by Adam Hartung | May 10, 2016 | Defend & Extend, In the Swamp, Leadership, Lifecycle, Web/Tech

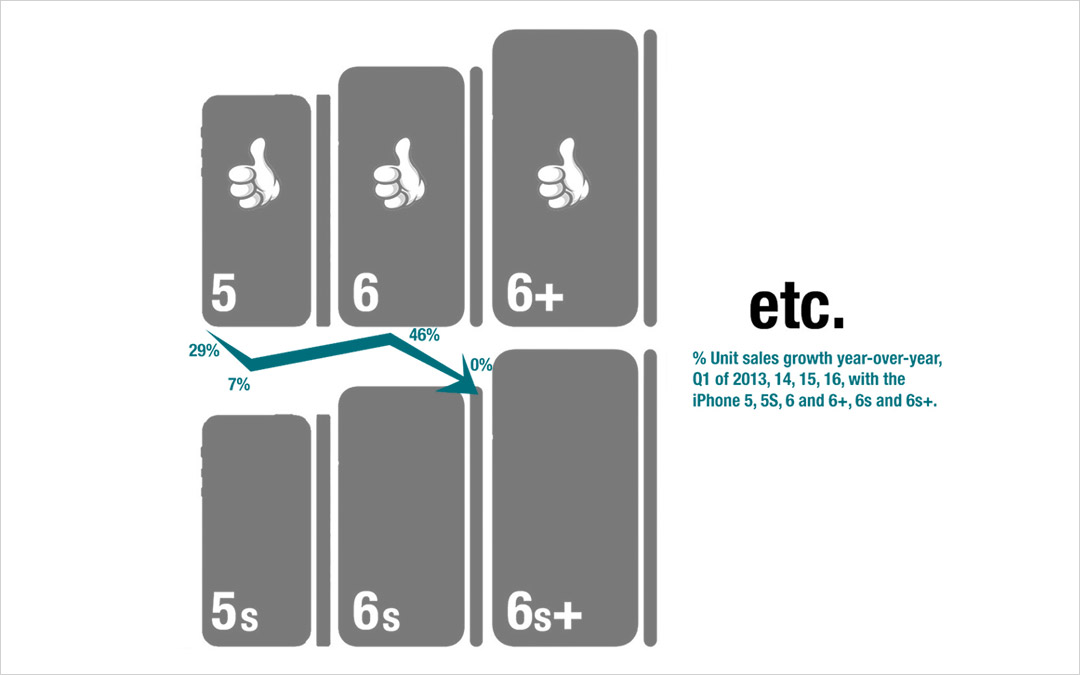

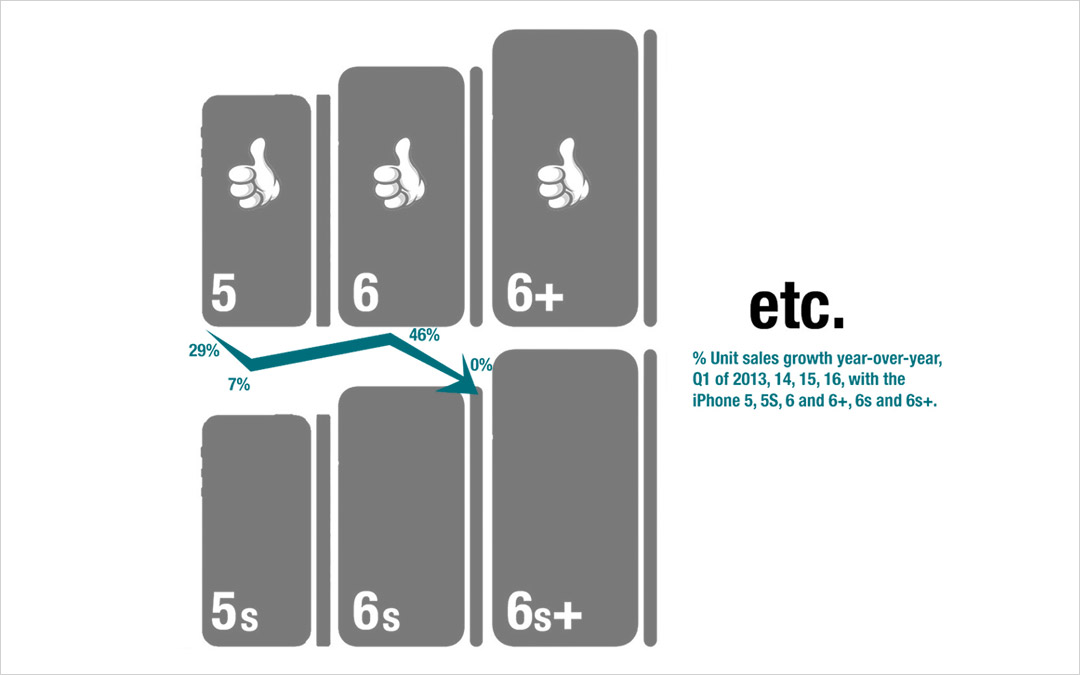

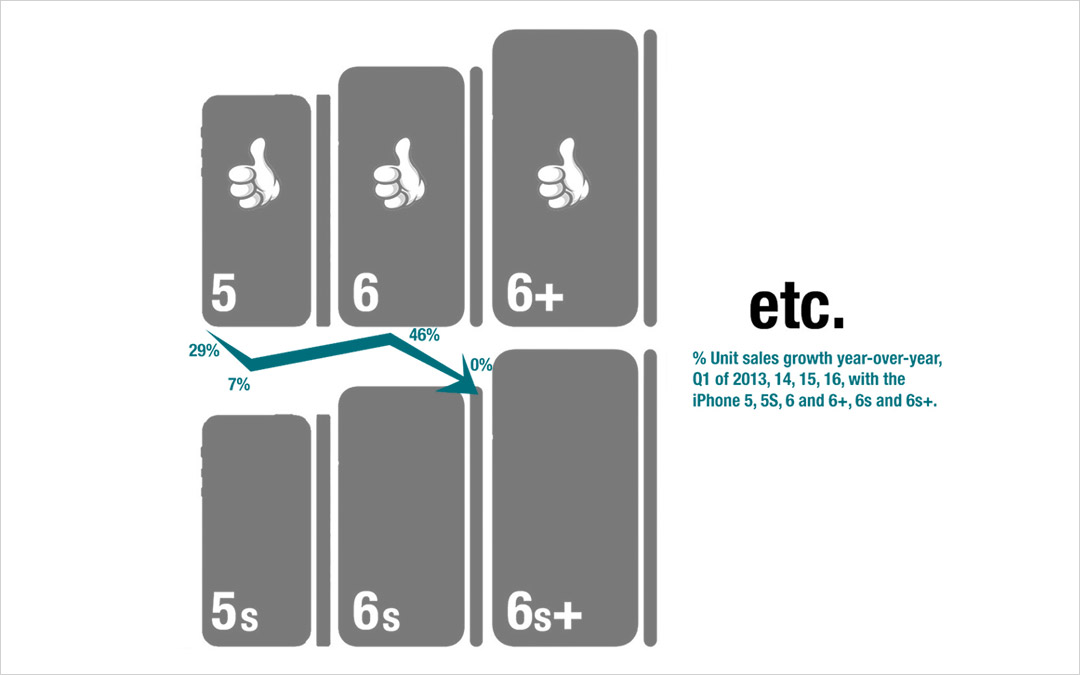

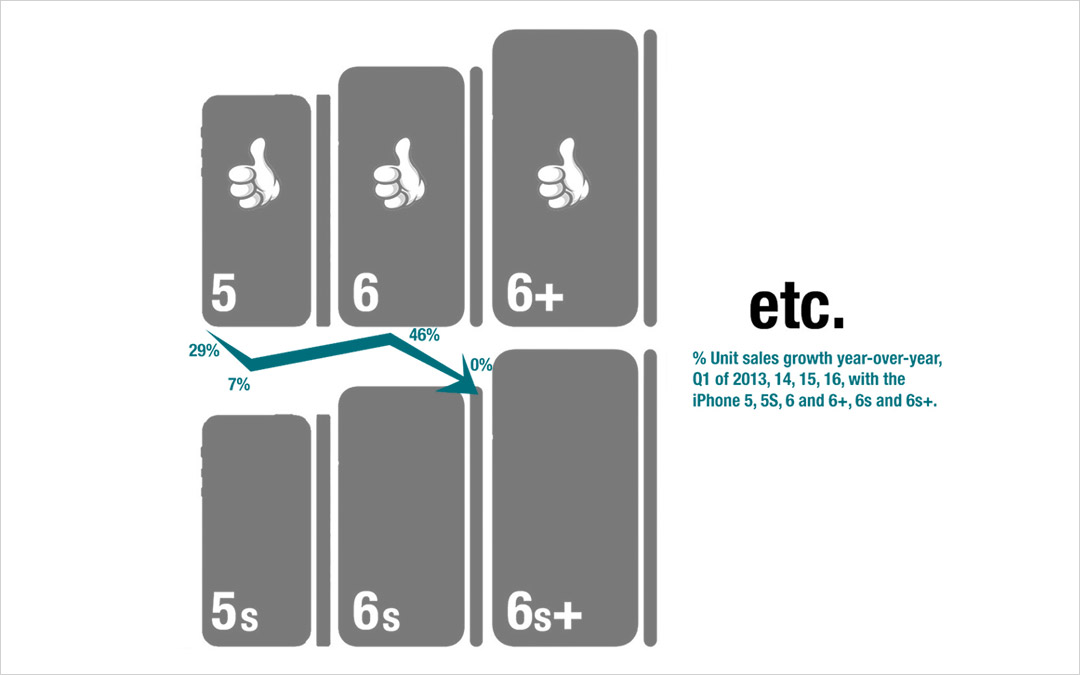

My last column focused on growth, and the risks inherent in a Growth stall. As I mentioned then, Apple will enter a Growth Stall if its revenue declines year-over-year in the current quarter. This forecasts Apple has only a 7% probability of consistently growing just 2%/year in the future.

This usually happens when a company falls into Defend & Extend (D&E) management. D&E management is when the bulk of management attention, and resources, flow into protecting the “core” business by seeking ways to use sustaining innovations (rather than disruptive innovations) to defend current customers and extend into new markets. Unfortunately, this rarely leads to high growth rates, and more often leads to compressed margins as growth