by Adam Hartung | Aug 4, 2016 | Election, Leadership, Politics

Donald Trump has had a lot of trouble gaining good press lately. Instead, he’s been troubled by people from all corners reacting negatively to his comments regarding the Democrat’s convention, some speakers at the convention, and his unwillingness to endorse re-election for the Republican speaker of the house. For a guy who has been in the limelight a really long time, it seems a bit odd he would be having such a hard time – especially after all the practice he had during the primaries.

The trouble is that Donald Trump still thinks like a CEO. And being a CEO is a lot easier than being the chief executive of a governing body.

CEOs are much more like kings than mayors, governors or presidents:

- They aren’t elected, they are appointed. Usually after a long, bloody in-the-trenches career of fighting with opponents – inside and outside the company.

- They have the final say on pretty much everything. They can choose to listen to their staff, and advisors, or ignore them. Not employees, customers or suppliers can appeal their decisions.

- If they don’t like the input from an employee or advisor, they can simply fire them.

- If they don’t like a supplier, they can replace them with someone else.

- If they don’t like a customer, they can ignore them.

- Their decisions about resources, hiring/firing, policy, strategy, fund raising/pricing, spending – pretty much everything – is not subject to external regulation or legal review or potential lawsuits.

- Most decisions are made by understanding finance. Few require a deep knowledge of law.

- There is really only 1 goal – make money for shareholders. Determining success is not overly complicated, and does not involve multiple, equally powerful constituencies.

- They can make a ton of mistakes, and pretty much nobody can fire them. They don’t stand for re-election, or re-affirmation. There are no “term limits.” There is little to tie them personally to their decisions.

- They have 100% control of all the resources/assets, and can direct those resources wherever they want, whenever they want, without asking permission or dealing with oversight.

- They can say anything they want, and they are unlikely to be admonished or challenged by anyone due to their control of resource allocation and firing.

- 99% of what they say is never reported. They talk to a few people on their staff, and those people can rephrase, adjust, improve, modify the message to make it palatable to employees, customers, suppliers and local communities. There is media attention on them only when they allow it.

- They have the “power of right” on their side. They can make everyone unhappy, but if their decision improves shareholder value (if they are right) then it really doesn’t matter what anyone else thinks

One might challenge this by saying that CEOs report to the Board of Directors. Technically, this is true. But, Boards don’t manage companies. They make few decisions. They are focused on long-term interests like compliance, market entry, sales development, strategy, investor risk minimization, dividend and share buyback policy. About all they can do to a CEO if one of the above items troubles them is fire the CEO, or indicate a lack of support by adjusting compensation. And both of those actions are far from easy. Just look at how hard it is for unhappy shareholders to develop a coalition around an activist investor in order to change the Board — and then actually take action. And, if the activist is successful at taking control of the board, the one action they take is firing the CEO, only to replace that person with someone knew that has all the power of the old CEO.

It is very alluring to think of a CEO and their skills at corporate leadership being applicable to governing. And some have been quite good. Mayor Bloomberg of New York appears to have pleased most of the citizens and agencies in the city, and his background was an entrepreneur and successful CEO.

But, these are not that common. More common are instances like the current Governor of Illinois, Bruce Rauner. A billionaire hedge fund operator, and first-time elected politician, he won office on a pledge of “shaking things up” in state government. His first actions were to begin firing employees, cutting budgets, terminating pension benefits, trying to remove union representation of employees, seeking to bankrupt the Chicago school district, and similar actions. All things a “good CEO” would see as the obvious actions necessary to “fix” a state in a deep financial mess. He looked first at the financials, the P&L and balance sheet, and set about to improve revenues, cut costs and alter asset values. His mantra was to “be more like Indiana, and Texas, which are more business friendly.”

Only, governors have nowhere near the power of CEOs. He has been unable to get the legislature to agree with his ideas, most have not passed, and the state has languished without a budget going on 2 years. The Illinois Supreme Court said the pension was untouchable – something no CEO has to worry about. And it’s nowhere near as easy to bankrupt a school district as a company you own that needs debt/asset restructuring because of all those nasty laws and judges that get in the way. Additionally, government employee unions are not the same as private unions, and nowhere near as easy to “bust” due to pesky laws passed by previous governors and legislators that you can’t just wipe away with a simple decision.

