Not All Earnings are Equal – Revenue Growth Matters! (Sell Microsoft)

For the first time in 20 years, Apple’s quarterly profit exceeded Microsoft’s (see BusinessWeek.com “Microsoft’s Net Falls Below Apple As iPad Eats Into Sales.) Thus, on the face of things, the companies should be roughly equally valued. But they aren’t. This week Microsoft’s market capitalization is about $215B, while Apple’s is about $365B – about 70% higher. The difference is, of course, growth – and how a lack of it changes management!

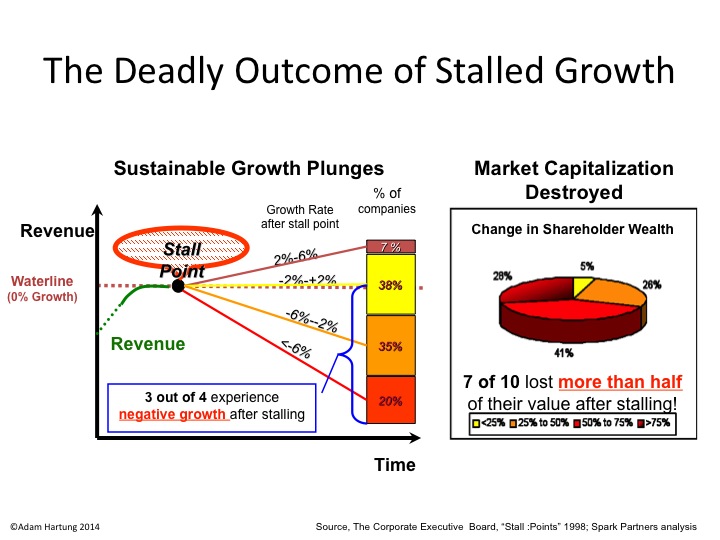

According to the Conference Board, growth stalls are deadly.

When companies hit a growth stall, 93% of the time they are unable to maintain even a 2% growth rate. 75% fall into a no growth, or declining revenue environment, and 70% of them will lose at least half their market capitalization. That’s because the market has shifted, and the business is no longer selling what customers really want.

At Microsoft, we see a company that has been completely unable to deal with the market shift toward smartphones and tablets:

- Consumer PC shipments dropped 8% last quarter

- Netbook sales plunged 40%

Quite simply, when revenues stall earnings become meaningless. Even though Microsoft earnings were up, it wasn’t because they are selling what customers really want to buy. In stalled companies, executives cut costs in sales, marketing, new product development and outsource like crazy in order to prop up earnings. They can outsource many functions. And they go to the reservoir of accounting rules to restate depreciation and expenses, delaying expenses while working to accelerate revenue recognition.

Stalled company management will tout earnings growth, even though revenues are flat or declining. But smart investors know this effort to “manufacture earnings” does not create long-term value. They want “real” earnings created by selling products customers desire; that create incremental, new demand. Success doesn’t come from wringing a few coins out of a declining market – but rather from being in markets where people prefer the new solutions.

Mobile phone sales increased 20% (according to IDC), and Apple achieved 14% market share – #3 – in USA (according to MediaPost.com) last quarter. And in this business, Apple is taking the lion’s share of the profits:

Image provided by BusinessInsider.com

When companies are growing, investors like that they pump earnings (and cash) back into growth opportunities. Investors benefit because their value compounds. In a stalled company investors would be better off if the company paid out all their earnings in dividends – so investors could invest in the growth markets.

But, of course, stalled companies like Microsoft and Research in Motion, don’t do that. Because they spend their cash trying to defend the old business. Trying to fight off the market shift. At Microsoft, money is poured into trying to protect the PC business, even as the trend to new solutions is obvious. Microsoft spent 8 times as much on R&D in 2009 as Apple – and all investors received was updates to the old operating system and office automation products. That generated almost no incremental demand. While revenue is stalling, costs are rising.

At Gurufocus.com the argument is made “Microsoft Q3 2011: Priced for Failure“. Author Alex Morris contends that because Microsoft is unlikely to fail this year, it is underpriced. Actually, all we need to know is that Microsoft is unlikely to grow. Its cost to defend the old business is too high in the face of market shifts, and the money being spent to defend Microsoft will not go to investors – will not yield a positive rate of return – so investors are smart to get out now!

Additionally, Microsoft’s cost to extend its business into other markets where it enters far too late is wildly unprofitable. Take for example search and other on-line products:

Chart source BusinessInsider.com

While much has been made of the ballyhooed relationship between Nokia and Microsoft to help the latter enter the smartphone and tablet businesses, it is really far too late. Customer solutions are now in the market, and the early leaders – Apple and Google Android – are far, far in front. The costs to “catch up” – like in on-line – are impossibly huge. Especially since both Apple and Google are going to keep advancing their solutions and raising the competitive challenge. What we’ll see are more huge losses, bleeding out the remaining cash from Microsoft as its “core” PC business continues declining.

Many analysts will examine a company’s earnings and make the case for a “value play” after growth slows. Only, that’s a mythical bet. When a leader misses a market shift, by investing too long trying to defend its historical business, the late-stage earnings often contain a goodly measure of “adjustments” and other machinations. To the extent earnings do exist, they are wasted away in defensive efforts to pretend the market shift will not make the company obsolete. Late investments to catch the market shift cost far too much, and are impossibly late to catch the leading new market players. The company is well on its way to failure, even if on the surface it looks reasonably healthy. It’s a sucker’s bet to buy these stocks.

Rarely do we see such a stark example as the shift Apple has created, and the defend & extend management that has completely obsessed Microsoft. But it has happened several times. Small printing press manufacturers went bankrupt as customers shifted to xerography, and Xerox waned as customers shifted on to desktop publishing. Kodak declined as customers moved on to film-less digital photography. CALMA and DEC disappeared as CAD/CAM customers shifted to PC-based Autocad. Woolworths was crushed by discount retailers like KMart and WalMart. B.Dalton and other booksellers disappeared in the market shift to Amazon.com. And even mighty GM faltered and went bankrupt after decades of defend behavior, as customers shifted to different products from new competitors.

Not all earnings are equal. A dollar of earnings in a growth company is worth a multiple. Earnings in a declining company are, well, often worthless. Those who see this early get out while they can – before the company collapses.

Update 5/10/11 – Regarding announced Skype acquisition by Microsoft

That Microsoft has apparently agreed to buy Skype does not change the above article. It just proves Microsoft has a lot of cash, and can find places to spend it. It doesn’t mean Microsoft is changing its business approach.

Skype provides PC-to-PC video conferencing. In other words, a product that defends and extends the PC product. Exactly what I predicted Microsoft would do. Spend money on outdated products and efforts to (hopefully) keep people buying PCs.

But smartphones and tablets will soon support video chat from the device; built in. And these devices are already connected to networks – telecom and wifi – when sold. The future for Skype does not look rosy. To the contrary, we can expect Skype to become one of those features we recall, but don’t need, in about 24 to 36 months. Why boot up a PC to do a video chat you can do right from your hand-held, always-on, device?

The Skype acquisition is a predictable Defend & Extend management move. It gives the illusion of excitement and growth, when it’s really “so much ado about nothing.” And now there are $8.5B fewer dollars to pay investors to invest in REAL growth opportunities in growth markets. The ongoing wasting of cash resources in an effort to defend & extend, when the market trends are in another direction.