by Adam Hartung | Sep 11, 2015 | Current Affairs, Defend & Extend, In the Swamp, Leadership

Jeff Smisek, CEO of United Continental Holdings, was fired this week. It appears he was making deals with public officials (specifically the Chairman of the Port Authority of New York and New Jersey) to keep personally favored flights of politicians in the air, even when unprofitable, in a quid-pro-quo exchange for government subsidies to move a taxiway and better airport transit.

Wow, horse-trading of the kind that put the governor of Illinois in the penitentiary.

But you have to ask yourself, couldn’t you see it coming? Or are we just so used to lousy leadership that we think there’s no end to it?

But you have to ask yourself, couldn’t you see it coming? Or are we just so used to lousy leadership that we think there’s no end to it?

United has been beset with a number of problems. Since Mr. Smisek organized the merger of Continental (his former employer) with United, creating the world’s largest airline at the time, things have not gone well. Since announcing the merger in 2010, more has gone wrong than right at United:

The merged airline didn’t start in a great position. It was in 2009 that a budding musician watched United baggage handlers destroy his guitar, leading to a series of videos on bad customer service that took to the top of YouTube and iTunes and his book on the culture of customer abuse at United underscored a major PR nightmare.

How could things seem to constantly become worse? It was clear that at the top, United’s leadership cared only about cost control (ironically code named Project Quality.) Operational efficiency was seen as the only strategy, and it did not matter how much this strategy disaffected employees, suppliers or customers. In 2013 United ranked dead last in the quality ranking of all airlines by Wichita State University, and the airline replied by saying it really didn’t care.

The power of thinking that if you focus on pennies and nickels the quarters and dollars will take care of themselves is strong. It encourages you be very focused on details, even myopic, and operate your business very narrowly. And it can set you up to make really dumb mistakes, like possibly trading airline flights for construction subsidies.

Focus, focus, focus often leads to being blind, blind, blind to the world around you.

There were ample signs of all the things going wrong at United, and the need for a change. The open question is why it took a criminal investigation into bribing government officials for the airline’s Board to fire the CEO? Bad performance apparently didn’t matter? Do you have to be an accused lawbreaker to be shown the door?

The story broke in February, so the Board has had a few months to find a replacement CEO. Mr. Oscar Munoz will now take the reigns. But one has to wonder if he is up for the challenges. As a former railroad President, his world of relationships was much smaller than the millions of customers and 84,000 employees at United.

United’s top brass has a serious need “to get over itself.” United’s internal focus, driven by costs, has disenfranchised its brand embassadors, its customer base, and many industry analysts.

United needs to become a lot clearer about what customers really need and want. Years of overly simplistic “all customers care about is price” has commoditized United’s approach to air travel. Customers have been smart enough to see through lower seat prices, only to be stuck with seat assignment and baggage fees raising total trip cost. And charging for everything on the plane, including cheesy TV shows, has customers wondering just how far from Spirit Airlines’ approach United would drift before someone reminded leadership what their customers want and why they used to choose United.

Unfortunately, it is a bit unsettling that CEO Munoz said his first action will be to take 90 days “traveling the system and listening and talking to our people and working with our management team.” Sounds like a lot more internal focus. Spending more time talking to customers at United’s hubs, and seeing how they are treated from check-in to baggage, might do him a lot more good.

United became big via acquisition. That is much different than building an airline, like say Southwest did. Growth via purchase is not the same as growth via loyal customers and an attractive brand proposition. United has clearly lost its way. It has a lot of problems to solve, but first among them should be understanding what customers want. Then designing the model to profitably deliver it.

by Adam Hartung | Sep 4, 2015 | Current Affairs, Leadership

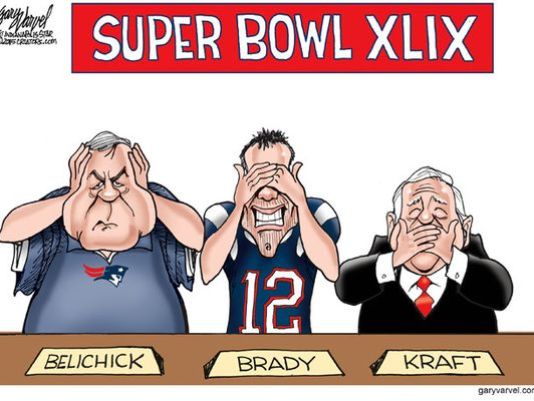

Tom Brady’s lawyers convinced a judge this week (9/3/15) to over-rule his four game suspension for using under-inflated footballs in playoff games. This could seem like making a mountain out of a molehill, if it wasn’t so important a statement about bad leadership.

In 1925 golf legend Bobby Jones was playing the U.S. Open when he called a penalty on himself. He claimed that as he moved his club near the ball during his set up he “felt the ball move.” The judges asked the other players if they saw anything which should cause a penalty, and they said no. The judges asked the spectators if they say the ball move, and unanimously everyone said no. So the judges told Mr. Bobby Jones that he need not call a penalty, and he should play on. But Mr. Jones said that he was sure, so he called the penalty on himself.

He lost the U.S. Open by 1 stroke. Had he not called that penalty he would have been in a playoff and may well have won. And that is the kind of thing which creates a legend. Leadership based on honor and ability.

It strains credulity to think Mr. Brady did not know he was playing with under-inflated footballs. This man has won four Superbowls, and been named most valuable player (MVP) 3 times. He is an athlete in the top 1% of professional football players. He touches the football on every play he is in the game, and he has thrown millions of passes in games and practices over his long career. Yet we are to believe he could not feel that these balls were somehow different?

It strains credulity to think Mr. Brady did not know he was playing with under-inflated footballs. This man has won four Superbowls, and been named most valuable player (MVP) 3 times. He is an athlete in the top 1% of professional football players. He touches the football on every play he is in the game, and he has thrown millions of passes in games and practices over his long career. Yet we are to believe he could not feel that these balls were somehow different?

I am a lousy golfer, not nearly good enough to play in amateur, much less professional, tournaments. Yet even I can tell the difference in a golf ball, which I hit with a 3 foot long stick that has a mallet on the end. Professional golfers can talk eloquently about the feel of a golf ball and how it shapes their shots.

Yet we are to believe that Mr. Brady does not have enough sense of feel in his multi-million dollar hands to notice these balls were under-inflated and thereby easier to control? Few professionals believe he did not know.

Tom Brady had his opportunity to call a penalty on himself, and he did not do it. He could have told his coaches, management or officials that the balls felt soft and this should be checked. But his desire to win kept him from pointing out something minor – but something upon which winning or losing could have turned. Then, when he was caught and it was proven he used under-inflated balls, he had the opportunity to say “this was wrong, and I will accept whatever penalty in hopes that this never happens in professional football again.” But instead he refused to accept his penalty and sued the league.

This is NOT the stuff upon which legends are made.

Mr. Brady is a role model for thousands, possibly millions, of football fans and young aspiring athletes. He had the opportunity to show great leadership. Whether Mr. Jones would have won that U.S. Open or not, he forever showed that athletic leaders should never stoop to cheating. No matter how small. Not only by winning golf tournaments did Mr. Jones become a leader, but by his behavior he demonstrated leadership requires honesty, integrity and trust.

