by Adam Hartung | Jul 8, 2011 | Books, Current Affairs, In the Rapids, Leadership, Lifecycle, Openness, Transparency, Web/Tech, Weblogs

Evolution doesn’t happen like we think. It’s not slow and gradual (like line A, below.) Things don’t go from one level of performance slowly to the next level in a nice continuous way. Rather, evolutionary change happens brutally fast. Usually the potential for change is building for a long time, but then there is some event – some environmental shift (visually depcted as B, below) – and the old is made obsolete while the new grows aggressively. Economists call this “punctuated equilibrium.” Everyone was on an old equilibrium, then they quickly shift to something new establishing a new equilibrium.

Momentum has been building for change in publishing for several years. Books are heavy, a pain to carry and often a pain to buy. Now eReaders, tablets and web downloads have changed the environment. And in June J.K. Rowling, author of those famous Harry Potter books, opened her new web site as the location to exclusively sell Harry Potter e-books (see TheWeek.com “How Pottermore Will Revolutionized Publishing.”)

Momentum has been building for change in publishing for several years. Books are heavy, a pain to carry and often a pain to buy. Now eReaders, tablets and web downloads have changed the environment. And in June J.K. Rowling, author of those famous Harry Potter books, opened her new web site as the location to exclusively sell Harry Potter e-books (see TheWeek.com “How Pottermore Will Revolutionized Publishing.”)

Ms. Rowling has realized that the market has shifted, the old equilibrium is gone, and she can be part of the new one. She’ll let the dinosaur-ish publisher handle physical books, especially since Amazon has already shown us that physical books are a smaller market than ebooks. Going forward she doesn’t need the publisher, or the bookstore (not even Amazon) to capture the value of her series. She’s jumping to the new equilibrium.

And that’s why I’m encouraged about AOL these days. Since acquiring The Huffington Post company, things are changing at AOL. According to Forbes writer Jeff Bercovici, in “AOL After the Honeymoon,” AOL’s big slide down in users has begun to reverse direction. Many were surprised to learn, as the FinancialPost.com recently headlined, “Huffington Post Outstrips NYT Web Traffic in May.”

Source: BusinessInsider.com

The old equilibrium in news publishing is obsolete. Those trying to maintain it keep failing, as recently headlined on PaidContent.org “Citing Weak Economy, Gannett Turns to Job Cuts, Furloughs.” Nobody should own a traditional publisher, that business is not viable.

But Forbes reports that Ms. Huffington has been given real White Space at AOL. She has permission to do what she needs to do to succeed, unbridled by past AOL business practices. That has included hiring a stable of the best talent in editing, at high pay packages, during this time when everyone else is cutting jobs and pay for journalists. This sort of behavior is anethema to the historically metric-driven “AOL Way,” which was very industrial management. That sort of permission is rarely given to an acquisition, but key to making it an engine for turn-around.

And HuffPo is being given the resources to implement a new model. Where HuffPo was something like 70 journalists, AOL is now cranking out content from some 2,000 journalists and editors! More than The Washington Post or The Wall Street Journal. Ms. Huffington, as the new leader, is less about “managing for results” looking at history, and more about identifying market needs then filling them. By giving people what they want Huffington Post is accumulating readers – which leads to display ad revenue. Which, as my last blog reported, is the fastest growing area in on-line advertising

Where the people are, you can find advertsing. As people are shift away from newspapers, toward the web, advertising dollars are following. Internet now trails only television for ad dollars – and is likely to be #1 soon:

Chart source: Business Insider

So now we can see a route for AOL to succeed. As traditional AOL subscribers disappear – which is likely to accelerate – AOL is building out an on-line publishing environment which can generate ad revenue. And that’s how AOL can survive the market shift. To use an old marketing term, AOL can “jump the curve” from its declining business to a growing one.

This is by no means a given to succeed. AOL has to move very quickly to create the new revenues. Subscribers and traditional AOL ad revenues are falling precipitously.

Source: Forbes.com

But, HuffPo is the engine that can take AOL from its dying business to a new one. Just like we want Harry Potter digitally, and are happy to obtain it from Ms. Rowlings directly, we want information digitally – and free – and from someone who can get it to us. HuffPo is now winning the battle for on-line readers against traditional media companies. And it is expanding, announced just this week on MediaPost.com “HuffPo Debuts in the UK.” Just as the News Corp UK tabloid, News of the World, dies (The Guardian – “James Murdoch’s News of the World Closure is the Shrewdest of Surrenders.“)

News Corp. once had a shot at jumping the curve with its big investment in MySpace. But leadership wouldn’t give MySpace permission and resources to do whatever it needed to do to grow. Instead, by applying “professional management” it limited MySpace’s future and allowed Facebook to end-run it. Too much energy was spent on maintaining old practices – which led to disaster. And that’s the risk at AOL – will it really keep giving HuffPo permission to do what it needs to do, and the resources to make it happen? Will it stick to letting Ms. Huffington build her empire, and focus on the product and its market fit rather than short-term revenues? If so, this really could be a great story for investors.

So far, it’s looking very good indeed.

by Adam Hartung | Jun 30, 2011 | Current Affairs, In the Swamp, Leadership, Web/Tech

Google rolled out its newest social media product this week. Unfortuntately for Google investors, this is not a good thing.

Internet usage is changing. Dramatically. Once the web was the world’s largest library, and simultaneously the world’s biggest shopping mall. In that environment, what everyone needed was to find things. And Google was the world’s best tool for finding things. When the noun, Google, became the verb “googled” (as in “I googled your history” or I googled your brand to see where I could buy it”) it was clear that Google had permanently placed itself in the long history of products that changed the world.

But increasingly the internet is not about just finding things. Today people are using the internet more as a way to network, communicate and cooperatively share information – using sites like Facebook, LInked-in and Twitter. Although web usage is increasing, old style “search-based” use is declining, with all the growth coming from “social-based” use:

Chart source: AllThingsD.com

This poses a very real threat to Google. Not in 2011, but the indication is that being dominant in search has a limit to Google’s future revenue growth through selling search-based ads. And, in fact, while internet ads continue growing in all ad categories, none is growing as fast as display ads. And of this the Facebook market is growing the fastest, as MediaPost.com pointed out in its headline “On-line Ad Spend up, Facebook soars 22%.” In on-line display ads Facebook is now first, followed by Yahoo! (the original market dominator) and Google is third, as described in “Facebook Serves 25% of Display Ads.”

While Google is not going to become obsolete overnight, the trend is now distinctly moving away from Google’s area of domination and toward the social media marketplace. Products like Facebook are emerging as platforms which can displace your need for a web site (why build a web site when all you need is on their platform?) or even email. Their referral networks have the ability to be more powerful than a generic web search when you seek information. And by tying you together with others like you, they can probably move you to products and buying locations you really want faster than a keyword Google-style search. BNet.com headlined “How Facebook Intends to Supplant Google as the Web’s #1Utility,” and it just might happen – as we see users are increasingly spending more time on Facebook than Google:

Source: Silicon Alley Insider

So, you would think it’s a good thing for Google to launch Google+. Although earlier efforts to enter this market were unsuccessful (Google Buzz and Google Wave being two well known efforts,) it would, on the surface, seem like Google has no option but to try, try again.

Only, Google + is not a breakthrough in social media. By all accounts its a collection of things already offered by Facebook and others, without any remarkable new packaging (see BusinessInsider.com “Google’s Launch of Google + is, once again, deeply embarrassing” or “Google Plus looks like everything else” or “Wow, Google+ looks EXACTLY like Facebook.”) With Facebook closing in on 1 billion users, it’s probably too late – and will be far too expensive, for Google to ever catch the big lead. Especially with Facebook in China, and Google noticably not.

Like many tech competitors, Google’s had a game-changer come along and move its customers toward a different solution. Google Plus will be in a gladiator war, where everyone gets bloody and several end up dead. NewsCorp is finally exiting social media as it sells MySpace for a $550m loss – clearly a body being drug from the colliseum! Even with its early lead, and big expenditures of time and managerial talent, NewsCorp was thrashed in the gladiator war.

