by Adam Hartung | Jan 19, 2011 | Current Affairs, Disruptions, Games, In the Rapids, In the Swamp, Innovation, Leadership, Lock-in, Music, Openness, Web/Tech

The Wall Street Journal headlined Monday, “Apple Chief to Take Leave.” Forbes.com Leadership editor Fred Allen quickly asked what most folks were asking “Where does Steve Jobs Leave Apple Now?” as he led multiple bloggers covering the speculation about how long Mr. Jobs would be absent from Apple, or if he would ever return, in “What They Are Saying About Steve Jobs.” The stock took a dip as people all over raised the question covered by Steve Caulfield in Forbes’ “Timing of Steve Jobs Return Worries Investors, Fans.”

If you want to make money investing, this is what’s called a “buying opportunity.” As Forbes’ Eric Savitz reported “Apple is More Than Just Steve Jobs.” Just look at the most recent results, as reported in Ad Age “Apple Posts ‘Record Quarter’ on Strong iPhone, Mac, iPad Sales:”

- Quarterly revenue is up 70% vs. last year to $26.7B (Apple is a $100B company!)

- Quarterly earnings rose 77% vs last year to $6B

- 15 million iPads were sold in 2010, with 7.3 million sold in the last quarter

- Apple has $50B cash on hand to do new product development, acquisitions or pay dividends

ZDNet demonstrated Apple’s market resiliency headlining “Apple’s iPad Represents 90% of All Tablets Shipped.” While it is true that Droid tablets are now out, and we know some buyers will move to non-Apple tablets, ZDNet predicts the market will grow more than 250% in 2011 to over 44 million units, giving Apple a lot of room to grow even with competitors bringing out new products.

Apple is a tremendously successful company because it has a very strong sense of where technology is headed and how to apply it to meet user needs. Apple is creating market shifts, while many other companies are reacting. By deeply understanding its competitors, being willing to disrupt historical markets and using White Space to expand applications Apple will keep growing for quite a while. With, or without Steve Jobs.

On the other hand, there’s the stuck-in-the-past management team at Microsoft. Tied to all those aging, outdated products and distribution plans built on PC technology that is nearing end of life. But in the midst of the management malaise out of Seattle Kinect suddenly showed up as a bright spot! SFGate reported that “Microsoft’s Xbox Kinect beond hackers, hobbyists.” Seems engineers around the globe had started using Kinect in creative ways that were way beyond anything envisioned by Microsoft! Put into a White Space team, it was possible to start imagining Kinect could be powerful enough to resurrect innovation, and success, at the aging monopolist!

But, unfortunately, Microsoft seems far too stuck in its old ways to take advantage of this disruptive opportunity. Joel West at SeekingAlpha.com tells us “Microsoft vs. Open Kinect: How to Miss a Significant Opportunity.” Microsoft is dedicated to its plan for Kinect to help the company make money in games – and has no idea how to create a White Space team to exploit the opportunity as a platform for myriad uses (like Apple did with its app development approach for the iPhone.)

In the end, ZDNet joined my chorus looking to oust Ballmer (possibly a case study in how to be the most misguided CEO in corporate America) by asking “Ballmer’s 11th Year as Microsoft’s CEO – Is it Time for Him to Go?” Given Ballmer’s massive shareholding, and thus control of the Board, it’s doubtful he will go anywhere, or change his management approach, or understand how to leverage a breakthrough innovation. So as the Cloud keeps decreasing demand for traditional PCs and servers, Brett Owens at SeekingAlpha concludes in “A Look at Valuations of Google, Apple, Microsoft and Intel” that Microsoft has nowhere to go but down! Given the amazingly uninspiring ad program Microsoft is now launching (as described in MediaPost “Microsoft Intros New Corporate Tagline, Strategy“) we can see management has no idea how to find, or sell, innovation.

We often hear advice to buy shares of a company. Rarely recommendations to sell. But Apple is the best positioned company to maintain growth for several more years, while Microsoft has almost no hope of moving beyond its Lock-in to old products and markets which are declining. Simplest trade of 2011 is to sell Microsoft and buy Apple. Just read the headlines, and don’t get suckered into thinking Apple is nothing more than Steve Jobs. He’s great, but Apple can remain great in his absence.

by Adam Hartung | Jan 8, 2011 | Books, Openness

My guest blogger today is Nick Morgan, Founder and CEO of America’s leading firm for developing and coaching great speeches. Leaders, especially those who promote innovation, need to be great communicators. You are never good enough when market shifts make the stakes so high. Here Nick offers particularly good insight to everyone who finds themselves in front of an audience in 2011:

“The only reason to give a speech is to change the world.” An old friend of mine, a speechwriter, used to say that to me. He meant it as a challenge. It was his way of saying that, if you’re going to take all the trouble to prepare and deliver a speech, make it worthwhile. Change the world.

Otherwise, why bother? Preparing speeches, giving speeches, and listening to speeches—each of these activities is fraught with peril. The opportunities for failure are many, and for success correspondingly few. An oft-quoted study suggests that executives would rather die than speak. Of all their fears, public speaking is number one, and death comes much further down the list, just before nuclear war. That must explain why they often put off the task of preparing speeches to the last minute—or give the task to someone else.

If speechmaking is hard work for presenters, it’s also hard work for their audiences. Most business presentations are dreadful—boring, platitudinous, and delivered with a compelling lack of enthusiasm. People don’t remember much of what they learn from speeches—something on the order of 10 to 30 percent. With some business talks I’ve attended, that failure rate must be close to 100 percent. How many presentations have you sat through where your mind started wandering a few minutes into the talk and never really came back? Where you surreptitiously picked up your smartphone and started planning your calendar for the next millennium or two? Where you ended up more familiar with the number of acoustic tiles in the ceiling than the number of points in the outline of the speech?

So why do we bother? We bother giving speeches because of the opportunities they offer presenters with passion and a cause. There is something profound about gathering a group of people together in a hall and giving them the full force of your ideas presented live and in person. There is something essential about the intellectual, emotional, and physical connections a good speaker can make with an audience, something that cannot happen on the printed page. There is something powerful about the chemistry that happens in the moment of contact that no other medium can reproduce.

It’s what I call the kinesthetic connection. It’s something I’ve observed in over 25 years of teaching and coaching public speaking. When it happens, it’s powerful. When it’s missing, everyone feels it—even the hapless speaker.

Why People Will Always Give Speeches

We still need speeches. We need them to move audiences to action. People may learn to believe in your expertise from the printed page. But they will only be moved to action if they come to trust you from hearing and seeing you offer a solution to a problem they have. That kind of trust is visceral as well as intellectual and emotional, and it only comes from presence.

