by Adam Hartung | Jan 19, 2011 | Current Affairs, Disruptions, Games, In the Rapids, In the Swamp, Innovation, Leadership, Lock-in, Music, Openness, Web/Tech

The Wall Street Journal headlined Monday, “Apple Chief to Take Leave.” Forbes.com Leadership editor Fred Allen quickly asked what most folks were asking “Where does Steve Jobs Leave Apple Now?” as he led multiple bloggers covering the speculation about how long Mr. Jobs would be absent from Apple, or if he would ever return, in “What They Are Saying About Steve Jobs.” The stock took a dip as people all over raised the question covered by Steve Caulfield in Forbes’ “Timing of Steve Jobs Return Worries Investors, Fans.”

If you want to make money investing, this is what’s called a “buying opportunity.” As Forbes’ Eric Savitz reported “Apple is More Than Just Steve Jobs.” Just look at the most recent results, as reported in Ad Age “Apple Posts ‘Record Quarter’ on Strong iPhone, Mac, iPad Sales:”

- Quarterly revenue is up 70% vs. last year to $26.7B (Apple is a $100B company!)

- Quarterly earnings rose 77% vs last year to $6B

- 15 million iPads were sold in 2010, with 7.3 million sold in the last quarter

- Apple has $50B cash on hand to do new product development, acquisitions or pay dividends

ZDNet demonstrated Apple’s market resiliency headlining “Apple’s iPad Represents 90% of All Tablets Shipped.” While it is true that Droid tablets are now out, and we know some buyers will move to non-Apple tablets, ZDNet predicts the market will grow more than 250% in 2011 to over 44 million units, giving Apple a lot of room to grow even with competitors bringing out new products.

Apple is a tremendously successful company because it has a very strong sense of where technology is headed and how to apply it to meet user needs. Apple is creating market shifts, while many other companies are reacting. By deeply understanding its competitors, being willing to disrupt historical markets and using White Space to expand applications Apple will keep growing for quite a while. With, or without Steve Jobs.

On the other hand, there’s the stuck-in-the-past management team at Microsoft. Tied to all those aging, outdated products and distribution plans built on PC technology that is nearing end of life. But in the midst of the management malaise out of Seattle Kinect suddenly showed up as a bright spot! SFGate reported that “Microsoft’s Xbox Kinect beond hackers, hobbyists.” Seems engineers around the globe had started using Kinect in creative ways that were way beyond anything envisioned by Microsoft! Put into a White Space team, it was possible to start imagining Kinect could be powerful enough to resurrect innovation, and success, at the aging monopolist!

But, unfortunately, Microsoft seems far too stuck in its old ways to take advantage of this disruptive opportunity. Joel West at SeekingAlpha.com tells us “Microsoft vs. Open Kinect: How to Miss a Significant Opportunity.” Microsoft is dedicated to its plan for Kinect to help the company make money in games – and has no idea how to create a White Space team to exploit the opportunity as a platform for myriad uses (like Apple did with its app development approach for the iPhone.)

In the end, ZDNet joined my chorus looking to oust Ballmer (possibly a case study in how to be the most misguided CEO in corporate America) by asking “Ballmer’s 11th Year as Microsoft’s CEO – Is it Time for Him to Go?” Given Ballmer’s massive shareholding, and thus control of the Board, it’s doubtful he will go anywhere, or change his management approach, or understand how to leverage a breakthrough innovation. So as the Cloud keeps decreasing demand for traditional PCs and servers, Brett Owens at SeekingAlpha concludes in “A Look at Valuations of Google, Apple, Microsoft and Intel” that Microsoft has nowhere to go but down! Given the amazingly uninspiring ad program Microsoft is now launching (as described in MediaPost “Microsoft Intros New Corporate Tagline, Strategy“) we can see management has no idea how to find, or sell, innovation.

We often hear advice to buy shares of a company. Rarely recommendations to sell. But Apple is the best positioned company to maintain growth for several more years, while Microsoft has almost no hope of moving beyond its Lock-in to old products and markets which are declining. Simplest trade of 2011 is to sell Microsoft and buy Apple. Just read the headlines, and don’t get suckered into thinking Apple is nothing more than Steve Jobs. He’s great, but Apple can remain great in his absence.

by Adam Hartung | Jan 13, 2011 | Current Affairs, In the Rapids, Innovation, Leadership, Web/Tech

Before there was Facebook, the social media juggernaut which is changing how we communicate – and might change the face of media – there was MySpace. MySpace was targeted at the same audience, had robust capability, and was to market long before Facebook. It generated enormous interest, received a lot of early press, created huge valuation when investors jumped in, and was undoubtedly not only an early internet success – but a seminal web site for the movement we now call social media. On top of that, MySpace was purchased by News Corporation, a powerhouse media company, and was given professional managers to help guide its future as well as all the resources it ever wanted to support its growth. By almost all ways we look at modern start-ups, MySpace was the early winner and should have gone on to great glory.

But things didn’t turn out that way. Facebook was hatched by some college undergrads, and started to grow. Meanwhile MySpace stagnated as Facebook exploded to 600 million active users. During early 2010, according to The Telegraph in “Facebook Dominance Forces Rival Networks to Go Niche,” MySpace gave up on its social media leadership dreams and narrowed its focus to the niche of being a “social entertainment destination.” As the number of users fell, MySpace was forced to cut costs, laying off half its staff this week according to MediaPost.com “MySpace Confirms Massive Layoffs.” After losing a reported $350million last year, it appears that MySpace may disappear – “MySpace Versus Facebook – There Can Be Only One” reported at Gigaom.com. The early winner now appears a loser, most likely to be unplugged, and a very expensive investment with no payoff for NewsCorp investors.

What went wrong? A lot of foks will be relaying the tactics of things done and not done at MySpace. As well as tactics done and not done at Facebook. But underlying all those tactics was a very simple management mistake News Corp. made. News Corp tried to guide MySpace, to add planning, and to use “professional management” to determine the business’s future. That was fatally flawed when competing with Facebook which was managed in White Space, lettting the marketplace decide where the business should go.

If the movie about Facebook’s founding has any veracity, we can accept that none of the founders ever imagined the number of people and applications that Facebook would quickly attract. From parties to social games to product reviews and user networks – the uses that have brought 600 million users onto Facebook are far, far beyond anything the founders envisioned. According to the movie, the first effort to sell ads to anyone were completely unsuccessful, as uses behond college kids sharing items on each other were not on the table. It appeared like a business bust at the beginning.

But, the brilliance of Mark Zuckerberg was his willingness to allow Facebook to go wherever the market wanted it. Farmville and other social games – why not? Different ways to find potential friends – go for it. The founders kept pushing the technology to do anything users wanted. If you have an idea for networking on something, Facebook pushed its tech folks to make it happen. And they kept listening. And looking within the comments for what would be the next application – the next promotion – the next revision that would lead to more uses, more users and more growth.

And that’s the nature of White Space management. No rules. Not really any plans. No forecasting markets. Or foretelling uses. No trying to be smarter than the users to determine what they shouldn’t do. Not prejudging ideas so as to limit capability and focus the business toward a projected conclusion. To the contrary, it was about adding, adding, adding and doing whatever would allow the marketplace to flourish. Permission to do whatever it takes to keep growing. And resource it as best you can – without prejudice as to what might work well, or even best. Keep after all of it. What doesn’t work stop resourcing, what does work do more.

