it led to a revolving door of managers. Leaders came and went in a year or two, blamed for failures that originated at the Chairman’s doorstep. By forcing agreement, rather than disagreement and dialogue, Sears lacked options or alternatives, and the company had no chance of turning around.

4 – Holding assets too long. In 2004 Sears had a LOT of assets. Many that could likely be redeployed at a gain for shareholders. Sears had many owned and leased store locations that were highly valuable with real estate prices climbing from then through 2008. But Mr. Lampert did not spin out that real estate in a REIT, capturing the value for SHLD shareholders while the timing was good. Instead he held those assets as real estate in general plummeted, and as retail real estate fell even further as more revenue shifted to e-commerce. By the time he was ready to sell his REIT much of the value was depleted.

Additionally, Sears had great brands in 2004. DieHard batteries, Craftsman tools, Kenmore appliances and Lands End apparel were just 4 household brands that still had high customer appeal and tremendous value. Mr. Lampert could have sold those brands to another retailer (such as selling DieHard to WalMart, for example) as their house brands, capturing that value. Or he could have mass marketd the brand beyond the Sears store to increase sales and value. Or he could have taken one or more brands on-line as a product leader and “category killer” for ecommerce customers. But he did not act on those options, and as Sears and Kmart stores faded, so did these brands – which largely no longer have any value. Had he sold when value was high there were profits to be made for investors.

5 – Hubris – unfailingly believing in oneself regardless the outcomes. In May, 2012 I wrote that Mr. Lampert was the 2nd worst CEO in America and should fire himself. This was not a comment made in jest. His initial plans had all panned out very badly, and he had no strategy for a turnaround. All results, from all programs implemented during his reign as Chairman had ended badly. Yet, despite these terrible numbers Mr. Lampert refused to recognize he was the wrong person in the wrong job. While it wasn’t clear if anyone could turn around the problems at Sears at such a late date, it was clear Mr. Lampert was not the person to do it. If Mr. Lampert had been as self-analytical as he was critical of others he would have long before replaced himself as the leader at Sears. But hubris would not allow him to do this, he remained blind to his own failings and the terrible outcome of a failed company was pretty much sealed.

From $11B valuation and a $92/share stock price at time of merging KMart and Sears, to a $1.6B valuation and a $15/share stock price. A loss of $9.4B (that’s BILLION DOLLARS). That is amazing value destruction. In a world where employees are fired every day for making mistakes that cost $1,000, $100 or even $10 it is a staggering loss created by Mr. Lampert. At the very least we should learn from his mistakes in order to educate better, value creating leaders.

by Adam Hartung | Jan 17, 2016 | Current Affairs, In the Rapids, Innovation, Leadership, Web/Tech

Stocks are starting 2016 horribly. To put it mildly. From a Dow (DJIA or Dow Jones Industrial Average) at 18,000 in early November values of leading companies have fallen to under 16,000 – a decline of over 11%. Worse, in many regards, has been the free-fall of 2016, with the Dow falling from end-of-year close 17,425 to Friday’s 15,988 – almost 8.5% – in just 10 trading days!

With the bottom apparently disappearing, it is easy to be fearful and not buy stocks. After all, we’re clearly seeing that one can easily lose value in a short time owning equities.

But if you are a long-term investor, then none of this should really make any difference. Because if you are a long-term investor you do not need to turn those equities into cash today – and thus their value today really isn’t important. Instead, what care about is the value in the future when you do plan to sell those equities.

Investors, as opposed to traders, buy only equities of companies they think will go up in value, and thus don’t need to worry about short-term volatility created by headline news, short-term politics or rumors. For investors the most important issue is the major trends which drive the revenues of those companies in which they invest. If those trends have not changed, then there is no reason to sell, and every reason to keep buying.

(1) Buy Amazon

Take for example Amazon. Amazon has fallen from its high of about $700/share to Friday’s close of $570/share in just a few weeks – an astonishing drop of over 18.5%. Yet, there is really no change in the fundamental market situation facing Amazon. Either (a) something dramatic has changed in the world of retail, or (b) investors are over-reacting to some largely irrelevant news and dumping Amazon shares.

