by Adam Hartung | Jul 17, 2015 | Current Affairs, General, In the Swamp, Leadership, Lifecycle

Most analysts, and especially “chartists,” put a lot of emphasis on earnings per share (EPS) and stock price movements when determining whether to buy a stock. Unfortunately, these are not good predictors of company performance, and investors should beware.

Most analysts are focused on short-term, meaning quarter-to-quarter, performance. Their idea of long-term is looking back 1 year, comparing this quarter to same quarter last year. As a result, they fixate on how EPS has done, and will talk about whether improvements in EPS will cause the “multiple” (meaning stock price divided by EPS) will “expand.” They forecast stock price based upon future EPS times the industry multiple. If EPS is growing, they expect the stock to trade at the industry multple, or possibly somewhat better. Grow EPS, hope to grow the multiple, and project a higher valuation.

Analysts will also discuss the “momentum” (meaning direction and volume) of a stock. They look at charts, usually less than one year, and if price is going up they will say the momentum is good for a higher price. They determine the “strength of momentum” by looking at trading volume. Movements up or down on high volume are considered more meaningful than on low volume.

But, unfortunately, these indicators are purely short-term, and are easily manipulated so that they do not reflect the actual performance of the company.

At any given time, a CEO can decide to sell assets and use that cash to buy shares. For example, McDonald’s sold Chipotle and Boston Market. Then leadership took a big chunk of that money and repurchased company shares. That meant McDonalds took its two fastest growing, and highest value, assets and sold them for short-term cash. They traded growth for cash. Then leadership spent that cash to buy shares, rather than invest in in another growth vehicle.

This is where short-term manipulation happens. Say a company is earning $1,000 and has 1,000 shares outstanding, so its EPS is $1. The industry multiple is 10, so the share price is $10. The company sells assets for $1,000 (for purposes of this exercise, let’s assume the book value on those assets is $1,000 so there is no gain, no earnings impact and no tax impact.)

This is where short-term manipulation happens. Say a company is earning $1,000 and has 1,000 shares outstanding, so its EPS is $1. The industry multiple is 10, so the share price is $10. The company sells assets for $1,000 (for purposes of this exercise, let’s assume the book value on those assets is $1,000 so there is no gain, no earnings impact and no tax impact.)

Company leadership says its shares are undervalued, so to help out shareholders it will “return the money to shareholders via a share repurchase” (note, it is not giving money to shareholders, just buying shares. $1,000 buys 100 shares. The number of shares outstanding now falls to 900. Earnings are still $1,000 (flat, no gain,) but dividing $1,000 by 900 now creates an EPS of $1.11 – a greater than 10% gain! Using the same industry multiple, the analysts now say the stock is worth $1.11 x 10 = $11.10!

Even though the company is smaller, and has weaker growth prospects, somehow this “refocusing” of the company on its “core” business and cutting extraneous noise (and growth opportunities) has led to a price increase.

Worse, the company hires a very good investment banker to manage this share repurchase. The investment banker watches stock buys and sells, and any time he sees the stock starting to soften he jumps in and buys some shares, so that momentum remains strong. As time goes by, and the repurchase program is not completed, selectively he will make large purchases on light trading days, thus adding to the stock’s price momentum.

The analysts look at these momentum indicators, now driven by the share repurchase program, and deem the momentum to be strong. “Investors love the stock” the analysts say (even though the marginal investors making the momentum strong are really company management) and start recommending to investors they should anticipate this company achieving a multiple of 11 based on earnings and stock momentum. The price now goes to $1.11 x 11 = $12.21.

Yet the underlying company is no stronger. In fact one could make the case it is weaker. But, due to the higher EPS, better multiple and higher share price the CEO and her team are rewarded with outsized multi-million dollar bonuses.

But, companies the last several years did not even have to sell assets to undertake this kind of manipulation. They could just spend cash from earnings. Earnings have been at record highs, and growing, for several years. Yet most company leaders have not reinvested those earnings in plant, equipment or even people to drive further growth. Instead they have built huge cash hoards, and then spent that cash on share buybacks – creating the EPS/Multiple expansion – and higher valuations – described above.

