by Adam Hartung | Nov 22, 2013 | Current Affairs, Defend & Extend, In the Whirlpool, Leadership, Television

Do you really think in 2020 you’ll watch television the way people did in the 1960s? I would doubt it.

In today’s world if you want entertainment you have a plethora of ways to download or live stream exactly what you want, when you want, from companies like Netflix, Hulu, Pandora, Spotify, Streamhunter, Viewster and TVWeb. Why would you even want someone else to program you entertainment if you can get it yourself?

Additionally, we increasingly live in a world unaccepting of one-way communication. We want to not only receive what entertains us, but share it with others, comment on it and give real-time feedback. The days when we willingly accepted having information thrust at us are quickly dissipating as we demand interactivity with what comes across our screen – regardless of size.

These 2 big trends (what I want, when I want; and 2-way over 1-way) have already changed the way we accept entertaining. We use USB drives and smartphones to provide static information. DVDs are nearly obsolete. And we demand 24×7 mobile for everything dynamic.

Yet, the CEO of Charter Cable company wass surprised to learn that the growth in cable-only customers is greater than the growth of video customers. Really?

It was about 3 years ago when my college son said he needed broadband access to his apartment, but he didn’t want any TV. He commented that he and his 3 roommates didn’t have any televisions any more. They watched entertainment and gamed on screens around his apartment connected to various devices. He never watched live TV. Instead they downloaded their favorite programs to watch between (or along with) gaming sessions, picked up the news from live web sites (more current and accurate he said) and for sports they either bought live streams or went to a local bar.

To save money he contacted Comcast and said he wanted the premier internet broadband service. Even business-level service. But he didn’t want TV. Comcast told him it was impossible. If he wanted internet he had to buy TV. “That’s really, really stupid” was the way he explained it to me. “Why do I have to buy something I don’t want at all to get what I really, really want?”

Then, last year, I helped a friend move. As a favor I volunteered to return her cable box to Comcast, since there was a facility near my home. I dreaded my volunteerism when I arrived at Comcast, because there were about 30 people in line. But, I was committed, so I waited.

The next half-hour was amazingly instructive. One after another people walked up to the window and said they were having problems paying their bills, or that they had trouble with their devices, or wanted a change in service. And one after the other they said “I don’t really want TV, just internet, so how cheaply can I get it?”

These were not busy college students, or sophisticated managers. These were every day people, most of whom were having some sort of trouble coming up with the monthly money for their Comcast bill. They didn’t mind handing back the cable box with TV service, but they were loath to give up broadband internet access.

Again and again I listened as the patient Comcast people explained that internet-only service was not available in Chicagoland. People had to buy a TV package to obtain broad-band internet. It was force-feeding a product people really didn’t want. Sort of like making them buy an entree in order to buy desert.

As I retold this story my friends told me several stories about people who banned together in apartments to buy one Comcast service. They would buy a high-powered router, maybe with sub-routers, and spread that signal across several apartments. Sometimes this was done in dense housing divisions and condos. These folks cut the cost for internet to a fraction of what Comcast charged, and were happy to live without “TV.”

But that is just the beginning of the market shift which will likely gut cable companies. These customers will eventually hunt down internet service from an alternative supplier, like the old phone company or AT&T. Some will give up on old screens, and just use their mobile device, abandoning large monitors. Some will power entertainment to their larger screens (or speakers) by mobile bluetooth, or by turning their mobile device into a “hotspot.”

And, eventually, we will all have wireless for free – or nearly so. Google has started running fiber cable in cities including Austin, TX, Kansas City, MO and Provo, Utah. Anyone who doesn’t see this becoming city-wide wireless has their eyes very tightly closed. From Albuquerque, NM to Ponca City, OK to Mountain View, CA (courtesy of Google) cities already have free city-wide wireless broadband. And bigger cities like Los Angeles and Chicago are trying to set up free wireless infrastructure.

And if the USA ever invests in another big “public works infrastructure” program will it be to rebuild the old bridges and roads? Or is it inevitable that someone will push through a national bill to connect everyone wirelessly – like we did to build highways and the first broadcast TV.

So, what will Charter and Comcast sell customers then?

It is very, very easy today to end up with a $300/month bill from a major cable provider. Install 3 HD (high definition) sets in your home, buy into the premium movie packages, perhaps one sports network and high speed internet and before you know it you’ve agreed to spend more on cable service than you do on home insurance. Or your car payment. Once customers have the ability to bypass that “cable cost” the incentive is already intensive to “cut the cord” and set that supplier free.

Yet, the cable companies really don’t seem to see it. They remain unimpressed at how much customers dislike their service. And respond very slowly despite how much customers complain about slow internet speeds. And even worse, customer incredulous outcries when the cable company slows down access (or cuts it) to streaming entertainment or video downloads are left unheeded.