With the state running a deficit, as a CEO he sees the need to undertake the pain of cutting services. Just like he’d cut “wasteful spending” on things he deemed non-essential at one of the companies he ran. So refusing funding during budget negotiations for health care worker overtime, child care, and dozens of other services that primarily are directed at small groups seems like a “hard decision, well needed.” And if the lack of funding means the college student loan program dries up, well those students will just have to wait to go to college, or find funding elsewhere. And if that becomes so acute that a few state colleges have to close, well that’s just the impact of trying to align spending with the reality of revenues, and the customers will have to find those services elsewhere.

And when every decision is subjected to media reporting, suddenly every single decision is questioned. There is no anonymity behind a decision. People don’t just see a college close and wonder “how did that happen” because there are ample journalists around to report exactly why it happened, and that it all goes back to the Governor. Just like the idea of matching employee rights, pay requirements, contract provisioning and regulations to other states – when your every argument is reported by the media it can come off sounding a lot like as state CEO you don’t much like the state you govern, and would prefer to live somewhere else. Perhaps your next action will be to take the headquarters (now the statehouse) to a neighboring state where you can get a tax abatement?

Donald Trump the CEO has loved the headlines, and the media. He was the businessman-turned-reality-TV-star who made the phrase “you’re fired” famous. Because on that show, he was the CEO. He could make any decision he wanted; unchallenged. And viewers could turn on his show, or not, it really didn’t matter. And he only needed to get a small fraction of the population to watch his show for it to make money, not a majority. And he appears to be very genuinely a CEO. As a CEO, as a TV celebrity — and now as a candidate for President.

Obviously, governing body chief executives have to be able to create coalitions in order to get things done. It doesn’t matter the party, it requires obtaining the backing of your own party (just as John Boehner about what happens when that falters) as well as the backing of those who don’t agree with you. ou don’t have the luxury of being the “tough guy” because if you twist the arm to hard today, these lawmakers, regulators and judges (who have long memories) will deny you something you really, really want tomorrow. And you have to be ready to work with journalists to tell your story in a way that helps build coalitions, because they decide what to tell people you said, and they decide how often to repeat it. And you can’t rely on your own money to take care of you. You have to raise money, a lot of money, not just for your campaign, but to make it available to give away through various PACs (Political Action Committees) to the people who need it for their re-elections in order to keep them backing you, and your ideas. Because if you can’t get enough people to agree on your platforms, then everything just comes to a stop — like the government of Illinois. Or the times the U.S. Government closed for a few days due to a budget impasse.

And, in the end, the voters who elected you can decide not to re-elect you. Just ask Jimmy Carter and George H.W. Bush about that.

On the whole, it’s a whole lot easier to be a CEO than to be a mayor, or governor, or President. And CEOs are paid a whole lot better. Like the moviemaker Mel Brooks (another person born in New York by the way) said in History of the World, Part 1 “it’s good to be king.“

by Adam Hartung | Jun 9, 2016 | Innovation, Investing, Software, Teamwork

Last week Bloomberg broke a story about how Microsoft’s Chairman, John Thompson, was pushing company management for a faster transition to cloud products and services. He even recommended changes in spending might be in order.

Really? This is news?

Let’s see, how long has the move to mobile been around? It’s over a decade since Blackberry’s started the conversion to mobile. It was 10 years ago Amazon launched AWS. Heck, end of this month it will be 9 years since the iPhone was released – and CEO Steve Ballmer infamously laughed it would be a failure (due to lacking a keyboard.) It’s now been 2 years since Microsoft closed the Nokia acquisition, and just about a year since admitting failure on that one and writing off $7.5B And having failed to achieve even 3% market share with Windows phones, not a single analyst expects Microsoft to be a market player going forward.

So just now, after all this time, the Board is waking up to the need to change the resource allocation? That does seem a bit like looking into barn lock acquisition long after the horses are gone, doesn’t it?

The problem is that historically Boards receive almost all their information from management. Meetings are tightly scheduled affairs, and there isn’t a lot of time set aside for brainstorming new ideas. Or even for arguing with management assumptions. The work of governance has a lot of procedures related to compliance reporting, compensation, financial filings, senior executive hiring and firing – there’s a lot of rote stuff. And in many cases, surprisingly to many non-Directors, the company’s strategy may only be a topic once a year. And that is usually the result of a year long management controlled planning process, where results are reviewed and few challenges are expected. Board reviews of resource allocation are at the very, very tail end of management’s process, and commitments have often already been made – making it very, very hard for the Board to change anything.

