by Adam Hartung | Feb 3, 2011 | Defend & Extend, eBooks, In the Rapids, In the Swamp, Innovation, Leadership, Lock-in, Openness

Summary:

- Company size is irrelevant to job creation

- New jobs are created by starting new businesses that create new demand

- Most leaders behave defensively, trying to preserve the old business

- But success comes from acting like a start-up and creating new opportunities

- Companies need to do more future-based planning that can change the competitive landscape and generate more growth, jobs and higher rates of return

A trio of economists just published "Who Creates Jobs? Small vs. Large vs. Young" at the National Bureau of Economic Research. For years businesspeople have said that the majority of jobs were created by small companies, therefore we should provide loans and other incentives for small business. At the same time, we all know that large companies employee millions of people, and therefore they have received benefits to keep their companies going even in tough times – like the recent bailouts of GM and Chrysler. But what these researchers discovered was that size was immaterial to job creation – and this ages-old debate is really irrelevant!

Digging deeper into the data, they discovered as reported in the New York Times, "To Create Jobs, Nurture Start-Ups." Regardless of size, most businesses over time get stuck defending their original success formula. What helped them initially grow becomes locked-in by behavioral norms, structural decision-making processes and a business model cost structure that may be tweaked, but rarely changed. Best practices serve to focus management on defending that business, even as market shifts lower the industry growth rate and profits. It doesn't take long before defensive tactics dominate, and as the leaders attempt to preserve historical practices there are no new jobs created. Usually quite the opposite happens as cost cutting dominates, leading to outsourcing and lay-offs reducing the workforce.

Look no further than most members of the Dow Jones Industrial Average to witness the lack of jobs created by older companies desperately trying to defend their historical business model. But what we've failed to realize is how the same management practices dominate small business as well! Most plumbing suppliers, window installers, insurance agencies, restaurants, car dealers, nurseries, tool rental shops, hair cutters and pet sitters spend all their time just trying to keep the business going. They look no further than what they did yesterday when making business decisions. Few think about growth, preferring instead to just keep the business the same – maybe by the owner/operator's father 3 decades ago! They don't create any new jobs, and are probably struggling to maintain existing employment as computers and other business aids reduce the need for labor – while competition keeps whacking away at historical margins.

So if you want to create jobs, throwing incentives at General Electric, General Motors or General Dynamics is not likely to get you very far. And asking the leaders of those companies what it takes to get them to create jobs is a wasted conversation. They don't know, and haven't really thought about the question. Leaders of almost all big organizations are just trying to make next quarter's profit projection any way they can – and that doesn't involve new hiring. After a lifetime of cutting costs and preservation behavior, how is Jeffrey Immelt of GE supposed to know anything about creating new businesses which leads to job creation?

Nor is offering loans or grants to the millions of existing small businesses who are just trying to keep the joint running going to make any difference. Their psychology is not about offering new products or services, and banks sure don't want to take the risk of investing in new experimental behaviors. They have little, if any, interest in figuring out how to grow when most of their attention is trying to preserve the storefront in the face of new competitors on-line, or from India, China or Vietnam!

To create jobs you have to focus on growth – not defense. And that takes an entirely different way of thinking. Instead of thinking about the past you have to be obsessive about the future, and how you can do things differently! Most of the time, business leaders don't think this way until their backs are up against the wall, looking at potential failure! For example, how Mr. Gerstner turned around IBM when he moved the company away from mainframe obsession and pointed the company toward services. Or when Steve Jobs redirected Apple away from its Mac obsession and pushed the company into new markets for music/entertainment and smartphones. Unfortunately, these stories are so rare that we tend to use them for a decade (or even 2 decades)!

