by Adam Hartung | Dec 11, 2014 | Current Affairs, Defend & Extend, In the Whirlpool, Leadership, Lifecycle, Television, Web/Tech

The trend toward the death of broadcast TV as we’ve known it keeps moving forward. This trend may not happen as fast as the death of desktop computers, but it is a lot faster than glacier melting.

This television season (through October) Magna Global has reported that even the oldest viewers (the TV Generation 55-64) watched 3% less TV. Those 35-54 watched 5% less. Gen Xers (25-34) watched 8% less, and Millenials (18-24) watched a whopping 14% less TV. Live sports viewing is not even able to maintain its TV audience, with NFL viewership across all networks down 10-19%.

Everyone knows what is happening. People are turning to downloaded entertainment, mostly on their mobile devices. With a trend this obvious, you’d think everyone in the media/TV and consumer goods industries would be rethinking strategy and retooling for a new future.

But, you would be wrong. Because despite the obviousness of the trend, emotional ties to hoping the old business sticks around are stronger than logic when it comes to forecasting.

CBS predicted at the beginning of 2014 TV ad revenue would grow 4%. Oops. Now CBS’s lead forecaster is admitting he was way off, and adjusted revenues were down 1% for the year. But, despite the trend in viewer behavior and ad expenditures in 2014, he now predicts a growth of 2% for 2015.

That, my young friends, is how “hockey stick” forecasts are created. A lot of old assumptions, combined with a willingness to hope trends will be delayed, and you can ignore real data while promising people that the future will indeed look like the past – even when it defies common sense.