Contrarily, at NewsCorp the leaders of MySpace had a plan. NewsCorp isn’t run by college kids lacking business sense. Leaders create Powerpoint decks describing where the business will head, where they will invest, how they will earn a positive ROI, projections of what will work – and why – and then plans to make it happen. They developed the plan, and then worked the plan. Plan and execute. The professional managers at News Corp looked into the future, decided what to do, and did it. They didn’t leave direction up to market feedback and crafty techies – they ran MySpace like a professional business.

And how’d that work out for them?

Unfortunately, MySpace demonstrates a big fallacy of modern management. The belief that smart MBAs, with industry knowledge, will perform better. That “good management” means you predict, you forecast, you plan, and then you go execute the plan. Instead of reacting to market shifts, fast, allowing mistakes to happen while learning what works, professional managers should be able to predict and perform without making mistakes. That once the bright folks who create the strategy set a direction, its all about executing the plan. That execution will lead to success. If you stumble, you need to focus harder on execution.

When managing innovation, including operating in high growth markets, nothing works better than White Space. Giving dedicated people permission to do whatever it takes, and resources, then holding their feet to the fire to demonstrate performance. Letting dedicated people learn from their successes, and failures, and move fast to keep the business in the fast moving water. There is no manager, leader or management team that can predict, plan and execute as well as a team that has its ears close to the market, and the flexibility to react quickly, willing to make mistakes (and learn from them even faster) without bias for a predetermined plan.

The penchant for planning has hurt a lot of businesses. Rarely does a failed business lack a plan. Big failures – like Circuit City, AIG, Lehman Brothers, GM – are full of extremely bright, well educated (Harvard, Stanford, University of Chicago, Wharton) MBAs who are prepared to study, analyze, predict, plan and execute. But it turns out their crystal ball is no better than – well – college undergraduates.

When it comes to applying innovation, use White Space teams. Drop all the business plan preparation, endless crunching of historical numbers, multi-tabbed Excel spreadsheets and powerpoint matrices. Instead, dedicate some people to the project, push them into the market, make them beg for resources because they are sure they know where to put them (without ROI calculations) and tell them to get it done – or you’ll fire them. You’ll be amazed how fast they (and your company) will learn – and grow.

by Adam Hartung | Jan 8, 2011 | Books, Openness

My guest blogger today is Nick Morgan, Founder and CEO of America’s leading firm for developing and coaching great speeches. Leaders, especially those who promote innovation, need to be great communicators. You are never good enough when market shifts make the stakes so high. Here Nick offers particularly good insight to everyone who finds themselves in front of an audience in 2011:

“The only reason to give a speech is to change the world.” An old friend of mine, a speechwriter, used to say that to me. He meant it as a challenge. It was his way of saying that, if you’re going to take all the trouble to prepare and deliver a speech, make it worthwhile. Change the world.

Otherwise, why bother? Preparing speeches, giving speeches, and listening to speeches—each of these activities is fraught with peril. The opportunities for failure are many, and for success correspondingly few. An oft-quoted study suggests that executives would rather die than speak. Of all their fears, public speaking is number one, and death comes much further down the list, just before nuclear war. That must explain why they often put off the task of preparing speeches to the last minute—or give the task to someone else.

If speechmaking is hard work for presenters, it’s also hard work for their audiences. Most business presentations are dreadful—boring, platitudinous, and delivered with a compelling lack of enthusiasm. People don’t remember much of what they learn from speeches—something on the order of 10 to 30 percent. With some business talks I’ve attended, that failure rate must be close to 100 percent. How many presentations have you sat through where your mind started wandering a few minutes into the talk and never really came back? Where you surreptitiously picked up your smartphone and started planning your calendar for the next millennium or two? Where you ended up more familiar with the number of acoustic tiles in the ceiling than the number of points in the outline of the speech?

So why do we bother? We bother giving speeches because of the opportunities they offer presenters with passion and a cause. There is something profound about gathering a group of people together in a hall and giving them the full force of your ideas presented live and in person. There is something essential about the intellectual, emotional, and physical connections a good speaker can make with an audience, something that cannot happen on the printed page. There is something powerful about the chemistry that happens in the moment of contact that no other medium can reproduce.

It’s what I call the kinesthetic connection. It’s something I’ve observed in over 25 years of teaching and coaching public speaking. When it happens, it’s powerful. When it’s missing, everyone feels it—even the hapless speaker.

Why People Will Always Give Speeches

We still need speeches. We need them to move audiences to action. People may learn to believe in your expertise from the printed page. But they will only be moved to action if they come to trust you from hearing and seeing you offer a solution to a problem they have. That kind of trust is visceral as well as intellectual and emotional, and it only comes from presence.

From the audience’s point of view, we still need to validate our impulse to action by seeing our champions, to test the sense of their messages and the integrity of their beings. Partly, we’re reading their nonverbal messages, those gestures and habits that we learn to interpret unconsciously for the most part, the ones that tell us something about the credibility and courage of the presenter. Partly, we’re testing to see if they can structure and present their ideas coherently in real time, abilities that tell us about how articulate and organized they are. And partly, we’re watching to see if we can find some sense of common humanity in the speaker, in order to make common cause with that speaker’s passion.

When Roger Mudd asked Ted Kennedy, on 60 Minutes in 1980, why he wanted to be president, Senator Kennedy famously fumbled the answer. Millions of Americans watched Kennedy at close hand, thanks to the eye of the camera, and judged his incoherent, rambling answer to lack credibility. The campaign was over almost before it began. Kennedy had changed the world—not in the way he intended, perhaps, but inescapably and irretrievably nonetheless. Potential backers slunk away from the Kennedy camp. Potential workers joined other campaigns. Potential voters resolved to find another candidate. And all of that happened through the faux-familiarity of television. Imagine how much more devastating it would have been in person.

Does changing the world seem like a daunting challenge? There’s good news buried in the challenge. With a powerful, audience-centered presentation, you can change the world. And that goes whether you’re talking to a small group of employees or colleagues—or a keynote audience of thousands. The principles are the same.

And there’s more good news to come: Regardless of how good you are now, you can learn how to give a better speech, one that makes a kinesthetic connection with your listeners. One that creates a sense of trust in you and moves them to action.

You Need to Listen to Your Audience

At the heart of this connection lies a counterintuitive truth: the secret to forming a strong bond between you and the people in the audience is to listen to them—from the very beginning.

Wait a minute, you say. I’m the one that has to do the talking. How can I listen to them? And what do you mean by kinesthetic? You’ve already used that word twice.

The answers to these questions are related. Let’s take the easy one first. Kinesthetic means being aware of the position and movement of the body in space. And to listen to the audience, you need to listen (and to show you’re listening) with your whole body. To give a simple example, consider the nervous executive in front of the shareholders for an annual meeting. He has some less-than-spectacular numbers to report, and everyone knows it. He’s prepared for the worst. He begins his talk with a curt, “Good morning,” arms folded, staring tensely over the audience members’ heads, looking into the middle distance, trying not to acknowledge the anger he sees in front of him. He immediately launches into a defensive talk aimed at minimizing the damage and second-guessing what the audience might ask him.

Not a pretty picture. Contrast that with a different executive in a similar pickle. She knows the meeting is going to be tough, but she’s ready. She stands up in front of the shareholders, smiles, and asks, “How are you?” Her arms are comfortably open at her sides. And she waits for a couple of seconds, making eye contact with at least one of the audience members on the right hand side of the room. Then she asks, no longer smiling, raising her eyebrows to invite response, “Are you angry about last year’s numbers? [Pause. Looking at someone else, on the left, now.] You have every right to be. We’re as disappointed as you are. Let’s talk about them. What’s on your mind?”

