by Adam Hartung | Mar 10, 2015 | Current Affairs, Defend & Extend, Leadership, Lock-in

This week marks the 6th anniversary of the stock market’s bull run, with the S&P up 206%. Only 3 other times since WWII have equities had such a prolonged, sustained growth series. Simultaneously, last week saw yet another month with over 200,000 non-farm jobs created, making the current rate of jobs growth the best in 15 years. And, in a move that has taken some by surprise, the U.S. dollar is hitting highs against foreign currencies that have not been seen in over 12 years.

It is a rare economic trifecta, and demonstrates America is doing better than all other developed countries.

It seemed an appropriate time to re-interview Bob Deitrick, Managing Director of Polaris Financial Partners, and author of “Bulls, Bears and the Ballot Box” to obtain his take on the economy. Mr. Deitrick’s book reviewed America’s economic performance under each President since the creation of the Federal Reserve, and in direct opposition to conventional wisdom concluded presidents from the Democratic party were better economic stewards than Republican presidents. When published in 2012 Mr. Deitrick predicted that the economy would continue to do well under President Obama, and so far he’s been proven correct.

AH: Since we discussed “Obama’s Miracle Market” in January, 2014 stocks have continued to rise. Has this bull run surprised you, and do you think it will continue?

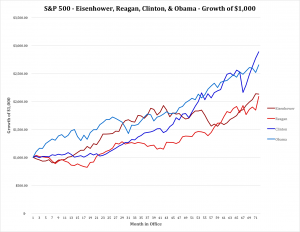

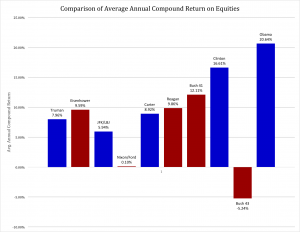

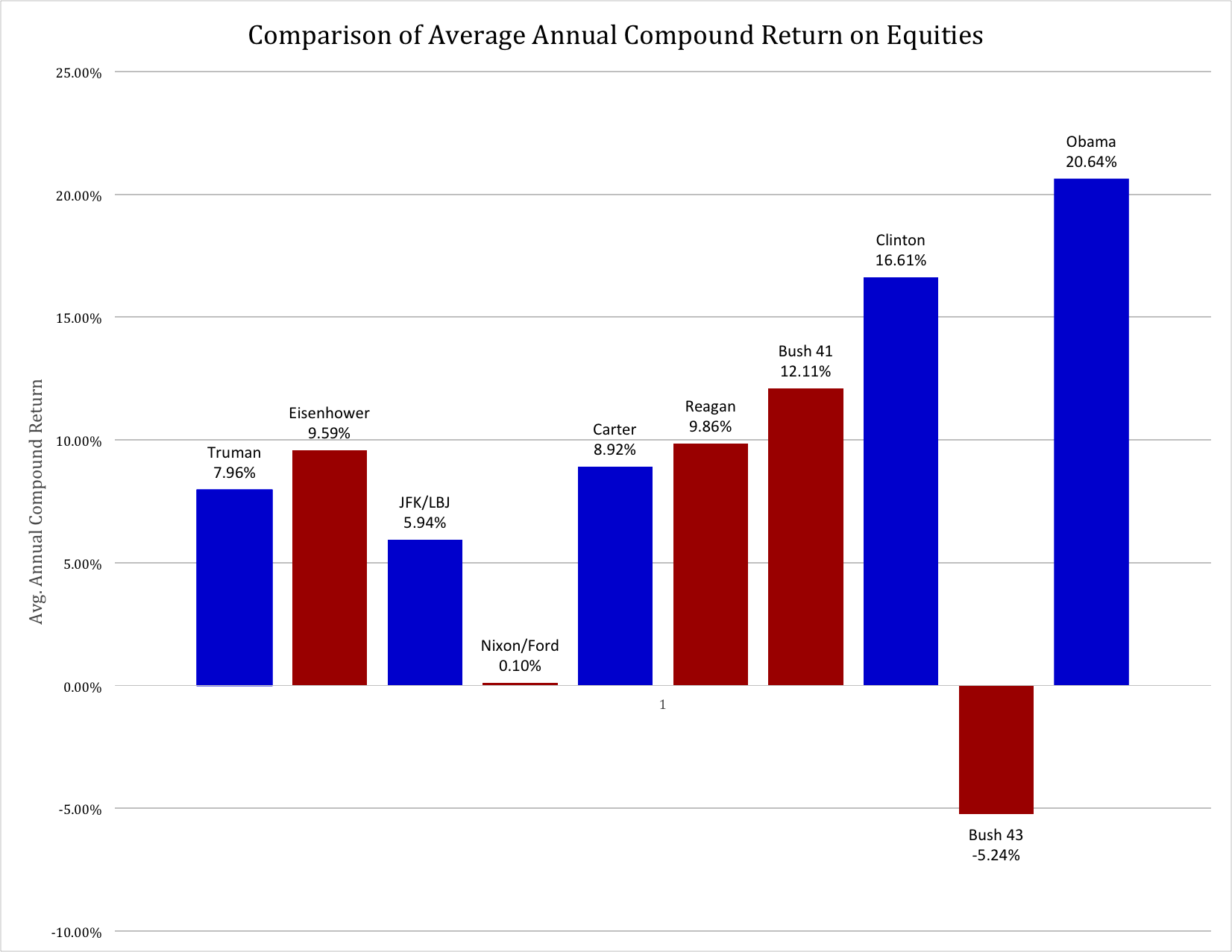

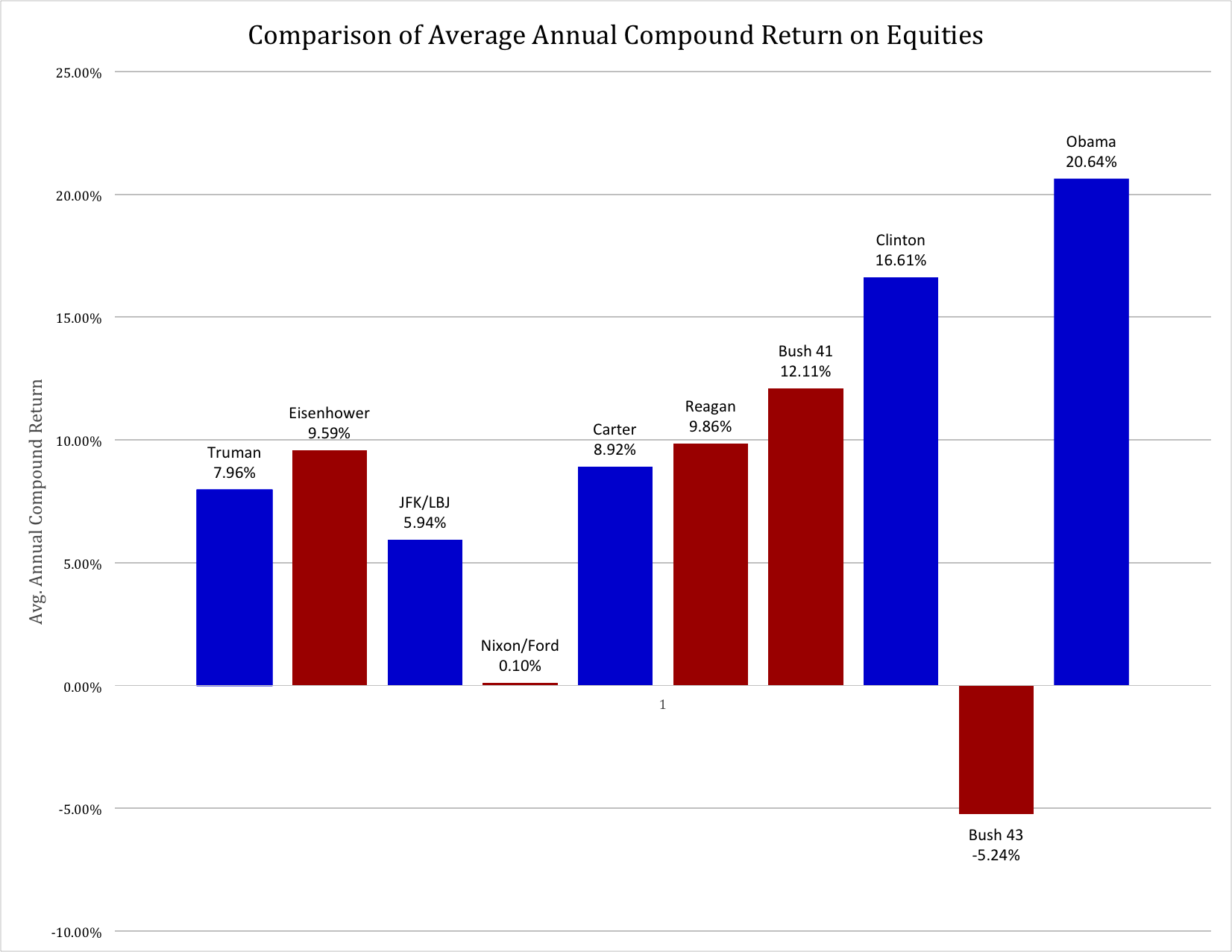

Bob Deitrick: No it has not surprised us. Looking across history since Hoover, Democrats in the White House have generally presided over good stock market gains. Since Clinton was elected, Democratic administrations have done remarkably well, with both Clinton and Obama outperforming the best Republican presidents which were Eisenhower and Reagan.

Looking at the S&P 500, Clinton and Obama have performed about the same with about a 17% annual rate of return through the first 62 months of office. Which is 70% better than the approximate 10% return of Republicans.

It is worth noting that when we take a broader gauge of equities (which we used in the book,) including the more volatile NASDAQ index and the highly selective Dow Jones Industrial Average, then the market’s performance during the Obama administration is unchallenged. The last 6 years generated compound annual returns of 22.5% (including dividend reinvestment) which is the best improvement in equities of all time.

