by Adam Hartung | Nov 6, 2013 | Defend & Extend, Innovation, Leadership, Web/Tech

Can you believe it has been only 12 years since Apple introduced the iPod? Since then Apple’s value has risen from about $11 (January, 2001) to over $500 (today) – an astounding 45X increase.

With all that success it is easy to forget that it was not a “gimme” that the iPod would succeed. At that time Sony dominated the personal music world with its Walkman hardware products and massive distribution through consumer electronics chains such as Best Buy, and broad-line retailers like Wal-Mart. Additionally, Sony had its own CD label, from its acquisition of Columbia Records (renamed CBS Records,) producing music. Sony’s leadership looked impenetrable.

But, despite all the data pointing to Sony’s inevitable long-term domination, Apple launched the iPod. Derided as lacking CD quality, due to MP3’s compression algorithms, industry leaders felt that nobody wanted MP3 products. Sony said it tried MP3, but customers didn’t want it.

All the iPod had going for it was a trend. Millions of people had downloaded MP3 songs from Napster. Napster was illegal, and users knew it. Some heavy users were even prosecuted. But, worse, the site was riddled with viruses creating havoc with all users as they downloaded hundreds of millions of songs.

Eventually Napster was closed by the government for widespread copyright infreingement. Sony, et.al., felt the threat of low-priced MP3 music was gone, as people would keep buying $20 CDs. But Apple’s new iPod provided mobility in a way that was previously unattainable. Combined with legal downloads, including the emerging Apple Store, meant people could buy music at lower prices, buy only what they wanted and literally listen to it anywhere, remarkably conveniently.

The forecasted “numbers” did not predict Apple’s iPod success. If anything, good analysis led experts to expect the iPod to be a limited success, or possibly failure. (Interestingly, all predictions by experts such as IDC and Gartner for iPhone and iPad sales dramatically underestimated their success, as well – more later.) It was leadership at Apple (led by the returned Steve Jobs) that recognized the trend toward mobility was more important than historical sales analysis, and the new product would not only sell well but change the game on historical leaders.

Which takes us to the mistake Intel made by focusing on “the numbers” when given the opportunity to build chips for the iPhone. Intel was a very successful company, making key components for all Microsoft PCs (the famous WinTel [for Windows+Intel] platform) as well as the Macintosh. So when Apple asked Intel to make new processors for its mobile iPhone, Intel’s leaders looked at the history of what it cost to make chips, and the most likely future volumes. When told Apple’s price target, Intel’s leaders decided they would pass. “The numbers” said it didn’t make sense.

Uh oh. The cost and volume estimates were wrong. Intel made its assessments expecting PCs to remain strong indefinitely, and its costs and prices to remain consistent based on historical trends. Intel used hard, engineering and MBA-style analysis to build forecasts based on models of the past. Intel’s leaders did not anticipate that the new mobile trend, which had decimated Sony’s profits in music as the iPod took off, would have the same impact on future sales of new phones (and eventually tablets) running very thin apps.

Harvard innovation guru Clayton Christensen tells audiences that we have complete knowledge about the past. And absolutely no knowledge about the future. Those who love numbers and analysis can wallow in reams and reams of historical information. Today we love the “Big Data” movement which uses the world’s most powerful computers to rip through unbelievable quantities of historical data to look for links in an effort to more accurately predict the future. We take comfort in thinking the future will look like the past, and if we just study the past hard enough we can have a very predictible future.

But that isn’t the way the business world works. Business markets are incredibly dynamic, subject to multiple variables all changing simultaneously. Chaos Theory lecturers love telling us how a butterfly flapping its wings in China can cause severe thunderstorms in America’s midwest. In business, small trends can suddenly blossom, becoming major trends; trends which are easily missed, or overlooked, possibly as “rounding errors” by planners fixated on past markets and historical trends.

Markets shift – and do so much, much faster than we anticipate. Old winners can drop remarkably fast, while new competitors that adopt the trends become “game changers” that capture the market growth.

