by Adam Hartung | Apr 23, 2014 | Current Affairs, Leadership

Every quarter I have to be reminded that “earnings season” is again upon us. The ritual of public companies announcing their sales and profits from recent quarters that generates a lot of attention in the business press. And I always wonder why this is a big deal.

What really matters to investors, employees, customers and vendors is “what will your business be like next quarter, and year?” We really don’t much care about the past. What we really want to know is “what should we expect in the future?”

For example, two companies announce quarterly results. One has a Price/Earnings (P/E) multiple of 12.8 and a dividend yield of 2.05%. The other has a multiple of 13.0, and a yield of 3.05%. For both companies net earnings overall were pretty much flat, but Earnings Per Share (EPS) improved due to an aggressive stock repurchase program. Both companies say they have new products in the pipeline, but they conservatively estimate full year results for 2014 to be flat or maybe even declining.

Do you know enough to make a decision on whether to buy either stock? Both?

Truthfully, the two companies are Xerox and Apple. Now does it matter?

While both companies have similar results and forward looking statements, how you view that information is affected by your expectations for each company’s future. So, in other words, the actual results are pretty meaningless. They are interpreted through the lens of expectations, which controls your decision.

You can say Xerox has been irrelevant for years, and its products increasingly look unlikely to change its future course, so you are disheartened by results you see as unspectacular and likewise see no reason to own the stock. For Apple you could say the same thing, and bring up the growing competitor sales of Android-based products. Or, you might say that Apple is undervalued because you have great faith in the growth of mobile products sales and you believe new devices will spur Apple to even better results. Whatever your conclusion about the announced earnings, those conclusions are driven by your view of the future – not the actual results.

Another example. Two companies have billions in sales, and devote their discussion of company value to technology and the use of new technology to pioneer new markets. Both companies report they continue a string of losses, and have no projection for when losses will become profits. There are no dividends. There is no P/E multiple, because there is no E. There is no EPS, again because there is no E. One company is losing $12.86/share, the other is losing $.61/share. Again, do these results tell you whether to buy either, one or both?

What if the first one (with the larger losses) is Sears Holdings, and the latter is Tesla? Now, suddenly your view on the data changes – based upon your view of the future. Either Sears is on the precipice of a turnaround to becoming a major on-line retailer that will sell some real estate and leverage the balance of its stores to grow, so you buy it, or you think Sears has lost all relevancy and you don’t buy it. Either you think Tesla is an industry game changer, so you buy it, or you think it is an over-rated fad that will never become big enough to matter and the giant global auto companies will destroy it, so you don’t buy it. It’s your future view that guides your conclusions about past results.

The critical factor when reviewing earnings is actually not the reported results. The critical factor is what you think the future is for these 4 companies. No matter how good or bad the historical results, your decision about whether to own the stock, buy the company products, work for the company or join its vendor program all hinges on your view about the company’s future.

Which makes not only the “earnings season” hoopla foolish, but puts a pronounced question mark on how executives – especially CEOs – in public companies spend their time as it relates to reporting results.

Enormous energy is spent by most CEOs and their staff on managing earnings. From the beginning to the end of every quarter the CFO and his/her staff pour over weekly outcomes in divisions and functions to understand revenues and costs in order to gain advance knowledge on likely results. Then, for the next several days/weeks the CFO’s staff, with the CEO and the leadership team, will pour over those results to make a myriad number of adjustments – from depreciation and amortization to deferring revenue changing tax structures or time-matching various costs – in order to further refine the reported results. Literally thousands of person-hours will be devoted to managing the reported results in order to provide the number they think is most appropriate. And this cycle is repeated every quarter.

But how many hours will be spent by that same CEO and the leadership team managing expectations about the company’s next year? How much time do these leaders spend developing scenarios, and communications, that will describe their vision, in order to manage investor expectations?

While every company has a CFO leading a large organization dedicated to reporting historical results, how many companies have a like-powered C level exec managing the expectations, and leading a large staff to create and deliver communications about the future?

