by Adam Hartung | Jun 10, 2021 | Entrepreneurship, In the Rapids, Innovation, Strategy, Transportation, Trends

The Slow Decline of Two Famous Brands

Demographics have been causing the slow death of 2 very famous brands. Radio Flyer and Harley-Davidson. Now they are reacting, and maybe it won’t be too little too late for them. Here’s the story and a small dose of innovation theory for you to implement in your business.

Radio Flyer for 100 years has been famous for its little red wagons. Since before the Great Depression, children have enjoyed these wagons (and scooters, etc.) for recreation. But family formation has fallen precipitously the last decade, and the birth rate has fallen even faster. Further, lots of competitors have entered the market for small pull wagons and scooters. The net impact is fewer babies, and a big drop in demand for the traditional metal wagons. For a company manufacturing in Chicago, it looked like another slow slide into irrelevancy and failure.

But now, Radio Flyer has announced its new e-bike and e-scooter products. This opens the door to an entirely new market and new customers. People of all ages have started purchasing e-bikes. They ride for pleasure, to run errands and even commuting. In some cities, electric scooter ride sharing rentals have soared faster than bicycle rentals. Sales have skyrocketed. Seeing the underlying trend in demographics, and the changing consumer behavior Radio Flyer is entering the market with new products – priced squarely in the market sweet spot – which just might make the company relevant again.

An even older company is Harley-Davidson. For years, Harley has dominated the market for large engine cruiser style motorcycles. In the 1970s and 1980s, this served the company well as motorcycle sales grew and customers would up-size to Harley bikes from smaller Japanese manufacturers. But the brand image wore old a long time ago. Images of “Hells Angels”, “Easy Rider” and accountants turned HOG (for Harley Owners Group) were not attractive to younger buyers. The average age of Harley buyers kept rising, until now it is almost 60 years old! The reality is that Harley’s market simply started dying off, aging out of buying new motorcycles (or any motorcycle for that matter.) And younger buyers were far less interested in the old-style cruiser in favor of the smaller sized, easier handling and mostly faster sport bikes made in Japan.

For years Harley-Davidson ignored the demographic trends and the impact on its business. Harley made an effort to update its product, and image, introducing the V-Rod with a Porsche manufactured engine. But dealers didn’t like it, and Harley never put in the promotion to bring in the new, younger rider the bike was designed to attract. Now, Harley-Davidson has launched its own e-bike, called the Serial 1. At $5,000 it’s a top-priced e-bike, I guess aligned with the company reputation for premium pricing. But the Serial 1 has garnered good reviews, and like the Radio Flyer e-bike it gives Harley a new technology and a new market with new customers. And most important, a chance to slow its slide into irrelevancy.

Will these products turn these companies around?

It’s hard to say. They aren’t creating a new market like Netflix did in streaming, or Apple did with apps on iPhones. They aren’t early to market. One could say they are a late entry into a crowded marketplace. And neither appear to be introducing any new technology, or enhanced functionality not already available. And the brands are outdated, loaded with nostalgia – which might be good, or bad. But at least they are reacting to trends.

Innovation Theory in Practice

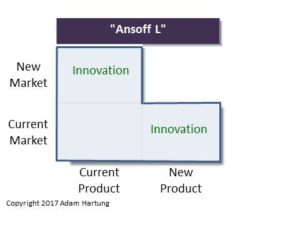

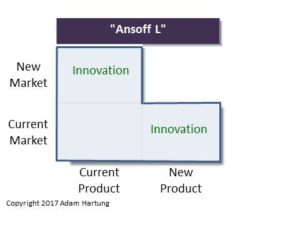

Both Radio Flyer and Harley-Davidson have responded to trends by introducing electric personal transportation products. Both also have loyal core customer segments and strong brand awareness in non-customer segments. The new products allow both companies to launch to existing customers which is the lowest risk choice because the segments are well-known. From there, the brands can expand to new customer segments via word-of-mouth, visibility and ad campaigns. This follows the Ansoff matrix from Current Market/New Product to New Market/New Product.

Both Radio Flyer and Harley-Davidson have responded to trends by introducing electric personal transportation products. Both also have loyal core customer segments and strong brand awareness in non-customer segments. The new products allow both companies to launch to existing customers which is the lowest risk choice because the segments are well-known. From there, the brands can expand to new customer segments via word-of-mouth, visibility and ad campaigns. This follows the Ansoff matrix from Current Market/New Product to New Market/New Product.

The second issue is that the market for electric personal transportation is past Early Adopters and into the Growth stage which is when new brands jump in and the market starts to fragment. There is plenty of market share for both Radio Flyer and Harley-Davidson to become established. One key question is- Can these brands offer the products and brand desire to make the jump to segments of new customers?

Are the Brands Structured to Succeed?

To succeed, they must COMMIT resources and focus to these new markets, and create new developments. I wish they would have launched with White Space teams that had permission to develop a new brand image, new distribution, new ad campaigns – an entirely new approach designed to seek out market leadership. Harley-Davidson did create a version of a “skunkworks” with the spinoff of Serial 1, LLC. For now the PR sounds more like they are doing it “on the sly” as something they aren’t really sure will succeed. So it’s really up to senior leadership now. They either commit to a new future allowing product teams to build on the e-bike opportunity to develop new technology, new customers and new markets – or they can slip back into the slide downward. We’ll have to wait and see if they can jump the re-invention gap.

Did you see the trends, and were you expecting the changes that would happen to your demand? It IS possible to use trends to make good forecasts, and prepare for big market shifts. If you don’t have time to do it, perhaps you should contact us, Spark Partners. We track hundreds of trends, and are experts at developing scenarios applied to your business to help you make better decisions.

TRENDS MATTER. If you align with trends your business can do GREAT! Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business. Click for Assessment info. Or, to keep up on trends, subscribe to our weekly podcasts and posts on trends and how they will affect the world of business at www.SparkPartners.com

Give us a call or send an email. Adam@sparkpartners.com 847-726-8465.

by Adam Hartung | Jul 19, 2018 | Entrepreneurship, In the Rapids, Innovation, Marketing, Medical

USA health care is ridiculously expensive. It’s good, but no statistics show that US healthcare is better than any other developed country. Nor any better than accredited facilities in large, developing countries. Look at these comparisons according to Medicaltourism.com:

Procedure USA cost India cost in accredited facility

Heart Bypass $123,000 $7,900

Heart Valve Replacement $170,000 $10,450

Hip Replacement $40,364 $7,200

Knee Replacement $35,000 $6,600

Spinal Fusion $110,000 $10,300

Hysterectomy $15,400 $3,200

Cornea Replacement $17,500 $2,800

Over 1/3 of Americans live with the myth that if they need medical care, somehow it will magically happen at no cost. The Affordable Care Act tried to fix that myth by making everyone buy health insurance. But Congress removed that government mandate. So most Americans that don’t have company-sponsored health insurance don’t buy insurance. Their primary source of health insurance is hope. When illness or accident happens these folks end up with extra-ordinary debt. And they can’t eliminate this debt because health care debt doesn’t go away in bankruptcy. So every year more and more people learn that an unexpected health incident means they will spend the rest of their lives paying for medical services that were 10x or 100x what they expected.

This is a trend that will not end soon. Costs keep going up. The political sides are too divided on what to do. And health insurance companies spend literally billions annually to make sure insurance for all (referred to as Medicare for all) never becomes reality.

This trend means there is opportunity. And that has become medical tourism. Literally, flying to foreign countries for medical procedures.

You may say “not me.” But if you have no money in the bank, and you let your health insurance lapse when you lost your last corporate job ended and you entered the gig economy, you could face a very tough situation. The same one almost all farmers face, and most small business owners, since their insurance is unaffordable. And most 1099 contract employees. When you have an unexpected heart attack at age 41 you wake up to hear a hospital admin say “you are alive, but you need surgery. If you want to live, we can do a heart bypass. Just sign this document and you’ll wake up somewhere north of $123,000 in debt.” Which means you’ll lose your house, for sure. Your kids won’t go to college. And you’ll never again buy a new car.

Or you blow out a hip, or knee,playing that Sunday basketball pick-up game – or golf. You’re 50-55, so too young for Medicare. But you lost health insurance years ago. Or you have a minimalistic plan which will cover a fraction of the cost. Finding the cost is $35,000 to $40,000 (or more likely $60,000 at a for-profit US hospital) are you really able to afford this? Or will you spend your life using crutches, or in a wheelchair? Or start an on–line begging campaign from your friends to cover the cost?

Suddenly, being a medical tourist doesn’t sound so unlikely. Saving $30,000 to $100,000 could determine your financial future. This trend was pretty clear back in 2010 when I pointed out that US medical tourists grew from 700,000 in 2007 to 1.2 million in just 3 years. The trend was actually obvious in 2005, when most people laughed at the idea of medical tourism – because they refused to look at the demographic and cost trends.

That’s why medical tourism is already a $20B business. And growing at 18% annually. Some analysts estimate the global market at almost $80B. Demographics are all in favor of future growth. The developed world population is aging. Health care costs are going up. Government ability to pay is going down. Insurers are charging outrageous rates. Fewer people are buying health care, and even fewer are buying “gold plated plans” that match the average plan in 1990. And American health care policies, in particular, keep driving up costs. It is EASY to see that as people can’t afford care at home, so they WILL be making more trips overseas.

