by Adam Hartung | Mar 15, 2011 | Defend & Extend, In the Rapids, Innovation, Leadership, Openness, Web/Tech

You gotta love the revenue growth in companies like Apple and Google. From 2000 to 2010 Apple revenues jumped from $8B to $65B. Google grew from nothing to $29B. But for some organizations, amidst market shifts, simply maintaining revenues is an enormous challenge.

In a dynamic world, many companies are losing revenues to new competitors who seem on a suicide mission to destroy industry profitability! In this situation, the ability to grow takes on an entirely different flavor. As “core” markets retract (in revenues or profits,) can the company find a way to enter new markets in order to maintain revenues – and possibly grow profits? For many organizations, facing radical market shifts, moving from no-growth, declining profit markets into higher growth, better profit markets is a huge challenge.

Recall that IBM once completely dominated the computer industry. An IBM skunk works program in Florida is credited for creating the modern day personal computer – and because of the team’s decision to use external componentry (an IBM heresy at the time) creating Microsoft. As the market shifted toward these smaller computers, IBM focused on defending its traditional mainframe base, eschewing PC sales entirely. By the 1990s IBM was almost bankrupt! In trying to preserve its old, “core,” mainframe business IBM completely missed the market shift and waited until its customers started disappearing before taking action. But by then new competitors had claimed the new market!

In came an outsider, Louis Gerstner, who saw the trend toward far greater user of external services by people in information technology. He pushed IBM from being a “hardware” company to an “IT services” provider (overly simplified explanation, to be sure) and IBM roared back as a tremendous turnaround success story.

But, what would be next? As Mr. Gerstner left IBM the company’s “core” market was in for another huge upheaval. Vast armies of IT consultants had been created in other companies, such as Electronic Data Systems (EDS), Computer Sciences Corporation (CSC) and audit firms such as Anderson (now named Accenture) Coopers & Lybrand and Deloitte & Touche. This created rampant competition and margin pressures from so much capacity.

Simultaneously, the emergence of similar armies, often even more highly trained, of consultants in India at companies such as Tata Consultancy Services (TCS) and Infosys – at dramatically lower cost and using development standards such as the Capability Maturity Model – was further transforming the landscape of service providers. More and more services contracts were going to these new competitors in foreign countries at prices a fraction of historical rates. Domestic margins were tanking!

As IT integration and services lost its margin several big competitors began paying enormous premiums to buy customer computer shops, completely taking them over customer via a new approach called “outsourcing” – a solution offering that nearly bankrupted EDS due to the razor thin margins. The market IBM entered to save itself, and make Mr. Gerstner famous, was no longer capable of keeping IBM a profitably growing concern.

In 2002 it was by no means clear whether IBM would remain successful, or end up again in dire straights. But, as detailed in Fortune’s CNNMoney web site, “IBM’s Sam Palmisano: A Super Second Act” things haven’t gone too badly for IBM this decade as profits have grown 4 fold.

Rather than simply trying to do more of what Mr. Gerstner did, Mr. Palmisano lead IBM into developing a new scenario of the future, leading to the birth of the Smarter Planet program. Not dissimilar from how Steve Jobs used Apple’s scenario planning to push the company from Macs into new growth product markets, the scenario planning such as Smarter Planet opened many doors for new business opportunities at IBM. The result has been a dramatic increase (well more than doubling) its more profitable software sales, as well as development of new solutions for everything from global banking to transportation management, government systems and a whole lot more. New solutions driven by the desire to fulfill the future scenario – and solutions that are considerably more profitable than the gladiator war that had become IT services.

Using scenario planning to create White Space where employees can develop new solutions is a hallmark of successful companies. By redirecting resources away from defensive activities, new solutions can be created before the proverbial roof collapses in the declining margin business. By spending money on new product development, and new market development, new revenues are generated where there is more growth – and less competition. And that allows the company to shift with the marketplace, rather than be stuck in a bad business when it’s way too late to shift — because new competitors have already captured the new markets.

(For a White Space primer, check out the InnovationManagement.com article “White Space Mapping – Seeing the Future Beyond the Core.”)

When markets shift the first sign is intense competition, driving down margins. Too many leaders decide to “hunker down” and put all resources into defending the old business. Costs are slashed and all spending is put into competitive warfare. This, inevitably, leads to ugly results, because such behavior ignores the market shift. Being Smarter means recognizing the market shift, and changing investments – putting more money into new projects directed at finding new revenues, and most often higher rates of return.

Not all companies are growing like Apple, Google, Facebook or Groupon. But that doesn’t mean they aren’t on the road to growth by shifting their revenues into new markets – like IBM. What ties these companies together is their use of scenario planning to focus on the future, rather than relying on traditional planning systems firmly tied to the past. And investing in White Space so the company can find new markets, and new solutions, before competition eliminates the margin altogether.

If Mr. Palmisano is soon to leave IBM, as the article indicates is likely, we can surely hope the Board will seek out a replacement who is equally willing to make the right investments. Keeping the company pushing forward by developing future scenarios, and creating solutions that fulfill them.

by Adam Hartung | Mar 4, 2011 | Current Affairs, In the Rapids, Innovation, Leadership, Openness, Television, Web/Tech

My high school physics teacher spent a week teaching students how to use a slide rule. I asked him, "why can't we just use calculators?" At the time a slide rule was about $2, and a calculator was $300. The minimum wage was $1.14/hour. He responded that slide rules had been around a long time, and you never knew if you'd have access to a calculator. To the day he retired he insisted on using, and teaching, slide rule use. Needless to say, by then plenty of folks were ready to see him go. Too bad for his students he stayed as long as he did, because that was a week they could have spent learning physics, and other important materials. Ignoring the new tool, and its advantages, was a wasteful decision that hurt him and his customers.

Yet, I am amazed at how few people are using today's new tools for business, and marketing. At a small business Board meeting this week the head of marketing presented his roll-out of the boldest campaign ever in the business's history. His promotion plan was centered around traditional PR, supplemented with radio and billboard ads. I asked for his social media campaign, and after he confirmed I was serious he said he had a manager working on that. I asked if he had a facebook page ready, the videos on YouTube, a linked-in program ready to run against targets and his twitter communications established, including hash tags? He said if those things were important somebody had to be working on them. Two weeks from roll-out and he wasn't giving them any personal consideration.