It seems pretty clear that most management teams should consider reallocating their precious resources. Instead of spending so much time managing earnings, they should spend more time managing expectations. If we think about the difference between Xerox and Apple, one is quickly aware of the difference the CEOs made in setting expectations. People still wax eloquently about the future vision for Apple created by CEO Steve Jobs, who’s been dead 2.5 years, while almost no one can tell you the name of Xerox’ CEO. If you think about the difference between Sears and Tesla one only needs to think briefly about the difference between the numbers driven hedge fund manager and cost-cutting CEO Ed Lampert compared with the “visionary” communications of Elon Musk.

Investors should all think long term. Investors should care completely about what the next 3 to 5 years will mean for companies in which they place their money. What sales and earnings are reported from months ago is pretty meaningless. What really matters is what is yet to happen.

What we don’t need is a lot of time spent talking about old earnings. What we need is a lot more time spent talking about the future, and what we should expect from our investments.

by Adam Hartung | Nov 6, 2013 | Defend & Extend, Innovation, Leadership, Web/Tech

Can you believe it has been only 12 years since Apple introduced the iPod? Since then Apple’s value has risen from about $11 (January, 2001) to over $500 (today) – an astounding 45X increase.

With all that success it is easy to forget that it was not a “gimme” that the iPod would succeed. At that time Sony dominated the personal music world with its Walkman hardware products and massive distribution through consumer electronics chains such as Best Buy, and broad-line retailers like Wal-Mart. Additionally, Sony had its own CD label, from its acquisition of Columbia Records (renamed CBS Records,) producing music. Sony’s leadership looked impenetrable.

But, despite all the data pointing to Sony’s inevitable long-term domination, Apple launched the iPod. Derided as lacking CD quality, due to MP3’s compression algorithms, industry leaders felt that nobody wanted MP3 products. Sony said it tried MP3, but customers didn’t want it.

All the iPod had going for it was a trend. Millions of people had downloaded MP3 songs from Napster. Napster was illegal, and users knew it. Some heavy users were even prosecuted. But, worse, the site was riddled with viruses creating havoc with all users as they downloaded hundreds of millions of songs.

Eventually Napster was closed by the government for widespread copyright infreingement. Sony, et.al., felt the threat of low-priced MP3 music was gone, as people would keep buying $20 CDs. But Apple’s new iPod provided mobility in a way that was previously unattainable. Combined with legal downloads, including the emerging Apple Store, meant people could buy music at lower prices, buy only what they wanted and literally listen to it anywhere, remarkably conveniently.

The forecasted “numbers” did not predict Apple’s iPod success. If anything, good analysis led experts to expect the iPod to be a limited success, or possibly failure. (Interestingly, all predictions by experts such as IDC and Gartner for iPhone and iPad sales dramatically underestimated their success, as well – more later.) It was leadership at Apple (led by the returned Steve Jobs) that recognized the trend toward mobility was more important than historical sales analysis, and the new product would not only sell well but change the game on historical leaders.