Source: BusinessInsider.com

Google may have a lot of money to spend on this battle, but shareholders will NOT benefit from the fight. It will be long, costly and inevitably not profitable. Yes, Google needs to find new ways to grow as the market shifts – but trying to do so by engaging such powerful, funded and well-positioned competitors as the big 3 of social media is not a smart investment.

And that leads us to why Google + is really problematic. Resources spent there cannot be spent on other opporunities which have high growth potential, and far fewer competitors. BI‘s headline “Google kills off two of its most ambitious projects” should send shudders of fear down shareholder backs. Google had practically no competitors in its efforts to change how Americans buy and use both healthcare servcies and utilities such as electricty and natural gas. Two enormous markets, where Google was alone in efforts to partner with other companies and rebuild supply chains in ways that would benefit consumers. Neither of these projects are as costly as Google+, and neither has entrenched competition. Both are enormous, and Google was the early entrant, with game-changing solutions, from which it could capture most, if not all, the value — just as it did with its early search and ad-words success.

Additionally, Chromebooks is now coming to market. Android has been a remarkable success, trouncing RIM and with multiple vendors supporting it rapidly taking ground from Apple’s iPhone. Only Google has made almost nothing from this platform. Chromebooks offers a way for Google to improve monetizing its growing – and perhaps someday #1 – platform in the rapidly growing tablet business against a very weak Microsoft. But, with so much attention on Google+ Microsoft is given berth for launching its Office 365 product as a challenger. With so much opportunity in cloud computing, and Google’s early lead in multiple products, Google has a real chance of being bigger than Apple someday. But it’s movement into social media will not allow it to focus on cloud products as it should, and give Microsoft renewed opportunity to compete.

Google is setting itself up for potential disaster. While its historical business slowly starts losing its growth, the company is entering into 3 very expensive gladiator wars. First is the ongoing battle for smartphone users against Apple, where it is spending money on Android that largely benefits handset manufacturers. Secondly it is now facing a battle for enterprise and personal productivity apps based in cloud computing where it has not yet succeeding in taking the lead position, yet faces increasing competition from Apple’s iCloud and Microsoft’s new round of cloud apps. And on top of that Google now tells investors it is going to go toe-to-toe with the fastest growing software companies out there – Facebook, Linked-in, Twitter and a host of other entrants. And to fund this they are abandoning markets where they were practically the only game changing solution.

There’s a lot yet to happen in the fast-moving tech markets. But now is the time for investors to wait and see. Google’s engineers are very talented. But it’s strategy may well be very costly, and unable to compete on all fronts. You may not want to sell Google shares today, but it’s hard to find a reason to buy them.

by Adam Hartung | Jun 23, 2011 | Defend & Extend, In the Swamp, In the Whirlpool, Lifecycle, Lock-in, Web/Tech

Will Cisco be like Apple and go on to continued greatness? Or will it be more like Sun Microsystems? The answer isn’t clear yet, but the negatives are looking a lot clearer than the positives.

Cisco grew like the internet – because it supplied a lot of the internet’s infrastructure. Most of those wi-fi connections, wired and wireless, were supplied by the highly talented team at Cisco. And yet today, revenues for internet routers, switches and company services for networks account for 90% of Cisco’s sales — and its non-cash value (see chart at Trefis.com.) The problem is that those markets aren’t growing like they used to, and some are shrinking, as companies are increasingly switching to common carrier services to access cloud-based services supporting corporate needs. Just like cloud-based IT architectures put risk on Microsoft PC usage, they create similar risks for private network suppliers. Even corporations, the (in)famous “enterprise” customers for Cisco, are finding they can create security and reliability by giving up proprietary networks.

The market capitalization for Cisco has plunged some 40% the last year, and over 55% since peaking in late 2007. Those who support investing in Cisco think like the SeekingAlpha.com headline “3 Reasons Why Cisco is Oversold.” They cite a huge cash hoard (some 25% of market cap) and Cisco’s dominance in its historical “core” product markets. They hope that a revived economy will create an uptick in infrastructure spending by corporations and public entities. Or big buying in emerging countries.

Detractors become vitriolic about the company’s lost valuation, blaming Chairman/CEO John Chambers in articles like the SeekingAlpha.com “Cisco, Either Chambers Goes or I Go.” Their arguments are less about product miscues, and more intensely claiming the CEO misdirected funds into bad consumer market opportunities (Flip phone,) undeveloped new projects like virtual conferencing and an overly complicated organization structure.

What Cisco really needs is more new products in growth markets. Places where demand is growing, and the company can flourish like it did in the hey-day halcyon growth days of the internet. That was why CEO Chambers implemented a market-focused organization structure – complete with multi-layered committees – in an effort to seek out growth opportunities and fund them. Only, the organization lacked the permission and resource commitment to really allow developing most new markets and was overly complex in the resource allocation process. Instead of moving rapidly to identify and develop growth, the organization stalled in endless discussions. A couple of months ago the new org was gutted in a “refocusing” effort (typical reaction: BusinessInsider.com “Cisco’s Crazy Management Structure Wasn’t Working, So Chambers is Changing It“.)

But, if the previously more open organization couldn’t find permission to identify, fund and develop new markets, how will a “more focused” organization do so? Focus isn’t going to make companies (or households) buy more switches and routers. Or buy more network consulting services. The market has shifted, so as people move to smartphones and tablets, and cloud-based apps they access over common networks, how will an organization focused on old customers and products prove more successful? While the old organization may have been problematic, is abandoning a market-focused organization going to be an improvement? Sounds like a set-up for future layoffs.

In the drive for new products Cisco bought a very successful business in the Flip camera two years ago, which according to MediaPost.com had 26% market share. But, “Flip Camera: Dream Becomes a Nightmare” details the story of how Cisco was too late. The market quickly was shifting from digital cameras to smart phones – and sales stagnated. Cisco didn’t learn much about consumer products, or smart phones or how to launch new products outside its “core” from the experience, choosing to shut the business down and withdraw the product this spring (“Cisco Kills the Flip Camera“.) Ouch!

Clearly, Flip was a financially unsuccessful venture. But that could be forgiven if Cisco learned from the experience so it could move, like Apple, toward launching something really good (like Apple did with iPods.) But we don’t hear of any organizational learning from Flip, just failure.

And that’s too bad, because Cisco’s virtual conferencing could have great promise. Most of us now hate to travel (thanks TSA and all that great airline service!) And most corporate controllers hate to pay for business travel. The trends all point toward more and more virtual conferencing. For everything from one-on-one meetings to multi-site meetings to industry conferences for learning. This is a BIG trend, that will go well beyond a simple WebEx. Someone is going to make money with this – taking Skype to an entirely new level of performance. But given how badly Cisco managed Flip, and the new “refocusing” effort, it’s hard to see how that winner will be Cisco.

Cisco’s not yet a Sun Microsystems, so locked-in to old products it cannot do anything else and unable to grow at all. It’s not yet a Dell or Microsoft that’s missed the market shifts and is trying to spend too much money, too late on weak products against well funded, fast growing and profitable competitors.

But, the signs don’t look good. There’s no discussion about what Cisco sees itself doing new and differently in 5 years. We don’t see Cisco offering leading edge products like it did 15 years ago in its old “core” market. It’s historical market is not growing like it once did, and new competitors are changing the market entirely. The layered organization was an effort to attack old sacred cows, and limit the power of old status quo police, but now the new “focused” re-organization is reversing those efforts to find new markets for growth. “Focus” rarely goes hand-in-hand with successful innovation. We cannot find an obvious group of people focusing on new markets, with permission and resources to bring out the “next big thing” that could drive a doubling of revenues by 2017.

Unlike RIMM, the game isn’t over for CSCO. It’s markets still have some longevity. But the organization has been failing at doing the kind of new things, bringing out the new innovations, that would make it a good investment. Until management shows it knows how to find new markets and launch disruptive innovations, CSCO is not a place to invest. Don’t expect a fat dividend, and don’t expect revisiting old growth rates any time soon.