I then asked the roughly 20 attendees, all but one of which were over 40, some questions:

- How many of you use skype at least once/month? Answer – 5%

- How many of you have a facebook page and check it daily? A – 15%

- How many of you check twitter daily? A – 5% Tweet at least 5 times/week? A – none

- How many own and use a tablet? A – 10%

- How many of you have a smartphone on which you've downloaded at least 10 apps? A – 10%

- How many of you carry a laptop? A – 100%

- Who knows the #1 company for new hires in Chicago in 2010? Answer – 5% (GroupOn)

- Who has used a Groupon coupon? Answer – 30%

Slide rule users.

New tools are here, and adopters will be the winners. If you still think we're a nation of laptop users, you need to think again. Laptop usage declined 20% in the last 2 years, to 2006 levels, as people have adopted easier to use technology

Chart Source: Silicon Alley Insider of BusinessInsider.com

If you are trying to pump out ads the new medium is mobile – not television, radio, outdoor or even web sites. Have you tested the look and feel of your web site on popular mobile devices? Do you know if new users to your business are even able to access your information from a mobile device?

And, it's more likely a customer will hear about you, and obtain a review of your product or service, via Facebook than vai the web! A CNet.com article asks the leading question "Will Facebook Replace Company Web Sites?" Want to understand the importance of Facebook, check out these same month comparisons:

- Starbucks: Facebook likes – 21.1M, site visits – 1.8M

- Coca-Cola: Facebook likes – 20.5M, site visits – .3M

- Oreo: Facebook likes – 10.1M, site visits – .3M

Yes, these are consumer products. But if you don't think the first place a potential customer looks for information on your business is Facebook, whether it's financial services, business insurance, catering or blow-molded plastic housings you need to think again. The use of facebook is simply exploding.

According to Business Insider, by the end of December, 2010 Facebook apps were downloaded to iPhones at a rate exceeding 500,000/day as the total shot to nearly 60million! Meanwhile the Facebook app downloads to Android devices grew to over 20million! Blackberry Facebook users has reached 27million, bringing the total by end of 2010 to well over 100M – just on smartphones! In September, 2010 Facebook became the #1 most time spent on the internet, passing combined time on all Google and all Yahoo sites! With over 500million users, Facebook isn't just kids checking on their friends any longer. When somebody wants a first peak at your business, odds are great it will be done over a smartphone and likely via a Facebook referral!

Chart Source: Silicon Alley Insider at Business Insider

As fast as smartphone usage has grown, tablet usage is on the precipice of explosion. Tablet sales will be 6 times (or more) notebook sales in just a few years! The second most popular product will be, of course, continued sales of advanced smartphones as the two new platforms overtake the traditional laptop. So what's your budgeted spend on mobile devices, mobile apps and mobile marketing?

Chart Source: Silicon Alley Insider of Business Insider

And in the effort to attract new customers, if you think the route will be newspapers, radio, TV, billboards, or direct mail – think again. Digital local deal delivery is projected to grow at least 45%/year through 2015 creating a market of over $10billion! If you want somebody to know about your product or service, Groupon and its competitors is already taking the lead over older, traditional techniques. By the way, when was the last time you bothered to open that latest Vallasis direct mail package – or did you just throw it immediately in the recycling bin without even a look?

Chart Source: Silicon Alley Insider of Business Insider

So, what is your business doing to leverage these tools? Are your marketing, and technology, plans for 2011 and 2012 still mired in old approaches and technologies? If so, expect to be eclipsed by competitors who more quickly implement these new solutions.

Too often we become comfortable in our old way of doing things. We keep implementing the same way, like the teacher giving slide rule instructions. And that simply wastes resources, and leaves you uncompetitive. The time to use these new solutions was yesterday – and today – and tomorrow – and every day. If you don't have plans to adopt these new solutions, and use them to grow your business, what's your excuse? Is it that much fun using the old slide rule?

by Adam Hartung | Mar 2, 2011 | Books, Defend & Extend, eBooks, In the Rapids, In the Swamp, Innovation, Leadership, Lock-in

What separates business winners from the losers? A lot of pundits would say you need to be efficient, cost conscious and manage margins. Others would say you need to be really good (excellent) at something – much better than anyone else. Unfortunately, that sounds good but in our fast-paced, highly competitive world today those platitudes don’t really create winners. Success has much more to do with the ability to shift. And to create shifts.

Think about Amazon.com. This company was started as an on-line retail channel for books most stores would not stock on their shelves. But Amazon used the shift to internet acceptance as a way to grow into selling all books, and eventually came to dominate book sales. Not only have most of the small book stores disappeared, but huge chains like B. Dalton and more recently Borders, were driven to bankruptcy. Amazon then built on this shift to expand into selling lots more than books, becoming a force for selling all kinds of products. And even opening itself to become a portal for other on-line retalers by routing customers to their sites, and even taking orders for products shipped from other e-tailers.

More recently, Amazon has taken advantage of the shift to digitization by launching its Kindle e-reader. And by making thousands of books available for digital downloading. By acting upon market trends, Amazon has shifted quickly, and has caused shifts in the market where it participates. And this shifting has been worth a lot to Amazon. Over the last 5 years Amazon’s stock has risen from about $30/share to about $180/share – about a 45%/year compounded rate of return!

Chart source: Yahoo Finance

Chart source: Yahoo Finance

In the middle to late 1990s, as Amazon was just starting to appear on radar screens, it appeared like Sears would be the kind of company that could dominate the internet. After all Sears was huge! It was a Dow Jones Industrial Average (DJIA) member that had ample resources to invest in the emerging growth market. Sears had a history of pioneering markets. It had once dominated retail with its catalogs, then became a powerhouse in free standing retail stores, then led the movement to shopping malls as an anchor chain, and even used its history in lending to develop what became Discover card, and had once shown its ability to be a financial services company and even an insurer! Sears had shifted with historical trends, and surely the company would see that it could bring its resources to the shifting retail landscape in order to remain dominant.

Unfortunately, Sears went a different direction, prefering to focus on defending its current business model. As the chain struggled, it was dropped from the DJIA. Eventually a financier, Edward Lampert, used his takeover of bankrupt KMart (by buying up their bonds) to take over Sears! Under his leadership Sears focused hard on being efficient, controlling costs and managing margins. Extensive financial rigor was applied to Sears to improve the profitability of every line item, dropping poor performers and closing low margin stores. While this initially excited investors, Sears was unable to compete effectively against other retailers that were lower cost, or had better merchandise or service, and the value has declined from about $190/share to $80; a loss of about 60% (at its recent worst the stock fell to almost 30 – or a decline of 84% peak to trough!)