It is also worth noting that the collapse of equities has happened 3 times since 1900, and all under Republican administrations – Hoover, Nixon/Ford, Bush 43. Even Carter had a rising equities market, and the Clinton + Obama years were unparalleled.

We agree with many other analysts that this bull market is not complete. We think the stock markets are only at the half way point in a secular bull cycle which will last, in total, 8 to 12 years.

AH: It was 6 months ago when you pointed out that President Obama outperformed President Reagan on jobs growth. At that time there were many, many naysayers. Yet, August’s numbers were later revised upward to over 200,000 and every month since has continued with strong jobs growth – some nearly 300,000. Are you surprised by the strength in jobs creation, and do you think it will stall?

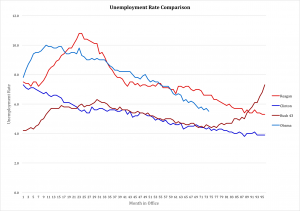

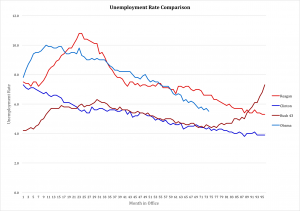

Bob Deitrick: Both Reagan and Obama inherited a bad jobs marketplace. Both of them saw unemployment spike into double digits early in their presidencies. And both created jobs programs that brought down the percentage of people unemployed. Obama had a lesser spike than Reagan, and during the last 5 years unemployment rate fell faster than it did under Reagan.