Not many chief executives would have the guts, frankly, to take the second approach. But which company would you rather hold stock in?

The second executive is well on the way to giving an audience-centered speech. She’s going to find kinesthetic moments to connect with her audience, and she’s begun by actually listening to them—reading their entire range of responses, including the nonverbal—from the start.

Indeed, even in this simplified example, the key to success is in making those rhetorical questions real. When you ask, “How are you?” of an audience, wait to see how some members of that audience actually are. Don’t continue until you’ve learned the answer, either verbally or nonverbally. It’s a small but vital way to begin an audience-centered talk. Success in public speaking is made up of a myriad little moments of connection like that.

And one big thing: charisma. That’s the magic quality, isn’t it? The one that everyone craves. And yet charisma doesn’t come from doing something difficult or esoteric that it takes years to master (and lots of expensive advice from speech coaches like me). We know now, thanks to the communications research of the last thirty years, what charisma is. Quite simply, it’s focused expressiveness. Expressiveness is the willingness to be open to your audience, both verbally and nonverbally. To show how you feel about your subject. To get past nervousness and self-consciousness and get to the stuff that you care about, and give that to the audience. That’s why they call it “giving a speech.” If you can unlock your own passion about the subject, and give that to the audience, in a focused way, you will be charismatic. The audience will not be able to take its eyes off you.

And so we’re back to audience-centered speaking, and kinesthetics. The only reason to give a speech is to change the world. You accomplish that by moving your audience to action. To do that, you have to be willing to listen to the audience, and to give it your passion. To get to that happy state, you need to find kinesthetic connections with the audience.

That’s audience-centered speaking in a paragraph. It’s a simple as that.

And lest you think that when I say “changing the world” I’m only talking about the big speeches (the ones that CEOs give to shareholders, for example) understand that I’m talking about every speech ever given. These principles apply to all public speaking, whether to five thousand people or five, for a grand public occasion or simply a regular meeting to report on 3Q numbers. After all, if you give a brilliant, inspiring, audience-centered presentation about those 3Q numbers, you will change the attitudes of your team in the room with you. And if you change their attitudes, you just might change their behavior. And if you change their behavior, you’ve changed the world in the only way that counts.

So that’s my wish for you in 2011: that you’ll start changing the world with every speech or presentation you give.

If you want to make sure yoru points are clear and communicated well consider contacting Nick and Public Words. Their clients have improved their communications dramatically for positive results. At the very least, pick up Nick’s books from Amazon or another source and use his recommendations – you’ll be glad you did! Reach out to Nick via his web site http://www.PublicWords.com

by Adam Hartung | Jan 5, 2011 | Defend & Extend, In the Rapids, In the Swamp, Leadership, Lock-in, Openness

Summary:

- Business planning systems are designed to defend historical markets

- Rapidly shifting markets makes it impossible to grow by defense alone

- Growth requires understanding what customers want, and creating new solutions that most likely aren’t part of the current business

- You can’t grow if you don’t plan to grow, but to plan for growth you have to shift resources from traditional planning into scenario planning

- High growth companies like Virgin, Apple and Google plan to fulfill future needs, not defend & extend past practicess

Imagine you see a pile of hay. Above it is a sign flashing “find the needle.” That achievement would be hard. Change the sign to “find the hay” and suddenly achieving the goal becomes much easier. So, as the comedian Bill Engvall might ask, what’s your sign? Unfortunately, most businesses plan for 2011, and beyond, using the first sign. Very few do planning using the latter. Most businesses won’t grow, because they simply don’t know how to plan for growth!!

Most businesses start planning with “I’m in the horseshoe (for example) business. My market isn’t growing, and there is more capacity than demand. How can I grow?” For these people, their sign is “find the needle.”

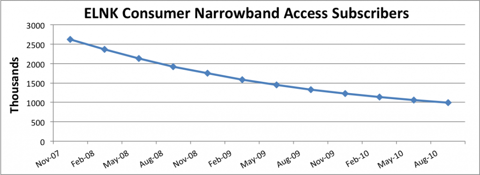

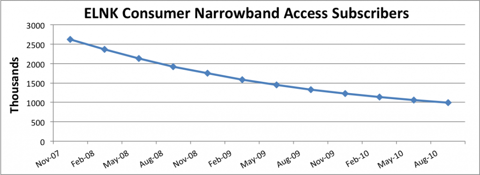

Take for example Earthlink. The company’s growth looked like a rocket ship in the early internet days as people by the millions signed up for dial-up service. But along came broadband, and the market for dial up died – never to return. Earthlink has no hope of growing as long as it thinks of itself as a dial-up company

Chart at SeekingAlpha.com author Ananthan Thangavel

Despite the absolute certainty that the market is shrinking, at this point almost all business planners will develop plans to defend this dying business as long as possible. Despite the impossibility of achieving good returns, there will be a plethora of actions to try and keep serving all the way to the very last customer. Just look at how AOL has invested millions trying to defend its dying internet access busiuness. Reality is, the company that walks away – gives up- is the smartest. There’s no way to make money as oversupply keeps too many companies spending too much to service too few customers.

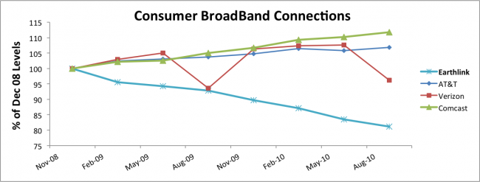

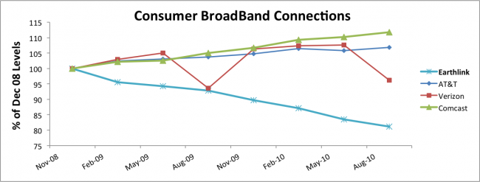

The next step for most planners is to attempt extending the business into something adjacent. For example, Earthlink would say “let’s invest in Broadband. We’ll hang onto customers as they want to switch, and maybe pick up a few customers.” But this completely ignores the fact that competitors already have a substantial lead. Competitors have learned the technology, and the marketplace. They are growing, and have no intention of giving up any room to a new competitor.

Chart at SeekingAlpha.com author Ananthan Thangavel

Planning systems are designed to keep the business doing more of what it always did, or possibly extending the business into adjacent markets after returns have faltered. Planning systems have no way of recognizing when a business, or market, has become obsolete. And practically never do they recognize the power of exsting competitors when looking at adjacent markets. As a result, the planning system produces no growth plans, leading 2011 to end with the self-fulfilling prophecy that the plan predicted – little or no growth.

The future for Earthlink is pretty grim. As it is for most companies that plan based upon history, trying to Defend & Extend their historical markets. In the highly dynamic, global marketplaces of 2011 trying to find growth by remaining focused on the past is like looking for the needle in a haystack. Maybe there’s something in there – but it’s not likely – and it’s even a lot less likely you’ll find it – and if you did, the cost of finding it will almost assuredly be greater than the value.

Alternatively, why not use planning resources to find, and develop, growth markets. Instead of looking at what you did (as in the past tense) try to figure out what you should do. Rather than studying past products, customers and markets, why not develop scenarios about the future that give you insight to what people will want to buy in 2011, 2012 and beyond? Rather than looking for needles, why not go explore the hay?