Chart Source: Yahoo Finance

Chart Source: Yahoo Finance

Meanwhile the world’s #1 retailer, Wal-Mart, has long excelled at being the very best at supply chain management, and low-price leadership in retailing. Wal-Mart has never varied from its original business model, and in the retail world it is undoubtedly the very best at doing what it does – buy cheap, sell cheap and run a very tight supply chain from purchase to sale. This excited some investors during the “Great Recession” as customers sought out low prices when fearing about their jobs and future.

But this strategy has not been able to produce much growth, as stores have begun saturating just about everywhere but the inner top 30 cities. And it has been completely unsuccessful outside the USA. As a result, despite its behemoth size, the value of Wal-Mart has really gone nowhere the last 5 years. While there has been price gyration (from $42 low to $62 high) for long-term investors the stock has really gone nowhere – mired mostly around $50. Chart Source: Yahoo Finance

Chart Source: Yahoo Finance

Investors in Amazon have clearly fared much better than Sears or Wal-Mart

Chart Source: Yahoo Finance

Chart Source: Yahoo Finance

Too often business leaders spend too much time thinking about what they do. They think about costs, margins, the “business model” and execution. But success really has less to do with those things than understanding trends, and capitlizing on those trends by shifting. You don’t have to be the lowest cost, or most efficient or even the most passionate. What works a lot better is to go where the trends are favorable, and give customers solutions that align with the trends. And if you do this early, before anyone else, you’ll have a lot of time to figure out how to make money before competitors try to cut your margins!

Recognize that most “execution” is about preserving what happened in the past. Trying to do things better, faster and cheaper. But in a rapidly changing world, new competitors change the basis of competition. Amazon isn’t a better classical bookseller, or retailer. It’s a company that leveraged trends – market shifts – to take advantage of new technologies and new ways of people shopping. First for books and then other things. Later it built on trends toward digitization by augmenting the production of electronic publications, which is destined to change the world of book publishing altogether – and even has impact on the publishing of everything from periodicals to manuals. Amazon is now creating market shifts, which is changing the fortunes of others.

For investors, employees and suppliers you are better off to be with the company that shifts. It has the ability to grow with the trends. And the faster you get out of those companies which are stuck, locked-in to their old business model and practices in an effort to defend historical behaviors, the better off you’ll be. Despite the P/E multiples, or other claims of “value investing,” to succeed you’re a lot better off with the company that’s finding and building on trends than the ones managing costs.

by Adam Hartung | Feb 3, 2011 | Defend & Extend, eBooks, In the Rapids, In the Swamp, Innovation, Leadership, Lock-in, Openness

Summary:

- Company size is irrelevant to job creation

- New jobs are created by starting new businesses that create new demand

- Most leaders behave defensively, trying to preserve the old business

- But success comes from acting like a start-up and creating new opportunities

- Companies need to do more future-based planning that can change the competitive landscape and generate more growth, jobs and higher rates of return

A trio of economists just published "Who Creates Jobs? Small vs. Large vs. Young" at the National Bureau of Economic Research. For years businesspeople have said that the majority of jobs were created by small companies, therefore we should provide loans and other incentives for small business. At the same time, we all know that large companies employee millions of people, and therefore they have received benefits to keep their companies going even in tough times – like the recent bailouts of GM and Chrysler. But what these researchers discovered was that size was immaterial to job creation – and this ages-old debate is really irrelevant!

Digging deeper into the data, they discovered as reported in the New York Times, "To Create Jobs, Nurture Start-Ups." Regardless of size, most businesses over time get stuck defending their original success formula. What helped them initially grow becomes locked-in by behavioral norms, structural decision-making processes and a business model cost structure that may be tweaked, but rarely changed. Best practices serve to focus management on defending that business, even as market shifts lower the industry growth rate and profits. It doesn't take long before defensive tactics dominate, and as the leaders attempt to preserve historical practices there are no new jobs created. Usually quite the opposite happens as cost cutting dominates, leading to outsourcing and lay-offs reducing the workforce.

Look no further than most members of the Dow Jones Industrial Average to witness the lack of jobs created by older companies desperately trying to defend their historical business model. But what we've failed to realize is how the same management practices dominate small business as well! Most plumbing suppliers, window installers, insurance agencies, restaurants, car dealers, nurseries, tool rental shops, hair cutters and pet sitters spend all their time just trying to keep the business going. They look no further than what they did yesterday when making business decisions. Few think about growth, preferring instead to just keep the business the same – maybe by the owner/operator's father 3 decades ago! They don't create any new jobs, and are probably struggling to maintain existing employment as computers and other business aids reduce the need for labor – while competition keeps whacking away at historical margins.

So if you want to create jobs, throwing incentives at General Electric, General Motors or General Dynamics is not likely to get you very far. And asking the leaders of those companies what it takes to get them to create jobs is a wasted conversation. They don't know, and haven't really thought about the question. Leaders of almost all big organizations are just trying to make next quarter's profit projection any way they can – and that doesn't involve new hiring. After a lifetime of cutting costs and preservation behavior, how is Jeffrey Immelt of GE supposed to know anything about creating new businesses which leads to job creation?

Nor is offering loans or grants to the millions of existing small businesses who are just trying to keep the joint running going to make any difference. Their psychology is not about offering new products or services, and banks sure don't want to take the risk of investing in new experimental behaviors. They have little, if any, interest in figuring out how to grow when most of their attention is trying to preserve the storefront in the face of new competitors on-line, or from India, China or Vietnam!

To create jobs you have to focus on growth – not defense. And that takes an entirely different way of thinking. Instead of thinking about the past you have to be obsessive about the future, and how you can do things differently! Most of the time, business leaders don't think this way until their backs are up against the wall, looking at potential failure! For example, how Mr. Gerstner turned around IBM when he moved the company away from mainframe obsession and pointed the company toward services. Or when Steve Jobs redirected Apple away from its Mac obsession and pushed the company into new markets for music/entertainment and smartphones. Unfortunately, these stories are so rare that we tend to use them for a decade (or even 2 decades)!

For years Cisco said it would obsolete its own products, and by implementing that direction Cisco has grown year after year in the tech world, where flame-outs abound (just look at what happened to Sun Microsystems, Silicon Graphics, AOL and rapidly Yahoo!) Look at how Netflix has pushed Blockbuster aside by expanding its business from snail-mail to downloads. Or how Amazon.com has found explosive growth by changing the way we read books, now selling more Kindle products than printed. Rather than thinking about how each could do more of what they always did, fearing cannibalization of the "core business," they are aiding destruction of their historical business by implementing the newest technology and solution before some start-up beats them to the punch!