From the audience’s point of view, we still need to validate our impulse to action by seeing our champions, to test the sense of their messages and the integrity of their beings. Partly, we’re reading their nonverbal messages, those gestures and habits that we learn to interpret unconsciously for the most part, the ones that tell us something about the credibility and courage of the presenter. Partly, we’re testing to see if they can structure and present their ideas coherently in real time, abilities that tell us about how articulate and organized they are. And partly, we’re watching to see if we can find some sense of common humanity in the speaker, in order to make common cause with that speaker’s passion.

When Roger Mudd asked Ted Kennedy, on 60 Minutes in 1980, why he wanted to be president, Senator Kennedy famously fumbled the answer. Millions of Americans watched Kennedy at close hand, thanks to the eye of the camera, and judged his incoherent, rambling answer to lack credibility. The campaign was over almost before it began. Kennedy had changed the world—not in the way he intended, perhaps, but inescapably and irretrievably nonetheless. Potential backers slunk away from the Kennedy camp. Potential workers joined other campaigns. Potential voters resolved to find another candidate. And all of that happened through the faux-familiarity of television. Imagine how much more devastating it would have been in person.

Does changing the world seem like a daunting challenge? There’s good news buried in the challenge. With a powerful, audience-centered presentation, you can change the world. And that goes whether you’re talking to a small group of employees or colleagues—or a keynote audience of thousands. The principles are the same.

And there’s more good news to come: Regardless of how good you are now, you can learn how to give a better speech, one that makes a kinesthetic connection with your listeners. One that creates a sense of trust in you and moves them to action.

You Need to Listen to Your Audience

At the heart of this connection lies a counterintuitive truth: the secret to forming a strong bond between you and the people in the audience is to listen to them—from the very beginning.

Wait a minute, you say. I’m the one that has to do the talking. How can I listen to them? And what do you mean by kinesthetic? You’ve already used that word twice.

The answers to these questions are related. Let’s take the easy one first. Kinesthetic means being aware of the position and movement of the body in space. And to listen to the audience, you need to listen (and to show you’re listening) with your whole body. To give a simple example, consider the nervous executive in front of the shareholders for an annual meeting. He has some less-than-spectacular numbers to report, and everyone knows it. He’s prepared for the worst. He begins his talk with a curt, “Good morning,” arms folded, staring tensely over the audience members’ heads, looking into the middle distance, trying not to acknowledge the anger he sees in front of him. He immediately launches into a defensive talk aimed at minimizing the damage and second-guessing what the audience might ask him.

Not a pretty picture. Contrast that with a different executive in a similar pickle. She knows the meeting is going to be tough, but she’s ready. She stands up in front of the shareholders, smiles, and asks, “How are you?” Her arms are comfortably open at her sides. And she waits for a couple of seconds, making eye contact with at least one of the audience members on the right hand side of the room. Then she asks, no longer smiling, raising her eyebrows to invite response, “Are you angry about last year’s numbers? [Pause. Looking at someone else, on the left, now.] You have every right to be. We’re as disappointed as you are. Let’s talk about them. What’s on your mind?”

Not many chief executives would have the guts, frankly, to take the second approach. But which company would you rather hold stock in?

The second executive is well on the way to giving an audience-centered speech. She’s going to find kinesthetic moments to connect with her audience, and she’s begun by actually listening to them—reading their entire range of responses, including the nonverbal—from the start.

Indeed, even in this simplified example, the key to success is in making those rhetorical questions real. When you ask, “How are you?” of an audience, wait to see how some members of that audience actually are. Don’t continue until you’ve learned the answer, either verbally or nonverbally. It’s a small but vital way to begin an audience-centered talk. Success in public speaking is made up of a myriad little moments of connection like that.

And one big thing: charisma. That’s the magic quality, isn’t it? The one that everyone craves. And yet charisma doesn’t come from doing something difficult or esoteric that it takes years to master (and lots of expensive advice from speech coaches like me). We know now, thanks to the communications research of the last thirty years, what charisma is. Quite simply, it’s focused expressiveness. Expressiveness is the willingness to be open to your audience, both verbally and nonverbally. To show how you feel about your subject. To get past nervousness and self-consciousness and get to the stuff that you care about, and give that to the audience. That’s why they call it “giving a speech.” If you can unlock your own passion about the subject, and give that to the audience, in a focused way, you will be charismatic. The audience will not be able to take its eyes off you.

And so we’re back to audience-centered speaking, and kinesthetics. The only reason to give a speech is to change the world. You accomplish that by moving your audience to action. To do that, you have to be willing to listen to the audience, and to give it your passion. To get to that happy state, you need to find kinesthetic connections with the audience.

That’s audience-centered speaking in a paragraph. It’s a simple as that.

And lest you think that when I say “changing the world” I’m only talking about the big speeches (the ones that CEOs give to shareholders, for example) understand that I’m talking about every speech ever given. These principles apply to all public speaking, whether to five thousand people or five, for a grand public occasion or simply a regular meeting to report on 3Q numbers. After all, if you give a brilliant, inspiring, audience-centered presentation about those 3Q numbers, you will change the attitudes of your team in the room with you. And if you change their attitudes, you just might change their behavior. And if you change their behavior, you’ve changed the world in the only way that counts.

So that’s my wish for you in 2011: that you’ll start changing the world with every speech or presentation you give.

If you want to make sure yoru points are clear and communicated well consider contacting Nick and Public Words. Their clients have improved their communications dramatically for positive results. At the very least, pick up Nick’s books from Amazon or another source and use his recommendations – you’ll be glad you did! Reach out to Nick via his web site http://www.PublicWords.com

by Adam Hartung | Jan 5, 2011 | Defend & Extend, In the Rapids, In the Swamp, Leadership, Lock-in, Openness

Summary:

- Business planning systems are designed to defend historical markets

- Rapidly shifting markets makes it impossible to grow by defense alone

- Growth requires understanding what customers want, and creating new solutions that most likely aren’t part of the current business

- You can’t grow if you don’t plan to grow, but to plan for growth you have to shift resources from traditional planning into scenario planning

- High growth companies like Virgin, Apple and Google plan to fulfill future needs, not defend & extend past practicess

Imagine you see a pile of hay. Above it is a sign flashing “find the needle.” That achievement would be hard. Change the sign to “find the hay” and suddenly achieving the goal becomes much easier. So, as the comedian Bill Engvall might ask, what’s your sign? Unfortunately, most businesses plan for 2011, and beyond, using the first sign. Very few do planning using the latter. Most businesses won’t grow, because they simply don’t know how to plan for growth!!

Most businesses start planning with “I’m in the horseshoe (for example) business. My market isn’t growing, and there is more capacity than demand. How can I grow?” For these people, their sign is “find the needle.”