Newspapers kept focusing on declining subscriptions, when they should have been studying Craig’s List, eBay, Vehix.com and other on-line environments to learn the future of advertising. Had Tribune company poured its resources into its early internet investments, such as cars.com and careerbuilder.com, rather than trying to defend its traditional newspapers, it may well have avoided bankruptcy. But rather than looking to the future when doing its planning, and understanding that on-line news was going to explode, Tribune kept looking for the needle (cost cuts, layoffs, outsourcing, etc.) to save the old success formula.

Direct mail companies and Sunday insert printers have continued looking for ways to defend & extend their coupon printing business – despite the fact that nobody reads junk mail or uses printed coupons. Several have failed, and larger companies have merged trying to find “synergies” and more cost cuts. Simultaneously a 28 year old music major from Nothwestern university starts figuring out how to help companies acquire new customers by offering email coupons, and within 2 years his company, Groupon, is valued at around $6B. There’s nothing that stopped coupon powerhouse Advo from being Groupon, except that its planning system was devoted to finding the needle, while Groupon’s leaders decided to go play in the hay.

Hallmark and American Greetings want us to buy birthday and holiday cards for various occasions – in a world where almost nobody mails cards any longer. As they keep trying to defend their old business, and extend it into a few new opportunities for on-line cards, Twitter captures the wave of instant communications by offering everyone 140 character ways to communicate. Because Twitter is out where the growth is, the company raises $200M giving it a value of $3.7B.

Nothing stops any business from being anything it wants to be. But as most enter 2011 they will use their planning resources, including all those management meetings and hours of forms completion, to do nothing more than re-examine the historical business. Most will devolve into trying to figure out how to do more with less. As future forecasts look grim, or perhaps cautiously optimistic (based on a lot of things going right – like a mysterious pick-up in demand) there will be much nashing of teeth – and meetings looking for a needle that can be offered to employees and investors as a hope for rising future value.

Smart companies get out of that rut. They focus their planning on the future. What do customers want, and how can we give them what they want? How can we create whole new markets. Apple was a PC company, but by exploring mobility it became a provider of MP3 consumer electronics, downloadable music, a mobile device and app supplier and the early winner in cloud accessing tablets. Google has moved from a search engine to a powerhouse ad placement company and is pushing the edges of growth in mobile computing as well as several other markets. Virgin started as a distributor of long-playing vinyl record albums, but by exploring what customers really wanted it has become an international airline, cell phone company, international lender and space travel pioneer (to mention just a few of its businesses.)

You can grow in 2011, but to do so you need to shed the old planning system (and its resource wasting processes) and get serious about scenario planning. Focus on the future, not the past.

by Adam Hartung | Dec 23, 2010 | Defend & Extend, General, In the Rapids, Innovation, Leadership, Openness

“Goodbye 2010, the Year of Austerity” is the headline from Mediapost.com‘s Marketing Daily. And that could be the mantra for many, many companies. Nobody is winning today by trying to save their way to prosperity! As we move into this decade, it is important business leaders realize that the only way to create a strong bottom line (profit) is to develop a strong top line (revenue.) Recommendations:

- Never be desperate. Go to where the growth is, and where you can make money. Don’t chase any business, chase the business where you can profitably growth. Be somewhat selective.

- Focus efforts on markets you know best. I add that it’s important you understand not to do just what you like, but learn to do what customers VALUE.

- Let go of crap, traditions and “playing it safe” actions. Growth is all about learning to do what the market wants, not trying to protect the past – whether processes, products or even customers.

- More lemonade making. You can’t grow unless you’re willing to learn from everything around you. We constantly find ourselves holding lemons, but those who prosper don’t give up – they look for how to turn those into desirable lemonade. What is your willingness to learn from the market?

- Austerity measures are counterproductive 99% of the time. Efficiency is the biggest obstacle to innovation. You don’t have to be a spendthrift to succeed, but you can’t be a miser investing in only the things you know, and have done before.

- Communicate, communicate, communicate. We don’t learn if we don’t share. Developing insight from the environment happens when all inputs are shared, and lots of people contribute to the process.

- Get off the downbeat buss. There’s more to success than the power of positive thinking, but it is very hard to gain insight and push innovation when you’re a pessimist. Growth is an opportunity to learn, and do exciting things. That should be a positive for everybody – except the status quo police.

Realizing that you can’t beat the cost-cutting horse forever (in fact, most are about ready for the proverbial glue factory), it’s time to realize that businesses have been under-investing in innovation for the last decade. While GM, Circuit City, Blockbuster, Silicon Graphics and Sun Microsystems have been failing, Apple, Google, Cisco, Netflix, Facebook and Twitter have maintained double-digit growth! Those who keep innovating realize that markets aren’t dead, they’re just shifting! Growth is there for businesses who are willing to innovate new solutions that attract customers and their dollars! For every dead DVD store there’s somebody making money streaming downloads. Businesses simply have to work harder at innovating.

Fast Company gives us “Five Innovative New Year’s Resolutions:”

- Associate. Work harder at trying to “connect the dots.” Pick up on weak signals, before others, and build scenarios to help understand the impact of these signals as they become stronger. For example, 24x7WallStreet.com clues us in that greater use of mobile devices will wipe out some businesses in “The Ten Businesses The Smartphone Has Destroyed.” But for each of these (and hundreds others over the next few years) there will be a large number of new business opportunities emerging. Just look at the efforts of Foursquare and Groupon and the direction those growth businesses are headed.

- Observe. Pay attention to what’s happening in the world, and think about what it means for your (and every other) business. $100/barrel oil has an impact; what opportunity does it create? Declining network TV watching has an impact – how will you leverage this shift? Don’t just wander through the market, and reacting. Figure out what’s happening and learn to recognize the signs of growth opportunities. Use market events to drive being proactive.

- Experiment. If you don’t have White Space teams trying figure out new business models, how will you be a future winner? Nobody “lucks” into a growth market. It takes lots of trial and learning – and that means the willingness to experiment. A lot. Plan on experimenting. Invest in it. And then plan on the positive results.

- Question. Keep asking “why” until the market participants are so tired they throw you out of the room. Then, invent scenarios and ask “why not” until they throw you out again. Markets won’t tell you what the next big thing is, but if you ask a lot of questions your scenarios about the future will be a whole lot better – and your experimentation will be significantly more productive.

- Network. You can’t cast your net too wide in the effort to obtain multiple points of view. Nothing is narrower than our own convictions. Only by actively soliciting input from wide-ranging sources can you develop alternative solutions that have higher value. We become so comfortable talking to the same people, inside our companies and outside, that we don’t realize how we start hearing only reinforcement for our biases. Develop, and expand, your network as fast as possible. Oil and water may be hard to mix, but it blending inputs creates a good salad dressing.

ChiefExecutive.net headlined “2010 CEO Wealth Creation Index Shows a Few Surprises.” Who creates wealth? Included in thte Top 10 list are the CEOs of Priceline.com, Apple, Amazon, Colgate-Palmolive and DeVry. These CEOs are driving industry innovation, and through that growth. This has produced above-average cash flow, and higher valuations for their shareholders. As well as more, and better quality jobs for employees. Meanwhile suppliers are in a position to offer their own insights for ways to grow, rather than constantly battling price discussions.

Who destroys wealth? In the Top 10 list are the CEOs of Dean Foods, Kraft, Computer Sciences (CSC) and Washington Post. These companies have long eschewed innovation. None have introduced any important innovations for over a decade. Their efforts to defend & extend old practices has hurt revenue growth, providing ample opportunity for competitors to enter their markets and drive down margins through price wars. Penny-pinching has not improved returns as revenues faltered, and investors have watched value languish. Employees are constantly in turmoil, wondering what future opportunities may ever exist. Suppliers never discuss anything but price. These are not fun companies to work in, or with, and have not produced jobs to grow our economy.