There are already companies making the plunge. Some are matching services between patients and medical facilities. Some are building certified medical facilities in places like India, Singapore, Brazil, Malaysia, Thailand, Costa Rica and Mexico. The opportunities are as big as the health industry.

And this trend affects every business. Are you still stuck in the status quo thinking of extremely expensive insurance for employees, or none? Medical tourism offers a plethora of other opportunities. You can offer a bare-bones domestic plan, with augmented insurance to be a medical tourist. Or even a company sponsored plan, with the opportunity for employees to build a health-care bank, and a relationship with a medical tourism company to help employees find providers offshore. And gig-economy employees can drop the idea of domestic coverage (other than bare bones) for a mixed program including offshore insurance.

Fighting the health cost trend in the USA is foolish. Doing nothing hurts your competitiveness. Given the opportunities in medical tourism, are you thinking about how to build on this trend as a new business? Or a way to offer more to full time and 1099 contractors?

by Adam Hartung | Jul 14, 2017 | In the Rapids, Innovation, Marketing

Amazon just had another record Prime Day, with sales up 60%. And the #1 product sold was Amazon’s Echo Dot speaker. At $34.99 it surpassed last year’s unit sales by seven-fold. And the traditional Echo speaker, marked down 50% to $90, broke all previous sales records.

Amazon just took a commanding lead in the voice assistant platform market

These Echo sales most likely sealed Amazon’s long-term leadership in the war to be the #1 voice assistant. Amazon already has 70% market share in voice activated speakers, nearly 3 times #2 provider Google. And all other vendors in total barely have 5% share.

While it may seem like digital speakers are no big deal, speaker sales are analogous to iPhone sales when evaluating the emergence of smartphones and apps. The iPhone seemed like a small segment until it became clear smartphones were the new personal technology platform. Apple’s early lead allowed iOS to dominate the growth cycle, making the company intensely profitable.

Echo and Echo Dot aren’t just speakers, but interfaces to voice activated virtual assistants. For Echo the platform is Amazon’s Alexa. Alexa is to voice activated devices and applications what iOS was to Smartphones. By talking to Alexa customers are able to do many things, such as shopping, altering their thermostats, opening and closing doors, raising and lowering blinds, recording people in their homes — the list is endless. And as that list grows customers are buying more Alexa devices to gain greater productivity and enhanced lifestyle. Echos are entering more homes, and multiplying across rooms in these homes.

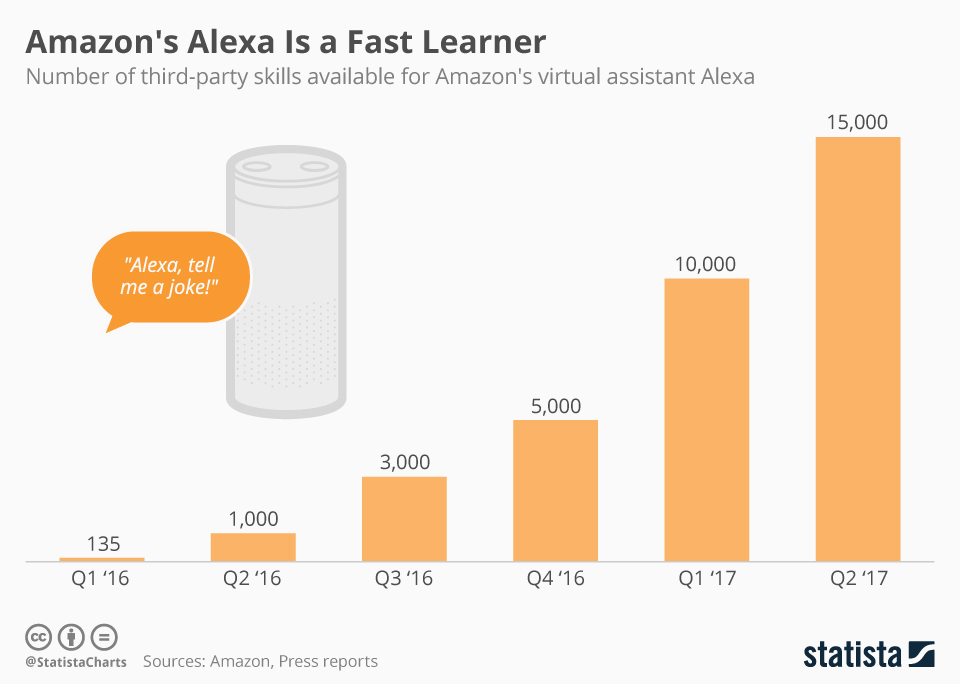

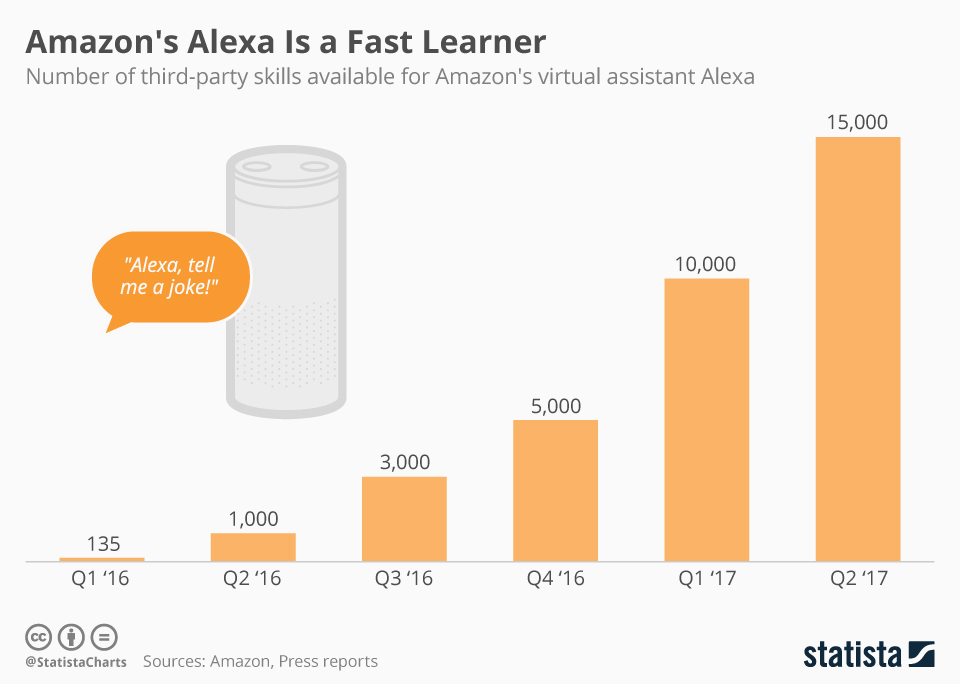

Do you remember when early iPhone ads touted “there’s an app for that?” That tagline told customers if they changed from a standard mobile phone to a smartphone there were a lot of advantages, measured by the number of available apps. Just like iOS apps gave an advantage to owning an iPhone, Alexa skills give an advantage to owning Echo products. In the last year the number of skills available for Alexa has exploded, growing from 135 to 15,000. Quite obviously developers are building on Alexa much faster than any other voice assistant.

By radically cutting the price of both Echo Dot and Echo, and promoting sales, Amazon is creating an installed base of units which encourages developers to write even more skills/apps.

The more Alexa devices are installed, the more likely developers will write additional skills for Alexa. As more devices lead to more skills, skills leads to more Alexa/Echo capability, which encourages more people to buy Alexa activated devices, which further encourages even more skills development. It’s a virtuous circle of goodness, all leading to more Amazon growth.