There are likely to be some good, and bad quarters. Cost management, and occasional big orders, combined with manipulating the timing of revenues and costs will allow for management to say “things are all better.” But there will be miscues and problems, and blaming of competitors and weak economic conditions in the bad quarters. Defend and extend management does not work when markets shift. Sideways is not moving forward. It’s more like treading water in the ocean – not a good strategy for rescue. Overall, I wouldn’t be optimistic.

by Adam Hartung | Jun 16, 2011 | Defend & Extend, In the Whirlpool, Innovation, Leadership, Lock-in, Web/Tech

Dell is a dog. From $25/share a decade ago the company rose to around $40/share around 2005, only to collapse. The stock now trades around $15, rising from recent lows of about $10. The company’s value is only $30B, only half revenues of $61B, instead of the revenue multiple obtained by most growth stocks. But then, revenues have been flat for the last 4 years — so maybe it’s time to say Dell isn’t a growth stock any longer.

And that would be correct.

In the 1990s Dell was a darling. The company could do no wrong as its revenues and valuation soared. Founder and CEO Michael Dell was a highly desired speaker at fees of $100,000+. Michael Dell was quick to tell people his success formula, which was pretty simple:

- Do no R&D. Outsource product development to key vendors (Intel and Microsoft). Focus on price and cost. Be operationally excellent! Be the best, most focused manufacturer/assembler.

- Genericize the product. Make it easy to buy, thus cheap and easy to sell.

- Sell direct rather than through distributors so you lower sales cost.

- Use supply chain practices to drive down parts cost and inventory, making it possible to compete on price and collect your funds before paying vendors.

In short, focus on operational excellence to be really fast and cheap. Faster and cheaper than anyone else.

And this success formula worked!! As long as folks wanted personal computers, Dell was the game to beat. And the company reaped the reward of PC market growth, expanding as the PC – especially the Wintel PC – market exploded.

Dell’s problems today aren’t the result of bad management. Dell has been focused, diligent, hard working and very cost conscientuous. Dell made no horrible decisions, and made no serious mistakes in its strategy or tactics. Although for a while it was vilified for weaker support from outsourced vendors in India (again, a tactic used in all parts of Dell’s strategy) that was rectified. Largely for 2 decades Dell has continued to perform better and better at its internal metrics – its success formula.

Dell’s fall from grace was due to the market shifting. Firstly, competitors figured out how to do what Dell did pretty much as good as Dell did it. No operationally oriented strategy is immune from copy-cats, and Dell discovered other companies could do pretty much what they did. It becomes a dog-eat-dog world quickly when your discussions are all “price, delivery, service” and you can’t offer something truly unique. It may not be obvious when markets are growing, and there’s plenty of business for everyone, but oh how quickly it shows up in declining margins when growth slows.

Secondly, and more importantly, the market shifted away from Dell’s primary products. PC sales are now flat to declining, depending on marketplace, as customers shift from Wintel platforms to smartphones and tablets. Despite big acquisitions in data storage and services (to the tune of $5B the last couple of years) Dell still has 70% of its revenues in PCs (55% hardware, 15% software and services.) Most of that money was spent attempting to shore up the Dell success formula by extending its core offerings to core customers. Now all future forecasts show the market will continue to move away from PCs and toward new platforms, making it impossible to create organic growth, and pinching margins in all sectors.

So, were Dell’s executives dumb, incompetent, lethargic or some combination of all 3? Actually, none of those things – as CNNMoney.com points out in “Dell’s Dilemma“. They were simply stuck. Stuck with their own best practices, doing what they do really well, and continuing to do more of it. Unable to move forward, because most attention was focused on defending and extending the old core.

Nobody knows the Dell core better than Michael Dell. His return spells only less likelihood of success for Dell. As opportunities emerged in smartphones and other markets he found it simply easier, faster, cheaper and more consistent to wait on those markets while defending the core PC business. Key vendors Intel and Microsoft, critical to historical success, were not offering new solutions for these markets, or promoting sales in them. Key customers, the IT departments in government and corporate accounts, weren’t clamoring for these new products. They wanted more PCs that were better, faster and cheaper. Dell was looking for the divine light of perfect future understanding to change the company investments – and when it didn’t emerge he kept right on plunking money into the business headed for decline.

Inside consultants (Bain and Co. is well known to be the primary strategists and tacticians at Dell) and employee experts had never-ending opportunities to improve the Dell systems, in their efforts to defend the Dell sales against other PC competitors and seek out additional expansion opportunities in targeted offshore or niche markets. Suppliers wanted Dell to keep building and promoting PCs. And customers locked-in to old platforms were just experimenting with new solutions – far from adopting anything new in the volumes that would match historical PC sales. “If just the economy comes around, I’m sure sales will return” it’s easy to imagine everyone at Dell saying.

Now Dell is in declining products, with an outdated strategy chasing a larger competitor as margins continue to remain squeezed. Nobody wants to exit this business quickly, so prices are under ever greater pressure – especially since Android tablets are cheaper than laptops already – and smartphones can be had for free from the right wireless supplier.

It’s too late for Dell. The time to act was 5 years ago. Then Dell could have set up a team to explore the market for new solutions. Dell could have been the first to offer an Android phone or tablet – the company has plenty of smart folks who could experiment and figure it out. They could have championed the Zune, and created a download store for the product to compete with iPods and iTunes (the Zune is no longer supported by Microsoft.) But there were no resources, and no permission given to try changing the success formula.

As Chromebooks are launched (“The First Google Chromebooks are On Sale Now, Here’s Everything You Need to Know” BusinessInsider.com) Dell could have been the market leader, instead of Acer and Samsung. There’s even a chance that Dell might have blunted the huge market lead Apple created since 2005 if management had just created a team with the opportunity to really discover what people would do with these new solutions. There was a time a “strategic partnership” between Dell and Google could have been a big threat to Apple. But no longer.

Apple, which put its resources into pioneering new markets the last decade has seen its value explode many-fold. It’s value is over 10x Dell. Apple has enough cash to buy Dell outright. But why would it? Dell has become a niche player – and due to its lock-in to historical best practices and its old success formula has no opportunities to grow.

All companies risk becoming marginalized. Focusing on your core products, core technology vendors and core customers leads to blindness about the possibility of market shifts. You can work yourself to death, be focused and diligent, and remain dedicated to constant improvement — even excellence! But when markets shift it’s easy to become obsolete, and fall into margin killing price wars as growth stagnates. Just look at Dell. From darling to dog in just 10 years.

If you still own DELL, the recent price rise makes this a great time to SELL. Dell has no new products, and no idea how to move into new markets. It’s commitment to its core is a death knell. And without white space to do anything new, it can/t (and won’t) transform itself into a winner.

by Adam Hartung | Jun 8, 2011 | Current Affairs, In the Rapids, Innovation, Leadership, Web/Tech

Apple’s market value has struggled in 2011. When I ask people why, the overwhelming top 3 responses are:

- How can a company nearly bankrupt 10 years ago become the second most valuable company on the equity market?

- Apple has had a long run, isn’t it about to end?

- How can Apple be worth so much, when it has no “real” assets?

I’m struck by how these questions are based on looking backward, rather than looking into the future.

Firstly, it doesn’t matter where you start, but rather how well you run the race. What happened in the past is just that, the past. Changing technologies, products, solutions, customers, business practices, economic conditions and competitors cause markets to shift. When they shift, competitor positions change. The strong can remain strong, but it’s also possible for company’s fortunes to change drastically. Apple has taken advantage of market shifts – even created them – in order to change its fortunes. What investors should care about is the future.

Which leads to the second question; and the answer that there’s no reason to think Apple’s growth run will end any time soon. Perhaps Apple won’t maintain 100% annual growth forever, but it doesn’t have to grow at that rate to be a very valuable investment. And worth a lot more than the current value. That Apple can grow at 20% (or a lot more) for another several years is a very high probability bet:

- Apple’s growth markets are young, and the markets themselves are growing fast. Apple is not in a gladiator war to maintain old customers, but instead is creating new customers for digital/mobile entertainment, smartphones and mobile tablets. Because it is in high growth markets it’s odds of maintaining company growth are very good. Just look at the recent performance of iPad tablet sales, a market most analysts predicted would struggle against cheaper netbooks. Quarterly sales are blowing past early 2010 estimates of annual sales, and are 250% over last year (chart source Silicon Alley Insider):

- Apple’s products continue to improve. Apple is not resting upon its past success, but rather keeps adding new capability to its old offerings in order to migrate customers to its new platforms. At the recent developer’s conference,for example, Apple described how it was adding Twitter integration for enhanced social media to its platforms and introducing its own messenger service, bypassing 3rd party services (like SMS) and replacing competitive products like RIM’s BBM.

