by Adam Hartung | Mar 2, 2011 | Books, Defend & Extend, eBooks, In the Rapids, In the Swamp, Innovation, Leadership, Lock-in

What separates business winners from the losers? A lot of pundits would say you need to be efficient, cost conscious and manage margins. Others would say you need to be really good (excellent) at something – much better than anyone else. Unfortunately, that sounds good but in our fast-paced, highly competitive world today those platitudes don’t really create winners. Success has much more to do with the ability to shift. And to create shifts.

Think about Amazon.com. This company was started as an on-line retail channel for books most stores would not stock on their shelves. But Amazon used the shift to internet acceptance as a way to grow into selling all books, and eventually came to dominate book sales. Not only have most of the small book stores disappeared, but huge chains like B. Dalton and more recently Borders, were driven to bankruptcy. Amazon then built on this shift to expand into selling lots more than books, becoming a force for selling all kinds of products. And even opening itself to become a portal for other on-line retalers by routing customers to their sites, and even taking orders for products shipped from other e-tailers.

More recently, Amazon has taken advantage of the shift to digitization by launching its Kindle e-reader. And by making thousands of books available for digital downloading. By acting upon market trends, Amazon has shifted quickly, and has caused shifts in the market where it participates. And this shifting has been worth a lot to Amazon. Over the last 5 years Amazon’s stock has risen from about $30/share to about $180/share – about a 45%/year compounded rate of return!

Chart source: Yahoo Finance

Chart source: Yahoo Finance

In the middle to late 1990s, as Amazon was just starting to appear on radar screens, it appeared like Sears would be the kind of company that could dominate the internet. After all Sears was huge! It was a Dow Jones Industrial Average (DJIA) member that had ample resources to invest in the emerging growth market. Sears had a history of pioneering markets. It had once dominated retail with its catalogs, then became a powerhouse in free standing retail stores, then led the movement to shopping malls as an anchor chain, and even used its history in lending to develop what became Discover card, and had once shown its ability to be a financial services company and even an insurer! Sears had shifted with historical trends, and surely the company would see that it could bring its resources to the shifting retail landscape in order to remain dominant.

Unfortunately, Sears went a different direction, prefering to focus on defending its current business model. As the chain struggled, it was dropped from the DJIA. Eventually a financier, Edward Lampert, used his takeover of bankrupt KMart (by buying up their bonds) to take over Sears! Under his leadership Sears focused hard on being efficient, controlling costs and managing margins. Extensive financial rigor was applied to Sears to improve the profitability of every line item, dropping poor performers and closing low margin stores. While this initially excited investors, Sears was unable to compete effectively against other retailers that were lower cost, or had better merchandise or service, and the value has declined from about $190/share to $80; a loss of about 60% (at its recent worst the stock fell to almost 30 – or a decline of 84% peak to trough!)

Chart Source: Yahoo Finance

Chart Source: Yahoo Finance

Meanwhile the world’s #1 retailer, Wal-Mart, has long excelled at being the very best at supply chain management, and low-price leadership in retailing. Wal-Mart has never varied from its original business model, and in the retail world it is undoubtedly the very best at doing what it does – buy cheap, sell cheap and run a very tight supply chain from purchase to sale. This excited some investors during the “Great Recession” as customers sought out low prices when fearing about their jobs and future.

But this strategy has not been able to produce much growth, as stores have begun saturating just about everywhere but the inner top 30 cities. And it has been completely unsuccessful outside the USA. As a result, despite its behemoth size, the value of Wal-Mart has really gone nowhere the last 5 years. While there has been price gyration (from $42 low to $62 high) for long-term investors the stock has really gone nowhere – mired mostly around $50. Chart Source: Yahoo Finance

Chart Source: Yahoo Finance

Investors in Amazon have clearly fared much better than Sears or Wal-Mart

Chart Source: Yahoo Finance

Chart Source: Yahoo Finance

Too often business leaders spend too much time thinking about what they do. They think about costs, margins, the “business model” and execution. But success really has less to do with those things than understanding trends, and capitlizing on those trends by shifting. You don’t have to be the lowest cost, or most efficient or even the most passionate. What works a lot better is to go where the trends are favorable, and give customers solutions that align with the trends. And if you do this early, before anyone else, you’ll have a lot of time to figure out how to make money before competitors try to cut your margins!

Recognize that most “execution” is about preserving what happened in the past. Trying to do things better, faster and cheaper. But in a rapidly changing world, new competitors change the basis of competition. Amazon isn’t a better classical bookseller, or retailer. It’s a company that leveraged trends – market shifts – to take advantage of new technologies and new ways of people shopping. First for books and then other things. Later it built on trends toward digitization by augmenting the production of electronic publications, which is destined to change the world of book publishing altogether – and even has impact on the publishing of everything from periodicals to manuals. Amazon is now creating market shifts, which is changing the fortunes of others.