As head of the NFL, Mr. Roger Goodell has used this experience to reinforce the better parts of athletic competition. He tried to demonstrate a commitment to athletic leadership and fairness. He did not ban Mr. Brady from the sport, but rather told him he must sit out 4 games for his error in judgement as a leader. This is not unreasonable, and Mr. Goodell gave Mr. Brady an opportunity to demonstrate leadership, and his own commitment to the principles of good leadership.

Mr. Brady could have used this opportunity to help himself, his teammates, his coaches and everyone who watches sports understand the role of a leader. But instead, he chose to argue for the concept of win at any cost. He will forever be remembered as someone who probably cheated, when perhaps cheating was not even necessary to win. And he will be remembered for promoting to millions of fans and followers that winning at any cost – even if you have to go to court – is more important than demonstrating good leadership.

When leaders think they are beyond punishment, bad things happen. Look at Bernie Ebbers of Worldcom, Dennis Koslowski at Tyco and Jeffrey Skilling at Enron. To them winning was all that mattered. They hurt millions of employees, customers, suppliers and investors with such hubris. They were bad leaders, and bad role models. While Mr. Brady will not go to jail, his role in teaching bad leadership principles is fully entrenched – and likely will affect many more future leaders than the worst American business has thus far produced.

by Adam Hartung | Aug 27, 2015 | In the Rapids, Innovation, Investing, Leadership, Web/Tech

As market volatility reached new highs this week, CNBC began talking about something called “FANG Investing.” Most commentators showed great displeasure in the fact that prior to the recent downturn high growth companies such as Facebook, Amazon, Netflix and Google (FANG) had performed much better than all the major market indices. And, in the short burst of recent recovery these companies again seemed to be doing much better.

Coined by “CNBC Mad Money” host Jim Cramer, he felt that FANG investing was bad for investors. He said he preferred seeing a much larger group of companies would go up in value, thus representing a much more stable marketplace.

Coined by “CNBC Mad Money” host Jim Cramer, he felt that FANG investing was bad for investors. He said he preferred seeing a much larger group of companies would go up in value, thus representing a much more stable marketplace.

Sound like Wall Street gobblygook? Good. Because as an individual investor why should you care about a stable market? What you should care about is your individual investments going up in value. And if yours go up and all others go down what difference does it make?

Most financial advisers today actually confuse investors much more than help them. And nowhere is this more true than when discussing risk. All financial advisers (brokers in the old days) ask how much risk you want as an investor. If you’re smart you say “none.” Why would you want any risk? You want to make money.

Only this is the wrong answer, because most investors don’t understand the question – because the financial adviser’s definition of risk is nothing like yours.

To a broker investment risk is this bizarre term called “beta,” created by economists. They defined risk as the degree to which a stock does not move with the market index. If the S&P down 5%, and the stock goes down 5%, then they see no difference between the stock and the “market” so they say it has no risk. If the S&P goes up 3% and the stock goes up 3%, again, no risk.

But if a stock trades based on its own investor expectation, and does not track the market index, then it is considered “high beta” and your broker will say it is “high risk.” So let’s look at Apple the last 5 years. If you had put all your money into Apple 5 years ago you would be up over 200% – over 4x. Had you bought the S&P 500 Index you would be up 80%. Clearly, investing in Apple would have been better. But your adviser would say that is “high risk.” Why? Because Apple did not move with the S&P. It did much better. It is therefore considered high beta, and high risk.

You buy that?

Thus, brokers keep advising investors buy funds of various kinds. Because the investors says she wants low risk, they try to make sure her returns mirror the indices. But it begs the question, why don’t you just buy an electronic traded fund (ETF) that mirrors the S&P or Dow, and quit paying those fund fees and broker fees? If their approach is designed to have you do no better than the average, why not stop the fees and invest in those things which will exactly give you the average?

Anyway, what individual investors want is high returns. And that has nothing to do with market indices or how a stock moves compares to an index. It has to do with growth.

Growth is a wonderful thing. When a company grows it can write off big mistakes and nobody cares. It can overpay employees, give them free massages and lunches, and nobody cares. It can trade some of its stock for a tiny company, implying that company is worth a vast amount, in order to obtain new products it can push to its customers, and nobody cares. Growth hides a multitude of sins, and provides investors with the opportunity for higher valuations.

On the other hand, nobody ever cost cut a company into prosperity. Layoffs, killing products, shutting down businesses and selling assets does not create revenue growth. It causes the company to shrink, and the valuation to decline.

That’s why it is lower risk to invest in FANG stocks than those so-called low-risk portfolios. Companies like Facebook, Amazon, Netflix, Google — and Apple, EMC, Ultimate Software, Tesla and Qualcomm just to name a few others — are growing. They are firmly tied to technologies and products that are meeting emerging needs, and they know their customers. They are doing things that increase long-term value.

McDonald’s was a big winner for investors in the 1960s and 1970s as fast food exploded with the baby boomer generation. But as the market shifted McDonald’s sold off its investments in trend-linked brands Boston Market and Chipotle. Now its revenue has stalled, and its value is in decline as it shuts stores and lays off employees.

Thirty years ago GE tied its plans to trends in medical technology, financial services and media, and it grew tremendously making fortunes for its investors. In the last decade it has made massive layoffs, shut down businesses and sold off its appliance, financial services and media businesses. It is now smaller, and its valuation is smaller.

Caterpillar tied itself to the massive infrastructure growth in Asia and India, and it grew. But as that growth slowed it did not move into new businesses, so its revenues stalled. Now its value is declining as it lays off employees and shuts down business units.

Risk is tied to the business and its future expectations. Not how a stock moves compared to an index. That’s why investing in high growth companies tied to trends is actually lower risk than buying a basket of stocks — even when that basket is an index like DIA or SPY. Why should you own the low-or no-growth dogs when you don’t have to? How is it lower risk to invest in a struggling McDonald’s, GE or Caterpillar or some basket that contains them than investing in companies demonstrating tremendous revenue growth?

Good fishermen go where the fish are. Literally. Anybody can cast out a line and hope. But good fisherman know where the fish are, and that’s where they invest their bait. As an investor, don’t try to fish the ocean (the index.) Be smart, and put your money where the fish are. Invest in companies that leverage trends, and you’ll lower your risk of investment failure while opening the door to superior returns.

by Adam Hartung | Aug 21, 2015 | Current Affairs, Disruptions, Leadership, Transparency

How clearly I remember. I was in the finals of my third grade arithmetic competition. Two of us at the chalkboard, we both scribbled the numbers read to us as fast as we could, did the sum and whirled to look at the judges. Only my competitor was a hair quicker than me, so I was not the winner.

As we walked to the car my mother was quite agitated. “You lost to a GIRL” she said; stringing out that last word like it was some filthy moniker not fit for decent company to here. Born in 1916, to her it was a disgrace that her only son lost a competition to a female.

But it hit me like a tsunami wall. I had underestimated my competitor. And that was stupid of me. I swore I would never again make the mistake of thinking I was better than someone because of my male gender, white skin color, protestant christian upbringing or USA nationality. If I wanted to succeed I had to realize that everyone who competes gets to the end by winning, and they can/will beat me if I don’t do my best.

This week 1st Lt. Shaye Haver, 25, and Capt. Kristen Griest, 26, graduated Army Ranger training. Maybe the toughest military training in the world. And they were awarded their tabs because they were good – not because they were women.

This week 1st Lt. Shaye Haver, 25, and Capt. Kristen Griest, 26, graduated Army Ranger training. Maybe the toughest military training in the world. And they were awarded their tabs because they were good – not because they were women.