- Further, Apple is introducing new solutions like iCloud (TechStuffs.net “Apple iCloud Key Features and Price) offering free wireless synching between Apple platforms, free and seamless back-ups, and the ability to operate without a PC (even Mac flavor) if you want to be mobile-only (“The 10 Huge Things Apple Just Revealed” BusinessInsider.com). These solutions keep expanding the market for Apple sales into new markets – such as small businesses (Entrepreneur.com “What Lion Means for Small Business“) as it solves unmet needs ignored by historically powerful solutions providers, or offered at far too high a price.

Thirdly, investors wonder how a company can be worth so much without much in the way of “real” assets. The answer lies in understanding how the business world has shifted. In an industrial economy real assets – like land, building, machinery – was greatly valued. They were the means of production, and wealth generation. But we have transitioned to the information economy. Now the information around a business, and providing digital solutions, are worth considerably more than “real” assets.

How many closed manufacturing plants, retail stores or restaurants have you seen? How many real estate developers have shuttered? Contrarily, what’s the value of customer lists and customer access at companies like Amazon.com, GroupOn, Linked-In, Twitter and Facebook in today’s information economy? What’s the demand for printed books, and what’s the demand for ebooks (such as Kindle?) “Real” asset values are tumbling because they are easy to obtain, and owning them produces precious little value, or profit, in today’s globally competitive economy.

This same week that Apple announced a barrage of revenue-generating upgrades and new products asset rich Wal-Mart made an announcement as well. After a decade in which Apple’s value skyrocketed to over $330B (More than Microsoft and Intel Combined by the way), Wal-Mart’s value has gone nowhere, mired around $185B. Wal-Mart’s answer is to buy back it’s shares. The Board has authorized continuing and expanding a massive share buyback program of literally 1 million shares/day – 10% of all shares traded daily! The amount allocated is 1/6th the entire market cap! At this rate 24x7WallStreet.com headlined “Wal-Mart’s Buyback Plan Grows & Grows.. Could Take Itself Private by 2025.”

Share buybacks produce NO VALUE. They don’t produce any revenue, or profit. All they do is take company cash, and spend it to buy company shares. The asset (cash) is spent (removed) in the process of buying shares, which are then removed from the company’s equity. The company actually gets smaller, because it has less assets and less equity. (Compared to LInked-In, for example, that grew larger by selling shares and increasing its cash assets.) Over time the cash disappears, and the equity disappears. Eventually, you have no company left! Stock buybacks are an end of lifecycle investment, and should trigger great fear in investors as they demonstrate management has lost the ability to identify high-yield growth opportunities.

Wal-Mart is steeped in assets. It has land, buildings, stores, shelves, warehouses, trucks, huge computer systems. But these assets simply don’t produce a lot of profit, as competitors are squeezing margins every year. And there’s not much growth, because doing more of what it always did isn’t really wanted by a lot more people. So it has gobs of assets. So what? The assets simply aren’t worth a lot when the market doesn’t need any more retail stores; especially boring ones with limited product selection, limited imagination and nothing but “low price.”

Assets aren’t the “store of value” analysts gave them in an industrial economy, and it’s time we realize investing in “assets” is fraught with risk. Assets, like homes and autos have shown us, can go down in value even easier and faster than they can go up. Global competitors can match the assets, and drive down prices using cheap labor and operating by less onerous standards. In today’s market, assets are as likely to be an anchor on value as an asset.

I started 2011 saying Apple was a screaming buy. Today that’s even more true than it was then. Apple’s revenues, profits and cash flow are up. Sales in existing lines are still profitably growing at double (or triple) digit rates, and enhancements keep Apple in front of competitors. Meanwhile Apple is entering new markets every quarter, with solutions meeting existing, unmet needs. Because value has been stagnant, the value (price) to revenue, earnings and cash flow have all declined, making Apple cheaper than ever. It’s time to invest based on looking to the future, and not the past. Doing so means you buy Apple today, and start dumping asset intensive stocks like Wal-mart.

Update 12 June, 2011 – Chart from SeekingAlpha.com. Apple’s cash hoard grows faster than its valuation. When a company can grow cash flow and profits faster than revenues – and it’s doubling revenues – that’s a screaming buy!

by Adam Hartung | Jun 3, 2011 | Current Affairs, Defend & Extend, In the Rapids, In the Swamp, In the Whirlpool, Leadership, Lock-in, Web/Tech

Were you ever told “pretty is as pretty does?” This homily means “don’t just look at the surface, it’s the underlying qualities that matter.” When I read analyst reviews of companies I’m often struck by how fascinated they are with the surface, and how weakly they seem to understand the underlying markets. Financials are a RESULT of management’s ability to provide competitive solutions, and no study of financials will give investors a true picture of management or the company’s future prospects.

The good:

Everyone should own Apple. The list of its market successes are clear, and well detailed at SeekingAlpha.com “Apple: The Most Undervalued Equity in Techdom.” The reason you should own Apple isn’t its past performance, but rather that the company has built a management team completely focused on the future. Apple is using scenario planning to create solutions that fit the way people want to work and live – not how they did things in the past.

And Apple managers are obsessive about staying ahead of competitors with better solutions that introduce new technologies, and higher levels of user productivity. By constantly being willing to disrupt the old ways of doing things, Apple keeps bringing better solutions to market via its ongoing investment in teams dedicated to developing new solutions and figuring out how they will adapt to fit unmet needs. And this isn’t just a “Steve Jobs thing” as the company’s entire success formula is built on the ability to plan for the future, and outperform competitors. We are seeing this now with the impending launch of iCloud (Marketwatch.com “Could Apple Still Surprise at Its Conference?“)

For nearly inexplicable reasons, many investors (and analysts) have not been optimistic about Apple’s future price. The company’s earnings have grown so fast that a mere fear of a slow-down has caused investors to retrench, expecting some sort of inexplicable collapse. Analysts look for creative negatives, like a recent financial analyst told me “Apple is second in value only to ExxonMobile, and I’m just not sure how to get my mind around that. Is it possible growth could be worth that much? I thought value was tied to assets.”

Uh, yes, growth is worth that much! Apple’s been growing at 100%. Perhaps it won’t continue to grow at that breakneck pace (or perhaps it will, there’s no competitor right now blocking its path), but even if it slows by 75% we’re still talking 25% growth – and that creates enormous value (compounded, 25% growth doubles your investment in 3 years.) When you find profitable growth from a company designed to repeat itself with new market introductions, you have a beautiful thing! And that’s a good investment.

Similarly, investors should really like Netflix. Netflix did what almost nobody does. It overcame fears of cannibalizing its base business (renting DVDs via mail-order) and introduced a streaming download service. Analysts decried this move, fearing that “digital sales would be far lower than physical sales.” But Netflix, with its focus firmly on the future and not the past, recognized that emerging competitors (like Hulu) were quickly changing the game. Their objective had to be to go where the market was heading, rather than trying to preserve an historical market destined to shrink. That sort of management thinking is a beautiful thing, and it has paid off enormously for Netflix.

Of course, those who look only at the surface worry about the pricing model at Netflix. They mostly worry that competitors will gore the Netflix digital ox. But what we can see is that the big competitors these analysts trot out for fear mongering – Wal-Mart, Amazon.com and Comcast – are locked-in to historical approaches, and not aggressively taking on Netflix. When you look at who has the #1 market position, the eyes and ears of customers, the subscriber/customer base and the delivery solution customers love you have to be excited about Netflix. After all, they are the leaders in a market that we know is going to shift their way – downloads. Sort of reminds you of Apple when they brought out the iPod and iTunes, doesn’t it?