Any company can grow in 2011. Will you? If you choose to keep doing what you’ve always done – well you shouldn’t plan on improved performance. On the other hand, embracing market shifts and creating an adaptive organization that identifies and launches innovation could well make you into a big winner. Next holiday season when you look at performance results for 2011 they will have more to do with management’s decisions about how to manage than any other factor. Any company can grow, if it does the right things.

by Adam Hartung | Dec 17, 2010 | Current Affairs, Defend & Extend, In the Rapids, In the Swamp, Leadership, Web/Tech

Summary:

- Many people think it is OK for large companies to grow slowly

- Many people admire caretaker CEOs

- In dynamic markets, low-growth companies fail

- It is harder to generate $1B of new revenue, than grow a $100B company by $10B

- Large companies have vastly more resources, but they squander them badly

- We allow large company CEOs too much room for mediocrity and failure

- Good CEOs never lose a growth agenda, and everyone wins!

“I may just be your little rent collector Mr. Potter, but that George Bailey is making quite a bit happen in that new development of his. If he keeps going it may just be time for this smart young man to go asking George Bailey for a job.” From “It’s a Wonderful Life“ an employee of the biggest employer in mythical Beford Falls talks about the growth of a smaller competitor.

My last post gathered a lot of reads, and a lot of feedback. Most of it centered on how GE should not be compared to Facebook, largely because of size differences, and therefore how it was ridiculous to compare Jeff Immelt with Mark Zuckerberg. Many readers felt that I overstated the good qualities of Mr. Zuckerberg, while not giving Mr. Immelt enough credit for his skills managing “lower growth businesses” in a “tough economy.” Many viewed Mr. Immelt’s task as incomparably more difficult than that of managing a high growth, smaller tech company from nothing to several billion revenue in a few years. One frequent claim was that it is enough to maintain revenue in a giant company, growth was less important.

Why do so many people give the CEOs of big companies a break? Given that they make huge salaries and bonuses, have fantastic perquesites (private jets, etc.), phenominal benefits and pensions, and receive remarkable payouts whether they succeed or fail I would think we’d have very high standards for these leaders – and be incensed when their performance is sub-par.

Facebook started with almost no resources (as did Twitter and Groupon). Most leaders of start-ups fail. It is remarkably difficult to marshal resources – both enough of them and productively – to grow a company at double digit rates, produce higher revenue, generate cash flow (or loans) and keep employees happy. Growing to a billion dollars revenue from nothing is inexplicably harder than adding $10B to a $100B company. Compared to Facebook, GE has massive resources. Mr. Immelt entered the millenium with huge cash flow, huge revenues, and an army of very smart employees. Mr. Zuckerberg had to come out of the blocks from a standing start and create ALL his company’s momentum, while comparatively Mr. Immelt took on his job riding a bullet out of a gun! GE had huge momentum, a low cost of capital, and enough resources to do anything it wanted.

Yet somehow we should think that we don’t have as high expectations from Mr. Immelt as we do Mr. Zuckerberg? That would seem, at the least, distorted.

In business school I read the story of how American steel manufacturers were eclipsed by the Japanese. Ending WWII America had almost all the steel capacity. Manufacturers raked in the profits. Japanese and German companies that were destroyed had to rebuild, which they progressively did with more efficient assets. By the 1960s American companies were no longer competitive. Were we to believe that having their industrial capacity destroyed somehow was a good thing for the foreign competitors? That if you want to improve your competitiveness (say in autos) you should drop a nuclear bomb on the facilities (some may like that idea – but not many who live in Detroit I dare say.) In reality the American leaders simply refused to invest in new technologies and growth markets, allowing competitors to end-run them. The American leaders were busy acting as caretakers, and bragging about their success, instead of paying attention to market shifts and keeping their companies successful!

Big companies, like GE, are highly advantaged. They not only have brand, and market position, but cash, assets, employees and vendors in position to help them be even more successful! A smart CEO uses those resources to take the company into growth markets where it can grow revenues, and profits, faster than the marketplace. For example Steve Jobs at Apple, and Eric Schmidt at Google have found new markets, revenues and cash flow beyond their original “core” markets. That’s what Mr. Welch did as predecessor to Mr. Immelt. He didn’t so much take advantage of a growth economy as help create it! Unfortunately, far too many large company CEOs squander their resources on low rate of return projects, trying to defend their existing business rather than push forward.

Most big companies over-invest in known markets, or technologies, that have low growth rates, rather than invest in growth markets, or technologies they don’t know as well. Think about how Motorola invented the smart phone technology, but kept investing in traditional cellular phones. Or Sears, the inventor of “at home shopping” with catalogues closed that division to chase real-estate based retail, allowing Amazon to take industry leadership and market growth. Circuit City ended up investing in its approach to retail until it went bankrupt in 2010 – even though it was a darling of “Good to Great.” Or Microsoft, which launched a tablet and a smart phone, under leader Ballmer re-focused on its “core” operating system and office automation markets letting Apple grab the growth markets with R&D investments 1/8th of Microsoft’s. These management decisions are not something we should accept as “natural.” Leaders of big companies have the ability to maintain, even accelerate, growth. Or not.

Why give leaders in big companies a break just because their historical markets have slower growth? Singer’s leadership realized women weren’t going to sew at home much longer, and converted the company into a defense contractor to maintain growth. Netflix converted from a physical product company (DVDs) into a streaming download company in order to remain vital and grow while Blockbuster filed bankruptcy. Apple transformed from a PC company into a multi-media company to create explosive growth generating enough cash to buy Dell outright – although who wants a distributor of yesterday’s technology (remember Circuit City.) Any company can move forward to be anything it wants to be. Excusing low growth due to industry, or economic, weakness merely gives the incumbent a pass. Good CEOs don’t sit in a foxhole waiting to see if they survive, blaming a tough battleground, they develop strategies to change the battle and win, taking on new ground while the competition is making excuses.

GM was the world’s largest auto company when it went broke. So how did size benefit GM? In the 1980s Roger Smith moved GM into aerospace by acquiring Hughes electronics, and IT services by purchasing EDS – two remarkable growth businesses. He “greenfielded” a new approach to auto manufucturing by opening the wildly successful Saturn division. For his foresight, he was widely chastised. But “caretaker” leadership sold off Hughes and EDS, then forced Saturn to “conform” to GM practices gutting the upstart division of its value. Where one leader recognized the need to advance the company, followers drove GM to bankruptcy by selling out of growth businesses to re-invest in “core” but highly unprofitable traditional auto manufacturing and sales. Meanwhile, as the giant failed, much smaller Kia, Tesla and Tata are reshaping the auto industry in ways most likely to make sure GM’s comeback is short-lived.

CEOs of big companies are paid a lot of money. A LOT of money. Much more than Mr. Zuckerberg at Facebook, or the leaders of Groupon and Netflix (for example). So shouldn’t we expect more from them? (Marketwatch.com “Top CEO Bonuses of 2010“) They control vast piles of cash and other resources, shouldn’t we expect them to be aggressively investing those resources in order to keep their companies growing, rather than blaming tax strategies for their unwillingness to invest? (Wall Street Journal “Obama Pushes CEOs on Job Creation“) It’s precisely because they are so large that we should have high expectations of big companies investing in growth – because they can afford to, and need to!