Both Democrats, Obama and Clinton, had big decreases in unemployment due to their policies. From peak to trough in this current administration unemployment has fallen by 5.5 percentage points, a decline of 81%. Clinton oversaw unemployment decline of 3.1 percentage points, or 73%. Both Democrats followed Bush Republican presidencies which had seen unemployment increase! During Bush 41 unemployment rose by 2 percentage points (5.4% to 7.3%,) and during Bush 43 unemployment nearly doubled from 4.2% to 8.3%. Not even the Carter presidency had unemployment increases anywhere close to the 12 years of Bush presidency.

Both Democrats, Obama and Clinton, had big decreases in unemployment due to their policies. From peak to trough in this current administration unemployment has fallen by 5.5 percentage points, a decline of 81%. Clinton oversaw unemployment decline of 3.1 percentage points, or 73%. Both Democrats followed Bush Republican presidencies which had seen unemployment increase! During Bush 41 unemployment rose by 2 percentage points (5.4% to 7.3%,) and during Bush 43 unemployment nearly doubled from 4.2% to 8.3%. Not even the Carter presidency had unemployment increases anywhere close to the 12 years of Bush presidency.

It is also worth noting that when comparing Obama and Reagan, Reagan undertook the largest increase in non-wartime deficit spending ever. He essentially used a form of “New Deal” debt spending on infrastructure and defense to stimulate jobs production. President Obama has been able to reduce the size of the annual deficit every year since taking office, in reality shrinking the amount of money spent by the government while simultaneously creating these new jobs. The only other president to accomplish this feat was Clinton, who actually balanced the budget during his presidency.

We believe the economy is very strong, and along with other analysts think the jobs recovery will remain intact. With less war spending, lower oil prices, more people covered by insurance, and higher minimum wages consumers will continue to spend and the economy will grow. New technology products will bring more people into the workforce, and manufacturing will continue its renaissance. We expect that unemployment will continue falling toward 4.4% by summer of 2016, returning the economy to non-wartime full employment.

AH: For years many talk show hosts and guests have been declaring that the Fed was flooding the markets with cash and setting the stage for rampant inflation which would ruin the dollar and the U.S. economy. But in the last few months the dollar has rallied to rates we haven’t seen since the 1990s. Did this surprise you, and do you think the dollar will remain strong?

Bob Deitrick: We were not surprised. Ben Bernanke ranks right up there with the first ever Federal Reserve Chairman Marriner Eccles at knowing what to do to keep the American economy from collapsing in the wake of the country’s second depression. Only by re-inflating the economy with more cash, and keeping interest rates low, did America avoid a horrible repeat of the 1930s.

As a result of Democratic policies America re-invested in growth, which allowed companies to invest in plant and equipment and create new jobs, while lowering the deficit. This happened simultaneously with opposite policies being implemented in Europe and Japan (so called “austerity”) which has caused their economies to weaken. And slowed demand from Europe has reduced growth rates in China and India, all leading global investors to return to the U.S. dollar as a safe haven. It is because of our economic strength that the dollar is returning to rates we have not seen since the Clinton presidency.

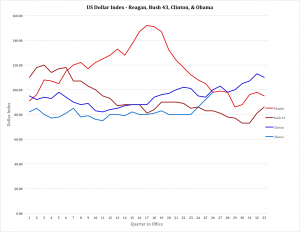

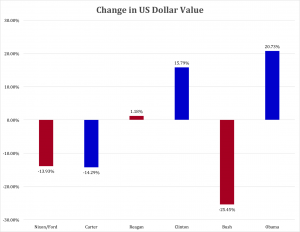

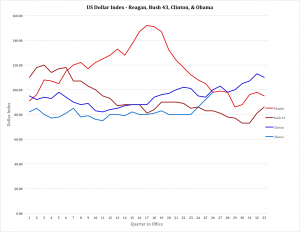

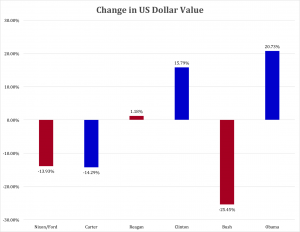

Many people recall the huge increase in the dollar’s value toward the middle of the Reagan presidency. However, as the U.S. deficits, and total debt, skyrocketed the dollar plummeted. By the time Reagan left office the dollar was worth almost the same as when he entered office.