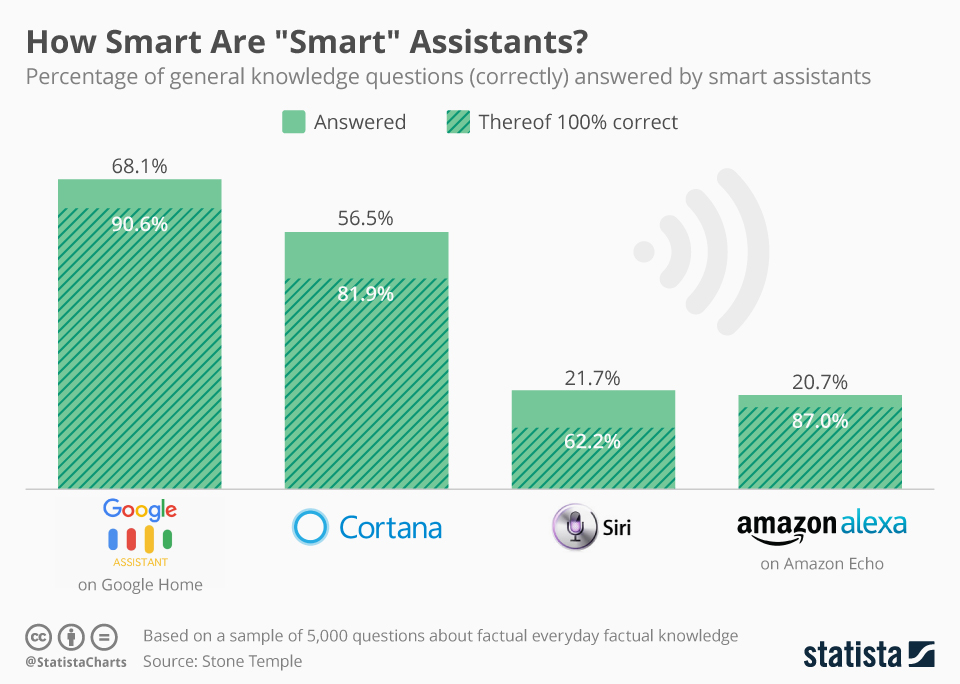

For marketers it is important to realize that success really doesn’t correlate with how “good” Alexa works. Google’s Assistant and Microsoft’s Cortana perform better at voice recognition and providing appropriate responses than Alexa and Siri. But there are relatively few (almost no) devices in the marketplace built with Assistant or Cortana as the interface. Developers need their skills/apps to be on platforms customers use. If customers are buying speakers, thermostats and televisions that are embedded with Alexa, then developers will write for Alexa. Even if it has shortcomings. It’s not the product quality that determines the winner, but rather the ability to create a base of users.

It is genius for Amazon to promote Echo and Echo Dot, selling both cheaper than any other voice activated speaker. Even if Amazon is making almost no profit on device sales. By using their retail clout to build an Alexa base they make the decision to create skills for Alexa easy for developers.

It is genius for Amazon to promote Echo and Echo Dot, selling both cheaper than any other voice activated speaker. Even if Amazon is making almost no profit on device sales. By using their retail clout to build an Alexa base they make the decision to create skills for Alexa easy for developers.

This is a horrible problem for Google, #2 in this market, because Google does not have the retail clout to place millions of their speakers (and other devices) in the market. Google is not a device company, nor a powerful retailer of Android devices. The Android device makers need to profit from their devices, so they cannot afford to sell devices unprofitably in order to build an installed base for Google. And because Android’s platform is not applied consistently across device manufacturers, Google Assistant skills cannot be assured of operating on every Android phone. All of which makes the decision to build Google Assistant skills problematic for developers.

Can Apple Stop the Alexa juggernaut?

The game is not over. Apple would like customers to use Siri on their iPhones to accomplish what Amazon and Alexa do with Echo. Apple has an enormous iPhone base, and all have Siri embedded. Perhaps Apple can encourage developers to create Siri-integrated apps which will beat back the Amazon onslaught?

Today, Apple customers still cannot use Siri to control their Apple TV (Though as of August, 2017, it’s been improved.), or make payments with ApplePay, for example. Nor can iPhone users tell Siri to execute commands for remote systems which are controlled by apps, like unlocking doors, turning on appliances, shooting remote security video or placing an on-line order. Apple has a lot of devices, and apps, but so far Siri is not integrated in a way that allows voice activation like can be done with Alexa.

Additionally, as big as the iPhone installed base has become, when comparing markets the actual raw number of speakers could catch up with iPhones. Echo Dot is $35. The cheapest iPhone is the SE, at $399 (on the Apple site although available from Best Buy at $160.) And an iPhone 7 starts at $650. The huge untapped Apple markets, such as China and India, will find it a lot easier to purchase low cost speakers than iPhones, especially if their focus is to use some of those 15,000 skills. And because of the low pricing ($35 to $90) it is easy to buy multiple devices for multiple locations in one’s home or office.

Will we look back and call Echo a Disruptive Innovation?

Innovator’s Dilemma

Recall the wisdom of Clayton Christensen‘s “Innovator’s Dilemma.” The incumbent keeps improving their product, hoping to maintain a capability lead over the competition. But eventually the incumbent far overshoots customer needs, developing a product that is overly enhanced. The disruptive innovator enters the market with a considerably “less good” product, but it meets customer needs at a much lower price. People buy the cheaper product to meet their limited goal, and bypass the more capable but more expensive early market leader.

Doesn’t this sound remarkably similar to the development of iPhones (now on version 8 and expected to sell at over $1,000) compared with a $35 speaker that is far less capable, but still does 15,000 interesting things?

The biggest loser in this new market is Microsoft

This week Microsoft announced another 1,500 layoffs in what has become an annual bloodletting ritual for the PC software giant. But even worse was the announcement that Microsoft would no longer support any version of Windows Phone OS version 8.1 or older – which is 80% of the Windows Phone market. Given that Microsoft has less than 2% market share, and that less than .4% of the installed smartphone base operates on Windows Phone, killing support for these phones will lead to sales declines. This action, along with gutting the internal developer team last year, clearly indicates Microsoft has given up on the phone business for good. This means that now Microsoft has no device platform for Cortana, Microsoft’s voice assistant, to use.

Microsoft ignored smartphones, allowing Apple’s iOS to become the early standard. Apple rapidly grew its installed base. Microsoft could not convince developers to write for Windows Phone because there weren’t enough devices in the market. Without a phone base, with tablet and hybrid sales flat to declining, and with PC sales in the gutter Cortana enters the market DOA (Dead On Arrival.) Even if it were the best voice assistant on the planet developers will not create skills for Cortana because there are no devices out there using Cortana as the interface.

So Microsoft completely missed yet another market. This time the market for voice activated devices in the smart phone, smart car or any other smart device in the IoT marketplace. It missed mobile, and now it has missed voice assist. As PC sales decline, Microsoft’s only hope is to somehow emerge a big winner in cloud storage and services (IaaS or Infrastructure as a Service) with Azure. But, Azure was a late-comer to the cloud market and is far behind Amazon’s AWS (Amazon Web Services.) Amazon has +40% market share, which is 40% more than the share of Microsoft, Google and IBM combined.

Build the base and developers will come…

by Adam Hartung | May 20, 2017 | In the Rapids, Innovation, Investing, Trends

Writing on trends, I frequently profile tech companies that use trends to outperform competitors. But using trends is not restricted to tech companies.

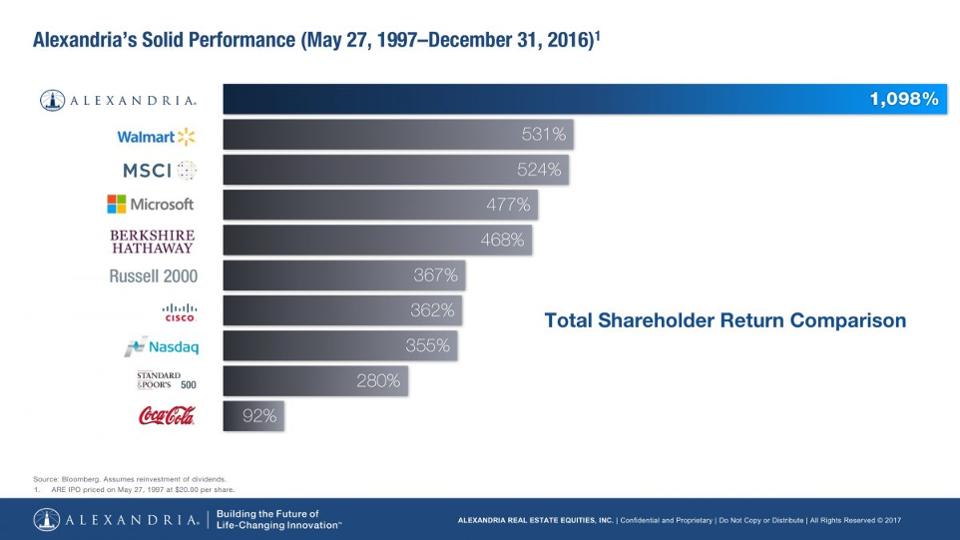

By following trends, since 1998 Alexandria Real Estate Equities has tripled the performance of the NASDAQ, quadrupled returns of the S&P 500, and quintupled the Russell 2000. Alexandria has even outperformed technology stalwart Microsoft, and investment guru Berkshire Hathaway by 230%.