The bad:

Google has been a great company. The internet wouldn’t be the internet if we didn’t have Google, the search engine that made the web easy and fast to use, plus gave us the ads making all of that search (and lots of content) free. But, the company has failed to deliver on its own innovations. Android is a huge market success, but unfortunately lock-in to its old mindset led Google to give the product away – just a tad underpriced. Other products, like Wave were great, but there hasn’t been enough White Space available for the products to develop into commercial successes. And we’ve all recently read how it happened that Google missed the emergence of social media, now positioning Facebook as a threaten to their long-term viability (AllThingsD.com “Schmidt Says Google’s Social Networking Problem is His Fault.“)

Chrome, Chromebooks and Google Wallet could be big winners. And there’s a new CEO in place who promises to move Google beyond its past glory. But these are highly competitive markets, Google isn’t first, it’s technology advantages aren’t as clear cut as in the old search days (PCWorld.com “Google Wallet Isn’t the Only Mobile POS Tool.”) Whether Google will regain its past glory depends on whether the company can overcome its dedication to its old success formula and actually disrupt its internal processes enough to take the lead with disruptive marketplace products.

Cisco is in a similar situation. A great innovator who’s products put us all on the web, and made us wi-fi addicted. But markets are shifting as people change their needs for costly internal networks, moving to the cloud, and other competitors (like NetApp) are the game changers in the new market. Cisco’s efforts to enter new markets have been fragmented, poorly managed, and largely ineffective as it spent too much energy focused on historical markets. Emblematic was the abandoned effort to enter consumer markets with the Flip camera, where its inability to connect with fast shifting market needs led to the product line shutdown and a loss of the entire investment (BusinessInsider.com “Cisco Kills the Flip Camera.”)

Cisco’s value is tied not to its historical market, but its ability to develop new ones. Even when they likely cannibalize old products. HIstorically Cisco did this well. But as customers move to the cloud it’s still not clear what Cisco will do to remain an industry leader. Whether Google and Cisco will ever be good investments again doesn’t look too good, today. Maybe. But only if they realign their investments and put in place teams dedicated to new, growth markets.

The ugly:

Another homily goes “beauty may be on the surface, but ugly goes clear to the bone.” Meaning? For something to be ugly, it has to be deeply flawed inside. And that’s the situation at Research in Motion and Microsoft. Optimistic investors describe both of these companies as potential “value stocks” that will find a way to “protect the installed base as an economic recovery develops” and “sell their products cheaply in developing countries that can’t afford new solutions” eventually leading to high dividend payouts as they milk old businesses. Right. That won’t happen, because these companies are on a self-destructive course to preserve lost markets which will eat up resources and leave them shells of their former selves.

Both companies were wildly successful. Both once had near-monopolies in their markets. But in both cases, the organizations became obsessed with defending and extending sales to their “core” or “base” customers using “core” technologies and products. This internal focus, and desire to follow best practices, led them to overspending on what worked in the past, while the market shifted away from them.

At RIMM the market has moved from enterprise servers and secure enterprise applications to local apps that access data via the cloud. People have moved from PCs to smartphones (and tablets) that allow them to do even more than they could do on old devices, and RIM’s devotion to its historical business base caused the company to miss the shift. Blackberry and Playbook have 1/10th the apps of leaders Apple and Android (at best) and are rapidly being competitively outrun.

Likewise, Microsoft has offered the market nothing new when it comes to emerging markets and unmet user needs as it has invested billions of dollars trying to preserve its traditional PC marketplace. Vista, Windows 7 and Office 2010 all missed the fact that users were going off the PC, and toward new solutions for personal productivity. Now the company is trying to play catch-up with its Skype acquisition, Nokia partnership (where sales are in a record, multi-year slide; SeekingAlpha.com “Nokia Deluged with Downgrades“) and a planned launch of Windows 8. Only they are against ferocious competition that has developed an enormous market lead, using lower cost technologies, and keep offering innovations that are driving additional market shift.

Companies that plan for the future, keep their eyes firmly focused on unmet needs and alternative competitors, and that accept and implement disruptions via internal teams with permission to be game-changers are the winners. They are good investments.

Big winners that keep seeking new opportunities, but fall into over-reliance (and focus) on historical markets and customers can move from being good investments to bad ones. They have to change their planning and competitive analysis, and start attacking old notions about their business to free up resources for doing new things. They can return to greatness, but only if they recognize market shifts and move aggressively to develop solutions for emerging needs in new markets.

It gets ugly when companies lose their ability to see external market shifts because they are inwardly focused (inside their organizations, and inside their historical customer base or supply chain.) Their market sensing disappears, and their investments become committed on trying to defend old businesses in the face of changes far beyond their control. Their internal biases cause reduction of shareholder value as they spend money on acquisitions and new products that have negative rates of return in their overly-optimistic effort to regain past glory. Those situations almost never return to former beauty, as ugly internal processes lock them into repeating past behaviors even when its clear they need an entirely new approach to succeed.

by Adam Hartung | May 25, 2011 | Defend & Extend, Disruptions, In the Swamp, Innovation, Leadership, Lock-in, Openness, Transparency, Web/Tech

Nobody admits to being the innovation killer in a company. But we know they exist. Some these folks “dinosaurs that won’t change.” Others blame “the nay-saying ‘Dr. No’ middle managers.” But when you meet these people, they won’t admit to being innovation killers. They believe, deep in their hearts as well as in their everyday actions, that they are doing the right thing for the business. And that’s because they’ve been chosen, and reinforced, to be the Status Quo Police.

When a company starts it has no norms. But as it succeeds, in order to grow quickly it develops a series of “key success factors” that help it continue growing. In order to grow faster, managers – often in functional roles – are assigned the task of making sure the key success factors are unwaveringly supported. Consistency becomes more important than creativity. And these managers are reinforced, supported, even bonused for their ability to make sure they maintain the status quo. Even if the market has shifted, they don’t shift. They reinforce doing things according to the rules. Just consider:

Quality – Who can argue with the need to have quality? Total Quality Management (TQM,) Continuous Improvement (CI,) and Six Sigma programs all have been glorified by companies hoping to improve product or service quality. If you’re trying to fix a broken product, or process, these work pretty well at helping everyone do their job better.

But these programs live with the mantra “if you can’t measure it, you can’t improve it. Measure everything that’s important.” If you’re innovating, what do you measure? If you’re in a new technology, or manufacturing process, how do you know what you really need to do right? If you’re in a new market, how do you know the key metric for sales success? Is it number of customers called, time with customers, number of customer surveys, recommendation scores, lost sales reports? When you’re trying to do something new, a lot of what you do is respond quickly to instant feedback – whether it’s good feedback or bad.

The key to success isn’t to have critical metrics and measure performance on a graph, but rather to learn from everything you do – and usually to change. Quality people hate this, and can only stand in the way of trying anything new because you don’t know what to measure, or what constitutes a “good” measure. Don’t ever forget that Motorola pretty much invented Six Sigma, and what happened to them in the mobile phone business they pioneered?

Finance. All businesses exist to make money, so who can argue with “show me the numbers. Give me a business plan that shows me how you’re going to make money.” When your’e making an incremental investment to an existing asset or process, this is pretty good advice.

But when you’re innovating, what you don’t know far exceeds what you know. You don’t know how to meet unment needs. You don’t know the market size, the price that people will pay, the first year’s volume (much less year 5,) the direct cost at various volumes, the indirect cost, the cost of marketing to obtain customer attention, the number of sales calls it will take to land a sale, how many solution revisions will be necessary to finally put out the “right” solution, or how sales will ramp up quarterly from nothing. So to create a business plan, you have to guess.

And, oh boy, then it gets ugly. “Where did this number come from? That one? How did you determine that?” It’s not long until the poor business plan writer is ridden out of the meeting on a rail. He has no money to investigate the market, so he can’t obtain any “real” numbers, so the business plan process leads to ongoing investment in the old business, while innovation simply stalls.

Under Akia Morita Sony was a great innovator. But then an MBA skilled in finance took over the top spot. What once was the #1 electronics innovator in the globe has become, well, let’s say they aren’t Apple.

Legal – No company wants to be sued, or take on unnecessary risk. And when you’re selling something, lawyers are pretty good at evaluating the risk in that business, and lowering the risk. While making sure that all the compliance issues are met in order to keep regulators – and other lawyers – out of the business.

But when you’re starting something new, everything looks risky. Customers can sue you for any reason. Suppliers can sue you for not taking product, or using it incorrectly. The technology could fail, or have negative use repercussions. Reguators can question your safety standards, or claims to customers.