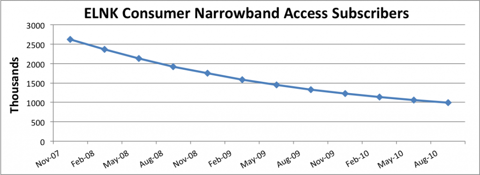

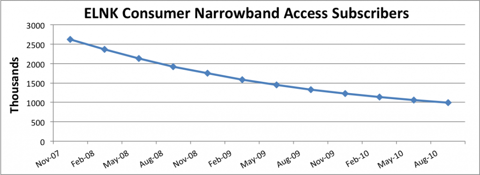

Take for example Earthlink. The company’s growth looked like a rocket ship in the early internet days as people by the millions signed up for dial-up service. But along came broadband, and the market for dial up died – never to return. Earthlink has no hope of growing as long as it thinks of itself as a dial-up company

Chart at SeekingAlpha.com author Ananthan Thangavel

Despite the absolute certainty that the market is shrinking, at this point almost all business planners will develop plans to defend this dying business as long as possible. Despite the impossibility of achieving good returns, there will be a plethora of actions to try and keep serving all the way to the very last customer. Just look at how AOL has invested millions trying to defend its dying internet access busiuness. Reality is, the company that walks away – gives up- is the smartest. There’s no way to make money as oversupply keeps too many companies spending too much to service too few customers.

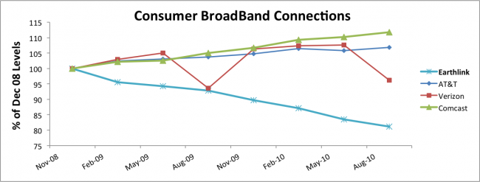

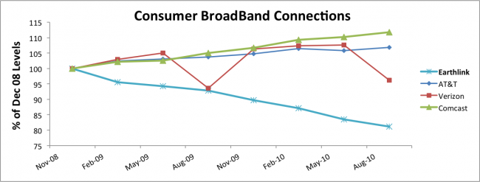

The next step for most planners is to attempt extending the business into something adjacent. For example, Earthlink would say “let’s invest in Broadband. We’ll hang onto customers as they want to switch, and maybe pick up a few customers.” But this completely ignores the fact that competitors already have a substantial lead. Competitors have learned the technology, and the marketplace. They are growing, and have no intention of giving up any room to a new competitor.

Chart at SeekingAlpha.com author Ananthan Thangavel

Planning systems are designed to keep the business doing more of what it always did, or possibly extending the business into adjacent markets after returns have faltered. Planning systems have no way of recognizing when a business, or market, has become obsolete. And practically never do they recognize the power of exsting competitors when looking at adjacent markets. As a result, the planning system produces no growth plans, leading 2011 to end with the self-fulfilling prophecy that the plan predicted – little or no growth.

The future for Earthlink is pretty grim. As it is for most companies that plan based upon history, trying to Defend & Extend their historical markets. In the highly dynamic, global marketplaces of 2011 trying to find growth by remaining focused on the past is like looking for the needle in a haystack. Maybe there’s something in there – but it’s not likely – and it’s even a lot less likely you’ll find it – and if you did, the cost of finding it will almost assuredly be greater than the value.

Alternatively, why not use planning resources to find, and develop, growth markets. Instead of looking at what you did (as in the past tense) try to figure out what you should do. Rather than studying past products, customers and markets, why not develop scenarios about the future that give you insight to what people will want to buy in 2011, 2012 and beyond? Rather than looking for needles, why not go explore the hay?

Newspapers kept focusing on declining subscriptions, when they should have been studying Craig’s List, eBay, Vehix.com and other on-line environments to learn the future of advertising. Had Tribune company poured its resources into its early internet investments, such as cars.com and careerbuilder.com, rather than trying to defend its traditional newspapers, it may well have avoided bankruptcy. But rather than looking to the future when doing its planning, and understanding that on-line news was going to explode, Tribune kept looking for the needle (cost cuts, layoffs, outsourcing, etc.) to save the old success formula.

Direct mail companies and Sunday insert printers have continued looking for ways to defend & extend their coupon printing business – despite the fact that nobody reads junk mail or uses printed coupons. Several have failed, and larger companies have merged trying to find “synergies” and more cost cuts. Simultaneously a 28 year old music major from Nothwestern university starts figuring out how to help companies acquire new customers by offering email coupons, and within 2 years his company, Groupon, is valued at around $6B. There’s nothing that stopped coupon powerhouse Advo from being Groupon, except that its planning system was devoted to finding the needle, while Groupon’s leaders decided to go play in the hay.

Hallmark and American Greetings want us to buy birthday and holiday cards for various occasions – in a world where almost nobody mails cards any longer. As they keep trying to defend their old business, and extend it into a few new opportunities for on-line cards, Twitter captures the wave of instant communications by offering everyone 140 character ways to communicate. Because Twitter is out where the growth is, the company raises $200M giving it a value of $3.7B.

Nothing stops any business from being anything it wants to be. But as most enter 2011 they will use their planning resources, including all those management meetings and hours of forms completion, to do nothing more than re-examine the historical business. Most will devolve into trying to figure out how to do more with less. As future forecasts look grim, or perhaps cautiously optimistic (based on a lot of things going right – like a mysterious pick-up in demand) there will be much nashing of teeth – and meetings looking for a needle that can be offered to employees and investors as a hope for rising future value.

Smart companies get out of that rut. They focus their planning on the future. What do customers want, and how can we give them what they want? How can we create whole new markets. Apple was a PC company, but by exploring mobility it became a provider of MP3 consumer electronics, downloadable music, a mobile device and app supplier and the early winner in cloud accessing tablets. Google has moved from a search engine to a powerhouse ad placement company and is pushing the edges of growth in mobile computing as well as several other markets. Virgin started as a distributor of long-playing vinyl record albums, but by exploring what customers really wanted it has become an international airline, cell phone company, international lender and space travel pioneer (to mention just a few of its businesses.)

You can grow in 2011, but to do so you need to shed the old planning system (and its resource wasting processes) and get serious about scenario planning. Focus on the future, not the past.

by Adam Hartung | Dec 23, 2010 | Defend & Extend, General, In the Rapids, Innovation, Leadership, Openness

“Goodbye 2010, the Year of Austerity” is the headline from Mediapost.com‘s Marketing Daily. And that could be the mantra for many, many companies. Nobody is winning today by trying to save their way to prosperity! As we move into this decade, it is important business leaders realize that the only way to create a strong bottom line (profit) is to develop a strong top line (revenue.) Recommendations:

- Never be desperate. Go to where the growth is, and where you can make money. Don’t chase any business, chase the business where you can profitably growth. Be somewhat selective.

- Focus efforts on markets you know best. I add that it’s important you understand not to do just what you like, but learn to do what customers VALUE.

- Let go of crap, traditions and “playing it safe” actions. Growth is all about learning to do what the market wants, not trying to protect the past – whether processes, products or even customers.

- More lemonade making. You can’t grow unless you’re willing to learn from everything around you. We constantly find ourselves holding lemons, but those who prosper don’t give up – they look for how to turn those into desirable lemonade. What is your willingness to learn from the market?