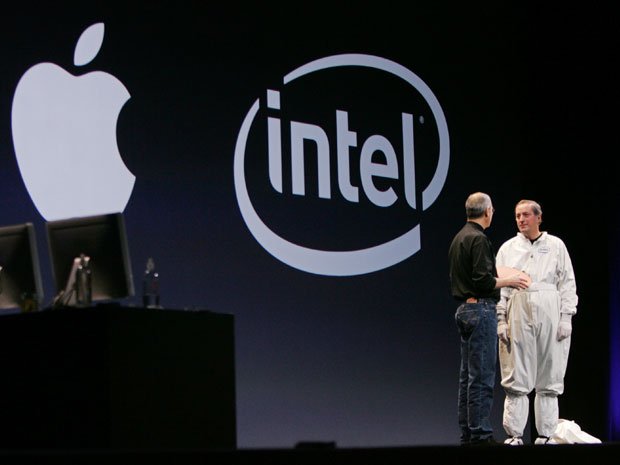

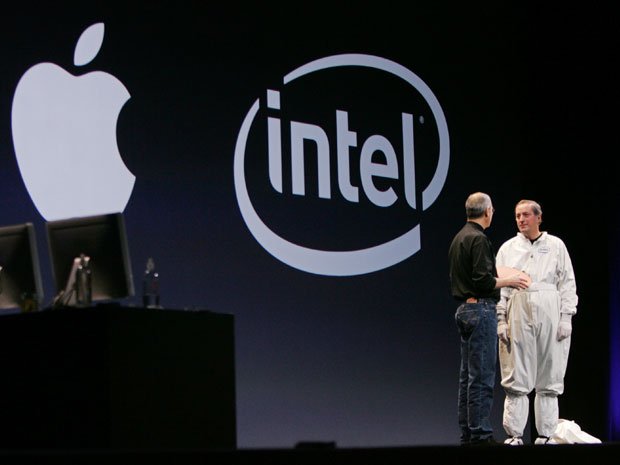

Which takes us to the mistake Intel made by focusing on “the numbers” when given the opportunity to build chips for the iPhone. Intel was a very successful company, making key components for all Microsoft PCs (the famous WinTel [for Windows+Intel] platform) as well as the Macintosh. So when Apple asked Intel to make new processors for its mobile iPhone, Intel’s leaders looked at the history of what it cost to make chips, and the most likely future volumes. When told Apple’s price target, Intel’s leaders decided they would pass. “The numbers” said it didn’t make sense.

Uh oh. The cost and volume estimates were wrong. Intel made its assessments expecting PCs to remain strong indefinitely, and its costs and prices to remain consistent based on historical trends. Intel used hard, engineering and MBA-style analysis to build forecasts based on models of the past. Intel’s leaders did not anticipate that the new mobile trend, which had decimated Sony’s profits in music as the iPod took off, would have the same impact on future sales of new phones (and eventually tablets) running very thin apps.

Harvard innovation guru Clayton Christensen tells audiences that we have complete knowledge about the past. And absolutely no knowledge about the future. Those who love numbers and analysis can wallow in reams and reams of historical information. Today we love the “Big Data” movement which uses the world’s most powerful computers to rip through unbelievable quantities of historical data to look for links in an effort to more accurately predict the future. We take comfort in thinking the future will look like the past, and if we just study the past hard enough we can have a very predictible future.

But that isn’t the way the business world works. Business markets are incredibly dynamic, subject to multiple variables all changing simultaneously. Chaos Theory lecturers love telling us how a butterfly flapping its wings in China can cause severe thunderstorms in America’s midwest. In business, small trends can suddenly blossom, becoming major trends; trends which are easily missed, or overlooked, possibly as “rounding errors” by planners fixated on past markets and historical trends.

Markets shift – and do so much, much faster than we anticipate. Old winners can drop remarkably fast, while new competitors that adopt the trends become “game changers” that capture the market growth.

In 2000 Apple was the “Mac” company. Pretty much a one-product company in a niche market. And Apple could easily have kept trying to defend & extend that niche, with ever more problems as Wintel products improved.

But by understanding the emerging mobility trend leadership changed Apple’s investment portfolio to capture the new trend. First was the iPod, a product wholly outside the “core strengths” of Apple and requiring new engineering, new distribution and new branding. And a product few people wanted, and industry leaders rejected.

Then Apple’s leaders showed this talent again, by launching the iPhone in a market where it had no history, and was dominated by Motorola and RIMM/BlackBerry. Where, again, analysts and industry leaders felt the product was unlikely to succeed because it lacked a keyboard interface, was priced too high and had no “enterprise” resources. The incumbents focused on their past success to predict the future, rather than understanding trends and how they can change a market.

Too bad for Intel. And Blackberry, which this week failed in its effort to sell itself, and once again changed CEOs as the stock hit new lows.

Then Apple did it again. Years after Microsoft attempted to launch a tablet, and gave up, Apple built on the mobility trend to launch the iPad. Analysts again said the product would have limited acceptance. Looking at history, market leaders claimed the iPad was a product lacking usability due to insufficient office productivity software and enterprise integration. The numbers just did not support the notion of investing in a tablet.

