by Adam Hartung | Sep 25, 2012 | Disruptions, In the Rapids, Innovation, Leadership, Transparency, Web/Tech

I like writing about tech companies, such as Apple and Facebook, because they show how fast you can apply innovation and grow – whether it is technology, business process or new best practices. But many people aren't in the tech industry, and think innovation applies a lot less to them.

Whoa there cowboy, innovation is important to you too!

Few industries are as mired in outdated practices and slow to adopt technology than construction. Whether times are good, or not, contractors and tradespeople generally do things the way they've been done for decades. Even customers like to see bids where the practices are traditional and time-worn, often eschewing innovations simply because they like the status quo.

Skanska, a $19B construction firm headquarted in Stockholm, Sweden with $6B of U.S. revenue managed from the New York regional HQ refused to accept this. When Bill Flemming, President of the Building Group recognized that construction industry productivity had not improved for 40 years, he reckoned that perhaps the weak market wasn't going to get better if he just waited for the economy to improve. He was sure that field-based ideas could allow Skanska to be better than competitors, and open new revenue sources.

Skanska USA CEO Mike McNally agreed instantly. In 2009 he brought together his management team to see if they would buy into investing in innovation. He met the usual objections

- We're too busy

- I have too much on my plate

- Business is already too difficult, I don't need something new

- Customers aren't asking for it, they want lower prices

- Who's going to pay for it? My budget is already too thin!

But, he also recognized that nobody said "this is crazy." Everyone knew there were good things happening in the organization, but the learning wasn't being replicated across projects to create any leverage. Ideas were too often tried once, then dropped, or not really tried in earnest. Mike and Bill intuitively believed innovation would be a game changer. As he discussed implementing innovation with his team he came to saying "If Apple can do this, we can too!"

Even though this wasn't a Sweden (or headquarters) based project, Mike decided to create a dedicated innovation group, with its own leader and an initial budget of $500K – about .5% of the Building Group total overhead.

The team started with a Director of innovation, plus a staff of 2. They were given the white space to find field based ideas that would work, and push them. Then build a process for identifying field innovations, testing them, investing and implementing. From the outset they envisaged a "grant" program where HQ would provide field-based teams with money to test, develop and create roll-out processes for innovations.

Key to success was finding the right first project. And quickly the team knew they had one in one of their initial field projects called Digital Resource Center, which could be used at all construction sites. This low-cost, rugged PC-based product allowed sub-contractors around the site to view plans and all documentation relevant for their part of the project without having to make frequent trips back to the central construction trailer.

This saved a lot of time for them, and for Skanska, helping keep the project moving quickly with less time wasted talking. And at a few thousand dollars per station, the payback was literally measured in days. Other projects were quick to adopt this "no-brainer." And soon Skanska was not only seeing faster project completion, but subcontractors willing to bake in better performance on their bids knowing they would be able to track work and identify key information on these field-based rugged PCs.

As Skanska's Innovation Group started making grants for additional projects they set up a process for receiving, reviewing and making grants. They decided to have a Skansa project leader on each grant, with local Skansa support. But also each grant would team with a local university which would use student and faculty to help with planning, development, implementation and generate return-on-investment analysis to demonstrate the innovation's efficacy. This allowed Skansa to bring in outside expertise for better project development and implementation, while also managing cost effectively.

With less than 2 years of Innovation Group effort, Skanska has now invested $1.5M in field-based projects. The focus has been on low-cost productivity improvements, rather than high-cost, big bets. Changing the game in construction is a process of winning through lots of innovations that prove themselves to customers and suppliers rather than trying to change a skeptical group overnight. Payback has been almost immediate for each grant, with ROI literally in the hundreds of percent.

You likely never heard of Skanska, despite its size. And that's because its in the business of building bridges, subway stations and other massive projects that we see, but know little about. They are in an industry known for its lack of innovation, and brute-force approach to getting things done.

But the leadership team at Skanska is proving that anyone can apply innovation for high rates of return. They

- understood that industry trends were soft, and they needed to change if they wanted to thrive.

- recognized that the best ideas for innovation would not come from customers, but rather from scanning the horizon for new ideas and then figuring out how to implement themselves

- weren't afraid to try doing something new. Even if the customer wasn't asking for it

- created a dedicated team (and it didn't have to be large) operating in white space, focused on identifying innovations, reviewing them, funding them and bringing in outside resources to help the projects succeed

In addition to growing its traditional business, Skanska is now something of a tech company. It sells its Digital Resource stations, making money directly off its innovation. And its iSite Monitor for monitoring environmental conditions on sensitive products, and pushing results to Skanska project leaders as well as clients in real time with an app on their iPhones, is also now a commercial product.

So, what are you waiting on? You'll never grow, or make returns, like Apple if you don't start innovating. Take some lessons from Skanska and you just might be a lot more successful.

by Adam Hartung | Sep 18, 2012 | Current Affairs, Defend & Extend, Food and Drink, In the Rapids, In the Whirlpool, Innovation, Leadership, Lifecycle

Apple is launching the iPhone 5, and the market cap is hitting record highs. No wonder, what with pre-orders on the Apple site selling out in an hour, and over 2 million units being presold in the first 24 hours after announcement.

We care a lot about Apple, largely because the company has made us all so productive. Instead of chained to PCs with their weight and processor-centric architecture (not to mention problems crashing and corrupting files) while simultaneously carrying limited function cell phones, we all now feel easily interconnected 24×7 from lightweight, always-on smart devices. We feel more productive as we access our work colleagues, work tools, social media or favorite internet sites with ease. We are entertained by music, videos and games at our leisure. And we enjoy the benefits of rapid problem solving – everything from navigation to time management and enterprise demands – with easy to use apps utilizing cloud-based data.

In short, what was a tired, nearly bankrupt Macintosh company has become the leading marketer of innovation that makes our lives remarkably better. So we care – a lot – about the products Apple offers, how it sells them and how much they cost. We want to know how we can apply them to solve even more problems for ourselves, colleagues, customers and suppliers.

Amidst all this hoopla, as you figure out how fast you can buy an iPhone 5 and what to do with your older phone, you very likely forgot that Kraft will be splitting itself into 2 parts in about 2 weeks (October 1). And, most likely, you don't really care.

And you can't imagine why I would even compare Kraft with Apple.

Kraft was once an innovation leader. Velveeta, a much maligned product today, gave Americans a fast, easy solution to cheese sauces that were difficult to make. Instant Mac & Cheese was a meal-in-a-box for people on the run, and at a low budget. Cheeze Whiz offered a ready-to-eat spread for canape's. Individually wrapped American cheese slices solved the problem of sticky product for homemakers putting together lunch sandwiches for school children. Miracle Whip added spice to boring sandwiches. Philadelphia brand cream cheese was a tasty, less fattening alternative to butter while also a great product for sauces.

But, the world changed and these innovations have grown a lot less interesting. Frozen food replaced homemade sauces and boxed solutions. Simultaneously, cooking skills improved. Better options for appetizers emerged than stuffed celery or something on a cracker. School lunches changed, and sandwich alternatives flourished. Across Kraft's product lines, demand changed as new technologies were developed that better fit customers' needs leading to revenue stagnation, margin erosion and an increasing irrelevancy of Kraft in the marketplace – despite its enormous size.

Apple turned itself around by focusing on innovation, becoming the most valuable American publicly traded company. Kraft eschewed innovation for cost cutting, doing more of the same trying to defend its "core," leaving investors with virtually no returns. Meanwhile thousands of Kraft employees have lost their jobs, even though revenues per employee at Kraft are 1/6th those at Apple. And supplier margins are a never-ending cycle of forced reductions as Kraft tries to capture their margin for itself.