- Austerity measures are counterproductive 99% of the time. Efficiency is the biggest obstacle to innovation. You don’t have to be a spendthrift to succeed, but you can’t be a miser investing in only the things you know, and have done before.

- Communicate, communicate, communicate. We don’t learn if we don’t share. Developing insight from the environment happens when all inputs are shared, and lots of people contribute to the process.

- Get off the downbeat buss. There’s more to success than the power of positive thinking, but it is very hard to gain insight and push innovation when you’re a pessimist. Growth is an opportunity to learn, and do exciting things. That should be a positive for everybody – except the status quo police.

Realizing that you can’t beat the cost-cutting horse forever (in fact, most are about ready for the proverbial glue factory), it’s time to realize that businesses have been under-investing in innovation for the last decade. While GM, Circuit City, Blockbuster, Silicon Graphics and Sun Microsystems have been failing, Apple, Google, Cisco, Netflix, Facebook and Twitter have maintained double-digit growth! Those who keep innovating realize that markets aren’t dead, they’re just shifting! Growth is there for businesses who are willing to innovate new solutions that attract customers and their dollars! For every dead DVD store there’s somebody making money streaming downloads. Businesses simply have to work harder at innovating.

Fast Company gives us “Five Innovative New Year’s Resolutions:”

- Associate. Work harder at trying to “connect the dots.” Pick up on weak signals, before others, and build scenarios to help understand the impact of these signals as they become stronger. For example, 24x7WallStreet.com clues us in that greater use of mobile devices will wipe out some businesses in “The Ten Businesses The Smartphone Has Destroyed.” But for each of these (and hundreds others over the next few years) there will be a large number of new business opportunities emerging. Just look at the efforts of Foursquare and Groupon and the direction those growth businesses are headed.

- Observe. Pay attention to what’s happening in the world, and think about what it means for your (and every other) business. $100/barrel oil has an impact; what opportunity does it create? Declining network TV watching has an impact – how will you leverage this shift? Don’t just wander through the market, and reacting. Figure out what’s happening and learn to recognize the signs of growth opportunities. Use market events to drive being proactive.

- Experiment. If you don’t have White Space teams trying figure out new business models, how will you be a future winner? Nobody “lucks” into a growth market. It takes lots of trial and learning – and that means the willingness to experiment. A lot. Plan on experimenting. Invest in it. And then plan on the positive results.

- Question. Keep asking “why” until the market participants are so tired they throw you out of the room. Then, invent scenarios and ask “why not” until they throw you out again. Markets won’t tell you what the next big thing is, but if you ask a lot of questions your scenarios about the future will be a whole lot better – and your experimentation will be significantly more productive.

- Network. You can’t cast your net too wide in the effort to obtain multiple points of view. Nothing is narrower than our own convictions. Only by actively soliciting input from wide-ranging sources can you develop alternative solutions that have higher value. We become so comfortable talking to the same people, inside our companies and outside, that we don’t realize how we start hearing only reinforcement for our biases. Develop, and expand, your network as fast as possible. Oil and water may be hard to mix, but it blending inputs creates a good salad dressing.

ChiefExecutive.net headlined “2010 CEO Wealth Creation Index Shows a Few Surprises.” Who creates wealth? Included in thte Top 10 list are the CEOs of Priceline.com, Apple, Amazon, Colgate-Palmolive and DeVry. These CEOs are driving industry innovation, and through that growth. This has produced above-average cash flow, and higher valuations for their shareholders. As well as more, and better quality jobs for employees. Meanwhile suppliers are in a position to offer their own insights for ways to grow, rather than constantly battling price discussions.

Who destroys wealth? In the Top 10 list are the CEOs of Dean Foods, Kraft, Computer Sciences (CSC) and Washington Post. These companies have long eschewed innovation. None have introduced any important innovations for over a decade. Their efforts to defend & extend old practices has hurt revenue growth, providing ample opportunity for competitors to enter their markets and drive down margins through price wars. Penny-pinching has not improved returns as revenues faltered, and investors have watched value languish. Employees are constantly in turmoil, wondering what future opportunities may ever exist. Suppliers never discuss anything but price. These are not fun companies to work in, or with, and have not produced jobs to grow our economy.

Any company can grow in 2011. Will you? If you choose to keep doing what you’ve always done – well you shouldn’t plan on improved performance. On the other hand, embracing market shifts and creating an adaptive organization that identifies and launches innovation could well make you into a big winner. Next holiday season when you look at performance results for 2011 they will have more to do with management’s decisions about how to manage than any other factor. Any company can grow, if it does the right things.

by Adam Hartung | Dec 15, 2010 | Current Affairs, In the Swamp, Leadership, Openness, Television, Web/Tech

Summary:

- Business leaders are honored for creating profitable growth

- Those who create the greatest growth disrupt the status quo and change the way things are done – such as Zuckerberg and Jobs

- Too many CEOs act as caretakers, overlooking growth

- Caretakers watch value decline

- Under Welch, GE dramatically grew and he was Time’s Person of the Year

- Under Immelt, GE has contracted

- Too many CEOs are like Immelt. They need to either change, or be replaced

It’s that time of year when magazines like to honor folks for major accomplishments. This year, Time’s Person of the Year is Mark Zuckerberg, honored for leading Facebook and its dramatic change in social behavior amongst so many people. Marketwatch.com selected Steve Jobs as its CEO of the Decade – an honor several journals gave him last year!

There is of course a bias in these selections. Most journals highly favor CEOs that drive up their stock price! For example, Ed Zander was CEO of the year in 2004 for his “turnaround” at Motorola – and within 2 years he was fired and Motorola was facing possible bankruptcy. Obviously his “quick fix” (getting the RAZR out the door with a big marketing push) didn’t pan out so well over time. We’ll have to see if Alan Mulallly deserves to be CEO of the Year at Marketwatch, since it appears his selection has more to do with not letting Ford go bankrupt – like competitors GM and Chrysler – and thus reaping the benefits of customers who wanted to buy domestic but feared any other selection. Whether Ford’s “turnaround” will be a winner, or another Zander/Motorola, we’ll know better in a couple of years.

One fellow who isn’t on anybody’s list is Jeff Immelt at General Electric. His predecessor was. Given that

- GE is the oldest company on the DJIA (Dow Jones Industrial Average)

- GE is one of the most widely held of all corporations

- GE is one of the largest American corporations in revenues and employees

- GE is in a plethora of businesses, globally

- Mr. Immelt is paid several million dollars per year to lead GE

It is worthwhile to think about why he’s not on this list – whether he should be – and if not, whether he should keep his job!