And the combination of lower taxes plus costs for waging war in the middle east sent the U.S. debt exploding again under Bush 43. What had been a balanced budget under Clinton, which had pushed the dollar almost back to post-war highs, was destroyed causing the dollar to plummet 25%.

The dollar is now up 21% against a basket of world currencies. Given ongoing European weakness and the never-ending fight over austerity we see no reason to think the Euro will make a comeback any time soon. Rather, we predict the strong U.S. economy, especially with oil prices likely to remain low (and priced in dollars,) the U.S. dollar will continue to rally. It could well go back to Clinton-era highs and possibly approach the values during Reagan’s presidency. Should this happen it would be a record improvement in the dollar by any modern administration.

AH: Any concluding comments?

Bob Deitrick: I have voted for both Republicans and Democrats, and think of myself as a centrist. Most people, by definition, are centrists. I long believed that the GOP was the party which was best for the economy. But I could tell something wasn’t adding up during the Bush 43 presidency, so I chose to research the performance of both parties.

The GOP has created an illusion that it is a better economic steward by promoting itself as the party with the better business acumen, frequently touting elected officials from business schools and with MBAs rather than law degrees. The GOP, and the media leaders who identify with the GOP, tell Americans every chance they can that Republicans are the party of financial acuity and have the policies to create economic prowess. Yet we found through our research that these claims were little more than myth. In the modern era, post Great Depression and with a strong Federal Reserve in place, Democratic administrations have been far better stewards of the economy and caretakers of the government’s wallet.

We have coached investors to be in this equity market, and remain long, since early in the Obama administration. We have continued to remain long, and coach investors that in our opinion this remains the best course. We see the economy growing due to a balanced approach to jobs creation, spending and taxation. Were there less partisanship, such as occurred during the Reagan era when the Democrat party controlled the Congress while Republicans controlled the administration, it might be possible for the economy to grow even more quickly.

by Adam Hartung | Sep 30, 2013 | Current Affairs, Defend & Extend, Leadership, Lock-in

Last week we learned that there is no doubt, the world is warming. A U.N. report affirmed by some 1,000 scientists asserted 95% confidence as to the likely outcomes, as well as the cause. We must expect more volatility in weather, and that the oceans will continue rising.

Yet, most people really could have cared less. And a vocal minority still clings to the notion that because the prior decade saw a slower heating, perhaps this will all just go away.

Incredibly, for those of us who don't live and work in Florida, there was CNN news footage of daily flooding in Miami's streets due to current sea levels which have risen over last 50 years. Given that we can now predict the oceans will rise between 1 and 6 feet in the next 50 years, it is possible to map the large areas of Miami streets which are certain to be flooded.

There is just no escaping the fact that the long-term trend of global warming will have a remarkable impact on everyone. It will affect transportation, living locations, working locations, electricity generation and distribution, agriculture production, textile production – everything will be affected. And because it is happening so slowly, we actually can do lots of modeling about what will happen.

Yet, I never hear any business leaders talk about how they are planning for global warning. No comments about how they are making changes to keep their business successful. Nor comments about the new opportunities this will create. Even though the long-term impacts will be substantial, the weather and how it affects us is treated like the status quo.

What does this have in common with the government shutdown?

America has known for decades that its healthcare system was dysfunctional; to be polite. It was incredibly expensive (by all standards) and yet had no better outcomes for citizens than other modern countries. For over 20 years efforts were attempted to restructure health care. Yet as the morass of regulations ballooned, there was no effective overhaul that addressed basic problems built into the system. Costs continued to soar, and more people joined the ranks of those without health care, while other families were bankrupted by illness.