In 2000 Apple was the “Mac” company. Pretty much a one-product company in a niche market. And Apple could easily have kept trying to defend & extend that niche, with ever more problems as Wintel products improved.

But by understanding the emerging mobility trend leadership changed Apple’s investment portfolio to capture the new trend. First was the iPod, a product wholly outside the “core strengths” of Apple and requiring new engineering, new distribution and new branding. And a product few people wanted, and industry leaders rejected.

Then Apple’s leaders showed this talent again, by launching the iPhone in a market where it had no history, and was dominated by Motorola and RIMM/BlackBerry. Where, again, analysts and industry leaders felt the product was unlikely to succeed because it lacked a keyboard interface, was priced too high and had no “enterprise” resources. The incumbents focused on their past success to predict the future, rather than understanding trends and how they can change a market.

Too bad for Intel. And Blackberry, which this week failed in its effort to sell itself, and once again changed CEOs as the stock hit new lows.

Then Apple did it again. Years after Microsoft attempted to launch a tablet, and gave up, Apple built on the mobility trend to launch the iPad. Analysts again said the product would have limited acceptance. Looking at history, market leaders claimed the iPad was a product lacking usability due to insufficient office productivity software and enterprise integration. The numbers just did not support the notion of investing in a tablet.

Anyone can analyze numbers. And today, we have more numbers than ever. But, numbers analysis without insight can be devastating. Understanding the past, in grave detail, and with insight as to what used to work, can lead to incredibly bad decisions. Because what really matters is vision. Vision to understand how trends – even small trends – can make an enormous difference leading to major market shifts — often before there is much, if any, data.

by Adam Hartung | Sep 4, 2013 | Current Affairs, Defend & Extend, In the Whirlpool, Leadership, Lock-in, Web/Tech

Just over a week after Microsoft announces plans to replace CEO Steve Ballmer the company announced it will spend $7.2B to buy the Nokia phone/tablet business. For those looking forward to big changes at Microsoft this was like sticking a pin in the big party balloon!

Everyone knows that Microsoft's future is at risk now that PC sales are declining globally at nearly 10% – with developing markets shifting even faster to mobile devices than the USA. And Microsoft has been the perpetual loser in mobile devices; late to market and with a product that is not a game changer and has only 3% share in the USA.

But, despite this grim reality, Microsoft has doubled-down (that's doubled its bet for non-gamblers) on its Windows 8 OS strategy, and continues to play "bet the company". Nokia's global market share has shriveled to 15% (from 40%) since former Microsoft exec-turned-Nokia-CEO Stephen Elop committed the company to Windows 8. Because other Microsoft ecosystem companies like HP, Acer and HP have been slow to bring out Win 8 devices, Nokia has 90% of the miniscule market that is Win 8 phones. So this acquisition brings in-house a much deeper commitment to spending on an effort to defend & extend Microsoft's declining O/S products.

As I predicted in January, the #1 action we could expect from a Ballmer-led Microsoft is pouring more resources into fighting market leaders iOS and Android – an unwinnable war. Previously there was the $8.5B Skype and the $400M Nook, and now a $7.2B Nokia. And as 32,000 Nokia employees join Microsoft losses will surely continue to rise. While Microsoft has a lot of cash – spending it at this rate, it won't last long!

Some folks think this acquisition will make Microsoft more like Apple, because it now will have both hardware and software which in some ways is like Apple's iPhone. The hope is for Apple-like sales and margins soon. But, unfortunately, Google bought Motorola months ago and we've seen that such revenue and profit growth are much harder to achieve than simply making an acquisition. And Android products are much more popular than Win8. Simply combining Microsoft and Nokia does not change the fact that Win8 products are very late to market, and not very desirable.

Some have postulated that buying Nokia was a way to solve the Microsoft CEO succession question, positioning Mr. Elop for Mr. Ballmer's job. While that outcome does seem likely, it would be one of the most expensive recruiting efforts of all time. The only reason for Mr. Elop to be made Microsoft CEO is his historical company relationship, not performance. And that makes Mr. Elop is exactly the wrong person for the Microsoft CEO job!

