by Adam Hartung | Aug 4, 2016 | Election, Leadership, Politics

Donald Trump has had a lot of trouble gaining good press lately. Instead, he’s been troubled by people from all corners reacting negatively to his comments regarding the Democrat’s convention, some speakers at the convention, and his unwillingness to endorse re-election for the Republican speaker of the house. For a guy who has been in the limelight a really long time, it seems a bit odd he would be having such a hard time – especially after all the practice he had during the primaries.

The trouble is that Donald Trump still thinks like a CEO. And being a CEO is a lot easier than being the chief executive of a governing body.

CEOs are much more like kings than mayors, governors or presidents:

- They aren’t elected, they are appointed. Usually after a long, bloody in-the-trenches career of fighting with opponents – inside and outside the company.

- They have the final say on pretty much everything. They can choose to listen to their staff, and advisors, or ignore them. Not employees, customers or suppliers can appeal their decisions.

- If they don’t like the input from an employee or advisor, they can simply fire them.

- If they don’t like a supplier, they can replace them with someone else.

- If they don’t like a customer, they can ignore them.

- Their decisions about resources, hiring/firing, policy, strategy, fund raising/pricing, spending – pretty much everything – is not subject to external regulation or legal review or potential lawsuits.

- Most decisions are made by understanding finance. Few require a deep knowledge of law.

- There is really only 1 goal – make money for shareholders. Determining success is not overly complicated, and does not involve multiple, equally powerful constituencies.

- They can make a ton of mistakes, and pretty much nobody can fire them. They don’t stand for re-election, or re-affirmation. There are no “term limits.” There is little to tie them personally to their decisions.

- They have 100% control of all the resources/assets, and can direct those resources wherever they want, whenever they want, without asking permission or dealing with oversight.

- They can say anything they want, and they are unlikely to be admonished or challenged by anyone due to their control of resource allocation and firing.

- 99% of what they say is never reported. They talk to a few people on their staff, and those people can rephrase, adjust, improve, modify the message to make it palatable to employees, customers, suppliers and local communities. There is media attention on them only when they allow it.

- They have the “power of right” on their side. They can make everyone unhappy, but if their decision improves shareholder value (if they are right) then it really doesn’t matter what anyone else thinks

One might challenge this by saying that CEOs report to the Board of Directors. Technically, this is true. But, Boards don’t manage companies. They make few decisions. They are focused on long-term interests like compliance, market entry, sales development, strategy, investor risk minimization, dividend and share buyback policy. About all they can do to a CEO if one of the above items troubles them is fire the CEO, or indicate a lack of support by adjusting compensation. And both of those actions are far from easy. Just look at how hard it is for unhappy shareholders to develop a coalition around an activist investor in order to change the Board — and then actually take action. And, if the activist is successful at taking control of the board, the one action they take is firing the CEO, only to replace that person with someone knew that has all the power of the old CEO.

It is very alluring to think of a CEO and their skills at corporate leadership being applicable to governing. And some have been quite good. Mayor Bloomberg of New York appears to have pleased most of the citizens and agencies in the city, and his background was an entrepreneur and successful CEO.

But, these are not that common. More common are instances like the current Governor of Illinois, Bruce Rauner. A billionaire hedge fund operator, and first-time elected politician, he won office on a pledge of “shaking things up” in state government. His first actions were to begin firing employees, cutting budgets, terminating pension benefits, trying to remove union representation of employees, seeking to bankrupt the Chicago school district, and similar actions. All things a “good CEO” would see as the obvious actions necessary to “fix” a state in a deep financial mess. He looked first at the financials, the P&L and balance sheet, and set about to improve revenues, cut costs and alter asset values. His mantra was to “be more like Indiana, and Texas, which are more business friendly.”

Only, governors have nowhere near the power of CEOs. He has been unable to get the legislature to agree with his ideas, most have not passed, and the state has languished without a budget going on 2 years. The Illinois Supreme Court said the pension was untouchable – something no CEO has to worry about. And it’s nowhere near as easy to bankrupt a school district as a company you own that needs debt/asset restructuring because of all those nasty laws and judges that get in the way. Additionally, government employee unions are not the same as private unions, and nowhere near as easy to “bust” due to pesky laws passed by previous governors and legislators that you can’t just wipe away with a simple decision.