For years Cisco said it would obsolete its own products, and by implementing that direction Cisco has grown year after year in the tech world, where flame-outs abound (just look at what happened to Sun Microsystems, Silicon Graphics, AOL and rapidly Yahoo!) Look at how Netflix has pushed Blockbuster aside by expanding its business from snail-mail to downloads. Or how Amazon.com has found explosive growth by changing the way we read books, now selling more Kindle products than printed. Rather than thinking about how each could do more of what they always did, fearing cannibalization of the "core business," they are aiding destruction of their historical business by implementing the newest technology and solution before some start-up beats them to the punch!

As you enter 2011 and prepare for 2012, is your planning based upon doing more of what your business has always done? A start up has no last year, so its planning is based entirely on views of the future. Are you fixated on improving your operations? A start up has no operations, so it is fixated on competitors to figure out how it can meet market needs better, and use "fringe" solutions in new ways that competitors have not yet adopted. Are you hoping that market shifts slow, or stop, so revenue, market share and profit slides abate? A start up is looking for ways to disrupt the marketplace to it can grab high growth from existing solutions while generating new demand by meeting unmet needs. Are you trying to preserve resources in order to defend your business from competitors? A start up is looking for places to experiment with new solutions and figure out how to change the competitive landscape while growing revenues and profits.

If you want to thrive you have to grow. To grow, you have to think young! Be willing to plan for the future, like Apple did when it moved into new markets for music downloads. Be willing to find competitive holes and fill them with new technology, like Netflix. Don't fear market changes – create them like Cisco does with new solutions that obsolete previous generations. And keep testing new ways to expand the market, even as you see intense competition in historical markets being attacked by new competitors. That is the only way to create value, and generate new jobs!

by Adam Hartung | Jan 5, 2011 | Defend & Extend, In the Rapids, In the Swamp, Leadership, Lock-in, Openness

Summary:

- Business planning systems are designed to defend historical markets

- Rapidly shifting markets makes it impossible to grow by defense alone

- Growth requires understanding what customers want, and creating new solutions that most likely aren’t part of the current business

- You can’t grow if you don’t plan to grow, but to plan for growth you have to shift resources from traditional planning into scenario planning

- High growth companies like Virgin, Apple and Google plan to fulfill future needs, not defend & extend past practicess

Imagine you see a pile of hay. Above it is a sign flashing “find the needle.” That achievement would be hard. Change the sign to “find the hay” and suddenly achieving the goal becomes much easier. So, as the comedian Bill Engvall might ask, what’s your sign? Unfortunately, most businesses plan for 2011, and beyond, using the first sign. Very few do planning using the latter. Most businesses won’t grow, because they simply don’t know how to plan for growth!!

Most businesses start planning with “I’m in the horseshoe (for example) business. My market isn’t growing, and there is more capacity than demand. How can I grow?” For these people, their sign is “find the needle.”

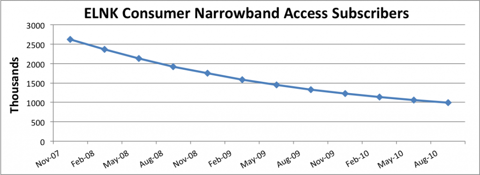

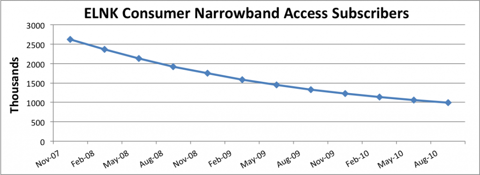

Take for example Earthlink. The company’s growth looked like a rocket ship in the early internet days as people by the millions signed up for dial-up service. But along came broadband, and the market for dial up died – never to return. Earthlink has no hope of growing as long as it thinks of itself as a dial-up company

Chart at SeekingAlpha.com author Ananthan Thangavel

Despite the absolute certainty that the market is shrinking, at this point almost all business planners will develop plans to defend this dying business as long as possible. Despite the impossibility of achieving good returns, there will be a plethora of actions to try and keep serving all the way to the very last customer. Just look at how AOL has invested millions trying to defend its dying internet access busiuness. Reality is, the company that walks away – gives up- is the smartest. There’s no way to make money as oversupply keeps too many companies spending too much to service too few customers.