Cable companies say the problem is “content.” So they want better “programming.” And Comcast has gone so far as to buy NBC/Universal so they can spend a LOT more money on programming. Even as advertising dollars are dropping faster than the market share of old-fashioned broadcast channels.

Blaming content flies in the face of the major trends. There is no shortage of content today. We can find all the content we want globally, from millions of web sites. For entertainment we have thousands of options, from shows and movies we can buy to what is for free (don’t forget the hours of fun on YouTube!)

It’s not “quality programming” which cable needs. That just reflects industry deafness to the roar of a market shift. In short order, cable companies will lack a reason to exist. Like land-line phones, Philco radios and those old TV antennas outside, there simply won’t be a need for cable boxes in your home.

Too often business leaders become deaf to big trends. They are so busy executing on an old success formula, looking for reasons to defend & extend it, that they fail to evaluate its relevancy. Rather than listen to market shifts, and embrace the need for change, they turn a deaf ear and keep doing what they’ve always done – a little better, with a little more of the same product (do you really want 650 cable channels?,) perhaps a little faster and always seeking a way to do it cheaper – even if the monthly bill somehow keeps going up.

But execution makes no difference when you’re basic value proposition becomes obsolete. And that’s how companies end up like Kodak, Smith-Corona, Blackberry, Hostess, Continental Bus Lines and pretty soon Charter and Comcast.

by Adam Hartung | Nov 6, 2013 | Defend & Extend, Innovation, Leadership, Web/Tech

Can you believe it has been only 12 years since Apple introduced the iPod? Since then Apple’s value has risen from about $11 (January, 2001) to over $500 (today) – an astounding 45X increase.

With all that success it is easy to forget that it was not a “gimme” that the iPod would succeed. At that time Sony dominated the personal music world with its Walkman hardware products and massive distribution through consumer electronics chains such as Best Buy, and broad-line retailers like Wal-Mart. Additionally, Sony had its own CD label, from its acquisition of Columbia Records (renamed CBS Records,) producing music. Sony’s leadership looked impenetrable.

But, despite all the data pointing to Sony’s inevitable long-term domination, Apple launched the iPod. Derided as lacking CD quality, due to MP3’s compression algorithms, industry leaders felt that nobody wanted MP3 products. Sony said it tried MP3, but customers didn’t want it.

All the iPod had going for it was a trend. Millions of people had downloaded MP3 songs from Napster. Napster was illegal, and users knew it. Some heavy users were even prosecuted. But, worse, the site was riddled with viruses creating havoc with all users as they downloaded hundreds of millions of songs.

Eventually Napster was closed by the government for widespread copyright infreingement. Sony, et.al., felt the threat of low-priced MP3 music was gone, as people would keep buying $20 CDs. But Apple’s new iPod provided mobility in a way that was previously unattainable. Combined with legal downloads, including the emerging Apple Store, meant people could buy music at lower prices, buy only what they wanted and literally listen to it anywhere, remarkably conveniently.

The forecasted “numbers” did not predict Apple’s iPod success. If anything, good analysis led experts to expect the iPod to be a limited success, or possibly failure. (Interestingly, all predictions by experts such as IDC and Gartner for iPhone and iPad sales dramatically underestimated their success, as well – more later.) It was leadership at Apple (led by the returned Steve Jobs) that recognized the trend toward mobility was more important than historical sales analysis, and the new product would not only sell well but change the game on historical leaders.