With the state running a deficit, as a CEO he sees the need to undertake the pain of cutting services. Just like he’d cut “wasteful spending” on things he deemed non-essential at one of the companies he ran. So refusing funding during budget negotiations for health care worker overtime, child care, and dozens of other services that primarily are directed at small groups seems like a “hard decision, well needed.” And if the lack of funding means the college student loan program dries up, well those students will just have to wait to go to college, or find funding elsewhere. And if that becomes so acute that a few state colleges have to close, well that’s just the impact of trying to align spending with the reality of revenues, and the customers will have to find those services elsewhere.

And when every decision is subjected to media reporting, suddenly every single decision is questioned. There is no anonymity behind a decision. People don’t just see a college close and wonder “how did that happen” because there are ample journalists around to report exactly why it happened, and that it all goes back to the Governor. Just like the idea of matching employee rights, pay requirements, contract provisioning and regulations to other states – when your every argument is reported by the media it can come off sounding a lot like as state CEO you don’t much like the state you govern, and would prefer to live somewhere else. Perhaps your next action will be to take the headquarters (now the statehouse) to a neighboring state where you can get a tax abatement?

Donald Trump the CEO has loved the headlines, and the media. He was the businessman-turned-reality-TV-star who made the phrase “you’re fired” famous. Because on that show, he was the CEO. He could make any decision he wanted; unchallenged. And viewers could turn on his show, or not, it really didn’t matter. And he only needed to get a small fraction of the population to watch his show for it to make money, not a majority. And he appears to be very genuinely a CEO. As a CEO, as a TV celebrity — and now as a candidate for President.

Obviously, governing body chief executives have to be able to create coalitions in order to get things done. It doesn’t matter the party, it requires obtaining the backing of your own party (just as John Boehner about what happens when that falters) as well as the backing of those who don’t agree with you. ou don’t have the luxury of being the “tough guy” because if you twist the arm to hard today, these lawmakers, regulators and judges (who have long memories) will deny you something you really, really want tomorrow. And you have to be ready to work with journalists to tell your story in a way that helps build coalitions, because they decide what to tell people you said, and they decide how often to repeat it. And you can’t rely on your own money to take care of you. You have to raise money, a lot of money, not just for your campaign, but to make it available to give away through various PACs (Political Action Committees) to the people who need it for their re-elections in order to keep them backing you, and your ideas. Because if you can’t get enough people to agree on your platforms, then everything just comes to a stop — like the government of Illinois. Or the times the U.S. Government closed for a few days due to a budget impasse.

And, in the end, the voters who elected you can decide not to re-elect you. Just ask Jimmy Carter and George H.W. Bush about that.

On the whole, it’s a whole lot easier to be a CEO than to be a mayor, or governor, or President. And CEOs are paid a whole lot better. Like the moviemaker Mel Brooks (another person born in New York by the way) said in History of the World, Part 1 “it’s good to be king.“

by Adam Hartung | Jul 13, 2016 | Employment, Leadership, Regulations, Trends

This week Starbucks and JPMorganChase announced they were raising the minimum pay of many hourly employees. For about 168,000 lowly paid employees, this is really good news. And both companies played up the planned pay increases as benefitting not only the employees, but society at large. The JPMC CEO, Jamie Dimon, went so far as to say this was a response to a national tragedy of low pay and insufficient skills training now being addressed by the enormous bank.

However, both actions look a lot more like reacting to undeniable trends in an effort to simply keep their organizations functioning than any sort of corporate altruism.

However, both actions look a lot more like reacting to undeniable trends in an effort to simply keep their organizations functioning than any sort of corporate altruism.

Since 2014 there has been an undeniable trend toward raising the minimum wage, now set nationally at $7.25. Fourteen states actually raised their minimum wage starting in 2016 (Massachusetts, California, New York, Nebraska, Connecticut, Michigan, Hawaii, Colorado, Nebraska, Vermont, West Virginia, South Dakota, Rhode Island and Alaska.) Two other states have ongoing increases making them among the states with fastest growing minimum wages (Maryland and Minnesota.) And there are 4 additional states that promoters of a $15 minimum wage think will likely pass within months (Illinois, New Jersey, Oregon and Washington.) That makes 20 states raising the minimum wage, with 46.4% of the U.S. population. And they include 5 of the largest cities in the USA that have already mandated a $15 minimum wage (New York, Washington D.C., Seattle, San Francisco and Los Angeles.)