For investors, employees and suppliers you are better off to be with the company that shifts. It has the ability to grow with the trends. And the faster you get out of those companies which are stuck, locked-in to their old business model and practices in an effort to defend historical behaviors, the better off you’ll be. Despite the P/E multiples, or other claims of “value investing,” to succeed you’re a lot better off with the company that’s finding and building on trends than the ones managing costs.

by Adam Hartung | Feb 9, 2009 | Current Affairs, Food and Drink, In the Swamp, Leadership

The second step in following The Phoenix Principle to achieve superior returns is to study competitors. Better, obsess about them. Why? So you can learn from them and position your products, services and skill sets in a way to be a leader. We would hope that studying competitors would not lead a company to take on battles it's almost assured of not winning. Too bad nobody told that to Mr. Schultz at Starbucks, who seems intent on killing Starbucks since his return as CEO.

Starbucks become an icon by offering coffee shops where people could meet, talk and share a coffee – while possibly reading, or checking their email. One of the most famous situation comedies of recent past was "Friends", a show in which people regularly met in a coffee shop not unlike Starbucks. People could order a wide range of different coffee drinks, and the ambience was intended to reflect a more European environment for meeting to drink and discuss. This combination of product and service found mass appeal, and rapid growth. Meanwhile, the previous CEO rapidly moved to seize the value of this appeal by stretching the brand into grocery store sales, coffee on airlines, liquor products, music sales, various retail items, some food (prepared sandwiches and high-end snacks, mostly), artist representation and even movie making. He knew there was a limit to store expansion, and he kept opening White Space to find new business opportunities.

But then Mr. Schultz, considered the "founding CEO" (even though he wasn't the founder) came roaring back – firing the previous expansion-oriented CEO. He claimed these expansion opportunities caused Starbucks to "lose focus". So he quickly set to work cutting back offerings. This led to layoffs. Which led to closing stores. Which led to more layoffs. The company fast went into a tailspin while he "refocused."

Meanwhile competitors started having a field day. Dunkin Donuts launched a campaign lampooning the drink options and the special language of Starbucks, appealing for old customers to return for a donut – and get a latte too. And McDonald's, after years of study, finally decided to roll out a company-wide "McCafe" in which McDonald's could offer specialty coffee drinks as well. While Starbuck's CEO was rolling backward, competitors were rolling forward – and in the case of McDonald's rolling like a Panzer tank.

Now, with a big recession in force, McDonald's is making hay by siezing on its long-held position as a low cost place. Like Wal-Mart, McDonald's is in the right place for people who want to seek out brands that represent "cheap." With sales up in this recession, the company is now launching a new program to highlight its McCafe concept directly aimed at trying to steal Starbucks customers (readarticle here).

So, here's Starbucks that has "repositioned" itself back as strictly a "coffee company". And the company has been spiraling downward for over a year. And the world's largest restaurant company has its sites set right on you. What should you do? Starbucks has decided to launch a "value meal" (read article here). Starbucks is going to go head-to-head with McDonald's. Uh, talk about walking in front of a truck.

Far too often company leadership thinks the right thing to do is "focus, focus, focus" then define battles with competitors and enter into a gladiator style war to the death. And that is just plain foolish. Why would anyone take on a fight with Goliath if you can avoid it? At the very least, shouldn't you study competitors so you compete with them in ways they can't? You wouldn't choose to go toe-to-toe when you can redefine competition to your benefit.

But that is exactly what Starbuck's has done. Starbucks spent its longevity building a brand that stood for being somewhat "upmarket." You may not be able to afford a Porsche, but you could afford a good coffee in a great environment. Sure, you might cut back when the purse is slim, but you still know where the place is that gave you the great, good-inside feeling you always got when buying their product or visiting their store. Now the CEO of that company has taken to comparing the product, and the stores, to the place where kids are jumping around in the play pit – and you can smell $1.00 hamburgers cooking in the background. He's decided to offer values which compare his store, where you remember the cozy stuffed chairs and the sounds of light jazz and the smell of chocolate – with the place where you sit in plastic, unmovable benches at plastic, unmovable tables while listening to canned music bouncing off the tile (or porcelain) walls where you can wipe down everything with a mop.

You study competitors so you can be fleet-of-foot. You want to avoid the bloody battles, and learn where you can use strengths to win. Instead, Starbucks' CEO is doing the opposite. He has chosen to go head-to-head in a battle that can only serve to worsen the impression of his business among virtually all customers, while tacitly acknowledging that a far more successful (at this time) and better financed competitor is coming into his market. His desire to Defend his old business is causing him to take actions that are sure to diminish its value.

Let's see, does this possibly remind you of — let's see — maybe Marc Andreeson's decision to have Netscape go head-to-head with Microsoft selling internet browsers? How'd that work out for him? His investors? His employees? His vendors?