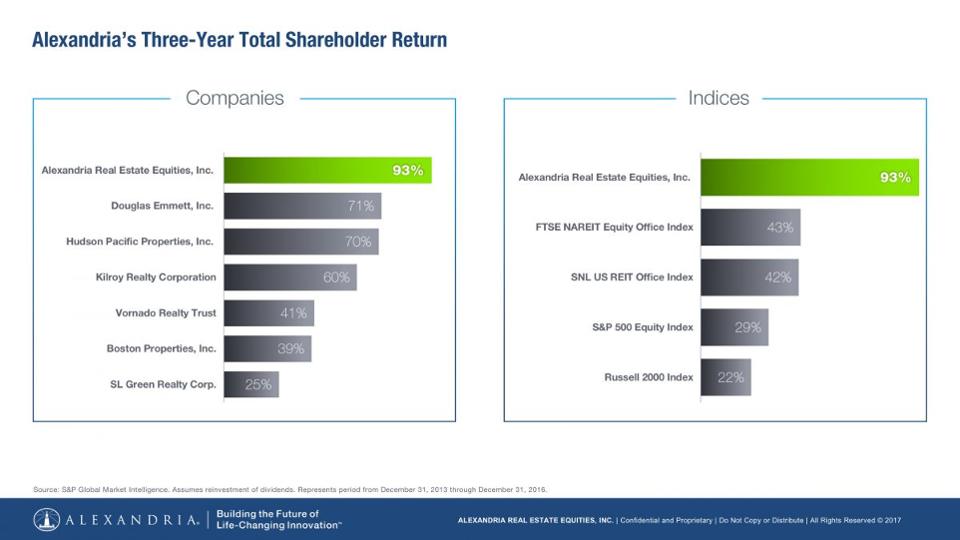

Although you probably never heard of it, Alexandria has trounced its real estate peers. Over the last three years Alexandria has returned double the FTSE NAREIT Equity Office Index, and double the SNL US REIT Office Index. Alexandria’s value has almost doubled during this time, and produced returns 2.3 times better than such well known competitors as Vornado Realty Trust and Boston Properties.

In 1983, Joel Marcus was a lawyer in the IPO market when he noticed the high value launch of biotech firms like Amgen and Genentech. He began tracking the growth of biotechs to see what kind of opportunity might appear to serve these high growth companies.

By 1994 Marcus realized that these companies were struggling to find appropriate real estate to serve their unique needs for laboratory space, and the infrastructure these labs require. It was a classic under-served market, and it was growing fast.

Jacobs Engineering (NYSE:JEC) was serving some of these companies’ needs, including erecting structures for them. But Jacobs did not own any buildings or consider itself a real estate developer. So Marcus approached Jacobs about starting a company to meet the real estate needs of this high growth biotech industry. Marcus put up some money, Jacobs put up some money, and other friends/associates combined to raise $19 million. There was no professionally managed money involved – and no real estate developers.

Focusing on the rapidly expanding biotech scene in San Diego, the newly created Alexandria bought 4 buildings. They refocused the buildings on the unserved needs of local biotech companies and did a quick flip, breaking even on the transaction. With just a bit of money Alexandria had proven that the market existed, the trend was real and users were under-served.

But, like any idea based on an emerging trend, growing was not easy. Using their first transaction as “proof of concept” CEO Marcus and his team set out to raise $100 million. Quickly Paine Webber (now UBS) secured $75 million in debt financing. But moving forward required raising $25 million in equity.

Over the next few weeks Alexandria pitched a slew of nay-sayers. From GE Capital to CALPERS investors felt that their first deal was a “1-trick pony,” and this “niche market” was not a sustainable business. Finally, after 29 failed pitches, the AEW pension fund, an early stage real estate investor, saw the trend and invested.

The Alexandria team realized that fast client growth meant there was no time to develop from ground up. They focused on high growth geographies for biotech, places where the trend was more pronounced, and bought 11 existing properties:

- In Seattle they found a cancer center they could buy, improve and do a sale-leaseback

- In San Francisco they identified a portfolio of properties in Alameda they could improve, lease to biotech companies and even suit the needs of the FDA as a tenant

- In Maryland they identified opportunities to support the lab needs of the Army Corps of Engineers forensic research lab, and ATF testing lab for imported vodka, and a medical testing lab near Dulles – which is now leased to Quest Diagnostics

Realizing that companies needing labs tended to cluster, leadership focused on finding locations where clusters were likely to emerge. They bought land in San Francisco, San Diego, New York and Worcester, MA. What looked like risky locations to others looked like profitable opportunities to Alexandria due to their superior trend research.

Historically pharma companies built their headquarters, and labs, in suburban locations where development was easy, and labs were welcome. Alexandria realized the new trend for emerging companies was to be near universities in urban environments, and although land was costly — and development more difficult — this was the right place to leverage the trend.

Today Alexandria is the bona fide market leader in labs and tech facilities in the USA. By seeing the trend early they bought land which is now so expensive it is practically untouchable – even for $1 billion. Their development pipeline includes Mission Bay, Kendall Square, the Manhattan borough of New York City and RTP (Research Triangle Park.) Today companies want to be where the lab is — and frequently the lab space is now owned, or being developed, by Alexandria.

This didn’t happen by accident. Not at the beginning nor as Alexandria plans its future growth. The company maintains a team of 13 researchers studying market trends in technology, and under-served real estate needs. They constantly track employers of tech/research people, competitors, historical and emerging customers — and identify prospective tech tenants who will need specialized real estate. A few of the leading trends Alexandria follows include:

- Urbanization — The siloed campuses set in bucolic suburbs is the past

- Innovation externalization — Over 50% of innovation in big pharma is now outsourced. And universities are spinning out innovations faster than ever into development centers for testing and commercialization

- Nutrition and disease management — These are emerging markets ripe with new products making their way to commercialization, and needing space to grow

Alexandria’s historical and ongoing successes relied first and foremost on using trends to understand underserved markets where needs will soon be the greatest. This is an important lesson for all businesses. No matter what you do, what you sell, or your industry you can generate higher returns, outperform your peers, and outperform the market rewarding investors by identifying trends and investing in them.

Thanks to Joel Marcus for providing an interview to explain the history and current practices at Alexandria.

by Adam Hartung | Mar 28, 2017 | In the Rapids, Innovation, Investing, Leadership

(Photo: General Electric CEO Jeffrey Immelt, ERIC PIERMONT/AFP/Getty Images)

General Electric stock had a small pop recently when investors thought CEO Jeffrey Immelt might be pushed out. Obviously more investors hope the CEO leaves than stays. And it appears clear that activist investor Nelson Peltz of Trian Partners thinks it is time for a change in CEO atop the longest running member of the Dow Jones Industrial Average (DJIA.)

You can’t blame investors, however. Since he took over the top job at General Electric in 2001 (16 years ago) GE’s stock value has dropped 38%. Meanwhile, the DJIA has almost doubled. Over that time, GE has been the greatest drag on the DJIA, otherwise the index would be valued even higher! That is terrible performance — especially as CEO of one of America’s largest companies.

But, after 16 years of Immelt’s leadership, there’s a lot more wrong than just the CEO at General Electric these days. As the JPMorgan Chase analyst Stephen Tusa revealed in his analysis, these days GE is actually overvalued, “cash is weak, margins/share of customer wallet are already at entitlement, the sum of the parts valuation points to a low 20s stock price.” He goes on to share his pessimism in GE’s ability to sell additional businesses, or create cost lowering synergies or tax strategies.

Former Chairman and CEO of General Electric Jack Welch. (AP Photo/Richard Drew)

What went so wrong under Immelt? Go back to 1981. GE installed Jack Welch as its new CEO. Over the next 20 years there wasn’t a business Neutron Jack wouldn’t buy, sell or trade. CEO Welch understood the importance of growth. He bought business after business, in markets far removed from traditional manufacturing, building large positions in media and financial services. He expanded globally, into all developing markets. After businesses were acquired the pressure was relentless to keep growing. All had to be no. 1 or no. 2 in their markets or risk being sold off. It was growth, growth and more growth.

Welch’s focus on growth led to a bigger, more successful GE. Adjusted for splits, GE stock rose from $1.30 per share to $46.75 per share during the 20 year Welch leadership. That is an improvement of 35 times – or 3,500%. And it wasn’t just due to a great overall stock market. Yes, the DJIA grew from 973 to 10,887 — or about 10.1 times. But GE outperformed the DJIA by 3.5 times (350%). Not everything went right in the Welch era, but growth hid all sins — and investors did very, very, very well.

Under Welch, GE was in the rapids of growth. Welch understood that good operating performance was not enough. GE had to grow. Investors needed to see a path to higher revenues in order to believe in long term value creation. Immediate profits were necessary but insufficient to create value, because they could be dissipated quickly by new competitors. So Welch kept the headquarters team busy evaluating opportunities, including making some 600 acquisitions. They invested in things that would grow, whether part of historical GE, or not.

Jeff Immelt as CEO took a decidedly different approach to leadership. During his 16 year leadership GE has become a significantly smaller company. He sold off the plastics, appliances and media businesses — once good growth providers — in the name of “refocusing the company.” Plans currently exist to sell off the electrical distribution/grid business (Industrial Solutions) and water businesses, eliminating another $5 billion in annual revenue. He has dismantled the entire financial services and real estate businesses that created tremendous GE value, because he could not figure out how to operate in a more regulated environment. And cost cutting continues. In the GE Transportation business, which is supposed to remain, plans have been announced to double down on cost cutting, eliminating another 2,900 jobs.

Under Immelt GE has focused on profits. Strategy turned from looking outside, for new growth markets and opportunities, to looking inside for ways to optimize the company via business sales, asset sales, layoffs and other cost cutting. Optimizing the business against some sense of an historical “core” caused nearsighted — and shortsighted — quarterly actions, financial gyrations and transactions rather than building a sustainable, growing revenue stream. Under Immelt sales did not just stagnate, sales actually declined while leadership pursued higher margins.