Chart Source: Yahoo Finance 18 September, 2012

Apple's value went up because it's revenues went up. In 2007 Apple had #24B in revenues, while Kraft was 150% bigger at $37B. Ending 2011 Apple's revenues, all from organic growth, were up 4x (400%) at $108B. But Kraft's 2011 revenues were only $54B, including roughly $10B of purchased revenues from its Cadbury acquisition, meaning comparative Kraft revenues were $44B; a growth of (ho-hum) 3.5%/year.

Lacking innovation Kraft could not grow the topline, and simply could not grow its value. And paying a premium price for someone else's revenues has led to…. splitting the company in 2 in only 2 years, mystifying everyone as to what sort of strategy the company ever had to grow!

But Kraft's new CEO is not deterred. In an Ad Age interview he promised to ramp up advertising while slashing more jobs to cut costs. As if somehow advertising Velveeta, Miracle Whip, Philadelphia and Mac & Cheese will reverse 30 years of market trends toward different products which better serve customer needs!

Apple spends nearly nothing on advertising. But it does spend on innovation. Innovation adds value. Advertising aging products that solve no new needs does not.

Unfortunately for employees, suppliers and shareholders we can expect Kraft to end up just like Hostess Brands, owner of Wonder Bread and Twinkies, which recently filed bankruptcy due to 40 years of sticking to its core business as the market shifted. Industry leaders know this, as they announced this week they are using Kraft's split to remove the company from the Dow Jones Industrial Average.

Companies that innovate change markets and reap the rewards. By delivering on trends they excite customers who flock to their solutions. Companies that focus on defending and extending their past, especially in times of market shifts, end up failing. Failure may not happen overnight, but it is inevitable.

by Adam Hartung | Aug 9, 2012 | Current Affairs, Disruptions, In the Rapids, Innovation, Leadership, Web/Tech

Mark Zuckerberg was Time magazine's Person of the Year in December, 2010. He was given that honor because Facebook dominated the emerging social media marketplace, and social media had clearly begun changing how people do things. Despite his young age, Mr. Zuckerberg had created a phenomenon demonstrated by the hundreds of million new Facebook users.

But things have turned pretty rough for the young Mr. Zuckerberg.

- Facebook was pretty much forced, legally, to go public because it had accumulated so many shareholders. The stock hit the NASDAQ with much fanfare in May, 2012 – only to have gone pretty much straight down since. It now trades at about 50% of IPO pricing, and is under constant pressure from analysts who say it may still be overpriced.

- Facebook discovered perhaps 83million accounts were fake (about 9%) unleashing a torrent of discussion that perhaps the fake accounts was a much, much larger number.

- User growth has fallen to some 35% – which is much slower than initial investors hoped. Combined with concerns about fake accounts, there are people wondering if Facebook growth is stalling.

- Facebook has not grown revenues commensurate with user growth, and people are screaming that despite its widespread use Facebook doesn't know how to "monetize" its base into revenues and profits.

- Mobile use is growing much faster than laptop/PC use, and Facebook has not revealed any method to monetize its use on mobile devices – causing concerns that it has no plan to monetize all those users on smartphones and tablets and thus future revenues may decline.

- Zynga, a major web games supplier, announced weak earnings and said its growth was slowing – which affects Facebook because people play Zinga games on Facebook.

- GM, one of the 10 largest U.S. advertisers, publicly announced it was dropping Facebook advertising because executives believed it had insufficient return on investment. Investors now fret Facebook won't bring in major advertisers.

- Google keeps plugging away at competitive product Google+. And while Facebook disappointed investors with its earnings, much smaller competitor Linked-in announced revenues and earnings which exceeded expectations. Investors now worry about competitors dicing up the market and minimalizing Facebook's future growth.

Wow, this is enough to make 50-something CEOs of low-growth, non-tech companies jump with joy at the upending of the hoody-wearing 28 year old Facebook CEO. Zynga booted its Chief Operating Officer and has shaken up management, and not suprisingly, there are analysts now calling for Mr. Zuckerberg to step aside and install a new CEO.

Yet, Mr. Zuckerberg has been wildly successful. Much more than almost anyone else in American business today. He may well feel he needs no advice. But…. what do you suppose Steve Jobs would tell him to do?

Recall that Mr. Jobs was once the young head of Apple, only to be displaced by former Pepsi exec John Sculley — and run out of Apple. As everyone now famously knows, after a string of Apple CEOs led the company to the brink of disaster Mr. Jobs agreed to return and completely turned around Apple making it the most successful tech company of the last decade. Given what we've observed of Mr. Jobs career, and read in his biography, what advice might he give Mr. Zuckerberg?

- Don't give up your job. Not even partly. If you create a "shadow" or "co" CEO you'll be gone soon enough. Lead, quit or make the Board fire you. If you had the vision to take the company this far, why would you quit?

- Nothing is more important than product. Make Facebook's the best in the world. Nothing less will allow a tech company to survive, much less thrive. Don't become so involved with financials and analysts that you lose sight of your #1 job, which is to make the very, very best social media product in the world. Never stop improving and perfecting. If your product isn't obviously superior to other solutions you haven't accomplished your #1 priority.

- Be unique. Make sure your products fulfill needs no one else fulfills – at least not well. Meet unserved and underserved needs so that people talk about your product and what it does – not how much it costs. Make sure that Facebook has devoted, diehard customers that believe your products meet their needs so well they would not consider your competition.

- Don't ask customers what they want – give them what they need. Understand the trends and create future scenarios so you are constantly striving to create a better future, not just improve on history. Never look backward at what you've done, but instead always look forward at creating what noone else has ever done. Push your staff to create solutions that meet user needs so well that you can tell customers why they need your product in ways they never before considered.

- Turn your product releases into a show. Don't just run out new products willy-nilly, or on a random timeline. Make sure you bundle products together and make a big show of each release so you can describe the upgrades, benefits and superiority of what you offer for customers. People need to understand the trends you are meeting, and need to see the future scenario you are creating, and you have to tell them that story or they won't "get it."

- Price for profit. You run a business, not a hobby or not-for-profit society. If you do the product right you shouldn't even be talking about price – so price to make ridiculous margins by industry standards. At Apple, Next and Pixar the products were never the cheapest, but they accomplished what customers needed so well that we could price high enough to make margins that supported additional product development. And you can't remain the best solution if you don't have enough margin to keep developing future products.

- Don't expect products to sell themselves. Be the #1 passionate spokesperson for the elegance and superiority of your products. Never stop beating the drum for the unique capability and superiority of your product, in every meeting, all the time, never ending. People like to "revert to the mean" so you have to keep telling them that isn't good enough – and you have something far superior that will greatly improve their success.

- Never miss an opportunity to compare your products to competition and tell everyone why your products are far better. Don't disparage the competition, but constantly reinforce that you are first, you are ahead of everyone else, you are far better — and the best is yet to come! Competition is everywhere, and listen to the Andy Groves advice "only the paranoid survive." You aren't satisfied with what the competition offers, and customers should not be satisfied either. Every once in a while give people a small glimpse as to the radically different world you see in 3-5 years so they buy what you are selling in order to prepare for that future world.

- Identify key customers that need your solution and SELL THEM. Disney needed Pixar, so we made sure they knew it. Identify the customers who can gain the most from doing business with you and SELL THEM. Turn them into lead customers, obtain their testimonials and spread the word. If GM isn't your target, who is? Find them and sell them, then tell us all how you will build on those early accounts to eventually dominate the market – even displacing current solutions that are more popular. If GM is your target then make the changes you need to make so you can SELL THEM. Everyone wants to do business with a winner, so you must show you are a winner.

- Identify 5 of your competition's biggest customers (at Google, Yahoo, Linked-in, etc.) and make them yours. Demonstrate your solutions are superior with competitive wins.

- Hire someone who can talk to the financial community for you – and do it incredibly well. While you focus on future markets and solutions someone has to tell this story to the financial analysts in their lingo so they don't lose faith (and they are a sacrilegious lot who have no faith.) Keep Facebook out of the forecasting game, but you MUST create and maintain good communication with analysts so you need someone who can tell the story not only with products and case studies but numbers. Facebook is a disruptive innovation company, so someone has to explain why this will work. You blew the IPO road show horribly by showing up at meetings in a hoodie – so now you need to make amends by hiring someone who will give them faith that you know what you're doing and can make it happen.