In retrospect, it is somewhat incredible that it took this long for our country to begin training all people at this level. If someone is good, why not let them compete? In what way is it smart to hold back someone from competing based on something as silly as their skin color, gender, religious beliefs or sexual orientation?

Our country, in fact much of mankind, has had a long history of holding people back from competing. Those in power like to stay in power, and will use about any tool they can to maintain the status quo – and keep themselves in charge. They will use private clubs, secret organizations, high investment rates, difficult admission programs, laws and social mores to “keep each to his own kind” as I heard far too often throughout my youth.

As I went to college I never forgot my 3rd grade experience, and I battled like crazy to be at the top of every class. It was clear to me there were a lot of people as smart as I was. If I wanted to move forward, it would be foolish to expect I would rise just because the status quo of the time protected healthy white males. There were plenty of women, people of color, and folks with different religions who wanted the spot I wanted – and they would win that spot. Maybe not that day, but soon enough.

In the 1980s I did a project for The Boston Consulting Group in South Africa. As I moved around that segregated apartheid country it was clear to me that those supporting the status quo did so out of fear. They weren’t superior to the native South Africans. But the only way they could maintain their lifestyle was to prohibit these other people from competing.

And that proved to be untenable. The status quo fell, and when it did many of European extraction quickly fled – unable to compete with those they long kept from competing.

In the last 30 years we’ve coined the term “diversity” for allowing people to compete. I guess that is a nice, politically favorable way to say we must overcome the status quo tools used to hold people back. But the drawback is that those in power can use the term to imply someone is allowed to compete, or even possibly wins, only because they were given “special permission” which implies “special terms.”

That is unfortunate, because most of the time the only break these folks got was being allowed to, finally, compete. Once in the competition they frequently have to deal with lots of attacks – even from their own teammates. Jim Thorpe was a Native American who mesmerized Americans by winning multiple Gold Medals at the 1912 Olympics, and embarrassing the Germans then preaching national/racial superiority as they planned the launch of WW1. But, once back on American soil it didn’t take long for his own countrymen to strip Mr. Thorpe of his medals, unhappy that he was an “Indian” rather than a white man. He tragically died a homeless alcoholic.

And never forget all the grief Jackie Robinson bore as the first African-American professional athlete. Branch Rickey overcame the status quo police by giving Mr. Robinson a chance to play in the all-white professional major league baseball. But Mr. Robinson endured years of verbal and physical abuse in order to continue competing, well over and beyond anything suffered by any of his white peers. (For a taste of the difficulties catch the HBO docudrama “42.”)

In 2014, 4057 highly trained, fit soldiers entered Ranger training. 1,609 (40%) graduated. In this latest class 364 soldiers started; 136 graduated (37%.) Officers Griest and Haver are among the very best, toughest, well trained, well prepared, well armed and smartest soldiers in the entire world. (If you have any doubts about this I encourage you to watch the HBO docudrama “Lone Survivor” about Army Rangers trapped behind enemy lines in Afghanistan.)

Officers Griest and Haver are like every other Ranger. They are not “diverse.” They are good. Every American soldier who recognizes the strength of character and tenacity it took for them to become Rangers will gladly follow their orders into battle. They aren’t women Rangers, they are Rangers.

When all Americans learn the importance of this lesson, and begin to see the world this way, we will allow our best to rise to the top. And our history of finding and creating great leadership will continue.

by Adam Hartung | Aug 16, 2015 | Current Affairs, Disruptions, Leadership, Transparency

Last week the National Association of Corporate Directors (NACD) pre-released some results of its 2015–2016 Public Company Governance Survey. One major finding is that the makeup of Boards is changing, for the betterment of investors – and most likely everyone else in business.

Boards once had members that almost never changed. Little was required of Directors, and accountability for Board members was low. Since passage of the Securities Act of 1933, little had been required of Board members other than to applaud management and sign-off on the annual audit. And there was nothing investors could do if a Board “checked out,” even in the face of poorly performing management.

But this has changed. According to NACD, 72% of public boards reported they either added or changed a director in the last year. That is up from 64% in the previous year. Board members, and especially committee chairs, are spending a lot more time governing corporations. As a result “retiring in job” has become nearly impossible, and Board diversity is increasingly quite quickly. And increased Board diversity is considered good for business.

Remember Enron, Arthur Anderson, Worldcom and Tyco? At the century’s turn executives in large companies were working closely with their auditors to undertake risky business propositions yet keep these transactions and practices “off the books.” As these companies increasingly hired their audit firm to also provide business consulting, the auditors found it easier to agree with aggressive accounting interpretations that made company financials look better. Some companies went so far as to lie to investors and regulators about their business, until their companies failed from the risks and unlawful activities.

As a result Congress passed the Sarbanes Oxley act in 2002 (SOX,) which greatly increased the duties of Board Directors – as well as penalties if they failed to meet their duties. This law required Boards to implement procedures to unearth off-balance sheet items, and potential illegal activities such as bribing foreign officials or failing to meet industry reporting requirements for health and safety. Boards were required to know what internal controls were in place, and were held accountable for procedures to implement those controls effectively. And they were also required to make sure the auditors were independent, and not influenced by management when undertaking accounting and disclosure reviews. These requirements were backed up by criminal penalties for CEOs and CFOs that fiddled with financial statements or retaliated on whistle blowers – and Boards were expected to put in place systems to discover possibly illegal executive behavior.

As a result Congress passed the Sarbanes Oxley act in 2002 (SOX,) which greatly increased the duties of Board Directors – as well as penalties if they failed to meet their duties. This law required Boards to implement procedures to unearth off-balance sheet items, and potential illegal activities such as bribing foreign officials or failing to meet industry reporting requirements for health and safety. Boards were required to know what internal controls were in place, and were held accountable for procedures to implement those controls effectively. And they were also required to make sure the auditors were independent, and not influenced by management when undertaking accounting and disclosure reviews. These requirements were backed up by criminal penalties for CEOs and CFOs that fiddled with financial statements or retaliated on whistle blowers – and Boards were expected to put in place systems to discover possibly illegal executive behavior.

In short, Sarbanes Oxley increased transparency for investors into the corporation. And it made Boards responsible for compliance. The demands on Board Directors suddenly skyrocketed.

In reaction to the failure of Lehman Brothers and the almost total bank collapse of 2008, Congress passed the Dodd-Frank Wall Street Reform and Consumer Protection Act in 2010. Most of this complex legislation dealt with regulating the financial services industry, and providing more protections for consumers and American taxpayers from risky banking practices. But also included in Dodd-Frank were greater transparency requirements, such as details of executive compensation and how compensation was linked to company performance. Companies had to report such things as the pay ratio of CEO pay to average employee compensation (final rules issued last week,) and had to provide for investors to actually vote on executive compensation (called “say on pay.”) And responsibility for implementing these provisions, across all industries, fell again on the Board of Directors.

Thus, after 13 years of regulatory implementation, we are seeing change in corporate governance. What many laypeople thought was the Board’s job from 1940-2000 is finally, actually becoming their job. Real responsibility is now on the Directors’ shoulders. They are accountable. And they can be held responsible by regulators.