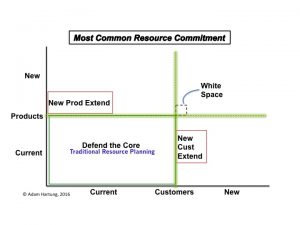

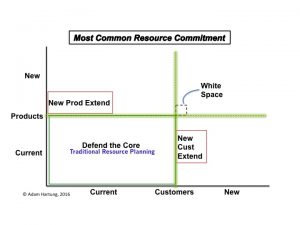

And these planning processes are backward-oriented tools, designed to defend and extend existing products and services, not predict changes in markets. These processes originated out of financial planning, which used almost exclusively historical accounting information. In later years these programs were expanded via ERP (Enterprise Resource Planning) systems (such as SAP and Oracle) to include other information from sales, logistics, manufacturing and procurement. But, again, these numbers are almost wholly historical data. Because all the data is historical, the process is fixated on projecting, and thus defending, the old core of historical products sold to historical customers.

Copyright Adam Hartung

Efforts to enhance the process by including extensions to new products or new customers are very, very difficult to implement. The “owners” of the planning processes are inherent skeptics, inclined to base all forecasts on past performance. They have little interest in unproven ideas. Trying to plan for products not yet sold, or for sales to customers not yet in the fold, is considered far dicier – and therefore not worthy of planning. Those extensions are considered speculation – unable to be forecasted with any precision – and therefore completely ignored or deeply discounted.

And the more they are discounted, the less likely they receive any resource funding. If you can’t plan on it, you can’t forecast it, and therefore, you can’t really fund it. And heaven help some employee has a really novel idea for a new product sold to entirely new customers. This is so “white space” oriented that it is completely outside the system, and impossible to build into any future model for revenue, cost or – therefore – investing.

Take for example Microsoft’s recent deal to sell a bunch of patent rights to Xiaomi in order to have Xiaomi load Office and Skype on all their phones. It is a classic example of taking known products, and extending them to very nearby customers. Basically, a deal to sell current software to customers in new markets via a 3rd party. Rather than develop these markets on their own, Microsoft is retrenching out of phones and limiting its investments in China in order to have Xiaomi build the markets – and keeping Microsoft in its safe zone of existing products to known customers.

The result is companies consistently over-investment in their “core” business of current products to current customers. There is a wealth of information on those two groups, and the historical info is unassailable. So it is considered good practice, and prudent business, to invest in defending that core. A few small bets on extensions might be OK – but not many. And as a result the company investment portfolio becomes entirely skewed toward defending the old business rather than reaching out for future growth opportunities.

This can be disastrous if the market shifts, collapsing the old core business as customers move to different solutions. Such as, say, customers buying fewer PCs as they shift to mobile devices, and fewer servers as they shift to cloud services. These planning systems have no way to integrate trend analysis, and therefore no way to forecast major market changes – especially negative ones. And they lack any mechanism for planning on big changes to the product or customer portfolio. All future scenarios are based on business as it has been – a continuation of the status quo primarily – rather than honest scenarios based on trends.

How can you avoid falling into this dilemma, and avoiding the Microsoft trap? To break this cycle, reverse the inputs. Rather than basing resource allocation on financial planning and historical performance, resource allocation should be based on trend analysis, scenario planning and forecasts built from the future backward. If more time were spent on these plans, and engaging external experts like Board Directors in discussions about the future, then companies would be less likely to become so overly-invested in outdated products and tired customers. Less likely to “stay at the party too long” before finding another market to develop.

If your planning is future-oriented, rather than historically driven, you are far more likely to identify risks to your base business, and reduce investments earlier. Simultaneously you will identify new opportunities worthy of more resources, thus dramatically improving the balance in your investment portfolio. And you will be far less likely to end up like the Chairman of a huge, formerly market leading company who sounds like he slept through the last decade before recognizing that his company’s resource allocation just might need some change.

by Adam Hartung | Sep 29, 2015 | Current Affairs, Leadership, Quotes

The stock market is incredibly fickle. In the short term, stock prices can swing significantly on such short-term news as:

- What are reviewers saying about the newest, yet-to-be released iPhone?

- Will Amazon use drones for shipping?

- How many people in Latin America signed up for Netflix?

You get the drift. But for long-term investors there is quite a bit more to creating long-term, sustainable shareholder value than short-term news. If you’re not a short-term trader, standing back and taking the long-term view is important for deciding where to invest your hard-earned savings.

The National Association of Corporate Directors (NACD) has over 17,000 members that serve on Boards of publicly traded, for-profit private and non-profit organizations. It is the world’s leading association studying regulations and how they are applied, and recommending best practices for Boards of Directors to apply corporate governance.