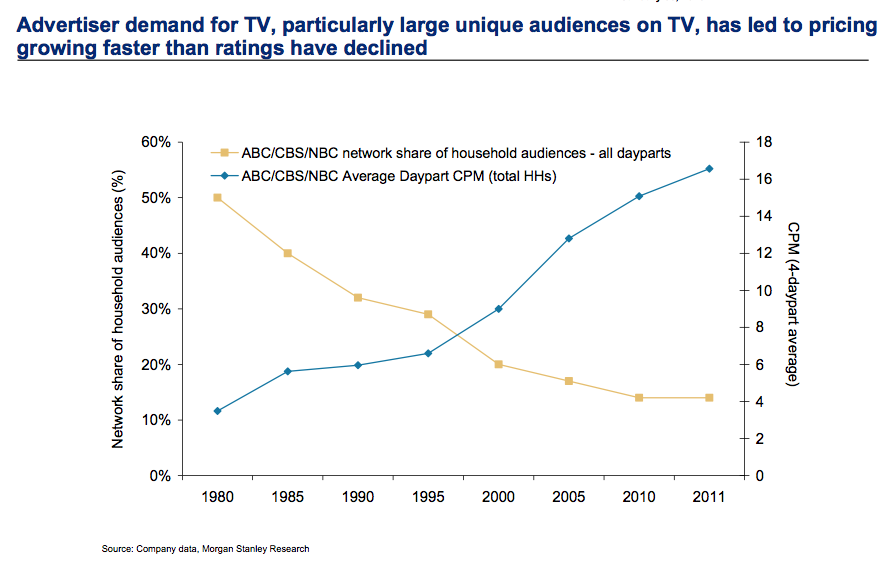

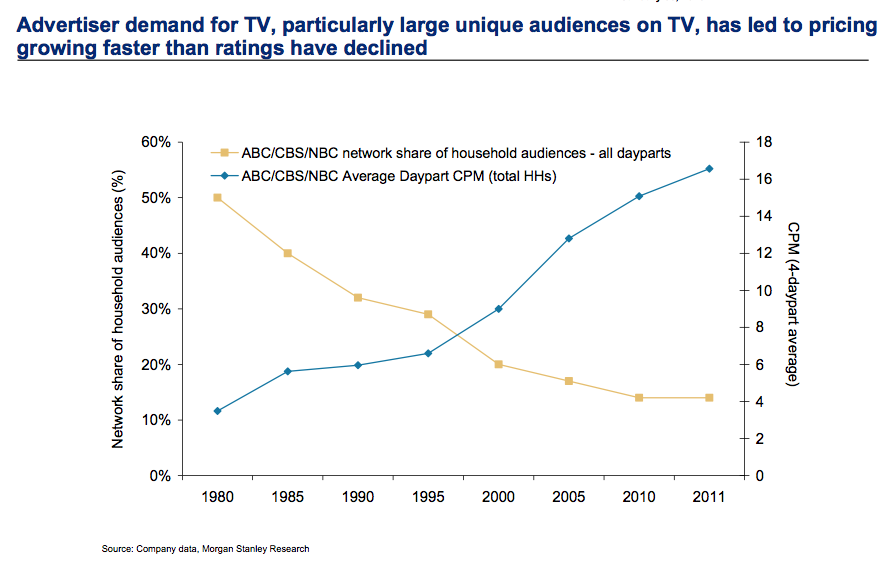

To compensate for fewer ads the networks have raised prices on all ads. But how long can that continue? This requires a really committed buyer (read more about CMO weaknesses below) who simply refuses to acknowledge the market has shifted and the dollars need to shift with it. That cannot last forever.

Meanwhile, us old folks can remember the days when Nielsen ratings determined what was programmed on TV, as well as what advertisers paid. Nielsen had a lock on measuring TV audience viewing, and wielded tremendous power in the media and CPG world.

But now AC Nielsen is struggling to remain relevant. With TV viewership down, time shifting of shows common and streaming growing like the proverbial weed Nielsen has no idea what entertainment the public watches. They don’t know what, nor when, nor where. Unwilling to move quickly to develop tools for catching all the second screen viewing, Nielsen has no plan for telling advertisers what the market really looks like – and the company looks to become a victim of changing markets.

Which then takes us to looking at those folks who actually buy ads that drive media companies. The Chief Marketing Officers (CMOs) of CPG companies. Surely these titans of industry are on top of these trends, and rapidly shifting their spending to catch the viewers with the most ads placed for the lowest cost.

You would wish.

Unfortunately, because these senior executives are in the oldest age groups, they are a victim of their own behavior. They still watch TV, so assume others must as well. If there is cyber-data saying they are wrong, well they simply discount that data. The Nielsen’s aren’t accurate, but these execs still watch the ratings “because it’s the best info we have” – a blatant untruth by the way. But Nielsen does conveniently reinforce their built in assumptions, and their hope that they won’t have to change their media spend plans any time soon.

Further, very few of these CMOs actually use social media. The vast majority watch their children, grandchildren and young employees use mobile devices constantly – and they bemoan all the activity on YouTube, Facebook, Instagram and Twitter – or for the most part even Linked-in. But they don’t actually USE these products. They don’t post information. They don’t set up and follow channels. They don’t connect with people, share information, exchange photos or tell stories on social media. Truthfully, they ignore these trends in their own lives. Which leaves them woefully inept at figuring out how to change their company marketing so it can be more relevant.

The trend is obvious. The answer, equally so. Any modern marketer should be an avid user of social media. Most network heads and media leaders are farther removed from social media than the Pope! They don’t constantly download entertainment, and exchanging with others on all the platforms. They can’t manage the use of these channels when they don’t have a clue how they work, or how other people use them, or understand why they are actually really valuable tools.

Are you using these modern tools? Are you actually living, breathing, participating in the trends? Or are you, like these outdated execs, biding your time wasting money on old programs while you look forward to retirement? And likely killing your company.

When trends emerge it is imperative we become part of that trend. You can’t simply observe it, because your biases will lead you to hope the trend reverts as you continue doing more of the same. A leader has to adopt the trend as a leader, be a practicing participant, and learn how that trend will make a substantial difference in the business. And then apply some vision to remain relevant and successful.

by Adam Hartung | Dec 10, 2012 | Current Affairs, Defend & Extend, In the Whirlpool, Leadership, Lifecycle, Television

Remember when almost everyone read a daily newspaper?