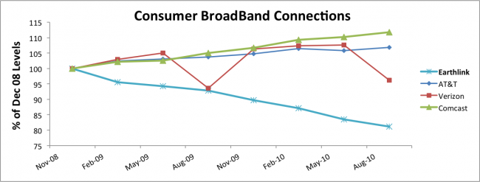

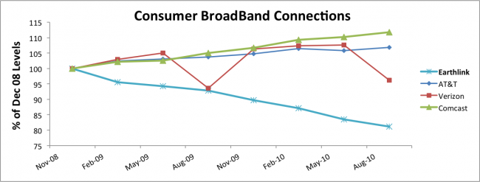

The next step for most planners is to attempt extending the business into something adjacent. For example, Earthlink would say “let’s invest in Broadband. We’ll hang onto customers as they want to switch, and maybe pick up a few customers.” But this completely ignores the fact that competitors already have a substantial lead. Competitors have learned the technology, and the marketplace. They are growing, and have no intention of giving up any room to a new competitor.

Chart at SeekingAlpha.com author Ananthan Thangavel

Planning systems are designed to keep the business doing more of what it always did, or possibly extending the business into adjacent markets after returns have faltered. Planning systems have no way of recognizing when a business, or market, has become obsolete. And practically never do they recognize the power of exsting competitors when looking at adjacent markets. As a result, the planning system produces no growth plans, leading 2011 to end with the self-fulfilling prophecy that the plan predicted – little or no growth.

The future for Earthlink is pretty grim. As it is for most companies that plan based upon history, trying to Defend & Extend their historical markets. In the highly dynamic, global marketplaces of 2011 trying to find growth by remaining focused on the past is like looking for the needle in a haystack. Maybe there’s something in there – but it’s not likely – and it’s even a lot less likely you’ll find it – and if you did, the cost of finding it will almost assuredly be greater than the value.

Alternatively, why not use planning resources to find, and develop, growth markets. Instead of looking at what you did (as in the past tense) try to figure out what you should do. Rather than studying past products, customers and markets, why not develop scenarios about the future that give you insight to what people will want to buy in 2011, 2012 and beyond? Rather than looking for needles, why not go explore the hay?

Newspapers kept focusing on declining subscriptions, when they should have been studying Craig’s List, eBay, Vehix.com and other on-line environments to learn the future of advertising. Had Tribune company poured its resources into its early internet investments, such as cars.com and careerbuilder.com, rather than trying to defend its traditional newspapers, it may well have avoided bankruptcy. But rather than looking to the future when doing its planning, and understanding that on-line news was going to explode, Tribune kept looking for the needle (cost cuts, layoffs, outsourcing, etc.) to save the old success formula.

Direct mail companies and Sunday insert printers have continued looking for ways to defend & extend their coupon printing business – despite the fact that nobody reads junk mail or uses printed coupons. Several have failed, and larger companies have merged trying to find “synergies” and more cost cuts. Simultaneously a 28 year old music major from Nothwestern university starts figuring out how to help companies acquire new customers by offering email coupons, and within 2 years his company, Groupon, is valued at around $6B. There’s nothing that stopped coupon powerhouse Advo from being Groupon, except that its planning system was devoted to finding the needle, while Groupon’s leaders decided to go play in the hay.

Hallmark and American Greetings want us to buy birthday and holiday cards for various occasions – in a world where almost nobody mails cards any longer. As they keep trying to defend their old business, and extend it into a few new opportunities for on-line cards, Twitter captures the wave of instant communications by offering everyone 140 character ways to communicate. Because Twitter is out where the growth is, the company raises $200M giving it a value of $3.7B.