Since Immelt took the helm at GE, the value has actually declined. He’s not likely to win any awards given that sort of performance. Amidst the financial crisis, he had to make a very sweet deal with Berkshire Hathaway to invest cash (via preferred shares) in order to keep GE out of bankruptcy court – a deal that has enriched Mr. Buffett’s company at the expense of GE. GE has exited several businesses, such as its current effort to unload NBC via a deal with Comcast, but it has not created (or bought) a single exciting, noteworthy growth business! GE has become a smaller, lower growth company that narrowly diverted bankruptcy. That isn’t exactly a ringing endorsement for honors!

Yes, GE has developed a nice positive cash flow, which will allow it to repurchase the preferred shares from Berkshire (Marketwatch “GE to Buy Back Buffett’s Preferreds Next Year.”) But what is Mr. Immelt doing to create future shareholder value? His plan to make a few acquisitions, pay some higher dividends (suspended when the company faltered) and repurchase equity offers shareholders very little as a way to generate high rates of return! Why would anyone want to own GE? Nobody expects the company to be a growth leader in 2012, or 2015. With its current businesses, and strategy, there is no reason to expect GE to produce double digit earnings growth – or double its equity within any reasonable investing horizon.

There’s more to being a CEO than being a “caretaker.” Mr. Immelt’s predecessor, Jack Welch, created enormous value for shareholders. Mr. Welch was willing to disurpt the GE status quo. In fact, he intentionally worked at it! He made sure business leaders were constantly challenged to find new markets, create new products, expand into new businesses, leverage new technologies and generate growth! Mr. Welch was willing to take GE into growth markets, give leaders permission to create new Success Formulas, and invest in whatever it took to profitably grow revenues. During the Welch era, competitors quaked at the thought of GE entering their markets because things were always shaken up – and GE changed the game in order to create higher rates of return. During the Welch era investors received amongst the highest rate of return on any common stock! GE value multiplied many-fold, making pensioners (invested in the stock) and employees quite wealthy – even as employment expanded dramatically. That’s why Mr. Welch was Time’s Person of the Year in 2000 — and for many the CEO of the previous decade.

Mr. Immelt, on the other hand, has done nothing to benefit any of his constituencies. Like far too many CEOs, he took a much less aggressive stance toward growth. He has been unwilling to challenge and disrupt existing leaders, or promote aggressive market disruptions through the GE business units. He has not invested in White Space projects that could continue the massive expansion started during the Welch era. To the contrary, he has moved much more slowly, and focused more on selling businesses than growing them. He has resorted to trying to protect GE – rather than keep it moving forward. As a result, the company has retrenched and actually become less interesting, less valuable and less clearly able to produce returns or create new jobs!

Mr. Immelt certainly has his apologists, and seems to securely have the support of his Board of Directors. But we should question this. It actually has an impact on the American economy (and that of several other countries) when the CEO of a company as large as GE loses the ability to create growth. The malaise of the American economy can be directly tied to CEOs who are operating just like Mr. Immelt: doing almost nothing to create new markets, new sources of revenue, new jobs. Many business journalists like to say the government doesn’t create revenue, or jobs. So who will create them when corporate leaders are as feckless as Mr. Immelt? Especially when they control such vast resources!

Congratulations to Mr. Zuckerberg and Mr. Jobs (and Mr. Hastings of Netflix who was named Fortune magazine’s CEO of the Year.) They have created substantial new revenues, profits, cash flow and return for investors. Their company’s employees, suppliers, customers and investors have all benefitted from their leadership. By disrupting the way their company’s operated they pushed into new markets, and demonstrated how in any economy it is possible to create success. Caretakers they are not, so like Mr. Welch each deserves its recent accolades.

And for all those CEOs out there who are behaving as caretakers – for all who are resting on past company laurels – for all who have watched their company value decline – for those who think it’s OK to not grow – for those who blame the economy, or government, or competitors, or customers or their industry for their inability to grow —- well, you either need to learn from these recently honored CEOs and dramatically change direction, or you should be fired.

by Adam Hartung | Dec 1, 2010 | Current Affairs, In the Rapids, Innovation, Leadership, Openness, Web/Tech

Summary:

- Most planning systems only focus on improving the existing business

- Most value comes from identifying new market opportunities, and filling them

- Extremely high growth can happen in any company that focuses on market needs, rather than business model optimization

- Groupon has grown from $0 to $500M in 2 years, yet is not a technology company

- Groupon is value at $3B to $6B in just 2 years

- Google could continue to expand the explosive growth at Groupon

- Any company has this opportunity, if it focuses on market needs

“You can’t get there from here.” That’s the punch line of an old joke about a city slicker that gets lost in the country. He sees a farmer and says “I want to get to the St. James ranch.” The farmer thinks about the washed out road #20, the destroyed bridge on Old Ferry Road, the blocked road on Westchester due to a property dispute – and given all his known ways to get to the St. James Ranch he conludes there’s no way to make it happen. He gives up, and recommends the traveler do the same.

And this is the conclusion far too often of most planning systems. When I ask the executive team “how will you grow revenue by 100% next year?” (or even 15% many times) the answer is “can’t happen. We only grew 2% last year, our product lines are becoming aged and the overall market is only growing at 5%. We can only, maximally, hope to grow 3-5%.” In other words, “can’t get there from here.”

But of course there’s a way.

Groupon was started in 2008 (“Groupon at $3 Billion Soars Like Silicon Valley from Chicago” Bloomberg). Now it has about $500M annual revenue, and 2,500 employees. While Sara Lee, Kraft, Motorola and other Chicago stalwarts are contracting – unable to find a growth path – Groupon has exploded. Most companies are complaining about the “great recession,” and its impact on customers and sales, saying they see no way to create triple digit growth. Yet Groupon didn’t invent any new technology, didn’t file any patents, didn’t open a “scale” manufacturing plant, didn’t buy an existing business, or raise a huge amount of money. Groupon is now dominant in local-market advertising – without the Foursquare technology play, or a partnership with Facebook. And it keeps adding new local markets every week. Piling up new revenues, and profits.

What Groupon did was offer the market something it highly valued – a local-based coupon service that was easy to use. Building on digital technology rapidly being accepted by everyone. While most companies are trying to focus on their “core capabilities” and bemoaning a dearth of growth, Groupon’s leaders looked into the marketplace to identify an unmet need and an application of developing technology. As good as Google AdWords is, it is expensive and not terribly good at local marketing. Newspaper coupons are expensive to print, and simply ignored by most modern consumers. There was a hole in what people needed, so the entrepreneurs set out to fill it. And by meeting a need, they’ve created an explosively growing company. As mentioned earlier, while unemployment overall in Chicago is going up, Groupon has hired 900 people over the last 2 years.

That’s what most businesspeople are loath to do these days. After years of being trained to focus on the supply chain, and that innovation is mostly about how to cut costs in the existing business, very few are thinking about market needs. The vast majority (almost all?) of planning is devoted to cutting costs and optimizing an existing business. Or trying to develop an adjacent opportunity to the existing business that has limited, if any growth prospects. And trying to find ways to take money out of the business, rather than invest. In that planning system, if you ask “how do you plan to create a half billion dollar new business in the next two years” the answer is “you can’t get there from here.”