At the end of the day, everyone wins when CEOs push for growth. Investors obtain higher valuation (Apple is worth more than Microsoft, and almost more than 10x larger Exxon!,) employees receive more pay (see Google’s recent 10% across the board pay raise,) employees have more advancement opportunities as well as personal growth, suppliers have the opportunity to earn profits and bring forward new innovation – creating more jobs and their own growth – rather than constantly cutting price. Answering the Economist in “Why Do Firms Exist?” it is to deliver to people what they want. When companies do that, they grow. When they start looking inward, and try being caretakers of historical assets, products and markets then their value declines.

Can Mr. Zuckerberg run GE? Probably. I’d sure rather have him at the helm of GM, Chrysler, Kraft, Sara Lee, Motorola, AT&T or any of a host of other large companies that are going nowhere the caretaker CEOs currently making excuses for their lousy performance. Think what the world would be like if the aggressive leaders in those smaller companies were in such positions? Why, it might just be like having all of American business run the way Steve Jobs, Jeff Bezos and John Chambers have led their big companies. I struggle to see how that would be a bad thing.

by Adam Hartung | Dec 15, 2010 | Current Affairs, In the Swamp, Leadership, Openness, Television, Web/Tech

Summary:

- Business leaders are honored for creating profitable growth

- Those who create the greatest growth disrupt the status quo and change the way things are done – such as Zuckerberg and Jobs

- Too many CEOs act as caretakers, overlooking growth

- Caretakers watch value decline

- Under Welch, GE dramatically grew and he was Time’s Person of the Year

- Under Immelt, GE has contracted

- Too many CEOs are like Immelt. They need to either change, or be replaced

It’s that time of year when magazines like to honor folks for major accomplishments. This year, Time’s Person of the Year is Mark Zuckerberg, honored for leading Facebook and its dramatic change in social behavior amongst so many people. Marketwatch.com selected Steve Jobs as its CEO of the Decade – an honor several journals gave him last year!

There is of course a bias in these selections. Most journals highly favor CEOs that drive up their stock price! For example, Ed Zander was CEO of the year in 2004 for his “turnaround” at Motorola – and within 2 years he was fired and Motorola was facing possible bankruptcy. Obviously his “quick fix” (getting the RAZR out the door with a big marketing push) didn’t pan out so well over time. We’ll have to see if Alan Mulallly deserves to be CEO of the Year at Marketwatch, since it appears his selection has more to do with not letting Ford go bankrupt – like competitors GM and Chrysler – and thus reaping the benefits of customers who wanted to buy domestic but feared any other selection. Whether Ford’s “turnaround” will be a winner, or another Zander/Motorola, we’ll know better in a couple of years.

One fellow who isn’t on anybody’s list is Jeff Immelt at General Electric. His predecessor was. Given that

- GE is the oldest company on the DJIA (Dow Jones Industrial Average)

- GE is one of the most widely held of all corporations

- GE is one of the largest American corporations in revenues and employees

- GE is in a plethora of businesses, globally

- Mr. Immelt is paid several million dollars per year to lead GE

It is worthwhile to think about why he’s not on this list – whether he should be – and if not, whether he should keep his job!

Since Immelt took the helm at GE, the value has actually declined. He’s not likely to win any awards given that sort of performance. Amidst the financial crisis, he had to make a very sweet deal with Berkshire Hathaway to invest cash (via preferred shares) in order to keep GE out of bankruptcy court – a deal that has enriched Mr. Buffett’s company at the expense of GE. GE has exited several businesses, such as its current effort to unload NBC via a deal with Comcast, but it has not created (or bought) a single exciting, noteworthy growth business! GE has become a smaller, lower growth company that narrowly diverted bankruptcy. That isn’t exactly a ringing endorsement for honors!

Yes, GE has developed a nice positive cash flow, which will allow it to repurchase the preferred shares from Berkshire (Marketwatch “GE to Buy Back Buffett’s Preferreds Next Year.”) But what is Mr. Immelt doing to create future shareholder value? His plan to make a few acquisitions, pay some higher dividends (suspended when the company faltered) and repurchase equity offers shareholders very little as a way to generate high rates of return! Why would anyone want to own GE? Nobody expects the company to be a growth leader in 2012, or 2015. With its current businesses, and strategy, there is no reason to expect GE to produce double digit earnings growth – or double its equity within any reasonable investing horizon.

There’s more to being a CEO than being a “caretaker.” Mr. Immelt’s predecessor, Jack Welch, created enormous value for shareholders. Mr. Welch was willing to disurpt the GE status quo. In fact, he intentionally worked at it! He made sure business leaders were constantly challenged to find new markets, create new products, expand into new businesses, leverage new technologies and generate growth! Mr. Welch was willing to take GE into growth markets, give leaders permission to create new Success Formulas, and invest in whatever it took to profitably grow revenues. During the Welch era, competitors quaked at the thought of GE entering their markets because things were always shaken up – and GE changed the game in order to create higher rates of return. During the Welch era investors received amongst the highest rate of return on any common stock! GE value multiplied many-fold, making pensioners (invested in the stock) and employees quite wealthy – even as employment expanded dramatically. That’s why Mr. Welch was Time’s Person of the Year in 2000 — and for many the CEO of the previous decade.

Mr. Immelt, on the other hand, has done nothing to benefit any of his constituencies. Like far too many CEOs, he took a much less aggressive stance toward growth. He has been unwilling to challenge and disrupt existing leaders, or promote aggressive market disruptions through the GE business units. He has not invested in White Space projects that could continue the massive expansion started during the Welch era. To the contrary, he has moved much more slowly, and focused more on selling businesses than growing them. He has resorted to trying to protect GE – rather than keep it moving forward. As a result, the company has retrenched and actually become less interesting, less valuable and less clearly able to produce returns or create new jobs!

Mr. Immelt certainly has his apologists, and seems to securely have the support of his Board of Directors. But we should question this. It actually has an impact on the American economy (and that of several other countries) when the CEO of a company as large as GE loses the ability to create growth. The malaise of the American economy can be directly tied to CEOs who are operating just like Mr. Immelt: doing almost nothing to create new markets, new sources of revenue, new jobs. Many business journalists like to say the government doesn’t create revenue, or jobs. So who will create them when corporate leaders are as feckless as Mr. Immelt? Especially when they control such vast resources!

Congratulations to Mr. Zuckerberg and Mr. Jobs (and Mr. Hastings of Netflix who was named Fortune magazine’s CEO of the Year.) They have created substantial new revenues, profits, cash flow and return for investors. Their company’s employees, suppliers, customers and investors have all benefitted from their leadership. By disrupting the way their company’s operated they pushed into new markets, and demonstrated how in any economy it is possible to create success. Caretakers they are not, so like Mr. Welch each deserves its recent accolades.