Everyone knows that the #1 retail trend is sales moving from brick-and-mortar stores to on-line. And that trend is still clearly in place. Black Friday sales in traditional retail stores declined in 2013, 2014 and 2015 – down 10.4% over the Thanksgiving Holiday weekend. For all December, 2015 retail sales actually declined from 2014. Due to this trend, mega-retailer Wal-Mart announced last week it is closing 269 stores. Beleaguered KMart also announced more store closings as it, and parent Sears, continues the march to non-existence. Nothing in traditional retail is on a growth trend.

However, on-line sales are on a serious growth trend. In what might well be the retail inflection point, the National Retail Federation reported that more people shopped on line Black Friday weekend than those who went to physical stores (and that counts shoppers in categories like autos and groceries which are almost entirely physical store based.) In direct opposition to physical stores, on-line sales jumped 10.4% Black Friday.

And Amazon thoroughly dominated on-line retail sales this holiday season. On Black Friday Amazon sales tripled versus 2014. Amazon scored an amazing 35% market share in e-commerce, wildly outperforming number 2 Best Buy (8%) and ten-fold numbers 3 and 4 Macy’s and WalMart that accomplished just over 3% market share each.

Clearly the market trend toward on-line sales is intact. Perhaps accelerating. And Amazon is the huge leader. Despite the recent route in value, had you bought Amazon one year ago you would still be up 97% (almost double your money.) Reflecting market trends, Wal-Mart has declined 28.5% over the last year, while the Dow dropped 8.7%.

Amazon may not have bottomed in this recent swoon. But, if you are a long-term investor, this drop is not important. And, as a long-term investor you should be gratified that these prices offer an opportunity to buy Amazon at a valuation not available since October – before all that holiday good news happened. If you have money to invest, the case is still quite clear to keep buying Amazon.

(2) Buy Facebook

(2) Buy Facebook

The trend toward using social media has not abated, and Facebook continues to be the gorilla in the room. Nobody comes close to matching the user base size, or marketing/advertising opportunities Facebook offers. Facebook is down 13.5% from November highs, but is up 24.5% from where it was one year ago. With the trend toward internet usage, and social media usage, growing at a phenomenal clip, the case to hold what you have – and add to your position – remains strong. There is ample opportunity for Facebook to go up dramatically over the next few years for patient investors.

(3) Buy Netflix

When was the last time you bought a DVD? Rented a DVD? Streamed a movie? How many movies or TV programs did you stream in 2015? In 2013? Do you see any signs that the trend to streaming will revert? Or even decelerate as more people in more countries have access to devices and high bandwidth?

Last week Netflix announced it is adding 130 new countries to its network in 2016, taking the total to 190 overall. By 2017, about the only place in the world you won’t be able to access Netflix is China. Go anywhere else, and you’ve got it. Additionally, in 2016 Netflix will double the number of its original programs, to 31 from 16. Simultaneously keeping current customers in its network, while luring ever more demographics to the Netflix platform.

Netflix stock is known for its wild volatility, and that remains in force with the value down a whopping 21.8% from its November high. Yet, had you bought 1 year ago even Friday’s close provided you a 109% gain, more than doubling your investment. With all the trends continuing to go its way, and as Netflix holds onto its dominant position, investors should sleep well, and add to their position if funds are available.

(4) Buy Google

Ever since Google/Alphabet overwhelmed Yahoo, taking the lead in search and on-line advertising the company has never looked back. Despite all attempts by competitors to catch up, Google continues to keep 2/3 of the search market. Until the market for search starts declining, trends continue to support owning Google – which has amassed an enormous cash hoard it can use for dividends, share buybacks or growing new markets such as smart home electronics, expanded fiber-optic internet availability, sensing devices and analytics for public health, or autonomous cars (to name just a few.)

The Dow decline of 8.7% would be meaningless to a shareholder who bought one year ago, as GOOG is up 37% year-over year. Given its knowledge of trends and its investment in new products, that Google is down 12% from its recent highs only presents the opportunity to buy more cheaply than one could 2 months ago. There is no trend information that would warrant selling Google now.