In October, 2010 when Mr. Elop took over Nokia I pointed out that he was the wrong person for that job – and he would destroy Nokia by making it a "Microsoft shop" with a Microsoft strategy. Since then sales are down, profits have evaporated, shareholders are in revolt and the only good news has been selling the dying company to Microsoft! That's not exactly the best CEO legacy.

Mr. Elop's job today is to sell more Win8 mobile devices. Were he to be made Microsoft CEO it is likely he would continue to think that is his primary job – just as Mr. Ballmer has believed. Neither CEO has shown any ability to realize that the market has already shifted, that there are two leaders far, far in front with brand image, products, apps, developers, partners, distribution, market share, sales and profits. And it is impossible for Microsoft to now catch up.

It is for good reason that short-term traders pushed down Microsoft's share value after the acquisition was announced. It is clear that current CEO Ballmer and Microsoft's Board are still stuck fighting the last war. Still trying to resurrect the Windows and Office businesses to previous glory. Many market anallysts see this as the last great effort to make Ballmer's bet-the-company on Windows 8 pay off. But that's a bet which every month is showing longer and longer odds.

Microsoft is not dead. And Microsoft is not without the ability to turn around. But it won't happen unless the Board recognizes it needs to steer Microsoft in a vastly different direction, reduce (rather than increase) investments in Win8 (and its devices,) and create a vision for 2020 where Microsoft is highly relevant to customers. So far, we're seeing all the wrong moves.

by Adam Hartung | Nov 29, 2012 | Defend & Extend, In the Swamp, In the Whirlpool, Leadership, Web/Tech

The web lit up yesterday when people started sharing a Fortune quote from Marissa Mayer, CEO of Yahoo, "We are literally moving the company from BlackBerrys to smartphones." Why was this a big deal? Because, in just a few words, Ms. Mayer pointed out that Research In Motion is no longer relevant. The company may have created the smartphone market, but now its products are so irrelevant that it isn't even considered a market participant.

Ouch. But, more importantly, this drove home that no matter how good RIM thinks Blackberry 10 may be, nobody cares. And when nobody cares, nobody buys. And if you weren't convinced RIM was headed for lousy returns and bankruptcy before, you certainly should be now.

But wait, this is certainly a good bit of the pot being derogatory toward the kettle. Because, other than the highly personalized news about Yahoo's new CEO, very few people care about Yahoo these days as well. After being thoroughly trounced in ad placement and search by Google, it is wholly unclear how Yahoo will create its own relevancy. It may likely be soon when a major advertiser says "When placing our major internet ad program we are focused on the split between Google and Facebook," demonstrating that nobody really cares about Yahoo anymore, either.

And how long will Yahoo survive?

The slip into irrelevancy is the inflection point into failure. Very few companies ever return. Once you are no longer relevant, customer quickly stop paying attention to practically anything you do. Even if you were once great, it doesn't take long before the slide into no-growth, cost cutting and lousy financial performance happens.

Consider:

- Garmin once led the market for navigation devices. Now practically everyone uses their mobile phone for navigation. The big story is Apple's blunder with maps, while Google dominates the marketplace. You probably even forgot Garmin exists.

- Radio Shack once was a consumer electronics powerhouse. They ran superbowl ads, and had major actresses parlaying with professional sports celebrities in major network ads. When was the last time you even thought about Radio Shack, much less visited a store?

- Sears was once America's premier, #1 retailer. The place where everyone shopped for brands like Craftsman, DieHard and Kenmore. But when did you last go into a Sears? Or even consider going into one? Do you even know where one is located?

- Kodak invented amateur photography. But when that market went digital nobody cared about film any more. Now Kodak is in bankruptcy. Do you care?

