by Adam Hartung | Jun 30, 2020 | Culture, Leadership, Marketing, Politics, Web/Tech

In my recent “Rebooting Business” on-line conference I was asked if Black Lives Mattered and other protests should affect strategy. I said “of course!!” These demonstrations clearly show a segment of the marketplace with unserved and under-served needs. Needs so badly served people have taken to the streets!

Every organization needs to assess its strategy to determine if it is on this trend toward inclusion. Are you sensitive to the needs of these under-served segments? Or are you sloppily still out there with old stereo-tropes like the Aunt Jemima syrup – which Quaker Oats finally pulled. Do you know if your organization, products, suppliers, customers and communities are meeting market needs for inclusion? Or are you just assuming you’ll be OK?

Amazingly one of the biggest trend creating companies has demonstrated the cost of missing trends. Facebook is a remarkable company. Where MySpace failed, and countless others never created a marketplace, Facebook used its initial platform, then added Instagram, then Messenger, then WhatsApp to take an enormous lead in social media. Facebook built on trends in our desire to be mobile, and to communicate asynchronously, to attract billions of people to its platform – and as a result advertisers.

But…. Inexplicably…. the CEO Mark Zuckerberg and his leadership team have been tone-deaf to the events since George Floyd was killed. And they were remarkably blindsided, showing they truly weren’t prepared. Zuckerberg has long refused to even look for false information on Facebook – and never really considered removing it. Lies, falsehoods, misstatements – Facebook let people of all stripes (good, and very often bad) say anything they wanted on the platform. This wasn’t inclusion, it was allowing loud voices to present harmful content – and it was clearly disturbing a whole lot of people.

Now is the comeuppance. Advertisers have decided not to advertise on Facebook. They realize that their ads, presented next to false, and sometimes truly hateful, content gives the impression that they support this content. So, in droves, they have said their ad dollars will go somewhere else. Giant consumer goods companies Honda, Unilever, Proctor & Gamble, Coca-Cola, Diageo and Hershey as well as one of the world’s largest mobile providers Verizon, and mercantile suppliers North Face and Patagonia have joined retailers like Starbucks and REI as just some of the larger boycotters – out of over 100 on the growing list. So serious is this problem that some advertisers are “pausing” social media ads all together, suggesting another possible trend

Nobody can fight trends and hope to win. Nobody. No matter how big. And this is a sharp rebuke for one of the trendiest companies on the planet. That the leadership team didn’t see this coming is astonishing. In a late reversal, Facebook has made new efforts to identify hate content (including harmful posts by politicians), but that they didn’t react much quicker is just absurd. That they appeared to think they could platform political ads, and political content, and not have viewers associate Facebook with politics is downright bizarre. This has been the dumbest self-inflicted move by a big company in a very long time. And all they had to do to avoid this nightmare was admit that inclusion was a very big global trend that they had to build into their offering.

But don’t lose sight of the lesson. TRENDS MATTER. If you align with trends your business can do GREAT! Like Facebook. But if you don’t pay attention, and you miss a big trend (like demographic inclusion) the pain the market can inflict can be HUGE and FAST. Like Facebook. Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business https://adamhartung.com/assessments/

by Adam Hartung | Jul 31, 2017 | In the Flats, Innovation, Investing, Leadership, Marketing

Amid all the political news last week it was easy to miss announcements in the business world. Especially one that was relatively small, like Starbucks announcement on Thursday July 27, 2017 that it was closing all 379 of its Teavana stores. While these will be missed by some product fanatics, the decision is almost immaterial given that these units represent only about 3% of Starbucks US stores, and about 1.5% of the 25,000 Starbucks globally.

Yet, closing Teavana is a telltale sign of concern for Starbucks investors.

Starbucks founding CEO Howard Schultz returned to the top job in January, 2008, promising to get out of distractions such as music production, movie production, internet sales, grocery products, liquor products and even in-store food sales in order to return the company to its “core” coffee business. Since then Starbucks valuation has risen some 5.5-6 fold, from $9.45/share to the recent range of $54 to $60 per share. A much better return than the roughly doubling of the Dow Jones Industrial Average over the same timeframe.