Nothing stops any business from being anything it wants to be. But as most enter 2011 they will use their planning resources, including all those management meetings and hours of forms completion, to do nothing more than re-examine the historical business. Most will devolve into trying to figure out how to do more with less. As future forecasts look grim, or perhaps cautiously optimistic (based on a lot of things going right – like a mysterious pick-up in demand) there will be much nashing of teeth – and meetings looking for a needle that can be offered to employees and investors as a hope for rising future value.

Smart companies get out of that rut. They focus their planning on the future. What do customers want, and how can we give them what they want? How can we create whole new markets. Apple was a PC company, but by exploring mobility it became a provider of MP3 consumer electronics, downloadable music, a mobile device and app supplier and the early winner in cloud accessing tablets. Google has moved from a search engine to a powerhouse ad placement company and is pushing the edges of growth in mobile computing as well as several other markets. Virgin started as a distributor of long-playing vinyl record albums, but by exploring what customers really wanted it has become an international airline, cell phone company, international lender and space travel pioneer (to mention just a few of its businesses.)

You can grow in 2011, but to do so you need to shed the old planning system (and its resource wasting processes) and get serious about scenario planning. Focus on the future, not the past.

by Adam Hartung | Nov 8, 2010 | Current Affairs, In the Swamp, Lifecycle, Web/Tech

Summary:

- Creating value requires growth, not cost reductions

- Yahoo and AOL have no growth, and no new market development plans

- Yahoo and AOL lack the resources to battle existing competitors Google and Apple

- Don’t invest in Yahoo or AOL individually, or if they merge

- Companies that generate high valuation, like Apple, do so by pioneering new markets with new products where they generate growth in revenue, profits and cash flow

Rumors have been swirling about Yahoo! and AOL merging – and Monday’s refresh led to about a 2% gain in the former, and 4% gain in the latter. But unless you’re a day trader, why would you care? Merging two failing companies does not create a more successful progeny.

AOL had a great past. But since the days of dial-up, the value proposition has been hard to discern. What innovations has AOL brought to market the last 2 years? What new technologies is AOL championing? What White Space projects are being trumpeted that will lead to new capabilities for web users if they purchase AOL products?

And the same is true for Yahoo! Although an early pioneer in on-line advertising, and to this day the location of many computer user’s browser home page, what has Yahoo! brought to market the last 2 years? In the search market, on-line content management, browser technology and internet ad placement the game has fully gone to competitor Google. Although the new CEO, Ms. Bartz, was brought in to much fanfare, there’s been nothing really new brought forward. And we don’t hear about any new projects in the company designed to pioneer some new market.

And from this merger, where would the cash be created to fight against the likes of Google and Apple? Unless one of these companies has a silver bullet, the competitors’ war chests assures “game over” for these two.

Sure, merging the two would likely lead to some capability to cut administrative costs. But is that how you create value for an internet company? What creates value is developing new markets – like AOL did when it brought millions of people to the internet for the first time. And like Yahoo! did with its pioneering products delivering news, and placing ads for companies. But since both companies have lost the willingness, capability and resources to develop new markets and products they’ve been unable to grow revenues and cash flow. The road to prosperity most assuredly does not lie in “synergistic cost reductions” across administration, selling and product development for these two market laggards.

The reason Apple is skyrocketing in value is because it has pioneered new markets. And produced enough cash to buy both these companies – if there was any value in them. SeekingAlpha.com lays out the case for almost 100million iPad sales, and a lot more iPhones, in “What Could Justify a $500 Apple Stock Price.” But beyond selling more of what it’s pioneered, Apple has not stopped pioneering new markets. Another SeekingAlpha article points out the likelihood of Apple making video chat something people will really want to use, now that it can be done on mobile devices like iPads and iPhones, in “Apple’s Future Revenue Driver: FaceTime.” It’s because Apple has the one-two punch of growing the markets it has pioneered while simultaneously developing new markets that makes it worth so much.

