by Adam Hartung | Oct 26, 2016 | Growth Stall, Innovation, Investing, Leadership, Web/Tech

Apple AAPL -0.72% announced sales and earnings yesterday. For the first time in 15 years, ever since it rebuilt on a strategy to be the leader in mobile products, full year sales declined. After three consecutive down quarters, it was not unanticipated. And Apple’s guidance for next quarter was for investors to expect a 1% or 2% improvement in sales or earnings. That’s comparing to the disastrous quarter reported last January, which started this terrible year for Apple investors.

Yet, most analysts remain bullish on Apple stock. At a price/earnings (P/E) of 13.5, it is by far the cheapest tech stock. iPad sales are stagnant, iPhone sales are declining, Apple Watch sales dropped some 70% and Chromebook breakout sales caused a 20% drop in Mac Sales. Yet most analysts believe that something will improve and Apple will get its mojo back.

Only, the odds are against Apple. As I pointed out last January, Apple’s value took a huge hit because stagnating sales caused the company to completely lose its growth story. And, the message that Apple doesn’t know how to grow just keeps rolling along. By last quarter – July – I wrote Apple had fallen into a Growth Stall. And that should worry investors a lot.

Ten Deadly Sins Of Networking

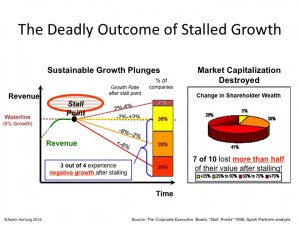

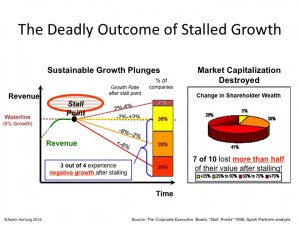

Companies that hit growth stalls almost always do a lot worse before things improve – if they ever improve. Seventy-five percent of companies that hit a growth stall have negative growth for several quarters after a stall. Only 7% of companies grow a mere 6%. To understand the pattern, think about companies like Sears, Sony, RIM/Blackberry, Caterpillar Tractor. When they slip off the growth curve, there is almost always an ongoing decline.

And because so few regain a growth story, 70% of the companies that hit a growth stall lose over half their market capitalization. Only 5% lose less than 25% of their market cap.

Why? Because results reflect history, and by the time sales and profits are falling the company has already missed a market shift. The company begins defending and extending its old products, services and business practices in an effort to “shore up” sales. But the market shifted, either to a competitor or often a new solution, and new rev levels do not excite customers enough to create renewed growth. But since the company missed the shift, and hunkered down to fight it, things get worse (usually a lot worse) before they get better.

Think about how Microsoft MSFT -0.42% missed the move to mobile. Too late, and its Windows 10 phones and tablet never captured more than 3% market share. A big miss as the traditional PC market eroded.

Right now there is nothing which indicates Apple is not going to follow the trend created by almost all growth stalls. Yes, it has a mountain of cash. But debt is growing faster than cash now, and companies have shown a long history of burning through cash hoards rather than returning the money to shareholders.

Apple has no new products generating market shifts, like the “i” line did. And several products are selling less than in previous quarters. And the CEO, Tim Cook, for all his operational skills, offers no vision. He actually grew testy when asked, and his answer about a “strong pipeline” should be far from reassuring to investors looking for the next iPhone.

Will Apple shares rise or fall over the next quarter or year? I don’t know. The stock’s P/E is cheap, and it has plenty of cash to repurchase shares in order to manipulate the price. And investors are often far from rational when assessing future prospects. But everyone would be wise to pay attention to patterns, and Apple’s Growth Stall indicates the road ahead is likely to be rocky.

by Adam Hartung | Jul 27, 2016 | Food and Drink, Growth Stall, In the Swamp, Leadership, Web/Tech

Growth Stalls are deadly for valuation, and both Mcdonald’s and Apple are in one.

August, 2014 I wrote about McDonald’s Growth Stall. The company had 7 straight months of revenue declines, and leadership was predicting the trend would continue. Using data from several thousand companies across more than 3 decades, companies in a Growth Stall are unable to maintain a mere 2% growth rate 93% of the time. 55% fall into a consistent revenue decline of more than 2%. 20% drop into a negative 6%/year revenue slide. 69% of Growth Stalled companies will lose at least half their market capitalization in just a few years. 95% will lose more than 25% of their market value. So it is a long-term concern when any company hits a Growth Stall.