This has been so successful that in the last quarter untethered corporations have spent $238B on buybacks, while earning only $228B. The short-term benefits are like corporate crack, and companies are spending all the money they have on buybacks rather than reinvesting in growth.

Where does the extra money originate? Many companies have borrowed money to undertake buybacks. Corporate interest rates have been at generational (if not multi-generational) lows for several years. Interest rates were kept low by the Federal Reserve hoping to spur borrowing and reinvestment in new products, plant, etc to drive economic growth, more jobs and higher wages. The goal was to encourage companies to take on more debt, and its associated risk, in order to generate higher future revenues.

Many companies have chosen to borrow money, but rather than investing in growth projects they have bought shares. They borrow money at 2-3%, then buy shares – which can have a much higher immediate impact on valuation – and drive up executive compensation.

This has been wildly prevalent. Since the Fed started its low-interest policy it has added $2.37trillion in cash to the economy. Corporate buybacks have totaled $2.41trillion.

This is why a company can actually have a crummy business, and look ill-positioned for the future, yet have growing EPS and stock price. For example, McDonald’s has gone through rounds of store closures since 2005, sold major assets, now has more stores closing than opening, and has its largest franchisees despondent over future prospects. Yet, the stock has tripled since 2005! Leadership has greatly weakened the company, put it into a growth stall (since 2012,) and yet its value has gone up!

Microsoft has seen its “core” PC market shrink, had terrible new product launches of Vista and Windows 8, wholly failed to succeed with a successful mobile device, written off billions in failed acquisitions, and consistently lost money in its gaming division. Yet, in the last 10 years it has seen EPS grow and its share price double through the power of share buybacks from its enormous cash hoard and ability to grow debt. While it is undoubtedly true that 10 years ago Microsoft was far stronger, as a PC monopolist, than it is today – its value today is now higher.

Share buybacks can go on for several years. Especially in big companies. But they add no value to a company, and if not exceeded by re-investments in growth markets they weaken the company. Long term a company’s value will relate to its ability to grow revenues, and real profits. If a company does not have a viable, competitive business model with real revenue growth prospects, it cannot survive.