Anyone can analyze numbers. And today, we have more numbers than ever. But, numbers analysis without insight can be devastating. Understanding the past, in grave detail, and with insight as to what used to work, can lead to incredibly bad decisions. Because what really matters is vision. Vision to understand how trends – even small trends – can make an enormous difference leading to major market shifts — often before there is much, if any, data.

by Adam Hartung | Sep 4, 2013 | Current Affairs, Defend & Extend, In the Whirlpool, Leadership, Lock-in, Web/Tech

Just over a week after Microsoft announces plans to replace CEO Steve Ballmer the company announced it will spend $7.2B to buy the Nokia phone/tablet business. For those looking forward to big changes at Microsoft this was like sticking a pin in the big party balloon!

Everyone knows that Microsoft's future is at risk now that PC sales are declining globally at nearly 10% – with developing markets shifting even faster to mobile devices than the USA. And Microsoft has been the perpetual loser in mobile devices; late to market and with a product that is not a game changer and has only 3% share in the USA.

But, despite this grim reality, Microsoft has doubled-down (that's doubled its bet for non-gamblers) on its Windows 8 OS strategy, and continues to play "bet the company". Nokia's global market share has shriveled to 15% (from 40%) since former Microsoft exec-turned-Nokia-CEO Stephen Elop committed the company to Windows 8. Because other Microsoft ecosystem companies like HP, Acer and HP have been slow to bring out Win 8 devices, Nokia has 90% of the miniscule market that is Win 8 phones. So this acquisition brings in-house a much deeper commitment to spending on an effort to defend & extend Microsoft's declining O/S products.

As I predicted in January, the #1 action we could expect from a Ballmer-led Microsoft is pouring more resources into fighting market leaders iOS and Android – an unwinnable war. Previously there was the $8.5B Skype and the $400M Nook, and now a $7.2B Nokia. And as 32,000 Nokia employees join Microsoft losses will surely continue to rise. While Microsoft has a lot of cash – spending it at this rate, it won't last long!

Some folks think this acquisition will make Microsoft more like Apple, because it now will have both hardware and software which in some ways is like Apple's iPhone. The hope is for Apple-like sales and margins soon. But, unfortunately, Google bought Motorola months ago and we've seen that such revenue and profit growth are much harder to achieve than simply making an acquisition. And Android products are much more popular than Win8. Simply combining Microsoft and Nokia does not change the fact that Win8 products are very late to market, and not very desirable.

Some have postulated that buying Nokia was a way to solve the Microsoft CEO succession question, positioning Mr. Elop for Mr. Ballmer's job. While that outcome does seem likely, it would be one of the most expensive recruiting efforts of all time. The only reason for Mr. Elop to be made Microsoft CEO is his historical company relationship, not performance. And that makes Mr. Elop is exactly the wrong person for the Microsoft CEO job!

In October, 2010 when Mr. Elop took over Nokia I pointed out that he was the wrong person for that job – and he would destroy Nokia by making it a "Microsoft shop" with a Microsoft strategy. Since then sales are down, profits have evaporated, shareholders are in revolt and the only good news has been selling the dying company to Microsoft! That's not exactly the best CEO legacy.

Mr. Elop's job today is to sell more Win8 mobile devices. Were he to be made Microsoft CEO it is likely he would continue to think that is his primary job – just as Mr. Ballmer has believed. Neither CEO has shown any ability to realize that the market has already shifted, that there are two leaders far, far in front with brand image, products, apps, developers, partners, distribution, market share, sales and profits. And it is impossible for Microsoft to now catch up.

It is for good reason that short-term traders pushed down Microsoft's share value after the acquisition was announced. It is clear that current CEO Ballmer and Microsoft's Board are still stuck fighting the last war. Still trying to resurrect the Windows and Office businesses to previous glory. Many market anallysts see this as the last great effort to make Ballmer's bet-the-company on Windows 8 pay off. But that's a bet which every month is showing longer and longer odds.

Microsoft is not dead. And Microsoft is not without the ability to turn around. But it won't happen unless the Board recognizes it needs to steer Microsoft in a vastly different direction, reduce (rather than increase) investments in Win8 (and its devices,) and create a vision for 2020 where Microsoft is highly relevant to customers. So far, we're seeing all the wrong moves.