by Adam Hartung | Jun 14, 2015 | Current Affairs, In the Rapids, Leadership, Web/Tech

Dick Costolo was let go from his role as CEO of Twitter, to be replaced by a former CEO that was also fired. Unfortunately, it looks very strongly as if the Board made this decision for the wrong reasons.

Even though investors have been unhappy with Twitter’s share price, as CEO Mr. Costolo was doing a decent job of growing the company and improving profits. And even though analysts keep offering reasons why he was fired, it looks mostly as if this was a political decision in a company with a “soap opera” executive culture. Investors should be worried.

Let’s compare Mr. Costolo to CEO Zuckerberg’s performance at Facebook, and Mr. Bezos’ performance at Amazon. The latter two have been widely heralded for their leadership, so it sets a pretty good bar.

None of these three companies have enough earnings to matter. If you aren’t a growth investor, and you always value a company on earnings, then none of these are your cup of tea. All are evaluated on revenue and user metrics.

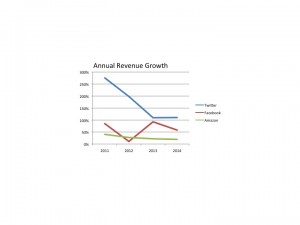

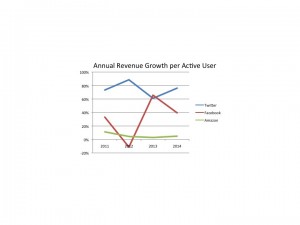

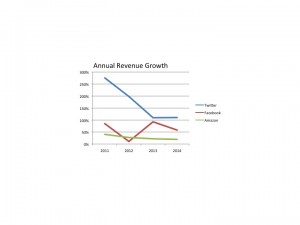

As you can see, Twitter’s revenue growth exceeds its comparators. Yes, its decline has been more dramatic, but we are comparing Twitter to companies that are much older and bigger. The net is to understand that revenues are growing, and at a better clip than Facebook and Amazon.

As you can see, Twitter’s revenue growth exceeds its comparators. Yes, its decline has been more dramatic, but we are comparing Twitter to companies that are much older and bigger. The net is to understand that revenues are growing, and at a better clip than Facebook and Amazon.

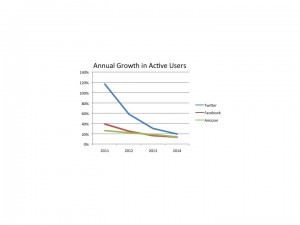

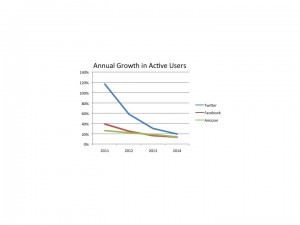

Next we should look at active monthly users. Again, these numbers are growing at all 3. And some analysts have said it is the deceleration in the rate of new user growth that doomed Mr. Costolo. But this defies logic given that during his tenure Twitter has dramatically outperformed its competition.

Next we should look at active monthly users. Again, these numbers are growing at all 3. And some analysts have said it is the deceleration in the rate of new user growth that doomed Mr. Costolo. But this defies logic given that during his tenure Twitter has dramatically outperformed its competition.