(5) Buy Apple

Despite spending most of the last year outperforming the Dow, a one-year investor would today be down 10.7% in Apple vs. 8.7% for the Dow. Apple is off 27.6% from its 52 week high. With a P/E (price divided by earnings) ratio of 10.6 on historical earnings, and 9.3 based on forecasted earnings, Apple is selling at a lower valuation than WalMart (P/E – 13). That is simply astounding given the discussion above about Wal-mart’s operations related to trends, and a difference in business model that has Apple producing revenues of over $2.1M/employee/year while Walmart only achieve $220K/employee/year. Apple has a dividend yield of 2.3%, higher than Dow companies Home Depot, Goldman Sachs, American Express and Disney!

Apple has over $200B cash. That is $34.50/share. Meaning the whole of Apple as an operating company is valued at only $62.50/share – for a remarkable 6 times earnings. These are the kind of multiples historically reserved for “value companies” not expected to grow – like autos! Even though Apple grew revenues by 26% in fyscal 2015, and at the compounded rate of 22%/year from 2011- 2015.

Apple has a very strong base market, as the world leader today in smartphones, tablets and wearables. Additionally, while the PC market declined by over 10% in 2015, Apple’s Mac sales rose 3% – making Apple the only company to grow PC sales. And Apple continues to move forward with new enterprise products for retail such as iBeacon and ApplePay. Meanwhile, in 2016 there will be ongoing demand growth via new development partnerships with large companies such as IBM.

Unfortunately, Apple is now valued as if all bad news imaginable could occur, causing the company to dramatically lose revenues, sustain an enormous downfall in earnings and have its cash dissipated. Yet, Apple rose to become America’s most valuable publicly traded company by not only understanding trends, but creating them, along with entirely new markets. Apple’s ability to understand trends and generate profitable revenues from that ability seems to be completely discounted, making it a good long-term investment.

In August, 2015 I recommended FANG investing. This remains the best opportunity for investors in 2016 – with the addition of Apple. These companies are well positioned on long-term trends to grow revenues and create value for several additional years, thereby creating above-market returns for investors that overlook short-term market turbulence and invest for long-term gains.

by Adam Hartung | Dec 19, 2015 | Books, Current Affairs, Ethics, Lifecycle

America’s middle class has been decimated. Ever since Ronald Reagan rewrote the tax code, dramatically lowering marginal rates on wealthy people and slashing capital gains taxes, America’s wealthy have been amassing even greater wealth, while the middle class has gone backward and the poor have remained poor. Losing 30% of their wealth, and for many most of their home equity, has left what were once middle class families actually closer to definitions of working poor than a 1950s-1960s middle class.

When Charles Dickens wrote “A Christmas Carole” he brought to life for readers the striking difference between those who “have” from those who “have not” in early England. If you had money England was a great place to be. If you relied on your labors then you were struggling to make ends meet, and regularly disappointing yourself and your family.

For a great many American’s that is the situation in 2015 USA.

At the book’s outset, Mr. Ebenezer Scrooge felt that his wealth was all due to his own great skill. He gave himself 100% of the credit for amassing a fortune, and he felt that it was wrong of laborers, such as his bookkeeper Mr. Cratchit, to expect to pay when seeking a day off for Christmas.

Unfortunately, this sounds far too often like the wealthy and 1%ers. They feel as if their wealth is 100% due to their great intelligence, skill, hard work or conniving. And they don’t think they owe anyone anything as they work to keep unions at bay as they campaign to derail all employee bargaining. Nor do they think they should pay taxes on their wealth as many actively seek to destroy the role of government.

Meanwhile, there are employers today who have taken a page right out of Mr. Scrooge’s book of worklife desolation. Ever since President Reagan fired the Air Traffic Controllers Union employee rights have been on the downhill. Employers increasingly do not allow employees to have any say in their work hours or workplace conditions – such as Marissa Mayer eliminating work from home at Yahoo, yet expecting 3 year commitments from all managers.

Just as Mr. Scrooge refused to put more coal in the office stove as Mr. Cratchit’s fingers froze, employers like WalMart rigidly control the workplace environment – right down to the temperature in every single building and office – in order to save cost regardless of employee satisfaction. Workplace comfort has little voice when implementing the CEOs latest cost-saving regimen.