Yet, one should take time to evaluate what this closing means for the long-term future of Starbucks. This is the second time Starbucks made an acquisition only to shut it down. In 2015 Starbucks closed all 23 La Boulange bakery cafes, with little fanfare. Now, after paying $620M to buy Teavana in 2012, they are closing all those stores. While leadership blamed its decision on declining mall visits (undoubtedly a fact) for the closures, Teavana is not missing goals due to the Amazon Effect. There are multiple options for how to market Teavana’s fresh and packaged products far beyond mall store locations. Choosing to close all stores indicates leadership has minimal interest in the brand.

Starbucks’ focus leaves little opportunity for new growth

It increasingly appears that today’s Starbucks literally isn’t interested, or able, to do anything other than build, and operate, more Starbucks stores. And Starbucks is clearly doubling down on its plans to be Starbucks store-centric. The company opened 575 new units in the last year, and announced plans to open more stores creating 68,000 additional US jobs in the next 5 years. Further, Starbucks is paying $1.3B to buy the half of its China business previously owned by a partner. Clearly, leadership continues to tighten company focus on the “core” coffee store business for the future.

This sounds great short-term, given how well things have gone the last 8 years. But there are concerns. Sales are up 4% last quarter, but that is wholly based upon higher prices. Customer counts are flat, indicating that stores are not attracting new customers from competitors. Sales gains are due to average ticket prices increasing 5%, which is marginal and likely refers to higher priced products. Starbucks is now relying completely on new stores to create incremental growth, since bringing in new customers to existing stores is not happening.

Frequently this stagnant store sales metric indicates store saturation. A bad sign. Does the US, or international markets, really need more, new Starbucks stores? It was 2010 when comedian Lewis Black had a successful viral rant (PG version) claiming that when he observed a Starbucks across the street from another Starbucks he knew it was the end of civilization.

What happens when the market doesn’t need new Starbucks stores?

One does have to wonder when the maximum number of Starbucks will be reached. Especially given the ever growing number of competitors in all markets. Direct competitors such as Caribou Coffee, The Coffee Bean, Seattle’s Best, Gloria Jean’s, Costa, Lavazza, Tully’s, Peet’s and literally dozens of chain and independent coffee shops are competing for Starbucks’ customers. Simultaneously competition from low priced alternatives is emerging from brands like Dunkin Donuts and McDonald’s, now catering more to coffee lovers. And non-coffee fast casual shops are seeking to attract more people for congregating, such as Panera, Fuddruckers, Pei Wei, TGI Friday’s and others. All of these are competitors, either directly or indirectly, for the customer dollars sought by Starbucks. Are more Starbucks stores going to succeed?

As McDonald’s, Pizza Hut and other fast food chains learned the hard way, there comes a time when a brand has built all the market needs. Then leadership has to figure out how to do something else. McDonald’s invested heavily in Boston Market and Chipotle’s, but let those high growth operations go when it decided to refocus on its “core” hamburger business – leading to heavy valuation declines. Starbucks is closing Teavana, but should it? When will Starbucks saturate? And what will Starbucks do to grow when that happens?

Starbucks has had a great run. And that run appears not fully over. But long-term investors have reason to worry.

Is it smart to make such a huge bet on China?

Will store growth successfully continue, with all the stores that already exist?

Will direct and indirect competitors eat away at market share?

What will Starbucks do when it has reached it market maximum, and it doesn’t seem to have any emerging new store concepts to build upon?

by Adam Hartung | Dec 6, 2016 | Disruptions, Innovation, Investing, Leadership, Retail