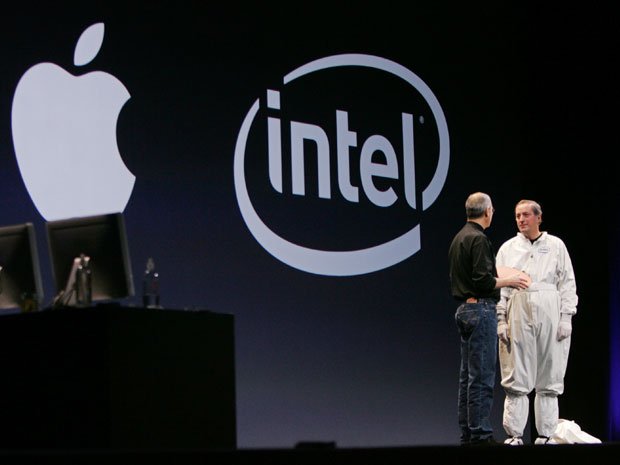

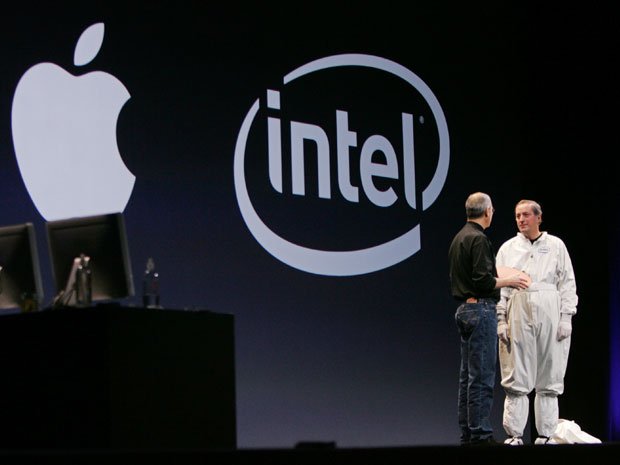

Which takes us to the mistake Intel made by focusing on “the numbers” when given the opportunity to build chips for the iPhone. Intel was a very successful company, making key components for all Microsoft PCs (the famous WinTel [for Windows+Intel] platform) as well as the Macintosh. So when Apple asked Intel to make new processors for its mobile iPhone, Intel’s leaders looked at the history of what it cost to make chips, and the most likely future volumes. When told Apple’s price target, Intel’s leaders decided they would pass. “The numbers” said it didn’t make sense.

Uh oh. The cost and volume estimates were wrong. Intel made its assessments expecting PCs to remain strong indefinitely, and its costs and prices to remain consistent based on historical trends. Intel used hard, engineering and MBA-style analysis to build forecasts based on models of the past. Intel’s leaders did not anticipate that the new mobile trend, which had decimated Sony’s profits in music as the iPod took off, would have the same impact on future sales of new phones (and eventually tablets) running very thin apps.

Harvard innovation guru Clayton Christensen tells audiences that we have complete knowledge about the past. And absolutely no knowledge about the future. Those who love numbers and analysis can wallow in reams and reams of historical information. Today we love the “Big Data” movement which uses the world’s most powerful computers to rip through unbelievable quantities of historical data to look for links in an effort to more accurately predict the future. We take comfort in thinking the future will look like the past, and if we just study the past hard enough we can have a very predictible future.

But that isn’t the way the business world works. Business markets are incredibly dynamic, subject to multiple variables all changing simultaneously. Chaos Theory lecturers love telling us how a butterfly flapping its wings in China can cause severe thunderstorms in America’s midwest. In business, small trends can suddenly blossom, becoming major trends; trends which are easily missed, or overlooked, possibly as “rounding errors” by planners fixated on past markets and historical trends.

Markets shift – and do so much, much faster than we anticipate. Old winners can drop remarkably fast, while new competitors that adopt the trends become “game changers” that capture the market growth.

In 2000 Apple was the “Mac” company. Pretty much a one-product company in a niche market. And Apple could easily have kept trying to defend & extend that niche, with ever more problems as Wintel products improved.

But by understanding the emerging mobility trend leadership changed Apple’s investment portfolio to capture the new trend. First was the iPod, a product wholly outside the “core strengths” of Apple and requiring new engineering, new distribution and new branding. And a product few people wanted, and industry leaders rejected.

Then Apple’s leaders showed this talent again, by launching the iPhone in a market where it had no history, and was dominated by Motorola and RIMM/BlackBerry. Where, again, analysts and industry leaders felt the product was unlikely to succeed because it lacked a keyboard interface, was priced too high and had no “enterprise” resources. The incumbents focused on their past success to predict the future, rather than understanding trends and how they can change a market.

Too bad for Intel. And Blackberry, which this week failed in its effort to sell itself, and once again changed CEOs as the stock hit new lows.

Then Apple did it again. Years after Microsoft attempted to launch a tablet, and gave up, Apple built on the mobility trend to launch the iPad. Analysts again said the product would have limited acceptance. Looking at history, market leaders claimed the iPad was a product lacking usability due to insufficient office productivity software and enterprise integration. The numbers just did not support the notion of investing in a tablet.

Anyone can analyze numbers. And today, we have more numbers than ever. But, numbers analysis without insight can be devastating. Understanding the past, in grave detail, and with insight as to what used to work, can lead to incredibly bad decisions. Because what really matters is vision. Vision to understand how trends – even small trends – can make an enormous difference leading to major market shifts — often before there is much, if any, data.

by Adam Hartung | Apr 4, 2012 | Current Affairs, Defend & Extend, In the Whirlpool, Leadership, Lock-in, Web/Tech

Understand your core strength, and protect it. Sounds like the key to success, and a simple motto. It's the mantra of many a management guru. Only, far too often, it's the road to ruin.

The last week 3 big announcements showed just how damning the "strategy" of building on historical momentum can be.

Start with Research in Motion's revenue and earnings announcement. Both metrics fell short of expectations as Blackberry sales continue to slide. Not many investors were actually surprised about this, to be honest. iOS and Android products have been taking away share from RIM for several months, and the trend remains clear. And investors have paid a heavy price.