And for all those CEOs out there who are behaving as caretakers – for all who are resting on past company laurels – for all who have watched their company value decline – for those who think it’s OK to not grow – for those who blame the economy, or government, or competitors, or customers or their industry for their inability to grow —- well, you either need to learn from these recently honored CEOs and dramatically change direction, or you should be fired.

by Adam Hartung | Dec 8, 2010 | Food and Drink, General, In the Rapids, Innovation, Leadership, Television, Web/Tech

Summary:

- We too often think of competition as “head to head”

- Smart competitors avoid direct competition, instead using alternative methods in order to lower cost while appealing directly to market needs

- Proctor & Gamble has long dominated advertising for many consumer goods, but the impact, value and payoff of traditional advertising has declined markedly as people have switched to the web

- New competitors can utilize internet and social media tools to achieve better brand positioning and targeted marketing at far lower cost than old mass media products

- Colgate is in a great position to blow past P&G by investing quickly and taking the lead in internet marketing for its products

- Eschew calls for investing in old methods of competition, and instead find new ways to compete that allow you to end-run traditional leaders

According to a recent Advertising Age article (“To Catch Up Colgate May Ratchet Up Its Ad Spending“) Colgate has done a surprisingly good job of holding onto market share, despite underspending almost all its competitors in advertising. This is no mean feat in consumer products, where advertising dominates the cost structure. But the AdAge folks are predicting that to avoid further declines, and grow, Colgate will have to dramatically up its ad spending. That would be old-fashioned, backward-thinking, short-sighted and a lousy use of resources!

Colgate competes with lots of companies, but across categories its primary competitor is Proctor & Gamble. In toothpaste, P&G’s Crest outspends Colgate by over $25M – or about 35%. In dishsoap Colgate spent nothing on Palmolive in 2010, compared to P&G’s spend of $30M on Dawn. In deodorant/body soap Colgate spent about $9M on Softsoap, Irish Spring and Speedstick while P&G spent 9 times more (over $82M) on Old Spice and Secret. (Side note, Unilever spent $148M on Dove and a whopping $267M when adding in Axe and Degree!) In pet food, Unilever spends $35M dollars more (almost 4x) on Iams than Colgate spent on Hills Science Diet. Altogether, in these categories, P&G spent almost $158M more than Colgate (2.5x more)! As a big believer in traditional advertising, AdAge therefore predicts that Colgate should dramatically increase its annual ad budget – and maintain these higher levels for 5 years in order to overcome its historical “underspending.”

But that would be like deciding to trade punches with Goliath!

Why would Colgate want to do more of what P&G does the most? While advisors try to pit competitors directly against each other, head-to-head “gladiator style” combat leaves the combatants bloody – some dead. That’s a dumb way to compete. Colgate has long spent in other areas, such as supporting dog rescue operations and with product specialists gaining endorsements while eschewing more general advertising. Now, if Colgate wants to take action to grow share, it should pick up a sling (to continue the (Biblical metaphor) in its ongoing battle. And the good news is that Colgate has an entire selection of new, alternative weapons to use today.

Across all its product categories, Colgate can utilize a plethora of new social media marketing tools. At costs far lower than traditional mass advertising, Colgate can build promotional web programs that appeal directly to targeted consumers. Twitter, Facebook, Foursquare, Groupon, YouTube, Google and many other tool providers allow Colgate to spend far, far less than traditional advertising to provide specific brand promotions, product information, purchase incentives (such as coupons) and product variations targeted at various niches.

With these tools Colgate can not only reach directly into buyer laptops and mobile devices, but offer specific information and incentives. Traditional advertising, whether print (newspaper and magazine), radio, television or coupons is a low percentage tool. Seeking response rates (or even recall rates) of just 1 to 5 percent is normal – meaning 90% percent of your spending is, quite literally, just “overhead” cost. But with modern on-line tools it is very common to have response rates of 50% – or even higher! (Depending upon how targeted and accurate, of course!)

Colgate is in a great position!

It has spent much less than competitors, and maintained good brand position. It’s biggest competitors are locked-in to spending vast sums on traditional tools that have low impact and are in declining media. Colgate could now decide to commit itself to using the new, modern tools which are lower cost, and have decidedly more targeted results. In this way, Colgate can get out of the “colliseum” where the gladiators are warring, and throw rocks at them from the stands. Play its own game – to win – while letting those in the pit whack away at each other becoming weaker and weaker trying to use the old, heavy and unsophisticated tools.

Now is a wonderful time to be the “underdog” competitor. “Media” and advertising are in transition. How people obtain information on products and services is moving from traditional advertsing and PR (public relations) focused through mass media to networks with common interests in social media. Instead of delays in obtaining information, based upon publisher programming dates, customers are seeking immediate, and current information, exactly when they need it – on their mobile devices. Those competitors who rapidly adopt these new tools are well positioned to be the new Davids in the battle with old Goliaths. And that includes YOU.

by Adam Hartung | Dec 6, 2010 | Current Affairs, Defend & Extend, Disruptions, Food and Drink, Leadership, Lock-in

Summary:

- Business leaders like consistency

- Consistency leads to repetition, sameness, and lower rates of return

- Kraft's product lines are consistent, but without growth

- Kraft's value has been stagnant for 10 years

- Disruptive competitors make higher rates of return, and grow

- Disruptive competitors have higher valuations – just look at Groupon

"Needless consistency is the hobgoblin of small minds" – Ralph Waldo Emerson

That was my first thought when I read the MediaPost.com Marketing Daily article "Kraft Mac & Cheese Gets New, Unified Look." Whether this 80-something year old brand has a "unified" look is wholly uninteresting. I don't care if all varieties have the same picture – and if they do it doesn't make me want to eat more powdered cheese and curved noodles.

In fact, I'm not at all interested in anything about this product line. It is kind of amusing, in an historical way, to note that people (largely children) still eat the stuff which fueled my no-cash college years (much like ramen noodles does for today's college kids.) While there's nothing I particularly dislike about the product, as an investor or marketer there's nothing really to like about it either. Pasta products always do better in a recession, as people look for cheaper belly-fillers (especially for the kid,) so that more is being sold the last couple of years doesn't tell me anything I would not have guessed on my own. That the entire category has grown to only $800M revenue across this 8 decade period only shows that it's a relatively small business with no excitement! Once people feel their finances are on firm footing sales will soon taper off.

Kraft's Mac & Cheese is emblematic of management teams that lock-in on defending and extending old businesses – even though the lack of growth leaves them struggling to grow cash flow and create a decent valuation. Introducing multiple varieties of this product has not produced growth that even matched inflation across the years. Primarily, marketing programs have been designed to try keeping existing customers from buying something else. This most recent Kraft program is designed to encourage adults to try a product they gave up eating many years ago. This is, at best, "foxhole" marketing. Spending money largely just to keep the brand from going away, rather than really expecting any growth. Truly, does anyone think this kind of spending will generate a billion dollar product line in 2011 – or even 2012?

What's wrong with defensive marketing, creating consistency across the product line – across the brand – and across history? It doesn't produce high rates of return. There are lots of pasta products, even lots of brands of mac & cheese. While Kraft's product surely produces a positive margin, multiple competitors and lack of growth means increased spending over time merely leaves the brand producing a marginal rate of return. Incremental ad spending doesn't generate real growth, just a hope of not losing ground. We know people aren't flocking to the store to buy more of the product. New customers aren't being identified, and short-term growth in revenues does not yield the kinds of returns that would enhance valuation and make the world a better place for investors – or employees.

While Kraft is trying to create headlines with more spending in a very tired product, across town in Chicago Groupon has created a $500M revenue business in just 2 years! And new reports from the failed acquisition attempt by Google indicate revenues are likely to reach $2B in 2011 (CNNMoney.com, Fortune, "Google's Groupon Groping Reveals the Shifting Power of the Web World.") Where's Kraft in this kind of growth market? After all, coupons for Kraft products have been in mailers and Sunday inserts for 50 years. Why isn't Kraft putting money into a real growth business, which is producing enormous value while cash flow grows in multiples? While Groupon has created somewhere around $6B of value in 2 years, Kraft's value has only gone sideways for the last decade (chart at Marketwatch.com.)