Studying competitors is incredibly important. It can help you to avoid bone-crushing competition. It can identify new ways to compete that leads to advantage. It can help you maneuver around better funded competitors so you can win – like Domino's building a successful pizza business by focusing on delivery while Pizza Hut focused on its eat-in pizzerias. But you have to be smart enough to realize not to try going headlong into battle with competitors that can crush you.

by Adam Hartung | Jan 12, 2022 | Boards of Directors, Leadership, Medical, Strategy, Trends

I was happy to end 2021 on a very high note. Kaiser Health Network interviewed me on the future of pharmacies, based on my historically accurate forecasts for retailers. READ MORE I was delighted when this went semi-viral, being picked up by Yahoo!News, Salon, Washington Post and about a dozen other publications.

I’ve had a nearly 2 decade relationship with Vistage and its global network of CEOs. I was delighted to be interviewed about the best short-term and long-term goal setting process, giving all Vistage members my insights for success and how to use their planning processes to build a road to greater profitable growth.

READ MORE I’m looking forward to working with more Vistage groups and individual members in 2022 as their ambition for success continues growing.

I kicked off 2022 with a live webcast interview with International Market & Competitive Intelligence

magazine, hosted by its Chief Editor Rom Gayoso. As the changing world remains in fast-shifting overdrive leaders are increasingly looking for insights about the future. I’m delighted more keep asking how they can use my 30+ years of trend tracking to help them find the right stars to follow. Let me know by email or phone if you’d like to talk about how I can help your business grow stronger every year, despite the seeming chaos around us. Here’s my

interview with Rom Gayoso.

Lesson – You are either growing, or you are dying. There is no “maintenance, status quo.”

For 2022, Spark Partners is offering its Master Class on strategic planning and innovation for HALF OFF! That’s right, for just $495 you can get this 28 module course that shows you how to identify and follow trends, then build plans that leverage those trends for faster, more profitable growth. There’s no similar tool in the marketplace. A year in the making, this course provides an overview of the process I’ve used to build successful forecasts for investors and business leaders across companies of all sizes.

https://www.sparkpartners.com/business-master-class-think-innovation-course

Respond to this email and I can arrange your limited time discount to get started building a stronger, more successful organization.

Are you on “cruise control” running your business?

Ask yourself, Are you trying to defend and extend what you’ve always done? Or are you meeting unmet customer needs, helping customers to grow and in turn growing yourself? If you’re the former, get ready for a rude awakening.

Did you see the trends, and were you expecting the changes that would happen to your demand? It IS possible to use trends to make good forecasts, and prepare for big market shifts. If you don’t have time to do it, perhaps you should contact us, Spark Partners. We track hundreds of trends, and are experts at developing scenarios applied to your business to help you make better decisions.

TRENDS MATTER. If you align with trends your business can do GREAT! Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business. Click for Assessment info. Or, to keep up on trends, subscribe to our weekly podcasts and posts on trends and how they will affect the world of business at www.SparkPartners.com

Give us a call or send an email. Adam@sparkpartners.com 847-726-8465.

by Adam Hartung | May 26, 2021 | Innovation, Investing, Software, Strategy, Trends

Free Trend Money!

Amazon is buying MGM film studios for something less than $9 B. Sounds like a lot of money. But since Amazon can make its own money, effectively this transaction is free. Now you must be wondering, how can Amazon make its own money? By creating “Trend Value.”