stalls. Instead of working on breakout performance products, efforts are focused on ways to make new versions of old products that are marginally better, faster or cheaper.

Using the D&E lens, we can identify what looks like a sea change in Apple’s strategy.

Using the D&E lens, we can identify what looks like a sea change in Apple’s strategy.

For example, Apple’s CEO has trumpeted the company’s installed base of 1B iPhones, and stated they will be a future money maker. He bragged about the 20% growth in “services,” which are iPhone users taking advantage of Apple Music, iCloud storage, Apps and iTunes. This shows management’s desire to extend sales to its “installed base” with sustaining software innovations. Unfortunately, this 20% growth was a whopping $1.2B last quarter, which was 2.4% of revenues. Not nearly enough to make up for the decline in “core” iPhone, iPad or Mac sales of approximately $9.5B.

Apple has also been talking a lot about selling in China and India. Unfortunately, plans for selling in India were at least delayed, if not thwarted, by a decision on the part of India’s regulators to not allow Apple to sell low cost refurbished iPhones in the country. Fearing this was a cheap way to dispose of e-waste they are pushing Apple to develop a low-cost new iPhone for their market. Either tactic, selling the refurbished products or creating a cheaper version, are efforts at extending the “core” product sales at lower margins, in an effort to defend the historical iPhone business. Neither creates a superior product with new features, functions or benefits – but rather sustains traditional product sales.

Of even greater note was last week’s announcement that Apple inked a partnership with SAP to develop uses for iPhones and iPads built on the SAP ERP (Enterprise Resource Planning) platform. This announcement revealed that SAP would ask developers on its platform to program in Swift in order to support iOS devices, rather than having a PC-first mentality.