In other words, the minimum wage is going up. And decisively so in heavily populated states with big cities where Starbucks and JPMC have lots of employees. And the jigsaw puzzle of different state requirements is actually a threat to any sort of corporate compensation plan that would attempt to treat employees equally for common work. Simultaneously the unemployment rate keeps dropping – now below 5% – causing it to take longer to fill open positions than at any time in the last 15+ years. Simply put, to meet local laws, find and retain decent employees, and have any sort of equitable compensation across regions both companies had no choice but to take action to raise the pay for these bottom-level jobs.

Starbucks pointed out that this will increase pay by 5-15% for its 150,000 employees. But at least 8.5% of those employees had already signed a petition demanding higher pay. Time will tell if this raise is enough to keep the stores open and the coffee hot. However, the price increases announced the very next day will probably be more meaningful for the long term revenues and profits at Starbucks than this pay raise.

At JPMC the average pay increase is about $4.10/hour – from $10.15 to $12-$16.50/hour. Across all 18,000 affected employees, this comes to about $153.5million of incremental cost. Heck, the total payroll of these 18,000 employees is only $533.5M (after raises.) Let’s compare that to a few other costs at JPMC:

Wow, compared to these one-off instances, the recent pay raises seem almost immaterial. While there is probably great sincerity on the part of these CEOs for improving the well being of their employees, and society, the money here really isn’t going to make any difference to larger issues. For example, the JPMC CEO’s 2015 pay of $27M is about the same as 900 of these lowly paid employees. Thus the impact on the bank’s financials, and the impact on income inequality, is — well — let’s say we have at least added one drop to the bucket.

The good news is that both companies realize they cannot fight trends. So they are taking actions to help shore up employment. That will serve them well competitively. And some folks are getting a long-desired pay raise. But neither action is going to address the real problems of income inequality.

by Adam Hartung | Sep 5, 2014 | Employment, Investing, Politics

The Bureau of Labor Statistics (BLS) just issued America’s latest jobs report covering August. And it’s a disappointment. The economy created an additional 142,000 jobs last month. After 6 consecutive months over 200,000, most pundits expected the string to continue, including ADP which just yesterday said 204,000 jobs were created in August. So, despite the lower than expected August jobs number, America will create about 2.5 million new jobs in 2014.

One month variation does not change a trend

Even thought the plus-200k monthly string was broken (unless revised upward at a future date,) unemployment did continue to decline and is now reported at only 6.1%. Jobless claims were just over 300k; lowest since 2007. And that is great news.

Back in May, 2013 (15 months ago) the Dow was out of its recession doldrums and hitting new highs. I asked readers if Obama could, economically, be the best modern President? Through discussion of that question, the #1 issue raised by readers was whether the stock market was a good economic barometer for judging “best.” Many complained that the measure they were watching was jobs – and that too many people were still looking for work.

To put this week’s jobs report in economic perspective I reached out to Bob Deitrick, CEO of Polaris Financial Partners and author of “Bulls, Bears and the Ballot Box” (which I profiled in October, 2012 just before the election) for some explanation. Since then Polaris’ investor newsletters have consistently been the best predictor of economic performance. Better than all the major investment houses.

This is the best private sector jobs creation performance in American history

Bob Deitrick – “President Reagan has long been considered the best modern economic President. So we compared his performance dealing with the oil-induced recession of the 1980s with that of President Obama and his performance during this ‘Great Recession.’

Bob Deitrick – “President Reagan has long been considered the best modern economic President. So we compared his performance dealing with the oil-induced recession of the 1980s with that of President Obama and his performance during this ‘Great Recession.’