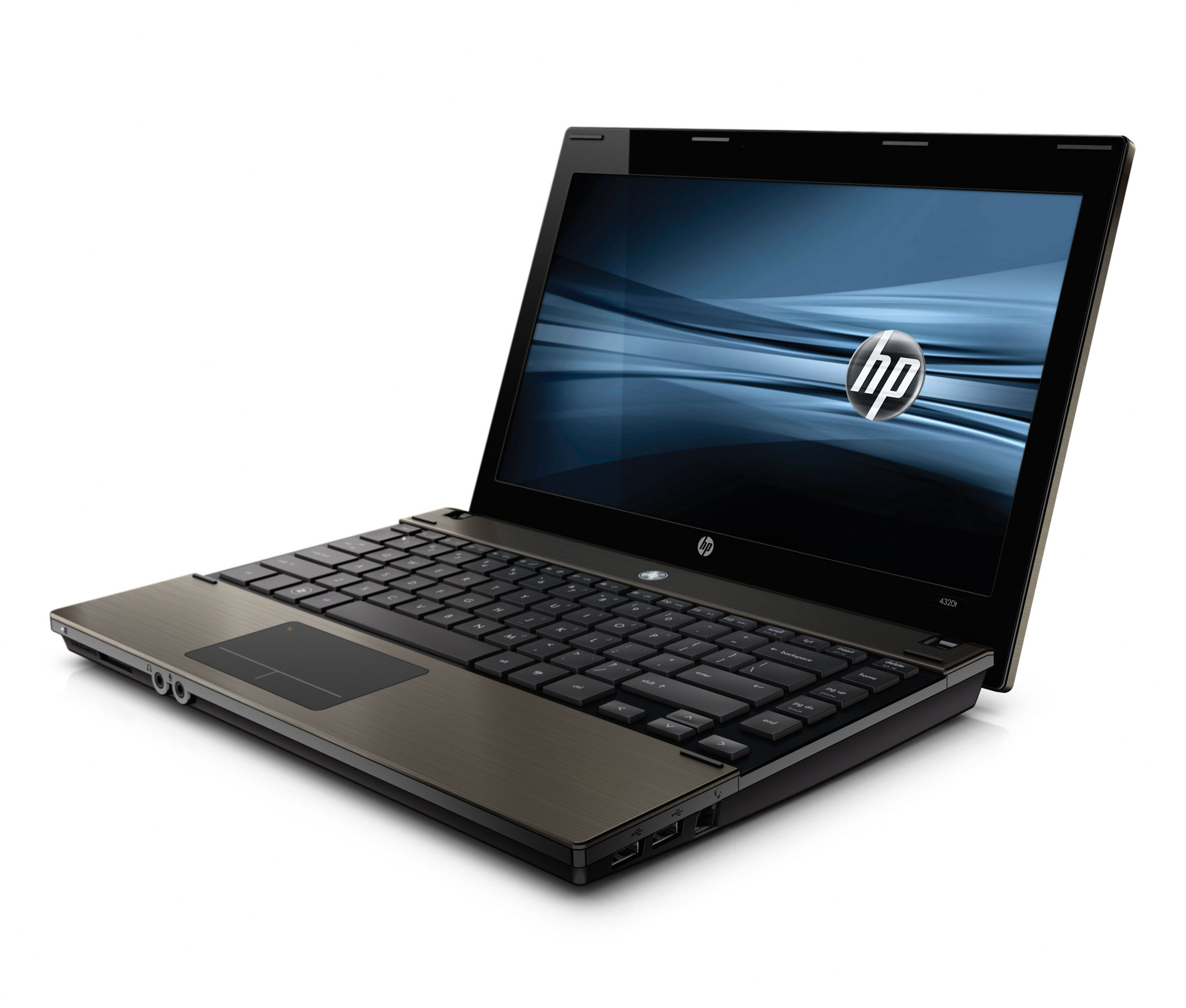

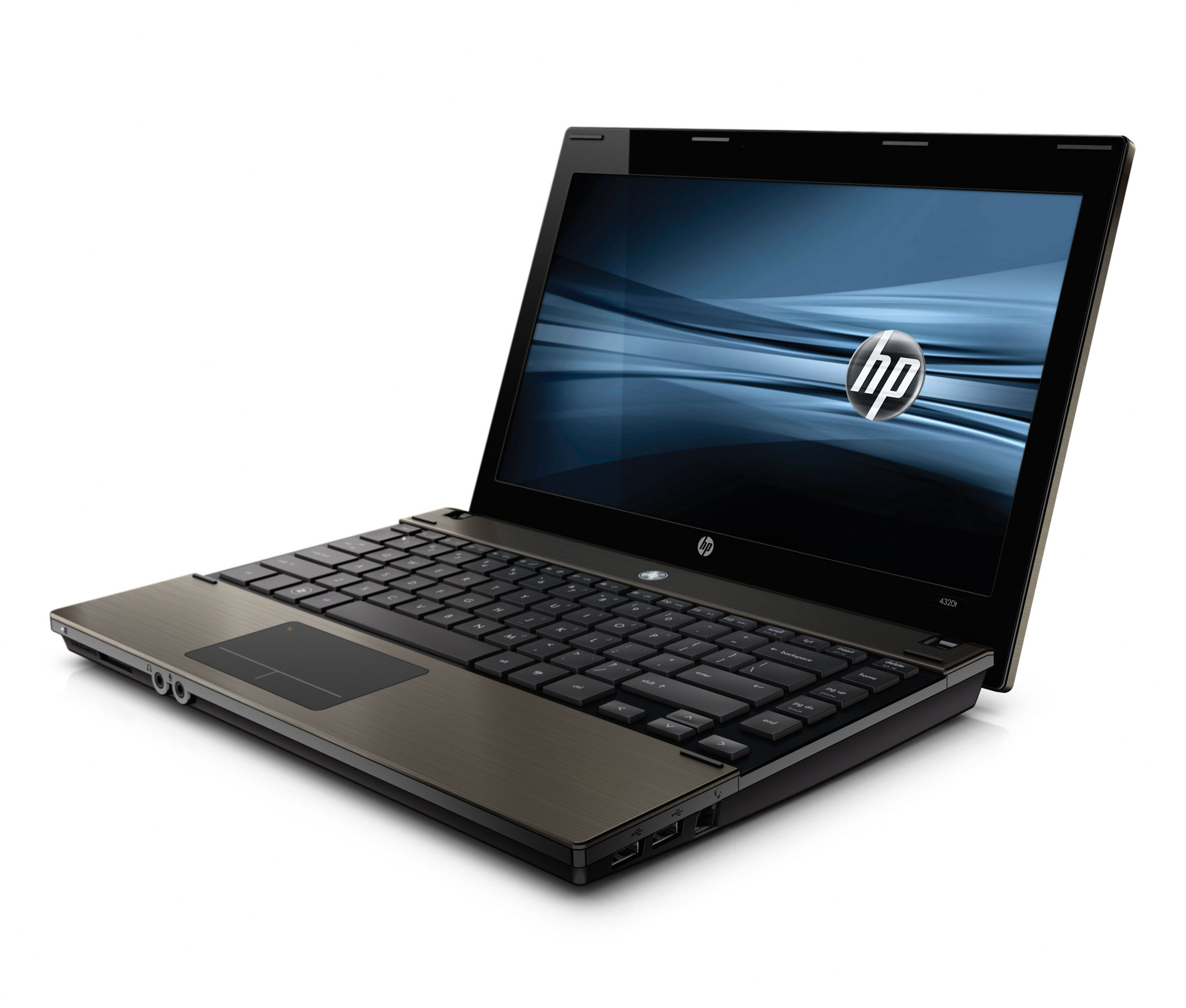

Look no further than HP, which has had massive buybacks but is today worth only what it was worth 10 years ago as it prepares to split. Or Sears Holdings which is now worth 15% of its value a decade ago. Short term manipulative actions can fool any investor, and actually artificially keep stock prices high, so make sure you understand the long-term revenue trends, and prospects, of any investment. Regardless of analyst recommendations.

by Adam Hartung | Oct 6, 2014 | Current Affairs, In the Swamp, In the Whirlpool, Leadership, Web/Tech

Hewlett Packard is splitting in two. Do you find yourself wondering why? You aren’t alone.

Hewlett Packard is nearly 75 years old. One of the original “silicone valley companies,” it started making equipment for engineers and electronic technicians long before computers were every day products. Over time HP’s addition of products like engineering calculators moved it toward more consumer products. And eventually HP became a dominant player in printers. All of these products were born out of deep skills in R&D, engineering and product development. HP had advantages because its products were highly desirable and unique, which made it nicely profitable.