This announcement builds on last year’s similar announcement with IBM. Now 2 very large enterprise players are building applications on iOS devices. This extends the iPhone, a product long thought of as great for consumers, deeply into enterprise sales. A market long dominated by Microsoft. With these partnerships Apple is growing its developer community, while circumventing Microsoft’s long-held domain, promoting sales to companies as well as individuals.

And Apple has shown a willingness to help grow this market by introducing the iPhone 6se which is smaller and cheaper in order to obtain more traction with corporate buyers and corporate employees who have been iPhone resistant. This is a classic market extension intended to sustain sales with more applications while making no significant improvements in the “core” product itself.

And Apple’s CEO has said he intends to make more acquisitions – which will surely be done to shore up weaknesses in existing products and extend into new markets. Although Apple has over $200M of cash it can use for acquisitions, unfortunately this tactic can be a very difficult way to actually find new growth. Each would be targeted at some sort of market extension, but like Beats the impact can be hard to find.

Remember, after all revenue gains and losses were summed, Apple’s revenue fell $7.6B last quarter. Let’s look at some favorite analyst acquisition targets to explain:

- Box could be a great acquisition to help bring more enterprise developers to Apple. Box is widely used by enterprises today, and would help grow where iCloud is weak. IBM has already partnered with Box, and is working on applications in areas like financial services. Box is valued at $1.45B, so easily affordable. But it also has only $300M of annual revenue. Clearly Apple would have to unleash an enormous development program to have Box make any meaningful impact in a company with over $500B of revenue. Something akin of Instagram’s growth for Facebook would be required. But where Instagram made Facebook a pic (versus words) site, it is unclear what major change Box would bring to Apple’s product lines.

- Fitbit is considered a good buy in order to put some glamour and growth onto iWatch. Of course, iWatch already had first year sales that exceeded iPhone sales in its first year. But Apple is now so big that all numbers have to be much bigger in order to make any difference. With a valuation of $3.7B Apple could easily afford FitBit. But FitBit has only $1.9B revenue. Given that they are different technologies, it is unclear how FitBit drives iWatch growth in any meaningful way – even if Apple converted 100% of Fitbit users to the iWatch. There would need to be a “killer app” in development at FitBit that would drive $10B-$20B additional annual revenue very quickly for it to have any meaningful impact on Apple.

- GoPro is seen as a way to kick up Apple’s photography capabilities in order to make the iPhone more valuable – or perhaps developing product extensions to drive greater revenue. At a $1.45B valuation, again easily affordable. But with only $1.6B revenue there’s just not much oomph to the Apple top line. Even maximum Apple Store distribution would probably not make an enormous impact. It would take finding some new markets in industry (enterprise) to build on things like IoT to make this a growth engine – but nobody has said GoPro or Apple have any innovations in that direction. And when Amazon tried to build on fancy photography capability with its FirePhone the product was a flop.

- Tesla is seen as the savior for the Apple Car – even though nobody really knows what the latter is supposed to be. Never mind the actual business proposition, some just think Elon Musk is the perfect replacement for the late Steve Jobs. After all the excitement for its products, Tesla is valued at only $28.4B, so again easily affordable by Apple. And the thinking is that Apple would have plenty of cash to invest in much faster growth — although Apple doesn’t invest in manufacturing and has been the king of outsourcing when it comes to actually making its products. But unfortunately, Tesla has only $4B revenue – so even a rapid doubling of Tesla shipments would yield a mere 1.6% increase in Apple’s revenues.

- In a spree, Apple could buy all 4 companies! Current market value is $35B, so even including a market premium $55B-$60B should bring in the lot. There would still be plenty of cash in the bank for growth. But, realize this would add only $8B of annual revenue to the current run rate – barely 25% of what was needed to cover the gap last quarter – and less than 2% incremental growth to the new lower run rate (that magic growth percentage to pull out of a Growth Stall mentioned earlier in this column.)