Finally, amidst enormous debate, the Affordable Care Act was passed. Despite wide ranging opinions from medical doctors, nurses, hospital and clinic administrators, patient advocacy groups, pharmaceutical companies, medical device companies and insurance companies (to name just some of those with a vested interest and loud, competing, viewpoints) Congress passed the Affordable Care Act which the President signed.

Like most such things in America, almost nobody was happy. No one got what they wanted. It was one of those enormous, uniquely American, compromises. So, like unhappy people do in America, we sued! And it took a few years before finally the Supreme Court ruled that the legislation was constitutional. The Affordable Care Act would be law.

But, people remain who simply do not want to accept the need for health care change. So, in a last ditch effort to preserve the status quo, they are basically trying to kidnap the government budget process and hold it hostage until they get their way. They have no alternative plan to replace the Affordable Care Act. They simply want to stop it from moving forward.

What global warming and the government shut down have in common are:

- Very long-term problems

- No quick solution for the problem

- No easy solution for the problem

- If you do nothing about the problem today, you have no immediate calamity

- Doing anything about the problem affects almost everyone

- Doing anything causes serious change

So, in both cases, people have emerged as the Status Quo Police. They take on the role of stopping change. They will do pretty much anything to defend & extend the status quo:

- Ignore data that is contradictory to the best analytical views

- Claim that small probability outcomes (that change may not be necessary) justifies doing nothing

- Delay, delay, delay taking any action until a disaster requires action

- Constantly claim that the cost of change is not justified

- Claim that the short-term impact of change is more deleterious than the long-term benefits

- Assume that the status quo will somehow resolve itself favorably – with no supporting evidence or analysis

- Undertake any action that preserves the status quo

- Threaten a "scorched earth policy" (that they will create big, immediate problems if forced to change the status quo)

The earth is going to become warmer. The oceans will rise, and other changes will happen. If you don't incorporate this in your plans, and take action, you can expect this trend will harm you.

U.S. health care is going to be reformed. How it will happen is just starting. How it will evolve is still unclear. Those who create various scenarios in their plans to prepare for this change will benefit. Those who do nothing, hoping it goes away, will find themselves struggling.

The Status Quo Police, trying their best to encourage people to ignore the need for change – the major, important trends – are helping nobody. By trying to preserve the status quo they inhibit effective planning, and action, to prepare for a different (better) future.

Does your organization have Status Quo Police? Are their functions, groups or individuals who are driven to defend and extend the status quo – even in the face of trends that demonstrate change is necessary? Can they stop conversations around substantial change? Are they allowed to stop future planning for scenarios that are very different from the past? Can they enforce cultural norms that stop considering new alternatives? Can they control resources resulting in less innovation and change?

Let's learn from these 2 big issues. Change is inevitable. It is even necessary. Trying to preserve the status quo is costly, and inhibits taking long-term effective action. Status Quo Police are obstructionists who keep us from facing, and solving, difficult problems. They don't help our organizations create a new, more successful future. Only by overcoming them can we reach our full potential, and create opportunities out of change.

by Adam Hartung | Nov 4, 2010 | Current Affairs, General, Innovation, Leadership, Web/Tech

Summary:

- Voters whipsawed from throwing out the Republicans 2 year ago to throwing out Democrats this election

- Americans are frustrated by a no-growth economy

- Recent government programs have been ineffective at stimulating growth, despite horrific expense

- Lost manufacturing/industrial jobs will never return

- America needs new government programs designed to create information-era jobs

- Education, R&D, Product Development and Innovation investment programs are desperately needed

“It’s the Economy, Stupid” was the driving theme used during Bill Clinton’s winning 1992 Presidential campaign. Following the dramatic changes produced in Tuesday’s American elections, this refrain seems as applicable as ever. Two years ago Americans changed leadership in the Presidency, Congress and the Senate out of disgust with the financial crisis and lousy economy. Now, Congress has shifted back the other direction – and the Senate came close – for ostensibly the same, ongoing reason. What seems pretty clear is that Americans are upset about their economy – and in particular they are worried about jobs and incomes.