By focusing on the “core” GE business (as defined by Immelt) and pursuing short term profit maximization, leadership significantly damaged GE. Nobody would have ever imagined an activist investor taking a position in Welch’s GE in an effort to restructure the company. Its sales growth was so good, its prospects so bright, that its P/E (price to earnings) multiple kept it out of activist range.

But now the vultures see the opportunity to do an even bigger, better job of whacking up GE — of tearing it into small bits while killing off all R&D and innovation — like they did at DuPont. Over 16 years Immelt has weakened GE’s business — what was the most omnipresent industrial company in America, if not the world – to the point that it can be attacked by outsiders ready to chop it up and sell it off in pieces to make a quick buck.

Thomas Edison, one of the world’s great inventors, innovators and founder of GE, would be appalled. That GE needs now, more than ever, is a leader who understands you cannot save your way to prosperity, you have to invest in growth to create future value and increase your equity valuation.

In May, 2012 (five years ago) I warned investors that Immelt was the wrong CEO. I listed him as the fourth worst CEO of a publicly traded company in America. While he steered GE out of trouble during the financial crisis, he also simply steered the company in circles as it used up its resources. Then was the time to change CEOs, and put in place someone with the fortitude to develop a growth strategy that would leverage the resources, and brand, of GE. But, instead, Immelt remained in place, and GE became a lot smaller, and weaker.

At this point, it is probably too late to save GE. By losing sight of the need to grow, and instead focusing on optimizing the old business while selling assets to raise cash for reorganizations, Immelt has destroyed what was once a great innovation engine. Now that the activists have GE in their sites it is unlikely they will let it ever return to the company it once was – creating whole new markets by developing new technologies that people never before imagined. The future looks a lot more like figuring out how to maximize the value of each piece of meat as it’s carved off the GE carcass.

by Adam Hartung | Sep 23, 2016 | Disruptions, In the Rapids, Innovation, Leadership, Television, Web/Tech

In early August Tesla announced it would be buying SolarCity. The New York Times discussed how this combination would help CEO Elon Musk move toward his aspirations for greater clean energy use. But the Los Angeles Times took the companies to task for merging in the face of tremendous capital needs at both, while Tesla was far short of hitting its goals for auto and battery production.

Since then the press has been almost wholly negative on the merger. Marketwatch’s Barry Randall wrote that the deal makes no sense. He argues the companies are in two very different businesses that are not synergistic – and he analogizes this deal to GM buying Chevron. He also makes the case that SolarCity will likely go bankrupt, so there is no good reason for Tesla shareholders to “bail out” the company. And he argues that the capital requirements of the combined entities are unlikely to be fundable, even for its visionary CEO.

Fortune quotes legendary short seller Jim Chanos as saying the deal is “crazy.” He argues that SolarCity has an uneconomic business model based on his analysis of historical financial statements. And now Fortune is reporting that shareholder lawsuits to block the deal could delay, or kill, the merger.

Fortune quotes legendary short seller Jim Chanos as saying the deal is “crazy.” He argues that SolarCity has an uneconomic business model based on his analysis of historical financial statements. And now Fortune is reporting that shareholder lawsuits to block the deal could delay, or kill, the merger.

But short-sellers are clearly not long-term investors. And there is a lot more ability for this deal to succeed and produce tremendous investor returns than anyone could ever glean from studying historical financial statements of both companies.

GM buying Chevron is entirely the wrong analogy to compare with Tesla buying SolarCity. Instead, compare this deal to what happened in the creation of television after General Sarnoff, who ran RCA, bought what he renamed NBC.

The world already had radio (just as we already have combustion powered cars.) The conundrum was that nobody needed a TV, especially when there were no TV programs. But nobody would create TV programs if there were no consumers with TVs. General Sarnoff realized that both had to happen simultaneously – the creation of both demand, and supply. It would only be by the creation, and promotion, of both that television could be a success. And it was General Sarnoff who used this experience to launch the first color televisions at the same time as NBC launched the first color programming – which fairly quickly pushed the industry into color.

Skeptics think Mr. Musk and his companies are in over their heads, because there are manufacturing issues for the batteries and the cars, and the solar panel business has yet to be profitable. Yet, the older among us can recall all the troubles with launching TV.

Early sets were not only expensive, they were often problematic, with frequent component failures causing owners to take the TV to a repairman. Often reception was poor, as people relied on poor antennas and weak network signals. It was common to turn on a set and have “snow” as we called it – images that were far from clear. And there was often that still image on the screen with the words “Technical Difficulties,” meaning that viewers just waited to see when programming would return. And programming was far from 24×7 – and quality could be sketchy. But all these problems have been overcome by innovation across the industry.

Yes, the evolution of electric cars will involve a lot of ongoing innovation. So judging its likely success on the basis of recent history would be foolhardy. Today Tesla sells 100% of its cars, with no discounts. The market has said it really, really wants its vehicles. And everybody who is offered electric panels with (a) the opportunity to sell excess power back to the grid and (b) financing, takes the offer. People enjoy the low cost, sustainable electricity, and want it to grow. But lacking a good storage device, or the inability to sell excess power, their personal economics are more difficult.

Electricity production, electricity storage (batteries) and electricity consumption are tightly linked technologies. Nobody will build charging stations if there are no electric cars. Nobody will build electric cars if there are not good batteries. Nobody will make better batteries if there are no electric cars. Nobody will install solar panels if they can’t use all the electricity, or store what they don’t immediately need (or sell it.)

This is not a world of an established marketplace, where GM and Chevron can stand alone. To grow the business requires a vision, business strategy and technical capability to put it all together. To make this work someone has to make progress in all the core technologies simultaneously – which will continue to improve the storage capability, quality and safety of the electric consuming automobiles, and the electric generating solar panels, as well as the storage capabilities associated with those panels and the creation of a new grid for distribution.

This is why Mr. Musk says that combining Tesla and SolarCity is obvious. Yes, he will have to raise huge sums of money. So did such early pioneers as Vanderbilt (railways,) Rockefeller (oil,) Ford (autos,) and Watson (computers.) More recently, Steve Jobs of Apple became heroic for figuring out how to simultaneously create an iPhone, get a network to support the phone (his much maligned exclusive deal with AT&T,) getting developers to write enough apps for the phone to make it valuable, and creating the retail store to distribute those apps (iTunes.) Without all those pieces, the ubiquitous iPhone would have been as successful as the Microsoft Zune.

It is fair for investors to worry if Tesla can raise enough money to pull this off. But, we don’t know how creative Mr. Musk may become in organizing the resources and identifying investors. So far, Tesla has beaten all the skeptics who predicted failure based on price of the cars (Tesla has sold 100% of its production,) lack of range (now up to nearly 300 miles,) lack of charging network (Tesla built one itself) and charging time (now only 20 minutes.) It would be shortsighted to think that the creativity which has made Tesla a success so far will suddenly disappear. And thus remarkably thoughtless to base an analysis on the industry as it exists today, rather than how it might well look in 3, 5 and 10 years.

The combination of Tesla and SolarCity allows Tesla to have all the components to pursue greater future success. Investors with sufficient risk appetite are justified in supporting this merger because they will be positioned to receive the future rewards of this pioneering change in the auto and electric utility industries.

by Adam Hartung | Sep 14, 2016 | Immigration, In the Rapids, Innovation, Telecom, Trends

I’m amazed about Americans’ debate regarding immigration. And all the rhetoric from candidate Trump about the need to close America’s borders.

I was raised in Oklahoma, which prior to statehood was called The Indian Territory. I was raised around the only real Native Americans. All the rest of us are immigrants. Some voluntarily, some as slaves. But the fact that people want to debate whether we allow people to become Americans seems to me somewhat ridiculous, since 98% of Americans are immigrants. The majority within two generations.

Throughout America’s history, being an immigrant has been tough. The first ones had to deal with bad weather, difficult farming techniques, hostile terrain, wild animals – it was very difficult. As time passed immigrants continued to face these issues, expanding westward. But they also faced horrible living conditions in major cities, poor food, bad pay, minimal medical care and often abuse by the people already that previously immigrated.

Throughout America’s history, being an immigrant has been tough. The first ones had to deal with bad weather, difficult farming techniques, hostile terrain, wild animals – it was very difficult. As time passed immigrants continued to face these issues, expanding westward. But they also faced horrible living conditions in major cities, poor food, bad pay, minimal medical care and often abuse by the people already that previously immigrated.

And almost since the beginning, immigrants have been not only abused but scammed. Those who have resources frequently took advantage of the newcomers that did not. And this persists. Immigrants that lack a social security card are unable to obtain a driver’s license, unable to open bank accounts, unable to apply for credit cards, unable to even sign up for phone service. Thus they remain at the will of others to help them, which creates the opportunity for scamming.

Take for example an immigrant trying to make a phone call to his relatives back home. For most immigrants this means using a calling card. Only these cards are often a maze of fees, charges and complex rules that result in much of the card’s value being lost. A 10-minute call to Ghana can range from $2.86 to $8.19 depending on which card you use. This problem is so bad that the FCC has fined six of the largest card companies for misleading consumers about calling cards. They continue to advise consumers about fraud. And even Congress has held hearings on the problem.