Such acquisitions would also be problematic because all have P/E (price/earnings) ratios far higher than Apple’s 10.4. FitBit is 24, GoPro is 43, and both Box and Tesla are infinite because they lose money. So all would have a negative impact on earnings per share, which theoretically should lower Apple’s P/E even more.

Acquisitions get the blood pumping for investment bankers and media folks alike – but, truthfully, it is very hard to see an acquisition path that solves Apple’s revenue problem.

All of Apple’s efforts big efforts today are around sustaining innovations to defend & extend current products. No longer do we hear about gee whiz innovations, nor do we hear about growth in market changing products like iBeacons or ApplePay. Today’s discussions are how to rejuvenate sales of products that are several versions old. This may work. Sales may recover via growth in India, or a big pick-up in enterprise as people leave their PCs behind. It could happen, and Apple could avoid its Growth Stall.

But investors have the right to be concerned. Apple can grow by defending and extending the iPhone market only so long. This strategy will certainly affect future margins as prices, on average, decline. In short, investors need to know what will be Apple’s next “big thing,” and when it is likely to emerge. It will take something quite significant for Apple to maintain it’s revenue, and profit, growth.

The good news is that Apple does sell for a lowly P/E of 10 today. That is incredibly low for a company as profitable as Apple, with such a large installed base and so many market extensions – even if its growth has stalled. Even if Apple is caught in the Innovator’s Dilemma (i.e. Clayton Christensen) and shifting its strategy to defending and extending, it is very lowly valued. So the stock could continue to perform well. It just may never reach the P/E of 15 or 20 that is common for its industry peers, and investors envisioned 2 or 3 years ago. Unless there is some new, disruptive innovation in the pipeline not yet revealed to investors.

by Adam Hartung | Oct 26, 2012 | Current Affairs, Defend & Extend, In the Whirlpool, Innovation, Leadership, Web/Tech

This is an exciting time of year for tech users – which is now all of us. The biggest show is the battle between smartphone and tablet leader Apple – which has announced new products with the iPhone 5 and iPad Mini – and the now flailing, old industry leader Microsoft which is trying to re-ignite its sales with a new tablet, operating system and office productivity suite.

I’m reminded of an old joke. Steve the trucker drives with his pal Alex. Someone at the diner says “Steve, imagine you’re going 60 miles an hour when you start down a hill. You keep gaining speed, nearing 90. Then you realize your brakes are out. Now, you see one quarter mile ahead a turn in the road, because there’s a barricade and beyond that a monster cliff. What do you do?”

Steve smiles and says “Well, I wake up Alex.”

“What? Why?” asks the questioner.

“Because Alex has never seen a wreck like the one we’re about to have.”

Microsoft has played “bet the company” on its Windows 8 launch, updated office suite and accompanied Surface tablet. (More on why it didn’t have to do this later.) Now Microsoft has to do something almost never done in business. The company has to overcome a 3 year lateness to market and upend a multi-billion dollar revenue and brand leader. It must overcome two very successful market pioneers, both of which have massive sales, high growth, very good margins, great cash flow and enormous war chests (Apple has over $100B cash.)

Just on the face of it, the daunting task sounds unlikely to succeed.

But there is far more reason to be skeptical. Apple created these markets with new products about which people had few, if any conceptions. But today customers have strong viewpoints on both what a smartphone and tablet should be like to use – and what they expect from Microsoft. And these two viewpoints are almost diametrically opposed.

Yet Microsoft has tried bridging them in the new product – and in doing so guaranteed the products will do poorly. By trying to please everyone Microsoft, like the Ford Edsel, is going to please almost no one:

- Since the initial product viewing, almost all professional reviewers have said the Surface is neat, but not fantastically so. It is different from iOS and Google’s Android products, but not superior. It has generated very little enthusiasm.

- Tests by average users have shown the products to be non-intuitive. Especially when told they are Microsoft products. So the Apple-based interface intuition doesn’t come through for easy use, nor does historical Microsoft experience. Average users have been confused, and realize they now must learn a 3rd interface – the iOS or Android they have, the old Microsoft they have, and now this new thing. It might as well be Linux for all its similarity to Microsoft.