Just as Mr. Scrooge refused to put more coal in the office stove as Mr. Cratchit’s fingers froze, employers like WalMart rigidly control the workplace environment – right down to the temperature in every single building and office – in order to save cost regardless of employee satisfaction. Workplace comfort has little voice when implementing the CEOs latest cost-saving regimen.

Just as Mr. Scrooge objected to giving the 25th December as a paid holiday (picking his pocket once a year was his viewpoint,) many employers keep cutting sick leave and holidays – or, worse, they allow days off but expect employees to respond to texts, voice mails, emails and social media 24x7x365. “Take all the holiday you want, just respond within minutes to the company’s every need, regardless of day or time.”

Increasingly, those who “go to work” have less and less voice about their work. How many of you readers will check your work voice mail and/or email on Christmas Day? Is this not the modern equivalent of your employer, like Scrooge, treating you like a filcher if you don’t work on the 25th December? But, do you dare leave the smartphone, tablet or laptop alone on this day? Do you risk falling behind on your job, or angering your boss on the 26th if something happened and you failed to respond?

Like many with struggling economic uncertainty, Bob Cratchit had a very ill son. But Mr. Scrooge could not be bothered by such concerns. Mr. Scrooge had a business to run, and if an employee’s family was suffering then it was up to social services to take care of such things. If those social services weren’t up to standards, well it simply was not his problem. He wasn’t the government – although he did object to any and all taxes. And he had no value for the government offering decent prisons, or medical care to everyone.

Today, employers right and left have dropped employee health insurance, recommending employees go on the exchanges; even though these same employers do not offer any incremental income to cover the cost of exchange-based employee insurance. And many employers are cutting employee hours to make sure they are not able to demand health care coverage. And the majority of employers, and employer associations such as the Chamber of Commerce, want to eliminate the Affordable Care Act entirely, leaving their employees with no health care at all – as was the case for many prior to ACA passage.

Even worse, there are employers (especially in retail, fast food and other minimum wage environments) with employees earning so little pay that as employers they recommend their employees file for government based Medicaid in order to receive the bottom basics of healthcare. Employees are a necessity, but not if they are sick or if the employer has to help their families maintain good health.

But things changed for Mr. Scrooge, and we can hope they do for a lot more of America’s employers and wealthy elite.

Mr. Scrooge’s former partner, Mr. Jakob Marley, visits Mr. Scrooge in a dream and reminds him that, in fact, there was a lot more to his life, and wealth creation, than just Ebenezer’s toils. Those around him helped him become successful, and others in his life were actually very important to his happiness. He reminds Mr Scrooge that as he isolated himself in the search for ever greater wealth he gained money, but lost a lot of happiness.

Today we have some business leaders taking the cue from Mr. Marley, and speaking out to the Scrooges. In particular, we can be thankful for folks like Warren Buffet who consistently points out the great luck he had to be born with certain skills at this specific point in time. Mr. Buffett regularly credits his wealth creation with the luck to receive a good education, learning from academics such as Ben Graham, and having a great network of colleagues to help him invest.

Further, amplifying his role as a modern day Jacob Marley, Mr. Buffett recognizes the vast difference between his situation and those around him. He has pointed out that his secretary pays a higher percent of her income in taxes than himself, and he points out this is a remarkably unfair situation. Additionally, he makes it clear that for many wealth is a gift of birth – and “winning the ovarian lottery” does not make that wealthy person smarter, harder working or more valuable to society. Rather, just lucky.

What we need is for more wealthy Americans to have a vision of Christmas future – as it appeared to Mr. Scrooge. He saw how wealth inequality would worsen young Tiny Tim’s health, leaving him crippled and dying. He saw his employee Mr. Cratchet struggle and become ill. These visions scared him. Scared him so much, he offered a bounty upon his community, sharing his wealth.

Mr. Scrooge realized that great wealth, preserved just for him, was without merit. He was doomed to a future of being rich, but without friends, without a great world of colleagues and without the sharing of riches among everyone in order that all in society could be healthy and grow. Many would suffer, and die, if society overall did not take actions to share success.