- Motorola Razr phones dominated the last wave of traditional cell phones. As sales plummeted they flirted with bankruptcy, until Motorola split into 2 pieces and the money losing phone business became Google – and nobody even noticed.

- When was the last time you thought about "building your body 12 ways" with Wonder bread? Right. Nobody else did either. Now Hostess is liquidating.

Being relevant is incredibly important, because markets shift quickly today. As they shift, either you are part of the trend going forward – or you are part of the "who cares" past. If you are the former, you are focused on new products that customers want to evaluate. If you are the latter, you can disappear a whole lot faster than anyone expected as customers simply ignore you.

So now take a look at a few other easy-to-spot companies losing relevancy:

- HP headlines are dominated by write offs of its investments in services and software, causing people to doubt the viability of its CEO, Meg Whitman. Who wants to buy products from a company that would spend billions on Palm, business services and Autonomy ERP software only to decide they overspent and can never make any money on those investments? Once a great market leader, HP is rapidly becoming a company nobody cares about; except for what appears to be a bloody train wreck in the making. In tech – lose customesr and you have a short half-life.

- Similarly Dell. A leader in supply chain management, what Dell product now excites you? As you think about the money you will spend this holiday, or in 2013, on tech products you're thinking about mobile devices — and where is Dell?

- Best Buy was the big winner when Circuit City went bankrupt. But Best Guy didn't change, and now margins have cratered as people showroom Amazon while in their store to negotiate prices. How long can Best Buy survive when all TVs are the same, and price is all that matters? And you download all your music and movies?

- Wal-Mart has built a huge on-line business. Did you know that? Do you care? Regardless of Wal-mart's on-line efforts, the company is known for cheap looking stores with cheap merchandise and customers that can't maintain credit cards. When you look at trends in retailing, is Wal-Mart ever the leader – in anything – anymore? If not, Wal-mart becomes a "default" store location when all you care about is price, and you can't wait for an on-line delivery. Unless you decide to go to the even cheaper Dollar General or Aldi.

And, the best for last, is Microsoft. Steve Ballmer announced that Microsoft phone sales quadrupled! Only, at 4 million units last quarter that is about 10% of Apple or Android. Truth is, despite 3 years of development, a huge amount of pre-release PR and ad spending, nobody much cares about Win8, Surface or new Microsoft-based mobile phones. People want an iPhone or Samsung product.

After its "lost decade" when Microsoft simply missed every major technology shift, people now don't really care about Microsoft. Yes, it has a few stores – but they dwarfed in number and customers by the Apple stores. Yes, the shifting tiles and touch screen PCs are new – but nobody real talks about them; other than to say they take a lot of new training. When it comes to "game changers" that are pushing trends, nobody is putting Microsoft in that category.

So the bad news about a $6 billion write-down of aQuantive adds to the sense of "the gang that can't shoot straight" after the string of failures like Zune, Vista and early Microsoft phones and tablets. Not to mention the lack of interest in Skype, while Internet Explorer falls to #2 in browser market share behind Chrome.

Chart Courtesy Jay Yarrow, BusinessInsider.com 5-21-12

Chart Courtesy Jay Yarrow, BusinessInsider.com 5-21-12

When a company is seen as never able to take the lead amidst changing

trends, investors see accquisitions like $1.2B for Yammer as a likely future write down. Customers lose interest and simply spend money elsewhere.

As investors we often hear about companies that were once great brands, but selling at low multiples, and therefore "value plays." But the truth is these are death traps that wipe out returns. Why? These companies have lost relevancy, and that puts them one short step from failure.

As company managers, where are you investing? Are you struggling to be relevant as other competitors – maybe "fringe" companies that use "voodoo solutions" you don't consider "enterprise ready" or understand – are obtaining a lot more interest and media excitment? You can work all you want to defend & extend your past glory, but as markets shift it is amazingly easy to lose relevancy. And it's a very, very tough job to play catch- up.