From a legal point of view, you’re best to never do anything new. The less new things you do, the less likely you are to make a mistake. So legal’s great at putting up roadblocks to make sure they protect the company from lawsuits, by making sure nothing really new happens. The old General Motors had plenty of lawyers making sure their cars were never too risky – or interesting.

R&D or Product Development – Who doesn’t think it’s good to be a leader in a specific technology? Technology advances have proven invaluable for companies in industries from computers to pharmaceuticals to tractors and even services like on-line banking. Thus R&D and Product Development wants to make sure investments advance the state of the technology upon which the company was built.

But all technologies become obsolete. Or, at least unprofitable. Innovators are frequently on the front end of adopting new technologies. But if they have to obtain buy-in from product development to obtain staffing or money they’ll be at the end of a never-ending line of projects to sustain the existing development trend. You don’t have to look much further than Microsoft to find a company that is great at pouring money into the PC platform (some $9B, 16% of revenue in 2009,) while the market moves faster each year to mobile devices and entertainment (Apple spent 1/8th the Microsoft budget in 2009.)

Sales, Marketing & Distribution – When you want to protect sales to existing customers, or maybe increase them by 5%, then doing more of what you’ve always done is smart. So money is spent to put more salespeople on key accounts, add more money to the advertising budget for the most successful (or most profitable) existing products. There are more rules about using the brand than lighters at a smoker’s convention. And it’s heresy to recommend endangering the distribution channel that has so successfully helped increase sales.

But innovators regularly need to behave differently. They need to sell to different people – Xerox sold to secretaries while printing press manufacturers sold to printers. The “brand” may well represent a bygone era, and be of no value to someone launching a new product; are you eager to buy a Zenith electronic device? Sprucing up the brand, or even launching something new, may well be a requirement for a new solution to be taken seriously.

And often, to be successful, a new solution needs to cut through the old, high-cost distribution system directly to customers if it is to succeed. Pre-Gerstner IBM kept adding key account sales people in hopes of keeping IT departments from switching out of mainframes to PCs. Sears avoided the shift to on-line sales successfully – and revenue keeps dropping in the stores.

Information Technology – To make more money you automate more functions. Computers are wonderful for reducing manpower in many tasks. So IT implements and supports “standard solutions” that are cost effective for the historical business. Likewise, they set up all kinds of user rules – like don’t go to Facebook or web sites from work – to keep people focused on productivity. And to make sure historical data is secure and regulations are met.

But innovators don’t have a solution mapped out, and all that automated functionality is an enormously expensive headache. When being creative, more time is spent looking for something new than trying to work faster, or harder, so access to more external information is required. Since the solution isn’t developed, there’s precious little to worry about keeping secure. Innovators need to use new tools, and have flexibility to discover advantageous ways to use them, that are far beyond the bounds of IT’s comfort zone.

Newspapers are loaded with automated systems to collect and edit news, to enter display ads, and to “Make up” the printed page fast and cheap. They have automated systems for classified advertising sales and billing, and for display ad billing. And systems to manage subscribers. That technology isn’t very helpful now, however, as newspapers go bankrupt. Now the most critical IT skills are pumping news to the internet in real-time, and managing on-line ads distributed to web users that don’t have subscriptions.

Human Resources – Growth pushes companies toward tighter job descriptions with clear standards for “the kinds of people that succeed around here.” When you want to hire people to be productive at an existing job, HR has the procedures to define the role, find the people and hire them at the most efficient cost. And they can develop a systematic compensation plan that treats everyone “fairly” based upon perceived value to the historical business.

But innovators don’t know what kinds of people will be most successful. Often they need folks who think laterally, across lots fo tasks, rather than deeply about something narrow. Often they need people who are from different backgrounds, that are closer to the emerging market than the historical business. And pay has to be related to what these folks can get in the market, not what seems fair through the lens of the historical business. HR is rarely keen to staff up a new business opportunity with a lot of misfits who don’t appreciate their compensation plan – or the rules so carefully created to circumscribe behavior around the old business.

B.Dalton was America’s largest retail book seller when Amazon.com was founded by Jeff Bezos. Jeff knew nothing about books, but he knew the internet. B.Dalton knew about books, and claimed it knew what book buyers wanted. Two years later B.Dalton went bankrupt, and all those book experts became unemployed. Amazon.com now sells a lot more than books, as it ongoingly and rapidly expands its employee skill sets to enter new markets – like publishing and eReaders.

Innovation requires that leaders ATTACK the Status Quo Police. Everything done to efficiently run the old business is irrelevant when it comes to innovation. Functional folks need to be told they can’t force the innovatoirs to conform to old rules, because that’s exactly why the company needs innovation! Only by attacking the old rules, and being willing to allow both diversity and disruption can the business innovate.

Instead of saying “this isn’t how we do things around here” it is critical leaders make sure functional folks are saying “how can I help you innovate?” What was done in the name of “good business” looks backward – not forward. Status Quo cops have to be removed from the scene – kept from stopping innovation dead in its tracks. And if the internal folks can’t be supportive, that means keeping them out of the innovator’s way entirely.

Any company can innovate. Doing so requires recognizing that the Status Quo Police are doing what they were hired to do. Until you take away their clout, attack their role and stop them from forcing conformance to old dictums, the business can’t hope to innovate.

by Adam Hartung | May 16, 2011 | Defend & Extend, In the Swamp, Leadership, Lifecycle, Lock-in, Web/Tech

In “Screening Large Cap Value Stocks” 24x7WallSt.com tries making the investment case for Dell. And backhandedly, for Hewlett Packard. The argument is as simple as both companies were once growing, but growth slowed and now they are more mature companies migrating from products into services. They have mounds of cash, and will soon start paying a big, fat dividend. So investors can rest comfortably that these big companies are a good value, sitting on big businesses, and less risky than growth stocks.

Nice story. Makes for good myth. Reality is that these companies are a lousy value, and very risky.

Dell grew remarkably fast during the PC growth heyday. Dell innovated computer sales, eschewing expensive distribution for direct-to-customer marketing and order-taking. Dell could sell individuals, or corporations, computers off-the-shelf or custom designed machines in minutes, delivered in days. Further, Dell eschewed the costly product development of competitors like Compaq in favor of using a limited number of component suppliers (Microsoft, Intel, etc.) and focusing on assembly. With Wal-Mart style supply chain execution Dell could deliver a custom order and be paid before the bill was due for parts. Quickly Dell was a money-making, high growth machine as it rode the growth of PC sales expansion.

But competitors learned to match Dell’s supply chain cost-cutting capabilities. Manufacturers teamed with retailers like Best Buy to lower distribution cost. As competition copied the use of common components product differences disappeared and prices dropped every month. Dell’s advantages started disappearing, and as they continued to follow the historical cost-cutting success formula with more outsourcing, problems developed across customer services. Competitors wreaked havoc on Dell’s success formula, hurting revenue growth and margins.

HP followed a similar path, chasing Dell down the cost curve and expanding distribution. To gain volume, in hopes that it would create “scale advantages,” HP acquired Compaq. But the longer HP poured printer profits into PCs, the more it fed the price war between the two big companies.

Worst for both, the market started shifting. People bought fewer PCs. Saturation developed, and reasons to buy new ones were few. Users began buying more smartphones, and later tablets. And neither Dell nor HP had any products in development where the market was headed, nor did their “core” suppliers – Microsoft or Intel.

That’s when management started focusing on how to defend and extend the historical business, rather than enter growth markets. Rather than moving rapidly to push suppliers into new products the market wanted, both extended by acquiring large consulting businesses (Dell famously bought Perot Systems and HP bought EDS) in the hopes they could defend their PC installed base and create future sales. Both wanted to do more of what they had always done, rather than shift with emerging market needs.

But not only product sales were stagnating. Services were becoming more intensely competitive – from domestic and offshore services providers – hampering sales growth while driving down margins. Hopes of regaining growth in the “core” business – especially in the “core” enterprise markets – were proving illusory. Buyers didn’t want more PCs, or more PC services. They wanted (and now want) new solutions, and neither Dell nor HP is offering them.