- For those who were excited about having native office products on a tablet, the products aren’t the same as before – in feel or function. And the question becomes, if you really want the office suite do you really want a tablet or should you be using a laptop? The very issue of trying to use Office on the Surface easily makes people rethink the question, and start to realize that they may have said they wanted this, but it really isn’t the big deal they thought it would be. The tablet and laptop have different uses, and between Surface and Win8 they are seeing learning curve cost maybe isn’t worth it.

- The new Win8 – especially on the tablet – does not support a lot of the “professional” applications written on older Windows versions. Those developers now have to redevelop their code for a new platform – and many won’t work on the new tablet processors.

- Many have been banking on Microsoft winning the “enterprise” market. Selling to CIOs who want to preserve legacy code by offering a Microsoft solution. But they run into two problems. (1) Users now have to learn this 3rd, new interface. If they have a Galaxy tab or iPad they will have to carry another device, and learn how to use it. Do not expect happy employees, or executives, who expressly desire avoiding both these ideas. (2) Not all those old applications (drivers, code, etc) will port to the new platform so easily. This is not a “drop in” solution. It will take IT time and money – while CEOs keep asking “why aren’t you doing this for my iPad?”

All of this adds up to a new product set that is very late to market, yet doesn’t offer anything really new. By trying to defend and extend its Windows and Office history, Microsoft missed the market shift. It has spent several billion dollars trying to come up with something that will excite people. But instead of offering something new to change the market, it has given people something old in a new package. Microsoft they pretty much missed the market altogether.

Everyone knows that PC sales are going to decline. Unfortunately, this launch may well accelerate that decline. Remember how slowly people were willing to switch to Vista? How slowly they adopted Microsoft 7 and Office 2010? There are still millions of users running XP – and even Office XP (Office Professional 2003.) These new products may convince customers that the time and effort to “upgrade” simply means its time to switch.

Microsoft has fallen into a classic problem the Dean of innovation Clayton Christensen discusses. Microsoft long ago overshot the user need for PCs and office automation tools. But instead of focusing on developing new solutions – like Apple did by introducing greater mobility with its i products – Microsoft has diligently, for a decade, continued to dump money into overshooting the user needs for its basic products. They can’t admit to themselves that very, very, very few people are looking for a new spreadsheet or word processing application update. Or a new operating system for their laptop.

These new Microsoft products will NOT cause people to quit the trend to mobile devices. They will not change the trend of corporate users supplying their own devices for work (there’s now even an IT acronym for this movement [BYOD,] and a Wikipedia page.) It will not find a ready, excited market of people wanting to learn yet another interface, especially to use old applications they thought they already new!

It did not have to be this way.

Years ago Microsoft started pouring money into xBox. And although investors can complain about the historical cost, the xBox (and Kinect) are now market leaders in the family room. Honestly, Microsoft already has – especially with new products released this week – what people are hoping they can soon buy from AppleTV or GoogleTV; products that are at best vaporware.

Long-term, there is yet another great battle to be fought. What will be the role of monitors, scattered in homes and bars, and in train stations, lobbies and everywhere else? Who will control the access to monitors which will be used for everything from entertainment (video/music,) to research and gaming. The tablet and smartphones may well die, or mutate dramatically, as the ability to connect via monitors located nearly everywhere using —- xBox?

But, this week all discussion of the new xBox Live and music applications were overshadowed by the CEO’s determination to promote the dying product line around Windows8.

This was simply stupid. Ballmer should be fired.

The PC products should be managed for a cash hoarding transition into a smaller market. Investments should be maximized into the new products that support the next market transition. xBox and Kinect should be held up as game changers, and Microsoft should be repositioned as a leader in the family and conference room; an indespensible product line in an ever-more-connected world.

But that didn’t happen this week. And the CEO keeps heading straight for the cliff. Maybe when he takes the truck over the guard rail he’ll finally be replaced. Investors can only wake up and watch – and hope it happens sooner, rather than later.