These days we do have a few of these visionary 1%ers, such as Bill Gates, Warren Buffett and recently Mark Zuckerberg, who are either currently, or in the future, planning to disseminate their vast wealth for the good of mankind.

Yet, middle class Americans have been watching their dreams evaporate. Over the last 50 years America has changed, and they have been left behind. Hard work, well…….. it just doesn’t give people what it once did. Policy changes that favored the wealthy with Ayn Rand style tax programs have made the rich ever richer, supported the legal rights of big corporations and left the middle class with a lot less money and power. Incomes that did not come close to matching inflation, and home values that too often are more anchors than balloons have beset 2015’s strivers.

It will take more than philanthropic foundations and a few standout generous donors to rebuild America’s middle class. It will take policies that provide more (more safety nets, more health care, more education, more pension protection, more job protections and more political power) for those in the middle, and give them economic advantages today offered only wealthier Americans.

Let us hope that in 2016 we see a re-awakening of the need to undertake such rebuilding by policymakers, corporate leaders and the 1%. Let us hope this Christmas for a stronger, more robust, healthier and disparate, shared economy “for each and every one.”

by Adam Hartung | Oct 16, 2015 | Current Affairs, Defend & Extend, In the Swamp, Lifecycle

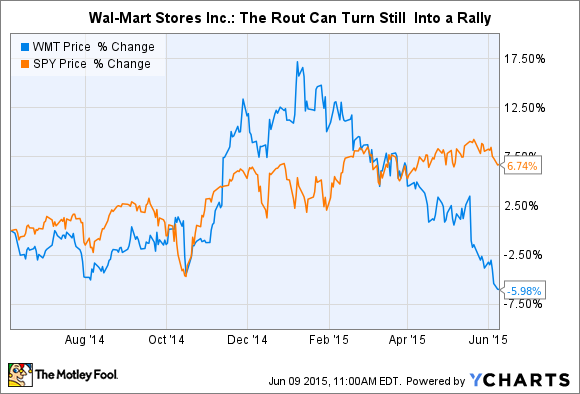

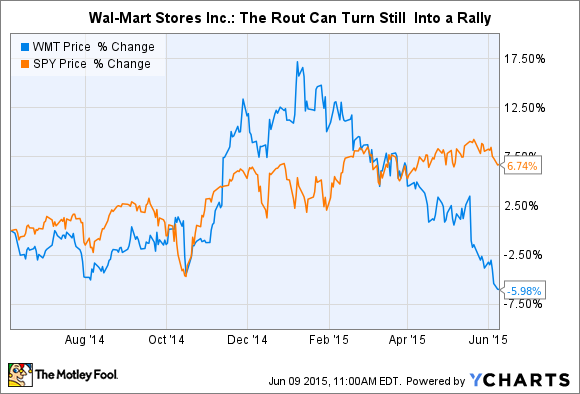

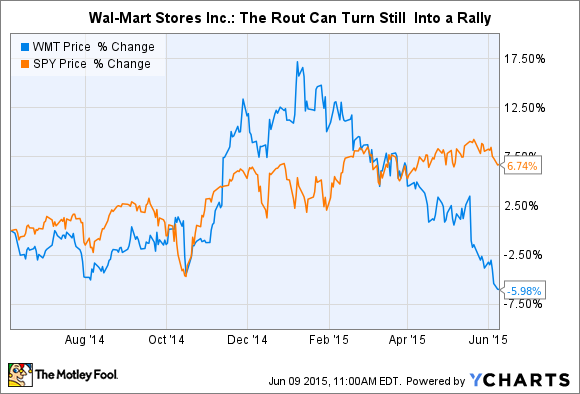

Wal-Mart market value took a huge drop on Wednesday. In fact, the worst valuation decline in its history. That decline continued on Thursday. Since the beginning of 2015 Wal-Mart has lost 1/3 of its value. That is an enormous ouch.

But, if you were surprised, you should not have been. The telltale signs that this was going to happen have been there for years. Like most stock market moves, this one just happened really fast. The “herd behavior” of investors means that most people don’t move until some event happens, and then everyone moves at once carrying out the implications of a sea change in thinking about a company’s future.