So the big “cash hoard” that 24×7 would like investors to think will become dividends is frittered away by company leadership – spent on acquisitions, or “special projects,” intended to save the “core” business. When allocating resources, forecasts are manipulated to make defensive investments look better than realistic. Then the “business necessity” argument is trotted out to explain why acquisitions, or price reductions, are necessary to remain viable, against competitors, even when “the numbers” are hard to justify – or don’t even add up to investor gains. Instead of investing in growth, money is spent trying to delay the market shift.

Take for example Microsoft’s recent acquisition of Skype for $8.5B. As Arstechnia.com headlined “Why Skype?” This acquisition is another really expensive effort by Microsoft to try keeping people using PCs. Even though Microsoft Live has been in the market for years, Microsoft keeps trying to find ways to invest in what it knows – PCs – rather than invest in solutions where the market is shifting. New smartphone/tablet products come with video capability, and are already hooked into networks. Skype is the old generation technology, now purchased for an enormous sum in an effort to defend and extend the historical base.

There is no doubt people are quickly shifting toward smartphones and tablets rather than PCs. This is an irreversable trend:  Chart source BusinessInsider.com

Chart source BusinessInsider.com

Executive teams locked-in to defending their past spend resources over-investing in the old market, hoping they can somehow keep people from shifting. Meanwhile competitors keep bringing out new solutions that make the old obsolete. While Microsoft was betting big on Skype last week Mediapost.com headlined “Google Pushes Chromebook Notebooks.” In a direct attack on the “core” customers of Dell and HP (and Microsoft) Google is offering a product to replace the PC that is far cheaper, easier to use, has fewer breakdowns and higher user satisfaction.

Chromebooks don’t have to replace all PCs, or even a majority, to be horrific for Dell and HP. They just have to keep sucking off all the growth. Even a few percentage points in the market throws the historical competitors into further price warring trying to maintain PC revenues – thus further depleting that cash hoard. While the old gladiators stand in the colliseum, swinging axes at each other becoming increasingly bloody waiting for one to die, the emerging competitors avoid the bloodbath by bringing out new products creating incremental growth.

People love to believe in “value stocks.” It sounds so appealing. They will roll along, making money, paying dividends. But there really is no such thing. New competitors pressure sales, and beat down margins. Markets shift wtih new solutions, leaving fewer customers buying what all the old competitors are selling, further driving down margins. And internal decision mechanisms keep leadership spending money trying to defend old customers, defend old solutions, by making investments and acquisitions into defensive products extending the business but that really have no growth, creating declining margins and simply sucking away all that cash. Long before investors have a chance to get those dreamed-of dividends.

This isn’t just a high-tech story. GM dominated autos, but frittered away its cash for 30 years before going bankrupt. Sears once dominated retailing, now its an irrelevent player using its cash to preserve declining revenues (did you know Woolworth’s was a Dow Jones company until 1997?). AIG kept writing riskier insurance to maintain its position, until it would have failed if not for a buyout. Kodak never quit investing in film (remember 110 cameras? Ektachrome) until competitors made film obsolete. Xerox was the “copier company” long after users switched to desktop publishing and now paperless offices.

All of these were once called “value investments.” However, all were really traps. Although Dell’s stock has gyrated wildly for the last decade, investors have lost money as the stock has gone from $25 to $15. HP investors have fared a bit better, but the long-term trending has only had the company move from about $40 to $45. Dell and HP keep investing cash in trying to find past glory in old markets, but customers shift to the new market and money is wasted.

When companies stop growing, it’s because markets shift. After markets shift, there isn’t any value left. And management efforts to defend the old success formula with investments in extensions simply fritter away investor money. That’s why they are really value traps. They are actually risky investments, because without growth there is little likelihood investors will ever see a higher stock price, and eventually they always collapse – it’s just a matter of when. Meanwhile, riding the swings up and down is best left for day traders – and you sure don’t want to be long the stock when the final downturn hits.

by Adam Hartung | May 10, 2011 | Current Affairs, In the Whirlpool, Innovation, Leadership, Lifecycle

Sears is threatening to move its headquarters out of the Chicago area. It’s been in Chicago since the 1880s. Now the company Chairman is threatening to move its headquarters to another state, in order to find lower operating costs and lower taxes.

Predictably “Officals Scrambling to Keep Sears in Illinois” is the Chicago Tribune headlined. That is stupid. Let Sears go. Giving Sears subsidies would be tantamount to putting a 95 year old alcoholic, smoking paraplegic at the top of the heart/lung transplant list! When it comes to subsidies, triage is the most important thing to keep in mind. And honestly, Sears ain’t worth trying to save (even if subsidies could potentially do it!)

“Fast Eddie Lampert” was the hedge fund manager who created Sears Holdings by using his takeover of bankrupt KMart to acquire the former Sears in 2003. Although he was nothing more than a financier and arbitrager, Mr. Lampert claimed he was a retailing genius, having “turned around” Auto Zone. And he promised to turn around the ailing Sears. In his corner he had the modern “Mad Money” screaming investor advocate, Jim Cramer, who endorsed Mr. Lampert because…… the two were once in college togehter. Mr. Cramer promised investors would do well, because he was simply sure Mr. Lampert was smart. Even if he didn’t have a plan for fixing the company.

Sears had once been a retailing goliath, the originator of home shopping with the famous Sears catalogue, and a pioneer in financing purchases. At one time you could obtain all your insurance, banking and brokerage needs at a Sears, while buying clothes, tools and appliances. An innovator, Sears for many years was part of the Dow Jones Industrial Average. But the world had shifted, Home Depot displaced Sears on the DJIA, and the company’s profits and revenues sagged as competitors picked apart the product lines and locations.

Simultaneously KMart had been destroyed by the faster moving and more aggressive Wal-Mart. Wal-Mart’s cost were lower, and its prices lower. Even though KMart had pioneered discount retailing, it could not compete with the fast growing, low cost Wal-Mart. When its bonds were worth pennies, Mr. Lampert bought them and took over the money-losing company.

By combining two losers, Mr. Lampert promised he would make a winner. How, nobody knew. There was no plan to change either chain. Just a claim that both were “great brands” that had within them other “great brands” like Martha Stewart (started before she was convicted and sent to jail), Craftsman and Kenmore. And there was a lot of real estate. Somehow, all those assets simlply had to be worth more than the market value. At least that’s what Mr. Lampert said, and people were ready to believe. And if they had doubts, they could listen to Jim Cramer during his daily Howard Beale impersonation.

Only they all were wrong.

Retailing had shifted. Smarter competitors were everywhere. Wal-Mart, Target, Dollar General, Home Depot, Best Buy, Kohl’s, JCPenney, Harbor Freight Tools, Amazon.com and a plethora of other compeltitors had changed the retail market forever. Likewise, manufacturers in apparel, appliances and tools had brough forward better products at better prices. And financing was now readily available from credit card companies.

Surely the real estate would be worth a fortune everyone thought. After all, there was so much of it. And there would never be too much retail space. And real estate never went down in value. At least, that’s what everyone said.

But they were wrong. Real estate was at historic highs compared to income, and ability to pay. Real estate was about to crater. And hardest hit in the commercial market was retail space, as the “great recession” wiped out home values, killed personal credit lines, and wiped out disposable income. Additionally, consumers increasingly were buying on-line instead of trudging off to stores fueling growth at Amazon and its peers rather than Sears – which had no on-line presence.

Those who were optimistic for Sears were looking backward. What had once been valuable they felt surely must be valuable again. But those looking forward could see that market shifts had rendered both KMart and Sears obsolete. They were uncompetitive in an increasingly more competitive marketplace. As competitors kept working harder, doing more, better, faster and cheaper Sears was not even in the game. The merger only made the likelihood of failure greater, because it made the scale fo change even greater.

The results since 2003 have been abysmal. Sales per store, a key retail benchmark, have declined every quarter since Mr. Lampert took over. In an effort to prove his financial acumen, Mr. Lampert led the charge for lower costs. And slash his management team did – cutting jobs at stores, in merchandising and everywhere. Stores were closed every quarter in an effort to keep cutting costs. All Mr. Lampert discussed were earnings, which he kept trying to keep from disintegrating. But with every quarter Sears has become smaller, and smaller. Now, Crains Chicago Business headlined, even the (in)famous chairman has to admit his past failure “Sears Chief Lampert: We Ought to be Doing a Lot Better.”