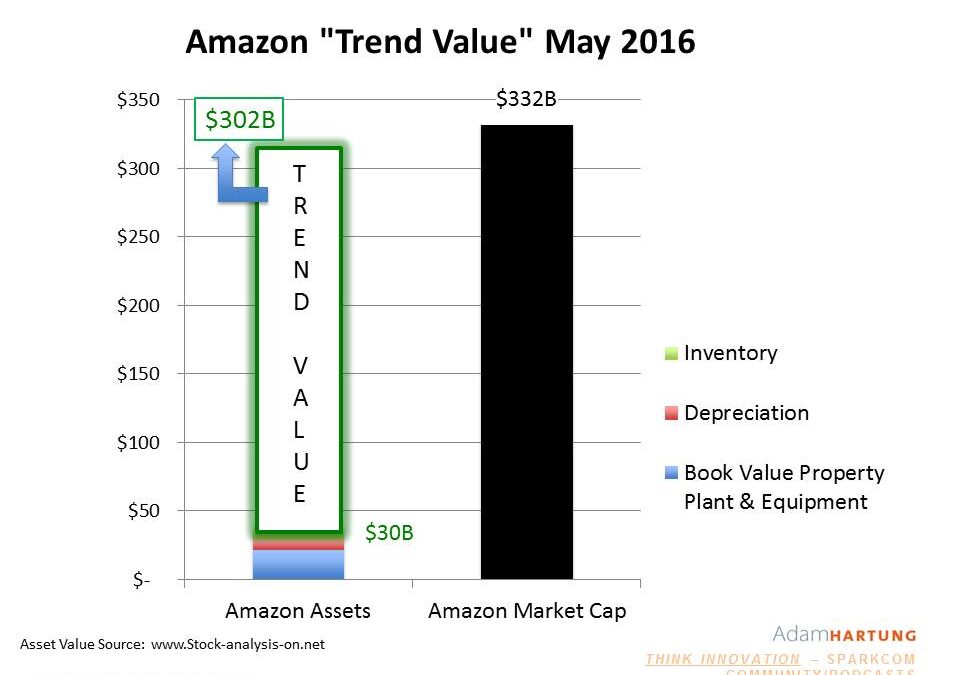

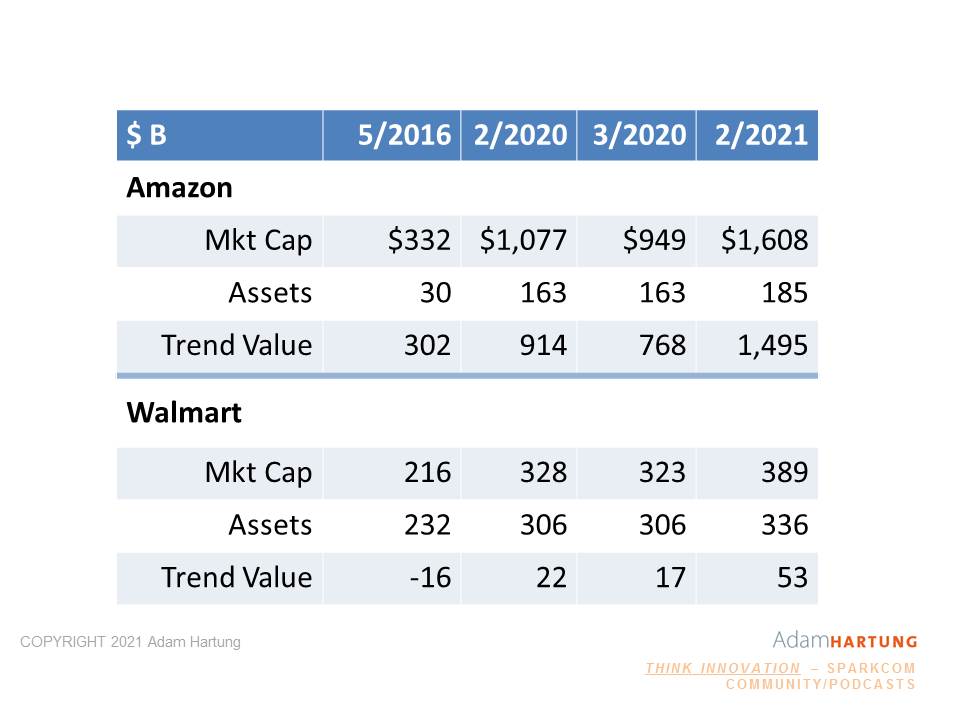

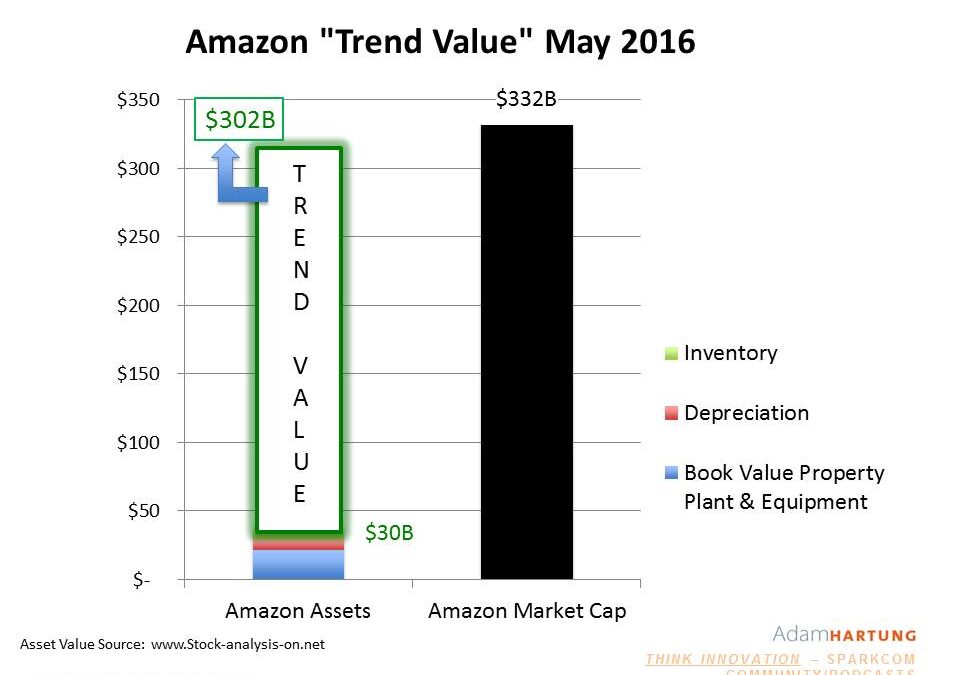

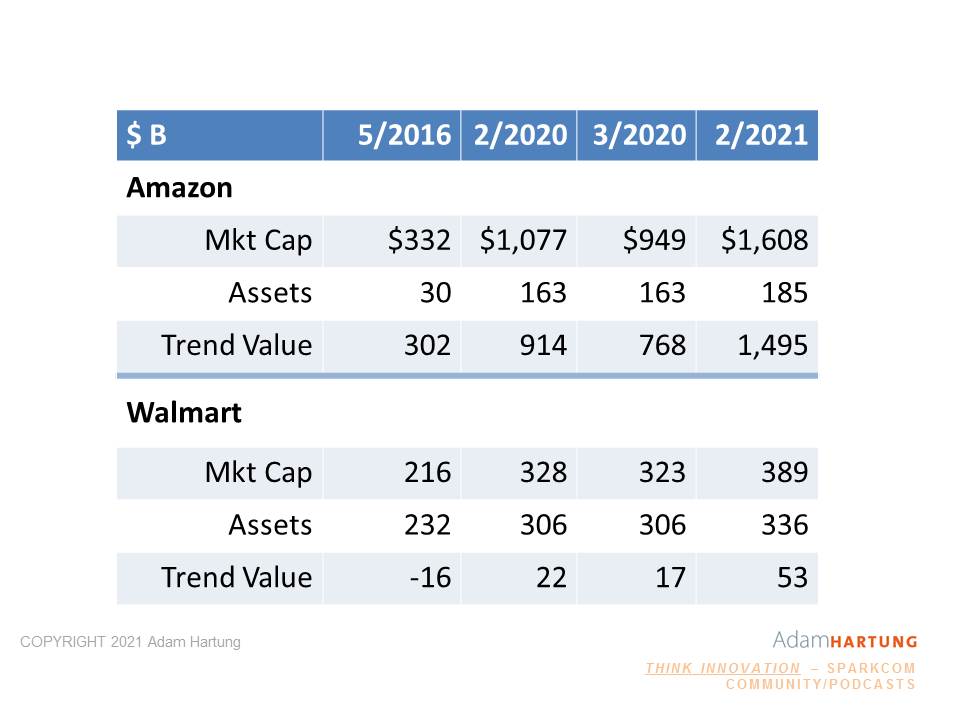

Back in 2016, before Amazon started making acquisitions like Whole Foods, its valuation (or market capitalization) was $332 B. But its assets were only worth $30 B. And remember, Amazon was not, and still isn’t, very profitable. Net income was only about $2 B at that time. That extra $300 B of valuation (10x the assets) wasn’t from earnings, but rather because Amazon was a global leader in e-commerce with about 40% market share in the USA. Because e-commerce and cloud computing were growing trends, investors gave Amazon an additional $300 B in value as a Trend Leader.

Because Amazon was riding the big trends to e-commerce it created $300 B of very real value. This very high share price allowed Amazon to keep investing in ways to grow, including making acquisitions.

Because Amazon was riding the big trends to e-commerce it created $300 B of very real value. This very high share price allowed Amazon to keep investing in ways to grow, including making acquisitions.

Compare with Walmart. In 2016 before, Walmart bought Jet, it had almost no e-commerce. Walmart had $232 B of assets (7 times the assets of Amazon,) but it’s valuation was only $216 B (2/3 Amazon’s.) Because Walmart’s assets (and business) were concentrated in the no-growth retail world of brick-and-mortar stores its value was less than its assets! Investors were basically saying that to create value Walmart would have to sell its assets – not grow its revenues. As a result, Walmart’s Trend Value was a NEGATIVE $16 B