If you’ve been thinking a merged Yahoo/AOL is a value play – well think again. Both companies are well into the swamp of declining returns. So focused on fighting off the alligators and mosquitos trying to eat them that they long ago forgot their mission was to create new markets with new products that could carry them out of the low-growth swamp. Sell both, if you haven’t already, and don’t look back. Whether you take a loss or gain, at least you’ll leave with some money. The longer you stay with these companies the less they’ll be worth, because neither has a sail of any kind to catch any growth wind.

Apple at $500 might sound crazy – but it’s a better bet than hoping to make any money in the individual, or merged, old-guard companies. They don’t have the cash, nor the cash flow, to drive new solutions. And that’s how value is created.

by Adam Hartung | Sep 7, 2010 | Current Affairs, Defend & Extend, In the Whirlpool, Leadership, Web/Tech

Summary:

- Not even dominant industry leaders are immune to decline from market shifts

- It’s easy to focus on what made you great, and miss a market shift

- Competitors drive market shifts, not customers – so pay attention to competitors!

- AOL lost industry domination to competitors with new solutions, and now new technologies, even though it executed its Success Formula really well

- You can become obsolete really quickly when fringe competitors introduce new solutions

- Do more competitor analysis

- Keep White Space teams experimenting with emerging solutions and competing in shifting markets

Do you remember when AOL (an acronym, and updated name, for America On-Line) dominated our perception of the internet? Fifteen years ago AOL was one of the leading companies introducing Americans to the wonders of the web. Providing dial-up access (remember that?) AOL offered users its own interface, and a series of apps that helped its customers discover how the world wide web could make their lives easier – and better. At its peak, AOL had over 30 million subscribers! AOL was so commercially strong, and investors were so optimistic, that a merger with powerhouse publisher Time/Warner, which already owned CNN and HBO, was organized so AOL’s young leader, Steve Case, could take the helm and push the company forward into the digital frontier.

Along the way, something went very wrong. In an example of what happened to AOL and its products, as seen below, after pioneering Instant Messaging as an internet application AOL’s AIM user base has declined precipitously – by more than 50% – in the last 3 years:

Source: BusinessInsider.com

Of course, the same thing that once drove AOL growth is now apparent somewhere else. New markets are emerging. Instead of using PCs with instant messaging, most people today text via their mobile device! Texting isn’t just a youthful activity. According to Pew Research, on PewInternet.org in “Cell Phones and American Adults” 72% of American adults now text – up from 65% a year ago. 87% of teens text. And I’m willing to bet a lot of those teens don’t even have an instant messaging account – on any platform. The amount of “instant messaging” has grown dramatically – just not using “instant messaging” software. It’s now happening via mobile device texting.

Where AOL once dominated the landscape for digital communication, it is now becoming almost insignificant. But it wasn’t because AOL didn’t know how to execute its strategy. AOL was an industry leader, with savvy management, and a blue-ribbon Board of Directors. AOL even bought Netscape in its effort to remain the best server and client technology for a proprietary internet platform.

AOL became obsolete because the market shifted – while AOL tried holding on to its initial Success Formula. AOL did not shift as the market shifted, it has remained Locke-in to its early Identity, original Strategy and all those product Tactics that once made it great! AOL didn’t do anything wrong. It just kept doing what it knew how to do, rather than recognizing the impact of competitors and changing markets.

Shortly after AOL emerged as the market leader, competitors sprang up. First they offered dial-up access, often more cheaply. Eventually dial-up was replaced with high-speed internet access from multiple providers. Instead of using a proprietary interface, competitors Netscape and Microsoft brought out their own internet browsers, making it possible for users to surf the web directly and easily. Instead of using an AOL directory to find things, search engines such as Ask Jeeves, Alta Vista and Yahoo! Search came along that would find things across the web for users based upon their query. Email alternatives emerged, such as Hotmail and Yahoo! Mail. Eventually, one piece at a time, all the proprietary packaged products that AOL provided – including instant messaging – was offered by a competitor. And the value of the AOL packaging declined. As competitor products improved, for most users being an AOL subscriber simply had little advantage.