The result is a sea change in how Boards behave, and the beginnings of big change in Board composition. Board members are leaving in record numbers. Unable to simply hang around and collect a check for doing little, more are retiring. The average age is lowering. And diversity is increasing as more women, and people of color as well as non-European family histories are being asked onto Boards. Recognizing the need for stronger Boards to make sure companies comply with regulations they are less inclined to idly stand by and watch management. Instead, Boards are seeking talented people with diverse backgrounds to ask better questions and govern more carefully.

Most business people wax eloquently about the negative effect of regulations. It is easy to find academic studies, and case examples, of the added cost incurred due to higher regulation. But what many people fail to recognize are the benefits. Thanks to SOX and Dodd-Frank companies are far more transparent than ever in history, and transparency is increasing – much to the benefit of investors, suppliers, customers and communities. And corporate governance of everything from accounting to compensation to industry compliance is far more extensive, and better. Because Boards are responsible, they are stronger, more capable and improving at a rate previously unseen – with dramatic improvement in diversity. And we can thank Congress for the legislation which demanded better Board performance – to the betterment of all business.

by Adam Hartung | Aug 6, 2015 | In the Rapids, Innovation, Leadership, Web/Tech

Would you like to triple your revenue next year? And have plans to keep tripling it – or more – every year into the future?

Of course you would. But is your business positioned for such explosive growth? Are you in growth markets, creating new products with new technologies that meet unmet needs and have the potential to completely change your business? Or are you stuck doing the same thing you’ve always done, a litle better, faster and cheaper in hopes you can just maintain your position?

If you’re constantly looking at your “core” markets and solutions, and you know those aren’t going to grow fast, what keeps you from changing to make your company a high growth winner?

First, most people don’t try. Leaders say it all the time, “I’m so busy running a business I don’t have time to chase rainbows. Sure technology is changing, but I don’t understand it, nor know how to use it. I’m better off investing in what I know than trying to chase trends.” That’s often followed by dragging out the old saw, usually attributed to Warren Buffet, of “don’t invest in what you don’t know – and I don’t know anything about trends.” The comfort, and ease, of repeating what you’ve always done allows lethargy to set in – so you keep doing more and more of what you’ve always done, over and again, hoping for a different result. It’s been attributed to Albert Einstein that such behavior is the very definition of insanity.

Everyone is busy. We live in a “culture of busy.” Years of layoffs and cost reductions have left most leaders simply struggling to keep up with making and selling last year’s solution. Constant busy-ness becomes a convenient excuse to not take the time to look at trends, evaluate new opportunities or consider doing things entirely differently. Busy, busy, busy – until someone knocks your business off its blocks and then you have all kinds of time on your hands.

For those who overcome these 2 built-in biases, the opportunities today are extra-ordinary. It is possible to slingshot into leadership positions with new solutions, literally from out of nowhere. If you take the time and try. Listen, and just do it – to steal from a popular ad campaign.

ikeGPS was started in 2003 as a government/military funded products research company. Focusing on the technology of lasers and cameras, they won contracts to develop and prototype new solutions with technology mostly buried in universities and labs. It was a good business, made money for the founders, and was intellectually stimulating. If not growing very fast or showing much potential of growing.

Eventually ikeGPS started making products with lasers and cameras for finding physical assets. This turned out to be quite beneficial for electric utilities, which have to maintain some 200,000 power poles in the U.S alone. EPC (Engineering, Procurement and Construction) companies like Black & Veatch, Bechtel. Burns & McDonel , FMC and Foster Wheeler had a need to find big physical things, then measure their size and location between each other and major points. For utility company suppliers like GE laser cameras for asset location were a handy, if slow growing business. Good, solid, reliable revenues, but not something that was going to create a $100M company.

So the Managing Director, Glenn Milnes, and Chief Marketing Officer, Jeff Ross, set about to see what they could do to become a $100M business. Not because anything in their history said they could do so. Rather because they wanted to make their company a bigger, faster growing and lot more valuable entity.

The first thing they identified was the trend to mobile devices. They noticed darn near everyone has one, and they were using them for all kinds of interesting things. There were thousands and thousands of apps, but none that really took advantage of the cameras to do much measuring, or integrated lasers. While they didn’t know anything about mobile operating systems, or much about the kinds of cameras in mobile phones or the software used for popular mobile camera uses – they could see a trend.

What if they could take their knowledge about lasers and cameras and figure out how to make mobile phones a lot more powerful? Could they apply what they knew into markets where they had no experience, using technologies with which they had no experience? Would it work, or waste their time? If it worked, what would they make? If they made something, who would buy it?

Despite these great questions, they wanted ikeGPS to grow, and they decided to take the cash flow from their solid, but low growth historical business and plow it into development of a new product. So they took to internal company brainstorming to see what they might do. And they came up with the very clever idea of making an add-on device that construction workers, like concrete installers, pavers, carpenters, masons and such, could use with their mobile phones to replace tape measures. Something that would be simple, easy to use, work with the phones in their pockets and be a lot more accurate than decades-old technology.

So they went to the lab and built it. They started design in October, 2013, and a year later they had a product ready to launch. – Spike! They took it to social media, Google adwords, all the low-cost ad tools available to small business today. They also went to industry trade shows, bought some ads in industry trade magazines and ads on industry specific sites. Things were OK, but it was a slow slog.

So they went to the lab and built it. They started design in October, 2013, and a year later they had a product ready to launch. – Spike! They took it to social media, Google adwords, all the low-cost ad tools available to small business today. They also went to industry trade shows, bought some ads in industry trade magazines and ads on industry specific sites. Things were OK, but it was a slow slog.

As they were preparing to launch Spike they thought, “why don’t we reach for outsiders to gain some input on this product. Let’s hear what others might have to say.” So they launched a Kickstarter campaign, offering investors the product to try. Via this route they gained the eyes and ears of early adopters.

This was when the surprise happened. The earliest adopters, and biggest fans of laser measuring via mobile devices weren’t in the construction business. They were signage companies. ikeGPS listened to their feedback, and realized they could tweek Spike to be very relevant for folks in signage. The made themselves accessible to these early adopters, and turned a few into fanatical loyalists.

With this early success, they began to downplay construction and seek signage companies. Across 2 months they placed about $20k (not millions, thousands) in ads in the 4 largest publishers to the signage industry. This led to on-line product sales, and smashing reviews.

So then they made overtures to the large franchisors of signage related shops – with retail names like Fast Sign, Sign-o-Rama, Alphagraphics, Speedy Sign, Sign World, etc — in companies like Franchise Services and Alliance Franchise. Within 6 months of launch they had stopped chasing construction customers and were full-tilt developing signage companies, to great success. Even sign supply companies llke Reece Sign saw the benefit of promoting (and even reselling) these new laser camera add-ons for mobile devices to stimulate sales and move sign design and creation into the 21st century.

After making this switch, they initial launch sold 1,200 units at $500/unit retail . But better yet, contracts for promotion and reselling has the company convinced they will blow far beyond their projection of 4,000 units in the first year.But they did not simply forget about construction. The idea was still sound, but clearly the market had not developed. So they asked themselves, “if we listened to sign guys and they told us what to do, could we listen to construction guys for advice?”

They pursued finding out more about construction, and learned the market was dominated by brand names. Few products were bought without a strong brand name – and most products are purchased through the very large home improvement chains such as Home Depot, Lowe’s, Menard’s and others. But that would be a nearly impossible task, at extremely high cost, for little ikeGPS. So they pursued finding a partner which knew the industry.