At their annual meeting this week NACD released its newest report The Board and Long-Term Value Creation created by its Blue Ribbon Commission of leading Directors. Succinctly, the report calls on all Boards to help management overcome myopia around short-term results, and increase attention on creating long-term value.

Most metrics used in business are very short-term, including sales, volume, costs and margin. The report points out that at most companies long-term compensation is defined as 3 years or less — shorter than most new product development programs or even new branding or image creation programs. Unfortunately, this can lead to spending too much time on tactics and machinations to drive short-term reporting, hoping that the long-term will simply take care of itself.

Most metrics used in business are very short-term, including sales, volume, costs and margin. The report points out that at most companies long-term compensation is defined as 3 years or less — shorter than most new product development programs or even new branding or image creation programs. Unfortunately, this can lead to spending too much time on tactics and machinations to drive short-term reporting, hoping that the long-term will simply take care of itself.

“Instead of viewing short-term results and long-term strategy as mutually exclusive, boards and executives should view them in terms of degrees of alignment,” said Karen Horn, co-chair of the NACD Blue Ribbon Commission; vice chair of the NACD board; and director of Eli Lilly & Co., Norfolk Southern Corp., Simon Property Group, and T. Rowe Price Mutual Funds. “It should be possible to draw a clear line from the company’s day-to-day activities to its long-term objectives.”

“Board agendas need to accommodate sufficient time for substantive discussions about long-term opportunities and risks, rather than being dominated by backward-looking reviews of past performance,” said Bill McCracken, co-chair of the NACD Blue Ribbon Commission, former CEO of CA Technologies, and director of MDU Resources and NACD.

The report notes that short-term pressures on management are greater than ever. But Boards can take measures to bring the focus back on long-term value creation by actively engaging in various activities, such as:

-

developing long-term strategy,

-

reviewing capital allocation process and where money is invested,

-

careful consideration of management incentives including compensation,

-

applying oversight to corporate culture,

-

participating in communications with analysts, investors, and other constituencies.

“The Commission believes that directors need to be active students of the business, seeking out information from multiple sources in preparation for boardroom discussions rather than being passive recipients of data from management. And rather than being dominated by retrospective analysis of past performance, board agendas should provide adequate time for substantive discussion of long-term strategic choices, risks, and opportunities.”

From great minds come great reads. NACD membership is growing at double digit rates, at a time when many associations struggle to maintain membership. As regulations on officers and directors grow, NACD’s active development of programs and reports providing guidance to Directors on how they can meet ever increasing demands to provide effective, active governance is providing great value to those leading America’s organizations. This Blue Ribbon Commission report is another example of forward-thinking guidance that all corporate directors and officers (and investors) should read.

by Adam Hartung | Nov 3, 2014 | Current Affairs, In the Rapids, Leadership, Web/Tech

On April 15 Zebra Technologies announced its planned acquisition of Motorola’s Enterprise Device Business. This was remarkable because it represented a major strategic shift for Zebra, and one that would take a massive investment in products and technologies which were wholly new to the company. A gutsy play to make Zebra more relevant in its B-2-B business as interest in its “core” bar code business was declining due to generic competition.

Last week the acquisition was completed. In an example of Jonah swallowing the whale, Zebra added $2.5B to annual revenues on its old base of $1B (2.5x incremental revenue,) an additional 4,500 employees joined its staff of 2,500 and 69 new facilities were added. Gulp.

As CEO Anders Gustafsson told me, “after the deal was agreed to I felt like the dog that caught the car. ”

Fortunately Zebra has a plan, and it is all around growth. Acquisitions led by private equity firms, hedge funds or leveraged buyout partners are usually quick to describe the “synergies” planned for after the acquisition. Synergy is a code word for massive cost cutting (usually meaning large layoffs,) selling off assets (from buildings to product lines and intellectual property rights) and shutting down what the buyers call “marginal” businesses. This always makes the company smaller, weaker and less likely to survive as the new investors focus on pulling out cash and selling the remnants to some large corporation.

There is no growth plan.

But Zebra has publicly announced that after this $3.25B investment they plan only $150M of savings over 2 years. Which means Zebra’s management team intends to grow what they bought, not decimate it. What a novel, or perhaps throwback, idea.

Minimal cost cutting reflects a deal, as CEO Gustafsson told me, “envisioned by management, not by bankers.”