These are my ideas for what Steve Jobs would tell Mark Zuckerberg. What are yours? What do you think the #1 CEO of the last decade would say to the young, embattled CEO as he faces his first test under fire leading a public company?

by Adam Hartung | Aug 9, 2012 | Current Affairs, Defend & Extend, In the Swamp, Leadership, Lock-in

McDonald’s is in a Growth Stall. Even though the stock is less than 10% off its recent 52 week high (which is about the same high it’s had since the start of 2012,) the odds of McDonald’s equity going down are nearly 10x the odds of it achieving new highs.

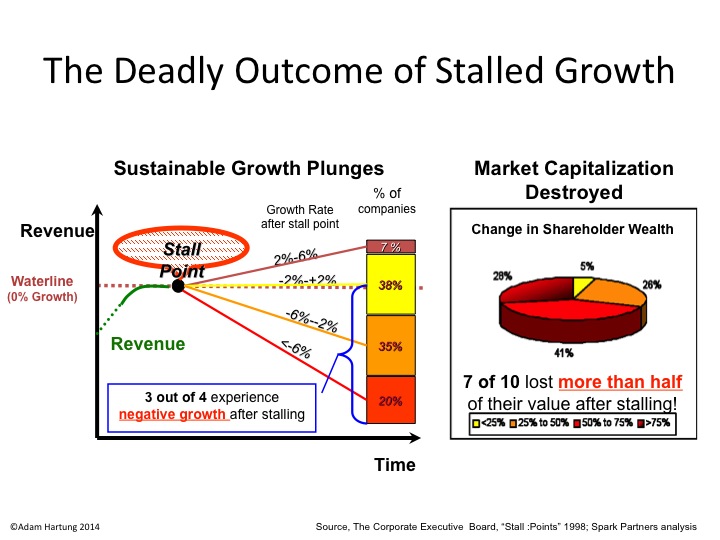

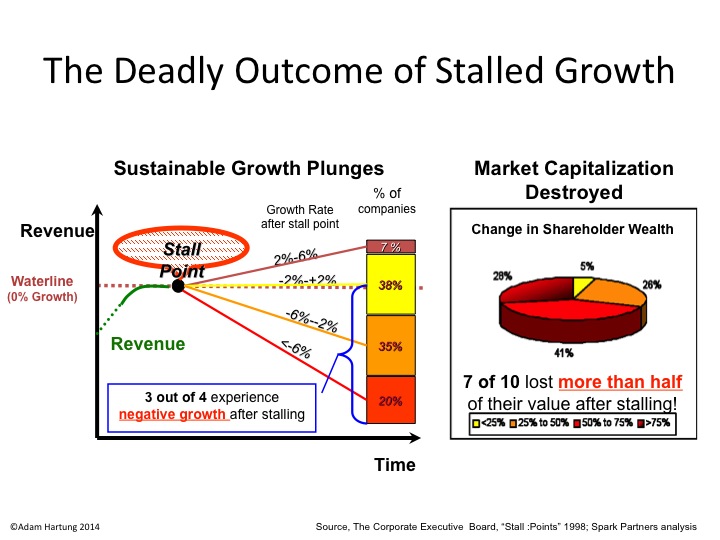

A Growth Stall occurs when a company has 2 consecutive quarters of declining sales or earnings, or 2 consecutive quarters of lower sales or earnings than the previous year. And our research, in conjunction with The Conference Board, proved that when this happens the future becomes fairly easy to predict.

Growth Stalls are Deadly

When companies hit a growth Stall, 93% of the time they are unable to maintain even a 2% growth rate. 55% fall into a consistent revenue decline of more than 2%. 1 in 5 drop into a negative 6%/year revenue slide. 69% of Growth Stalled companies will lose at least half their market capitalization in just a few years. 95% will lose more than 25% of their market value.

Back in February, McDonalds sales in USA stores open at least 13 months fell 1.4%. By May these same stores reported reported their 7th consecutive month (now more than 2 quarters) of declining revenues. And in July McDonald’s reported the worst sales decline in over a decade – with stores globally selling 2.5% less (USA stores were down 3.2% for the month.) McDonald’s leadership is now warning that annual sales will be weaker than forecast – and could well be a reported decline.

While McDonald’s has been saying that Asian store revenue growth had offset the USA declines, we now can see that the USA drop is the key signal of a stall. There was no specific program in Asia to indicate that offshore revenues could create a renewed uptick in USA sales. Now with offshore sales plummeting we can see that McDonald’s American performance is the lead indicator of a company with serious performance issues.

Growth Stalls are a great forecasting tool because they indicate when a company has become “out of step” with its marketplace. While management, and in fact many analysts, will claim that this performance deficit is a short term aberration which will be repaired in coming months, historical evidence — and a plethora of case stories – tell us that in fact by the time a Growth Stall shows itself (especially in a company as large as McDonald’s) the situation is far more dire (and systemic) than management would like investors to believe.

Something fundamental has happened in the marketplace, and company leadership is busy trying to defend its historical business in the face of a major change that is pulling customers toward substitute solutions. Frequently this defend & extend approach exacerbates the problems as retrenchment efforts further hurt revenues.

McDonald’s has reached this inflection point as the result of a long string of leadership decisions which have worked to submarine long-term value.

Back in 2006 McDonald’s sold its fast growing Chipotle chain in order to raise additional funds to close some McDonald’s stores, and undertake an overhaul of the supply chain as well as many remaining stores. This one-time event was initially good for McDonald’s, but it hurt shareholders by letting go of an enormously successful revenue growth machine.

Since that sale Chipotle has outperformed McDonalds by 3x, and it was clear in 2011 that investors were better off with the faster growing Chipotle than the operationally focused McDonald’s. Desperate for revenues as its products lagged changing customer tastes, by December, 2012 McDonald’s was urging franchisees to stay open on Christmas Day in order to add just a bit more to the top line. However, such operational tactics cannot overcome a product line that is fat-and-carb-heavy and off current customer food trends, and by this July was ranked the worst burger in the marketplace. Meanwhile McDonald’s customer service this June ranked dead last in the industry. All telltale signs of the problems creating the emergent Growth Stall.

Meanwhile, McDonald’s is facing a significant attack on its business model as trends turn toward higher minimum wages. By August, 2013 the first signs of the trend were clear – and the impact on McDonald’s long-term fortunes were put in question. By February, 2014 the trend was accelerating, yet McDonald’s continued ignoring the situation. And this month the issue has become a front-and-center problem for McDonald’s investors as the National Labor Relations Board (NLRB) has said it will not separate McDonald’s from its franchisees in pay and hours disputes – something which opens McDonald’s deep pockets to litigants looking to build on the living wage trend.

The McDonald’s CEO is somewhat “under seige” due to the poor revenue and earnings reports. Yet, the company continues to ascribe its Growth Stall to short-term problems such as a meat processing scandal in China. But this inverts the real situation. Such scandals are not the cause of current poor results. Rather, they are the outcome of actions taken to meet goals set by leadership pushing too hard, trying to achieve too much, by defending and extending an outdated success formula desperately in need of change to meet new competitive market conditions.

Application of Growth Stall analysis has historically been very valuable. In May, 2009 I reported on the Growth Stall at Motorola which threatened to dramatically lower company value. Subsequently Motorola spun off its money losing phone business, sold other assets and businesses, and is now a very small remnant of the business prior to its Growth Stall; which was brought on by an overwhelming market shift to smartphones from 2-way radios and traditional cell phones.