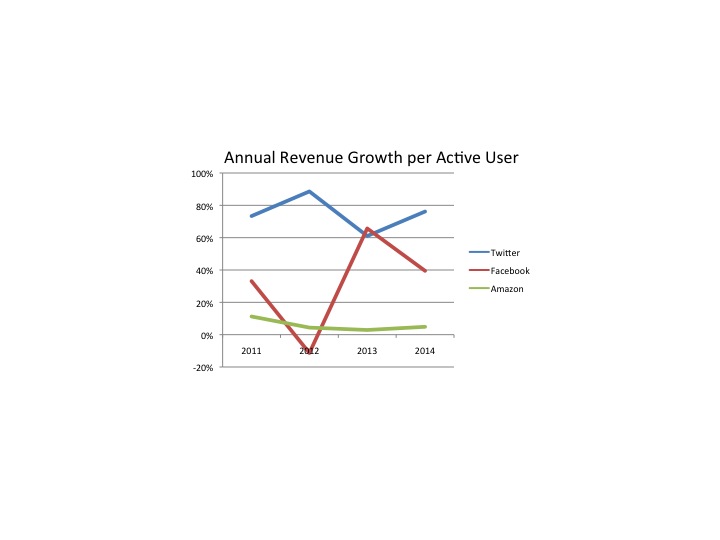

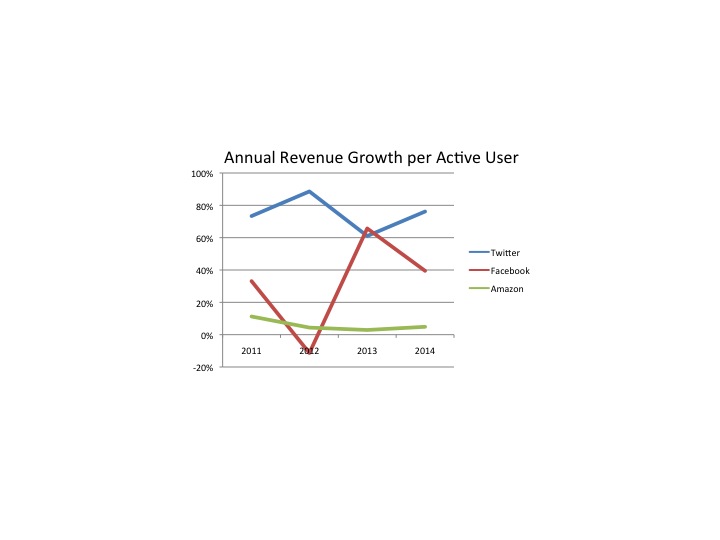

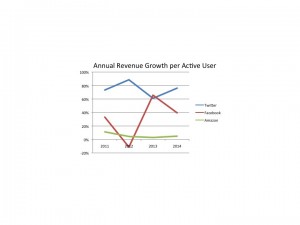

Lastly, let’s look at the “quality” of users. We can measure this by calculating the revenue per user. If this goes up, then the company is growing it top line by gaining more revenue per user – it is not “discounting” its way to higher volume. Instead,we can expect profits to improve based upon growth in this metric.

And here we can see that Twitter has wildly outperformed Facebook and Amazon. Twitter has grown its revenue per user by over 9-fold in the last 4 years, an excellent 75% per year compounded. Facebook, by comparison, roughly tripled its revenue/user (still very good) creating a 25%/year growth (certainly not to be sneezed at.) Amazon’s growth per user across the full 4 years was 25% – or about 4%/year.

And here we can see that Twitter has wildly outperformed Facebook and Amazon. Twitter has grown its revenue per user by over 9-fold in the last 4 years, an excellent 75% per year compounded. Facebook, by comparison, roughly tripled its revenue/user (still very good) creating a 25%/year growth (certainly not to be sneezed at.) Amazon’s growth per user across the full 4 years was 25% – or about 4%/year.

It isn’t hard to see that Mr. Costolo has been doing a pretty good job leading Twitter.

But Twitter has had a very checkered past when it comes to leaders. Several articles have been written about the revolving door on the CEO office, with founders back-stabbing each other as money is raised and efforts are made to improve company performance technologically and financially.

The Board has shown a proclivity to spend too much time listening to rumors, and previous CEOs. Rather than focusing on exactly how many users are coming aboard, and how much revenue is generated on those users.

The returning CEO was himself previously replaced. And during his tenure there were many technical problems. Why he would be inserted, and the best performing CEO in company history shunted aside is completely unclear. But for investors, employees, users (of which I am one) and customers this change in leadership looks to be poorly conceived, and quite concerning. Mr. Costolo was doing a pretty good job.