As you enter 2011 and prepare for 2012, is your planning based upon doing more of what your business has always done? A start up has no last year, so its planning is based entirely on views of the future. Are you fixated on improving your operations? A start up has no operations, so it is fixated on competitors to figure out how it can meet market needs better, and use "fringe" solutions in new ways that competitors have not yet adopted. Are you hoping that market shifts slow, or stop, so revenue, market share and profit slides abate? A start up is looking for ways to disrupt the marketplace to it can grab high growth from existing solutions while generating new demand by meeting unmet needs. Are you trying to preserve resources in order to defend your business from competitors? A start up is looking for places to experiment with new solutions and figure out how to change the competitive landscape while growing revenues and profits.

If you want to thrive you have to grow. To grow, you have to think young! Be willing to plan for the future, like Apple did when it moved into new markets for music downloads. Be willing to find competitive holes and fill them with new technology, like Netflix. Don't fear market changes – create them like Cisco does with new solutions that obsolete previous generations. And keep testing new ways to expand the market, even as you see intense competition in historical markets being attacked by new competitors. That is the only way to create value, and generate new jobs!

by Adam Hartung | Feb 1, 2011 | Current Affairs, In the Rapids, Innovation, Leadership, Television, Web/Tech

Summary:

- There is dramatic change in the television/media industry

- NBC Universal/Comcast is changing ownership, and leaders

- The company’s future success will have more to do with which battles the new President invests in than the history, or style of the past and future company President’s

- Trying to “fix” the old business will waste resources and harm future prospects

- Success will require developing a management approach that gives permission and resources to find a path to the future – a future that will be nothing like the past

NBC Universal is changing owners, from General Electric to Comcast. The former NBC President, Jeff Zucker, is being replaced by Steve Burke. Stylistically, it’s hard to imagine two fellas less alike. Mr. Burke, portraited in the New York Times “A Little Less Drama at NBC,” is a mild-mannered, quiet, self-effacing executive who almost attended divinity school. He avoids the limelight as much as he avoids being abrasive with colleagues. The outgoing Mr. Zucker is by all accounts brash,abrasive and quick to make decisions, as he was portraited in PaidContent.org “Was Jeff Zucker Really So Bad For NBC Universal?“

But it isn’t executive style that will determine whether Mr. Burke succeeds. Although NBCU just returned its highest profits since 2004, the television and media industries are in dramatic transition. Things aren’t like they used to be, and they will never be that way again. Growing revenues, and profits, at the combined NBCU/Comcast will require Mr. Burke quickly move both companies into a different kind of competitor focused on the changed market of 2015 – when media customers and suppliers will both be very different, with quite different demands.

Although Mr. Zucker is blasted for allowing NBC’s ratings to fall to last among the Big 3 networks (including CBS and ABC), it’s not at all clear why that wasn’t a smart move. What has grown NBC’s profits has been far removed from network programming. It was the acquisition of cable channels USA and Sci Fi (now Syfy) via Universal, and later Bravo, Oxygen and The Weather Channel that contributed greatly to NBC’s revenue and profit growth. These were also enhanced by building, from scratch, the #1 business-content television channel at CNBC, and the profitable, somewhat populist counter-channel to powerhouse conservative Fox News with MSNBC. Despite what the critics (who are largely interested in programs rather than profits) have said, it may have been an act of brilliance to avoid investing in the declining business that is prime time network programming.

What anyone thinks about the brouhaha over Jay Leno’s attempt at prime time, and Conan O’Brien’s stint leading The Today Show, is immaterial to revenue growth and profits. I’m a late boomer, so I remember when there were only 3 stations, and Johny Carson dominated the post-news late evening. But now I have college age sons that don’t even own televisions, have almost no idea who Jay Leno is (other than know of him as a car and motorcycle collector) and find all interview programs boring. “Network” TV is something they don’t quite understand – since their tolerance for watching entertainment on someone else’s pre-determined schedule is non-existent, and their patience for sitting through commercials of real-time programming is even lower. In other words, what happens in the “prime time” race, or with network celebrities, really doesn’t matter any more. And if NBCU can’t grow viewers it can’t grow ad revenues – so why should it invest in the prime time business? Just because it used to? Or started that way?

While lots of media “experts” are screaming for Mr. Burke to “fix” NBC, that business is already well into the hospice. Network share of entertainment interest is falling rapidly as boomers die, dozens of new offerings are micro-targeting across the channel spectrum, and we all turn to the internet for downloads, ignoring the TV for news or entertainment several additional hours each year. Meanwhile, people under the age of 30 aren’t even watching much television any more. They just pretend to watch while sitting with their parents as they text, check Facebook or watch a downloaded program on their iPhone.

“Network” programming is a business which is not going to grow again. Given how costs are increasing for traditional shows, and the over-explosion of inexpensive “reality” or “news” shows, and fragmentation and decline of advertising why would anyone ever expect this to be a profitable business? Being last in that 3 horse race is about as interesting as tracking share of market for printed phone directories. Probably the first to quit ist he big winner. So why should Mr. Burke spend much time, or money, fighting the last war? “Fixing” that outdated business model is fraught with high risk, and low return. Now that tthe artificial limits on news and entertainment programming have been removed (thanks to the internet) isn’t it time to let go of that historial artifact and focus on the future?

We know the future will be a mix of traditional TV (at least for a while, but don’t make any bets on it being too long), as well as targeted channels we now refer to as “cable” (even though that moniker is clearly losing meaning in a WiFi world.) Some of these will be free access, and some will be paid content. But all of that now must compete with downloads from Netfilx, Hulu (in which NBCU is a part owner) and YouTube (partially owned by Google.) People can create and post their own programs, and even do their own marketing. Instant availability, reviews and promotion will be couresy of Twitter and Facebook. This is a lot more complex than just ordering a new crime drama series, or situation comedy, and foisting it on a market with only a handful of channel options.

Viewership will range from 50″ panels, to 2″ hand-held screens – with a plethora of optional sizes in between. Program length will be infinitely variable from hours of non-stop viewing to constantly interrupted sound bites, no longer proscribed by 30 minute increments. Traditional programming, like local or national “news” will have little meaning, or value, in 2020 (or maybe 2015) when we will be receiving instant updates several times each day on our mobile device.

Mr. Zucker did a yeoman’s job of steering NBCU toward the future. He was smart enough to understand that only historians, locked-in media critics and old farts in Lay-Z-Boys care about what’s happening on The Tonight Show or the NBC News. His primary investments were oriented toward understanding the future, and getting NBCU’s toes into that rapidly churning water where future growth lies. But he’s leaving just as the stream is turning into a torrent. Even what he did could well be out of date within a few years – or months!