In February, 2008 a Growth Stall at General Electric indicated the company would struggle to reach historical performance for long-term investors. The stock peaked at $57.80 in 2000, then at $41.40 in July, 2007. By January, 2009 (post Stall) the company had crashed to only $10, and even recent higher valuations ($28 in 10/2013) are still far from the all-time highs – or even highs in the last decade.

In May, 2008 the Growth Stall at AIG portended big problems for the Dow Jones Industrial (DJIA) giant as financial markets continued to shift radically and quickly. By the end of 2008 AIG stock cratered and the company was forced to wipe out shareholders completely in a government-backed restructuring.

Perhaps the most compelling case has been Microsoft. By February, 2010 a Growth Stall was impending (and confirmed by May, 2011) warning of big changes for the tech giant. Mobile device sales exploded, sending Apple and Google stocks soaring, while Microsoft’s primary, core market for PCs (and software for PCs) has fallen into decline. Windows 8 subsequently had a tepid market acceptance, and gained no traction in mobile devices, causing Microsoft to write-off its investment in the Surface tablet. Recent announcements about enormous lay-offs, with vast cuts in the acquired Nokia handheld unit, do not bode well for long-term revenue growth at the decaying (yet cash rich) giant.

As the Dow has surged to record highs, it has lifted all boats. Including those companies which are showing serious problems. It is easy to look at the ubiquity of McDonald’s stores and expect the chain to remain forever dominant. But, the company is facing serious strategic problems with its products, service and business model which leadership has shown no sign of addressing. The recent Growth Stall serves as a key long-term indicator that McDonald’s is facing serious problems which will most likely seriously jeopardize investors’ (as well as employees’, suppliers’ and supporting communities’) potential returns.

by Adam Hartung | Jul 31, 2012 | Current Affairs, In the Whirlpool, Leadership, Lock-in

In a fascinating move this week, Best Buy's septuagenarion founder (who is no longer part of the company) has started calling company execs and offering them jobs – at Best Buy! Apparently he hopes to engage a private equity firm to take over Best Buy, and he wants to keep some of the exec team, while replacing others. Even more fascinating is that at last some of the execs are taking his calls, and agreeing to his "job offer." Clearly these folks have lost faith in Best Buy's future.

This happens one day after the Board of Directors fired the CEO at Supervalu, parent company of such large grocery chains as Albertson's, Jewel-Osco, ACME, Shaw's and Star Markets. Apparently this pleased most everyone, since the company has lost 85% of its equity value since he was brought in from Wal-Mart while simultaneously killing bonuses and even free employee coffee. Even though just last week he was paid a retention bonus by the same Board to remain in his job!

And even thought the Chairman at Wal-Mart was clearly in the thick of bribing Mexican officials to open stores south of the border, there is no sign of any changes expected in Wal-Mart's leadership team.

What is sparking such bizarre behavior in retail? Quite simply, industry leadership that is so stuck in the past it has no idea how to grow or make money in a dramatically changed marketplace. They keep trying to do more of the same, while growth goes elsewhere.

Everyone, and I mean everyone, outside of retail knows that the game has changed – permanently. Since 2000 on-line sales of everything, and I mean everything, has increased. Sure, there were some collosal flops in early on-line retail (remember Pets.com?) But every year sales of products on-line increase at double digit rates. It's rare to walk through a store – and I mean any store – and not see at least one customer comparison shopping the product on the shelf with an on-line vendor.

What 15 years ago was a niche seller of non-stock books, Amazon.com, has become the industry vanguard selling everything from apple juice to zombie memorabilia. Even though most industry analysts don't clump it as a direct competitor to Best Buy, Sears, and Wal-Mart – holding it aside in its own "internet retail" category – everyone knows Amazon is growing and changing shopping habits, and reducing demand in traditional stores.

The signs of this shift are everywhere. From the complete collapse of Circuit City and Sharper Image to the flat sales, reduced number of U.S. outlets and falling per-store numbers at Wal-Mart.

Across America drivers are accustomed to seeing retail outlets boarded up, and strip malls full of empty window space. You don't have to be a fancy analyst to notice how many malls would be knocked down entirely if they weren't being converted to low-cost office space for lawyers, tax preparers, dentists, veterinarians and emergency clinics – demonstrably non-retail businesses. Or to recognize an old Sears or superstore location converted into an evangelical nondenominational church.

For example, in the collar counties around Chicago vacant retail space has accumulated to over 3million square feet – a 45% increase since 2007. In that local market retail rents have fallen to $16.76 per foot, down 29% in the last four years. And this is typical of just about everywhere. America simply has a LOT more retail space than it needs – and will need for the foreseeable future. Demand for traditional retail is going down, not up, and that is a permanent change.

It is not impossible to make money in retail. But you can't do it the way it was done in the past. The answer isn't as simple as "location, location, location;" or even inventory. As the new, and struggling, CEO at JC Penney has learned the hard way, it's not about "every day low price." Or even low price at all, as the former WalMart exec just fired at Supervalu learned – along with all their employees.

Today traditional retail store success requires you have unique products, unique merchandising, sales assistance that meets immediacy needs, strong trend connectivity and effective pricing. Just look at IKEA, Lululemon, Sephora, Whole Foods, Trader Joe's and PetSmart – for example.

Of course there will be grocery stores. Traditional retail will not disappear. But that doesn't mean it will be profitable. And trying to chase profits by constantly beating down costs gets you – well – Circuit City, Toys R Us, Drug Emporium, Pay N Save, Crazy Eddie, Egghead Software, Bradlee's, Korvette's, TG&Y, Wickes, Skagg's, Payless Cashways, Musicland — and Supervalu. There is more to business than price, something the vast, vast majority of retailers keep forgetting.

Fifty years ago if you wanted a TV you went to a television store where they not only sold you a TV, they repaired it! You selected from tube-based machines made by Zenith, RCA, Philco and Magnavox. The TV shop owner made some money on the TV, but he also made money on the service. And if you wanted a washer or refrigerator you went to an "appliance store" for the same reason. But the world changed, and the need for those stores disappeared. Almost none changed to what people wanted – they simply failed.

Now the world has changed again. The customer value proposition in retail is shifting from location and inventory to information. And it is extremely hard to have salespeople – or shelf tags – with comparable information to a web page, which have not only product and price info but competitive comparisons on everything. There simply isn't enough profit in a TV, stereo, PC, CD or DVD to cover the overhead of salespeople, check-out clerks, on-hand inventory and the building.

And that's why Best Buy had to shutter 50 stores in March. On its way to the same ending as Polk Brothers, Grant's Appliance and Circuit City.

Don't expect a 70 year old retailer to understand what retail markets will look like in 2020. Or anyone trained in traditional retail at Wal-Mart. Or anyone who thinks they can save a traditional "retail brand" like Sears. The world has already shifted – and those are stories from last decade (or long before.)

If you are interested in retail go where the growth is – and that is all about on-line leadership. Sell Best Buy and put your money in Amazon. You'll sleep better.

by Adam Hartung | Jul 17, 2012 | Current Affairs, Defend & Extend, In the Swamp, Leadership, Lock-in

Most investors shouldn't be. Given demands of work and family, there is almost no time to study companies, markets and select investments. So smaller investors rely on 3rd parties, who rarely perform better than the most common indeces, such as the S&P 500 or Dow Jones Industrial Average. For that reason, few small investors make more than 5-10% per year on their money, and since 2000 many would beg for that much return!

Most investors would make more money with their available time by studying prices on the web and simply buying bargains where they could save more than 10% on their purchase. The satisfaction of a well priced computer, piece of furniture, nice suit or pair of shoes is far more gratifying than earning 2-4% on your investment, while worrying about whether you might LOSE 10-20-30%, or more!

And that's why you don't want to own JPMorganChase (JPMC.) Last week's earning's call was a remarkable example of boredom. Yes, Chairman and CEO Jamie Dimon and his team spent considerable time explaining how the London investment office lost $6B, and why they felt it was an "accident" that would not happen again. But the truth is that this $6B "mistake" wasn't really all that big a deal, compared to the $100B in mortgage and credit card losses since the financial crisis started!