Data on revenues came from Marketwatch for Twitter, Facebook and Amazon. Data on users (in Amazon’s case customers) came from Statista.com for Twitter, Facebook and Amazon. Charts were created by Adam Hartung (C).

by Adam Hartung | Nov 3, 2014 | Current Affairs, In the Rapids, Leadership, Web/Tech

On April 15 Zebra Technologies announced its planned acquisition of Motorola’s Enterprise Device Business. This was remarkable because it represented a major strategic shift for Zebra, and one that would take a massive investment in products and technologies which were wholly new to the company. A gutsy play to make Zebra more relevant in its B-2-B business as interest in its “core” bar code business was declining due to generic competition.

Last week the acquisition was completed. In an example of Jonah swallowing the whale, Zebra added $2.5B to annual revenues on its old base of $1B (2.5x incremental revenue,) an additional 4,500 employees joined its staff of 2,500 and 69 new facilities were added. Gulp.

As CEO Anders Gustafsson told me, “after the deal was agreed to I felt like the dog that caught the car. ”

Fortunately Zebra has a plan, and it is all around growth. Acquisitions led by private equity firms, hedge funds or leveraged buyout partners are usually quick to describe the “synergies” planned for after the acquisition. Synergy is a code word for massive cost cutting (usually meaning large layoffs,) selling off assets (from buildings to product lines and intellectual property rights) and shutting down what the buyers call “marginal” businesses. This always makes the company smaller, weaker and less likely to survive as the new investors focus on pulling out cash and selling the remnants to some large corporation.

There is no growth plan.

But Zebra has publicly announced that after this $3.25B investment they plan only $150M of savings over 2 years. Which means Zebra’s management team intends to grow what they bought, not decimate it. What a novel, or perhaps throwback, idea.

Minimal cost cutting reflects a deal, as CEO Gustafsson told me, “envisioned by management, not by bankers.”

Zebra’s management knew the company was frequently pitching for new work in partnership with Motorola. The two weren’t competitors, but rather two companies working to move their clients forward. But in a disorganized, unplanned way because they were two totally different companies. Zebra’s team recognized that if this became one unit, better planning for clients, the products could work better together, the solutions more directly target customer needs and it would be possible to slingshot forward ahead of competitors to grow revenues.

As CEO since 2007, Anders Gustafsson had pushed a strategy which could grow Zebra, and move the company outside its historical core business of bar code printers and readers. The leadership considered buying Symbol Technology, but wasn’t ready and watched it go to Motorola.

Then Zebra’s team knuckled down on their strategy work. CEO Gustafsson spelled out for me the 3 trends which were identified to build upon:

- Mobility would continue to be a secular growth trend. And business customers needed products with capabilities beyond the generic smart phone. For example, the kind of integrated data entry and printing device used at a remote rental car return. These devices drive business productivity, and customers hunger for such solutions.

- From the days of RFID, where Zebra was an early player, had emerged automatic data capture – which became what now is commonly called “The Internet of Things” – and this trend too had far to extend. By connecting the physical and digital worlds, in markets like retail inventory management, big productivity boosts were possible in formerly moribund work that added cost but little value.

- Cloud-based (SaaS and growth of lightweight apps) ecosystems were going to provide fast growth environments. Client need for capability at the employee’s (or their customer’s) fingertips would grow, and those people (think distributors, value added resellers [VARs]) who build solutions will create apps, accessible via the cloud, to rapidly drive customer productivity.

With this groundwork, the management team developed future scenarios in which it became increasingly clear the value in merging together with Motorola devices to accelerate growth. According to CEO Gustafsson, “it would bring more digital voice to the Zebra physical voice. It would allow for more complete product offerings which would fulfill critical, macro customer trends.”

But, to pull this off required selling the Board of Directors. They are ultimately responsible for company investments, and this was – as described above – a “whopper.”

The CEO’s team spent a lot of time refining the message, to be clear about the benefits of this transaction. Rather than pitching the idea to the Board, they offered it as an opportunity to accelerate strategy implementation. Expecting a wide range of reactions, they were not surprised when some Directors thought this was “phenomenal” while others thought it was “fraught with risk.”