Six years (and a pandemic) later, and the world of e-commerce has exploded. WalMart bought Jet, eschewing adding traditional stores and instead investing in e-commerce. As a result its assets grew very little, but its market valuation improved to $399 B, an 85% enhancement. And it’s Trend Value went up to $60 B. A good thing, but still only 1/5 the 2016 Trend Value of Amazon. A $9 B acquisition would be a very notable acquisition for Walmart using up over 50% of its cash. And taking out a 2.5% chunk of its market cap, and a whopping 15% of its enhanced Trend Value. Meanwhile, since 2016 Amazon has purchased an entire grocery chain (Whole Foods) and made enormous investments in distribution centers, trucks, and other supply chain assets. That has increased Amazon’s asset base 10-fold, to about $320B. But now Amazon’s publicly traded shares are worth $1.62 TRILLION. That’s right, with a “T.” By investing in Trends (e-commerce and cloud computing services [AWS]) Amazon’s Trend Value has risen to a whopping $1,300 Billion. Amazon’s Trend Value is 21.5x Walmart’s.

Meanwhile, since 2016 Amazon has purchased an entire grocery chain (Whole Foods) and made enormous investments in distribution centers, trucks, and other supply chain assets. That has increased Amazon’s asset base 10-fold, to about $320B. But now Amazon’s publicly traded shares are worth $1.62 TRILLION. That’s right, with a “T.” By investing in Trends (e-commerce and cloud computing services [AWS]) Amazon’s Trend Value has risen to a whopping $1,300 Billion. Amazon’s Trend Value is 21.5x Walmart’s.