In early 2015 ideGPS announced that Stanley Black&Decker would brand and sell Spike via traditional retail. The product should be on shelves before the end of year, and substantial additional sales volumes are expected.

In 2013 100% of ikeGPS revenues were in their traditional government/military and utility markets with their bespoke device. In just one year they developed a mobile device, and launched it. In 2015 1/3 or more of their $10.5 estimated revenue will be from Spike, and they expect to at a minimum triple revenues in 2016. And they think that rate of growth is sustainable into future years.

ikeGPS shows that it IS possible to move beyond historical markets and create new products for break-out growth. You aren’t stuck in old businesses with no hope of growth. if you want to grow, and reap the rewards of growth, you can. You have to

- Want to do it

- Take time to do it

- Pay attention to trends, and support obvious trend growth

- Learn about new technologies and how you can apply them. Start with the trend technologies first, then see how to apply something new. Don’t start by trying to push what you know onto another platform. Be ethnocentric in product development, not egocentric.

- Brainstorm how to meet unmet needs

- Listen to early sales results, and go where the need is highest/selling is easiest

- Don’t forget to learn from what did not work, and see if you can overcome early weaknesses.

by Adam Hartung | Aug 2, 2015 | Current Affairs, In the Rapids, In the Swamp, Leadership, Web/Tech

eBay was once a game changer. When the internet was very young, and few businesses provided ecommerce, eBay was a pioneer. From humble beginnings selling Pez dispensers, eBay grew into a powerhouse. Things we used to sell via garage sale we could now list on eBay. Small businesses could create stores on eBay to sell goods to customers they otherwise would never reach. And collectors as well as designers suddenly discovered all kinds of products they formerly could not find. eBay sales exploded, as traditional retail started it slide downward.

To augment growth eBay realized those selling needed a simple way to collect money from people who lacked a credit card. Many customers simply had no card, or didn’t trust giving out the information across the web. So eBay bought fledgling PayPal for $1.5B in 2002, in order to grease the wheels for faster ecommerce growth. And it worked marvelously.

But times have surely changed. Now eBay and Paypal have roughly the same revenue. About $8B/year each. eBay has run into stiff competition, as CraigsList has grown to take over the “garage sale” and small local business ecommerce. Simultaneously, powerhouse Amazon has developed its storefront business to a level of sophistication, and ease of use, that makes it viable for businesses from smallest to largest to sell products on-line. And far more companies have learned they can go it alone with internet sales, using search engine optimization (SEO) techniques as well as social media to drive traffic directly to their stores, bypassing storefronts entirely.

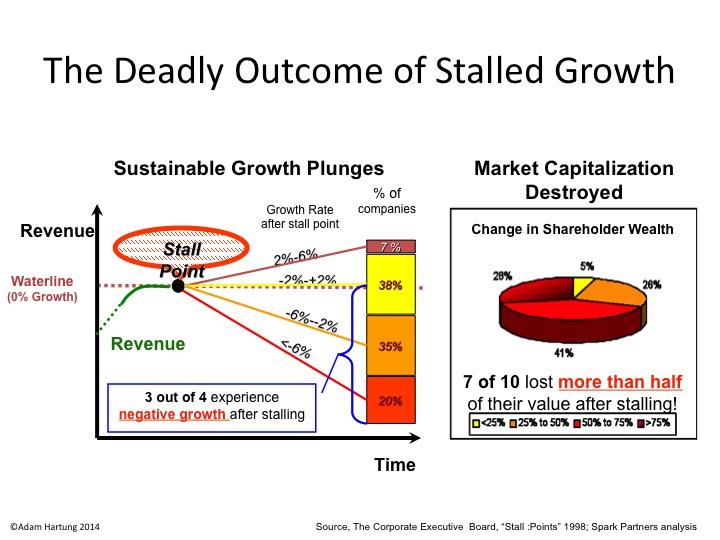

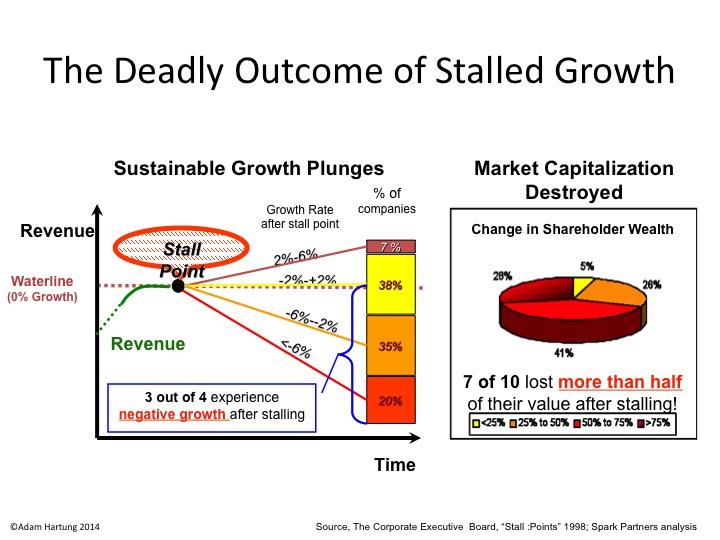

eBay was a game changer, but now is stuck in practices that have become far less relevant. The result has been 2 consecutive quarters of declining revenue. By definition that puts eBay in a growth stall, and fewer than 7% of companies ever recover from a growth stall to consistently increase revenue by a mere 2%/year. Why not? Because once in a growth stall the company has already missed the market shift, and competition is taking customers quickly in new directions. The old leader, like eBay, keeps setting aggressive targets for its business, and tells everyone it will find new customers in remote geographies or vertical markets. But it almost never happens – because the market shift is making their offering obsolete.

eBay was a game changer, but now is stuck in practices that have become far less relevant. The result has been 2 consecutive quarters of declining revenue. By definition that puts eBay in a growth stall, and fewer than 7% of companies ever recover from a growth stall to consistently increase revenue by a mere 2%/year. Why not? Because once in a growth stall the company has already missed the market shift, and competition is taking customers quickly in new directions. The old leader, like eBay, keeps setting aggressive targets for its business, and tells everyone it will find new customers in remote geographies or vertical markets. But it almost never happens – because the market shift is making their offering obsolete.

On the other hand, Paypal has blossomed into a game changer in its own right. Not only does it support cash and credit card transactions for the growing legions of on-line shoppers, but it is providing full payment systems for providers like Uber and AirBnB. It’s tools support enterprise transactions in all currencies, including emerging bitcoin, and even provides international financial transactions as well as working capital for businesses.

Paypal is increasingly becoming a threat to traditional banks. Today most folks use a bank for depositing a pay check, and making payments. There are loans, but frequently that is shopped around irrespective of where you bank. Much like your credit cards, which most people acquire for their benefits rather than a relationship with the issuing bank. If customers increasingly make payments via Paypal, and borrow money via operations like Quicken Loans (a division of Intuit,) why do you need a bank? Discover Services, which now does offer cash deposits and loans on top of credit card services, has found that it can grow substantially by displacing traditional banks.

Paypal is today at the forefront of digital payments processing. It is a fast growing market, which will displace many traditional banks. And emerging competitors like Apple Pay and Google Wallet will surely change the market further – while aiding its growth. How it will shake out is unclear. But it is clear that Paypal is growing its revenue at 60% or greater since 2012, and at over 100%/quarter the last 2 quarters.