Now it is Mr. Burke’s turn. The very pleasant fellow has a daunting challenge. If he isn’t supposed to “double down” his bets in network TV, and traditional “cable,” what is he supposed to do? In a dramatically changing advertising world, where Google, Facebook and mobile device ads are now becoming the hot markets, what is the role for NBCU/Comcast? If we no longer need the physucal cable (say in 2020), won’t Comcast lose subscribers for cable access just like we’re seeing declines in subscribers for newspapers, DVD subscriptions, land-line telephones and land-line long distance? What is the role of a “programmer” like NBCU if viewers all have unlimited access to everything, anytime, anywhere, in any format? And what is the value of a content provider if self-published content streams onto the web by the terabyte daily? And is sorted by engines like Google and YouTube?

What Mr. Burke must do, regardless of style, is develop some scenarios about the future, and understand the much more complex playing field that is today’s media business. He has to find the holes in competition, and learn how to leverage what the “fringe” competitors are doing that drives all that usage, and viewership. And, most importantly, he has to keep experimenting – just as Mr. Zucker did. He has to create opportunities to test the newly developing markets, figure out who will buy, and what they will buy. He has to set up white space teams who have permission to be experimental, even if they attack the old businesses like “network” TV – even cannibalizing the historical viewr base as they transition toward future media markets. If he can create these teams, give them the right permission and resources, NBCU/Comcast could be the next great media company.

We’ll have to wait and see. Will the sirens of the past, looking backward, pull the company into gladiator battles with old foes trying to hold share in narrowing, declining markets? That path looks like a sure disaster. Despite being an early leader with satellite TV and MySpace that approach has not helped NewsCorp. But betting on the future is more a bet on the journey, and finding the right path, than betting on any particular destination. The future-based approach takes a lot of faith in company leadership, and the company management team. It will be interesting to see which way Mr. Burke goes.

by Adam Hartung | Jan 19, 2011 | Current Affairs, Disruptions, Games, In the Rapids, In the Swamp, Innovation, Leadership, Lock-in, Music, Openness, Web/Tech

The Wall Street Journal headlined Monday, “Apple Chief to Take Leave.” Forbes.com Leadership editor Fred Allen quickly asked what most folks were asking “Where does Steve Jobs Leave Apple Now?” as he led multiple bloggers covering the speculation about how long Mr. Jobs would be absent from Apple, or if he would ever return, in “What They Are Saying About Steve Jobs.” The stock took a dip as people all over raised the question covered by Steve Caulfield in Forbes’ “Timing of Steve Jobs Return Worries Investors, Fans.”

If you want to make money investing, this is what’s called a “buying opportunity.” As Forbes’ Eric Savitz reported “Apple is More Than Just Steve Jobs.” Just look at the most recent results, as reported in Ad Age “Apple Posts ‘Record Quarter’ on Strong iPhone, Mac, iPad Sales:”

- Quarterly revenue is up 70% vs. last year to $26.7B (Apple is a $100B company!)

- Quarterly earnings rose 77% vs last year to $6B

- 15 million iPads were sold in 2010, with 7.3 million sold in the last quarter

- Apple has $50B cash on hand to do new product development, acquisitions or pay dividends

ZDNet demonstrated Apple’s market resiliency headlining “Apple’s iPad Represents 90% of All Tablets Shipped.” While it is true that Droid tablets are now out, and we know some buyers will move to non-Apple tablets, ZDNet predicts the market will grow more than 250% in 2011 to over 44 million units, giving Apple a lot of room to grow even with competitors bringing out new products.

Apple is a tremendously successful company because it has a very strong sense of where technology is headed and how to apply it to meet user needs. Apple is creating market shifts, while many other companies are reacting. By deeply understanding its competitors, being willing to disrupt historical markets and using White Space to expand applications Apple will keep growing for quite a while. With, or without Steve Jobs.

On the other hand, there’s the stuck-in-the-past management team at Microsoft. Tied to all those aging, outdated products and distribution plans built on PC technology that is nearing end of life. But in the midst of the management malaise out of Seattle Kinect suddenly showed up as a bright spot! SFGate reported that “Microsoft’s Xbox Kinect beond hackers, hobbyists.” Seems engineers around the globe had started using Kinect in creative ways that were way beyond anything envisioned by Microsoft! Put into a White Space team, it was possible to start imagining Kinect could be powerful enough to resurrect innovation, and success, at the aging monopolist!

But, unfortunately, Microsoft seems far too stuck in its old ways to take advantage of this disruptive opportunity. Joel West at SeekingAlpha.com tells us “Microsoft vs. Open Kinect: How to Miss a Significant Opportunity.” Microsoft is dedicated to its plan for Kinect to help the company make money in games – and has no idea how to create a White Space team to exploit the opportunity as a platform for myriad uses (like Apple did with its app development approach for the iPhone.)

In the end, ZDNet joined my chorus looking to oust Ballmer (possibly a case study in how to be the most misguided CEO in corporate America) by asking “Ballmer’s 11th Year as Microsoft’s CEO – Is it Time for Him to Go?” Given Ballmer’s massive shareholding, and thus control of the Board, it’s doubtful he will go anywhere, or change his management approach, or understand how to leverage a breakthrough innovation. So as the Cloud keeps decreasing demand for traditional PCs and servers, Brett Owens at SeekingAlpha concludes in “A Look at Valuations of Google, Apple, Microsoft and Intel” that Microsoft has nowhere to go but down! Given the amazingly uninspiring ad program Microsoft is now launching (as described in MediaPost “Microsoft Intros New Corporate Tagline, Strategy“) we can see management has no idea how to find, or sell, innovation.

We often hear advice to buy shares of a company. Rarely recommendations to sell. But Apple is the best positioned company to maintain growth for several more years, while Microsoft has almost no hope of moving beyond its Lock-in to old products and markets which are declining. Simplest trade of 2011 is to sell Microsoft and buy Apple. Just read the headlines, and don’t get suckered into thinking Apple is nothing more than Steve Jobs. He’s great, but Apple can remain great in his absence.

by Adam Hartung | Jan 13, 2011 | Current Affairs, In the Rapids, Innovation, Leadership, Web/Tech

Before there was Facebook, the social media juggernaut which is changing how we communicate – and might change the face of media – there was MySpace. MySpace was targeted at the same audience, had robust capability, and was to market long before Facebook. It generated enormous interest, received a lot of early press, created huge valuation when investors jumped in, and was undoubtedly not only an early internet success – but a seminal web site for the movement we now call social media. On top of that, MySpace was purchased by News Corporation, a powerhouse media company, and was given professional managers to help guide its future as well as all the resources it ever wanted to support its growth. By almost all ways we look at modern start-ups, MySpace was the early winner and should have gone on to great glory.