One outcome of immigrants’ difficulties has been the ingenuity and innovativeness of Americans. To this day around the world people marvel at how clever Americans are, and how often America leads the world in developing new things. As a young country, and due to the combination of resources and immigrants’ tough situation, America frequently is first at developing new solutions to solve problems – many of which are problems that clearly affect the immigrant population.

So, back to that phone call. Some immigrants can use Microsoft Skype to talk with their relatives, using the Internet rather than a phone. But this requires the people back home have a PC and an internet connection. Both of which could be dicey. Another option would be to use something like Facebook’s WhatsApp, but this requires the person back home have either a PC or mobile device, and either a wireless connection or mobile coverage. And, again, this is problematic.

But once again, ingenuity prevails. A Romanian immigrant named Daniel Popa saw this problem, and set out to make communications better for immigrants and their families back home. In 2014 he founded QuickCall.com to allow users to make a call over wireless technology, but which can then interface with the old-fashioned wired (or wireless) telecom systems around the world. No easy task, since telephone systems are a complex environment of different international, national and state players that use a raft of different technologies and have an even greater set of complicated charging systems.

But this new virtual phone network, which links the internet to the traditional telecom system, is a blessing for any immigrant who needs to contact someone in a rural, or poor, location that still depends on phone service. If the person on the other end can access a WiFi system, then the calls are free. If the connection is to a phone system then the WiFi interface on the American end makes the call much cheaper – and performs far, far better than any other technology. QuickCall has built the carrier relationships around the world to make the connections far more seamless, and the quality far higher.

But like all disruptive innovations, the initial market (immigrants) is just the early adopter with a huge need. Being able to lace together an internet call to a phone system is pretty powerful for a lot of other users. Travelers heading to a remote location, like Micronesia, Africa or much of South America — and even Eastern Europe – can lower the cost of planning their trip and connect with locals by using QuickCall.com. And for most Americans traveling in non-European locations their cell phone service from Sprint, Verizon, AT&T or another carrier simply does not work well (if at all) and is very expensive when they arrive. QuickCall.com solves that problem for these travelers.

Small businesspeople who have suppliers, or customers, in these locations can use QuickCall.com to connect with their business partners at far lower cost. Businesses can even have their local partners obtain a local phone number via QuickCall.com and they can drive the cost down further (potentially to zero). This makes it affordable to expand the offshore business, possibly even establishing small scale customer support centers at the local supplier, or distributor, location.

In The Innovator’s Dilemma Clayton Christensen makes the case that disruptive innovations develop by targeting a customer with an unmet need. Usually the innovation isn’t as good as the current “standard,” and is also more costly. Today, making an international call through the phone system is the standard, and it is fairly cheap. But this solution is often unavailable to immigrants, and thus QuickCall.com fills their unmet need, and at a cost substantially lower than the infamous calling cards, and with higher quality than a pure WiFi option.

But now that it is established, and expanding to more countries – including developed markets like the U.K. – the technology behind QuickCall.com is becoming more mainstream. And its uses are expanding. And it is reducing the need for people to have international calling service on their wired or wireless phone because the available market is expanding, the quality is going up, and the cost is going down. Exactly the way all disruptive innovations grow, and thus threaten the entrenched competition.

The end-game may be some form of Facebook in-app solution. But that depends on Facebook or one of its competitors seizing this opportunity quickly, and learning all QuickCall.com already knows about the technology and customers, and building out that network of carrier relationships. Notice that Skype was founded in 2003, and acquired by Microsoft in 2011, and it still doesn’t have a major presence as a telecom replacement. Will a social media company choose to make the investment and undertake developing this new solution?

As small as QuickCall.com is – and even though you may have never heard of it – it is an example of a disruptive innovation that has been successfully launched, and is successfully expanding. It may seem like an impossibility that this company, founded by an immigrant to solve an unmet need of immigrants, could actually change the way everyone makes international calls. But, then again, few of us thought the iPhone and its apps would cause us to give up Blackberries and quit carrying our PCs around.

America is known for its ingenuity and innovations. We can thank our heritage as immigrants for this, as well as the immigrant marketplace that spurs new innovation. America’s immigrants have the need to succeed, and the unmet needs that create new markets for launching new solutions. For all those conservatives who fear “European socialism,” they would be wise to realize the tremendous benefits we receive from our immigrant population. Perhaps these naysayers should use QuickCall.com to connect with a few more immigrants and understand the benefits they bring to America.

by Adam Hartung | Apr 27, 2016 | Food and Drink, In the Rapids, In the Swamp, Retail, Software, Web/Tech

Growth fixes a multitude of sins. If you grow revenues enough (you don’t even need profits, as Amazon has proven) investors will look past a lot of things. With revenue growth high enough, companies can offer employees free meals and massages. Executives and senior managers can fly around in private jets. Companies can build colossal buildings as testaments to their brand, or pay to have thier names on public buildings. R&D budgets can soar, and product launches can fail. Acquisitions are made with no concerns for price. Bonuses can be huge. All is accepted if revenues grow enough.

Just look at Facebook. Today Facebook announced today that for the quarter ended March, 2016 revenues jumped to $5.4B from $3.5B a year ago. Net income tripled to $1.5B from $500M. And the company is basically making all its revenue – 82% – from 1 product, mobile ads. In the last few years Facebook paid enormous premiums to buy WhatsApp and Instagram – but who cares when revenues grow this fast.

Anticipating good news, Facebook’s stock was up a touch today. But once the news came out, after-hours traders pumped the stock to over $118//share, a new all time high. That’s a price/earnings (p/e) multiple of something like 84. With growth like that Facebook’s leadership can do anything it wants.

But, when revenues slide it can become a veritable poop puddle. As Apple found out.

Rumors had swirled that Apple was going to say sales were down. And the stock had struggled to make gains from lows earlier in 2016. When the company’s CEO announced Tuesday that sales were down 13% versus a year ago the stock cratered after-hours, and opened this morning down 10%. Breaking a streak of 51 straight quarters of revenue growth (since 2003) really sent investors fleeing. From trading around $105/share the last 4 days, Apple closed today at ~$97. $40B of equity value was wiped out in 1 day, and the stock trades at a p/e multiple of 10.

The new iPhone 6se outsold projections, iPads beat expectations. First year Apple Watch sales exceeded first year iPhone sales. Mac sales remain much stronger than any other PC manufacturer. Apple iBeacons and Apple Pay continue their march as major technologies in the IoT (Internet of Things) market. And Apple TV keeps growing. There are about 13M users of Apple’s iMusic. There are 1.5M apps on the iTunes store. And the installed base keeps the iTunes store growing. Share buybacks will grow, and the dividend was increased yet again. But, none of that mattered when people heard sales growth had stopped. Now many investors don’t think Apple’s leadership can do anything right.

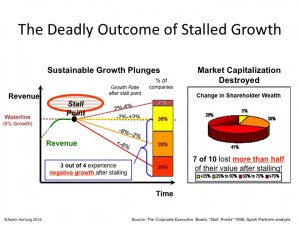

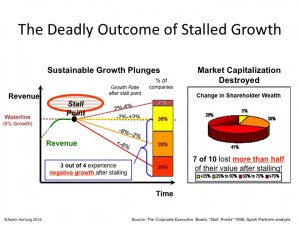

Yet, that was just one quarter. Many companies bounce back from a bad quarter. There is no statistical evidence that one bad quarter is predictive of the next. But we do know that if sales decline versus a year ago for 2 consecutive quarters that is a Growth Stall. And companies that hit a Growth Stall rarely (93% of the time) find a consistent growth path ever again. Regardless of the explanations, Growth Stalls are remarkable predictors of companies that are developing a gap between their offerings, and the marketplace.

Yet, that was just one quarter. Many companies bounce back from a bad quarter. There is no statistical evidence that one bad quarter is predictive of the next. But we do know that if sales decline versus a year ago for 2 consecutive quarters that is a Growth Stall. And companies that hit a Growth Stall rarely (93% of the time) find a consistent growth path ever again. Regardless of the explanations, Growth Stalls are remarkable predictors of companies that are developing a gap between their offerings, and the marketplace.

Which leads us to Chipotle. Chipotle announced that same store sales fell almost 30% in Q1, 2016. That was after a 15% decline in Q4, 2015. And profits turned to losses for the quarter. That is a growth stall. Chipotle shares were $750/share back in early October. Now they are $417 – a drop of over 44%.

Customer illnesses have pointed to a company that grew fast, but apparently didn’t have its act together for safe sourcing of local ingredients, and safe food handling by employees. What seemed like a tactical problem has plagued the company, as more customers became ill in March.

Whether that is all that’s wrong at Chipotle is less clear, however. There is a lot more competition in the fast casual segment than 2 years ago when Chipotle seemed unable to do anything wrong. And although the company stresses healthy food, the calorie count on most portions would add pounds to anyone other than an athlete or construction worker – not exactly in line with current trends toward dieting. What frequently looks like a single problem when a company’s sales dip often turns out to have multiple origins, and regaining growth is nearly always a lot more difficult than leadership expects.