Just look at the money being spent trying at RIM, Microsoft, HP, Dell, Yahoo…………

–

by Adam Hartung | Aug 9, 2012 | Current Affairs, Defend & Extend, In the Swamp, Leadership, Lock-in

McDonald’s is in a Growth Stall. Even though the stock is less than 10% off its recent 52 week high (which is about the same high it’s had since the start of 2012,) the odds of McDonald’s equity going down are nearly 10x the odds of it achieving new highs.

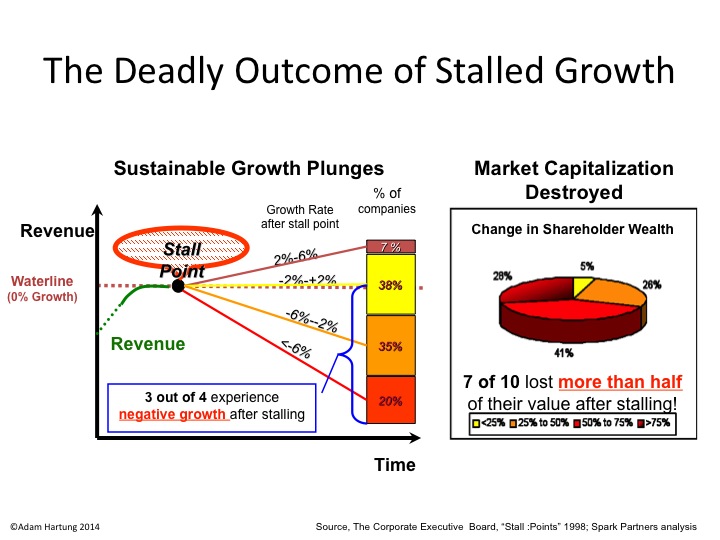

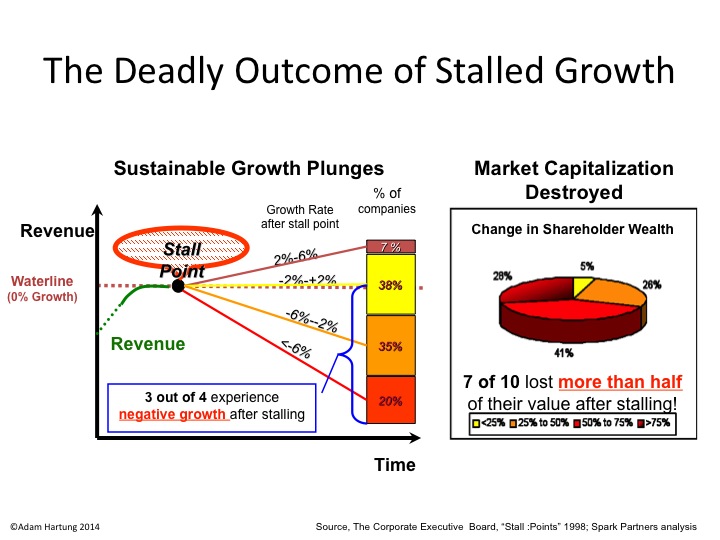

A Growth Stall occurs when a company has 2 consecutive quarters of declining sales or earnings, or 2 consecutive quarters of lower sales or earnings than the previous year. And our research, in conjunction with The Conference Board, proved that when this happens the future becomes fairly easy to predict.

Growth Stalls are Deadly

When companies hit a growth Stall, 93% of the time they are unable to maintain even a 2% growth rate. 55% fall into a consistent revenue decline of more than 2%. 1 in 5 drop into a negative 6%/year revenue slide. 69% of Growth Stalled companies will lose at least half their market capitalization in just a few years. 95% will lose more than 25% of their market value.

Back in February, McDonalds sales in USA stores open at least 13 months fell 1.4%. By May these same stores reported reported their 7th consecutive month (now more than 2 quarters) of declining revenues. And in July McDonald’s reported the worst sales decline in over a decade – with stores globally selling 2.5% less (USA stores were down 3.2% for the month.) McDonald’s leadership is now warning that annual sales will be weaker than forecast – and could well be a reported decline.