Perhaps Mr. Dimon was right, given JPMC's size, that the whole experience was mostly "a tempest in a teapot." Throughout the call the CEO kept emphasizing that JPMC was "going to go about the business of deposits and lending that is the 'core' business for the bank." Although known for outspokenness, Mr. Dimon sounded like any other bank CEO saying "things happen, but trust us. We really are conservative."

So if a $6B surprise loss isn't that big a deal, what is important to shareholders of JPMC?

How about the unlikelihood of JPMC earning any sort of decent return for the next decade, or two?

The world has changed. But this call, and the mountain of powerpoint slides and documents put out with it, reiterated just how little JPMC (and most of its competition, honestly) has not. In this global world of network relationships, digital transactions, struggling home values and upside down mortgages, and very slow economic growth in developed countries, JPMC has no idea what "the next big thing" will be that could make its investors a 20-30% rate of return.

Yes, in many traditional product lines return-on-equity is in the upper teens or even over 20%. But, then there are losses in others. So lots of trade-offs. Ho-hum. To seek growth JPMC is opening more branches (ho-hum). And trying to sign up more credit card customers (ho-hum) and make more smalll-business loans (ho-hum) while running ads and hoping to accumulate more deposit acounts (ho-hum.) And they have cut compensation and other non-interest costs 12% (ho-hum.)

You could have listened to this call in the 1980s, or 1990s, and it would have sounded the same.

Only the world isn't at all the same.

And Mr. Dimon, and his team, knew this. That's why JPMC created the Chief Investment Office (CIO) in London, and the synthetic credit portfolio that has caused such a stir. The old success formula, despite the bailout which created these highly concentrated, huge banks, simply doesn't have much growth – in revenues or profits. So to jack up returns the bank created an extremely complex business unit that made bets – big bets – sometimes HUGE bets – on interest rates and securities it did not own.

These bets allowed small sums (like, say, $1B) to potentially earn multiples on the investment. Or, lose multiples. And the bets were all based on forecasts about future events – using a computer model created by the CIO's office. As Mr. Dimon's team eloquently pointed out, this model became very complicated, and as reality varied from forecast nobody at JPMC was all that clear why the losses started to happen. As they kept using the model, losses mounted. Oops.

But now, we are to be very assured that JPMC's leaders are paying a lot more attention to the model, and thus JPMC isn't going to have such variations between forecast and reality. So this event won't happen again.

Right.

If JPMC didn't need to use the highly complicated world of derivatives to potentially jack up its returns it would have closed the CIO before these losses happened. Now they claim to have closed the synthetic trading portfolio, but not the CIO. Think about that, if you had a unit operated by one of your very top leaders that "made a mistake" and lost $6B wouldn't you closing it? You would only keep it open if you felt like you had to.

Anybody out there remember the failure of Long Term Capital Management (LTCM?) Certainly Mr. Dimon does. In the 1990s LTCM was the most famous "hedge fund" of its day. The "model" used at Long Term Capital supposedly had zero risk, but extremely high returns. Until a $4B loss created by the default of Russion bonds wiped out all the bank's reserves and capital.

Let's see, what's the big news these days? Oh yeah, possible bond defaults in Greece, Portugal, Spain, Ireland……

The recent "crisis" at JPMC reflects a company locked-in to an antiquated business model which has no growth and declining returns. In order to prop up returns the bank took on almost unquantifiable additional risk, through its hedging operation. Even though hedging long had a risky history, and some spectacular failures.

But this was the only way JPMC knew how to boost returns, so it did it anyway. In an almost off-hand comment Mr. Dimon remarked a capable executive fired CIO Ina Drew was. And that she was credited with "saving the bank" by some of Mr. Dimon's fellow executives. Most likely her money-losing, high risk efforts were another attempt by Ms. Drew to "save the bank's returns" and thus why she was lauded even after losing $6B.

But no more. Now the bank is just going to slog it out being the boring bank it used to be. Amidst all the slides and documents there was NO explanation of what JPMC was going to do next to create growth. So JPMC is still susceptible to crisis – from debt defaults, Euro crisis, no growth economies, etc. – but shows little, if any, upside growth.

And that's why you don't want to invest in JPMC. For the last 3 years the stock has swung wildly. Big swings are loved by betting stock traders. But quarter to quarter vicissitudes are not helpful for investors who need growth so they can generate a 50% gain in 5 years when they need the money for junior's college tuition.

For that matter, I can't think of any "money center" bank worth investing. All of them have the same problem. After being "saved" they are less likely to behave differently than ever before. At JPMC leadership took bets in derivatives trying to jack up returns. At Barclay's Bank it appears leadership manipulated a key lending rate (LIBOR.) All actions typical of executives that are stuck in a lousy market, that is shifting away from them, and feeling it necessary to push the envelope in an effort to squeek out higher returns.

If you feel compelled to invest in financial services, look outside the traditional institutions. Consider Virgin, where Virgin Money is behaving uniquely – and could create incredible growth with very high returns. In a business no "traditional" bank is pursuing. Or Discover Financial Services which is using a unique on-line approach to deposits and lending. Although these are nothing like JPMC, they offer opportunity for growth with probably less risk of another future crisis.

by Adam Hartung | Jul 11, 2012 | Current Affairs, Defend & Extend, Disruptions, Innovation, Leadership, Lock-in

The news is not good for U.S. auto companies. Automakers are resorting to fairly radical promotional programs to spur sales. Chevrolet is offering a 60-day money back guarantee. And Chrysler is offering 90 day delayed financing. Incentives designed to make you want to buy a car, when you really don't want to buy a car. At least, not the cars they are selling.

On the other hand, the barely known, small and far from mainstream Tesla motors gave one of its new Model S cars to Wall Street Journal reviewer Dan Neil, and he gave it a glowing testimonial. He went so far as to compare this 4-door all electric sedan's performance with the Lamborghini and Ford GT supercars. And its design with the Jaguar. And he spent several paragraphs on its comfort, quiet, seating and storage – much more aligned with a Mercedes S series.

There are no manufacturer incentives currently offered on the Tesla Model S.

What's so different about Tesla and GM or Ford? Well, everything. Tesla is a classic case of a disruptive innovator, and GM/Ford are classic examples of old-guard competitors locked into sustaining innovation. While the former is changing the market – like, say Amazon is doing in retail – the latter keeps laughing at them – like, say Wal-Mart, Best Buy, Circuit City and Barnes & Noble have been laughing at Amazon.

Tesla did not set out to be a car company, making a slightly better car. Or a cheaper car. Or an alternative car. Instead it set out to make a superior car.

Its initial approach was a car that offered remarkable 0-60 speed performance, top end speed around 150mph and superior handling. Additionally it looked great in a 2-door European style roadster package. Simply, a wildly better sports car. Oh, and to make this happen they chose to make it all-electric, as well.

It was easy for Detroit automakers to scoff at this effort – and they did. In 2009, while Detroit was reeling and cutting costs – as GM killed off Pontiac, Hummer, Saab and Saturn – the famous Bob Lutz of GM laughed at Tesla and said it really wasn't a car company. Tesla would never really matter because as it grew up it would never compete effectively. According to Mr. Lutz, nobody really wanted an electric car, because it didn't go far enough, it cost too much and the speed/range trade-off made them impractical. Especially at the price Tesla was selling them.

Meanwhile, in 2009 Tesla sold 100% of its production. And opened its second dealership. As manufacturing plants, and dealerships, for the big brands were being closed around the world.

Like all disruptive innovators, Tesla did not make a car for the "mass market." Tesla made a great car, that used a different technology, and met different needs. It was designed for people who wanted a great looking roadster, that handled really well, had really good fuel economy and was quiet. All conditions the electric Tesla met in spades. It wasn't for everyone, but it wasn't designed to be. It was meant to demonstrate a really good car could be made without the traditional trade-offs people like Mr. Lutz said were impossible to overcome.