Paypal is now valued at about $47B. That is roughly the same as the #5 bank in America (according to assets) Bank of New York Mellon, and number 8 massive credit card issuer Capital One, as well as #9 PNC Bank – and over 50% higher valuation than #10 State Street. It is also about 50% higher than Intuit and Discover. Based on its current market leadership and position as likely game changer for the banking sector, Paypall is selling for about 8 times revenue. If its revenue continues to grow at 100%/quarter, however, revenues will reach over $38B in a year making the Price/Revenue multiple of today only 1.25.

Meanwhile, eBay is valued at about $34B. Given that all which is left in eBay is an outdated on-line ecommerce conglomerator, stuck in a growth stall, that valuation is far harder to justify. It is selling at about 4.25x revenue. But if revenues continue declining, as they have for 2 consecutive quarters, this multiple will expand. And values will be harder and harder to justify as investors rely on hope of a turnaround.

eBay was a game changer. But leadership became complacent, and now it is very likely overvalued. Just as Yahoo became when its value relied on its holdings of Alibaba rather as its organic business shrank. Meanwhile Paypal is the leader in a rapidly growing market that is likely to change the face of not just how we pay, but how we do personal and business finance. There is no doubt which is more valuable today, and likely to be in the future.

by Adam Hartung | Jul 25, 2015 | Current Affairs, In the Whirlpool, Leadership

This week an important event happened on Wall Street. The value of Amazon (~$248B) exceeded the value of Walmart (~$233B.) Given that Walmart is world’s largest retailer, it is pretty amazing that a company launched as an on-line book seller by a former banker only 21 years ago could now exceed what has long been retailing’s juggernaut.

WalMart redefined retail. Prior to Sam Walton’s dynasty retailing was an industry of department stores and independent retailers. Retailing was a lot of small operators, primarily highly regional. Most retailers specialized, and shoppers would visit several stores to obtain things they needed.

But WalMart changed that. Sam Walton had a vision of consolidating products into larger stores, and opening these larger stores in every town across America. He set out to create scale advantages in purchasing everything from goods for resale to materials for store construction. And with those advantages he offered customers lower prices, to lure them away from the small retailers they formerly visited.

And customers were lured. Today there are very few independent retailers. WalMart has ~$488B in annual revenues. That is more than 4 times the size of #2 in USA CostCo, or #1 in France (#3 in world) Carrefour, or #1 in Germany (#4 in world) Schwarz, or #1 in U.K. (#5 in world) Tesco. Walmart directly employes ~.5% of the entire USA population (about 1 in every 200 people work for Walmart.) And it is a given that nobody living in America is unaware of Walmart, and very, very few have never shopped there.

But, Walmart has stopped growing. Since 2011, its revenues have grown unevenly, and on average less than 4%/year. Worse, it’s profits have grown only 1%/year. Walmart generates ~$220,000 revenue/employee, while Costco achieves ~$595,000. Thus its need to keep wages and benefits low, and chronically hammer on suppliers for lower prices as it strives to improve margins.

And worse, the market is shifting away from WalMart’s huge, plentiful stores toward on-line shopping. And this could have devastating consequences for WalMart, due to what economists call “marginal economics.”

And worse, the market is shifting away from WalMart’s huge, plentiful stores toward on-line shopping. And this could have devastating consequences for WalMart, due to what economists call “marginal economics.”

As a retailer, Walmart spends 75 cents out of every $1 revenue on the stuff it sells (cost of goods sold.) That leaves it a gross margin of 25 cents – or 25%. But, all those stores, distribution centers and trucks create a huge fixed cost, representing 20% of revenue. Thus, the net profit margin before taxes is a mere 5% (Walmart today makes about 5 cents on every $1 revenue.)

But, as sales go from brick-and-mortar to on-line, this threatens that revenue base. At Sears, for example, revenues per store have been declining for over 4 years. Suppose that starts to happen at Walmart; a slow decline in revenues. If revenues drop by 10% then every $100 of revenue shrinks to $90. And the gross margin (25%) declines to $22.50. But those pesky store costs remain stubbornly fixed at $20. Now profits to $2.50 – a 50% decline from what they were before.

A relatively small decline in revenue (10%) has a 5x impact on the bottom line (50% decline.) The “marginal revenue”, is that last 10%. What the company achieves “on the margin.” It has enormous impact on profits. And now you know why retailers are open 7 days a week, and 18 to 24 hours per day. They all desperately want those last few “marginal revenues” because they are what makes – or breaks – their profitability.

All those scale advantages Sam Walton created go into reverse if revenues decline. Now the big centralized purchasing, the huge distribution centers, and all those big stores suddenly become a cost Walmart cannot avoid. Without growing revenues, Walmart, like has happened at Sears, could go into a terrible profit tailspin.

And that is what Amazon is trying to do. Amazon is changing the way Americans shop. From stores to on-line. And the key to understanding why this is deadly to Walmart and other big traditional retailers is understanding that all Amazon (and its brethren on line) need to do is chip away at a few percentage points of the market. They don’t have to obtain half of retail. By stealing just 5-10% they put many retailers, they ones who are weak, right out of business. Like Radio Shack and Circuit City. And they suck the profits out of others like Sears and Best Buy. And they pose a serious threat to WalMart.

And Amazon is succeeding. It has grown at almost 30%/year since 2010. That growth has not been due to market growth, it has been created by stealing sales from traditional retailers. And Amazon achieves $621,000 revenue per employee, while having a far less fixed cost footprint.

What the marketplace looks for is that point at which the shift to on-line is dramatic enough, when on-line retailers have enough share, that suddenly the fixed cost heavy traditional retail business model is no longer supportable. When brick-and-mortar retailers lose just enough share that their profits start the big slide backward toward losses. Simultaneously, the profits of on-line retailers will start to gain significant upward momentum.

And this week, the marketplace started saying that time could be quite near. Amazon had a small profit, surprising many analysts. It’s revenues are now almost as big as Costco, Tesco – and bigger than Target and Home Depot. If it’s pace of growth continues, then the value which was once captured in Walmart stock will shift, along with the marketplace, to Amazon.

In May, 2010 Apple’s value eclipsed Microsoft. Five years later, Apple is now worth double Microsoft – even though its earnings multiple (stock Price/Earnings) is only half (AAPL P/E = 14.4, MSFT = 31.) And Apple’s revenues are double Microsoft’s. And Apple’s revenues/employee are $2.4million, 3 times Microsoft’s $731k.

While Microsoft has about doubled in value since the valuation pinnacle transferred to Apple, investors would have done better holding Apple stock as it has more than tripled. And, again, if the multiple equalizes between the companies (Apple’s goes up, or Microsoft’s goes down,) Apple investors will be 6 times better off than Microsoft’s.

Market shifts are a bit like earthquakes. Lots of pressure builds up over a long time. There are small tremors, but for the most part nobody notices much change. The land may actually have risen or fallen a few feet, but it is not noticeable due to small changes over a long time. But then, things pop. And the world quickly changes.

This week investors started telling us that the time for big change could be happening very soon in retail. And if it does, Walmart’s size will be more of a disadvantage than benefit.

by Adam Hartung | Jul 17, 2015 | Current Affairs, General, In the Swamp, Leadership, Lifecycle

Most analysts, and especially “chartists,” put a lot of emphasis on earnings per share (EPS) and stock price movements when determining whether to buy a stock. Unfortunately, these are not good predictors of company performance, and investors should beware.

Most analysts are focused on short-term, meaning quarter-to-quarter, performance. Their idea of long-term is looking back 1 year, comparing this quarter to same quarter last year. As a result, they fixate on how EPS has done, and will talk about whether improvements in EPS will cause the “multiple” (meaning stock price divided by EPS) will “expand.” They forecast stock price based upon future EPS times the industry multiple. If EPS is growing, they expect the stock to trade at the industry multple, or possibly somewhat better. Grow EPS, hope to grow the multiple, and project a higher valuation.

Analysts will also discuss the “momentum” (meaning direction and volume) of a stock. They look at charts, usually less than one year, and if price is going up they will say the momentum is good for a higher price. They determine the “strength of momentum” by looking at trading volume. Movements up or down on high volume are considered more meaningful than on low volume.

But, unfortunately, these indicators are purely short-term, and are easily manipulated so that they do not reflect the actual performance of the company.

At any given time, a CEO can decide to sell assets and use that cash to buy shares. For example, McDonald’s sold Chipotle and Boston Market. Then leadership took a big chunk of that money and repurchased company shares. That meant McDonalds took its two fastest growing, and highest value, assets and sold them for short-term cash. They traded growth for cash. Then leadership spent that cash to buy shares, rather than invest in in another growth vehicle.

This is where short-term manipulation happens. Say a company is earning $1,000 and has 1,000 shares outstanding, so its EPS is $1. The industry multiple is 10, so the share price is $10. The company sells assets for $1,000 (for purposes of this exercise, let’s assume the book value on those assets is $1,000 so there is no gain, no earnings impact and no tax impact.)

This is where short-term manipulation happens. Say a company is earning $1,000 and has 1,000 shares outstanding, so its EPS is $1. The industry multiple is 10, so the share price is $10. The company sells assets for $1,000 (for purposes of this exercise, let’s assume the book value on those assets is $1,000 so there is no gain, no earnings impact and no tax impact.)

Company leadership says its shares are undervalued, so to help out shareholders it will “return the money to shareholders via a share repurchase” (note, it is not giving money to shareholders, just buying shares. $1,000 buys 100 shares. The number of shares outstanding now falls to 900. Earnings are still $1,000 (flat, no gain,) but dividing $1,000 by 900 now creates an EPS of $1.11 – a greater than 10% gain! Using the same industry multiple, the analysts now say the stock is worth $1.11 x 10 = $11.10!

Even though the company is smaller, and has weaker growth prospects, somehow this “refocusing” of the company on its “core” business and cutting extraneous noise (and growth opportunities) has led to a price increase.

Worse, the company hires a very good investment banker to manage this share repurchase. The investment banker watches stock buys and sells, and any time he sees the stock starting to soften he jumps in and buys some shares, so that momentum remains strong. As time goes by, and the repurchase program is not completed, selectively he will make large purchases on light trading days, thus adding to the stock’s price momentum.

The analysts look at these momentum indicators, now driven by the share repurchase program, and deem the momentum to be strong. “Investors love the stock” the analysts say (even though the marginal investors making the momentum strong are really company management) and start recommending to investors they should anticipate this company achieving a multiple of 11 based on earnings and stock momentum. The price now goes to $1.11 x 11 = $12.21.

Yet the underlying company is no stronger. In fact one could make the case it is weaker. But, due to the higher EPS, better multiple and higher share price the CEO and her team are rewarded with outsized multi-million dollar bonuses.

But, companies the last several years did not even have to sell assets to undertake this kind of manipulation. They could just spend cash from earnings. Earnings have been at record highs, and growing, for several years. Yet most company leaders have not reinvested those earnings in plant, equipment or even people to drive further growth. Instead they have built huge cash hoards, and then spent that cash on share buybacks – creating the EPS/Multiple expansion – and higher valuations – described above.

This has been so successful that in the last quarter untethered corporations have spent $238B on buybacks, while earning only $228B. The short-term benefits are like corporate crack, and companies are spending all the money they have on buybacks rather than reinvesting in growth.

Where does the extra money originate? Many companies have borrowed money to undertake buybacks. Corporate interest rates have been at generational (if not multi-generational) lows for several years. Interest rates were kept low by the Federal Reserve hoping to spur borrowing and reinvestment in new products, plant, etc to drive economic growth, more jobs and higher wages. The goal was to encourage companies to take on more debt, and its associated risk, in order to generate higher future revenues.

Many companies have chosen to borrow money, but rather than investing in growth projects they have bought shares. They borrow money at 2-3%, then buy shares – which can have a much higher immediate impact on valuation – and drive up executive compensation.

This has been wildly prevalent. Since the Fed started its low-interest policy it has added $2.37trillion in cash to the economy. Corporate buybacks have totaled $2.41trillion.

This is why a company can actually have a crummy business, and look ill-positioned for the future, yet have growing EPS and stock price. For example, McDonald’s has gone through rounds of store closures since 2005, sold major assets, now has more stores closing than opening, and has its largest franchisees despondent over future prospects. Yet, the stock has tripled since 2005! Leadership has greatly weakened the company, put it into a growth stall (since 2012,) and yet its value has gone up!

Microsoft has seen its “core” PC market shrink, had terrible new product launches of Vista and Windows 8, wholly failed to succeed with a successful mobile device, written off billions in failed acquisitions, and consistently lost money in its gaming division. Yet, in the last 10 years it has seen EPS grow and its share price double through the power of share buybacks from its enormous cash hoard and ability to grow debt. While it is undoubtedly true that 10 years ago Microsoft was far stronger, as a PC monopolist, than it is today – its value today is now higher.

Share buybacks can go on for several years. Especially in big companies. But they add no value to a company, and if not exceeded by re-investments in growth markets they weaken the company. Long term a company’s value will relate to its ability to grow revenues, and real profits. If a company does not have a viable, competitive business model with real revenue growth prospects, it cannot survive.

Look no further than HP, which has had massive buybacks but is today worth only what it was worth 10 years ago as it prepares to split. Or Sears Holdings which is now worth 15% of its value a decade ago. Short term manipulative actions can fool any investor, and actually artificially keep stock prices high, so make sure you understand the long-term revenue trends, and prospects, of any investment. Regardless of analyst recommendations.

by Adam Hartung | Jul 8, 2015 | Current Affairs, Defend & Extend, In the Whirlpool, Leadership, Lock-in, Web/Tech

Microsoft announced today it was going to shut down the Nokia phone unit, take a $7.6B write-off (more than the $7.2B they paid for it,) and lay off another 7,800 employees. That makes the layoffs since CEO Nadella took the reigns almost 26,000. Finding any good news in this announcement is a very difficult task.

Unfortunately, since taking over as Microsoft’s #1 leader, Mr. Nadella has been remarkably predictable. Like his peer CEOs who take on the new role, he has slashed and burned employment, shut down at least one big business, taken massive write-offs, and undertaken at least one wildly overpriced acquisition (Minecraft) that is supposed to be a game changer for the company. He apparently picked up the “Turnaround CEO Playbook” after receiving the job and set out on the big tasks!

Unfortunately, since taking over as Microsoft’s #1 leader, Mr. Nadella has been remarkably predictable. Like his peer CEOs who take on the new role, he has slashed and burned employment, shut down at least one big business, taken massive write-offs, and undertaken at least one wildly overpriced acquisition (Minecraft) that is supposed to be a game changer for the company. He apparently picked up the “Turnaround CEO Playbook” after receiving the job and set out on the big tasks!

Yet he still has not put forward a strategy that should encourage investors, employees, customers or suppliers that the company will remain relevant long-term. Amidst all these big tactical actions, it is completely unclear what the strategy is to remain a viable company as customers move, quickly and in droves, to mobile devices using competitive products.

I predicted here in this blog the week Steve Ballmer announced the acquisition of Nokia in September, 2013 that it was “a $7.2B mistake.” I was off, because in addition to all the losses and restructuring costs Microsoft endured the last 7 quarters, the write off is $7.6B. Oops.

Why was I so sure it would be a mistake? Because between 2011 and 2013 Nokia had already lost half its market share. CEO Elop, who was previously a Microsoft senior executive, had committed Nokia completely to Windows phones, and the results were already catastrophic. Changing ownership was not going to change the trajectory of Nokia sales.

Microsoft had failed to build any sort of developer community for Windows 8 mobile. Developers need people holding devices to buy their software. Nokia had less than 5% share. Why would any developer build an app for a Windows phone, when almost the entire market was iOS or Android? In fact, it was clear that developing rev 2, 3, and 4 of an app for the major platforms was far more valuable than even bothering to port an app into Windows 8.

Nokia and Windows 8 had the worst kind of tortuous whirlpool – no users, so no developers, and without new (and actually unique) software there was nothing to attract new users. Microsoft mobile simply wasn’t even in the game – and had no hope of winning. It was already clear in June, 2012 that the new Windows tablet – Surface – was being launched with a distinct lack of apps to challenge incumbents Apple and Samsung.

By January, 2013 it was also clear that Microsoft was in a huge amount of trouble. Where just a few years before there were 50 Microsoft-based machines sold for every competitive machine, by 2013 that had shifted to 2 for 1. People were not buying new PCs, but they were buying mobile devices by the shipload – literally. And there was no doubt that Windows 8 had missed the mobile market. Trying too hard to be the old Windows while trying to be something new made the product something few wanted – and certainly not a game changer.

A year ago I wrote that Microsoft has to win the war for developers, or nothing else matters. When everyone used a PC it seemed that all developers were writing applications for PCs. But the world shifted. PC developers still existed, but they were not able to grow sales. The developers making all the money were the ones writing for iOS and Android. The growth was all in mobile, and Microsoft had nothing in the game. Meanwhile, Apple and IBM were joining forces to further displace laptops with iPads in commercial/enterprise uses.

Then we heard Windows 10 would change all of that. And flocks of people wrote me that a hybrid machine, both PC and tablet, was the tool everyone wanted. Only we continue to see that the market is wildly indifferent to Windows 10 and hybrids.

Imagine you write with a fountain pen – as most people did 70 years ago. Then one day you are given a ball point pen. This is far easier to use, and accomplishes most of what you want. No, it won’t make the florid lines and majestic sweeps of a fountain pen, but wow it is a whole lot easier and a darn site cheaper. So you keep the fountain pen for some uses, but mostly start using the ball point pen.

Then the fountain pen manufacturer says “hey, I have a contraption that is a ball point pen, sort of, and a fountain pen, sort of, combined. It’s the best of all worlds.” You would likely look at it, but say “why would I want that. I have a fountain pen for when I need it. And for 90% of the stuff I write the ball point pen is great.”

That’s the problem with hybrids of anything – and the hybrid tablet is no different. The entrenched sellers of old technology always think a hybrid is a good idea. But once customers try the new thing, all they want are advancements to the new thing. (Just look at the interest in Tesla cars compared to the stagnant sales of hybrid autos.)

And we’re up to Surface 3 now. When I pointed out in January, 2013 that the markets were rapidly moving away from Microsoft I predicted Surface and Surface Pro would never be important products. Reader outcry at that time from Microsoft devotees was so great that Forbes editors called me on the carpet and told me I lacked the data to make such a bold prediction. But I stuck by my guns, we changed some language so it was less blunt, and the article ran.

Two and a half years later and we’re up to rev number Surface 3. And still, almost nobody is using the product. Less than 5% market share. Right again. It wasn’t a technology prediction, it was a market prediction. Lacking app developers, and a unique use, the competition was, and remains, simply too far out front.

Windows 10 is, unfortunately, a very expensive launch. And to get people to use it Microsoft is giving it away for free. The hope is then users will hook onto the cloud-based Office 365 and Microsoft’s Azure cloud services. But this is still trying to milk the same old cow. This approach relies on people being completely unwilling to give up using Windows and/or Office. And we see every day that millions of people are finding alternatives they like just fine, thank you very much.

Gamers hated me when I recommended Microsoft should give (for free) xBox to Nintendo. Unfortunately, I learned few gamers know much about P&Ls. They all assumed Microsoft made a fortune in gaming. But anyone who’s ever looked at Microsoft’s financial filings knows that the Entertainment Division, including xBox, has been a giant money-sucking hole. If they gave it away it would save money, and possibly help leadership figure out a strategy for profitable growth.

Unfortunately, Microsoft bought Minecraft, in effect “doubling down” on the bet. But regardless of how well anyone likes the products, Microsoft is not making money. Gaming is a bloody war where Sony and Microsoft keep battling, and keep losing billions of dollars. The odds of ever earning back the $2.5B spent on Minecraft is remote.

The greater likelihood is that as write offs continue to eat away at profits, and as markets continue evolving toward mobile products offered by competitors hurting “core” Microsoft sales, CEO Nadella will eventually have to give up on gaming and undertake another Nokia-like event.

All investors risk looking at current events to drive decision-making. When Ballmer was sacked and Nadella given the CEO job the stock jumped on euphoria. But the last 18 months have shown just how bad things are for Microsoft. It is a near monopolist in a market that is shrinking. And so far Mr. Nadella has failed to define a strategy that will make Microsoft into a company that does more than try to milk its heritage.

I said the giant retailer Sears Holdings would be a big loser the day Ed Lampert took control of the company. But hope sprung eternal, and investors jumped on the Sears bandwagon, believing a new CEO would magically improve a worn out, locked-in company. The stock went up for over 2 years. But, eventually, it became clear that Sears is irrelevant and the share price increase was unjustified. And the stock tanked.

Microsoft looks much the same. The actions we see are attempts to defend & extend a gloried history. But they don’t add up to a strategy to compete for the future. HoloLens will not be a product capable of replacing Windows plus Office revenues. If developers are attracted to it enough to start writing apps. Cortana is cool, but it is not first. And competitive products have so much greater usage that developer learning curve gains are wildly faster. These products are not game changers. They don’t solve large, unmet needs.

And employees see this. As I wrote in my last column, it is valuable to listen to employees. As the bloom fell off the rose, and Nadella started laying people off while freezing pay, employee support of him declined dramatically. And employee faith in leadership is far lower than at competitors Apple and Google.

As long as Microsoft keeps playing catch up, we should expect more layoffs, cost cutting and asset sales. And attempts at more “hail Mary” acquisitions intended to change the company. All of which will do nothing to grow customers, provide better jobs for employees, create value for investors or greater revenue opportunities for suppliers.

But you have to ask yourself, couldn’t you see it coming? Or are we just so used to lousy leadership that we think there’s no end to it?

But you have to ask yourself, couldn’t you see it coming? Or are we just so used to lousy leadership that we think there’s no end to it?