Sears once built, and owned, America’s tallest structure. But long ago Sears left the Sears Tower. Now it’s called the Willis Tower by the way – there is no Sears Tower any longer. Sears headquarters are offices in suburban Hoffman Estates, and are half empty. Eighty percent of the apparel merchandisers were let go in a recent move, taking that group to California where the outcome has been no better. Constant cost cutting does that. Makes you smaller, and less viable.

And now Sears is, well….. who cares? Do you even know where the closest Sears or Kmart store is to you? Do you know what they sell? Do you know the comparative prices? Do you know what products they carry? Do you know if they have any unique products, or value proposition? Do you know anyone who works at Sears? Or shops there? If the store nearest you closed, would you miss it amidst the Home Depot, Kohl’s or Best Buy competitors? If all Sears stores closed – every single location – would you care?

And now Illinois is considering giving this company subsidies to keep the headquarters here?

Here’s an alternative idea. Using whatever logic the state leaders can develop, using whatever dream scenario and whatever desperation economics they have in mind to save a handful of jobs, figure out what the subsidy might be. Then invest it in Groupon. Groupon is currently the most famous technology start-up in Illinois. Over the next 10 years the Groupon investment just might create a few thousand jobs, and return a nice bit of loot to the state treasury. The Sears money will be gone, and Sears is going to disappear anyway. Really, if you want to give a subsidy, if you want to “double down,” why not bet on a winner?

It really doesn’t have to be Groupon. The state residents will be much better off if the money goes into any business that is growing. Investing in the dying horse simply makes no sense. Beg Amazon, Google or Apple to open a center in Illinois – give them the building for free if you must. At least those will be jobs that won’t disappear. Or invest the money into venture funds that can invest in the next biotech or other company that might become a Groupon. Invest in senior design projects from engineering students at the University of Illinois in Chicago or Urbana/Champaign. Invest in the fillies that have a chance of winning the race!

Sentimenatality isn’t bad. We all deserve the right to “remember the good old days.” But don’t invest your retirement fund, or state tax receipts, in sentimentality. That’s how you end up like Detroit. Instead put that money into things that will grow. So you can be more like silicon valley. Invest in businesses that take advantage of market shifts, and leverage big trends to grow. Let go of sentimentality. And let go of Sears. Before it makes you bankrupt!

by Adam Hartung | May 3, 2011 | Current Affairs, Defend & Extend, In the Swamp, Leadership, Lock-in, Web/Tech

For the first time in 20 years, Apple’s quarterly profit exceeded Microsoft’s (see BusinessWeek.com “Microsoft’s Net Falls Below Apple As iPad Eats Into Sales.) Thus, on the face of things, the companies should be roughly equally valued. But they aren’t. This week Microsoft’s market capitalization is about $215B, while Apple’s is about $365B – about 70% higher. The difference is, of course, growth – and how a lack of it changes management!

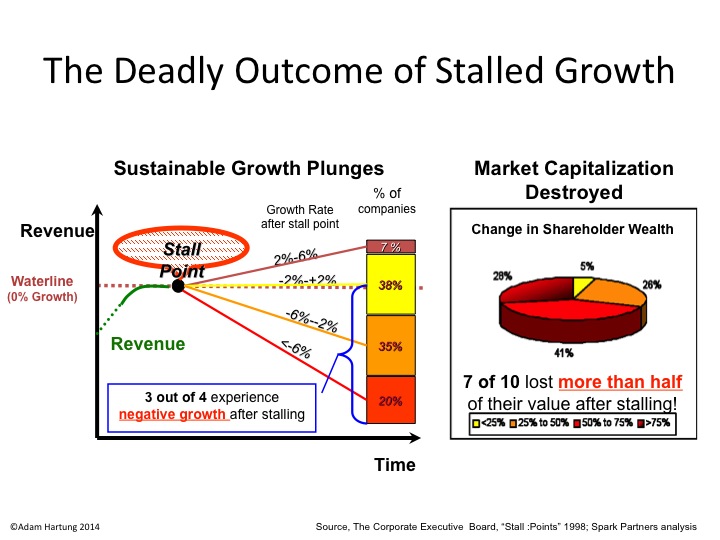

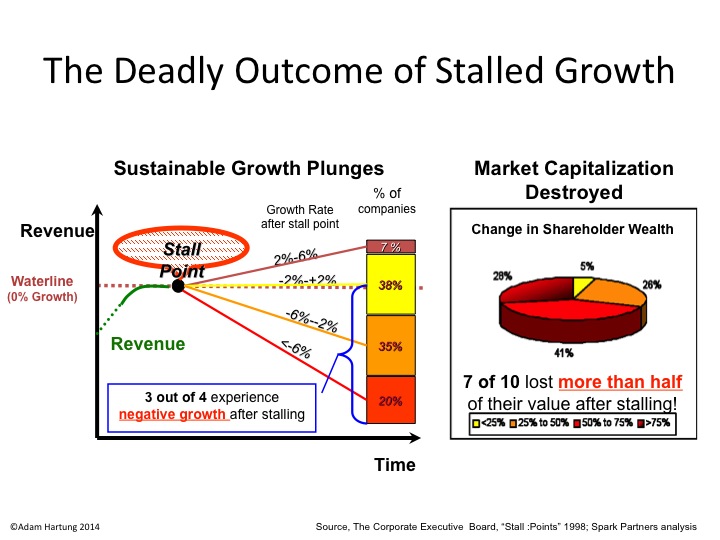

According to the Conference Board, growth stalls are deadly.

When companies hit a growth stall, 93% of the time they are unable to maintain even a 2% growth rate. 75% fall into a no growth, or declining revenue environment, and 70% of them will lose at least half their market capitalization. That’s because the market has shifted, and the business is no longer selling what customers really want.

At Microsoft, we see a company that has been completely unable to deal with the market shift toward smartphones and tablets:

- Consumer PC shipments dropped 8% last quarter

- Netbook sales plunged 40%

Quite simply, when revenues stall earnings become meaningless. Even though Microsoft earnings were up, it wasn’t because they are selling what customers really want to buy. In stalled companies, executives cut costs in sales, marketing, new product development and outsource like crazy in order to prop up earnings. They can outsource many functions. And they go to the reservoir of accounting rules to restate depreciation and expenses, delaying expenses while working to accelerate revenue recognition.

Stalled company management will tout earnings growth, even though revenues are flat or declining. But smart investors know this effort to “manufacture earnings” does not create long-term value. They want “real” earnings created by selling products customers desire; that create incremental, new demand. Success doesn’t come from wringing a few coins out of a declining market – but rather from being in markets where people prefer the new solutions.

Mobile phone sales increased 20% (according to IDC), and Apple achieved 14% market share – #3 – in USA (according to MediaPost.com) last quarter. And in this business, Apple is taking the lion’s share of the profits:

Image provided by BusinessInsider.com

When companies are growing, investors like that they pump earnings (and cash) back into growth opportunities. Investors benefit because their value compounds. In a stalled company investors would be better off if the company paid out all their earnings in dividends – so investors could invest in the growth markets.

But, of course, stalled companies like Microsoft and Research in Motion, don’t do that. Because they spend their cash trying to defend the old business. Trying to fight off the market shift. At Microsoft, money is poured into trying to protect the PC business, even as the trend to new solutions is obvious. Microsoft spent 8 times as much on R&D in 2009 as Apple – and all investors received was updates to the old operating system and office automation products. That generated almost no incremental demand. While revenue is stalling, costs are rising.

At Gurufocus.com the argument is made “Microsoft Q3 2011: Priced for Failure“. Author Alex Morris contends that because Microsoft is unlikely to fail this year, it is underpriced. Actually, all we need to know is that Microsoft is unlikely to grow. Its cost to defend the old business is too high in the face of market shifts, and the money being spent to defend Microsoft will not go to investors – will not yield a positive rate of return – so investors are smart to get out now!

Additionally, Microsoft’s cost to extend its business into other markets where it enters far too late is wildly unprofitable. Take for example search and other on-line products:

Chart source BusinessInsider.com