But, if you were surprised, you should not have been. The telltale signs that this was going to happen have been there for years. Like most stock market moves, this one just happened really fast. The “herd behavior” of investors means that most people don’t move until some event happens, and then everyone moves at once carrying out the implications of a sea change in thinking about a company’s future.

All the way back in October, 2010 I wrote about “The Wal-Mart Disease.” This is the disease of constantly focusing on improving your “core” business, while market shifts around you increasingly make that “core” less relevant, and less valuable. In the case of Wal-Mart I pointed out that an absolute maniacal focus on retail stores and low-cost operations, in an effort to be the low price retailer, was being made obsolete by on-line retailers who had costs that are a fraction of Wal-Mart’s expensive real estate and armies of employees.

At that time WMT was about $54/share. I recommended nobody own the stock.

In May, 2011 I reiterated this problem at Wal-Mart in a column that paralleled the retailer with software giant Microsoft, and pointed out that because of financial machinations not all earnings are equal. I continued to say that this disease would cripple Wal-Mart. Six months had passed, and the stock was about $55.

By February, 2012 I pointed out that the big reorganization at Wal-Mart was akin to re-arranging deck chairs on a sinking ship and said nobody should own the stock. It was up, however, trading at $61.

At the end of April, 2012 the Wal-Mart Mexican bribery scandal made the press, and I warned investors that this was a telltale sign of a company scrambling to make its numbers – and pushing the ethical (if not legal) envelope in trying to defend and extend its worn out success formula. The stock was $59.

Then in July, 2014 a lawsuit was filed after an overworked Wal-Mart truck driver ran into a car killing James McNair and seriously injuring comedian Tracy Morgan. Again, I pointed out that this was a telltale sign of an organization stretching to try and make money out of a business model that was losing its ability to sustain profits. Market shifts were making it ever harder to keep up with emerging on-line competitors, and accidents like this were visible cracks in the business model. But the stock was now $77. Most investors focused on short-term numbers rather than the telltale signs of distress.

In January, 2015 I pointed out that retail sales were actually down 1% for December, 2014. But Amazon.com had grown considerably. The telltale indication of a rotting traditional retail brick-and-mortar approach was showing itself clearly. Wal-Mart was hitting all time highs of around $87, but I reiterated my recommendation that investors escape the stock.

By July, 2015 we learned that the market cap of Amazon now exceeded that of Wal-Mart. Traditional retail struggles were apparent on several fronts, while on-line growth remained strong. Bigger was not better in the case of Wal-Mart vs. Amazon, because bigger blinded Wal-Mart to the absolute necessity for changing its business model. The stock had fallen back to $72.

Now Wal-Mart is back to $60/share. Where it was in January, 2012 and only 10% higher than when I first said to avoid the stock in 2010. Five years up, then down the roller coaster.

From October of 2010 through January, 2015 I looked dead wrong on Wal-Mart. And the folks who commented on my columns here at this journal and on my web site, or emailed me, were profuse in pointing out that my warnings seemed misguided. Wal-Mart was huge, it was strong and it would dominate was the feedback.

But I kept reiterating the point that long-term investors must look beyond short-term reported sales and earnings. Those numbers are subject to considerable manipulation by management. Further, short-term operating actions, like shorter hours, lower pay, reduced benefits, layoffs and gouging suppliers can all prop up short-term financials at the expense of recognizing the devaluation of the company’s long-term strategy.

Investors buy and hold. They hold until they see telltale signs of a company not adjusting to market shifts. Short-term traders will say you could have bought in 2010, or 2012, and held into 2014, and then jumped out and made a profit. But, who really can do that with forethought? Market timing is a fools game. The herd will always stay too long, then run out too late. Timers get trampled in the stampede more often than book gains.

In this week’s announcement Wal-Mart executives provided more telltale signs of their problems, and the fact that they don’t know how to fix them, and therefore won’t.

- Wal-Mart is going to spend $20B to buy back stock in order to prop up the price. This is the most obvious sign of a company that doesn’t know how to keep up its valuation by growing profits.