But along came a CEO named Carly Fiorina, and she decided HP needed to grow much bigger, much more quickly. So she bought Compaq, which itself had bought Digital Equipment, so HP could sell Wintel PCs. PCs were a product in which HP had no advantage. PC production had always been an assembly operation of other companies’ intellectual property. It had been a very low margin, brutally difficult place to grow unless one focused on cost lowering rather than developing intellectual capital. It had nothing in common with HP’s business.

To fight this new margin battle HP replaced Ms. Fiorina with Mark Hurd, who recognized the issues in PC manufacturing and proceeded to gut R&D, product development and almost every other function in order to push HP into a lower cost structure so it could compete with Dell, Acer and other companies that had no R&D and cultures based on cost controls. This led to internal culture conflicts, much organizational angst and eventually the ousting of Mr. Hurd.

But, by that time HP was a company adrift with no clear business model to help it have a sustainably profitable future.

Now HP is 4 years into its 5 year turnaround plan under Meg Whitman’s leadership. This plan has made HP much smaller, as layoffs have dominated the implementation. It has weakened the HP brand as no important new products have been launched, and the gutted product development capability is still no closer to being re-established. And PC sales have stagnated as mobile devices have taken center stage – with HP notably weak in mobile products. The company has drifted, getting no better and showing no signs of re-developing its historical strengths.