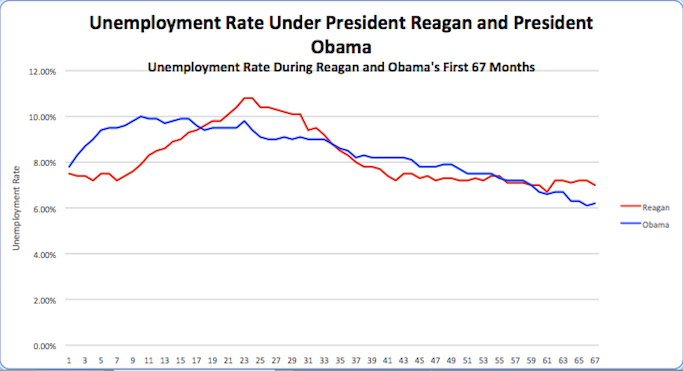

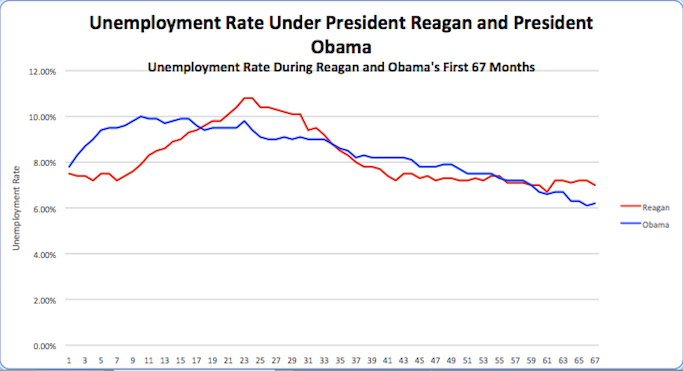

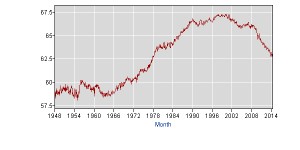

As this unemployment chart shows, President Obama’s job creation kept unemployment from peaking at as high a level as President Reagan, and promoted people into the workforce faster than President Reagan.

President Obama has achieved a 6.1% unemployment rate in his 6th year, fully one year faster than President Reagan did. At this point in his presidency, President Reagan was still struggling with 7.1% unemployment, and he did not reach into the mid-low 6% range for another full year. So, despite today’s number, the Obama administration has still done considerably better at job creating and reducing unemployment than did the Reagan administration.

We forecast unemployment will fall to around 5.4% by summer, 2015. A rate President Reagan was unable to achieve during his two terms.”

What about the Labor Participation Rate?

Much has been made about the poor results of the labor participation rate, which has shown more stubborn recalcitrance as this rate remains higher even as jobs have grown.

Source: Polaris Financial Partners Using BLS Data

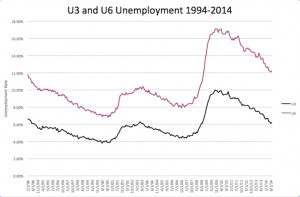

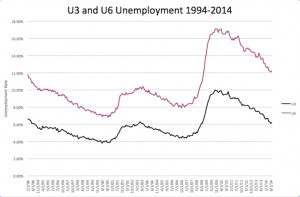

Bob Deitrick: “The labor participation rate adds in jobless part time workers and those in marginal work situations with those seeking full time work. This is not a “hidden” unemployment. It is a measure tracked since 1900 and called ‘U6.’ today by the BLS.

As this chart shows, the difference between reported unemployment and all unemployment – including those on the fringe of the workforce – has remained pretty constant since 1994.

Source: BLS Databases, Tables and Calculators by Subject – Labor Participation

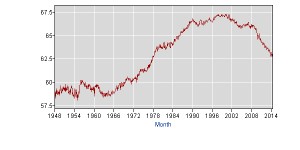

Labor participation is affected much less by short-term job creation, and much more by long-term demographic trends. As this chart from the BLS shows, as the Baby Boomers entered the workforce and societal acceptance of women working changed labor participation grew.

Now that ‘Boomers’ are retiring we are seeing the percentage of those seeking employment decline. This has nothing to do with job availability, and everything to do with a highly predictable aging demographic.

What’s now clear is that the Obama administration policies have outperformed the Reagan administration policies for job creation and unemployment reduction. Even though Reagan had the benefit of a growing Boomer class to ignite economic growth, while Obama has been forced to deal with a retiring workforce developing special needs. During the 8 years preceding Obama there was a net reduction in jobs in America. We now are rapidly moving toward higher, sustainable jobs growth.”