Newspaper readership peaked around 2000. Since then printed media has declined, as readers shifted on-line. Magazines have folded, and newspapers have disappeared, quit printing, dramatically cut page numbers and even more dramatically cut staff.

Amazingly, almost no major print publisher prepared for this, even though the trend was becoming clear in the late 1990s.

Newspapers are no longer a viable business. While industry revenue grew for

almost 2 centuries, it collapsed in a mere decade.

Chart Source: BusinessInsider.com

This market shift created clear winners, and losers. On-line news sites like Marketwatch and HuffingtonPost were clear winners. Losers were traditional newspaper companies such as Tribune Corporation, Gannett, McClatchey, Dow Jones and even the New York Times Company. And investors in these companies either saw their values soar, or practically disintegrate.

In 2012 it is equally clear that television is on the brink of a major transition. Fewer people are content to have their entertainment programmed for them when they can program it themselves on-line. Even though the number of television channels has exploded with pervasive cable access, the time spent watching television is not growing. While simultaneously the amount of time people spend looking at mobile internet displays (tablets, smartphones and laptops) is growing at double digit rates.

Chart Source: Silicone Alley Insider Chart of the Day 12/5/12

It would be easy to act like newspaper defenders and pretend that television as we've known it will not change. But that would be, at best, naive. Just look around at broadband access, the use of mobile devices, the convenience of mobile and the number of people that don't even watch traditional TV any more (especially younger people) and the trend is clear. One-way preprogrammed advertising laden television is not a sustainable business.

So, now is the time to prepare. And change your business to align with impending new realities.

Losers, and winners, will be varied – and not entirely obvious. Firstly, a look at those trying to maintain the status quo, and likely to lose the most.

Giant consumer goods and retail companies benefitted from the domination of television. Only huge companies like P&G, Kraft, GM and Target could afford to lay out billions of dollars for television ads to build, and defend, a brand. But what advantage will they have when TV budgets no longer control brand building? They will become extremely vulnerable to more innovative companies that have better products and move on fast lifecycles. Their size, hierarchy and arcane business practices will lead to huge problems. Imagine a raft of new Hostess Brands experiences.

Even as the trends have started changing these companies have continued pumping billions into the traditional TV networks as they spend to defend their brand position. This has driven up the value of companies like CBS, Comcast (owns NBC) and Disney (owns ABC) over the last 3 years substantially. But don't expect that to last forever. Or even a few more years.

Just like newspaper ad spending fell off a cliff when it was clear the eyeballs were no longer there, expect the same for television ad spending. As giant advertisers find the cost of television harder and harder to justify their outlays will eventually take the kind of cliff dive observed in the chart (above) for newspaper advertising. Already some consumer goods and ad agency executives are alluding to the fact that the rate of return on traditional TV is becoming sketchy.

So far, we've seen little at the companies which own TV networks to demonstrate they are prepared for the floor to fall out of their revenue stream. While some have positions in a few internet production and delivery companies, most are clearly still doing their best to defend & extend the old business – just like newspaper owners did. Just as newspapers never found a way to replace the print ad dollars, these television companies look very much like businesses that have no apparent solution for future growth. I would not want my 401K invested in any major network company.

And there will be winners.

For smaller businesses, there has never been a better time to compete. A company as small as Tesla or Fisker can now create a brand on-line at a fraction of the old cost. And that brand can be as powerful as Ford, and potentially a lot more trendy. There are very low entry barriers for on-line brand building using not only ad words and web page display ads, but also using social media to build loyal followers who use and promote a brand. What was once considered a niche can become well known almost overnight simply by applying the new dynamics of reaching customers on-line, and increasingly via mobile. Look at the success of Toms Shoes.