By investing in Trends, Amazon created a cache of value

They used that value to make more acquisitions. Even though it made huge investments in assets – far beyond WalMart’s – its Trend Value grew even more. Now Amazon could purchase MGM for $9 B and use only 10% of its cash. But it won’t. It will use shares. But that $9 B is now only .55% of Amazon’s value – and only .7% of its Trend Value. Negligible on the balance sheet, but opening up tremendous revenue growth for Prime Video.

If you want to create money, invest in trends. Walmart was the renowned leader in retail, and computing for retail, until trends shifted the market. Now it is an also-ran compared to Amazon. And because Amazon is leading in the Trending markets of e-commerce and cloud computing it has created the money to buy MGM. Again, not with profits (which are still only $20 B) but with the Trend Value created by proper market selection and investing.

So are you creating money by investing in trends? You can literally create your own money, usable for all kinds of investments, when you invest in trends. Or are you grinding out the business, like Walmart with all those stores, but creating almost no value in the vast majority of what you do? The choice is really up to you.

Did you see the trends, and were you expecting the changes that would happen to your demand? It IS possible to use trends to make good forecasts, and prepare for big market shifts. If you don’t have time to do it, perhaps you should contact us, Spark Partners. We track hundreds of trends, and are experts at developing scenarios applied to your business to help you make better decisions.

TRENDS MATTER. If you align with trends your business can do GREAT! Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business. Click for Assessment info. Or, to keep up on trends, subscribe to our weekly podcasts and posts on trends and how they will affect the world of business at www.SparkPartners.com

Give us a call or send an email. Adam@sparkpartners.com 847-726-8465.

by Adam Hartung | Dec 29, 2020 | eBooks, Innovation, Investing, Strategy, Trends

Thrive to the Future – 4 top trends for 2021 and beyond.