Economic growth, including manufacturing, is driving jobs

When President Obama took office America was gripped in an offshoring boom, started years earlier, pushing jobs to the developed world. Manufacturing was declining, and plants were closing across the nation.

This week the Institute for Supply Management (ISM) released its manufacturing report, and it surprised nearly everyone. The latest Purchasing Managers Index (PMI) scored 59, 2 points higher than July and about that much higher than prognosticators expected. This represents 63 straight months of economic expansion, and 25 consecutive months of manufacturing expansion.

New orders were up 3.3 points to 66.7, with 15 consecutive months of improvement and reaching the highest level since April, 2004 – 5 years prior to Obama becoming President. Not surprisingly, this economic growth provided for 14 consecutive months of improvement in the employment index. Meaning that the “grass roots” economy made its turn for the better just as the DJIA was reaching those highs back in 2013 – demonstrating that index is still the leading indicator for jobs that it has famously always been.

As the last 15 months have proven, jobs and economy are improving, and investors are benefiting

The stock market has converted the long-term growth in jobs and GDP into additional gains for investors. Recently the S&P has crested 2,000 – reaching new all time highs. Gains made by investors earlier in the Obama administration have further grown, helping businesses raise capital and improving the nest eggs of almost all Americans. And laying the foundation for recent, and prolonged job growth.

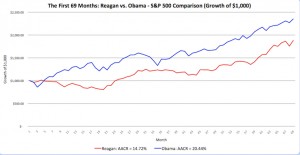

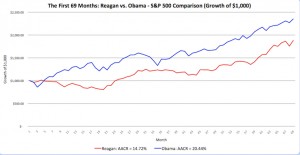

Source: Polaris Financial Partners

Bob Deitrick: While most Americans think they are not involved with the stock market, truthfully they are. Via their 401K, pension plan and employer savings accounts 2/3 of Americans have a clear vested interest in stock performance.

As this chart shows, over the first 67 months of their presidencies there is a clear “winner” from an investor’s viewpoint. A dollar invested when Reagan assumed the presidency would have yielded a staggering 190% return. Such returns were unheard of prior to his leadership.

However, it is undeniable that President Obama has surpassed the previous president. Investors have gained a remarkable 220% gain over the last 5.5 years! This level of investor growth is unprecedented by any administration, and has proven quite beneficial for everyone.

In 2009, with pension funds underfunded and most private retirement accounts savaged by the financial meltdown and Wall Street losses, Boomers and Seniors were resigned to never retiring. The nest egg appeared gone, leaving the ‘chickens’ to keep working. But now that the coffers have been reloaded increasingly people age 55 – 70 are happily discovering they can quit their old jobs and spend time with family, relax, enjoy hobbies or start new at-home businesses from their laptops or tablets. It is due to a skyrocketing stock market that people can now pursue these dreams and reduce the labor participation rates for ‘better pastures.”

Where myth meets reality

There is another election in just 8 weeks. Statistics will be bandied about. Monthly data points will be hotly contested. There will be a lot of rhetoric by candidates on all sides. But, understanding the prevailing trends is critical. Recognizing that first the economy, then the stock market and now jobs are all trending upward is important – even as all 3 measures will have short-term disappointments.

Although economic performance has long been a trademark issue for Republican candidates, there was once a Democratic candidate that won the presidency by focusing on the economy and jobs (Clinton,) and his popularity has never been higher! President Obama’s popularity is not high, and seems to fall daily. This seems incongruous with his incredible performance on the economy and jobs, which has outperformed his party predecessor – and every other modern President.

There are a lot of reasons voters elect a candidate. Jobs and the economy are just one category of factors. But, for those who place a high priority on jobs, economic performance and the markets the data clearly demonstrates which presidential administration has performed best. And shows a very clear trend one can expect to continue into 2015.