A new CEO was hired, and he implemented several changes. He implemented all-day breakfast, and multiple new promotions. He also closed 700 stores in 2015, and 500 in 2016. And he announced the company would move its headquarters from suburban Oakbrook to downtown Chicago, IL. While doing something, none of these actions addressed the fundamental problem of customers switching to competitive options that meet modern consumer food trends far better than McDonald’s.

A new CEO was hired, and he implemented several changes. He implemented all-day breakfast, and multiple new promotions. He also closed 700 stores in 2015, and 500 in 2016. And he announced the company would move its headquarters from suburban Oakbrook to downtown Chicago, IL. While doing something, none of these actions addressed the fundamental problem of customers switching to competitive options that meet modern consumer food trends far better than McDonald’s.

McDonald’s stock languished around $94/share from 8/2014 through 8/2015 – but then broke out to $112 in 2 months on investor hopes for a turnaround. At the time I warned investors not to follow the herd, because there was nothing to indicate that trends had changed – and McDonald’s still had not altered its business in any meaningful way to address the new market realities.

Yet, hopes remained high and the stock peaked at $130 in May, 2016. But since then, the lack of incremental revenue growth has become obvious again. Customers are switching from lunch food to breakfast food, and often switching to lower priced items – but these are almost wholly existing customers. Not new, incremental customers. Thus, the company trumpets small gains in revenue per store (recall, the number of stores were cut) but the growth is less than the predicted 2%. The only incremental growth is in China and Russia, 2 markets known for unpredictable leadership. The stock has now fallen back to $120.

Given that the realization is growing as to the McDonald’s inability to fundamentally change its business competitively, the prognosis is not good that a turnaround will really happen. Instead, the common pattern emerges of investors hoping that the Growth Stall was a “blip,” and will be easily reversed. They think the business is fundamentally sound, and a little management “tweaking” will fix everything. Small changes will lead to the classic hockey-stick forecast of higher future growth. So the stock pops up on short-term news, only to fall back when reality sets in that the long-term doesn’t look so good.

Unfortunately, Apple’s Q3 2016 results (reported yesterday) clearly show the company is now in its own Growth Stall. Revenues were down 11% vs. last year (YOY or year-over-year,) and EPS (earnings per share) were down 23% YOY. 2 consecutive quarters of either defines a Growth Stall, and Apple hit both. Further evidence of a Growth Stall exists in iPhone unit sales declining 15% YOY, iPad unit sales off 9% YOY, Mac unit sales down 11% YOY and “other products” revenue down 16% YOY.

This was not unanticipated. Apple started communicating growth concerns in January, causing its stock to tank. And in April, revealing Q2 results, the company not only verified its first down quarter, but predicted Q3 would be soft. From its peak in May, 2015 of $132 to its low in May, 2016 of $90, Apple’s valuation fell a whopping 32%! One could say it met the valuation prediction of a Growth Stall already – and incredibly quickly!

But now analysts are ready to say “the worst is behind it” for Apple investors. They are cheering results that beat expectations, even though they are clearly very poor compared to last year. Analysts are hoping that a new, lower baseline is being set for investors that only look backward 52 weeks, and the stock price will move up on additional company share repurchases, a successful iPhone 7 launch, higher sales in emerging countries like India, and more app revenue as the installed base grows – all leading to a higher P/E (price/earnings) multiple. The stock improved 7% on the latest news.

So far, Apple still has not addressed its big problem. What will be the next product or solution that will replace “core” iPhone and iPad revenues? Increasingly competitors are making smartphones far cheaper that are “good enough,” especially in markets like China. And iPhone/iPad product improvements are no longer as powerful as before, causing new product releases to be less exciting. And products like Apple Watch, Apple Pay, Apple TV and IBeacon are not “moving the needle” on revenues nearly enough. And while experienced companies like HBO, Netflix and Amazon grow their expanding content creation, Apple has said it is growing its original content offerings by buying the exclusive rights to “Carpool Karaoke“ – yet this is very small compared to the revenue growth needs created by slowing “core” products.

Like McDonald’s stock, Apple’s stock is likely to move upward short-term. Investor hopes are hard to kill. Long-term investors will hold their stock, waiting to see if something good emerges. Traders will buy, based upon beating analyst expectations or technical analysis of price movements. Or just belief that the P/E will expand closer to tech industry norms. But long-term, unless the fundamental need for new products that fulfill customer trends – as the iPad, iPhone and iPod did for mobile – it is unclear how Apple’s valuation grows.

A new CEO was hired, and he implemented several changes. He implemented all-day breakfast, and multiple new promotions. He also

A new CEO was hired, and he implemented several changes. He implemented all-day breakfast, and multiple new promotions. He also