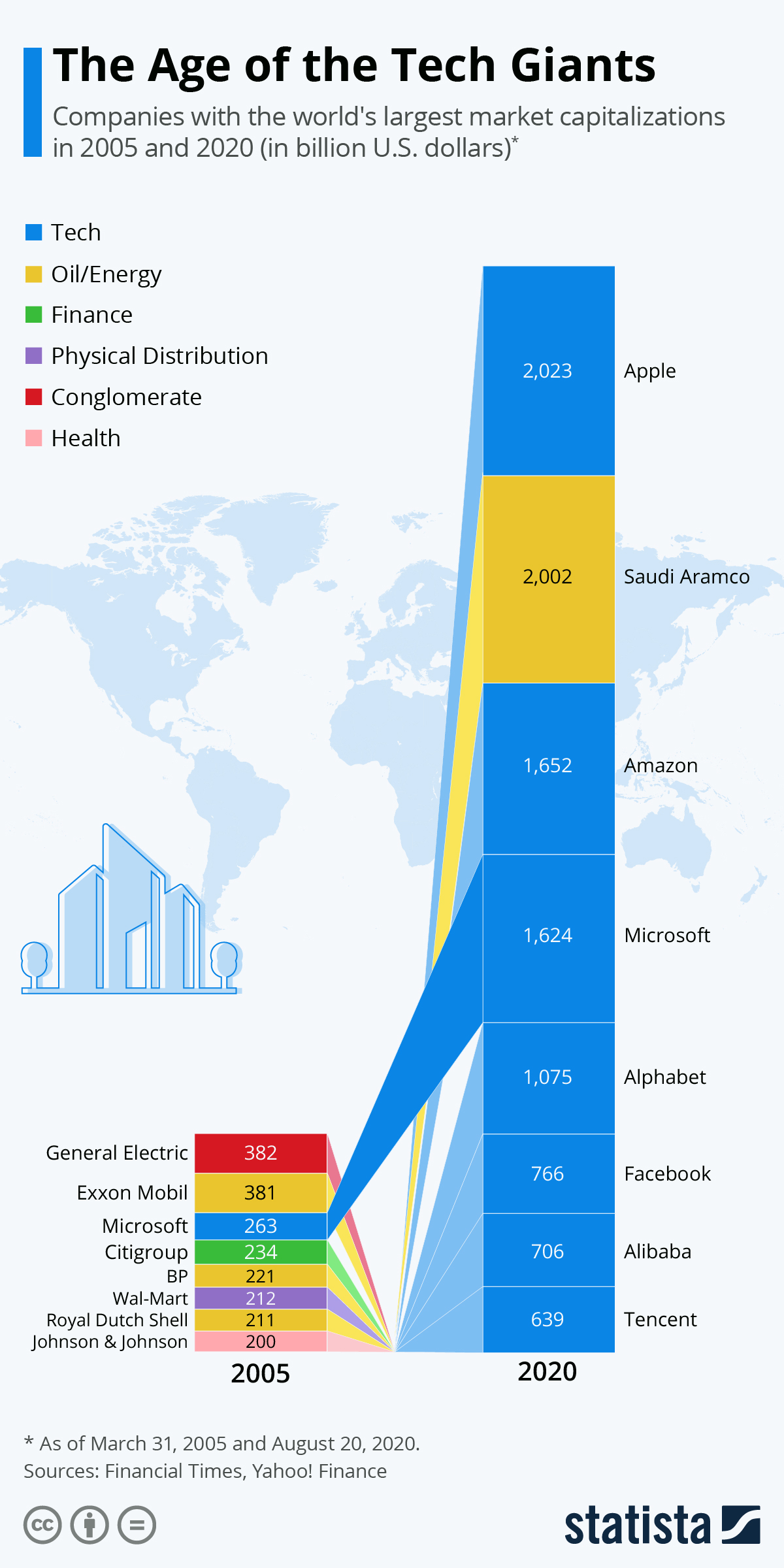

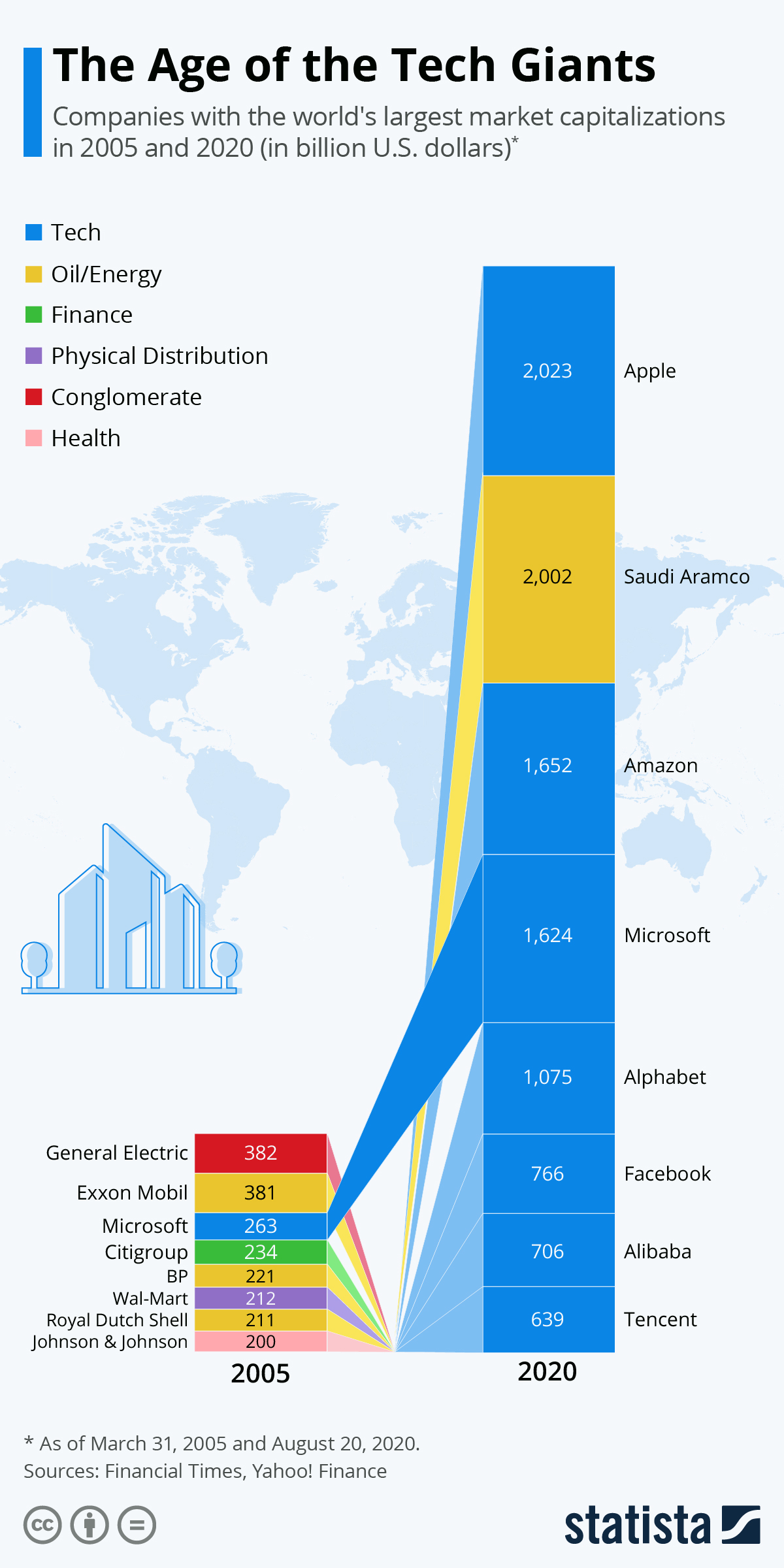

When looking at America’s 8 largest companies, a LOT has changed in 15 years. Back in 2005 the most valuable company was GE. The list was dominated by oil & gas companies; ExxonMobil, BP, Royal Dutch Shell. The biggest bank (Citi) and biggest retailer (Walmart) and 1 pharma company (J&J.) There was only 1 tech company on the list (Microsoft.)