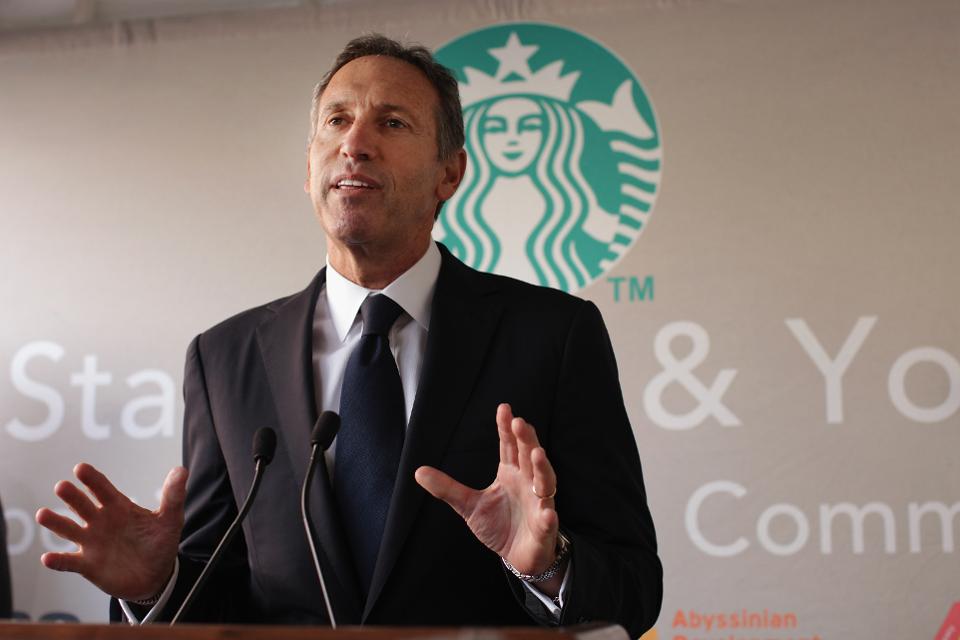

(Photo by Spencer Platt/Getty Images)

But, is it right to hand-wring over Schultz’s departure as CEO? After all, things have not been pretty for investors since Mr. Jobs turned over Apple to his hand-picked successor Tim Cook. However, could this change mean something better is in store for shareholders?

First, let’s address the very – and Starbucks was saved only by Mr. Schultz returning with his tremendous creativity and servant leadership. While it is great propaganda for making the Schultz as hero story more appealing, it isn’t exactly accurate.

Starting in 1982, Howard Schultz built Starbucks from four stores to over 2,800 (and over $2 billion revenue) in 16 years. That was a tremendous success. And he is to be lauded. But when he left,

Starbucks had only 35o stores outside the USA. It was an American phenomenon, a place to buy and drink coffee, with every store company owned, every employee company trained, and not an ounce of variability in the business model. Not exactly diversified. At the time, the stock traded for roughly (split adjusted) $4 per share.

His successor, Orin Smith, far outperformed Mr. Schultz, more than tripling the chain to over 9,000 stores and expanding revenue to over $5 billion in just four years! He expanded the original model internationally, began adding many new varieties of coffee and other drinks, and even added food. These enhancements were tremendously successful at bringing in additional revenue, even if the average store revenue fell as smaller stores were added in places like airports, hotels and entertainment venues.

In 2005, Jim Donald replaced Mr. Smith. By 2007 (in just teo years) he added a staggering additional 4,000 stores. He expanded the menu. And he even branched out to selling branded Starbucks coffee on airplanes, in hotels and even retailed in grocery stores. Further, he launched a successful international coffee liqueur under the Starbucks brand. And he moved the company into entertainment, creating an artist representation company and even producing movies (Akeelah and the Bee) which won multiple awards.

In 2007 Starbucks fourth quarter saw 22% revenue increase, and for the year 21% growth. Comparable store sales grew 5%. International margins expanded, and net earnings grew over 19% from $564 million to $673 million.

Starbucks’ stock, from 2000 when Mr. Schultz departed into 2006 rose 375%, from $4 to just under $19 per share. Not the ruination that some seem to think was happening.

But Mr. Schultz did not like the diversification, even if it produced more revenue and profit. He joined the chorus of analysts that beat down the P/E ratio, and the stock price, as the company expanded beyond its “core” coffee store business.

When the Great Recession hit, and people realized they could live without $4 per cup of coffee and a $50 per day habit, revenues plummeted, as they did for many restaurants and retailers. Mr. Schultz seized the opportunity to return to his old job as CEO. That the downturn in Starbucks had far more to do with the greatest economic debacle since the 1930s was overlooked as Mr. Schultz blamed everything on the previous CEO and his leadership team – firing them all.

Since 2012 Starbucks has returned to doing what it did prior to 2000 – opening more stores. Growing from 17,000 to 25,000 stores. Refocused on its very easy to understand, if dated, business model analysts loved the simpler company and bid up the P/E to over 30 – creating a trough (2008) to peak (2016) increase in adjusted stock price from $4 to $60 – an incredible 15 times!

But, more realistically one should compare the price today to that of 2006, before the entire market crashed and analysts turned negative on the profitable Starbucks diversification and business model expansion. That gain is a more modest 300% – basically a tripling over a decade – far less a gain for investors than happened under the 2000-2006 era of Mr. Schultz’s successors.

Mr. Schultz succeeded in returning Starbucks to its “core.” But now he’s leaving a much more vulnerable company. As my fellow Forbes contributor Richard Kestenbaum has noted, retail success requires innovation. Starbucks is now almost everywhere, leaving little room for new store expansion. Yet it has abandoned other revenue opportunities pioneered under Messrs. Smith and Donald. And competition has expanded dramatically – both via direct coffee store competitors and the emergence of new gathering spots like smoothie stores, tech stores and fast casual restaurants that are attracting people away from a coffee addiction.

At some point Starbucks and its competition will saturate the market. And tastes will change. And when that happens, growth will be a lot harder to find. As McDonald’s and WalMart have learned, . Exciting new competitors emerge, like Starbucks once was, and Amazon.com is increasingly today.

Mr. Schultz has said he is vastly more confident in this change of leadership than he was the last time he left – largely because he feels this hand-picked team (as if he didn’t pick the last team, by the way) will continue to remain tightly focused on defending and extending Starbucks “core” business. This approach sounds all too familiar – like Jobs selection of Cook – and the risks for investors are great.

A focus on the core has real limits. Diminishing returns do apply. And P/E compression (from the very high 30+ today) could cause Starbucks to lose any investor upside, possibly even cause the stock to decline. If Mr. Schultz’s departure was opening the door for more innovation, new business expansion and a change to new trends that sparked growth one could possibly be excited. But there is real reason for concern – just as happened at Apple.

by Adam Hartung | Jul 13, 2016 | Employment, Leadership, Regulations, Trends

This week Starbucks and JPMorganChase announced they were raising the minimum pay of many hourly employees. For about 168,000 lowly paid employees, this is really good news. And both companies played up the planned pay increases as benefitting not only the employees, but society at large. The JPMC CEO, Jamie Dimon, went so far as to say this was a response to a national tragedy of low pay and insufficient skills training now being addressed by the enormous bank.

However, both actions look a lot more like reacting to undeniable trends in an effort to simply keep their organizations functioning than any sort of corporate altruism.

However, both actions look a lot more like reacting to undeniable trends in an effort to simply keep their organizations functioning than any sort of corporate altruism.

Since 2014 there has been an undeniable trend toward raising the minimum wage, now set nationally at $7.25. Fourteen states actually raised their minimum wage starting in 2016 (Massachusetts, California, New York, Nebraska, Connecticut, Michigan, Hawaii, Colorado, Nebraska, Vermont, West Virginia, South Dakota, Rhode Island and Alaska.) Two other states have ongoing increases making them among the states with fastest growing minimum wages (Maryland and Minnesota.) And there are 4 additional states that promoters of a $15 minimum wage think will likely pass within months (Illinois, New Jersey, Oregon and Washington.) That makes 20 states raising the minimum wage, with 46.4% of the U.S. population. And they include 5 of the largest cities in the USA that have already mandated a $15 minimum wage (New York, Washington D.C., Seattle, San Francisco and Los Angeles.)

In other words, the minimum wage is going up. And decisively so in heavily populated states with big cities where Starbucks and JPMC have lots of employees. And the jigsaw puzzle of different state requirements is actually a threat to any sort of corporate compensation plan that would attempt to treat employees equally for common work. Simultaneously the unemployment rate keeps dropping – now below 5% – causing it to take longer to fill open positions than at any time in the last 15+ years. Simply put, to meet local laws, find and retain decent employees, and have any sort of equitable compensation across regions both companies had no choice but to take action to raise the pay for these bottom-level jobs.

Starbucks pointed out that this will increase pay by 5-15% for its 150,000 employees. But at least 8.5% of those employees had already signed a petition demanding higher pay. Time will tell if this raise is enough to keep the stores open and the coffee hot. However, the price increases announced the very next day will probably be more meaningful for the long term revenues and profits at Starbucks than this pay raise.

At JPMC the average pay increase is about $4.10/hour – from $10.15 to $12-$16.50/hour. Across all 18,000 affected employees, this comes to about $153.5million of incremental cost. Heck, the total payroll of these 18,000 employees is only $533.5M (after raises.) Let’s compare that to a few other costs at JPMC:

Wow, compared to these one-off instances, the recent pay raises seem almost immaterial. While there is probably great sincerity on the part of these CEOs for improving the well being of their employees, and society, the money here really isn’t going to make any difference to larger issues. For example, the JPMC CEO’s 2015 pay of $27M is about the same as 900 of these lowly paid employees. Thus the impact on the bank’s financials, and the impact on income inequality, is — well — let’s say we have at least added one drop to the bucket.

The good news is that both companies realize they cannot fight trends. So they are taking actions to help shore up employment. That will serve them well competitively. And some folks are getting a long-desired pay raise. But neither action is going to address the real problems of income inequality.

by Adam Hartung | May 8, 2015 | Current Affairs, Defend & Extend, Food and Drink, In the Swamp, In the Whirlpool, Leadership

McDonald’s just had another lousy quarter. All segments saw declining traffic, revenues fell 11%. Profits were off 33%. Pretty well expected, given its established growth stall.

A new CEO is in place, and he announced is turnaround plan to fix what ails the burger giant. Unfortunately, his plan has been panned by just about everyone. Unfortunately, its a “me too” plan that we’ve seen far too often – and know doesn’t work:

- Reorganize to cut costs. By reshuffling the line-up, and throwing out a bunch of bodies management formerly said were essential, but now don’t care about, they hope to save $300M/year (out of a $4.5B annual budget.)

- Sell off 3,500 stores McDonald’s owns and operate (about 10% of the total.) This will further help cut costs as the operating budgets shift to franchisees, and McDonald’s book unit sales creating short-term, one-time revenues into 2018.

- Keep mucking around with the menu. Cut some items, add some items, try a bunch of different stuff. Hope they find something that sells better.

- Try some service ideas in which nobody really shows any faith, like adding delivery and/or 24 hour breakfast in some markets and some stores.

Needless to say, none of this sounds like it will do much to address quarter after quarter of sales (and profit) declines in an enormously large company. We know people are still eating in restaurants, because competitors like 5 Guys, Meatheads, Burger King and Shake Shack are doing really, really well. But they are winning primarily because McDonald’s is losing. Even though CEO Easterbrook said “our business model is enduring,” there is ample reason to think McDonald’s slide will continue.

Needless to say, none of this sounds like it will do much to address quarter after quarter of sales (and profit) declines in an enormously large company. We know people are still eating in restaurants, because competitors like 5 Guys, Meatheads, Burger King and Shake Shack are doing really, really well. But they are winning primarily because McDonald’s is losing. Even though CEO Easterbrook said “our business model is enduring,” there is ample reason to think McDonald’s slide will continue.

Possibly a slide into oblivion. Think it can’t happen? Then what happened to Howard Johnson’s? Bob’s Big Boy? Woolworth’s? Montgomery Wards? Size, and history, are absolutely no guarantee of a company remaining viable.

In fact, the odds are wildly against McDonald’s this time. Because this isn’t their first growth stall. And the way they saved the company last time was a “fire sale” of very valuable growth assets to raise cash that was all spent to spiffy up the company for one last hurrah – which is now over. And there isn’t really anything left for McDonald’s to build upon.

Go back to 2000 and McDonald’s had a lot of options. They bought Chipotle’s Mexican Grill in 1998, Donato’s Pizza in 1999 and Boston Market in 2000. These were all growing franchises. Growing a LOT faster, and more profitably, than McDonald’s stores. They were on modern trends for what people wanted to eat, and how they wanted to be served. These new concepts offered McDonald’s fantastic growth vehicles for all that cash the burger chain was throwing off, even as its outdated yellow stores full of playgrounds with seats bolted to the floors and products for 99cents were becoming increasingly not only outdated but irrelevant.

But in a change of leadership McDonald’s decided to sell off all these concepts. Donato’s in 2003, Chipotle went public in 2006 and Boston Market was sold to a private equity firm in 2007. All of that money was used to fund investments in McDonald’s store upgrades, additional supply chain restructuring and advertising. The “strategy” at that time was to return to “strategic focus.” Something that lots of analysts, investors and old-line franchisees love.

But look what McDonald’s leaders gave up via this decision to re-focus. McDonald’s received $1.5B for Chipotle. Today Chipotle is worth $20B and is one of the most exciting fast food chains in the marketplace (based on store growth, revenue growth and profitability – as well as customer satisfaction scores.) The value of all of the growth gains that occurred in these 3 chains has gone to other people. Not the investors, employees, suppliers or franchisees of McDonald’s.

We have to recognize that in the mid-2000s McDonald’s had the option of doing 180degrees opposite what it did. It could have put its resources into the newer, more exciting concepts and continued to fidget with McDonald’s to defend and extend its life even as trends went the other direction. This would have allowed investors to reap the gains of new store growth, and McDonald’s franchisees would have had the option to slowly convert McDonald’s stores into Donato’s, Chipotle’s or Boston Market. Employees would have been able to work on growing the new brands, creating more revenue, more jobs, more promotions and higher pay. And suppliers would have been able to continue growing their McDonald’s corporate business via new chains. Customers would have the benefit of both McDonald’s and a well run transition to new concepts in their markets. This would have been a win/win/win/win/win solution for everyone.

But it was the lure of “focus” and “core” markets that led McDonald’s leadership to make what will likely be seen historically as the decision which sent it on the track of self-destruction. When leaders focus on their core markets, and pull out all the stops to try defending and extending a business in a growth stall, they take their eyes off market trends. Rather than accepting what people want, and changing in all ways to meet customer needs, leaders keep fiddling with this and that, and hoping that cost cutting and a raft of operational activities will save the business as they keep focusing ever more intently on that old core business. But, problems keep mounting because customers, quite simply, are going elsewhere. To competitors who are implementing on trends.

The current CEO likes to describe himself as an “internal activist” who will challenge the status quo. But he then proves this is untrue when he describes the future of McDonald’s as a “modern, progressive burger company.” Sorry dude, that ship sailed years ago when competitors built the market for higher-end burgers, served fast in trendier locations. Just like McDonald’s 5-years too late effort to catch Starbucks with McCafe which was too little and poorly done – you can’t catch those better quality burger guys now. They are well on their way, and you’re still in port asking for directions.

McDonald’s is big, but when a big ship starts taking on water it’s no less likely to sink than a small ship (i.e. Titanic.) And when a big ship is badly steered by its captain it flounders, and sinks (i.e. Costa Concordia.) Those who would like to think that McDonald’s size is a benefit should recognize that it is this very size which now keeps McDonald’s from doing anything effective to really change the company. Its efforts (detailed above) are hemmed in by all those stores, franchisees, commitment to old processes, ingrained products hard to change due to installed equipment base, and billions spent on brand advertising that has remained a constant even as McDonald’s lost relevancy. It is now sooooooooo hard to make even small changes that the idea of doing more radical things that analysts are requesting simply becomes impossible for existing management.

And these leaders, frankly, aren’t even going to try. They are deeply wedded, committed, to trying to succeed by making McDonald’s more McDonald’s. They are of the company and its history. Not the CEO, or anyone on his team, reached their position by introducing a revolutionary new product, much less a new concept – or for that matter anything new. They are people who “execute” and work to slowly improve what already exists. That’s why they are giving even more decision-making control to franchisees via selling company stores in order to raise cash and cut costs – rather than using those stores to introduce radical change.

These are not “outside thinkers” that will consider the kinds of radical changes Louis V. Gerstner, a total outsider, implemented at IBM – changing the company from a failing mainframe supplier into an IT services and software company. Yet that is the only thing that will turn around McDonald’s. The Board blew it once before when it sold Chipotle, et.al. and put in place a core-focused CEO. Now McDonald’s has fewer resources, a lot fewer options, and the gap between what it offers and what the marketplace wants is a lot larger.

However, both actions look a lot more like reacting to undeniable trends in an effort to simply keep their organizations functioning than any sort of corporate altruism.

However, both actions look a lot more like reacting to undeniable trends in an effort to simply keep their organizations functioning than any sort of corporate altruism.