But things didn’t turn out that way. Facebook was hatched by some college undergrads, and started to grow. Meanwhile MySpace stagnated as Facebook exploded to 600 million active users. During early 2010, according to The Telegraph in “Facebook Dominance Forces Rival Networks to Go Niche,” MySpace gave up on its social media leadership dreams and narrowed its focus to the niche of being a “social entertainment destination.” As the number of users fell, MySpace was forced to cut costs, laying off half its staff this week according to MediaPost.com “MySpace Confirms Massive Layoffs.” After losing a reported $350million last year, it appears that MySpace may disappear – “MySpace Versus Facebook – There Can Be Only One” reported at Gigaom.com. The early winner now appears a loser, most likely to be unplugged, and a very expensive investment with no payoff for NewsCorp investors.

What went wrong? A lot of foks will be relaying the tactics of things done and not done at MySpace. As well as tactics done and not done at Facebook. But underlying all those tactics was a very simple management mistake News Corp. made. News Corp tried to guide MySpace, to add planning, and to use “professional management” to determine the business’s future. That was fatally flawed when competing with Facebook which was managed in White Space, lettting the marketplace decide where the business should go.

If the movie about Facebook’s founding has any veracity, we can accept that none of the founders ever imagined the number of people and applications that Facebook would quickly attract. From parties to social games to product reviews and user networks – the uses that have brought 600 million users onto Facebook are far, far beyond anything the founders envisioned. According to the movie, the first effort to sell ads to anyone were completely unsuccessful, as uses behond college kids sharing items on each other were not on the table. It appeared like a business bust at the beginning.

But, the brilliance of Mark Zuckerberg was his willingness to allow Facebook to go wherever the market wanted it. Farmville and other social games – why not? Different ways to find potential friends – go for it. The founders kept pushing the technology to do anything users wanted. If you have an idea for networking on something, Facebook pushed its tech folks to make it happen. And they kept listening. And looking within the comments for what would be the next application – the next promotion – the next revision that would lead to more uses, more users and more growth.

And that’s the nature of White Space management. No rules. Not really any plans. No forecasting markets. Or foretelling uses. No trying to be smarter than the users to determine what they shouldn’t do. Not prejudging ideas so as to limit capability and focus the business toward a projected conclusion. To the contrary, it was about adding, adding, adding and doing whatever would allow the marketplace to flourish. Permission to do whatever it takes to keep growing. And resource it as best you can – without prejudice as to what might work well, or even best. Keep after all of it. What doesn’t work stop resourcing, what does work do more.

Contrarily, at NewsCorp the leaders of MySpace had a plan. NewsCorp isn’t run by college kids lacking business sense. Leaders create Powerpoint decks describing where the business will head, where they will invest, how they will earn a positive ROI, projections of what will work – and why – and then plans to make it happen. They developed the plan, and then worked the plan. Plan and execute. The professional managers at News Corp looked into the future, decided what to do, and did it. They didn’t leave direction up to market feedback and crafty techies – they ran MySpace like a professional business.

And how’d that work out for them?

Unfortunately, MySpace demonstrates a big fallacy of modern management. The belief that smart MBAs, with industry knowledge, will perform better. That “good management” means you predict, you forecast, you plan, and then you go execute the plan. Instead of reacting to market shifts, fast, allowing mistakes to happen while learning what works, professional managers should be able to predict and perform without making mistakes. That once the bright folks who create the strategy set a direction, its all about executing the plan. That execution will lead to success. If you stumble, you need to focus harder on execution.

When managing innovation, including operating in high growth markets, nothing works better than White Space. Giving dedicated people permission to do whatever it takes, and resources, then holding their feet to the fire to demonstrate performance. Letting dedicated people learn from their successes, and failures, and move fast to keep the business in the fast moving water. There is no manager, leader or management team that can predict, plan and execute as well as a team that has its ears close to the market, and the flexibility to react quickly, willing to make mistakes (and learn from them even faster) without bias for a predetermined plan.

The penchant for planning has hurt a lot of businesses. Rarely does a failed business lack a plan. Big failures – like Circuit City, AIG, Lehman Brothers, GM – are full of extremely bright, well educated (Harvard, Stanford, University of Chicago, Wharton) MBAs who are prepared to study, analyze, predict, plan and execute. But it turns out their crystal ball is no better than – well – college undergraduates.

When it comes to applying innovation, use White Space teams. Drop all the business plan preparation, endless crunching of historical numbers, multi-tabbed Excel spreadsheets and powerpoint matrices. Instead, dedicate some people to the project, push them into the market, make them beg for resources because they are sure they know where to put them (without ROI calculations) and tell them to get it done – or you’ll fire them. You’ll be amazed how fast they (and your company) will learn – and grow.

by Adam Hartung | Jan 5, 2011 | Defend & Extend, In the Rapids, In the Swamp, Leadership, Lock-in, Openness

Summary:

- Business planning systems are designed to defend historical markets

- Rapidly shifting markets makes it impossible to grow by defense alone

- Growth requires understanding what customers want, and creating new solutions that most likely aren’t part of the current business

- You can’t grow if you don’t plan to grow, but to plan for growth you have to shift resources from traditional planning into scenario planning

- High growth companies like Virgin, Apple and Google plan to fulfill future needs, not defend & extend past practicess

Imagine you see a pile of hay. Above it is a sign flashing “find the needle.” That achievement would be hard. Change the sign to “find the hay” and suddenly achieving the goal becomes much easier. So, as the comedian Bill Engvall might ask, what’s your sign? Unfortunately, most businesses plan for 2011, and beyond, using the first sign. Very few do planning using the latter. Most businesses won’t grow, because they simply don’t know how to plan for growth!!

Most businesses start planning with “I’m in the horseshoe (for example) business. My market isn’t growing, and there is more capacity than demand. How can I grow?” For these people, their sign is “find the needle.”