“Google May Acquire Groupon for $6 Billion, and It Would Be Worth Every Penny” headlines Mashable.com. Not bad for the guys who started up this distinctly non-techie company in the non-techie midwest. Whether they sell out or not, the next fundraising is guaranteed to make them extremely wealthy folks. There are still a lot of markets yet to be developed, and a lot more deals to be made in the existing markets, as buyers seek out discounts for products they buy regularly.

It mashable right? Is this a smart idea for Google? Unless you think coupons, and deals, are dead – you have to like this investment. There’s a reason Groupon has grown so very fast – and that lies in meeting a market need. How fast can it grow if Google adds its skills at ad sales, email (gmail) use, user database analytics, networking connections and technology wizardry? While $6B is a lot of money, if you can see how Groupon on its own could become a $6B revenue company within 4 years from today is it really too miuch? (Groupon has grown from $0 to $500M in just about 2 years, so does 12x growth in 4 years [just under an annual doubling] really appear that difficult?)

Smart investing doesn’t mean “hold your nose and jump” off the bridge, hoping the water is OK. And that’s not what Groupon did, or Google might do if it acquires Groupon. Both companies are focusing on future scenarios about how we will get things done in 2012 and beyond. Both are thinking about the impact of existing trends, and how those will allow everyone to be more effective, efficient and successful in 3 or 5 years. Both are developing solutions that help us be more productive by building on trends – and not merely expecting the future to look like the past. Their planning is based upon views of the future – and that’s why they can see such greater opportunity, and create so much value.

Most business limit their planning, and investing, to doing more of what they have always done. Better, faster, cheaper are the hallmarks of the traditional planning process output. Expecting to get dramatic growth, or value, out of a system so narrowly focused is expecting the impossible. Creating value – big value – comes from providing solutions that meet new market needs. And that requires overcoming the limits of traditional planning – and traditional ways of thinking about investing. Instead of doing more of what you know, you have to do more of what the market wants. Any company can get there from here – if you simply open your planning to moving beyond the limits of what you’ve historically done.

by Adam Hartung | Nov 29, 2010 | Current Affairs, Disruptions, In the Rapids, Innovation, Leadership, Lifecycle, Openness, Television, Web/Tech

Summary:

- Most leaders optimize their core business

- This does not prepare the business for market shifts

- Motorola was a leader with Razr, but was killed when competitors matched their features and the market shifted to smart phones

- Netflix's leader is moving Netflix to capture the next big market (video downloads)

- Reed Hastings is doing a great job, and should be emulated

- Netflix is a great growth story, and a stock worth adding to your portfolio

"Reed Hastings: Leader of the Pack" is how Fortune magazine headlined its article making the Netflix CEO its BusinessPerson of the Year for 2010. At least part of Fortune's exuberance is tied to Netflix's dramatic valuation increase, up 200% in just the last year. Not bad for a stock called a "worthless piece of crap" in 2005 by a Wedbush Securities stock analyst. At the time, popular wisdom was that Blockbuster, WalMart and Amazon would drive Netflix into obscurity. One of these is now gone (Blockbuster) the other stalled (WalMart revenues unmoved in 2010) and the other well into digital delivery of books for its proprietary Kindle eReader.

But is this an honor, or a curse? It was 2004 when Ed Zander was given the same notice as the head of Motorola. After launching the Razr he was lauded as Motorola's stock jumped in price. But it didn't take long for the bloom to fall off that rose. Razr profits went negative as prices were cut to drive share increases, and a lack of new products drove Motorola into competitive obscurity. A joint venture with Apple to create Rokr gave Motorola no new sales, but opened Apple's eyes to the future of smartphone technology and paved the way for iPhone. Mr. Zander soon ran out of Chicago and back to Silicon Valley, unemployed, with his tale between his legs.

Netflix is a far different story from Motorola, and although its valuation is high looks like a company you should have in your portfolio.

Ed Zander simply took Motorola further out the cell phone curve that Motorola had once pioneered. He brought out the next version of something that had long been "core" to Motorola. It was easy for competitors to match the "features and functions" of Razr, and led to a price war. Mr. Zander failed because he did not recognize that launching smartphones would change the game, and while it would cannibalize existing cell phone sales it would pave the way for a much more profitable, and longer term greater growth, marketplace.

Looking at classic "S Curve" theory, Mr. Zander and Motorola kept pushing the wave of cell phones, but growth was plateauing as the technology was doing less to bring in new users (in the developed world):

Meanwhile, Research in Motion (RIM) was pioneering a new market for smartphones, which was growing at a faster clip. Apple, and later Google (with Android) added fuel to that market, causing it to explode. The "old" market for cell phones fell into a price war as the growth, and profits, moved to the newer technology and product sets:

The Motorola story is remarkably common. Companies develop leaders who understand one market, and have the skills to continue optimizing and exploiting that market. But these leaders rarely understand, prepare for and implement change created by a market shift. Inability to see these changes brought down Silicon Graphics and Sun Microsystems in 2010, and are pressuring Microsoft today as users are rapidly moving from laptops to mobile devices and cloud computing. It explains how Sony lost the top spot in music, which it dominated as a CD recording company and consumer electronics giant with Walkman, to Apple when the market moved people from physical CDs to MP3 files and Apple's iPod.

Which brings us back to what makes Netflix a great company, and Mr. Hastings a remarkable leader. Netflix pioneered the "ship to your home" DVD rental business. This helped eliminate the need for brick-and-mortar stores (along with other market trends such as the very inexpensive "Red Box" video kiosk and low-cost purchase options from the web.) Market shifts doomed Blockbuster, which remained locked-in to its traditional retail model, made obsolete by competitors that were cheaper and easier with which to do business.

But Netflix did not remain fixated on competing for DVD rentals and sales – on "protecting its core" business. Looking into the future, the organization could see that digital movie rentals are destined to be dramatically greater than physical DVDs. Although Hulu was a small competitor, and YouTube could be scoffed at as a Gen Y plaything, Netflix studied these "fringe" competitors and developed a superb solution that was the best of all worlds. Without abandoning its traditional business, Netflix calmly moved forward with its digital download business — which is cheaper than the traditional business and will not only cannibalize historical sales but make the traditional business completely obsolete!

Although text books talk about "jumping the curve" from one product line to another, it rarely happens. Devotion to the core business, and managing the processes which once led to success, keeps few companies from making the move. When it happens, like when IBM moved from mainframes to services, or Apple's more recent shift from Mac-centric to iPod/iPhone/iPad, we are fascinated. Or Google's move from search/ad placement company to software supplier. While any company can do it, few do. So it's no wonder that MediaPost.com headlines the Netflix transition story "Netflix Streams Its Way to Success."