So management agreed to work with the Board to undertake a thorough due diligence process, over many weeks (or months it turned out) to ask all the questions. A key executive, who was a bit skeptical in her own right, took on the role of the “black hat” leader. Her job was to challenge the many ideas offered, and to be a chronic skeptic; to not let the team become enraptured with the idea and thereby sell themselves on success too early, and/or not consider risks thoroughly enough. By persistently undertaking analysis, education led the Board to agree that management’s strategy had merit, and this deal would be a breakout for Zebra.

Next came completing financing. This was a big deal. And the only way to make it happen was for Zebra to take on far more debt than ever in the company’s history. But, the good news was that interest rates are at record low levels, so the cost was manageable.

Zebra’s leadership patiently met with bankers and investors to overview the market strategy, the future scenarios and their plans for the new company. They over and again demonstrated the soundness of their strategy, and the cash flow ability to service the debt. Zebra had been a smaller, stable company. The debt added more dynamism, as did the much greater revenues. The requirement was to decide if the strategy was soundly based on trends, and had a high likelihood of success. Quickly enough, the large shareholders agreed with the path forward, and the financing was fully committed.

Now that the acquisition is complete we will all watch carefully to see if the growth machine this leadership team created brings to market the solutions customers want, so Zebra can generate the revenue and profits investors want. If it does, it will be a big win for not only investors but Zebra’s employees, suppliers and the communities in which Zebra operates.

The obvious question has to be, why didn’t Motorola do this deal? After all, they were the whale. It would have been much easier for people to understand Motorola buying Zebra than the gutsy deal which ultimately happened.

Answering this question requires a lot more thought about history. In 2006 Motorola had launched the Razr phone and was an industry darling. Newly minted CEO Ed Zander started partnering with Google and Apple rather than developing proprietary solutions like Razr. Carl Icahn soon showed up as an activist investor intent on restructuring the company and pulling out more cash. Quickly then-CEO Ed Zander was pushed out the door. New leadership came in, and Motorola’s new product introductions disappeared.

Under pressure from Mr. Icahn, Motorola started shrinking under direction of the new CEO. R&D and product development went through many cuts. New product launches simply were delayed, and died. The cellular phone business began losing money as RIM brought to market Blackberry and stole the enterprise show. Year after year the focus was on how to raise cash at Motorola, not how to grow.

After 4 years, Mr. Icahn was losing money on his position in Motorola. A year later Motorola spun out the phone business, and a year after that leadership paid Mr. Icahn $1.2B in a stock repurchase that saved him from losses. The CEO called this buyout of Icahn the “end of a journey” as Mr. Icahn took the money and ran. How this benefited Motorola is – let’s say unclear.

But left in Icahn’s wake was a culture of cut and shred, rather than invest. After 90 years of invention, from Army 2-way radios to police radios, from AM car radios to home televisions, the inventor analog and digital cell towers and phones, there was no more innovation at Motorola. Motorola had become a company where the leaders, and Board, only thought about how to raise cash – not deploy it effectively within the corporation. There was very little talk about how to create new markets, but plenty about how to retrench to ever smaller “core” markets with no sales growth and declining margins. In September of this year long-term CEO Greg Brown showed no insight for what the company can become, but offered plenty of thoughts on defending tax inversions and took the mantle as apologist for CEOs who use financial machinations to confuse investors.

Investors today should cheer the leadership, in management and on the Board, at Zebra. Rather than thinking small, they thought big. Rather than bragging about their past, they figured out what future they could create. Rather than looking at their limits, they looked at the possibilities. Rather than giving up in the face of objections, they studied the challenges until they had answers. Rather than remaining stuck in their old status quo, they found the courage to become something new.

Bravo.

by Adam Hartung | Oct 21, 2014 | Current Affairs, Innovation, Leadership

“Where was the Board of Directors?”