While McDonald’s has been saying that Asian store revenue growth had offset the USA declines, we now can see that the USA drop is the key signal of a stall. There was no specific program in Asia to indicate that offshore revenues could create a renewed uptick in USA sales. Now with offshore sales plummeting we can see that McDonald’s American performance is the lead indicator of a company with serious performance issues.

Growth Stalls are a great forecasting tool because they indicate when a company has become “out of step” with its marketplace. While management, and in fact many analysts, will claim that this performance deficit is a short term aberration which will be repaired in coming months, historical evidence — and a plethora of case stories – tell us that in fact by the time a Growth Stall shows itself (especially in a company as large as McDonald’s) the situation is far more dire (and systemic) than management would like investors to believe.

Something fundamental has happened in the marketplace, and company leadership is busy trying to defend its historical business in the face of a major change that is pulling customers toward substitute solutions. Frequently this defend & extend approach exacerbates the problems as retrenchment efforts further hurt revenues.

McDonald’s has reached this inflection point as the result of a long string of leadership decisions which have worked to submarine long-term value.

Back in 2006 McDonald’s sold its fast growing Chipotle chain in order to raise additional funds to close some McDonald’s stores, and undertake an overhaul of the supply chain as well as many remaining stores. This one-time event was initially good for McDonald’s, but it hurt shareholders by letting go of an enormously successful revenue growth machine.

Since that sale Chipotle has outperformed McDonalds by 3x, and it was clear in 2011 that investors were better off with the faster growing Chipotle than the operationally focused McDonald’s. Desperate for revenues as its products lagged changing customer tastes, by December, 2012 McDonald’s was urging franchisees to stay open on Christmas Day in order to add just a bit more to the top line. However, such operational tactics cannot overcome a product line that is fat-and-carb-heavy and off current customer food trends, and by this July was ranked the worst burger in the marketplace. Meanwhile McDonald’s customer service this June ranked dead last in the industry. All telltale signs of the problems creating the emergent Growth Stall.

Meanwhile, McDonald’s is facing a significant attack on its business model as trends turn toward higher minimum wages. By August, 2013 the first signs of the trend were clear – and the impact on McDonald’s long-term fortunes were put in question. By February, 2014 the trend was accelerating, yet McDonald’s continued ignoring the situation. And this month the issue has become a front-and-center problem for McDonald’s investors as the National Labor Relations Board (NLRB) has said it will not separate McDonald’s from its franchisees in pay and hours disputes – something which opens McDonald’s deep pockets to litigants looking to build on the living wage trend.

The McDonald’s CEO is somewhat “under seige” due to the poor revenue and earnings reports. Yet, the company continues to ascribe its Growth Stall to short-term problems such as a meat processing scandal in China. But this inverts the real situation. Such scandals are not the cause of current poor results. Rather, they are the outcome of actions taken to meet goals set by leadership pushing too hard, trying to achieve too much, by defending and extending an outdated success formula desperately in need of change to meet new competitive market conditions.

Application of Growth Stall analysis has historically been very valuable. In May, 2009 I reported on the Growth Stall at Motorola which threatened to dramatically lower company value. Subsequently Motorola spun off its money losing phone business, sold other assets and businesses, and is now a very small remnant of the business prior to its Growth Stall; which was brought on by an overwhelming market shift to smartphones from 2-way radios and traditional cell phones.

In February, 2008 a Growth Stall at General Electric indicated the company would struggle to reach historical performance for long-term investors. The stock peaked at $57.80 in 2000, then at $41.40 in July, 2007. By January, 2009 (post Stall) the company had crashed to only $10, and even recent higher valuations ($28 in 10/2013) are still far from the all-time highs – or even highs in the last decade.

In May, 2008 the Growth Stall at AIG portended big problems for the Dow Jones Industrial (DJIA) giant as financial markets continued to shift radically and quickly. By the end of 2008 AIG stock cratered and the company was forced to wipe out shareholders completely in a government-backed restructuring.