Zebra’s management knew the company was frequently pitching for new work in partnership with Motorola. The two weren’t competitors, but rather two companies working to move their clients forward. But in a disorganized, unplanned way because they were two totally different companies. Zebra’s team recognized that if this became one unit, better planning for clients, the products could work better together, the solutions more directly target customer needs and it would be possible to slingshot forward ahead of competitors to grow revenues.

As CEO since 2007, Anders Gustafsson had pushed a strategy which could grow Zebra, and move the company outside its historical core business of bar code printers and readers. The leadership considered buying Symbol Technology, but wasn’t ready and watched it go to Motorola.

Then Zebra’s team knuckled down on their strategy work. CEO Gustafsson spelled out for me the 3 trends which were identified to build upon:

- Mobility would continue to be a secular growth trend. And business customers needed products with capabilities beyond the generic smart phone. For example, the kind of integrated data entry and printing device used at a remote rental car return. These devices drive business productivity, and customers hunger for such solutions.

- From the days of RFID, where Zebra was an early player, had emerged automatic data capture – which became what now is commonly called “The Internet of Things” – and this trend too had far to extend. By connecting the physical and digital worlds, in markets like retail inventory management, big productivity boosts were possible in formerly moribund work that added cost but little value.

- Cloud-based (SaaS and growth of lightweight apps) ecosystems were going to provide fast growth environments. Client need for capability at the employee’s (or their customer’s) fingertips would grow, and those people (think distributors, value added resellers [VARs]) who build solutions will create apps, accessible via the cloud, to rapidly drive customer productivity.

With this groundwork, the management team developed future scenarios in which it became increasingly clear the value in merging together with Motorola devices to accelerate growth. According to CEO Gustafsson, “it would bring more digital voice to the Zebra physical voice. It would allow for more complete product offerings which would fulfill critical, macro customer trends.”

But, to pull this off required selling the Board of Directors. They are ultimately responsible for company investments, and this was – as described above – a “whopper.”

The CEO’s team spent a lot of time refining the message, to be clear about the benefits of this transaction. Rather than pitching the idea to the Board, they offered it as an opportunity to accelerate strategy implementation. Expecting a wide range of reactions, they were not surprised when some Directors thought this was “phenomenal” while others thought it was “fraught with risk.”

So management agreed to work with the Board to undertake a thorough due diligence process, over many weeks (or months it turned out) to ask all the questions. A key executive, who was a bit skeptical in her own right, took on the role of the “black hat” leader. Her job was to challenge the many ideas offered, and to be a chronic skeptic; to not let the team become enraptured with the idea and thereby sell themselves on success too early, and/or not consider risks thoroughly enough. By persistently undertaking analysis, education led the Board to agree that management’s strategy had merit, and this deal would be a breakout for Zebra.

Next came completing financing. This was a big deal. And the only way to make it happen was for Zebra to take on far more debt than ever in the company’s history. But, the good news was that interest rates are at record low levels, so the cost was manageable.

Zebra’s leadership patiently met with bankers and investors to overview the market strategy, the future scenarios and their plans for the new company. They over and again demonstrated the soundness of their strategy, and the cash flow ability to service the debt. Zebra had been a smaller, stable company. The debt added more dynamism, as did the much greater revenues. The requirement was to decide if the strategy was soundly based on trends, and had a high likelihood of success. Quickly enough, the large shareholders agreed with the path forward, and the financing was fully committed.

Now that the acquisition is complete we will all watch carefully to see if the growth machine this leadership team created brings to market the solutions customers want, so Zebra can generate the revenue and profits investors want. If it does, it will be a big win for not only investors but Zebra’s employees, suppliers and the communities in which Zebra operates.

The obvious question has to be, why didn’t Motorola do this deal? After all, they were the whale. It would have been much easier for people to understand Motorola buying Zebra than the gutsy deal which ultimately happened.

Answering this question requires a lot more thought about history. In 2006 Motorola had launched the Razr phone and was an industry darling. Newly minted CEO Ed Zander started partnering with Google and Apple rather than developing proprietary solutions like Razr. Carl Icahn soon showed up as an activist investor intent on restructuring the company and pulling out more cash. Quickly then-CEO Ed Zander was pushed out the door. New leadership came in, and Motorola’s new product introductions disappeared.

Under pressure from Mr. Icahn, Motorola started shrinking under direction of the new CEO. R&D and product development went through many cuts. New product launches simply were delayed, and died. The cellular phone business began losing money as RIM brought to market Blackberry and stole the enterprise show. Year after year the focus was on how to raise cash at Motorola, not how to grow.