That is one of the questions I am asked most frequently. And it’s a good one. Readers, and audiences, wonder how a well-educated and experienced Board could allow a company – like Blockbuster, Hostess, Radio Shack, Sears, Circuit City and Blackberry, to name a few – to fall into bankruptcy, or a situation where the future looks dismal, perhaps impossible.

Isn’t the Board accountable for company strategy, performance and the decisions made by the CEO? Perhaps, but they often haven’t acted like it.

Powerless Past

Historically Boards of Directors reviewed a company strategy once per year, and it was far from a discussion. The CEO, perhaps along with his/her top few executives, would present a multi-page document, attaching ample appendices including elaborate spreadsheets and charts. This would be a one-way presentation to the Board, overviewing recent performance, past strategy and management’s view of the future strategy.

There might have been polite discussion, but the Board only had one available action, either approve the strategy, or reject it. Given that Boards had no ability to create their own strategy, and rarely much data to contradict the mountain of statistics presented by management, the vote was a given – out came the “rubber stamp” of approval. All orchestrated by an “Imperial CEO” who rarely wanted discussion, or anything other than quick approval.

A Call For Change

Facing mounting investor concerns about strategic guidance and the Board’s role, the increasing involvement of activist investors willing to replace Board members, and the long arm of enhanced regulation the National Association of Corporate Directors (NACD) created a Blue Ribbon Commission to review the Board’s role in setting corporate strategy. Co-Chaired by Ray Gilmartin (former Chair and CEO of Becton Dickinson and Merck, Board member of Microsoft and General Mills, HBS ’68) and Maggie Wilderotter (Chair and CEO of Frontier Communications, Board member Procter & Gamble and Xerox) and containing 21 diverse business leaders, this commission just published “The NACD Blue Ribbon Commission Report on Strategy Development.”

This report makes 10 specific recommendations regarding Board involvement in corporate strategy, which in total represent a substantial change in how often, and how deeply, Boards discuss and alter strategy in conjunction with management. The report calls for greater accountability by the Board, increased transparency from management and the requirement for better strategy development.

A New, More Controversial Involvement by Boards of Directors

In an interview, Dr. Raetha King, Chair of NACD (former Board member Exxon Mobil, Wells Fargo, HB Fuller, Lenox Group and General Mills Foundation) said “it is time for Boards to change their approach regarding strategy formulation toward ‘shape and monitor.’ Boards must move from a passive role to a more active role. The Board must be fully engaged, at all times, with strategy.”

When asked what has prompted this significant recommendation, Dr. King went on to say “This report was deeply influenced by the external disruptions which are happening to companies on a regular basis in today’s dynamic markets. Boards are too often blindsided by external events, as is management. The solution is a fundamental change in the strategy process to engage the Board earlier, and more often. To have Boards participate in the strategy process, and not merely approve a finished product. The Board must become a strategic asset for the CEO and his executive team by engaging all members, and their cognitive diversity, for insight and direction.”

Recognizing and Managing Disruption

Co-chair Ray Gilmartin has been a professor at the Harvard Business School, and a colleague of fellow professor and famed innovation guru Dr. Clayton Christensen. He has observed how disruptive innovations have affected many companies, and has asked Dr. Christensen to provide Boards with advice on how to avoid becoming stuck in the “Innovator’s Dilemma.” Mr. Gilmartin offered “The NACD’s Blue Ribbon Commission report on strategy is intended to help corporate directors and their boards prepare for the unpredictable, even the unthinkable. More specifically, the report is intended to evolve director’s strategy development role from the typical ‘review and concur’ to a higher level of year-round engagement in the strategy development process.”

This is a remarkable change in Board involvement, well beyond anything previously recommended by any association or other body which works with corporate Boards. And the impact should be widely felt, as NACD has 14,000 members, all belonging to Boards. By recommending that Boards re-allocate their time to spend more on strategy discussion, and less on historical results and reviews of well-known practices, this commission is pushing for a sea change in the strategy process.