Now Tesla has a car that is much more aligned with what most people buy. A sedan. But it's nothing like any gasoline (or diesel) powered sedan you could buy. It is much faster, it handles much better, is much roomier, is far quieter, offers an interface more like your tablet and is network connected. It has a range of distance options, from 160 to 300 miles, depending up on buyer preferences and affordability. In short, it is nothing like anything from any traditional car maker – in USA, Japan or Korea.

Again, it is easy for GM to scoff. After all, at $97,000 (for the top-end model) it is a lot more expensive than a gasoline powered Malibu. Or Ford Taurus.

But, it's a fraction of the price of a supercar Ferrari – or even a Porsche Panamera, Mercedes S550, Audi A8, BMW 7 Series, or Jaguar XF or XJ - which are the cars most closely matching size, roominess and performance.

And, it's only about twice as expensive as a loaded Chevy Volt – but with a LOT more advantages. The Model S starts at just over $57,000, which isn't that much more expensive than a $40,000 Volt.

In short, Tesla is demonstrating it CAN change the game in automobiles. While not everybody is ready to spend $100k on a car, and not everyone wants an electric car, Tesla is showing that it can meet unmet needs, emerging needs and expand into more traditional markets with a superior solution for those looking for a new solution. The way, say, Apple did in smartphones compared to RIM.

Why didn't, and can't, GM or Ford do this?

Simply put, they aren't even trying. They are so locked-in to their traditional ideas about what a car should be that they reject the very premise of Tesla. Their assumptions keep them from really trying to do what Tesla has done – and will keep improving – while they keep trying to make the kind of cars, according to all the old specs, they have always done.

Rather than build an electric car, traditionalists denounce the technology. Toyota pioneered the idea of extending a gas car into electric with hybrids – the Prius – which has both a gasoline and an electric engine.

Hmm, no wonder that's more expensive than a similar sized (and performing) gasoline (or diesel) car. And, like most "hybrid" ideas it ends up being a compromise on all accounts. It isn't fast, it doesn't handle particularly well, it isn't all that stylish, or roomy. And there's a debate as to whether the hybrid even recovers its price premium in less than, say, 4 years. And that is all dependent upon gasoline prices.

Ford's approach was so clearly to defend and extend its traditional business that its hybrid line didn't even have its own name! Ford took the existing cars, and reformatted them as hybrids, with the Focus Hybrid, Escape Hybrid and Fusion Hybrid. How is any customer supposed to be excited about a new concept when it is clearly displayed as a trade-off; "gasoline or hybrid, you choose." Hard to have faith in that as a technological leap forward.

And GM gave the market Volt. Although billed as an electric car, it still has a gasoline engine. And again, it has all the traditional trade-offs. High initial price, poor 0-60 performance, poor high-end speed performance, doesn't handle all that well, isn't very stylish and isn't too roomy. The car Tesla-hating Bob Lutz put his personal stamp on. It does achieve high mpg – compared to a gasoline car – if that is your one and only criteria.

Investors are starting to "get it."

There was lots of excitement about auto stocks as 2010 ended. People thought the recession was ending, and auto sales were improving. GM went public at $34/share and rose to about $39. Ford, which cratered to $6/share in July, 2010 tripled to $19 as 2011 started.

But since then, investor enthusiasm has clearly dropped, realizing things haven't changed much in Detroit – if at all. GM and Ford are both down about 50% – roughly $20/share for GM and $9.50/share for Ford.

Meanwhile, in July of 2010 Tesla was about $16/share and has slowly doubled to about $31.50. Why? Because it isn't trying to be Ford, or GM, Toyota, Honda or any other car company. It is emerging as a disruptive alternative that could change customer perspective on what they should expect from their personal transportation.

Like Apple changed perspectives on cell phones. And Amazon did about retail shopping.

Tesla set out to make a better car. It is electric, because the company believes that's how to make a better car. And it is changing the metrics people use when evaluating cars.

Meanwhile, it is practically being unchallenged as the existing competitors – all of which are multiples bigger in revenue, employees, dealers and market cap of Tesla – keep trying to defend their existing business while seeking a low-cost, simple way to extend their product lines. They largely ignore Tesla's Roadster and Model S because those cars don't fit their historical success formula of how you win in automobile competition.

The exact behavior of disruptors, and sustainers likely to fail, as described in The Innovator's Dilemma (Clayton Christensen, HBS Press.)

Choosing to be ignorant is likely to prove very expensive for the shareholders and employees of the traditional auto companies. Why would anybody would ever buy shares in GM or Ford? One went bankrupt, and the other barely avoided it. Like airlines, neither has any idea of how their industry, or their companies, will create long-term growth, or increase shareholder value. For them innovation is defined today like it was in 1960 – by adding "fins" to the old technology. And fins went out of style in the 1960s – about when the value of these companies peaked.

by Adam Hartung | Jul 2, 2012 | Current Affairs, Defend & Extend, In the Whirlpool, Leadership

Cost cutting never improves a company. Period.

We've become so used to reading about reorganizations, layoffs and cost cutting that most people just accept such leadership decisions as "best practice." No matter the company, or industry, it has become conventional wisdom to believe cost cutting is a good thing.

As a reporter recently asked me regarding about layoffs at Yahoo, "Isn't it always smart to cut heads when your profits fall?" Of course not. Have the layoffs at Yahoo in any way made it a better, more successful company able to compete with Google, Microsoft, Facebook and Apple? Given the radical need for innovation, layoffs have only hurt Yahoo more – and made it more likely to end up like RIM (Research in Motion.)

But like believing in a flat world, blood letting to cure disease and that meteorites are spit up out of the ground – this is just another conventional wisdom that is untrue; and desperately needs to be challenged. Cost reductions are killing most companies, not helping them.

Take for example Sara Lee. Sara Lee was once a great, growing company. Its consumer brands were well known, considered premium products and commanded a price premium at retail.

The death spiral at Sara Lee began in 2006. "Professional managers" from top-ranked MBA schools started "improving earnings" with an ongoing program of reorganizations and cost reductions. Largely under the leadership of the much-vaunted Brenda Barnes, none of these cost reductions improved revenues. And the stock price went nowhere.

With each passing year Sara Lee sold parts of the business, such as Hanes, under the disguise of "seeking focus." With each sale a one-time gain was booked, and more people were laid off as the reorganizations continued. Profits remained OK, but the company was actually shrinking – rather than growing.

To prop up the stock price all avaiable cash was used to buy back stock, which helped maximize executive compensation but really did nothing for investors. R&D was eliminated, as was new product development and any new product launches. Instead Sara Lee kept selling more businesses, reorganizing, cutting costs — and buying its own shares. Until finally, after Ms. Barnes left due to an unfortunate stroke, Sara Lee was so small it had nothing left to sell.

So the company decided to split into two parts! Magically, it's like pushing the reset button. What was Sara Lee is now an even smaller Hillshire Brands. All that poor track record of sales, profits and equity value goes POOF as the symbol SLE disappears, and investors are left following HSH – which has only traded for about 2 days! No more looking at that long history of bad performance, it isn't on Bloomberg or Marketwatch or Yahoo. Like the name Sara Lee, the history vanishes.

Well, "if you can't dazzle 'em with brilliance you baffle 'em with bull**it" W.C. Fields once said.

Cost cuts don't work because they don't compound. If I lay off the head of Brand Marketing this year I promise to save $300,000 and improve the Profit & Loss Statement (P&L) by that amount. So a one time improvement. Now – ignoring the fact that the head of branding probably did a number of things to grow revenue – the problem becomes, what do you do the next year? You can't lay off the Brand V.P. again to save that $300,000 twice. Further, if you want to improve the P&L by $450,000 this time you actually have to find 2 Directors to lay off!