After 4 years, Mr. Icahn was losing money on his position in Motorola. A year later Motorola spun out the phone business, and a year after that leadership paid Mr. Icahn $1.2B in a stock repurchase that saved him from losses. The CEO called this buyout of Icahn the “end of a journey” as Mr. Icahn took the money and ran. How this benefited Motorola is – let’s say unclear.

But left in Icahn’s wake was a culture of cut and shred, rather than invest. After 90 years of invention, from Army 2-way radios to police radios, from AM car radios to home televisions, the inventor analog and digital cell towers and phones, there was no more innovation at Motorola. Motorola had become a company where the leaders, and Board, only thought about how to raise cash – not deploy it effectively within the corporation. There was very little talk about how to create new markets, but plenty about how to retrench to ever smaller “core” markets with no sales growth and declining margins. In September of this year long-term CEO Greg Brown showed no insight for what the company can become, but offered plenty of thoughts on defending tax inversions and took the mantle as apologist for CEOs who use financial machinations to confuse investors.

Investors today should cheer the leadership, in management and on the Board, at Zebra. Rather than thinking small, they thought big. Rather than bragging about their past, they figured out what future they could create. Rather than looking at their limits, they looked at the possibilities. Rather than giving up in the face of objections, they studied the challenges until they had answers. Rather than remaining stuck in their old status quo, they found the courage to become something new.

Bravo.

by Adam Hartung | Apr 22, 2013 | Current Affairs, Defend & Extend, In the Swamp, In the Whirlpool, Leadership

JCPenney's board fired the company CEO 18 months ago. Frustrated with weak performance, they replaced him with the most famous person in retail at the time. Ron Johnson was running Apple's stores, which had the highest profit per square foot of any retail chain in America. Sure he would bring the Midas touch to JC Penney they gave him a $50M sign-on bonus and complete latitude to do as he wished.

Things didn't work out so well. Sales fell some 25%. The stock dropped 50%. So about 2 weeks ago the Board fired Ron Johnson.

The first mistake: Ron Johnson didn't try solving the real problem at JC Penney. He spent lavishly trying to remake the brand. He modernized the logo, upped the TV ad spend, spruced up stores and implemented a more consistent pricing strategy. But that all was designed to help JC Penney compete in traditional brick-and-mortar retail. Against traditional companies like Wal-Mart, Kohl's, Sears, etc. But that wasn't (and isn't) JC Penney's problem.

The problem in all of traditional retail is the growth of on-line. In a small margin business with high fixed costs, like traditional retail, even a small revenue loss has a big impact on net profit. For every 5% revenue decline 50-90% of that lost cash comes directly off the bottom line – because costs don't fall with revenues. And these days every quarter – every month – more and more customers are buying more and more stuff from Amazon.com and its on-line brethren rather than brick and mortar stores. It is these lost revenues that are destroying revenues and profits at Sears and JC Penney, and stagnating nearly everyone else including Wal-Mart.

Coming from the tech world, you would have expected CEO Johnson to recognize this problem and radically change the strategy, rather than messing with tactics. He should have looked to close stores to lower fixed costs, developed a powerful on-line presence and marketed hard to grab more customers showrooming or shopping from home. He should have targeted to grow JCP on-line, stealing revenues from other traditional retailers, while making the company more of a hybrid retailer that profitably met customer needs in stores, or on-line, as suits them. He should have used on-line retail to take customers from locked-in competitors unable to deal with "cannibalization."

No wonder the results tanked, and CEO Johnson was fired. Doing more of the tired, old strategies in a shifting market never works. In Apple parlance, he needed to be focused on an iPad strategy, when instead he kept trying to sell more Macs.

But now the Board has made its second mistake. Bringing back the old CEO, Myron Ullman, has deepened JP Penney's lock-in to that old, traditional and uncompetitve brick-and-mortar strategy. He intends to return to JCP's legacy, buy more newspaper coupons, and keep doing more of the same. While hoping for a better outcome.

What was that old description of insanity? Something about repeating yourself…..

Expectedly, Penney's stock dropped another 10% after announcing the old CEO would return. Investors are smart enough to recognize the retail market has shifted. That newsapaper coupons, circulars and traditional advertising is not enough to compete with on-line merchants which have lower fixed costs, faster inventory turns and wider product selection.

It certainly appears Mr. Johnson was not the right person to grow JC Penney. All the more reason JCP needs to accelerate its strategy toward the on-line retail trend. Going backward will only worsen an already terrible situation.