Source: BusinessInsider.com

There is no doubt the executives at RIM are very aware of this performance, and desperately would like the results to be different. RIM has known for months that iOS and Android handhelds have been taking share. The executives aren't unaware, nor stupid. But, they have not been able to change the internal momentum at RIM to the right issues.

The success formula at RIM has long been to "own" the enterprise marketplace with the Blackberry server products, offering easy to connect and secure network access for email, texting and enterprise applications. Handsets came along with the server and network sales. All the momentum at RIM has been to focus on the needs of IT departments; largely security and internal connectivity to legacy systems and email. And, honestly, even today there is probably nobody better at that than RIM.

But the market shifted. Individual user needs and productivity began to trump the legacy issues. People wanted to leave their laptops at home, and do everything with their smartphones. Apps took on a far more dominant role, as did ease of use. Because these were not part of the internal momentum at RIM the company ignored those issues, maintaining its focus on what it believed was the core strength, especially amongst its core customers.

Now RIM is toast. It's share will keep falling, until its handhelds become as popular as Palm devices. Perhaps there will be a market for its server products, but only via an acquisition at a very low price. Momentum to protect the core business killed RIM because its leaders failed to recognize a critical market shift.

Turn next to Yahoo's announcement that it is laying off 1 out of 7 employees, and that this is not likely to be the last round of cuts. Yahoo has become so irrelevant that analysts now depicct its "core" markets as "worthless."

Source: SiliconAlleyInsider.com

Yahoo was an internet pioneer. At one time in the 1990s it was estimated that over 90% of browser home pages were set to Yahoo! But the need for content aggregation largely disappeared as users learned to use search and social media to find what they wanted. Ad placement revenue for keywords transferred to the leading search provider (Google) and for display ads to the leading social media provider (Facebook.)

But Yahoo steadfastly worked to defend and extend its traditional business. It enhanced its homepage with a multitude of specialty pages, such as YahooFinance. But each of these has been outdone by specialist web sites, such as Marketwatch.com, that deliver everyhing Yahoo does only better, attracting more advertisers. Yahoo's momentum caused it to miss shifting with the internet market. Under CEO Bartz the company focused on operational improvements and efforts at enhancing its sales, while market shifts made its offerings less and less relevant.

Now, Yahoo is worth only the value of its outside stockholdings, and it appears the new CEO lacks any strategy for saving the enterprise. The company appears ready to split up, and become another internet artifact for Wikipedia. Largely because it kept doing more of what it knew how to do and was unable to overcome momentum to do anything new.

Last, but surely not least, was the Dell announced acquisition of Wyse.

Dell is synonymous with PC. But the growth has left PCs, and Dell missed the markets for mobile entertainment devices (like iPods or Zunes,) smartphones (like iPhone or Evo) and tablets (like iPads and Galaxy Tab.) Dell slavisly kept to its success formula of doing no product development, leaving that to vendors Microsoft and Intel, as it focused on hardware manufacturing and supply chain excellence. As the market shifted from the technologies it knew Dell kept trying to cut costs and product prices, hoping that somehow people would be dissuaded from changing technologies. Only it hasn't worked, and Dell's growth in sales and profits has evaporated.

Don't be confused. Buying Wyse has not changed Dell's "core." In Wyse Dell found another hardware manufacturer, only one that makes old-fashioned "dumb" terminals for large companies (interpret that as "enterprise,") mostly in health care. This is another acquisition, like Perot Systems, in an effort to copy the 1980s IBM brand extension into other products and services that are in like markets – a classic effort at extending the original Dell success formula with minimal changes.

Wyse is not a "cloud" company. Rackspace, Apple and Amazon provide cloud services, and Wyse is nothing like those two market leaders. Buying Wyse is Dell's effort to keep chasing HP for market share, and trying to pick up other pieces of revenue as it extends is hardware sales into more low-margin markets. The historical momentum has not changed, just been slightly redirected. By letting momentum guide its investments, Dell is buying another old technology company it hopes it can can extend its "supply chain" strenths into – and maybe find new revenues and higher margins. Not likely.

Over and again we see companies falter due to momentum. Why? Markets shift. Faster and more often than most business leaders want to admit. For years leaders have been told to understand core strengths, and protect them. But this approach fails when your core strength loses its value due to changes in technologies, user preferences, competition and markets. Then the only thing that can keep a company successful is to shift. Often very far from the core – and very fast.

Success actually requires overcoming internal momentum, built on the historical success formula, by putting resources into new solutions that fulfill emerging needs. Being agile, flexible and actually able to pivot into new markets creates success. Forget the past, and the momentum it generates. That can kill you.