Is Netflix worth its premium? Was Apple worth its premium earlier this decade? Was Google worth its premium during the first 3 years after its Initial Public Offering? Most investors fear the high valuations, and shy away. Reality is that when a company pioneers a growth business, the value is far higher than analysts estimate. Today, many traditionalists would say to stay with Comcast and set-top TV box makers like TiVo. But Comcast is trying to buy NBC in order to move beyond its shrinking subscriber base, and "TiVo Widens Loss, Misses Street" is the Reuters' headline. Both are clearly fighting the problems of "technology A" (above.)

What we've long accepted as the traditional modes of delivering entertainment are well into the plateau, while Netflix is taking the lead with "technology B." Buying into the traditionalists story is, well, like buying General Motors. Hard to see any growth there, only an ongoing, slow demise.

On the other hand, we know that increasingly young people are abandoning traditional programing for 100% entertainment selection by download. Modern televisions are computer monitors, capable of immediately viewing downloaded movies from a tablet or USB drive – and soon a built-in wifi connection. The growth of movie (and other video) watching is going to keep exploding – just as the volume of videos on YouTube has exploded. But it will be via new distribution. And nobody today appears close to having the future scenarios, delivery capability and solutions of Netflix. 24×7 Wall Street says Netflix will be one of "The Next 7 American Monopolies." The last time somebody used that kind of language was talking about Microsoft in the 1980s! So, what do you think that makes Netflix worth in 2012, or 2015?

Netflix is a great story. And likely a great investment as it takes on the market leadership for entertainment distribution. But the bigger story is how this could be applied to your company. Don't fear revenue cannibalization, or market shift. Instead, learn from, and behave like, Mr. Hastings. Develop scenarios of the future to which you can lead your company. Study fringe competitors for ways to offer new solutions. Be proactive about delivering what the market wants, and as the shift leader you can be remarkably well positioned to capture extremely high value.

by Adam Hartung | Sep 29, 2010 | Current Affairs, General, Innovation, Leadership, Openness, Web/Tech, Weblogs

Summary:

- Traditional news formats – such as magazines and newspapers – are faltering

- On-line editions of traditional formats are not faring well

- Important journalists are transitioning to blogger roles to better provide news consumers what they want

- Important journalists from Newsweek and the New York Times have joined HuffingtonPost.com as bloggers

- Forbes.com is transitioning from traditional publishing to bloggers in its effort to meet market needs

- The new era of journalism will be nothing like the last

In early 2006, before it completed the leveraged buyout (LBO) that added piles of debt onto Tribune Corporation I was talking with several former Chicago Tribune executives who had been placed in senior positions at the acquired Los Angeles Times. Their challenge was figuring out how they would ever improve cash flow enough to justify the huge premium paid for the newspaper. Unfortunately, 90% or more of their energy was focused on cost cutting and outsourcing, with almost none looking at revenue generation.

In the face of a declining subscriber base, intense competitiion from smaller, targeted newspapers in the area, and a lousy ad market I asked both the publisher and the General Manager what they were going to do to drive revenue growth. They, quite literally, had no ideas. There was a fledgling effort, dramatically underfunded for the scale of the country’s largest local newspaper, to post part of the LATimes content on-line. But the entire team was only 30 people, they were restricted to re-treading newspaper content, and mostly they focused on local sports reports (pages which drew the largest number of hits). About a third of the staff were technical folks (IT), and half were sales – leaving very few bodies (or brains) to put energy into making a really world-class news environment worthy of the LATimes.com name. The group head was trying to find internet ad buyers who would pay a premium to be on a well-named but woefully content-weak web-site.

Lacking any plans to drive growth, in old or new markets, it was no surprise that lay-offs and draconian cost cutting continued. Several floors in the famous newspaper building right in downtown Los Angeles, like the Tribune Tower in Chicago, became empty. By 2008 as much of the building was used as a movie set as used by editors or reporters! Eventually Tribune Corp. filed bankruptcy – where it has remained going on 3 years now.

When asked if the newspaper would consider adding bloggers to the on-line journal, the entire management team was horrified. “Bloggers are not journalists,” was the first concern, “so quality would be unacceptable. You cannot expect a major journalistic enterprise to consider blogging to have any correlation with professional journalism.” I asked what they thought about the then-fledgling HuffingtonPost.com, to which they retorted “that is not a legitimate news company. The product is not comparable to our newspaper. It has nothing to do with the business we’re in.” And with that simple attack, the executives promptly dismissed the fledgling, fringe competition.

How things have changed in news publishing. Four years later newspapers are dramatically smaller, in both ad dollars and staff. Many major journals – magazines as well as newspapers – have discontinued print editions as subscriptions have declined. Print formats (physical size) are substantially smaller. While millions of internet news sites attract readers hourly, print readership has only gone down. Major journals, unable to maintain their cash flow, have been acquired at low prices by newcomers hopeful of developing a new business model, and many well known and formerly influential news journalists have been laid off, or moved to on-line environments in order to maintain employment.

About a week ago the Wall Street Journal reported “Newsweek’s Howard Fineman to Join Huffington Post.” This week Mediapost.com headlined “The HuffPo’s Hiring of NYT’s Peter Goodman Is More Significant Than You Think.” Rather rapidly, in just a few years, HuffingtonPost.com has become a major force in the news industry. Well known journalists from Newsweek and the New York Times add considerable credibility to a new media which traditional publishers far too often ignored. Much to the chagrin, to be sure, of Sam Zell and the leadership at Tribune Corporation.

Today people want not only sterile reporting, but some insight. “What does this mean? Why do you think this happened? Is this event important, or not, longer term? What am I supposed to do with this information?” People want some analysis, as well as news. And readers want the input NOW – immediately – not at some later time that meets an arbitrary news cycle. Increasingly news consumers want Bill O’Reilly or Keith Olberman (depending upon your point of view) rather than Walter Cronkite – and they’d like that input as soon as possible.

Bloggers provide this insight. They provide not only information, but make some sense of it. They utlize past experience and insight to bring together relevant, if disparate, facts coupled with some ideas as to what it means. Where 4 year ago publishers scoffed at HuffingtonPost.com, nobody is scoffing any longer.

And it’s with great pleasure, and a pretty hefty dose of humility, that I’ve become a blogger at Forbes.com (http://blogs.forbes.com/adamhartung/). Hand it to the publisher and editors at Forbes that they are moving Forbes.com from an on-line magazine to a bi-directional, real-time site for information and insight to the world of business and economic news. Writers aren’t limited to a set schedule, a set word length or even set topics. Readers will now be able to visit Forbes.com 24×7 and acquire up-to-the-minute news and insight on relevant topics.