Changed Role for the CEO, and the Board

Co-chair Maggie Wilderotter has the view not only of an outside director, but as someone currently holding both CEO and Chair positions in a company. She completely concurred with her commission colleagues. In our interview she commented “Historically, strategy was not dynamic. Now it must be, due to so many marketplace changes happening so quickly. It is critical that the CEO utilize the Board to re-assess strategy at each Board meeting so as to better prepare for changes and avoid incurring any additional marketplace risk.”

She continued “The new best practice, today, is for management to draft the strategy, but not finalize it. Options must be posited and discussed. Yes, the CEO must own the strategy, and the strategy development process. And part of that process is to drive discussion with not only internal management but external leaders on the Board. It is critical companies track more trends from outside the company, add more external inputs to the data, and be increasingly aware of how the external world impacts the company. Good execution today involves connecting internal metrics to external markets.”

This will involve quite a bit of change in Board dynamics. Many CEOs, as mentioned above, may not be prepared for such a radical shift in the strategy development process. To address this Ms. Wilderotter recommends “Board members must pressure the Chairman and/or Lead Director for updates on strategy before documents are made final, and before final decisions are made. Members must resist accepting final documents, and insist on receiving interim information. Members must constantly push for management to supply not only internal information, but external data on trends, competitors, customers and all factors that could impact future performance. There must be a proactive conversation on the new expectations directors have about management engaging them in the strategy development process. And Board members must insist on Executive Sessions, apart from management, to discuss strategy amongst themselves and develop feedback for the CEO.”

The report pulls no punches in its strong recommendations for changing the Board’s involvement in strategy. And the degree to which the report, and its authors, identify the importance of disruptive change on company performance today is eye opening. The report’s first recommendation sets the tone for significant change:

“Expect change and understand how it may affect the company’s current strategic course, potentially undermining the fundamental assumptions on which the strategy rests.”

Is this the end of the “Imperial CEO?” Readers know I have long called for greater transparency and more Board involvement in challenging CEOs where the strategy does not align with market realities. This report seeks the same thing. Boards can no longer allow the failure of management, or overly rely on a dictatorial CEO, on something as important as corporate strategy. They owe too much to the investors, employees, suppliers and communities in which their organizations operate.

As readers of my book and this blog know, this has long been my mantra. Like Dr. Christensen, I too encourage leaders to open their eyes to the extent which disruption affects their organizations in my columns, my keynote speeches and workshops. No longer is excellent execution enough. In a world where technologies, regulations, customers, products and competitors change so quickly strategy must be reviewed and updated constantly. And this report, from a noteworthy organization and blue ribbon panel, is a clear call for Boards to sink their teeth deeper into strategy.

All Board members, and people who want to be on Boards, should seek out a copy of this report, read it and share it with executives and Board members across your networks. These are recommendations which can have a profound impact on future performance in our rapidly changing world.

[Update 10-28-2014 — NACD has released a summary of the report. Follow this link to read all 10 recommendations and become better informed.]

by Adam Hartung | Oct 6, 2014 | Current Affairs, In the Swamp, In the Whirlpool, Leadership, Web/Tech

Hewlett Packard is splitting in two. Do you find yourself wondering why? You aren’t alone.

Hewlett Packard is nearly 75 years old. One of the original “silicone valley companies,” it started making equipment for engineers and electronic technicians long before computers were every day products. Over time HP’s addition of products like engineering calculators moved it toward more consumer products. And eventually HP became a dominant player in printers. All of these products were born out of deep skills in R&D, engineering and product development. HP had advantages because its products were highly desirable and unique, which made it nicely profitable.

But along came a CEO named Carly Fiorina, and she decided HP needed to grow much bigger, much more quickly. So she bought Compaq, which itself had bought Digital Equipment, so HP could sell Wintel PCs. PCs were a product in which HP had no advantage. PC production had always been an assembly operation of other companies’ intellectual property. It had been a very low margin, brutally difficult place to grow unless one focused on cost lowering rather than developing intellectual capital. It had nothing in common with HP’s business.