And now entirely new apps are coming along. As the market quickly shifts to mobile data and applications, devices like smartphones and tablets are replacing PCs. And the apps that made internet companies rich and famous are poised for decline – as users shift to the new way of doing things.

Whether the currently popular internet companies will make the next step, or end up like AOL, will be determined by whether they remain stuck on defending & extending their “core” business, or if they can shift with the market. There is no doubt that the amount of “instant messaging” is skyrocketing. It’s just not happening on the PC. Like many tasks, the demand is growing very fast. But it is via a new, and different solution. If the company sees itself as providing a PC type of internet solution, then the company will likely decline. But, alternatively, the leadership could see that demand is exploding and they need to shift – with the market – to the new solution environment to maintain growth.

Whether you are the market leader or not, you know you don’t want to end up like AOL. Once rich with resources, and a commanding market lead, AOL is now irrelevant to the latest market trends – and growth. AOL stuck to what it knew how to do. It has not shifted with changing market requirements – including changes in technology. For your company to succeed it must be (1) aware of competitors and how they are constantly changing the market – especially fringe competitors, and (2) enlisting White Space teams that are participating in the new markets, learning what works and how to migrate to capture the ongoing growth.

Postscript: I want to thank a pair of colleagues for some great mentions over the weekend. Firstly, to FMI Daily for posting to its readership about my blog on The Power of Myth. Secondly, a big thank you to Management Consulting News for referring its newsletter readers to this blog as notable, and my recent posting on the failure of Fast Follower strategy. I encourage readers to follow the links here to these sites and sign up for future information from both!!

by Adam Hartung | Dec 15, 2009 | General, In the Swamp, Leadership, Web/Tech

In a tough year like 2009, many business leaders want to jump in a foxhole and focus on survival. The goal becomes maintain, and then try to grow again sometime in the future – when the economy gets better. They cut marketing and sales costs, stop new product development/introduction, and literally plan to do nothing new until "the business" improves. Unfortunately, that sets a business up for failure.

In today's fast moving competitive world, it's impossible to stand still. Your business either grows, or it falls behind. Think about Yahoo!. The company hoped to maintain it's search business at it entered a "turnaround." Unfortunately, the competition isn't willing to give Yahoo! any time at all. Microsoft grabs off 10% of the market with its Bing introduction, and Google just keeps taking share. Take a look at Yahoo's performance:

source: Silicon Alley Insider

Or consider AOL. AOL was the undoubted leader in bringing people to the internet. But over the last decade AOL has tried to maintain its customers without offering any new products. It has saved investment dollars, but lost its relevancy. Now Facebook has more unique visitors than AOL – a clear sign AOL (which recently went public) is well on the way to disappearing:

source: Silicon Alley Insider

Blockbuster was the clear market leader for video/movie rentals. The company even had a college football bowl game named after it! The CEO bought a baseball team, and made it into a World Series winner! Blockbuster was THE store for obtaining entertainment for many years. But the company saved its dimes, tried to defend its market position, and didn't develop new solutions. Now it is being overwhelmed by competitor Netflix:

source: Silicon Alley Insider

Too many business leaders believe in "The Myth of the Flats" (from Create Marketplace Disruption.) They think that you can build a business, and then ride a market position. When business is bad they depend upon living on past brand position. They think they can wait for a better market to come along before they use White Space to introduce new solutions that meet emerging needs. And the competitors, who don't slow down, use market downturns to introduce new solutions and overtake the former market leader.

Smart companies don't rest on their laurels. They don't wait for a better market. They keep using White Space to develop new solutions. And even in a bad overall economy, like 2009, they sell more and make more profits. Just look at Amazon, achieving record market valuation in 2009:

source: Silicon Alley Insider

If you want 2010 to be a great year, it starts with recognizing that you can't stand still. You can't wait for "a better market." You have to create that better market by pushing forward with White Space to introduce new solutions that meet emerging market needs.