- Wal-Mart will spend $11B on sprucing up and opening stores. Really. The demand for retail space has been declining at 4-6%/year for a decade, and retail business growth is all on-line, yet Wal-Mart is still massively investing in its old “core” business.

- Wal-Mart will spend $1.1B on e-commerce. That is the proverbial “drop in the competitors bucket.” Amazon.com alone spent $8.9B in 2014 growing its on-line business.

- Wal-Mart admits profits will decline in the next year. It is planning for a growth stall. Yet, we know that statistically only 7% of companies that have a growth stall ever go on to maintain a consistent growth rate of a mere 2%. In other words, Wal-Mart is projecting the classic “hockey stick” forecast. And investors are to believe it?

The telltale signs of an obsolete business model have been present at Wal-Mart for years, and continue.

In 2003 Sears Holdings was $25/share. In 2004 Sears bought K-Mart, and the stock was $40. I said don’t go near it, as all the signs were bad and the merger was ill-conceived. Despite revenue declines, consistent losses, a revolving door at the executive offices and no sign of any plan to transform the battered, outdated retail giant against growing on-line competition investors believed in CEO Ed Lampert and bid the stock up to $77 in early 2011. (I consistently pointed out the telltale signs of trouble and recommended selling the stock.)

By the end of 2012 it was clear Sears was irrelevant to holiday shoppers, and the stock was trading again at $40. Now, SHLD is $25 – where it was 12 years ago when Mr. Lampert started his machinations. Again, only a market timer could have made money in this company. For long-term investors, the signs were all there that this was not a place to put your money if you want to have capital growth for retirement.

There will be plenty who will call Wal-Mart a “value” stock and recommend investors “buy on weakness.” But Wal-Mart is no value. It is becoming obsolete, irrelevant – increasingly looking like Sears. The likelihood of Wal-Mart falling to $20 (where it was at the beginning of 1998 before it made an 18 month run to $50 more than doubling its value) is far higher than ever trading anywhere near its 2015 highs.

by Adam Hartung | Jul 25, 2015 | Current Affairs, In the Whirlpool, Leadership

This week an important event happened on Wall Street. The value of Amazon (~$248B) exceeded the value of Walmart (~$233B.) Given that Walmart is world’s largest retailer, it is pretty amazing that a company launched as an on-line book seller by a former banker only 21 years ago could now exceed what has long been retailing’s juggernaut.

WalMart redefined retail. Prior to Sam Walton’s dynasty retailing was an industry of department stores and independent retailers. Retailing was a lot of small operators, primarily highly regional. Most retailers specialized, and shoppers would visit several stores to obtain things they needed.

But WalMart changed that. Sam Walton had a vision of consolidating products into larger stores, and opening these larger stores in every town across America. He set out to create scale advantages in purchasing everything from goods for resale to materials for store construction. And with those advantages he offered customers lower prices, to lure them away from the small retailers they formerly visited.

And customers were lured. Today there are very few independent retailers. WalMart has ~$488B in annual revenues. That is more than 4 times the size of #2 in USA CostCo, or #1 in France (#3 in world) Carrefour, or #1 in Germany (#4 in world) Schwarz, or #1 in U.K. (#5 in world) Tesco. Walmart directly employes ~.5% of the entire USA population (about 1 in every 200 people work for Walmart.) And it is a given that nobody living in America is unaware of Walmart, and very, very few have never shopped there.

But, Walmart has stopped growing. Since 2011, its revenues have grown unevenly, and on average less than 4%/year. Worse, it’s profits have grown only 1%/year. Walmart generates ~$220,000 revenue/employee, while Costco achieves ~$595,000. Thus its need to keep wages and benefits low, and chronically hammer on suppliers for lower prices as it strives to improve margins.

And worse, the market is shifting away from WalMart’s huge, plentiful stores toward on-line shopping. And this could have devastating consequences for WalMart, due to what economists call “marginal economics.”

And worse, the market is shifting away from WalMart’s huge, plentiful stores toward on-line shopping. And this could have devastating consequences for WalMart, due to what economists call “marginal economics.”