Growth is magical. It allows companies to invest in new products and services, and buoy’s a stock’s value enhancing acquisition ability. It allows for experimentation into new markets, and discovering other growth avenues. But lack of growth is a vital predictor of future performance. Companies without growth find themselves cost cutting and taking actions which often cause valuations to decline.

Right now Facebook is in a wonderful position. Apple has investors rightly concerned. Will next quarter signal a return to growth, or a Growth Stall? And Chipotle has investors heading for the exits, as there is now ample reason to question whether the company will recover its luster of yore.

by Adam Hartung | Apr 21, 2016 | In the Rapids, Leadership, Lifecycle, Television, Web/Tech

Netflix has been a remarkable company. Because it has accomplished something almost no company has ever done. It changed its business model, leading to new growth and higher profits.

Almost nobody pulls that off, because they remain stuck defending and extending their old model until they become irrelevant, or fail. Think about Blackberry, that gave us the smartphone business then lost it to Apple and its creation of the app market. Consider Circuit City, that lost enough customers to Amazon it could no longer survive. Sun Microsystems disappeared after PC servers caught up to Unix servers in capability. Remember the Bell companies and their land-line and long distance services, made obsolete by mobile phones and cable operators? These were some really big companies that saw their market shifts, but failed to “pivot” their strategy to remain competitive.

Netflix built a tremendous business delivering physical videos on tape and CD to homes, wiping out the brick-and-mortar stores like Blockbuster and Hollywood Video. By 2008 Netflix reached $1B revenues, reducing Blockbuster by a like amount. By 2010 Blockbuster was bankrupt. Netflix’ share price soared from $50/share to almost $300/share during 2011. By the end of 2012 CD shipments were dropping precipitously as streaming viewership was exploding. People thought Netflix was missing the wave, and the stock plummeted 75%. Most folks thought Netflix couldn’t pivot fast enough, or profitably, either.

But in 2013 Netflix proved the analysts wrong, and the company built a very successful – in fact market leading – streaming business. The shares soared, recovering all that lost value. By 2015 the company had more than doubled its previous high valuation.

But Netflix may be breaking entirely new ground in 2016. It is becoming a market leader in original programming. Something we long attributed to broadcasters and/or cable distributors like HBO and Showtime.

Today’s broadcast companies, like NBC, CBS and ABC, are offering less and less original programming. Overall there are 3 hours/night of prime time television which broadcasters used to “own” as original programming hours. Over the course of a year, allowing for holidays and one open night per week, that meant about 900 hours of programming for each network (including reruns as original programming.) But that was long ago.

These days most of those hours are filled with sports – think evening games of football, basketball, baseball including playoffs and “March Madness” events. Sports are far cheaper to program, and can fill a lot of hours. Next think reality programming. Showing people race across countries, or compete to survive a political battlefield on an island, or even dancing or dieting, uses no expensive actors or directors or sets. It is far, far less expensive than writing, casting, shooting and programming a drama (like Blacklist) or comedy (like Big Bang Theory.) Plan on showing every show twice in reruns, plus intermixing with the sports and reality shows, and most networks get away with around 200-250 hours of original programming per year.

These days most of those hours are filled with sports – think evening games of football, basketball, baseball including playoffs and “March Madness” events. Sports are far cheaper to program, and can fill a lot of hours. Next think reality programming. Showing people race across countries, or compete to survive a political battlefield on an island, or even dancing or dieting, uses no expensive actors or directors or sets. It is far, far less expensive than writing, casting, shooting and programming a drama (like Blacklist) or comedy (like Big Bang Theory.) Plan on showing every show twice in reruns, plus intermixing with the sports and reality shows, and most networks get away with around 200-250 hours of original programming per year.

Against that backdrop, Netflix has announced it will program 600 hours of original programming this year. That will approximately double any single large broadcast network. In a very real way, if you don’t want to watch sports or reality TV any more you probably will be watching some kind of “on demand” program. Either streamed from a cable service, or from a provider such as Netflix, Hulu or Amazon.

When it comes to original programming, the old broadcast networks are losing their relevancy to streaming technology, personal video devices and the customer’s ability to find what they want, when they want it – and increasingly at a quality they prefer – from streaming as opposed to broadcast media.

To complete this latest “pivot,” from a video streaming company to a true media company with its own content, Morgan Stanley has published that Netflix is now considered by customers as the #1 quality programming across streaming services. 29% of viewers said Netflix was #1, followed by long-time winner HBO now #2 with 21% of customers saying their programming is best. Amazon, Showtime and Hulu were seen as the best quality by 4%-5% of viewers.

So a decade ago Netflix was a CD distribution company. The largest customer of the U.S. Postal Service. Signing up folks to watch physical videos in their homes. Now they are the largest data streaming company on the planet, and one of the largest original programming producers and programmers in the USA – and possibly the world. And in this same decade we’ve watched the network broadcast companies become outlets for sports and reality TV, while cutting far back on their original shows. Sounds a lot like a market shift, and possibly Netflix could be the game changer, as it performs the first strategy double pivot in business history.

by Adam Hartung | Apr 5, 2016 | Disruptions, In the Rapids, Leadership, Web/Tech

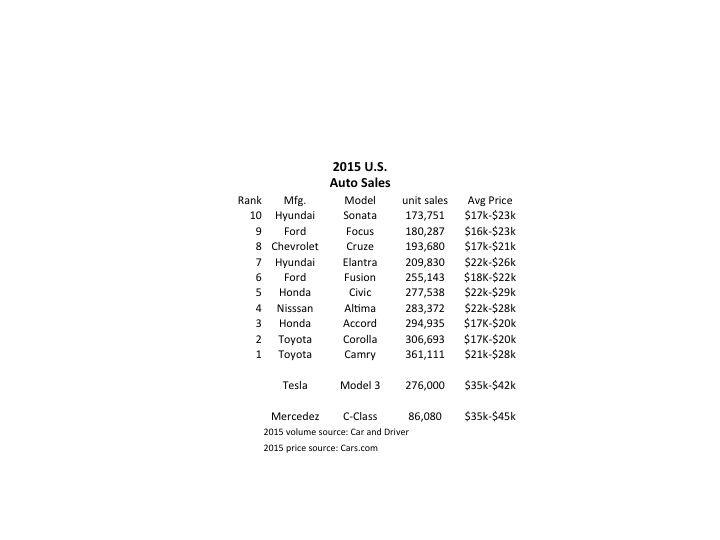

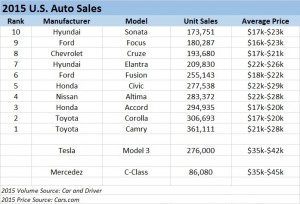

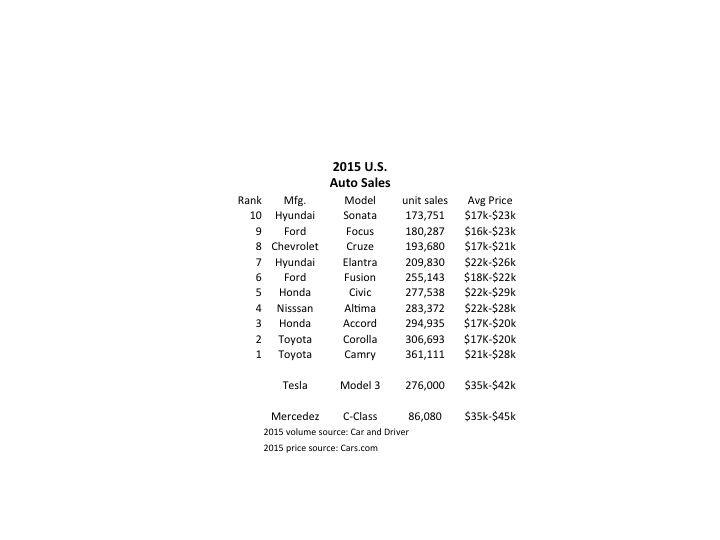

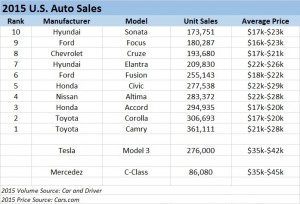

Tesla started taking orders for the Model 3 last week, and the results were remarkable. In 24 hours the company took $1,000 deposits for 198,000 vehicles. By end of Saturday the $1,000 deposits topped 276,000 units. And for a car not expected to be available in any sort of volume until 2017. Compare that with the top selling autos in the U.S. in 2015:

Remarkably, the Model 3 would rank as the 6th best selling vehicle all of last year! And with just a few more orders, it will likely make the top 5 – or possibly top 3! And those are orders placed in just one week, versus an entire year of sales for the other models. And every buyer is putting up a $1,000 deposit, something none of the buyers of top 10 cars did as they purchased product widely available in inventory. [Update 7 April – Tesla reports sales exceed 325,000, which would make the Model 3 the second best selling car in the USA for the entire year 2015 – accomplished in less than one week.]

Remarkably, the Model 3 would rank as the 6th best selling vehicle all of last year! And with just a few more orders, it will likely make the top 5 – or possibly top 3! And those are orders placed in just one week, versus an entire year of sales for the other models. And every buyer is putting up a $1,000 deposit, something none of the buyers of top 10 cars did as they purchased product widely available in inventory. [Update 7 April – Tesla reports sales exceed 325,000, which would make the Model 3 the second best selling car in the USA for the entire year 2015 – accomplished in less than one week.]