UPDATE 16 April, 2019 – Android TV is a new emerging tech that could have a big impact on the overall marketplace. Read more about Android TV here.

by Adam Hartung | Sep 17, 2009 | Current Affairs, General, Leadership, Lifecycle, Openness

How many cars do you own? Odds are, it's at least 1 more than you need. There are more licensed vehicles in the USA than there are licensed drivers – so it's clear America is loaded with cars. Now it looks like a permanent shift is developing, to less auto ownership, and it will change competition significantly.

In places as far ranging as Detroit/Ann Arbor, Chicago and San Francisco increasingly people are opting for a new approach to transportation. Take the bus and train – yes. Take a cab – sometimes. And for a lot of folks they are joining car-sharing companies. According to Freep.com, "Service Lets Users Borrow a Car Whenevery they want." Pay a flat annual fee, as low as $30 to $150, then you rent a car in your neighborhood for as little as $8.00/hour. Right. No monthly insurance fee, no gas charge, no parking bills. You rent cars when you need them, and only as long as you need them.

To those of us, mostly older, this may seem heretical. How can you give up your car? It's long been a status symbol. What you drive is supposed to say something about who you are. But this is getting turned upside down. People, lots of people, are renting by the hour and they want something very cheap and easy to park. Cars have a place, but not in your personal parking spot at an enormous cost.

Implications are powerful. Firstly, recognize that the USA is increasingly an urban country. Every election we are reminded that while most the people live in cities, the electoral map is by state. Thus, a President can be elected while losing the popular vote! Just like the tendency across the globe, as agriculture makes less and less importance to the economy people gravitate to major urban centers. Likewise, as manufacturing jobs move offshore from America, people shift to office work which is more centralized in urban areas than the former "factory towns." These demographic trends have been developing for over 30 years, and show every sign of accelerating – not decreasing.

Thus, watching what the "early movers" are doing in urban areas is really important. We have to develop our scenarios about the future, and we can see that what happens in cities is becoming even more important than it was just a couple of decades ago. And in cities, people are opting not to buy cars. Nor even rent them for a day or two. Nor are they relying on ever more costly taxis. They are going for hourly rentals they can preschedule.

GM, Chrysler and Ford are getting very little of this business because the renters, 80%, prefer small hybrids. Hertz and other big rental car companies were being shut out, because their model was the daily rental — largely from an airport location for a traveling business person or vacationer.

In a real way, this shows all the signs of a classic Clayton Chrstensen "Disruptive Innovation." An unserved, or underserved, customer who cannot obtain personal transportation is able to get it. An unconventional solution, perhaps, but it's working. What does that tell us? As the business grows expect the leaders to develop better and better solutions, leading to more and more people accessing the solution. This is how we get to a very large market shift – not from the people currently served suddenly changing, but rather from the underserved market creating a new solution which gets improved and refined until it meets the needs of the majority of customers – who shift much later – but cut the legs out from under old Success Formulas. Meaning we could get back to families having one car (circa 1948) and when a second is needed they rent by the hour – even in the suburbs!! With insurance costs often topping $100/month for a second car, plus the cost to license and maintain it, it's less clear that multi-car ownership is as beneficial as it once was. If a viable new solution comes along – well it just might work!

This, of course, is not a good thing for auto companies dependent on a demand rebound to fix their recent woes. Their "good case" scenarios have people returning to adding to their personal fleets, while also returning to new car acquisition every 2 or 3 years. If instead buyers go the direction of less ownership and less frequent purchases it will be impossible for these companies to repay the government loans.

Markets shift. Often quickly and violently. Far too oten, we ignore these shifts. Because they look so different, so odd, that we believe it must be a short term phenomenon. We expect that things will soon get "back to normal." We have future scenarios – they are extensions of the past. But in the post-millenial global economy people are starting to do a lot of things differently. They aren't trying to return to old patterns. They are developing new ones. And if you want to compete, it's becoming crystal clear you have to change your assumptions about the future, your scenarios of the future and your approach to markets. Before you get left so far behind you fail.

Using the D&E lens, we can identify what looks like a sea change in Apple’s strategy.

Using the D&E lens, we can identify what looks like a sea change in Apple’s strategy.