So why can’t the politicians seem to get it right? After all, economic improvement allowed Bill Clinton to retain the Presidency in 1996. If smart politicians know that Americans are “voting with their pocketbooks” these days, you’d think they would be doing things to improve the economy and jobs. Wasn’t that what the big big bailouts and government spending programs of the last 4 years were supposed to do?

What we can now see, however, is that programs which worked for FDR, or Ronald Reagan and other politicians in the late 1900s aren’t working these days. Everything from Great Depression Keynesians to Depression retreading Chicago School monatarists to Laffer Curve idealists have offered up and applied programs the last 8 years intended to stimulate growth. But so far, the needle simply hasn’t moved. Recognizing that the economy is sick, looking at the symptoms of weak jobs and high unemployment, could it be that the country’s leaders are trying to apply old medicine when the illness has substantially changed?

What’s missed by so many Americans today – populace and politicians – is that the 2010 economy is nothing like that of the 1940s; and bares little resemblance to the economy as recently as the 1990s. Scan these interesting facts reported by BusinessInsider.com:

- In 2009 there were 12M Americans in manufacturing jobs. That’s the lowest number since 1941 (in 1941 there were 133.4M Americans; today there are over 300M)

- In 1959 manufacturing was 28% of U.S. economic output. Today it is 11.5%

- Since 2001 42,400 factories have closed in America

- Since 2000, America has lost 5.5M manufacturing jobs (32%)

- Fewer Americans are working at making computers in 2009 than were doing so in 1975 – when mainframes were the dominant technology and buyers were severely limited.

- From 1999 to 2008 jobs in foreign affiliates of U.S. companies grew by 2.3M

- A list of products no longer made in America includes Gerber baby food, Levi jeans, Mattel Toys, Dell computers, major league baseballs, dress shirts, vending machines, incandescent light bulbs, televisions, canned sardines, ordinary silverware and dress shirts.

These lost jobs are NEVER coming back. The American economy has fundamentally shifted, and it will never go back to the way it was. Clocks don’t run backward.

In 1910 90% of Americans were working in agriculture. By 1970 that proportion had dropped to 10%. Had American policy in the last century remained fixated on protecting farming jobs the country would have failed. Only by shifting to industrialization (manufacturing) was America able to continue its growth – and create all those new industrial jobs. Now American policy has to shift again if it wants to start creating new jobs. We have to create information-era jobs.

But government programs applied the last 12 years were all retreaded industrial era ideas (implemented by Boomer-era leaders educated in those programs.) They were intended to grow industrial jobs by spurring supply and demand for “things.” Lower interest rates were intended to increase manufacturing investment and generate more supply at lower cost. These jobs were expected to create more service jobs (retailers, schools, plumbers, etc.) supporting the manufacturing worker. But today, supply isn’t coming from America. Nobody is going to build a manufacturing plant in America when gobs of capacity is shuttered and available, and costs are dramatically lower elsewhere with plentiful skill supply. We can keep GM and Chrysler on life support, but there is no way these companies will grow jobs in face of a global competitive onslaught with very good products, new innovations and lower cost. Cheap interest rates make little difference – no matter what the cost to taxpayers.

Other old-school programs focused on increasing demand. TARP, cheap consumer lending, tax cuts, rebates and subsidies were intended to encourage people to buy more stuff. Consumers were expected to take advantage of the increased supply and spend the cash, thus reviving the economy. But today, many people are busy paying down debt or saving for retirement. Further, even when they do spend money the goods simply aren’t made in America. If consumers (including businesses) buy 10 Dell computers or 20 uniform shirts it creates no new American jobs. Spurring demand doesn’t matter when “things” are made elsewhere. In fact, it benefits the offshore economies of China and other manufacturing centers more than the USA!