But the world has changed, and that has impacted these companies dramatically. Most had GREAT pasts, but they did not adapt to a changing world. GE’s market cap has fallen 75% as it failed to keep up with trends. Oil companies failed to move into renewables and other industries (like electric car production) and they’ve lost over HALF their value. Walmart is most noted for missing the e-commerce trend, the big banks were clobbered by the Great Recession and “big pharma” hasn’t produced a blockbuster for many years. All down significantly.

But, the value of the top 8 companies is MUCH higher than 15 years ago – 5X more. These losers were replaced by some very serious winners. From $2.1T in combined value, the top 8 are now worth $10.5T. But notably, only 1 company is still on that list – Microsoft – which is up 620%!

The list is now dominated by 7 technology companies.

And for good reason – they all followed trends. Apple, Amazon, Microsoft, Alphabet (Google,) Facebook, Alibaba and Tencent all built their strategies around developing solutions for people to follow the major trends of being mobile, operating asynchronously, supporting gig work and adding artificial intelligence (AI) to their customers. By refusing to rest on past laurels they have become the mega-giants of today. (Hartung, “Thrive to the Future – The 4 Top Trends for 2021 and Beyond)

That these companies would overtake old leaders was not a foregone conclusion – nor an obvious one to most people. Not only were the previous giants big, they had incredible reputations and extremely strong management teams. And these tech companies were not without problems.

That these companies would overtake old leaders was not a foregone conclusion – nor an obvious one to most people. Not only were the previous giants big, they had incredible reputations and extremely strong management teams. And these tech companies were not without problems.

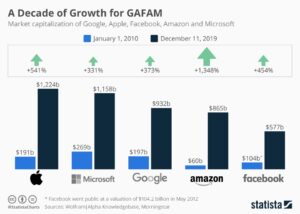

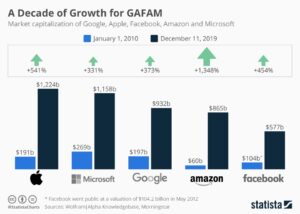

- Apple almost went bankrupt just a few years prior to 2005, trying to be the “Mac” company. But Apple built one innovation after another helping people meet the emerging big trends – until it became the most valuable company on the planet (10 yr value increase 540%)

- Microsoft was locked in to its Windows/Office domination and seemed unable (or unwilling) to acknowledge the big trends and its value languished under a terribly myopic CEO (Ballmer.) Yet, new leadership was able to see the trends and moved radically to build out cloud services and support for alternative customer solutions that changed the company and its fortunes (10 year value increase 330%)

- Amazon was a former book seller turned general merchandiser. But Amazon started applying technology to understand its customers and help them be better shoppers, using AI to make them the leader in all things e-commerce. Simultaneously Amazon built the worlds largest and most secure cloud services business (AWS) helping support all major trends (10 year value increase 1,350%)

- Google was a search engine, with an unclear business model. But Google went to unexpected lengths to make ALL forms of information digital, and accessible, and searchable. And it monetized that digitization in ways far beyond anyone expected leading to the end of newspapers and many other publishers (10 year value increase 370%)

- Facebook was considered a fad for young people. Most business leaders thought Facebook’s users would disappear, and its young leaders would learn there was no revenue in attracting eyeballs (just as News Corps learned and shut down MySpace.) But Facebook built out the trend for social contact in a mobile, asynchronous smart way creating an entirely new business market called “social media.” Facebook looked at trends in how people connected, making brilliant acquisitions early of Instagram and WhatsApp that allowed Facebook family of products to become the #1 use of the internet (10 year value increase 450%)

Key lessons?

First, the world is growing and leading businesses will grow. If you’re not growing, you’re dying. Just like GE and Exxon. Second, never plan from past success, but instead plan for the future. You don’t grow value by being operationally excellent, because the world is forever changing and it will make your past business less valuable even if you do run it well. Third, make sure your plans are all built on trends. Let trends be the wind in your sales, or the current under your boat, or whatever analogy you like – just be sure you’re using TRENDS to drive you business planning, product development and solutions generation. Customers buy trends and help for them to achieve the future.

Do you know your Value Proposition? Can you clearly state that Value Proposition without any linkage to your Value Delivery System? If not, you better get on that pretty fast. Otherwise, you’re very likely to end up like encyclopedias and newspaper companies. Or you’ll develop a neat technology that’s the next Segway. It’s always know your customer and their needs first, then create the solution. Don’t be a solution looking for an application. Hopefully Uber and Aurora will both now start heading in the right directions.

Did you see the trends, and were you expecting the changes that would happen to your demand? It IS possible to use trends to make good forecasts, and prepare for big market shifts. If you don’t have time to do it, perhaps you should contact us, Spark Partners. We track hundreds of trends, and are experts at developing scenarios applied to your business to help you make better decisions.

TRENDS MATTER. If you align with trends your business can do GREAT! Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business. Click for Assessment info. Or, to keep up on trends, subscribe to our weekly podcasts and posts on trends and how they will affect the world of business at www.SparkPartners.com

Give us a call or send an email. Adam@sparkpartners.com 847-331-6384

Chart Source: Yahoo Finance