Perhaps the most compelling case has been Microsoft. By February, 2010 a Growth Stall was impending (and confirmed by May, 2011) warning of big changes for the tech giant. Mobile device sales exploded, sending Apple and Google stocks soaring, while Microsoft’s primary, core market for PCs (and software for PCs) has fallen into decline. Windows 8 subsequently had a tepid market acceptance, and gained no traction in mobile devices, causing Microsoft to write-off its investment in the Surface tablet. Recent announcements about enormous lay-offs, with vast cuts in the acquired Nokia handheld unit, do not bode well for long-term revenue growth at the decaying (yet cash rich) giant.

As the Dow has surged to record highs, it has lifted all boats. Including those companies which are showing serious problems. It is easy to look at the ubiquity of McDonald’s stores and expect the chain to remain forever dominant. But, the company is facing serious strategic problems with its products, service and business model which leadership has shown no sign of addressing. The recent Growth Stall serves as a key long-term indicator that McDonald’s is facing serious problems which will most likely seriously jeopardize investors’ (as well as employees’, suppliers’ and supporting communities’) potential returns.

by Adam Hartung | Jun 18, 2012 | Current Affairs, Defend & Extend, In the Whirlpool, Innovation, Leadership, Web/Tech

While there is an appropriately high interest in the Win8 Tablet announcement from Microsoft today, there is no way it is going to be a game changer. Simply because it was never intended to be.

Game changers meet newly emerging, unmet needs, in new ways. People are usually happy enough, until they see the new product/solution and realize "hey, this helps me do something I couldn't do before" or "this helps me solve my problem a lot better." Game changers aren't a simple improvement, they allow customers to do something radically different. And although at first they may well appear to not work too well, or appear too expensive, they meet needs so uniquely, and better, that they cause people to change their behavior.

Motorola invented the smart phone. But Motorola thought it was too expensive to be a cell phone, and not powerful enough to be a PC. Believing it didn't fit existing markets well, Motorola shelved the product.

Apple realized people wanted to be mobile. Cell phones did talk and text OK – and RIM had pretty good email. But it was limited use. Laptops had great use, but were too big, heavy and cumbersome to be really mobile. So Apple figured out how to add apps to the phone, and use cloud services support, in order to make the smart phone fill some pretty useful needs – like navigation, being a flashlight, picking up tweets – and a few hundred thousand other things – like doctors checking x-rays or MRI results. Not as good as a PC, and somewhat on the expensive side for the device and the AT&T connection, but a whole lot more convenient. And that was a game changer.

From the beginning, Windows 8 has been – by design – intended to defend and extend the Windows product line. Rather than designed to resolve unmet needs, or do things nobody else could do, or dramatically improve productivity over all other possible solutions, Windows 8 was designed to simply extend Windows so (hopefully) people would not shift to the game changer technology offered by Apple and later Google.

The problem with trying to extend old products into new markets is it rarely works. Take for example Windows 7. It was designed to replace Windows Vista, which was quite unpopular as an upgrade from Windows XP. By most accounts, Windows 7 is a lot better. But, it didn't offer users anything that that made them excited to buy Windows 7. It didn't solve any unmet needs, or offer any radically better solutions. It was just Windows better and faster (some just said "fixed.")

Nothing wrong with that, except Windows 7 did not address the most critical issue in the personal technology marketplace. Windows 7 did not stop the transition from using PCs to using mobile devices. As a result, while sales of app-enabled smartphones and tablets exploded, sales of PCs stalled:

Chart reproduced with permission of Business Insider Intelligence 6/12/12 courtesy of Alex Cocotas

People are moving to the mobility provided by apps, cloud services and the really easy to use interface on modern mobile devices. Market leading cell phone maker, Nokia, decided it needed to enter smartphones, and did so by wholesale committing to Windows7. But now the CEO, Mr. Elop (formerly a Microsoft executive,) is admitting Windows phones simply don't sell well. Nobody cares about Microsoft, or Windows, now that the game has changed to mobility – and Windows 7 simply doesn't offer the solutions that Apple and Android does. Not even Nokia's massive brand image, distribution or ad spending can help when a product is late, and doesn't greatly exceed the market leader's performance. Just last week Nokia announced it was laying off another 10,000 employees.