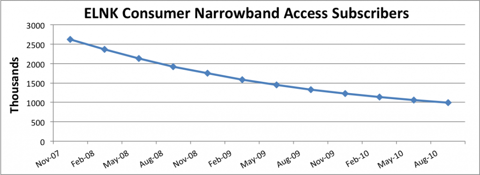

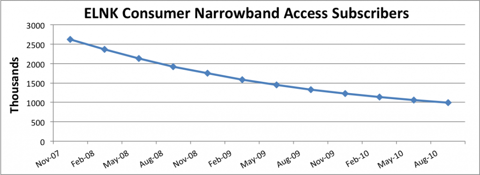

Take for example Earthlink. The company’s growth looked like a rocket ship in the early internet days as people by the millions signed up for dial-up service. But along came broadband, and the market for dial up died – never to return. Earthlink has no hope of growing as long as it thinks of itself as a dial-up company

Chart at SeekingAlpha.com author Ananthan Thangavel

Despite the absolute certainty that the market is shrinking, at this point almost all business planners will develop plans to defend this dying business as long as possible. Despite the impossibility of achieving good returns, there will be a plethora of actions to try and keep serving all the way to the very last customer. Just look at how AOL has invested millions trying to defend its dying internet access busiuness. Reality is, the company that walks away – gives up- is the smartest. There’s no way to make money as oversupply keeps too many companies spending too much to service too few customers.

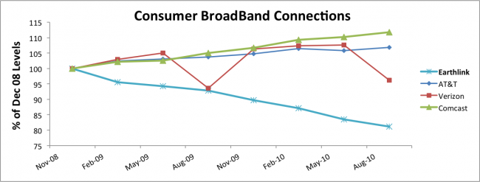

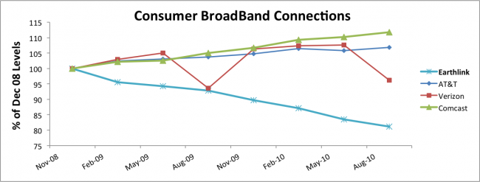

The next step for most planners is to attempt extending the business into something adjacent. For example, Earthlink would say “let’s invest in Broadband. We’ll hang onto customers as they want to switch, and maybe pick up a few customers.” But this completely ignores the fact that competitors already have a substantial lead. Competitors have learned the technology, and the marketplace. They are growing, and have no intention of giving up any room to a new competitor.

Chart at SeekingAlpha.com author Ananthan Thangavel

Planning systems are designed to keep the business doing more of what it always did, or possibly extending the business into adjacent markets after returns have faltered. Planning systems have no way of recognizing when a business, or market, has become obsolete. And practically never do they recognize the power of exsting competitors when looking at adjacent markets. As a result, the planning system produces no growth plans, leading 2011 to end with the self-fulfilling prophecy that the plan predicted – little or no growth.

The future for Earthlink is pretty grim. As it is for most companies that plan based upon history, trying to Defend & Extend their historical markets. In the highly dynamic, global marketplaces of 2011 trying to find growth by remaining focused on the past is like looking for the needle in a haystack. Maybe there’s something in there – but it’s not likely – and it’s even a lot less likely you’ll find it – and if you did, the cost of finding it will almost assuredly be greater than the value.

Alternatively, why not use planning resources to find, and develop, growth markets. Instead of looking at what you did (as in the past tense) try to figure out what you should do. Rather than studying past products, customers and markets, why not develop scenarios about the future that give you insight to what people will want to buy in 2011, 2012 and beyond? Rather than looking for needles, why not go explore the hay?

Newspapers kept focusing on declining subscriptions, when they should have been studying Craig’s List, eBay, Vehix.com and other on-line environments to learn the future of advertising. Had Tribune company poured its resources into its early internet investments, such as cars.com and careerbuilder.com, rather than trying to defend its traditional newspapers, it may well have avoided bankruptcy. But rather than looking to the future when doing its planning, and understanding that on-line news was going to explode, Tribune kept looking for the needle (cost cuts, layoffs, outsourcing, etc.) to save the old success formula.

Direct mail companies and Sunday insert printers have continued looking for ways to defend & extend their coupon printing business – despite the fact that nobody reads junk mail or uses printed coupons. Several have failed, and larger companies have merged trying to find “synergies” and more cost cuts. Simultaneously a 28 year old music major from Nothwestern university starts figuring out how to help companies acquire new customers by offering email coupons, and within 2 years his company, Groupon, is valued at around $6B. There’s nothing that stopped coupon powerhouse Advo from being Groupon, except that its planning system was devoted to finding the needle, while Groupon’s leaders decided to go play in the hay.

Hallmark and American Greetings want us to buy birthday and holiday cards for various occasions – in a world where almost nobody mails cards any longer. As they keep trying to defend their old business, and extend it into a few new opportunities for on-line cards, Twitter captures the wave of instant communications by offering everyone 140 character ways to communicate. Because Twitter is out where the growth is, the company raises $200M giving it a value of $3.7B.

Nothing stops any business from being anything it wants to be. But as most enter 2011 they will use their planning resources, including all those management meetings and hours of forms completion, to do nothing more than re-examine the historical business. Most will devolve into trying to figure out how to do more with less. As future forecasts look grim, or perhaps cautiously optimistic (based on a lot of things going right – like a mysterious pick-up in demand) there will be much nashing of teeth – and meetings looking for a needle that can be offered to employees and investors as a hope for rising future value.

Smart companies get out of that rut. They focus their planning on the future. What do customers want, and how can we give them what they want? How can we create whole new markets. Apple was a PC company, but by exploring mobility it became a provider of MP3 consumer electronics, downloadable music, a mobile device and app supplier and the early winner in cloud accessing tablets. Google has moved from a search engine to a powerhouse ad placement company and is pushing the edges of growth in mobile computing as well as several other markets. Virgin started as a distributor of long-playing vinyl record albums, but by exploring what customers really wanted it has become an international airline, cell phone company, international lender and space travel pioneer (to mention just a few of its businesses.)

You can grow in 2011, but to do so you need to shed the old planning system (and its resource wasting processes) and get serious about scenario planning. Focus on the future, not the past.

by Adam Hartung | Dec 27, 2010 | General, In the Rapids, Leadership, Web/Tech

"Too Add Value Through IT, Pick Up the Ball" headlines my latest article published by IDG group. For years IT leaders thought their job was to "keep the joint running." Today, that's insufficient. Nobody can avoid being part of the growth agenda if they are to be a successful leader or manager.

To drive success, and keep their jobs, IT leaders now have to move beyond simply being defensive. Keeping the systems running, and cutting operating costs, is not enough to be a great CIO. Too many have ended up outsourcing almost everything in order to lower costs, only to discover that IT becomes far too rigid and unable to support market needs when so many services are outsourced to third parties.