Even more astonishing is the average selling price. Note that top 10 cars are not highly priced, mostly in the $17,000 to $25,000 price range. But the Tesla is base priced at $35,000, and expected with options to sell closer to $42,000. That is almost twice as expensive as the typical top 10 selling auto in the U.S.

Tesla has historically been selling much more expensive cars, the Model S being its big seller in 2015. So if we classify Tesla as a “luxury” brand and compare it to like-priced Mercedes Benz C-Class autos we see the volumes are, again, remarkable. In under 1 week the Model 3 took orders for 3 times the volume of all C-Class vehicles sold in the U.S. in 2015.

[Car and Driver top 10 cars; Mercedes Benz 2015 unit sales; Tesla 2015 unit sales; Model 3 pricing]

Although this has surprised a large number of people, the signs were all pointing to something extraordinary happening. The Tesla Model S sold 50,000 vehicles in 2015 at an average price of $70,000 to $80,000. That is the same number of the Mercedes E-Class autos, which are priced much lower in the $50,000 range. And if you compare to the top line Mercedes S-Class, which is only slightly more expensive at an average $90,0000, the Model S sold over 2 times the 22,000 units Mercedes sold. And while other manufacturers are happy with single digit percentage volume growth, in Q4 Tesla shipments were 75% greater in 2015 than 2014.

In other words, people like this brand, like these cars and are buying them in unprecedented numbers. They are willing to plunk down deposits months, possibly years, in advance of delivery. And they are paying the highest prices ever for cars sold in these volumes. And demand clearly outstrips supply.

Yet, Tesla is not without detractors. From the beginning some analysts have said that high prices would relegate the brand to a small niche of customers. But by outselling all other manufacturers in its price point, Tesla has demonstrated its cars are clearly not a niche market. Likewise many analysts argued that electric cars were dependent on high gasoline prices so that “economic buyers” could justify higher prices. Yet, as gasoline prices have declined to prices not seen for nearly a decade Tesla sales keep going up. Clearly Tesla demand is based on more than just economic analysis of petroleum prices.

People really like, and want, Tesla cars. Even if the prices are higher, and if gasoline prices are low.

Emerging is a new group of detractors. They point to the volume of cars produced in 2015, and first quarter output of just under 15,000 vehicles, then note that Tesla has not “scaled up” manufacturing at anywhere near the necessary rate to keep customers happy. Meanwhile, constructing the “gigafactory” in Nevada to build batteries has slowed and won’t meet earlier expectations for 2016 construction and jobs. Even at 20,000 cars/quarter, current demand for Model S and Model 3 They project lots of order cancellations would take 4.5 years to fulfill.

Which leads us to the beauty of sales growth. When products tap an under- or unfilled need they frequently far outsell projections. Think about the iPod, iPhone and iPad. There is naturally concern about scaling up production. Will the money be there? Can the capacity come online fast enough?

Of course, of all the problems in business this is one every leader should want. It is certainly a lot more fun to worry about selling too much rather than selling too little. Especially when you are commanding a significant price premium for your product, and thus can be sure that demand is not an artificial, price-induced variance.

With rare exceptions, investors understand the value of high sales at high prices. When gross margins are good, and capacity is low, then it is time to expand capacity because good returns are in the future. The Model 3 release projects a backlog of almost $12B. Booked orders at that level are extremely rare. Further, short-term those orders have produced nearly $300million of short-term cash. Thus, it is a great time for an additional equity offering, possibly augmented with bond sales, to invest rapidly in expansion. Problematic, yes. Insolvable, highly unlikely.

On the face of it Tesla appears to be another car company. But something much more significant is afoot. This sales level, at these prices, when the underlying economics of use seem to be moving in the opposite direction indicates that Tesla has tapped into an unmet need. It’s products are impressing a large number of people, and they are buying at premium prices. Based on recent orders Tesla is vastly outselling competitive electric automobiles made by competitors, all of whom are much bigger and better resourced. And those are all the signs of a real Game Changer.

Both Radio Flyer and Harley-Davidson have responded to trends by introducing electric personal transportation products. Both also have loyal core customer segments and strong brand awareness in non-customer segments. The new products allow both companies to launch to existing customers which is the lowest risk choice because the segments are well-known. From there, the brands can expand to new customer segments via word-of-mouth, visibility and ad campaigns. This follows the Ansoff matrix from Current Market/New Product to New Market/New Product.

Both Radio Flyer and Harley-Davidson have responded to trends by introducing electric personal transportation products. Both also have loyal core customer segments and strong brand awareness in non-customer segments. The new products allow both companies to launch to existing customers which is the lowest risk choice because the segments are well-known. From there, the brands can expand to new customer segments via word-of-mouth, visibility and ad campaigns. This follows the Ansoff matrix from Current Market/New Product to New Market/New Product.

Fortune quotes legendary short seller Jim Chanos as saying the deal is “crazy.” He argues that SolarCity has an uneconomic business model based on his analysis of historical financial statements. And now Fortune is reporting that shareholder lawsuits to block the deal could delay, or kill, the merger.

Fortune quotes legendary short seller Jim Chanos as saying the deal is “crazy.” He argues that SolarCity has an uneconomic business model based on his analysis of historical financial statements. And now Fortune is reporting that shareholder lawsuits to block the deal could delay, or kill, the merger.

Throughout America’s history, being an immigrant has been tough. The first ones had to deal with bad weather, difficult farming techniques, hostile terrain, wild animals – it was very difficult. As time passed immigrants continued to face these issues, expanding westward. But they also faced horrible living conditions in major cities, poor food, bad pay, minimal medical care and often abuse by the people already that previously immigrated.

Throughout America’s history, being an immigrant has been tough. The first ones had to deal with bad weather, difficult farming techniques, hostile terrain, wild animals – it was very difficult. As time passed immigrants continued to face these issues, expanding westward. But they also faced horrible living conditions in major cities, poor food, bad pay, minimal medical care and often abuse by the people already that previously immigrated.

Yet, that was just one quarter. Many companies bounce back from a bad quarter. There is no statistical evidence that one bad quarter is predictive of the next. But we do know that if sales decline versus a year ago for 2 consecutive quarters that is a Growth Stall. And companies that hit a Growth Stall rarely (93% of the time) find a consistent growth path ever again. Regardless of the explanations, Growth Stalls are remarkable predictors of companies that are developing a gap between their offerings, and the marketplace.

Yet, that was just one quarter. Many companies bounce back from a bad quarter. There is no statistical evidence that one bad quarter is predictive of the next. But we do know that if sales decline versus a year ago for 2 consecutive quarters that is a Growth Stall. And companies that hit a Growth Stall rarely (93% of the time) find a consistent growth path ever again. Regardless of the explanations, Growth Stalls are remarkable predictors of companies that are developing a gap between their offerings, and the marketplace.

These days most of those hours are filled with sports – think evening games of football, basketball, baseball including playoffs and “March Madness” events. Sports are far cheaper to program, and can fill a lot of hours. Next think reality programming. Showing people race across countries, or compete to survive a political battlefield on an island, or even dancing or dieting, uses no expensive actors or directors or sets. It is far, far less expensive than writing, casting, shooting and programming a drama (like Blacklist) or comedy (like Big Bang Theory.) Plan on showing every show twice in reruns, plus intermixing with the sports and reality shows, and most networks get away with around 200-250 hours of original programming per year.

These days most of those hours are filled with sports – think evening games of football, basketball, baseball including playoffs and “March Madness” events. Sports are far cheaper to program, and can fill a lot of hours. Next think reality programming. Showing people race across countries, or compete to survive a political battlefield on an island, or even dancing or dieting, uses no expensive actors or directors or sets. It is far, far less expensive than writing, casting, shooting and programming a drama (like Blacklist) or comedy (like Big Bang Theory.) Plan on showing every show twice in reruns, plus intermixing with the sports and reality shows, and most networks get away with around 200-250 hours of original programming per year.

Remarkably, the Model 3 would rank as the 6th best selling vehicle all of last year! And with just a few more orders, it will likely make the top 5 – or possibly top 3! And those are orders placed in just one week, versus an entire year of sales for the other models. And every buyer is putting up a $1,000 deposit, something none of the buyers of top 10 cars did as they purchased product widely available in inventory. [Update 7 April – Tesla reports sales exceed 325,000, which would make the Model 3 the second best selling car in the USA for the entire year 2015 – accomplished in less than one week.]

Remarkably, the Model 3 would rank as the 6th best selling vehicle all of last year! And with just a few more orders, it will likely make the top 5 – or possibly top 3! And those are orders placed in just one week, versus an entire year of sales for the other models. And every buyer is putting up a $1,000 deposit, something none of the buyers of top 10 cars did as they purchased product widely available in inventory. [Update 7 April – Tesla reports sales exceed 325,000, which would make the Model 3 the second best selling car in the USA for the entire year 2015 – accomplished in less than one week.]