Economically, President Obama’s administration has outperformed President Reagan’s in all commonly watched categories. Simultaneously the current administration has reduced the debt, which skyrocketed under Reagan. Additionally, Obama has reduced federal employment, which grew under Reagan (especially when including military personnel,) and truly delivered a “smaller government.” Additionally, the current administration has kept inflation low, even during extreme international upheaval, failure of foreign economies (Greece) and a dramatic slowdown in the European economy.

by Adam Hartung | Sep 7, 2011 | Employment, Innovation, Leadership, Politics, Transparency, Web/Tech

Friday we learned, as the New York Daily News headlined, “August 2011 Jobs Report: NO Net Jobs Created.” U.S. unemployment, and underemployment, remain stubbornly stuck at very high levels. This situation is unlikely to improve, as reported at 24×7 Wall Street in “August Lay-off Plans Up 47%” with the latest Challenger Gray report telling us 51,144 people are soon getting the axe. No wonder we saw a dramatic decline of nearly 15 points, to 44.5, in the Conference Board’s Consumer Confidence Index – near record-low levels.

This has all the Presidential candidates talking about jobs, and President Obama signed up to deliver a jobs speech to Congress.

The problem actually goes beyond just jobs. Buried within consumer concerns lies the fact that for most people, their incomes are going nowhere. Adjusted for inflation, almost everyone is making less now than they did when the millenium turned. Generally speaking, about 15% less than 11 years ago! Most family incomes are about where they were in 1998. For the wealthiest, income since the mid-1960s has grown only about 1.5%/year on average. For everyone else the improvement has only been about .5%/year. And universally almost all of that increase occurred between 1992 and 2000 (for anyone who wonders about Bill Clinton’s resurgent popularity, just look at incomes during his Presidency compared to every other administration on this chart!)

Source: “U.S. Household Incomes: A 42 Year Perspective” Doug Short, BusinessInsider.com

But will anything the President, or the candidates, recommend make a difference?

So far, the politicos keep fighting the last war, and seem surprised that nothing is improving. The recommendations for putting people back to work in factories, such as autos and heavy equipment, or building roads simply defies the reality of work today. America has not been a manufacturing-dominated jobs country for over 60 years! All job creation has been in services!

Source:”Charting the Incredible Shift From Manufacturing to Services” Doug Short, BusinessInsider.com

For this entire period, productivity has been climbing. Just 50 years ago most people spent 1/3 to 1/2 their income on food. No longer. Today, few spend more than 5 to 10%, and everyone can enjoy an automobile, telephone, television and computer – regardless of their income! We have all the stuff anyone could want, and in many cases a lot more of some stuff than we need – or want!

The old notion of “what’s good for G.M. (General Motors) is good for America” is simply no longer true! As we recently witnessed, a multi-billion dollar bail-out of the largest American auto maker may have saved some unemployment – but it did not create an economic turn-around, or create a slew of jobs!

Today’s jobs are all in information – the accumulation, assimilation, analysis and use of information. Few “managers” actually manage people any more – most manage a data set, or a computer program, or some sort of analysis. The vast majority of “managers” have no direct reports at all! The jobs – and incomes – are all in information. Job growth is in places like Facebook, Google, Linked-in, Groupon, Amazon and Apple (the latter of which outsources all its manufacturing.)

No President or economist can manufacture jobs today. As we’ve seen, interest rates are at unprecedent low levels – yet nobody wants to take a loan to hire a new employee! In fact, business productivity is at record high levels as business keeps accomplishing more and more with fewer and fewer workers!

Source: “Corporate Efficiency is Getting Absurd” BusinessInsider.com

Public companies aren’t going broke, by and large. Most have cash balances at record levels. Only they keep using the money to buy back their own stock! Every month sees a wave of new stock buy back commitments, as 24×7 Wall Street reported “August’s New Massive Stock Buybacks… Over $30 Billion!” Business leaders find it less risky to buy back their own stock (supporting their own bonuses, by the way) than invest in any sort of growth program – something that might create jobs.

So what’s the President to do?

We need to radically jack up the investment in innovation! Think about that last period of very low unemployment and growing incomes – in the 1990s. We had the explosion in technology as people began using PCs, the internet, mobile phones, etc. New technology introduced new business ideas (mostly services) and created a rash of growth! And that created new jobs – and higher incomes. Innovation is the jobs engine – not trying to save another tired manufacturing company, or pave another highway or extend another bridge! Today those projects simply do not employ very many people, and the “trickle down” affect of a highway project creating more jobs has disappeared!