Reviews of Win8 have been mixed. And that should not be surprising. Microsoft has made the mistake of trying to make Win8 something nobody really wants. On the one hand it has a new interface called Metro that is supposed to be more iOS/Android "like" by using tiles, touch screen, etc. But it's not a breakthrough, just an effort to be like the existing competition. Maybe a little better, but everyone believes the leaders will be better still with new updates soon. By definition, that is not game changing.

Simultaneously, with Win8 users can find their way into a more historical Windows inteface. But this is not obvious, or intuitive. And it has some pretty "clunky" features for those who like Windows. So it's not a "great" Windows solution that would attract developers today focused on other platforms.

Win8 tries to be the old, and the new, without being great at either, and without offering anything that solves new problems, or creates breakthroughs in simplicity or performance.

Do you know the story about the Ford Edsel?

By focusing on playing catch up, and trying to defend & extend the Windows history, Microsoft missed what was most important about mobility – and that is the thousands of apps. The product line is years late to market, short on apps, short on app developers and short on giving anyone a reason to really create apps for Win8.

Some think it is good if Microsoft makes its own tablet – like it has done with xBox. But that really doesn't matter. What matters is whether Microsoft gives users and developers something that causes them to really, really want a new platform that is late and doesn't have the app base, or the app store, or the interfaces to social media or all the other great thinks they already have come to expect and like about their tablet (or smartphone.)

When iOS came out it was new, unique and had people flocking to buy it. Developers could only be mobile by joining with Apple, and users could only be mobile by buying Apple. That made it a game changer by leading the trend toward mobility.

Google soon joined the competition, built a very large, respectable following by chasing Apple and offering manufacturers an option for competing with Apple.

But Microsoft's new entry gives nobody a reason to develop for, or buy, a Win8 tablet – regardless of who manufactures it. Microsoft does not deliver a huge, untapped market. Microsoft doesn't solve some large, unmet need. Microsoft doesn't promise to change the game to some new, major trend that would drive early adopters to change platforms and bring along the rest of the market.

And making a deal so a dying company, on the edge of bankruptcy – Barnes & Noble – uses your technology is not a "big win." Amazon is killing Barnes & Noble, and Microsoft Windows 8 won't change that. No more than the Nook is going to take out Kindle, Kindle Fire, Galaxy Tab or the iPad. Microsoft can throw away $300million trying to convince people Win8 has value, but spending investor money on a dying businesses as a PR ploy is just stupid.

Microsoft is playing catch up. Catch up with the user interface. Catch up with the format. Catch up with the device size and portability. Catch up with the usability (apps). Just catch up.

Microsoft's problem is that it did not accept the PC market was going to stall back in 2008 or 2009. When it should have seen that mobility was a game changing trend, and required retooling the Microsoft solution suite. Microsoft dabbled with music mobility with Zune, but quickly dropped the effort as it refocused on its "core" Windows. Microsoft dabbled with mobile phones across different solutions including Kin – which it dropped along with Microsoft Mobility. Back again to focusing on operating systems. By maintaining its focus on Windows Microsoft hoped it could stop the trend, and refused to accept the market shift that was destined to stall its sales.

Microsoft stock has been flat for a decade. It's recent value improvement as Win8 approaches launch indicates that hope beats eternally in some investors' breasts for a return of Microsoft software dominance. But those days are long past. PC sales have stalled, and Windows is a product headed toward obsolescence as competitors make ever better, more powerful mobile platforms and ecosystems. If you haven't sold Microsoft yet, this may well be your last chance above $30. Ever.