Zappos and Amazon have shown that with almost no television ads they can create powerhouse retail brands. The new retailers do not compete just on price, but are able to offer selection, availability and customer service at levels unachievable by traditional brick-and-mortar retailers. They can suggest products and prices of things you're likely to need, even before you realize you need them. They can educate better, and faster, than most retail store employees. And they can offer great prices due to less overhead, along with the convenience of shipping the product right into your home.

And as people quit watching preprogrammed TV, where will they go for content? Anybody streaming will have an advantage – so think Netflix (which recently contracted for all the Disney content,) Amazon, Pandora, Spotify and even AOL. But, this will also benefit those companies providing content access such as Apple TV, Google TV, YouTube (owned by Google) to offer content channels and the increasingly omnipresent Facebook will deliver up not only friends, but content — and ads.

As for content creation, the deep pockets of traditional TV production companies will likely disappear along with their ability to control distribution. That means fewer big-budget productions as risk goes up without revenue assurances.

But that means even more ability for newer, smaller companies to create competitive content seeking audiences. Where once a very clever, hard working Seth McFarlane (creator of Family Guy) had to hardscrabble with networks to achieve distribution, and live in fear of a single person controlling his destiny, in the future these creative people will be able to own their content and capture the value directly as they build a direct audience. A phenomenon like George Lucas will be more achievable than ever before as what might look like chaos during transition will migrate to a much more competitive world where audiences, rather than network executives, will decide what content wins – and loses.

So, with due respects to Don McLean, will today be the day TV Died? We will only know in historical context. Nobody predicted newspapers had peaked in 2000, but it was clear the internet was changing news consumption behavior. And we don't know if TV viewership will begin its rapid decline in 2013, or in a couple more years. But the inevitable change is clear – we just don't know exactly when.

So it would be foolish to not think that the industry is going to change dramatically. And the impact on advertising will be even more profound, much more profound, than it was in print. And that will have an even more profound impact on American society – and how business is done.

What are you doing to prepare?

by Adam Hartung | Jun 20, 2010 | Current Affairs, In the Rapids, Innovation, Web/Tech, Weblogs

Will YouTube be the USAToday or Wall Street Journal or New York Times of 2015 or 2020? According to Mediapost.com "YouTubes Secret Citizen Journalism Plot Exposed." Referring to a SFWeekly article by Eve Batey "YouTube Explains Top Secret 'News Experiment' to Local Media, But Doesn't Really" the reporting is that YouTube plans to hire groups of citizens in major cities, starting in San Francisco, to report news events via YouTube. Could this replace the local newspaper? Or maybe even the local evening news?

Americans are so used to freedom of speech that it's easy to forget what the concept launched in the USA. 200 years ago anybody who could access a printing press, of any size, could produce a newspaper. That as revolutionary. "Citizen journalism" was the norm, and there were literally thousands of newspapers. That situation remained very true well into the 1900s. Eventually acquisitions led to consolidation and a dramatic reduction in the number of newspapers.

The decline in the number of newspapers was aided by consumer journalism preferences shifting, in part, to radio and television. As radio and television journalism was born the limitation was "bandwidth" and therefore access. Thus, from the beginning there was government control over the number of stations. That scenario very different from the founding of newspapers, as there were limited channels from the beginning. But that didn't mean that the desire for video journalism was lower.

What will journalism be in 2020? We know that most major city newspapers are on the brink of failure, with bankruptcies (such as Tribune Corporation, owner of The Chicago Tribune and The Los Angeles Tkimes as well as others) not uncommon. As newspaper pages have shrunk, the internet has allowed the return of "citizen journalism" as bloggers and reporters have emerged able to tell a story, and with very low cost access to potential readers. Having internet access is possibly cheaper, and certainly easier, than operating a printing press in the era of Benjamin Franklin, or even a local newspaper of 1900. By numbers there is no doubt many more "citizen journalists" than "professional journalists" working at American newspapers today.

So why couldn't YouTube take advantage of a preference for video, and link together the armies of independent "journalists?"