As a retailer, Walmart spends 75 cents out of every $1 revenue on the stuff it sells (cost of goods sold.) That leaves it a gross margin of 25 cents – or 25%. But, all those stores, distribution centers and trucks create a huge fixed cost, representing 20% of revenue. Thus, the net profit margin before taxes is a mere 5% (Walmart today makes about 5 cents on every $1 revenue.)

But, as sales go from brick-and-mortar to on-line, this threatens that revenue base. At Sears, for example, revenues per store have been declining for over 4 years. Suppose that starts to happen at Walmart; a slow decline in revenues. If revenues drop by 10% then every $100 of revenue shrinks to $90. And the gross margin (25%) declines to $22.50. But those pesky store costs remain stubbornly fixed at $20. Now profits to $2.50 – a 50% decline from what they were before.

A relatively small decline in revenue (10%) has a 5x impact on the bottom line (50% decline.) The “marginal revenue”, is that last 10%. What the company achieves “on the margin.” It has enormous impact on profits. And now you know why retailers are open 7 days a week, and 18 to 24 hours per day. They all desperately want those last few “marginal revenues” because they are what makes – or breaks – their profitability.

All those scale advantages Sam Walton created go into reverse if revenues decline. Now the big centralized purchasing, the huge distribution centers, and all those big stores suddenly become a cost Walmart cannot avoid. Without growing revenues, Walmart, like has happened at Sears, could go into a terrible profit tailspin.

And that is what Amazon is trying to do. Amazon is changing the way Americans shop. From stores to on-line. And the key to understanding why this is deadly to Walmart and other big traditional retailers is understanding that all Amazon (and its brethren on line) need to do is chip away at a few percentage points of the market. They don’t have to obtain half of retail. By stealing just 5-10% they put many retailers, they ones who are weak, right out of business. Like Radio Shack and Circuit City. And they suck the profits out of others like Sears and Best Buy. And they pose a serious threat to WalMart.

And Amazon is succeeding. It has grown at almost 30%/year since 2010. That growth has not been due to market growth, it has been created by stealing sales from traditional retailers. And Amazon achieves $621,000 revenue per employee, while having a far less fixed cost footprint.

What the marketplace looks for is that point at which the shift to on-line is dramatic enough, when on-line retailers have enough share, that suddenly the fixed cost heavy traditional retail business model is no longer supportable. When brick-and-mortar retailers lose just enough share that their profits start the big slide backward toward losses. Simultaneously, the profits of on-line retailers will start to gain significant upward momentum.

And this week, the marketplace started saying that time could be quite near. Amazon had a small profit, surprising many analysts. It’s revenues are now almost as big as Costco, Tesco – and bigger than Target and Home Depot. If it’s pace of growth continues, then the value which was once captured in Walmart stock will shift, along with the marketplace, to Amazon.

In May, 2010 Apple’s value eclipsed Microsoft. Five years later, Apple is now worth double Microsoft – even though its earnings multiple (stock Price/Earnings) is only half (AAPL P/E = 14.4, MSFT = 31.) And Apple’s revenues are double Microsoft’s. And Apple’s revenues/employee are $2.4million, 3 times Microsoft’s $731k.

While Microsoft has about doubled in value since the valuation pinnacle transferred to Apple, investors would have done better holding Apple stock as it has more than tripled. And, again, if the multiple equalizes between the companies (Apple’s goes up, or Microsoft’s goes down,) Apple investors will be 6 times better off than Microsoft’s.

Market shifts are a bit like earthquakes. Lots of pressure builds up over a long time. There are small tremors, but for the most part nobody notices much change. The land may actually have risen or fallen a few feet, but it is not noticeable due to small changes over a long time. But then, things pop. And the world quickly changes.

This week investors started telling us that the time for big change could be happening very soon in retail. And if it does, Walmart’s size will be more of a disadvantage than benefit.

As a case study in bad leadership, Sears under Chairman Lampert offers great lessons in Value Destruction that would serve Professor Fruhan’s teachings well:

As a case study in bad leadership, Sears under Chairman Lampert offers great lessons in Value Destruction that would serve Professor Fruhan’s teachings well: