by Adam Hartung | Jan 17, 2016 | Current Affairs, In the Rapids, Innovation, Leadership, Web/Tech

Stocks are starting 2016 horribly. To put it mildly. From a Dow (DJIA or Dow Jones Industrial Average) at 18,000 in early November values of leading companies have fallen to under 16,000 – a decline of over 11%. Worse, in many regards, has been the free-fall of 2016, with the Dow falling from end-of-year close 17,425 to Friday’s 15,988 – almost 8.5% – in just 10 trading days!

With the bottom apparently disappearing, it is easy to be fearful and not buy stocks. After all, we’re clearly seeing that one can easily lose value in a short time owning equities.

But if you are a long-term investor, then none of this should really make any difference. Because if you are a long-term investor you do not need to turn those equities into cash today – and thus their value today really isn’t important. Instead, what care about is the value in the future when you do plan to sell those equities.

Investors, as opposed to traders, buy only equities of companies they think will go up in value, and thus don’t need to worry about short-term volatility created by headline news, short-term politics or rumors. For investors the most important issue is the major trends which drive the revenues of those companies in which they invest. If those trends have not changed, then there is no reason to sell, and every reason to keep buying.

(1) Buy Amazon

Take for example Amazon. Amazon has fallen from its high of about $700/share to Friday’s close of $570/share in just a few weeks – an astonishing drop of over 18.5%. Yet, there is really no change in the fundamental market situation facing Amazon. Either (a) something dramatic has changed in the world of retail, or (b) investors are over-reacting to some largely irrelevant news and dumping Amazon shares.

Everyone knows that the #1 retail trend is sales moving from brick-and-mortar stores to on-line. And that trend is still clearly in place. Black Friday sales in traditional retail stores declined in 2013, 2014 and 2015 – down 10.4% over the Thanksgiving Holiday weekend. For all December, 2015 retail sales actually declined from 2014. Due to this trend, mega-retailer Wal-Mart announced last week it is closing 269 stores. Beleaguered KMart also announced more store closings as it, and parent Sears, continues the march to non-existence. Nothing in traditional retail is on a growth trend.

However, on-line sales are on a serious growth trend. In what might well be the retail inflection point, the National Retail Federation reported that more people shopped on line Black Friday weekend than those who went to physical stores (and that counts shoppers in categories like autos and groceries which are almost entirely physical store based.) In direct opposition to physical stores, on-line sales jumped 10.4% Black Friday.

And Amazon thoroughly dominated on-line retail sales this holiday season. On Black Friday Amazon sales tripled versus 2014. Amazon scored an amazing 35% market share in e-commerce, wildly outperforming number 2 Best Buy (8%) and ten-fold numbers 3 and 4 Macy’s and WalMart that accomplished just over 3% market share each.

Clearly the market trend toward on-line sales is intact. Perhaps accelerating. And Amazon is the huge leader. Despite the recent route in value, had you bought Amazon one year ago you would still be up 97% (almost double your money.) Reflecting market trends, Wal-Mart has declined 28.5% over the last year, while the Dow dropped 8.7%.

Amazon may not have bottomed in this recent swoon. But, if you are a long-term investor, this drop is not important. And, as a long-term investor you should be gratified that these prices offer an opportunity to buy Amazon at a valuation not available since October – before all that holiday good news happened. If you have money to invest, the case is still quite clear to keep buying Amazon.

(2) Buy Facebook

(2) Buy Facebook

The trend toward using social media has not abated, and Facebook continues to be the gorilla in the room. Nobody comes close to matching the user base size, or marketing/advertising opportunities Facebook offers. Facebook is down 13.5% from November highs, but is up 24.5% from where it was one year ago. With the trend toward internet usage, and social media usage, growing at a phenomenal clip, the case to hold what you have – and add to your position – remains strong. There is ample opportunity for Facebook to go up dramatically over the next few years for patient investors.

(3) Buy Netflix

When was the last time you bought a DVD? Rented a DVD? Streamed a movie? How many movies or TV programs did you stream in 2015? In 2013? Do you see any signs that the trend to streaming will revert? Or even decelerate as more people in more countries have access to devices and high bandwidth?

Last week Netflix announced it is adding 130 new countries to its network in 2016, taking the total to 190 overall. By 2017, about the only place in the world you won’t be able to access Netflix is China. Go anywhere else, and you’ve got it. Additionally, in 2016 Netflix will double the number of its original programs, to 31 from 16. Simultaneously keeping current customers in its network, while luring ever more demographics to the Netflix platform.

Netflix stock is known for its wild volatility, and that remains in force with the value down a whopping 21.8% from its November high. Yet, had you bought 1 year ago even Friday’s close provided you a 109% gain, more than doubling your investment. With all the trends continuing to go its way, and as Netflix holds onto its dominant position, investors should sleep well, and add to their position if funds are available.

(4) Buy Google

Ever since Google/Alphabet overwhelmed Yahoo, taking the lead in search and on-line advertising the company has never looked back. Despite all attempts by competitors to catch up, Google continues to keep 2/3 of the search market. Until the market for search starts declining, trends continue to support owning Google – which has amassed an enormous cash hoard it can use for dividends, share buybacks or growing new markets such as smart home electronics, expanded fiber-optic internet availability, sensing devices and analytics for public health, or autonomous cars (to name just a few.)

The Dow decline of 8.7% would be meaningless to a shareholder who bought one year ago, as GOOG is up 37% year-over year. Given its knowledge of trends and its investment in new products, that Google is down 12% from its recent highs only presents the opportunity to buy more cheaply than one could 2 months ago. There is no trend information that would warrant selling Google now.

(5) Buy Apple

Despite spending most of the last year outperforming the Dow, a one-year investor would today be down 10.7% in Apple vs. 8.7% for the Dow. Apple is off 27.6% from its 52 week high. With a P/E (price divided by earnings) ratio of 10.6 on historical earnings, and 9.3 based on forecasted earnings, Apple is selling at a lower valuation than WalMart (P/E – 13). That is simply astounding given the discussion above about Wal-mart’s operations related to trends, and a difference in business model that has Apple producing revenues of over $2.1M/employee/year while Walmart only achieve $220K/employee/year. Apple has a dividend yield of 2.3%, higher than Dow companies Home Depot, Goldman Sachs, American Express and Disney!

Apple has over $200B cash. That is $34.50/share. Meaning the whole of Apple as an operating company is valued at only $62.50/share – for a remarkable 6 times earnings. These are the kind of multiples historically reserved for “value companies” not expected to grow – like autos! Even though Apple grew revenues by 26% in fyscal 2015, and at the compounded rate of 22%/year from 2011- 2015.

Apple has a very strong base market, as the world leader today in smartphones, tablets and wearables. Additionally, while the PC market declined by over 10% in 2015, Apple’s Mac sales rose 3% – making Apple the only company to grow PC sales. And Apple continues to move forward with new enterprise products for retail such as iBeacon and ApplePay. Meanwhile, in 2016 there will be ongoing demand growth via new development partnerships with large companies such as IBM.

Unfortunately, Apple is now valued as if all bad news imaginable could occur, causing the company to dramatically lose revenues, sustain an enormous downfall in earnings and have its cash dissipated. Yet, Apple rose to become America’s most valuable publicly traded company by not only understanding trends, but creating them, along with entirely new markets. Apple’s ability to understand trends and generate profitable revenues from that ability seems to be completely discounted, making it a good long-term investment.

In August, 2015 I recommended FANG investing. This remains the best opportunity for investors in 2016 – with the addition of Apple. These companies are well positioned on long-term trends to grow revenues and create value for several additional years, thereby creating above-market returns for investors that overlook short-term market turbulence and invest for long-term gains.

by Adam Hartung | Sep 22, 2015 | Current Affairs, Disruptions, In the Rapids, Innovation

A recent analyst took a look at the impact of electric vehicles (EVs) on the demand for oil, and concluded that they did not matter. In a market of 95million barrels per day production, electric cars made a difference of 25,000 to 70,000 barrels of lost consumption; ~.05%.

You can’t argue with his arithmetic. So far, they haven’t made any difference.

But then he goes on to say they won’t matter for another decade. He forecasts electric vehicle sales grow 5-fold in one decade, which sounds enormous. That is almost 20% growth year over year for 10 consecutive years. Admittedly, that sounds really, really big. Yet, at 1.5million units/year this would still be only 5% of cars sold, and thus still not a material impact on the demand for gasoline.

But then he goes on to say they won’t matter for another decade. He forecasts electric vehicle sales grow 5-fold in one decade, which sounds enormous. That is almost 20% growth year over year for 10 consecutive years. Admittedly, that sounds really, really big. Yet, at 1.5million units/year this would still be only 5% of cars sold, and thus still not a material impact on the demand for gasoline.

This sounds so logical. And one can’t argue with his arithmetic.

But one can argue with the key assumption, and that is the growth rate.

Do you remember owning a Walkman? Listening to compact discs? That was the most common way to listen to music about a decade ago. Now you use your phone, and nobody has a walkman.

Remember watching movies on DVDs? Remember going to Blockbuster, et.al. to rent a DVD? That was common just a decade ago. Now you likely have shelved the DVD player, lost track of your DVD collection and stream all your entertainment. Bluckbuster, infamously, went bankrupt.

Do you remember when you never left home without your laptop? That was the primary tool for digital connectivity just 6 years ago. Now almost everyone in the developed world (and coming close in the developing) carries a smartphone and/or tablet and the laptop sits idle. Sales for laptops have declined for 5 years, and a lot faster than all the computer experts predicted.

Markets that did not exist for mobile products 10 years ago are now huge. Way beyond anyone’s expectations. Apple alone has sold over 48million mobile devices in just 3 months (Q3 2015.) And replacing CDs, Apple’s iTunes was downloading 21million songs per day in 2013 (surely more by now) reaching about 2billion per quarter. Netflix now has over 65million subscribers. On average they stream 1.5hours of content/day – so about 1 feature length movie. In other words, 5.85billion streamed movies per quarter.

What has happened to old leaders as this happened? Sony hasn’t made money in 6 years. Motorola has almost disappeared. CD and DVD departments have disappeared from stores, bankrupting Circuit City and Blockbuster, and putting a world of hurt on survivors like Best Buy.

The point? When markets shift, they often shift a lot faster than anyone predicts. 20%/year growth is nothing. Growth can be 100% per quarter. And the winners benefit unbelievably well, while losers fall farther and faster than we imagine.

Tesla was barely an up-and-comer in 2012 when I said they would far outperform GM, Ford and Toyota. The famous Bob Lutz, a long-term widely heralded auto industry veteran chastised me in his own column “Tesla Beating Detroit – That’s Just Nonsense.”

Mr. Lutz said I was comparing a high-end restaurant to McDonald’s, Wendy’s and Pizza Hut, and I was foolish because the latter were much savvier and capable than the former. He should have used as his comparison Chipotle, which I predicted would be a huge winner in 2011. Those who followed my advice would have made more money owning Chipotle than any of the companies Mr. Lutz preferred.

The point? Market shifts are never predicted by incumbents, or those who watch history. The rate of change when it happens is so explosive it would appear impossible to achieve, and far more impossible to sustain. The trends shift, and one market is rapidly displaced by another.

While GM, Ford and Toyota struggle to maintain their mediocrity, Tesla is winning “best car” awards one after another – even “breaking” Consumer Reports review system by winning 103 points out of a maximum 100, the independent reviewer liked the car so much. Tesla keeps selling 100% of its production, even at its +$100K price point.

So could the market for EVs wildly grow? BMW has announced it will make all models available as electrics within 10 years, as it anticipates a wholesale market shift by consumers promoted by stricter environmental regulations. Petroleum powered car sales will take a nosedive.

The International Energy Agency (IEA) points out that EVs are just .08% of all cars today. And of the 665,000 on the road, almost 40% are in the USA, where they represent little more than a rounding error in market share. But there are smaller markets where EV sales have strong share, such as 12% in Norway and 5% in the Netherlands.

So what happens if Tesla’s new lower priced cars, and international expansion, creates a sea change like the iPod, iPhone and iPad? What happens if people can’t get enough of EVs? What happens if international markets take off, due to tougher regulations and higher petrol costs? What happens if people start thinking of electric cars as mainstream, and gasoline cars as old technology — like two-way radios, VCRs, DVD players, low-definition picture tube TVs, land line telephones, fax machines, etc?

What if demand for electric cars starts doubling each quarter, and grows to 35% or 50% of the market in 10 years? If so, what happens to Tesla? Apple was a nearly bankrupt, also ran, tiny market share company in 2000 before it made the world “i-crazy.” Now it is the most valuable publicly traded company in the world.

Already awash in the greatest oil inventory ever, crude prices are down about 60% in the last year. Oil companies have already laid-off 50,000 employees. More cuts are planned, and defaults expected to accelerate as oil companies declare bankruptcy.

It is not hard to imagine that if EVs really take off amidst a major market shift, oil companies will definitely see a precipitous decline in demand that happens much faster than anticipated.

To little Tesla, which sold only 1,500 cars in 2010 could very well be positioned to make an enormous difference in our lives, and dramatically change the fortunes of its shareholders — while throwing a world of hurt on a huge company like Exxon (which was the most valuable company in the world until Apple unseated it.)

[Note: I want to thank Andreas de Vries for inspiring this column and assisting its research. Andreas consults on Strategy Management in the Oil & Gas industry, and currently works for a major NOC in the Gulf.]

by Adam Hartung | Mar 9, 2015 | Current Affairs, In the Rapids, Leadership, Television

The Netflix hit series “House of Cards” was released last night. Most media reviewers and analysts are expecting huge numbers of fans will watch the show, given its tremendous popularity the last 2 years. Simultaneously, there are already skeptics who think that releasing all episodes at once “is so last year” when it was a newsworthy event, and no longer will interest viewers, or generate subscribers, as it once did. Coupled with possible subscriber churn, some think that “House of Cards” may have played out its hand.

So, the success of this series may have a measurable impact on the valuation of Netflix. If the “House of Cards” download numbers, which are up to Netflix to report, aren’t what analysts forecast many may scream for the stock to tumble; especially since it is on the verge of reaching new all-time highs. The Netflix price to earnings (P/E) multiple is a lofty 107, and with a valuation of almost $29B it sells for just under 4x sales.

But investors should ignore any, and in fact all, hype about “House of Cards” and whatever analysts say about Netflix. So far, they’ve been wildly wrong when making forecasts about the company. Especially when projecting its demise.

But investors should ignore any, and in fact all, hype about “House of Cards” and whatever analysts say about Netflix. So far, they’ve been wildly wrong when making forecasts about the company. Especially when projecting its demise.

Since Netflix started trading in 2002, it has risen from (all numbers adjusted) $8.5 to $485. That is a whopping 57x increase. That is approximately a 40% compounded rate of return, year after year, for 13 years!

But it has not been a smooth ride. After starting (all numbers rounded for easier reading) at $8.50 in May, 2002 the stock dropped to $3.25 in October – a loss of over 60% in just 5 months. But then it rallied, growing to $38.75, a whopping 12x jump, in just 14 months (1/04!) Only to fall back to $9.80, a 75% loss, by October, 2004 – a mere 9 months later. From there Netflix grew in value by about 5.5x – to $55/share – over the next 5 years (1/10.) When it proceeded to explode in value again, jumping to $295, an almost 6-fold increase, within 18 months (7/11). Only to get creamed, losing almost 80% of its value, back down to $63.85, in the next 4 months (11/11.) The next year it regained some loss, improving in value by 50% to $91.35 (12/12,) only to again explode upward to $445 by February, 2014 a nearly 5-fold increase, in 14 months. Two months later, a drop of 25% to $322 (4/14). But then in 4 months back up to $440 (8/14), and back down 4 months later to $341 (12/14) only to approach new highs reaching $480 last week – just 2 months later.

That is the definition of volatility.

Netflix is a disruptive innovator. And, simply put, stock analysts don’t know how to value disruptive innovators. Because their focus is all on historical numbers, and then projecting those historicals forward. As a result, analysts are heavily biased toward expecting incumbents to do well, and simultaneously being highly skeptical of any disruptive company. Disruptors challenge the old order, and invalidate the giant excel models which analysts create. Thus analysts are very prone to saying that incumbents will remain in charge, and that incumbents will overwhelm any smaller company trying to change the industry model. It is their bias, and they use all kinds of historical numbers to explain why the bigger, older company will project forward well, while the smaller, newer company will stumble and be overwhelmed by the entrenched competitor.

And that leads to volatility. As each quarter and year comes along, analysts make radically different assumptions about the business model they don’t understand, which is the disruptor. Constantly changing their assumptions about the newer kid on the block, they make mistake after mistake with their projections and generally caution people not to buy the disruptor’s stock. And, should the disruptor at any time not meet the expectations that these analysts invented, then they scream for shareholders to dump their holdings.

Netflix first competed in distribution of VHS tapes and DVDs. Netflix sent them to people’s homes, with no time limit on how long folks could keep them. This model was radically different from market leader Blockbuster Video, so analysts said Blockbuster would crush Netflix, which would never grow. Wrong. Not only did Blockbuster grow, but it eventually drove Blockbuster into bankruptcy because it was attuned to trends for convenience and shopping from home.

As it entered streaming video, analysts did not understand the model and predicted Netflix would cannibalize its historical, core DVD business thus undermining its own economics. And, further, much larger Amazon would kill Netflix in streaming. Analysts screamed to dump the stock, and folks did. Wrong. Netflix discovered it was a good outlet for syndication, created a huge library of not only movies but television programs, and grew much faster and more profitably than Amazon in streaming.

Then Netflix turned to original programming. Again, analysts said this would be a huge investment that would kill the company’s financials. And besides that people already had original programming from historical market leaders HBO and Showtime. Wrong. By using analysis of what people liked from its archive, Netflix leadership hedged its bets and its original shows, especially “House of Cards” have been big hits that brought in more subscribers. HBO and Showtime, which have depended on cable companies to distribute their programming, are now increasingly becoming additional programming on the Netflix distribution channel.

Investors should own Netflix because the company’s leadership, including CEO Reed Hastings, are great at disruptive innovation. They identify unmet customer needs and then fulfill those needs. Netflix time and again has demonstrated it can figure out a better way to give certain user segments what they want, and then expand their offering to eat away at the traditional market. Once it was retail movie distribution, increasingly it is becoming cable distribution via companies like ComCast, AT&T and Time Warner.

And investors must be long-term. Netflix is an example of why trading is a bad idea – unless you do it for a living. Most of us who have full time day jobs cannot try timing the ups and downs of stock movements. For us, it is better to buy and hold. When you’re ready to buy, buy. Don’t wait, because in the short term there is no way to predict if a stock will go up or down. You have to buy because you are ready to invest, and you expect that over the next 3, 5, 7 years this company will continue to drive growth in revenues and profits, thus expanding its valuation.

Netflix, like Apple, is a company that has mastered the skills of disruptive innovation. While the competition is trying to figure out how to sustain its historical position by doing the same thing better, faster and cheaper Netflix is figuring out “the next big thing” and then delivering it. As the market shifts, Netflix is there delivering on trends with new products – and new business models – which push revenues and profits higher.

That’s why it would have been smart to buy Netflix any time the last 13 years and simply held it. And odds are it will continue to drive higher valuations for investors for many years to come. Not only are HBO, Showtime and Comcast in its sites, but the broadcast networks (ABC, CBS, NBC) are not far behind. It’s a very big media market, which is shifting dramatically, and Netflix is clearly the leader. Not unlike Apple has been in personal technology.

by Adam Hartung | Dec 11, 2014 | Current Affairs, Defend & Extend, In the Whirlpool, Leadership, Lifecycle, Television, Web/Tech

The trend toward the death of broadcast TV as we’ve known it keeps moving forward. This trend may not happen as fast as the death of desktop computers, but it is a lot faster than glacier melting.

This television season (through October) Magna Global has reported that even the oldest viewers (the TV Generation 55-64) watched 3% less TV. Those 35-54 watched 5% less. Gen Xers (25-34) watched 8% less, and Millenials (18-24) watched a whopping 14% less TV. Live sports viewing is not even able to maintain its TV audience, with NFL viewership across all networks down 10-19%.

Everyone knows what is happening. People are turning to downloaded entertainment, mostly on their mobile devices. With a trend this obvious, you’d think everyone in the media/TV and consumer goods industries would be rethinking strategy and retooling for a new future.

But, you would be wrong. Because despite the obviousness of the trend, emotional ties to hoping the old business sticks around are stronger than logic when it comes to forecasting.

CBS predicted at the beginning of 2014 TV ad revenue would grow 4%. Oops. Now CBS’s lead forecaster is admitting he was way off, and adjusted revenues were down 1% for the year. But, despite the trend in viewer behavior and ad expenditures in 2014, he now predicts a growth of 2% for 2015.

That, my young friends, is how “hockey stick” forecasts are created. A lot of old assumptions, combined with a willingness to hope trends will be delayed, and you can ignore real data while promising people that the future will indeed look like the past – even when it defies common sense.

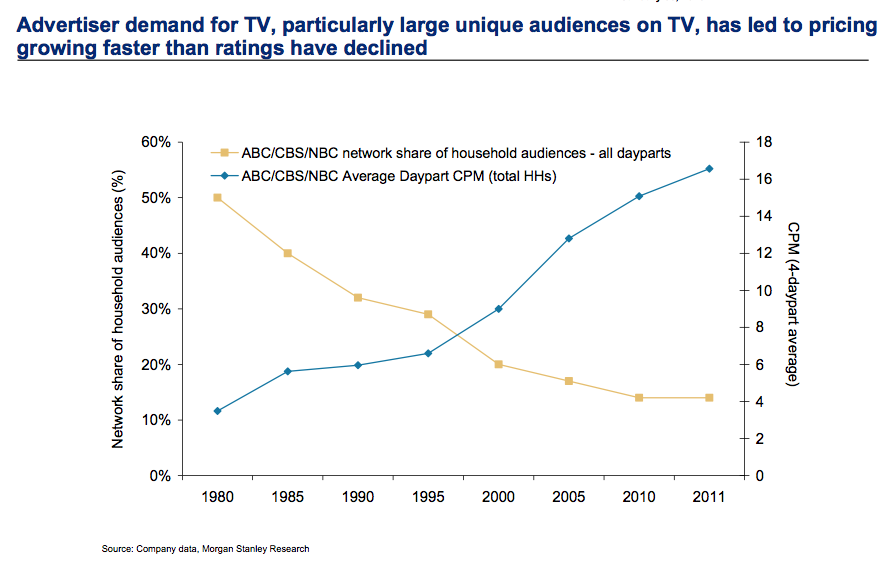

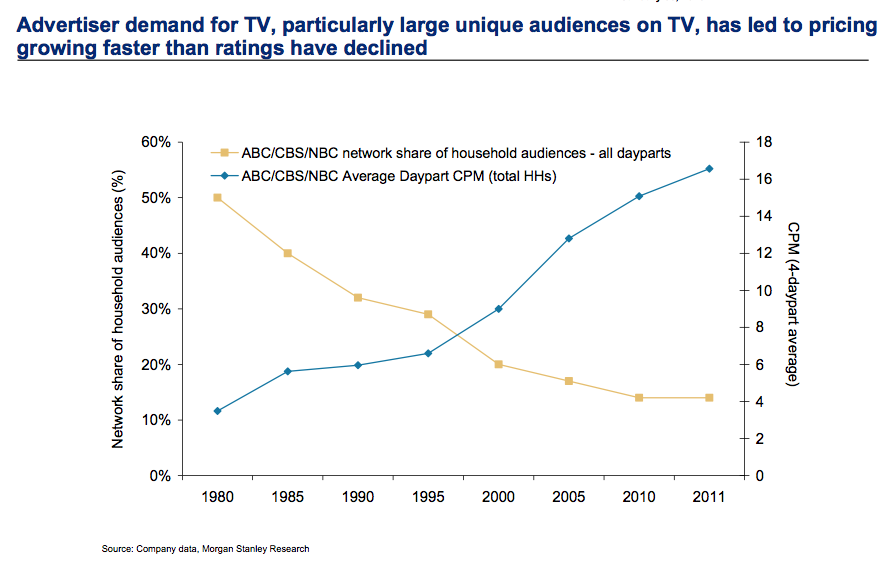

To compensate for fewer ads the networks have raised prices on all ads. But how long can that continue? This requires a really committed buyer (read more about CMO weaknesses below) who simply refuses to acknowledge the market has shifted and the dollars need to shift with it. That cannot last forever.

Meanwhile, us old folks can remember the days when Nielsen ratings determined what was programmed on TV, as well as what advertisers paid. Nielsen had a lock on measuring TV audience viewing, and wielded tremendous power in the media and CPG world.

But now AC Nielsen is struggling to remain relevant. With TV viewership down, time shifting of shows common and streaming growing like the proverbial weed Nielsen has no idea what entertainment the public watches. They don’t know what, nor when, nor where. Unwilling to move quickly to develop tools for catching all the second screen viewing, Nielsen has no plan for telling advertisers what the market really looks like – and the company looks to become a victim of changing markets.

Which then takes us to looking at those folks who actually buy ads that drive media companies. The Chief Marketing Officers (CMOs) of CPG companies. Surely these titans of industry are on top of these trends, and rapidly shifting their spending to catch the viewers with the most ads placed for the lowest cost.

You would wish.

Unfortunately, because these senior executives are in the oldest age groups, they are a victim of their own behavior. They still watch TV, so assume others must as well. If there is cyber-data saying they are wrong, well they simply discount that data. The Nielsen’s aren’t accurate, but these execs still watch the ratings “because it’s the best info we have” – a blatant untruth by the way. But Nielsen does conveniently reinforce their built in assumptions, and their hope that they won’t have to change their media spend plans any time soon.

Further, very few of these CMOs actually use social media. The vast majority watch their children, grandchildren and young employees use mobile devices constantly – and they bemoan all the activity on YouTube, Facebook, Instagram and Twitter – or for the most part even Linked-in. But they don’t actually USE these products. They don’t post information. They don’t set up and follow channels. They don’t connect with people, share information, exchange photos or tell stories on social media. Truthfully, they ignore these trends in their own lives. Which leaves them woefully inept at figuring out how to change their company marketing so it can be more relevant.

The trend is obvious. The answer, equally so. Any modern marketer should be an avid user of social media. Most network heads and media leaders are farther removed from social media than the Pope! They don’t constantly download entertainment, and exchanging with others on all the platforms. They can’t manage the use of these channels when they don’t have a clue how they work, or how other people use them, or understand why they are actually really valuable tools.

Are you using these modern tools? Are you actually living, breathing, participating in the trends? Or are you, like these outdated execs, biding your time wasting money on old programs while you look forward to retirement? And likely killing your company.

When trends emerge it is imperative we become part of that trend. You can’t simply observe it, because your biases will lead you to hope the trend reverts as you continue doing more of the same. A leader has to adopt the trend as a leader, be a practicing participant, and learn how that trend will make a substantial difference in the business. And then apply some vision to remain relevant and successful.

by Adam Hartung | Nov 28, 2014 | Current Affairs, Innovation, Leadership, Web/Tech

Last week I gave 1,000 VHS video tapes to Goodwill Industries. These had been accumulated through 30 years of home movie watching, including tapes purchased for entertaining my 3 children.

It was startling to realize how many of these I had bought, and also surprising to learn they were basically valueless. Not because the content was outdated, because many are still popular titles. But rather because today the content someone wants can be obtained from a streaming download off Amazon or Netflix more conveniently than dealing with these tapes and a mechanical media player.

It isn’t just a shift in technology that made those tapes obsolete. Rather, a major trend has shifted. We don’t really seek to “own” things any more. We’ve become a world of “renters.”

The choice between owning and renting has long been an option. We could rent video tapes, and DVDs. But even though we often did this, most Boomers also ended up buying lots of them. Boomers wanted to own things. Owning was almost always considered better than renting.

Boomers wanted to own their cars, and often more than one. Auto renting was only for business trips. Boomers wanted to own their houses, and often more than one. Why rent a summer home, when, if you could afford it, you could own one. Rent a boat? Wouldn’t it be better to own your own boat (even if you only use it 10 times/year?)

Now we think very, very differently. I haven’t watched a movie on any hard media in several years. When I find time for video entertainment, I simply download what I want, enjoy it and never think about it again. A movie library seems – well – unnecessary.

As a Boomer, there’s all those CDs, cassette tapes (yes, I have them) and even hundreds of vinyl records I own. Yet, I haven’t listened to any of them in years. It’s far easier to simply turn on Pandora or Spotify – or listen to a channel I’ve constructed on YouTube. I really don’t know why I continue to own those old media players, or the media.

Since the big real estate meltdown many people are finding home ownership to be not as good as renting. Why take such a huge risk, paying that mortgage, if you don’t have to?

That this is a trend is even clearer generationally. Younger people really don’t see the benefit of home ownership, not when it means taking on so much additional debt. Home ownership costs are so high that it means giving up a lot of other things. And what’s the benefit? Just to say you own your home?

Where Boomers couldn’t wait to own a car, young people are far less likely. Especially in, or near, urban areas. The cost of auto ownership, including maintenance, insurance and parking, becomes really expensive. Compared with renting a ZipCar for a few hours when you really need a car, ownership seems not only expensive, but a downright hassle.

And technology has followed this trend. Once we wanted to own a PC, and on that PC we wanted to own lots of data – including movies, pictures, books – anything that could be digitized. And we wanted to own software applications to capture, view, alter and display that data. The PC was something that fit the Boomer mindset of owning your technology.

But that is rapidly becoming superfluous. With a mobile device you can keep all your data in a cloud. Data you want to access regularly, or data you want to rent. There’s no reason to keep the data on your own hard drive when you can access it 24×7 everywhere with a mobile device.

And the same is true for acting on the data. Software as a service (SaaS) apps allow you to obtain a user license for $10-$20/user, or $.99, or sometimes free. Why spend $200 (or a lot more) for an application when you can accomplish your task by simply downloading a mobile app?

So I no longer want to own a VCR player (or DVD player for that matter) to clutter up my family room. And I no longer want to fill a closet with tapes or cased DVDs. Likewise, I no longer want to carry around a PC with all my data and applications. Instead, a small, easy to use mobile device will allow me to do almost everything I want.

It is this mega trend away from owning, and toward a simpler lifestyle, that will end the once enormous PC industry. When I can do all I really want to do on my connected device – and in fact often do more things because of those hundreds of thousands of apps – why would I accept the size, weight, complexity, failure problems and costs of the PC?

And, why would I want to own something like Microsoft Office? It is a huge set of applications which contain dozens (hundreds?) of functions I never use. Wouldn’t life be much simpler, easier and cheaper if I acquire the rights to use the functionality I need, when I need it?

There was a time I couldn’t imagine living without my media players, and those DVDs, CDs, tapes and records. But today, I’m giving lots of them away – basically for recycling. While we still use PCs for many things today, it is now easy to visualize a future where I use a PC about as often as I now use my DVD player.

In that world, what happens to Microsoft? Dell? Lenovo?

The implications of this are far-reaching for not only our personal lives, and personal technology suppliers, but for corporate IT. Once IT managed mainframes. Then server farms, networks and thousands of PCs. What will a company need an IT department to do if employees use their own mobile devices, across common networks, using apps that cost a few bucks and store files on secure clouds?

If corporate technology is reduced to just operating some “core” large functions like accounting, how big – or strategic – is IT? The “T” (technology) becomes irrelevant as people focus on gathering and analyzing information. But that’s not been the historical training for IT employees.

Further, if Salesforce.com showed us that even big corporations can manage something as critical as their customer information in a SaaS environment on mobile devices, is it not possible to imagine accounting and supply chain being handled the same way? If so, what role will IT have at all?

The trend toward renting rather than owning is monumental. It affects every business. But in an ironic twist of fate, it may dramatically reduce the focus on IT that has been so critical for the Boomer generation.

(2) Buy Facebook

(2) Buy Facebook