I can't help but recall the television program Max Headroom from 20 years ago – where it was perceived that real-time information on practically all topics would be reported on millions of televisions everywhere – televisions which could not be turned off by law. Wasn't Max simply an avatar, running around what we could now consider the web, popping up on computer – rather than television – screens? Today I can create my own Max Headroom avatar to search the web for real-time content – mostly text. Why couldn't YouTube give me a tool to do the same thing with video?

Many people are bemoaning the decline of traditional journalism. But is this a bad thing? Given all the screaming about today's "media bias" it would seem that citizen journalism could become a great equalizer. If YouTube and Google can help give me the tools to search for what's interesting to me that would seem to be a very good thing. And if in the process they sell some ads so that the content can grow, that doesn't seem like a bad thing either.

In the movie Network, made some 30 years ago, the thesis was put forward that news would become entertainment – and less "news". With the growth of Fox News, MSNBC News and the number of broadcast minutes given to television news magazines like Nightline, one could reasonably claim that the movie was surprisingly foretelling. Today, getting up to the minute news is even hard on a channel like CNN. It's not at all unclear that providing a platform for citizen journalists, via YouTube and Google searches of the web, is a bad thing at all.

Are you prepared? Are you learning how to use these new tools? Are you prepared to change your learning behavior? Your advertising programs? Could you be a citizen journalist? It certainly looks clearer every year that journalism in 2020 will look substantially different than it does in 2010.

by Adam Hartung | May 6, 2009 | Uncategorized

"In the land of the blind the one-eyed man is king." I've heard this phrase many times, and never has it been truer than today. With so many companies fairing so poorly – revenues down, profits down, layoffs – doing better than most doesn't mean you have to do all that well.

An example is News Corp. The Tribune Company is bankrupt, casting doubts on the future of The Chicago Tribune, Los Angeles Times and its other newspapers. The New York Times company threatened to close The Boston Globe unless it received major employee concessions. But even these won't save either the Globe or the Times as the headline "Boston Globe's obituary already written" comes from commentator Chuck Jaffe. Newspapers are discontinuing daily circulation, slimming down, and closing.

So when Marketwatch.com reports "News Corp. posts flat third-quarter profit" it sounds like a monumental success compared to its competitors. But it does beg the question, why is News Corp. doing so much better than its brethren? The answer lies in the multi-faceted approach News Corp. took to connecting with those who want information – and then connecting to their advertisers. While the web sites for most newspaper companies are weak products that attract few readers (or advertisers), and the writers feed only one outlet (papers) rather than multiple outlets, News Corp. stands in stark contrast with major outlets across all media internationally.

In addition to multiple newpapers News Corp. owns multiple television stations and entire networks. It is a major player in cable programming – including the #1 ranked cable news channel in the U.S. as well as networks across the globe. It is a leader in direct broadcast satellite with SKY, owns multiple weekly magazines (that all have web sites), is a major player in billboards, and owns several internet properties including MySpace.com

Across News Corp. the leadership is able to share acquisition costs for programming – including news – and the distribution – including all forms of programming outlets. News Corp.'s leadership did an excellent job of paying attention to market shifts. After starting as an Australian newspaper company it moved into all these different businesses in order to be part of the evolving market landscape. It obsessed about competitors, never fearing to enter markets others avoided – such as launching a national broadcast network in the 1980s, and taking on CNN when nobody agreed there was need for more than one 24 hour news channel. And early in the internet era it paid up to acquire MySpace in order to be a participant in the internet's growth, not just a spectator.

The leadership at News Corp. has never been shy about Disruptions – often making itself the target of many groups. But these Disruptions allowed News Corp. to open many White Space projects, teaching the company how to compete in rapidly changing markets.

And now, as several competitors are disappearing, News Corp. is doing the best in its class. While competitors are hopelessly mired in Whirlpools from which escape is likely impossible, News Corp. is merely "flat". And there's a lot to be said for "flat" results when competitors from GE (owner of NBC and several other channels) to New York Times Company are seeing their poorest results in decades – or even filing bankruptcy (like Tribune).