Shooting your own troops in order to manage a smaller army rarely wins battles.

Cost cuts are one-time, and are impossible to duplicate. Following this route leads any company toward being much smaller. Like Sara Lee. From a once great company with revenues in the $10s of billions, the new Hillshire Brands isn't even an S&P 500 company (it was replaced by Monster Beverage.) And how can any investor obtain a great return on investment from a company that's shrinking?

What does create a great company? Growth! Unlike cost cutting, if a company launches a new product it can sell $300,000 the first year. If it meets unmet needs, and is a more effective solution, then the product can attract new customers and sell $600,000 the second year. And then $900,000 or maybe $1.2M the third year. (And even add jobs!)

If you are very good at creating and launching products that meet needs, you can create billions of dollars in new revenue. Like Apple with the iPhone and iPad. Or Facebook. Or Groupon. These companies are growing revenues extremely fast because they have products that meet needs. They aren't trying to "save the P&L."

And revenue growth creates "compound returns." Unlike the cost savings which are one time, each dollar of revenue produces cash flow which can be invested in more sales and delivery which can generate even more cash flow. So if growth is 20% and you invest $1,000 in year one, that can become $1,200 in year two, then $1,440 in year three, $1,728 in year four and $2,070 in year five. Each year you receive 20% not only on the $1,000 you invested, but on returns from the previous years!

By compounding year after year, at20% investor money doubles in 5 years. That's why the most important term for investing is CAGR – Compound Annual Growth Rate. Even a small improvement in this number, from say 9% to 11%, has very important meaning. Because it "compounds" year after year. You don't have to add to your investment – merely allowing it to support growth produces very, very handsome returns. The higher the CAGR the better.

Something no cost cutting program can possibly due. Ever.

So, what is the future of Hillshire Brands? According to the CEO, interviewed Sunday for the Chicago Tribune, the company's historically poor performance could be blamed on —– wait —– insufficient focus. Alas, Sara Lee's problem was obviously too much sales! Well, good thing they've been solving that problem.

Of course, having too many brands led to too much lateral thinking and not enough really deep focus on meat. So now that all they need to think about is meat, he expects innovation will be much improved. Right. Now that HSH is a "meat focused meals" company, and the objective is to add innovation to meat, they are considering such radical dietary improvements for our fat-laden, overcaloried American society as adding curry powder to the frozen meatloaf.

Not exactly the iPhone.

To create future growth the first act the new CEO took to push growth was —- wait —– cutting staff by $100million over the next 3 years. Really. He will solve the "analysis paralysis" which seems to concern him as head of this much smaller company because there won't be anyone around to do the analysis, nor to discuss it and certainly not to disagree with the CEO's decisions. Perhaps meat loaf egg rolls will be next.

All reorganizations and cost reductions point to leadership's failure to create growth. Every time. Staff reductions say to investors, employees, suppliers and customers "I have no idea how to add profitable revenue to this company. I really have no clue how to put these people to work productively – even if they are really good people. I have no choice but to cut these jobs, because we desperately need to make the profits look better in order to prop up the stock price short term; even if it kills our chances of developing new products, creating new markets and making superior rates of return for investors long term."

Hillshire's CEO may do very well for himself, and his fellow executives. Assuredly they have compensation plans tied to stock price, and golden parachutes if they leave. HSH is now so small that it is a likely purchase by a more successful company. By further gutting the organization Hillshire's CEO can reduce staff to a minimum, making the acquisition appear easier for a large company. This would allow a premium payment upon acquisition, providing millions to the executives as options pay out and golden parachutes enact.

And it might give a return to the shareholders. If the ongoing slaughter finds a buyer. Otherwise investors will see the stock crater as it heads to bankruptcy. Like RIM and Yahoo. So flip a coin. But that's called gambling, not investing.

What investors need is CAGR. Not cost cutting and reorganizations. And as I've said since 2006 – you don't want to own Sara Lee; even if it's now called Hillshire Brands.

by Adam Hartung | Jun 18, 2012 | Current Affairs, Defend & Extend, In the Whirlpool, Innovation, Leadership, Web/Tech

While there is an appropriately high interest in the Win8 Tablet announcement from Microsoft today, there is no way it is going to be a game changer. Simply because it was never intended to be.

Game changers meet newly emerging, unmet needs, in new ways. People are usually happy enough, until they see the new product/solution and realize "hey, this helps me do something I couldn't do before" or "this helps me solve my problem a lot better." Game changers aren't a simple improvement, they allow customers to do something radically different. And although at first they may well appear to not work too well, or appear too expensive, they meet needs so uniquely, and better, that they cause people to change their behavior.

Motorola invented the smart phone. But Motorola thought it was too expensive to be a cell phone, and not powerful enough to be a PC. Believing it didn't fit existing markets well, Motorola shelved the product.

Apple realized people wanted to be mobile. Cell phones did talk and text OK – and RIM had pretty good email. But it was limited use. Laptops had great use, but were too big, heavy and cumbersome to be really mobile. So Apple figured out how to add apps to the phone, and use cloud services support, in order to make the smart phone fill some pretty useful needs – like navigation, being a flashlight, picking up tweets – and a few hundred thousand other things – like doctors checking x-rays or MRI results. Not as good as a PC, and somewhat on the expensive side for the device and the AT&T connection, but a whole lot more convenient. And that was a game changer.

From the beginning, Windows 8 has been – by design – intended to defend and extend the Windows product line. Rather than designed to resolve unmet needs, or do things nobody else could do, or dramatically improve productivity over all other possible solutions, Windows 8 was designed to simply extend Windows so (hopefully) people would not shift to the game changer technology offered by Apple and later Google.

The problem with trying to extend old products into new markets is it rarely works. Take for example Windows 7. It was designed to replace Windows Vista, which was quite unpopular as an upgrade from Windows XP. By most accounts, Windows 7 is a lot better. But, it didn't offer users anything that that made them excited to buy Windows 7. It didn't solve any unmet needs, or offer any radically better solutions. It was just Windows better and faster (some just said "fixed.")

Nothing wrong with that, except Windows 7 did not address the most critical issue in the personal technology marketplace. Windows 7 did not stop the transition from using PCs to using mobile devices. As a result, while sales of app-enabled smartphones and tablets exploded, sales of PCs stalled:

Chart reproduced with permission of Business Insider Intelligence 6/12/12 courtesy of Alex Cocotas

People are moving to the mobility provided by apps, cloud services and the really easy to use interface on modern mobile devices. Market leading cell phone maker, Nokia, decided it needed to enter smartphones, and did so by wholesale committing to Windows7. But now the CEO, Mr. Elop (formerly a Microsoft executive,) is admitting Windows phones simply don't sell well. Nobody cares about Microsoft, or Windows, now that the game has changed to mobility – and Windows 7 simply doesn't offer the solutions that Apple and Android does. Not even Nokia's massive brand image, distribution or ad spending can help when a product is late, and doesn't greatly exceed the market leader's performance. Just last week Nokia announced it was laying off another 10,000 employees.

Reviews of Win8 have been mixed. And that should not be surprising. Microsoft has made the mistake of trying to make Win8 something nobody really wants. On the one hand it has a new interface called Metro that is supposed to be more iOS/Android "like" by using tiles, touch screen, etc. But it's not a breakthrough, just an effort to be like the existing competition. Maybe a little better, but everyone believes the leaders will be better still with new updates soon. By definition, that is not game changing.

Simultaneously, with Win8 users can find their way into a more historical Windows inteface. But this is not obvious, or intuitive. And it has some pretty "clunky" features for those who like Windows. So it's not a "great" Windows solution that would attract developers today focused on other platforms.

Win8 tries to be the old, and the new, without being great at either, and without offering anything that solves new problems, or creates breakthroughs in simplicity or performance.

Do you know the story about the Ford Edsel?