So now HP will split into two different companies. Following the old adage “if you can’t dazzle ’em with brilliance, baffle ’em with bulls**t.” When all else fails, and you don’t know how to actually lead a company, then split it into pieces, push off the parts to others to manage and keep at least one CEO role for yourself.

Let’s not forget how this mess was created. It was a former CEO who decided to expand the company into an entirely different and lower margin business where the company had no advantage and the wrong business model. And another that destroyed long-term strengths in innovation to increase short-term margins in a generic competition. And then yet a third who could not find any solution to sustainability while pushing through successive rounds of lay-offs.

This was all value destruction created by the persons at the top. “Strategic” decisions made which, inevitably, hurt the organization more than helped it. Poorly thought through actions which have had long-term deleterious repercussions for employees, suppliers, investors and the communities in which the businesses operate.

The game of musical chairs has been very good for the CEOs who controlled the music. They were paid well, and received golden handshakes. They, and their closest reports, did just fine. But everyone else….. well…..

by Adam Hartung | Nov 29, 2012 | Defend & Extend, In the Swamp, In the Whirlpool, Leadership, Web/Tech

The web lit up yesterday when people started sharing a Fortune quote from Marissa Mayer, CEO of Yahoo, "We are literally moving the company from BlackBerrys to smartphones." Why was this a big deal? Because, in just a few words, Ms. Mayer pointed out that Research In Motion is no longer relevant. The company may have created the smartphone market, but now its products are so irrelevant that it isn't even considered a market participant.

Ouch. But, more importantly, this drove home that no matter how good RIM thinks Blackberry 10 may be, nobody cares. And when nobody cares, nobody buys. And if you weren't convinced RIM was headed for lousy returns and bankruptcy before, you certainly should be now.

But wait, this is certainly a good bit of the pot being derogatory toward the kettle. Because, other than the highly personalized news about Yahoo's new CEO, very few people care about Yahoo these days as well. After being thoroughly trounced in ad placement and search by Google, it is wholly unclear how Yahoo will create its own relevancy. It may likely be soon when a major advertiser says "When placing our major internet ad program we are focused on the split between Google and Facebook," demonstrating that nobody really cares about Yahoo anymore, either.

And how long will Yahoo survive?

The slip into irrelevancy is the inflection point into failure. Very few companies ever return. Once you are no longer relevant, customer quickly stop paying attention to practically anything you do. Even if you were once great, it doesn't take long before the slide into no-growth, cost cutting and lousy financial performance happens.

Consider:

- Garmin once led the market for navigation devices. Now practically everyone uses their mobile phone for navigation. The big story is Apple's blunder with maps, while Google dominates the marketplace. You probably even forgot Garmin exists.

- Radio Shack once was a consumer electronics powerhouse. They ran superbowl ads, and had major actresses parlaying with professional sports celebrities in major network ads. When was the last time you even thought about Radio Shack, much less visited a store?

- Sears was once America's premier, #1 retailer. The place where everyone shopped for brands like Craftsman, DieHard and Kenmore. But when did you last go into a Sears? Or even consider going into one? Do you even know where one is located?

- Kodak invented amateur photography. But when that market went digital nobody cared about film any more. Now Kodak is in bankruptcy. Do you care?

- Motorola Razr phones dominated the last wave of traditional cell phones. As sales plummeted they flirted with bankruptcy, until Motorola split into 2 pieces and the money losing phone business became Google – and nobody even noticed.

- When was the last time you thought about "building your body 12 ways" with Wonder bread? Right. Nobody else did either. Now Hostess is liquidating.

Being relevant is incredibly important, because markets shift quickly today. As they shift, either you are part of the trend going forward – or you are part of the "who cares" past. If you are the former, you are focused on new products that customers want to evaluate. If you are the latter, you can disappear a whole lot faster than anyone expected as customers simply ignore you.