If this new crop of politicians, and the President, want to keep their jobs in the next election they had better face facts. The American economy has shifted – and it will take very different policies to revive it. New American jobs will not be created by thinking we’ll will make jeans, baby food or baseballs, so applying old approaches and focusing on increasing supply and demand will not work. America is no longer an industrial economy.

The jobs at Dell are engineering, design and managerial. Hiring organizations like Google, Apple, Cisco and Tesla are adding workers to generate, analyze, interpret and gain insight from information. Jobs today are based upon brain work, not brawn. An old American folk song told the story about John Henry’s inability to keep up with the automated stake driving machine – and showed all Americans that the industrial era made conventional, uneducated hand-labor of little value. Now, computers, networks and analytics are making the value of manufacturing work low value. Because we are in an information economy, rather than an industrial one, pursuing growth of industrial jobs today is as misguided as trying to preserve manual labor and farm jobs was in the 1960s and 1970s.

Directionally, American politicians need to implement programs that will create the kind of jobs that are valuable, and likely, in America. Incenting education, to improve the skills necessary to be productive in this economy, is fairly obvious. Instead of cutting education benefits, raise them to remain a world leader in secondary education and produce a highly qualified workforce of knowledge workers. Support universities struggling in the face of dwindling state tax funds. Subsidize masters and PhD candidates who can create new products and lead companies into new directions, and do things to encourage their hiring by American companies.

Investments in R&D and product development are likewise obvious. America’s growth companies are driving innovation; bringing forward world-demanded products like digital music, on-line publications, global networks, real-time feedback on ad links, ways to purify water – and in the future trains, planes and automobiles that need no fossil fuels or drivers (just to throw out a not-unlikely scenario.) For every dollar thrown at GM trying to keep lower-skilled manufacturing jobs alive there would be a 10x gain if those dollars were spent on information era jobs in innovation. America doesn’t need to preserve jobs for high school graduates, it must create jobs for the millions of college grads (and post-graduate degree holders) working today as waiters and grocery cashiers. Providing incentives for angel investing, venture capital and other innovation investment will have a rapid, immediate impact on job creation in everything from IT to biotech, nanotech, remote education and electric cars.

A stalled economy is a horrible thing. Economies, like companies, thrive on growth! Everyone hurts when tax receipts stall, government spending rises and homes go down in value while inflationary fears grow. And Americans keep saying they want politicians to “fix it.” But the “fix” requires thinking about the American economy differently, and realizing that programs designed to preserve/promote the old industrial economy – by saving banks that invest in property, plant and equipment, or manufacturers that have no money for new product development – will NOT get the job done. It’s going to take a different approach to drive economic growth and job creation in America, now that the shift has occurred. And the sooner politicians understand this, the better!

Both Democrats, Obama and Clinton, had big decreases in unemployment due to their policies. From peak to trough in this current administration unemployment has fallen by 5.5 percentage points, a decline of 81%. Clinton oversaw unemployment decline of 3.1 percentage points, or 73%. Both Democrats followed Bush Republican presidencies which had seen unemployment increase! During Bush 41 unemployment rose by 2 percentage points (5.4% to 7.3%,) and during Bush 43 unemployment nearly doubled from 4.2% to 8.3%. Not even the Carter presidency had unemployment increases anywhere close to the 12 years of Bush presidency.

Both Democrats, Obama and Clinton, had big decreases in unemployment due to their policies. From peak to trough in this current administration unemployment has fallen by 5.5 percentage points, a decline of 81%. Clinton oversaw unemployment decline of 3.1 percentage points, or 73%. Both Democrats followed Bush Republican presidencies which had seen unemployment increase! During Bush 41 unemployment rose by 2 percentage points (5.4% to 7.3%,) and during Bush 43 unemployment nearly doubled from 4.2% to 8.3%. Not even the Carter presidency had unemployment increases anywhere close to the 12 years of Bush presidency.