Forbes.com is transitioning to be much more like HuffingtonPost.com – a change that aligns with the market shift. For readers, employees and advertisers this is a very, very good thing. Because nobody wants the end of journalism – just a transition to the market needs of 2010. I look forward to joining you at Forbes.com blogs, and hearing your comments to my take on business and economic news.

by Adam Hartung | Sep 26, 2010 | Current Affairs, In the Rapids, Leadership, Openness, Web/Tech

Summary:

- Apple is worth more than Microsoft today, even though Microsoft is larger, because it has better growth prospects

- Apple is closing in on the most valuable company in the world – Exxon

- Exxon’s value is stalled because it has no growth markets

- Exxon once developed, then abandoned, a growth business called Exxon Office Systems

- Apple’s value may eclipse Exxon, which has almost 8 times the revenue, because its growth prospects are so bright

- Profitable growth is worth more than monopolistic market share – or even huge revenue

We all know that over the last 10 years Apple has moved from the brink of bankruptcy to great success. Apple has been able to dramatically increase its revenues, growing at double-digit rates for several years. And Apple now competes in markets like mobile computing and entertainment where its hardware and software products are demonstrating a leading position as users migrate toward different platforms (iPods and downloadable music or video, iPads and downloadable video or text, iPhones and downloadable apps of all sorts).

Because of this profitable growth, Apple’s market value now exceeds Microsoft’s. An accomplishment nobody predicted a decade ago.

As this chart from Silicon Alley Insider shows, Apple’s profitable revenue growth has allowed its value to soar. Even though Microsoft is larger, and dominates its market of PC operating systems and office automation software, its value has stalled due to lack of growth. Because Apple is in very large, emerging markets with successful products it is generating a very high valuation.

In fact, Apple’s market cap is closing in on the most valuable company in the world – Exxon:

Source: Silicon Alley Insider

Exxon and Apple have nothing in common. Exxon is a petroleum company. It’s growth almost all from acquisition. You could say it’s nonsensical to compare the two.

But for those of us with long memories, we can remember in the early 1980s when Exxon opened Exxon Office Systems. As the price of crude oil, and its refined products, hit record highs Exxon made record profits. Leadership invested a few billion dollars into creating a new business intended to compete with IBM and Xerox – leading office equipment companies of the time. But, when the price of crude oil fell Exxon abandoned this venture – by then already achieving more than $1B/year in revenue. All the suppliers and customers were left in the lurch, and the employees were left looking for new jobs. Within weeks Exxon Office Products disappeared.

Exxon abandoned its opportunity for growth into new markets in order to “focus” on its “core” business of oil exploration and production, oil refining, and marketing of petroleum products. As a result, Exxon – augmented via its many acquisitions across the years – is now the world’s largest “oil” company as well as the world’s highest market capitalization company. But it has no growth. And thus, its value is totally dependent upon the price of oil – a commodity. Over the last 2 years this has caused Exxon’s value to decline.

At $43B in 2009, Apple has nowhere near the revenue of Exxon’s $310B. But what Apple has is new markets, and growth. Someday we’ll run out of oil (long time yet, to be sure). What will Exxon do then? But in the case of Apple we already know there will be future revenues from all the new products for a long time after the Mac has run its course and disappeared from backpacks. It’s that willingness to seek out new markets, to develop new products for emerging markets and constantly push for new, profitable revenues that makes Apple worth so much.

Could Apple become the world’s most valuable company? Possibly. If so, it won’t be from industry domination. That sort of monopolistic thinking drove the industrial era, and companies like AT&T as well as Exxon — and Microsoft. What’s worth more today than monopolism is entering new markets and generating profitable growth. It’s what once made the original Standard Oil worth so much, and it initially made Microsoft worth more than any other tech company. Too many of us forget that profitable growth, more than anything else, generates huge value and wealth. And that’s true in spades in 2010!

by Adam Hartung | Sep 23, 2010 | Current Affairs, In the Rapids, Leadership, Openness, Travel

Summary:

- Most people misunderstand the way toward building a valuable company

- Richard Branson has developed massive wealth by finding and entering growth markets

- Success comes from developing new solutions that fulfill unmet needs – not maximizing performance of core capabilities

- Virgin is now moving into luxury hotels, a market being ignored by most investors, with new products that fit still unmet needs

Very few people are as wealthy as Richard Branson. But few people can manage like he does.

Branson started out selling records via mail-order in Britain. Over the years he got into retailing, international airlines, domestic airlines, mobile telephony, international lending (amongst other businesses) – and now his company is investing $500milion in hotels and hotel management. According to Bloomberg.com “Branson’s Virgin Group to Invest $500million in Hotels.”

Despite all we hear about how impossible it is to be an entrepreneur in Europe, Sir Branson has done quite well, building a wildly successful, profitable company. Although he didn’t follow conventional wisdom. Instead of “sticking to his core” Sir Branson has built a company that invests in opportunities which are highly profitable – regardless of the industry or market. He doesn’t grow by doing more of the same better, faster or cheaper. Instead, he takes advantage of shifting markets – getting into businesses with opportunities and exiting those that don’t earn high rates of return.

During last decade’s building boom there were a lot of high-end hotels built. Now, with the economy not growing, excess capacity has made it difficult for these to cover the mortgage. Bankers don’t want to refinance – they want out of the buildings. Occupancy has been so low that many traditional name brands, such as Ritz Carlton or Intercontinental, have been forced to abandon properties. As a result, several hotels have closed, and the property offered for sale at a fraction of original construction cost. With most investors shying away from all things real estate, prices have plummeted. Some hotels, nearly new, have sold for the value of underlying land.

And now Virgin enters the market. Although Virgin has no background in real estate or hotel management, it is clear that there is demand for luxury goods and luxury travel — if someone can make it attractive and affordable. By purchasing premier properties at a fraction (literally 10-25% of their initial cost) Virgin will be able to offer hotel guests a superior experience at an attractive price! Management sees an unmet need by high-income, well educated “creative class” customers. By getting into the market Virgin will learn, just as it did in airlines, how to meet customer expectations in a way that allows for highly profitable delivery when meeting a currently unmet need.

While some would say that if the current competitors, steeped in experience and tradition, can’t succeed Virgin should not think it can. But a Virgin executive rightly says “If you look at Virgin’s history, we have come into markets with big powerful players, where customers are generally satisfied but not in love, and we have been able to cut through that.” Well said. Virgin doesn’t do what competitors do – it develops a solution that locks competitors into their position while positioning Virgin to meet the untapped market.

Even though this opportunity is available to everyone, almost no companies are interested in buying these undervalued hotels. “It’s not our business.” “We don’t know how to operate hotels.” “We don’t invest in real estate.” “I’m too busy taking care of my current business to consider something new.” “What if we’re wrong?” These are all things people say to stop themselves from taking action to enter new opportunities with high rates of return. The magic of Virgin is its willingness to overcome Lock-in to its existing business, look for market opportunities, and then (as Nike advertises) Do It!