So now take a look at a few other easy-to-spot companies losing relevancy:

- HP headlines are dominated by write offs of its investments in services and software, causing people to doubt the viability of its CEO, Meg Whitman. Who wants to buy products from a company that would spend billions on Palm, business services and Autonomy ERP software only to decide they overspent and can never make any money on those investments? Once a great market leader, HP is rapidly becoming a company nobody cares about; except for what appears to be a bloody train wreck in the making. In tech – lose customesr and you have a short half-life.

- Similarly Dell. A leader in supply chain management, what Dell product now excites you? As you think about the money you will spend this holiday, or in 2013, on tech products you're thinking about mobile devices — and where is Dell?

- Best Buy was the big winner when Circuit City went bankrupt. But Best Guy didn't change, and now margins have cratered as people showroom Amazon while in their store to negotiate prices. How long can Best Buy survive when all TVs are the same, and price is all that matters? And you download all your music and movies?

- Wal-Mart has built a huge on-line business. Did you know that? Do you care? Regardless of Wal-mart's on-line efforts, the company is known for cheap looking stores with cheap merchandise and customers that can't maintain credit cards. When you look at trends in retailing, is Wal-Mart ever the leader – in anything – anymore? If not, Wal-mart becomes a "default" store location when all you care about is price, and you can't wait for an on-line delivery. Unless you decide to go to the even cheaper Dollar General or Aldi.

And, the best for last, is Microsoft. Steve Ballmer announced that Microsoft phone sales quadrupled! Only, at 4 million units last quarter that is about 10% of Apple or Android. Truth is, despite 3 years of development, a huge amount of pre-release PR and ad spending, nobody much cares about Win8, Surface or new Microsoft-based mobile phones. People want an iPhone or Samsung product.

After its "lost decade" when Microsoft simply missed every major technology shift, people now don't really care about Microsoft. Yes, it has a few stores – but they dwarfed in number and customers by the Apple stores. Yes, the shifting tiles and touch screen PCs are new – but nobody real talks about them; other than to say they take a lot of new training. When it comes to "game changers" that are pushing trends, nobody is putting Microsoft in that category.

So the bad news about a $6 billion write-down of aQuantive adds to the sense of "the gang that can't shoot straight" after the string of failures like Zune, Vista and early Microsoft phones and tablets. Not to mention the lack of interest in Skype, while Internet Explorer falls to #2 in browser market share behind Chrome.

Chart Courtesy Jay Yarrow, BusinessInsider.com 5-21-12

Chart Courtesy Jay Yarrow, BusinessInsider.com 5-21-12

When a company is seen as never able to take the lead amidst changing

trends, investors see accquisitions like $1.2B for Yammer as a likely future write down. Customers lose interest and simply spend money elsewhere.

As investors we often hear about companies that were once great brands, but selling at low multiples, and therefore "value plays." But the truth is these are death traps that wipe out returns. Why? These companies have lost relevancy, and that puts them one short step from failure.

As company managers, where are you investing? Are you struggling to be relevant as other competitors – maybe "fringe" companies that use "voodoo solutions" you don't consider "enterprise ready" or understand – are obtaining a lot more interest and media excitment? You can work all you want to defend & extend your past glory, but as markets shift it is amazingly easy to lose relevancy. And it's a very, very tough job to play catch- up.

Just look at the money being spent trying at RIM, Microsoft, HP, Dell, Yahoo…………

–

This is where short-term manipulation happens. Say a company is earning $1,000 and has 1,000 shares outstanding, so its EPS is $1. The industry multiple is 10, so the share price is $10. The company sells assets for $1,000 (for purposes of this exercise, let’s assume the book value on those assets is $1,000 so there is no gain, no earnings impact and no tax impact.)

This is where short-term manipulation happens. Say a company is earning $1,000 and has 1,000 shares outstanding, so its EPS is $1. The industry multiple is 10, so the share price is $10. The company sells assets for $1,000 (for purposes of this exercise, let’s assume the book value on those assets is $1,000 so there is no gain, no earnings impact and no tax impact.)