To fight this new margin battle HP replaced Ms. Fiorina with Mark Hurd, who recognized the issues in PC manufacturing and proceeded to gut R&D, product development and almost every other function in order to push HP into a lower cost structure so it could compete with Dell, Acer and other companies that had no R&D and cultures based on cost controls. This led to internal culture conflicts, much organizational angst and eventually the ousting of Mr. Hurd.

But, by that time HP was a company adrift with no clear business model to help it have a sustainably profitable future.

Now HP is 4 years into its 5 year turnaround plan under Meg Whitman’s leadership. This plan has made HP much smaller, as layoffs have dominated the implementation. It has weakened the HP brand as no important new products have been launched, and the gutted product development capability is still no closer to being re-established. And PC sales have stagnated as mobile devices have taken center stage – with HP notably weak in mobile products. The company has drifted, getting no better and showing no signs of re-developing its historical strengths.

So now HP will split into two different companies. Following the old adage “if you can’t dazzle ’em with brilliance, baffle ’em with bulls**t.” When all else fails, and you don’t know how to actually lead a company, then split it into pieces, push off the parts to others to manage and keep at least one CEO role for yourself.

Let’s not forget how this mess was created. It was a former CEO who decided to expand the company into an entirely different and lower margin business where the company had no advantage and the wrong business model. And another that destroyed long-term strengths in innovation to increase short-term margins in a generic competition. And then yet a third who could not find any solution to sustainability while pushing through successive rounds of lay-offs.

This was all value destruction created by the persons at the top. “Strategic” decisions made which, inevitably, hurt the organization more than helped it. Poorly thought through actions which have had long-term deleterious repercussions for employees, suppliers, investors and the communities in which the businesses operate.

The game of musical chairs has been very good for the CEOs who controlled the music. They were paid well, and received golden handshakes. They, and their closest reports, did just fine. But everyone else….. well…..

by Adam Hartung | Jul 15, 2014 | Current Affairs, Defend & Extend, In the Swamp, Leadership

Famed actor and comedian Tracy Morgan has filed a lawsuit against Walmart. He was seriously injured, and his companion and fellow comedian James McNair was killed, when their chauffeured vehicle was struck by a WalMart truck going too fast under the control of an overly tired driver.

It would be easy to write this off as a one-time incident. As something that was the mistake of one employee, and not a concern for management. Walmart is huge, and anyone could easily say “mistakes will happen, so don’t worry.” And as the country’s largest company (by sales and employees) Walmart is an easy target for lawsuits.

But that would belie a much more concerning situation. One that should have investors plenty worried.

Walmart isn’t doing all that well. It is losing customers, even as the economy recovers. For a decade Walmart has struggled to grow revenues, and same store sales have declined – only to be propped up by store closings. Despite efforts to grow offshore, attempts at international expansion have largely been flops. Efforts to expand into smaller stores have had mixed success, and are marginal at generating new revenues in urban efforts. Meanwhile, Walmart still has no coherent strategy for on-line sales expansion.

Unfortunately the numbers don’t look so good for Walmart, a company that is absolutely run by numbers. Every single thing that can be tracked in Walmart is tracked, and managed – right down the temperature in every facility (store, distribution hub, office) 24x7x365. When the revenue, inventory turns, margin, distribution costs, etc. aren’t going in the right direction Walmart is a company where leadership applies the pressure to employees, right down the chain, to make things better.

Unfortunately, a study by Northwestern University Kellogg School of Management has shown that when a culture is numbers driven it often leads to selfish, and unethical, behavior. When people are focused onto the numbers, they tend to stretch the ethical (and possibly legal) boundaries to achieve those numerical goals. A great recent example was the U.S. Veterans Administration scandal where management migrated toward lying about performance in order to meet the numerical mandates set by Secretary Shinseki.

Back in November, 2012 I pointed out that the Walmart bribery scandal in Mexico was a warning sign of big problems at the mega-retailer. Pushed too hard to create success, Walmart leadership was at least skirting with the law if not outright violating it. I projected these problems would worsen, and sure enough by November the bribery probe was extended to Walmart’s operations in Brazil, China and India.