Bloomberg/BusinessWeek reported in “Failing at Innovation? Bank On It“

- Government spending on higher education has been declining since the 1970s reducing the number of graduate students and innovation projects

- Federal share of R&D has been less than 1% since 1992 – all while corporate R&D spending has declined dramatically! The days of spending “to put a man on the moon” has disappeared, as we fairly quietly mothballed the space program and commence to dismantle NASA

- The number of entrepreneurs is actually declining! There were fewer startups with 1 or more employees in 2007 (before the financial collapse and ensuing economic mayhem) than in 1990

- New companies are not employing people. In the 1990s the average startup employed 7.5 people, but now the number is 4.9

- Meanwhile “infrastructure” spending today is the same as it was in 1968!

We’ve done a great job of cutting taxes, but we’ve simultaneoously gutted our investment in R&D, innovation and doing anything new! If you wonder where the jobs went it wasn’t oversees, it was into higher corporate cash levels, more stock buybacks, increased bank reserves and dramatically higher executive compensation!

We don’t need more tax cuts – because nobody is investing in any new projects! We don’t need more unemployment insurance, because that – at best – delays the day of reconning without a solution.

Here’s what we do need today:

- Implement a tax on corporate stock buybacks. At least as great as the tax on corporate dividends. Buybacks simply drain the economy of investment funds, with no benefit. At least dividends give returns back to shareholders – who might invest in a new company! And if buybacks are taxed, executives might start investing in projects again!

- Quit giving such large depreciation allowances for physical assets. We don’t need more buildings – we’re overbuilt as we are right now! Again, it’s not “things” that make up our economy, it’s services!

- Re-introduce R&D credits! Give businesses a $3 tax break for every dollar spent in R&D and new product development! Prior to President Reagan this was considered normal. It’s not a new idea, just one that’s been forgotten. If we can give credits for oil and gas drilling, which creates almost no jobs, why not innovation?

- Cut payroll taxes on the self-employed and small business. Today self-employed pay 2x the payroll taxes, so it’s a big dis-incentive to entrepreneurship. Give start-ups a break by lowering employment taxes on small employers – say less than 50 employees.

- Allow investors in start-ups to write off up to 2x their losses. It takes away a lot of the risk if you can get most of your money back from a tax break should your investment fail. And for all those corporations that abhore taxes this would incent them to invest in small enterprises that have new ideas they’d like to see developed.

- Remember the Small Business Administration (SBA)? Re-activate it by giving it $100B (maybe $200B) to guarantee bank loans of small businesses. Bank lending has ground to a halt as banks eliminate risk – so let’s get them back into their primary business again. In WWII the government guaranteed every loan for the construction of the Liberty Ships – and behold business built 2,751 of the things in 4 years!

- Increase funding for higher education. Increase the grants for science, engineering and new product research at America’s universities. Increase grants for students in science and engineering, and allow students to deduct out-of-pocket educational expenses from their taxes. Allow corporations to deduct all the expense of employee education – uncapped! Allow corporations to deduct the university grants they make!

- Invest in today’s digital infrastructure. Once we paid to send men to the moon – and a flood of innovation (from microwave ovens to powdered drinks and frozen food) followed. Today we should invest in a nationwide WiFi network that’s everywhere from rural forests to city buildings – and make it all FREE. Digital networks are the highways we need today – not concrete ribbons. Create tax deductions for people to buy smartphones, tablets and other products that drive innovation, and make it easy for innovators to network for solutions to emerging needs.

- Streamline the process for small companies to test and sell new bio-engineered products. The existing complicated process is a legacy of big companies and traditional pharmaceutical research. Make it easy for entrepreneurs to test and launch the next wave of medical technology based on the new bio-sciences. Offer federal-backed safety insurance to protect small businesses that show efficacy in new solutions.

These are just 9 ideas. I’m sure readers can think up 90 more (in fact, I challenge you to offer them as comments to this blog.) If we invest in innovation, we can create a lot of jobs. But we need to start NOW!

However, both actions look a lot more like reacting to undeniable trends in an effort to simply keep their organizations functioning than any sort of corporate altruism.

However, both actions look a lot more like reacting to undeniable trends in an effort to simply keep their organizations functioning than any sort of corporate altruism.