By focusing on playing catch up, and trying to defend & extend the Windows history, Microsoft missed what was most important about mobility – and that is the thousands of apps. The product line is years late to market, short on apps, short on app developers and short on giving anyone a reason to really create apps for Win8.

Some think it is good if Microsoft makes its own tablet – like it has done with xBox. But that really doesn't matter. What matters is whether Microsoft gives users and developers something that causes them to really, really want a new platform that is late and doesn't have the app base, or the app store, or the interfaces to social media or all the other great thinks they already have come to expect and like about their tablet (or smartphone.)

When iOS came out it was new, unique and had people flocking to buy it. Developers could only be mobile by joining with Apple, and users could only be mobile by buying Apple. That made it a game changer by leading the trend toward mobility.

Google soon joined the competition, built a very large, respectable following by chasing Apple and offering manufacturers an option for competing with Apple.

But Microsoft's new entry gives nobody a reason to develop for, or buy, a Win8 tablet – regardless of who manufactures it. Microsoft does not deliver a huge, untapped market. Microsoft doesn't solve some large, unmet need. Microsoft doesn't promise to change the game to some new, major trend that would drive early adopters to change platforms and bring along the rest of the market.

And making a deal so a dying company, on the edge of bankruptcy – Barnes & Noble – uses your technology is not a "big win." Amazon is killing Barnes & Noble, and Microsoft Windows 8 won't change that. No more than the Nook is going to take out Kindle, Kindle Fire, Galaxy Tab or the iPad. Microsoft can throw away $300million trying to convince people Win8 has value, but spending investor money on a dying businesses as a PR ploy is just stupid.

Microsoft is playing catch up. Catch up with the user interface. Catch up with the format. Catch up with the device size and portability. Catch up with the usability (apps). Just catch up.

Microsoft's problem is that it did not accept the PC market was going to stall back in 2008 or 2009. When it should have seen that mobility was a game changing trend, and required retooling the Microsoft solution suite. Microsoft dabbled with music mobility with Zune, but quickly dropped the effort as it refocused on its "core" Windows. Microsoft dabbled with mobile phones across different solutions including Kin – which it dropped along with Microsoft Mobility. Back again to focusing on operating systems. By maintaining its focus on Windows Microsoft hoped it could stop the trend, and refused to accept the market shift that was destined to stall its sales.

Microsoft stock has been flat for a decade. It's recent value improvement as Win8 approaches launch indicates that hope beats eternally in some investors' breasts for a return of Microsoft software dominance. But those days are long past. PC sales have stalled, and Windows is a product headed toward obsolescence as competitors make ever better, more powerful mobile platforms and ecosystems. If you haven't sold Microsoft yet, this may well be your last chance above $30. Ever.

by Adam Hartung | May 25, 2012 | Defend & Extend, In the Whirlpool, Leadership, Web/Tech

Things are bad at HP these days. CEO and Board changes have confused the management team and investors alike. Despite a heritage based on innovation, the company is now mired in low-growth PC markets with little differentiation. Investors have dumped the stock, dropping company value some 60% over two years, from $52/share to $22 – a loss of about $60billion.

Reacting to the lousy revenue growth prospects as customers shift from PCs to tablets and smartphones, CEO Meg Whitman announced plans to eliminate 27,000 jobs; about 8% of the workforce. This is supposedly the first step in a turnaround of the company that has flailed ever since buying Compaq and changing the company course into head-to-head PC competition a decade ago. But, will it work?

Not a chance.

Fixing HP requires understanding what went wrong at HP. Simply, Carly Fiorina took a company long on innovation and new product development and turned it into the most industrial-era sort of company. Rather than having HP pursue new technologies and products in the development of new markets, like the company had done since its founding creating the market for electronic testing equipment, she plunged HP into a generic manufacturing war.

Pursuing the PC business Ms. Fiorina gave up R&D in favor of adopting the R&D of Microsoft, Intel and others while spending management resources, and money, on cost management. PCs offered no differentiation, and HP was plunged into a gladiator war with Dell, Lenovo and others to make ever cheaper, undifferentiated machines. The strategy was entirely based upon obtaining volume to make money, at a time when anyone could buy manufacturing scale with a phone call to a plethora of Asian suppliers.

Quickly the Board realized this was a cutthroat business primarily requiring supply chain skills, so they dumped Ms. Fiorina in favor of Mr. Hurd. He was relentless in his ability to apply industrial-era tactics at HP, drastically cutting R&D, new product development, marketing and sales as well as fixating on matching the supply chain savings of companies like Dell in manufacturing, and WalMart in retail distribution.

Unfortunately, this strategy was out of date before Ms. Fiorina ever set it in motion. And all Mr. Hurd accomplished was short-term cuts that shored up immediate earnings while sacrificing any opportunities for creating long-term profitable new market development. By the time he was forced out HP had no growth direction. It's PC business fortunes are controlled by its suppliers, and the PC-based printer business is dying. Both primary markets are the victim of a major market shift away from PC use toward mobile devices, where HP has nothing.

HPs commitment to an outdated industrial era supply-side manufacturing strategy can be seen in its acquisitions. What was once the world's leading IT services company, EDS, was bought in 2008 after falling into financial disarray as that market shifted offshore. After HP spent nearly $14B on the purchase, HP used that business to try defending and extending PC product sales, but to little avail. The services group has been downsized regularly as growth evaporated in the face of global trends toward services offshoring and mobile use.

In 2009 HP spent almost $3B on networking gear manufacturer 3Com. But this was after the market had already started shifting to mobile devices and common carriers, leaving a very tough business that even market-leading Cisco has struggled to maintain. Growth again stagnated, and profits evaporated as HP was unable to bring any innovation to the solution set and unable to create any new markets.

In 2010 HP spent $1B on the company that created the hand-held PDA (personal digital assistant) market – the forerunner of our wirelessly connected smartphones – Palm. But that became an enormous fiasco as its WebOS products were late to market, didn't work well and were wholly uncompetitive with superior solutions from Apple and Android suppliers. Again, the industrial-era strategy left HP short on innovation, long on supply chain, and resulted in big write-offs.

Clearly what HP needs is a new strategy. One aligned with the information era in which we live. Think like Apple, which instead of chasing Macs a decade ago shifted into new markets. By creating new products that enhanced mobility Apple came back from the brink of complete failure to spectacular highs. HP needs to learn from this, and pursue an entirely new direction.

But, Meg Whitman is certainly no Steve Jobs. Her career at eBay was far from that of an innovator. eBay rode the growth of internet retailing, but was not Amazon. Rather, instead of focusing on buyers, and what they want, eBay focused on sellers – a classic industrial-era approach. eBay has not been a leader in launching any new technologies (such as Kindle or Fire at Amazon) and has not even been a leader in mobile applications or mobile retail.

While CEO at eBay Ms. Whitman purchased PayPal. But rather than build that platform into the next generation transaction system for web or mobile use, Paypal was used to defend and extend the eBay seller platform. Even though PayPal was the first leader in on-line payments, the market is now crowded with solutions like Google Wallets (Google,) Square (from a Twitter co-founder,) GoPayment (Intuit) and Isis (collection of mobile companies.)

Had Ms. Whitman applied an information-era strategy Paypal could have been a global platform changing the way payment processing is handled. Instead its use and growth has been limited to supporting an historical on-line retail platform. This does not bode well for the future of HP.

HP cannot save its way to prosperity. That never works. Try to think of one turnaround where it did – GM? Tribune Corp? Circuit City? Sears? Best Buy? Kodak? To successfully turn around HP must move – FAST – to innovate new solutions and enter new markets. It must change its strategy to behave a lot more like the company that created the oscilliscope and usher in the electronics age, and a lot less like the industrial-era company it has become – destroying shareholder value along the way.

Is HP so cheap that it's a safe bet. Not hardly. HP is on the same road as DEC, Wang, Lanier, Gateway Computers, Sun Microsystems and Silicon Graphics right now. And that's lousy for investors and employees alike.