We know from the many employee actions happening at Walmart that in-store personnel are feeling pressure to do more with fewer hours. It does not take a great leap to consider it possible (likely?) that distribution personnel, right down to truck drivers are feeling pressured to work harder, get more done with less, and in some instances being forced to cut corners in order to improve Walmart’s numbers.

Exactly how much the highest levels of Walmart knows about any one incident is impossible to gauge at this time. However, what should concern investors is whether the long-term culture of Walmart – obsessed about costs and making the numbers – has created a situation where all through the ranks people are feeling the need to walk closer to ethical, and possibly legal, lines. While it may be that no manager told the driver to drive too fast or work too many hours, the driver might have felt the pressure from “higher up” to get his load to its destination at a certain time – or risk his job, or maybe his boss’s.

If this is a widespread cultural issue – look out! The legal implications could be catastrophic if customers, suppliers and communities discover widespread unethical behavior that went unchecked by top echelons. The C suite executives don’t have to condone such behavior to be held accountable – with costs that can be exorbitant. Just ask the leaders at JPMorganChase and Citibank who are paying out billions for past transgressions.

Worse, we cannot expect the marketplace pressures to ease up any time soon for Walmart. Competitors are struggling mightily. JCPenney cannot seem to find anyone to take the vacant CEO job as sales remain below levels of several years ago, and the chain is most likely going to have to close several dozen (or hundreds) of stores. Sears/KMart has so many closed and underperforming stores that practically every site is available for rent if anyone wants it. And in the segment which is even lower priced than Walmart, the “dollar stores,” direct competitor Family Dollar saw 3rd quarter profits fall another 33% as too many stores and too few customer wreak financial havoc and portend store closings.

So the market situation is not improving for Walmart. As competition has intensified, all signs point to a leadership which tried to do “more, better, faster, cheaper.” But there is no way to maintain the original Walmart strategy in the face of the on-line competitive onslaught which is changing the retail game. Walmart has continued to do “more of the same” trying to defend and extend its old success formula, when it was a disruptive innovator that stole its revenues and cut into profits. Now all signs point to a company which is in grave danger of over-extending its success formula to the point of unethical, and potentially illegal, behavior.

If that doesn’t scare the heck out of Walmart investors I can’t imagine what would.

As you can see, Twitter’s revenue growth exceeds its comparators. Yes, its decline has been more dramatic, but we are comparing Twitter to companies that are much older and bigger. The net is to understand that revenues are growing, and at a better clip than Facebook and Amazon.

As you can see, Twitter’s revenue growth exceeds its comparators. Yes, its decline has been more dramatic, but we are comparing Twitter to companies that are much older and bigger. The net is to understand that revenues are growing, and at a better clip than Facebook and Amazon. Next we should look at active monthly users. Again, these numbers are growing at all 3. And some analysts have said it is the deceleration in the rate of new user growth that doomed Mr. Costolo. But this defies logic given that during his tenure Twitter has dramatically outperformed its competition.

Next we should look at active monthly users. Again, these numbers are growing at all 3. And some analysts have said it is the deceleration in the rate of new user growth that doomed Mr. Costolo. But this defies logic given that during his tenure Twitter has dramatically outperformed its competition. And here we can see that Twitter has wildly outperformed Facebook and Amazon. Twitter has grown its revenue per user by over 9-fold in the last 4 years, an excellent 75% per year compounded. Facebook, by comparison, roughly tripled its revenue/user (still very good) creating a 25%/year growth (certainly not to be sneezed at.) Amazon’s growth per user across the full 4 years was 25% – or about 4%/year.

And here we can see that Twitter has wildly outperformed Facebook and Amazon. Twitter has grown its revenue per user by over 9-fold in the last 4 years, an excellent 75% per year compounded. Facebook, by comparison, roughly tripled its revenue/user (still very good) creating a 25%/year growth (certainly not to be sneezed at.) Amazon’s growth per user across the full 4 years was 25% – or about 4%/year.