Kraft has not introduced a new product since — well — DiGiorno. And that's been more than a decade. While the company has big revenues – so did General Motors. The longer a company plays defense, regardless of size, trying to extend its outdated products (and business model) the riskier that business becomes. While big revenues appear to offer some kind of security, we all know that's not true. Not only does competition drive down margins in these older businesses, but newer products make it harder and harder for the old products to compete at all. Eventually, the effort to maintain historical consistency simply allows competitors to completely steal the business away with new products, creating a big revenue drop, or producing such low returns that failure is inevitable.

Lots of business people like consistency. They like consistency in how the brand is executed, or how products are aligned. They like consistency in the technology base, or production capabilities. They like consistency in customers, and markets. They like being consistent with company history – doing what "made the company famous." They like the similarity of doing something again, and again, hoping that consistency will produce good returns.

But consistency is the hobgoblin of small minds. And those who are more clever find ways to change the game. Xerox figured out how to let everyone be a one-button printer, and killed the small printing press manufacturers. HP's desktop printers knocked the growth out of Xerox. Google figured out a better way to find information, and place ads, just about killing newspapers (and magazines.) Apple found a better way to use mobile minutes, taking a big bite out of cell phone manufacturers. Amazon found a better way to sell things, killing off bookstores and putting a world of hurt on many retailers. Netflix found a better way of distributing DVDs and digital movies, sending Blockbuster to bankruptcy. Infosys and Tata found a better way of doing IT services, wiping out PWC and nearly EDS. Hulu (and soon Netflix, Google and Apple) has found a better way of delivering television programming, killing the growth in cable TV. Groupon is finding a better way of delivering coupons, creating huge concerns for direct mail companies. Now tablet makers (like Apple) are demonstrating a better way of working remotely, sending shivers of worry down the valuation of Microsoft. These companies, failed or in jeapardy, were very consistent.

Those who create disruptions show again and again that they can generate growth and above average returns, even in a recession. While those who keep trying to defend and extend their old business are letting consistency drive their behavior – leading to intense competition, genericization, and lower rates of return. Maybe Kraft should spend more money looking for the next food we would all like, rather than consistently trying to convince us we want more Mac & Cheese (or Velveeta).

by Adam Hartung | Dec 1, 2010 | Current Affairs, In the Rapids, Innovation, Leadership, Openness, Web/Tech

Summary:

- Most planning systems only focus on improving the existing business

- Most value comes from identifying new market opportunities, and filling them

- Extremely high growth can happen in any company that focuses on market needs, rather than business model optimization

- Groupon has grown from $0 to $500M in 2 years, yet is not a technology company

- Groupon is value at $3B to $6B in just 2 years

- Google could continue to expand the explosive growth at Groupon

- Any company has this opportunity, if it focuses on market needs

“You can’t get there from here.” That’s the punch line of an old joke about a city slicker that gets lost in the country. He sees a farmer and says “I want to get to the St. James ranch.” The farmer thinks about the washed out road #20, the destroyed bridge on Old Ferry Road, the blocked road on Westchester due to a property dispute – and given all his known ways to get to the St. James Ranch he conludes there’s no way to make it happen. He gives up, and recommends the traveler do the same.

And this is the conclusion far too often of most planning systems. When I ask the executive team “how will you grow revenue by 100% next year?” (or even 15% many times) the answer is “can’t happen. We only grew 2% last year, our product lines are becoming aged and the overall market is only growing at 5%. We can only, maximally, hope to grow 3-5%.” In other words, “can’t get there from here.”

But of course there’s a way.

Groupon was started in 2008 (“Groupon at $3 Billion Soars Like Silicon Valley from Chicago” Bloomberg). Now it has about $500M annual revenue, and 2,500 employees. While Sara Lee, Kraft, Motorola and other Chicago stalwarts are contracting – unable to find a growth path – Groupon has exploded. Most companies are complaining about the “great recession,” and its impact on customers and sales, saying they see no way to create triple digit growth. Yet Groupon didn’t invent any new technology, didn’t file any patents, didn’t open a “scale” manufacturing plant, didn’t buy an existing business, or raise a huge amount of money. Groupon is now dominant in local-market advertising – without the Foursquare technology play, or a partnership with Facebook. And it keeps adding new local markets every week. Piling up new revenues, and profits.

What Groupon did was offer the market something it highly valued – a local-based coupon service that was easy to use. Building on digital technology rapidly being accepted by everyone. While most companies are trying to focus on their “core capabilities” and bemoaning a dearth of growth, Groupon’s leaders looked into the marketplace to identify an unmet need and an application of developing technology. As good as Google AdWords is, it is expensive and not terribly good at local marketing. Newspaper coupons are expensive to print, and simply ignored by most modern consumers. There was a hole in what people needed, so the entrepreneurs set out to fill it. And by meeting a need, they’ve created an explosively growing company. As mentioned earlier, while unemployment overall in Chicago is going up, Groupon has hired 900 people over the last 2 years.

That’s what most businesspeople are loath to do these days. After years of being trained to focus on the supply chain, and that innovation is mostly about how to cut costs in the existing business, very few are thinking about market needs. The vast majority (almost all?) of planning is devoted to cutting costs and optimizing an existing business. Or trying to develop an adjacent opportunity to the existing business that has limited, if any growth prospects. And trying to find ways to take money out of the business, rather than invest. In that planning system, if you ask “how do you plan to create a half billion dollar new business in the next two years” the answer is “you can’t get there from here.”

“Google May Acquire Groupon for $6 Billion, and It Would Be Worth Every Penny” headlines Mashable.com. Not bad for the guys who started up this distinctly non-techie company in the non-techie midwest. Whether they sell out or not, the next fundraising is guaranteed to make them extremely wealthy folks. There are still a lot of markets yet to be developed, and a lot more deals to be made in the existing markets, as buyers seek out discounts for products they buy regularly.

It mashable right? Is this a smart idea for Google? Unless you think coupons, and deals, are dead – you have to like this investment. There’s a reason Groupon has grown so very fast – and that lies in meeting a market need. How fast can it grow if Google adds its skills at ad sales, email (gmail) use, user database analytics, networking connections and technology wizardry? While $6B is a lot of money, if you can see how Groupon on its own could become a $6B revenue company within 4 years from today is it really too miuch? (Groupon has grown from $0 to $500M in just about 2 years, so does 12x growth in 4 years [just under an annual doubling] really appear that difficult?)

Smart investing doesn’t mean “hold your nose and jump” off the bridge, hoping the water is OK. And that’s not what Groupon did, or Google might do if it acquires Groupon. Both companies are focusing on future scenarios about how we will get things done in 2012 and beyond. Both are thinking about the impact of existing trends, and how those will allow everyone to be more effective, efficient and successful in 3 or 5 years. Both are developing solutions that help us be more productive by building on trends – and not merely expecting the future to look like the past. Their planning is based upon views of the future – and that’s why they can see such greater opportunity, and create so much value.

Most business limit their planning, and investing, to doing more of what they have always done. Better, faster, cheaper are the hallmarks of the traditional planning process output. Expecting to get dramatic growth, or value, out of a system so narrowly focused is expecting the impossible. Creating value – big value – comes from providing solutions that meet new market needs. And that requires overcoming the limits of traditional planning – and traditional ways of thinking about investing. Instead of doing more of what you know, you have to do more of what the market wants. Any company can get there from here – if you simply open your planning to moving beyond the limits of what you’ve historically done.