Today's CIO has to spend more time figuring out how to flexibly, adaptively, bring new solutions to both insiders and customers. It's important CIOs not just track historical (and accounting) data, but behave like the offensive team, identifying and tracking considerably more market-based data. And creating various future scenarios to help the company spot trends and opportunities. On top of this, IT must demonstrate how using emerging solutions – from Salesforce.com to Groupon, Foursquare and Facebook (examples) – can reach more customers, faster – driving higher revenues.

Read how important it is for IT to become part of the growth engine at one of the locations where this article has been published:

@ CIO Magazine – @ PC World – @ Network World – @ IT World Canada – @ CIO Australia – @ ComputerWorld Norway

Additionally, read my latest article on effective strategic planning – for IT or any part of the organization – published by the Strategic Planning Society of the UK "Disrupting the Marketplace". This article describes how to add maximum value, growing revenue, cash flow and profits, by identifying and implementing opportunities to disrupt the marketplace. And allowing those disruptions to invade your own organization for more dynamism.

by Adam Hartung | Dec 23, 2010 | Defend & Extend, General, In the Rapids, Innovation, Leadership, Openness

“Goodbye 2010, the Year of Austerity” is the headline from Mediapost.com‘s Marketing Daily. And that could be the mantra for many, many companies. Nobody is winning today by trying to save their way to prosperity! As we move into this decade, it is important business leaders realize that the only way to create a strong bottom line (profit) is to develop a strong top line (revenue.) Recommendations:

- Never be desperate. Go to where the growth is, and where you can make money. Don’t chase any business, chase the business where you can profitably growth. Be somewhat selective.

- Focus efforts on markets you know best. I add that it’s important you understand not to do just what you like, but learn to do what customers VALUE.

- Let go of crap, traditions and “playing it safe” actions. Growth is all about learning to do what the market wants, not trying to protect the past – whether processes, products or even customers.

- More lemonade making. You can’t grow unless you’re willing to learn from everything around you. We constantly find ourselves holding lemons, but those who prosper don’t give up – they look for how to turn those into desirable lemonade. What is your willingness to learn from the market?

- Austerity measures are counterproductive 99% of the time. Efficiency is the biggest obstacle to innovation. You don’t have to be a spendthrift to succeed, but you can’t be a miser investing in only the things you know, and have done before.

- Communicate, communicate, communicate. We don’t learn if we don’t share. Developing insight from the environment happens when all inputs are shared, and lots of people contribute to the process.

- Get off the downbeat buss. There’s more to success than the power of positive thinking, but it is very hard to gain insight and push innovation when you’re a pessimist. Growth is an opportunity to learn, and do exciting things. That should be a positive for everybody – except the status quo police.

Realizing that you can’t beat the cost-cutting horse forever (in fact, most are about ready for the proverbial glue factory), it’s time to realize that businesses have been under-investing in innovation for the last decade. While GM, Circuit City, Blockbuster, Silicon Graphics and Sun Microsystems have been failing, Apple, Google, Cisco, Netflix, Facebook and Twitter have maintained double-digit growth! Those who keep innovating realize that markets aren’t dead, they’re just shifting! Growth is there for businesses who are willing to innovate new solutions that attract customers and their dollars! For every dead DVD store there’s somebody making money streaming downloads. Businesses simply have to work harder at innovating.

Fast Company gives us “Five Innovative New Year’s Resolutions:”

- Associate. Work harder at trying to “connect the dots.” Pick up on weak signals, before others, and build scenarios to help understand the impact of these signals as they become stronger. For example, 24x7WallStreet.com clues us in that greater use of mobile devices will wipe out some businesses in “The Ten Businesses The Smartphone Has Destroyed.” But for each of these (and hundreds others over the next few years) there will be a large number of new business opportunities emerging. Just look at the efforts of Foursquare and Groupon and the direction those growth businesses are headed.

- Observe. Pay attention to what’s happening in the world, and think about what it means for your (and every other) business. $100/barrel oil has an impact; what opportunity does it create? Declining network TV watching has an impact – how will you leverage this shift? Don’t just wander through the market, and reacting. Figure out what’s happening and learn to recognize the signs of growth opportunities. Use market events to drive being proactive.

- Experiment. If you don’t have White Space teams trying figure out new business models, how will you be a future winner? Nobody “lucks” into a growth market. It takes lots of trial and learning – and that means the willingness to experiment. A lot. Plan on experimenting. Invest in it. And then plan on the positive results.

- Question. Keep asking “why” until the market participants are so tired they throw you out of the room. Then, invent scenarios and ask “why not” until they throw you out again. Markets won’t tell you what the next big thing is, but if you ask a lot of questions your scenarios about the future will be a whole lot better – and your experimentation will be significantly more productive.

- Network. You can’t cast your net too wide in the effort to obtain multiple points of view. Nothing is narrower than our own convictions. Only by actively soliciting input from wide-ranging sources can you develop alternative solutions that have higher value. We become so comfortable talking to the same people, inside our companies and outside, that we don’t realize how we start hearing only reinforcement for our biases. Develop, and expand, your network as fast as possible. Oil and water may be hard to mix, but it blending inputs creates a good salad dressing.

ChiefExecutive.net headlined “2010 CEO Wealth Creation Index Shows a Few Surprises.” Who creates wealth? Included in thte Top 10 list are the CEOs of Priceline.com, Apple, Amazon, Colgate-Palmolive and DeVry. These CEOs are driving industry innovation, and through that growth. This has produced above-average cash flow, and higher valuations for their shareholders. As well as more, and better quality jobs for employees. Meanwhile suppliers are in a position to offer their own insights for ways to grow, rather than constantly battling price discussions.

Who destroys wealth? In the Top 10 list are the CEOs of Dean Foods, Kraft, Computer Sciences (CSC) and Washington Post. These companies have long eschewed innovation. None have introduced any important innovations for over a decade. Their efforts to defend & extend old practices has hurt revenue growth, providing ample opportunity for competitors to enter their markets and drive down margins through price wars. Penny-pinching has not improved returns as revenues faltered, and investors have watched value languish. Employees are constantly in turmoil, wondering what future opportunities may ever exist. Suppliers never discuss anything but price. These are not fun companies to work in, or with, and have not produced jobs to grow our economy.

Any company can grow in 2011. Will you? If you choose to keep doing what you’ve always done – well you shouldn’t plan on improved performance. On the other hand, embracing market shifts and creating an adaptive organization that identifies and launches innovation could well make you into a big winner. Next holiday season when you look at performance results for 2011 they will have more to do with management’s decisions about how to manage than any other factor. Any company can grow, if it does the right things.